13 minute read

MedPAC Formally Votes to Recommend Payment Reductions to Congress for IRFs

Remy Kerr, MPH, Health Policy and Research Manager

MedPAC PAC Setting Payment Update Recommendations for 2021 • IRF Recommendation: 5% payment reduction • LTCH Recommendation: 2% payment increase • SNF Recommendation: No update • HHA Recommendation: 7% payment reduction

28 AMRPA Magazine / February 2020 In December 2019 and January 2020, the Medicare Payment Advisory Commission (MedPAC) held public meeting sessions to discuss payment adequacy and updates for the four Medicare post-acute care (PAC) settings. The initial session, held on December 5, 2019, covered each PAC setting’s payment adequacy in detail and allowed for Commissioner discussion and review of draft payment recommendations. The subsequent session, held on January 16, 2020, included a brief overview of the field for each PAC setting and a formal, expedited vote on the payment update recommendations.

MedPAC staff reiterated their prior findings that Medicare payment levels are high in inpatient rehabilitation facilities (IRFs), skilled nursing facilities (SNFs), and home health agencies (HHAs) relative to cost. Additionally, the SNF and HHA revised payment systems (effective in FY 2020 and CY 2020, respectively) aim to increase payment equity among settings, but may require future changes based on provider incentives. Lastly, MedPAC staff explained that settings with provider-reported functional measures may be biased in regards to data, and MedPAC continues to work toward improvements in consistency and accuracy.

At the December meeting, MedPAC staff recommended a 5% payment reduction in fiscal year (FY) 2021 for IRFs. In addition to the payment update, staff restated its March 2016 recommendation for the Secretary to conduct focused medical record reviews of IRFs with unusual patterns of case mix and coding and expand the high-cost outlier pool. The 5% payment reduction has been recommended since 2017; however, Congress has not previously acted on the recommendation.

In addition to the IRF payment update, MedPAC recommended for 2021: 2% payment increase for long-term care hospitals (LTCHs); 7% payment reduction for HHAs; and no update for SNFs. At the subsequent January meeting, Commissioners unanimously approved each of the recommendations via an expedited formal vote. The recommendations are expected to be included in MedPAC’s March 2020 Report to Congress.

Further details for each PAC setting presentation are included below.

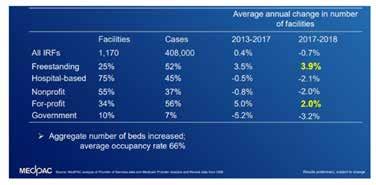

Inpatient Rehabilitation Facilities At the December public meeting, staff provided a comprehensive overview of the state of the field for IRFs in 2018. The total number of IRFs in 2018 decreased slightly (0.7%) to 1,170, and were mostly hospital-based units. While the majority of IRFs are hospital-based, freestanding IRFs increased by 3.9%, and hospital-based units declined by 2.1% between 2017 and 2018. IRFs accounted for $8 billion of total Medicare fee-for-service (FFS)

expenditures, and Medicare accounted for 59% of IRF discharges. The average payment per case was down slightly from $20,300 in 2017 to $20,124 in 2018. Volume increased to a total of 408,000 stays for 364,000 beneficiaries. This was an increase from 396,000 stays in 2016 and 365,000 in 2010. Additionally, IRFs treated 105.7 cases per 10,000 Medicare FFS beneficiaries, compared to 103.2 cases per 10,000 in 2016. Occupancy rates for IRFs increased by a modest 1% to 66% in 2018.

Readmission Rate

Discharge to SNF

Number of Beds

Occupancy Rate Medicare Margin Relatively Efficient IRFs Other IRFs 2.3% 2.6%

4.8% 6.6%

30 23

69% 63% 17.8% 1.1%

Case Types

Predominant Facility Types

Source: MedPAC analysis

More neurological Freestanding, for-profit More strokes

Hospitalbased, non-profit

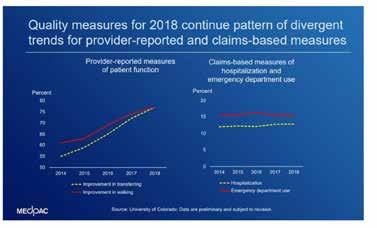

Quality measures for IRFs have remained stable or continued to improve since 2012. Staff cautioned commissioners that providerreported functional measures that influence payment could be at risk for bias.

Risk-adjusted measure

2012 2018

Gain in motor function, in points 22.1 24.3

Gain in cognitive function, in points 3.5 4.0

Rate of discharge to community 74.4% 76.4% Rate of discharge to SNFs 6.7% 6.6% Potentially-avoidable hospitalization during IRF stay 2.8% 2.6% Potentially-avoidable hospitalization within 30 days after IRF discharge 5.0% 4.8%

Source: MedPAC analysis

Staff went on to explain that financial performance varies across the setting. In 2018, the aggregate Medicare margin was 14.7% with a projected 2020 margin of 12.7%. Marginal profits (profit of admitting one additional patient) for freestanding IRFs was 41%, and hospital-based units was 20% in 2018. Staff attributed the variation in provider margins to facility cost. Facilities with lower IRF margins are often smaller units with lower occupancy, there may be a different case mix, and assessment and coding practices may vary.

As in prior years, staff evaluated “relatively efficient IRFs.” MedPAC defines relatively efficient providers as those with consistently low costs and high quality. They must be in the top third performance on costs or MedPAC’s quality metrics every year over a threeyear lookback period, and cannot be in the bottom third on cost or quality metrics in any years. The staff again reported that freestanding, for-profit facilities were “disproportionately represented” among relatively efficient providers. As in past years, the staff reported that the sector’s overall access to capital remains adequate. The large majority (75%) of IRFs are hospital-based units, and MedPAC staff reported that these units maintain good access to capital through their parent institutions. Staff did not expect any adverse effects on beneficiaries’ access to care or out-of-pocket spending as a result of the recommended payment update, but did state that the update may increase financial pressure on some providers.

There was no dissent raised in either meeting regarding the IRF payment recommendation, and it passed unanimously at the January public meeting without discussion.

Long-Term Care Hospitals At the December public meeting, staff reviewed the payment changes for LTCHs, and associated PPS criteria. In order to qualify as an LTCH with Medicare, a facility must first qualify as an acutecare hospital under Medicare Conditions of Participation (CoP), and have an average length of stay for certain Medicare cases of longer than 25 days. The Pathway for SGR Reform Act of 2013 altered the way LTCHs are paid. LTCHs now have a dual-payment rate structure. Cases meeting the LTCH PPS criteria are: 1) preceded by an acute care hospital discharge and 2) spend three or more days in the ICU of a referring acute care hospital or receive prolonged mechanical ventilation in the LTCH. Cases that do not meet the criteria receive a lower, site-neutral payment.

Staff proceeded to update commissioners on the state of the field as of 2018. There were approximately 102,000 LTCH stays. Between 2017 and 2018 there was a 5.1% decrease in supply leading to a total of 374 LTCHs in 2018. LTCHs accounted for $4.2 billion in 2018 Medicare spending. The average Medicare payment was approximately $40,000 across all cases, and $47,000 for cases meeting LTCH PPS criteria. The sector-wide occupancy rate was 63%. The sector-wide occupancy rate decreased slightly (1%) to 63% in 2018.

readmitted to an acute-care hospital directly from an LTCH, 16% died in the LTCH, and 13% died within 30 days of discharge. In total, close to 40% of LTCH cases meeting PPS criteria in 2018 died or were readmitted within 30 days of LTCH discharge. Cases not meeting the PPS criteria generally had lower rates of readmission and mortality.

Staff reported that margins vary considerably across the sector, particularly between LTCHs with at least 85% of Medicare cases meeting the PPS criteria and LTCHs that do not. In 2018, the allpayer margin improved to 2.2% for all LTCHs up from 0.2% in 2017. LTCHs with a high share of patients meeting the LTCH criteria were up by 1.0% to 4.5% in 2018. The 2018 aggregate Medicare margin was 4.7%, with a projected drop to 3.7% in 2020.

In aggregate, cost growth varied by share of cases meeting the LTCH PPS criteria. Cost growth was low prior to 2017 and increased to 2.7% from 2017 to 2018. LTCHs with a high share of cases meeting the LTCH PPS criteria in 2018, however, had higher cost growth from 2015 to 2017 followed by slowed growth. Staff stated that differences in cost growth reflect LTCH’s adaptation to payment system changes. willingness and ability to care for Medicare beneficiaries who meet the criteria.

Each commissioner agreed with the recommendation, and it passed unanimously at the January public meeting without discussion.

Skilled Nursing Facilities At the December public meeting, staff provided an update on the state of the field for SNFs. In 2018, approximately 15,000 SNFs provided care for 1.5 million Medicare FFS beneficiaries, equivalent to 4% of all FFS beneficiaries. SNFs accounted for $28.5 billion of Medicare’s FFS 2018 spending. Additionally, FFS accounted for approximately 10% of all SNF facility days and 18% of facility revenue. SNF admission volume decreased, as was expected due to a decrease in qualifying inpatient hospital stays. SNF stays were also shorter in duration. Occupancy rates also slightly decreased in 2018 to 84%. Staff explained that the changes were expected due to alternative payment models and increasing participation in accountable care organizations (ACOs).

Staff evaluated and presented new data regarding “relatively efficient SNFs.” Much like for IRFs, MedPAC has specific cost and quality criteria benchmarks to qualify as a relatively efficient SNF. Compared to non-relatively efficient SNFs, relatively efficient SNFs must have higher community discharge rates and lower readmission rates, higher intensive therapy days, a higher average daily census and occupancy, lower cost per day, and higher revenues per day.

SNF quality measures have remained stable or improved. Rate of discharge to community and potentially avoidable readmissions during SNF stay and 30 days after discharge saw improvement. Staff caveated that the functional information should be viewed with caution given that the scores are provider-reported. Staff added that changes between 2017 and 2018 could be attributable to the FY 2020 PPS update.

LTCHs’ access to capital is limited, which staff explained was expected given the changes in payment structure. As a result, MedPAC staff report that major chains have been diversifying their portfolios and have been strategic in purchasing, selling, and closing LTCH facilities in competitive LTCH markets. Such business practices, staff asserted, have reduced the need for capital. Staff did not anticipate any adverse effect on beneficiaries’ access to care. Staff explained the update is not expected to affect providers’

Staff then went on to explain that payment adequacy indicators are all positive. The 2018 aggregate margin for freestanding SNFs was 10.3%; however, across SNFs margins have significant variation. The lowest margin quartile had margins of -0.7% or lower, and the highest quartile had 19.7% or higher margins. There is also more than a 10% difference in Medicare margins for nonprofit and forprofit facilities. Staff attributed this to differences in case mix, cost

growth, per day costs, and economies of scale. The marginal profit for SNFs was 18%. Relatively efficient SNFs had a Medicare margin of 16.9%. Staff explained that the margins suggest current SNF Medicare payment is too high.

CMS asserted that it revised the FY 2020 SNF PPS with the goal of moving away from incentivizing high therapy use. In other words, SNFs payments will be redistributed from high therapy needs to the medically complex. The payment changes include payments based on patient characteristics such as comorbidities, ability to swallow, depression, functional status, and cognitive impairment. Staff stated that the goal of the change was to better prepare for a unified PAC PPS, and more closely align SNF payments with other settings.

Staff expressed concern about disparities between Medicare Advantage (MA) payments and FFS payments to SNFs. In three publicly traded companies operating SNFs, FFS per day payment rates were approximately 20% higher than MA payments. Staff explained that case mix characteristics between MA and FFS do not explain the payment differences.

Staff explained that SNFs have adequate access to capital and buyer demand is strong but some lender wariness exists. Staff attributed the wariness to lower total margins, declining FFS SNF use, and increasing share of facility revenues from lower-paying payers (i.e. Medicaid and MA plans).

Each commissioner agreed with the recommendation, and it passed unanimously at the January session without discussion.

Home Health Agencies At the December public meeting, MedPAC staff concluded with an update on home health agencies. In 2018, over 11,500 agencies provided care for 6.3 million episodes for 3.4 million FFS beneficiaries. FFS spending accounted for $17.9 billion of total Medicare FFS expenditures, equivalent to approximately 2.6% of aggregate Medicare spending. Nearly 98% of Medicare beneficiaries live in a zip code with at least one HHA available. 2018 volume decreased slightly from 2017 (1.2%) to 6.3 million episodes, while volume has declined by 8.3% since 2011. This decline followed an increase of 67% between 2002 and 2011. Staff explained the decline was primarily concentrated in states that experienced higher than average growth in the prior period. Per capita utilization increased by 39% to 16.3 episodes per 100 FFS beneficiaries. The current HHA PPS factors in therapy utilization when determining payment. This incentivizes providing therapy, and as a result has led to an increasing share of total episodes. Since 2011, MedPAC has recommended the removal of therapy as a factor of payment. As part of the new payment system mentioned below, therapy will no longer be considered a payment factor for HHAs beginning in 2020.

Staff provided a brief overview of HHA quality measures. The measures continue a pattern of divergence between providerreported and claims-based measures, with claims-based measures remaining relatively stable over time, and provider-reported measures showing a pattern of improvement.

A new HHA payment system and case-mix system (PDGM) went into effect on January 1, 2020. The payment system is expected to redistribute payments and maintain budget neutrality. Staff explained that the new PDGM is not intended to address high payment rates. Per the final rule, CMS anticipates payments for non-profit, hospital-based, and rural agencies will experience increased payments, while for-profit, freestanding, and urban agencies will see lower payments. A projected 4.36% payment increase is expected by CMS in 2020 due to the changes associated with the new system.

Staff reported Medicare margins for HHAs continue to be high despite payment reductions mandated by the Affordable Care Act beginning in 2014. Staff did note that profit margins have remained relatively consistent despite high margins. 2018 average payments were 7% higher than in 2013 even with rebasing. HHA margins have significant variability across settings. The average margin for freestanding HHAs in 2018 was 15.3%. The lowest-margin quartile had margins of 1.2%, and the highest quartile had 24% margins. Non-profit and for-profit agencies also had significant variability (7%age point difference).

Like IRFs and SNFs, staff presented new data about “relatively efficient HHAs.” HHAs classifying as relatively efficient had to meet cost and quality measure benchmarks. In 2017, 7% of HHAs were classified as such. Relatively efficient HHAs had an 8% lower median hospitalization rate, 7% higher average payment, higher annual volume, and 14% lower standardized cost per episode compared to all other HHAs. The 2017 Medicare margin for relatively efficient HHAs was 23.1%, signaling the payment rate is too high according to MedPAC staff.

Staff reported that payment adequacy indicators are all positive, and that access to capital is adequate. Additionally, HHAs are less capital intensive than other settings. Staff noted that large, for-profit HHAs continue to expand and acquire new business and expand HHA operations.

Each commissioner agreed with the recommendation, and it passed unanimously at the January session without discussion.

MedPAC meeting materials and transcripts can be found at http://medpac.gov/-public-meetings-. AMRPA will continue to monitor MedPAC and associated recommendations provided to Congress in the March 2020 report.