7 minute read

Build a Better Business

from SE21 March 2021

by SE Magazines

Angela Burgess Coaching

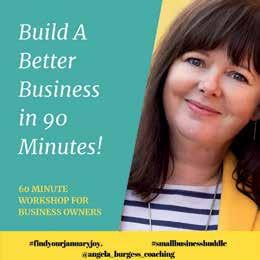

Build a Better Business in 90 Minutes!

In my other life as a business coach I ran a workshop last month called “Build a Better Business in 90 Minutes”. There was a lot of interest, with 56 people turning up on the day (virtually!). So what was the workshop all about? The concept was looking at how we spend so much time “in” our business and don’t pay enough attention to working “on” our business. So by mastering your time and working

“on” your business, you can make your business grow. I talked about investing your time rather than just spending time and being intentional with what you want to achieve. We can all be busy during the day, but if you get to the end of it and wonder what you have achieved, you maybe just spending your time and not getting the real work done.

How are you spending your time?

We all have the same amount of hours each week, so how come others seem to get so much done? Most likely they plan! My talk went through how if you started the day at 9am and finished at 6pm, you have 12 x 45 minutes slots. If you take one for lunch, then that leaves 11. Over a full week, that is 55 x 45 slots that you can get stuff done. Sounds like a lot doesn’t it? Well it is! If you then allocate two of those slots per day, 90 minutes in total to work “on” your business, being the marketeer rather than the doer, you will reap the rewards. The more marketing you do, the more profit you make. So it is all about stopping the talking and start doing.

Why 90 Minutes?

Good question. It is manageable. Even better if you split it in to two 45 minutes sessions. Imagine how much you could get done if you focussed on just one thing and completed it. Our brain craves completion. The satisfaction of completing a job, finishing a chapter of a book, another episode of your favourite tv series. What is doesn’t like is continually doing the same thing but not finishing it. This can get you down, leads to frustrating and inevitably, leaving the very thing that you need to finish, undone.

So what should I be doing in my 90 Minutes?

I feel the most important thing in business is getting and keeping more customers. So you 90 minutes should be based around that. If you manage that; everything else with be OK. • So think about what you are going to do every day to achieve this? • Surely you would set time aside to focus on this? • How can we do it?

www.angelaburgess.co.uk Build a Better Business

Are you a morning person or an evening person?

Maybe you come alive in the afternoon. It doesn’t matter when it is, but pick a time when you feel energised. You won’t carry on doing this if your force yourself to do it first thing in the morning, but only really come alive at 11am! So you pick your time. Then get planning. I have some great planners to help me (I can send you links to some) get organised. I have one especially for tasks for my 90 minutes each week. I know once they are written down on a particular day, they will get done.

Be intentional

Plan for the next 7-10 days. Remember “Today ain’t over until tomorrow is planned!” This is one of my favourite quotes from Nigel Botterill and it is so true. I have a fantastic checklist of 26 things you can be doing in your 90 minutes sessions. Here is a taster. If you would like the full checklist, you can download it from my website.

1) Write to your list. Every business should have a list of their current and past clients. You should also be keeping details of people who enquire about your services or products. Most of us are keeping a list of these in a CRM system. This allows us to easily stay in contact, usually by sending out a newsletter. If you are not doing this, then this is very easy to set up and essential for all businesses. 2) Do you have a follow-up campaign? If someone does contact you and asks for your prices, do you have an organised follow-up? Remember it is your business to remind your clients to do business with you. Not the other way round!

3) Reading. This may sound like an odd use of time but reading about other inspiring business owners can really help with your creativity. Or you could be reading a marketing book, there are so many to choose from. I think it is essential to read (or listen if you prefer) and I know I get some of my best ideas, when I am reading.

“Great presentation, feeling inspired!” - Nisha “Thank you Angela, this was inspirational - so many practical tips and a great presentation” - Phil

If you want to the full list, there is a free download at www.angelaburgess.co.uk If you would like to sign up for my next workshop, you can do that via my website too. The workshops are completely free and the feedback has been fantastic.

Financial Matters

With David Frederick FCCA | Marcus Bishop Associates | marcus-bishop.com

Tax Spring Clean

As we are fast approaching the end of the 2020-21 tax year it is time to focus on some spring cleaning of our tax affairs. For some this may be addressing the mountain of tax planning things we’ve been intending to do since the fiscal year started. Perhaps the increasing anxiety and fear of a radical overhaul of many areas of taxation pending the Chancellor’s forthcoming Budget on 3rd March may or may not be the stimulus for action. Nevertheless four key areas for reflection are discussed below.

ISA

An easy win for savers even at historic low interest rates is to make use of this year’s £20,000 ISA allowance, before 5 April 2021. Unused allowances cannot be transferred forward or backward. It is a standard use it or lose it. Minors or those saving on behalf of minors have a threshold of £9,000 for 2020-21. Taxpayers under 40 years old can still contribute £4,000 of their of their £20,000 ISA allowance into a lifetime ISA which receives an annual government bonus of up to £1,000 a year. This affords savers the option to use the lifetime ISA to buy a first home or fund retirement. Savers should note that penalties for withdrawals from their lifetime ISA were put on hold in 2020-21. Meanwhile savers currently utilising the help-tobuy ISAs can continue to save a maximum of £200 a month towards obtaining a mortgage for the first home purchase.

Pensions

The maximum annual pension contribution is £40,000. This is subject to a tapered reduction where taxpayers have a threshold income over £200,000 and an adjusted income over £240,000. Threshold income is all UK earnings and not solely employment income. However it is net of all pension contributions paid personally to any UK registered pension schemes. Unused pension allowances from previous years can be carried forward for a maximum of three years. Taxpayers should also be aware that if in 2020-21 their pension savings exceeds their lifetime allowance of £1,073,100, they may be liable to income tax on when drawing pension benefits.

IHT Gifts

The inheritance tax (IHT) threshold remains unchanged at £325,000 with any excess being subject to 40% inheritance tax. However, some estates will qualify for an additional residence nil-rate band of £175,000, if the family home, or share of the family home, is left to the children or grandchildren. This will provide a threshold of £500,000. However, even this higher threshold is easily surpassed by many home owners within Dulwich. With this in mind, taxpayers with estates that will be subject to IHT, may want to consider whether their will is up to date. In addition, consider making use of their annual £3,000 gift exemption. Furthermore, taxpayers in this category should consider having an annual financial health check to ascertain whether they have surplus assets that they can give away and potentially reduce the value of their estate that is chargeable to inheritance tax.

CGT

Capital gains tax is the tax of most consternation for the upcoming budget with rumours of rates hitting 40% or 50%. In advance of any changes which will take effect from 6th April 2021 at the earliest taxpayers can still use their 2020-21 annual exemption of £12,300. Civil partners and married couples can also take advantage of spousal transfer at nil rate, before a disposal. An additional area of focus applies to VAT registered businesses. From 1st April 2021, VATregistered businesses with a taxable turnover above the VAT threshold (£85,000) are required to comply with the Making Tax Digital rules. In short, they must keep digital records and use compatible software to submit their VAT returns.