2024 Legislative Session Recap March

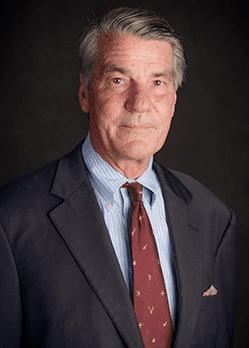

Moderatedby : APA Florida President-Elect

W. Thomas Hawkins, AICP, JD Allara Mills Gutcher, AICP State Sen. Bobby Powell Jr., AICP Wiatt Bowers. AICP Lester Abberger Alex Magee

THE HONORABLE SENATOR

BOBBY POWELL JR., AICP

SB 262 Florida Bright Futures Scholarship Program

SB 1614 High School Graduation Requirements

SB 712 Public Records/County Attorneys and City Attorneys

SB 776 Temporary Cash Assistance

SB 732 Theft from Nonprofit Organizations

SB 740 Wireless Services Provider Automatic Location Identification Information

SB 744 Task Force on Public Safety in Urban and Inner-City Communities

SB 1676 Task Force on Public Safety in Urban and Inner-City Communities

SB 786 Youth Conflict Resolution and Peer Mediation Pilot Program

SB 788 Wills & Estates

This bill provides an exemption from public records requirements for the personal identifying and location of current county attorneys, assistant county attorneys, deputy county attorneys, city attorneys, deputy city attorneys, and assistant city attorneys.

Personal Information relating to their spouses and children is likewise exempt. The specific personal information made exempt from public records disclosure requirements include:

• Home Address, telephone numbers, places of employment, photographs, and dates of birth.

• Names, home addresses, telephone numbers, photographs, places of employment, and dates of birth of the spouse and children.

• Names and locations of schools and day care facilities by the children.

Provides and clarifies procedures to resolve probate disputes regarding property owned by spouses in this state but acquired while the spouses lived n one of the nine community property states.

Amends and repeals various provisions of the Act, and other related provisions of the Florida Probate Code, to:

• Clarify existing law by exempting title disputes arising under the Act from: The term “claim” as defined in the Florida Probate Code.

The bill ensures the availability of necessary information about deceased individuals is contained in the land records maintained by the Clerks of the Circuit Courts so that proper heirs can be identified in the chain of title, thereby protecting the public interest of certainty in the ownership of real property.

Palm Beach Shores - Dredging Project, $1,000,000

Westgate CRA Enhanced Street Lighting & Safety Initiative, $250,000

Oak Street Home II - Female Teen Delinquency Prevention Program $350,000

Roosevelt School Program Enhancements, $847,920

Palm Beach Atlantic University - LeMieux Center for Public Policy, $500,000

Catapult! Afterschool Youth Mentoring Center Students, $500,000

T3 - Teach, Touch the Trades, $358,750

Palm Springs Congress Avenue Sewer Force Main - Palm Beach County, $1,000,000

Mangonia Park Water Plant Expansion and Modernization, $750,000

Mangonia Park Water Plant Expansion and Modernization, $750,000

Riviera Beach Design and Demolition of Existing Fire Station on Singer Island,

$500,000

North Palm Beach Public Safety Resiliency, $255,000

Palm Beach Zoo Safety & Security Upgrades, $110,000

West Palm Beach Fire Department Contaminant Reduction Project, $116,000

Riviera Beach - Shore, Palm, Riviera Drive Pavement Restoration, $350,000

Fort Lauderdale Business Corridor Stormwater Pump Station Generators, $175,000

Palm Beach State College - Remodel of Student Library, $9,762,824

Regional Entrepreneurship Centers and Small Business Loan Fund, $2,000,000

Cox Science Center and Aquarium Expansion, $5,000,000

Peanut Island Historic Restoration, $1,000,000

YMCA of the Palm Beaches Community Center, $500,000

Town of Lake Clarke Shores - Pine Tree Lane Bridge Replacement, $250,000

City of Belle Glade Sidewalk Replacement, $250,000

City of Greenacres - Chickasaw Road Expansion Project, $250,000

City of Palm Beach Gardens RCA Boulevard Roadway Improvements, $400,000 and more APPROPRIATIONS FOR PALM BEACH COUNTY = $27,615,494

• Lawmakers passed a bill that would loosen work restrictions on 16- and 17-year-old youths. For example, it would maintain a 30-hour-a-week limit for the teens when school is in session but would allow parents or school superintendents to waive the limit.

HOMELESS: Lawmakers passed a controversial plan that would bar cities and counties from allowing homeless people to sleep at places such as public buildings and in rights of way. Local governments could designate sites for sleeping or camping if they meet certain standards.

The bill will ban social media accounts for children under 14 and require parental permission for 15- and 16-yearolds. It was slightly watered down from a proposal DeSantis vetoed a week before the annual legislative session ended

Lawmakers passed a bill regulating short-term vacation rental platforms like Airbnb and Vrbo which preempts regulation to the state while local governments could have registration programs.

The bill says that the maximum overnight occupancy of a vacation rental cannot exceed two persons per bedroom, plus an additional two persons in one common area, or more than two persons per bedrooms if at least 50 square feet per person, plus an additional two persons in one common area, whichever is greater.

Makes three modifications to the property tax exemption for affordable multifamily middle-income rental units

(1) clarifies that the proportionate value of the land and common areas attributable to an exempt affordable unit would also be exempt;

(2) relaxes the 71 affordable unit minimum requirement for projects in the Florida Keys (reduced to a minimum of 10 affordable units); and (3) gives the county property appraiser full authority to grant and enforce the exemption, replacing the original law’s apparent joint responsibility between the property appraiser and the FHFC.

W. Thomas Hawkins, AICP, JD

W. Thomas Hawkins, AICP, JD

In depth discussion

• SB 328/HB 1239 - Affordable

Housing

Some discussion

• SB 684/HB 267 - Building

Regulations

• SB 1526/HB 1647 - Local Regulation of Nonconforming and Unsafe Structures

Worth mentioning

• SB 738/HB 739 - Environmental Management

• SB 1058/HB 7013 - Special Districts

• SB 1150/HB 791 - Development

Permits and Orders

• SB 1184/HB 1221 - Land Use and Development Regulations

Glitch bill for Live Local Act (Laws of Florida chapter 2023-17)

• Revised exemptions for density, height, and parking

• New exemption for floor area ratio

• New special rules for height when developing by single -family homes

• New standards for treating a Live Local Act development as a conforming use or nonconforming use

• Requires local governments to maintain administrative approval policy on website

Prohibits administrative approval for development within 1/4 mile of military installation

Makes airport-impacted areas not eligible for Live Local Act projects

• no projects in defined area around runways

• no projects in airport noise zone

• no project may exceed height restrictions in airport zoning regulation adopted pursuant to Florida Statutes § 330.03 (local government may consider readopting height restrictions here )

Developers with pending applications can choose whether to proceed under 2023

Live Local Act or under 2024 revisions

“[Local government] must authorize multifamily and mixed-use residential as allowed uses in any area zoned for commercial, industrial, or mixed use if at least 40 percent of the residential units in a proposed multifamily development are rental units that, for a period of at least 30 years, are affordable as defined in s. 420.0004.”

- Florida Statutes §§ 125.01055(7)(a) and 166.04151(7)(a).

Local government must not:

• limit density below highest density allowed anywhere in jurisdiction;

• limit floor area ratio below 150% highest allowed floor area ratio anywhere in jurisdiction; or

• limit height below taller of highest allowed within one mile or 3 stories.

Measures are currently allowed density, floor area ratio, or height

No Live Local Act benefits based on: other Live Local Act projects, bonuses, variances, or exceptions

Development near single-family homes gets modified Live Local Act

height exemption:

• Height allowance is tallest of 150% height of tallest adjacent building, height land development regulations allow, or 3 stories

• Applies “If the proposed development is adjacent to, on two or more sides, a parcel zoned for single-family residential use which is within a single-family residential development with at least 25 contiguous single-family homes.”

Local government must reduce parking requirements by at least 20% for Live Local Act development that is:

• within 1/2 mile of a transit station “served by public transit with a mix of other transportation options” that is “accessible from the development by safe, pedestrian-friendly means”, or

• within 600 feet of “available” parking.

Local government must not require parking for Live Local Act development that is within a transit-oriented development or area.

What are “rental units that, for a period of at least 30 years, are affordable”?

• Generally, “affordable” means rent does not exceed 30% of income of a household earning up to 120% of median annual adjusted gross income of Florida households. See Florida Statutes §§ 420.0004(3) and 420.0004(12).

Live Local Act requires local government to make development decision now dependent on lease terms over next 30 years

Local government must treat Live Local Act development as “conforming use” after 30 years.

If owner of Live Local Project violates state-mandated lease terms, local government must—

• allow “a reasonable time to cure such violation” and then

• treat the development as “nonconforming use.”

• Must local government rely on developer promise?

• How will local government enforce provisions against subsequent owner?

• What if owner leases at required terms, but lessee sublets at market rate?

• What if owner charges high application fees or creates other barriers to leasing?

• Should local government audit leases?

• What is a “reasonable time to cure violation” and how does local government treat a “nonconforming use”?

Existing development review and code enforcement tools almost certainly not adequate.

A local government must “maintain on its website a policy containing procedures and expectations for administrative approval” for Live Local Act developments.

Administrative approval policy appropriate place for evidentiary standard to establish property owner will rent Live Local Act units to residents under state-mandated terms.

Possible tools include —

• deed restriction benefitting local government,

contract for tenant referral with local housing agency, or • contract for sale to local housing agency or community land trust.

Removes requirement for “sealed drawings by a design professional” to replace some residential doors, windows, and garage doors.

Revised deadlines for building permit review:

• 60 days—Residential structures larger than 7,500 square feet; Nonresidential structures smaller than 25,000 square feet; multi-family residential structures with 50 or fewer units

• 30 days—Residential structures smaller than 7,500 square feet

• 12 days—When developer has a master building permit

• 10 days—When developer pays a private provider who is a licensed engineer or architect; When property owner participates in Department of Commerce administered Community Development Block Grant-Disaster Recovery program

Local government must permit demolition of structures and redevelopment of real property when —

• any part of subject land is seaward of the coastal construction control line;

• an existing structure is unsafe or is nonconforming;

• the structure is not on the National Register of Historic Places; and

• the structure is not a single-family home.

Exempts some barrier island communities with populations below 10,000.

• Entitled prevailing party to recover attorney fees and costs in challenges to certain Department of Environmental Protection and water management district permits.

• Florida Chapter of the American Planning Association opposed bill pointing out it would discourage citizen enforcement of Clean Water Act.

• A new state law undermining public participation in Clean Water Act could threaten federal delegation of Clean Water Act permitting to state of Florida.

• On March 21, 2024, U.S. House of Representatives passed bill codifying delegation of Clean Water Act enforcement to Florida.

Creates new rules, including governing body term limits, for some special districts

• Consistently exempts community development districts

Prohibits creation of a new safe neighborhood improvement district.

Repeals provisions requiring a referendum on municipal incorporation referenda for a community development district meeting certain standards

• Would have required local governments to publish information an applicant must submit to request a change in zoning, subdivision, certification, variance or exception.

• Would have required local governments to refund portions of application fees if local government failed to meet statutory timelines for reviewing development orders.

Sweeping changes to Community Planning Act such as —

• limiting what evidence local governments may use to plan;

• requiring local government to administratively approve certain residential development without regard to local comprehensive plan and certain land development regulations;

• requiring local government to permit development of certain agricultural land without regard to local comprehensive plan; and

• increasing size of future land use map amendment subject to smallscale comprehensive plan amendment review process to 150 acres.

Streamlines the process for issuing residential building permits in Florida, aiming to expedite building permit approvals before a final plat is recorded:

• Mandates certain local governing bodies to implement a program to accelerate residential building permit issuance

• Specifies that the accelerated process should include a two-step application for preliminary plat adoption and a master building permit process valid for up to three years.

• Allows applicants to employ private providers to hasten the building permit application process upon preliminary plat approval.

• Clarifies conditions under which building permits must be issued and establishes an applicant's right to sell residential structures before final plat approval and recording

• Protects applicants' vested rights to an approved preliminary plat, prohibiting substantive changes without consent

• Requires applicants to indemnify local governments, their bodies, employees, and agents from liabilities relating to the construction within the residential subdivision or community.

1) a governing body of a county that has 75,000 residents or more (Monroe County is an exception)

2) a governing body of a municipality that has 10,000 residents or more and 25 acres or more of contiguous land that the local government has designated in the local comprehensive plan and future land use map as land that is agricultural or to be developed for residential purposes

By Oct. 1, 2024, must create a program to expedite the process for issuing building permits for residential subdivisions or planned communities before a final plat is recorded

- must include an application for an applicant to identify up to 50 percent of planned homes, or the number of building permits that the governing body must issue for the residential subdivision or planned community

By Dec. 31, 2027, must update program to contain an application that allows an applicant to request an increased percentage of up to 75 percent of building permits for planned homes that the local governing body must issue for the residential subdivision or planned community.

Requires the governing body to issue the number or percentage of building permits requested by an applicant provided the residential buildings or structures are unoccupied and all of the following conditions are met:

1) the governing body has approved a preliminary plat for each residential subdivision or planned community.

2) the applicant provides proof to the governing body that the applicant has provided a copy of the approved preliminary plat, along with the approved plans, to the relevant electric, gas, water, and wastewater utilities.

3) the applicant holds a valid performance bond for up to 130 percent of the necessary improvements, as defined in s.177.031(9) that have not been completed upon submission of the application. For purposes of a master planned community a valid bond is required on a phase-by-phase basis.

Applicants are allowed to contract to sell, but not transfer ownership of, a residential structure or building located in the residential subdivision or planned community until the final plat recorded.

Applicants are prohibited from obtaining a temporary or final certificate of occupancy for each residential structure or building for which a building permit is issued until the final plat is approved by the governing body and recorded.

An applicant has a vested right in a preliminary plat that has been approved by a governing body if all of the following conditions are met:

1) the applicant relies in good faith on the approved preliminary plat or any amendments thereto

2) the applicant incurs obligations and expenses, commences construction of the residential subdivision or planned community, and is continuing in good faith with the development of the property

Upon the establishment of an applicant's vested rights, a governing body may not make substantive changes to the preliminary plat without the applicant's written consent.

Effective Date: Upon Governor’s signature

NotyettransmittedtotheGovernorasofMarch25

Implements new regulations for vacation rentals, including tax collection by advertising platforms and local licensing requirements:

• Requires advertising platforms or operators listing vacation rentals to collect and remit specified taxes for certain transactions

• Defines "advertising platform" and sets mandates for displaying license and registration numbers in advertisements

• Preempts the regulation of advertising platforms to the state effective Jan. 1, 2025, authorizes local governments to adopt registration programs for vacation rentals, and outlines registration processes and requirements

• Establishes criteria for local governments to fine, suspend, or revoke vacation rental registrations for non-compliance.

• Mandates visibility of rental licenses and unique identifiers within the rental properties.

• Stipulates that the Division of Hotels and Restaurants must create and maintain a vacation rental information system to facilitate compliance and provide a mechanism for local governments and platforms to verify vacation rental statuses

• Provides that a “grandfathered” local law, ordinance, or regulation adopted on or before June 1, 2011, may be amended to be less restrictive or to comply with local registration requirements.

• Requires local government must prepare a business impact estimate before implementing a vacation rental registration program.

• Allows a local government to impose a fine for failure to register under the local program.

• Allows local government to charge a reasonable fee per unit to process a registration fee and a reasonable fee to process an annual renewal application.

• Allows local governments to charge a reasonable fee to inspect a vacation rental after registration to verify compliance with the Florida Building Code and the Florida Fire Prevention Code.

• Requires local governments to review a registration application for completeness and accept the registration or issue a written notice of denial specifying deficient areas within 15 days of receipt of an application.

Registration Program may only require the operator of a vacation rental to do the following:

1) Submit identifying information about the owner and the operator, if applicable, and the subject vacation rental premises.

2) Provide proof of a license with the unique identifier issued by the division to operate as a vacation rental.

3) Obtain all required tax registrations, receipts, or certificates issued by the Department of Revenue, a county, or a municipality.

4) Update required information as necessary to ensure it is current.

5) Pay in full all recorded municipal or county code liens against the subject vacation rental premises.

6) Designate and maintain at all times a responsible party who is capable of responding to complaints or emergencies related to the vacation rental, including being available by telephone at a provided contact telephone number 24 hours a day, 7 days a week, and receiving legal notice of violations on behalf of the vacation rental operator.

7) State and comply with the maximum overnight occupancy of the vacation rental which does not exceed either two persons per bedroom, plus an additional two persons in one common area; or more than two persons per bedroom if there is at least 50 square feet per person, plus an additional two persons in one common area, whichever is greater.

• If a local government denies an application, the written notice of denial may be sent by United States mail or electronically and must state with particularity the factual reasons for the denial and include a citation to the applicable portions of an ordinance, rule, statute, or other legal authority for the denial.

• A local government cannot prohibit an applicant from reapplying if the applicant cures the identified deficiencies.

• If a local government fails to accept or deny the registration within the provided timeframes, the application is deemed accepted.

• Local government can fine a vacation rental operator or suspend a local vacation rental registration under certain circumstances.

• A local government may not suspend a vacation rental registration of violations of local laws, ordinances or regulations that are not directly related to the vacation rental premise.

• A vacation rental owner is allowed to appeal a denial, suspension, revocation, or refusal to renew of a vacation rental registration to the circuit court within 30 days after the issuance of the denial, suspension, revocation or refusal to renew , and the court may assess and award reasonable attorney fees and costs and damages to the prevailing party.

Effective Date: Except as otherwise expressly provided, effective July 1, 2024.

NotyettransmittedtotheGovernorasofMarch25

Prohibits a citizen-led county charter amendment that is not required to be approved by the board of county commissioners preempting any development order, land development regulation, comprehensive plan, or voluntary annexation unless expressly authorized in a county charter that was lawful and in effect on January 1, 2024 (this provision goes into effect upon becoming law)

• Amends the Expedited State Review Process to provide that:

o if the local government fails, within 180 days of receipt of agency comments, to hold the second public hearing, and to adopt the comprehensive plan amendments, the amendments are deemed to be withdrawn unless extended by agreement

o if the local government adopts the amendments but fails to transmit them within 10 working days after the final adoption hearing, the amendments are deemed withdrawn

• Amends the State Coordinated Review Process to provide that:

o if the local government fails to hold the second hearing and adopt the amendments within 180 days after receipt of the state land planning agency’s report, the amendments shall be deemed withdrawn unless extended by agreement

o if the local government adopts the amendments but fails to transmit them within 10 working days after the final adoption hearing, the amendments are deemed withdrawn

Includes spending limitations of state transportation trust fund for transit projects

FDOT may not commit more than 20% of state fuel tax revenues and other fees for public transit projects

• Exempts projects with federal funding or in an MPO TIP and county commission super majority

• Also exempts premium transit (BRT and rail) projects that maintain or enhance LOS on the state highway system – provided state revenues do not exceed 50%

Effective Date: July 1, 2024.

• Includes numerous transportation policy changes:

o Deletes requirement that FDOT Secretary be appointed from nominations by the FTC

o Traffic study and public outreach required to evaluate and address adverse impacts of proposed lane repurposing

• Numerous new requirements for transit agencies.

• Grants Florida Rail Enterprise power and responsibility for preserving rail corridors in conjunction with FDOT.

• House bill barred FDOT and MPOs from considering social, political, or ideological factors in their planning – ex. net zero emissions.

• The amended and combined bills removed this.

Effective Date: July 1, 2024.

NotyettransmittedtotheGovernorasofMarch25

• Authorizes local government to adopt alternative mobility plan and fee system.

• Prohibits alternative system from imposing responsibility for funding existing deficiencies on new development.

• Requires local government issuing building permits to collect for extrajurisdictional impacts.

• Prevents developers from being charged multiple times for the same impacts.

• Bill amended to ensure counties would not go uncompensated for transportation impacts.

Effective Date: July 1, 2024.

• Bill would have prohibited the designation of new MPOs after a specified date, with some exceptions.

• Would have imposed provisions on MPOs, including performance metrics and new reporting.

• Would have burdened MPOs with additional oversight and reporting –already subject to state and federal oversight.

• MPOs would potentially have been held responsible for results of actions by others.

Required that plans submitted for construction of pedestrian crosswalks at any point other than an intersection must include traffic control signals and pedestrian control signals.

• Proposed the creation of a new section in the Florida State Constitution prohibiting the state or political subdivisions from placing and operating traffic infraction detectors for specified purposes.

• Last year, the Legislature passed a bill allowing for limited use of speed cameras in school zones, if approved by local government.

• Several cities and counties are now introducing these.