Live Local Act

A Legal Perspective

Rick Geller

Rick Geller

Rick Geller

Rick Geller

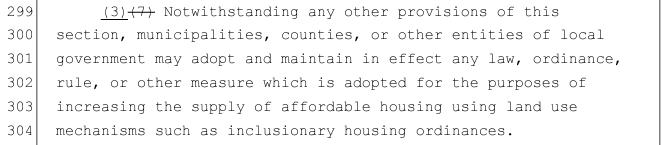

But local governments can increase supply with inclusionary housing ordinances…

Option 5: Fee-in-Lieu

Applicants may pay a fee-in-lieu in place of providing affordable units. PHB staff calculate the fee amount due by multiplying the gross square footage of the residential and residential-related areas of the building by the Fee-in-Lieu Factor.

Option 1: Build On-Site at 80% MFI

A minimum of 15%* of the units must be affordable at 80% MFI, except within the Central City and Gateway Plan Districts, where 20% of the units must be affordable.

Option 4: Designate Units in an Existing Building

Applicants can elect to designate IH Units in an existing building (Existing Receiving Building), on a separate site from the multifamily development subject to the IH Program requirements (Sending Building).

Option 2: Build On-Site at 60% MFI

Applicants can elect to make 10% of units affordable at 60% MFI in buildings within the Central City and Gateway Plan Districts, or 8% of units in buildings in all other areas.

Option 3: Build Off-Site - New Construction

Applicants can elect to build IH Units off-site in another new development (New Construction Receiving Building), on a separate site from the multifamily development that is subject to the IH Program requirements (Sending Building).

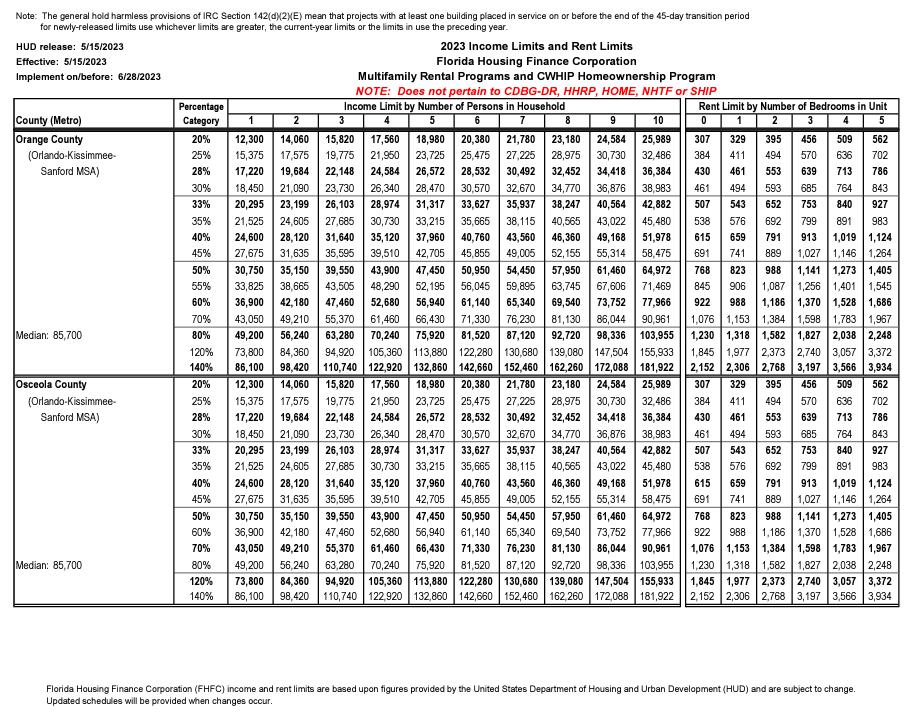

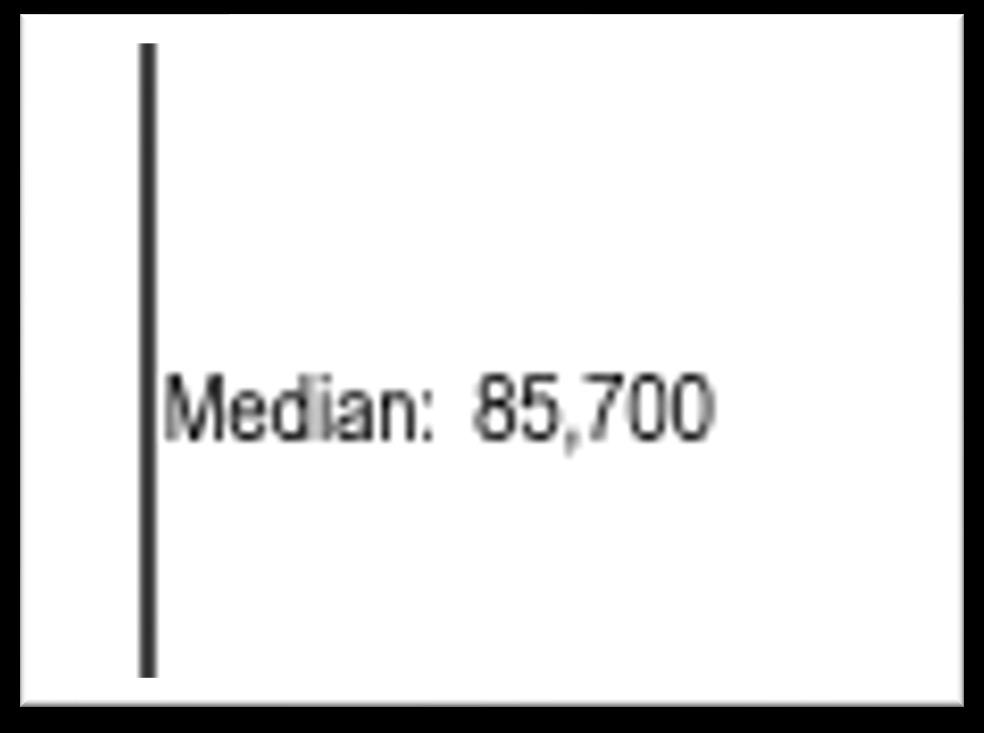

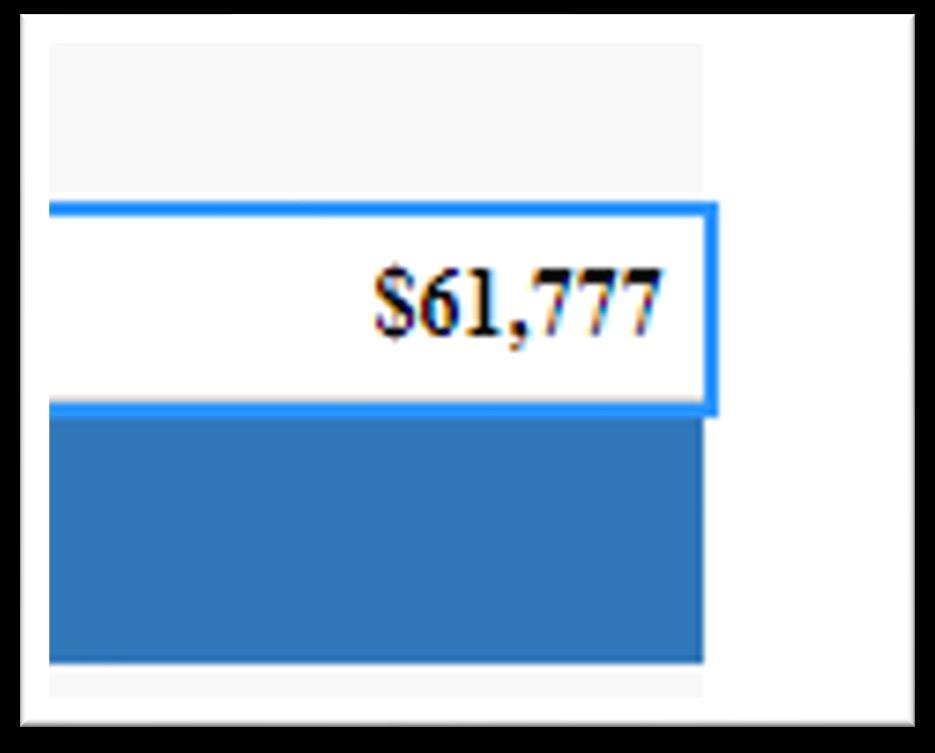

420.0004 Definitions.—As used in this part, unless the context otherwise indicates:

(3) “Affordable” means that monthly rents or monthly mortgage payments including taxes, insurance, and utilities do not exceed 30 percent of that amount which represents the percentage of the median adjusted gross annual income for the households as indicated in subsection (9) [for “Extremely-low-income persons”], subsection (11) [for “Low-income persons”], subsection (12) [for “Moderate-income persons”], or subsection (17) [for “Very-low-income persons”].

(9) “Extremely-low-income persons” means one or more natural persons or a family whose total annual household income does not exceed 30 percent of the median annual adjusted gross income for households within the state. The Florida Housing Finance Corporation may adjust this amount annually by rule to provide that in lower income counties, extremely low income may exceed 30 percent of area median income and that in higher income counties, extremely low income may be less than 30 percent of area median income.

(11) “Low-income persons” means one or more natural persons or a family, the total annual adjusted gross household income of which does not exceed 80 percent of the median annual adjusted gross income for households within the state, or 80 percent of the median annual adjusted gross income for households within the metropolitan statistical area (MSA) or, if not within an MSA, within the county in which the person or family resides, whichever is greater.

(12) “Moderate-income persons” means one or more natural persons or a family, the total annual adjusted gross household income of which is less than 120 percent of the median annual adjusted gross income for households within the state, or 120 percent of the median annual adjusted gross income for households within the metropolitan statistical area (MSA) or, if not within an MSA, within the county in which the person or family resides, whichever is greater.

(17) “Very-low-income persons” means one or more natural persons or a family, not including students, the total annual adjusted gross household income of which does not exceed 50 percent of the median annual adjusted gross income for households within the state, or 50 percent of the median annual adjusted gross income for households within the metropolitan statistical area (MSA) or, if not within an MSA, within the county in which the person or family resides, whichever is greater.

($85,700 x 120%) = $102,840

$102,840 x 30% = $30,852

$30,852/12 = $2,571 monthly rent

What is Missing?...

Does “any area zoned for commercial, industrial, or mixed use” include Planned Developments?

a. Many cities will argue “no,” because PD is a negotiated, contractual zoning category and courts should not interpret statutes so as to impair contracts;

b.Some cities will say “no,” and allow lawsuits to delay the matter until a legislative fix excludes PDs;

c. Developers will argue the statute is remedial and must be liberally interpreted.

d. If the answer is “yes,” and the Act includes PDs, does entitlement to construct affordable housing extend to the entire Planned Development, or only those portions where commercial, industrial, or mixed uses are planned under the adopted LUP?

Is a golf course a “commercial” use under the local government code, which would mandate affordable housing?

What if the golf course is zoned “recreational” but operates as a for-profit business? What if its operates as a non profit country club?

Does the local government typically consider “Recreational” zoning a “commercial” use?

For example, the zoning would allow commercial, industrial, or mixed uses, but the Comprehensive Plan is still zoned agriculture and was never updated. The zoning is nonconforming. Is affordable housing mandated?

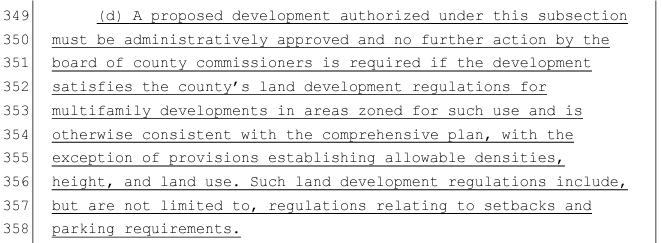

Non-Conforming Use Under Comp Plan Is Insufficient But Local Gov’t Can Enforce Setback, Parking and other Land Development Regs for Multifamily Development

Unanswered Legal Question— How will Local Governments Enforce the 30 year requirement?

1.Municipalities could require yearly reporting to ensure each development meets the 40% affordable housing threshold;

2.If units revert to market rates, municipalities could use their code enforcement powers.

3.Is each unit a separate violation, for which a $250/daily fine could issue?

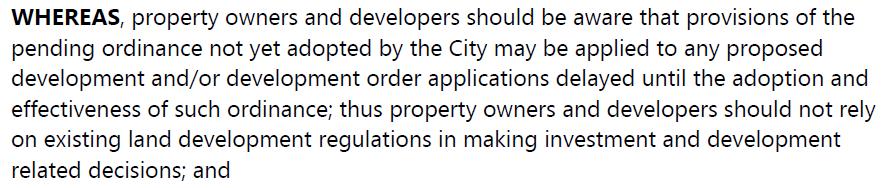

“[T]he city commission had directed the department to go forward with the drafting of appropriate ordinances. Hence, the new ordinances were applicable to appellants' property.”

383 So. 2d 681, 689 (Fla. 2d DCA 1980).

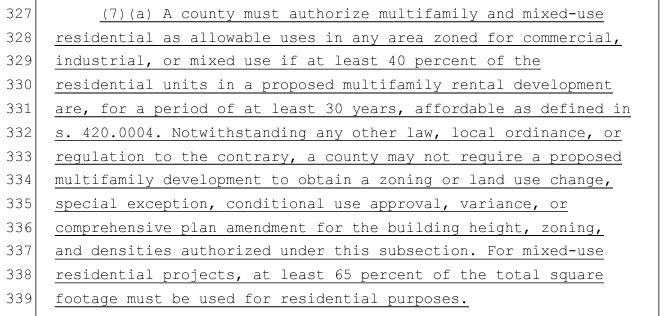

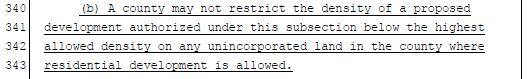

County:

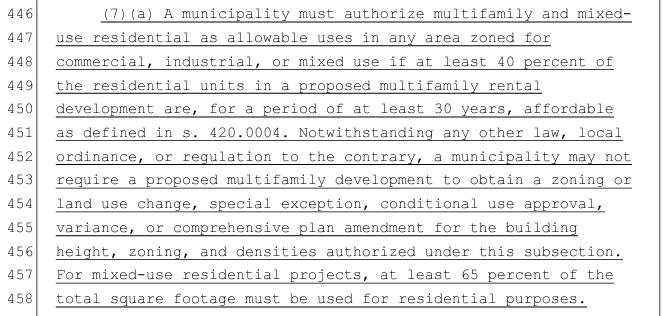

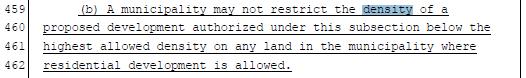

Municipality:

What

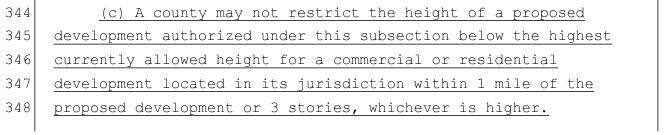

1. “Currently allowed” at the time of the Act’s enactment?

2. Or at the time of the application for affordable housing?

If the latter then the 1 mile radius can expand continually, with a new 1 mile radius established for each new multistory affordable housing project.

1 mile

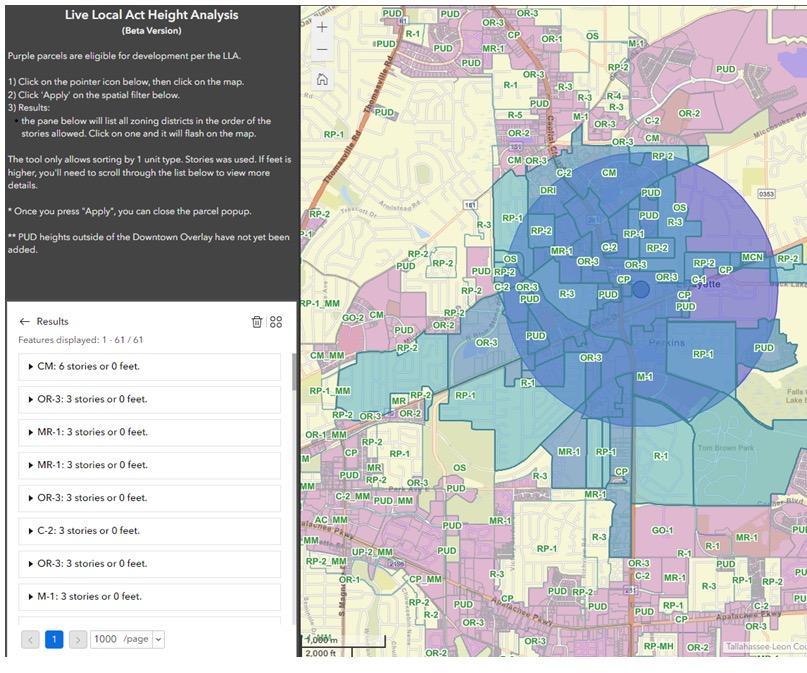

Beta Version: “An estimating tool”

County:

Municipality:

…and the local government can define “major transit stop.”

Live Local Act & Community Development

July 26th, 2023

Daphne Green, AICP

East Central Florida Regional Planning Council

• The East Central Florida Regional Planning Council (ECFRPC) was founded in 1962

• One of 10 Regional Planning Councils in Florida

• Provides technical assistance services to communities and organizations within its 8county region

• Areas of Expertise:

• Planning and Technical Assistance

• Resilience

• Economic Development

• Emergency Management

• Geographic Information Services

Senate Bill 102 filed on 1/26, signed into law on 3/29

• $811 total for affordable housing

• State Apartment Incentive Loan Program

(SAIL) - $259M

• State Housing Initiatives Partnership Program

(SHIP) - $252M

• Florida Hometown Hero Program - $100M

• New Inflation Response Program - $100M

• Live Local Tax Donation Program - $100M

Senator Alexis Calatayud

Rep. Demi Busatta Cabrera

Senate President Passidomo

Senator Alexis Calatayud

Rep. Demi Busatta Cabrera

Senate President Passidomo

• Three new property tax exemptions

• New sales tax refund on building materials

• Live Local Corporate Tax Donation Program

LLA Property Tax Exemptions

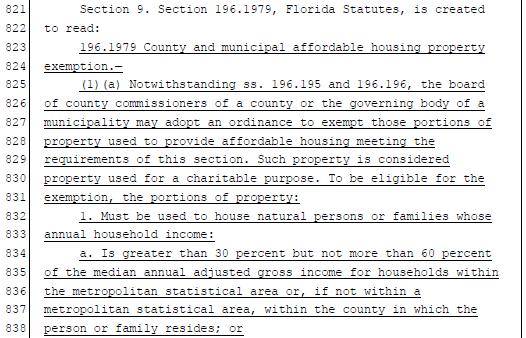

Local Government Affordable Housing Property Tax Exemption

Nonprofit Property Tax Exemption

New option for local governments to provide tax exemptions for projects with at least 50 units, and at least 20% are affordable, to households at or below 60% AMI

Tax incentives for non-profit owned land, leased for minimum of 99 years and made affordable to households up to 120% AMI

Multifamily Property Tax Exemption

Property tax exemption for MF projects with more than 70 affordable units for households up to 120% AMI

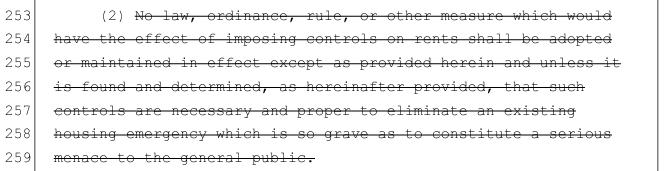

• Bans rent control

• Preempts critical land development regulations

• Time limits for building permit applications

“Stateandlocalgovernmentsshallprovide incentivestoencouragetheprivatesectortobethe primarydeliveryvehicleforthedevelopmentof affordablehousing”

Florida Supreme Court decides not to take up Orange County rent control fight

Rent control isn’t coming to Orange County after all.

Retrieved from the Orlando Weekly

Retrieved from the Orlando Weekly

Orange County Commissioner Bonilla worries about 'sabotage' of Office of Tenant Service's mission – Orlando Sentinel

Orange County Commissioner Bonilla worries about 'sabotage' of Office of Tenant Service's mission – Orlando Sentinel

Source: Florida Housing Coalition Sadowski Affiliates Webinars

Regulatory barriers can negatively impact housing development

NIMBY

ShortTerm Rentals

Many Mobile/RV Parks

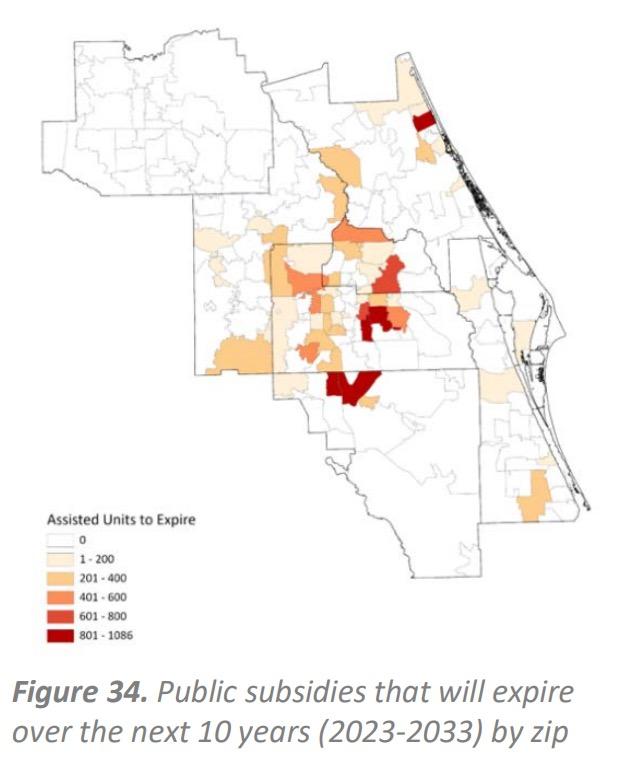

Affordable housing being lost at high rates

Rent hikes and difficult landlords increase eviction rates

Cost Burden Homeless ness

Sprawl compounds housing and transportation costs

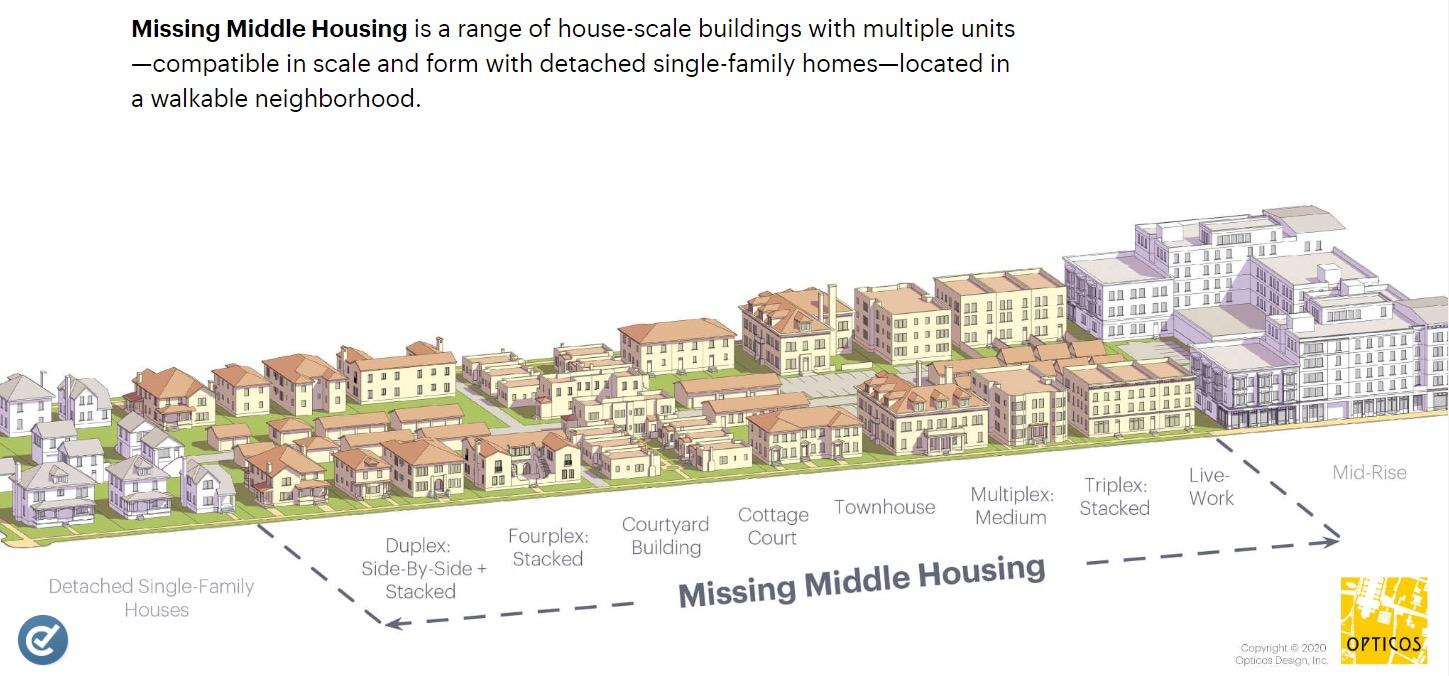

Difficult to find developers for affordable / ADU / missing middle housing

Need for more density

Few housing experts on staff

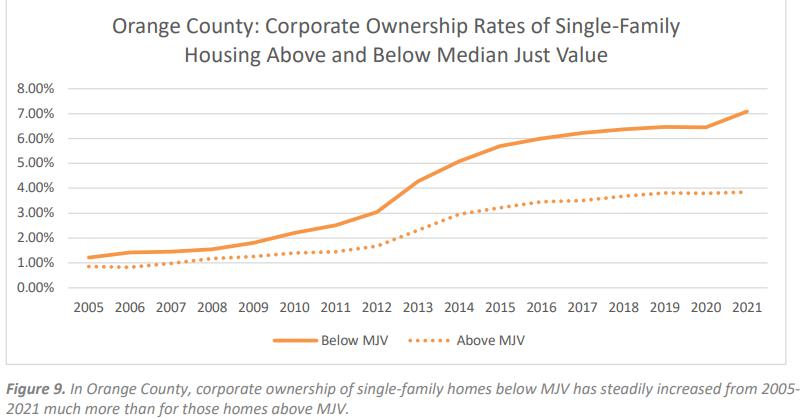

Private corporations and investors buying up housing units for higher rents

Regulatory barriers that make residential development take longer or cost more

State preemptions

Enables quicker development with no need for land use amendments

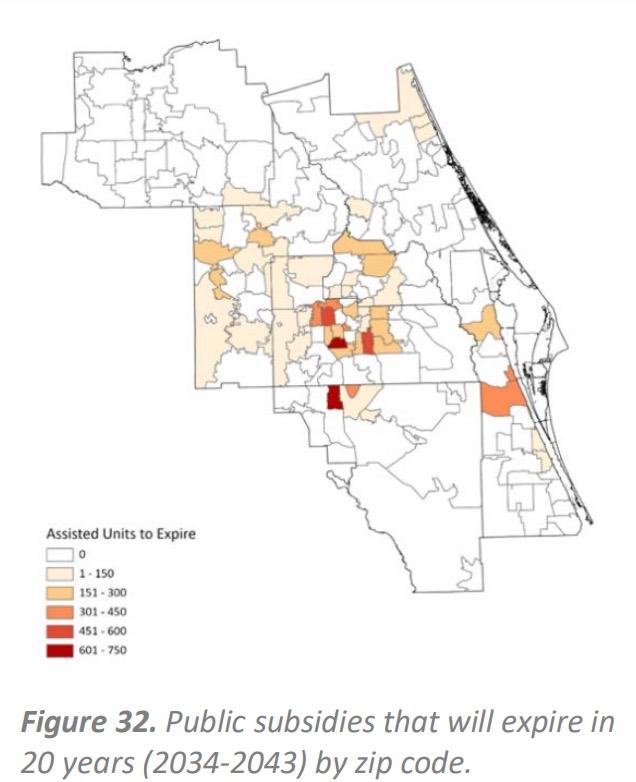

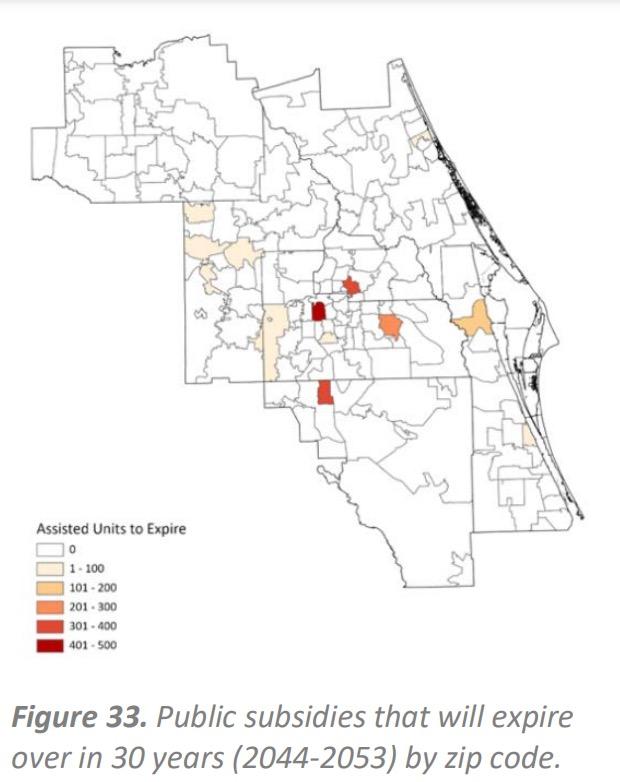

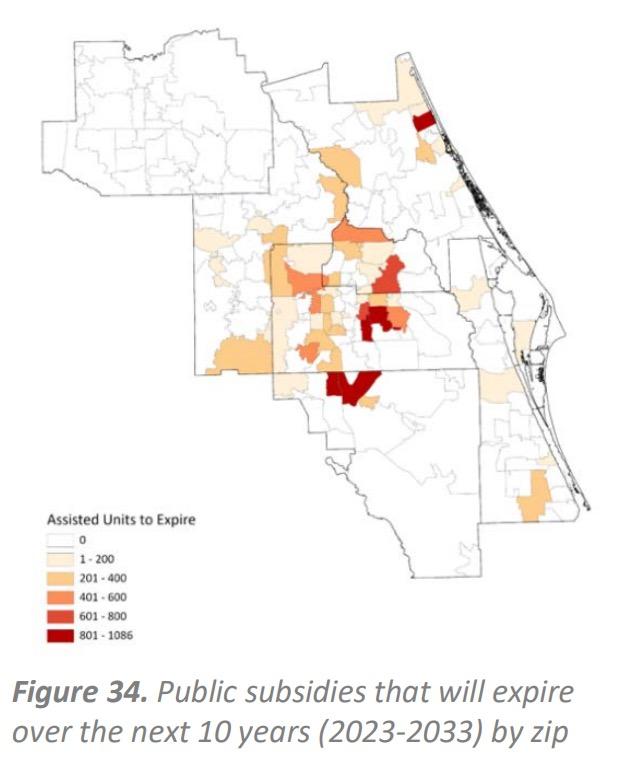

Loss of existing subsidized affordable housing units

Will be determined if development fails to provide units for extremely low-income residents

Sprawl compounds housing and transportation cost burden

May create mixed-use or residential development in unsuitable places

High prevalence of rent increases, difficult landlords, and evictions

Increase in short-term rentals and private corporations buying up housing supply

Difficulty finding affordable / ADU / Missing Middle residential developers

Will increase number of local landlords and market-rate rental units

Fully funds each state affordable housing program and promotes use of public lands for affordable housing development

Encourages infill, mixed-use, and transit-oriented development while expanding the Florida Job Growth Grant Fund

Will increase number of affordable housing units and address causes of higher housing costs

May encourage increased investment and number of STRs

State funds are only allowed to jurisdictions whose comp plans are compliant with Ch. 163, comp plan can be used to address issues

Private sector will likely prefer developing apartments

Supports innovative housing and providing affordable housing incentives to help offset costs

NIMBYism

Few housing experts on staff

Loss of public workshops required by land use amendments

More dense and affordable housing

10-day rule on permit applications

Provides new sources of technical assistance for local governments

Housing Production And Rehabilitation Programs

• Incentivize development and long-term affordability

• Increase public-owned lands

• Community-led planning

• Increase housing density

• Mixed-income projects

• Innovative housing

Public-private Partnerships

• Emphasizes data development to assess affordable housing activities

• Training and technical assistance from state

• Provide incentives for development

Preservation Of Housing Stock

Unique Housing Needs

• Housing rehabilitation programs

• Neighborhood revitalization efforts

• Enhanced quality of life for individuals and families

• Promote self-sufficiency of seniors and disabled

• Provide a range of housing options to support special needs populations

• Fair housing

• Rural and urban

• Bolster existing programs

Source: Congress for the New Urbanism

• Missing Middle Housing

• Mixed-Use Residential

• Infill Residential

• Built to Rent

• ADU’s

• Tiny Homes

• Manufactured Homes

• Consider strategies for improving renter’s housing stability

• Tenant Bill of Rights (HUD)

• Just Clause Eviction policy

• Landlord education and eviction prevention programs

• Consider strategies for improving renter’s housing stability

• Tenant Bill of Rights (HUD)

• Just Clause Eviction policy

• Landlord education and eviction prevention programs

Figure retrieved from report Critical Housing Assets and Compounding Vulnerabilities: Short-Term Rentals and Investor-Owned Properties in the ECFR2C Region

Figure retrieved from report Critical Housing Assets and Compounding Vulnerabilities: Short-Term Rentals and Investor-Owned Properties in the ECFR2C Region

• Comprehensive Planning and Land Development Regulations*

– State preemptions: Identify all relevant properties and LDRs

– Expand housing policies

• Definitions for housing strategies

• Right of first refusal, inclusionary housing, tenant protections

• Minimum lot size requirements, parking requirements

– Support infill and infrastructure projects to preserve conservation lands

• Create and manage Inventory of Public Lands*

• Review and amend as needed local incentives for affordable housing (expedited processing of building permits)

• Ensure staff capacity to address building permits in timely manner*

• Consider utilizing TA or creating a Housing Task Force

• Housing Plans

– Better incorporate new and existing housing data

– Develop new housing mitigation strategies

– Align policies with new State Housing Strategy

• Community-led planning

• Public-private partnerships

• Unique housing needs

• Regional Planning Councils

• Florida Housing Coalition

• Florida Housing Finance Corporation

• HUD

• Policy and Data Repositories

• Shimberg Center for Housing Studies

• Local Housing Solutions

• Urban Land Institute’s Terwilliger Center for Housing

• Congress for the New Urbanism

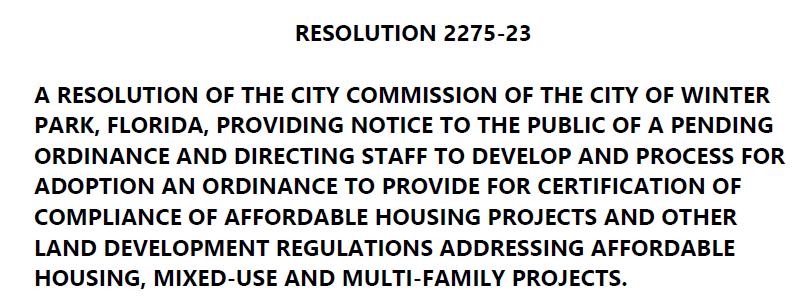

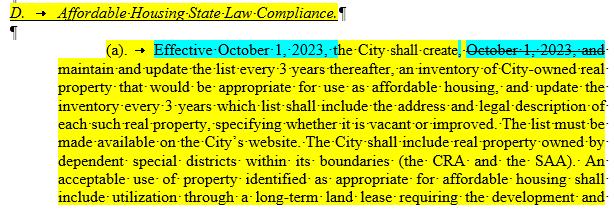

Process Land Use Provisions

• Pre - emptions on location

• Parking and Transit

• Local Inventory of Lands

• Definitions

• Other rules still apply

• Expedited processes

• Amendments cannot be required

• Tree permitting

• Home occupations

• Short term rentals

• Medical Marijuana

• Housing

• 40% of the residential units are at or below

120% AMI

• Note: units must remain affordable for 30 years

• If a project is mixed-use, 65% of total sq. ft. must be for residential purposes.

• Can be built on any land zoned commercial, industrial, or mixed - use.

• Can have same building height as any residential or commercial projects within one mile, or three stories, whichever is higher.

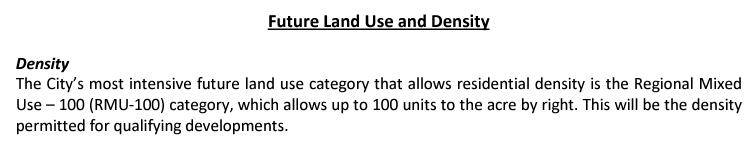

• Can have same density as highest residential density allowed within the jurisdiction.

• Project applications must be approved administratively, with no regulatory changes required.

• Parking may be reduced if a development is located within a half mile of a transit stop.

• 40% of the residential units are at or below

120% AMI

• Note: units must remain affordable for 30 years

• If a project is mixed-use, 65% of total sq. ft. must be for residential purposes.

Municipal Exemption

• If a Municipality has less than 20% of it’s land dedicated to commercial or industrial, than only mixed - use projects apply.

• If a project qualifies

• Can be built in commercial, industrial, mixed-use zoning

• No amendments required

• Must be approved administratively

• Safety of residential in industrial district

MORE THOUGHTS

• FAR requirements?

• Architecture requirements

• Existing heights and special exceptions

A FEW MORE THOUGHTS

• Who provides the information?

• Who monitors the affordable units?

• Public participation

• GIS capabilities

• What other rules are still in play?

• Staffing issues

• Definitions

• Projects are “one size fits all”?

• All other bulk requirements are still in play (setbacks, parking, FAR, etc.)

• Other requirements are still in play (transportation, school concurrency, etc.)

• GIS Maps of Commercial & Industrial Land

• Review all bulk requirements

• GIS maps of building heights

• Setbacks, landscape buffers, architecture, etc.

• Create your processes

• Files of all special approvals related to and density

• Consider other zoning toolkit options for

• Inventory of all municipal land

• Update all definitions

• Urban infill, “major transit stop”, mixed -use, etc.

• Public land inventory “appropriate for use as affordable housing”.

• Work closely with developers of affordable product.

• Inventory required by 10/1/2023 and must be updated every three years

• Policies and procedures for process expedition must be published online.

• Other ways to involve the public.

• Review your ordinances, and how they should be adjusted to accommodate residential where it wasn’t previously considered.

• Know your processes and how you plan to attack every application. Time is of the essence and transparency is required.

• Very similar thoughts to the local side (“visible confusion”)

• This is a work in progress.

• Collaborate with local partners.

• Projects may be expedited, but they may also be much more complex.