Funding & property tax incentives

• Record amount of funding for affordable housing programs – SHIP and SAIL fully funded

• Missing middle property tax exemption - (s. 196.1978(3)

• Nonprofit land exemption for affordable housing - s. 196.1978(1)(b)

• Local option property tax exemption - s. 196.1979

Land use tools

• Mandate for AH in commercial, industrial, and mixed-use zones (ss. 125.01055(7)/166.04151(7)

• Optional land use tool (ss. 125.01055(6)/166.04151(6)

Publicly owned land

• Identifying public land “appropriate” for affordable housing (ss. 125.379/166.0451)

• Using public land for permanently/long-term public good

Other innovative housing solutions

• Zoning reforms to allow more homes by-right

• Local incentive programs

• Guided growth

• Innovative building techniques

Mandate contains certain use, density, height, floor area ratio, administrative approval, parking, and other standards for affordable housing developments if a proposed development meets the following criteria:

• Multifamily or mixed-use residential in any area zoned for commercial, industrial, or mixed use

• At least 40% of units are affordable rentals for households up to 120% AMI for at least 30 years

• If mixed-use, at least 65% of the total square footage must be residential

Local government cannot require a development authorized under this preemption to obtain a zoning/land use change, special exception, conditional use approval, variance, or comp plan amendment for use, density, floor area ratio, or height.

Use

• Multifamily or mixed-use areas zoned for commercial, industrial, or mixed-use without zoning or land use change

Density

Height

• Highest currently allowed density on any land in City or County where residential development is allowed

• Highest currently allowed height for a commercial or residential development within 1 mile of the proposed development or 3 stories, whichever is higher

• Exception – if proposal is on two or more sides adjacent to SF zoned property within SF home development w/ at least 25 contiguous SF homes, local gov’t. may limit height to the highest of the following:

•150% of tallest building adjacent to development

•Highest currently allowed height for the property based on LDRs

•3 stories

Floor Area

Ratio

Parking

• 150% of the highest currently allowed floor area ratio in the jurisdiction where development is allowed under the jurisdiction’s LDRs

Admin.

Approval

• Reduction of at least 20% if proposal is 1) within ½ mile of a “major transportation hub”; and 2) has available parking within 600 feet

• Elimination of parking requirements if proposal within an area recognized by the jurisdiction as a transit-oriented development or area

• LG must “consider” reducing parking if project within ¼ mile of a transit stop as defined by the local code

• Proposal must be administratively approved if proposal satisfies the LDRs and is otherwise consistent with the comp plan excepting density, floor area ratio, height, and use.

• Local govt must post expectations for admin approval on its website.

• If proposal also qualifies for a local entitlement bonus, bonus must be provided administratively.

• Parcels within a certain proximity to an airport runway.

• Admin approval not allowed for parcels within ¼ mile of a military installation as defined in in s. 163.3175(2).

Was Live Local a one-time thing?

Or did it mark a new era in how the state legislature approaches housing policy?

of the affordable

bills filed as of 2/25/25

HB 923: Housing (Lopez, V.)*

HB 943: Real Property and Land Use and Development (Lopez, V.)*

SB 184/HB 247: Affordable Housing (Gaetz/Conerly)

HB 701: Local Housing Assistance Plans (Stark)

HB 411/SB 488: Affordable Property Ad Valorem Tax Exemption for Leased Land

HB 365/SB 382: Rent of Affordable Housing Dwelling Units

HB 401/SB 634: Residential Land Use Regulations

HB 579: Development Permits and Orders

HB 393/SB 592: My Safe Florida Condominium Pilot Program

HB 853: Home Hardening

SB 948: Real Property and Condominium Flood Disclosures

SB 140/HB 123: Education

• Widely expected to be this session’s vehicle for tax policies related to affordable housing

• Amends several existing affordable housing property tax exemptions at s. 196.1978

• Extends the affordable housing property tax exemption for property owned by nonprofits to also include property owned by governmental entities

• Extends the nonprofit land exemption passed in Live Local to include property owned by governmental entities

• Amends the “Multifamily Middle Market” Property Tax exemption from the Live Local Act

• Expands eligibility from multifamily developments with 71+ affordable units to multifamily projects with only at least 1 affordable unit

• Creates new pre-approval process

• Makes it more difficult for taxing authorities to opt out of the 80-120% AMI exemption

• Amends the local option property tax exemption at s. 196.1979

• Expands the use of the infrastructure surtax for affordable housing purposes

• Widely expected to be this session’s vehicle for land use polices related to affordable housing

• Yes-in-God’s-Backyard (YIGBY) Reforms – requiring local governments to allow religious institutions to build affordable housing on their land without needing a zoning/land use change

• Lots of amendments to the LLA land use mandate for AH in commercial, industrial, and mixed-use areas, including:

• Newly defines “commercial use,” “industrial use,” “planned unit development”, “areas zoned for mixed use”

• Expands application to any sites owned by a city or county, a district school board, religious institution as defined in s. 170.201(2), any planned unit development with commercial, industrial, and mixed-use allowances, and any zoning district not zoned solely for use as a single-family home or duplex.

• Prevents local governments from directly or indirectly limiting the density, height, FAR, maximum lot size allowed by statute

• More amendments to the LLA land use mandate:

• Newly prevents local governments from directly or indirectly restricting the maximum lot size of a proposal below the max lot size allowed in the jurisdiction where MF and MU is allowed

• Requires local governments to reduce parking by at least 20% for LLA projects or 100% for structures that are 20,000 sq feet or less

• Requires local governments to post on its website a zoning map and zoning regulations in effect on 7/1/23

• Requires annual reporting to the state about the LLA land use tool

• Establishes a cause of action for property owners to sue local governments for violating the terms in the statute and requires expedited review

• Prohibits building moratoriums that impact affordable housing development

• Legalizes ADUs in all areas zoned for single-family housing, adds reporting requirements for ADUs, and ensures that homestead status is not lost if a homeowner rents an ADU

• Amends the FL Fair Housing Act to prohibit local governments from discriminating against affordable housing developments when making land use and permitting decisions – also waives sovereign immunity for cities and counties under this provision.

• Reduces impact fees by 20% for affordable housing developments authorized pursuant to s. 125.01055 or s. 166.04151.

• Prevents optional elements in a local government’s comprehensive plan from restricting the density or intensity established in the jurisdiction’s future land use element.

• Deems all residential land use categories to be compatible with each other in the Community Planning Act.

• Provides that any increase in height or FAR must be approved only by a simple majority vote of the city or county commission (not a supermajority vote).

• Creates an expedited foreclosure proceeding for abandoned real property.

• Requires school districts to use surplus land for affordable housing.

What is going to be Florida’s balance between state housing mandates and local action?

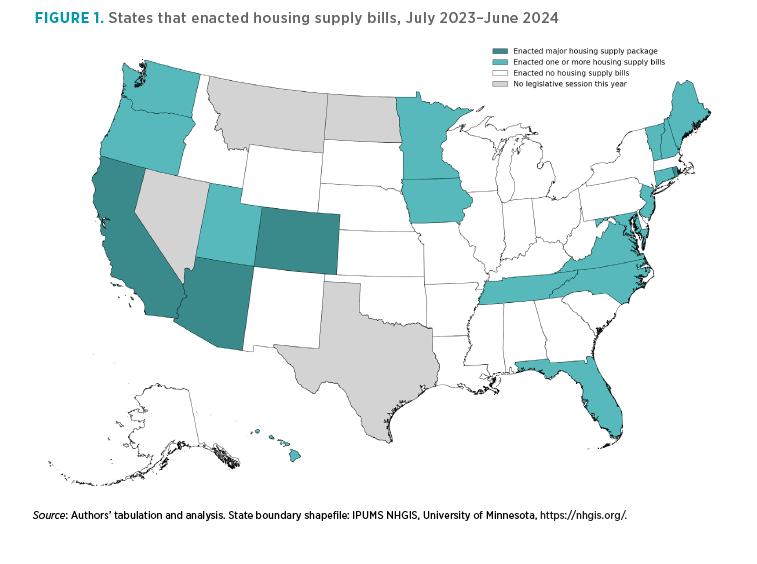

Source: Mercatus Center - Laying Foundations: Momentum Continues for Housing Supply Reforms in 2024