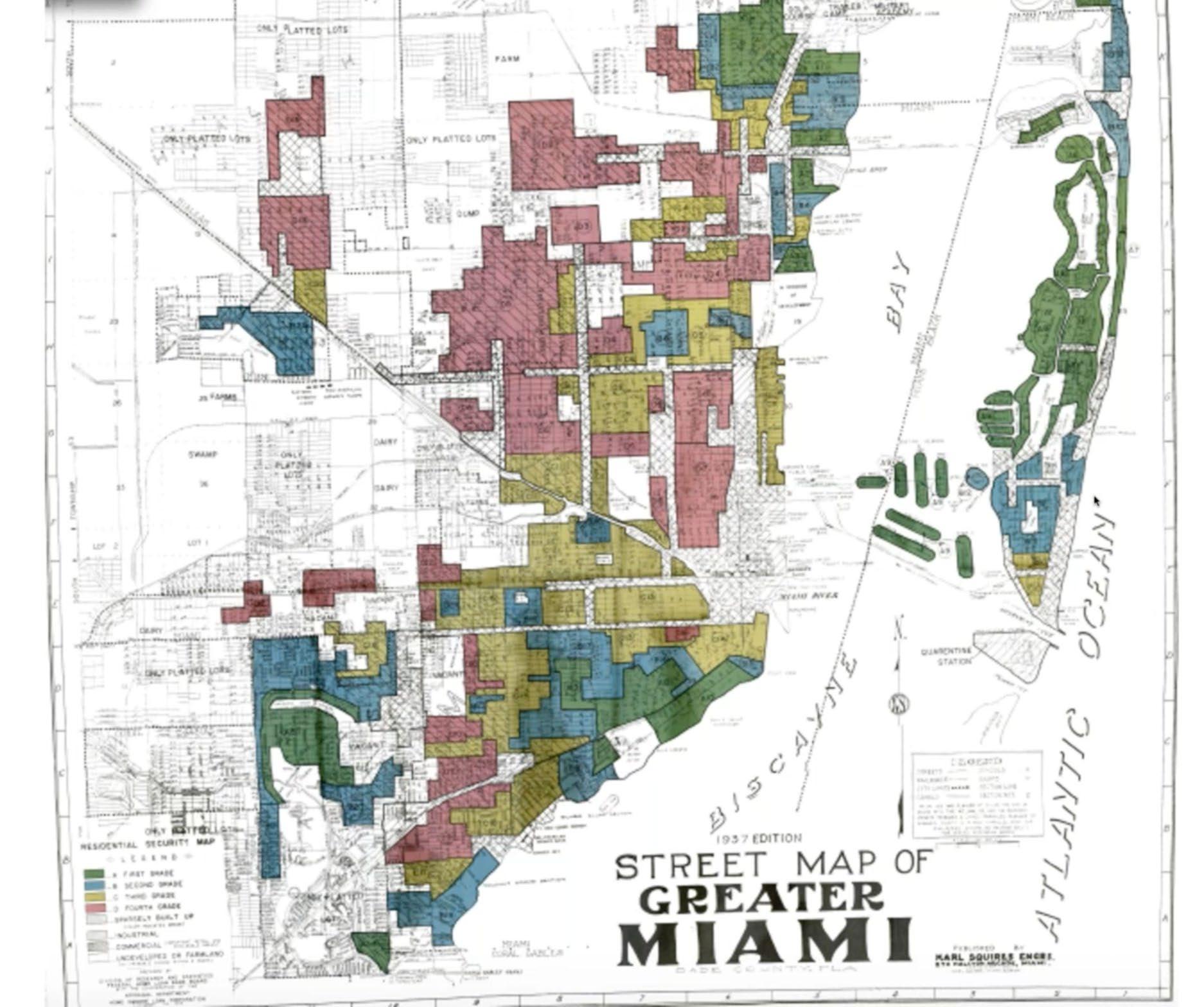

housing transportation

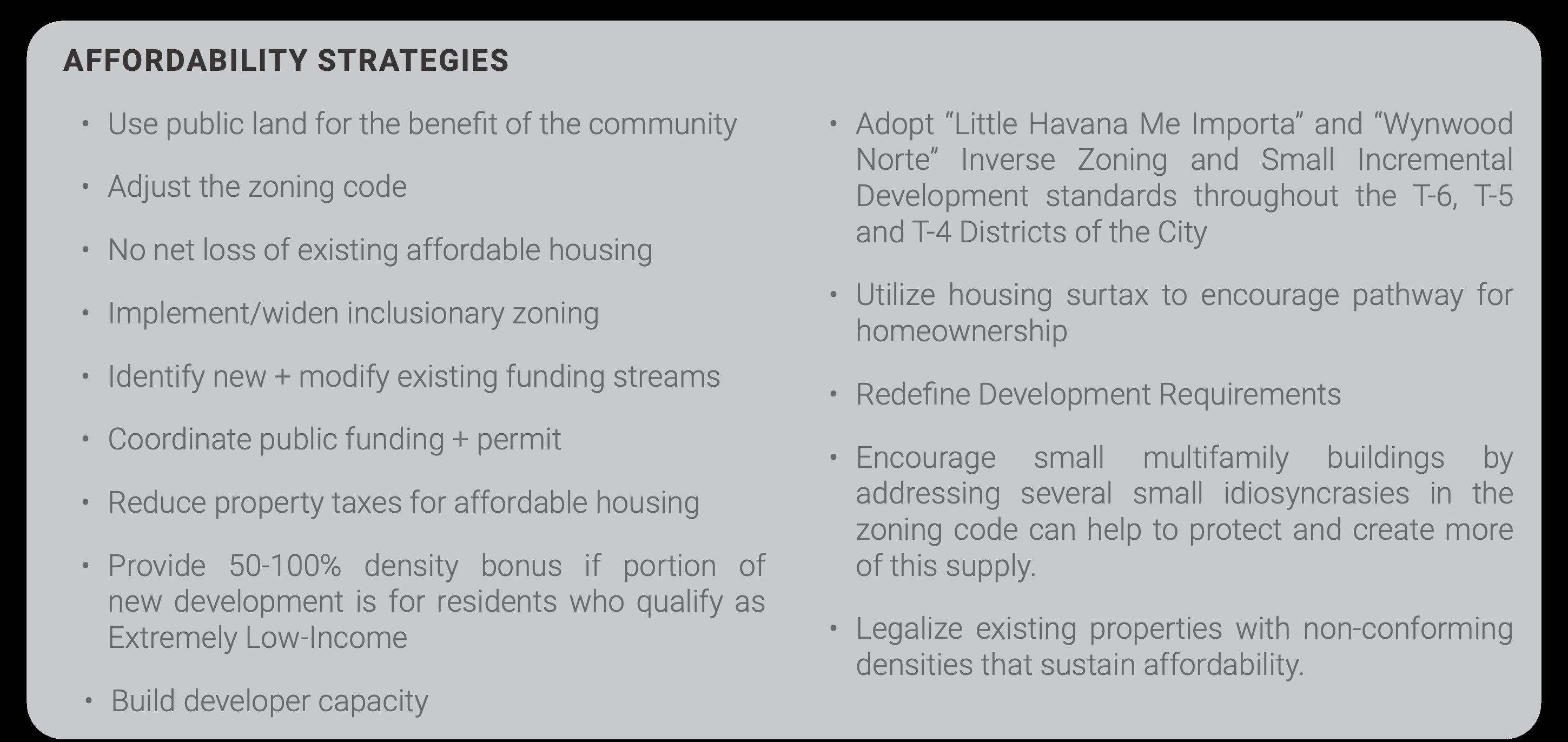

• IMPLEMENTATION IS A STAGE TWO FIGHT

• PARKING

• COMPREHENSIVE PLAN – Updates required to allow for changes

• DEVELOPMENT REGULATIONS

• ALL AT ONCE?

• Result - NO

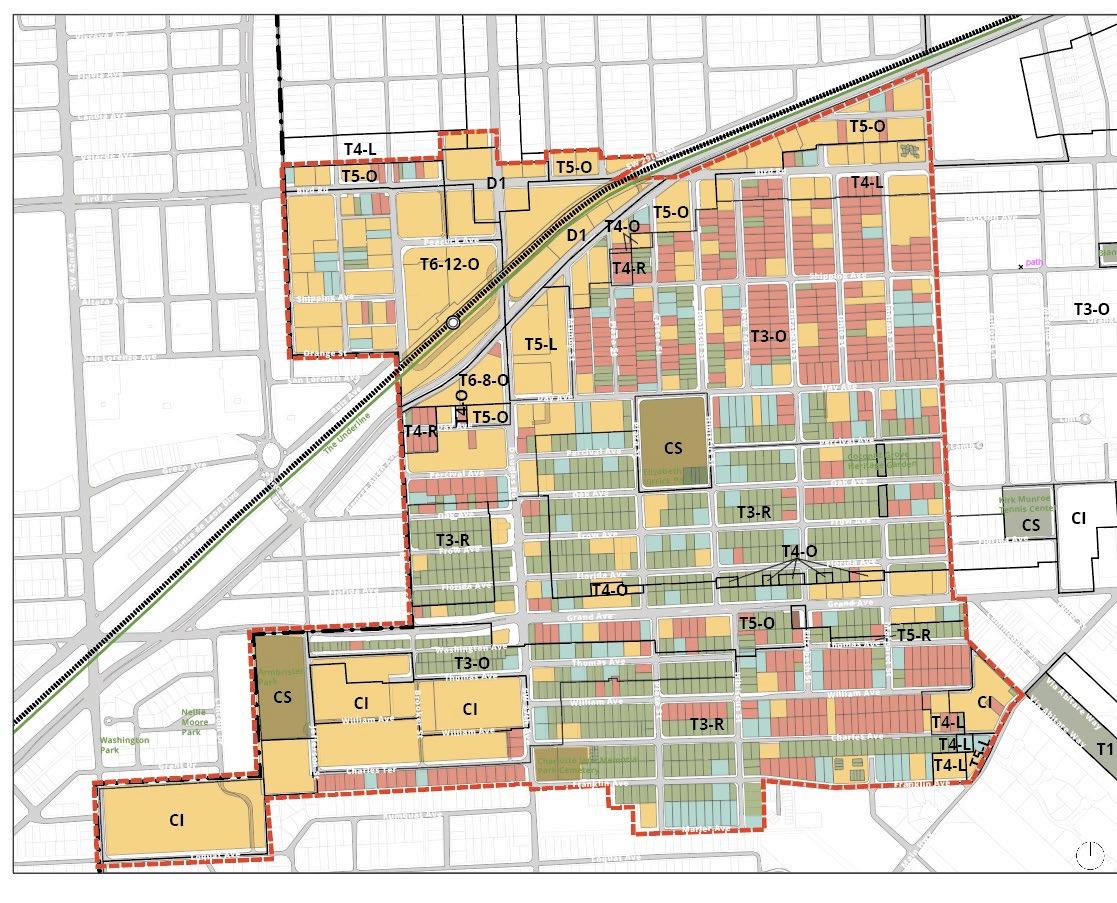

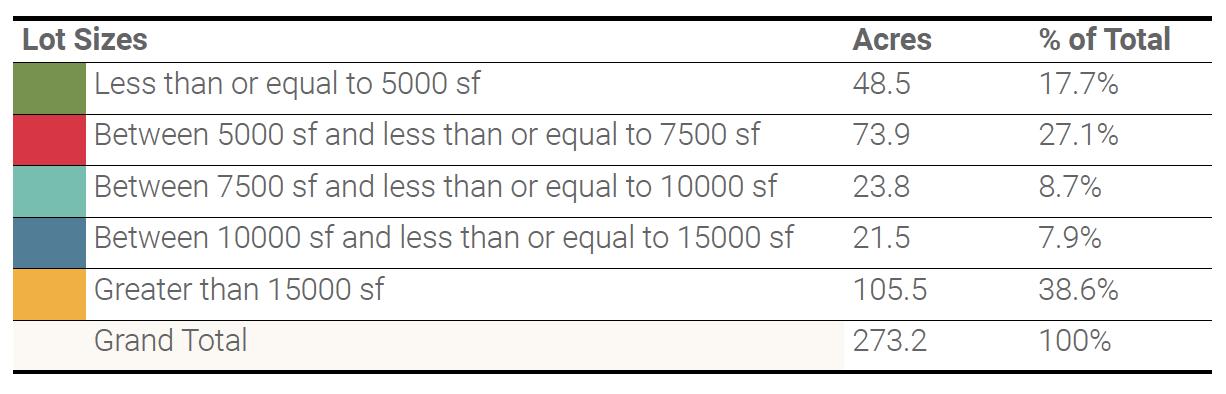

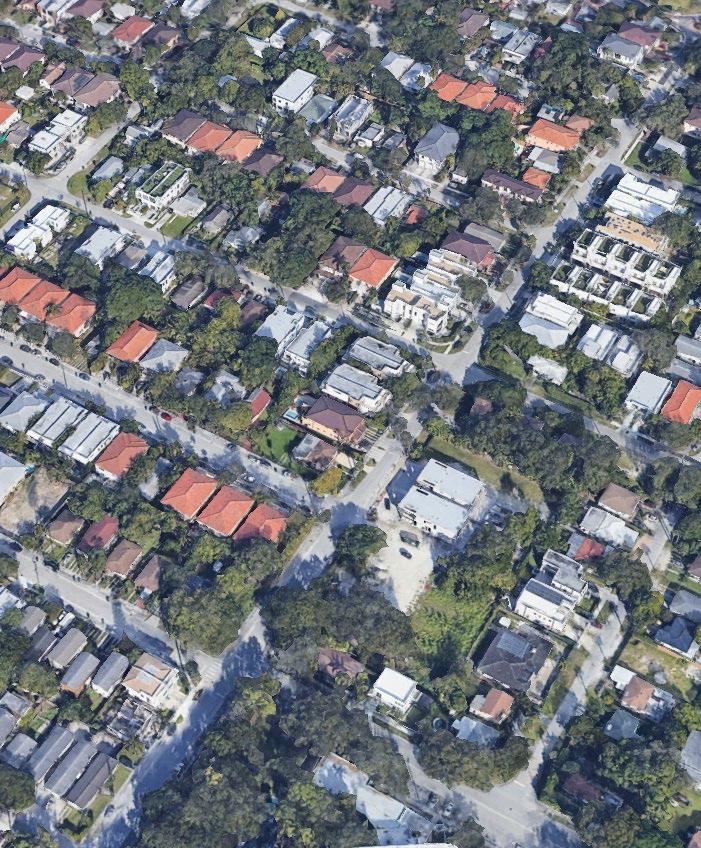

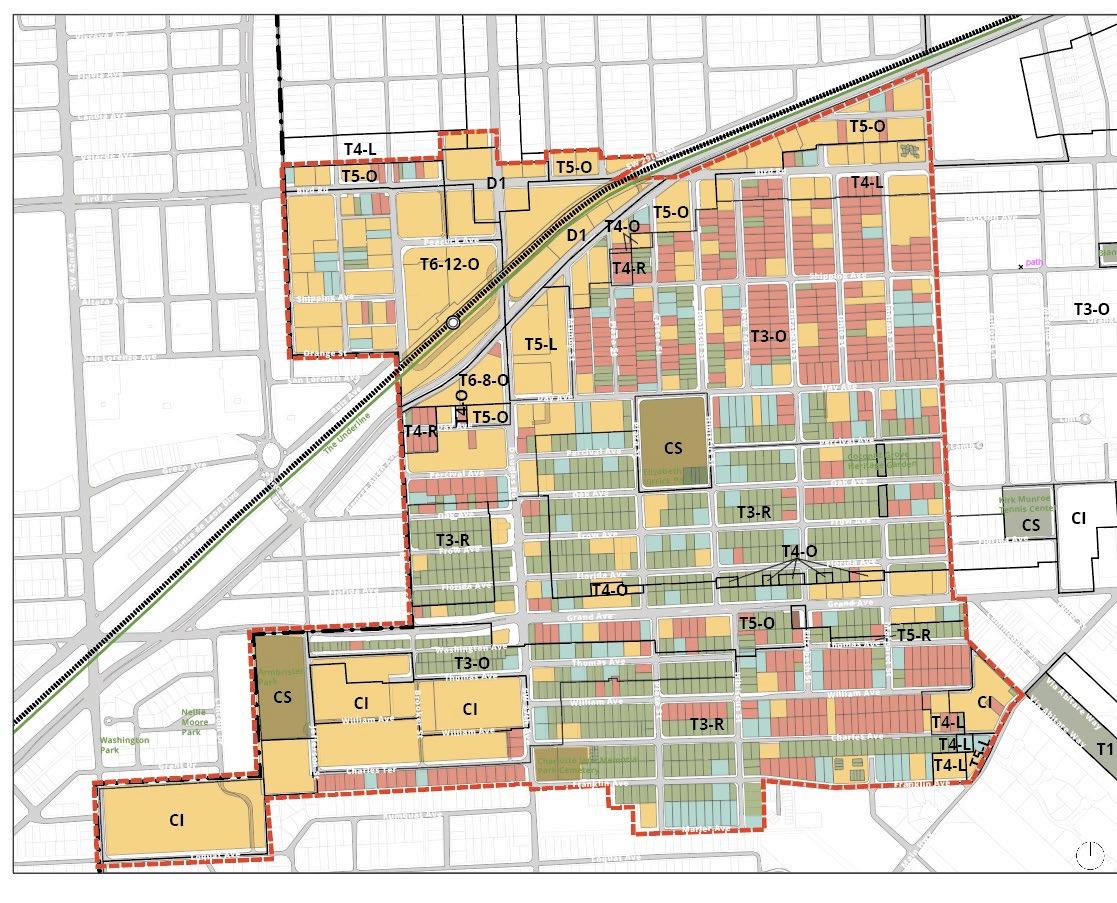

• CORRIDORS PRIORITIZED

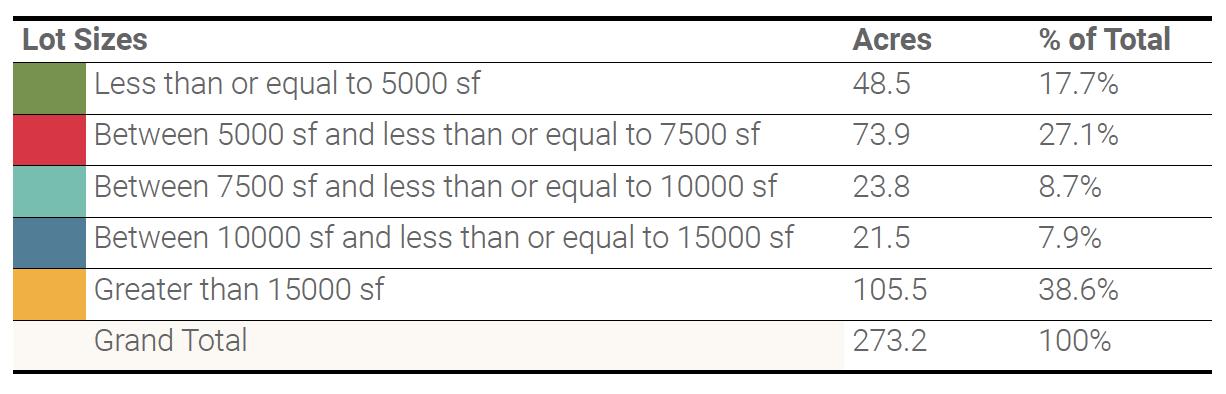

• But what about the single-family areas and less dense multifamily areas?

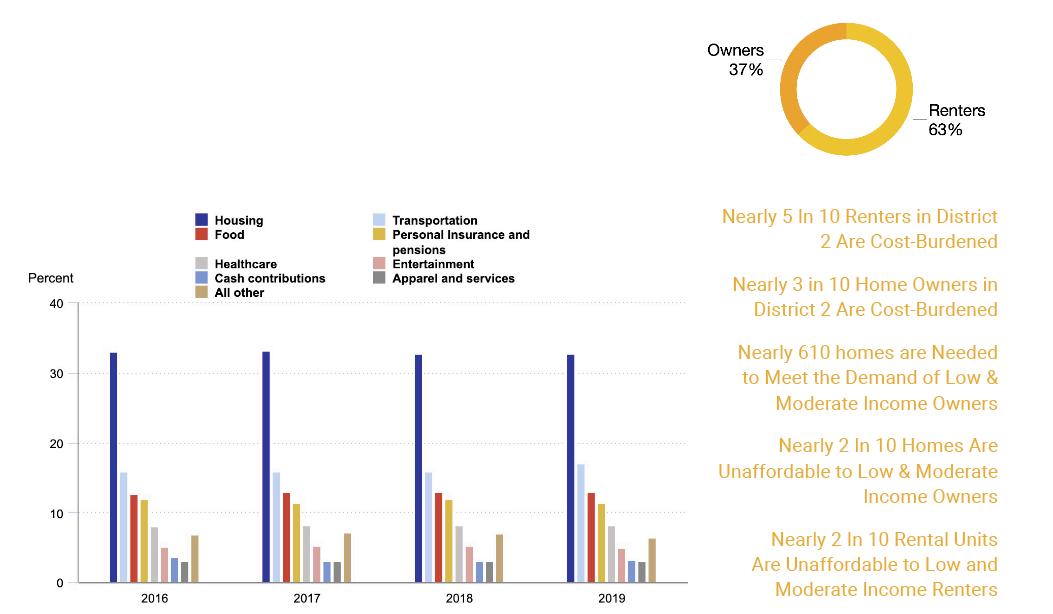

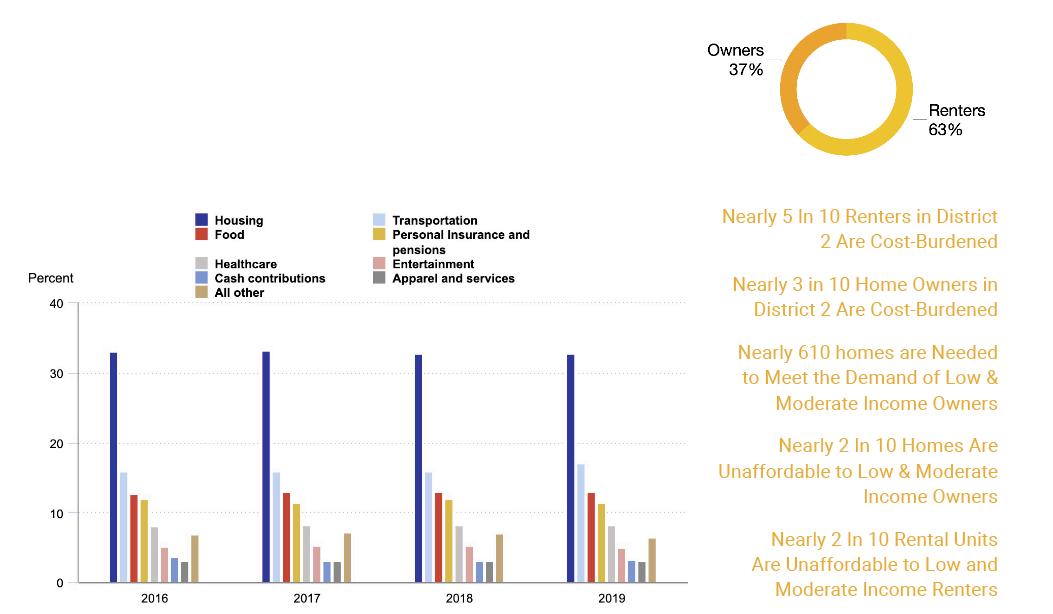

• Consider the impetus behind a lot of the recommendations.

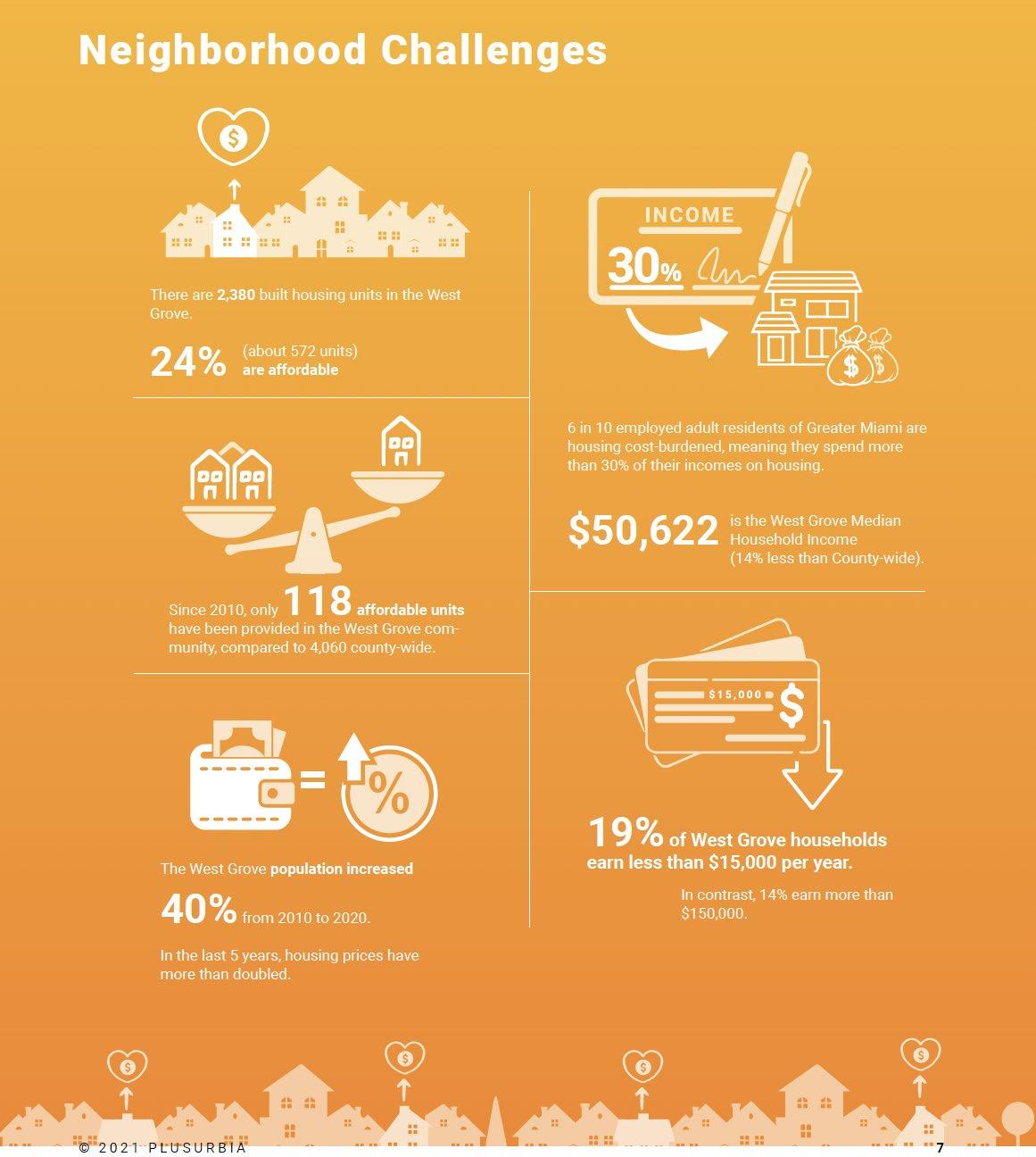

OBSTACLES AND CHALLENGES

• A local government cannot regulate the use, density, or height of an affordable housing development if project is:

• Multifamily or mixed-use residential in any area zoned for commercial, industrial, or mixed use;

• At least 40% of units are affordable for households up to 120% AMI for at least 30 years

• If mixed-use, at least 65% is residential

• Local government cannot require a development authorized under this preemption to obtain a zoning/land use change, special exception, conditional use approval, variance, or comp plan amendment for use, density, or height.

• Does not preempt site requirements.

• Setbacks

• Parking

• Concurrency

• Max lot coverage

• Etc.

THE LIVE LOCAL ACT

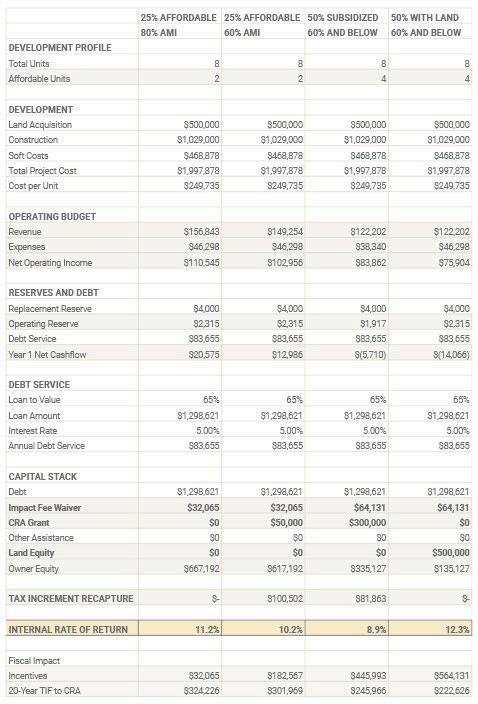

Does it really matter?

1. 40% rule – High threshold, but…current legislation as written DOES NOT require certain percentages based on AMI other than 120%.

2. What about what we have here?

It’s conditional, so it’s opt-in.

THE LIVE LOCAL ACT

It’s important to consider that the Live Local Act is based on”by-right” qualities.

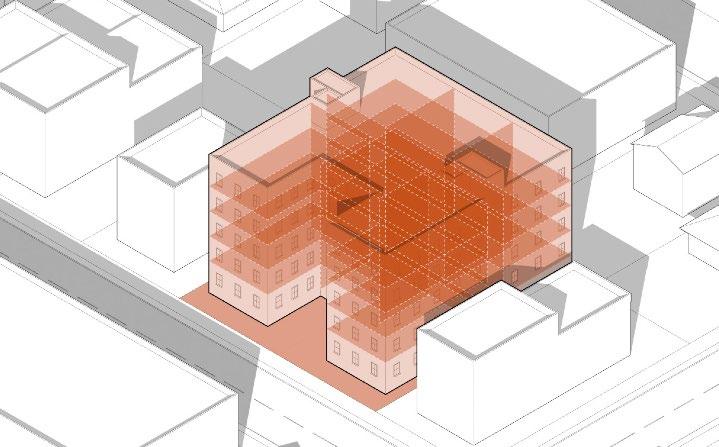

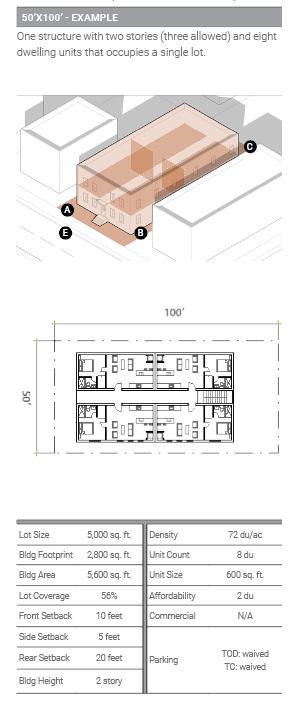

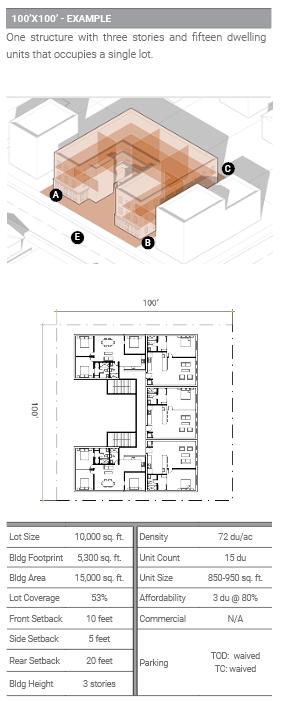

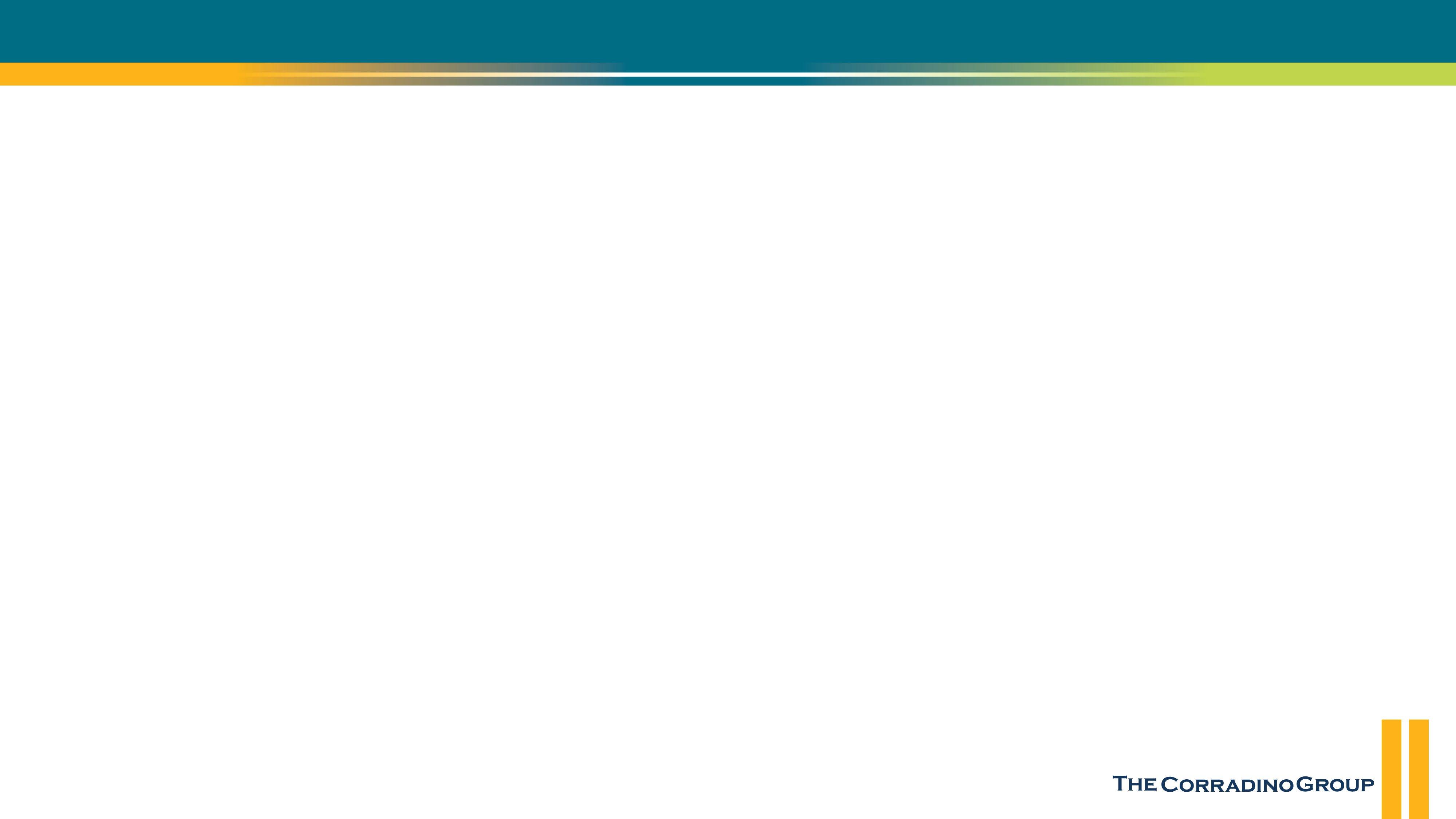

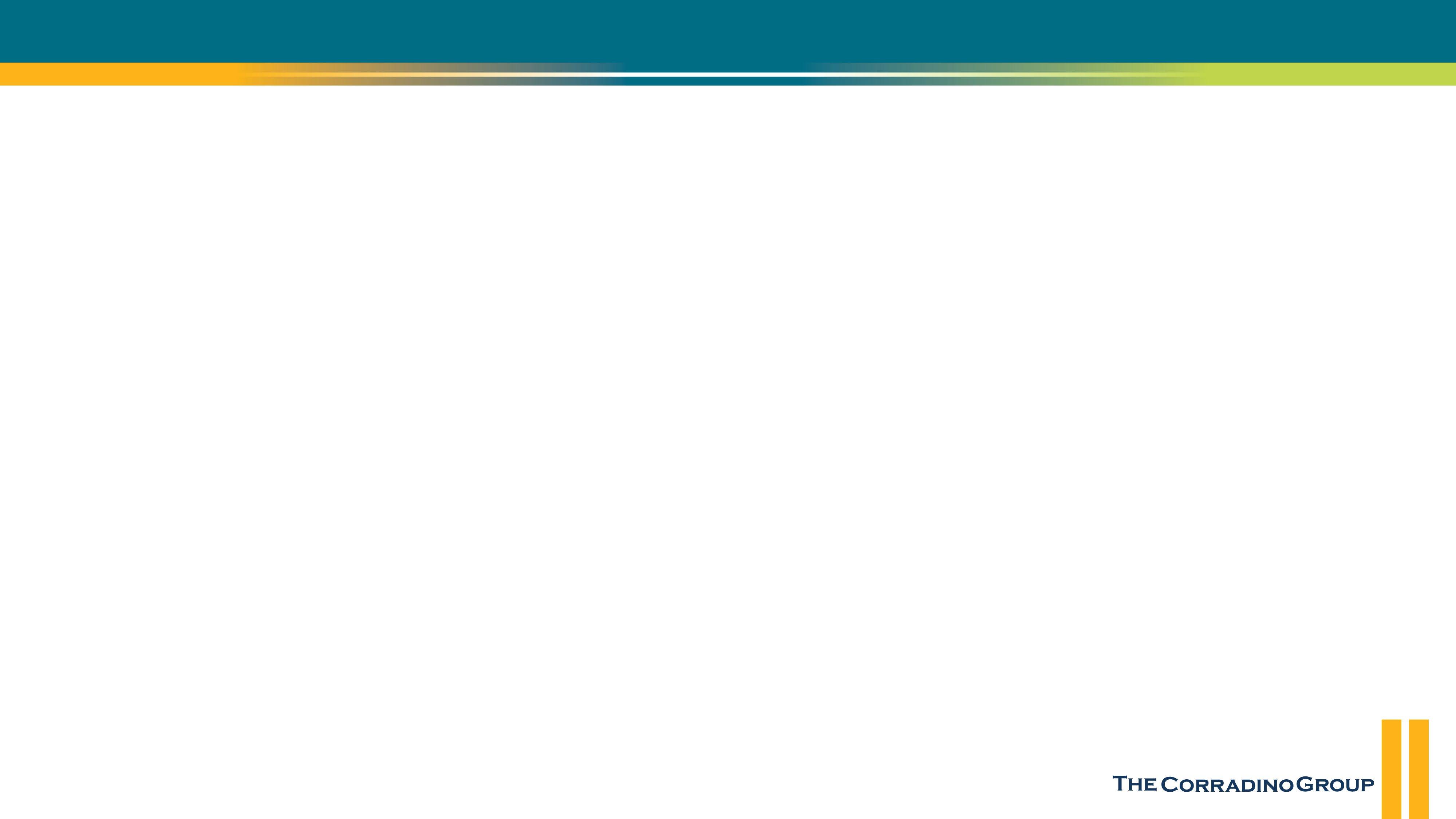

So, the below is a parallel structure

THE LIVE LOCAL ACT

1. Local option affordable housing property tax exemption

2. Nonprofit land used for affordable housing with a 99-year ground lease

3. “Missing middle” property tax exemption

Live Local Act:

• Authorizes local governments to provide property tax exemptions for specified affordable housing developments.

• Eligible developments:

• Contain at least 50 or more units

• At least 20% of the units must be affordable to households at or below 60% AMI

• Tax exemptions only apply to the affordable units

• Property tax exemptions allowed are based on % of affordability

• <100% of the units are affordable = up to 75% property tax exemption:

• 100% of the units are affordable = up to 100% property tax exemption

THE LIVE LOCAL ACT

• Property tax exemption applies to land owned entirely by a nonprofit -

1. 99 years minimum lease

2. Provide affordable housing for households up to 120% AMI • Square footage of the improvements on the land for affordable housing must be greater than 50% of all the square footage of the improvements • Tax exemption is for the land only – not the improvements

THE LIVE LOCAL ACT

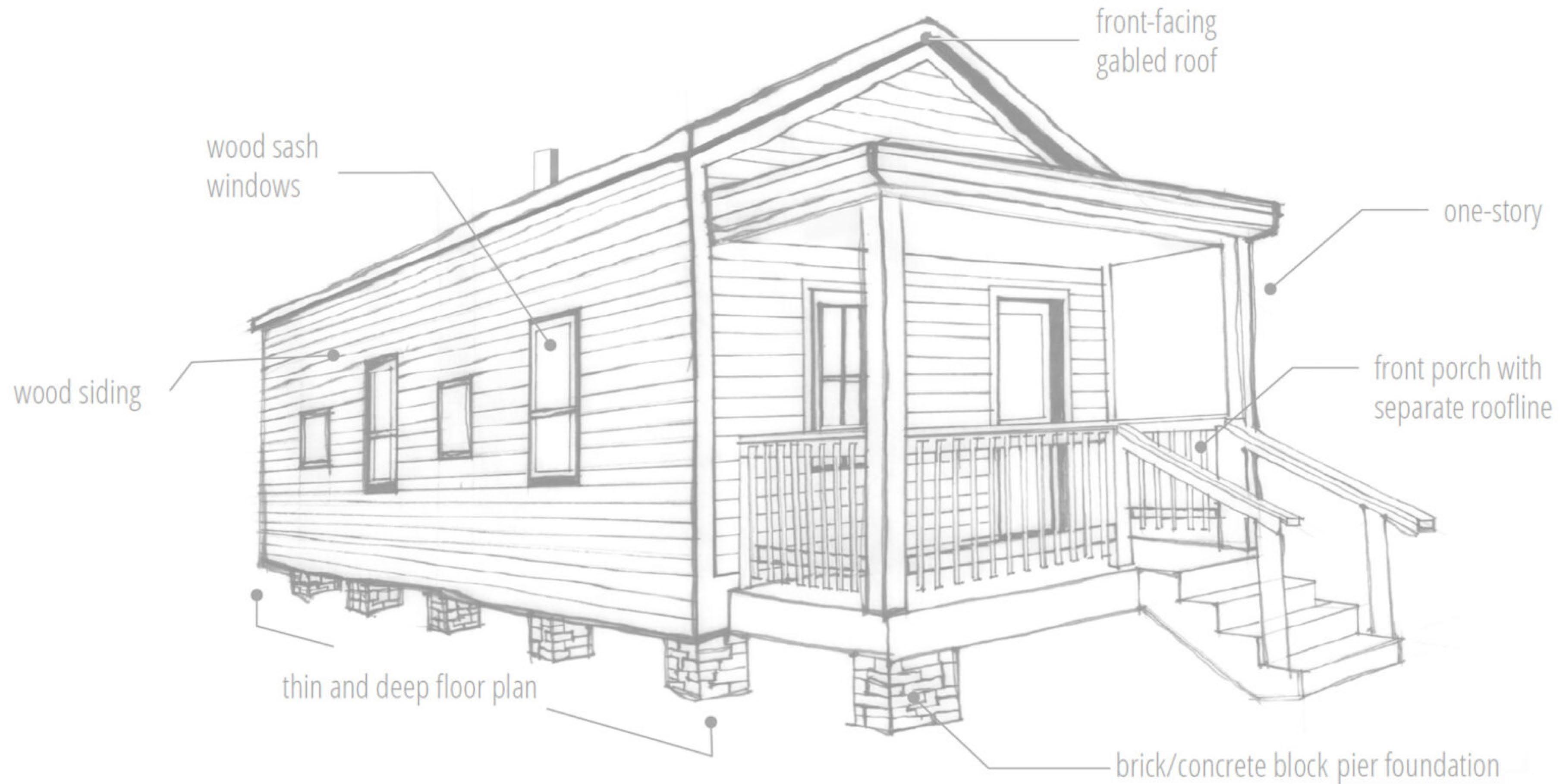

Missing Middle

1. Provides a property tax exemption to “newly constructed” multifamily developments with more than 70 affordable units for households up to 120% AMI

2. Tax exemption only applies to the affordable units

3. Tiered property tax exemptions:

• Units affordable to 80-120% AMI = 75% property tax exemption

• Units affordable to <80% AMI = 100% property tax exemption

THE LIVE LOCAL ACT •

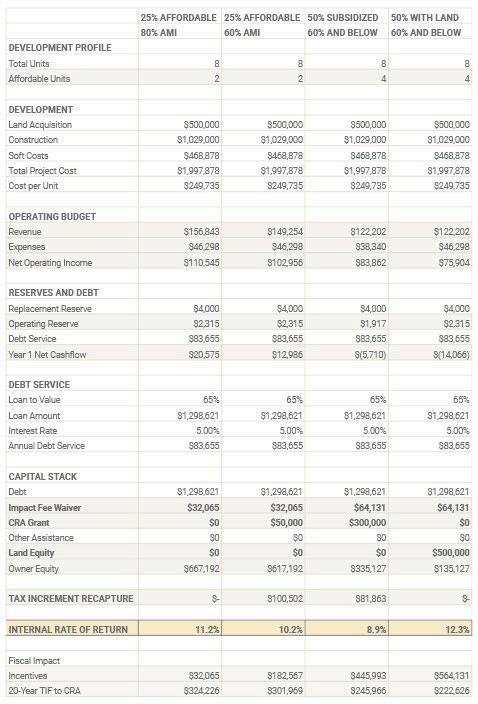

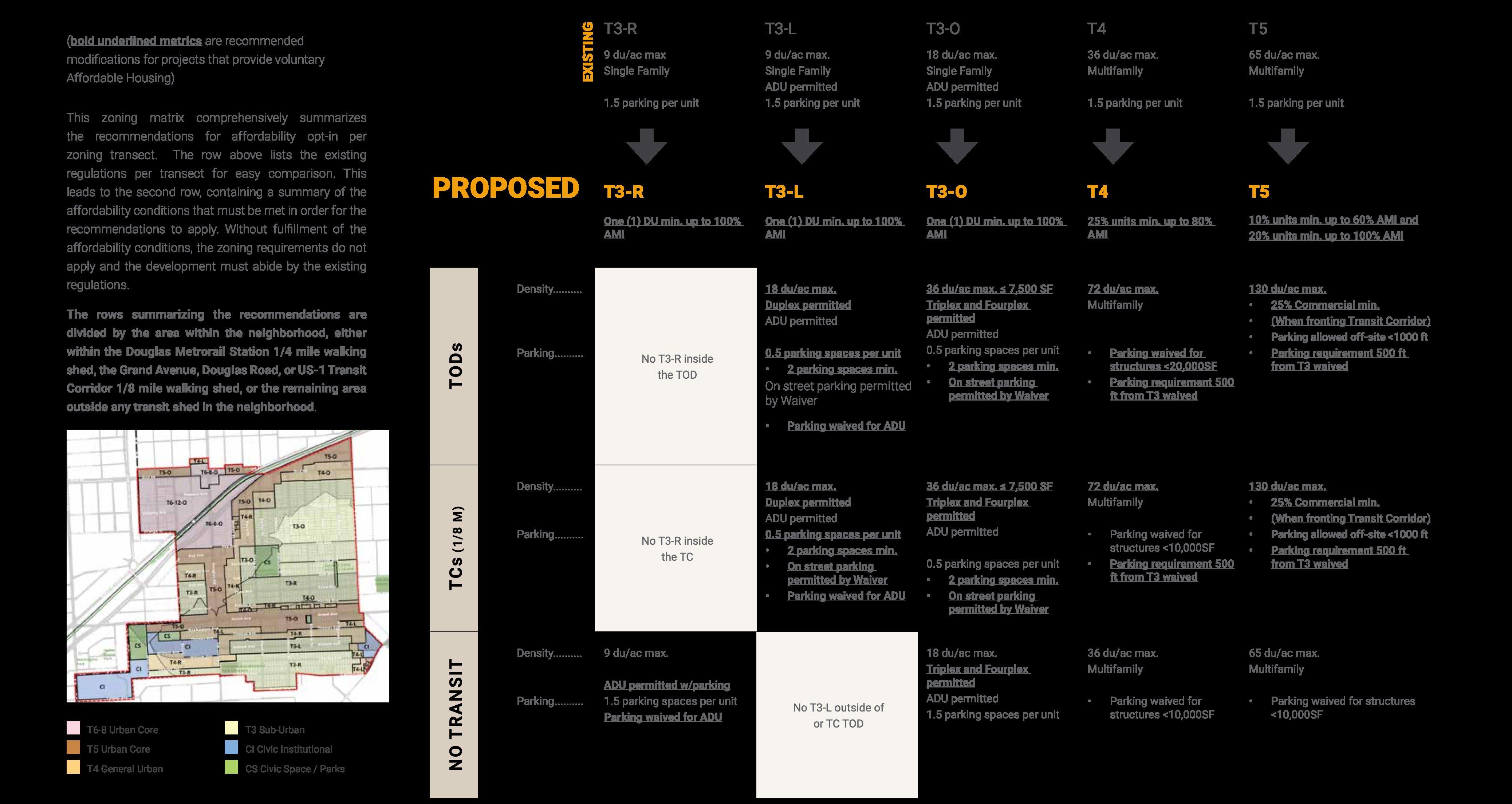

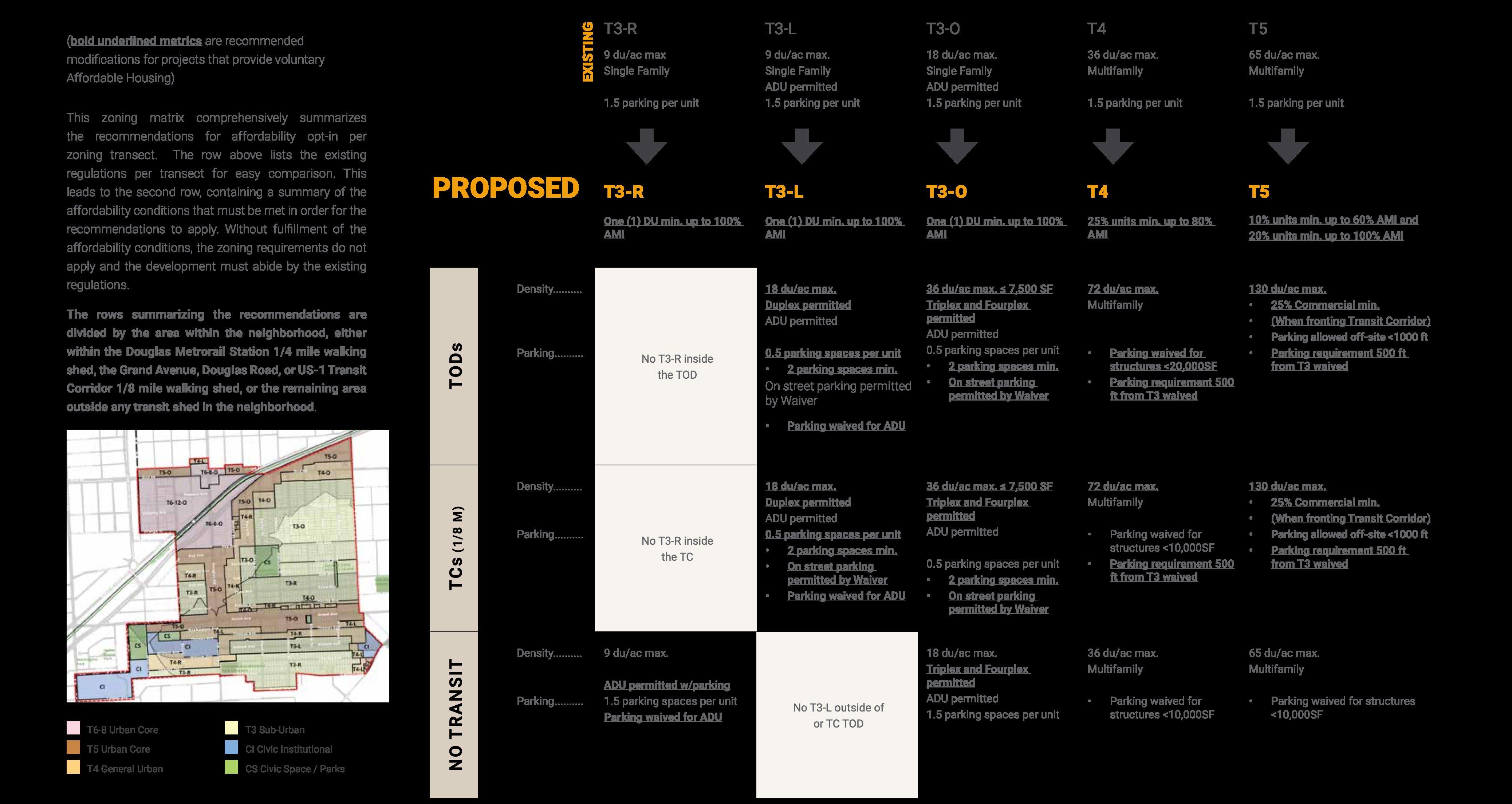

1. Rezoning aspects within our report should probably be adjusted slightly

2. Emphasis on this approach should reiterate what is “opt-in” and what are “by-right” aspects, and consider form- based aspects/qualities

3. Setting up this system is complementary to Live Local Act

4. Further tie-ins available now with tax abatement/incentives

TAKEAWAYS