Weknowchoosingtherightretirementvillageis abigdecision.Butwebelievethatonceyoumeet oursalesteam,you’llrealisethere’snobetterplace tocallhomethanaMetlifecarevillage.

That’swhywe’regivingyouaninstantprize,justforcomingin tomeetwiththem.You’llreceiveascratchcardwiththechance towinfromarangeofgiftcardsuptothevalueof$100.It’sa funandexcitingwaytomakeyourvisitevenmorerewarding.

Andthat’snotall.Thescratchcardwillalsorevealamystery discountofbetween$5kto$50koffyournewhome, shouldyoumovein.*

How’sthatforawinningwelcome? Booktomeetoursalesteamtoday.

Findavillagethatfeelslikehome Call0800909303| metlifecare.co.nz

*Amountsvarybetweenvillages,T&Csapply.ForfullTerms&Conditionsvisitmetlifecare.co.nz/come-in-and-win

Instantprizesupforgrabs

Instant prizes up for grabs

$100 petrolgiftcard $60 grocerygiftcard

THE FINANCE ISSUE Maximiseyour KiwiSaver investmentwith expertadvice TakechargeofyourKiwiSaveraccountand ensureyourinvestmentisworkinghardforyou. Generateadviser,EdwardBryant,discussesthe benefitsofadvicesessionstohelpyouoptimise contributionsandfundselection

Manyyoungandnot-quite-so-young peoplesigneduptoKiwiSaverwhenit firstlaunched,ortheystartedworking andthenforgotaboutit,saysGenerateadviser EdwardBryant Thatmeanstoomanyare missingoutonpotentialinvestmentreturns thatcouldhelpthembuyafirsthomeorretire comfortably

Rotorua-basedBryantisoneofateam ofGenerateadvisersnationwidewhooffer no-obligation,in-personKiwiSaveradvice sessions Thesessionsempowerclientsto understandhowKiwiSaverworks,setgoals, andmaketweaksifnecessarythatcouldhelp maximisetheirreturnsoveralifetime

NOOBLIGATIONADVICE

Generateoffersone-on-oneKiwiSaveradvice sessionswithnoobligationtojoinGenerate Ithasanationwideteamofadviserssuchas Bryantnationwidewhoarehappytomeet youatyourhome,work,acafé,oronlinevia Zoomatatimethatsuitsyou They’lltalkyou throughallyouroptions,soyoucanmakean informeddecisionandhaveabetterideaof whatyou’reontracktohaveatretirement Advicesessionstackleeverythingfromthe rightlevelofcontributionsateveryageand stageinlife,tochoosingafundtomatchyour personalappetiteforrisk “Youneedtomake

sureyousetupyourKiwiSaveraccountright foryourgoals,”Bryantadds ” Whateveryourgoalsandpriorities,making goodKiwiSaveraccountdecisionscanmean havingabetterfinancialfuture,hesays THEBENEFITSOFCONTRIBUTINGTOTHE RIGHTFUND

ManyNewZealandersarepayingintotheir KiwiSaveraccounts,butareinthewrongfund typeforthem,saysBryant It’ssomething Generateadvisersseeregularlywithnew clientswhohaven’thadadvicebefore Growthandaggressivefundswilltypically havebetteroutcomesattimesoverthe decadesthanadefaultfund

“ManypeoplesignuptoaKiwiSaver schemethroughwork,orgototheirbank andendupinadefaultfund,”hesays “Then they’veforgottenaboutit”

“Yourfundchoiceisarguablythemost importantpartofyourKiwiSaverinvestment andmostoverlooked,”saysBryant

Choosingtherightfundtypeisoneofa numberoftweaksclientstypicallymakeafter seekingadvice

ADVICEANDEDUCATIONNOWWILLPAYOFF Everyagegrouphasamixofpeoplewith differentprioritiesandgoals Inthe30to

Photo/Supplied

45-year-oldagegroup,clientsareoftensaving forafirsthome,orhaverecentlyovercome thathurdle,saysBryant

“It’stemptingafterbuyingahometoput KiwiSavercontributionsonthebackburner Youstartbackatsquareonewitha$1,000 balance That’sactuallythestageinlifewhere contributingandmakingsomechangesto yourKiwiSaveraccountcanhavethebiggest impact”

Increasing,notstopping,contributions afterbuyingafirsthomeisdesirable Time isaninvestor’sfriendandtheearlierevery dollariscontributedthemoretimethereis forittosnowball That’swhycontributinga littleandoftenisthegoldenrule,especially foryoungeragegroups Thelongerthetime horizon,thegreatertheinvestmentgrowth

Generateadviserstalktoclientsabout howuppingcontributionsto4,6,or8%can benefitthem “Increasingyourcontributions byjust1-2%couldpotentiallyaddtens ofthousandsofdollarstoyourKiwiSaver accountatretirement You’renevergoingto regretit I’venevertalkedtosomebodywho’s 65andsaid,‘I’mreallyguttedthatIputthat extrabitintomyKiwiSaveraccount’’”

ANYAGEISAGOODAGETOENGAGE

Forpeopleaged45to60it’snevertoolate totakegoodadvice,rampupcontributions, andearnthebestreturnsoverthenext decadeortwo,saysBryantSomepeoplecan affordtocontributemoretotheirKiwiSaver accountoncechildrenhavelefthomeandthe mortgageispaidoff

“Whenpeoplegettothoselateryearsthey canstarttopanicabit It’sdefinitelyharder, thelateryoustart,”saysBryant

AGenerateKiwiSaveradviserwillcreate projectionsforyoutoillustratewhatagood retirementmightlooklikeandoptionsto maximisesavings “Projectionscanreally sparkpeopleintomakingthosechangesand gettingintherightfund Itwillstarttocost

youinthelongrunifyoudon’t”

THEOPTIONOFUPPINGCONTRIBUTIONS

Whileuppingcontributionsisgreatatany agethatleadstosignificantimpactsonyour KiwiSaverinvestmentover-time,switching toagrowthoraggressivefundforadecade ortwocanalsobehelpfulforsomepeople “Whilstwecan’tpredictthefuture,these fundsoftenreturn1-2%more peryear thanbalancedandconservativefunds Compoundedovertimethatextrafewper centreallyaddsup

“Over300kKiwis arestillindefault fundsandmanyothersstayinconservative orbalancedfundsbecausethey’vebeen scaredoffbythe‘risk’element,”saysBryant “Thewordinghasmadepeoplethinkthat thesehigh-riskfundsarearealgamblewith theirmoney”Abetterwaytolookatitis “volatility”[upsanddowns]asopposedto the“risk”oflosingeverything Investorsget morevolatilityalongtheway,butusually highergrowthasaresult

“Attheageof50,there’sstill15yearstogo beforeyoucantouchthemoney,”headds “If youdon’thaveabigbalance,there’salotto gainbydiallingupandverylittletolose Time canreallyhelptomitigate[thatvolatility]”

Butbeforeswitching,talktoyouradviser aboutyourrisktoleranceandoptions,says Bryant Aggressiveandgrowthfundsaren’t rightforeveryone–particularlyifyouare lookingtowithdrawwithintwo-threeyears Andsomepeoplesimplycan’tsleepatnight withmoneyinavolatilefund Othersare happywiththeupsanddownsalongtheway inreturnforgreatergrowth

KIWISAVERFORSELF-EMPLOYED

CONTRACTORSANDPROPERTYINVESTORS

BryantsaysKiwiSaverisn’tjustfor employees Contractorsandself-employed peoplecanbenefit Theyoftentellhimthat investinginaKiwiSaveraccountisn’tfor

them Yetthefirst$1042investedeachyear attractsa$521ingovernmentcontributions “It’sprettydifficulttomatchthat50%return,” hesays “That’sthebestsmallinvestment you’lllikelyevermake

“Likewise,propertyinvestorsshouldview aKiwiSaveraccountasanotherstringtotheir bow,”hesays “I’dneverdiscouragesomeone fromdoingpropertyinvestment Goforit But KiwiSaverisagreatwaytohedgeyourbets” Becauseofitsdiversification,KiwiSaverhelps tolowertheoveralllevelofriskofrelyingon businessprofitsand/orpropertyinvestment forretirement

Fora30yearold,theminimum$1042 contributioncombinedwiththegovernment topupwouldgrowtoaround$55Kat retirement-plusinvestmentreturnswould beontop,saysBryant

EDUCATEYOURSELF

OneofthemainreasonsGeneratewas foundedwastheeducationpiece:to addressagapinthemarketofKiwisnot understandinghowKiwiSaverworksandhow tomakethemostofit

“ThegreatthingabouthavingaKiwiSaver accountisthatitisquiteasimpleproduct, andwecansitdownandtakeyouthrough fromstarttofinishexactlyhowitworks,”says Bryant

“Wehavesomeawesomecalculatorsthat weusetoshowprojectionsofwhatyoucould finishupwithwhenyoudobuythatfirst homeorwhenyou’regettingto65”

Advicesessionsgenerallylastabout45 minutes,andyou’rewelcometobringalong afriend,partner,housemate,orcolleague, saysBryant

AKIWIBUSINESSWORKINGFORYOU

GenerateisproudlyNewZealand-ownedand operatedandhasbeenaroundfor10+years Ithasover$5Bfundsundermanagement Itisaward-winning(ConsumerNZPeople’s Choice,CanstarMostSatisfiedCustomers,

Reader’sDigestTrustedBrand)andhavea trackrecordofstronglong-termperformance: TheGenerateFocusedGrowthFundranked 1stoutof8NZMulti-SectorAggressive CategoryFundsfor10-yearresultsto30 June2024*

• TheGenerateGrowthFundranked2nd outof13NZMulti-SectorGrowthCategory Fundsfor10-yearresultsto30June2024*

• TheGenerateModerateFundranked 1stoutof13NZMulti-SectorModerate CategoryFundsfor10-yearresultsto30 June2024*

Generate’sgoalistoeducateandempower Kiwistomakesmartfinancialdecisionsthat willhelpthembebetteroffinthefuture Tofindoutmoreorrequestameetingwith aGenerateadviser,headto generatekiwisaverco nz/letschat

Nopartofthisarticleisintendedasfinancialadvice;itis intendedasgeneralinformationonly Pastperformancedoesnotguaranteefuture performance andallinvestmentsinvolveriskand returnscanbenegativeaswellaspositive

*Source:MorningstarKiwiSaverSurveyJuneQuarter End2024 TheGenerateFocusedGrowthFundreturns ranked1stoutof8NZMultiSectorAggressiveCategory Funds,theGenerateGrowthFundranked2ndoutof 13NZMultiSectorGrowthCategoryFundsandthe GenerateModerateFundranked1stoutof13NZMulti SectorModerateCategoryFunds,foraperiodof10 yearsasof30/06/2024 ©2024Morningstar,Inc All rightsreserved NeitherMorningstar,itsaffiliates,nor thecontentprovidersguaranteethedataorcontent containedhereintobeaccurate,completeortimelynor willtheyhaveanyliabilityforitsuseordistributionin NewZealand Toseeacopyoftheproductdisclosurestatementor advertisingdisclosures,seegeneratekiwisaverconz/ disclosuresTheissueroftheschemeisGenerate InvestmentManagementLimited

Photo/GettyImages

The costs of growing old OlderpeopleinNewZealand areoftentreatedasiftheywere cashmachines. Whetherit’sscams,financial exploitationsuchasfamilyor caregivershelpingthemselvesto money,expensiveessentialssuchashearing aids,orsimplypayingthecostofretirement villagesandresthomes,olderpeopleare sometimesseenasaneasysourceofmoney byfamilies,businessesandscammers Theslideintotakingadvantageofolder peoplebeginswitheverydaylanguagesuch as“theelderly,”“boomers,”“greytsunami”, whichdehumanisestheperson Once they’renolongerhuman,it’seasierforless honourablepeopleandorganisationstohelp themselvestosomeone’smoney AgeConcernalsoseescaseswherefamilies don’twanttoletmumordadspendmoney anddeplete“theirinheritance”Olderpeople workedfortheirmoneyandit’stheirstouse

IT’SEXPENSIVETOGETOLD

It’sexpensivetogetold Whetherit’sthe$500

or$1,000wheelchair,the$4,000hearing aid,orthelonglistofotherstuffthatmakes someone’slifecomfortable,itcomesatacost Thinkelectricbeds,stairlifts,mobility scooters,automatedLa-Z-Boychairs,andso on Evensimpletoolssuchasbedrails,raised toilets,walkingsticks,magnifiers,braces, walkers,ramps,andaheapofotherstuffcan costwaymorethansomeoneonNZSupercan afford Oncesomeonebecomestoofrailtoclean thehouse,dobasicDIY,orevencuttheirown toenails,they’repaying$30to$50anhourfor services Oriftheycan’tdrivethere’sDriving MissDaisy,oramobilitytaxitopayfor HannyNausofAgeConcernsaidthe perceptionthatolderpeopleallhave mortgage-freehomesandthereforeno costs,isnotcorrect Rates,insuranceand maintenanceaddupandhomesneed repaintingandreroofing

THEEYEWATERINGCOSTSOFLIVING ANDINSURANCE Housingforolderpeoplesuchasretirement villageunitsandagedcarecostsapretty penny Atthetimeofwritingretirementvillage unitscostfrom$200,000to$4m Thevillage typicallytakesa20-30%cutofthatwhenthe residentdiesormoveson Basicroomsinrest homesforpeoplewithsavingscost$146426 perweek($76,14152annually)inAuckland Aprivatebathroomcanaddthousandsmore peryear

AccordingtoLifedirect’sonlinecomparison, privatemedicalinsuranceincludingsurgical andspecialistvisitscosts$725296atage 75,whichmostolderpeoplecan’tafford onNZSuper Ifpayingprivately,aknee replacementrangesfrom$24,700to$30,100, asimplecolonoscopy$1900to$3300,ahip replacement$23,800to$28,600,andcataracts $3000to$5500pereye

FINANCIALEXPLOITATIONOF OLDERPEOPLE Olderpeoplecanbethevictimoffinancial exploitationespeciallyiftheystarttohave memoryproblems They’reaneasytargetfor carers’sobstories,commissionsalespeople whothinkthey’reontoawinner,andoversized billsfortradesandservices

It’sjustaslikelytobeamemberofthe familywhowants“theirinheritance”early helpingthemselvestomoney Orason,

daughter,orgrandchildhasaccesstothe EFTPOScardwhiledoingcaregivingwork Ifarelativedoesneedhelp,thensomeof thethingsacaringrelativecantryare:

• Geteducated Alzheimer’sNZandother groupssuchasDementiaAucklandoffer educationandsupportgroups Haveafamilyconferenceorsetupafamily discussiongroup

• Discussenduringpowersofattorneyfor propertyandpersonalcareandwelfare (EPAs)withtherelative

• Createalivingwill/advancedcareplan

• Talktothebank Withtheaccountowner’s approval,thebankmightbeableto structureaccountssothatonlysmall sumsofmoneyareavailabledaily Or jointsignatoriesarerequiredforlarge withdrawals

• Shareconcernswithgeneralpractitioners, eveniftheycan’tdiscusstherelative specifically Makecontactwiththe hairdresser,caféstaff,librarianoranyone elsewhomayhaveconcerns

• Usecareagencies Careagencieshavestrict policiesaroundclientsandmoneythat privatecarersaren’tsubjectto,saidNaus

• Checktherelative’screditfileswiththeir permission CreditfilesfromIllion,Equifax andCentrixcangiveanindicationifthere arefinancialirregularitiesorcreditbeing takenoutinsomeone’sname

Photo/GettyImages

Connections: The Heartbeat of Our Lives Aswemovethroughlife,thevalueof ourconnectionswithothersbecomes increasinglyclear Theserelationships areourtruesocialcurrency,andit’sthrough communicationthatwemaintainanddeepen them Whetherit’saheartfeltconversation withalovedone,achatwithafriendwhile outshopping,orenjoyingalivelydinnerina bustlingrestaurant,thesemomentsarewhat enrichourlives

However,hearinglosscanmakethese connectionsmorechallenging,particularlyin noisyenvironments Whatwereonceeffortless conversationscanbecomefrustratingand isolatingexperiences

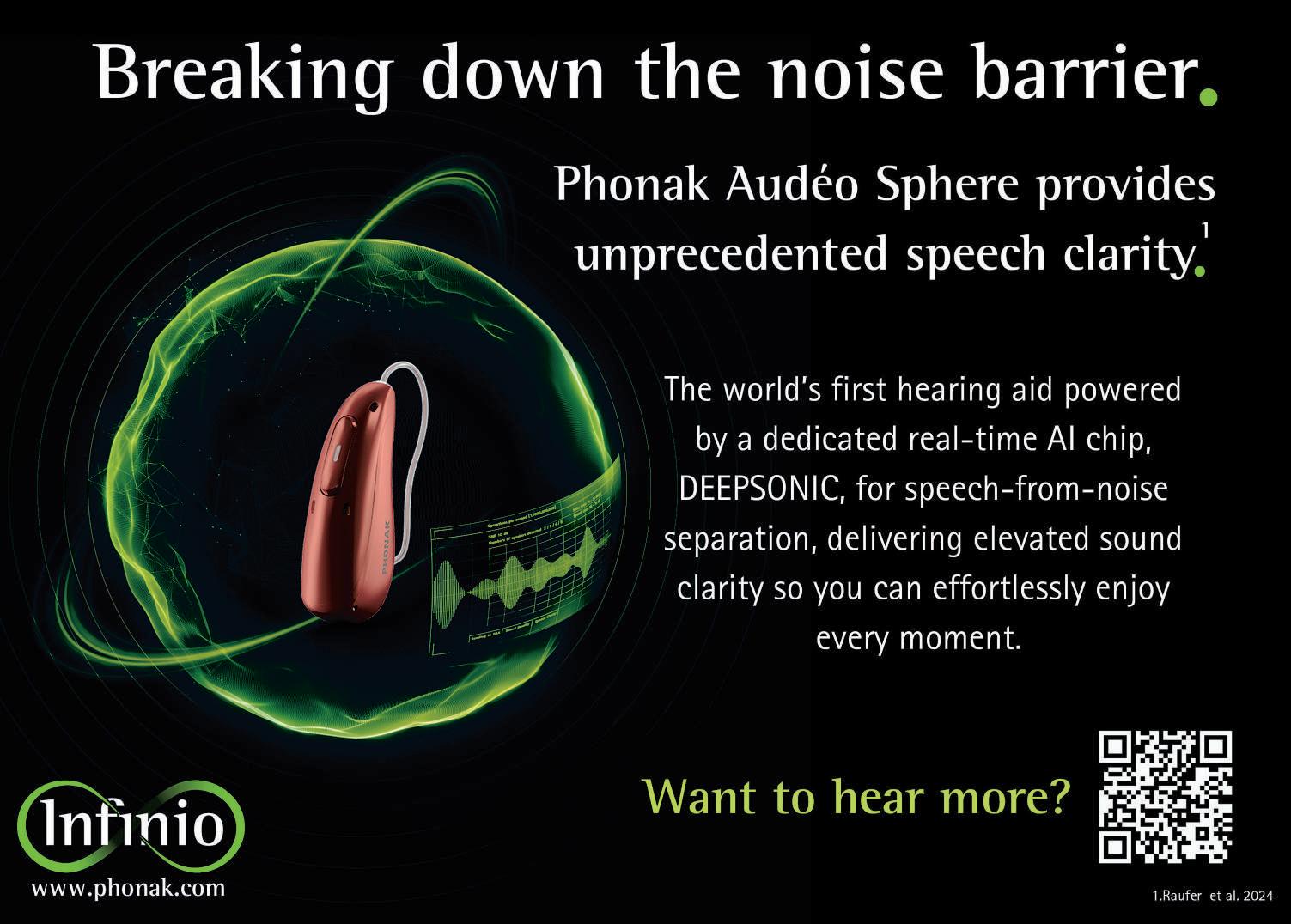

THEFUTUREOFHEARING:AUDÉOSPHERE INFINIO

ThisSeptember,agroundbreakinginnovationin hearingtechnologyisarrivinginNewZealand PhonakisintroducingtheInfinioplatform, featuringtheAudéoSphereInfinio theworld’s firsthearingaidequippedwithadedicated real-timeAIchipcalledDEEPSONIC,designed specificallyforseparatingspeechfromnoise Thistechnologyisagame-changerforthose whohavestruggledtohearclearlyinnoisy settings

TheAudéoSphereInfinioisnotjustanother hearingaid;itrepresentsarevolutioninhow weexperiencesound With53timesmore processingpowerthanpreviouslyseenin theindustry1,thisdevicemakesdynamic, real-timeadjustments,allowinguserstohear conversationswithunprecedentedclarity,no matterthedirectionofthesound Imagine beinginacrowdedrestaurantandhearing

References 1 PressRelease:Sonovaannouncestwonewhearingad platforms,includingthefirsthearingaidwithreal-timeAI toaddressmostpressingneedinhearinglosshttps://www sonovacom/en/sonova-announces-two-new-hearing-aidplatforms-including-first-hearing-aid-real-time-ai-address

theconversationclearlywithease that’sthe experiencetheAudéoSphereInfiniodelivers Infact,usersoftheAudéoSphereInfinioare twotothreetimesmorelikelytounderstand speechfromanydirectioncomparedtoother leadinghearingaids2 Thismakesitatrue breakthroughforanyonestrugglingtokeepup innoisyenvironments

Reflectingonhis25-yearscareerinaudiology, DavidCrowhen,AudiologistandCommercial andOperationsDirectorforSonovaNew Zealand(Wholesale)Ltdsaid:“I’velistened tocountlesshearingaidsastechnologyhas developedovertime,buttheAudéoSphere Infinioistrulyone-of-a-kind It’sasifthis devicecreatesashieldaroundyou,filtering outdistractingnoiseandallowingyoutofocus entirelyontheconversation Theexcitement aroundthistechnologyisunprecedented, and,throughpartneringwithhearingcare professionalsacrossNewZealand,weare excitedtobringthisrevolutionarysolutionto thosewhoneeditmost”

Phonak’sInfinioplatform,alongsidethe AudéoSphereInfinio,isusheringinanewera ofhearingtechnology Thisisn’tjustabout improvingsoundquality it’saboutenhancing thequalityoflifebymakingiteasiertomaintain thoseall-importantconnections

Asweage,stayingconnectedwithour lovedonesandcommunitybecomeseven morecrucial WithinnovationsliketheAudéo SphereInfinio,Phonakisensuringthatthese connectionsremainstrong,clear,andvibrant, nomatterwherelifetakesus Readyto experiencethefutureofhearing?Learnmoreat wwwphonakconz

2 Wright A Kuehnel V Keller M Seitz-Paquette K Latzel M (2024) “SphericSpeechClarityappliesDNNsignal processingtosignificantlyimprovespeechunderstanding fromanydirectionandreducethelisteningeffort”Phonak FieldStudyNewsretrievedfromhttps://wwwphonakcom/ evidence

Harnessing Kiwi savings to support the country’s agricultural backbone RabobankstandsoutinNewZealand’sfinancial landscapeasthesolefoodandagribusiness bankingspecialist.BysavingwithRabobank, Kiwisnotonlyreceivecompetitiveinterest,they activelysupportasectorthatisvitaltothenation’s economy

EstablishedbyfarmersintheNetherlands morethan125yearsago,Rabobanknow operatesin38countries,servicingthe needsofaboutninemillionclientsworldwide Foodandagriisinthebank’sDNA,said RabobankNZCEOToddCharteris

“HereinAotearoaNewZealand,wehavea singlefocusonfoodandagribusiness Under ourbusinessgrowthstrategy,we’recommitted tocontinuingtosupportKiwifarmers,growers andfoodproducers,”hesaid

InNewZealand,Rabobank’s500employees workfrom27officeslocatedacrossthe countryandthey’reproudofthecommunities inwhichtheyliveandwork Guidedbya globalmissionofGrowingaBetterWorld Together,Rabobanktakesalong-termviewof theruralsector,saidCharteris

“Weworkalongsideourclients,supporting themtoachievetheirbusinessgoalsandto helpthemrealiseopportunitiesinareassuch asclimatechangeandfreshwaterregulations,” hesaid

“Rabobank’sstrategyistobecomeNew Zealand’sleadingfoodandagribank–

buildingonitsdeepglobalconnectionsand strongNewZealandnetworks”

Backedbyourglobalteamofresearch analysts,Rabobankhasaccesstothelatest in-depthinsightsintofoodandagrimarket trendsandopportunities,saidCharteris

“We’realsocommittedtoworkingwith policymakerstoprovideinputtoimportant policyissuesthroughtheeyesofourclients,” hesaid

“Wedoallofthisaspartofourlong-term commitmenttosupportNewZealand’sworldleadingfarmers,growersandfoodproducers Infact,that’sattheheartofeverythingwedo”

RABOBANK’SDEPOSITOFFERINGFOR SAVERS

SaverswithRabobankarepartofsomething trulyproductive,aseverydollarsavedwith RabobankhelpsfundNewZealand’sfarmers andgrowers,Charterissaid

“WeknowthatNewZealand’ssaversare increasinglyinterestedininvestingforpositive impact ”hesaid

“Andwhatbetterwaytomakeapositive

impact,thanbysavingwithRabobank andhelpingfundNewZealand’sprimary producersandtheworktheydoproducing deliciousfoodforusall

“Rabobankoffersarangeofsavings products,completewithcompetitiveratesto helpyoursavingsgrow Whetheryou’reinthe marketforanon-callsavingsaccountwith competitiveinterestrates,a60-daynotice accounttomaximizeyoursavingspotential, orastabletermdepositwithgoodrates, Rabobankcanhelp”

THERABOCOMMUNITYFUND&HOWIT’S SUPPORTINGRURALCOMMUNITIES

Asafoodandagrispecialist,Rabobank understandsthatruralcommunitiesareat theheartofnewZealand’sagribusinessand farmingsectors TheRaboCommunityFund assistsarangeofinitiativesandwassetupto contributetothevibrancyandresilienceof ruralNewZealand,saidCharteris

“Prosperousruralcommunitiesleadtomore successfulfarmingandproductionbusinesses, whichinturnmeansbetteroutcomesand achievementsforeveryoneinvolved,”hesaid

“TheRaboCommunityFundisbasedonthe internationalRaboFoundation’ssocialfund, whichhasoperatedformorethan45years investinginfarmers’self-sufficiencyinarange ofcountriesaroundtheworld

“TheCommunityFundwassetupherein NewZealandinlate2021andisfundedby anannualcontributionfromRabobankNew Zealand Sincethen,thefundhascontributed morethan$2millionintoover100community initiativesacrossNewZealand

“Decisionsonwheretoallocatefunding aremadeinconjunctionwiththebank’sfour regionalClientCouncils,groupsofRabobank’s

farmingclientrepresentativeswhowork withthebanktoaddresskeyindustryand communitychallengesinfarmingand agribusiness Thecouncilshaveidentified sixkeythemes:long-termindustrycapacity andagriculturaleducation,environmental sustainability,therural/urbanconnection, ruralwellbeing,adaptation/disruptionand naturaldisasterresilience”

SOMEOFTHEFUND’SCURRENTINITIATIVES INCLUDE:

• SurfingforFarmers:Thisinitiativeinvites farmerstocatchsomewaves,offeringa refreshingbreaktomanagestressandboost mentalhealth It’smorethanjustsurfing;it’s asocialgatheringwherefarmerscanenjoya barbecueandcamaraderiepost-surf

• GrowingFutureFarmers:This comprehensivetwo-yearprogrammeequips graduateswithspecialisedtrainingand developmentopportunities,tailoredforthe agriculturalindustry

• GardentoTable:Asanationalfood educationcharity,GardentoTable empowerschildrenacrossNewZealand tocultivate,harvest,prepare,andshare wholesomefood

• MeattheNeed:Afarmerfoundedand farmerledcharitywhichhelpsconnectthe dotsbetweenfarmerswhowanttodonate someoftheirproduceandthoseaffectedby foodinsecurity

RabobankNewZealandLimitedisNew Zealand’sonlyspecialistfoodandagribank TofindoutmoreaboutRabobankandits onlinesavingsoptions,visit www.rabobank.co.nz

HopperLivingVillagesarethoughtfullydesigned withyourneedsinmind.Proudlyfamily-ownedand operatedbylongstandingpropertyexperts,Hopper Developments,theyarelocatedinNorthland, Auckland,andnowinWhitianga—thehomeof NewZealand’strueWaterfrontVillages.

Scams The new frontier Scamsaregrowingincreasinglysophisticated andNewZealandersaremoreatriskthanever before.No-oneistoosmarttobescammedasthe scammersuseAIandothertechnologytobecome increasinglybelievable.

Scammersarenolongerjustphishingfor information.Theyarecreatingcomplex identities,manipulatingvoices,and evenproducingfakevideostodeceivetheir victims.

Videosandvoicesareusedincreasinglyin avarietyofwaysincludingromancescams, kidnappingscamsandevenbusinessemail scamswhereascammerinsertsthemselves betweenatradespersonorlawyerandtheir clientandrequeststhepaymentaccounttobe changedtotheirown.

ROMANCESCAMS

ToomanyKiwisgetcaughtupinromance scamsanditcanhappenatanyage.Typically, thevictimmeetssomeoneonline,notrealising thatthedateisafakeidentityadoptedbya criminal.Thescammerconvincesthevictim they’rerealandplaysonemotionstoscam moneyoutofthem.Thescammeroftenstarts askingforsmallsumsofmoneythatcansolve

personalproblemssuchashealthproblemsor businesstroubles.Theamountsgetlargerand largerasthevictimiscaughtbelievingaweb oflies.

ThankstoAIscammerscannowfakewhat theylookandsoundlike.Theycancreatedeep fakeavatarsthatlookhumanwhenchatting online,andtheirvoicescanbemanipulatedto soundlikeanyaccenttheywant.

Kiwivictimsmaybelesslikelytobe suspiciousofanaccentfromanEnglishspeakingorotherwesterncountrythanamore exoticone.Scammerscanlooklikeanyone theywant.

Thevictimsareoftencompletelyhooked andgotosomelengthstoconvincebanks, friendsandrelativesthattheirpartnerisreal.

FACEBOOKMARKETPLACESCAMS FacebookMarketplaceisawashwithscams. Scammersveryoftenlistexpensiveitems suchasiPhones,carsordesignerclothingat bargainpricesandaskbuyerstodepositthe

moneyinabankaccount.However,theitem neverarrivesandthesellerblocksthebuyer.

It’snotuncommonforscammerstoclaim thatmultiplepeopleareinterestedandthe firstpersontopaybybanktransferwins, creatingtimepressure.

Onescamdoingtheroundsinvolvesbuyers whotellsellersthatthey’llsendacourierwith thecashtocollecttheitem.Thescammerasks thesellertopayforinsuranceorotherfeesup front,usuallyviaafakeinsuranceorcourier website.

Ortheyareencouragedtoclickonasite thatlookslikethebuyer’sbank,buttheirlogin detailsareharvested.Scammersthenusethis logininformationtoemptythevictim’sbank account.

Evenpickupisarisk.It’snotuncommonfor thescammertoaskfora“deposit”andthe resttobepaidonpickup.Onlytheaddressfor pickupisn’ttheirs.

Anotherscamiswherebuyerssendthrough fakebanktransferconfirmations,ormeet thesellerinperson,pretendtodoabank transfer,andthesellerhandsoverthegoods. Themoneyneverappearsintheiraccount. Screenshotsoftransactionsareeasilyfaked. ScamscanhappenthroughTradeMe,but theyaren’tascommon.Thefeedbacksystem onTradeMe,providessomeadditional protection,althoughtherehavebeencases ofscammerstakingcontrolofaninnocent person’sTradeMeaccountandofferingnonexistentgoodsforsale.

CRYPTOSCAMSGROWING NewZealandersarelosinghundredsof thousandsofdollarstocryptoscammers. Onceanovelty,cryptohasbecomepopular andsadly,scammershavelatchedontoit. Inthenottoodistantpast,scammers sometimesdemandedransomsinBitcoin orothercryptotounlockcomputersthey’d hijacked.

Nowoneoftheirmanyrusesisencouraging peopletoinvestincryptobytransferringreal moneyfromtheirbankaccountstoafake cryptoinvestmentscheme.

JanineGrainger,chiefexecutiveofgenuine NewZealand-basedbrokerEasyCrypto,said scammerswillconvincetheirvictimsnottotell thebankwhattheyaredoingwiththemoney.

“[Victims]arecoachedbyscammerstolie. [One]excuseIheardwas‘ifyoutellyourbank aboutthistransaction,thenyourbankwilltry todiscourageyoufromdoingitbecausethey wantthecommissionandtheywantyoutodo thedealwithus’.”

TAKECARE

Avoidingscamsgetsharderandharder. However,Kiwisshouldbevigilant.Avoid clickingonemailsfromstrangersandbewary oflinksandwebsites.Theycanbefakedto lookreal,butgotoaclonedsite.Bewaryof givingoutpersonalinformation,usestrong passwords,not‘12345’orapet’sname,and installantivirus,andfirewallsoftware. VisitNetsafe.org.nzformoreinformation.

Photo/GettyImages

How are your retirement savings faring against inflation? InflationinNewZealandisslowlyfalling. However,ithasbeenabovetheReserveBank ofNewZealand’s1%to3%targetbandfor morethanthreeyearsnow,makingabigdent inmanypeople’sretirementsavings

FromJune2021wheninflationfirstexceeded 3%ithasbeenaheadacheforsome InJune 2022inflationhitaneye-watering73%and hasbeenaproblemeversince,althoughitfellto 33%inthefirstquarterofthisyear

Highinflationhasmeantthatsomepeople havehadtocurtailtheirsavingstopayforliving expensesandskyrocketingmortgagepayments

That’snottheonlyhitretirementsavingshave taken Involatiletimespeopleoftenchoose“safe” investmentssuchastermdepositsovermore volatile[subjecttoupsanddowns]investments suchasKiwiSaverandfunds

Evenifthenewnormalforinflationsettles backat3%or2%,ratherthanthe1%thatKiwis becameusedtopriortothepandemic,retirement savingscouldtakeahitovertime,erodingin value

TERMDEPOSITSARISK

Movingtotermdepositsisariskinitsownright becauseinflationalsoeatsawayattermdeposits bystealth Thesavingslosevalueinrealtermsand buylessevenafterinterest

Theworldalsowentthroughadecadeof inflationfrom1970to1980 Peoplewhorelied ontermdepositsandfixed-ratebondssawtheir savingseatenawayoverthatdecade

Manywereearning25%to4%inthebank, whileinflationaveraged115%forthedecade Thatmeantalotlessintheretirementpotwhen theyfinallyclockedoutofworkforthelasttime Orifthey’dalreadyretired,abigchunkoftheir capitalwaseatenupbyinflation

AMP’smanagingdirectorJeffRuscoecites statisticsthatafter15years,evenat25%inflation, thespendingpowerofmoneywillhavefallenby 31%

“Soifyouare50today,andyouwantto

continuetolivealifestylelikeyoudonow,you’re goingtoneed31%moremoneybythetimeyou gettoretirementtolivethatlifestyle[on25% inflation]”

KIWISAVERABETTERBET?

Overthelongtermitisgenerallyexpectedthat growthKiwiSaverfundswilloutruninflationAs pricesincrease,sotoousuallydoesthevalueof thebusinessesinvestedinbyfunds Thatisnot guaranteed

Anyonewhoisconcernedabouttheir retirementsavingsshouldseekadvicefroma financialadviser SomeKiwiSaverproviderscan offerfreeadvicetomembers

Whetherthey’re25or55,peoplesavingfor thefutureneedtoensuretheirKiwiSaverand otherinvestmentsaresufficientlyweightedfor growthtooutpaceinflation “Byinvestinginterm deposits,[retirees]fixtheirincome,anditdoesn’t goupwithinflation Soyou’realwaysgoing backwardsinthatspace,”saidRuscoe

Thetrickisthatmostpeoplearen’tgoing tospendtheirsavingsinthefirstfiveyearsof theirretirement,anddon’tneedtowithdraw everythingtoputintermdepositsassomedo Adiversifiedportfoliowithaportioningrowth fundsallowsthecapitaltokeepgrowing,instead ofbeingeatenupbyinflation

THINKOFITASAROADTRIP

Goodplanningmakesretirementeasier Ruscoe citestheexampleofaroadtrip “Ifyouwere headingoffonaroadtripintoacountry,you didn’tknow,youwouldsitdownandmapouta plan

“That’sthesamewithretirementplanning If youdon’tmakethatplan,youwilljustarrive,and youmightnotarriveattherighttimeandplace”

Photoo/GettyImages

Making a will can help avoid a messy end Dyingwithoutawillisamessyandcostly businessforthoseleftbehind Awillisalegal documentthatsetsouthowanestateisdealt withwhensomeonedies Yetonly50%ofKiwi adultshaveone,accordingtothePublicTrust.

ItisaveryNewZealandattitudetosay“no worries,Iwillbefinewithoutawill” In realitythatisn’tthecase Ifthereismore than$15,000inassetsincludingKiwiSaverand cars,themoneyisdistributedaccordingtolaw, whichisn’talwayswhatsomeonemightwant Deathisn’tjustaboutmoney Thereare thingsthatmaybeimportanttothedeceased, butwhichthelawdisposesofclinicallyifthey don’thaveawill Thatincludes:

• Jewellery,artworksorfamilyheirlooms

• Funeralwishes

• Appointmentofguardiansforchildrenaged under18and

• Thefateofpets

Willsneedupdatingperiodicallyaswell A person’schoiceofhowtheirestateshouldbe

dealtwithchangesovertime Abeneficiary mayhavedied,oranewpersonofimportance mayhavecomeintothefamily Orsomeone hashadassistancefromaparticularcharity andwantstogiveback

WHATHAPPENSIFYOUHAVENOWILL?

Ifthereisnowill,thereisastatutoryformulain theAdministrationAct1969fordistributingthe estateofanyonewhodies“intestate”

Thespouseorpartner,ifthereisone,gets thefirst$155,000oftheestate,thechattels, personalpossessionsandfurniture,andathird ofeverythingelse Thisoftencomesasashock tosurvivingspousesandpartners Especially whentherestofthemoneypassesdownto stepchildren

Thereareadultchildrenwhoarehappyfor theirparentorstep-parenttoremaininthe houseuntiltheydie Othersmaynotbeso willingandmaypushforthesaleofthehouse LEAVINGMONEYTOCHARITY

Peopleoftenchoosetogivemoneytocharity whentheydie That’scalledabequest Even modestsumssuchas$1,000reallycountfor charitiesIfeveryoneleftasmallpercentageof theirlegacytogoodcauses,charitiescoulddo awholelotmoregoodwork

Leavingmoneytocharityinawillworksfor peoplewhomaynotbeabletogiveduring theirlivesforavarietyofreasons,butwould likesomeoftheirlegacytogotogoodcauses

PublicTrustchiefexecutiveGlenysTalivai saidit’snotjustthewealthywholeaveto charity Anyonecan “Theycanusetheirwill notonlytohelptheirwhānauandfriends,but alsotolookafteracharityoracausethatthey careabout”

Manycharitiesaresufferingfromincreased costsduringthecostoflivingcrisis “It’sa challengingtimeforcharitiesbecausetheir owncostsareincreasing,”Talivaisaid “So eveniftheirdonationsarestayingaboutthe same,actually,thecostsofthembeingable todowhattheydohaveincreasedquite significantly”

Inadditiontowell-knowncharitiessuchas theRedCross,SalvationArmy,orSPCA,some peoplechoosetoleavemoneyintheirwillsto charitabletrustsorcommunityfoundations thatpoolthemoneyandsupportmultiple charitiesfrominvestmentincome

HOWMUCHTOGIVE

Whenitcomestochoosinghowmuchtoleave inawill,apercentageisoftenbetterthana fixedsum,whichmightgeterodedbyinflation Giftsgetpaidfirst,whichmakesapercentage abetteridea,thanafixedsum,whichcouldbe problematiciftheestatehasbeen eatenaway overtheyearsbylivingcosts

Thegiftmightjustbe1%or5%,Talivaisaid “Onaveragefromourresearch,theaverage charitablegiftinawillisaround$10,000 So itdoesn’thavetobeamulti-million[dollar sum]”

Anotherapproachistotreatcharitiesasan additionalchild Ifsomeonehastwochildren, forexample,thewillcanbesplitthreeways, withathirdgoingtocharity Givingtocharitywhilealiveismoretax efficientthanleavingabequestinawill That’s becausetaxpayerscanclaim3333centsin thedollarfordonationstocharitiesapproved bytheInlandRevenueDepartment,which includesmostwell-knowncharities

Photo/GettyImages

Frominsurerstogovernmentdepartments,Kiwis haveoptionswhendisputesarise.Independent complaintsbodiesarefreeforthepublictouse andcansolveawiderangeofproblemsfairly.

Whetherit’sacomplaintabout abusinessoragovernment department,thefirstplacetostart isbycomplainingtotheorganisationin question.Mostwillhaveaprocessandquite oftenateamthatdealswithcomplaints. Sometimescompletinganonlinecomplaint formisallthat’sneededtogettheproblem solved.

Whenanacceptableresolutioncan’t bereachedthereareawiderangeof organisationsthatcanhelp.Forexample, ifacomplainttoWork&IncomeaboutNZ Superfails,there’stheoptionofcontacting thelocalMemberofParliament(MP),the parliamentaryOmbudsman,whichhandles complaintsaboutgovernmentagencies,the OfficeofthePrivacyCommissioner,orin somecircumstancesTeKāhuiTikaTangata HumanRightsCommission.

OrinthecaseofaKiwiSavercomplaint thatisn’tresolvedbythecompanyin question,memberscancomplaintothe scheme’sstatutorysupervisor.Andifthat doesn’twork,allKiwiSaverschemesmust

belongtoanindependentombudsman’s scheme.

FINANCIALOMBUDSMEN

Complaintsaroundmoneyarecommon. Mostbanks,lenders,insurers,foreign exchangedealers,andestatesproviders,in mostcases,arerequiredbylawtobelongto anindependentdisputeresolutionservice. Customersneedtocomplainformallyto theirproviderfirst.Ifthatfails,thecustomer shouldaskforaletterofdeadlock.They canthentakethecomplainttooneofNew Zealand’sfinancialombudsmanservices: theBankingOmbudsman,Insurance &FinancialServicesOmbudsman,and FinancialServicesComplaintsLimited. Theseombudsmenactasimpartialreferees. Aswellasthefinancialombudsmen services,FairWay,aprivatecompany,is thedisputeresolutionserviceformany financialadvisers.TheLawSocietyhandles complaintsaboutlawyers.

TELECOMSANDUTILITIESCOMPANIES NewZealanderslovetocomplainabout

theirtelecomsandutilitiesproviders.When thosecomplaintsaren’tresolvedfairly, independentcomplaintsservicesarefree touse.

In2023yearalone,over3000Kiwis voicedtheirdissatisfactionwithtelephone andinternetprovidersthroughFairWay’s telecommunicationsdisputeresolution service:TelecommunicationsDispute Resolution(TDR).

PrivatecompanyUtilitiesDisputes Limitedhandlesindependentdispute resolutionforelectricity,gas,andwater complaintsthatcan’tbesolvedbythe provider.Onlinecomplaintsummaries revealintriguingcases,fromunauthorised customerswitchestoundeliverediPhones. Somearemoreobscure,suchasthe homeownerwhowasplaguedwithbad smellsfromawaterprovider’sbiofilter. Theresolutionforthatinvolvedthe providerinstallinganairconditionerinthe customer’shouse.

MOTORVEHICLEDEALERS Dodgymotorvehicledealersfeature regularlyincasesheardbytheMotor VehicleDisputesTribunal.

Thetribunalhandlesdisputesofupto $100,000.CasestudiesontheNZLegal InformationInstitutedatabasessuggestit’s notuncommonforcomplainantstoseek torejectthecar.Somearesuccessful.It’s definitelyworthsearchingthenamesof caryardsbeforebuyingfromthem.Some appearrathertoooftenincomplaints.

EQCCOMPLAINTS IndependentcomplaintsabouttheNatural HazardsCommission/TokaTūAke[formerly EQC]havebeentakenoverbyFairWay in2024.Thankstoearthquakes,floods, cyclones,andothernaturaldisastersin thepastdecade,manyKiwishavefound themselvesleftoutofpocketbyEQC decisions.

OTHERWAYSTOCOMPLAIN Thisisnotanexhaustivelistofcomplaints bodies.TheOmbudsman[whichisa separateorganisationtothefinancial ombudsmanschemes]canhandleawide rangeofothercomplaintsincludingaged care,fairtreatmentofdisabledpeople, andcomplaintsaboutothergovernment agencies.Complaintsaboutworkcan betakentotheLabourInspectorate. Homeownerswithcomplaintsabouttheir buildercantakethemtotheMasterBuilders Associationiftheircontractorisamember. Tenantsandownersinbodycorporateshave theTenancyTribunal.

Noteverycomplainthasafreecomplaints service.Fordisputeresolutionwherethere isnomandatedfreeservice,therearequite afewprivateprovidersofpaidmediation,or otherwisethecourts.

Forlower-valuecomplaints,theDisputes Tribunalisanoption.Itcostsonly$45to lodgeacomplaint,andmightresultinagood outcome.

Finally,sometimessimplygoingtosocial media,andoftenrepeatedly,cangetthe desiredoutcome.

Howtocomplainifyougetarawdeal Alegacyofcare TheselflessactofleavingagiftinyourWillto MédecinsSansFrontières/Doctorswithout Borders(MSF)canhelptoensureMSFisalways readytorespond,deliveringhumanitarian medicalaid–today,tomorrowandalways.

ThelateGillianBrame,whopassed awayinOctober2023,wasa remarkableindividual whochosetosupport MSF’smission, throughher exceptional$2 millionbequest.

Bornin Chinain1942 tomissionary parents,Jill’s lifejourney wasshaped byresilience anda commitmentto helpingothers. Afternavigating turbulenttimes andtravellingthough India,Englandand eventuallysettlinginNew Zealand,withalotoftimespentin Samoa,shebecameadedicatedteacher. In2023,morethan69,000MSFstaff

respondedtocrises,includingconflicts, disasters,diseaseoutbreaksand exclusionfromhealthcare,in over70countries.Inthe sameyear,generous supportfrom Australianand NewZealand donorswent towards projectsin 34ofthose countries.

MSF’s activities inPalestine, Yemenand Nigerwerethe top-supportedby AustraliansandNew Zealanders,including surgicalandwoundcare, maternalandchildhealth, nutrition,andmentalhealthcare.The visionarysupportfromgenerousdonorsis whatmakesthisworkpossible.

AsviolenceragedinWestDarfurinJune2023,woundedpeoplecameinwavesto AdréhospitalinChad,wheretheyweretreatedbyMSFandMinistryofHealthteams. PHOTO/©MohammadGhannam/MSF

MatthewReid,ChairofMSFNewZealand, emphasisedhisgratitudeforthegenerosity ofgiftslikeJill’s.“Asanimpartialand independentorganisation,MSFdoesnot receivefundingfromthegovernmentsof NewZealandandAustralia,soreliesheavily ondonationsfromthecommunity.Gillian’s giftwillensureMSFisalwaysindependent andalwaysreadytorespond,delivering humanitarianmedicalaid–today, tomorrowandalways.” Accordingtoarecentstudybyonline

Willwritingprovider,Safewill,almost halfofNewZealand’sadultsdon’thave aWill.WhenyouwriteaWill,youensure yourwishesarecarriedintothefuture, protectingthoseyouloveandallthatyou careabout.Tolearnmoreabouthowto leavealegacyofexpertmedicalcare,then pleasegetintouchwithMSF’sfriendlyGifts inWillsteamon0508633324or gifts.wills@nz.msf.org.

TolearnmoreaboutMSFpleasevisit msf.org.nz

GillianBrame

How(not)tospend aninheritance NewZealand’s‘greatwealthtransfer’isseeing moreandmorepeopleintheir50sand60s inheritingmoney.

Likeany‘windfall’rangingfromselling businesses,orevenwinningthe lottery,somepeoplewillsquander theirgains.

ResearchbytheGrattanInstitutein Australiafoundthatmostinheritedmoney isreceivedbypeopleagedover55.It makessensethatwouldbethecaseinNew Zealandaswell.Theirparentsaremost likelyinthe75-85yearagebracket.

Thesuddeninfluxofwealthtempts peoplewhohaven’tworkedfortheirwealth tomakeimpulsivedecisions.

Storiesofpeoplewhohavequickly squanderedtheirfortunesareplentiful. Tipsonhowtohandlenew-foundwealth include:

DON’TMAKEIMPULSIVEPURCHASES

Oneofthemostcommonmistakespeople makeafterreceivingawindfallisspending moneyonhigh-ticketitemssuchasluxury cars,expensiveholidays,orevenalarge home.Whileitmightfeelgoodintheshort term,suchimpulsivepurchasescandeplete

thewindfallrapidly.

Barfoot&Thompson’sPaulNeshausen oncehelpedalotterywinnerbuyatotal of10housesoverayear.Neshausentold OneRoofthatgoingfromnomoneytoa lotofmoneycouldsendsomeofftherails, however.“Ilikenittorugbyleagueplayers whoturnprofessional.Theygofrombeing destitutetoearning$300,000[to]$500,000 ayear,andtheygoofftherailsbecause they’venotbeengiventherightguidanceor guardianship.Theywastealltheirmoney, [and]theygetthemselvesintrouble.”

RIVALWealthfinancialadviserTim Fairbrotherisn’tagainstsomeonewho hasreceivedawindfallspendingalittleon themselves.Butherecommendsgetting advicebeforemakinganybigdecisions.He toldOneRoof:“Yourgoalswillsubstantially changeintermsofthelifestyleyou’regoing tolive,thehouseyou’regoingtobuy,and thingslikethat,”hesaid.“You’veessentially hadaone-offchange,foryou,yourfamily andfuturegenerations.”Thatrequires

carefulplanning.?

AVOIDRISKYINVESTMENTS

Itcanbetemptingtoplungemoneyinto cryptoorotherhighrisk-venturessuch asunprovenbusinessideas.Whilethese investmentscansometimesyieldhigh returns,theycanalsoresultinsignificant losses.Afinancialadvisercanhelpa beneficiaryorwinnercreateadiversified portfoliothatbalancesriskandreturn. “You’dwanttosetupalargepieceof[the win]inaportfolioofassets,whichwould produceenoughincomeforyoutoliveoff andcontinuetogrowintermsofcapital growth,”saidFairbrother.

AVOIDSUPPORTINGUNSUSTAINABLE LIFESTYLES

Suddenwealthcanleadtoanunsustainable lifestyle.Plentyoflotterywinnersorsports starswhocomeintounimaginablewealth endupbroke.OpesPartnerseconomistEd McKnighttoldOneRoofthathewouldcreate abudgetbeforebuyingaluxuryhome. Headded:“Iwouldn’tbuya$20mhouse, becauseoftheexpenses.Yourrateswillbe absolutelyoutrageous.Samewithinsurance andmaintenance.Youmaynothavethe incometocoverthat.I’dbuysomething morehumble,likea$4mor$5mhouse.A reallynicehouse.ButIwouldn’tgospending itonamassivehouse.”Peoplealsoneedto

budgetfortaxes,whichsometimescomeas ashock.Whilstinheritancesandlotterywins aren’tsubjecttoincometaxinNewZealand, thesubsequentearningsandcapitalgains mightbeincertaincircumstances.

SETYOURSELFUPFIRST

Financialadvisorsrecommendpayingoff existingdebt,settingupanemergencyfund, andstillcontributingtoKiwiSaver.This wouldputfinancialsecurityinplaceand givepeaceofmind.McKnightsaidhewould belookingtocreateaportfoliotolastthe person’slife,thenpassdowntochildrenand grandchildren.“Iwouldtalktoafinancial adviserandsplititbetweensharesand property,”hetoldOneRoof.“OnceIhad sortedmyselfout[withafinancialplanand investments],Icanthenpayoffmyfamily’s mortgagesandaffordtobegenerous.ButI wouldbesettingupmylifefirst.”

AVOIDTHE‘TOOGOODTOBETRUE’ OFFERS

Anyonewhocomesintomoneyoughtto bewaryofnewfriendsandalsopeople ororganisationsoffering“investment opportunities”or“businessdeals”that seemtoogoodtobetrue.Scamstargeting peoplewhohavecomeintomoneyare common.Peopleshoulddotheirdue diligence,seekindependentadvice,and neverrushintodecisions.

Photo/GettyImages