25 minute read

Strategies for

Strategies for Accelerating Project Execution

By Brandon Darroch, Southeast Division Manager and Senior Associate; and Brian Arend, Senior Associate; SSOE

More than 75 percent of the companies responding to a recent survey from the National Association of Manufacturers (NAM)1 expect the COVID-19 pandemic will have a financial impact on their business, with more than 50 percent anticipating changes to their operations.

Prior to the pandemic many manufacturing companies had design and construction projects, either in progress or in the pipeline, with aggressive schedules. To slow the spread of the disease, many manufacturing operations and construction sites were shut down while new safety precautions were developed and implemented. Furthermore, uncertainty in the market caused many companies to delay committing large capital investments into expanding their operations.

Over the summer, the manufacturing industry has slowly begun its return to pre-pandemic production levels. As this occurs, companies have done little to relax pre-COVID targets for newly constructed facilities, as projected production dates are a key driver for the majority of manufacturers, especially for advanced technology markets like electric vehicles where speed to market is such an important factor. This has resulted in compressed design and construction schedules and a need for the architecture/engineering/construction (A/E/C) industry to offer unique ways to accelerate project delivery.

Following are insights into strategies, solutions, and key considerations which can be implemented to accelerate project execution and help companies get back on track.

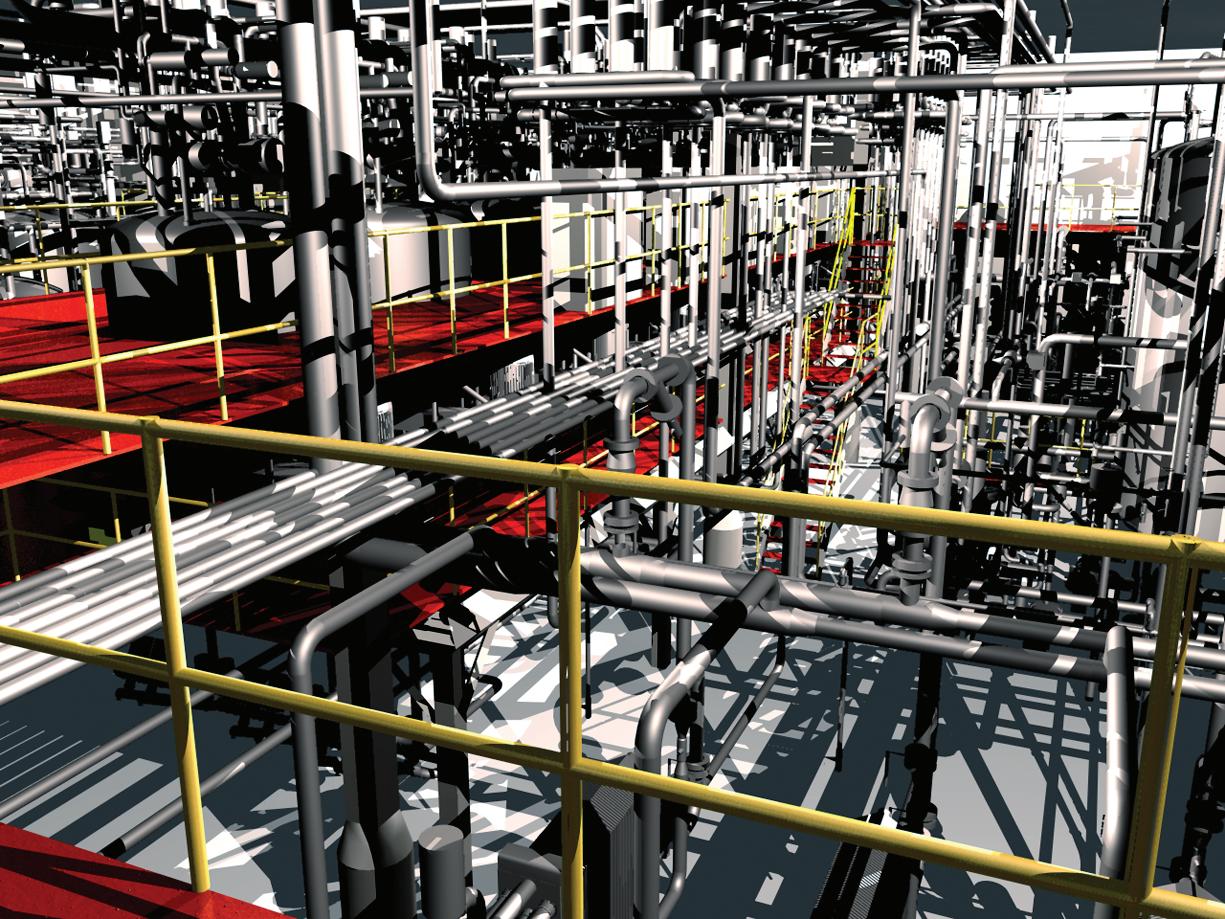

Involving an A/E that can produce fabrication level designs in-house can significantly reduce the construction schedule.

Consider Alternative Project Delivery Methods

Historically, many manufacturing leaders have preferred the traditional design/bid/build model. This delivery method takes a linear, step-by-consecutive-step approach, first bringing an A/E on board to design a complete package of construction documents. Once design is complete, project execution goes on hold as the construction documents are bid out to contractors. This bid process can take a considerable amount of time, dependent on the level of detail an owner puts into reviewing, evaluating, and eventually awarding a contractor.

Although this process has the least amount of risk to the owner, its step-by-step approach makes it the longest in terms of schedule duration. Instead, consider a design/build approach where the A/E and the contractor are simultaneously brought on board at the beginning of a project. Not only does this delivery method facilitate a more expedited constructability review process, it can substantially compress the overall project schedule by omitting the bid delay between the design and construction phases.

An alternative project delivery method, similar to the design/ build approach, is EPCM (engineering, procurement, construction, management). This “single source” approach, where a sole firm acts as designer, contractor, and owner of all vendor contracts, has been used extensively throughout the oil, gas, and petrochemical industries where projects are inherently complex and require extensive coordination. In a situation where it is imperative to meet an aggressive production date, an EPCM approach may prove beneficial, as having all project vendors leveraging their expertise under a single contract can reduce construction change orders and result in significant schedule reductions.

One of the more progressive delivery methods from a procurement perspective is integrated project delivery (IPD). In this approach, the owner, design firm, and contractor are all bound by a joint agreement and, if well executed, all parties share the financial incentives of a project being completed ahead of schedule and below budget. Although this delivery method may come with an owner’s perceived loss of control, this extremely collaborative delivery method has resulted in projects completed with drastically reduced schedule and cost.

Similar to design/build and

INFRASTRUCTURE

GEORGIA MOVES AT THE SPEED OF BUSINESS

World-class transportation systems – airport, sea port, trucking, and rail – provide Georgia companies unparalleled access to domestic and global markets.

Georgia.org/ProBusiness

EPCM, IPD invites key subcontractors to be part of the design process. This allows owner requirements and design intent to be communicated early to trades who can, in turn, provide constructability feedback in real time during the planning phase when its impact is most beneficial. This early collaboration between owner, A/E, and contractor can have a significant impact on reducing construction costs and compressing project schedules.

Courtesy of SSOE

Implement “Pull Ahead” Approach

engineering details to be refined without impacting the overall construction schedule. By breaking the project up into smaller packages that are released sequentially and in alignment with the construction schedule, stakeholders can achieve the benefits of an accelerated schedule, while maintaining owner-required competitive procurement protocols. This does require a more robust level Early collaboration between owner, A/E, and contractor can have a significant impact on reducing construction costs and of construction management staff and may compressing project schedules. necessitate additional resources for manufactur-

Each of the above alternative project delivery meth- ers that do not have a U.S.-based facilities team. ods requires the owner to relinquish some portion of control over to the design/construction team in order to Determine Level of Design Detail accelerate the schedule. However, some manufacturing Under a traditional design/bid/build approach, conorganizations have very stringent procurement proto- struction documents and 3D models are developed to cols that do not allow this perceived loss of control over a sufficient level of detail to support the contractor bid the competitive bid process. process. Once a contractor is awarded, select trades

If that is the case, projects can be broken into must further develop the design to a fabrication level smaller, defined scopes of work based on critical path of detail based on the design intent provided within the activities. These “pull ahead” packages can enable an construction documents. owner requiring the design/bid/build delivery method For example, many engineering firms will produce to start construction activities before the bulk of design steel design drawings that require shop drawings, and is complete, allowing for the project to be completed at a subsequent lengthy shop drawing approval process a more accelerated pace than the traditional design/ (e.g., exact dimensions and details of bolt hole locabid/build approach. tions) before the steel can be ordered and fabricated.

For example, take a greenfield manufacturing facil- This step inherently comes with over-production and ity. By designing and awarding an early civil/sitework extra processing — both of which are forms of waste as package, construction can begin while the structural defined by Lean methodology. steel and foundation design development is under Owners are encouraged to investigate the 3D modelway. As soon as key mechanical and/or electrical ing capabilities of potential A/E’s before selecting a equipment requirements are known, a long-lead equip- design team, as some firms have the ability to design ment package can be released for pre-purchase. The to the fabrication level of detail, potentially avoiding the building shell can then be designed and bid, typically waste of redundant design effort. Involving an A/E that followed by the mechanical, electrical, and plumbing can produce fabrication-level designs in-house shortens (MEP) package to be released last. This process allows the schedule by eliminating this added step, and on construction to start early and gives more time for the large-scale manufacturing projects, this approach can

significantly reduce the construction schedule by enabling steel to be ordered months sooner than traditional methods.

It is important to understand the impact of schedule compression strategies on the overall project lifecycle, and keep in mind that design hours and construction hours do not always translate directly as a one-to-one time savings. An emphasis in decisive planning during the design process can translate into substantial construction time and cost savings. Just like swimming one mile can provide an equivalent workout and calorie burn as seven miles running, a one-day increase in the planning/design phase might result in a 15-day savings to the construction schedule based on the increase in coordination it can provide. Spending additional time up front during the planning and design phases can result in substantial time and money savings during construction execution. Owners should ensure those responsible for making schedule compression decisions consider recommendations from both the design and construction industry experts.

Remember Design and Construction Is a People Process

Often in the design and construction of manufacturing projects there is a huge emphasis on technical qualifications of the design and construction team. Predominantly less of a focus is placed on the “soft skills” that are necessary at the leadership levels of the project team, and it is the soft skills/personalities of leaders that drive the success of the team.

When conducting project interviews — especially for the design/ construction of a complex, fasttracked manufacturing project that requires extensive collaboration to meet an aggressive schedule — consider whether team members have the right “chemistry” to work collaboratively. Many organizations underestimate the positive impact team compatibility can have on project execution or, just as important, how the lack of this chemistry can negatively impact it.

Accelerating Project Execution After COVID Delay

Many manufacturing organizations continue to utilize the same project delivery method over and over because of familiarity and comfort with the status quo. Pandemic-related project delays, however, have prompted manufacturers to investigate alternative approaches to make up for lost time. If implemented effectively, these alternative delivery methods can help manufacturers not only make up for pandemic-related delays and meet critical start-of-production dates, but also enhance their competitiveness by ensuring their product’s speed to market, while potentially achieving some cost savings along the way.

PRO-BUSINESS ENVIRONMENT

COMMITTED TO YOUR BUSINESS

Pro-business policies, a responsive government, and a partnership approach to business makes Georgia the state for companies to relocate, grow, and thrive.

Georgia.org/ProBusiness

Companies involved in the knowledge sector, software, and financial and business services are showing interest in locating in Puerto Rico.

CARIBBEAN: BUSINESS LOCATIONS IN SUNNY PLACES

SOPHISTICATED TECHNOLOGY AND INFRASTRUCTURE ATTRIBUTES, FRIENDLY WAGE RATES, MULTILINGUAL SKILLED LABOR, AND SOMETIMES SURPRISING REAL ESTATE DEALS MAKE THE CARIBBEAN ISLANDS AN ATTRACTIVE OPTION FOR INVESTMENT.

BY STEVE KAELBLE

It’s one of the top tourist destinations in the world, and with good reason. The scenery in the Caribbean is stunning, the cultures inviting and diverse, the location convenient but with a refreshing outof-the-way feel. How do the warm and sunny nations and territories of the Caribbean fare as locations for business operations beyond tourism?

Some of the opportunities are obvious; some may be surprising. The benefits for ocean-centric businesses, including those tied to resources and commodity exports, almost go without saying. But there are also great opportunities in services, from financial operations to call centers, as well as the digital and creative sectors and advanced manufacturing.

Similarly, there are some challenges that come immediately to mind for most observers, but advantages that may be less apparent to outsiders. Natural disasters from hurricanes to earthquakes make global headlines and thus won’t surprise anyone as they tally up the challenges. But some observers may overlook various bright points, from advanced digital infrastructure in some jurisdictions to diverse workforce capabilities in others.

A Wide Range of Industries

Consider a recent summation from the financial analysis website Investopedia.1 “The Caribbean region consists of small island economies that are major players in a wide range of global industries,” the analysis points out. Trinidad and Tobago, for example, has grown by way of oil and gas export revenues, and Jamaica sends the world not just tasty rum but lots of bauxite, valuable

for production of aluminum and various other products. “The Dominican Republic and the Cayman Islands are well-known offshore tax havens of choice for multinational corporations and billion-dollar financial service companies,” Investopedia adds.

The World Bank2 describes the Caribbean as “a diverse region with significant economic potential and growth opportunities…Many small economies, including those that are tourism-dependent, were maintaining a positive growth rate prior to the onset of the COVID-19 pandemic.”

The United Nations’ Economic Commission for Latin America and the Caribbean also keeps watch over the Caribbean economy, and its most recent overview3 also found generally positive growth rates (again, before the pandemic rewrote the story all over the world). In particular, economies of those Caribbean nations that are part of the Eastern Caribbean Currency Union had a positive growth rate of 4.1 percent in 2019, even as there was a bit of a decline overall in the growth rates of the region’s service-producing economies. Goodsproducing economies in the region were seeing slow but positive growth in 2019.

Opportunities for Renewal

Needless to say, the coronavirus pandemic threw a major wrench into the picture in 2020, but that is certainly not a challenge unique to the Caribbean. For the record, the World Bank last year was forecasting eco-

Continued on page 22

Puerto Rico: A “Muscle Memory” to Meet Any Challenge

AS ANYONE WHO HAS BEEN AROUND through 2020 and the first part of 2021 knows, disaster can strike anywhere. And while no one volunteers to be part of a severe weather event or a pandemic, the one silver lining of such terrible occurrences is how they can teach ingenuity and build resilience.

That’s certainly the case in Puerto Rico, according to Rodrick Miller, CEO of Invest Puerto Rico. The island has seen its share of tragedy, such as the devastating Hurricane Maria in 2017, a series of earthquakes, and financial crises. Through these challenges, Miller says, “There is a muscle memory of response. There is no market that is immune to risk, but Puerto Rico has a muscle memory that allows us to respond to disasters.”

To that strengthened resolve and ingenuity, add in the fact that the island is a U.S. territory. “We are part of the United States but also part of the Caribbean and Latin America. That is a unique picture,” Miller says, with the benefits of U.S. connections ranging from intellectual property protection to billions of dollars’ worth of federal funds now being pumped into the infrastructure.

No wonder Puerto Rico has a strong manufacturing economy, led by pharmaceutical companies and medical device-makers. Lots of big pharma names operate there, and newer biotech additions include CytoImmune Therapeutics and Biosimilar Solutions, which among other things are developing cancer therapies and COVID-19 vaccines, respectively.1 Add in an ever-growing location interest from companies involved in the knowledge sector, software, and financial and business services.

The bottom line, Miller says, is Puerto Rico knows how to reinvent a better picture after getting through challenges. “If people think they know Puerto Rico, I’d advise them to look at Puerto Rico again. The last three to five years have put us on a different path and an exciting path.”

1 https://www.areadevelopment.com/newsitems/2-4-2021/cytoimmune-therapeuticsbiosimilar-solutions-puerto-rico.shtml

Caribbean: Business Locations in Sunny Places –

Continued from page 19

U.S. Virgin Islands: American Advantages with a Caribbean Address

The U.S. Virgin Islands combines the benefits of a Caribbean location with the advantages of U.S. connections. It’s an unincorporated U.S. territory, which means American currency, courts, and protections. And products made in the USVI can be labeled “Made in the USA.”

Locating here comes with shipping advantages, duty-free imports, plus exports into the U.S. that are duty- and quota-free. There’s no state or territory tax, either. In fact, companies that qualify for the Economic Development Commission’s tax program can see their corporate and personal income tax dwindle by 90 percent, and there’s a 100 percent exemption on excise taxes, property taxes, and gross receipts tax.

The local workforce has plenty of experience in both industrial work and services. That includes advanced manufacturing, rum distilling, and energy, along with financial/professional services, call center and back office operations, knowledge industries, and e-commerce. And of course, being in the Caribbean, there are plenty of opportunities in tourism and hotel development, as well as marine businesses.

That said, USVI has all of the workforce-development options that you’d expect on the American mainland. The labor department’s One Stop Centers provide wide-ranging training and skills-upgrade options, along with recruitment and screening services and lots of consultation on labor markets and laws.

Infrastructure is highly advanced as well, including two international airports, numerous ports, and shipping options that connect with major routes and the Panama Canal. Broadband connections are speedy, thanks to the public corporation known as Virgin Islands Next Generation Network, which makes sophisticated and affordable fiber connections available all over.

nomic contraction of just under 2 percent in 2020, with tourism-dependent economies taking a hit from the slowdown in travel and the global economic struggle.

Aside from that wild card that affects just about everyone around the world, “Caribbean countries are extremely vulnerable to climate change and natural disasters,” according to the World Bank. “Extreme weather events are common — the region experienced three Category 5 hurricanes between 2017 and 2019.” For example, according to the U.N.’s Economic Commission for Latin America and the Caribbean,4 Hurricane Dorian in 2019 affected most of the population of the Bahaman islands of Abaco and Grand Bahama, with an economic price tag of $3.4 billion that’s more than a quarter of the nation’s GDP.

But fixating on such challenges would create a misleading and unfair picture of the region’s economic development prospects. Indeed — as proven by the pandemic and resulting economic downturn, along with weather catastrophes in the mainland U.S. and elsewhere — negative events can come into the picture anywhere. What’s more important is, how do the locals respond to challenges, and do the various upsides outweigh the fears of potential downsides?

Check the sidebar to this article focused on Puerto Rico for thoughts related to that first question. Disasters are a challenge, to be sure, but they also build character, strengthen ingenuity, and in some cases open the door to unexpected opportunities for renewal. As a U.S. territory, Puerto Rico gains access to relief funds that are helping

the island not just recover from past natural disasters but wind up in a better place in everything from the electrical grid to educational facilities.

Other resources also provide opportunities for improvement, too. The World Bank, for example, points to an electrical distribution system modernization project that will rehab more than a thousand kilometers of distribution networks in the Dominican Republic.

Driving Positive Outcomes

And the other upsides of Caribbean business locations are more numerous than many people understand. Jamaica, for example, has a strong investment climate that drives positive outcomes in a number of focus sectors, including energy, global digital services, manufacturing, mining, agribusiness, film and, of course, tourism.

The Bahamas strives to supplement its tourist economy with investments in a variety of sectors, including banking/ insurance, IT/data processing, light manufacturing, pharmaceuticals, offshore medical services, and ship repair. Or consider Barbados, which encourages investment in everything from financial services to informatics and e-commerce, which supplement tourism and light manufacturing, among other sectors.

Take manufacturing as an example. Jamaica is seen as a prime choice for near-shore facilities, aided by location, infrastructure, trade agreements that open market doors, generous business incentives, and an experienced English-speaking labor pool. Digital services is another opportunity that is an eye-opener for some. In Jamaica, for example, the sector drives more than 30,000 jobs, enabled by solid IT infrastructure, skilled labor, and laws that safeguard data.

That last point — regulatory safeguards that coexist with business

Continued on page 27

Why invest in the Turks & Caicos Islands?

n Easy Access Extensive direct air routes, from the Caribbean, UK and major US and Canadian cities. n Available Real Estate Prime undeveloped land available across 40 small islands and cays. n Pro-Business Investment Climate Government support at all levels, including the provision of investment incentives in priority sectors. n Strong Economy Sovereign Credit Rating of BBB+, an estimated annual growth rate of 2.5% and the US$ as our national currency. n Exceptional Weather 40 beautiful islands with 350 average days of sunshine, world-class beaches and great outdoor activities under the Caribbean sun. n Attractive Incentives Temporary and Permanent Residence status available to qualified investors. No direct corporate, personal, capital gains or inheritance taxes. No exchange controls.

Courtyard Plaza #2D, Leeward Highway, Providenciales, Turks & Caicos Islands Telephone: #1-649-338-4770 info@investturksandcaicos.tc www.investturksandcaicos.tc

WHAT’S DRIVING RECORD INDUSTRIAL REAL ESTATE DEMAND

THE GLOBAL PANDEMIC ACCELERATED the growth of e-commerce as lockdowns and safety concerns prompted an increasing number of consumers worldwide to shop online. As a result, several years of online sales growth were condensed into 2020 alone, causing industrial leasing to surge globally as logistics became essential for retailers. Changes in population densities, shifting consumer expectations, and increasing transportation costs all played a role in this rise in industrial property demand. But it’s the need for speed that will shatter industrial CRE pricing.

2020 – A BANNER YEAR FOR INDUSTRIAL

Throughout Asia Pacific, strong leasing and tight market conditions translated into double-digit increases in rental rates. Tenant demand was also strong across

By JASON TOLLIVER, Global Head of Retail, Logistics & Industrial Research, Cushman & Wakefield

Europe with impressive year-over-year gains in leasing activity in both Eastern Europe (+28 percent) and Western Europe (+10 percent). Meanwhile, activity in the Americas reached a new all-time high with more than 680 million square feet (msf) of new leasing.

The U.S. industrial market finished the year remarkably strong with 90 msf of net occupancy growth, the strongest single quarter on record. More than half of U.S. markets recorded year-over-year leasing gains, with Southern California’s Inland Empire, Phoenix, Las Vegas, and Salt Lake City posting the strongest occupancy growth in the West, while the Pennsylvania I-81 and I-78 distribution corridor, Philadelphia, and New Jersey were the strongest markets in the East. In fact, 2020 was a recordbreaking year for the Pennsylvania corridor — with overall net occupancy growth of 23.5 msf, 40 percent more than the market’s previous record and two times the preceding three-year average. In the South, Atlanta, Dallas, and Houston bustled with activity (collectively growing by more than 60 msf), while Chicago, Indianapolis, Kansas City, St. Louis, and Cincinnati sat atop the leaderboard in the Midwest.

FOLLOW THE PEOPLE

Changes in population densities have always been an important driver for commercial real estate demand, perhaps even more so in an online world where orders are individually picked, packed, and shipped to a doorstep. As millennials age, they are increasingly moving to more suburban locations where a lower cost of living makes it easier to purchase a home. Looking ahead, some of the metros expected to see the strongest domestic net migration gains over the next decade include Phoenix, Dallas, Miami, Houston, Las Vegas, Atlanta, Orlando, Tampa, Austin, and Seattle. The projected inflow of people to these cities will support demand for industrial real estate within them, and within the markets that support the delivery of goods with distribution hubs.

In the years ahead, e-commerce leasing activity and development will be concentrated on regional distribution centers that allow retailers to position inventory much closer to end-consumers, on return centers that help manage reverse logistics costs and recirculate returned inventory faster, and on A BOOM IN E-COMMERCE AND SHIFTING POPULATION DENSITIES AS WELL INCREASING TRANSPORTATION COSTS ARE MAKING INDUSTRIAL REAL ESTATE A “CAN’T MISS.”

urban locations that allow for rapid order fulfillment.

THE LAST LINK IS THE COSTLIEST

Last mile, final touch, and last link are just a few of the many terms used to refer to the final part of an ecommerce supply chain. The last link is the costliest part of the supply chain — often accounting for more than half of total supply chain costs — which explains why it will remain a key focus for occupiers. Attempting to control delivery costs while simultaneously ensuring speed and predictability is a tall task.

The last link is also one of the most important steps in delivery, as it is the point of contact with consumers whose expectations on service, flexibility, reliable delivery times, and speed are rising in tandem with the surge in online shopping. Compounding the challenge for retailers to rise to consumer expectations are higher transportation costs caused by increasing driver wages, fuel costs, and the number of vans needed for daily deliveries. Partial van loading, inefficient delivery routes, and separate returns trips are also contributing factors.

A general rule of thumb for last link facilities is to be within a 30-minute drive to a major city center and as close as possible to the first delivery point. Not every city, however, will require an urban-sited warehouse in the future. Deliveries in smaller cities and towns can often be effectively served from regional fulfillment centers where storing, picking, sorting, and shipping take place under one roof. Whether or not a last link is necessary must be determined on an individual market and property basis, but the growing number of retailers that must rely on proximity to consumers will shatter the logistics land price ceiling.

THE NEED FOR SPEED WILL SHATTER PRICING

In the case of the last link, inefficiencies and costs converge around transportation, especially in dense urban areas. Although real estate is a small part of overall supply chain costs (typically 3–5 percent), it can make a big impact on controlling costs elsewhere. The trade-off of spending more on real estate costs through multiple warehouses or distribution centers can be an effective way to reduce transport distances, thereby reducing transportation costs.

Investors and developers are primed to deliver more logistics space but are often challenged by a lack of rent pricing comparables to adequately underwrite the purchase of an expensive industrial-zoned site close to cities. At the same time, demand from retailers and 3PLs for just such locations is increasing. Eventually, more developers and investors will accept the risk to speculatively purchase these sites at prices that, until now, were only affordable for developers of other asset classes. Strong rental growth potential for last link depots puts logistics in the same revenue ballpark as traditional urban land uses. In fact, it is likely we are now at the beginning of that wave and news of record logistics land prices and rents will become a regular occurrence.

WHAT’S ON THE HORIZON FOR INDUSTRIAL CRE?

According to Cushman & Wakefield’s North American Industrial Forecast,1 industrial asking rents are expected to reach a new nominal high of USD $6.97 per square foot by year-end 2022, and the growth will be broad-based across many markets in all regions. For the eighth consecutive year, net absorption in the U.S. will exceed 200 msf in 2021; we anticipate this streak will extend through 2022, further illustrating that industrial real estate is about as close to a “can’t miss” as it gets in the years ahead. n

1 https://www.cushmanwakefield.com/en/united-states/insights/ northamerican-industrialoutlook

Caribbean: Business Locations in Sunny Places –

Continued from page 23

friendliness — is an important consideration, one for which there are positive answers not just in Jamaica but numerous Caribbean destinations. Those with past or ongoing ties to major Western nations are among those ensuring that they deliver the right levels of regulatory security to companies that make an investment.

Puerto Rico, for example, offers intellectual property protections that stem from its U.S. ties. Turks and Caicos has British historical ties that are still reflected in its safeguards for those in financial services. The U.S. Virgin Islands as a territory has tax benefits that make doing business there in many ways like operating within America’s states. Barbados prides itself on a well-developed legal system with roots in English Common Law. Saint Lucia promotes, among other things, strong protections for intellectual property and patents.

The bottom line is, as with most places in the world, it’s well worth digging deep to get beyond the most obvious Caribbean attributes. For some, 300-plus days of sunshine and year-round warmth is plenty of reason to give Caribbean destinations high quality-of-life marks. For others, headlines of hurricanes provide enough concern to steer clear.

The real story is in the middle ground of less obvious details. That’s where the picture emerges of locations with sophisticated technology and infrastructure attributes, friendly wage rates, multilingual skilled labor, and sometimes surprising real estate deals. The culture and landscape may feel like a world apart, but the actual distance in miles can be comfortably close to markets and home offices. n

1 https://www.investopedia.com/articles/investing/011916/ profits-paradise-top-4-economies-caribbean.asp 2 https://www.worldbank.org/en/country/caribbean/overview 3 https://www.cepal.org/en/publications/45729-preliminaryoverview-economies-caribbean-2019-2020 4 https://www.miamiherald.com/news/nation-world/world/ americas/article237435814.html

The Turks and Caicos Islands: Sophisticated and Business-Friendly

IN SOME WAYS, this small chain of islands is a separate world unto itself, but its strong cultural and business ties to both the United States and United Kingdom are quite apparent, too. It’s an easy 90-minute flight out of Miami, with an economy tied to the U.S. dollar. And it’s a British Overseas Territory; its citizens are British citizens; the educational system is based on the British model; and the judicial system is based on English Common Law.

Given its breathtaking natural beauty, it’s hardly surprising that tourism is a prime industry and major investment opportunity, with more than a million annual visitor arrivals. Adventure tourism is a big deal, thanks to a wealth of great dive sites, and ecotourism is quite the draw, too. Marina and lodging development are seen as promising sectors, and so is a completely different draw for visitors: medical tourism. An exceptional medical system combines with the lovely location, creating an enticing place to get cosmetic surgery or a new hip or knee, and then recuperate on the beach.

Turks and Caicos is also an offshore financial center, one that is seen as safe and secure for international banking, corporate and offshore investing. That’s because its regulatory system fits snugly into the standards and practices of its bigger partners across the Western business world. Turks and Caicos is fully compliant with the International Monetary Fund, the Organization for Economic Cooperation and Development, and Financial Action Task Force standards. The territory is committed to the Foreign Account Tax Compliance Act as well as early adoption of the Common Reporting Standard.

The business-friendly government is eager to encourage light manufacturing, especially businesses that serve the tourism and hospitality sectors. The government has also identified such things as agri-industries, food processing, and fish farming and processing as priority sectors.