3 minute read

Engaging workers as contractors — what you should know

There’s nothing new about engaging contractors to perform work in our industry.

Contracting, or subcontracting, is legitimate and widespread in building and construction. The project nature of our work necessitates this form of engagement in many cases. Arguably, it’s also because we have a workforce of highly skilled tradespeople that prefer to operate their own business, often as a sole trader, rather than being employed by someone else.

At MBV, we often receive inquiries about engaging contractors. These questions are often about correctly classifying workers and the obligations that attach to these forms of engagement.

To provide you with insight, we’ve put together some of the important considerations to be aware of when engaging a worker as a contractor.

Have a written agreement

Two landmark decisions from the High Court of Australia last year highlight the importance of having a written agreement with a contractor. These two decisions outline that the written contract is paramount when determining if a worker is a contractor or an employee.

The key takeaway is that if you have a written agreement reflecting the relationship is contractual, a Court will more likely find the worker is a contractor rather than an employee.

Having a written contract that reflects a contract of service reduces the risk of the worker being misclassified as an employee. This is very important as misclassification could mean that you are liable to pay employment-related entitlements, including annual and sick leave, public holiday pay, notice and redundancy.

We recommend you have an agreement in writing where you engage a worker as a contractor. If this is something you don’t have, the MBV EIR team has an independent contractor agreement template available for purchase.

Superannuation, CoINVEST and WorkCover

Independent of whether your worker is classified as a contractor or employee at general law, statutory schemes may apply to the arrangement. You may still be required to contribute to superannuation and CoINVEST, along with having adequate WorkCover insurance covering the contractor. Superannuation may apply to a contractor where they are engaged wholly or principally for the supply of labour, they perform the work personally and they cannot delegate to others. For portable long service leave, CoINVEST will analyse the relationship in line with general law principles. If the worker would be considered an employee at law and they perform work covered by the CoINVEST rules, you’ll need to make contributions for them.

Alongside using general law principles, WorkCover may deem your contractor as a worker for the purposes of WorkCover insurance. A person may be deemed a worker for coverage if 80% of the work is performed by the same individual and 80% of the person’s services income is earned from you. This is provided they don’t supply materials or equipment as the main object of the engagement. If this is the case, you may need to have adequate WorkCover insurance for the contractor.

Be aware of payroll tax

While you may not expect payroll tax to apply to a contractor, you may have to include what you pay them as wages for the purposes of calculating your payroll tax obligation.

Payments to contractors are typically liable for payroll tax unless an exemption applies. The tax-free threshold on wages for payroll tax purposes is currently $700,000 per annum.

If this may apply to your business, we recommend that you speak to your accountant or taxation advisor.

Final point – company contractors

Finally, it is generally advisable to engage contractors that are incorporated entities (for example, a company). This may still involve the specific worker performing work for your business but often allows the work to be performed by others. Where this occurs, it further reduces your risk of mischaracterisation and means it is less likely the statutory schemes will apply.

Please be aware this article contains general information and is not a substitute for professional advice. If you’d like further information, you can speak with our EIR team on (03) 9411 4555.

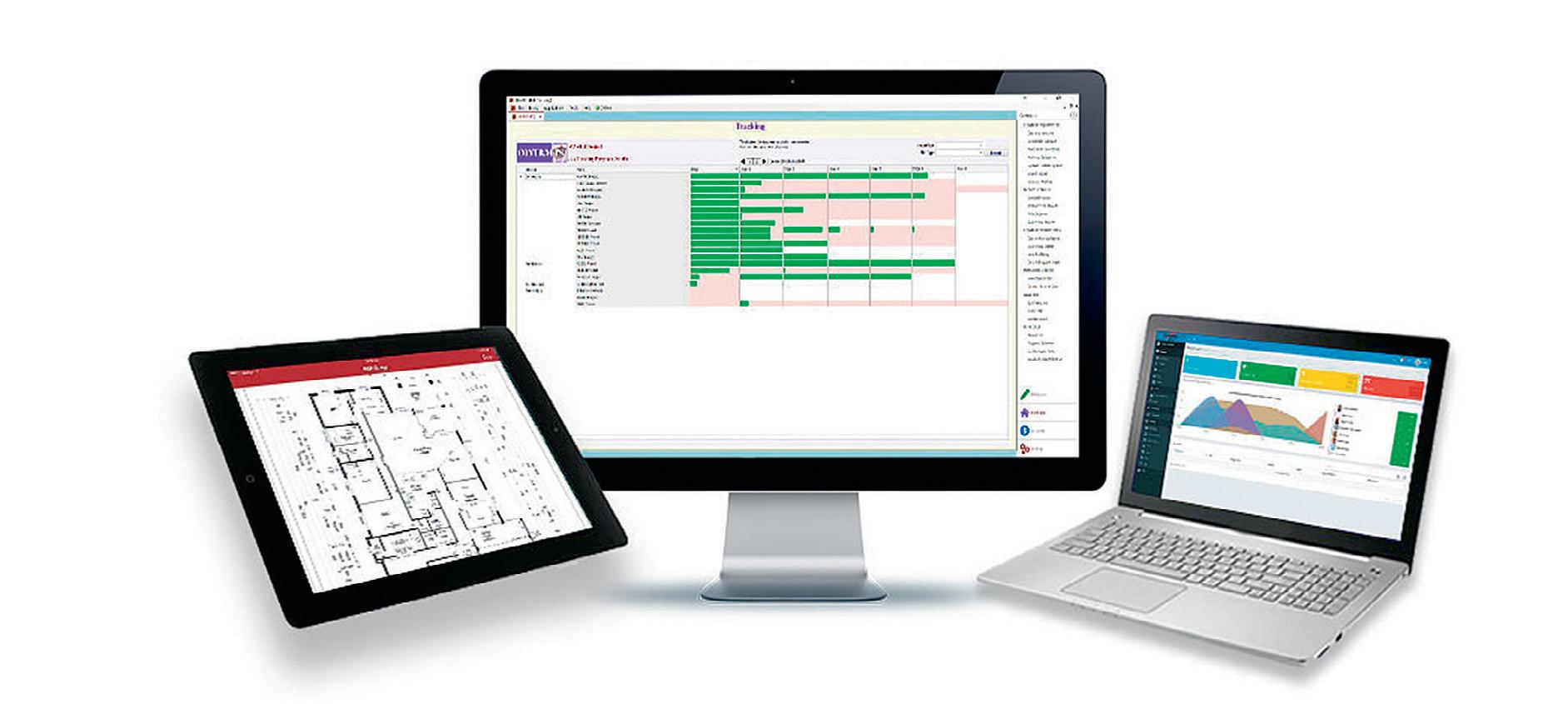

With BEAMS, there is no need to switch between other programs when estimating, quoting or keeping track of your accounts.

BEAMS was designed for the construction industry in 1989 and the software is now used by many companies in many sectors.

Unlike others systems in the market, BEAMS is a complete, fully integrated Estimating, Scheduling and Accounting system with the addition of a Mobile application to deal with all the supervisor’s onsite activities. This means no double up of processes or information as it flows seamlessly from one section of the program to the next — saving time and frustration.

BEAMS also allows you more control over your data, allowing you to store your valuable data locally rather than relying on internet connections or cloud based applications.

Ask about our no-obligation free demo!

• CRM with direct email leads and customer portal.

• CAD Image for fast accurate on screen take offs.

• Quotes Register and auto Addenda selections.

• Purchase Orders and integrated Variations.

• Progress Claims, Percentage Claims and Retentions.

• Full Accounting including auto BAS, Cashflow and WIP.

• Job Cost control with security settings for overpayments.

• BEAMS Mobile for onsite construction time line scheduling.

• Document Storage for emails, letters, images etc.

Full integration and functionality streamlines your entire business. Provides fast quotes, documents, scheduling, purchase orders and reports – anytime, anywhere.

Delivers fully detailed quotes in just 30 minutes.

Suits sole trader sub-contractors right up to Top 100 Builders. 10% ongoing discount for all HIA and MBA members, on initial software purchases.

Still the #1 choice for construction industry software in Australia