City Snapshot: Welcome to Prescott

AZ CPA November/December 2022 The Arizona Society of Certified Public Accountants y www.ascpa.com

CPACharge has made it easy and inexpensive to accept payments via credit card. I’m getting paid faster, and clients are able to pay their bills with no hassles.

– Cantor Forensic Accounting, PLLC

Trusted by accounting industry professionals nationwide, CPACharge is a simple, web-based solution that allows you to securely accept client credit and eCheck payments from anywhere.

increase in cash flow with online payments

of consumers prefer to pay electronically

of bills sent online are paid in 24 hours

Get started with CPACharge today cpacharge.com/ascpa AL: $3,000.00 *** PAY CPA 22%

65%

62%

CPACharge is a registered agent of Wells Fargo Bank N.A., Concord, CA, Synovus Bank, Columbus, GA., and Fifth Third AffiniPay customers experienced 22% increase on average in revenue per firm using online billing solutions

+

Corporations

Arizona S & C Corporations, and Insurance Companies that pay premium tax may direct 100% of their Arizona liability through the Low Income and Disabled/ Displaced dollar-for-dollar tax credits! Business leaders such as APS, Earnhardt Auto Centers, GCU, Lumen Technologies, Shea Homes, and 130 + are investing in AZ future leaders. There is still $18.7m remaining* in the Low Income corporate tax credit cap to claim.

*as of 09/08/22

Contribute any amount up to:

Changing lives one scholarship at a time.

“Thank you

for making my dream come true!”

–

Gabriella

• 99.4% Graduation Rate • 97% Matriculate to Higher Education, Trade School, or Military Service • 1000s Hours of Community Service • Corporate Tax Credits • Individual Tax Credits Catholic Education Arizona is an IRS 501(c)(3) nonprofit charitable organization and has never accepted gifts designated for individuals. Per state law, a school tuition organization cannot award, restrict or reserve scholarships solely on the basis of donor recommendation. A taxpayer may not claim a tax credit if the taxpayer agrees to swap donations with another taxpayer to benefit either taxpayer’s own dependent. *2020 ADOR Report Through your support, we have awarded over 148,000 tuition scholarships to underserved students since 1998! Are Your Clients Changing Lives with Their Arizona Tax Dollars?

Individuals CELEBRATING YEARS It’s Quick. It’s Easy. Ask us How!

602-218-6542 WWW.CEAZ.ORG

Stay Connected

Meet your CPA community by following our LinkedIn page for member highlights, announcements and more.

AZ CPA

The Arizona Society of Certified Public Accountants

President & CEO Oliver Yandle Editor Haley MacDonell

Advertising Heidi Frei

Board of Directors

Chair Rachael Crump Chair-Elect Andrea Levy Secretary/Treasurer Lauren Murro Directors Benjamin Cilek David Collins Samantha Crum Tithi Debnath Glen Evans Barbara Gonzalez Joseph Heidleburg Gabrielle Luoma Eugene Park Jesse Porras Megan Romo Christopher Tyhurst

Immediate Past Chair Tom Duensing AICPA Council Members Mike Allen Jared Van Arsdale

AZ CPA is published by the Arizona Society of Certified Public Accountants (ASCPA) to provide information, news and trends to the accounting profession. It is distributed six times a year as a benefit to ASCPA members. The ASCPA, its members, board of directors and administrative staff assume no responsibility for advertisements herein. The ASCPA and the above people also assume no liability for business decisions made by readers in reference to statements and/or claims in articles or advertisements within this publication. Opinions expressed by contributors are not necessarily those of the ASCPA.

Arizona Society of CPAs 4801 E. Washington St., Suite 180 Phoenix, AZ 85034-2040

Telephone (602) 252-4144 AZ Toll-Free (888) 237-0700 www.ascpa.com

4 AZ CPA NOVEMBER/DECEMBER 2022

Features

November /December 2022

City Snapshot: Welcome to Prescott

Snapshot:

to Prescott

By Haley MacDonell

The Future of Accounting: How Finance Professionals are Navigating New Tools and Ideas

By Jody Padar

Have You Been “Phished” Before? The Value of Phishing Awareness Trainings

ASCPA 100% Club

The Ethics of Pricing

By Elizabeth Pittelkow Kittner

9 City

Welcome

9

15

19

By Kenny Kang, CPA (in CA), CGMA, CFE

24

27

Columns & Departments Chair’s Message by Rachael Crump, CPA, CGMA 6 Member News 7 Classifieds 30 Quick Quiz 31 AZ CPA

Volume 38 Number 6

4801 E. Washington St., Suite 180 Phoenix, Arizona 85034-2040 www.ascpa.com NOVEMBER/DECEMBER 2022 AZ CPA 5

ASCPA Chair’s Message

Appreciation for You, Our Membership!

I would like to start the last column of the 2022 calendar with appreciation and gratitude for our membership. Our mission is to work for you by advocating for the CPA profession and provid ing community to maximize your growth. As an organization, and a cohort of CPAs, we have core values: collaboration, integrity, diversity, equity, inclusion, access and continuous growth. As we enter this season of reflection, I want to talk about another value many of us share: gratitude.

Rachael Crump, CPA, CGMA Chair, Arizona Society of CPAs Senior Vice President, Global Corporate Controller and Principal Accounting Officer at Insight

Part of my leadership philosophy is showing gratitude in all – the big and small, each and every day. For example, I am grateful that I’ve been able to experience many different cultures around the world through the work I’ve done as a CPA. Those experiences are special to me and have impacted who I am as a professional. Likewise, I have great appreciation for everyone along my career that has taken time and energy to invest in my growth. Even the simplest action of letting someone else observe can teach a valuable lesson, as I know from experience.

Now, I am in a place in my career when I can look at my colleagues and do the same. As a leader at Insight, I show my appreciation for teammates by sponsoring their ASCPA membership and other professional development opportunities. I’m sure we all have someone in our minds that has mentored and supported us in the professional sphere, and I hope that I can be one of them.

Having a strong sense of gratitude can embrace a healthy outlook on life and lets you become a more empathetic version of yourself. It’s impossible to know with certainty another person’s full context. I think it was my parents who instilled in me a strong sense of grit – a sense of pride that hard work and determination could open so many opportunities (a subject we covered in the prior column). I have a strong sense of appreciation for my family and friends that have supported me throughout the journey of life – career and otherwise –and I’m grateful every day that I get to enjoy life with each of them.

As you may have noticed by the title, we at the ASCPA are grateful for our chance to maximize your growth and your commitment to the CPA profession. Keep an eye out for messages on how we’re celebrating this November, which is member appreciation month.

How have you shown gratitude and appreciation for people in your life? How has someone shown their gratitude for you? Please take time as the year wraps up to stop and appreciate the moments of gratitude throughout your life. l

Best, Rachael Crump

6 AZ CPA NOVEMBER/DECEMBER 2022

Member News

Our new class of ASCPA Champions honed their storytelling skills to inspire students to become CPAs. Thank you to our CPA volunteers who attended this workshop in September: Sandy Abalos, Patricia Bambridge, Nicole Bartlett, Sabrina Boever, Janeen Butler, Kelly Damron, Joanne Elsen, Marissa Graves, Meghan Hieger, Tracy Karns, Laura Leopardi, Michael Loeschen, Coulson Painter, Sarai Santos, Shawna Stapleton, Monica Stern, Duncan Torrance, Kent Utter, Madison Vernon, Xingli Zhang and Yue Michelle Zhang. If you are interested in volunteering to empower accounting students, please reach out to membership@ ascpa.com.

ASCPA Champions

520.512.5438 ibescholarships.org Largest Educational Tax Credit Ask About S-Corp 162 Deduction C & S Corps | Insurance Companies | LLC's with S Election Hurry, Cap is Almost Met! Solicit STO Funds While on ESA* Largest Individual Tax Credit Kids | Schools | General Fund Online Application AZ Corporate Tax Credit AZ Individual Tax Credit Help Arizona Kids Phone | Chat | Email Support | Pay With Credit Card Simple 5 Minute Process Notice (A.R.S 43-1603): A school tuition organization cannot award, restrict, or reserve scholarships based solely on a donor’s recommendation. A taxpayer may not claim a tax credit if the taxpayer agrees to swap donations with another taxpayer to benefit either taxpayer’s own dependent. *if eligible

NOVEMBER/DECEMBER 2022 AZ CPA 7

are preparing for year-end, tax season, or everything in between, Paychex is here to provide

professionals with the

remain compliant, and enhance their

Year-End Reference Center

services.

and tools they need to stay

Accountant Knowledge Center

© 2022 Paychex, Inc. All Rights Reserved. | 09/29/22 Paychex is proud to be the preferred provider of payroll, retirement, and HR solutions for the ASCPA. L ea r n more (87 7 ) 53 4 -4198 Resources To Make a Complex Job, Simpler payx.me/ascpa_ye22 payx.me/ascpa_akc22 Whether you

accounting

resources

informed,

advisory

• Year-end guides and checklists • Up dated deadlines, forms, and laws • Information to help you and your clients

• Monthly spotlight on relevant topics • Tax guides and forms • Online U.S. Master Tax Guide®

City Snapshot: Welcome to Prescott

By Haley MacDonell

When you think of Prescott, you may instantly see the iconic town square in front of the courthouse in your mind, a landmark to the city’s role as Arizona’s first capitol. Maybe you think of Whiskey Row, the world’s oldest rodeo and great antique stores. Or, Prescott National Forest – 1.25 million acres of trees, trails and campsites.

Gidget S. Slater, CPA, is a partner at the Prescott-based firm Slater & Rutherford, PLLC and one of 54 ASCPA members who calls the town home. She loves to hike in her free time along the dot-to-dot trails, which are city-maintained and guide hikers with white spots along the path. When she has a little more time, she takes her family to camp in one of the National Forest’s 11 campgrounds, or just a few short hours to Cottonwood or Lake Pleasant.

Continued on next page...

NOVEMBER/DECEMBER 2022 AZ CPA 9

About 20 years ago, Slater moved from the San Francisco Bay Area to Prescott, ready to raise a family. She had great memories of the town where she had vacationed with her parents as a child.

“When my daughter was about nine months, I decided I had enough of being home,” she recalled. “I decided to go back to work at an established public accounting firm in the area.”

As she started part-time, she settled back into the routine built during the early part of her career. But, the first time she called someone at 5:05 in the evening, nobody answered. It was the first sign that work in Prescott would be different from the early part of her career in San Francisco.

“People call it the rat race, and it really was,” Slater remembered. “That was just the way of life, and it wasn’t a hardship. I loved my job, and I loved where I lived.”

As her children got older, Slater transitioned to full-time work. She championed the firm’s move to Microsoft products, and when the partner at the firm retired, she teamed up with a colleague to buy him out. Now, Slater & Rutherford continues as the successor to a business that has served North-Central Arizona for over 35 years.

It may be known in part as a retire ment community, but the allure of Prescott as a “small town” has brought new residents and industry in the past few years. The pandemic and

remote work contributed to acceler ate Prescott’s development. According to The Center Square, the Prescott Valley-Prescott metro area had a 2.2% increase in population in 2021, compared to metro Phoenix’s 1.48% increase during the same time. The growing city needs professional ex perts to keep up with the demands by new out-of-state transplants and busi nesses, including CPAs, bookkeepers and accountants.

The Slater & Rutherford office is located in a small business complex, nestled between other businesses and a neighborhood nearby. It’s green, and when it rains the clouds hang low and touch the mountains and the houses built into them. One house nearby protrudes from the mountain on stilts; it was rumored to belong to Cher at one point.

As Slater puts it, it’s never been easy to lure people to leave a larger metro area to work in Prescott. To re cruit new employees, the firm beefed up benefits and tries to keep up with competitive salaries. However, the ac ceptance of remote work has made it more challenging to find profession als ready to join teams like theirs.

“We’re turning away new clients daily,” said Adam Robert Rutherford, CPA, a tax partner of Slater & Ruth erford, PLLC. “If we had the staffing or the capacity, we could probably almost double within a year or two.”

Though there are more clients requesting services than they can take on, the firm has gotten more selec tive. It no longer onboards clients like retirees from California looking for tax assistance in multi-state matters. These one-season opportunities aren’t always worth the bandwidth of their small but mighty team. Clients who want ongoing relationships are much more worth their time and care.

“If we didn’t have the capacity, we started referring potential clients out to other people, other CPAs or ac countants in town that we know and trust,” Rutherford said. “Most of them have come back to us to tell us to stop sending them more referrals.”

Even as a firm that has had remote employees since before 2020, hiring talent within and beyond the tristate area has been a challenge. They compete with offers and opportuni ties from other businesses around the

Slater, Rutherford and office manager Cathie Weber chat in the lobby area. At Slater & Rutherford, PLLC, half of employees work on site and the other half are remote, based in Arizona, New Mexico and Texas.

Sigafoos sits in his personal office, which displays a wide collection of Native American art.

10 AZ CPA NOVEMBER/DECEMBER 2022

country on salary, benefits and more. The costs have eventually passed on to clients, some of which have been with them for 15 years.

Despite the challenges, Slater & Rutherford continues to prioritize quality client services and the worklife balance that makes life in Prescott so attractive.

“We don’t want to overwhelm our employees more,” Rutherford explained. “We want to keep them happy, more than we want to take on new clients. Our priority right now is trying to keep workload manageable.”

Finding Solutions in Education

The office of Raymond B. Sigafoos, CPA, does not look like your typical firm. Walking into the building, which was custom-built back in the 80s, you will be greeted by walls of Native American rugs and art, only about 10% of Sigafoos’s entire collection. Most of the art on the office walls are the work of David Paladin, an artist born in Canyon de Chelly in the mid20s and whom Sigafoos met when the artist lived in Prescott decades ago.

Sigafoos has lived, studied and worked in Prescott since the late 60s. Now owner of his own firm, he is also one of five elected members of the Yavapai College District Governing Board, which oversees Yavapai Col lege’s accountability through policy. His experience with higher education governance began in 1981 when he joined the board of Embry-Riddle Aeronautical University. He retired from the board in 2009.

Prescott’s dearth of CPAs is a small-scale sign of the larger pipeline problem, an issue talked about ad nauseam with justification. While a CPA, bookkeeper or accountant with decades of experience is invaluable, many from the baby boomer genera tion are retiring. To upskill current and future CPAs and fill in the new gaps created by community develop ment, perhaps the best opportunity is investing and inspiring young talent that already knows the burgeoning community.

Adam Rutherford was born and raised in Prescott, and he loves the small-town energy built by a friendly community, a more balanced profes sional experience and being close to family. Back when he studied at Yavapai College, accounting was a perfect match for his ambitions. When he transferred after two years to complete his bachelor’s degree at Northern Arizona University, there was no question what his major would be.

“I wish more people could see it here,” he said. “Some people are just looking at the dollar amount, and they’re not seeing the full picture of the opportunity and the community. Our firm is not a typical accounting firm, as far as personality. We have Nerf fights. We do office Olympics during tax season, just to keep it relaxed. It’s a trade that’s worth it for me.”

In communities like this one, small businesses support other small busi nesses. An entrepreneur just starting out on a venture or a restaurateur opening their first location might be able to navigate the journey easier alongside someone who knows the community as well as they do. If there are questions, the answers are just a phone call or email away – and, they’re much more reliable than a generic Google search.

There is great potential to recruit and train future accountants and

bookkeepers in smaller cities like Prescott from the pool of talent who already live there. We can look to Yavapai College as an example of lower-cost, accessible and local edu cation in accounting.

Sigafoos joined the District Gov erning Board of Yavapai College in 2005 and has since served as board chair for seven years over the course of a 17-year tenure. Currently, he is the only member with a financial background.

“What’s important to me is that we have an educated society, and I have the opportunity to help facilitate the education of a portion of that society,” Sigafoos explained. “That was impor tant to me, to guide the organization to help it succeed so that they can help the students succeed.”

More than four in 10 Gen Zers plan to pursue entrepreneurship in some way, and more than half believe that it should be a part of higher education curriculum, according to a survey from Northeastern Univer sity. The appetite for accounting, bookkeeping and similar paths – all fundamental to what makes a small business run – is there, and now local opportunities can play a big role in serving the newcomers to the Prescott area.

Coming Home to Prescott

Laurie M. Boaz, CPA, grew up in Prescott and only left her hometown

Continued on next page...

NOVEMBER/DECEMBER 2022 AZ CPA 11

to study accounting at Arizona State University. It was one of two career paths that a high school aptitude test recommended to her. The other recommendation was forestry.

“I get paid to go to work every day and do something I love,” Boaz said. “So, I’ve never really considered any other career. It’s a great way to coordinate being an active parent and still being able to make a living.”

Boaz, whose firm supports income and estate tax planning and compliance for complex clients, has opted to keep the firm in-office. The business restricts the scope of practice to only include services at which Boaz knows she can excel for her clients, which includes meeting with each one and being a part of the tax and financial strategy, not just to report results. Unless staffing changes, there is no expectation of expanding soon.

She understands what the decision is like to weigh the pros and cons of moving to a place like Prescott. CPAs in the area are likely to earn less over the course of their career than their metro Phoenix counterparts, and that certainly plays a role in the conversation.

“I continue to remind my Phoenix peers that this is such a great place to live, and it’s worth it,” Boaz emphasized. “I would urge anybody that wants to get out of the city or wants to get out of the heat to think about coming to Prescott. It’s a really fun, social, active community, and anybody that would move up here would be welcomed and they would hit the ground running. l

As a

Wealth Management

Insurance Solutions

• Estate Planning & Trust Services

• Business Succession & Valuation Planning

Why partner with a top-ranked firm?

Growth

Additional services to meet and exceed client expectations

Succession Planning support and opportunities

Revenue Create diverse, recurring revenue

Retention Attract and retain top talent

For more information, please visit: joinmwa.com/cpa-alliance/

Registration of an

Some

listed in this

are

business in the State of Kansas. Registration of an investment adviser does not imply a certain level of skill or training. For additional information about MWA, including fees and services, please contact MWA or refer to the Investment Adviser Public Disclosure website (www.adviserinfo.sec.gov). Please read the disclosure statement carefully before you invest or send money.

Mariner Wealth Advisors (“MWA”) is an

•

•

CPA Alliance partner, you’ll collaborate with our in-house teams to offer your clients comprehensive financial services: MARINER WEALTH ADVISORS RANKE D TOP FIVE MARINER WEALTH ADVISORS RANKE D TOP FIVE *Barron’s awarded 2022, 2021, and 2020 #5, 2019 #4 and 2018 #3 Top RIA Firms ranking to Mariner Wealth Advisors based on data compiled for Mariner Wealth Advisors and the 2017 #2 and 2016 #1 rankings to Mariner Holdings based upon data compiled for Mariner Holdings’ registered investment adviser subsidiaries. The number of firms included in the rankings was: 20 (2016), 30 (2017), 40 (2018), 50 (2019), and 100 (2020, 2021, 2022). Barron’s publishes these lists based upon several criteria, and the firm’s filings with the SEC were used to cross-check the data provided to Barron’s. The listing includes the firms’ numbers of clients, employees, advisors, offices, and state locations. The award is not indicative of future performance, and there is no guarantee of future investment success.

investment advisor does not imply a certain level of training or skill. For additional information visit www.barrons.com.

services

piece

provided by affiliates of MWA and are subject to additional fees.

SEC registered investment adviser with its principal place of

12 AZ CPA NOVEMBER/DECEMBER 2022

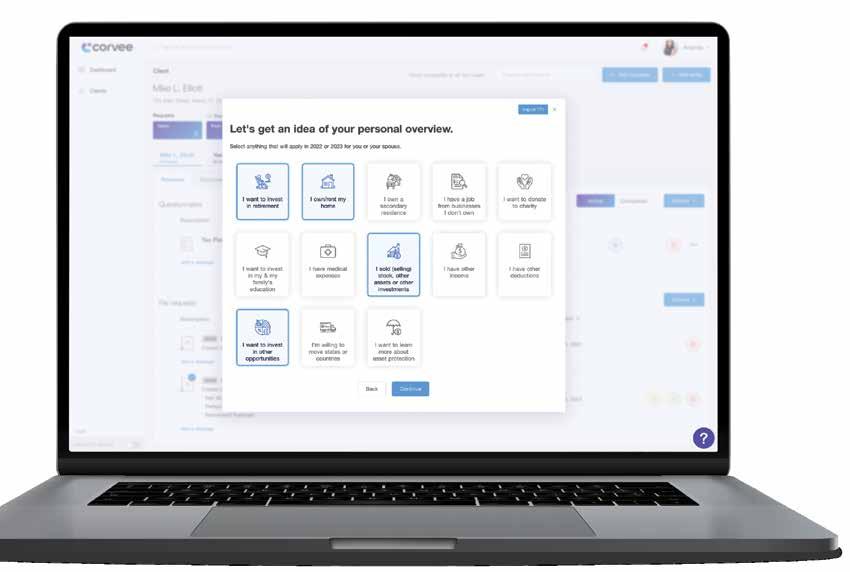

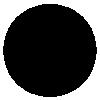

Save Clients

on

Request Your Demo at corvee.com/AZCPA

Money

Taxes With Corvee Tax Planning Software

The Future of Accounting: How Finance Professionals are Navigating New Tools and Ideas

By Jody Padar

How has the accounting profession changed since you entered it? You likely don’t have a calculator on your desk anymore. You haven’t seen a paper form in decades. You have more new software to help you than ever before. Technology has changed the way you’ve done things. It’s a trend that continues today.

The cloud has become a great enabler for accounting teams, providing access to new technologies that automate and speed up the accounting process. Today, the technologies radicalizing accounting are artificial intelligence (AI) and automation.

If you’ve been busy doing things you’ve always done, now is the time to explore easier, more efficient ways to get work done. That starts with using technology better. Why should CPAs and CFOs be embracing new technology? Because it changes lives. It transforms organizations. It makes a difference in your hiring.

Let’s explore how your organization can use technology to your advantage and what it means for your team and company.

Continued on next page... NOVEMBER/DECEMBER 2022 AZ CPA 15

Winning the War for Talent

AI and automation can actually make the work environment better. If you view technology as part of your team, that shift in mindset can help you attract and retain the next generation of accountants and financial experts. In a tight labor market, we need all the help we can get.

Using a new technology-based model, as much as 40% of the work a finance team does today should or could be done by AI, machine learn ing or automation in general. Another 40% should be done by the lowerlevel staff, and the remaining 15% or so by senior-level persons.

In the past, technology has been viewed as an extra, an add-on. Now is the time to shift your thinking – AI can be part of your labor force.

Can you imagine a world where you’re not working crazy hours to get period-end reports done? What about going home early – on a regular basis? It’s completely possible.

You need to think about technology as a part of your team.

Not technology to replace your team, but rather, to take away the grunt work and to elevate peoples’ jobs. That’s radical.

Bots can be trained to handle repetitive tasks, which reduces much of the manual calculations and review. That means you don’t need as much talent. And that’s a good thing, be cause talent is hard to come by.

There’s more to technology and automation than just being efficient.

It also has to be effective. Efficiency is no longer good enough – disrup tion is happening in real-time, and the real-time data is getting smarter, faster and more automated.

The Downside of Utilizing Technology

Technology is not all sunshine and roses. Anytime you introduce a new process or innovation, there will be growing pains, learning curves and change. You need to think through these challenges and acknowledge and work through them as they happen.

Technology will change team communications.

One of the important discussions you’ll need to have early on is how enabling technology will change your team’s communications. You don’t really log out of work at 5 p.m. You have your phone on. You check email at night. You respond to a text you didn’t get to earlier in the day. The questions are, is that good for the team? Is it good for leadership? Is it good for mental health?

CFOs, managing partners and ex ecutives need to be crystal clear about what’s important and what their expectations are in this new world.

Also, realize that technology can spur miscommunications. You’ve likely seen this play out a lot over the last two years. Most teams need to spend some time intentionally think ing about how to communicate as things become more automated.

Enhancing the Role of Technology on Finance Teams

In addition to using automated tech nology and AI in your fight to retain top talent, these tools can make the work environment better. Technology is part of your team, and that shift in mindset can help you get your hands around a sometimes-tricky topic.

Afterall, there is another piece of the AI and automation puzzle: how technology will help us attract and retain the next generation of accoun tants and financial experts.

The expectation that AI is going to fix all your data challenges is prob ably not realistic. Data is only as good as the process and people behind it. Machine learning won’t uncover perfect insights. You’ll still need the human being to digest the data and respond to it.

Processes will need to standardize and scale. You don’t want to put an expensive technology on a bad pro cess. You want to alter the way your department operates to use these technologies better, including training your employees. Shiny new technol ogy isn’t worth much if your people don’t know how to use it. Processes can’t be changed if only a few people know how to adapt and integrate the technology.

Not all companies are actively engaging and spending the money to upskill their teams. If this is your company, then ask yourself: “What does it cost to train my employees versus hiring new ones?” It’s actually a big difference. People want to work on teams where they feel valued, supported and invested in. There’s this familiar saying you need to consider – what happens if you don’t train your employees, and they stay? That’s not exactly the makeup for great organizational DNA.

Steps to Digital Transformation

It’s not really all about the technology. It’s more about having the right people and the right processes. The technology paired with that allows you to win.

It might take a little time to see the change. In the end, you and your employees will be much happier with the results. Here’s where your organization can get started:

• The Cloud: Your team must operate in the cloud for all this data to come together.

• Automation: What tasks on your plate are repeated or structured? Think about what you can automate and consider how you’ll share insights and offer advice.

• Pair Roles With the Right Technology: Different tools are best suited for different levels in an accounting department. What’s needed to advise the next person up?

Technology can transform your organization, and your life as a result. You can spend more time on strategy, do your job better, increase the busi ness’s revenue and profits, and you can go home earlier. l

Jody Padar, CPA (licensed in IL), is the “Radical CPA.” A former practice owner, Padar is now head of tax and evangelism for April, where she is working to help revolutionize fintech and tax spaces. She will present “Portrait of a Future CPA Firm – A Radical Approach” as a keynote speaker at Converge, the ASCPA’s annual conference, on November 8, 2022. Register for the conference at www.ascpa.com/converge.

16 AZ CPA NOVEMBER/DECEMBER 2022

Sherif Boctor Sherif@APS.net 888 783 7822 x1 www.APS.net Our HEAD START Program Will Make It Happen! Scan Here Delivering Results - One Practice At a time READY TO SELL YOUR PRACTICE, AND… Make this Tax Season YOUR LAST?

5

Have You Been “Phished” Before? The Value of Phishing Awareness Trainings

By Kenny Kang, CPA (in CA), CGMA, CFE

Have you ever opened email attachments from people you do not know?

Do you reply to emails that are unusual or out of character? Do you open email attachments or click on links that you did not expect or ask for?

Do you overshare on social media, constantly posting your locations and answers to personal questions?

Continued on next page... NOVEMBER/DECEMBER 2022 AZ CPA 19

If you answer “yes” to many of these questions, you are more prone to fall into a phishing scam. A successful phishing campaign often leads to user credential thefts, installation of malwares and ransomwares and data breaches.

According to the Federal Bureau of Investigation’s 2021 Internet Crime Report1, the FBI received 847,376 complaints, resulting in $6.9 billion in losses. In 2021, phishing, vish ing, smishing and pharming scams ballooned to 323,972 complaints versus 25,344 complaints merely four years prior. That is an increase of over 1,100% from 2017 to 2021.

Fast forward to 2022, Agari and PhishLabs released their Quarterly Threat Trends & Intelligence Report2 in May 2022. This report covers the first quarter of 2022 analyzing hundreds of thousands of phishing and social media attacks targeting enterprises, employees and brands. This report announced a 4.4% increase in phishing volume in Q1 2022 versus Q1 2021. Furthermore, the authors anticipate high-volume attack campaigns to spike throughout 2022 as bad actors target vulnerable enterprises and brands. The report further detailed that almost 59% of all malicious report ed emails targeting corporate inboxes were credential theft attacks, which is the top threat to employees.

Common Types of Social Engineering

• Phishing exploits human error and our reliance on email communication. Attackers send an email to their potential victims, usually in bulk, posing as a trusted source or contact to manipulate victims into handing over sensitive information, such as banking information or login credentials.

Example: People are interested in your latest _[fill in your favorite social media platform] _ post! Click here to view it.

• Vishing, or voice phishing, is a type of phishing that utilizes a phone to manipulate potential victims into handing over sensitive data. Attackers often employ deadlines or time limits

to create a sense of urgency, or they impersonate someone with authority, such as an IRS agent, to intimidate victims into handing over banking information. The phone number is typically spoofed to pretend the call is from an internal line or a phone number associated with a geographic region, such as Washington, D.C.

Example: Hello, may I speak to _[victim’s name]_. This is _ [threat actor]_ agent number 123455, with the IRS Criminal Division in Washington, D.C. The purpose of this call is to let you know that you are currently under investigation for underpayment of your _[tax year]_ tax.

• Smishing uses fraudulent Short Message Service (SMS) messages. The text message encourages potential victims to open a URL that would take the victims to a fraudulent credential log-in page or download a malicious payload into your phone. The text message can also request victims to call a specific number, which leads to a criminally organized call center.

Example: Dear User, Your _[financial institution]_ account

is delinquent and will be terminated in the next two days. Please visit http:_[xyz company.com]_or call _[telephone number]_ to request our representative to assist you.

• Pharming typically involves two stages. At the first stage, attackers install malicious codes on potential victims’ computers or servers. Once the malicious codes are installed, potential victims are automatically redirected from a genuine website to a seemingly identical spoofed page to steal victims’ information.

Example: You entered “https:// office.com” (the genuine website), and your computer or server would direct you to “http://office.com” (http, not https) or “https://0ffice. com” (the number zero instead of the letter “o”).

Phishing Awareness Training

During tax season, tax profession als are hectically serving their clients’ needs. Attackers often start their phishing campaigns during that time, knowing tax professionals and staff are often physically and mentally tired. Through human error, attackers expect a certain number of victims to fall into their trap, causing havoc during the busiest time of the year. Once a

20 AZ CPA NOVEMBER/DECEMBER 2022

fraudulent link is clicked, victims are typically faced with data exfiltration, data loss and ransomware extortions. Therefore, phishing awareness training (PAT) should be done throughout the year, especially during tax season.

PAT should include training all employees, owners and administrative staff; conducting phishing simulations; analyzing the results; and reinforc ing the results with positive feedback. PAT reduces the chance of malware and ransomware infections; lays the groundwork for more competent staff and increases their productivity; promotes cybersecurity to protect the value and the brand of your firm; and saves time and cost in avoiding data breaches and at incident responses.

Form W-12 Compliance

Form W-12 IRS Paid Preparer Tax Identification Number (PTIN) Application and Renewal instruction4 (Rev. May 2021) Box 11 requires PTIN holders to check the box to confirm awareness of your responsibility to protect taxpayer information3. The

instructions for Form W-12 includes a reference to the latest Publication 4557 Safeguarding Taxpayer Data (Rev. July 2021)4, which requires tax return preparers to create and enact written information security plans to protect client data. The word “written” was added to this revision emphasizing the importance of documenting an information security plan. You should include and document any phishing awareness trainings that you have conducted over the year.

Conclusion

Cyber criminals know humans make mistakes. We are more prone to mistakes when we are in the midst of stressful events, being physically and mentally tired. While the latest tech nology can safeguard us from many of these threats, ultimately attackers are chancing that one of us would click on that malicious link or attachment. With frequent phishing awareness trainings, we can secure the human layer of our cyber security. l

Footnotes: https://www.ic3.gov/Media/PDFAnnualReport/2021 _IC3Report.pdf https://info.phishlabs.com/hubfs/Agari%20 PhishLabs_QTTI%20Report%20-%20May%20 2022.pdf

https://www.irs.gov/pub/irs-pdf/iw12.pdf https://www.irs.gov/pub/irs-pdf/p4557.pdf

Kenny Kang is a Certified Public Accountant (in California), Chartered Global Management Accountant (CGMA) and Certified Fraud Examiner (CFE). He is the owner of Kenny Kang CPA and has over 19 years of public and industry experience.

Kang specializes in forensic accounting, fraud examination and fraud prevention & detection. He also provides consultation services in fraud risk assessment, internal control assessment, accounting processes review, cybersecurity policies & procedures documentation and phishing awareness training.

This article does not constitute any professional advice, and the content is intended for general informational purpose only. Circumstances may differ from situation to situation. Kenny Kang CPA is not liable for any errors or omissions in this article nor any losses, injuries or damages from the consumption or use of this information.

NOVEMBER/DECEMBER 2022 AZ CPA 21

violence!

by making a tax credit donation or share this tax credit with your clients

Right now, there are thousands of victims of domestic violence living in fear across Arizona. Many of these innocent people will lose their lives at the hands of their abuser, unless we take action as soon as possible. You can donate your Arizona Charitable Tax Credit to A New Leaf and save the lives of domestic violence survivors across the Valley by providing safety and shelter. Donations to A New Leaf qualify for the Arizona Charitable Tax Credit up to $800 for a married couple, or $400 for singles. A New Leaf' QCO i Your donation will save a life by providing: Safe, secure shelter Food & basic needs Legal advocacy Counseling services 24/7 hotline support You can end domestic

Donate at TurnaNewLeaf.org/TaxCredit Your support can save families like Jessica and her daughter Emma from abuse! Save a life

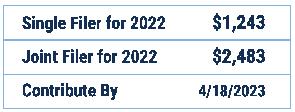

Go Behind the

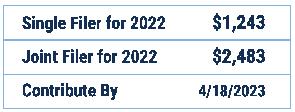

Scenes Join us Jan. 6 in Tucson as we tour Reid Park Zoo and learn about the organization’s publicprivate partnerships, conservation efforts and more. Plus, earn CPE credit. Register: www.ascpa.com/ btszoo Take the Credit FOR EDUCATION Year 2022 $1,243 for individuals $2,483 for married couples Provide scholarships by supporting the JTO through Arizona’s dollar-for-dollar private school tuition tax credit Deadline April 18, 2023 or when you file your taxes, whichever comes first Help your clients maximize their tax credits! Call for corporate tax credit information 480.634.4926 | JTOphoenix.org NOVEMBER/DECEMBER 2022 AZ CPA 23

A F and P CPAs

Abbott Company, Ltd.

Abdo

Addington & Associates, PLLC

Allen L. Nahrwold CPA PC

Alyx Cohan CPA, PC

Andersen & Sarnowski, P.C.

Anthony Choi, CPA

Arevon Energy

ATLAS CPAs & Advisors PLLC

Ball & McGraw, PC

Bashas’

BeachFleischman PLLC

Benjamin H. Field CPA, PC

Black & Soli, P.C., CPA

Boudreau Consulting LLC

Busby Sanford Brady CPAs, PLC

Butler Hansen, PLC

C. Wesley Addison, P.C.

Cary Millar, PC

CBIZ & MHM

Chaffee Traasdahl Crockett, PC

Charles L. Hummel, CPA PC

Christian Care

CHS Tax & Business Services, PLLC

CliftonLarsonAllen LLP

Colby & Powell, PLC

Concierge Consulting and Accounting, PLLC

Conover Asay CPAs, PLLC

Cordova & Jones, PC

CPA Financial Advantage, P.C.

ASCPA 100% Club

The Arizona Society of CPAs is celebrating another year of support from our 100% Club members. Thank you for continuing to encourage the development of your CPAs and strengthen the Arizona CPA community. Membership in the 100% Club ensures that all the CPAs in an organization are members of the ASCPA.

Curosh Law Group, PLLC

CW Clarke Ltd

Daniel A. Calabro, CPA, PLLC

Darin Guthrie, CPA, PLLC

David Lipinski, CPA, PC

DeBenedetti & Co., PLLC

Debra L. Zarbock CPA

Delores I. Nance CPA, PC

Dickman & Company CPAs PC

Douglas J Kingston CPA /International & Accounting

Eaton & Kasprzyk CPAs, PC

Eaton-Cambridge Inc.

Edward M. Osinski, Jr., CPA, PC

Edwards, Largay, Mihaylo & Co., PLC

Eide Bailly LLP

Elliott CPA LLC

Emelia Mensa, CPA

Epstein Schneider, PLC Evers Robinson Ltd. EY

Fenix Financial Forensics LLC

Fester & Chapman, PLLC

FORVIS, LLP

Four Leaf Financial & Accounting, PLLC

Frost, PLLC

Fulcrum LLC

Gary L Williams, CPA, CGMA

Ginsburg & Dwaileebe CPAs, LLP

Gosney & Company, P.C.

Hammond, Travers & Tuttle PC

Hanagan CPA, PLLC

Haynie & Company

HBL CPAs, P.C.

Heinfeld, Meech & Co., P.C. Henry+Horne

Herb Anderson CPA, LLC Hopkins Tameron Hostal PLLC

Horne & Company, LLC Howard S. Simon, CPA, P.C. Hunter Hagan & Company, Ltd.

Jaffa Simmons, PLLC

Jansen & Company CPAs, PLLC

Joanne M. Elsen CPA, PC

Johnson Goff, PLLC

Judith M Meduna, CPA

kAKB PLLC Koivisto Adams Kvittem-Barr CPAs

Karpinski, Bernstein & Adler, P.L.C. KeatsConnelly

Keegan Linscott & Associates, PC Kent O. Utter, CPA KML CPA LLC

Koeller Thompson CPAs, PLLC

Landmark PLC, CPAs

Laura S. Leopardi, CPA, PLLC

Leonard F. Baker, CPA PC

Lisa M. Smith, CPA

Lohman Company, PLLC

Ludwig Klewer & Rudner, PLLC

Lumbard Consulting, LLC

Mansperger Patterson & McMullin, PLC

Marley Management Corporation Martinez & Shanken, PLLC

24 AZ CPA NOVEMBER/DECEMBER 2022

Mary Beth Wifler, CPA

McGrath Nothman PC

Mesquite Tax LLC

Michael S. Patinella, PLLC

Minniti CPA LLC

Monica J. Stern, CPA, PLLC

Morrison, Clark & Company CPAs, PLLC

Moss Adams LLP

Ng Accounting, P.L.L.C.

Nordstrom & Associates, P.C. O’Malley & Berberich CPAs, PC

On-Call Controller

Osiris CPA, PLLC

Pace & Company, P.C.

Patel + Co. PLLC

Pescatore Cooper, PLC

Pioneer Title Agency, Inc.

Preston CPA, P.C.

Price Kong & Co., CPAs, P.A.

R & A CPAs

R. Michael Beltran, CPA

R.C. Thornton Accounting Group, LLC

Ralph Willett CPA, PLC

Randy C. Kiesel, CPA, PC

RC Acosta & Associates, CPAs

REDW LLC

Regier Carr & Monroe LLP, CPAs

Robert Martin, CPA, Ltd

Roger T. Bollard, CPA

RSM US LLP

Safari Club International

Seby & Associates, Ltd., CPAs

Sechler Morgan CPAs PLLC

Secore & Niedzialek, P.C.

Semple, Marchal & Cooper, LLP

Shaffer & Danker, CPAs, PC

Sherri A. Fieber, CPA

Shippen, Pope & Associates PLLC

Simmons Tax & Accounting Services LLP

Singer Tax & Accounting, P.C.

Skinner Clouse Group PLLC

Slater & Rutherford, PLLC

Splaver & Splaver, CPA, PLC

Sportiqe Apparel Co.

Springsteel Investment Advisors, LLC

Sprowls and Company, PC

Stocking and Heard, CPAs, LLC

Streamline Accounting

Tess L. Ridgway, CPA

The Royce CPA Firm PLLC

The Ruboyianes Company, PLLC

Tull, Forsberg & Olson, P.L.C.

Ullmann & Company, P.C.

Upworth, PLLC

Urke & Stoller, LLP

Valerie A. Lubken PLLC

Vearle M. Jones, CPA

Vincent J. Harder, CPA, PC

Walker & Armstrong, LLP Wallace, Plese + Dreher, LLP

Weech Financial, PLLC

West, Christensen, DeGomez & Ignace, PLLC

William Dobridge, CPA P.C.

William M. Perius, CPA

WS Weiss CPA PC

YB Company LLC

ASCPA 100% Club members enjoy additional perks, such as an exclusive Professional Issues Update presented by ASCPA President & CEO Oliver Yandle for one hour of CPE credit. If you are part of a 100% Club organization, you may register for the November 28 Professional Issues Update via Zoom at www.ascpa.com/piu22.

We make every effort to ensure the accuracy of this list. If your organization’s name does not appear in this list or is incorrect, or for questions regarding the 100% Club, please email membership@ascpa.com.

We Appreciate You!

November is member appreciation month at the ASCPA.

This month, we celebrate our members’ support and their many contributions to the CPA profession. Thank you for continuing to strengthen the CPA community.

To celebrate and show our appreciation, the ASCPA will raffle off prizes every Monday in November. Winners will be announced every Monday on the Connect site: https://connect.ascpa.com

You can show your appreciation for a colleague by sending your nominee’s name and sharing how they impacted your career. Include a photo of your nominee, and we will add the post on the ASCPA’s social media. Send your submissions to membership@ascpa.com.

NOVEMBER/DECEMBER 2022 AZ CPA 25

OF THE LOOKING TO GET OUT FAST LANE? www.apexcpas.com CONTACT US TODAY! 623.250.6544 JAMES CHAKIRES CPA, CVA Managing Partner revenue and are looking to merge? We are interested in Do you own a successful accounting firm up to $1 million in WE CAN HELP! and business. Reach out today to start the conversation. commitment to success, you can trust Apex with your clients exploring that opportunity with you. With our relentless 26 AZ CPA NOVEMBER/DECEMBER 2022

The Ethics of Pricing

By Elizabeth Pittelkow Kittner

Whether it be toilet paper, chocolate, coffee or toothpaste, consumer prices for everyday staples and commodities, and so many other goods, are increasing quicker than they have in 40 years. Additionally, these price increases are often coupled with decreases in product size and/or quantity – a widely known phenomenon called “shrinkflation.”

Although the term “shrinkflation” was officially coined in 2009 by British economist Dr. Pippa Malmgren, companies have been employing shrinkflation for decades. Whether due to rising costs for ingredients, packaging, labor or logistics, most companies at some point have been faced with the decision to increase prices, shrink product and/or packaging sizes, or both. Since most consumers use price instead of weight and volume to make their purchasing decisions, companies often gravitate toward shrinkflation.

Continued on next page...

NOVEMBER/DECEMBER 2022 AZ CPA 27

In general, shrinkflation is legal. Where the practice usually crosses a legal line is around a concept known as price gouging, in which a seller increases prices to a much higher level than is considered reasonable or fair. This instance may occur for certain goods or services deemed essential during a disaster or another emergency, such as in a pandemic. An online retailer is facing price gouging allegations from the state of Pennsylvania for increasing prices of hand sanitizer tenfold in the early part of the COVID-19 pandemic when such products were considered essential. One of the only defenses for significantly increasing prices in this scenario is if the seller can prove that the increased price directly relates to increases in the costs of product labor and/or product materials.

Despite shrinkflation being legal, some consumers find it a deceptive marketing tactic and feel taken advantage of by the companies and organizations doing it. Therefore, it raises a question: What are the ethics of shrinkflation?

Regarding ethics, shrinkflation brings to light two competing theories:

1. Shareholder Theory

This theory matches teleological ethics or consequentialism, meaning, do the outcomes justify the means? Some companies are more than making up for their increased costs by increasing prices opportunistically, a concept some are terming “greedflation.” Greedflation examples cited early during the COVID-19 pandemic included increased webcam and ventilator prices. The defense for raising prices was protection of employees and shareholders by maintaining and, in several instances, growing profits. If consumers are content paying the same or slightly higher prices for less versus paying much higher for the same, then consequentialism says it is OK.

Advocates of this theory say: The most overall good outcome is prioritized, and the philosophy can easily be applied to edge cases.

Example: Lying may be wrong, but lying to save someone’s life would be justified under consequentialism.

Opponents of this theory say:

It is difficult to apply due to the research needed to ensure individuals know the consequences of the actions taken before making the choice that maximizes the most good. Additionally, people will lose trust in individual decision-makers and institutions who prioritize the outcome over the ways to get there. Example: A patient awaiting an organ transplant pays the hospital money to receive the next organ. While the most good may be done by saving the paying patient and receiving money for more research, the people on the waiting list ahead of the paying patient may die.

2. Stakeholder Theory

Tied to deontology or duty-based ethics, this theory focuses on the right versus the wrong of the actions instead of the outcomes.

Advocates of this theory say:

The value of the human being is prioritized, and humans are treated with equal respect; this philosophy also reviews intentions and motives –if intentions are bad, then the action should not take place. Example: In an organ transplant situation, hospitals would prioritize an organ transplant based on who needed it most versus who has the most money to pay for it.

Opponents of this theory say:

This philosophy does not focus on results, which could lead to less overall happiness; it is a philosophy of absolute right or wrong, which does not leave much room for edge cases. Example: Lying under any circumstance would be wrong, even if it could save someone’s life.

Despite the different theories of ethics, research suggests that keeping ethics at the forefront of business decisions is worth it. The Londonbased Institute of Business Ethics reports in “Does Business Ethics Pay?” that companies with codes of ethics produce higher than average profits than those without. Business

leaders should consider short-term profit versus long-term profitability and reputation. Today’s consumers care about the companies and organizations they purchase from, and social media has further increased the accountability of brands and organizations.

While many accounting professionals may not provide tangible goods to their clients, the costs of providing services have changed over the years. Therefore, although shrinkflation generally applies to goods, the concept for services is similar and ethical considerations do apply. Ethically speaking, it seems reasonable to raise prices for services when you are adding value and can articulate that value to your clients.

Shrinkflation has become a com mon topic of conversation largely due to media coverage, and apps and websites designed to help consumers track shrinkflation will continue to build greater awareness and concern over pricing practices.

Whether you work with products, services or both, consider the ethics of proposed price increases and be ready to discuss them within your organization and with those that will be impacted. Approached ethically, you should be able to avoid having shrinkflation shrink your client base. l

Elizabeth Pittelkow Kittner is vice president of finance for GigaOm. Reprinted courtesy of Insight, the magazine of the Illinois CPA Society. For the latest issue, visit www.icpas.org/insight.

28 AZ CPA NOVEMBER/DECEMBER 2022

February 3, 2023 · Desert Willow Conference Center and via webcast Your Favorite Returning Speakers

Jim Rounds Economic Update

David R. Bean GASB Update

David Cotton Bribery and Corruption

8 CPE credits designed for CPAs in federal, state, local & tribal governments Inflation Risk Management Industry Updates Platinum Sponsor Gold Sponsors: Debtbook CLA (CliftonLarsonAllen LLP) Heinfeld Meech & Co., P.C. The Pun Group LLP www.ascpa.com/gac

Classifieds

Employment Opportunities

TAX PARTNER/MANAGER UP TO $200K PLUS!!

Flowers Rieger & Associates, PLLC |http://www.flowersrieger.com | Tucson CPA firm seeking a tax manager then partner by April 30, 2023, for a 10-person tax practice. Candidate will take over the business of approximately $750K. Strong communication, strong analytical and problem-solving skills and detail and deadline-oriented are desired. Firm was founded in 1984. We offer competitive salaries up to $200K plus and bonuses for new client development as well as tax season bonuses, group health insurance, 401(k) with a 5% company contribution, paid holidays, vacation and complete reimbursement of all CPA-related expenses. Please reply with your resume and salary requirements to mcf@theriver.com.

Get the inside scoop on legislative issues affecting the profession

Beginning in January, the Legislative Scoop series brings you 30-minute webinars for CPE during the Arizona legislative session. Join the ASCPA’s advocacy team and a state policymaker to enhance your understanding of the latest on happenings at the Capitol.

Attend one or all of the webinars for up to 5 CPE credits: Jan. 20 · Feb. 3 · Feb. 17 · March 3 · March 17 · March 31 · April 21 · May 5 · May 19 · June 2

Register now: www.ascpa.com/scoop

30 AZ CPA NOVEMBER/DECEMBER 2022

AZ CPA Quick Quiz

You’ve Read It, Now Get Credit

Earn one hour of CPE credit in specialized knowledge by completing the AZ CPA Quick Quiz, available online. Receive a score of 70 percent or more about this issue’s articles for credit. It’s that easy!

Fees: Members: $25 Nonmembers: $40

Online Access

Go to www.ascpa.com/quickquiz to access links to all active quizzes. Once a quiz is purchased, a link and password will be emailed to you. Your results will be sent immediately after completion, and certificates are emailed within two business days.

Upcoming Events

Join us for these exclusive ASCPA events, including some returning favorites.

Converge: Your learning journey starts at the ASCPA’s annual conference. Join us for a mix of session tracks in your practice area and keynotes relevant to all CPAs, including fraud, technology, ethics and more. Register: www.ascpa.com/converge

Member Happy Hour: Network and enjoy the barrel room at Fate Brewing in South Scottsdale for an evening of appetizers, drinks and new connections. Register: www.ascpa.com/happyhour

Legislative Roundtable: Hear from Arizona legislators and our advocacy team about the 2022 election and what is in store for the next legislative session. Register: www.ascpa.com/lr22

Nov. 8-9 |

Dec. 1 |

Dec. 6 |

NOVEMBER/DECEMBER 2022 AZ CPA 31

4801 E. Washington St., Suite 180 Phoenix, AZ 85034-2040

Pre-Order Your

2023 Arizona Tax Guide

After more than 30 years of production, the Arizona Tax Guide continues to be the only comprehensive guide on Arizona taxes, built for the tax professional. It includes the following guides:

• The Arizona Income Tax Guide is a comprehensive and easy reference guide that highlights the differenc es between Arizona and Federal income tax law and provides references to the Arizona Revised Statutes for a more in-depth analysis. It contains individual, cor porate, partnership and trust tax differences, including tax tables, and is arranged in a manner that facilitates research on any topic.

• The Arizona Sales and Use Tax Guide is a resource for anyone preparing or filing Arizona and city sales and use tax returns. The guide details the various sales tax classifications, exemptions, deductions and rates as well as compliance, audits, refund claims and ad ministrative appeals.

Learn more and purchase the guide at www.ascpa.com/taxguide

PRSRT STD U.S. Postage PAID Phoenix, Arizona

Permit No. 952

ADDRESS SERVICE REQUESTED

• The Arizona Personal Property Tax Guide provides an overview of Arizona’s personal property tax system, including exemptions, the classification structure and assessment rates, reporting, valuation and appeals.

• The Arizona Unclaimed Property Guide explains what unclaimed property is, reporting requirements for holders of unclaimed property, how owners of un claimed property can claim their property and audits.

Authored by Pat Derdenger, Steve Rodis and Ed Zollars

Authored by Pat Derdenger, Steve Rodis and Ed Zollars

Authored by Pat Derdenger, Steve Rodis and Ed Zollars

Authored by Pat Derdenger, Steve Rodis and Ed Zollars