Welcome to Atlas’ inaugural Market Report, which will provide valuable insights to guide you on your selling or buying journey. But before you flick forward to what the property market has in store for 2021, I want to share with you the Atlas story.

When the world paused last year, we used the time to rethink and develop how we could revolutionise the way people buy, sell and market property. We concluded to deliver the best outcomes for you, our client, we needed to use global insights, and local expertise, and realised by pairing this with cutting-edge technology we can deliver the best outcomes for all involved.

Fast forward to 2021, and Atlas was founded as a fresh and modern agency that’s backed by LJ Hooker, Australia’s most iconic brand for over 90 years.

Our high-performing agents are the best in the business with world-class industry experience and stellar reputations. We are authentic, transparent and client-centric, meaning the service and results you receive are second to none.

So, talking about results, what can you expect in 2021?

We partnered with CoreLogic to bring you the most comprehensive market report available. We look at how 2020 has changed the way we live, work and make lifestyle decisions, and what this means for real estate today, and in the months and years ahead.

In a world of uncertainty brought upon by a global pandemic, Australia’s property market continues to stand strong. However, undoubtedly 2021 will be a pivotal time in history.

Not only is there a shift towards lowdensity housing, but the newfound popularity of remote working is encouraging buyers to look to regional areas, where lifestyle factors rate higher and property prices are lower.

Thanks in particular to record-low interest rates and government incentives, buyer demand is also on the rise. And so are prices, which are expected to continue climbing at pace this year, the fastest since 2003. This growth is fuelled by improving economic conditions and a limited supply of property.

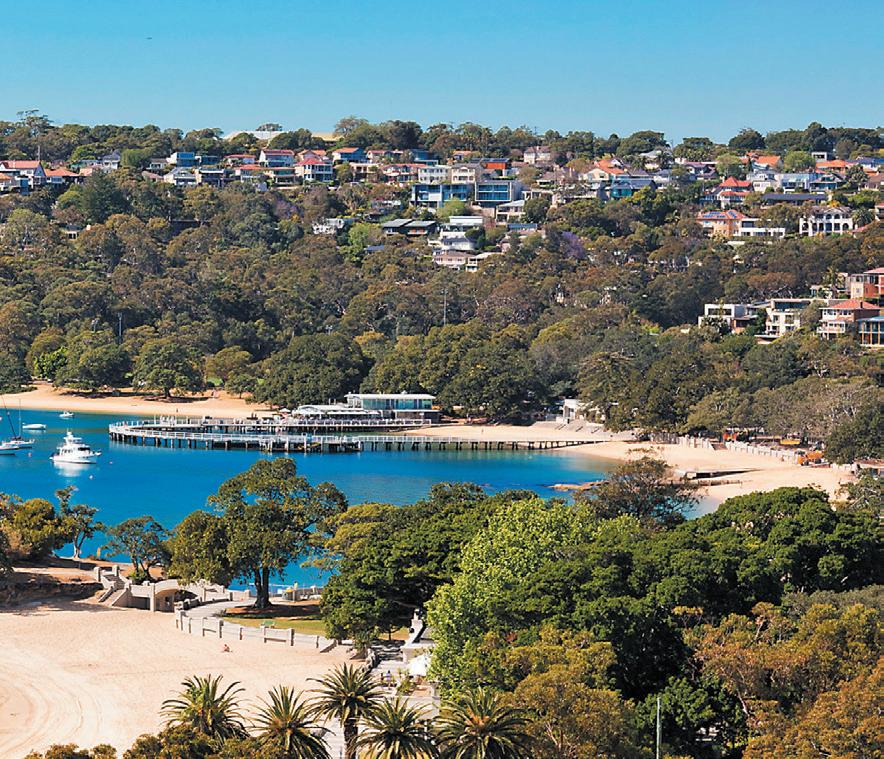

In Sydney, the number of suburbs that hit a median sale price of $3 million doubled through 2020. This number is expected to double yet again in 2021. Because of increased competition, buyers are willing to pay premiums to secure properties. A testament to this is auction clearance rates, which are averaging more than 75 per cent each week across the city.

In Brisbane, housing values are rising faster than most other capital cities. Many factors are contributing to this but, put most simply, it’s affordability. Brisbane house prices are, on average, $440,000 less than in Sydney, or roughly half. Income gaps between the two cities are not as large as this figure, meaning that property is more affordable. Brisbane has also benefited from a positive rate of interstate migration, also contributing to more people moving to the river city than leaving. This is all putting upward pressure on house prices.

Further south, the Byron Bay boom is having a ripple effect onto surrounding areas like Brunswick Heads and the hinterland. What was once a pipe dream for Sydney-siders to reside in the sleepy surf town has now become a viable reality for many, with four in 10 buyers coming from the harbour city.

These are just some of the insights you will find in our report which, like an atlas, will guide you on your real estate journey this year.

In a world of uncertainty brought upon us by a global pandemic, Australia’s property market continues to stand strong in comparison to other markets around the world.

The Atlas team spoke with Nerida Conisbee, Chief Economist at REA Group to get further insight into the global and national drivers that will have the most impact on the property market in 2021.

The market is turbo charged at the moment, and the main driver of this is incredibly low interest rates, as well as very high savings rates. The RBA has set the cash rate at 0.1%, and banks are following this and reducing their interest rates. In fact, you can get a home loan with an interest rate of under 2%, which is remarkably low.

There is also plenty of competition between banks, as they compete for customers. With new responsible lending laws being relaxed with the start of the pandemic, banks are also far more willing and likely to approve home loans. Some are even offering cash back as a promotion, which is very rare for home loan customers.

Another trend to expect in the market is an increase in suburbs considered to be in the luxury market. Through 2020, the number of suburbs that hit a median sale price of $3 million doubled. This number is expected to double yet again in 2021.

Upgraders are particularly active at all price points however the top end of the market has been a star performer over the past 12 months.

In 2021 we are also likely to see rental markets improving. Although the rental market was weak during the peak of the pandemic, it continues to improve, particularly for house rentals. Nevertheless, it does remain weak in some locations, but it isn’t deterring investors who are increasing their buying activity in the market.

As we see the COVID-19 vaccine become readily available across the globe, we are likely to see foreign students return and higher levels of immigration which will even further stimulate the market.

The return of investors will be a key part of market demand in 2021. In January 2021, housing finance commitments made by investors was at 29%, which is an increase from the last quarter of 2020. This is expected to rise back to the decade average of roughly a third over the next

year or more. The market is strong and is experiencing high levels of activity, which often attracts investors.

Paradoxically, this strength is deterring first home buyers from the market, which were the most active segment throughout last year. This is typical behaviour of first home buyers though, as they prefer a slower, predictable marketplace unlike investors.

An interesting point is that returning expats are likely to be stimulating blue chip areas. Although data is hard to find on expats, we are seeing increased searches on realestate.com.au from overseas, particularly countries like the US, Hong Kong, Singapore and the UK. These are countries with large Australian expat communities, so it is likely these people are searching to return home.

Anecdotal evidence from real estate agents also suggests that expats are extremely interested in buying into premium and lifestyle markets in Australia.

We might also begin to see economic migrants moving to Sydney, but perhaps once the vaccine is more widely spread.

What do you anticipate happening when the government ceases all pandemicdriven stimuli?

Although last September was expected to be a fiscal cliff, what we saw was a gradual reduction in Government assistance. The government was very cautious with how and when they withdrew stimulus and there is no reason to believe they will act differently this time. Australia is in a strong position economically, with job vacancies now at pre-covid levels.

Overall, it is unlikely we will see trouble in the marketplace due to lack of subsidies, but some segments will be more impacted than others. Renters will likely be impacted most, particularly younger ones, as they are often employed in industries that are still recovering such as tourism and hospitality.

I predict that if there is a huge impact to this demographic, the government will release a more targeted round of payments or stimulus to help those impacted.

Despite this, there is unlikely to be an impact on the property prices which continue to be buoyed by very low interest rates and high household savings rates.

For decades, the state government has been trying to encourage people to move out from Sydney and to other regional capitals. Ironically, these strategies weren’t always that successful, but the pandemic helped homeowners to realign their home goals and place space at the top of their priorities.

People who do not have to work in an office anymore or those in mining, agriculture and entertainment are finding plenty of jobs in regional centres, particularly the North Coast. The property market here has seen a 36% increase in price over the last 12 months, which is outstanding.

Although it is always favourable to get congestion out of the cities, I predict that many workers will be called back into the office soon, likely on a flexible basis. This will likely lead to lower levels of demand in more far flung regional areas but is good news for places like Wollongong and the Central Coast.

The desirability of inner-city living will surely return soon as well, with cafes, nightclubs and other arts centres beginning to open to their full capacity again soon. We will probably see a rush back to metro suburbs around this time.

Simply put, it’s a seller’s market at the moment. What we are seeing in terms of pricing and time on market is incredible across the board. Auction activity is high and clearance rates average above 75% every week across the city. Buyers also appear to be willing to pay premiums to secure properties, which works well in sellers’ favour.

For buyers, conditions are more challenging, primarily because listings aren’t matching buyer demand. More positively, interest rates are low and it is easier to get a home loan.

With the cash rate at a historic 0.1% low, and the big banks following suit with rates as low as 2% there appears to be plenty of opportunity to borrow in the current market. Theo Chambers, Chief Executive Officer of Shore Financial, discusses the mortgage market landscape and the banks’ approach to lending in the current market.

Big banks have come a long way since their risk averse policies during the 2008 Global Financial Crisis. They were far stricter on mortgage repayments and quickly foreclosed on houses where borrowers were in extended periods of mortgage arears. However, the precedent has now been changed due to the pandemic.

This approach has mostly been established by the Government setting a new attitude for the banks when dealing with financially distressed borrowers. Instead of being risk averse and foreclosing on houses in arears sooner rather than later, all the banks simply offered to pause repayments and help coach borrowers through financially difficult times. Means testing for applying to pause your repayments was also fairly easy with little to no verification of financial difficulty needing to be proved evident.

Separate to this in July 2019, APRA adjusted lending policies where the assessment rate, or the rate used for the bank to calculate whether you can afford

a loan, is scaled based on a margin above the current interest rates. Previously, this was a firm 7.25%. Now, as interest rates decrease, it is easier for consumers to borrow money as the assessment rate subsequently reduces as well.

Since the introduction of this new policy in 2019, there have been six RBA cash rate cuts, which means six instances where borrowing power potentially became stronger depending on each banks’ lending policy.

This has made home loans more accessible and affordable than they have ever been for most buyers, which sets the foundation for more buyers to compete in the market and drive prices higher.

With regards to assessment, banks are really scrutinising over borrowers who received a cash boost or job keeper during the pandemic, which doesn’t necessarily impact your ability to get loan approval, but the bank will deduct this out of your revenue. However, if banks see that you deferred your home loan repayments, ironically a service that they readily offered, they will be more apprehensive to approve your loan.

Mortgage demand from investors has dropped off substantially across Australia. It usually sits at a third of all mortgage approvals but is now at 23% nationally. Investors are sitting on the fence at the moment. Right now, you would be lucky to find an investment apartment giving you 3% gross rental yield which is not that attractive.

It is likely that investors are also putting their funds into improving their primary residence. Especially as work-from-home arrangements have increased in popularity, homeowners are placing more importance on their family home. And this is a great idea as it’s one of the only tax-free wealth generation strategies available in Australia, as there are capital gains exemptions on primary residences.

Although property investment is not as attractive as usual, it is still holding far stronger than other investments such as stocks, which have been volatile throughout last year.

Australians are still keen to invest their money in bricks and mortar, something tangible. It’s far safer and more predictable than other investments.

First home buyers are an extremely active segment of the market right now. With assistance from the government, this sector has never been more empowered to take out a home loan.

Shore Financial mostly sees first home buyers who have assistance from the government or even another source, sometimes with a third party acting as a loan guarantor. These people often co-sign as a couple and look for houses over units.

With such a low cost of funding, due to low interest rates, it will be difficult for the property market not to take off. I’m very optimistic about the growth we will see over the coming years.

Shore Financial equips their clients with the tools to best maximise these capital gains, helping experienced and inexperienced buyers structure their borrowing to optimise returns especially when a consumer has multiple properties and negative gearing and ideal tax structuring becomes more relevant. Where possible, it is a good time to invest in property as growth will skyrocket with the impending economic growth Australia will see as buyer confidence returns to the market.

“This tool provides a simple 90 Second Home Loan Health check that identifies cost savings on your existing home loan. I’ve had clients save up to $10,000/annum through a simple quick review. With interest rates at all times lows and the way the market is performing, homeowners often have access to more equity and borrowing capacity to tap into along with sharper interest rates than they realise. If you haven’t reviewed your home loan in the last 12 months then you’ve waited too long”.

Fane Levy Senior Credit Advisor – Shore Financial powered by

powered by

Scan here to find out

Now, more than ever, it is important to have an edge if you are a landlord in the rental market. Expertise and guidance are crucial in landing reliable tenants. Thom Richards, Co-Founder of property management tool Managed App, gives a comprehensive explanation of how to take advantage of investing in the current Sydney market.

In 2020 we saw vacancy rates rise substantially, what’s happening now?

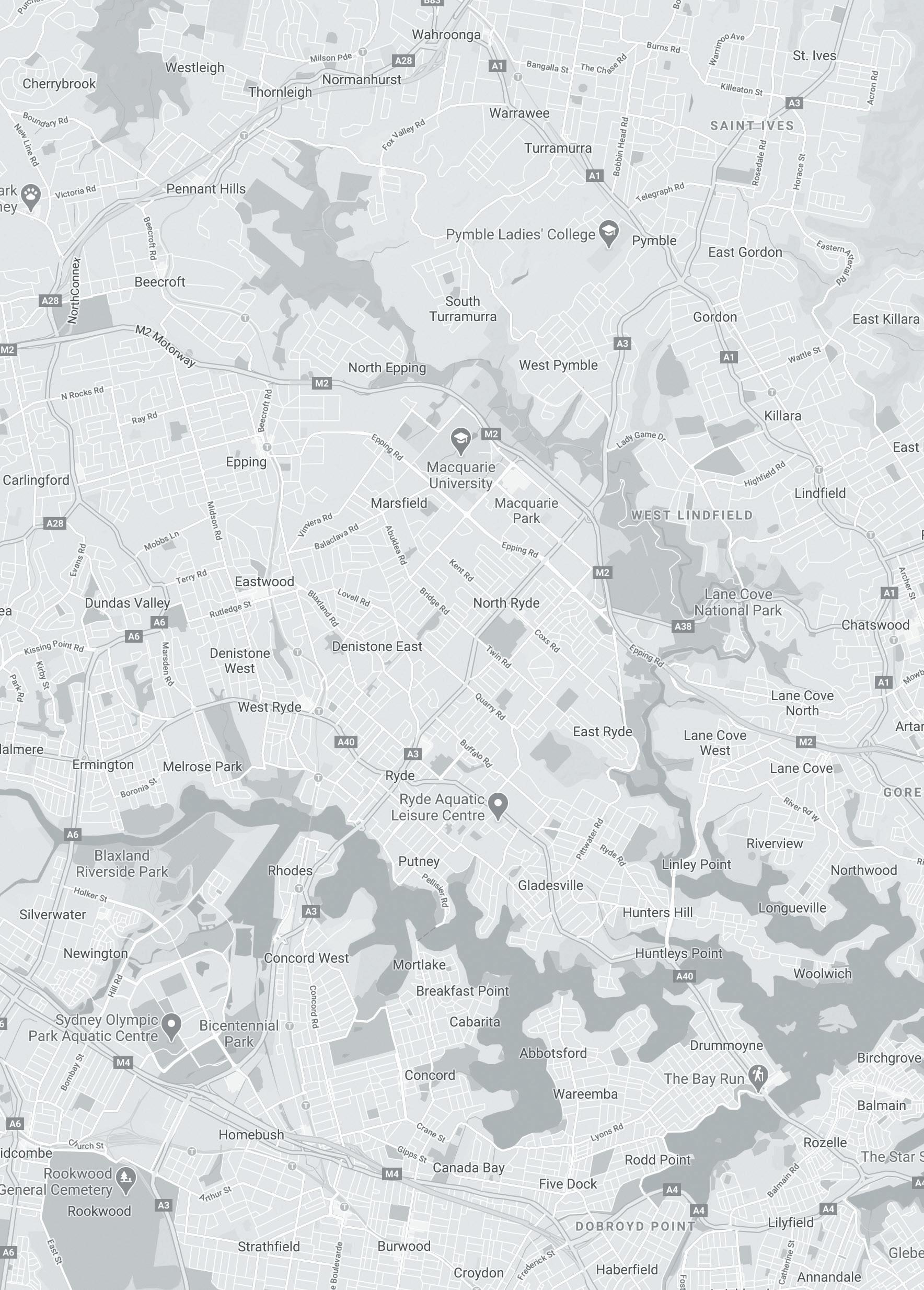

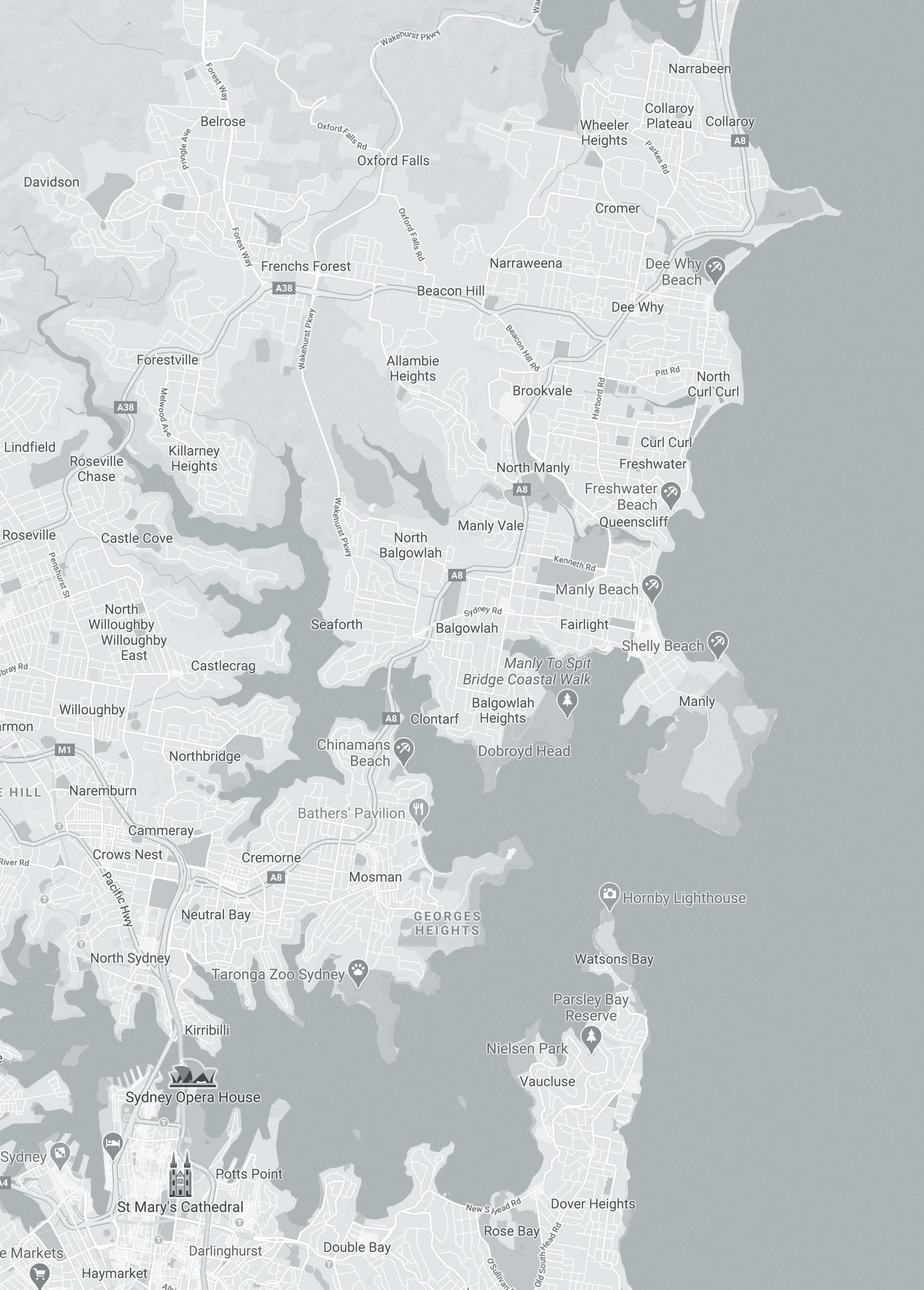

Sydney’s vacancy rates were the highest they had ever been in 2020. The city’s vacancy rate ended on 3.9% last year but is now seeing a bounce back.

Sydney vacancy rates for January 2021 were 2.9%, which is exactly the same as the vacancy rate in January 2020. This demonstrates increased confidence in the economy from renters and this positivity is likely to continue as the market strengthens throughout the year.

It could also indicate a tightening of rental listings on the market. Many short-term rentals, such as Airbnb listings, marketed themselves as long term rentals during the pandemic, increasing the supply of rental properties and therefore, the vacancy rate. With interstate travel opening up, these properties are now returning to short-term rentals, and in part have helped the recovery of Sydney’s vacancy rates.

Rental returns in inner city properties have dropped by 20% on average, which is a considerable drop. Rental yield in Sydney was 2.9% in January 2021, below the national average of 3.6%.

However, this can be expected to increase as rental supply and vacancy rates tighten, and competition for rental properties becomes stronger.

What properties are we seeing on the market?

Market quality is seemingly low. Just the other day, I was browsing for rental properties and none of them seemed to be well maintained. Low market quality is a big issue in Sydney inner city rentals at the moment.

Landlords became complacent as the convenience of inner-city properties used to outpace the need for comfort. As people look further afield due to work-from-home conditions, poor quality properties simply will not be leased. However, quality is something that landlords and property managers can easily control, unlike market conditions. Standout properties are likely to be snapped up, so take advantage of this opportunity.

How can an investor make their property stand out?

A standout property is far more likely to rent, and the first step is to update your investment. Landlords need to make their properties more modern. This doesn’t necessarily have to be an expensive fix; it could simply be updating paint, flooring and light fittings. But this small update will go a long way in the market.

To give your property an edge, it is also vital to aim for perfect quality of the home. With extra competition on the market, weathered floors or unmanicured gardens can set your property behind another. Ensure you are maintaining it and keeping it sparkling for inspections.

Unique properties are seemingly the ones that are being snapped up. Heritage style buildings and loft style apartments are being secured by renters at a premium. Embrace the different aspects of your property, as this could be what makes renters fall in love with the home and compete for the lease.

Once you have followed these steps and have tenants move in, it is important to keep them for as long as possible to maximise your rental returns, provided they are reliable lease holders. Employing a property manager who is enabled by cutting edge tools such as Managed App will ensure excellent communication and maintenance of your property. This is likely to encourage tenants to stay and will increase your return.

12 month median sale price growth

Median days on market

Median rental yield

Styling your home professionally can help your property campaign stand out in the market against other listings. Charlotte Dub, National Commercial Manager for Coco Republic, says that for almost all properties, styling reduces time on market and improves profitability. We sat down with Charlotte to gain her insights on property styling and its impact on sales.

What is the difference in styling a home for sale and furnishing a home to live in?

Styling a home for sale requires a completely different approach from furnishing a home to live in. When styling a home to live in, we start by taking a detailed brief from the client regarding their practical requirements. Who will be living in the home, how do they like to live, do they have hobbies, children, pets? Do they like to entertain? Once we understand how a client wants to utilise their personal space we can then start selecting furniture items and consider the decorative and styling components to compliment their practical needs.

Contrastingly, the goal of styling for sale is to present the home to its maximum potential and appeal to the widest range of buyers. This means styling the property in the way that most people will want to live in it, presenting a desirable lifestyle and evoking emotion in the potential purchaser. When styling a property for sale we also need to consider the photography and ensure we allow for more than one group of purchasers to walk through the home at any one time. We generally have to leave more space for flow through of foot traffic than we would for a home that was being styled to live in.

Why should sellers get their properties styled?

All vendors wishing to maximise the sale price of their home should consider styling for sale. Most of us don’t live in show homes and would benefit from styling to some degree. By having a property styled, you can be assured that you have put your best foot forward and are enabling purchasers to see your property presented at its absolute maximum. From anecdotal evidence, I often experience that styled homes sell more quickly and more profitably. In fact, recently some of our styled homes in the Eastern Suburbs of Sydney sold in just 6 days.

Another important reason to get your property styled is that almost all Australian homeowners highly value interior design. I would go as far as saying that interior design is at the forefront of Australian home living. We have bestselling publications and prime time television shows all based around the importance of home styling and the impact that it can make. Having a beautifully decorated home is clearly a goal of Australian homeowners, so it’s important to appeal to this.

What target market do you style the property for?

Although we try to appeal to the widest range of buyers as possible our target market completely depends on the property. The target market is generally dictated by the location and demographic, however, we take the agents advice with regards to the expected purchaser profile as they are experts in their area. We also dedicate our stylists to specialise in particular areas and suburbs throughout Sydney to ensure that we understand typical purchaser profiles in different markets.

When you style a property, where do sellers live?

This answer depends on the seller’s personal situation. It is, of course, most ideal when the vendor has already found another property and has moved their furniture into the new property so we have an empty property to work with. However, this is not always possible as many people can’t buy a new home without selling their current one. In this situation we work around the vendors existing furniture and practical requirements, integrating Coco Republic rental furniture in to a suitable styling scheme to compliment their existing pieces.

What design trends are you seeing in homes this year?

Of course, people are opting for more home offices due to increased working from home. We are also seeing warm tones being brought into interior colour palettes. Grey schemes are still popular, however, people are balancing a cool palette with accents of warmer tones. Colour is also back which as a design firm is always good to see. Seamless indoor to outdoor living is a continuous trend but has been brought to a peak as people are entertaining at home far more instead of going out.

What can homeowners do before they get their home styled?

After our initial consultation at Coco Republic we provide a full review specific to the property. However, overall, our main piece of advice is to declutter and neutralise the property. Purchasers won’t buy a house that they can’t see. Lots of belongings and clutter distract a potential purchaser and often can put them off even viewing the home. Personal belongings also make it difficult for potential buyers to attach themselves to the property, if they can clearly see who does live their it can make it difficult for them to imagine themselves living there.

Another tip is to give the home a fresh coat of paint, marked walls and chipped trim can make a property appear tired and in poor conditions. Painting is a simple and affordable to refresh your property. Curb appeal is also incredibly important, we always advise our vendors to clean the gutters, tidy the driveway and freshen up the exterior of the property where possible. This is the potential purchasers first impression of the property and incredibly important.