To benchmark your business against industry standards and your competitors, you need accurate, timely information. American Coin-Op’s annual State of the Industry survey is a time-tested tool to use for that purpose. What percentage of store owners saw their total coin business increase last year? What are the most popular washer and dryer prices being charged? How many operators have purchased, or are planning to purchase, new equipment this year? Our analysis begins on page 10.

Distributor Dion Marcionetti says the ability to offer an extra wash or rinse for a small upcharge means that operators can upsell without applying pressure on customers. How would you like to increase revenue without giving the appearance of increasing pricing? Read this month’s Coin-Op 101 column.

Don’t expect to see depressing beige or white walls if you visit the Calvary Laundromat in Raleigh, N.C. Owner David Makepeace has decorator-designed his 3,000-square-foot laundry to create a vibrant, inviting atmosphere. Turn to page 26 to take a look at what he’s done, with a great deal of help.

The success of using hydraulic fracturing—fracking—in mining for natural gas in North Dakota has brought with a necessity: laundry facilities to serve the influx of oil field workers and their families. Editorial assistant Carlo Calma spoke to a distributor and two new store owners about the opportunities in the region and the demands of running a “greaser” laundry.

There is still more in this springtime issue, so I won’t keep you any longer. Dig in!

Beggs Editorial DirectorCharles Thompson, Publisher

E-mail: cthompson@ americantrademagazines.com Phone: 312-361-1680

Bruce Beggs, Editorial Director E-mail: bbeggs@ americantrademagazines.com Phone: 312-361-1683

Roger Napiwocki, Production Manager

Jean Teller, Contributing Editor

Carlo Calma, Editorial Assistant

Nathan Frerichs, Digital Media Director

E-mail: nfrerichs@ americantrademagazines.com Phone: 312-361-1681

Donald Feinstein, Natl. Sales Director E-mail: dfeinstein@ americantrademagazines.com Phone: 312-361-1682

office information

Main: 312-361-1700 Fax: 312-361-1685 subscriptions 630-739-0600 www.AmericanCoinOp.com

American Coin-Op (ISSN 0092-2811) is published monthly. Subscription prices, payment in advance: U.S. and Possessions, 1 year $39.00; 2 years $73.00. Foreign, 1 year $89.00; 2 years $166.00. Single copies $7.00 for U.S. and Possessions, $14.00 for all other countries. Published by American Trade Magazines LLC, 566 West Lake Street, Suite 420, Chicago, IL 60661. Periodicals postage paid at Chicago, IL and at additional mailing offices.

POSTMASTER, Send changes of address and form 3579 to American Coin-Op, Subscription Dept., 440 Quadrangle Drive, Suite E, Bolingbrook, IL 60440. Volume 54, number 4. Editorial, executive and advertising offices are at 566 West Lake Street, Suite 420, Chicago, IL 60661. Charles Thompson, President and Publisher. American Coin-Op is distributed selectively to owners, operators and managers of chain and individually owned coin-operated laundry establishments in the United States. No material appearing in American Coin-Op may be reprinted without written permission. The publisher reserves the right to reject any advertising for any reason.

© Copyright AMERICAN TRADE MAGAZINES LLC, 2013. Printed in U.S.A.

CHICAGO — They say you have to take the bad with the good. And so it is that American Coin-Op asked readers to list the best and the worst things about their store in March’s Wire survey.

Thirty-three percent of respondents say a 40- to 50-pound front loader is their store’s most popular washer, followed by a 27- to 35-pound front loader (30%) and an 18- to 25-pound front loader (23.3%). Equal shares (6.7%) chose a 55- to 60-pound front loader and a 70-pound-plus front loader as most popular. No one who took the unscientific survey said a top loader was their store’s most popular washer.

Wednesday is the slowest business day (38.7%), edging out Tuesday (29%) and Thursday (25.8%). Summer is the best revenue-generating season (35.5%), followed by winter (32.3%), spring (22.6%), and fall (9.7%).

Soft drinks, by far, are the best-selling food/drink item at laundries. Roughly 52% of respondents say soft drinks are the No. 1 seller, followed by snack chips (19.4%) and water (6.5%). Approximately 13% of respondents say they don’t offer vended items in their laundry.

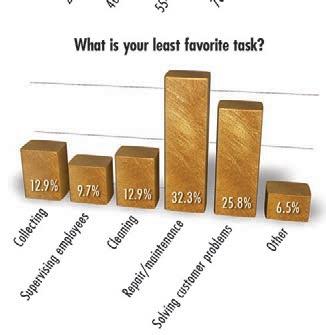

Doing repair/maintenance work (32.3%) is the least favorite task for owners, followed by “solving customer problems” (25.8%), collecting (12.9%) and cleaning (12.9%). Only 9.7% selected “supervising employees” as being least favorite.

Respondents were asked to name the worst thing a customer had done to or at their laundry. Answers were varied, and some were downright disturbing. Incidents of theft (money, a toilet seat) and vandalism (poured beverages on floor, ripped off washer door) were most common. Following are some examples of the rest:

• Customer brought in laundry containing dozens of roaches.

• “One blew ours up a few years before we bought it. He was washing greasers (oil field clothes) and he poured some gasoline into the washer with the clothes.”

• “Had a bowel movement in the middle of the store because the restroom was busy.”

While the Wire survey presents a snapshot of readers’ viewpoints at a particular moment, it should not be considered scientific. Subscribers to Wire e-mails are invited to take the industry survey anonymously online each month.

Every little hinge, hose and housing is engineered with long-lasting energy savings in mind.

The closer you look at Maytag® equipment, the more resourceful thinking you’ll see. Take the innovative TurboWash™ System, for instance, which allows our MFR30 washer to deliver impressive cleaning power—along with the potential to cut your water use by over 60%.* Add to that extra-large capacity that helps you turn more profits per load, plus our 5-year warranty** on every single part. Visit mclaundry.com for digital brochures, or for more information, visit our website at maytagcommerciallaundry.com or call 800-662-3587. *Average savings by using super cycle, compared to previous Maytag MFR washers; actual savings varies by model. **Visit maytagcommerciallaundry.com for warranty details.

After Jon Horn decided to reequip his eight laundromats with the benefits of owning the most profitable machines on the 42 percent and electrical energy by up to 33 percent. Cu ing-edge profitability. Plus, in-house, industry-leading financing made newly increased cash flow. Learn more about Jon’s success

– JON HORN OWNER, CONSOLIDATED COIN LAUNDRIES, INC. ALLENTOWN, PA

LEARN FROM A LAUNDRY EXPERT AT A DISTRIBUTOR OPEN HOUSE.

Minnesota Chemical Co. N57 W13636 Carmen Avenue, Unit 4 Menomonee Falls, WI 53051

Coin-O-Matic of IL 3900 W. 127th St. Alsip, IL 60803

Minnesota Chemical Co. Kelly Inn Best Western, 161 St. Anthony St. Paul, MN 55103

Star Distributing Company, Inc. 729 Charlo e Ave. Nashville, TN 37209

Hermes Equipment 205 S. Lee St. Bloomington, IL 61701

Learn from a laundry expert about how Speed Queen can help you grow your profitability. distributors.speedqueen.com • 800.590.8872

new, state-of-the-art Speed Queen® equipment, it didn’t take long for him to notice market. His new equipment is remarkably efficient, reducing water usage by up to Quantum™ controls give him the ability to easily adjust vend prices for maximized purchasing his new equipment easy and affordable, allowing Jon to maintain his story and our special 5.99% finance rate at SpeedQueen.com/JonHorn

How do you think your self-service laundry business compared to others in the industry last year? Did you have a good year or a bad year in 2012? How does your pricing compare to others?

American Coin-Op’s annual State of the Industry survey offers you the opportunity to compare your operation to others in the industry.

It focuses on 2012/2013 business conditions, pricing, equipment, common problems, turns per day, and utilities cost.

In instances where respondents were asked about 2012 business results, they were given the opportunity to state whether their results were up, down or unchanged. This is a departure from surveys compiled in 2011 and earlier, when they were asked only if their business results were up or down. Keep this in mind as you are making comparisons to previous years’ polls.

The survey is an unscientific electronic poll of American Coin-Op readers who operate stores. Some percentages may not equal 100% due to rounding.

By Bruce Beggs, Editorial DirectorIn 2012, 54% of respondents saw their overall coin laundry business increase compared to 2011.

More specifically, these operators reported an increase in business (gross dollar volume) in 2012 compared to 2011. In last year’s survey, 45% reported an increase in business, and two years ago, 42% reported a bump.

The average 2012 business increase was 11.7%, up only slightly from 11.5% in 2011. Other past average business increases were 10.8% (2010), 7.9% (2009), 14% (2008) and 12.2% (2007).

Here’s a closer look at the 2012 business increases (the figures relate to those reporting increases, not all respondents):

• Operators with a business increase of less than 10%: 41.0%

• Operators with a business increase of 10-14%: 27.9%

• Operators with a business increase of 15% or more: 31.1%

The largest single increase in 2012 was reported to be 50%.

Approximately 30% of respondents saw their business

That’s a giant number. Speed Queen Financial Services has funded over $1 billion to vended laundry investors, more than anyone else in the world. We’re freeing up cash flow for current and new laundry investors with big savings on all-new Speed Queen ® equipment. Current laundromat owners can take advantage of interest-only payments and rates as low as 5.99%. Current owners can also receive thousands in fast cash rebates when upgrading to new equipment. New investors and store developers can cash in with interest-only payments and rates as low as 6.99%. To learn more about these limited-time savings, visit SpeedQueen.com/5.99

decrease (in gross dollar volume) last year. In our survey of 2011 business, roughly 35% saw a drop in business. The percentage was 58% in 2010 and 59.8% in 2009.

The average 2012 business decrease was 9.5%, down a bit from last year’s figure (10.2%). Previous averages were 11.2% in 2010, 13.7% in 2009, 14.3% in 2008 and 13.2% in 2007.

Were the losses consistent last year or did they vary? Here’s a closer look at the 2012 business decreases:

• Operators with a business reduction of less than 10%: 50%

• Operators with a business reduction of 10-14%: 32.4%

• Operators with a business reduction of 15% or more: 17.6%

The largest single decrease in 2012 was reported to be 40%.

Approximately 16% of operators reported their 2012 business was unchanged compared to their 2011 results.

Overall, these results continue to reflect year-to-year improvement, on average. The number of operators reporting an increase in business was up slightly from last year, as was the average business increase.

The average business decrease (9.5%) was nearly a percentage point lower than the prior year. Additionally, the number of operators suffering a large business deduction (15% or more) shrank from 26.8% in 2011 to 17.6% in 2012.

Drop-off service has become a popular choice for self-service laundry operators looking for ways to help their customers

free up time for other pursuits, and the numbers continue to bear that out.

Approximately 42% of respondents reported that drop-off-service business (gross dollar volume) increased in 2012. For 2011, approximately 32% reported business increases in that category.

The average drop-off-service business increase last year was 16.2%, falling below 2011’s average increase of 17.3%, but it’s worth noting that 77% of respondents whose drop-off service improved in 2012 reported double-digit gains.

Twenty-six percent saw a decrease in drop-off-service business. The average decrease in 2012 was 18.1%, which matched the average from the prior year. Previous averages were 18.8% in 2010 and 24.2% in 2009.

Approximately 32% of respondents said their 2012 drop-off-service business was unchanged from 2011.

About three out of five respondents offer some type of dry cleaning service, and 19.4% reported business increases in 2012. The average business increase was 27.6%, and the average decrease was 33.7%.

Roughly 44.6% of the respondents had an increase in vending sales business in 2012, exceeding the previous year’s reported 35%. Approximately 22% saw their vending sales business decline in 2012, and 33.7% saw vending sales remain unchanged.

The average vending gain was 11.3%, up slightly from last year’s figure (11.2%).

The average decrease in vending business was 9.1%, compared to 11% in 2011.

American Coin-Op asked respondents about their current washer prices, and if they increased prices this year or planned on doing so by the end of the year.

More than 85% of respondents offer top loaders. The price range for a top-load wash is $1 to $4. The most expensive top-load wash was 50 cents more that last year’s top price.

Here are the most popular top-load prices, followed by the percentage of respondents using them:

1. $2 (30.9%)

2. $1.75 (16.5%)

3. $2.25 and $2.50 (14.4% - tie)

There really isn’t much change in toploader prices from a year ago. The $2 price remains the most popular, followed by $1.75. The only difference reported in this equipment type is in third place, where $1.50 and $2.25 were tied in last year’s survey.

An extremely small share of operators continue to charge $3 or more for a topload wash. This is the third straight year that there have been multiple prices topping $3 reported in the survey.

The most popular prices for some of the small front loaders are:

• 18 pounds: $2

• 20 pounds: $2.50

• 25 pounds: $3

The lowest price reported in the above grouping is $1.25 (18-pound washer) and the highest is $6 (25-pound washer). Overall, the most popular small-front-loader prices reported in this year’s survey are comparable to last year’s.

The price range for a 30-pound wash is $2 to $6.50. Here are the most popular 30-pound prices, along with the percentages

9

Continental Girbau West Service School

Santa Fe Springs, Calif. Info: 866-950-2449

16 Century Laundry Dist. Service Seminar - All Brands Des Moines, Iowa Info: 800-791-9321

16 Minnesota Chemical Co.

Huebsch/Speed Queen Coin Seminar and Service School Menomonee Falls, Wis. Info: 651-646-7521

Danbury, Ct. Info: 800-229-4572

18 Coin-O-Matic of IL Open House Alsip, Ill. Info: 708-371-9595

23 Great Lakes Laundry Wascomat/Electrolux Earth Day Product Expo Lisle, Ill. Info: 800-236-5599

17

HK Laundry Annual Sales Extravaganza

23 Minnesota Chemical Co. Huebsch/Speed Queen Coin Seminar and Service School St. Paul, Minn. Info: 651-646-7521

23 Northeast Laundry Equip. Dexter Service Seminar Dover, N.H. Info: 800-222-3472

25 Southeastern Laundry Equip. Dexter Service Seminar Marietta, Ga. Info: 800-522-9274

27 Loomis Bros. Equip. Co. Open House

Overland Park, Kan. Info: 800-783-7094

30 D&M Equipment

Dexter Service Seminar Wauwatosa, Wis. Info: 800-451-2676

of respondents using them:

1. $3.50 (25%)

2. $3 (19.1%)

3. $3.75 (11.8%)

There was a tie between $3.50 and $3.75 for the most popular price for a 35-pound wash. Next in order are $4.50 and $3. The price range for a 35-pound wash is $2 to $5.50.

The most popular price for a 40-pound wash is $4, but $4.50 and $4.25 aren’t far behind. The most popular 50-pound wash price is $5, followed by $5.50 and $6. There was a three-way tie for the most popular price for a 55-pound wash: $5, $5.50 and $7.

The most popular price for a 60-pound wash is $6, unchanged from last year’s survey. The price range for an 80-pound wash is $5.75 to $13.50, with $8 and $8.25 tying as the most popular price.

Other prices reported were $9.75 and $15.25 for a 90-pound washer, $9.50 for 100 pounds, and $14.99 for 125 pounds.

The operators responding to our survey vary year to year, so prices tend to vary. But the survey consistently has shown that operators offer a wide variety of front loaders (prices for 15 different capacities were logged this year) with a broad price range.

Roughly 44% of respondents have raised or plan to raise washer prices this year, and 26.9% are undecided. The remaining

29.4% have not raised prices nor intend to do so.

Raising dryer prices is something that operators have tended to shy away from, choosing instead to focus on washer price hikes. But it’s worth noting that some operators indicated that they have shortened cycle times in the past year. While customers in those stores aren’t paying a higher price, they are getting less drying per cycle.

Here are the most popular dryer prices, followed by the percentage of respondents using them:

1. 25 cents/5 minutes (19.1%)

2. 25 cents/7 minutes (18.3%)

3. 25 cents/6 minutes (13.9%)

4. 25 cents/8 minutes, 25 cents/10 minutes (10.4% - tie)

The No. 3 price from last year’s survey has jumped to No. 1 in this year’s. Seven minutes of drying time returned to the No. 2 slot after being bumped to No. 4 last year, while eight minutes of drying time fell from No. 2 last year to No. 4 this year, where it shared the spot with 10 minutes of drying time.

The 25-for-10 price, which was once an industry staple, picked up a couple of percentage points on last year’s result but still remains well down the list.

Once again, there was a wide variety of dryer prices reported. The most expensive (and longest) cycle was $1.75 for 35 minutes.

Roughly 18% of respondents have raised or plan to raise dryer prices this year, and 20.2% are undecided. The remaining 62.2% have not raised prices nor intend to do so.

More than 83% of respondents operate coin-only stores, 7.6% operate card-only stores, and 9.2% have operations that offer both payment types.

Nearly 48% of respondents say their stores are fully attended. Roughly 29% say their stores are partially attended, and the remaining 23.1% say their stores are unattended.

Drop-off-service pricing ranges from 70 cents to $3 per pound. Here are the most popular drop-off-service prices (per

pound), followed by the percentage of respondents using them:

1. $1 (36%)

2. $1.25 (16%)

3. $1.10 (9.3%)

The drop-off-service prices remain similar to 2012 prices, and there is a wide variety of prices charged for the service. There were 20 different prices charged per pound in the responses to our survey.

Two-thirds of the respondents offer drop-off service, which is identical to last year’s survey.

We asked operators if they have already raised washer and/or dryer prices in 2013, or if they intend to do so before year’s end.

Approximately 44% say they have raised washer prices this year or intend to raise prices by the end of the year. Roughly 29% of respondents say they are not planning to raise prices this year, and 27% are undecided if they are going to hike prices in 2013.

Regarding dryer prices, 17.6% have raised prices this year or intend to do so later in the year. Roughly 62% don’t plan to hike prices this year, and 20.2% are undecided about raising their prices.

In last year’s survey, 50% said they raised washer prices or intended to do so by the end of 2012, and 17.8% said they raised dryer prices or intended to do so before that year’s end.

Approximately 48% of respondents purchased at least one piece of equipment

I’ve personally handled insurance for hundreds of coin laundries! I’ve already dealt with most any issue your business is likely to face. If you have any questions about insuring coin laundries, I can and will give you a prompt, clear answer. Skeptical? Call me with a question and find out for yourself.

There’s more: I’m just one member of a team of experts. NIE has been insuring fabricare business since 1915!

Anne

Anne

(washer, dryer, water heater, vender or changer) in 2012. In 2011, that figure was approximately 45%.

Here’s a breakdown of 2012 purchases:

• 12.7% of respondents purchased at least one top loader. The average purchase was 5.4 machines. In last year’s survey, when a single operator’s reported purchase of 97 machines was excluded from the calculations, the average purchase was 9.1 machines.

• 26.3% of respondents purchased at least one front loader (a breakdown by capacity follows below).

• 16.9% of respondents purchased at least one dryer (regular or stacked). The average purchase was 7.4 machines. In last year’s survey, when a single operator’s reported purchase of 97 machines was excluded from the calculations, the average purchase was 5.1 machines.

And we break it down further by frontload wash capacity:

• 16.1% of buyers purchased at least one machine with a capacity up to 25 pounds. The average purchase was 6.0 machines.

• 29% of buyers purchased at least one machine with a capacity of 25 to 50 pounds. The average purchase was 4.8 machines.

• 35.5% of buyers purchased at least one machine with a capacity of more than 50 pounds. The average purchase was 2.6 machines.

(Editor’s note: Some respondents didn’t

identify machine sizes, so the front-loader breakdown doesn’t include their purchases. Also, the percentages do not total 100% because some buyers purchased equipment in multiple equipment categories.)

Respondents were asked if they have bought, or are planning to buy, any new machinery this year. Approximately 36%—the same percentage from last year’s survey—intend to add something (washer, dryer, water heater, vender or changer) to their mix, or have already done so.

• 8.5% of respondents have purchased, or plan to purchase, a new top loader this year. The average purchase is (or will be) 8.8 machines.

• 22.9% of respondents have purchased, or plan to purchase, a new front loader this year. (A breakdown by capacity follows below.)

• 12.7% of respondents have purchased, or plan to purchase, a new dryer this year.

And we break things down further by front-load wash capacity:

• 29.6% purchased, or plan to purchase, at least one machine with a capacity up to 25 pounds. The average purchase is 10.8 machines.

• 29.6% purchased, or plan to purchase, at least one machine with a capacity of 25 to 50 pounds. The average purchase is 4.9 machines.

• 25.9% purchased, or plan to purchase, at least one machine with a capacity of more than 50 pounds. The average purchase is 2.0 machines.

(Editor’s note: Some respondents didn’t identify machine sizes, so the front-loader breakdown doesn’t include their purchases. Also, the percentages do not total 100% because some buyers purchased equipment in multiple equipment categories.)

What problems cause you the most grief? Here, according to this year’s State of the Industry survey, are the top-five industry problems:

1. High cost of utilities

2. Dealing with employees

3. Equipment maintenance/repair issues

4. Competition

5. Customer base/lack of customers

Gone from the top five is the economy, although it was mentioned on a number of surveys.

Turns per day refers to the number of cycles (turns) that each of a store’s machines experiences each day. You can calculate that figure using total top-loader cycles for a one-week period divided by the total number of top loaders, then dividing that number by seven.

According to this year’s survey, the average number of turns per day for top loaders is 3.1, up slightly from last year (3.0). The average number of turns per day for a front loader is 4.0, also up from last year (3.8).

We asked operators about their utilities cost (as a percentage of gross). The responses ranged from 6% to 75%(!). The most common response was 25% or 30% (tie). At the time of our survey in February, operators were paying an average of 24.1% for utilities (as a percentage of gross). That number is identical to last year’s poll.

Nearly half of respondents (47%) say utilities is the largest of their store’s expenses. The smallest of their expenses, according to 56.9%, is insurance.

Slightly more than 46% of respondents expect their 2013 business to be better than it was in 2012. Approximately 38% expect business to be about the same this year, and 16.2% expect their business to not perform as well this year as it did in 2012.

Want to track the coin laundry business month to month? Check out our StatShot reports, available exclusively on American CoinOp.com!

MLA PRePs foR AnnuAL sPRIng educAtIonAL confeRence

The Multi-housing Laundry Association (MLA) is preparing for its annual Spring Educational Conference, scheduled for April 21-23 at The Ritz-Carlton, Naples, Fla.

The event will feature a variety of educational sessions, route operator roundtable discussions, board and committee meetings, and more. To learn more about the conference, or to register, visit mla-online.com

wAsh LAundRy AcquIRes coInAMAtIc cAnAdA

WASH Multifamily Laundry Systems, which provides laundry facilities management services, has acquired Coinamatic Canada, that country’s largest provider of multifamily laundry services. The transaction makes WASH the second largest route laundry company and the only multinational laundry company in North America, it reports.

Coinamatic becomes a wholly owned subsidiary of WASH Laundry but maintain its brand name in the Canadian market.

With Coinamatic’s approximately 100,000 installed washers and dryers throughout Canada, WASH’s installed base climbs to

more than 400,000 machines with an estimated combined revenue of $425 million. Coinamatic Canada also runs a commercial laundry division and a division that manages parking facilities.

MAc-gRAy deLIveRs IncReAsed PRofItAbILIty desPIte fLAt Revenue Mac-Gray Corp. recently announced its financial results for the quarter and year ended Dec. 31, reporting greater profitability despite flat total revenue.

For the 12 months ended Dec. 31, the company reported net revenue of $322.1 million, compared to $322.0 million for 2011. Net income for 2012 increased to $4.3 million compared to $3.2 million in 2011.

“Mac-Gray concluded 2012 with a solid fourth-quarter performance,” says CEO Stewart G. MacDonald. “We improved our operating margins, achieved a higher level of adjusted EDITBA, and more than doubled our adjusted earnings.”

While the effect of Hurricane Sandy on Mac-Gray’s revenue was less than originally feared, MacDonald says, it cost the company more than $600,000 to replace damaged or destroyed equipment in the Northeast. n

by

Every business owner knows how important it is to keep your store looking fresh and inviting. Even more crucial: increasing the value.

With Face Changer by Laundry Parts Market, you can upgrade the appearance of reliable equipment to last you another 10 or 15 years. It’s the perfect opportunity to have your equipment looking brand new for a fraction of the price.

With the Face Changer by Laundry Parts Market, your small investment today is guaranteed to show you growing profit tomorrow.

Install your new Face Changer Kit

Install your new Face Changer Kit easily or contact FaceChanger@ LaundryPartsMarket.com for more information.

Wholesale discounting is available.

The Whirlpool® Commercial Laundry top-load washer models are easy to use and deliver exceptional and dependable cleaning performance, the company says.

The top-load models have a capacity of 3.2 cubic feet, and customers still have the option of a small-load setting, helping minimize water usage to 23.22 gallons per cycle.

The washers feature a thermistor on the water valves to regulate water temperature, and washer spin time has been increased to allow more water to be removed from loads. The machines also feature a beltless Direct-Drive System.

whirlpoolcommerciallaundry.com 800-662-3587

Continental Girbau’s Econ-O-Wash washers are engineered to help vended laundries cut utility usage on smaller loads, the company says. Unlike most homestyle top-load washers, which typically use around 40 gallons of water per load, the Econ-O-Wash features a 3.26-cubic-foot tub and uses an average of 27.3 gallons of water per load, according to Continental.

The Econ-O-Wash washer not only generates a 710-rpm spin speed to remove more water from every load, it draws fewer amps at start-up to help conserve electricity. The machine boasts a modified energy factor (MEF) of 1.65, which meets the latest U.S. Department of Energy standards requiring an MEF of at least 1.26. The MEF is the official energy-efficiency metric used to compare relative efficiencies of different washers, Continental says, and a washer’s efficiency increases as the MEF rises.

GE Appliances offers topload washers for the commercial laundry industry. Both the WMCD2050JWC and WCCD2050JWC are coinoperated models that feature a 3.3-cubic-foot capacity.

GE’s commercial coin-operated washers feature an LED readout that provides accurate wash times from fill to finish; five wash cycles; three wash and rinse temperatures to help provide better washing results, maintaining longer fabric life; two wash/spin speed combinations to match wash action to fabric type for better cleaning and clothes care; and a dual-action agitator that moves clothes gently through the water to help reduce wear and tear, the company says.

ge.com/appliances 502-452-7184

Econ-O-Wash commercial washers make it easy for customers to select from several wash cycles. The user simply chooses a cycle—normal, permanent press, delicate, or one of three unique energy-saving cycles—and presses “Start.” The washer offers three water temperature options for the wash cycle—hot, warm and cold—and automatically uses coldwater rinses on the factory setting. The user-friendly control makes it easy for customers to locate cycle selections, cycle status and wash temperature, the company says.

Econ-O-Wash top loaders feature a curved, four-vane polypropylene agitator with a 210-degree wash stroke. Designed to automatically adjust out-of-balance loads, its liquid-filled balance ring at the top of the tub and the washer’s advanced suspension design combine to eliminate interrupted wash cycles, according to Continental.

continentalgirbau.com 800-256-1073

aytag® Commercial Laundry’s Energy Advantage™ high-efficiency, top-load washers are equipped with microprocessor Computer Trac® controls to allow the flexibility to set vend prices by day, time or specific wash cycles.

Operators have the option to program the equipment with a PDA and download the machine data for review off premises. An additional Super Cycle option is available, the company says.

Additional features include a direct-drive transmission, front access for easier selfservice, and a self-diagnostic feature. The high-security vault is compatible with card readers and dual coin drops.

The Energy Advantage™ top-load washer reduces water usage by 25% compared to Maytag commercial top-load washers manufactured before 2005, the company says. maytagcommerciallaundry.com 800-662-3587

peed Queen recently introduced a topload washing machine with watersaving features for vended laundry. The new washer incorporates operational and functional modifications to help reduce water usage and improve the modified energy factor (MEF). The top-loader will help reduce water consumption by up to seven gallons per load, Speed Queen says. A new mixing valve helps to regulate water flow, providing an optimal rinse pattern across a wide range of inlet pressures; optimizing the rinse cycle allows Laundromat owners to reduce utility costs, according to the company.

Other features include a curved, four-vane agitator to deliver a 210-degree stroke; a stain-

less steel washtub that won’t corrode, chip, crack or pit in normal use; a six “V” mounted suspension for better handling of unbalanced loads to help reduce wear and tear; and a commercial-grade porcelain enamel top and lid for optimum durability.

Quantum™ Gold controls also are available on the 2013 top-load washer. They allow customers to customize 31 cycle options. The controls offer a digital display for vend price and cycle-time countdown, plus three watertemperature selections (hot, warm or cold), three fabric selections (normal, permanent press or delicate), as well as solid modifier levels. speedqueen.com 800-590-8872

Super-size it. Would you like peppers? Would you like to add cheese?

This is a common concept adopted by restaurants nationwide. Although the phrasing may differ, “upselling” is a familiar concept to American consumers. Most restaurants offer a good product without the extras, but eateries and other businesses have found that consumers like being given the option to make their own choices about the type of product or service they want. This in no way means the original product or service is inadequate without the add-ons.

What does this mean for our industry? Let’s take a look.

Although there have been many Laundromat innovations in recent years, the two most valuable, in my opinion, are:

1. The ability to offer additional service options on vended washers and dryers.

2. The ability to offer an alternative payment method such as card systems, and its effect on the industry.

I would like to focus on these and explain how they tie together.

Several years ago, washer manufacturers introduced the ability to offer additional services to customers for additional vend price. Long before that, they offered the ability to sell hot and cold washes for a different cost. Competitors that did not have these sophisticated machines kept their prices low, ultimately reversing customers’ perceptions of the new pricing structure. Today, we have the ability to offer a quality wash, and customers who feel they will benefit from an extra wash or extra rinse will pay more for what they perceive is a superior wash result. This is upselling with no pressure on the customer to pay more money unless he or she chooses to add services.

This is a powerful tool to increase volume. For many years, we in the industry have been trying to figure out how to increase our revenue by giving customers choices they want, which increases revenue without the perception of increased pricing. I will show what this means in dollars and cents when we talk about the card systems.

Most manufacturers have an ability to offer these options, but each does it in a slightly different way.

Additional service options have to be made easy to understand and easy to use, but this doesn’t mean you provide less service and make it up in add-ons. We have to learn from industries that are successful in marketing upselling options. We need to offer good results at a fair price, plus the ability to let our customers decide if they want to spend more. It’s their choice.

80-Pound Washer

Total Starts 4,112 100%

Normal – Hot Water 2,037 49.54%

Normal – Warm Water 1,188 28.89%

Normal – Cold Water 500 12.16%

Perm Press – Warm Water 211 5.13%

Delicate – Cold Water 43 1.05% Rugs, Blankets – Cold 133 3.23%

Extra Wash 895 21.77%

Extra Rinse 603 14.66%

40-Pound Washer

Total Starts 10,999 100%

Normal – Hot Water 5,469 49.72%

Normal – Warm Water 3,351 30.47%

Normal – Cold Water 1,385 12.59%

Perm Press – Warm Water 508 4.62%

Delicate – Cold Water 130 1.18% Rugs, Blankets – Cold 156 1.42%

Extra Wash 1,602 14.56%

Extra Rinse 1,252 11.38%

30-Pound Washer

Total Starts 13,180 100%

Normal – Hot Water 6,852 51.99%

Normal – Warm Water 3,726 28.27%

Normal – Cold Water 1,745 13.24%

Perm Press – Warm Water 499 3.79%

Delicate – Cold Water 239 1.81%

Rugs, Blankets – Cold 119 0.90%

Extra Wash 1,529 11.60%

Extra Rinse 1,379 10.46%

20-Pound Washer

Total Starts 11,877 100%

Normal – Hot Water 7,197 60.60%

Normal – Warm Water 2,802 23.59%

Normal – Cold Water 1,004 8.45%

Perm Press – Warm Water 321 2.70%

Delicate – Cold Water 464 3.91%

Rugs, Blankets – Cold 89 0.75%

Extra Wash 1,500 12.63%

Extra Rinse 1,162 9.78%

Another way to add choices in the Laundromat is by utilizing a card system. These systems, which began as an alternative to accepting coins, have been available for many years. They have come a long way. Card systems are used today by owners who want to operate their businesses with all the advantages that most retail businesses offer. I’m going to touch on a few of these advantages, but this is really just a small representation of the benefits of managing a card-operated laundry.

First, card systems build loyalty. Once a customer uses a card and leaves a balance on it, they will more often than not come back to your Laundromat. The ability to accept credit cards and to use penny incremental pricing helps keep your vend prices in line with your utility costs. There are a variety of marketing pro-

• The 30-pound washers processed 13,180 loads, of which 2,908—or about 22% of the total number of loads—used an “extra” button. At a 35-cent upcharge per load, an additional $1,017 was collected from the 16 washers.

• The 40-pound washers processed 10,999 loads, of which 2,859—or about 25% of the total number of loads—used an “extra” button. At a 40-cent upcharge per load, an additional $1,143 was collected from the 14 machines.

• The 20-pound washers processed 11,877 loads, of which 2,662—or about 22% of the total number of loads—used an “extra” button. At a 30-cent upcharge per load, an additional $798 was collected from the 12 washers.

That adds up to $3,707 in additional revenue for this store in five months. Extrapolate that to a year and the added revenue

grams available to help increase your volume. Coupon programs give laundry owners the ability to offer rewards directly to the customer without an attendant and without fear of coupon fraud.

Card systems can also provide the ability to account for revenue and employee hours. Reports are available that reflect business revenue totals, individual usage, customer information, income by the hour, equipment usage, and average money spent per visit. This is just a small sample of the information that is available.

I have been able to gather reporting to solidify the value of the extra-wash and extra-rinse options. My family owns and operates three laundries with equipment that has these add-ons available. The stores are located in different geographic areas and have differing ethnic demographics. My report, illustrated in detail by the chart at left, is from one of our stores. It shows equipment usage over a five-month period.

The numbers will focus on extra-wash/extra-rinse usage and what it means in terms of additional revenue.

• The 80-pound washers processed 4,112 loads, of which 1,498—or about 36% of the total number of loads—used an “extra” button. At a 50-cent upcharge per load, an additional $749 was collected from the six machines.

comes to $8,899. The numbers speak for themselves, and that’s on top of the normal vend prices!

Keep in mind that these were customer choices; they made them of their own free will. That’s upselling.

In my experience, that kind of additional revenue (80%) goes to the bottom line. Without a card system, our stores would not have the tools to properly evaluate those numbers and help make any future equipment purchases.

Talk to your distributor about the options that are available. Evaluate this information to see if these innovations will work within your store’s budget.

In today’s business climate, any advantage that will help a business grow must be seriously considered.

I have heard many excuses for not moving forward with new innovations. The list would be so long, it would take another article to cover them all. The reality is, without these advantages, your business may struggle. It’s your choice. n

Dion Marcionetti is president of Laundry Concepts, a Huebsch distributor in the Chicagoland area. He can be reached at dion@ laundryconcepts.com or 630-628-4500, extension 110.

The yellows, blues, greens and shades of red at Calvary Laundromat in Raleigh, N.C., are decoratordesigned to create an inviting atmosphere, says owner David Makepeace.

“It’s very vibrant,” says Makepeace, and makes customers feel more energetic. “It’s not depressing beige or white walls.”

But the intangible atmosphere, the one that customers find welcoming, is created by his staff, he says. Or, as one teen folding clothes with her mother put it recently, her family comes because “We know people here.”

“The people here” are full-time atten-

dant Lizeth Brito and three members of a family that share work hours: mother Valentina Hernandez and daughters Oneyda Blanchard and Mirian Martinez. All are bilingual and can converse with Hispanic customers who make up a large part of Calvary’s customer base.

“Valentina and I have worked together forever,” says Makepeace, 47. They are both veterans of the large, multisite Medlin-Davis Cleaners operation in Raleigh, and he turned to her when he started Calvary four years ago.

He recalls asking if she knew of anyone who could help him. “She said, ‘Yes, me.’”

Makepeace says he’s “extremely” happy with sales at the 3,000-square-foot laundry, located in a small shopping center in the midst of large apartment complexes. “The success of it depends on the people you hire,” he says. “I have wonderful attendants.”

He names several other contributing factors, including the technological sophistication of its 30 front loaders and 28 dryers. (They include one 80-pound washer, charging $7.75; three 60-pound, $6; six 40-pound, $4; five 30-pound, $3.75, and 15 20-pound, $2.50. Every dryer—two 75-pound models, 24 45-pound, and two

35-pound—runs six minutes for 25 cents.)

They all accept Presidential dollar coins, which Makepeace says are so popular among customers as a novelty that they keep them instead of using them. “I have to replace them all the time.”

The advantage of dollar coins, he says, is the flexibility they provide customers using the coin changer. Without it, anybody putting a large bill in the changer “would have to use two hands” to hold the resulting quarters, he says. “It’s much more manageable.”

Charlotte’s T & L Equipment Sales, which supplied the equipment, programmed all the washers so that the seventh wash is free. That’s been a big hit and a factor in keeping customers coming back, Makepeace says. “The first thing they do is go look at all the machines and see if any of them are free.”

Another plus is the bright color scheme, he says. A decorator friend of Lee Makepeace, David’s wife and business partner, chose the overall design. “We started with the floor (multi-colored tile) and worked our way up the (yellow) walls,” David Makepeace says.

Lee and her dad, Riley Pleasant of Raleigh, painted squares within squares in contrasting colors to break up the long expanse. Even a neighbor contributed to the décor, bringing forth a large piece of art. Purchased at a yard sale for $15, it echoes the colors in the laundry and hangs above the entrance desk.

In the front of the store, a kids’ corner offers lots of windows, a wall-mounted TV showing cartoons, and walls that, for a few feet up, are actually blackboards. Children are encouraged to dig into a bucket of chalk and draw on them.

walls for children in a jewelry store and thought it was a clever idea.

“Parents are focused on sorting the clothes and getting them in the washers. If we can distract the kids for at least 15 minutes, the parents will appreciate that,” he thought.

For the adults, there are two large-screen TVs and free Wi-Fi.

Believing firmly that hands-on ownership makes for success, he visits the store three times a week, as well as other times when he’s called upon to repair equipment.

When he and his wife were planning the store, he personally canvassed the apartment communities near the site, which is on a connector road between two major traffic arteries. He discovered that most residents are Hispanic families.

He returned to personally put flyers for the new laundry under car windshields

at the apartments. He also mailed 1,500.

Makepeace is a former commercial banker in Charlotte and Raleigh who decided 13 years ago that “I wanted to go out on my own, to find a business and learn it and eventually buy it.” He was drawn to a cleaner/laundry because “It’s not going to go out of fashion like the buggy whip. Everybody’s going to need to get their clothes cleaned.”

He approached the then-owner of Medlin-Davis Cleaners and proposed, “You train me, and I’ll buy it from you.” Over the years, he rose to president, supervising three cleaning plants, three pickup and delivery routes and nine stores in Raleigh and neighboring towns, plus one small coin-op in the long-established Cameron Village shopping center in Raleigh.

Makepeace noticed similar blackboard

Makepeace noticed similar blackboard

Four years ago, unsure about the owner’s intentions of selling, he determined to start his own laundry while continuing to supervise Medlin-Davis. His wife gave him her full support.

It was at the beginning of the recession, but some businesses, including laundries, do well in that environment, he believes.

To financially strapped customers who need to clean their clothes, “This is a very affordable way to do that, rather than going to Lowe’s or Home Depot to purchase a washer and dryer.”

He’d worked with Medlin-Davis’ 1,500-square-foot laundry so he “had a general feel of how they operate.” Plus, T&L gave him the specific knowledge he needed.

Makepeace discovered the Coin Laundry Association and joined immediately. “They had an absolute wealth of information they could give me.”

Co-owner Lee worked as full-time attendant the first six months, and David gives her credit for starting the laundry off on a good footing. “She did a wonderful job of establishing relationships.”

In 2010, he bought the part of Medlin-Davis that operated in Raleigh and the nearby town of Wake Forest: two cleaning plants, four dry cleaning stores, three pickup and delivery routes for cleaning and wash/dry/fold, and the Cameron Village coin-op.

His wife became head of accounting and administration, while he functions as head of operations. They have 60 employees.

Wash/dry/fold work for the routes is done at one of the cleaning plants. Wash/dry/fold work for the Cameron Village coin-op, which is unattended, is processed at Calvary along with its work.

Makepeace is a firm believer in keeping up not only equipment but appearances.

Four-year-old Calvary has already been repainted once, and the checkerboard of floor tiles there is stripped and waxed every quarter, Makepeace says. Recently, some floor tiles were replaced, and a chair rail was added. “It’s very important that we keep up with wear and tear,” he says.

At the 1,500-square-foot Cameron Village coin-op, Makepeace renovated everything: floor, walls, ceiling. He replaced all the machines with new ones after he found, “Stuff was always breaking down. I was losing business.”

Once again, he turned to his wife’s decorator friend for a color scheme. This one is more subdued—lots of pale blues and browns—in keeping with the supposed preferences of the retirees and the North Carolina State University students who are its customers.

He added a large-screen TV, Wi-Fi, and new furniture.

He’s now enlisted the help of a marketing firm in designing not only a marketing plan but a logo, revamped storefronts for the cleaners, and even “the lettering on our vans.” And he says he wouldn’t mind having another coin-op.

After a 10-year apprenticeship and now four years of ownership, Makepeace believes he knows “what it takes to be successful.” n

Hannah Miller is a freelance writer who resides in Charlotte, N.C.

Tuesday, April 16th, 2013 Des Moines, IA

Ramada Tropics Resort Merle Hay Road by Century Laundry Distributing To Register Call: 1-800-791-9321

Tuesday, April 30, 2013 Milwaukee, WI Radisson Milwaukee West 2303 N Mayfair Rd Wauwatosa, WI 53226 Tel: (414) 257-3400 Special Hotel Room rate: $ 109.00 by D&M Laundry Equipment To Register Call 1-800-451-2676

Wednesday, May 1, 2013 Neenah, WI Bridgewood Resort Hotel & Conference Center1000 Cameron Way, Neenah, WI 54956 - (920) 720-8000 Special

Sometimes, your store is overly busy. Other times, it is underutilized. You don’t want your customers to walk in, see your facility is extremely busy and turn around to leave. You also don’t want customers coming in at odd hours and being so freaked out by the empty facility that they dare not enter your premises.

The perfect balance is to have eight customers in your store during every hour of operation each week. Of course, no one achieves this perfection. But one should try to better align customer use, which I call balancing traffic.

But your customers want to do their laundry at their own convenience. That’s why self-service laundries are open, on average, from 7 a.m. to 10 p.m. seven days a week. Let’s say that Saturday is a madhouse in your store. The suppertime hours are almost completely dead. Weekday mornings are steady, but afternoons crawl along with almost no one in the store. For some reason, Monday and Wednesday nights are quiet. How do you correct this imbalance?

Manage your store’s traffic with inducements and persuasion.

First, act only if you think there is a problem. Say your Saturday volume is so busy that customers trip over themselves. Children can’t play because every toy is in use and all the spaces are taken. Heavy use causes too many of your machines to break down. Customers walk around, their faces tense with aggravation. This is the perfect scenario to call for balancing traffic.

You would like to convert a number of customers to come in Sundays after 1 p.m. But how do you get these individuals to change their habits? Hand out a $1 coupon to every Sunday-afternoon customer. Do that for 10 weeks, and you’ll have more business in that time slot.

The good thing is that you don’t have to do this permanently. Ten weeks will be enough time to create a larger base of customers who will stay even when they

are no longer receiving the $1 inducement. Or perhaps 80% of the changeovers will stay; they will have gotten used to their new hours. Of course, this coupon redemption requires an attendant on duty. If you don’t use an attendant, arrange for someone to be there at designated coupon times.

How much would this effort cost? Suppose you had 30 customers coming in on week one and now have 100 customers coming in on week 10. Splitting the difference, the average customer base is roughly 70 per week. That’s $70 “paid out” each Sunday multiplied by 10 Sundays for a total cost of $700. Is the traffic-aligning worth the cost? You probably will have won 40 to 50 more Sunday-after-1 regular customers. This frees up a busier time slot, plus you’ve earned some customer goodwill. They appreciate the dollar. You have better balanced your customer traffic. Yes, it is worth the cost.

You can use this sort of tactic with any time period. Hang a sign in your store that reads, “Earn $1 if you clean your clothes after 1 p.m. on Sundays.” Use all of your marketing efforts to promote the offer. If a custom-

er asks how long the dollar inducement will be in effect, be frank. Tell them you want to even out business, so the promotion will be in effect a minimum of six weeks but could continue for as long as a year. In fact, you are going to end the inducements after 10 weeks.

Another tactic is to have a musician come in and play/ sing on a slow night. For instance, the musician plays from 7 to 9 on Wednesday night. You might pay him or her a token amount, and customers could be encouraged to tip the performer. This opportunity might be the inducement for a talented young man or woman to come in and reach a new audience. Of course, you

Howard Scott

Howard Scott

or a staffer will have to be there to manage the traffic flow, keep out undesirables, and keep the music to an acceptable decibel level. In a short amount of time, Wednesday nights at your store could become the neighborhood event, a can’t-miss for the locals. Business will thrive.

Still another approach is to schedule a weekly drawing on a slow business day. The rule is that a customer must wash his/her clothes on that designated day to be eligible to win. Offering an attractive prize—free dinner for two, or a gift certificate to a local store—might shift traffic.

This approach simply asks customers to switch their washing day. This must be done by a knowledgeable person (you?), and it involves greeting customers and quietly talking to them. It could be accomplished simply by pointing out that the facility opens at 7 a.m. and one could get their clothes cleaned in only an hour at that time because most of the machines are available. Everybody wants to save time and avoid hassle. That information might just get them to try the early slot.

Or, you might be more aggressive. Say you have an overly busy Monday night. You might casually go up to several customers and speak to them. “You know, it is awfully busy around here Monday nights. Tuesday or Wednesday evenings are much less hectic, and customers can get any machine they want. They get in and out much quicker.” Everyone wants to save time. That might just plant the seed. Next week, you might see one or more of your Monday regulars on Wednesday night.

Another thing you might pitch during these conversations is the wash/dry/fold service you offer (if you do). It doesn’t hurt for you to sidle up to a customer and say, “Did you ever think about using our wash/dry/fold service? You’d bring clothes in the morning and pick them up that same night. You might spend $5 more a week, but, heck, your time is worth more than that.” Anybody you convince to use the wash/dry/fold service helps to balance store traffic.

Balancing traffic is another way to make your operation more efficient. Don’t ignore this tool. n

Howard Scott is a long-time business writer and small-business consultant. He has published four books.

Afour-hour drive northwest from Bismarck, N.D., will lead drivers to the city of Williston, where a modern-day gold rush has incited oil miners to flock to the area to mine for natural gas trapped beneath the state’s water table in the Williston Basin.

Oil is mined through a process known as hydraulic fracturing—or fracking—which involves drilling a mixture of water, sand and additives into a reservoir, ultimately creating a passageway for miners to procure the previously trapped natural gas, says energy services company Halliburton.

Oil production and takeaway capacity in the Williston area has steadily increased over the years, with the U.S. Energy Information Administration reporting last April that 600,000 barrels of crude oil were being produced per day.

While the oil business has brought a financial boom to the Williston area, a new necessity has emerged, roused by the influx of workers and their families: “greaser” laundry facilities.

“You have people all over living in man camps [or] living in RV parks that don’t have laundry [facilities],” says Terry

Anderson, a coin laundry equipment salesman for The Minnesota Chemical Co., a distributor headquartered in St. Paul, Minn.

In the past year, Anderson has had a hand in answering the Williston area’s laundry needs by designing and building two laundries: one in neighboring Watford City (pop. 1,759) and the other in Tioga (pop. 1,230), each about an hour’s drive from Williston.

Owner Charles Barton consulted with Anderson to build his facility, Clean Jean’s Express Laundry, in Tioga. Barton’s family has been in the area since the late 1930s. In addition to owning Clean Jean’s, he has also set up an RV park to cater to workers from the oil fields.

“I have 31 spaces since putting that in three years ago,” says Barton, who’s seen about a half-dozen more parks built within a three-mile radius and predicts more are on the way.

Clean Jean’s, which opened in August 2012, is an attended coin laundry located three blocks up Tioga’s Main Street, and

sits at the far end of Barton’s RV park. A portion of the facility, encompassing 1,760 square feet, was originally a Quonset hut built in 1956 for a cement plant. Barton’s family took ownership of the building in 1976, and in the construction process ended up adding another 480 square feet at the front of the facility.

His store offers Speed Queen industrial equipment, including 15 front-load washers with capacities of 20, 30, 40 and 60 pounds, as well as 28 dryers with capacities of 30, 45 and 55 pounds.

Like many coin laundry stores, Barton’s has taken advantage of the added service of wash/dry/fold.

“We started off primarily with self-serve and then there [was] a need for [wash/ dry/fold],” says Barton, who began offering wash/dry/fold service in October. “We started off with 10 customers the first month, and we’re well past 200 customers now.”

But what sets his facility apart from others, he believes, is the fact that he accepts greaser laundry—garments that oil workers wear in the oil fields—which he explains is “just about impossible to get cleaned.”

WASCO 185’s 220/1 & 220/3 $3,500

WASCO 184’s 220/1 & 220/3 $2,700

WASCO 125’s 220/1 & 220/3 $2,400

WASCO 124’s 220/1 & 220/3 $1,850

WASCO 74’s 110 v & 220/3 $ 975

WASCO 75’s 110 v & 220/3 $1,200

WASCO 620’s 110V $1,600

Our Parts Department has thousands of products on over an acre lot.

If we don’t have what you want, ask us, and we’ll find it for you.

From initial site inspections and recommendations to equipment purchase and installation, we are here to help with every aspect of your project.

We can help you with specifications, dimensions, illustrations of commercial and on-premise laundry equipment.

We are able to offer competitive rates and low, affordable monthly payments for financing coin laundry and laundromat facilities.

We have a coin laundry financing solution to meet the needs of new store owners, and veterans alike.

ACRES OF HARD TO FIND USED WASHER & DRYER PARTS WASHER & DRYER FRONT & SIDE PANELS ALL MAKES AND MODELS STARTING @ $50

WASHER DOOR $35 & UP COMPLETE DRYER DOOR $35 & UP COMPLETE ANY WASHER TUB 18#, 35#, 50#, WITH NEW BEARINGS $175 & UP WITH EXCHANGE ALL DRYER BASKETS $75 & UP ESD CARD READERS $150 EA

EMERALD SERIES COMPUTER BOARDS $575 EA

LET US REFURBISH YOUR PANELS ~ FRESHLY PAINTED PANELS IN EITHER ALMOND OR WHITE ... $70 EA

“You can’t just throw it in the washer and go through the same motions that one does for non-greaser clothes,” he says.

Barton’s facility sees mostly uniforms and coveralls that have “heavy oil on them,” he adds.

Robert Trupe processes similar greaser garments at his store in Watford City.

“You’ll get anything from gloves to their jeans or shirts [or] coveralls,” Trupe says. “Other companies that do have uniforms [will] bring in their uniforms. It’s really any of the exterior clothes that these guys are getting muddy.”

Trupe also consulted with Anderson in building Suds Laundry, a 3,600-squarefoot Laundromat he opened last September on Watford City’s Main Street. His store, which employs six attendants and a fulltime manager, also offers added services such as shower stalls, mailboxes and a

Trupe. “And then we put the same type of signs out on the self-service side for the customers.”

Considering the blend of mud, oil and grease that covers workers’ uniforms and garments, what cleaning procedures are needed? Many of the garments face a variety of washes, Anderson explains, that are adjusted at different settings than traditional laundry loads.

“What you need to have [is] a pre-wash and a wash where you can inject detergents,” says Anderson. “Normal clothes can have a wash-dry-spin in about 24 to 30 minutes. These, you might set the water levels a little higher, and then extend that wash cycle longer.”

“The greaser machines are programmed for longer wash cycles [or] additional rinses, so they all have two washes and two rinses,” says Trupe of his store, adding that those machines use 140-degree water.

Despite all this, there are times when garments have to be rewashed because of the condition they are in, he adds. “Once in a while, if you get a really heavy load, some of the oil is pretty tough to get out because it’s thoroughly saturated with this heavy grease that they use in the oil fields.”

Equipment in greaser laundries endures a heavy toll, what with the concoction of grease and industrial-strength detergents on top of hot temperature settings and numerous cycles run daily.

“If you don’t clean them, it’s not good on the equipment [and] certainly it won’t last as long,” says Barton. “We take quite a bit of pride in regards to our equipment, so we clean it on a routine basis.”

In addition to wiping and cleaning machines multiple times throughout the day, Barton also practices running a noload cycle to ensure that washers are thoroughly cleaned. “Oftentimes we’ll have to run a special concoction […] through the washers to make sure that they’re all clean. And we also clean the [dryer] filters on an everyday basis.”

For its part, Minnesota Chemical sends out technicians to service machines on a regular basis, Anderson says. And to ensure that store owners know how to properly take care of their machines, the company hosts educational sessions on maintenance standards.

“We have these service schools [where] we talk about the things [owners] need to do [for] preventative maintenance to make sure [the machines] are cleaned out and make sure everything is working,” says Anderson.

Wi-Fi lounge area, in addition to wash/ dry/fold.

“We took the approach that we needed to be more than a Laundromat,” says Trupe. “We see it as kind of taking the pain away from laundry, because it’s a little more [of a] relaxing atmosphere.”

Like Barton, Trupe invested in Speed Queen equipment—washer-extractors ranging in capacity from 20 to 80 pounds, and dryers up to 75 pounds in capacity.

For greaser laundries, it’s important that certain machines are designated specifically for greaser use, according to Anderson. “You can’t have somebody do their greaser laundry, and then somebody comes [after them] and puts their white sheets, towels and regular clothes in, because greaser laundry machines can never get all of [the grease cleaned].”

At his store, Trupe has designated two machines for his attendants to process commercial accounts, and six for selfservice, specifically for greaser laundry.

“In the wash/dry/fold area, we just have two of them that we put big, yellow labels marked ‘Greasers’ so the attendants know which machines to use for greasers,” says

Barton’s employees have had to re-wash garments as well, despite the pre-soak and different washes that they use to process garments. “We do our best to run several types of cycles through them, depending upon what the grease is. Sometimes we have to extend the wash cycle, sometimes we have to soften the water. Sometimes we have to use more soap than what you ordinarily would use, sometimes we use a different mixture than what we’d ordinarily use.”

Barton’s chemistry background as a consultant for pharmaceutical companies comes in handy at times, but he also learns from his employees which combinations of industrial detergents work best. “We’re refining the process,” he says.

Trupe has also used trial and error in finding which detergents to use at his store. “Finding the right mix of chemicals [is] a little bit of trial and error until you get all of your machines [and] cycles set up. It’s taken us a few months to get it down [but] we have help from Minnesota Chemical and some other vendors that were able to help us get the right mix of chemicals.”

As a safety precaution, Trupe requires his employees to wear rubber gloves and face shields while handling the strong detergents.

Besides the maintenance requirements, greaser laundries face another challenge: the lingering odor of grease in dryers.

Trupe says that using certain chemicals helps reduce the smell. “There are a couple of different chemicals that we use depending on the application. There are deodorizers, but then there are other chemicals that we can add that [are] additional cleaning agents that have a nicer smell.”

Regardless of the special challenges that their facilities present each day, Trupe and Barton both say it was worth moving into the area.

“We’ve been hearing a lot of good things,” says Barton. “We certainly wouldn’t be at the level that we are in, particularly with our wash-and-fold business, if we didn’t provide high-quality service.”

In addition to growing Clean Jean’s wash/dry/fold service, Barton is in the process of opening an Internet cafe and gourmet coffee shop at the front end of his facility.

Trupe says opening Suds Laundry has “been a good investment.” Though he’s considered looking at neighboring towns for business opportunities, he would first like to establish his Laundromat before pursuing other ventures.

“Finding the right mix of chemicals (is) a little bit of trial and error until you get all of your machines [and] cycles set up.”

—Robert Trupe, Suds Laundry

Advertiser

AC Power

13

American Switch 39

Clean Show 33

D&M Laundry Equipment

ESD Inc.

29

20, 21, BC

FrontecStore.com 38

Gold Coin Laundry Equipment

Great Lakes Commercial Sales

17

38

HHC Electronic Service 39

Huebsch FC, 23, 25, 27

Irving Weber

Laundry Concepts

31

Laundry Parts Market 19

LG

Low Cost Manufacturing 32

Maytag Commercial Laundry 7

Mountain Electronics

NATCO 37

New York Laundry Equipment 35

NIE Insurance

R&B Wire Products

Setomatic Systems IFC

Speed Queen 8, 9, 11

Super Computer Boards

Wells Fargo Insurance Services 18

DIRECT LAUNDRY SYSTEM

98-47-212 St, Queens NY 718-468-1119 / 917-678-2095

Laundry Equipment Parts Repairs Bearing Job Over 20 Years’ Experience.

W 185 $3000.00 W 125 $1700.00 W 75 $900.00 W 184 $2800.00 W 124 $1600.00 W 74 $800.00 JT0300 $1800.00 JT32DG $1500.00

Lots of Washers, Dryers, Motors, Baskets, Gas Valve, Computers, Doors, Front & Side Panels etc.

Washers comes with 2 Years Bearing, 1 Year Limited Parts & 90 Days Service in the NYC and Tri-State Area.

Many Brand Names not listed. Florida & Georgia area VICTOR @ 321-946-9890

Repair Front Load WASHER Bearings. Call Tony P. 516-805-4193

Merrill to lead Vended laundry deVelopMent, SaleS for CG WeSt Van Merrill recently joined Continental Girbau West (CG West) as its vice president of vended laundry development and sales, the company reports.

Merrill, who hails from North Tustin, Calif., has 27 years of experience in vended laundry ownership, development, management, marketing and sales, and has particular expertise in lease negotiations, CG West says.

“Van is a talented developer of profitable vended laundries,” says Mike Floyd, president of Continental Girbau Inc. (of which CG West is a subsidiary). “We’ll look to him to provide expertise, management and guidance. He excels at finding vended laundry locations and developing those laundries to their fullest profit potential.”

Merrill most recently provided consulting services to coin laundry investors. Prior to that, he co-owned Sparklean Laundry Systems, a Continental distributorship, for eight years.

network, and the competitive advantages and positive business climate of Wisconsin.”

In addition to the “Market Leadership” award, the Wisconsin Manufacturer of the Year program handed out four grand awards to companies categorized by the number of employees – small, medium, large and mega. Alliance, nominated for the first time in 2012, competed in but did not win the Mega category.

MaytaG honorS Standout diStributor perforManCeS Maytag® Commercial Laundry recently recognized standout distributor performances at its 55th Annual Meeting in Amelia Island, Fla. The following companies excelled, Maytag says, in the coin laundry, multi-housing and on-premise markets in 2012:

• Fred Maytag Award — Receiving the company’s most prestigious award was Intertrade Chile S.A., Santiago, Chile. The award is presented to the customer that best emulates the founder’s marketing philosophy and supports Maytag® Commercial Laundry brand with professionalism and integrity, Maytag says.

• Shaping the Future Award — Mac-Gray Corp., Waltham, Mass., was recognized for its history of innovation and longtime leadership in the industry.

• Multi-Housing Excellence Award — Coinamatic Canada, Mississauga, Ont., was honored for its outstanding service to the multi-housing market, including colleges and universities, condominiums and apartment buildings.

• Maytag® Red Carpet Service® Excellence Award — BDS Laundry Systems, St. Paul, Minn., was recognized for best exemplifying excellent service and dependability.

• Top Quota Award — Tri-State Technical Services/TLC Equipment Co., Waycross, Ga., was honored for exceeding its annual sales target by the highest percentage this year.

• On-Premises Laundry (OPL) Excellence Award — Pierce Commercial Laundry, Mandeville, La., was recognized for effective and efficient service to OPL market customers.

allianCe laundry SySteMS reCoGnized for Market leaderShip Alliance Laundry Systems recently received a special award for “Market Leadership” as part of the Wisconsin Manufacturer of the Year program recognizing outstanding achievements in manufacturing in 2012.

Alliance was one of eight companies honored out of 58 nominated in the statewide awards program, now in its 25th year.

“Alliance’s story started more than 100 years ago when two Ripon hardware store owners figured out how to mechanize handpowered washing machines,” notes Alliance CEO and President Mike Schoeb. “Now, we are the largest manufacturer of commercial laundry equipment in the world. Our continued success is driven by that same spirit of innovation, the dedication and work ethic we find in the local labor force, our world-class distribution

• Maytag® Marketing Excellence Award — Equipment Marketers, Cherry Hill, N.J., was honored for its development and implementation of marketing and sales programs and overall support of Maytag® Commercial Laundry offerings.

• Outstanding Achievement Award — Richard Jay Laundry Equipment, Adelaide, Australia, was recognized for “unmatched sales performance and use of marketing and social media.”

• Maytag® Energy Advantage™ Excellence Award — Hercules, Hicksville, N.Y., was honored for exceptional promotion and marketing of energy and water efficiency.

“We’re honored to collaborate with quality partners, such as those recognized at our recent annual meeting,” says Bob English, general manager at Maytag® Commercial Laundry. “Our successes are a direct result of the dedication and support exemplified by these outstanding customers. We congratulate and commend them for their superb efforts.”