FlexiblePaymentOptions

FlexiblePaymentOptions

Family-owned and -operated company, among the oldest serving the self-service laundry industry, marks a key anniversary in 2023.

Laundromats share many similarities, so how and where a business differentiates itself from its competitors carries great importance.

Yesterday’s management styles are often not the best way to get today’s employees to pull together to build a company.

Want to know what business conditions, sales and utilities cost were like in 2022 for vended laundry owners across the country? Our annual State of the Industry survey report has the answers for you. Find out how your store stacks up against others in a multitude of ways.

Correctly pricing your laundromat’s washers and dryers can have big implications for your success, retired multi-store owner Paul Russo believes. Price them too low and you’ll have lower margins with too much volume. Price them too high and you may not generate enough volume to support your business. Russo suggests some strategies for pricing self-service equipment as well as drop-off service.

American Coin-Op releases a new podcast on a different topic of interest every other month? Give it a listen at AmericanCoinOp.com/podcasts.

If you want to compare your self-service laundry business to your competitors and to the industry standard, it’s important to have accurate, up-to-date, meaningful information. But where can you find reliable data to make such a comparison?

Why, right here in the pages of American Coin-Op, of course. Specifically, in our annual State of the Industry survey report. You’ll find the 2022 data and 2023 forecasts you can use to measure the performance of your business against others.

In preparing our report, I analyzed survey results received from qualified respondents based around the country to develop a picture of 20222023 business conditions, vend prices, equipment purchases, turns per day, and much more.

It’s easy to see how you stack up by answering questions like these:

• Did your total vended laundry business increase or decrease in 2022, and by what percentage?

• What wash and dry vend prices are you charging?

• How many persons besides owners are employed full-time vs. part-time by your store(s), and how much do you pay them?

• If you offer wash/dry/fold service, how much do you charge per pound?

• What’s the average number of turns per day for a front loader in your store?

• What was your store’s utilities cost, as a percentage of gross, last year?

• Have you purchased, or are you planning to purchase, new equipment this year?

If you want to see how your vend prices, wash/dry/fold pricing, turns, or more than a dozen other metrics compare to similar laundries, flip to page 6 and get a feel for the numbers.

Bruce Beggs Editorial DirectorThe phone number for New Jersey Commercial Laundry Repair that was published in March’s Buyer’s Guide issue was incorrect. The company’s phone number is 732-226-7053 American Coin-Op regrets the error and any inconvenience it may have caused.

Charles Thompson, Publisher

E-mail: cthompson@ATMags.com

Phone: 312-361-1680

Donald Feinstein, Associate Publisher/ National Sales Director

E-mail: dfeinstein@ATMags.com

Phone: 312-361-1682

Bruce Beggs, Editorial Director

E-mail: bbeggs@ATMags.com

Phone: 312-361-1683

Mathew Pawlak, Production Manager

Nathan Frerichs, Digital Media Director

E-mail: nfrerichs@ATMags.com

Phone: 312-361-1681

ADVISORY BOARD

Douglas Pratt Michael Schantz

Tony Regan Matt Simmons

Sharon Sager

OFFICE INFORMATION

Main: 312-361-1700

SUBSCRIPTIONS

847-504-8175

ACO@Omeda.com

www.AmericanCoinOp.com

American Coin-Op (ISSN 0092-2811) is published monthly. Subscription prices, payment in advance: U.S., 1 year $50.00; 2 years $100.00. Single copies $10.00 for U.S. Published by American Trade Magazines LLC, 650 West Lake Street, Suite 320, Chicago, IL 60661. Periodicals postage paid at Chicago, IL and at additional mailing offices.

POSTMASTER, Send changes of address and form 3579 to American Coin-Op, Subscription Dept., 125 Schelter Rd., #350, Lincolnshire, IL 60069-3666. Volume 64, number 4. Editorial, executive and advertising offices are at 650 West Lake Street, Suite 320, Chicago, IL 60661. Charles Thompson, President and Publisher. American Coin-Op is distributed selectively to owners, operators and managers of chain and individually owned coin-operated laundry establishments in the United States. The publisher reserves the right to reject any advertising for any reason.

© Copyright AMERICAN TRADE MAGAZINES LLC, 2023. Printed in U.S.A. No part of this publication may be transmitted or reproduced in any form, electronic or mechanical, without written permission from the publisher or his representative. American Coin-Op does not endorse, recommend or guarantee any article, product, service or information found within. Opinions expressed are those of the writers and do not necessarily reflect the views of American Coin-Op or its staff. While precautions have been taken to ensure the accuracy of the magazine’s contents at time of publication, neither the editors, publishers nor its agents can accept responsibility for damages or injury which may arise therefrom.

After COVID-19 ravaged 2020’s self-service laundry profits, the industry rebounded in 2021. Based on results from this year’s American Coin-Op annual State of the Industry survey, many self-service laundry owners and operators are still working their way back.

But despite any challenges left by the pandemic and more recently by inflation and higher costs, nearly three out of four owners polled this year say their total business improved in 2022.

The annual State of the Industry Survey report provides many statistics valuable to store owners and investors who wish to compare their operations to the industry average. This year’s survey focused on 2022-23 business conditions, vend pricing, equipment, turns per day and utilities cost.

When asked about their 2022 business results, respondents were given the opportunity to state whether their results were up, down or unchanged. (Surveys conducted prior to 2012 asked only if business was up or down, so keep this in mind if you’re making comparisons to results of that vintage.)

The annual survey is an unscientific, online poll of American Coin-Op readers who operate stores. Some percentages may not equal 100% due to rounding or other factors.

More than half of respondents polled this year—52.3%—own just one selfservice laundry, while the remainder are multi-store owners (26.2% own two or three stores, 21.5% own four or more).

In terms of store size, 43.1% say their largest covers 3,000 square feet or more, 33.8% say it’s between 2,000 and 2,999 square feet, and the remaining 23.1% say it measures 1,999 square feet or less.

Approximately 47% of respondents own their store space, 42.2% rent their store space, and the remaining 10.9% say their arrangement varies by property.

Fully attended stores among the audience polled account for 46.2%. Roughly 31% are partially attended, and 16.9% are unattended. Among the remaining 6.2%, the arrangement varies by store.

More than 86% of laundry owners surveyed employ either part-time or full-time workers in their stores. Of these, 58.9% have four or more employees, 28.6% employ two or three, and 12.5% have only one employee.

On average, responding store owners have 4.6 full-time employees and 7.2 parttime employees (this calculation reflects averages by respondent, not by store).

Among these store owners, when compensating their non-management-level attendants, 12.1% pay an average hourly wage between $10 and $10.49, 1.7% pay $11-$11.49, 3.4% pay $11.50-$11.99, 37.9% pay $12-$14.99, and 39.7% pay $15 or more. The remaining 5.2% say all of their employees are management level.

As for payment types accepted, 75.4% of respondents say they offer coin, 49.2% offer card, and 26.2% offer other noncoin systems (store owners were asked to identify every type that applies to their operations). Roughly 46% of respondents offer customers more than one type of payment, compared to 53% last year.

American Coin-Op asked respondents

to name which ancillary services their stores offer from a list of 20 choices, with an option to identify others. When checking all that applied to them, soap vending was a choice of 90.6%, followed by soft drinks and/or snack vending (82.8%), laundry bag sales (70.3%), drop-off wash/ dry/fold service (68.8%) and Wi-Fi access (68.8%).

Respondents were also asked how they had advertised their store(s) in the past 12 months. They were provided a list of 14 choices plus given the option to identify others. Named most often was the store’s website (49.2%), followed closely by social media (46.2%). Other popular choices included signs or banners (35.4%), in-store promotions (32.3%) and digital ads (29.2%).

What are the biggest challenges you face in operating your laundry business today? In asking that in this year’s survey, American Coin-Op offered a list of nine, plus the option to write in “other” choices, and directed operators to select all that apply.

Here are the results:

1. High cost: utilities (75.4%)

2. High cost: new equipment (43.1%)

3. High cost: labor (37.0%)

4. Finding/keeping reliable employees (33.8%)

5. High cost: maintenance (20.0%)

6. Equipment abuse/vandalism (18.5%)

7. High cost: rent (16.9%)

8. “Other” (9.2%)

9. Poor industry image, and too much competition (tie, 6.2%)

For 2022, nearly three-quarters of respondents (71.4%) say their overall selfservice vended laundry business in gross dollar volume increased from that of 2021. By comparison, 86.7% reported increases in the 2021-22 survey.

The average 2022 business increase was 13.2%, down from 17% in 2021. Other past average business increases have been 7.1% (2020), 12.6% (2019), 9.9% (2018), 9.4% (2017), 11.2% (2016), 9.6% (2015), 8.9% (2014), 9.6% (2013), 11.7% (2012), 11.5% (2011) and 10.8% (2010).

Following is a breakdown of 2022 business increases (the figures relate to those reporting increases, not all respondents):

• Operators with a business increase of less than 10%: 25.7%;

• Operators with a business increase of 10-14%: 34.3%;

• Operators with a business increase of 15% or more: 40.0%.

Roughly 8% of operators polled faced a decrease in total business (in gross dollar volume) in 2022, compared to less than 4% in 2021. Results from previous years showed the following with business declines: 58% (2020), 12% (2019), 8% (2018), 10% (2017), 22% (2016), 17% (2015), 29% (2014), 25% (2013), 30% (2012), 35% (2011), and 58% (2010).

The average 2022 business decrease was 8.9%, compared to 20.0% reported for 2021. Other prior average decreases were 20.5% (2020), 7.5% (2019), 5.0% (2018), 6.7% (2017), 9.1% (2016), 16.3% (2015), 6.6% (2014), 8.7% (2013), and 9.5% (2012).

Among respondents who reported experiencing decreased business in 2022, the drop was as low as 4% or as high as 20%.

Roughly 18% of respondents say their 2022 business was unchanged compared to 2021 business.

About 53% of operators surveyed reported that drop-off service business (in gross dollar volume) increased for them in 2022, compared to 62% in 2021, 34% in 2020, 54% in 2019, 58% in 2018, 68% in 2017 and 61% in 2016.

The average increase in drop-off service business last year was 13.4%, compared to 30.4% in 2021, 14.2% in 2020, 21.0% in 2019, 29.8% in 2018, 26.1% in 2017 and 18% in 2016.

Just 2.6% of respondents saw a decrease in 2022 drop-off business, which matches the share from 2021. In previous years, the shares of laundry owners with declining drop-off business were 51% in 2020, 12% in 2019, 10% in 2018, 16% in 2017 and 6.5% in 2016.

Roughly 45% of respondents say their 2022 drop-off business was unchanged from the previous year. That compares to 36% for 2021, 20% for 2020, 34% for 2019, 32% for 2018, 16% for 2017 and 35% for 2016.

Current drop-off pricing (in dollars per pound) ranges from 90 cents to $2.50, based on the survey responses.

Following is a breakdown of the most popular drop-off service prices (per pound), followed by the percentage of operators who charge them:

1. $1.25 (16.7%)

2. $1.75 (14.3%)

3. $1.50 (11.9%)

Overall, prices for drop-off service remain fairly consistent with previous years’ surveys. In total, 17 different drop-off prices were reported in this year’s survey.

Roughly 65% of operators who took the annual poll offer drop-off service, which closely matches the share from last year’s survey.

Among store owners who offer commercial laundry services (that share was 47.7% in this survey), 35.5% reported that business (in gross dollar volume) increased for them in 2022. The average increase was 8.5%.

Roughly 7% of respondents reported a decline in commercial laundry business; the average was 17.5%. Approximately 58% of respondents say their 2022 commercial business was unchanged.

The share of respondents reporting their vending sales rose in 2022 was 39.1%, compared to 65.3% the previous year.

The average vending sales increase last year was 10.4%.

Thirteen percent reported declines in vending sales in 2022, compared to 8.2% for 2021.

The average decrease in 2022 was 19.3%.

Operators reporting no change for 2022 accounted for 47.8%, compared to 26.5% in the prior year’s survey.

Respondents were asked to report how much they charge for a variety of washes.

Roughly 46% of operators surveyed, compared to 62% last year, offer top loaders in their store(s). The current price range for a top-load wash is $2.00 to $4.75.

Here are the most popular top-load prices, followed by the shares of respondents charging them:

1. $3.00 (20.0%)

2. $2.00 (16.7%)

3. $2.50 and $3.50 (tie, 13.3%)

These prices mirror those reported last year, with the addition of $3.50 as a differentiator.

The most popular prices charged for some of the small front loaders are:

• 18 pounds: $3.00

• 20 pounds: $3.00

• 25 pounds: $4.00 ▼

Average turns per day, current: Top loaders: 3.3 Front loaders: 4.1(Photo: © Syda_Productions/Depositphotos)

Most popular 30-pound front loader prices, current:1. $5.00 2. $4.00 3. $4.50

Before investing tens of thousands of dollars into a retool, upgrade your existing machines to accept modern, mobile payment. All you need is a BluKeyTM for each machine to give your store a boost. You can install them yourself, and then accept payment from virtually any source through the PayRange app. Plus, add loyalty features, discounts and convenience. Enable your customers to pay as they please on your existing machines with PayRange. Join the 3,500+ laundromats already using PayRange.

The lowest price reported in this group was $2.00 (18 pounds) while the highest price was $5.50 (25 pounds).

The price range for a 30-pound wash is $3.50 to $8.00. Following are the most popular 30-pound prices, along with the percentages of operators who charge them:

1. $5.00 (19.2%)

2. $4.00 (15.4%)

3. $4.50 (13.5%)

Prices for a 35-pound wash currently range from $4.75 to $6.50.

The price range for a 40-pound wash is $4.25 to $9.00. Following are the most popular 40-pound prices, along with the percentage of operators who charge them:

1. $6.00 (25.5%)

2. $5.00 (11.8%)

3. $4.75 and $5.50 (tie, 9.8%)

Prices for a 50-pound wash currently range from $5.00 to $8.00. For the 55-pounder, it’s $6.50 to $10.25.

The price range for a 60-pound wash is $5.50 to $10.00. Following are the most popular 60-pound prices being charged, along with the percentages of operators who charge them:

1. $8.00 (23.1%)

2. $7.00 (15.4%)

3. $6.75 and $9.00 (tie, 11.5%)

Operators who offer 75-pounders are charging between $8.25 and $11.00 per wash.

The price range for an 80-pound wash is $7.00 to $14.00. Following are the most popular 80-pound prices, along with percentages of operators who charge them:

1. $10.00 (23.7%)

2. $9.00 (15.8%)

3. $8.50 and $12.00 (tie, 7.9%)

Prices charged by operators for a 90-pound wash today range from $10.00 to $16.00. For a 100-pound wash, the price range is $8.00 to $10.75.

Operators who respond to American Coin-Op’s unscientific survey vary year to year, which could account for the variety of prices reported. Respondents were asked to provide prices for front loaders of 14 traditional capacities, plus were given the option to list others.

Among all the washer capacities, the 20-pounder (14 prices), 40-pounder (15 prices) and 80-pounder (18 prices) have

the broadest pricing among operators surveyed.

Turns per day refers to the number of cycles (turns) that each of a store’s machines completes daily. For each machine class (top loader or front loader), you can calculate this using total cycles for a oneweek period divided by the total number of machines in the class, then dividing by seven.

At present, the average turns per day for top loaders among respondents is 3.3, which is a tick lower than the 3.4 average logged in last year’s survey.

For front loaders, the average number is 4.1 turns per day, compared to an average of 4.6 registered in 2022.

Respondents were asked to list their current prices for their dryers as “25 cents for X minutes.” As in previous years, a variety of responses was reported.

Most popular among this year’s respondents—at 22.9%—is 25 cents for 5 minutes. It marks the first time in seven years that 25 cents for 6 minutes wasn’t the top choice; it was, however, second at 20.5%.

Coming in third were 25 cents for 4 minutes and 8 minutes (tie, 12.0%).

Operators were asked about their 2022 utilities cost (as a percentage of gross). The responses ranged from 8% to 55%. Collectively, respondents paid an average of 21.8%, up slightly from 19.5% in last year’s survey.

The most common individual response—also most common in last year’s survey—was 20%. Whereas 57.5% reported a utilities cost of 20% or less last year, 54.2% reported the same this year.

American Coin-Op asked respondents if they have already raised washer and/or dryer prices in 2023, or if they plan to do so before the end of the year.

Regarding washer prices, the majority of respondents (78.1%) say they have already raised prices, or intend to do so, ▼

78.1%

Have raised wash prices, or intend to by end of year:(Photo: © borodai.andrii/Depositphotos)

by year’s end. Roughly 6% say they have no such plans, and the remaining 15.6% are undecided.

As for dryer prices, 45.3% say they have raised, or plan to raise, their prices this year. Roughly 20% say they have not and aren’t planning to this year. Roughly 34% are undecided.

Nearly 51% of respondents purchased at least one piece of equipment (washer, dryer, water heater, vending machine, or other) in 2022, which is just a couple percentage points below the previous annual survey.

Following is a breakdown of 2022 purchases by respondent (percentages do not total 100% because some buyers purchased equipment in multiple equipment categories):

• 12.1% purchased at least one top loader, with the average buy being 8.9 machines.

• 78.8% purchased at least one front loader, with the average buy being 17.1 machines.

• 48.5% purchased at least one dryer

(regular or stack), with the average buy being 25.1 machines. (Editor’s note: This accounting includes a small share of operators who each purchased 40 or more machines last year.)

• 33.3% purchased a water heater.

• 33.3% purchased a vending machine. Respondents to this year’s survey also listed changers, floor scrubbers, credit card systems, soap/bag venders and air conditioning units among the equipment they had purchased.

Operators were also asked if they have purchased, or plan to purchase, new equipment in 2023. Roughly 45% of respondents have added, or plan to add, some type of equipment (washer, dryer, water heater, vending machine, or other) to their mix in 2023. By comparison, last year’s percentage was 42%.

Following is a breakdown of purchases that operators have already made in 2023, or plan to make by the end of the year (percentages do not total 100% because some buyers purchased or plan to pur-

chase equipment from multiple categories):

• 13.8% of respondents have purchased, or plan to purchase, a new top loader this year, with the average buy being 7.3 machines.

• 65.5% of respondents have purchased, or plan to purchase, a new front loader this year, with the average buy being 20.2 machines. (Editor’s note: This accounting includes a small share of operators who have each purchased or will purchase more than 100 machines.)

• 58.6% of respondents have purchased, or plan to purchase, a new dryer (regular or stack) this year, with the average buy being 23.2 machines. (Editor’s note: This accounting includes a small share of operators who have each purchased or will purchase more than 100 machines.)

Roughly 55% of respondents are optimistic that their 2023 total business will be better than 2022’s.

Some of the reasons given for their predictions were acquiring new equipment, raising vend prices, expanding wash/dry/ fold pickup and delivery, adding commercial accounts, and beginning to accept payment by card.

About 35% expect their 2023 business to be about the same, while 9.2% say their business won’t perform as well in 2023 as it did in 2022.

Those who believe their business will be poorer in 2023 point to economic inflation and higher costs related to labor, rent and utilities as the reasons.

21.8% Average utilities cost (% of gross), 2022:

55.4% expect total business will be better in 2023 35.4% expect total business will be about the same as 2022 9.2% expect total business won’t do as well in 2023

Operator outlook: 2023

50.8%

Purchased at least one piece of equipment (washer, dryer, water heater, vending machine or other) in 2022:

Monarch Coin & Security, one of the oldest companies serving the self-service laundry industry and still family-owned and -operated, marks its 120th year of service in 2023.

The company headquartered in Covington, Kentucky, specializes in replacement coin boxes, coin/token slides, locks/keys and other accessories. It offers full body guards and coin box guards for security, coin/token-operated bathroom door locks, and coin/token-operated meters for showers, lights and other applications.

According to a history posted on its website, the business originally called Monarch Tool and Manufacturing Company was founded in 1903 and incorporated in 1905. Louis Hall and Walter Boer were the original partners.

When the company was founded, few places had electricity. Home appliances were nonexistent, and clothes washing was done with a tub, washboard and mangle. Automobiles were rare, and most people still traveled by horse. It was late in 1903 when the Wright brothers flew the first airplane.

While Monarch was involved in the production of many different parts, from marine engines to specialty valves and parts for appliances and automobiles, it’s always been involved in producing coin mechanisms. Those with a slide were a part of its line from the earliest days. Early player pianos used its coin boxes and timers as well as the player bar. Later, jukeboxes used Monarch coin devices and stampings for internal mechanisms, and pool tables have long used the company’s mechanisms as well.

In the early 1940s, Mitchell Hall bought the company from his father and his father’s partner, Lindel Myers. Soon, he began working with Ed Heath, who established Heath Sales of Macon, Georgia, to market Monarch products to manufacturers. For the next 35 years, this arrangement

built on a handshake and mutual respect saw Monarch grow and become an innovator in coin mechanisms.

Mitchell Hall accumulated a number of patents for features and variations involving coin mechanisms and other products.

Monarch says the birth of coin-operated laundry equipment actually began much earlier than is usually recognized; pilot projects using coin mechanisms and timers installed in the skirts of wringer-type washers began as early as 1936 but were put on hold for the retooling of America for World War II. Monarch was involved in producing parts for munitions, and other materiel for the war effort.

Following the war, Monarch was ready to serve with its Model 444 Single Coin Mechanism. That product is still available today, although it’s mostly used for tokens and tokettes. Monarch estimates more than 10 million units have been produced over the decades.

In the late 1950s, Monarch introduced the Model 1000, which accepted two coins. The 444 and 1000 models were the “workhorses for the coin laundry industry for many years,” the company says. With the radical inflation of the 1970s, it was time to introduce the Vertical Eight Coin mechanism. The rise of vertical multi-coin acceptors—Monarch also offers 15- and 16-coin models now—eventually led to production of the 1000 being discontinued.

When Mitchell Hall died in 2001, his daughter Stephanie managed the day-to-day operations. Today, her daughter, Danielle, is the fourth generation of the Hall family to oversee the company.

Monarch Coin & Security has weathered many storms in its long history. Through it all, its commitment to customer service has never wavered, and today the company says it promises to work with its customers to find the products that best serve their needs.

Model 4100 Series Coin Drops’ unique design allows the drop to be highly selective to assure proper coin acceptance.

• Stainless-steel face plate

• Coin return

• Simple to service and clean

• Available for a large number of international coins

Our Money Boxes are constructed with a stainless steel face plate which makes them extra attractive. We also offer the widest selection of locks.

Laundromats generally share many similarities, so how and where such a service business differentiates itself from its competitors carries great importance.

And there are often sure signs when a laundry business isn’t setting itself apart, according to Bill Corbett Jr., chief strategy officer for Corbett Public Relations based in New York state.

“A sure sign is certainly that there is silence in the real world and online,” Corbett says. “Nobody is talking about the business, nobody is sharing info online, nobody cares enough to provide a review (good or bad), and when people are asked about the business, they don’t know anything about it or the owner and/or staff.

“When a business is seen as a commodity, there is no reason to think it is any better than any other provider of the same service.”

Laundromat owners we interviewed say they can detect other signs.

“Not embracing new technology such as payment systems and convenience,” says Tim Gill, a multi-store owner with locations in Florida and Georgia. “Not letting customers know what service you have available, such as wash/dry/fold.”

Todd Ofsink, founder and CEO of Todd Layne Cleaners & Laundromat in New York City, sees competing solely on price as a troubling sign: “A competition based solely on a price point is almost always a race to the bottom.”

Randy Roberts, who partners with a cousin in operating Columbus Express Laundry in Ohio, sees something else: “When there is a state of disrepair in the laundromat that shows that the owner is using a harvest strategy, instead of investing in it to maintain an optimal operational environment for the equipment and general state of appearance, no matter its age.”

Michael Finkelstein’s Associated Services Corp. operates a large chain of laundries in the Southeast. To him, a laundry business isn’t setting itself apart if it’s “simply duplicating the same services and has made no effort from an appearance, staffing, or equipment standpoint to say, ‘Look at me and check me out!’”

Kristyn Van Ostern, who co-owns Wash Street in New Hampshire, says her business actively tracks the metric of returning customers vs. new customers: “If our percentage of returning customers month over month is slipping, then we know that they are likely going to a competitor. We also look at the number of new customers. If we aren’t bringing in new customers, then we probably aren’t articulating why we are the right choice.”

Corbett favors businesses focusing on customer service and personal interaction to differentiate their offering from others.

“People remember and like people, especially those that go out of the way to help them,” he says. “It could be as simple as greeting customers, providing free coffee, carrying bags to their car or just offering a comfortable environment. We believe that owners or managers should greet people, be friendly, ask questions and be helpful. It does not cost anything to be friendly.”

In what area or areas a laundry owner might focus his/her differentiation strategy depends on the kind of business they want to operate and the neighborhood’s needs, Finkelstein says: “Start with the basics first and see what the needs dictate. Bright colors, new lights and shiny, new equipment is a good way to attract attention to start.

“(But) you don’t want to offer full-service wash-and-fold service if the neighborhood can’t support that, as an example. Or a 24-hour laundry if the area can’t support that.”

“About once a year, we visit our local competitors to take a pulse of the

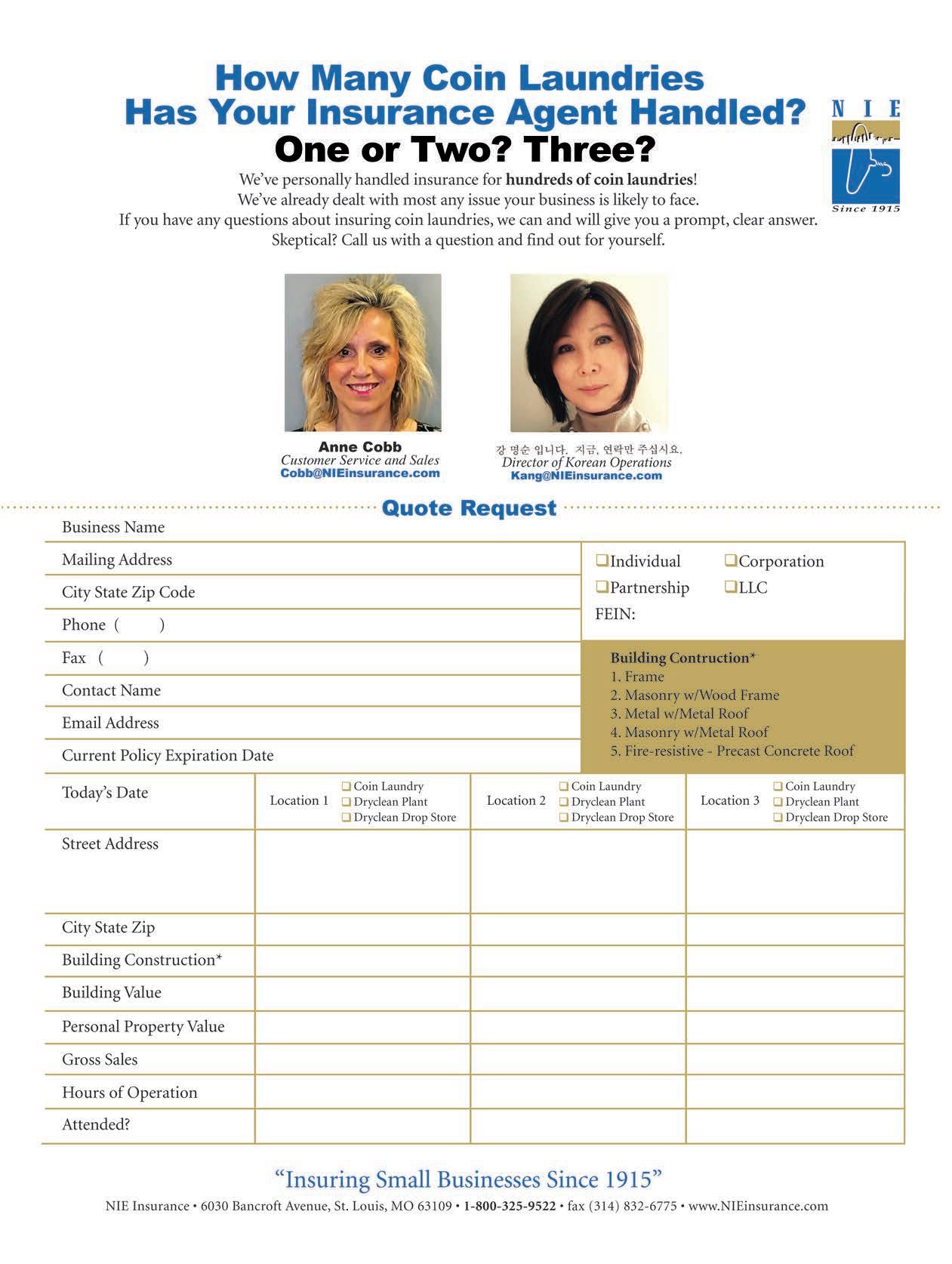

There’s more: We’re just two members of NIE’s team of experts. NIE has been handling fabricare insurance since 1915!

landscape, and each time we do, we have come back to a focus on cleanliness and having attendants available to help and answer questions,” Van Ostern says. “Other laundromats in our area focus on price or machine mix, but cleanliness and staffing are the differentiators for our laundromat.”

“People buy from people, so having attendants where the model supports it improves the customer experience,” says Roberts. “This improved experience leads to repeat business.”

Gill believes that store appearance, the range of services offered, and customer service are all important.

“It makes the most sense to focus on cleanliness and customer service of a laundromat and product differentiation in providing wash-and-fold laundry services to customers,” Ofsink says. “Since we are located in New York City, we don’t have the space to make a separate waiting area, coffee shop or children’s play area. Our self-serve customers are most concerned about clean/well-maintained equipment and friendly staff to assist them with questions. For our wash-and-fold laundry service, we offer a menu of cleaning products, extra wash/rinse cycles, delicate drying, air/hang drying for delicates/gym gear and a quick 30-minute delivery window.”

So where does customer trust fit in when trying to build a unique business identity?

“Without customer trust, there cannot be any business identity,” Ofsink states. “A laundry business is very different from (other) types of businesses, specifically because a customer is entrusting us with taking in their personal garments.”

“Customer trust is a two-way street and critical for our identity, especially around cleanliness,” says Van Ostern. “In order to have a clean facility, customers trust us to clean regularly and completely, and we trust customers to help keep it clean by respecting our facility.”

“It is paramount in the service business,” Roberts believes. “Work to ensure that the customer feels you care for them, and about them, and they will be a customer for life.”

“You have to earn trust by doing what you say you are going to do and then do it,” Gill says.

“If you do what you say (hours of operation, services offered, etc.), the trust will come,” Finkelstein adds. “Also, if you have other stores, then

the name of your laundry transcends and whatever positive (or negative) feelings are transferred to this location.”

When a laundromat is competing against other similar businesses, Corbett believes that being different is better than being “the best.”

“Most people are sick of hearing about how some business is ‘better’ than another, and ‘award-winning,’” he says. “Being different is the key, (so) show how your customer experience is different. Listen, go above and beyond, and spend the money to fix what’s broken or invest a little to make the customer experience better.

“Business that creates custom experiences also win. When you know a customer’s name or what they need when they walk in, they feel special, and that goes a long way.”

Is it ever too late for a laundromat owner to start trying to set his or her business apart in the marketplace? Corbett doesn’t think so.

“The owner needs to take the lead, and they may have to greet people, help them, talk with them, or simply be present and watch the operation,” he says. “An added bonus of having a well-known or respected owner is talent acquisition. People want to work with leaders who lead, businesses that are growing, and businesses that are great places to work.”

“Never too late if you are willing to change,” according to Gill.

“If your point of differentiation will be a new strategy (lower prices when you had been high or spiffy new digs when you had been worn down), expect to have to spend some time communicating and advertising your changes,” Van Ostern says.

“No, it’s never too late,” Finkelstein believes. “As neighborhoods and markets change, and by adapting to the needs of the area, you set your business apart.”

“It requires creativity, innovation, willingness to try new things, research on other laundry businesses, and a positive attitude,” Ofsink says. “If something doesn’t work, that’s OK. It’s just practice and you move onto something else.

“Eventually, you develop the mindset of an entrepreneur and find a way to stand out amongst your competition.”

Correctly pricing your laundromat’s washers and dryers can have big implications for your success.

If you price them too low, you’ll have lower margins with too much volume, causing your equipment wear out faster. You’ll have more out-of-order machines, harder upkeep, conflicts between customers competing for available equipment, and a generally declining mat condition due to bumps, scratches, dings, etc.

If you price too high, you may not get enough volume to support your mat.

So what’s the best strategy?

There is a sweet spot that can be determined by studying your competitors’ pricing in relation to condition of their mats. If your mat is in better overall condition than those of your competitors, you can afford to price higher. If not, you must either fix up your mat (best choice) or price lower. If you run a 5-star mat—a clean, beautiful store with wellrunning equipment that looks mostly new—pricing becomes less of an issue. When the quality of your mat is head and

shoulders above your competition, people are attracted to your mat by its attributes much more than its vend prices.

Since people prefer a mat with new equipment, a basic rule of thumb is to keep your mat looking like it was just built. You’ll be able to command higher vend prices and discourage new competitors to some degree.

Start with Comfortable Prices — It’s important that your mat is properly priced to make a decent profit to begin with. You must charge prices that are healthy enough for you to absorb some cost increases throughout the year.

Additionally, you want to have some leeway in case the need to cut prices comes up. At the same time, you don’t want to be so greedy with charging prices that are too high, lest you invite competition.

I like to see pricing set to produce a margin of 25% net earnings from gross, if not more.

Run Sales and Promotions — Once your basic pricing leaves

you a comfortable margin, you have some breathing room to run specials.

I ran them all the time: 2 for 1; cold water only; time of day; day of week; etc. I even had a half-price special whenever it snowed!

I rotated my promos to keep my mat fresh, since each special can appeal to a different slice of the population.

Running promos from time to time does two things. First, you keep your mat fresh in the customer’s eyes, as promotions can draw different demographics. Second, your mat will end up in the public’s long-term memory as the one that “always has a sale.” When someone’s home washer breaks down, they’ll think of you first.

Make Promos Specific — Don’t just lower all your wash or dry prices. Doing that may pull customers in but it will narrow your margins and could trigger price wars. In my mind, it’s better to have most of your equipment reasonably priced and then run deals on a group of washers or a part of a cycle.

Discounts for Seniors — This was one of my favorites. Discounts for certain groups on your slowest days can help round out the peaks and valleys of your business. Retired seniors are the No. 1 group because they can visit anytime.

Change Things Up from Time to Time — After you’ve run a special for several weeks or longer, switch to a new special to keep things fresh, and use new signs featuring different colors to advertise them. If you had a white sign with red letters for one special, post a yellow sign with black letters for the next to catch more views. The next time, you may want to use fluorescent pink, and so forth. The same goes for your online ads.

Shift to Dollar Coins or Tokens — Inflation has worn down the value of a quarter to less than what a nickel was worth only a few decades ago. Do you really want customers inserting nearly a roll of quarters in your big washers? If your smallest washers are still only $3, you can raise the price to $4. Some people may gripe but most will accept it.

If you fear this, then try converting your big machines to take dollar coins, and leave the quarters for your small ones. But a “dollar coin only” strategy is simpler and easier overall.

Or you can offset the increase by providing an extra minute on your dryers. A few months later, you can bring the dryer time back down.

What’s interesting about dollar coins is that customers feel like they are spending less money because they are inserting one-quarter the number of coins.

The same is true for tokens, and a token dispenser can accept credit cards if needed.

The Cold Water Special — Much of the cost of a wash cycle involves heating the water. Not everyone needs or wants to use hot/warm water. Assuming you have washers that can be programmed, you could advertise your smallest washers for a “lead-in price” for cold water. You don’t have to lowball your bigger machines because a nice, low price to get them in the door is the goal and the best way to do that is with your smallest machines.

Advertise Those Specials! — Once you offer a great deal to reel in business, shout it from the treetops and multiply the effect! Put up a nice, big window sign, or hang a banner outside, along with an interior sign or two. Again, don’t forget to use the internet.

‘Push’ the Back of the Store — See if you can promote the machines found in the rear of your mat. If you’re not sure which group of washers to promote (aside from the ones with the fewest turns per day), choose the ones in the back.

Big retailers do this. For example, just about every major drug store chain puts its pharmacies in the rear, knowing that anyone with a prescription will have to pass all the other aisles and other things being sold.

So if your promo machines are in the rear, customers will have to pass ▼

the more profitable machines on their way, and some will stop to use them.

Full-Cycle Drying — This is charging a price for, say, a half-hour of drying. At cycle’s end, the laundry should be ready. A pro is the customer pays and leaves the dryer alone until the end, preventing a lot of energywasting door openings. But there are cons: When a dryer is overloaded, the laundry may not dry in time; if it’s underloaded, this may cause other customers to wait unnecessarily.

There are basically two strategies when a new competitor opens up nearby, and I tried both during my career.

Some believe you should do nothing and just maintain your pricing. I don’t like this method because I saw my sales steadily drop over a period of months and eventually reach an unacceptable level. It’s especially true if the new mat is undercutting you in price, which many do.

If you have an established mat, you do have strong points. If your customers are happy with your mat, they are less likely to want to change their habits. This is why it’s so important to keep your mat clean and up to date.

The other strategy is to drop your prices, either with sales on certain group of machines, sales on your entire inventory, or the dreaded “free dry.”

Free Dry — This often triggers a domino effect for your other competitors to match it, causing an ugly price war won by no one. Entire laundromat markets have been screwed up by free dry, so I’m basically against it. And once you offer free dry, if you take it away, customers will not like it.

But I am in favor of free dry in only two circumstances:

1. As a temporary grand-opening status for a month or six weeks just to attract attention and get customers in the door. Your competitors will hate your free-dry offer but may not engage in matching you if they understand your position is only temporary.

2. If you operate a card store that allows the customer to build dry credits on their card when they purchase washer cycles. Customers are not stupid, however, and they quickly figure out they’re spending the same amount of money overall as in nonfree-dry mats.

Drop Prices on Group of Washers — I believe this is an acceptable strategy. You choose a group of washers and put them on sale. Small washers would allow you to advertise a low, eyecatching price. I did that while also making them “cold water only” to lower my costs more. You could also cut a rinse, if you choose. The main thing is to be able to advertise a genuinely low price to get folks in the door, yet won’t cost you an arm and leg.

“Larry’s E-Cycles” — With more than 50 years of experience, Michigan’s Larry Adamski recently retired from laundromat ownership. He priced his mat accordingly to make a healthy profit, and did very well with his “dollar coin only” strategy for years.

When a brand-new competitor opened near him, Adamski came up with a pricing strategy so effective that the newcomer closed down and never came back. What did he do?

Since Adamski’s washers were programmable, he offered a no-frills type

of wash cycle that he cleverly dubbed “E-Cycles.” Instead of a cycle with a pre-soak and three rinses, with spins in between, his 20-minute E-Cycle offered a wash, rinse and spin at a nicely discounted price. This saved him money on water and electricity, plus the shorter cycle time gave his store more throughput.

People came in looking for the special “E-Cycle” and then could choose to upgrade the machine to a more comprehensive cycle for another dollar coin per upgrade.

Apart from your self-service pricing, there are some strategies for pricing drop-off wash/dry/fold service.

Drop-off customers, on average, tend to have more disposable income. They can afford the luxury of having someone else do their laundry for them. I found that drop-off customers were more concerned with quality and good service than price.

We operated what I considered to be a high-end drop-off service and were charging as much as 50% more than our competitors. Still, everyone wants a deal, so how could we appeal to them?

The service demand on the weekends was very high and we had a lot of trouble getting the work out. What’s more, it was harder to get good help to work on weekends.

So, I raised the per-pound price overall but discounted it by 10% Monday through Friday. Early on, I found that the 10% wasn’t enough incentive to move customers to drop off during the week, so I pushed it to 20%.

In a short time, we were bombarded with Friday drop-offs, so we had to limit the 20% off to Monday-Thursday, and that worked out well. I kept that deal in place for years until I sold my mats.

Most of the work was coming in during the week, which was much more manageable. Amazingly, we still got a lot of work on the weekends, but at least it was easier to get done without interfering with our self-service customers.

In essence, we empowered the customer with a way to save money, if they so desired.

Another drop-off deal is to offer free nylon bags. The word “free” is powerful in advertising. Since we printed our own nylon bags at a low cost, I sometimes offered the special of a free nylon bag with any drop-off order over 25 pounds.

Lastly, we’d offer to process comforters at a sale price to lure in people who wouldn’t normally drop off laundry (as well as our regular customers). It was our hope that we could convert some to full drop-off customers, and we were successful with a small percentage.

Best of luck as you try to determine the pricing and promotions that’ll produce for you.

Paul Russo owned and operated multiple laundromats in New York City for more than 40 years before retiring in 2018. You’re welcome to direct any questions or comments for Russo to Editor Bruce Beggs at bbeggs@atmags.com.

The Clean Show, North America’s largest laundry, drycleaning and textile care exposition, has selected Aug. 23-26, 2025, as the dates for its next edition. Orlando, Florida’s Orange County Convention Center will host the four-day (Saturday through Tuesday) event.

The Clean Show attracts industry professionals from around the globe to see the newest and most technologically advanced products the textile care industry has to offer. It features hundreds of exhibits, networking opportunities, live demonstrations, and educational seminars addressing the latest in technology, business management, sustainability, and more.

Clean 2022, staged in Atlanta after a yearlong postponement due to the COVID-19 pan-

demic, drew nearly 10,000 professionals from North America and beyond who were ready to do in-person business.

“With the momentum of Clean 2022 still pushing our industries forward, we’re very excited to have our Clean 2025 dates and location finalized and ready to share,” says Brian Wallace, president/CEO of the Coin Laundry Association (CLA) and chair of Clean’s advisory council. “The Clean Show is an essential destination for all five partner associations (Association for Linen Management, CLA, Drycleaning & Laundry Institute, TRSA, and Textile Care Allied Trades Association) and for our collective stakeholders. We look forward to working together to bring the best show experi-

ence to all in 2025.”

Show manager Messe Frankfurt will announce details on exhibition space sales later this year. Exhibitors returning from Clean 2022 (there were 347) will have early access to secure their exhibition space.

“The Clean Show has proven to be the ideal exposition for industry leaders to find the latest innovations in textile care, ranging from industrial machinery and conveyor equipment to computer software and business systems,” says Show Director Greg Jira. “We’re excited to bring these business leaders, decision makers, product designers and purchasers back together in 2025 to continue to drive innovation, collaboration and growth within this sector.”

by Dave Davis

by Dave Davis

Because employee expectations and the nature of business are constantly evolving, owners of laborintensive companies such as laundry businesses need to recognize these changes and adapt to the times. Otherwise, they will constantly struggle to fill their labor needs and the atmosphere of their company will suffer.

This was Dirk Beveridge’s message during “Reimagining Leadership in a Post-Pandemic World,” a webinar hosted by the University of Innovative Distribution (UID) and made available to Textile Care Allied Trades Association (TCATA) members.

Beveridge founded the strategy firm UnleashWD,

and has been a consultant to a wide range of companies to strengthen their sales and leadership strategies.

He shared some findings he’s gathered from surveys and from visiting dozens of different companies the last two summers, speaking with hundreds of workers and leaders. These findings, he believes, can be applied to almost any industry because the forces at play are universal.

For many small and mid-sized businesses, the ability to find people to work has been a huge obstacle in the aftermath of the pandemic — so much so that there’s a term for this tightening of the labor market: the Great Resignation.

“I don’t think the Great Resignation is the overall focus of what we, as leaders, need to be talking about,” he says. “It’s a real issue, but I believe that, at a higher level, and even as perhaps a more important issue for leaders, we need to think of this as what I’m calling the Great Redefinition.”

Three great forces make up this redefinition, Beveridge says, and they are colliding in an unprecedented way. These are external forces, internal forces, and people forces. Understanding these factors is key to seeing the

big picture of the economic realities as they exist.

“The external forces are the ‘megatrends’ — the global trends that you and I have zero control over,” Beveridge says.

These trends include supply chain issues, inflation, changing labor markets, new technology, social changes, consolidation in various industries, changing customer expectations and lingering COVID forces.

These external forces are not just acting on one segment or industry. These forces affect the entire national — and global — economy.

“These are the trends that we can have no impact on, but they impact us,” Beveridge says, “because those external forces move into our markets, they move into our companies. And they generate the internal forces.”

These forces are the ones that leaders must deal with and can at least have some agency over, although it could be limited.

“These are the challenges that you and I have in terms of attracting talent,” he says. “The challenges we have in retaining team members, and the succession that has taken place in our

organizations. This includes the blending of generations in our businesses, the shifting needs and wants of employees and customers, margin pressures, and so on.”

Leaders who ignore the third facet of the Great Redefinition, what Beveridge calls the people forces, will be facing an uphill battle.

“I really believe that for years, we’ve talked about the disruption that our companies are facing,” Beveridge says. “But in reality, when you look at the last two and a half years, through COVID, and coming out of COVID, I believe that we, as human beings, have been disrupted. Your employees, your team members, your peers — the individual has been disrupted.”

These people forces include increased social pressures that have taken on new weight.

“There’s the polarization of social and political views,” Beveridge says. “Three, four or five years ago, we didn’t have any problem talking about social or political issues in our organizations. But now, have any of you lost or almost lost a family member or a friend ... because you started clashing? I’m not proud of it, but I have.”

Other elements of people forces include ▼

the human toll of COVID, a shifting definition of work, and greater desire for a better work/ life balance.

“Everything is being redefined,” Beveridge believes, saying that changes are constantly coming, thanks in part to new technology, changing customer behaviors, the needs of employees, shifting marketing options, and other workplace realities.

Owners who play by a decades-old playbook in personnel management, Beveridge says, are setting themselves and their teams up for failure.

Beveridge believes that leaders have to redefine what the very term “leadership” means, both to themselves and to their employees. It is at an inflection point, he believes.

Based on his research, interviews and personal experience, Beveridge offers the four evolutions of leadership:

Controlling — “Controlling leadership was the way people like me were taught to lead years ago,” he says. “You lead through legislation, through policing and through fear.” Beveridge believes that this is the most outdated, least effective way to lead today’s employees.

Managing — “This is where I have my to-do

list as a manager. I’ve got processes in place, and we’ve got things working. … So, let’s just manage the status quo. Let’s get the day-to-day work done.”

Leading — “‘Managing’ then evolved into ‘leading,’” Beveridge says. “The world is changing around us, so just administering the dayto-day isn’t good enough. We’ve got to think about the change that’s going to be required, and the innovation that’s going to be required. We need a new vision for our department, and for my function in my company. Then, we need to develop strategies and create the cultures that are required.”

Noble Calling — Beveridge says he’s found this evolution most often in independent, family-owned businesses and employee-owned companies.

“This is where, as leaders, we need to ensure a deeper meaning and a deeper purpose,” he says. “Our teammates ... want to know that they’re making a difference, that they’re contributing to the greater good. ... People don’t want to just be a cog in a wheel. They want to make an impact, that their contributions add to something greater.”

If properly understood and utilized, this facet of desire can improve employees’ lives and a

company’s future, Beveridge believes.

“Look at that spectrum of leadership,” Beveridge says. “Controlling, when leaders put the company first to produce, produce, produce. ... That’s how businesses did it in the past. That’s evolved to where people come first.”

He recounted a meeting in the field with a worker who told him that coming to work at her place of employment was “the greatest decision in my life.”

“She told me the story about her previous employer,” he says. “The way they treated her with a lack of dignity, and a lack of respect, leading by fear through intimidation, and using her as a vehicle. She finally got the courage to leave there, she found (her current employer), where the team members are treated with dignity, respect and empathy.”

Leaders who want to increase their company’s production and profits but also have loyal employees who stay longer need to understand this essential change from yesterday’s worker to today’s team member.

2023 RATES: One- to five-time rate: $3.00 per word, boldface $3.05 per word. Minimum charge: $50.00 per ad. Call or write for our six- and 12-time rates. If box number is used, add cost of 5 words.

BUSINESSOPPORTUNITIES

18 Select Laundry Center

Add pro t to your establishment by vending your patron’s favorite laundry goods.

Vending Machine Sales 515-480-4613

www.vendingmachinesales.com

Display classified rates are available on request. All major credit cards are accepted.

DEADLINE: Ads must be received by the 1st of the preceding month. For

example, for a July ad, the closing date is May 1st.

PAYMENT FOR CLASSIFIED ADS: Must accompany order.

Alliance Laundry Systems, maker of Huebsch and Speed Queen commercial laundry equipment, reports it has reorganized its North America sales team to streamline operations and better serve its customers.

The team has been divided into three regions: Northeast, Central, and West Coast (which will include Latin America). General managers Eric Meyers (Northeast), Ross Van Horne (Central) and Eduardo Fernandes (West Coast) head their respective regions.

Additionally, Susan Peppler has been promoted to director of commercial key accounts.

“It is my hope that, through this alignment, we will strengthen our relationships with customers and further drive their successes,” says Craig Dakauskas, senior vice president of Americas for Alliance Laundry Systems.

As part of the reorganization, it was announced late last year that Mike Hand will directly oversee the sales team and was promoted to vice president of Americas Commercial.

Alliance also is creating three new sales development manager positions that will report to the general managers and lead the company’s teams of regional sales managers (RSMs). Anthony Vis (Central), Corbin Vail (Multi-Housing) and Jeff Harvey (Northeast) are tasked with growing and maintaining sales of commercial laundry products within their assigned regions and partner with RSMs to bolster business relationships.

Clean Laundry Funding reports it has launched its new financing service for commercial laundry investors and distributors. The company says that it “offers a fresh take” on financing that delivers express approvals and hands-on customer support.

The business says it provides loans for new laundry equipment purchases on all commercial brands; laundromat acquisitions; laundry room renovations; and refinancing and debt consolidation.

“We’ve assembled a winning team of experts with decades of experience in the industry to deliver a more personalized and flexible financing experience,” says Chad Palmer, president of Clean Laundry Funding. “Time is of the essence in this competitive market — we know that funding delays often cause distributors to lose deals and get in the way of business owners achieving their dreams. That’s why we prioritize a faster turnaround that gives them the confidence to move forward more quickly.”

Point-of-sale and laundry pickup/delivery software developer Curbside Laundries is now offering tours of Super Suds, a laundromat owned by Curbside’s founders, to laundry owners using Curbside software.

Super Suds, located in Long Beach, California, earns over $120,000 a month in wash and fold business, and 70% of that business is generated through pickup and delivery, Curbside says.

The tour provides a unique opportunity for laundry owner customers to learn from experts about the wash and fold process, including spending time with the launderers and drivers to see the laundry pickup and delivery process in person.

Curbside believes tour participation can provide “valuable insights and tips for laundry business owners to improve their business operations, as well as gain a better understanding of the potential for growth in the pickup and delivery sector.”

Jeff Posner of Crown Laundry in San Diego says visiting the laun-

dromat, and its fully operational fluff and fold and pickup and delivery business, was eye-opening for him.

“The business operations tour helped me learn what I needed to get, what I needed to do, and what the expectations of the business are,” he says.

Andrea Carney, who acquired Let’s Talk Dirty Laundry in mid-2022, made the trip from Cocoa Beach, Florida: “I came out to Super Suds because the team has been very friendly, welcoming and helpful. I’m learning how they use the Curbside software for pickup and delivery, folding, and binning.”

Laundry owners who use Curbside Laundries software can sign up for a Super Suds tour by contacting Curbside directly.

Through a new partnership with Cobblers Direct, laundry and drycleaning point-of-sale provider CleanCloud has enabled its North American laundromat customers to offer quality repair services for leather goods to their existing business without increasing operational overhead.

Texas-based Cobblers Direct is the online spinoff of shoe and leather goods repair company The Shoe Hospitals.

With this new integration, laundromats using the CleanCloud system can now accept leather goods—including shoes, belts and handbags— from their drop-off customers for repair.

When receiving such an item, the business owner inputs the order into their CleanCloud POS and uses a prepaid shipping label to mail all items to Cobblers Direct once or twice a week depending on quantity. The laundry owner keeps a portion of the sale value, providing an additional revenue stream.

CleanCloud says there is no need for additional training for laundromat owners. All questions and customer communication relating to repair services are handled by Cobblers Direct; customers can even scan a QR code and chat in real time with a representative.

When repairs are completed, Cobblers Direct ships the items back to the drop-off location, and the customer receives an email alert that their order is ready to be picked up.

“We know that there is huge demand for local shoe repairs in the market,” says CleanCloud CEO John Buni. “Utilizing a familiar CleanCloud interface, and having access to bite-sized video training content, CleanCloud users will be able to offer shoe repair services for customers, adding significant value with minimal effort.”

Customers favor the large capacity of LG Commercial Laundry machines because they can finish their laundry in one load. Bigger capacity means more customer rotations for your business.

• 35lbs capacity in a very small space

• Soft-mount design with low noise and less vibration

• Premium powder coating helps resist scratches and contamination

• High performance with less water consumption

• Durable and reliable with extended operation life

• Available in single and stack washer and dryer

• Auto-dosing ready

• Powerful and cost-saving

• Efficient system and easy maintenance

• Increase revenue and customer satisfaction

LG Titan, A Smarter Machine. gnalaundry.com/lg