On the face of it, having more options to achieve our goals seems like a positive thing. In reality, however, being confronted with an ever-expanding list of ways to conduct business can lead to what psychologists call the “Paradox of Choice.” Dry cleaners have to make more decisions than ever before. This takes mental effort and can leave that nagging voice in the back of your head wondering if you chose correctly. In this issue, we’ll examine some of the options open to owners today and shed some light and perhaps quiet those voices. The first feature, “Making the Move from Cash,” examines some of the advantages and challenges of exclusively accepting digital payments rather than cash from customers. While cash might still be king for many companies, going digital removes some of the headaches — and risks — from operating a business.

The second feature, “Profile-Powered Marketing,” looks at one of the most powerful tools a dry cleaner has to reach his or her clients — customer profiles. Using this method, cleaners can hone their marketing efforts for a more personalized way of connecting with current and prospective customers. And while such an undertaking might seem intimidating, almost all cleaners already have the information necessary to get started.

The final feature of our April issue, “Surveying the Economic Landscape,” comes from an online workshop held earlier this year. In an interconnected economy like ours, nothing happens in a vacuum. By understanding the market forces at work in today’s chaotic economy, dry cleaners can better gauge what the future will bring to their companies.

We’ve also conducted a survey for this issue, asking dry cleaners about their experiences dealing with the supply chain and what they require and expect from their vendors to help them serve their clients.

The future is full of questions. Keeping an open mind and staying curious about new ideas will help us find the answers that are right for us.

ADC

American Drycleaner (ISSN 0002-8258) is published monthly except Nov/Dec combined. Subscription prices, payment in advance: U.S., 1 year $50.00; 2 years $100.00. Foreign, 1 year $120.00; 2 years $240.00. Single copies $10.00 for U.S., $20.00 for all other countries. Published by American Trade Magazines LLC, 650 West Lake Street, Suite 320, Chicago, IL 60661. Periodicals postage paid at Chicago, IL and at additional mailing offices.

POSTMASTER, Send changes of address and form 3579 to American Drycleaner, Subscription Dept., 125 Schelter Rd., #350, Lincolnshire, IL 60069-3666. Volume 89, number 1. Editorial, executive and advertising offices are at 650 West Lake Street, Suite 320, Chicago, IL 60661. Charles Thompson, President and Publisher. American Drycleaner is distributed selectively to: qualified dry cleaning plants and distributors in the United States. The publisher reserves the right to reject any advertising for any reason.

© Copyright AMERICAN TRADE MAGAZINES LLC, 2022. Printed in U.S.A. No part of this publication may be transmitted or reproduced in any form, electronic or mechanical, without written permission from the publisher or his representative. American Drycleaner does not endorse, recommend or guarantee any article, product, service or information found within. Opinions expressed are those of the writers and do not necessarily reflect the views of American Drycleaner or its staff. While precautions have been taken to ensure the accuracy of the magazine’s contents at time of publication, neither the editors, publishers nor its agents can accept responsibility for damages or injury which may arise therefrom.

American Drycleaner, April 2022

Publisher

Charles Thompson

312-361-1680 cthompson@ATMags.com

Associate Publisher/ National Sales Director

Donald Feinstein 312-361-1682 dfeinstein@ATMags.com

Editorial Director

Bruce Beggs 312-361-1683 bbeggs@ATMags.com

Editor Dave Davis 312-361-1685 ddavis@ATMags.com

Digital Media Director

Nathan Frerichs 312-361-1681 nfrerichs@ATMags.com

Production Manager

Mathew Pawlak

Advisory Board

Jan Barlow Mike Bleier John-Claude Hallak Wesley Nelson Kyle Nesbit Mike Nesbit Fred Schwarzmann Beth Shader Vic Williams

Contributing Editors

Dan Miller Diana Vollmer Martin Young

Office Information Main: 312-361-1700

Subscriptions 847-504-8175 ADC@Omeda.com www.american drycleaner.com

The continuing problems with the global supply chain are causing many dry cleaners to rethink how they use supplies in their plants and re-examine their relationship with their vendors. Based on the answers from our American Drycleaner “Your Views” survey, the key for cleaners to get what they need is to have a good relationship — or a partnership — with their suppliers.

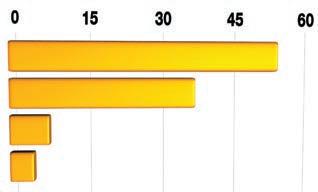

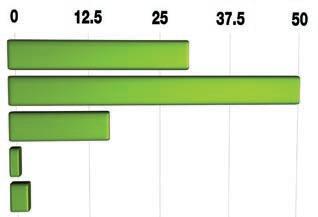

When asked about their current ability to keep essential supplies in stock, most of the respondents have managed to avoid a crisis, with half (50%) reporting that they “occasionally run short,” while 29.4% have “kept the supply lines fully open.” Of those who are encountering more broken supply chain links, 16.2% say they “often scramble to keep up,” 1.5% are “usually out of something” they really need, and 2.9% are “constantly out of critical supplies.”

Of the supplies our respondents are finding the most challenging to keep in stock, hangers (46.8%) and hanger struts (30.6%) topped the list by a wide margin. Other highly sought-after items included detergents and chemicals (8.1%), while equipment and repair parts tied with wedding gown boxes at 4.8%. Rounding out the list was poly at 3.2%, with 1.6% responding that they weren’t having a supply challenge at all.

One of the results of these supply chain issues is rising costs, as the law of supply and demand asserts itself. When asked to describe the impact of rising supply costs on their business and how they were dealing with it, many of our respondents said they were raising their own prices and passing it along to the consumer. Answers included:

• “I tried to get ahead of the game in August 2021 — we did a 15% price increase across the board. Then in February 2022, we did another 3% price increase.”

• “A good manager will monitor fluctuations in availability and cost; they make necessary adjustments. A poor manager will continue operations ‘as usual,’ with changes coming only in response to the competition. Adapt and overcome.”

Maintaining a positive relationship between their suppliers can make the difference between dry cleaners having what they need to operate and always being on the short end. When asked to describe their relationship with their primary vendor, more than half (52.2%) say that they “think of them as a true partner,” while more than a third

Describe your current ability to keep essential supplies in stock

Describe your current ability to keep essential supplies in stock

We’ve kept the supply lines fully open We occasionally run short We often scramble to keep up We’re usually out of something we really need We’re constantly out of critical supplies

We’ve kept the supply lines fully open We occasionally run short We often scramble to keep up We’re usually out of something we really need We’re constantly out of critical supplies I think of them as a true partner They are usually there when I need them It could be improved I’m looking for a new vendor

What is your relationship with your primary vendor?

What is your relationship with your primary vendor?

I think of them as a true partner They are usually there when I need them It could be improved I’m looking for a new vendor

(35.8%) report that “they are usually there when I need them.” Only 7.5% say that the relationship “could be improved,” while 4.5% are “looking for a new vendor.”

So, what qualities do cleaners look for in their vendors? “Communication” featured in many of our respondents’ answers:

• “Keeping me advised of his company’s ebb and flow so I can plan accordingly. I am looking six weeks out to have the opportunity to fill any gaps that develop.”

• “Honesty, even when the news isn’t good.”

• “Trusted advisor. Friend. There for you. Respond quickly. Get creative.”

• “Communication prior to something becoming a major issue, and assistance in finding alternative products.”

The “Your Views” survey offers a current snapshot of the trade audience’s views. The publication invites qualified subscribers to American Drycleaner emails to participate anonymously in the unscientific poll each quarter. ADC

ash may still be king for many business transactions, but that kingdom is shrinking.

Digital payment solutions are providing increased convenience and security for many dry cleaners and their customers — to the point where some cleaners are going completely cashless.

“Digital payments have grown exponentially over the last several years, especially as consumer preferences and habits have evolved since the start of the COVID-19 pandemic,” says Elizabeth Karl, vice president and global head, Payments Consulting, at American Express. “As consumers have shown a preference for digital payments that limit interaction with the point-of-sale system, we anticipate that there will be more account-to-account payments, bank-based payments, and more forms of digital payments.”

While Brian Butler, president of Dublin Cleaners in Columbus, Ohio, made the change to a cashless system around 2018, he agrees that cleaners wanting to make the change now have a good reason to give their clients.

“When COVID hit, it seemed to be the perfect excuse,” he says. “So many places temporarily stopped accepting cash. I think a number of people never switched back — or found they just didn’t have to. The pandemic accelerated so much change in the world.”

For Dublin Cleaners, the move to a cashless system made sense well before the pandemic because the vast majority of Butler’s client base had already moved to a cashless model on their own.

“There was so little cash being used that the expense of administering the balancing of drawers, the change orders and the deposits was totally unjustified,” he says. “We were at 1.8% of sales in cash. When you have that little cash, it becomes even more work than having a medium amount of cash — one or two cash transactions per day with large bills just wipes out your change drawer.”

Rechelle Balanzat, CEO and founder of New York City’s JULIETTE, built her business around a cashless mindset from its first day in 2014.

“If you think back to that time, this was when on-demand mobile commerce was starting,” she says. “That prompted an idea: ‘Why isn’t there an app that picks up and delivers laundry and dry cleaning?’ And so, when we launched, our founding principle was always to be cashless, consistent, and convenient.”

Because the cashless mindset was baked into the DNA of her business, Balanzat didn’t have to ask her customers to adjust to a new method of payment.

“When a client signs up on our app, they automatically register with their credit cards,” she says. “It’s one time — one and done. After we pick up and clean

their clothes, we charge their card on file and email them a receipt before we deliver.”

Still, some habits die hard. For clients wanting to pay cash, Butler offers them an option.

“It’s not that we won’t take cash,” he says. “The right way to describe would be ‘changeless.’ If you want to pay us some cash and you don’t want to leave the change, buy a gift card. Then whenever that balance gets too low to settle your next pickup, throw some more cash on the card.”

This option offers customers a choice while minimizing the hassle for Butler’s business.

“The burden is in the change,” he says, noting that the only alteration he made to his business was simply removing change from his tills. “It’s not that we’re unwilling to accept cash; we’re just unwilling to maintain change.”

Butler piloted his cashless program in two of his four stores before rolling it out companywide — and quickly learned one of the advantages of operating a cashless system.

“We’re in a safe neighborhood,” he says. “We’d never had a confrontational burglary. Then, the week after we switched over, a guy comes in wearing a ski mask on a 60-degree day with a note in his hand. Before the clerk can come around the partition, he looks down on the counter where we have in large letters saying we’re

The man was later arrested for holding up six other retail stores within a couple of blocks from Butler’s operation. “That was within a week of setting up my pilot program,” he says. “I went to church that Sunday and said, ‘Message received.’”

This experience underlined one of the major drawbacks of a cash-based system for Butler.

“Cash attracts trouble,” he says. “It just does — and that’s on both sides of the counter. I think everybody who’s in any kind of retail business, including dry cleaners, knows that. It attracts trouble and temptation.”

Balanzat agrees with this assessment: “When you’re dealing with cash, transparency becomes an issue, and transparency can be a good thing or a bad thing. It varies from business to business. Every business is different, and everyone has their own way of conducting business. But it all comes down to transparency.”

For clients who have their credit/debit cards on file, such as route customers, Dublin Cleaners uses a process called “tokenization” to secure their data. With this type of system, the users’ information isn’t kept on Butler’s computers. Rather, Dublin Cleaners is authorized to make charges on the customer’s card using

a cashless store. His hand starts to tremble, stuffs the note in his pocket, and pulls up the ski mask. He makes some excuse about his girlfriend dropping off his suit but couldn’t remember where and then leaves.”

a cashless store. His hand starts to tremble, stuffs the note in his pocket, and pulls up the ski mask. He makes some excuse about his girlfriend dropping off his suit but couldn’t remember where and then leaves.”

nonsensitive data unique to his company — information that can only be used through his specific system.

“If you hacked into my database, you would get that token, but you wouldn’t be able to use it anywhere else on Earth,” he says. “It has to come through my terminal.”

As digital payments become more commonplace, Karl says, both customers and business owners are adopting the cashless mindset. According to American Express research, 42% of consumers trust businesses with ongoing or future payments. “Additionally,” she says, “many merchants agree that storing cards on file is worth it, with 74% having customer profiles and card payment information on file.”

Another advantage Butler has found in a cashless system is that his customers begin to use his services out of habit, rather than a choice made for every transaction.

“Convenience is No. 1 in our industry,” he says. “We secret-shop some of the less-technically advanced options in our geography, and we just walk away scratching our heads sometimes with what they put a customer through.”

“Digital payments offer quicker transaction speeds, more reliable ‘tap-to-pay’ technology, and the ability to use either your contactless card or digital wallet to complete payments,” Karl says. “Customers benefit from the ease of use, enhanced security, and greater flexibility of payment devices, card or mobile wallets.”

Butler has found that a cashless system is more convenient for the business, as well.

“It reduces a lot of labor costs,” he says. “My employees can open and close a store in about a minute flat. Turn on the lights, shake the mouse and they’re ready to go.”

As a third-generation owner, Butler remembers the pain of balancing a cash drawer that didn’t come up quite right: “When I was working here as a young person, I would keep about three bucks in loose change in my pocket. If I had plans, was closing out the drawer, and it didn’t balance quite right, I’d feed it. I didn’t want to get trapped there for a halfhour trying to figure it out, fill out a report as to why it was wrong, and face my aunt, who was the CSR manager.”

Butler has also found that running a cashless business has not only made his business more efficient, but it’s cleared up an area many dry cleaners struggle with: overdue accounts receivable.

“When I first rejoined the company and they were still doing statements, the amount owed to us on routes over 90 days could be more than $25,000,” he says. “That was just common in the age of all the receivables. Right now, we have under $600 owed, and we’re a much bigger company and have a much bigger route operation overall.”

Balanzat has also found that the cashless model

streamlines her business and makes it more efficient.

“It’s traceability, it’s transparency, it’s record keeping,” she says. “It makes AR [accounts receivable] easier, and it makes billing easier. You’re not chasing people for money. You’re just charging them before you deliver, or you don’t deliver at all.”

Butler says that when his system notices an overdue amount or a declined or expired card, that customer gets an immediate text with a secure link to update.

“If they update by the time the van gets to their home, they get the delivery,” he says. “If they don’t, they don’t.”

This system also eliminated the need to send hundreds of statements out every month and make calls to chase down customers behind in their payments.

“That work is all gone now,” he says. “None of that work made our product better. Now the staff who did it can do more value-added tasks.”

“Another positive is the record keeping it provides,” Balanzat says. “It actually makes tax season much easier. We can see exactly how everything breaks down — it makes reporting and filing simplier, as well as bookkeeping.”

One of the potential drawbacks to going to a cashless system is the transaction fees charged by financial institutions for using the service.

While Butler says that merchant service transactions must be figured into the cashless model, for him, it’s worth it.

“When I was doing cash, I had internal costs that exceeded those transaction fees,” he says. “We don’t have two full-time employees in the office who used to deal with accounts receivables and deposits.”

“Transaction fees are a line item in our (profit and loss statement),” Balanzat says. “It’s simply the cost of doing business in exchange for the convenience and ease of running our company.”

While these fees can be included in a dry cleaner’s total price structure, Karl cautions owners not to simply add the fee on top of what the consumer is paying for their services as a separate charge. “Imposing these surcharges against your customers can create a negative impact on their experience,” she says.

She points to a 2021 survey conducted by American Express that found 70% of consumers surveyed said being surcharged makes them feel like the merchant does not appreciate their business. “Additionally, 72% said it leaves a bad impression on their entire experience with the business,” she says.

Butler has actually taken a step beyond the traditional cashless model and is also accepting cryptocurrency.

“I was an investor myself, so I was learning about it,” he says. “I thought that, if this is important, we’re going to get a lot of action, and if it turns out not to be important, we might get some attention.”

Users wanting to use cryptocurrency can simply select it as a tender type in Dublin Cleaners’ pickup screen, where they’ll be taken to Coinbase Commerce to enter their credentials and proceed with their transaction.

So far, customers haven’t taken Butler up on this option — “The people who do own it see it as an equity more than a currency, I think,” he says, “so they just really aren’t spending it too much” — but his business is ready if paying with cryptocurrency becomes a more accepted practice.

Butler notes that owners should do a thorough examination of their customers’ history and preferences before making the decision to go cashless.

“I have a colleague in Akron, Ohio, about two hours from my location,” he says. “He claims that his cash sales are closer to 25%. I told him not to change a thing. His customers were telling him what payment type they wanted to use. If you put out all your options and that’s what they choose 25% of the time, don’t mess with it. Don’t follow me down this road.”

“Consumers are looking for the right balance of payment security and convenience,” Karl says. “Help ensure your business and payment system is protected without creating too many barriers for your customers.”

Thinking through the entire process before entering customers into the mix is crucial, Balanzat says.

“I think a lot of people already have this capability with some of the existing POS systems out there today,” she says. “Make sure that, once you go cashless, it fits with your current day-to-day operations, such as ensuring you have a way of capturing their credit card from the beginning. Once you have the credit card, you can keep doing business with the same client.”

Still, for all the advantages, Butler advises a “look before you leap” approach to going cashless. He cautions owners to take their time, communicate with their customers and, if possible, run a pilot program before taking it to all locations.

“If your percentage of sales is substantial, it probably means that that’s a preferred method,” he says. “If yours is 1.8%, like ours was, it doesn’t matter. Because ultimately, when we pulled the trigger, we asked, ‘What if every one of our cash customers quits?’ We would be down 1.8%. And further, we went through to see if we had any top-20-percentile people who were paying in cash — we had zero. Those are the clients you need to keep happy.”

By Dave Davis, Editor

By Dave Davis, Editor

One of the first steps in hitting a target is to know what that target looks like and where it’s located — and modern marketing practices have taken this lesson to heart.

While the “shotgun” method of marketing might have been more effective in decades past, when pointof-display ad, radio, TV, billboards and newspapers were about the only options, today’s consumers can be reached in many different ways — and have come to expect a much more sophisticated approach.

To accomplish this, customer profiling is one of the most powerful tools dry cleaners can use to connect with their clients in the way those customers increasingly demand — as individuals.

“Customer profiling makes your marketing very efficient,” says Diana Vollmer, managing director of the Ascend Consulting Group, based in San Francisco. “It allows you to target the most receptive audience — the people who want and need your services and can afford them.”

Thanks in large part to online browsing, shopping and viewing habits, individuals leave a bigger trackable “footprint” than ever. Marketing profiles can leverage that information to allow businesses to target increasingly refined groups with a more personalized message. This information has powered the individualized marketing efforts younger generations have come to require — and this is the group that dry cleaners need to reach to grow into the future, Vollmer says.

“There are almost 400 million people in the U.S.,” she says, “and, according to the demographic studies, less than 10% of those people have ever even used dry cleaning, and a much smaller amount than that, by far, do the majority of dry cleaning. So, it’s crucial to find out who those people are, what they want, what they need, and what their passions and their lifestyles are. That’s what profiling is about.”

There’s no single way to reach customers, Vollmer says, and one of the benefits profiling can provide to a business owner is being able to choose the most targeted and economical methods to reach specific groups. Social media, for instance, might be great to connect with younger people, but classic methods can still be effective for messaging older groups.

“Many households have different generations within them,” she says, “and you’ll find that these generations have a different profile of what services they use, what they watch and what they read. Younger people, for example, just don’t buy newspapers because they get their news online. However, if you look at the demographics of newspaper readers — which are shrinking by the day — you’ll see that they match older, more traditional drycleaning customers, and it’s a more affordable way to reach that particular generation.”

Vollmer cautions that cleaners who resist these modern marketing tools to grow their client base do so at their peril.

“If you’re trying to bring in somebody new, you have to take a new approach,” she says. “In a sense, that’s true of any generation, but it’s urgently true for our industry with these young generations. They just don’t think that dry cleaning is for them, unless maybe there’s going to a wedding or prom or another one-off situation. But those one-off situations are good opportunities to bring them in as customers in the future.”

Knowing your customers can supercharge your outreach efforts

When it comes to building a profile, the two most valu able sets of information marketers can use to define their audiences are demographic data and psychographic data.

“Demographic information tells you if someone is male or female, what age they are, where they live, how much income they have, and so on,” says Lauren Essex, vice president of Bospar, a national public relations and marketing organization based in California.

Essex says that dry cleaners can start the process of building a demographic picture of their clientele on their own at any time.

“There are lots of different ways to accomplish this,” she says. “It can be done by using online surveys, or it can be done by sending questionnaires to see who currently is buy ing from you right now. You could also buy a list of custom ers from the drycleaner industry in general and do a survey.”

This method can be a valuable yet simple way to build a picture of the customer base and what they might want from their dry cleaner.

“Survey your customers to understand who they are, what they’re looking for, and if they are satisfied with your services today,” Essex advises. “Also, you can learn what else they might be looking for. Have a couple of ‘straw man’ ideas to put in there — perhaps new products or services they might be looking for — and you could ask them to rate those ideas to gain an understanding of what a new-product pipeline might look like.”

But demographic data has its limitations. The more valuable data, she says, is found in psychographic information.

“Psychographics talk about attitudes, emotions, and other kinds of behaviors that point to other interests they might have,” she says. “If there’s a gardening interest that pops up in one of the segments based on a psychographic analysis, for instance, you might have targeted ads that feature dirt-soiled knees. It’s based on the psychographics of what your audience actually does, versus

simply ‘45-year-old women living in a suburban area.’”

Vollmer gives an example of two 50-year-old males living in the same ZIP code and making a similar income. They might seem similar demographically, but if you dig a little deeper, you’ll start to see the differences.

One man might be an artist, for instance, while the other might be a nuclear physicist. “Their lifestyles are very different,” she says, “so their needs are going to be different, and their passions are going to be different.”

Knowing this information about their customer base allows dry cleaners to shape their messages and reach different groups with different offers or messages through various media.

“Once you identify who the broad target audience is,” Essex says, “you drill down to the subgroups that act the same way — who have the same philosophy, the same needs and same motivations, and then you can group those people together.”

Most cleaners already collect the data that they need to get the profiling process started, Vollmer says, so it’s a relatively simple thing to initiate.

“It starts with any combination of names, addresses, phone numbers and email addresses — anything that you have in your data file already,” she says. “Then, that simple data set is put through the process of profiling.”

Part of that process is done by online programs — called web crawlers or spiders — that use internet search engine data to build a picture based on your customers’ behaviors. Other information can come from activities such as streaming media profiles. The information is heavily weighted toward spending routines, recreational activities and professional habits.

“This information is aggregated, so you don’t see the exact profile of one individual,” Vollmer says. “What you do see is an aggregate profile of your best customer (Continued on page 21)

For business owners such as small- to mid-sized dry cleaners to understand how to navigate their companies around economic challenges, it can be helpful to understand the forces at work at a broader scale.

To address this topic, Dr. Chris Kuehl, a managing direc tor of Armada Corporate Intelligence, presented “Looking at the Economic Landscape of Today and Forecasting To morrow.” His appearance came during the three-day Win terFest Expo, a recent series of virtual workshops sponsored by three regional drycleaning associations in cooperation with the Drycleaning & Laundry Institute (DLI).

The severity of the coronavirus pandemic was something that caught many off guard — including economists, Kuehl says.

“No one expected 2020 to be what it was. I was look ing at it and saying, ‘This isn’t so bad. We’re going to be out of this and see a May-June rebound at the latest. No body’s really being laid off. They’re just being furloughed a few months. We’ll be fine.’ Well, that didn’t work.”

Since people were not given access to services, Kuehl says, they spent money on items instead, giving manufacturers a boost in 2020. As society started to reopen, services began to recover, and the gap between services and goods started to close.

“The service sector recovered very quickly in 2021, as we all wanted to go back to our old lives. We started spending on services again, and less on things.”

Kuehl says that the recovery we’re witnessing reminds him of the last economic crisis the country faced: “The numbers that we’re seeing now, whether it’s manufactured goods or services, are reminiscent of 2012 and 2013, when we are still kind of coming out of the 2008 recession.

“We’re back to balance, but a little bit lower than we were before. Not a crisis by any stretch, but we’re not seeing a boom in the manufacturing side or the service side going forward.”

Kuehl points out that, in late 2021, economists were thinking that the economy would be hitting around 4% to 4.5% growth rates in 2022. Those outlooks have been lowered to 3 to 3.5% growth as we’ve begun the year.

“But even with the ratcheting down, it’s not awful,” he says. “Three or four years ago, that would have looked really good — our normal 20-year pattern of growth annually is around 2.5%, so anything above that would have been seen as pretty good.”

The recovery that started to take place last year, however, can affect how this news is received, according to Kuehl.

“We’re comparing it to the blistering pace that we set in 2021, so it feels slow. At one point in 2021, we’re growing at 9.5% because consumers were coming back to life, and they were spending on services and doing all the things they had done before the pandemic. That began to fade, and we didn’t keep that pace up for the entire year. We ended up at somewhere around 5-5.5% percent growth for 2021, which is pretty spectacular.”

The outlook for growth in 2022 is estimated to be a point or two below 2021’s numbers because of another economic component.

“Inflation has been sparked by all this growth,” Kuehl says. “(Inflation has) gone up to 7%, which has not been seen in maybe 30 years.”

While Kuehl says that this rise has been played up in the media, there’s a simple reason why we’re seeing a rise in

prices: “It’s the only inflation we’ve seen in 30 years, be cause for the last 30 years, whenever you were confronted by the factors that were going to increase inflation, you could export the problem. If labor rates went up, move to China. If production costs went up, move to Mexico.”

That choice, Kuehl says, is not an option in today’s post-pandemic reality.

“The supply chain has people very concerned,” he says. “People are bringing a lot of their production back to the U.S. That is good for U.S. business, but it also means higher prices. So, it’s a bit of a trade-off.”

Transportation remains a huge part of the supply chain problems that businesses are seeing all around the country.

“Trucking capacity is as bad as it has been in years,” Kuehl says. “The load-to-truck ratio is very high, and it means that for every truck on the road, seven or eight loads are waiting.”

Things are slowly starting to get better, however, he says, but the knot in the supply chain isn’t undone yet.

“We’re beginning to see a little more supply chain catch ing up on the ocean side, but even that’s a little bit mislead ing. A report came out of the White House that said that port congestion was back to normal because we demanded that the ports stay open 24/7, and the problem is all solved.”

That outlook is overstated, to say the least.

“Actually, it hasn’t been solved, because what they also did was tell the ships that they had to wait 150 miles offshore,” he says. “So, they’re not clogging up the ports. They’re 150 miles out into the sea, clogging that route. They’re still out there and still aren’t unloading.”

The cost of energy is another driver of inflation.

“The No. 1 driver for inflation over the last couple of months has been the price of oil, which then becomes the price of fuel in general,” Kuehl says. “And it affects a lot of the chemicals that are used in this industry. The energy sector percolates through everything really quickly.”

Economists believe that the inflation we’re experiencing will be temporary, Kuehl says: “The prediction is that most of the inflation that we’re seeing now is going to be dissipating, probably by the end of the first quarter or in the second quarter.”

One economic indicator that is having a direct effect on the drycleaning industry is labor — more specifically, the lack of available workers.

“We’re looking now at seeing record unemployment rates in 2022,” Kuehl says, “back down to where we saw them in 2019 when we hit 3.5%.” This number, however, doesn’t provide a complete picture of the unemploy-

ment numbers because there are six different Bureau of Labor Statistics (BLS) classifications people can fall into. The 3.5% statistic is the “U-3” number.

“U-3 is the one we all see quoted in the press,” Kuehl says, “because it’s the easiest of the six to release. It’s basically those people who are formally on unemployment — they’re getting the unemployment check and getting help from the unemployment office. U-6 picks up those classified as ‘discouraged workers.’ These are people who are just as unemployed but are not getting unemployment compensation. It also doesn’t pick up the involuntary part-time workers, people who would rather be working full-time who are working a part-time position, which right now is a large category.”

So, where are the people needed to fill positions? Why is there a lack of workers? Kuehl says that they’re still out there, but there are other factors at play.

“There are 858,000 jobs openings in manufacturing alone,” he says. “With truck drivers, we’re almost 180,000 short. We’re short of people in health care, in construction — you name it, we’re short. There are 6.3 million unemployed in the United States and almost 12 million job openings at the same time — twice as many as there are people unemployed.”

The biggest problem employers are having, Kuehl says, is that many of the people available in the labor pool don’t have the skills that are in demand.

“If you’re in manufacturing, or construction, or transportation, you usually don’t hire people off the street,” he says. “There’s been this glib assumption by some that manufacturers — or any business — can just simply hire somebody and train them.”

The limiting factor with training, Kuehl believes, is time.

“(The drycleaning) sector is a lot like manufacturing,” he says. “It’s overwhelmingly small to mid-size busi nesses — 75% of the manufacturers in the U.S. have 25 employees or less. So, you go about this training process. And what you’re doing is turning to your senior guy and saying, ‘I need you to train this person. And the senior guy says, ‘Are you going to give me fewer hours to work? Are you going to give me a big raise? No? So let me get this straight. You want me to continue to do my 50 hours of work to keep this company going, and you want me to train this person who has no background at all?’”

This pattern often leads to overworked employees looking elsewhere, where they might work fewer hours for more pay.

“The No. 1 way that manufacturers, construction companies, and pretty much anyone hires now is by poaching other people’s workers,” Kuehl says. “They literally go after those who are somewhat open to relocation, and it’s

American Drycleaner, April 2022

usually around money and what they are asked to do.”

Another factor limiting the pool of potential job seekers is those people who have either left the workforce or aren’t looking for employment at the moment.

“Two of the biggest reasons that we now have workforce participation down to 61% — the lowest that we’ve seen since the 1970s — is retirement and the inability of women to get back into the workforce,” Kuehl says.

The retiring baby boomers are leaving a void proving difficult to fill.

“We have been watching boomers come out of the workforce at the rate of 10,000 a day, for the last four or five years,” Kuehl says. “That’s taking about 3 million people out of the workforce every year. We’ve got another five or six years of boomers coming out of the workforce, and that’s taken a big chunk out of that total workforce.”

And, while the boomers are choosing retirement, Kuehl says, many women are being forced to choose between work and family.

“There are many women trying to get back to the work force when child care and schools are in complete disar ray,” he says. “You’ve got an estimate of 8 million women who have not been able to get back into the workforce. Those are numbers similar to what we had in the ’70s be fore women started coming into the workforce in strength.”

Kuehl believes that society will recover from the impact of the coronavirus pandemic — and that includes the drycleaning and laundry industry, with estimates stating that the sector’s market size will rebound to prepandemic levels by 2023 or 2024, and then keep gaining ground. This will be driven by people who want their lives to return to “normal.”

“Most of the assumptions in 2020 were that a lot of these changes were going to be permanent,” he says, “but the experience as of 2021 shows that, once consumers were allowed to get back to their old ways, they went back quickly.”

He also predicts that new strains and concerns about COVID-19 are unlikely to derail the recovery underway: “You’re seeing it again with Omicron, because people are saying, ‘I’m sick of this mask and all this stuff. I’m going back to my old patterns.’”

One measure of this is the attendance at trade shows and meetings. He cites the experience of an event he recently attended: “They almost called off their meeting two months ago when the new variant showed up, but they went ahead and did it anyway. They had 500 people show up, and that’s about their average. So, the numbers have been indicating that people are deciding to go back to their old patterns.”

Over the past decade, our world has had an explosive development in technology. This evolution has caused a dramatic shift in the way businesses and consumers operate. We’ve seen a massive transition from traditional brick-and-mortar business to online business models. Companies like Uber to Airbnb, Amazon to Alibaba, Netflix to Disney Plus and more have completely dominated the market.

These major industry takeovers, however, don’t mark the completion of this phase of change; they mark the beginning, with the next installment being the smallbusiness landscape. And one major element in the domain of small enterprise, of course, is the drycleaning and laundry industry.

To stay competitive in any market, cleaners have to be able to provide their services to the consumer in the most accessible and convenient way possible. Unsurprisingly the online business model has taken commercialism by storm — not to mention the pressure of digital business transformation brought on by the coronavirus pandemic.

According to KPMG, 55% of people will search online for reviews and recommendations before making a purchase, 47% will visit the company website, and only 26% will visit the physical store.

So, what do these statistics really mean?

It’s safe to say that consumers enjoy the ease and comfort of purchasing from home, which of course comes with the new norm of delivery of goods and services. This brings us to the democratization of the next big flourishing industry, transportation.

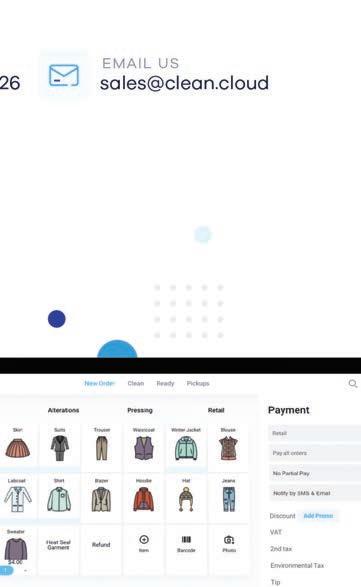

Cutting-edge POS software packages can marry the drycleaning, laundry and alteration industries with intuitive and convenient brick-and-mortar, mobile, and delivery systems to help you create and manage your new business.

What should the implementation of this technology look like?

A Modern POS – Payment processing and in-store POS solutions have historically made you fit their mold, rather than them fitting your mold. In a modern POS, a merchant is looking for the best technology but also a simple solution. It does no one any good if the POS can calculate a merchant’s profit to the 1000th decimal if no one can read it or know how to do it. A merchant is looking to have a POS be easy to use, help their employees in everyday life and, most importantly, help them improve their business.

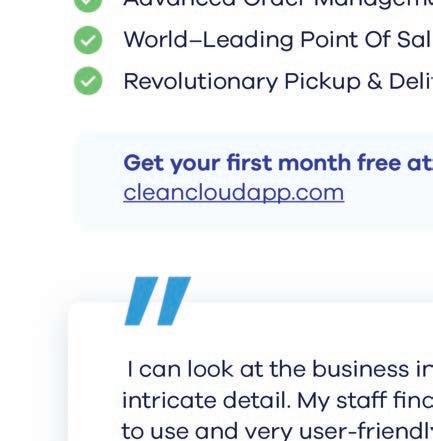

A Driving App — Modern solutions encompass route management software to make it easy to fulfill deliveries by providing step-by-step delivery instructions. They allow the owner to onboard new drivers quickly with a simple and intuitive native app with interactive navigation. Delivery drivers can save time and fuel with up-todate information on traffic conditions, distances between points, and estimated travel times.

A cleaner’s driving app should also have an integrated communication tool that allows drivers to make a call or send a direct message to the customer with a single tap. The customer can receive updates via automatic SMS or push notifications about when a delivery has started, when it should be expected and when it’s arriving. With this technology, you can select your delivery route manifest, scan delivery invoices from a built-in camera feature, and optimize your delivery route quickly and accurately.

Reach out to your technology partners to understand what possibilities exist for you today. These partners are eyeing trends within the marketplace today to understand how they can help you save money, evolve your business, and ensure you have the right solution for your store or mobile service. It’s time to put 2022 on a spin cycle and freshen up how our industry is doing business. ADC

Andrea Einlo is the marketing director of Cleantie.

Georgia World Congress

Atlanta, Georgia USA If you attend one industry event in 2022, The Clean Show should be it! Discover new products, exciting technology, and groundbreaking research in commercial laundering, dry-cleaning, and the textile service industry as exhibitors from around the world showcase their latest innovations. Registration opens this winter. Start making your plans to attend!

Largest U.S. industry show begins July 30 in Atlanta

ATLANTA — Visitor registration for The Clean Show 2022, the premier event in the U.S. for the drycleaning, laundering, textile care services, supplies, and equipment industry, is now open.

The four-day event, bringing thousands of industry leaders together from around the world, is scheduled to take place from July 30 to Aug. 2, 2022, at the Georgia World Congress Center in Atlanta. The Clean Show allows professionals from all across the globe to conduct new business and discover the latest product developments, technology, and more.

“The Clean Show has proven to be the ideal exposition for industry leaders to find the latest innovations in textile care, ranging from industrial machinery and conveyor equipment to computer software and business systems,” says Show Director Greg Jira. “The show offers a great opportunity for exhibitors and visitors to learn how the various products and services can help their businesses to thrive in today’s highly competitive market. We can’t wait to host the show this year.”

The Clean Show is organized in collaboration with the Association for Linen Management (ALM), Coin Laundry Association (CLA), Drycleaning & Laundry Institute (DLI), Textile Care Allied Trades Association (TCATA), and the Textile Rental Services Association of America (TRSA).

Members of these associations may pre-register through June 29, 2022, for $119; the cost for non-members is $149 through that date. Onsite registration will be $169.

The 2022 event is the first Clean Show since the New Orleans program in 2019. The coronavirus pandemic prompted the show’s presenter, the Messe Frankfurt Group, to postpone the scheduled June 2021 show until this year. The Group says that the 2019 show brought together more than 11,000 industry professionals from more than 100 countries.

This year’s edition of The Clean Show will feature live demonstrations, networking opportunities, and educational sessions where industry experts will showcase the latest technological advancements available to the industry. It will also feature trend predictions, strategies

to grow and expand into new markets, and insights on staying ahead of the competition.

The Clean Show’s website (https://the-clean-show. us.messefrankfurt.com ) offers information for visitors, along with a direct link for registration. Attendees can also find detailed information about the show date and hours in the Planning & Preparation section of the website, as well as information about the venue, registration prices and deadlines, housing, and tips to explore Atlanta.

Messe Frankfurt has also arranged for exclusive discounts and amenities at a variety of Atlanta hotels, some of which are located within walking distance of the Georgia World Congress Center. Reservations must be made through Connections Housing to ensure receipt of these rates and amenities.

Hotels included are Aloft Atlanta Downtown Hotel, Atlanta Marriott Marquis, Courtyard Atlanta Downtown, Embassy Suites Atlanta at Centennial Park, Hilton Garden Inn Atlanta Downtown, Holiday Inn Express & Suites Atlanta Downtown, Omni Hotel at CNN Center, Renaissance Atlanta Midtown and The Westin Peachtree Plaza. Some hotels are designated headquarters for each of The Clean Show’s sponsoring associations.

Nightly rates range from $175 to $259 and do not include local taxes. Rates are based on availability, and additional room types and rates may be available at some hotels.

Complimentary shuttle bus service to and from the Georgia World Congress Center is provided for headquarter hotels. All other Clean Show hotels (except those within walking distance of the venue) are within two blocks of a shuttle pickup point.

Hotel reservations may be made online via the Connections Housing website (https://www.connections-housing. com/LandingPage/Clean2022.php ) or by calling 702-6756584. Exhibitor and attendee groups requiring 10 or more rooms may choose to submit an online block request.

The housing reservation deadline is July 7, 2022. ADC

or the customer group you want to be profiled.”

The results are used to craft meaningful communication, Vollmer says: “Without it, you are trying to offer something for everyone, and that doesn’t work as well as trying to offer the products that fit the lifestyle.”

Big retailers, such as Amazon and Apple, have trained entire generations of consumers to expect more from their interactions with companies — and this behavior has trickled down from megacompanies to Main Street.

“When a customer thinks that you’re speaking directly to them, when you know them and can anticipate their needs and wants, they will be loyal,” she says. “And if you’re doing a good job of supplying the things they need, they don’t have time to look for anyone else. So, by habit, they become loyal.”

The key, Vollmer says, is being able to target a customer based on their individual needs rather than as an anonymous group.

“Talking to them one on one, knowing them like a friend or family member, is where the strength lies in profiling,” she says. “You know what they’re likely to be doing and how pressed they are for time, and what’s prob

ably going to resonate with them. That’s what this profil ing provides.”

While simple surveys can help build a picture of a client base, marketing professionals can assist dry cleaners in building a truly accurate and detailed breakdown of the people who will become their best customers. While such an undertaking can seem overwhelming at first, Vollmer says there’s nothing to fear.

The best place for cleaners to start, she says, is to determine how comfortable they are with handling their marketing efforts.

“A lot of big firms will build profiles online, so, if you’re technically skilled, you have a world of options,” she says. “If you’re at the other end of the spectrum and need some hand-holding, then I would say go to a small firm that either specializes in profiling, a marketing firm that has access to the profile, or a consultant who special izes in this area so they can actually get a path through to successful marketing.”

When speaking with a marketing company, Vollmer believes that if the subject of profiling needs to be addressed: “If the marketing firm doesn’t bring up profiling, they are not current on how to reach customers.” ADC

For example, for a September ad, the closing date is August 1st.

ADS: Must accompany order.

(in- training)

Ehrenreich & Associates is looking for Retired Business Owners or B to B Sales Pro to join E & A as an Equity Partner (in-training) while you learn the Business Merger, Brokerage, Expert Witness & Consulting professions. Reply with your history, location, Contact Info & availability: Ehrenassoc@gmail.com

REMOTE / $85K+ EARNING POTENTIAL (BASE

Who are we? Cleantie’s cloud-based platform is the fastest-growing Dry Cleaning & Laundry POS and Pickup Delivery Apps in North America.

We’re searching for a skilled person to join our team as a digital sales associate. We’re looking for people that want to develop with us, and are familiar with the dry cleaning and laundry industry. The Digital Sales Associate must be a self-driven, highly motivated sales professional. They will be responsible for acquiring new clients and capturing future interest through outbound, dialer-assisted call campaigns. All sales operations will take place over the phone or during onsite visits. Please email your resume to career@cleantie.com if you believe you are a suitable fit for this role.

2022 RATES: One- to five-time rate: $2.20 per word, boldface $2.30 per word. Minimum charge: $25.00 per ad. Call or write for our three- and 11-time rates. If box number is used, add cost of 5 words. Display classified rates are available on request. All major

cards are accepted.

Ads must be received by the 1st of the preceding month. For example, for a June ad, the closing date is May 1st.

10 YEARS

After the assessment of the U.S. Environmental Protection Agency (EPA) that perchloroethylene (perc) was a “likely human carcinogen,” 71.6% of respondents to the American Drycleaner Wire survey believed that the solvent would no longer be a viable option for the average operator within 10 years.

Of that group, 37.5% believed perc had another 10 years, while 34.1% believed it was only five years, and 13% gave perc another 20 years. In the survey, 69.9% said they currently used perc.

25 YEARS AGO. Testimony — The House Committee on Small Businesses scheduled a mid-April hearing and asked Baise & Miller P.C. to arrange for one or two dry cleaners to participate alongside scientists and other small business representatives. The subject was good science and regulatory rulemaking, with testimony on how regulations based on bad science impact small businesses. This was connected to work on the Barton Bill — legislation that would protect drycleaners when it came to environmental cleanup.

50 YEARS AGO. Slow Merge — “The merger of the National Institute of Drycleaning and the American Institute of Laundering is progressing, but it’s progressing slowly,” accord-

ing to a statement from Albert Hofheimer, AIL president. The merger was moving at a “careful pace,” he said, pointing out that a merger, like a marriage, “requires patience, planning and sincere belief in longrange compatibility.” He went on to say that, rather than a take-over by one party over another, this was to be a consolidation of peers, “so it is far more difficult — but far more healthy — than a takeover.”

75 YEARS

A new type of drycleaning school — a school of management — was

opened by Bill Ayers and Associates of Covington, Virginia. The school was opened to combat something cleaners said there was a need for in the industry. “We have schools to teach our employees how to clean and spot, but no school to supply training where we need it most: in management.” The course was considered unique because of its simplicity and practical approach to solving the management problems in small and medium-sized plants. ADC —

Compiled by Dave Davis, EditorProductshaveproventolastupto10timeslongerthan similarproductioninthisindustryandapplications.

Wehavemanyinstallationswithsteamboilersthathave beeninserviceforover50-years,10hoursperday.

Thematerialsusedincurrentproductsarebetterthanthe materialsused50yearsago.Forexample,inthe80’s, steam drumwentfrom3/8”thickto1/2”thick.

Ourheatingsurfaceoramountofsteelabsorbingenergy has alwaysbeen2to3timesthatofotherunits(upto6sf ofheatingsurface per boilerhorsepower,whichsomeunits arecloserto2sfofsteel per hp,andsomeeven1sf).

Wehavethebestdistributedflameormostevensurface areaevenlydistributedundertheentirepressurevessel. It isalsoamodulardesign,so it canberepairedeasily.

Tube materials were upgraded from seamlessrated pipe to seamlessrated tubing. Material is not only thicker, ends up .133 wall, but is annealed which give the surface on both sides a mill scale coating that is more resistant to corrosion and is long lasting from testing.