Self Administration Manual Welcome to

This administration manual is intended to provide guidance to you and your employees in the areas listed in the Table of Contents on the following page.

TABLE OF CONTENTS

1.Contact Information 2.Website Login 3.Enrollment Information 4.Explanation of Benefits and Appeals Process 5.Monthly Invoices and Month End Reports 6.Enrollee Questionnaires and Forms 7.SBC Guidelines 8.Miscellaneous

CONTACT INFORMATION

Sales and Retention Department

Company representatives* should contact the Sales and Retention Department to request new enrollment packets and any other issues not listed below.

Phone: 330-363-6390

Fax: 330-454-7845

Service Center

Company representatives and employees should contact the Service Center for questions regarding benefits that your plan covers or an outstanding claim. An AultCare Service Representative is available Monday through Friday 7:30 am to 5:00 pm.

Phone: 330-363-2050 / 855-270-8497

Fax: 330-363-7717

Billing Department

Company representatives may contact the Billing Department with questions in regards to monthly invoices.

Phone: 330-363-6360

Fax: 330-363-5012

Member Services/Eligibility Department

Company representatives may contact the Member Services/Eligibility Department with enrollment questions.

Phone: 330-363-6360

Fax: 330-363-7746

Email: aultcareeligibility@aultcare.com

Visit our website at www.aultragroup.com

representatives are individuals authorized to request information on behalf of the company.

*Company

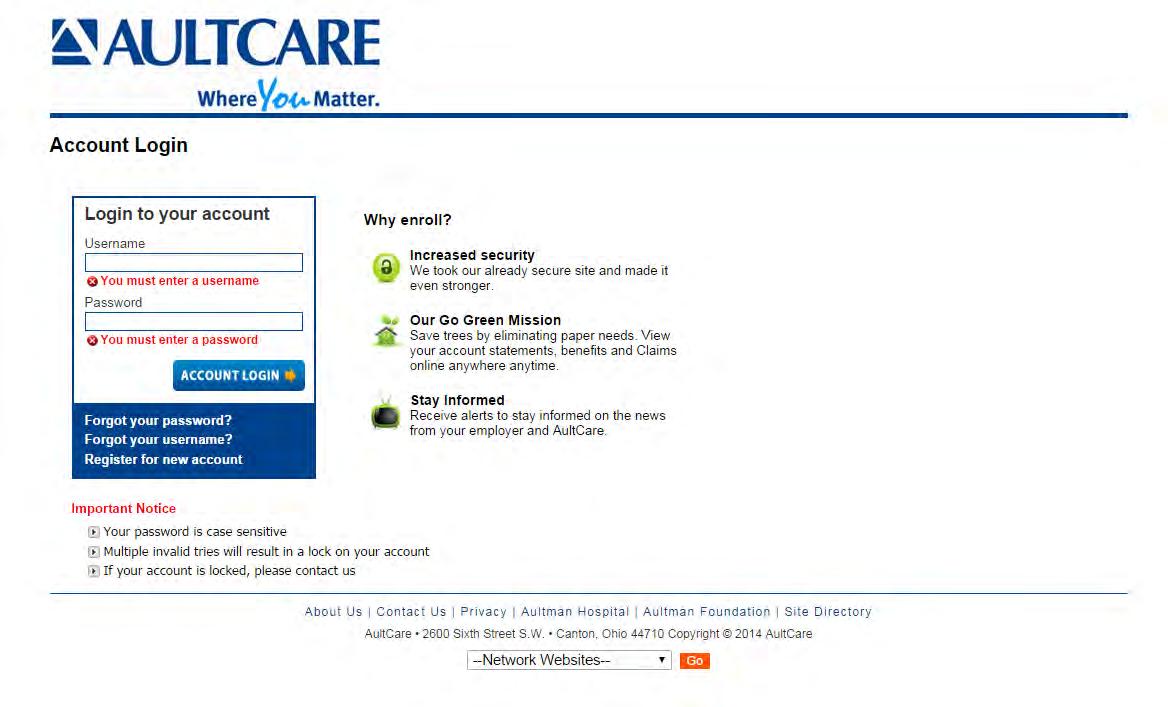

WEBSITE LOGIN

Attachment #1: Employer Account Registration Guide

Attachment #2: File Retrieval Guide

Attachment #3: Member ID Card Retrieval Guide

AULTRA

WEBSITE EMPLOYER GUIDE

Employer Account REGISTRATION GUIDE

Welcome

Welcome to our Aultra family. Whether you are a new client, or have been with us for many years, we are proud to assist you managing your employer account.

We have created an area on www.aultragroup.com designed just for you. You can use the online account to retrieve monthly reporting and invoices send us files, view your group’s eligibility, order ID cards, and more.

To get started, you and each authorized representative, must register for a secured, online account. Once you have created an online account, use this document to learn how to retrieve files from your online account.

If you have questions, you can contact your Account Coordinator, Account Executive, or for technical assistance, email the Aultra Web Team at AultConnect@AultCare.com.

Helpful links:

• Frequently Asked Questions

• Website How to Guides

Thank you, Your Aultra Team

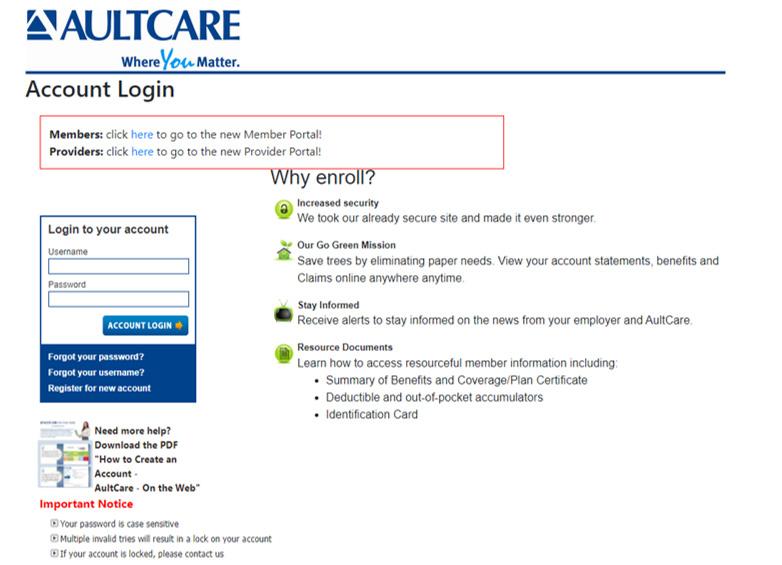

CREATING YOUR EMPLOYER LOGIN ON THE AULTRA WEBSITE

• Open a web browser and go to www.aultragroup.com.

• Click the Account Login button towards the middle of the page.

1

• Then click on the “Register for a new account” link.

• Select “Employers” as your “Membership Type” and click on the “SIGN UP NOW” button.

AULTCAREEMPLOYERACCOUNTREGISTRATIONGUIDE

Select “Employers” as your “Membership Type” and click on the “SIGN UP NOW” button.

2

1. Select “I Agree” to agree with the “Terms of service” outlined on this page.

2. By entering your name next to the “By” textbox, you are signing your signature.

Step # 1

You must agree with our “Terms of Service” before you can create an account with us.

Click on “CONTINUE” button to proceed.

1. Select “I Agree” to agree with the “Terms of service” outlined on this page.

2. By entering your name next to the “By” text-box, you are signing your signature.

Click on “CONTINUE” button to proceed.

Step # 2

Enter the following information

Your first name

Your middle initial

Your last name

A phone number where we can reach you

The title of your position at your company

Click on “CONTINUE” button to proceed.

Step # 2

Enter the following information

• First Name

• Middle Initial

• Last Name

• A phone number where we can reach you

• The title of your position at your company

Click on “CONTINUE” button to proceed.

AULTCAREEMPLOYERACCOUNTREGISTRATIONGUIDE

3

STEP #3

1. Enter the 9 digit Tax ID number of your company (without the dash)

2. Enter the name of your company

3. Enter the street address, city and state of your company

Adding Group Numbers

1. Enter the Group Number of your company

2. Click “Add” button

3. The Group Number will then appear in a list box underneath

4. If you need to add more groups, repeat the steps in this section

the following information: for your account enter a username, the system will tell you if it is already taken or not. If the is already taken, please choose and enter a different username. for your account password that you choose should consist of: characters least one uppercase character and one lowercase character least one number

Optional

If you already know someone at Aultra (e.g Account Coordinator), you can help us expedite the verification process for your employer account by supplying the following ”optional” information:

1. Enter your phone number

2. Enter the name of the person you know at AultCare;

Click

2. Enter the name of the person you know at Aultra; (e.g., Group Account Coordinator)

email address enter correct email address. We will use this email to communicate with you.

Click on “CONTINUE” button to proceed.

security questions with answers select your security questions carefully. We will ask you these questions if you forget username and/or password. CONTINUE” button to proceed.

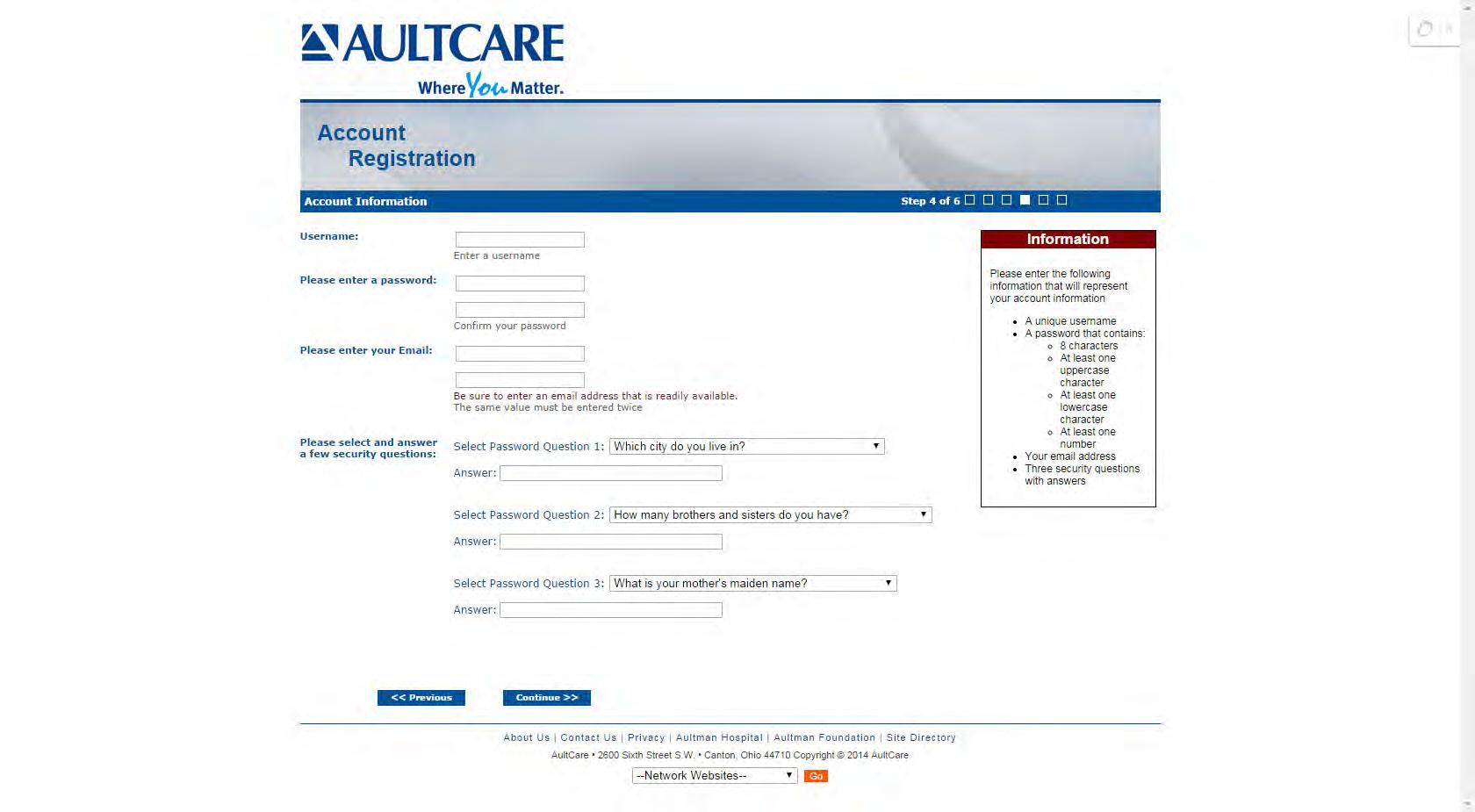

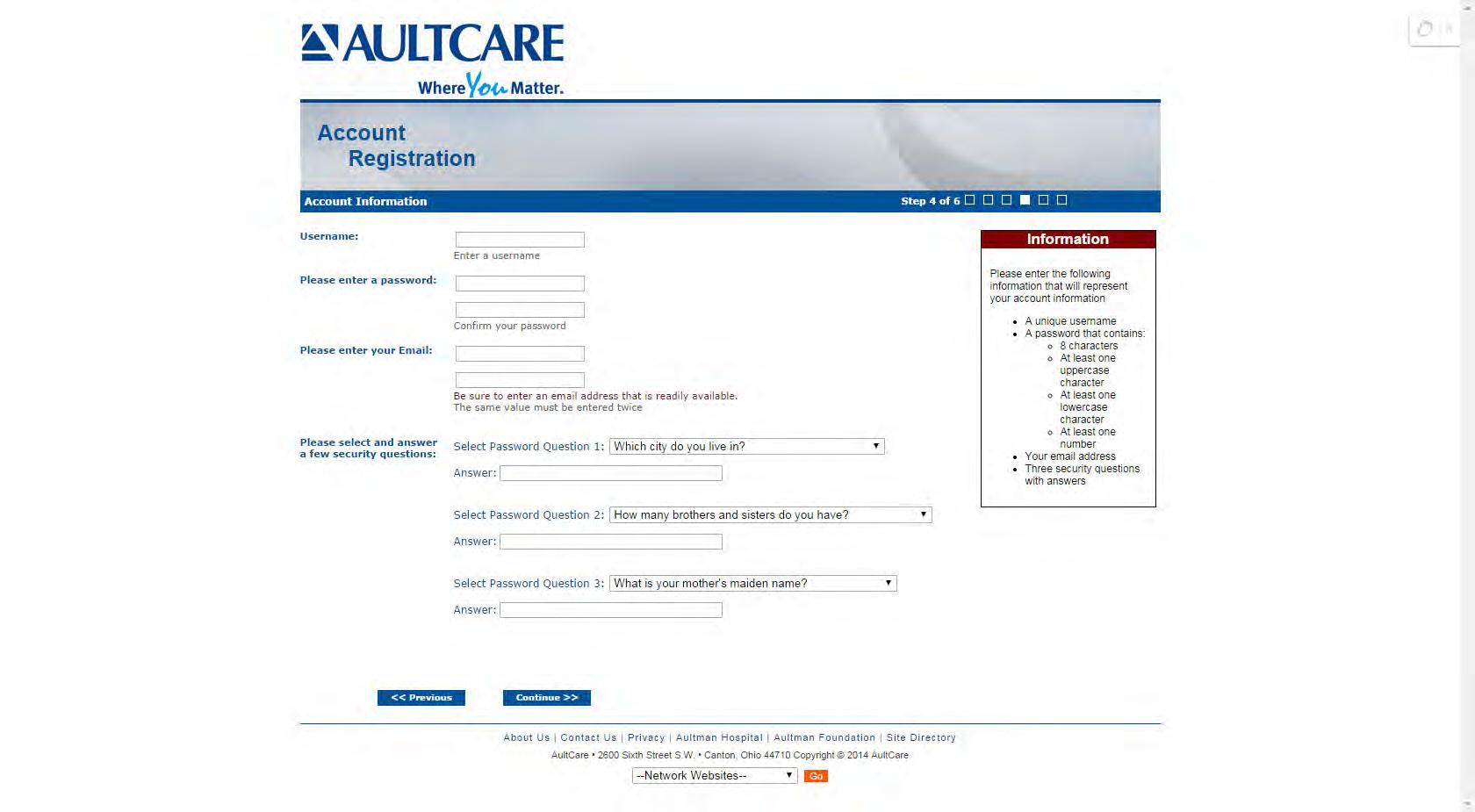

STEP # 4

Enter the following information:

Username for your account

When you enter a username, the system will tell you if it is already taken or not. If the username is already taken, please choose and enter a different username.

8

Password for your account

The password you choose should consist of:

» 8 characters

» At least one uppercase character and one lowercase character

» At least one number

Your email address

Please enter your email address. We will use this email to communicate with you.

Three security questions with answers

Please select your security questions carefully. We will ask you these questions if you forget your username and/or password.

Click on “CONTINUE” button to proceed.

(e.g.

Group

on

CONTINUE” button to proceed.

“

AULTCAREEMPLOYERACCOUNTREGISTRATIONGUIDE 9

4

Step #

Reason for requesting access

Select your reason(s) for requesting access. You can select more than one reason.

2. SFTP IP Addresses

If you will be using secure FTP transfer in addition to our website , please list the IP address(s) that will be used.

3. Authorization to represent your company Select “I Agree” to state you are an authorized representative of the company you are applying for this account.

Sign your name electronically by entering your name in “ By ” textbox.

Optional on this page

If you need to send us a message or have a question, enter it in the comments box.

Click on the “CONTINUE” button to proceed.

5 1.

5

an authorized

AULTCAREEMPLOYERACCOUNTREGISTRATIONGUIDE

I, John Smith, am

representative of X Company.

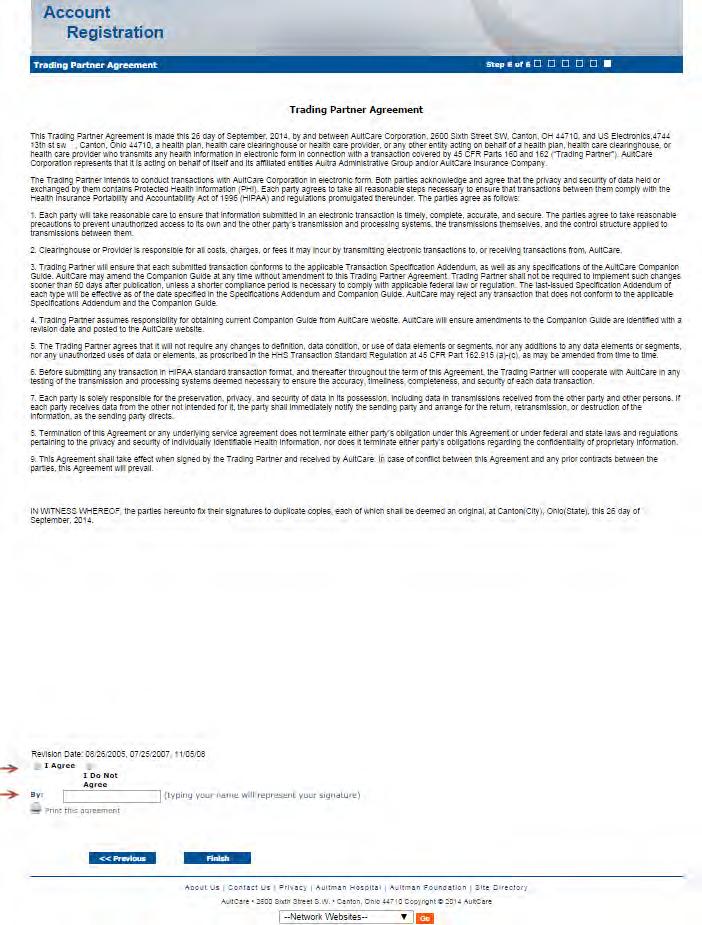

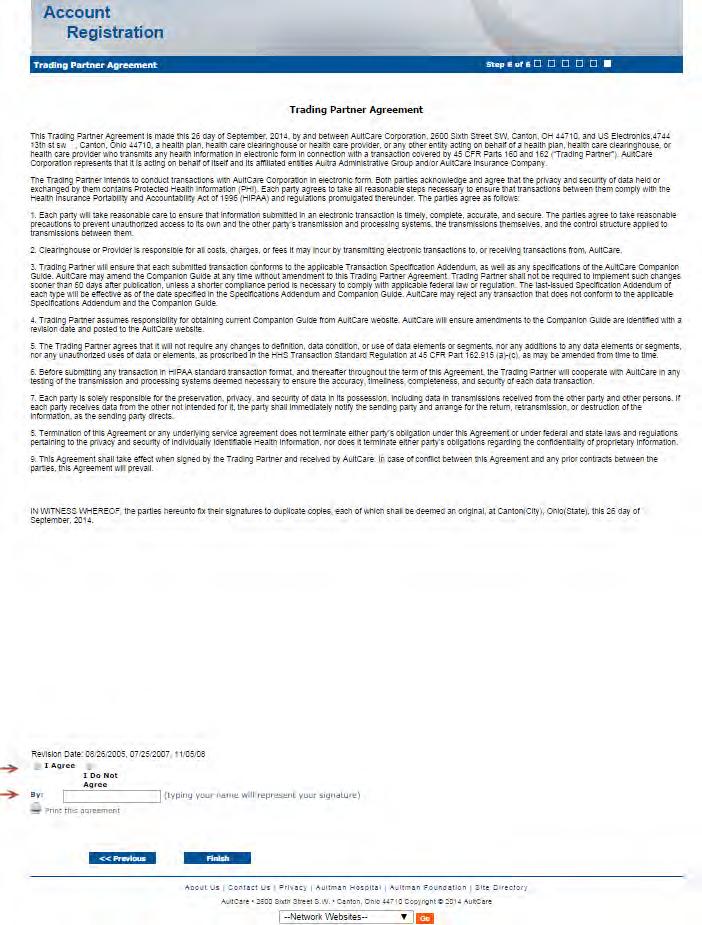

Step # 6

This is the final page of your account registration process. You must agree to the Trading Partner Agreement specified on this page. You can print this agreement by clicking on “Print this agreement.”

From this page:

1. Select “I Agree” to agree to the “Trading Partner Agreement” outlined on this page.

2. Indicate your approval by entering your name in “By:” textbox.

Click on the “FINISH” button to proceed.

Upon successful completion of your account registration, you will see the following message:

12

Thank you for the submission of your registration request. You will receive an email advising on the next steps to complete the process.

What to expect next?

• Upon completion of the registration process, you should receive an email stating the registration process has been completed. (Note: At this time, your account is not active yet)

• We will review the application and finish with the account setup process.

• When your account setup has been completed, you will receive an email informing you your account has been set up and is ready for use. (Note: At this time, the process is complete, and you will be able to login to our website)

If you have questions, you can contact your group coordinator, or for technical assistance, email the Aultra Web Team at aultconnect@aultcare.com

6

Aultra EMPLOYER FILE AND ID CARD RETRIEVAL GUIDE

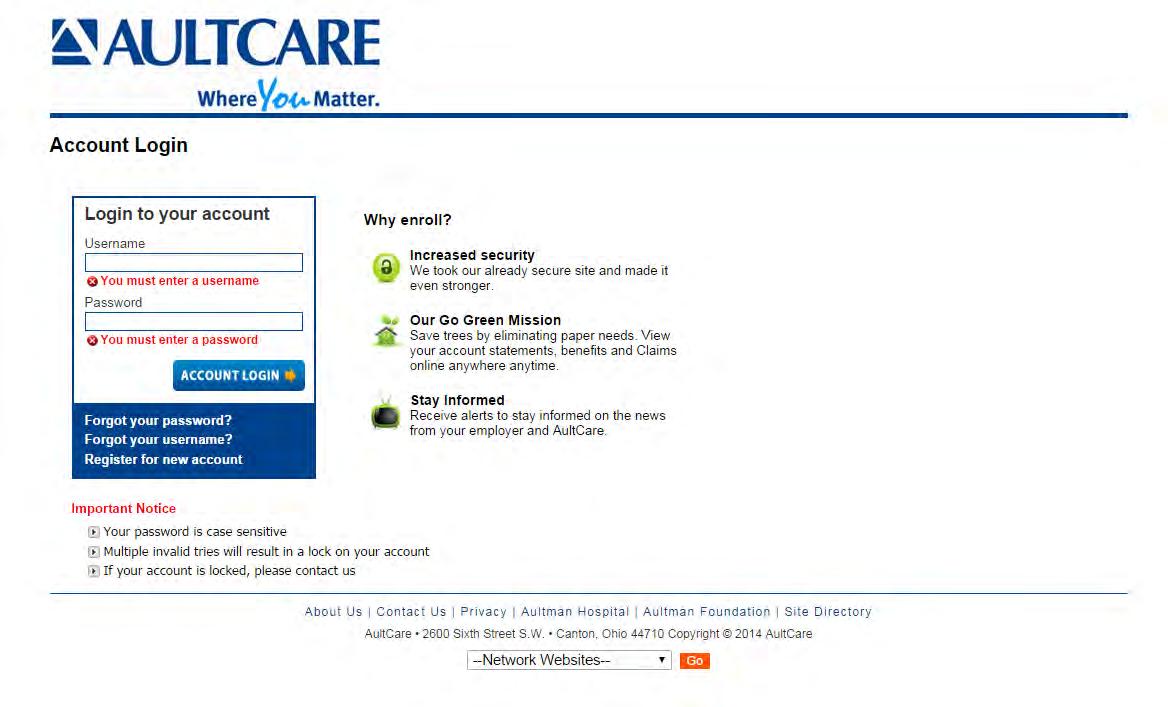

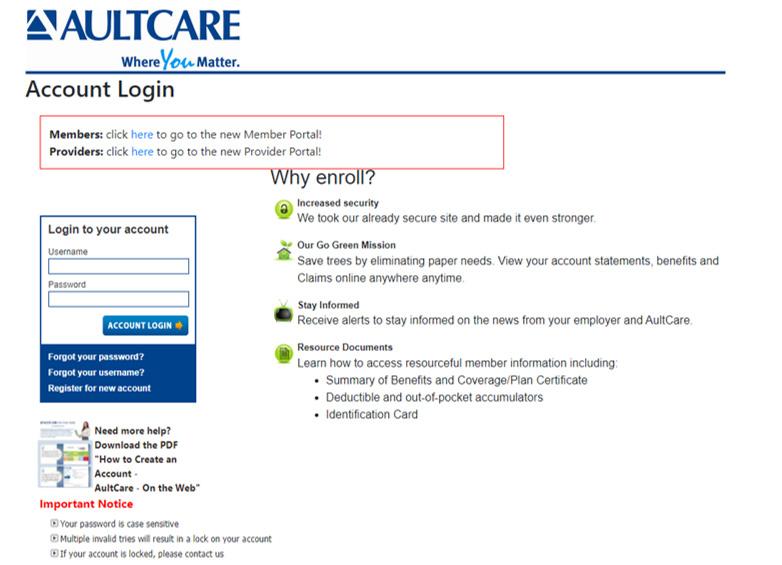

1. Visit www.aultragroup.com.

2. Select Employer Resources and click Account Login

3. Enter your username and password. Click Account Login to access your account.

4. You must have an online account to retrieve files. Select Register for new account if you do not have an account.

.

How to retrieve your monthly files on the Aultra website

1

My Dashboard

Once you are logged into your account, your dashboard will appear. All links associated to your account will be displayed. In the screenshot below, three main areas have been identified.

• Location A lists the last three (3) files Aultra has posted for you. These are on your dashboard so you can easily view these files.

• Location B is a link. This link will take you to your Secure FTP Center. The FTP Center allows you to download all files Aultra uploaded to your account. This is where you can upload files to Aultra.

• Location C is a link similar to Area B. It will take you to the same place and files as Location B.

2

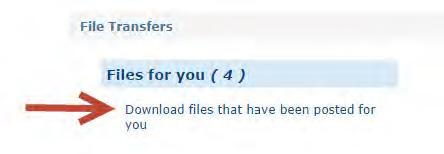

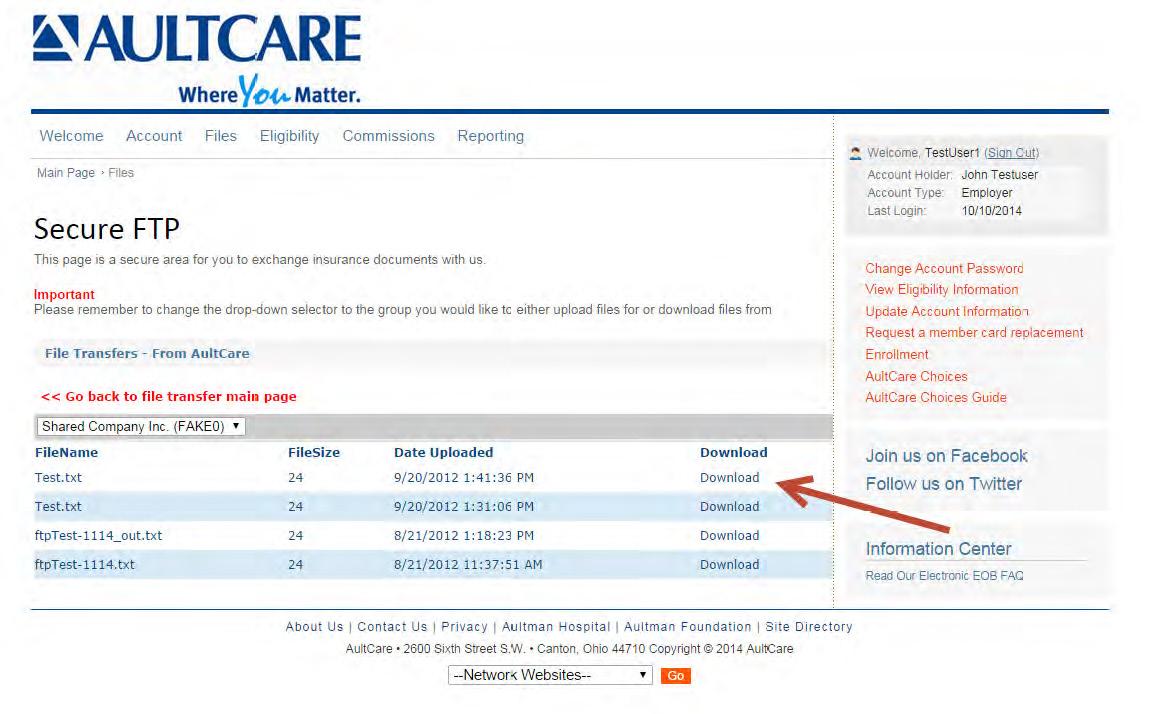

Secure FTP Center

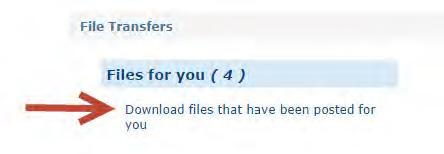

When you click on the Files link from your dashboard (Location C in the example) you will be directed to the Secure FTP Center (see image below). You will see two links: Files for you and Files from you.

VIEWING YOUR FILES

Files for you

This link will show all of the files Aultra uploaded to your account. Retrieve your files by clicking on this link. The number displayed is the number of available files.

UPLOADING FILES TO SEND TO AULTRA

Files from you

This link will take you to a page where you can upload files to Aultra.

3

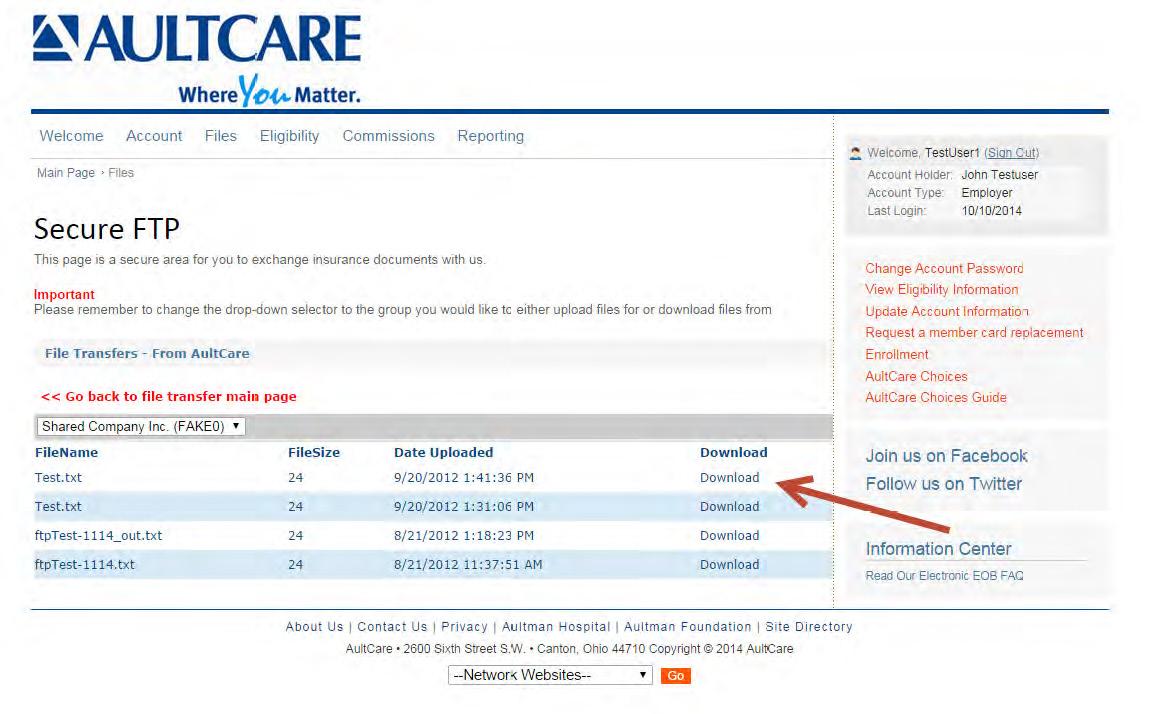

Downloading a File

Step #1

Click on the text labeled Download files that have been posted for you

Step #2

When you click the link, a dropdown list will appear. From the list, select the group name to view files. (Based on your authorization, only those particular group names will be displayed.)

Step #3

For employers who have more than one Aultra account, select the appropriate account from the drop down box.

4

Step #4

Once you see a list of files, click on the Download link to view/download it on your computer.

5

Uploading a File

1. Click the link labeled Click here to upload files.

An example of the upload center is shown to the right.

2. Select the group number associated with your file upload.

3. Select the specific file type.

4. Browse for the file you want to upload on your computer.

5. Select Upload.

Previously Uploaded Files

You can also see files previously uploaded.

If you have questions, contact your group coordinator, or for technical assistance, email the Aultra Web Team at AultConnect@AultCare.com.

6

Step #1

Log in to your employer secured account and select Eligibility.

Step #2

Click Search to view a list of active members. Member ID Cards on the Employer Portal

7

Step #3

Select a name to view the member’s ID card.

Step #4

To view a copy of the member ID card, select this link: Member Card click here.

www.aultcare.com PCP Co-Pay $ Specialist Co-Pay $ Member Employer: Group #: Member: Member ID: Effective: Rx Claims: Rx Bin: Rx PCN: Rx Group: Issuer: For Pharmacy Help Desk 888-219-3164 In-Network Ded Ind/Family $ Out-of-Network Ded Ind/Family $ In-Network OOP Ind/Family $ Out-of-Network OOP Ind/Family $ Pharmacy Plan Medical Plan da : Mail: AultCare P.O. Box 6910 Canton, OH 44706 Claims Submission Customer Service/Eligibility This card is not a guarantee of coverage. For verification and coverage details call 330-363-6360 or 1-800-344-8858 weekdays, 7:30 AM to 5:00 PM. Hearing Impaired: Call 711 PRECERTIFICATION is required for all elective admissions and within two working days following an emergency admission. For preadmission certification, call Utilization Management at 330-363-6397 or 1-800-344-8858 weekdays, 8:30 AM to 5:00 PM. Benefits may be reduced if this does not occur. 7525/22 8 www.aultragroup.com Aultra

ENROLLMENT INFORMATION

The following information is provided to explain the process of enrolling and terminating employees and/or dependents. In order to ensure timely enrollment of new eligible employee, please complete and return the membership report and group employee application.

Attachment #1: Step-By-Step Guide

This guide was created to assist with the completion of enrollment application/change form. The text denoted in red provides additional information to help understand what information is being requested.

Attachment #2: Enrollment Application

All new employees and those employees requesting a change in their coverage, must complete this entire form, unless otherwise instructed, to prevent delays.

Any questions you have as you complete this form may be directed to Customer Service.

Once completed, these forms may be mailed to: AultCare

Eligibility Department PO Box 6910 Canton, OH 44706

It may also be faxed directly to our eligibility Department at 330-363-7746. All changes must be received by the 10th of the month to be reflected on your next bill.

Attachment #3: Cancellation and Continuation Form

Please indicate all cancellations on this report. Do not make changes on the monthly premium statement. Utilize transaction codes for each change. Include enrollment form where indicated and provide within 31 days of event. (Signed enrollment forms must include spouse's signature when applicable.

Attachment #4: HIPAA Disclosure Form Notice of Privacy Practice Member Guide Letter

The attached enclosures must be given to any potential AultCare enrollee in addition to the Group Employee Application so that the person understands portability and creditable coverage.

Attachment #5: Getting the Most from your Healthcare plan

Guide for Completing the Enrollment Application/Change Form

Please complete this form in its entirety.

EMPLOYER USE ONLY

This section is to be completed by the employer representative.

Employer Group Numbers

List all Aultra group numbers that apply. (Medical, Dental, Vision)

Employee Location/Job Classification

Use this section to designate an employee classification, if needed. These designations should be set-up as rate codes during the implementation of your plan.

(Example: hourly vs. salary; executive or management; physical plant location.)

Leased Network

Designate if the employee is accessing an out-of-area network. (Cigna, First Health Network, etc.)

Aultra Effective Date

Provide the date the coverage is set to begin.

EMPLOYEE COVERAGE ELECTION

This section is to be completed by the employee.

A) NEW POLICY APPLICATION

New Group New Hire Open Enrollment

Waiving Coverage

Designate the reason for applying for coverage or if coverage is being waived. If waiving coverage, a signature is required on the back of this form.

Qualifying Event — Explain:

If applying for coverage for a qualifying event, please provide a detailed explanation. (For example: spouse lost coverage, marriage, birth, adoption.)

Hire Date

If the original hire date is not available, please provide the month and year.

Coverage Type(s) Requested:

Check All that Apply Medical Dental Rx

Vision STD Life Flex HSA HRA

Be sure to check all benefit options being elected.

Plan Requested: Plan Name

Use this section to designate the employee’s plan election. (Example: PPO, HDHP or OPT 1, OPT 2, etc.)

ADDITIONAL COVERAGE FOR DEPENDENTS

This section is to be completed by the employee.

A(dd), C(hange), D(elete)

Please provide the reason code for enrolling or disenrolling dependents.

Social Security Number SSN are required for all dependents with coverage.

Benefits Selected (M,D,V,R)

List all that apply.

Other Insurance Coverage? (Y/N)

If yes, please complete the other coverage information on the back of this form.

OTHER COVERAGE INFORMATION

This section is to be completed by the employee if any covered persons have other health insurance coverage.

MEDICARE INFORMATION

This section is to be completed by the employee if any covered persons are enrolled in Medicare.

OTHER INFORMATION

This section is to be completed by the employee to designate any specified needs.

All Employees

Signature______________ Date __________

Employee must sign and date when electing coverage.

Employees Waiving Coverage

Reason for waiver of coverage: ______________

Employee and spouse must provide reason for waiving coverage.

Signature______________ Date __________

Employee and spouse must sign if either are waiving coverage.

Please submit this form to Aultra by one of the following methods:

Email: aultcareeligibility@aultcare.com |

Fax: 330-363-7746 | Mail: Aultra Member Services

PO Box 6910 Canton, OH 44706

Employer to send completed form to Aultra by one of the following methods.

7032/20

Enrollment Application/Change Form without

Employer Employer Name Group Numbers Employee Location/ Leased Network Aultra Job Classification Yes No Effective Date AULTRA USE ONLY Date Completed Completed By Card Sent EMPLOYER USE ONLY M - Medical D - Dental V - Vision R - Prescription ADDITIONAL COVERAGE FOR DEPENDENTS A(dd), C(hange), D(elete) Relationship to Enrollee First Name M.I. Last Name (If different from employee) Social Security Number Benefits Selected (M,D,V,R) Gender (M or F) Date of Birth Other Insurance Coverage? (Y/N) Date of Qualifying Event (Qualified enrollment must be made within 31 days of event) A) NEW POLICY APPLICATION New Group New Hire Open Enrollment Waiving Coverage You Only You & Your Spouse You & Your Child(ren) You, Your Spouse & Your Child(ren) Qualifying Event — Explain: B) EMPLOYEE INFORMATION Last Name First Name Middle Initial Suffix Gender Male Female Date of Birth Social Security Number Home Address Zip (Number & Street) County City State Code Preferred Email Primary Care Physician Name Phone Number Address (HMO Only) Marital Status Married — Date of Marriage Single Widowed Divorced Separated Employment Currently on Hire Hours Worked Are you currently actively at work? Status Full Time Part-Time Retired COBRA Date Per Week Yes No If not, why? Coverage Type(s) Requested: Plan Requested: Check All that Apply Medical Dental Rx Vision STD Life Flex HSA HRA Plan Name EMPLOYEE COVERAGE ELECTION 8128/24

Medical Questions

IMPORTANT INFORMATION

Upon your effective date with this plan, will you or any of your family members have other health insurance? YES NO

If yes, what is the name of the other insurance company?

If yes, what type(s) of other health insurance will you have? Check all that apply Medical Dental Rx Vision

Do you or your spouse or any enrolled dependents have Medicare coverage? YES NO If yes, please provide information below.

Do you have Medicare Part D coverage? YES NO If yes, what is the effective date of your coverage?

Do you, or any of your dependents, have any cultural or linguistic needs? YES NO

If yes, what are they?

Ethnicity: Non-Hispanic/Latino Race: White Black American Indian/Alaska Native Language: English Spanish Hispanic/Latino Choose not to answer Asian Native Hawaiian/Pacific Islander Other _________________________ Choose not to answer

RELEASE OF INFORMATION/PLEASE READ CAREFULLY

I am applying for group health coverage through Aultra Administrative Group and its related entities (“Aultra”). I acknowledge the coverage for which I am applying is subject to eligibility requirements and the terms of the policy. I acknowledge that I have read and understood all of the information contained within this document. Additionally, I acknowledge that all information that I have entered in this application, to the best of my knowledge, is complete, true, and accurate. I understand that any attempt to mislead or defraud Aultra is considered insurance fraud.

INSURANCE FRAUD WARNING:

Any person who, with intent to defraud or knowing that he or she is facilitating a fraud against an insurer, submits an application or files a claim containing a false or deceptive statement is guilty of insurance fraud.

I acknowledge that Aultra may use and disclose my protected health information, as well as, the protected health information of my family for payment, treatment, and operations. This information may be disclosed to other insurance companies, third party administrators, state and federal agencies, health care providers and other organizations and persons that perform professional, business, or insurance functions for Aultra, as permitted by state and federal law.

The information may be used for, but not limited to, processing enrollment applications, risk classifications, detecting or preventing fraud, internal and external audits, claims administration, case management, quality improvement programs, public health reporting, law enforcement investigations, coordination of benefits, medical management programs, and subrogation.

Medicare

Medical Effective Date Enrollee

ID

(Part A) (Part B)

Medicare

Hospital Effective Date

Name

Number

INFORMATION

MEDICARE

OTHER COVERAGE INFORMATION

OTHER INFORMATION

All Employees

I have read all of the statements contained in this application and declare that by signing this application the information I have provided is true and complete to the best of my knowledge. Electronic Signature Disclaimer: Please be advised that Aultra will not deny the enforceability or effect of an electronic signature solely because it is in an electronic format. Any valid signature provided in this section shall have the same legal effect and enforceability as a manually executed signature. I authorize deduction from my wages, as necessary, for any required premium for the coverage for which I have applied.

Signature Date

Employees Waiving Coverage

I have read all of the statements contained in this application and declare by signing that the information I have provided is true and complete to the best of my knowledge. I understand that I am eligible to apply for coverage through my employer. And I acknowledge that, subject to the terms and conditions of the policy, by waiving coverage at this time, I may not be able to enroll myself or my family again until the next annual enrollment period or a special enrollment period. I hereby decline coverage for (check all that apply): Myself Spouse Child(ren)

Reason for waiver of coverage:

Signature Spouse Signature Date

Per the 2015 FTC TCPA, Aultra or a vendor of Aultra, may contact you for demographic, satisfaction, and/or medical care management information in accordance with its obligation under Federal Law.

Please submit this form to Aultra by one of the following methods:

Email: aultcareeligibility@aultcare.com | Fax: 330-363-7746 | Mail: Aultra Member Services PO Box 6910 Canton, OH 44706

Cancellation/Continuation Notification

Please indicate all cancellations on this report. Do not make changes on the monthly premium statement. Utilize transaction codes for each change. Include enrollment form where indicated and provide within 31 days of event. *Signed enrollment forms must include spouse’s signature when applicable.

TRANSACTION CODES

Cancellation of Coverage:

A. Cancellation – Left Employment/Termination (Include in Comments section Termination Date & if Voluntary, Involuntary or due to Gross Misconduct)

B. Cancellation – Deceased (Specify Date of Death in Comments section)

C. Cancellation – Layoff (Include in Comments section the Date of Layoff & if Voluntary or Involuntary)

D. Cancellation - Waiving (Specify in Comments if waiving coverage, include Enrollment Form with waiver section signed*.)

E. Cancellation – Reduction in hours: no longer meets minimum eligibility requirements

Continuation of Coverage:

F. COBRA Coverage Elected (Include Expiration Date, Copy of signed election form & proof of first payment) (This is not necessary if Aultra administers the COBRA)

G. State Continuation of Coverage (For employers under 20 – please indicate expiration date of State Continuation of Coverage in the Comments section. Please include a signed Continuation of Coverage Election Form.)

Other:

H. Other (Include detailed explanation)

I understand Aultra is relying on my answers to the above questions to ensure overall compliance for my group health plan. I certify the answers are true to the best of my knowledge and belief. I also understand I am responsible for promptly notifying Aultra if any information changes.

Please submit this form to Aultra by one of the following methods:

Email: aultcareeligibility@aultcare.com | Fax: 330-363-7746 | Mail: Aultra Member Services PO Box 6910 Canton, OH 44706

Please contact Customer Service with any questions: 330-363-2050

ID NUMBER TRANS. CODE COVERAGE TYPE M-Medical, D-Dental, V-Vision COMMENTS Today’s Date: Employer: Group Numbers: Completed By:

EFFECTIVE DATE OF TRANSACTION EMPLOYEE NAME LAST,FIRST,M.

7033/20

Notice of HIPAA Special Enrollment Rights

We would like to take this opportunity to advise you of an important provision in your health care plan. To participate, you must complete an enrollment form. Dependent upon which specific plan you wish to enroll in, you may have to pay part of the premium through payroll deduction.

Additionally, HIPAA requires that we notify you of the “Special Enrollment Provision”.

Special Enrollment Provision

Loss of Other Coverage. If you decline enrollment for yourself or for another eligible dependent (including your spouse) while other health insurance or group health plan coverage is in effect, you may be able to enroll yourself and your dependents in this plan if you or your dependents lose eligibility for that other coverage (or if the employer stops contributing toward your or your dependents’ other coverage). However, you must request enrollment within 30 days after your or your dependents’ other coverage ends (or after the employer stops contributing toward the other coverage).

New Dependent by Marriage, Birth, Adoption, or Placement for Adoption. In addition, if you have a new dependent as a result of marriage, birth, adoption, or placement for adoption, you may be able to enroll yourself and your new dependents. However, you must request enrollment within 30 days after the marriage, birth, adoption, or placement for adoption.

To request special enrollment or to obtain more information about the plan’s special enrollment provisions, contact your AultCare Service Center at 330-363-6360 or 1-800-344-8858

Procedures for Requesting Certificate of Creditable Coverage/Certificate of Health Plan Coverage

HIPAA requires that plan sponsors and/or insurers provide a Certificate of Creditable Coverage/Certificate of Health Plan Coverage (HIPAA Certificate) to each individual who requests one, so long as it is requested while the individual is covered under the AultCare Health Plan or within 24 months of the individual’s coverage under the AultCare Health Plan ending. The request also can be made by someone else’s behalf for an individual. For example, an individual who previously was covered under the AultCare Health Plan may authorize a new plan in which the individual enrolls to request a certificate of the individual’s Creditable Coverage/Health Plan Coverage from the AultCare Health Plan. An individual is entitled to receive a Certificate upon request even if the AultCare Health Plan has previously issued a Certificate to that individual.

Requests for Certificates should be directed to AultCare Corporation, Attn: Member Services, P.O. Box 6910, Canton, Ohio 44706-0910 or by calling your AultCare Service Center at 330-363-6360 or 1-800-3448858.

Telephone requests are accepted only if the Certificate is to be mailed to the address the plan has on file for the individual to who the request relates. Other requests must be made in writing.

All requests must include:

The name of the individual for whom the Certificate is requested;

AultCare Group Number and Identification Number

P.O. Box 6910 | Canton, OH 44706

PHONE: 330-363-6360 | TOLL FREE: 1-800-344-8858

TTY LINE: 711

WEBSITE: www.aultcare.com

The last date that the individual was covered under the plan;

The name of the participant that enrolled the individual in the plan; and

A telephone number to reach the individual for whom the Certificate is requested.

Required written request must also include:

The name of the person making the request and evidence of the person’s authority to request and receive the Certificate on behalf of the individual

The address to which the Certificate should be mailed.

The requester’s signature

After receiving a request that meets these requirements, the plan will act in a reasonable and prompt fashion to provide the Certificate.

(Note: A preexisting condition exclusion does not apply to enrollees of AultCare plans that have renewed effective January 1, 2014 and after.)

The Certificate of Creditable Coverage/Health Plan Coverage can be used as proof of loss of coverage.

P.O. Box 6910 | Canton, OH 44706

PHONE: 330-363-6360 | TOLL FREE: 1-800-344-8858

TTY LINE: 711

WEBSITE: www.aultcare.com

HIPAA/Omnibus Rule and Self-Funded Group Health Plans

In regards to the Health Insurance Portability and Accountability Act of 1996 and the Omnibus Rule of 2013, employers who provide medical benefits to their employees using self-funded health plans need to be aware of their compliance responsibilities. This notification is intended to provide an overview for the employer sponsors of self-funded health plans.

All employer health plans are regulated by the Health Insurance Portability and Accountability Act of 1996 (HIPAA). The Omnibus Rule of 2013 strengthened the privacy and security rules of HIPAA.

HIPAA-covered entities, including self-funded group health plans, and their “business associates,” should review their responsibilities under HIPAA and the Omnibus Rule.

When an employer purchases insurance through a group policy, exposures and risks from different Protected Health Information (PHI) may occur. It is usually limited to enrollment and summary information used to shop for insurance.

However, when an employer funds the benefits, instead of purchasing the insurance, the employer can directly, or through its agent (Aultra), access its employees’ medical information and is responsible for complying with privacy and security rules.

These rules include:

Requirements regarding uses and disclosures of health information

Notification of breaches

Preparation and distribution of notices of privacy practices and procedures

Updating business associate agreements

Training personnel who have access to PHI

For more comprehensive information on the HIPAA and the Omnibus Rules, please contact your own company’s Benefits Counsel.

P.O. Box 6910 / Canton, OH 44706-0910

PHONE: 330-363-2050 / 1-855-270-8497 / FAX: 330-363-7717

WEBSITE: www.aultragroup.com

AultCare/Aultra Insurance Plans—Notice of Privacy Practices

Your Information. Your Rights. Our Responsibilities.

This Notice of Privacy Practices (NPP) describes how medical and claims information about you may be used and disclosed, how you can get access to your information, and your rights under HIPAA. Please review this NPP carefully. Feel free to share it with your family or personal representative.

Introduction

AultCare Insurance Company (dba AultCare HMO), which is part of an Organized Health Care Arrangement with AultCare Corporation, AultCare Health Insuring Corporation dba PrimeTime Health Plan, and Aultra Administrative Group (AultCare or We) is a Group Health Plan Covered Entity under HIPAA.

We’re committed to safeguarding the Privacy and Security of Protected Health Information of its enrollees and their eligible dependents (you) in paper (PHI) or electronic form (ePHI).

This NPP describes our HIPAA-compliant policies and procedures for the Use and Disclosure of your PHI/ePHI, including the use of PHI/ePHI for eligibility, enrollment, underwriting, claims processing, coordination of benefits, and payment of treatment under your group health plan in compliance with HIPAA’s Privacy and Security Rules (updated by the Omnibus Rule of 2013), the HITECH Act, and the Genetic Information Nondiscrimination Act (GINA).

You may access this NPP on our website www.aultcare.com. If you do not have a computer or internet access, or if you want a paper copy of this NPP, please call our Service Center at 330-363-6361 or 1-800-344-8858.

Not every use or disclosure of PHI, with or without a signed Authorization, is listed in this NPP. Uses or disclosures not specified in this NPP often require an Authorization. Please contact our Privacy Officer if you have a question, concern, or need further guidance.

Terms

Accounting. An Accounting is a list of disclosures of your PHI/ePHI we have made.

Authorization. An Authorization is a document signed and dated by the individual who authorizes the use or disclosure of PHI/ePHI for purposes other than treatment, payment, or healthcare operations.

Business Associates. We contract with outside business associates that may access, use, or disclose PHI/ePHI to perform covered services for us. Examples include auditing, accounting, accreditation, actuarial services, and legal services. Business associates must protect the privacy and security of your PHI/ePHI to the same extent we do. If a business associate delegates services to a subcontractor or agent, that subcontractor or agent also is a business associate that must comply with HIPAA.

Covered Entities Covered entities include health care providers (e.g. hospitals, doctors, nurses, nursing homes, home health agencies, durable medical equipment suppliers, other health care professionals and suppliers), and group health plans. AultCare is a group health plan covered entity.

Designated Record Set. A designated record set is a group of records containing PHI in paper or electronic form that we created and store. A designated record set include medical, healthcare and service records, billing, claims and payment information, eligibility and enrollment information, and other information we use to make decisions regarding the coverage and payment of medical care under your plan. Records created by others are not part of a designated record set.

1

Disclose. Disclose means our releasing, transferring, providing access to, or divulging PHI/ePHI to a third party, including covered entities and their business associates: (1) for treatment, payment, and health care operations; or (2) when you permit us by your signed authorization; or (3) as required by law.

Genetic Information. Genetic information includes genetic testing of the individual or family members.

Health Plan. Health plan means an individual or group health plan that provides, or pays the cost of, medical care and includes a health insurance issuer, HMO, Part A or B of Medicare, Medicaid, voluntary prescription drug benefit program, issuer of Medicare supplemental policy, issuer or a long-term care policy, employee welfare benefit plan, plan for uniformed services, veterans health care program, CHAMPUS, Indian health service program, federal employee health benefit program, Medicare Advantage plan, approved state child health plan, high risk pool, and any other individual or group health plans or combination that provides or pays for the cost of medical care. AultCare is a group health plan.

Health Care Operations Health care operations include quality assurance, performance improvement, utilization review, accreditation, licensing, legal compliance, provider/supplier credentialing, peer review, business management, auditing, enrollment, underwriting, stop-loss/reinsurance, and other functions related to your health plan, as well as offering and providing preventive, wellness, case management, and related services.

Individual. Individual means the enrollee or eligible dependent (including minors) to whom PHI belongs It also applies to your family member or personal representative acting on your behalf.

Minimum Necessary. We will limit the use or disclosure of your PHI/ePHI to the minimum needed to accomplish the intended purpose of the use, disclosure, or request.

Payment. Payment means the activities by a group health plan to obtain premiums or to determine or fulfill its responsibility for coverage and the provisions of benefits under your plan and includes eligibility or coverage determination, coordination of benefits, adjudication and subrogation of health benefit claims, billing, claims management, EOBs, health care data processing, reinsurance (including stop-loss and excess), determination of medical necessity, utilization review (including pre-certification and retrospective review), and related activities.

Personal Representative. Personal Representative means a person acting on behalf of the individual, including family, spouse, guardian, attorney-in-fact under a durable or general power of attorney, or friend assisting the individual with healthcare and payment decisions.

Protected Health Information (PHI/ePHI). PHI/ePHI means individually identifiable medical and health information regarding your medical condition, treatment of your medical condition, and payment of your medical condition, and includes oral, written, and electronically generated and stored information. PHI/ePHI excludes de-identified information or health information regarding a person who has been deceased for more than 50 years.

Treatment. Treatment means the provision, coordination, and management of health care and services by one or more health care providers, including referrals and consultations between providers or suppliers.

Use. Use means our accessing, sharing, employing, applying, utilizing, examining, or analyzing your PHI/ePHI within the AultCare organization for payment and health care operation purposes. Your PHI/ePHI is accessible only to members of AultCare’s workforce who have been trained in HIPAA Privacy and have signed a confidentiality agreement that limits their access and use of PHI/ePHI, according to the minimum necessary standard, to perform the authorized purpose.

2

Wellness Program. Wellness Program means a program that an employer has adopted to promote health and disease prevention, which is offered to employees as part of an employer-sponsored group health plan or separately as a benefit of employment.

Your Rights

When it comes to your health information, you have certain rights. This section explains some of your rights and our responsibilities.

You may get a copy or summary of your health and claims records:

You may ask to see or get a copy of your health and claims records and PHI kept in a designated record set Please call the Service Center to ask how to do this. There are some restrictions.

We will get you a paper copy or electronic version of your health and claims records, or give you a summary, usually within 30 days of your request. We may charge reasonable, cost-based fees.

You may ask us to correct your health and claims records:

You may ask us in writing to correct your health and claims records in a designated records set if you believe they are incorrect, inaccurate, or incomplete. Please call the Service Center or visit our website to get an amendment request form.

We may say “no” to your request, but we’ll tell you why in writing within 60 days.

You will have an opportunity to appeal.

You may request confidential communications of communications by alternative means:

You may ask us to contact you about claims, premiums, EOBs, or other matters about your health plan and coverage in a specific way, such as home phone, office phone, or cell phone, or by alternate means, such as an address different from your home or usual email address.

Let us know if you do not want us to leave any voice mail message.

Contact the Service Center to request. We will consider all reasonable requests.

You may ask us to limit (restrict) what we use or disclose:

You may ask us in writing not to use or disclose certain health information for treatment, payment, or operations. We may honor your request if you pay for treatment in full out-of-pocket.

Please call the Service Center for a restriction request form or visit our website.

While we will consider reasonable requests, we are not required to agree to your request. We may say “no” if restricting information could affect your care or if disclosure is required by law.

You may request a list (“Accounting”) of those to whom we’ve disclosed PHI/ePHI:

You may ask in writing for a list of disclosures of your PHI/ePHI (Accounting) for the six years prior to your request.

We will include all disclosures except for those about treatment, payment, and health care operations, and disclosures made to you or you authorized us to make. We’ll provide one accounting a year for free but will charge a reasonable, cost-based fee if you ask for another one within 12 months.

3

You may get a copy of this NPP:

You may ask for a paper copy of this NPP at any time, even if you have agreed to receive this NPP electronically. We will provide you with a paper copy promptly.

You may access electronic copy of this NPP on our website at any time.

You may choose someone to act for you:

You may choose a family member or personal representative to receive PHI/ePHI from us, exercise your rights, and make choices for you.

We will use reasonable efforts to confirm that the person is authorized to act on your behalf before we take any action.

You may file a complaint if you believe your rights have been violated:

If you believe your privacy or your HIPAA rights have been violated, we urge you to contact our privacy officer, either by calling the Service Center or filing a written complaint at AultCare, P.O. Box 6029, Canton, OH 44706.

We take all complaints very seriously. We will investigate and take appropriate action if needed.

You also may file a complaint with the U.S. Department of Health and Human Services Office for Civil Rights by sending a letter to 200 Independence Avenue, S.W., Washington, D.C. 20201, calling 1-877-6966775, or visiting www.hhs.gov/ocr/privacy/hipaa/complaints/.

We will never retaliate against you for filing a complaint, asking a question, or expressing a concern.

Communicating with You

This section describes how we may communicate with you, family members, or your personal representative.

Communicating with You:

We may communicate with you about claims, premiums, or other things regarding your health plan.

Communicating with Family or Others Involved In Your Care:

We may disclose your PHI/ePHI to designated family, friends, guardians, persons named in a durable or general power of attorney, personal representatives, or others assisting in your care or payment of claims.

Minors and Emancipated Minors:

We may disclose a minor’s PHI/ePHI to the minor’s parent(s) or guardian, unless there are legal or policy reasons not to.

We will not disclose PHI/ePHI to the parent(s) or guardian of an emancipated minor. A minor is emancipated if he/she: (1) does not live with his/her parent(s); (2) is not covered by parental health insurance; (3) is financially independent of parent(s); (4) is married; (5) has children; or (6) is in the military.

4

Deceased Enrollees:

If you die, we may disclose your PHI to the executor or administrator of your estate.

We may disclose PHI/ePHI to your spouse, family, personal representative, or others who were involved in your care or management of your affairs, unless doing so would be inconsistent with your wishes made known to us.

Uses and Disclosures

This section describes how we typically use or disclose your PHI/ePHI with and without an Authorization.

No Authorization Needed:

We will create, receive, or access your PHI/ePHI, which we may use or disclose to other covered entities for treatment, payment, and health care operations, without the need for you to sign an Authorization.

We will disclose PHI/ePHI needed to treat or authorize treatment. For example, a doctor or health facility involved in your care may request your PHI/ePHI to make treatment decisions covered by the plan.

We will use or disclose your PHI needed for payment. For example, we will use information about your medical procedures and treatment to process and pay claims, to determine whether services are medically necessary, and to pre-authorize or certify services covered by your health plan.

We may disclose PHI/ePHI to governmental or commercial health plans that may be obligated under coordination of benefit rules to process and pay your claims.

We will use and disclose your PHI/ePHI as necessary or required by law to administer your plan and for our health care operations. For example, we may use or disclose PHI/ePHI for underwriting purposes. We will not use or disclose genetic information for underwriting purposes.

We may disclose PHI/ePHI to business associates to perform covered services. It is not necessary for you to sign an Authorization for us to share PHI/ePHI with our business associates for covered services.

Authorization Needed:

We will not use or disclose your PHI/ePHI for any purpose other than treatment, payment, or healthcare operations without your signed HIPAA-compliant Authorization, unless required by law.

We will not disclose psychotherapy notes without a signed Authorization unless required by law.

We will not disclose your PHI/ePHI to your employer without your signed Authorization. We may disclose PHI/ePHI to the plan sponsor of your health benefit plan on condition that the plan sponsor certifies that it will maintain the confidentiality of PHI/ePHI and will not use PHI to make employment-related decisions or employee benefit determinations.

We will not release medical records if subpoenaed, unless you sign an Authorization, or the lawyers sign a qualified protective order, or if we receive a valid court or administrative order.

You may choose to receive information about health-related products or services or fundraising:

We may use your PHI/ePHI if we believe you may be interested in, or benefit from, treatment alternatives, wellness, preventive, disease management, or health-related programs, products or services that may be available to you as an enrollee or eligible beneficiary under your health plan. For example, we may use your PHI/ePHI to identify whether you have a particular illness, and contact you to let you know about a disease management program is available to help manage your illness.

5

Let us know if you do not want to be contacted or receive information about these services and programs. Opting out will not affect coverage or services.

We will not sell or disclose your PHI/ePHI to third-parties for marketing without your Authorization, which will indicate whether we are paid for selling PHI.

We may contact you about charitable fundraising. If you do not want to be contacted or receive fundraising materials, let our Service Center know. Opting out will not affect coverage or services.

Wellness Programs:

If you voluntarily choose to participate in a Wellness Program, you may be asked to answer questions on a health risk assessment (HRA) and/or undergo biometric screenings for risk factors,

Wellness Programs may also provide educational health-related information or services that may include nutrition classes, weight loss and smoking cessation programs, onsite exercise facilities, and/or health coaching to help employees meet their health goals.

If your employer has entered or may enter into a contract with us to perform services, as well as receive, collect, use, disclose, and store data in connection with a Wellness Program. We will protect the privacy of your PHI.

Use and Disclosure of Health Information Permitted or Required by Law

We may use or disclose PHI/ePHI, without your Authorization, as required by law, including, but not limited to:

Workers’ Compensation

Public health agencies

FDA and OSHA

Ohio Department of Insurance and other regulatory and licensing agencies

Armed Forces to assist in notifying family members of your location, general condition, or death

Law Enforcement

Homeland security

Emergency and disaster

Prevent threat of serious harm

Proof of immunization

Breach Notification

You have the right to notification if a breach of your PHI/ePHI occurs. We will promptly notify you by firstclass mail, at your last known address, or by email (if you prefer) if we discover a breach of unsecured PHI/ePHI, which includes the unauthorized acquisition, access, use, or disclosure of your PHI/ePHI, unless we determine through a risk analysis that a low probability exists that the compromise of your PHI would cause you financial, reputational, or other harm.

We will include in the breach notification a brief description of what happened, a description of the types of unsecured PHI involved, steps you should take to protect yourself from potential harm, a brief description of what we are doing to investigate the breach and mitigate any potential harm, as well as contact information for you to ask questions and learn additional information.

6

Changes to this NPP

This section describes how and when we may changes NPP and how we will inform you of any material changes.

We reserve the right to change this NPP at any time, which we may make effective for PHI/ePHI we already used or disclosed, and for any PHI/ePHI we may create, receive, use, or disclose in the future.

We will make material amendments based on changes in the HIPAA laws.

The revised NPP will be posted on our website www.aultcare.com. Copies of revised NPPs will be mailed to all enrollees covered by the plan, and copies may be obtained by mailing a request to: Privacy Coordinator, P.O. Box 6029, Canton, Ohio 44706.

If you have questions or need further assistance regarding this NPP, you may contact the Service Center at 330-363-6360 or 1-800-344-8858. If you are hearing impaired and have access to a TTY phone, you may reach us at our TTY line at 330-363-2393 or 1-866-633-4752. Our Service Center hours are from 7:30 a.m. to 5:00 p.m., Monday-Friday.

CT2:739688_v1

AultCare/Aultra General Tag Lines for the State of Ohio

English

If you, or someone you are helping, have questions about AultCare/Aultra you have the right to get help and information in your language at no cost. To speak with an interpreter, call Local: 330.363.6360 Outside Stark County: 1.800.344.8858 TTY Local: 330.363.2393 Outside Stark County: 1.866.633.4752

Spanish Español

Si usted, o alguien a quien usted está ayudando, tiene preguntas acerca AultCare/Aultra tiene derecho a obtener ayuda e información en su idioma sin costo alguno. Para hablar con un intérprete, llame al Local : 330.363.6360 Fuera del condado de Stark : 1.800.344.8858 TTY Local : 330.363.2393 Fuera del condado de Stark : 1.866.633.4752

Chinese 中文

如果您,或是您正在協助的對象,有關於AultCare/Aultra保险公司 方面的問題,您有權利免費以您的母語得到幫助和訊息。洽詢一位翻譯員,請撥電話本地:330.363.6360 斯塔克縣外: 1.800.344.8858 TTY線本地:330.363.2393斯塔克縣外:1.866.633.4752。

German

Deutsche

Falls Sie oder jemand, dem Sie helfen, Fragen zum AultCare/Aultra haben, haben Sie das Recht, kostenlose Hilfe und Informationen in Ihrer Sprache zu erhalten. Um mit einem Dolmetscher zu sprechen, rufen Sie bitte die Nummer Local: 330.363.6360 Außerhalb von Stark County : 1.800.344.8858 TTY –Linie Local: 330.363.2393

Außerhalb von Stark County : 1.866.633.4752 an.

Arabic

7

ةيبرعلا ةيبرعلا لكتةيانود نم كتغلبةيرورضلا تامولعملاو ةدعاسملا ىلعلوصحلا يف قحلا كيدل ، ب لصتا مجرتم عم ثدحتلل .ةف صوصخبةلئسأهدعاستصخش ىدل وأكيدلناكنإ نيمأتلاةكرش AultCare/Aultra كراتس ةعطاقمجراخ . 1.866.633.4752:يلحملا طخلا330.363.2393 TTY : كراتس ةعطاقمجراخ 1.800.344.8858

Pennsylvania Dutch Deitsch

Wann du hoscht en Froog, odder ebber, wu du helfscht, hot en Froog baut

AultCare/Aultra hoscht du es Recht fer Hilf un Information in deinre eegne Schprooch griege, un die Hilf koschtet nix. Wann du mit me Interpreter schwetze witt, kannscht du Local: 330.363.6360 Außerhalb von Stark County: 1.800.344.8858 TTY –Linie

Local: 330.363.2393 Außerhalb von Stark County : 1.866.633.4752 uffrufe.

Russian

русский

Если у вас или лица, которому вы помогаете, имеются вопросы по поводу Страховая компания

AultCare/Aultra, то вы имеете право на бесплатное получение помощи и информации на вашем языке. Для разговора с переводчиком позвоните по телефону Местный: 330.363.6360 Вне Старка County : 1.800.344.8858 TTY линия Местный: 330.363.2393 Вне Старка County : 1.866.633.4752.

French Français

Si vous, ou quelqu'un que vous êtes en train d’aider, a des questions à propos de Compagnie d'Assurance

AultCare/Aultra, vous avez le droit d'obtenir de l'aide et l'information dans votre langue à aucun coût. Pour parler à un interprète, Appelez Locale 330.363.6360 En dehors du comté de Stark : 1.800.344.8858 ligne ATS Local : 330.363.2393 En dehors du comté de Stark : 1.866.633.4752

Vietnamese

Việt Nam

Nếu quý vị, hay người mà quý vị đang giúp đỡ, có câu hỏi về Công ty Bảo hiểm AultCare/Aultra quý vị sẽ có quyền được giúp và có thêm thông tin bằng ngôn ngữ của mình miễn phí. Để nói chuyện với một thông dịch viên, xin gọi Địa phương: 330.363.6360 Bên ngoài của Stark County : 1.800.344.8858 TTY đường dây Địa phương: 330.363.2393 Bên ngoài của Stark County : 1.866.633.4752.

Cushite-Oromo

Isin yookan namni biraa isin deeggartan AultCare/Aultra, irratti gaaffii yo qabaattan, kaffaltii irraa bilisa haala ta’een afaan keessaniin odeeffannoo argachuu fi deeggarsa argachuuf mirga ni qabdu. Nama isiniif ibsu argachuuf, lakkoofsa bilbilaa Local: 330.363.6360 Outside of Stark County: 1.800.344.8858 TTY Line Local: 330.363.2393 Outside of Stark County: 1.866.633.4752 tiin bilbilaa.

Korean 한국어

만약 귀하 또는 귀하가 돕고 있는 어떤 사람이AultCare/Aultra 보험 회사 에 관해서 질문이 있다면 귀하는

그러한 도움과 정보를 귀하의 언어로 비용 부담없이 얻을 수 있는 권리가 있습니다. 그렇게 통역사와 얘기하기 위해서는 지역 : 330.363.6360 스타크 카운티 의 외부 : 1.800.344.8858 TTY 라인 지역 : 330.363.2393 스타크 카운티 의 외부 : 1.866.633.4752 로 전화하십시오.

Italian

Italiano

Se tu o qualcuno che stai aiutando avete domande su AultCare/Aultra, hai il diritto di ottenere aiuto e informazioni nella tua lingua gratuitamente. Per parlare con un interprete, puoi chiamare Locale: 330.363.6360 Al di fuori di Stark County : 1.800.344.8858 TTY linea Locale: 330.363.2393 Al di fuori di Stark County : 1.866.633.4752.

8

Japanese 日本語

ご本人様、またはお客様の身の回りの方でもAultCare/Aultra保険会社についてご質問がございましたら、 ご希望の言語でサポートを受けたり、情報を入手したりすることができます。料金はかかりません。通 訳とお話される場合、 ローカル:330.363.6360 スターク郡の外:1.800.344.8858 TTYラインローカル:330.363.2393 スターク郡の外: 1.866.633.4752までお電話ください。

Dutch Nederlands

Als u, of iemand die u helpt, vragen heeft over AultCare/Aultra, heeft u het recht om hulp en informatie te krijgen in uw taal zonder kosten. Om te praten met een tolk, bel Local : 330.363.6360 Buiten Stark County : 1.800.344.8858 TTY Line Local : 330.363.2393 Buiten Stark County : 1.866.633.4752.

Ukrainian український Якщо у Вас чи у когось, хто отримує Вашу допомогу, виникають питання про Страхова компанія

AultCare/Aultra, у Вас є право отримати безкоштовну допомогу та інформацію на Вашій рідній мові. Щоб зв’язатись з перекладачем, задзвоніть на Місцевий : 330.363.6360 Поза Старка County : 1.800.344.8858 TTY лінія Місцевий : 330.363.2393 Поза Старка County : 1.866.633.4752.

Romanian Română

Dacă dumneavoastră sau persoana pe care o asistați aveți întrebări privind Compania de Asigurari

AultCare/Aultra, aveți dreptul de a obține gratuit ajutor și informații în limba dumneavoastră. Pentru a vorbi cu un interpret, sunați la Locale : 330.363.6360 In afara Stark Judet : 1.800.344.8858 TTY linie Locale : 330.363.2393 In afara Stark Judet : 1.866.633.4752.

Non-Discrimination Notice:

AultCare/Aultra complies with applicable Federal civil rights laws and does not discriminate on the basis of race, color, national origin, age, disability, or sex. AultCare/Aultra does not exclude people or treat them differently because of race, color, national origin, age, disability, or sex. AultCare/Aultra provides free aids and services to people with disabilities to communicate effectively with us, such as: Qualified sign language interpreters and written information in other formats (large print, audio, accessible electronic formats, other formats). AultCare/Aultra provides free language services to people whose primary language is not English, such as: Qualified interpreters and information written in other languages.

If you need these services, or if you believe that AultCare/Aultra has failed to provide these services or discriminated in another way on the basis of race, color, national origin, age, disability, or sex, you can contact or file a grievance with the: AultCare/Aultra Civil Rights Coordinator, 2600 6th St. S.W. Canton, OH 44710, 330-3637456, CivilRightsCoordinator@aultcare.com. You can file a grievance in person or by mail, fax, or email. If you need help filing a grievance, our Civil Rights staff is available to help you.

You can also file a civil rights complaint with the U.S. Department of Health and Human Services, Office for Civil Rights electronically through the Office for Civil Rights Complaint Portal, available at https://ocrportal.hhs.gov/ocr/portal/lobby.jsf, or by mail or phone at: U.S. Department of Health and Human Services 200 Independence Avenue, SW Room 509F, HHH Building Washington, D.C. 20201 1-800-368-1019, 800-537-7697 (TDD). Complaint forms are available at http://www.hhs.gov/ocr/office/file/index.html.

9

Dear Member,

Aultra recognizes the importance of understanding your benefits as well as our operating procedures prior to your enrollment. This information would include, but is not limited to, the following:

Covered benefits

Non-covered benefits

Access to doctors, healthcare providers, and facilities (provider network)

Key medical management (Utilization Management) procedures

Potential network, service, or benefit restrictions

Pharmaceutical management procedures

Policies and practices regarding collection, use, and disclosure of Protected Health Information (PHI), including:

o Routine notification of privacy practices

o Use of authorizations

o Access to medical records

o Protection of oral, written, and electronic information across the organization

o Information for employers

To ensure this information is easily accessible to our potential members, we provide the information in our Member Guide, which is located on our website www.aultcare.com. The Member Guide can be found on the Members page under the Member Information section.

To request a printed copy of the Member Guide, please contact Customer Service at 330-363-2050 or 1800-270-8497. Representatives are available Monday-Friday from 7:30 am – 5:00 pm. (For hearingimpaired assistance, please call 711).

Sincerely,

Aultra Sales and Retention Departments

P.O. Box 6910 | Canton, OH 44706

PHONE: 330-363-2050

| TOLL FREE: 1-855-270-8497

| TTY: 711

FAX: 330-363-7717

WEBSITE: www.aultragroup.com

EMPLOYEE COUNT ANALYSIS

Various state and federal laws have requirements based on employee counts. When counting employees, it’s important to conduct a related employer analysis.

The information detailed below does not constitute legal advice and is intended only for informational purposes. Please reach out to your benefits counsel to discuss your individual circumstances.

1. RELATED EMPLOYER ANALYSIS requires counting all employees of all members of the employers in a controlled group of companies or affiliated service group to determine employee count. Below is a summary of those groups.Bank Name

A controlled group may exist when two or more companies have any of the following:

• A Parent-Subsidiary Relationship: Exists when one or more chains of organizations are connected through ownership of a common parent company and 80% or more of the voting power or total value of each member of the group is owned by another member of the group, except for the common parent.

• A Brother-Sister Relationship: Exists when at least 50% of the voting power or total value of two or more organizations is owned by the same 5 or fewer persons taking into account only the ownership of each such organization that is identical for each other organization.

• A Combination Relationship: Exists when two or more organizations are members of a group that has common ownership which includes both parent-subsidiary relationships and brother-sister relationships, in which case all such organizations are considered the same controlled group of business.

An affiliated service group may exist when two or more organizations have a service relationship and/or ownership relationship with one another as satisfied by 1 of 3 tests (A-Org Test; B-Org Test; or Management Group Test).

More information about Controlled and Affiliated Service Groups can be found in the following IRS publication: https://www.irs.gov/pub/irs-tege/epchd704.pdf

2. GROUP SIZE FOR A FULLY INSURED PLAN OFFERING UNDER OHIO LAWnk Name

Under Ohio law, a small, Ohio-based employer, for purposes of a group health plan and with respect to a calendar year and a plan year, is an employer who employed an average of at least two but no more than fifty eligible employees on business days during the preceding calendar year and who employs at least two employees on the first day of the plan year. With “Eligible Employee” being defined as an employee who works a normal work week of thirty or more hours. Eligible employee does not include a temporary or substitute employee, or a seasonal employee who works only part of the calendar year on the basis of natural or suitable times or circumstances. Ohio Rev. Code § 3924.01

3. CONSOLIDATED OMNIBUS BUDGET RECONCILIATION ACT (COBRA) ANALYSIS

COBRA generally applies to all private sector group health plans as well as plans sponsored by state and local governments. To be subject to COBRA, employers need to have at least 20 employees on more than 50% of their typical business days in the previous calendar year. When counting employees for COBRA purposes, both full- and part-time employees are counted, taking into consideration the above Related Employer Analysis. Each part-time employee counts as a fraction of a full-time employee. The fraction should be equal to the number of hours worked divided by the number of hours required to be considered full-time. (For example, a company requires a full-time employee work 40 hours a week. A part-time employee who works 20 hours a week is considered ½ of a full-time employee.) If you have fewer than 20 employees, you may be subject to state continuation of coverage requirements under ORC 3923.38 depending on whether your group health plan is subject to state regulation. These plans typically include Insured, MEWA plans, and self-funded public employers.

For more information, visit https://www.dol.gov/sites/dolgov/files/EBSA/about-ebsa/our-activities/resource-center publications/anemployers-guide-to-group-health-continuation-coverage-under-cobra.pdf

7774/22

MEDICARE SECONDARY PAYER (MSP) ANALYSIS

MSP is a federal law that requires Medicare pay secondary to group health plans unless certain circumstances apply. These exceptions are based on group size and the scenarios are listed below. This is not intended to be a comprehensive guide to the MSP law. As an employer group sponsoring a group health plan, you are required to maintain documentation regarding your total employee counts during the year. Please use the above Related Employer Analysis to report your employee count.

If Medicare requests a review of MSP status, AultCare will reach out to obtain information regarding your group size during the period in question. Medicare can inquire about claims that are several years old, so it’s imperative to maintain accurate records.

MSP SUMMARY RULES

Medicare Beneficiary

Age 65 or older (employee or spouse) and group health plan due to current employment of the Medicare beneficiary or the beneficiary’s spouse

Age 65 or older (employee or spouse) and group health plan not due to current employment (e.g. through a retiree health plan or COBRA) of the Medicare beneficiary or the beneficiary’s spouse

Disabled under age 65 (employee, spouse, or dependent) and group health plan due to current employment of the Medicare beneficiary or the beneficiary’s spouse or parent

Employer Characteristics

Employer with fewer than 20 employees

Employer with at least 20 employees full or part-time in at least 20 weeks of the preceding or current year (the 20 weeks do not have to be consecutive)

Primary Payer Secondary Payer

Medicare Group Health Plan

Group Health Plan

Medicare

All employers regardless of the number of employees Medicare Group Health Plan

Disabled under age 65 (employee, spouse, or dependent) and group health plan not due to current employment (e.g. through a retiree health plan or COBRA) of the Medicare beneficiary of the beneficiary’s spouse or parent

ESRD patient (employee, spouse, or dependent) during the first 30 months of Medicare ESRD coverage

During at least half the year of the employer’s regular business days in the previous calendar year, the employer had:

Employer with fewer than 100 employees

Employer with at least 100 employees during at least half the year of the employer’s regular business days in the previous calendar year

All employers regardless of the number of employees

Medicare Group Health Plan

Group Health Plan

Medicare

ESRD patient (employee, spouse, or dependent) regardless of age beginning with the 31st month of Medicare ESRD coverage

All employers regardless of the number of employees

If, when ESRD coverage begins, the employer plan is already primary payer according to MSP provisions

If, when ESRD coverage begins, the employer plan is correctly secondary payer because it is not subject to the applicable MSP provisions for working aged or for disability

All employers regardless of the number of employees

Medicare

Group Health Plan

Group Health Plan (Active and COBRA coverage)

Medicare

Medicare

Medicare, regardless of coverage for age 65 or disability, for the duration of ESRD coverage

Group Health Plan (Active and COBRA coverage)

Group Health Plan (Active and COBRA coverage)

More information about Medicare Secondary Payer rules can be found in the following publication: https://www.cms.gov/Outreach-and-Education/Medicare-Learning-Network-MLN/MLNProducts/Downloads/MSP_Fact_Sheet.pdf

4.

ANNUAL DETERMINATION OF GROUP SIZE DEMOGRAPHICS

1. RELATED EMPLOYER ANALYSIS

Does the attached Related Employer Analysis define your company as part of a controlled group or affiliated service group?

Yes No

a. If yes, list the other Related Employer name(s):_________________________________________________________

b. If yes, consider that fact when answering all of the questions below.

2. GROUP SIZE FOR A FULLY INSURED PLAN OFFERING UNDER OHIO LAW*

For Ohio-based employer plans, provide the number of employees in the preceding calendar year that worked at least 30 hours during a normal work week? (Note: If your answer is between 2 to 50 employees, you will be offered a Small Group or MEWA plan option.)

*Self-funded plans or employers outside Ohio may skip this question.

3. CONSOLIDATED OMNIBUS BUDGET RECONCILIATION ACT (COBRA) ANALYSIS

To determine the appropriate continuation of coverage (COBRA vs State Continuation) provide the following counts for 50% of the typical business days in the previous calendar year:

Full-time ________ Part-time (Each is counted as a fraction of a full-time employee.) ________

Total number of employees ________

4. MEDICARE SECONDARY PAYER (MSP) ANALYSIS

a. Did you (including all Related Employers) have 100 or more full-time, part-time, seasonal employees or partners on 50 percent or more of your business days during:

The current calendar year? Yes No

The preceding calendar year? Yes No

b. Did you (including all Related Employers) have 20 or more full-time, part-time, seasonal employees, or partners for each working day in each of 20 or more calendar weeks (weeks do not have to be consecutive) during:

The current calendar year? Yes No

The preceding calendar year? Yes No

If you checked “Yes” for the current calendar year, and the 20-employee threshold was met during the current year, provide the date:_________________.

I understand AultCare is relying on my answers to the above questions to ensure overall compliance for my group health plan. I also understand the information submitted will be used to determine: whether Medicare will be the primary payer of claims for my Medicare-eligible insured(s), employer size for continuation of coverage, and employer size status under State and Federal regulations. I certify the answers are true to the best of my knowledge and belief. I also understand I am responsible for promptly notifying AultCare (as indicated above) if my answers to any of these questions change because our organization has increased or decreased the number of employees. I understand that CMS penalties may apply. Signature of Company Officer or Authorized Representative Print Name Title

7775/22

_____________

Daily Contact Email Address Date Executive Email Address Return to: AultCare Insurance Company Attn: Retention Department | P.O. Box 6910, Canton, OH 44706 | retention@aultcare.com

/ Legal

of Company Group Number Employer Identification Number (EIN/TIN)

Employer Name

Name

Specific Participant Notices and Disclosures Under Health Care Reform

The following provides a checklist of the specific notices and disclosures under health care reform. For each topic, we provide a citation to the statutory provision, a description of the notice or disclosure, effective date/timing of distribution, and who is required to comply.

Citation to Statutory Provision Description of Notice or Disclosure

Exchange Notice [FLSA§ 18B]

Patient protections [PHSA § 2719A]

Rescissions Prohibition [PHSA § 2712]

Information Reporting of Minimum Essential Coverage

MEC (Insurers and Employers That Self- Insure) [Code § 6055]

Information Reporting of Employer-Sponsored Coverage (Applicable Large Employers ALE) [Code § 6056]

Summary of Benefits and Coverage (SBC) & Glossary of Terms & Notice of Material

Modifications to SBC {SMM} [PHSA § 2715]

Information on Exchanges and the consequences if employee purchases a QHP through Exchange in lieu of employersponsored coverage

Choice of primary care provider/ pediatrician (if plan requires or allows for this) and OB/GYN care without referral (if applicable, include in SPD or any description of benefits)

(Notice of the right to designate any participating PCP; designate a pediatrician as PCP for any child and obtain OB/GYN care without PA or referral)

30 day advance notice of retroactive cancellation or discontinuance of coverage (permitted only in limited circumstances such as fraud or misrepresentation of a material fact upon event or on request)

Forms 1094-B directly to IRS and 1095-B to covered employee

Written statement of health coverage provided

Forms 1094-C directly to IRS and 1095-C to the covered employee

Written statement of health coverage provided

SBC must meet certain appearance, language, and content requirements & 60-day advance notice required for material modifications not reflected in most recent summary

Date/Timing Required to Comply

To new employees hired after October 1, 2013, within 14 days of their start date

Employers subject to FLSA

9/23/10

After 9/23/10

Generally, annually on or before 1/31 after calendar year in which coverage was provided

Generally, annually on or before 1/31 after calendar year in which coverage was provided

Distribution starting with first open enrollment

beginning on or after 9/23/12; Exchange/FFM notice must occur within 14 days after start date

Group health plans and insurers (n/a to grandfathered plans or coverage)

Group health plans and insurers

For Insurers, sponsors of self-insured plans, and other entities providing “minimum essential coverage”

Applicable large employers

Group health plans and insurers

Group Health Plans: Federal Mandates Other

Than COBRA

& HIPAA

Mental Health Parity

• Under the MHPA/MHPAEA, cost-exemption notices notifying participants and beneficiaries of the plan’s reliance on the increased cost exemption, including among other things, a statement regarding the availability upon request of a summary of the information on which the exemption was based (required only if plan claims exemption) Triggered only if plan claims the exemption from MHPAEA Provide upon event (must provide a 30 days advance notice to participants, beneficiaries and DOL) or on request

• Opt-out notices notifying enrollees of opt-out by selffunded non-federal governmental plan, annually and upon enrollment

• Employer Health Plans must provide a comparative analysis of the application of Non-Quantitative Treatment Limits (NQTLs) to Mental Health/Substance Use benefits in comparison to Medical/Surgical benefits to ensure parity exists.

Women’s Health and Cancer Rights Act (WHCRA)

• Enrollment notices notifying participants of WHCRA rights included upon initial enrollment, if not included in an SPD that is distributed upon initial enrollment

• Annual notices notifying participants of WHCRA rights, if not included in an SPD that is distributed annually

• Opt-out notices notifying enrollees of opt-out by selffunded non-federal governmental plan, annually and upon enrollment Plans

Newborns’ and Mothers’ Health Protection Act (NMHPA)

• Include in the SPD – Must describe, with respect to childbirth hospital stay for mother and newborn the applicable State or Federal requirements and the plan’s coverage – use DOL model language

• Opt-out notices notifying enrollees of opt-out by selffunded non-federal governmental plan, annually and upon enrollment

Patient Protections Under Health Care Reform

• Written notice of the right to designate a primary care provider or pediatrician and to obtain obstetrical or gynecological care without preauthorization or referral must be provided not later than the first day of the first plan year beginning on or after September 23, 2010, and with SPD

Surprise Billing

• Employer Health Plans must provide to participants, in plain language, information regarding balance billing protections in both emergency and certain nonemergency situations. The information must be listed on the plan’s website and on all EOBs.

Cost Transparency Rules

• Employer Health Plans must make available to members price comparison information. The information must be accessible in an internet-based self-service tool (or paper upon request). By January 1, 2023, plans must have price comparison information for 500 items and services as described in regulation. By January 1, 2024, all other items and services must be accessible through the internet tool.

Group Health Plans: Federal Mandates Other

Member ID Cards

• Must list the plan’s deductible and out-of-pocket information, as well as, the plan’s contact information.

Continuity of Care

• Employer Health Plans must continue to cover certain benefits on an in-network basis when a provider or facility ceases to be in-network. Will require COBRAlike provisions, with plan notifying enrollee of right to obtain this benefit and enrollee electing the benefit. Generally applicable for serious and complex (or terminal) medical conditions.

Provider Directory and Coverage Information Requests

• Employer Health Plans must create a database on a public website that includes a list of providers and facilities that are in-network. Information must be verified and updated every 90 days (to remove providers who have left network.) If information that plans provide about in-network status is incorrect, the plan enrollee may be protected from higher cost-sharing amounts.

Americans with Disabilities Act (ADA)

• EEOC notice of rights to be posted on employer’s premises