ADMINISTRATIVE MANUAL

Contact Information

Website Information

Enrollment Information

Monthly Invoices

Enrollee Questionnaires and Forms

Summary of Benefits Coverage Guidelines

Contact Information

Website Information

Enrollment Information

Monthly Invoices

Enrollee Questionnaires and Forms

Summary of Benefits Coverage Guidelines

Company representatives* should contact the Sales and Retention Department to request new enrollment packets and any other issues not listed below.

Phone: 330-363-6390

Fax: 330-454-7845

Company representatives and employees should contact Customer Service for questions regarding benefits your plan covers or an outstanding claim. An AultCare Service Representative is available Monday through Friday 7:30 am to 5:00 pm.

Phone: 330-363-6360 or 800-344-8858

TTY: 711

Fax: 330-438-9804

Email: insuredservice@aultcare.com

Company representatives may contact the Billing Department with questions regarding to monthly invoices.

Phone: 330-363-6360

Fax: 330-363-5012

Company representatives may contact the Member Services/Eligibility Department with enrollment questions.

Phone: 330-363-6360

Fax: 330-363-7746

Email: aultcareeligibility@aultcare.com

» Visit our website at www.aultcare.com

*Company representatives are individuals authorized to request information on behalf of the company.

Welcome to our AultCare family. Whether you are a new client, or have been with us for many years, we are proud to assist you managing your employer account.

We have created an area on www.aultcare.com designed just for you. You can use the online account to retrieve monthly reporting and invoices send us files, view your group’s eligibility, order ID cards, and more.

To get started, you and each authorized representative, must register for a secured, online account. Once you have created an online account, use this document to learn how to retrieve files from your online account.

If you have questions, you can contact your Account Coordinator, Account Executive, or for technical assistance, email the AultCare Web Team at AultConnect@AultCare.com.

Helpful links:

• Frequently Asked Questions

• Website How to Guides

Thank you, Your AultCare Team

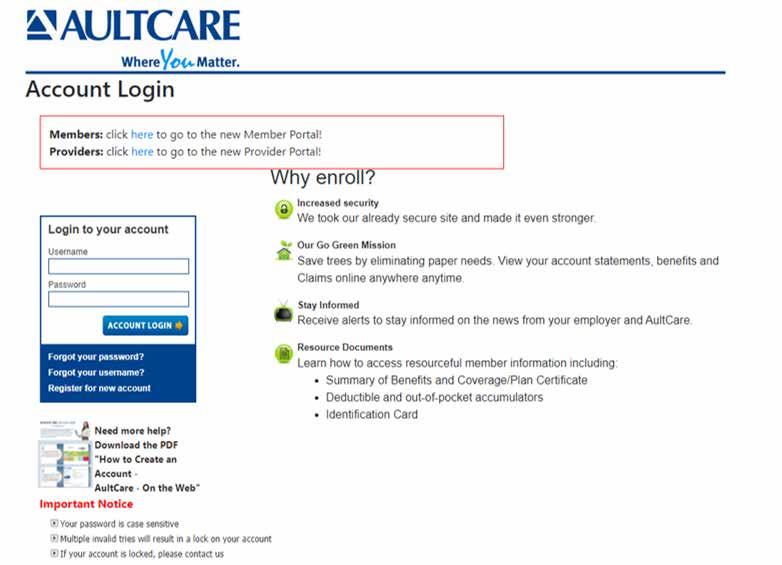

• Open a web browser and go to www.aultcare.com

• Click Account Login in the upper right corner and select ‘Employer’ from the drop down menu.

• Then click on the “Register for a new account” link.

• Select “Employers” as your “Membership Type” and click on the “SIGN UP NOW” button.

1. Select “I Agree” to agree with the “Terms of service” outlined on this page.

2. By entering your name next to the “By” textbox, you are signing your signature.

Step # 1

You must agree with our “Terms of Service” before you can create an account with us.

Click on “CONTINUE” button to proceed.

1. Select “I Agree” to agree with the “Terms of service” outlined on this page.

2. By entering your name next to the “By” text-box, you are signing your signature.

Click on “CONTINUE” button to proceed.

Step # 2

Enter the following information

Your first name

Your middle initial

Your last name

A phone number where we can reach you

The title of your position at your company

Click on “CONTINUE” button to proceed.

Step # 2

Enter the following information

• First Name

• Middle Initial

• Last Name

• A phone number where we can reach you

• The title of your position at your company

Click on “CONTINUE” button to proceed.

2. Enter the name of the person you know at AultCare; (e.g. Group

Click on “CONTINUE” button to proceed.

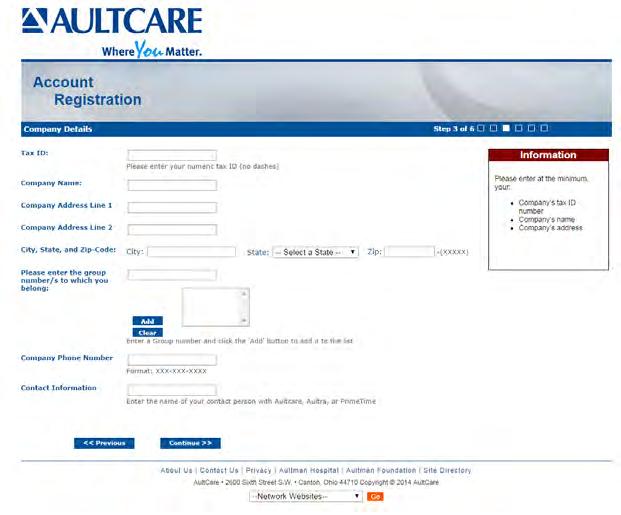

1. Enter the 9 digit Tax ID number of your company (without the dash)

2. Enter the name of your company

3. Enter the street address, city and state of your company

1. Enter the Group Number of your company

2. Click “Add” button

3. The Group Number will then appear in a list box underneath

4. If you need to add more groups, repeat the steps in this section

Optional

the following information: for your account enter a username, the system will tell you if it is already taken or not. If the is already taken, please choose and enter a different username. for your account

password that you choose should consist of: characters least one uppercase character and one lowercase character least one number

If you already know someone at AultCare (e.g Account Coordinator), you can help us expedite the verification process for your employer account by supplying the following ”optional” information:

email address

1. Enter your phone number

enter correct email address. We will use this email to communicate with you.

2. Enter the name of the person you know at AultCare; (e.g., Group Account Coordinator)

Click on “CONTINUE” button to proceed.

security questions with answers select your security questions carefully. We will ask you these questions if you forget username and/or password. CONTINUE” button to proceed.

Enter the following information:

When you enter a username, the system will tell you if it is already taken or not. If the username is already taken, please choose and enter a different username.

8

The password you choose should consist of:

» 8 characters

» At least one uppercase character and one lowercase character

» At least one number

Please enter your email address. We will use this email to communicate with you.

Please select your security questions carefully. We will ask you these questions if you forget your username and/or password.

Click on “CONTINUE” button to proceed.

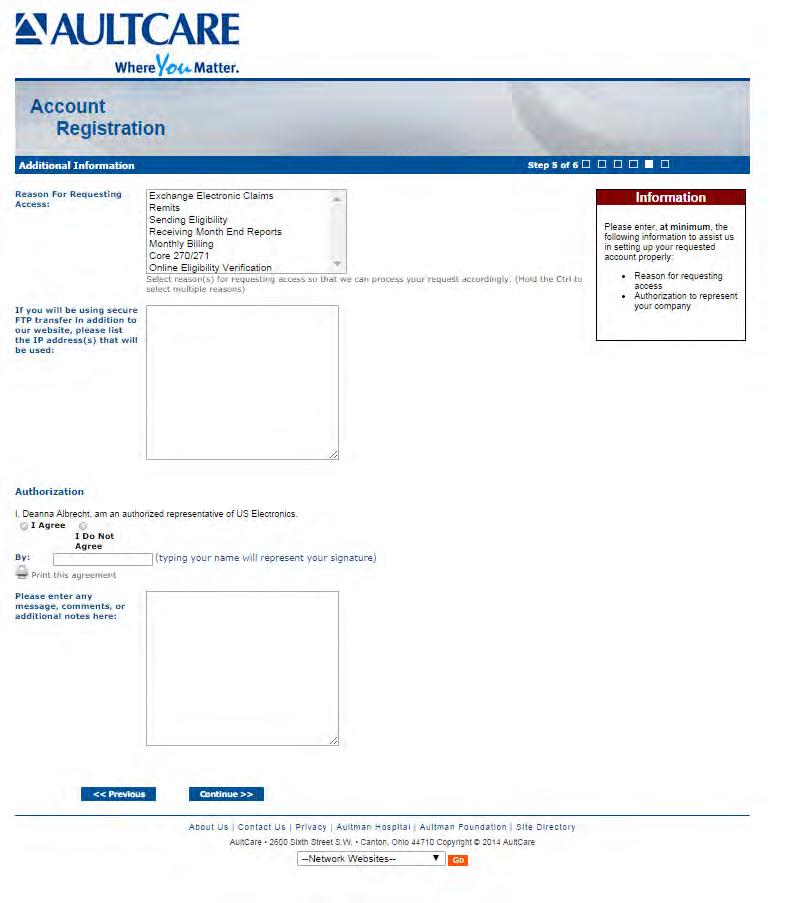

1. Reason for requesting access

Select your reason(s) for requesting access. You can select more than one reason.

2. SFTP IP Addresses

If you will be using secure FTP transfer in addition to our website, please list the IP address(s) that will be used.

3. Authorization to represent your company

Select “I Agree” to state you are an authorized representative of the company you are applying for this account.

Sign your name electronically by entering your name in “By” textbox.

Optional on this page

If you need to send us a message or have a question, enter it in the comments box. Click on the “CONTINUE” button to proceed.

This is the final page of your account registration process. You must agree to the Trading Partner Agreement specified on this page. You can print this agreement by clicking on “Print this agreement.”

From this page:

1. Select “I Agree” to agree to the “Trading Partner Agreement” outlined on this page.

2. Indicate your approval by entering your name in “By:” textbox.

Click on the “FINISH” button to proceed.

Upon successful completion of your account registration, you will see the following message: Thank you for the submission of your registration request. You will receive an email advising on the next steps to complete the process.

• Upon completion of the registration process, you should receive an email stating the registration process has been completed. (Note: At this time, your account is not active yet)

• We will review the application and finish with the account setup process.

• When your account setup has been completed, you will receive an email informing you your account has been set up and is ready for use. (Note: At this time, the process is complete, and you will be able to login to our website)

If you have questions, you can contact your group coordinator, or for technical assistance, email the AultCare Web Team at aultconnect@aultcare.com

1. Visit www.aultcare.com.

2. Click Account Login on the homepage and select Employer.

3. Enter your username and password. Click Account Login to access your account.

4. You must have an online account to retrieve files. Select Register for new account if you do not have an account.

Once you are logged into your account, your dashboard will appear. All links associated to your account will be displayed. In the screenshot below, three main areas have been identified.

• Location A lists the last three (3) files AultCare has posted for you. These are on your dashboard so you can easily view these files.

• Location B is a link. This link will take you to your Secure FTP Center. The FTP Center allows you to download all files AultCare uploaded to your account. This is where you can upload files to AultCare.

• Location C is a link similar to Area B. It will take you to the same place and files as Location B.

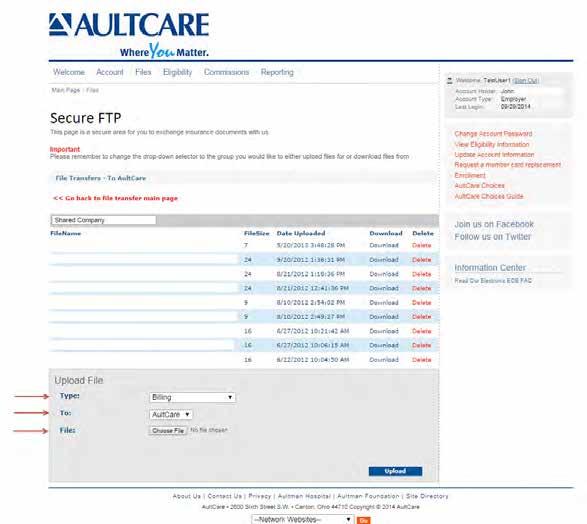

When you click on the Files link from your dashboard (Location C in the example) you will be directed to the Secure FTP Center (see image below). You will see two links: Files for you and Files from you.

Files for you

This link will show all of the files AultCare uploaded to your account. Retrieve your files by clicking on this link. The number displayed is the number of available files.

Files from you

This link will take you to a page where you can upload files to AultCare.

Click on the text labeled Download files that have been posted for you

When you click the link, a dropdown list will appear. From the list, select the group name to view files. (Based on your authorization, only those particular group names will be displayed.)

For employers who have more than one AultCare account, select the appropriate account from the drop down box.

Once you see a list of files, click on the Download link to view/download it on your computer.

1. Click the link labeled Click here to upload files.

An example of the upload center is shown to the right.

2. Select the group number associated with your file upload.

3. Select the specific file type.

4. Browse for the file you want to upload on your computer.

5. Select Upload.

Previously Uploaded Files

You can also see files previously uploaded.

If you have questions, contact your group coordinator, or for technical assistance, email the AultCare Web Team at AultConnect@AultCare.com.

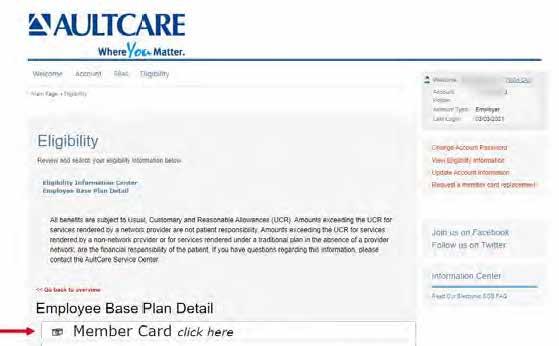

Log in to your employer secured account and select Eligibility.

Click Search to view a list of active members.

Select a name to view the member’s ID card.

To view a copy of the member ID card, select this link: Member Card click here.

» Cancellation/Continuation Notification

All employee changes, additions, and deletions are to be submitted on a Cancellation/Continuation Notification Form. Please be sure your company’s name and group number on each sheet. Refer to the Transaction Codes listed at the bottom of the form and include an Enrollment Application/Change Form (see explanation below) when indicated.

» Enrollment Application/Change Form

Whenever an addition or change is made on the Cancellation/Continuation Notification Form, it is also necessary to have the employee complete an Enrollment Application/Change Form. Be sure to have all new employees and those employees requesting a change in their coverage complete the entire form unless otherwise instructed to prevent delays. If an employee and/or dependent was covered by a prior health plan, attach a Creditable Coverage Letter provided by the former carrier. If this information is not provided, AultCare will not be able to credit the system for the amount of time they were insured.

If you have any questions, please contact the AultCare Customer Service. Once completed, these forms may be mailed to: AultCare Eligibility Department

PO Box 6910 Canton, OH 44706

Forms may also be faxed directly to our Eligibility Department at 330-363-7746. Forms may also be emailed to aultcareeligibility@aultcare.com. All changes must be received by the 10th of the month to be reflected on your next bill.

» MEWA Fact Sheet

» HIPAA Disclosure Form/Notice of Privacy Practice

/Member Guide Letter

The attached enclosures must be given to any potential AultCare enrollee in addition to the Group Employee Application so the person understands portability and creditable coverage.

» Getting the Most From Your Health Plan

Please indicate all cancellations on this report. Do not make changes on the monthly premium statement. Utilize transaction codes for each change. Include enrollment form where indicated and provide within 31 days of event. *Signed enrollment forms must include spouse’s signature when applicable.

TRANSACTION CODES

Cancellation of Coverage:

A. Cancellation – Left Employment/Termination (Include in Comments section Termination Date & if Voluntary, Involuntary or due to Gross Misconduct)

B. Cancellation – Deceased (Specify Date of Death in Comments section)

C. Cancellation – Layoff (Include in Comments section the Date of Layoff & if Voluntary or Involuntary)

D. Cancellation - Waiving (Specify in Comments if waiving coverage, include Enrollment Form with waiver section signed*.)

E. Cancellation – Reduction in hours: no longer meets minimum eligibility requirements

Continuation of Coverage:

F. COBRA Coverage Elected (Include Expiration Date, Copy of signed election form & proof of first payment)

G. State Continuation of Coverage (For employers under 20 – please indicate expiration date of State Continuation of Coverage in the Comments section. Please include a signed Continuation of Coverage Election Form.)

Other:

H. Other (Include detailed explanation)

I understand AultCare is relying on my answers to the above questions to ensure overall compliance for my group health plan. I certify the answers are true to the best of my knowledge and belief. I also understand I am responsible for promptly notifying AultCare if any information changes.

Please submit this form to AultCare by one of the following methods: Email: aultcareeligibility@aultcare.com | Fax: 330-363-7746 | Mail: AultCare Member Services PO Box 6910 Canton, OH 44706

7121/21

Please contact Customer Service with any questions: 330-363-6360

Upon your effective date with this plan, will you or any of your family members have other health insurance? YES NO

If yes, what is the name of the other insurance company?

If yes, what type(s) of other health insurance will you have? Check all that apply Medical Dental Rx Vision

Do you or your spouse or any enrolled dependents have Medicare coverage? YES NO

If yes, please provide information below.

Do you have Medicare Part D coverage? YES NO If yes, what is the effective date of your coverage?

Do you, or any of your dependents, have any cultural or linguistic needs? YES NO

If yes, what are they?

I am applying for group health coverage through AultCare Insurance Company and its related entities (“AultCare”). I acknowledge the coverage for which I am applying is subject to eligibility requirements and the terms of the policy. I acknowledge that I have read and understood all of the information contained within this document. Additionally, I acknowledge that all information that I have entered in this application, to the best of my knowledge, is complete, true, and accurate. I understand that any attempt to mislead or defraud AultCare is considered insurance fraud.

INSURANCE FRAUD WARNING: Any person who, with intent to defraud or knowing that he or she is facilitating a fraud against an insurer, submits an application or files a claim containing a false or deceptive statement is guilty of insurance fraud.

I acknowledge that AultCare may use and disclose my protected health information, as well as, the protected health information of my family for payment, treatment, and operations. This information may be disclosed to other insurance companies, third party administrators, state and federal agencies, health care providers and other organizations and persons that perform professional, business, or insurance functions for AultCare, as permitted by state and federal law.

The information may be used for, but not limited to, processing enrollment applications, risk classifications, detecting or preventing fraud, internal and external audits, claims administration, case management, quality improvement programs, public health reporting, law enforcement investigations, coordination of benefits, medical management programs, and subrogation.

I have read all of the statements contained in this application and declare that by signing this application the information I have provided is true and complete to the best of my knowledge. Electronic Signature Disclaimer: Please be advised that AultCare will not deny the enforceability or effect of an electronic signature solely because it is in an electronic format. Any valid signature provided in this section shall have the same legal effect and enforceability as a manually executed signature. I authorize deduction from my wages, as necessary, for any required premium for the coverage for which I have applied.

Signature Date

Employees Waiving Coverage

I have read all of the statements contained in this application and declare by signing that the information I have provided is true and complete to the best of my knowledge. I understand that I am eligible to apply for coverage through my employer. And I acknowledge that, subject to the terms and conditions of the policy, by waiving coverage at this time, I may not be able to enroll myself or my family again until the next annual enrollment period or a special enrollment period. I hereby decline coverage for (check all that apply): Myself Spouse Child(ren)

Reason for waiver of coverage:

Signature Spouse Signature Date

Per the 2015 FTC TCPA, AultCare or a vendor of AultCare, may contact you for demographic, satisfaction, and/or medical care management information in accordance with its obligation under Federal Law.

Please submit this form to AultCare by one of the following methods: Email: aultcareeligibility@aultcare.com | Fax: 330-363-7746 | Mail: AultCare Member Services PO Box 6910 Canton, OH 44706

Please indicate all cancellations on this report. Do not make changes on the monthly premium statement. Utilize transaction codes for each change. Include enrollment form where indicated and provide within 31 days of event. *Signed enrollment forms must include spouse’s signature when applicable.

Cancellation of Coverage:

A. Cancellation – Left Employment/Termination (Include in Comments section Termination Date & if Voluntary, Involuntary or due to Gross Misconduct)

B. Cancellation – Deceased (Specify Date of Death in Comments section)

C. Cancellation – Layoff (Include in Comments section the Date of Layoff & if Voluntary or Involuntary)

D. Cancellation - Waiving (Specify in Comments if waiving coverage, include Enrollment Form with waiver section signed*.)

E. Cancellation – Reduction in hours: no longer meets minimum eligibility requirements

Continuation of Coverage:

F. COBRA Coverage Elected (Include Expiration Date, Copy of signed election form & proof of first payment)

G. State Continuation of Coverage (For employers under 20 – please indicate expiration date of State Continuation of Coverage in the Comments section. Please include a signed Continuation of Coverage Election Form.)

Other:

H. Other (Include detailed explanation)

I understand AultCare is relying on my answers to the above questions to ensure overall compliance for my group health plan. I certify the answers are true to the best of my knowledge and belief. I also understand I am responsible for promptly notifying AultCare if any information changes.

Please submit this form to AultCare by one of the following methods:

Email: aultcareeligibility@aultcare.com | Fax: 330-363-7746 | Mail: AultCare Member Services PO Box 6910 Canton, OH 44706

Please contact Customer Service with any questions: 330-363-6360

Please complete this form in its entirety.

This section is to be completed by the employer representative.

List all AultCare group numbers that apply. (Medical, Dental, Vision)

Employee Location/Job Classification

Use this section to designate an employee classification, if needed. These designations should be set-up as rate codes during the implementation of your plan. (Example: hourly vs. salary; executive or management; physical plant location.)

Designate if the employee is accessing an out-of-area network. (Cigna, First Health Network, etc.)

AultCare Effective Date

Provide the date the coverage is set to begin.

This section is to be completed by the employee. EMPLOYEE COVERAGE ELECTION

New Group New Hire Open Enrollment

Waiving Coverage

Designate the reason for applying for coverage or if coverage is being waived. If waiving coverage, a signature is required on the back of this form.

Qualifying Event — Explain:

Hire

If the original hire date is not available, please provide the month and year.

Medical

Plan Requested: Plan Name

Use this section to designate the employee’s plan election. (Example: PPO, HDHP or OPT 1, OPT 2, etc.)

ADDITIONAL COVERAGE FOR DEPENDENTS

Benefits Selected (M,D,V,R)

Please provide the reason code for enrolling or disenrolling dependents.

Social Security Number

SSN are required for all dependents with coverage.

List all that apply.

Other Insurance Coverage? (Y/N)

If yes, please complete the other coverage information on the back of this form.

This section is to be completed by the employee if any covered persons have other health insurance coverage.

MEDICARE INFORMATION

This section is to be completed by the employee if any covered persons are enrolled in Medicare.

OTHER INFORMATION

This section is to be completed by the employee to designate any specified needs.

All Employees

Signature______________ Date __________

Employee must sign and date when electing coverage.

Employees Waiving Coverage

Reason for waiver of coverage: ______________

Employee and spouse must provide reason for waiving coverage.

Signature______________ Date __________

Employee and spouse must sign if either are waiving coverage.

Please submit this form to AultCare by one of the following methods:

Email: aultcareeligibility@aultcare.com |

Fax: 330-363-7746 | Mail: AultCare Member Services PO Box 6910 Canton, OH 44706

Employer to send completed form to AultCare by one of the following methods.

» If we do not receive the completed annual MEWA attestation by the date indicated, your group may be placed on hold. Once placed on hold, claims will not be paid, and prescription benefits will be suspended until the MEWA attestation is received. Open enrollment is the month immediately prior to your renewal date.

» Member coverage ends on the date of termination.

» If you have an employee who becomes effective on the first day of the month, you will be invoiced for the entire month. If they become effective after the first of the month, you will not be charged until the following month.

» If an employee terminates after the first of the month, you will be charged for the entire month.

» COBRA vs. State Continuation

• COBRA is for companies with 20 or more employees on at least half of the previous calendar year. AultCare to administer.

• State Continuation is for companies with fewer than 20 employees. Must be involuntary termination other than gross misconduct. Employer to handle. (See attached model audit form.)

» Set-up your account on the AultCare website to retrieve your monthly invoices and to access other important information. Refer to the Administrative Guide for instructions.

» VSP Vision coverage is included with your MEWA plan. Please review benefits and coverage options on VSP’s website: www.VSP.com.

Various state and federal laws have requirements based on employee counts. When counting employees, it’s important to conduct a related employer analysis.

Various state and federal laws have requirements based on employee counts. When counting employees, it’s important to conduct a related employer analysis.

The information detailed below does not constitute legal advice and is intended only for informational purposes. Please reach out to your benefits counsel to discuss your individual circumstances.

RELATED EMPLOYER ANALYSIS requires counting all employees of all members of the employers in a controlled group of companies or affiliated service group to determine employee count. Below is a summary of those groups.

The information detailed below does not constitute legal advice and is intended only for informational purposes. Please reach out to your benefits counsel to discuss your individual circumstances.

• A controlled group may exist when two or more companies have any of the following:

RELATED EMPLOYER ANALYSIS requires counting all employees of all members of the employers in a controlled group of companies or affiliated service group to determine employee count. Below is a summary of those groups.

- A Parent-Subsidiary Relationship: Exists when one or more chains of organizations are connected through ownership of a common parent company and 80% or more of the voting power or total value of each member of the group is owned by another member of the group, except for the common parent

• A controlled group may exist when two or more companies have any of the following:

- A Brother-Sister Relationship: Exists when at least 50% of the voting power or total value of two or more organizations is owned by the same 5 or fewer persons taking into account only the ownership of each such organization that is identical for each other organization

- A Parent-Subsidiary Relationship: Exists when one or more chains of organizations are connected through ownership of a common parent company and 80% or more of the voting power or total value of each member of the group is owned by another member of the group, except for the common parent

- A Combination Relationship: Exists when two or more organizations are members of a group that has common ownership which includes both parent-subsidiary relationships and brother-sister relationships, in which case all such organizations are considered the same controlled group of business

- A Brother-Sister Relationship: Exists when at least 50% of the voting power or total value of two or more organizations is owned by the same 5 or fewer persons taking into account only the ownership of each such organization that is identical for each other organization

- A Combination Relationship: Exists when two or more organizations are members of a group that has common ownership which includes both parent-subsidiary relationships and brother-sister relationships, in which case all such organizations are considered the same controlled group of business

• An affiliated service group may exist when two or more organizations have a service relationship and/or ownership relationship with one another as satisfied by 1 of 3 tests (A-Org Test; B-Org Test; or Management Group Test)

More information about Controlled and Affiliated Service Groups can be found in the following IRS publication: https://www.irs.gov/pub/irs-tege/epchd704.pdf

• An affiliated service group may exist when two or more organizations have a service relationship and/or ownership relationship with one another as satisfied by 1 of 3 tests (A-Org Test; B-Org Test; or Management Group Test)

More information about Controlled and Affiliated Service Groups can be found in the following IRS publication: https://www.irs.gov/pub/irs-tege/epchd704.pdf

COBRA generally applies to all private sector group health plans as well as plans sponsored by state and local governments. To be subject to COBRA, employers need to have at least 20 employees on more than 50% of their typical business days in the previous calendar year. When counting employees for COBRA purposes, both full- and part-time employees are counted, taking into consideration the above Related Employer Analysis. Each part-time employee counts as a fraction of a full-time employee. The fraction should be equal to the number of hours worked divided by the number of hours required to be considered full-time. (For example, a company requires a full-time employee work 40 hours a week. A part-time employee who works 20 hours a week is considered ½ of a full-time employee.) If you have fewer than 20 employees, you may be subject to state continuation of coverage requirements under ORC 3923.38 depending on whether your group health plan is subject to state regulation. These plans typically include Insured, MEWA plans, and self-funded public employers.

COBRA generally applies to all private sector group health plans as well as plans sponsored by state and local governments. To be subject to COBRA, employers need to have at least 20 employees on more than 50% of their typical business days in the previous calendar year. When counting employees for COBRA purposes, both full- and part-time employees are counted, taking into consideration the above Related Employer Analysis. Each part-time employee counts as a fraction of a full-time employee. The fraction should be equal to the number of hours worked divided by the number of hours required to be considered full-time. (For example, a company requires a full-time employee work 40 hours a week. A part-time employee who works 20 hours a week is considered ½ of a full-time employee.) If you have fewer than 20 employees, you may be subject to state continuation of coverage requirements under ORC 3923.38 depending on whether your group health plan is subject to state regulation. These plans typically include Insured, MEWA plans, and self-funded public employers.

For more information, visit https://www.dol.gov/sites/dolgov/files/EBSA/about-ebsa/our-activities/resource-center/ publications/an-employers-guide-to-group-health-continuation-coverage-under-cobra.pdf

For more information, visit https://www.dol.gov/sites/dolgov/files/EBSA/about-ebsa/our-activities/resource-center/ publications/an-employers-guide-to-group-health-continuation-coverage-under-cobra.pdf

Complete this form to update Group Size and Eligibility changes. Changes will become effective on your renewal. Form is to be completed no later than 15 days days prior to renewal date.

GENERAL INFORMATION

Company Name:

Current Group Number: Current Plan Design(s):

Are you a Public Employer: Yes No If yes, please check one of the options below:

The Broker has not been retained as a consultant by the Public Employer for the purchase of insurance for the Public Employer

The Broker has been retained as a consultant by the Public Employer for the purchase of insurance for the Public Employer and is not authorized to receive commissions or other forms of compensations without the prior written consent of the Public Employer

GROUP SIZE INFORMATION

1. Is your company a part of an affiliated service group or controlled group? YES NO (Refer to the Employee Count Analysis Fact Sheet) If yes, please list the other Related Employer names

b. If yes, please consider that fact when answering the remaining questions in this section.

2. Provide the following current employee counts:

Full-time: Part-time: Average number of seasonal and temporary employees for current year:

Other (Briefly describe):

Total number of employees:

3. To determine the appropriate continuation of coverage (COBRA v State Continuation), provide the following counts for 50% of the typical business days in the previous calendar year:

Full-time: Part-time (Each is counted as a fraction of a full-time employee): (Refer to the Employee Count Analysis Fact Sheet)

Total number of employees: ELIGIBILITY INFORMATION

Waiting Period – New hires on or after renewal date will be eligible to participate in plan on: (Eligible employees are those working 30 hours or more per week) Keep existing waiting period Change in the waiting period

If a change, complete below:

1st of the month following date of hire 1st of the month following 30 days 1st of the month following 60 days

30 days-coverage effective on 31st day 45 days-coverage effective on 46th day Contract start date

90 days-coverage effective on 91st day Date of hire

I hereby certify that the information provided herein, relative to this application and agreement form, is true and complete to the best of my knowledge. I understand that all terms of the group insurance coverage are governed by the terms of the group insurance policy(ies). I understand that it is the employer’s responsibility to notify all covered employees of any change or termination in coverage. I understand that Workers’ Compensation coverage is not a policy benefit under any of the plans in the application. I also understand that the Group Health Insurance Policy is not a substitute for Workers’ Compensation and does not satisfy any legal requirement for such coverage. Any person who with intent to defraud or knowing that he is facilitating a fraud against an insurer, submits an application or files a claim containing a false or deceptive statement is guilty of insurance fraud.

NOTE: FALSE INFORMATION MAY RESULT IN THE FULL OR PARTIAL DENIAL OF A CLAIM AND/OR THE IMMEDIATE CANCELLATION OF COVERAGE FOR THE GROUP.

By: Date:

(Signature of Authorized Company Representative) (Title)Witness:

Date:

Ohio’s law provides that an employee has a right to continue coverage under his or her employer’s group health plan upon involuntary termination of employment if certain requirements are met. All employer groups should be knowledgeable about Ohio’s continuation insurance laws; employers with fewer than 20 employees must be particularly aware of the requirements. For those employers, Ohio’s continuation coverage is the only continuation coverage available to their employees.

An employee is eligible for continuation of coverage if he or she satisfies all of the following requirements:

• Employee must have been continuously covered under the employer’s group health plan during the entire three months preceding his or her termination.

• Employee must have been involuntarily terminated for reasons other than gross misconduct.

• Employee is not eligible for or enrolled in Medicare or other group health coverage or COBRA.

If an employee satisfies these requirements, then the employer must offer that employee the right to continue coverage under its group health plan (even after the employee loses eligibility as a member of that group). The employer must inform the employee of his or her contribution amount in advance.

Important Notes:

• Coverage is only available for a maximum of twelve months.

• Coverage is not required to include benefits in addition to the hospital, surgical or major medical coverage, and prescription drug coverage if covered under the group policy. However, it may include dental, vision, or other benefits under the health plan.

• Payment is due from the employee to the employer in advance of each month of continuation coverage.

• Continuation coverage ceases if the employee fails to make timely premium payments. There is no grace period.

• Coverage ceases if the employee becomes eligible for or is covered under Medicare or any other group health plan.

This information is only intended to highlight the major requirements for the right to receive continuation of coverage and is not intended to offer legal guidance or advice regarding how an employer can comply with Ohio’s laws. There are many other significant requirements relating to continuation insurance not covered in this notice.

Employers are advised to consult with their tax professionals and attorneys to ensure compliance with these state laws. Employers may also call the Ohio Department of Insurance at 614-644-2658 or visit www.insurance.ohio.gov for additional information.

called or ordered to active duty

1) Covered by group health plan at least three months prior to termination;

2) Involuntary termination other than gross misconduct

3) Not eligible for or enrolled in Medicare or other group health coverage.

1) Employee is a reservist called or ordered to active duty; and

2) Policy in effect covers eligible person at time of active duty.

1) Employer must notify Employee of right of continuation at time Employee is notified of termination

2) Employer must notify Insurer of Employee’s continuation of coverage.

Employee must request continuation coverage and pay the first contribution to the Employer by the earliest of the following dates:

1) 31 days after date Employee’s coverage terminates

1) Premium payments are not made on a timely basis. NOTE: Payment can be made by parties other than the Employee.

2) Group policy is terminated by the Employer.

after date coverage would otherwise terminate with an option to extend to 36 months.

At the time reservist is called to duty, Employer notifies Employee about continuation.

2) 10 days after date Employee’s coverage terminates, if Employer has notified Employee of right to continuation prior to that date

3) 10 days after date Employer notifies Employee of right to continuation if notice is given after Employee’s coverage terminates

Eligible person files a written election of continuation with the Employer and pays the first required contribution no later than 31 days after the date on which the coverage would otherwise terminate.

3) Period of 12 months expires after date Employee’s coverage would have terminated because of termination of employment.

4) Employee becomes eligible for or covered by Medicare or any group health plan.

1) Premium payments are not made on a timely basis. NOTE: Payment may be made by parties other than the enrollee.

2) Group policy is terminated by the Employer.

Loss of Other Coverage. If you decline enrollment for yourself or for another eligible dependent (including your spouse) while other health insurance or group health plan coverage is in effect, you may be able to enroll yourself and your dependents in this plan if you or your dependents lose eligibility for that other coverage (or if the employer stops contributing toward your or your dependent’s other coverage). However, you must request enrollment within 30 days after you or your dependents’ other coverage ends or after the employer stops contributing toward the other coverage.

We would like to take this opportunity to advise you of an important provision in your healthcare plan. To participate, you must complete an enrollment form. Dependent upon which specific plan you wish to enroll in, you may have to pay part of the premium through payroll deduction.

Additionally, HIPAA requires that we notify you of the “Special Enrollment Provision.”

In addition, if you have a new dependent because of marriage, birth, adoption, or placement for adoption, you may be able to enroll yourself and your new dependents. However, you must request enrollment within 30 days after the marriage, birth, adoption, or placement for adoption.

To request special enrollment or to obtain more information about the plan’s special enrollment provisions, contact your Human Resources representative or the AultCare Customer Service at 330-363-6360 or 1-800-344-8858.

HIPAA requires that plan sponsors and/or insurers provide a Certificate of Health Plan Coverage (HIPAA Certificate) to each individual who requests one, as long as it is requested while the individual is covered under the AultCare Health Plan or within 24 months of the individual’s AultCare Health Plan ending. The request also can be made on someone else’s behalf for an individual. For example, an individual who previously was covered under the AultCare Health Plan may authorize a new plan in which the individual enrolls to request a certificate of the individual’s health plan coverage from the AultCare Health Plan. An individual is entitled to receive a certificate upon request even if the AultCare Health Plan has previously issued a certificate to that individual.

Requests for certificates should be directed to AultCare Corporation, Attn: Member Services, P.O. Box 6910, Canton, OH 44706 or by calling the AultCare Customer Service at 330-363-6360 or 1-800-344-8858.

Telephone requests are accepted only if the certificate is to be mailed to the address the plan has on file for the individual to whom the request relates. Other requests must be made in writing.

All requests must include:

• The name of the individual for whom the certificate is requested

• AultCare Group Number and Identification Number

• The last date the individual was covered under the plan

• The name of the person who enrolled the individual in the plan

• A telephone number to reach the individual for whom the Certificate is requested

Required written requests must also include:

• The name of the person making the request and evidence of the person’s authority to request and receive the certificate on behalf of the individual

• The address to which the certificate should be mailed

• The requester’s signature

After receiving a request that meets these requirements, the plan will act in a reasonable and prompt fashion to provide the Certificate.

NOTE: A pre-existing condition exclusion does not apply to enrollees of any AultCare plans that have renewed effective January 1, 2014, and after.

The Certificate of Health Plan Coverage can be used as proof of loss of coverage.

Please review it carefully.

AultCare Insurance Company (also dba AultCare HMO, dba PrimeTime Health Plan, and Aultra), which is part of an Organized Health Care Arrangement with AultCare Corporation and Aultra Administrative Group (collectively referred to as “AultCare,” “We,” or “Our”) is a Group Health Plan Covered Entity under HIPAA.

AultCare is committed to safeguarding the Privacy and Security of Protected Health Information of its enrollees and their eligible dependants (referred to as “You”) whether it is oral, paper or in electronic form (“PHI/ePHI”).

This Notice of Privacy Practices (NPP) describes our HIPAA-compliant policies and procedures for the Use and Disclosure of your PHI/ePHI. It also describes how you can access your PHI/ePHI and your legal rights.

This NPP is available on our website www.aultcare.com. If you do not have a computer or internet access, or if you prefer a paper copy of this Notice, please call Customer Service at 330-363-6360 or 1-800-344-8858. Please read this Notice. Feel free to share it with your family or personal representative.

Not every use or disclosure of PHI, with or without a signed Authorization, may be listed in this Notice. Uses or disclosures not specified in this Notice generally will require an Authorization.

Business Associates. We contract with outside persons or entities called business associates who may access, use, or disclose PHI/ePHI to perform covered services for us, such as auditing, accounting, accreditation, actuarial services, and legal services. Business associates must protect the privacy and security of your PHI/ePHI to the same extent we do. If a business associate delegates responsibilities for performing services to a subcontractor or agent, that subcontractor or agent also is considered to be a business associate, which must comply with HIPAA.

Covered Entities. Covered entities include healthcare providers (e.g., hospitals, doctors, nurses, nursing homes, home health agencies, durable medical equipment suppliers, and other healthcare professionals and suppliers), group health plans, and health care clearinghouses. AultCare is a group health plan covered entity.

Disclose. Disclose means our releasing, transferring, providing access to, or divulging your PHI/ePHI to a third party, including covered entities and their business associates: (1) for treatment, payment, and healthcare operations; or (2) when you permit us by your signed authorization; or (3) as permitted or required by law.

Health Plan. Health plan means an individual or group health plan that provides, or pays the cost of, medical care and includes a health insurance issuer, HMO, Part A or B of Medicare, Medicaid, voluntary prescription drug benefit program, issuer of Medicare supplemental policy, issuer or a long-term care policy, employee welfare benefit plan, plan for uniformed services, veterans health care program, CHAMPUS, Indian health service program, federal employee health benefit program, Medicare+Choice program, Medicare Advantage plan, approved state child health plan, high-risk pool, and any other individual or group health plans or combination that provides or pays for the cost of medical care. AultCare is a group health plan.

Health Care Operations. We will use PHI/ePHI for health care operations that include quality assurance, performance improvement, utilization review, accreditation, licensing, legal compliance, provider and supplier credentialing, peer review, business management, auditing, enrollment, underwriting, reinsurance, and other functions related to your health plan and its status as a group health plan, as well as offering and providing preventive, wellness, case management, and related services. We may disclose your PHI/ePHI to another healthcare facility, healthcare professional, or health plan for purposes of quality assurance, case management and related services if that facility, professional, or plan also has a relationship with you.

Minimum Necessary. We will limit the use or disclosure of your PHI/ePHI to the minimum needed to accomplish the intended purpose of the use, disclosure, or request.

Payment. Payment means the activities undertaken a group health plan to obtain premiums or to determine or fulfill its responsibility for coverage and the provisions of benefits under your plan and includes eligibility or coverage determination, coordination of benefits, adjudication and subrogation of health benefit claims, billing, claims management, healthcare data processing, reinsurance (including stop-loss and excess), determination of medical necessity, utilization review (including precertification and retrospective review), and related activities.

Protected Health Information (PHI/ePHI). PHI/ePHI means individually identifiable medical and health information regarding your medical condition, treatment of your medical condition, and payment of your medical condition, and includes oral, written, and electronically generated and stored information. PHI/ePHI excludes de-identified information or health information regarding a person who has been deceased for more than 50 years.

Treatment. Treatment means the provision, coordination, and management of healthcare and related services by one or more health care providers, including referrals and consultations between providers or suppliers.

Use. Use means our accessing, sharing, employing, applying, utilizing, examining, or analyzing your PHI/ePHI within the AultCare organization for payment and health care operation purposes. Your PHI/ePHI is accessible only to members of AultCare’s workforce who have been trained in HIPAA Privacy and have signed a confidentiality agreement that limits their access and use of PHI/ePHI, according to the minimum necessary standard, to perform the authorized purpose.

No Authorization Needed. We will create, receive, or access your PHI/ePHI, which we may use or disclose to other covered entities for treatment, payment, and healthcare operations, without the need for you to sign an authorization.

• Disclosures for Treatment. We will disclose your PHI/ePHI necessary for treatment. For example, a doctor or health facility involved in your care may request your PHI/ePHI that we hold to make decisions about your care.

• Uses and Disclosures for Payment. We will use or disclose your PHI needed for payment. For example, we will use information about your medical procedures and treatment to process and pay claims, to determine whether services are medically necessary, and to pre-authorize or certify services covered by your health plan. We may disclose PHI/ePHI to other governmental or commercial health plans that may be obligated under coordination of benefit rules to process and pay your claims.

• Uses and Disclosures for Healthcare Operations. We will use and disclose your PHI/ePHI as necessary or permitted by law for our healthcare operations. For example, we may use or disclose PHI/ePHI for underwriting purposes; however, we will not use or disclose your genetic information for underwriting purposes.

No Authorization Needed for Business Associates. We may disclose PHI/ePHI to business associates with whom we contract to perform certain covered services. It is not necessary for you to sign an authorization for us to share PHI/ePHI with our business associates.

Authorization. Except for treatment, payment, or health care operations, or as stated below, we will not use or disclose your PHI/ePHI for any other purpose without your signed HIPAA-compliant authorization unless required by law. We will not condition your treatment or coverage on your signing an authorization.

We will not disclose psychotherapy notes without a signed authorization unless required by law.

We will not disclose your PHI/ePHI to your employer without your signed authorization. We will not release medical records if we are subpoenaed, unless you sign an authorization, or the lawyers enter into a qualified protective order, or if we receive a valid court or administrative order.

You may cancel your authorization at any time by notifying us in writing. Once we receive your written cancellation, we no longer will disclose your PHI/ePHI. We are not responsible for any use or disclosure of PHI/ePHI according to your authorization before we receive your written cancellation.

Communications With You. We may communicate with you about your claims, premiums, or other things connected with your health plan. You may request us to communicate with you by alternative means or at alternatives locations. For example, you may request messages not to be left on voice mail or that explanation of benefits (EOBs) be sent to post office box or address other than your home. You may send your request to: Privacy Coordinator, P.O. Box 6029, Canton, OH 44706. We will honor reasonable requests.

Communications with Family or Others Involved In Your Care. With your approval, we may disclose your PHI/ePHI to designated family, friends, guardians, persons authorized by a durable power of attorney for healthcare, personal representative, or others involved in your care or payment for your care to assist that person’s caring for you or paying your medical bills. If you are unavailable, incapacitated, or facing an emergency medical situation, and we determine a limited disclosure may be in your best interest, we may share limited PHI/ePHI with these individuals without your approval. We may disclose limited PHI/ePHI to a public or private entity authorized to assist in disaster relief efforts, so it may locate a family member or other persons who may be involved in caring for you.

Minors and Emancipated Minors. We will disclose PHI/ePHI of a minor (a person less than 18 years old) to the minor’s parent(s) or guardian. We will not disclose PHI/ePHI to the parent(s) or guardian of an emancipated minor. A minor is considered emancipated if he/she: (1) does not live with his/her parent(s); (2) is not covered by parental health insurance; (3) is financially independent of parent(s); (4) is married; (5) has children; or (6) is in the military.

Deceased Enrollees and their Dependents. If you die, we will disclose your PHI/ePHI to the probate court’s appointed executor or administrator of your estate. We may disclose PHI/ePHI to your spouse, family, personal representative, or others who were involved in your care or management of your affairs, unless doing so would be inconsistent with your expressed wishes made known to us.

Other Health-Related Products or Services. We may periodically use your PHI/ePHI to determine whether you may be interested in, or benefit from, treatment alternatives, wellness, preventive, disease management, or health-related programs, products or services that may be available to you as an enrollee or eligible beneficiary under your health plan. For example, we may use your PHI/ePHI to identify whether you have a particular illness and contact you to advise you that a disease management program is available to help manage your illness. If you do not want to be contacted or receive information about these services and programs, you may opt-out by contacting Customer Service. Your opting out will not affect any coverage or services we provide to you. We will not use your information to communicate with you about products or services that are not health-related without your authorization. We will not sell or disclose your PHI/ePHI to third-parties for marketing without your authorization, which will indicate whether we receive remuneration for selling PHI.

Fundraising. We may contact you about charitable fundraising. If you do not want to be contacted or receive fundraising materials, you may opt-out by contacting Customer Service. Your opting out will not affect any coverage or services we provide to you.

Research. In limited circumstances, we may use and disclose your PHI/ePHI for research. For example, a research organization wishing to compare outcomes of patients by payer source would need to review a series of records we hold. In all cases where your specific authorization has not been obtained, your privacy will be protected by strict confidentiality requirements applied by an Institutional Review Board or privacy board that oversees the research.

We may use or disclose PHI/ePHI, without your authorization, as permitted or required by law, including, but not limited to, the following:

Plan Sponsor. We may disclose PHI/ePHI to the plan sponsor of your health benefit plan on condition that the plan sponsor certifies that it will maintain PHI/ePHI provided a confidential manner and will not use it for employment-related decisions, other improper employee benefit determinations, or in any other manner not permitted by law.

Workers’ Compensation. Ohio law permits us to disclose PHI/ePHI to workers’ compensation agencies and for related purposes when an employee files a workers’ compensation claim or seeks benefits for work-related injuries or illnesses.

Public Health Agencies. Ohio law requires us to disclose PHI/ePHI to public health agencies for reporting births and deaths, to help control disease, injury or disability and for reporting cases of suspected abuse, neglect, or domestic violence.

FDA and OSHA . Certain Federal laws from the FDA and OSHA require us to disclose PHI/ePHI for reporting adverse events, product problems, and biological product deviations, so safety precautions, recalls, and notifications can be conducted.

Regulatory and Licensing Agencies. We will disclose PHI/ePHI to certain Ohio and Federal governmental regulatory and licensing agencies (including the Ohio Department of Insurance) and health oversight agencies for purposes of their reviewing health care system, civil rights, privacy laws, and compliance with other governmental programs.

National and Homeland Security. We may disclose information concerning enrollees and their eligible dependents to authorized federal officials for intelligence and other National and Homeland Security purposes.

Protective Services for the President and Others. We may disclose PHI/ePHI to authorized federal officials, so they may protect the President, other authorized persons and foreign heads of state and officials, or to conduct special investigations.

Red Cross and Armed Forces. We may disclose PHI/ePHI to the Red Cross or Armed Forces to assist them in notifying family members of your location, general condition, or death.

Coroners, Medical Examiners, and Funeral Directors. We may disclose PHI/ePHI to coroners, medical examiners, or funeral directors for them to perform legally authorized responsibilities.

Law Enforcement. We may disclose PHI to law enforcement officials when it: (1) is limited to identification purposes; (2) applies to victims of crime; (3) involves a suspicion that injury or death has occurred because of criminal conduct; (4) is needed for a criminal investigation; (5) is needed to prevent or lessen the threat to the health or safety of a person or to the public; (6) is in response to a valid court order; (7) is used to identify or locate a suspect, fugitive or missing person; (8) is used to report a crime on our premises; or (9) is otherwise required by law.

Reporting of Wounds. We may disclose PHI/ePHI to law enforcement officials as required by law to report gunshot wounds, stabbing, burns, injuries and crimes.

Emergency or Disaster. If the President declares an emergency or disaster, and the Secretary of HHS declares a public health emergency, the Secretary may waive our obligation to comply with any or all of the following Privacy requirements to: (1) obtain your agreement to speak to family members or friends involved in your care; (2) your right to request privacy restrictions; or (3) your right to request confidential communications. Waiver only applies during an emergency period up to 72 hours.

Prevent Threat of Serious Harm. We will disclose PHI/ePHI if a reasonable belief exists that it may prevent or lessen a serious and imminent threat to the health or safety to you, another person, or the public, and disclosure is made to a person(s) reasonably able to prevent or lessen the threat, including the target or intended victim of the threat.

Proof of Immunization. We may disclose PHI to schools for the limited purpose of showing proof of immunization of a student or prospective student, and the parent, guardian, or person acting in loco parentis does not object.

Organ and Tissue Donation. If you are an organ or tissue donor, we may disclose medical information to the organizations that handle: (1) organ procurement; (2) organ, eye, or tissue transplantation; or (3) an organ donation bank, as applicable, to facilitate organ or tissue donation and transplantation.

Correction Institution or Custody. If you are an inmate of a jail, prison, correctional institution, or under the custody of law enforcement officials, we may use or disclose medical information about you for purposes of: (1) the institution’s providing you with health care; (2) protecting your health and safety and the health and safety of others; and (3) protecting the safety and security of the correctional institution or custodial facility.

Institutional Review Board. We may release PHI/ePHI for certain research purposes where the research is approved by a formal institutional review board with established rules to ensure privacy.

Restrictions on Use and Disclosure of Your PHI. You have the right to request restrictions on our use and disclosures of your PHI/ePHI for treatment, payment, or health care operations by notifying us in writing of your request. A restriction request form can be obtained by calling the AultCare Service Center or by visiting our website at www.aultcare.com. We are not required to agree to your request for restriction, unless disclosure is for the purpose of carrying out payment or healthcare operations and is not otherwise required by law, or the PHI/ePHI pertains solely to a healthcare item or service for which you or your personal representative has paid out-of-pocket the covered entity in full. In other instances, we will attempt to accommodate reasonable requests, if appropriate. We reserve the right to terminate a restriction at any time if we believe termination is appropriate. We will notify you if we terminate the restriction. You also have the right to terminate any by calling or sending the termination notice to the Privacy Coordinator.

Access to Your PHI. You have the right to copy and/or inspect your PHI/ePHI maintained in a designated record set. There are exceptions. You may not have the right to inspect or copy psychotherapy notes or information compiled for civil, criminal or administrative proceedings. Your right may not extend to information covered by other laws or information obtained from someone other than another covered entity. We may deny you access if, in our judgment, seeing the information could endanger the life or safety of you or another. All requests for access must be made in writing and signed by you or your personal representative. If the subject of the request for access is ePHI maintained in one or more designated record sets electronically, and if you request an electronic copy, we will provide you with access to your ePHI in the electronic form and format requested if it is readily producible in such form or format or, if not, in a mutually agreed-to readable electronic form and format. If your request for access directs us to transmit a copy of the ePHI to another person whom you designate, we will provide a copy of the requested ePHI to that designated person. We may charge you for postage if you request a mailed paper copy and will charge for preparing a summary of the requested information if you request such summary. You may obtain an access request form by calling AultCare Customer Service or by visiting our website at www.aultcare.com.

Amendments to Your PHI. You have the right to request in writing that PHI/ePHI we maintain about you in a designated record set be amended or corrected. We are not obligated to make all requested amendments but will give each request careful consideration. All amendment requests, in order to be considered by us, must be in writing, signed by you or your personal representative, and must state the reasons for the amendment/correction request. If an amendment or correction you request is made by us, we may also notify others who work with us and have copies of the uncorrected record if we believe that such notification is necessary. You may obtain an amendment request form by calling AultCare Customer Service or by visiting our website at www.aultcare.com.

Accounting for Disclosures of Your PHI. You have the right to receive an accounting of certain disclosures we made of your PHI after April 14, 2003. There are certain exceptions and limitations, including, but not limited to disclosures made: (1) for treatment, payment, and healthcare operations; (2) to you or personal representative of your own PHI; and (3) according to your signed authorization. Requests must be made in writing and signed by you or your personal representative. Accounting request forms are available by calling AultCare Customer Service or by visiting our website at www.aultcare.com. The first accounting in any 12-month period is free. You may be charged a fee for each subsequent accounting you request within the same 12-month period.

Breach Notification. You have the right to notification if a breach of your PHI/ePHI occurs. We will promptly notify you by first-class mail, at your last known address, or by email (if you prefer) if we discover a breach of unsecured PHI/ePHI, which includes the unauthorized acquisition, access, use, or disclosure of your PHI/ePHI, unless we determine that a low probability exists that the compromise of your PHI would cause you financial, reputational, or other harm. We will include in the breach notification a brief description of what happened, a description of the types of unsecured PHI involved, steps you should take to protect yourself from potential harm, a brief description of what we are doing to investigate the breach and mitigate any potential harm, as well as contact information for you to ask questions and learn additional information.

We are committed to protecting your PHI/ePHI. Despite our best efforts, questions, concerns, or problems may occur. If you have a concern, or if you believe that your privacy rights have been violated or breached, we encourage you to contact us immediately. You may ask a question, express a concern, or file a complaint by writing to the Privacy Coordinator, P.O. Box 6029, Canton, OH 44706. You may also file a complaint with the Secretary of the U.S. Department of Health and Human Services in Washington D.C. in writing within 180 days of a violation of your rights. Under no circumstances, will we “retaliate” against you for expressing a concern or filing a complaint regarding your privacy rights.

We reserve the right to change this Notice of Privacy Practices at any time, which we may make effective for PHI/ePHI we already used or disclosed, and/or for any PHI/ePHI we may create, receive, use, or disclose in the future. We will make material amendments based on changes in the HIPAA laws. The revised notice will be posted on our website www.aultcare.com. Copies of revised notices will be mailed to all enrollees covered by the plan, and copies may be obtained by mailing a request to: Privacy Coordinator, P.O. Box 6029, Canton, OH 44706.

If you have questions or need further assistance regarding this Notice, you may contact AultCare Customer Service at 330-3636360 or 1-800-344-8858. If you are hearing impaired and have access to a TTY phone, you may reach us at our TTY line at 711. Our call center hours of business are from 7:30 a.m. to 5:00 p.m., Monday-Friday.

This Notice of Privacy Practices became effective on April 14, 2003.

» An example of the monthly invoice that each company receives is provided on the following page. The invoice you receive may differ in column headings and amounts.

The top portion of the invoice indicates the Run Date of the invoice and the Due Date of the payment. AultCare strives to have all bills run by the 15th and mailed by the 25th of each month. Payment is then due by the date indicated. If you have signed up to receive your bill electronically, you will be notified by email the invoices are available and you will access your invoice throughout our website at www.aultcare.com

Any adjustments made to membership, such as termination, will be indicated in a section before the Grand Total. Eligibility changes that were received by the 10th of the month will be reflected on that month’s bill. General policy is to credit up to three months for terminations, so it is important to be up-to-date with eligibility changes. It is your responsibility to review this monthly billing for accuracy. Please note when mailing in your payment that no adjustments are to be written on the invoices and the amount sent should equal the Grand Total.

Company Name:

Group Number:

Monthly Invoice (Pay as billed, enrollment adjustments will be made to subsequent invoices)

ACH Transfer to AultCare:

• Yes

• No

Canton Regional Chamber Health Fund

Account Number: 01030329006

Routing Code: 044115090

Mail Check:

AultCare Draft From Your Account:

Bank Name:

• Yes

• No

Make check payable to: Canton Regional Chamber Health Fund

• Yes

• No

If yes, provide the following:

Bank Contact: Phone Number:

Account Number:

Routing Code:

Note: Automatic withdrawal on the 1st of every month

Completed by (printed name):

Signature:

Date: Forward to AultCare Billing Department

Administered by

» This section provides an explanation of various questionnaires enrollees may receive if there is a question regarding how to pay a claim. Encourage employees to respond to any forms received in order to have their claims paid quickly and correctly.

Unless otherwise instructed by a self-funded company, AultCare will send out a yearly Other Coverage Information Form to be updated with the next claims received for any member of the family following one year on the plan. Upon receipt of the completed form, the system is noted with the updated information and any pended claims are processed.

The Accident Questionnaire is mailed in the cases of accidents mainly to determine if a third party might be responsible for an accident. Claims are pended until we receive a signed response to the questionnaire. Cases involving a third party are referred to our Subrogation Department to pursue reimbursement for the Plan.

The Designation of Authorized Representative Form is used to confirm permission to discuss with or disclose to a person’s Protected Health Information (PHI).

Group #:

Enrollee Name:

Member ID#:

•

•

•

Have you, your spouse, or any dependents covered under this AultCare plan had any other

RX, or Medicare coverage in the past 24 months?

• No: The rest of the form does not need to be completed, please sign and date second page, and return to AultCare.

• Yes: Please complete entire form, sign, date, and return to AultCare.

Do you have health insurance in which you are the enrollee/policyholder other than this AultCare plan?

•

**For any children age 18 or older who have insurance coverage other than through a natural/step parent, please complete part 4A.**

Group #:

Enrollee Name:

Member ID#:

***Please complete all information in this section for each child covered under your plan who have a different biological parent other than the enrollee & spouse listed on the first page. If not previously provided, court documentation and/or divorce decrees must be submitted to AultCare in order to accurately update your records***

Child’s Name:

Is their address the same as the enrollee? • Yes • No provide address:

If 17 or older, please provide date of graduation from high school:

Other

Does child(ren) have insurance coverage other than this AultCare plan?

Name:

Part A Effective Date ____/____/____

Part B Effective Date ____/____/____

Part D Effective Date ____/____/____

Reason for Medicare coverage:

• Age 65 or older • Disabled

• End Stage Renal Disease (ESRD)

Date dialysis treatment began ____/____/____

Dialysis started in a: • Facility • Self / Home Dialysis

Date of kidney transplant ____/____/____

Name:

Part A Effective Date ____/____/____

Part B Effective Date ____/____/____

Part D Effective Date ____/____/____

Reason for Medicare coverage:

• Age 65 or older • Disabled

• End Stage Renal Disease (ESRD)

Date dialysis treatment began ____/____/____

Dialysis started in a: • Facility • Self / Home Dialysis

Date of kidney transplant ____/____/____

Insurance Fraud Warning: “Any person who, with intent to defraud or knowing that he is facilitating a fraud against an insurer, submits an application or files any claim containing false or deceptive statements is guilty of insurance fraud.”

Enrollee’s Signature:

Enrollee’s Phone Number: Email:

Note:

REGIONAL

Group #:

Member ID:

Member Name:

Patient Name:

All claims related to this injury / accident questionnaire will be PENDED / DENIED until this fully completed questionnaire is returned. If you have any questions, please contact customer service at the number listed below.

1. What was the date of your injury / accident?

2. How did your injury / accident occur?

3. Where did the injury / accident occur? (Please check appropriate box)

• Auto / Motorized Vehicle

• Home

• Work - if yes, was a workers’ compensation claim filed? • Yes • No

• There was no accident, sudden onset (please contact customer service)

• Other, please specify

4. Automobile Accident Information

a) If an automobile accident, were you a driver, a passenger, or a pedestrian?

b) If an auto accident, were all the covered family members involved wearing seatbelts at the time of the accident?

c) If accident involved a motorcycle or recreational vehicle, was a helmet being worn at the time of accident?

d) If motor vehicle accident, were you or a covered family member under the influence of drugs or alcohol? (includes all motorized recreational vehicles, boats, etc.)?

e) Is there a police report? • Yes If yes, where can we obtain a copy? • No

f) Were any parties in the accident charged? Who? What offense?

5. What is the name, address, and telephone number of other insurance carriers that a claim has been filed with? What is the claim number and adjuster’s name?

Group #:

Member ID:

Patient Name: REGIONAL

Member Name:

6. Were you responsible for the accident? • Yes • No

7. Was another party responsible for your accident? • Yes • No - (Please sign and return form, do not complete questions 8 - 10.)

8. a) What is the name, address, and telephone number of the party responsible for your accident?

b) What is the name, address, and telephone number of the other party’s insurance carrier? Claim number and adjuster’s name?

9. Have my payments been made for expenses incurred as a result of this accident? • Yes • No

If yes, please explain.

10. Have you retained an attorney? • Yes • No

If yes, what is the name, address, and telephone number of your attorney?

I hereby authorize that the plan administrator is entitled to recover claim payments made on my behalf, from any future settlement in my favor, from the third party of other insurance carriers responsible for my accident and corresponding claim(s) outline above. Recovery can also be made from me if I receive the settlement directly from the third party or other insurance carrier.

I hereby authorize the plan administrator to forward copies of claims to the insuring company and attorney.

I hereby authorize release of any information necessary to verify or investigate items pertaining to this accident. Signature

You have the right to appoint a representative, including an attorney, to act on your behalf. This form is used to confirm permission to discuss with or disclose a person’s Protected Health Information (PHI) held by the affiliated entities AultCare Corporation, Aultra Administrative Group (AAG), and AultCare Insurance Company (AIC) which also does business as AultCare HMO, to a particular individual who acts as the person’s personal representative. We are not always required to grant such access, but each request will be carefully reviewed and approved if warranted. Use of this information is strictly limited to that purpose.

Name: Date of Birth:

ID Number: Group Number:

I hereby authorize the following person to act as my personal representative as indicated below. (Must fill out)

Name of Representative: Relationship:

Password that the personal representative must provide to access “PHI” about me:

Password: OR No Password needed • (Check Box)

I understand that I have the right to limit the information that is released under this authorization. For example, I may limit my personal representative’s access to information about a particular issue. *Any such limitations must be described below in writing. I understand that by leaving this section blank, I am imposing no limitations on disclosure.* However, if my authorization is for use/disclosure of substance abuse information, I understand that the recipient may be prohibited from disclosing substance abuse information under the Federal Substance Abuse Confidentiality Requirements. Therefore I release the affiliated entities AultCare Corporation, AultCare Insurance Company, and Aultra Administrative Group from all liability arising from this disclosure of my health information.

Note: State Law mandates that Authorizations are limited to 12 months. This form will expire upon 12 months from the date of signature unless an earlier date is noted here

*Any limitations described here:

I understand that this authorization is voluntary and that I may revoke this authorization at any time by providing written notice of such revocation to the Health Plan, except to the extent that action has been taken in reliance on this authorization.

I have had full opportunity to read and consider the content of this form. I understand that this authorization is consistent with my request. I understand that, by signing this form, I am confirming my authorization that the Health Plan may use and/or disclose my PHI to the person named as personal representative for the purpose as described above.

Your Signature: Date:

Form must be signed by member. If form is signed by Power of Attorney or Legal Representative, a copy of documentation of position must be in AultCare’s receipt or attached to form. Please designate position held.

Please return the completed form to: ATTN: Privacy Coordinator, PO Box 6029, Canton, OH 44706.

SUMMARY OF BENEFITS AND COVERAGE

GLOSSARY OF HEALTH COVERAGE AND MEDICAL TERMS

On Feb. 14, 2012, the Departments of Treasury, Internal Revenue Service, Labor, Health and Human Services, and Employee Benefits Security Administration released a final rule that implemented disclosure requirements under section 2715 of the Public Health Service Act.

This health insurance market reform under the Patient Protection and Affordable Care Act requires group health plans and health insurance issuers in the group market to provide a summary of benefits and coverage and uniform glossary to members of their health plans.

Final Regulations were again issued in June 2015. A revised SBC template and uniform glossary was finalized for Plan Year 2021.

• What’s

• What is Culturally and Linguistically Appropriate Manner?

• How do I meet the Electronic Disclosure requirements to distribute the SBC to my employees?

• What happens if I fail to comply?

• Who will provide me with the materials I need for distribution to my employees?

• When will I receive my SBC?

• Who should receive the SBC?

• When do I need to distribute the materials?

• FAQs