By John Yoswick, Autobody News

Collision repairers for decades have understood the concept of “judgement times,” having to determine while looking at the vehicle how much labor will be required to repair a particular dent in a panel, for example.

Given changes in the estimating systems in the past year, determining blend time has become another of the items requiring an “on-the-spot evaluation.”

Though the 50% of full refinish time remains the default setting for calculating blend times in the CCC Intelligent Solutions and Solera (Audatex) estimating systems, users can change that percentage, and the two companies changed their guidance to say blend times vary and require a vehicle-by-vehicle evaluation. Mitchell continues to use the 50% formula but has given users the ability to change that percentage in the system.

A committee presentation at the Collision Industry Conference (CIC) in Denver this past summer highlighted how many other collision repair labor operations there are that, like blending, require the judgement or “on-thespot evaluation” by the estimator.

Danny Gredinberg of the Database Enhancement Gateway (DEG) noted there are many notincluded labor procedures that body technicians in shops may be performing. He said the “labor general information” section of the Mitchell P-pages lists 17 bodylabor-related items that would be additions to its published times, including broken glass clean-up and tar and grease removal.

“It should not be inferred that a component with no established labor time has been included in another component’s replacement allowance,” the Mitchell P-pages state.

The Motor Information Guide to Estimating — the basis for the CCC estimating system — lists 43 not-included items in the body section alone, including “road test vehicle” and “anti-corrosion material restoration/application.”

The Solera (Audatex) database reference manual lists 61 bodyrelated “labor exclusions,” including “assembly of new parts that come unassembled,” and “disassembly of recycled parts and assemblies.”

“So there’s many different things you may need to consider in the repair process as an ‘on-the-spot’

By Ben Shimkus Autobody News

Collision repair shop owners and automotive insurance company lawyers clashed at a recent public meeting, a year after Vermont lawmakers asked regulators to examine pricing policies.

State officials hope to hear from consumers about the price of automotive insurance. But the regulatory scrutiny highlighted an everexpanding chasm between local shops and automotive insurance brands.

In June 2023, Vermont lawmakers asked the state’s Department of Financial Regulations (DFR) to analyze the auto insurance prices for Vermont drivers. The law sought to ensure that insurance brands’ pricing

policies were “fair and reasonable.”

“The department is required to assess a number of specific issues, and to solicit and receive feedback from stakeholders,” Emily Brown, Vermont’s deputy commissioner for insurance, told Autobody News.

“Auto body shops are a key group of stakeholders, and we want to hear their perspectives.”

The department met publicly Sept. 10 to hear from consumers. The meeting was held in the Montpelier City Center and livestreamed for digital participants on Teams.

Instead, the only participants who spoke were two collision repair shop owners and representatives from the automotive insurance brands.

l CONTINUED ON

By Brian Bradley Autobody News

The Maine Automotive Right to Repair Working Group during its September meeting considered issues including independent repairers’ current access to OEMs’ diagnostic data, cost effectiveness of diagnostic systems used by repair shops, and creation of an online portal for repairers and OEMs to share data.

“It’s turning into a tug-of-war match with manufacturers and independent repair shops,” Wes Luther, technician for VIP Tires and Service in Kittery, ME, said during the Sept. 26 meeting. “If you do not have the right stuff and have access to it, the manufacturers are going to monopolize everything, because the only thing we’re going to be stuck doing is tires and basic, basic stuff.”

A new law created Maine’s right to repair working group in August. The law tasks the working group with drafting legislative recommendations

See it at our booth #31017 upstairs, South Hall

The liner reimagined.

When used with SATA spray guns, there is no need for an adapter.

Particle free premium strainers that click into the lid before painting.

Lids offer a quadruple bayonet safety system

Hard cup, liner and lid are made with high quality materials.

Complete and detailed scale system with an upside-down scale

LCS: .40 liter, .65 liter, .85 liter

Mike Anderson Shops’ Needs from OEM Parts Wholesalers Go Beyond Prices, Discounts 24

Abby Andrews Connecting Vehicles Could Be Useful in Collision Repair 26

Negotiate with Insurance Companies to Get Compensated for Proper Repairs 34

Using DRPs to Fuel Your Collision Repair Shop’s Growth 8

Brian Bradley Analysts: Fed Rate Cut Could Drive Brownfield Acquisitions in Collision Repair 30

Maine Right-to-Repair Meeting Features Lively Debate, Considers Access to OEM Data 1

New Hampshire Law Impacts Collision Repair Shops Doing Cross-State Car Sales, Upgrades 38

Elizabeth Crumbly

3D Printing Offers Collision Repair Innovative Option for Parts, Shipping, Design 48

Mitchell Donates $1.5M in Tech to Boost Collision Engineering Program 20

Why MSOs are Stepping Up to Purchase Dealership Collision Centers 4

Paul Hughes

Arkansas MSO Owners Find Out How Much Work Goes into Selling to Consolidator 18 Should Independent Body Shops Care

About Growing State-Level Push for Consumer Privacy? 10

Stacey Phillips Ronak

3M Skills Development Center Celebrates First Anniversary of Educating, Upskilling Technicians 6

Auto Additive on Track to Provide HighQuality, OEM-Grade 3D-Printed Parts, Tools & Jigs 40

Lucid Hosts First Certified Body Repair Network Conference 22

Leona Scott

Exclusive Look: 2024 MSO Symposium

Agenda Offers Critical Insights for Collision Industry Leaders 28

How Body Shops Can Navigate the Challenges of EV Collision Repairs 46

Jorge Sandoval Goes from Selling Cheese to 2024 Auto Glass Technician Olympics Champ 52

Ben Shimkus

Vermont Collision Shop Owners, Insurance Companies Fight Over Pricing Regulations 1

John Yoswick

Blend Times Now Require ‘On-the-Spot’ Determination 1

Collision Shops, Vendors Can Help Counter Grim Entry-Level Tech Numbers 16

Low-Voltage Batteries in EVs, Hybrids Need Particular Attention in Collision Repair Shops 36

Leader of Ring That Stole 500 Catalytic Converters Sentenced 50 New Jersey Maaco’s Custom-Painted Cars Shine in Upcoming Streaming Series 54

By Elizabeth Crumbly Autobody News

Sales of dealership collision centers pose multifaceted benefits, both for dealerships selling and the MSOs that often purchase. These changes aren’t without challenges, but a consolidating industry means these moves will likely become more common in coming years.

“It’s a slow and steady trend that we’ve seen for many years,” said Madeleine Roberts Rich, senior associate with Focus Advisors, a firm that represents MSO owners as they grow or exit. “The reason is

that the collision repair industry is consolidating. As we’ve seen, there’s a handful of consolidators that are establishing more and more market share primarily through acquisitions.”

When Dealerships Sell

So, why are dealerships selling? It’s primarily to streamline operations and enhance focus on automotive sales, reducing the added management needs for collision repair operations. Keeping up with technology and the hiring competition for highly trained technicians can be prohibitive in keeping a shop going.

“The game is much more expensive than it has been in the past, and the tech workforce really drives volumes,” explained David Roberts, Focus Advisors founder and managing director. “So, if you don’t have a steady volume of vehicles going through your collision repair shop, people are going to look around where they can make more money, and they’ll almost invariably find an MSO in the area that is doing more work.”

And dealerships that find a buyer free up significant funds.

“They have cash that they can then use as capital to invest in their core competency if it’s expanding their existing dealership operations in place or then trying to expand to a new location,” Rich explained. “They

have freed up cash in this liquidity event, and in a high interest rate environment like we’re in, access to cash can be quite important.”

There’s also built-in opportunity for sale of more parts for dealerships as they continue to funnel repairs from vehicle buyers toward shops they’ve sold. This scenario is beneficial when a dealership sells the shop but keeps the real estate in a long-term lease situation.

One drawback Roberts noted in that scenario is that buyers will likely extract regular repair discounts from a dealer, but the volume of business can make up for that factor. Indeed, Rich said, lifetime customers often mean lifetime servicing of a vehicle or multiple vehicles: It’s one more reason to make sure a collision center is in capable hands.

MSOs looking to purchase dealership collision centers get the benefits of having a staffed location with ready equipment, and ostensibly, they start out with dealership customers. That doesn’t mean there aren’t potential hurdles, though.

These purchasers, explained Roberts, need to be sure they’ll really have access to a steady pipeline of customers as dealerships’ modes of operation often differ from those of shops that have been historically focused strictly on repair.

“If you’re an MSO buying a dealer

shop, you really do have to have your act together,” Roberts said. “The dealer is trying to manage a bunch of different things, and if they’ve got a bunch of different nameplates and they’re really into selling new and used cars and servicing those cars, then getting access to repairable vehicles today comes much more through insurance companies. And most dealers don’t have arrangements with insurance companies in which they participate in direct repair programs.”

Making sure a shop is the right fit is also important for an MSO looking

to purchase.

Joe Hudson’s Collision Center, an-Alabama-based MSO, which recently entered the dealership shop acquisition trend by buying Bedford Nissan Collision Center in Bedford, OH, is an example of this factor. Bedford Nissan’s existing certifications made it a fit for acquisition, Joe Hudson’s Chief Operating Officer Cameron Dickson explained in a press release.

“Identifying growth opportunities that align with our standards for quality and outstanding customer service is crucial,” Dickson said. “Bedford Nissan Collision Center’s numerous OEM certifications and I-CAR Gold Class recognition make it an ideal partner. This acquisition allows us to quickly integrate our operations and continue delivering the top-notch service our customers have come to expect.”

Dealership sales are on the rise right now, according to a report released in June by Kerrigan Advisors, an auto buy/sell advisory firm. The first quarter of this year, the firm reported, saw a 38% rise in dealership sales compared to first quarter of 2023.

It’s important for dealers to consider how their collision operations factor into these sales, and transition of body shop ownership can happen in a number of ways. Some dealers just want to be out of the game altogether, and that can mean moving the shop off their premises.

“They just want to sell the business,” Roberts explained. “They don’t get as much for the business, but they repurpose the body shop into more service space.”

In this case, he said, a buying MSO might move the business, its equipment and its employees to an existing shop that has capacity.

Dealers will also participate in the aforementioned long-term lease situation. This, Rich pointed out, makes for a built-in credit tenant and a lowered capitalization rate. Lower cap rates (annual net operating income divided by market value) indicate less risk and higher value for commercial real estate.

But how does a dealership reach this point? Long-term lease rates, Rich explained, are based as a percentage of trailing 12-month sales for the body shop. The valuation of the body shop itself is then based on adjusted EBITDA (earnings before interest, taxes, depreciation and amortization) figures.

Getting accurate numbers through this process is especially important as

the selling of a business is a bespoke thing, and it’s a process worth pursuing fully, Rich said.

“What we, as investment bankers, hate to see is for owner operators to sell themselves short by not fully understanding what their true adjusted EBITDA is,” she explained. “Because with selling a business, it’s not like selling a house where there’s tons of records on Redfin or Zillow.”

Some dealers want to sell the whole business, dealership and all, and in those cases, it can be beneficial to look at chunking up the transaction, as selling the body shop separately can result in more money, Roberts contended.

Separating the body shop from the rest of the sale allows consolidators and MSOs to step into the equation. Sometimes in these situations, the real estate changes hands, and there’s a lease opportunity for the new owner. Body shop acquisition may not be a priority for another dealer looking to acquire the business, so the profit opportunity can be less there.

“If they just want to sell their body shop, the process is different because dealers are always being approached by other dealers that want to buy to bulk up in their market, but they’re not often being approached by people that want to buy their body shop,” Roberts explained.

However a sale takes place, offloading a body shop can be relief for a dealership owner looking to free up cash. And it’s a way for dealers to simplify operations and for MSOs to step up and do what they do best.

“The body shop business and the business of selling cars are very different, and they’re both getting a lot more complex,” Rich said. “So, splitting one’s focus, especially if the body shop, as involved as it is, is only a very small fraction of your annual sales — it’s just going to pull focus. Doubling down on what you do best and then getting a best-in-class operator to run the body shop side is an advantage.”

By Stacey Phillips Ronak Autobody News

Just over a year ago, the 3M Skills Development Center opened its doors in St. Paul, MN, to help educate and upskill the collision repair industry. Since the first class was held in June 2023, more than 55 events

3M is finding the classes are also attracting people from outside collision repair facilities. For example, students from different military bases have been interested in attending the courses.

“We’re fixing cars and they’re fixing planes, automobiles and tanks,” said Spah. “You might be next to

have taken place with more than 1,100 attendees from all experience levels. They include technicians, CEOs and managers, OEM partners, distributors, performance groups and the military.

Adam Spah , application engineering manager at 3M, said the 15,000-square-foot 3M Skills Development Center has been a source of training for students from across the country in 42 U.S. states, as well as Canada, with 80% of attendees from outside Minnesota and the surrounding states.

“It has been an exciting journey over the last 12 months,” said Spah. “The industry is very busy, but proactive business owners and shop managers are realizing the importance of investing in training technicians to increase the quality of work they put in each day, even though it’s a challenge to send a technician away for three or four days.”

The backbone of the Skills Development Center is multi-day hands-on training that focuses on the most updated body repair and paint preparation and refinishing methods. The body repair and paint classes are each held one week a month and offered to anyone who has an interest in taking them, whether that’s a college student, someone working out of their garage or technicians who have been part of the industry for just a few months or more than 30 years.

“We’re really focused on getting people through the classes to help upskill the industry,” said Spah.

around knowledge, skills and abilities so students learn what they need to repair vehicles properly. Within the open enrollment courses, 3M focuses on being product agnostic, hands-on, OEM-aligned and process-oriented.

“You would think that coming into a 3M facility, you’re just going to learn about 3M products, but we keep it very product agnostic, so you could potentially use various brands during the classes,” Spah explained.

With much of the industry training being conducted virtually during the pandemic, 3M has put a high emphasis on 90% of the learning at the facility being hands-on. Rather than looking at a screen and flipping through slides, Spah said students are doing the activities they are taught.

depending on that OEM,” said Spah. “There is also a focus on the science of ‘why’ something is done so students will retain the skills taught.”

Technicians learn the proper OEMapproved techniques for squeeze type welding on various components of a repair.

a bodyman or painter in the class, but we’ll also have somebody from a military base in that same class learning together.”

When training classes aren’t being held, the center typically plans meetings and events with industry organizations, OEMs, vocational technical instructors, collision performance groups, MSOs, distributors and several others.

The Collision Repair Education Foundation (CREF) has brought in students to get a glimpse of the industry and encourage interest in working on vehicles.

“We explain to them that they can make really good money — even six figures — in this industry and have a good career,” said Spah. “Their eyes light up and they get excited.”

The 3M Skills Development Center works closely with OEMs to share information about what is taking place at the facility. Several auto manufacturers have visited over the past year.

“They want to learn what we’re teaching and how they can leverage our high level of education for their technician certification programs,” noted Spah. “We tell them how we dive deep into OEM repair manuals and find that it excites OEMs to know technicians are following the procedures.”

Since opening the center, Spah said there has been a solid increase in demand for open enrollment classes and site visits, which he predicts will continue to accelerate in 2024.

Training classes are centered

“Getting somebody out of their element and focusing on what they’re learning goes a long way,” he explained. “They are more likely to learn and retain the skills as well as the proper technique by doing the repair activities on a physical piece.”

To support the goal of handson training, the facility was built with a flexible layout that can be adjusted to fit the needs of those in attendance. In addition to a traditional classroom space, there is a hands-on work environment that features stations with electrical and air service. A 36-foot GFS XL paint booth is set up with three-stage filtration, which can accommodate 16 painters. There is also a dedicated welding area with stations equipped with fume extraction hoods.

Spah noted only about 40% of technicians look at repair manuals or procedures when they fix vehicles. As a result, 3M educators spend time teaching where to find the OEM procedures and how to fix a vehicle to its pre-collision condition.

“Trainers explain the standard operating procedures (SOPs) to follow to ensure the procedure is done the same way every time,

3M’s trainers are technical engineers with a strong collision repair background. Their backgrounds range from 20-40 years of collision experience, and include I-CAR certified instructors, paint company technical experts, and those with insurance experience. Some have authored several technical articles.

“We know vehicles are becoming more complex so we work closely with trainers to ensure the training is relevant to the cars being repaired,” said Spah.

The training programs complement those available through the online 3M Collision Repair Academy, the 3M Collision YouTube channel and virtual I-CAR Alliance training. In addition, live webinars are held at the facility where students can participate in a real-time Q&A.

Spah said they have noticed an uptick in skills as technicians leave and they’re becoming more efficient.

“They are reporting getting more repair orders through after going through our sessions,” he added.

After a course is completed, 3M asks for feedback from students to continually improve the program.

“The feedback we’ve had with the classes so far has been incredibly positive,” said Spah.

3M also welcomes feedback from the industry to ensure timely and relevant courses are offered. Looking ahead, potential classes include welding certification, front office training and repair planning. Spah said 3M is currently working toward a new curriculum with a new course set to debut soon. Look for new classes in early 2025.

For more information about courses offered through the 3M Skills Development Center, visit www.3M.com.

By Abby Andrews Autobody News

G&C Auto Body was founded in Santa Rosa, CA, in 1972 by Gene Crozat and Leo Gassell. Two satellite locations were opened in the 1990s. When the business was handed down to Crozat’s children, they decided to ramp up the growth. It now has 42 locations in 14 counties in Northern California.

Patrick Crozat, Gene’s son and the current COO of G&C Auto Body, appeared on The Collision Vision podcast, hosted by Cole Strandberg and driven by Autobody News, as part of its “Insurance Talk: Navigating Insurance and Repairs” series, to talk about how Direct Repair Program (DRP) agreements with insurance companies have fueled his family business’ explosive growth.

Crozat said DRPs have been a part of the collision repair industry since he got into it 22 years ago.

He described them as “contractual agreements where in turn for referrals from that insurance partner, you’re going to make concessions where you’re going to look out for the cost of the bill for them, and provide customer service.”

He said DRPs are valuable to insurance companies because they help foster a relationship with a body shop, which is the “face” of the repair process for the customer, while giving the insurance company some control over the customer’s experience.

“To ease the process between the claim and the body shop and the insurance company, I see a lot of benefits to the programs,” Crozat said.

DRPs have been “crucial” to G&C Auto Body’s growth, Crozat said. “I think it would be very, very hard for any body shop owner to grow to multiple locations without DRP relationships. I think it’s always been that way,” he added.

It’s difficult to run multiple stores in the same niche, Crozat said, whether it’s going after luxury brands or referrals from a local dealership.

Crozat said his dad was always an advocate for DRPs. “He wanted it to be a symbiotic relationship between the body shop and the insurance company, and that we’re both working towards taking care of our customer,” he said.

Pros and Cons of DRPs DRPs require a lot more administrative paperwork, and usually include a

discount on the shop’s stated labor rate.

“You are focusing on pleasing a second customer in a way,” Crozat said, referring to the insurance company.

There are often multiple body shops in an area with the same DRP, leading to competition for the insurance company’s referrals.

“I love competition. I think competition is always needed and it drives businesses to excellence,” Crozat said. “If someone owns the market and they don’t have to work hard for it, they don’t have to try and earn it every day. Human nature. I think people will get very complacent and they wouldn’t give the best job that they could do.”

Most of G&C’s DRP partners like to have sit-down meetings with management at least twice a year to review the business, Crozat said. A large MSO like G&C Auto Body then disseminates any information to all of its locations.

G&C has a DRP account manager, who has nine employees under them, each with a specialization. The company has a training website with every DRP’s individual processes, to serve as a reference for employees, and holds monthly training sessions on each DRP for any new hires or anyone who needs a refresher.

Strandberg asked what advice Crozat could give owners of smaller companies looking to build infrastructure like that.

“It all starts with one step,” Crozat said. “It can be overwhelming to look at the big picture.”

certified facilities, it is restricting other repairers from being able to get parts for those manufacturers. Crozat said that led G&C Auto Body to get Tesla certifications at 11 locations, since there are so many Teslas in the MSO’s California markets.

He said when going after an OEM’s certification, form strong relationships with the local dealerships who the vehicles for repair. But it is also key to advertise OEM certifications directly to consumers, in the event of personnel changes at the dealership.

G&C Auto Body updates a “scorecard” weekly showing each shop’s performance in the metrics important to each DRP agreement at that shop.

Technology has made it easier to track shops’ KPIs and other metrics, meaning insurance companies now make referrals based on performance. “That’s what’s going to drive profitability for the insurance company, and that’s going to drive better CSI and lower rental days,” he said.

That has helped G&C Auto Body excel, Crozat said, as it performs well in terms of cycle time and CSI, so insurance companies want to establish a DRP at any shop the company opens.

Strandberg asked if G&C’s DRPs are leading to it being pulled into some of the markets it is growing into

Crozat said there have been instances of an insurance company asking about G&C’s growth plans, and then encouraging entry into a particular market.

“In those conversations they’ll be like, ‘Hey, you know what? We could really use a shop in that area. So let’s start looking at it,’” he said.

Crozat said his company prefers to open locations within a certain distance of each other, to support each other and build out markets. Insurance companies can provide data on how many competitor shops already exist in a set radius.

“It would have been really scary back in the day to do something like that, if you didn’t know if you could get the insurance companies and have that business,” Crozat said.

Crozat’s wife, Tara Crozat, joined G&C Auto Body as a customer support representative. She was then promoted to a clerical lead and then a writer. Now she manages the service writer program, which includes building SOPs and maintaining the training website. She also implemented a training program for new hires interested in becoming estimators.

“She was the most thorough, detailed writer,” Crozat said. “I would look internally at who is a writer in your organization that is on top of everything — very detail-oriented, process-driven and organized.”

Crozat said he thinks DRP agreements will largely remain the same, but maybe with some tweaks.

“I don’t think I’ve seen too much evolution with insurance partner relationships over the years,” he said.

G&C Auto Body has at least six DRPs per facility; some longerserving locations have up to 13.

“We’ve always been an advocate of having every DRP that we can get in our locations, so that we’re not hoping that all of our business comes from one insurance company all the time,” Crozat said. “I would recommend going towards having more DRP partners and growing your business to be able to meet all their needs.”

As more OEMs demand their vehicles are repaired only at

If a store isn’t hitting certain metrics, its estimates are reviewed centrally until they meet the standard, Crozat said.

“It’s continuous coaching until people understand the program and how to win with that insurance contract,” he said.

Overcoming Challenges with DRPs There have been instances where an insurance company hasn’t wanted to pay for a part of the repair process.

“You’re not always going to get what you want with an insurance partner. And that’s what is -- it’s a partnership, and a partnership is everyone gives and takes,” Crozat said.

He recommended maintaining good communication with DRP partners, as it increases the likelihood they’ll work with a shop if a part of the agreement is harming their business.

“Be open and honest and share the numbers with them,” Crozat said. “Maybe they’ll make a concession with you and work with you on it.”

Crozat also recommended talking to them regularly about how the shop can “be a better partner” for the insurance company.

“How am I doing currently? Where could I improve? How can I earn more of your business? And how can I grow with you? See if you can chart that path with the insurance partner,” Crozat said.

“If that path isn’t there, go looking to add maybe more insurance partners, where then you have enough business to be able to open a second location, or to take the building over next door down the street,” he added.

Axalta Irus Mix is the future for bodyshops. It is the fastest fully automated, completely hands-free mixing machine for the automotive refinish industry. It delivers highly accurate color, maximizing profitability and minimizing environmental impact to help bodyshops meet or exceed key business goals. Axalta Irus Mix, which works with Axalta’s innovative bottles made from 50%

Axalta Irus Mix, with its patented technology, is the fastest fully automated mixing machine on the market - between 15% and 100% faster than anything else available. Refinish customers can save more than 60% on labor time with Axalta Irus Mix compared to manual mixing.

As cutting-edge as Axalta Irus Mix is, it is extremely easy to use. In fact, one of the benefits of Axalta Irus Mix is that a skilled refinisher doesn’t have to operate it; anyone can, freeing up skilled technicians to do other jobs while the paint is being mixed. It is straight-forward and intuitive so after only one training session someone will be very comfortable and confident using Axalta Irus Mix.

Axalta Irus Mix was designed to work with Axalta’s proven bottle system, so there is no need to refill or decant product into special bottles. Additionally, the bottles are fitted with precise dosing lids, delivering accurate color without waste. The computer-controlled dosing enables bodyshops to mix colors in small amounts resulting in less consumption and less waste. And for those tints that are not used frequently, there are four optimized bottle sizes that perfectly match tint popularity. For the bodyshop, this means less money tied up in stock.

Axalta’s bottle system is made from 50% recycled plastic, underscoring Axalta’s commitment to sustainability. Spies Hecker Permahyd Hi-TEC is available in bottles exclusively with Axalta Irus Mix.

Axalta Irus Mix is the final step of Axalta’s simple, three-step Axalta Irus digital color management process: Scan – Match – Mix.

First, refinishers scan the color with Axalta Irus Scan – the newly launched spectrophotometer. This new technology scientifically measures paint color on a vehicle to provide accurate color matches in both waterborne and solventborne basecoat technologies.

Second, match the color using Axalta Nimbus Color, a revolutionary platform that leverages proprietary algorithms to find, sort, and return accurate color formulas.

Then it’s time to mix with Axalta Irus Mix. Axalta Irus Mix enables its users to work more efficiently, profitably and sustainably. Everything about Axalta Irus Mix is technologically advanced. Simply launch the mixing process from a PC or tablet and put the empty mixing cup in Axalta Irus Mix. The mixing formula is wirelessly sent from Axalta Nimbus Color to Axalta Irus Mix and, with a simple push of a button, Axalta Irus Mix does the rest, allowing skilled refinishers to do other, more productive tasks. The mixing cup is removed when finished and ready to be attached to the spray gun. For added convenience, after dispensing, the machine carries out quick automatic nozzle cleaning procedures to avoid blockages.

Axalta Irus Mix is linked to a cloud-based monitoring system that continuously checks its status. Users also have access to Axalta sales, technical and color teams.

Troy Weaver, Senior Vice President, Global Refinish, says, “At Axalta, we strive to be at the forefront of innovation. We constantly look for ways to help our customers to do business better, to enable our customers to work as efficiently as possible and to maximize their profitability. Axalta Irus Mix has done just that – as we have seen with more than 100 machines in use globally. Axalta Irus Mix is ideal for bodyshops and multi-shop owners who are looking to increase efficiency, profitability and to do more jobs per day. It not only reduces bodyshops bottlenecks and frees up refinishers to carry out more profitable, highly-skilled tasks, but also it boosts bodyshops’ capacities, saving them money and helping them become more sustainable. We are delivering technology that truly automates color like never before.”

By Paul Hughes Autobody News

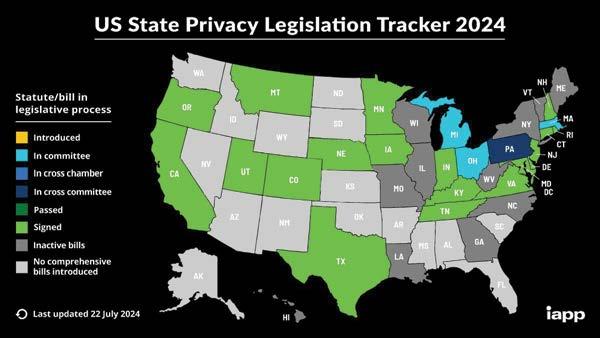

A push by individual states to regulate consumer information collected by businesses isn’t yet touching smaller body shops and collision centers, but efforts are gaining steam and there are great reasons for indie operators to know and prepare for local laws.

Act in 2018, and two years later, voters approved a proposition that expanded on CCPA. All regulations were effective by January 2023.

Other states are joining in.

Six states’ laws will have gone into effect this year and last, when Montana’s begins Oct. 1, according to nonprofit International Association of Privacy Professionals (IAPP). Nine

California was first with legislation often presented as “privacy protection” bills dealing with individuals’ data. The state passed the California Consumer Privacy

more are slated to hit in 2025 — six of these by January — with three more in January 2026. Four more states have active bills.

Only about one-fourth of states

haven’t tried to enact privacy legislation.

There is currently no national law, but that’s in the works as well.

“What’s really changing is the statelevel stuff,” said Brad Miller, head of legal at Utah-based ComplyAuto, which develops software to aid companies’ compliance with state and federal regulations.

The changes are more than just new legislation itself. Because it’s happening — or not — one-by-one, there are differences within and among various laws. Multiplied by dozens of states, it gets complicated.

Miller said “privacy” generally refers to “non-public personal information” — but not just the usual suspects. It involves obvious datapoints — insurance, driver licenses, Social Security numbers — but “anything personally identifiable” as well.

Some states let businesses correct a problem before they’re punished; some don’t.

“There are lots of layers to this, and all the laws are different,” Miller said.

A common approach seems to

be good for most shops: smallbusiness exemptions, which also differ state-to-state.

California’s law applies to businesses with more than $25 million in gross annual revenue or information on at least 100,000 residents or households.

Most independent body shops aren’t touched. MSOs and dealerships with shops likely are, and online privacy adds a whole ‘nother slew of considerations.

Roberto Baires owns Micro Tech Resources IT in Northern California. Among his clients are 100 or so body shops. More are concerned with the long-time CARFAX issue — past repairs not being in a vehicle history — than with the state’s stringent customer data privacy rules.

He stressed the limited information shops hold, noting, “customer data they see is in the estimating software, insurance companies, parts procurement, credit cards — they’re the ones managing it.”

“We have to keep some information for lifetime warranty repairs,” said Tiffany Silva, who

The Collision Industry Foundation (CIF) is a non-profit organization dedicated to providing support and assistance to collision repair professionals during times of crisis and hardship.

MISSION

Secure and distribute donations to individuals who have experienced significant losses due to natural disasters or other catastrophic events.

Tax-deductible donations needed to provide assistance: www.CollisionIndustryFoundation.org

co-owns Accurate Auto Body in Richmond, CA. But for the most part, “there’s nothing for me to hold.”

“Shops hold some data, but more of it is physical,” Baires added.

“I’m ‘old-school,’” said Ken Pike , owner of Ken’s Custom Auto Body in Marysville, CA. He collects a name and phone number for estimating but doesn’t keep any customer data. “I charge their credit card and that’s it.”

He’s never had a customer ask about their information.

Silva said her shop has policies in place — where it can exist, what happens if an employee takes a photo of a vehicle — developed with an attorney and IT. “We have data and we protect the data, but it doesn’t come up.”

Miller said if the law applies to a shop, it overlaps with much standard practice, apart from the exemptions.

And Silva’s policy approach is a good step even for shops that don’t strictly “need” it.

With the industry’s increasing complexity, technological advances and customer privacy and data concerns, there are good reasons to be ready to act.

Acquisitions: If a shop might ever

be sold, it’s best to have operations as pristine as possible. Big buyers will have their own method, of course, but keeping data collection clean and in compliance is never bad.

Breaches: Shop relationships with insurance companies, suppliers and dealers, among others, are at risk for hacking, ransomware and other cybersecurity issues. And these attacks are only expected to increase.

Customers: A formal policy developed with the right people and communicated to anyone who walks in the door ups the body shop’s game. It speaks to professionalism, customer care and a strong work ethic.

A policy defines relationships with consumers, third parties and the state. It prevents problems and prepares a shop for service today, and tomorrow.

Miller said federal legislation frequently stalls over particulars; but if not inevitable, it’s also not impossible. And without one, the news is more complex than good, since states passing a different law every time doesn’t make compliance any easier.

“The auto body industry is having to deal with this,” he said. “And new regulations are coming.”

Stellantis, the parent company of Chrysler, filed eight lawsuits Oct. 7 against the United Auto Workers (UAW) and 23 local units, accusing the union of breaching their contract by threatening to strike due to the automaker’s postponed investments.

The lawsuits were filed in Michigan, Ohio, Indiana, Texas, Arizona, Massachusetts and Oregon.

The lawsuits joined a similar one Stellantis filed Oct. 3 against the UAW and its Local 230 in Los Angeles after the union members at the Los Angeles parts distribution center voted for strike authorization. This vote was in response to grievances over Stellantis’s faltering on promised investments.

The union has argued Stellantis is violating the terms agreed upon last fall, which included significant financial commitments to

various facilities, including a $1.5 billion pledge to revamp the shuttered Belvidere, IL, assembly plant for new midsize truck production by 2027.

The UAW’s proposed reinstatement of the Jobs Bank — a concept that prohibits layoffs but was a factor in the automaker’s 2009 bankruptcy — was rejected by Stellantis during a meeting Oct. 5. Stellantis argued that such measures could jeopardize the company’s future.

In July, the Energy Department announced plans to award Stellantis $334.8 million to convert the Belvidere Assembly plant to build electric vehicles (EVs), though this award is yet to be finalized. This comes amid Stellantis’s contention that their investment plans, including those for EVs, are always subject to market conditions, which have recently shown a slowdown in demand for EVs.

evaluation,” Gredinburg said.

‘Repair or Replace’ Considerations

Andrew Batenhorst of the CIC Estimating and Repair Planning Committee pointed to a series of factors that can play into case-bycase decisions during estimating related to repair versus replace of a damaged panel.

The first, he said, involves reviewing the automaker documentation to look for any guidelines, the types and mil thickness of material involved, limits on the use of heat, whether there are restrictions on access to replacement parts, and what types of tools or consumables would be needed for repair.

“That brings us to accessibility, basically factoring what panels are around where we’re working, how much room we have from the backside, are we going to have any issues with getting the tools onto the panel to do what we need to do to properly straighten it,” Batenhorst said. “If we’re inhibited from doing that, that could lead to a ‘replace’ decision instead.”

Another factor is whether there is damage in a crumple zone that would affect repairability.

“In many cases, that’s a dealbreaker automatically,” he said. “If a crumple zone is affected, going back to the OEM instructions, that may right away warrant the replacement.”

Similarly, an estimator needs to determine if body lines or contours on a damaged part can be recreated accurately.

“The invasiveness of the repair is also very important,” Batenhorst said. “Our approach is always to minimize the intrusiveness to the vehicle, and try to preserve as much of factory e-coating, and limit how drastically we need to go into the car.”

There are refinish considerations, such as how much factory corrosion protection needs to be protected or restored, maximizing the amount of factory paint as possible, and considering whether refinishing or blending of adjacent panels would be involved.

One final consideration is part availability.

“Obviously, there’s a financial or economic decision that gets factored into this,” Batenhorst said. “We are still dealing in many cases with part delays from all the turmoil that’s in the world currently. Sometimes that may cause you to have a different approach to that repair or replace decision that you’re trying to make.”

Despite the prevalence of onthe-spot evaluations required during estimating, many in the industry see resistance among some insurers to move away from strict use of the 50% formula for blending rather than looking at it based on the factors that vary from vehicle to vehicle.

Darrell Amberson of the LaMettry’s Collision chain in Minnesota said changes to such things as the blend formula often take too long to get implemented.

“As an industry, when we have some significant changes come along, we’re notoriously slow,” Amberson said. “It tends to take us years to really evolve to the point where the dust settles and common compensation methodologies are established as the norm.”

He said he’s discouraged by how few insurers have been open to moving away from the old blend formula.

“I get a lot of excuses that are not necessarily based on good logic,” Amberson said. “Right now we have one insurer that’s adjusted its normal pricing. We have some others that are on a case-by-case

basis. But a whole lot of them are just not doing anything.”

He said he agreed repairers need to focus on the variables impacting the blend procedure the paint companies point to, rather than just the outcome of the 2022 blend study by the Society of Collision Repair Specialists, despite the efforts to make the study “accurate, fair and reasonable.”

“I’ve seen many industry changes over the years where we start a conversation and often there’s not much flexibility on the two sides,” Amberson said. “And then after a lot of education and discussions, we tend to evolve and find some kind of common ground. But we don’t do that enough or quick enough.

“We need more discussions like this [at CIC]. We need more activity from the paint companies. We need more insurance companies to come in and really understand the situation and help us all evolve,” he continued. “Too many times there’s a kind of a bullheadedness, ‘We’re just not going to accept a change,’ and that’s not necessarily reasonable.”

Saying he was speaking for a shop owner who couldn’t attend CIC, Andy Tylka of TAG Auto Group said that shop owner sees part of the problem is that 50% of full refinish time is still the default for blending in the CCC estimating system.

“He feels that doesn’t open up the mentality that it is an on-thespot evaluation,” Tylka said. “He is continuing to get responses from insurance companies that assume that the default is the standard. They’re referencing it as the standard, the established formula of CCC. He asked me to [say] that he feels like that 50% needs to go away. It needs to be a forced adjustment on every profile. Because right now it [seems to be] implying that there’s a recommended formula.”

Dan Risley of CCC Intelligent Solutions is the current chair of CIC, and he addressed that comment later in the meeting.

“I think it’s really a continual education process because we have the slider in there for the [user] to choose whatever they feel is necessary as an on-thespot evaluation,” Risley said. “The language is in there referencing the fact that it’s an on-the-spot evaluation. But that said, I heard the point loud and clear, and I’ll make sure I’ll bring that back to our team.”

The ASE Education Foundation is actively calling on automotive industry professionals to volunteer as mentors in an effort to combat the ongoing shortage of qualified automotive service technicians. Mentorships are a critical tool in bridging the skills gap by giving students hands-on experience and industry connections.

Mentors from local businesses provide essential real-world training, enabling students to apply classroom knowledge in professional settings. These mentors work alongside schools and instructors, offering both guidance and feedback to students while helping place them in entrylevel positions within the automotive and transportation industries.

Industry members interested in becoming mentors are encouraged to contact their local ASE field manager, who serves as a liaison between students, schools, and ASE industry partners. A full list of ASE field managers and the areas they serve is available at www. aseeducationfoundation.org.

by Feb. 28, to chart the creation of a state-run entity that will ultimately draft and enforce right to repair regulations in Maine. The Maine Attorney General’s Office is hosting monthly public meetings of the group to help frame the forthcoming recommendations.

Though federal right to repair legislation recently died in the U.S. House Energy and Commerce Committee, right to repair policies have advanced in states in recent years, and remain a hot topic in the automotive world.

Industry advocates and private citizens as of early September had sent more than 114,000 total letters to Congress requesting the passage of right to repair legislation, according to a press release by the Auto Care Association (ACA).

And in August 2023, the National Highway Transportation Safety Administration finally agreed that automakers are able to comply with a 2020 Massachusetts law giving consumers the right to use a mobile app to directly access all of a vehicle’s mechanical data.

Every year, right to repair legislation is introduced in several

state legislatures, but usually languishes before having the chance to be enacted.

Brett Cartwright, owner/operator of Windham Automotive in Windham, ME, noted it is more difficult to get data on newer cars than older ones.

He said his shop pays for a thirdparty scan tool subscription that updates with new vehicle info on a bimonthly basis, but it’s not a cure-all.

Compared to many cars made since 2020, for instance, “I can get more information on, say, a 2011 Chevy Malibu,” he said.

Everything in new cars has an electronic module, even traditionally basic components like power steering racks, Luther said. This means that shops that don’t have adequate passthrough devices will be left behind, he added.

Third-party passthrough companies often charge per-scan fees ranging from roughly $75 to $150 to use their devices for each repair instance, according to Society of Collision Repair Specialists (SCRS) board member Kris Burton, who is also owner/operator of Rosslyn Auto Body in Alexandria, VA. His shop performs pre- and post-repair scans, and sometimes performs calibration

scans with that third-party software, to ensure cars’ issues are accurately identified and the correct repairs made.

While scan tools can generally stream live data and partially calibrate vehicle control modules, passthrough devices are able to more deeply reprogram vehicle control modules. Both OEMs and third-party companies sell passthrough devices.

Tesla Director of Service Engineering Brian Boggs mentioned a 2014 memorandum of understanding (MOU), a 2023 repair data sharing commitment, and the recently passed Maine right to repair working group legislation, all of which require car manufacturers sell their scan tool to independent repairers at “fair and reasonable terms,” he said.

The MOU signed by leaders of the Auto Alliance, Automotive Aftermarket Industry Association (now ACA), Global Automakers, and Coalition for Auto Repair Equity generally calls for due consideration of costs to car dealerships and independent repairers for providing and obtaining the information, respectively.

The 2023 Automotive Repair Data/Sharing Commitment between the Automotive Service Association, SCRS and Alliance for Automotive Innovation called for “fair and

reasonable terms” for data sharing to be established in alignment with U.S. Environmental Protection Agency, California Air Resources Board and Massachusetts statutory requirements.

The “fair and reasonable” provisions of the above guidelines are meant to ensure car manufacturers’ OEM scan tools remain widely available to independent shops, meaning the OEMs “don’t have a monopoly” on the scan tool market, Boggs said.

Cartwright’s shop uses a universal, third-party scan tool, made by Snap-on, which aggregates data across several different car makes and models, acting as a value-add for repairers who don’t want to pay separately for OEMs’ much more detailed and exclusive diagnostic tools, he said.

To get a comprehensive list of diagnostics for every make and model, “we would need to buy a Ford scan tool, a Dodge scan tool, a Chevy scan tool, a BMW scan tool, a Honda scan tool, a Toyota scan tool,” Cartwright said. “At $10,000 to $15,000 apiece, it’s just not feasible.”

Patrick Horan, owner of Kittery, ME-based Autoworks Diagnostics and Repair, made the case for

OEMs’ vehicle data to be provided to independent shops on an ongoing basis, so that repairers could address drivers’ periodic car problems as they arise. But Horan said he didn’t expect Maine’s right to repair regulations to spur this type of data flow.

“These vehicles, as they’re driving, are taking data every day,” he said. “If you have an intermittent problem on your vehicle, if I had the access to it, I could go into your vehicle and see what’s going on when the problem is actually happening to save you a trip to the dealership or to our shop. And that’s the piece that I don’t think we’re going to have access to, which I think is unfair, because that information should be up to the customer who gets to share that information.”

Burton, whose shop is OEMcertified and uses mainly OEM parts for collision repair, said his shop gets access to all OEM information, as it regularly deals with car manufacturers for training and pulls repair instructions directly from the OEM.

Burton said the biggest challenge he sees in collision repair is reimbursement from insurance companies, not OEM data access.

“When we have a vehicle that comes in that’s damaged, we go through and pull all the OEM repair information, get all the instructions;

it tells you where to weld, what types of weld, what types of rivets, where the rivets go,” Burton said. “All the relevant information is there.”

Voit Ritch, owner of Freeport, MEbased European specialty repair shop Autowerkes Maine, cautioned against right to repair legislation, saying that industry agreements, including the 2014 MOU and 2023 repair data sharing commitment, already fill the would-be role of right to repair legislation.

“Aftermarket-developed and secondary repair information is historically inaccurate and unreliable,” he said. “To think that some entity could develop a reliably functional universal information system is certain to fail. I have been, and currently am, a beta tester for numerous companies’ tools, and none of them have ever proven universally reliable.”

Ritch reiterated Boggs’ point that since the MOU, most manufacturers have offered proprietary factory repair data on a subscription basis. Ritch also mentioned the then-active U.S. House right to repair bill, and the potential for a patchwork of individual state regulations of a large industry issue such as right to repair, which he

said could lead to “legal paralysis.”

“Shouldn’t we just let this federal legislation take the lead?” he said. “When the government gets involved with legislation, lawyers become involved, and litigation will commence.”

As OEMs will prospectively offer more remote diagnostics services in future years, Maine Right to Repair Coalition Director Tommy Hickey asked Ritch whether it would be fair to repair shops for OEMs to be able to preemptively call customers when their remote diagnostics identify issues, even if independent shops won’t have access to the same data.

If “I do a good enough job, they’ll want to come to my shop instead of the dealership,” Ritch replied.

Hickey said: “They won’t know to go to you when there’s remote diagnostics you don’t have access to.”

Ritch rebutted: “They can call me on the phone and tell me what’s going on.”

Hickey replied: “Not if the manufacturer and the dealer are reaching out” to the driver.

Soon after this spirited exchange, Maine Chief Deputy Attorney General Christopher Taub turned the attention to the meeting’s remaining presenters, noting that substantive policy debate would occur in future meetings.

Registration Portal and ‘Connected Tools’ Independent repairers hope that as OEMs open access to their vehicle data to independent repairers and consumers, they will both receive inexpensive and comprehensive information to fix their cars.

But there needs to be a reliable mechanism to ensure open access.

A cyber-secure registration portal accessible to multiple parties -- rather than being administered unilaterally by OEMs — could allow independent repair shops to create accounts and have connected tools that talk directly to the registration portals and vehicles, said Brian Romansky, general manager of connected vehicle solutions for Monroe, CTbased Internet of Things company INTEGRITY Security Services, LLC.

Romansky raised the possibility of repair industry adoption of a Service Oriented Vehicle Diagnostics (SOVD) framework, which the International Standards Organization is in the process of standardizing.

In lieu of using scan tools to physically plug into a car to glean diagnostic data, SOVD contains a technology gateway in the car that acts like a connector for a physical scan tool.

“The logic, the smarts, of the scan l CONTINUED ON PAGE 39

By John Yoswick Autobody News

George Arrants, vice president of the ASE Education Foundation, doesn’t think the collision industry’s technician shortage is based on a lack of interest in the trades by young people nor too few students entering collision repair training.

“The number of students in a program this year is higher than ever before,” said Arrants, whose organization evaluates and accredits entry-level automotive technology education programs against industry standards. “We see that most of our programs are at capacity or higher. But then for some reason, once we get them in the programs, we think our job is done.”

The problem, he said, is the followthrough during those students’ time in the program and into their first job in the industry. Arrants estimates 1 in 5 graduates of automotive training programs never enter the industry, and about an equal number leave the industry within two years.

I-CAR research has produced even more stark findings: Only 15% of students who enter the industry stay for more than 18 months.

“We’re eating our young,” Arrants said. “These people are interested in our industry. But we bring them into our shops and expect them to be productive. There’s not one of us who was productive our first day on the job. There’s no on-boarding, there’s no mentoring.”

Waiting to employ students only once they finish a program is also an issue, he said.

“If you don’t hire them until after they graduate, the only thing they know is the program they were in,” Arrants said. “That means when they come to you, it’s a whole new experience. And that’s why we lose a lot of them. But we have found that for those students who work in your shops while they’re in school, it’s a more seamless transition. And they stay for decades.”

He said there’s another sad truth about those entry-level technicians leaving the collision industry: “They’re not leaving skilled trades,” he said. “They’re staying in the skilled trades. They’re just not staying with us.”

What else can shops and vendors in the industry do to help collision repair training programs and the students they are training to help stem the flow of potential technicians out of the industry?

Supporting the Collision Repair Education Foundation (CREF) is one good step. CREF provided $136,000 in scholarships to collision repair students last year, and another $678,000 in grants to 110 schools to benefit their collision repair training program. CREF also donated more than $18 million in product donations to the programs, including 78 current model Audi and Volkswagen vehicles to schools.

for more participants in their program advisory committees.

“One of instructors’ biggest pet peeves is an employer, who they’ve never heard from or seen, coming in at the end of the spring semester and saying, ‘I want your best students,’” Eckenrode said. “The instructors look at them thinking, ‘Where have you been for the past school year? I’m going to help those employers and local businesses that

Brandon Eckenrode, executive director of CREF, said any organization within the industry can sponsor uniforms for students at their local school.

“We’ve heard from instructors that when the students have brand new uniforms rather than just wearing street clothes, that has made the biggest impact of all that we’ve given out,” Eckenrode said. “It’s a way for you to connect with the students as it’s you, the sponsoring company, that’s helping distribute the uniforms, and talking to these students, helping make sure that these students look professional while they’re learning. The sponsoring company’s logo is on the front of all the uniforms, so it’s almost a walking billboard for your company.”

CREF can also assist with parts donations.

“Instructors have told us their No. 1 need is donated scrap and spare parts,” Eckenrode said. “We literally have instructors rummaging through the Dumpsters of body shops and dealerships looking for spare parts that they can bring back for their students to work on. I think we can agree that with the number of damaged and slightly used parts that are taken off of customers’ cars, there’s absolutely no reason why instructors should be rummaging through the trash to get these parts.”

He said most schools are looking

different companies that are waiting for them to graduate, and it’s that that motivates them to stay in the collision industry and that program,’” Eckenrode said. “They walk out of those events with a stack of business cards. Some of them walk out with multiple job offers.”

For more information about working with CREF to help a school’s collision repair program, check the foundation’s website.

Shops can also help relieve the industry’s technician shortage by training new entry-level workers inhouse. I-CAR is now making its new I-CAR Academy Program available to collision repair facilities, after launching it for schools earlier this year. The I-CAR Academy program is an early career program to educate and recognize new technicians starting a career in the industry.

I-CAR’s Jeff Peevy said the program is in part a response to what he heard from shops about entry-level technicians they were seeing from school collision repair training programs.

are committed throughout the entire year, not just coming in and trying to cherry pick those best students when they are graduating.’”

Eckenrode noted that in-kind donations made up the bulk of the assistance the foundation provided to schools last year.

“Tools, equipment, supplies, parts, everything that your companies may have, we can find homes for those in local schools,” Eckenrode said. “There are some schools that have 150 students and their total program budget is $3,000, and that is the state of what they have. So it’s an opportunity for us to make sure that they have the items they need to provide a quality technical education.”

He said CREF also continues to hold career fairs around the country.

“These help showcase to these students all the different companies that are interested in them, Eckenrode said. “And what’s great about these events is it’s not just repair facilities. It’s tool and equipment companies, paint vendors, insurance, rental car. Everybody is there to showcase, ‘Hey, we need you.’

“We’ve heard from instructors who say, ‘I’ve had students who are kind of trying out collision repair and they’re not quite sure if they like it, but they come to these career fair events, they see all the

“There was a lot of feedback saying a young person coming out of a school had experienced an inch-deep and a mile-wide training experience,” Peevy said. “And when they were put into the shop environment, they really did not have a high level of proficiency in anything. They had experienced a lot of things, but they could not be put on something to do without having a lot of oversight.”

The new program focuses instead on “what would you have an entrylevel technician do that would make them valuable to your operation from day one, what would make them feel valued from day one,” he said.

I-CAR Academy’s curriculum covers collision repair fundamentals such as safety and tool skills, plastic repair, small dent repair, disassembly and reassembly, and supports a shop using it by including resources on selecting and training a mentor. A badging system recognizes a new technician’s progress.

“Our industry is in dire need of technicians,” I-CAR CEO John Van Alstyne said. “For some, the right starting point is a school, while others excel beginning their career in a shop. Regardless of where a technician enters the industry, they can count on I-CAR Academy to give them a solid and relevant foundation from which to build their future.”

By Paul Hughes Autobody News

Sometimes a “nice problem to have” is not quite true.

Two Steve Halls — father and son — and son and brother Shaun Hall sold their four-unit MSO, Steve’s Auto Body, in northeastern Arkansas to consolidator Joe Hudson’s Collision Centers in September 2023.

The four shops were in Marion, Jonesboro, Paragould and Searcy. In a way, they ended up like eight shops, and, in an unhelpful way, like just one.

Steve Hall Sr. had the first one in Marion by 1999. The others came in five years, between 2010 and 2015. At its sale, the four sites —

“that was our first mess up,” Hall Jr said; a near-monopoly in the market — “the only MSO … we had a great reputation;” inexperienced workforce — “the talent we had, had never done anything that large;” and exponential expense growth — “keeping up with ADAS … changing metals … I-CAR [training.]”

Grouping expenses is a big no-no, but the Halls are by no means unique in the industry here. And while a near-monopoly sounds like a nice problem to have, market dominance bred some carelessness. The busy business has to keep serving the customer; paperwork didn’t get done.

Expense growth is a given, and employment issues — changes wrought by COVID like finding willing techs, then having them miss time for training on new systems -also hit ops.

The shops had no fulltime bookkeeper.

Boiled down: scant attention for financials. “We were just focused on getting things done.”

“It was chaotic,” Hall Jr. said. “We’d created a beast.”

center, taxes — make you want to say, “Are you sure?”

She’s sure.

Hall added to the list: “assets, sales information, land, leases, list of employees and their certifications.”

“This is something all shop owners should do,” Gay said.

Employment issues crop up, again, too.

“Estimator, parts person, whoever closes the ticket, the actual person doing the books, coding it all properly,” Gay said. “You need people who embrace it.”

She said ideally collision centers do this as they go; often they don’t. “There’s always lug nuts that don’t get tightened.”

Steve’s Auto Body created a whole new set of books for each shop, and filed amended tax returns as numbers clarified.

“There was a lot of unwinding to rewind,” Gay said.

“I didn’t want to sell to an MSO that wasn’t like us,” Steve Hall Jr. said. “Joe Hudson — the quality, good reputation, they take care of their employees; they‘re not coming in to just completely change everything.”

Joe Hudson’s has more than 230 locations. This month it entered Ohio, its 17th state, and most recently bought shops in Georgia and Mississippi.

It had 194 shops in 15 states when it bought the Halls’ MSO, which was its entrance into Arkansas. JHCC CEO Brant Wilson said in a press release on the deal the consolidator would be “developing a successful Arkansas market with these new locations.”

Gay called buying a dominant mini-MSO “a platform opportunity for a consolidator.”

Joe Hudson’s website this month lists 12 Arkansas collision shops in its system.

The Halls have seen more health issues, and Hall Jr. said they can spend more time together.

And work slower, doing real estate development. The family kept the land the shops sit on, and lease it to the new owner. Hall Jr. called the lease “awesome.”

Five acres near one of the shops remain in the family; the Halls plan to develop a self-storage facility. They work with the accountant who rebuilt the shops’ financials.

“She’s very black and white,” Hall Jr. said.

regularly outgrowing original spaces; renovated; and adding land, buildings and shop space — totaled some 120,000 square feet, 55 employees and north of $13 million in annual sales.

The brothers joined as growth began.

Opening and expanding multiple shops fast, usually doubling space, means four were like eight. Combining numbers across the four means you could see them as one operation.

Which became a problem.

“We just didn’t know,” Steve Hall Jr. said.

The business was growing, new hires coming onboard, technology spawned new equipment, there were loans for land and building buys —and money was coming in.

The MSO saw 15% gross sales growth annually for the five years from 2018 leading to the exit, Hall Jr. said.

“We were growing so rapidly and didn’t realize it had gotten out of control until we got ready to sell.”

There were four problems: grouping expenses for the shops —

construction project, Shaun running a store.

“Things got away from us a bit.”

The MSO’s metrics were good, the family said, and made shops an acquisition target, with the usual nosing about by big buyers, including Joe Hudson’s, who’d been calling for about a year, and Caliber Holdings LLC.

Before they saw the problem, the family had decided to sell.

“My dad’s health started turning [and] COVID left a bad taste” on labor, Hall Jr. said. “Big MSOs were buying up shops; we felt it was a good time.”

Consultant based Consolidation Coach stepped in.

“It’s hard to keep the books clean, if you’re running a fast-paced, highproduction collision shop,” she said.

“To take it to market,” material has to be structured for the gimleteyed, green eyeshade guys. Gay called the process “forensic financial analysis.”

The list of financial must-haves — multiple income and cost-of-goods accounts, separate labor costing for each area, profitability by profit

Our knowledgeable and helpful parts professionals want to earn your business and will provide you with the highest level of customer friendly service.

• We stock over $2,000,000 in collision & mechanical parts

• We stock over $2,000,000 in collliision & mechanical parts 0

• We deliver throughout Massachusetts, Rhode Island and New Hampshire ever y day

• We deliver throughout Massachussetts, Rhode Island and New Hampshire ever y day

• Our reputation is built on providing you the best SERVICE

• Our reputation is built on providing you the best SERVICE

• Save time, improve profits and keep your customers loyal

• Sav a e time, improve profits and keep p your customers loyal

• Place any order on line with our parts order form at buycolonial.com

• Place any order on line with our parts order form at buycolonial.com

• Join our growing list of satisfied customers

• Join our growing list of satisfied customers

Colonial Ford

147 Samoset St., Plymouth, MA 02360

Ph: 800-233-8109 / Fx: 508-830-1658

Hours: M-F 7:30-5; Sat 7:30-4

Colonial Ford of Marlboro

428 Maple St., Marlborough, MA 01752 wtrottier@buycolonialfordmarlboro.com

Ph: 888-617-3599 / Fx: 508-460-3464

Colonial Volkswagen

89 Turnpike Rd. (Rte. 9), Westborough, MA 01581

Ph: 888-322-6570 / Fx: 508-616-0445

Hours: M-F 7:30-5:30; Sat 7:30-4

Colonial VW of Medford

Ph: 781-475-5208 / Fx: 781-391-3506

Hours: M-Th 7-7; F 7-5; Sat 8-4

340 Mystic Ave., Medford, MA 02155 nmedeiros@vwmedford.com

Wellesley Volkswagen

231 Linden St., Wellesley, MA 02482

Ph: 800-228-8344 / Fx: 781-237-6024

Hours: M-F 7:30-5; Sat 7:30-4

wellesleyvwparts@aol.com

Contact: Dan Bettencourt / Wholesale Parts Manager

• Daily shipping available throughout New England and the Northeast

• Daily shipping available throughout New England and the Northeast

Nissan

Ph: 781-395-3025 Fx: 781-475-5063 104 Mystic Ave. Medford, MA 02155 Hours: M-F 7:30-5 Sat 8-4

North End Mazda

747 Chase Rd. (Rte.13) Lunenburg, MA 01462

Ph: 800-322-1241 Fx: 978-582-9841

Hours: M-F 7:30-5:30 Sat 8-4

225 State Rd., Dartmouth, MA 02747

Toll Free: 888-240-2773

Parts Dir: 508-997-2919 Fx: 508-730-6578

jdelcolle@buycolonialhonda.com

www.hondapartswholesaledirect.com

Cityside Subaru

790 Pleasant St., Belmont, MA 02478

Ph: 617-826-5013 / Fx: 617-489-0733

Hours: M-F 7:30-5:30; Sat 8-4

Hours: M-Th 7-7; F 7-5:30; Sat 8-4:30 Colonial Honda of Dartmouth parts@citysidesubaru.com

757 Chase Rd. (Rte.13), Lunenburg, MA 01462

Ph: 888-686-4387 / Fx: 978-582-9843

Hours: M-F 7:30-5:30; Sat 8-4 North End Subaru

parts@northendsubaru.com www.northendsubaru.com

Hours: M-F 8-5; Sat 8-4

Colonial Chrysler-Jeep-Dodge-Ram

24 Coolidge St. (Rte. 62), Hudson, MA 01749

Ph: 978-568-8000 / Fx: 978-562-1213

www.buymoparpartsnow.com

Colonial South Chrysler-Jeep-Dodge-Ram

42 State Rd., Dartmouth, MA 02747

Ph: 508-984-1900 / Fx: 774-328-9915

Hours: M-F 8-5; Sat 8-3

parts@buycolonialsouthcjd.com www.buymoparparts.com

201 Cambridge Rd., Woburn, MA 01801

Ph: 781-935-7009 / Fx: 781-933-7728

Hours: M, T, Th, F 7-5; W 7-8; Sat 8-4

Colonial Cadillac of Woburn www.buycolonialcadillac.com

171 Great Rd., Acton, MA 01720

Ph: 978-263-3994 / Fx: 978-263-8587

Hours: M-F 7-5; Sat 8-4

Colonial Chevrolet parts@colonialchevrolet.com

Colonial South Chevrolet

361 State St., Dartmouth, MA 02747

Ph: 508-997-6711 / Fx: 508-979-1219

Hours: M-F 8-5; Sat 8-4

parts@colonialsouthchevrolet.com

Colonial West Chevrolet

314 John Fitch Hwy., Fitchburg, MA 01420

Ph: 978-503-7480 / Fx: 978-345-1152

Hours: M-F 8-5; Sat 8-4

By Elizabeth Crumbly Autobody News

An unexpected contribution has bolstered an education program nurturing bright-eyed new talent through the industry pipeline. San Diego-based Mitchell, a company that specializes in claims technology solutions, recently announced a $1.5 million in-kind donation to the Collision Engineering program, which serves students at seven colleges across the nation.

“What a surprise it was to receive that donation from them,” said

in the program will enhance the employability of graduates.

Advanced software like this, Mahoney said, can be difficult to integrate into a curriculum because of the training needed. To curb that challenge, Mitchell is providing ondemand training for instructors, along with product guidance and live webinar training sessions for students hosted by Mitchell trainers.

The technology should go into use in the next few months: Instructors, Mahoney said, are “ecstatic.”

“They were so excited, and they

Mary Mahoney, vice president for Enterprise Mobility, which launched the Collision Engineering program in partnership with Ranken Technical College in St. Louis, MO. The program includes eight weeks in the classroom and another eight in a body shop apprenticeship.

“They are a valuable partner of ours,” she told Autobody News of Mitchell. “They believe in the mission. They believe in trying to build, recruit, coach and develop that next generation of collision repair technicians.”

The donation, Mahoney explained, will provide more students with access to its advanced technology solutions, including Mitchell Cloud Estimating with Integrated Repair Procedures and Mitchell TechAdvisor.

New vehicle innovations mean body shop technicians need software knowledge alongside collision repair skills. Through Mitchell’s technology donation, students receive realworld experience using the same advanced solutions as collision facilities do today to restore vehicles to pre-accident condition, she said. Students’ access to the system

“When I was picking a career, I knew I wanted to be passionate about it, but I also wanted to make an impact and the trades had that to offer,” said Karina Badillo, a College of Lake County CEP graduate. “When I first started college, I bounced around through welding and through automotive technology, but they didn’t have a program that was similar to this … you can really connect the bookwork to the actual hands-on experience that the real world has to offer … It is really nice being able to have a team behind you.”

Expansion means the need for more industry collaboration and partnership.

Enterprise Mobility Foundation has provided most Collision Engineering funding thus far, Mahoney said, with expenditures per student coming in at just over $10,500. That number covers tools, PPE equipment books and other supplies.

The foundation also funds school needs like instructors and training equipment, and it subsidizes student pay during their shop participation by adding to the amount employers can provide. Additionally, funds support the professional and personal

development of students and their mentors.

“We want these students to understand how to operate successfully in a work environment, and develop strong relationships,” Mahoney explained. “The idea is to help build a culture where people feel more comfortable. That has been a wonderful add, and people want more of that.”

A significant contributor has been the Ford Fund, which provided nearly half a million dollars allowing the collision program at Parkland College in Champaign, IL, to continue and relaunch as Collision Engineering.

Westmont, IL-based MSO Crash Champions has hosted program apprentices in shops, and CEO Matt Ebert has made the program the company’s charity of choice for an annual fundraiser, Mahoney said. AAA Northern California has also committed to contributions to the program, including vehicle donations.

“Our goal now is building off what we have learned and continuing to expand. What we recognize is we can’t do this alone, and we are looking for everyone in the industry to join the movement,” Mahoney said.

just saw so much more value for the student, and so much more opportunity to inspire them and give them more confidence,” she said.

The Collision Engineering program began as a pilot endeavor in 2020 at Ranken and has since spread to seven colleges, including, most recently, Sandhills Community College in Southern Pines, NC. Since launching, the CEP has graduated 165 students, Mahoney said, and it maintains roughly an 87.5% retention rate.

A focus moving forward is on which schools to bring into the program and how to continue financial support for students and the colleges currently participating. Bringing more women into the program, and thus the industry, is also close to the forefront.