A nationwide survey conducted by the Auto Care Association has shed light on the significant obstacles that independent automotive repair shops encounter due to restricted access to vehicle repair and maintenance data. This limitation not only hampers their operational capabilities but also leads to substantial financial losses.

technician recruitment and inflation. This data is crucial for these businesses to perform routine repairs and maintenance effectively.

Moreover, the majority of these shops face routine difficulties in servicing vehicles, with 63% encountering obstacles on a daily or weekly basis. About 51% of the shops reported being forced to

The findings support the need for the REPAIR Act (H.R. 906), a federal bill that would ensure vehicle owners and repairers of their choice have access to the vehicle data, tools and software required to maintain and repair modern vehicles.

The survey revealed 84% of independent repair facilities identify access to vehicle repair and maintenance data as their paramount concern, overshadowing other pressing issues such as

redirect up to five vehicles each month to dealerships due to these data restrictions, resulting in an estimated annual financial impact of $3.1 billion across the industry.

“This research sheds new light on the stark reality facing the 273,000 shops and 900,000 technicians in in the United States if Congress fails to take action on federal right to repair legislation,” said Bill Hanvey , president and

A survey conducted earlier this year by the Northwest Automotive Trades Association (NATA) showed the general shop labor rate is up statewide to about $151, a 25% increase from 2021, the last time the survey was conducted.

NATA said it distributed the survey to more than 500 shops throughout Oregon, both members and nonmembers of the association. More than 100 shops participated. Those shops averaged just under seven full-time employees each, including an average of 4.3 fulltime production employees and 2.5 fulltime office staff.

In addition to finding a 25% increase in the general shop labor rate, the survey found:

Shops tend to charge slightly

more than their general labor rate for diagnostic work. There is even more range in diagnostic rates shop to shop, from a low statewide of $95 to a high of $239 per hour.

Of shops charging a flat fee for an oil change — as about two-thirds of shops do — the average was $60, up nearly 18% since 2021. Of those charging based on a labor rate, the average labor rate was $90, up nearly 70% from three years ago.

NATA noted the sample size for this category was quite small.

There is significant variance in how much shops mark-up prices on parts. Mark-up on used parts is fairly consistent across the state, with shops typically charging a customer

l

The Northwest Auto Care Alliance (NWACA) is hosting its second annual Collision Training Expo (CTE), May 3-4 at Clover Park Technical College in Lakewood, WA.

The inaugural CTE in 2023 was such a success, it has been expanded from one to two full days of training classes and a trade show.

The event is designed for everyone

One of the most important skills for successful collision repair estimators is a good working knowledge of the “p-pages,” or estimating reference manual, for the information system they are using, whether it is made by Audatex, CCC or Mitchell. These guides help an estimator understand what is included – and just as importantly, what isn’t included – in the labor times provided within the systems. The guides differ from one another and continue to evolve, so staying abreast of changes is important.

Danny Gredinberg of the Database Enhancement Gateway (DEG) said while the guide is generally accessible within the system itself, estimators reviewing an estimate prepared in one of the other systems may need to review that system’s guide as well. All three guides are available on the DEG’s website, degweb.org/industryestimating-systems/.

Gredinberg highlighted some of the recent changes in the guides in a presentation at an industry event earlier this year.

Audatex Solera Qapter Database Reference Manual

The latest version of the Audatex Solera Qapter Database Reference Manual, for example, spells out that “any fees related to OEM data subscriptions or information access are not included in part prices or labor values within Audatex estimating.” The same is true for any labor related to access or research of OEM service information or electronic parts catalogues.

Another new labor exclusion in section 4-2 of the document reads that “additional repair operations that are taught in an OEM training environment but aren’t included in the current OEM reference material” are not included in the system’s labor times.

“You may have to go to an OEM technical school to learn a specific repair procedure, for example,” Gredinberg said. “A lot of manufacturers may have specific information they don’t define in the actual OEM repair procedure. So it’s very important to attend the [OEM] training if it’s available because there are going to be a lot of takeaways from those for specific repairs.”

Also newly excluded from Audatex labor times is the labor to apply seam sealer on new parts that require it.

“This is an update because previously they did include seam

sealer application on bolt-on parts,” Gredinberg said.

Also excluded is assembly of new parts that come in multiple unassembled parts from the manufacturer.

“If you order a grille assembly, you may receive a box of four or five or seven different parts,” Gredinberg said. “You have to build that component to be installed. That is a not-included operation.”

Set-up of riveting equipment and

have to put a part on a stand to refinish it in a certain way,” he said. “Sometimes you have to get creative in order to get the coatings to all the nooks and crannies, the backsides and undersides. If you have to set a stand up in a unique way, that’s a notincluded operation.”

The guide now indicates repair times in the system include “one test fit of a component.” In response to a inquiry, Gredinberg said, Motor

materials, as well as test riveting, is also another new labor exclusion in Audatex.

Within the refinish guidelines in section 4-4, Gredinberg said, the blend formula wording – previously defined as 50% of the full panel refinish time –has been deleted, with Audatex stating that it “does not provide a standard labor allowance for blending panels as this requires the estimate preparer’s judgment [and] expertise, [along with] consideration of the unique requirements for each repair.”

“It allows the end-user to put whatever percentage they feel is necessary for performing the blend,” Gredinberg said.

A similar change related to the blend formula has been made in the Motor Guide to Estimating, the basis for the CCC Intelligent Solutions estimating system. Motor has eliminated blend formula, Gredinberg said, and instead states “estimated refinish times for color blending should defer to the judgment of an estimator or appraiser following an on-the-spot evaluation of the specific vehicle and refinishing requirements in question.”

Also in the refinish section, Gredinberg said, Motor has added that assembling or setting up a unique fixture or stand to hold parts for refinishing is a not-included operation.

“Many times when we’re painting parts off of the vehicle, we may

be included in that section with a labor allowance for the performance of the task if necessary.”

Gredinberg said another update notes the labor times shown for air conditioning evacuation and recharge represent “utilizing A/C servicing equipment in a collision repair environment that evacuates the system by applying vacuum that must be held by the system for a certain period of time (leak check) confirmed with an electronic leak detection equipment post refill.”

“So essentially take an electronic sniffer monitor like an A/C leak detection tool and check just the service ports, that’s included,” Gredinberg said. “But if you have to diagnose a leak within the entire system, that time is not factored into evacuate and recharge. Some vehicle manufacturers may have different routing of those lines and refrigerant type. So always follow manufacturer guidelines but, again, to leak check just at the ports is an included operation.”

clarified its labor times do not “include a second (or more) fitment of a component to the vehicle, for any reason (including verification of dimensional accuracy or adjacent part alignment),” and “if more than one component installation is required for a specific repair plan, an on-the-spot evaluation should be used for the number of fitments beyond the first one required to perform the repair.”

In the wheel section of the guide, Gredinberg said, “torque wheel to OE specifications” is now included in labor times.

“But if you look at a lot of these repair operations or repair manuals, it may tell you to retorque the wheel after so many miles of road testing the vehicle,” he said. “If you have to retorque, perform duplicate effort, it’s a not-included operation. So again, this identifies that one ‘torque wheel to specifications’ is included.”

Mitchell P-pages

Mitchell also has made recent changes to its Collision Estimating Guide P-pages. Under the labor general information section, for example, a new section on caulking indicates that “labor times…for bolton panels includes the application of caulking/seam sealer.” If Mitchell determines an OEM replacement part is not serviced consistently by a vehicle manufacturer, it will add a footnote — “does not include application of caulking” – to the specific panels, and “a headnote will

In any case, diagnosing a failed leak check test is not included, the guide states.

In terms of adhesive emblems, Gredinberg said, Mitchell says the times shown “represent installing the emblem in the correct location by performing some combination of measuring, marking and aligning to ensure proper positioning,” but “time for the fabrication of a template for emblem installation per a specific OEM procedure is not included.” Gredinberg said it’s important to check the OEM procedures for the emblems you are installing, and noted that according to the Mitchell guide, “research, retrieval, review or usage cost of OEM or other service procedural information” is a not-included operation – something all three information providers have updated to define as not-included steps.

Lastly, Gredinberg said, Mitchell has updated the guide to indicate the time to “perform weld testing or matching [including] destructive weld testing” is not included in the labor times in the estimating system.

about $156 for a used part that costs the shop $100; this has remained mostly unchanged since 2017. But the customer charge for a $100 new OEM part ranges from a low of $105 to a high of $250. The range in markup on aftermarket parts is even wider, from a low of

$112 to a high of $242. Some shops noted that some of their parts pricing is based on list prices for the parts.

More than one-third of shops statewide are not charging for hazardous waste disposal. Of those charging a flat-fee per work order for it, the statewide average is about $7, up about $3 from 2021.

There is also wide variation in how shops charge for shop supplies. The flatfee used by some shops averages about $7, while other shops base the charge as a percentage of labor, typically between 4% and 5%, and often with a cap.

The statewide data findings have a margin of error of about 10%. This means that, if the statewide average labor rate was found to be $100, there is 95% confidence the actual average is between $90 and $110.

Geographic regional data may have higher or lower margins of error based on sample size.

in a collision repair shop, including managers, owners, estimators and technicians, to help them keep up with evolving technology, enhance their skills, improve safety in their workplaces and make sure their shops are meeting state regulations and standards.

Micah Strom, collision chair of NWACA and the owner of Modern Collision Rebuild and Service in Bainbridge Island, WA, said the NWACA hosted a training expo for mechanical shops for 20 years and felt it was time to offer the same to its collision shop members.

“We started the CTE for our members and for the industry in general, to get some good training out there,” Strom said. “There’s not a lot [of collision training] here in the Northwest, and that’s why we put this together.”

CTE is open to the entire collision repair industry. The cost to attend is $175 for NWACA members and $250 for non-members. Visit ctetrainingexpo.com for more information and to register.

Strom said there are a lot of returning sponsors from the first CTE, including CCC, ATI, 3M and

Wesco, but there are also several new sponsors, which reached out after last year’s event to ask to participate in 2024.

“They realized what a success it was,” Strom said. “This is the first event like this in the IdahoWashington-Oregon area, where you can send the whole shop to it, because it covers everything.”

Among the new sponsors are I-CAR, whose lead subject matter expert, Jeff Poole, is teaching “EV Overview and Considerations,” and Hunter Engineering, which is sponsoring “Collision Alignments” and “Wheel Alignment Fundamentals,” taught by Ken Sumerlin

There will be several hands-on classes.

“Spray Efficiency Training,” sponsored by PPRC, will show painters, using a VR system, how to improve their paint spray efficiency

and consistency, reducing both hazardous waste and materials costs.

A dent-pulling demo, led by Ben Else with Industrial Finishes, will show attendees how to use a GYS steel and aluminum dent repair system, as well as a glue pulling system.

Chris Pope of Wesco will lead a hands-on resistance welding workshop, and Stephen Flaiz will lead “What to Do When Calibrations Don’t Go as Planned!”

Other educational sessions will cover everything from complying with Washington State’s Automotive Repair Act to understanding your shop’s key numbers so you can grow your business.

Finally, a Shop Owner Roundtable will be held from noon to 1:30 p.m. May 4 to bring together owners and managers to discuss the issues they are facing and learn from each other.

State-of-the-art paint systems and the latest application recommendations open up new possibilities, but also pose new challenges for professional painters. The SATAjet X 5500 featuring the new X-nozzle system defines a completely new application standard for the future.

Revolutionary: The X-nozzles are taking atomization to a whole new level

Noticeably quieter: reduced noise level in the relevant sound frequency ranges due to optimized flow geometry of the whispering nozzle

Individual: Matches any application requirement, such as specific characteristics of the paint system, climatic conditions and application method (application speed/control)

Precise: Optimized material distribution for enhanced spraying uniformity and atomization with both spray fan shapes

Low maintenance: No air distribution ring required, which ensures a much easier and faster cleaning process

Efficient: The optimized atomization concept allows for considerable material savings

INFO

www.sata.com/x5500

SATA USA Inc.

1 Sata Drive • PO Box 46

Spring Valley, MN 55975

Phone: 800-533-8016

E-mail: satajet@satausa.com

www.satausa.com

A new survey conducted by WrenchWay found the average collision repair technician makes far more than the U.S. Bureau of Labor Statistics (BLS) reports, but more data is needed to be able to definitively present that positive information to young people considering a career in the industry.

WrenchWay co-founders Jay Goninen and Mark Wilson presented the results from their 2024 Technician Pay survey, which gathered data on pay and benefits from technicians across the country, in a Zoom webinar March 26: “Is BLS Data a Bunch of BS?”

median experience of 13 years.

“We were light on data for the collision side, but hopefully you guys can help us get more,” Wilson said.

The survey results are available for all to see via the Automotive and Diesel Technician Compensation Tool at wrenchway.com/pay. Users can filter the results by industry category, shop type, ZIP code and radius, and years of experience in the industry.

That is also where technicians can continue to submit their own pay data, which Wilson and Goninen encouraged everyone to do. They also asked technicians and managers to invite friends, employees and coworkers to fill out the sevenquestion survey.

According to the BLS, the average pay of an automotive technician is $46,970 per year, or $22.58 per hour, and the average pay for diesel technicians is $54,360 per year, or $26.14 per hour. The agency also cites the highest 10% earning around $75,000.

Goninen and Wilson said they already knew from the more than 1,000 shops on WrenchWay and countless others they work with that the data is simply not accurate.

Their brief, self-reported survey has been completed by about 3,000 technicians so far, which were broken down into four industry categories: automotive, diesel, collision and school, which covers high school and college instructors.

The data shows the mean salary for collision repair technicians was about $87,000 per year, and the average was $89,000.

However, of those 3,000 responses, only 43 came from collision repair technicians, with a

Wilson said the problem with the BLS statistics is that it groups so many careers under “automotive technician,” from an entry-level employee at a quick lube shop to a master technician with 40 years of experience.

BLS data also figures out annual salaries by simply multiplying hourly rates by 2,080 hours a year, but that doesn’t take into account those who work more than 40 hours per week, so a lot of technicians make more in a year than their hourly wage would indicate.

“That method just doesn’t work in our industry,” Wilson said.

The result is an average pay that doesn’t look appealing to young people considering a career to pursue.

“The problem is a high school student shows interest, they look at salary data from BLS and it s good, but not great,” Goninen said. “There’s a lot of training to keep up with and the student has to pay for their own

tools. It’s all false except the tool part. There are some really competitive salaries.”

Goninen and Wilson acknowledged the fact the responses largely came from experienced technicians, which skewed the average salary numbers higher than those for entry-level technicians with less than three years of work experience.

“A lot of people want to see the industry promoted as a great career,” Wilson said to explain why longtime technicians seemed to be more willing to participate.

Goninen said going in, they had been a little concerned only entrylevel technicians would respond, which would not show the long-term earning potential.

“We want to have realistic data,” Goninen continued. “We don t want to over emphasize the beginning salary, because it’s hard to compete with Amazon and others offering bigger starting salaries, but we can give them hope, that maybe if I can stay in this industry, I can have a very successful career.”

Looking at the rest of the survey results, a large majority – about twothirds – of all respondents said they were automotive technicians. They reported a mean experience level of 18 years, a mean salary of just over $89,000 and a median of $83,000.

Wilson said setting the results to show auto techs with zero to three years of experience returned a mean salary of $49,173, about what he expected. There were not enough collision repair respondents with the same amount of experience to generate a result.

The automotive technician data can be further broken down into those working for dealerships, either domestic or import brands; independent shops servicing all makes and models or specializing in one; fleet; service and tire chains; quick change lube shops; mobile services; or those servicing RVs or EVs.

Diesel technicians were the next-largest segment, with 644 respondents with a mean experience of 13 years, a mean salary of $83,519 and median of $77,509. They could indicate if they worked in a shop, or on construction or agricultural equipment.

The “school” category had a handful more respondents than collision repair – 50 respondents with a mean experience of 30 years reported a mean salary of $79,013 and median of $77,750.

In a follow up call, Goninen said WrenchWay is still developing its relationship with the collision repair industry. The aim is to gather enough data from technicians to be able to break it down into salaries for working in dealerships vs. independent shops and other subsets, similar to the automotive technician and diesel categories.

“We’re still very much growing the collision side of this,” Goninen said. “It’s very early in the process.”

Goninen said collision repair shops can join WrenchWay to post jobs, be searchable for technicians looking for jobs, and connect with local schools.

“The job board is like Zillow is to housing,” Goninen said. “A technician can do their due diligence on an employer, and an employer has a chance to ‘sell’ themselves to new employees.”

The School Connect program allows automotive education programs at high schools and postsecondary schools to ask for what they need to effectively teach their students – be it speakers to come to class, new equipment, or shops to place their students in apprenticeships, internships and job shadows.

For instance, one school posted to the School Connect board looking for a new brake lathe, which was donated before the end of the week by a local car dealership.

“It helps grow that program,” Goninen said. “So many schools have significant budget restrictions that lead to the program being cut. They need proper equipment and tools. The [donating] shop gets to build a relationship with that school beyond a twice-a-year advisory committee meeting.”

“I think job shadows will be critical as we move forward,” Goninen added.

For more information, visit wrenchway.com.

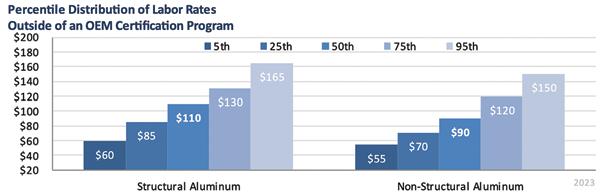

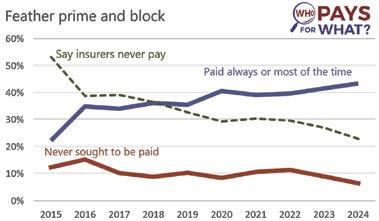

A recent industry survey found while fewer shops are successfully negotiating to be paid their higher labor rate for aluminum repair work, other new vehicle technology is adding more lines to shops’ estimates and final invoices.

Among more than 500 shops participating in a recent “Who Pays for What?” survey, the vast majority — 84% — perform aluminum repair work, and 43% hold an OEM certification for aluminum repair from one or more automakers. With the added expense of separate tools and work areas designated for aluminum work, along with training and other certification requirements, shops have seen a need for different hourly rates for aluminum repair compared to standard steel body repairs.

It appears insurers, however, have been pushing back on those higher labor rates for aluminum work. Over the past five years, fewer and fewer shops participating in the surveys are being paid the higher rates. Just 29% of those performing aluminum work reported through the survey they are being paid their aluminum rate on a regular basis (“always” or “most of the

time”) by the eight largest national insurers. That was down significantly from the same survey five years ago, when 54% of shops said they were regularly being paid their aluminum repair rates.

The average percentage of shops reporting that insurers “never” pay their aluminum rates has been slowly

grows, for example, more shops are getting paid for keeping those vehicles charged while in the shop. Nearly 2 in 5 shops (38%) say they are paid always or most of the time by the largest insurers for electric vehicle recharge. That was up nearly 13 percentage points from a year earlier. About an equal percentage

increasing over the past five years as well, rising from 25% in 2019 to 37% in late 2023.

In better news for collision repairers, however, shops are more regularly being paid for labor operations that are becoming increasingly common because of changes in vehicle technology.

As the electric vehicle population

(41%) said those insurers never pay for that procedure, but that was down from about 50% the prior year.

Given that only a small — but growing — number of automakers require a radar power test on select vehicle models, it’s perhaps not surprising that two-thirds of shops responding to the survey said they had never billed for the procedure.

But the survey, which was the first to ask about radar power tests, found more than 2 in 5 shops (42%) that have billed one or more of the eight largest insurers for the procedure said they have been paid all or most of the time.

“It’s a static function test to see if painting the bumper has reduced the power of a radar sensor too much,” said Mike Anderson of Collision Advice, who conducts the “Who Pays” surveys. “The test is needed if the system uses higher resolution radar for blind spot systems that are able to identify not just a vehicle in the blind spot, but even smaller objects such as a bicycle.

“The test uses what is essentially a metal pole on wheels, to measure, when the system is engaged, how much the bumper cover is reducing the power signal of the radar sensor,” Anderson continued. “The test is currently required for some Mercedes-Benz and Toyota vehicles but likely will be required on more makes and models in the future.”

The latest “Who Pays” survey, which focuses on not-included frame and mechanical labor operations, is open during the month of April; shops can click visit www.surveymonkey. com/r/9NC7D6B to take the survey.

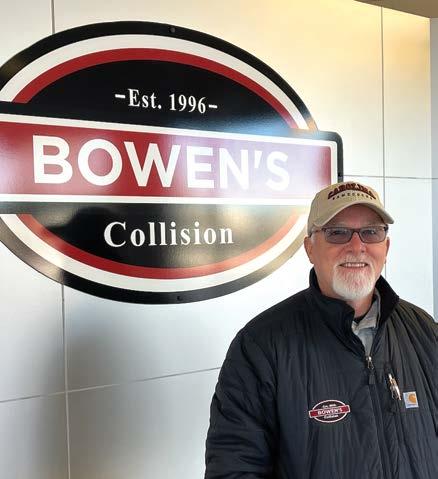

For 27 years, Bowen’s Collision has been a pillar of the Columbia, South Carolina community, but it was only in the last two years that the family-owned and operated business experienced impressive growth, adding two new locations, with plans to open more in the next few years.

General Manager Scott Austin attributes Bowen’s Collision’s success to their world-class customer service and top-quality repairs.

Putting customers first and delivering high-caliber repairs wouldn’t be possible without consistent performance, which is why Austin focused on developing more standardized routines and processes for his technicians to streamline things like diagnostic scans, which he believes gives Bowen’s Collision a competitive edge.

In fact, the decision to scan every vehicle that comes into the shop was a “no-brainer,” according to Austin, because the benefits of doing so far outweigh the drawbacks. He said most manufacturers no longer recommend scans –– they require them, yet not every shop does them consistently.

“Scans cover all the bases,” says Austin. “Pre-repair scans help us find out where the initial problems are and eliminate others right away. Documentation beats conversation and having all the information up front helps us know what we’re getting into and be prepared to have a discussion if we have to. It’s good for our customers and it’s great for our shops.”

Austin says the benefits of knowing more about vehicle damage earlier in the repair process can help save everyone time,

money, and resources, which leads to happier customers. It’s also increased revenue and profitability for his shop, he said. The cost of a brand-new scanner quickly pays for itself because the shop can bill carriers or self-paying customers for each scan, and the scans aren’t time-consuming to perform.

The problem shops often have with integrating diagnostics into their repair processes is “remembering not to forget” to scan or calibrate, sometimes even resorting to sticky notes to remind them of these critical tasks.

Austin says that’s why he uses CCC® Diagnostics Workflow, because it helps his team integrate diagnostics into every single repair plan and keep track of every scan all in one place. The result?

A diagnostics process that comes naturally to his technicians. They no longer need reminders, and they don’t even have to think about it –– it’s simply a required operation for every vehicle, every time.

“You’ve got to make sure you do it, because it’s the times you don’t that you get whistle bit,” Austin says. “We’re all about helping people –– that’s truly our mission, and if we can make a customer feel better about their repair knowing we did everything we could to diagnose the problem, well, then, we’re practicing what we preach.”

To learn more about CCC Diagnostics Workflow, visit www.cccis.com/diagnostics

On a recent episode of The Collision Vision podcast, driven by Autobody News, host Cole Strandberg spoke with Michelle Sullivan , who became CEO of Certified Collision Group (CCG) earlier this year.

The conversation touched on high level industry trends, the future of independent collision repairers, and how independent shops can stay competitive in an increasingly consolidated industry.

“There’s no sign of [consolidation] slowing down in 2024,” Sullivan said. “We’re seeing a lot of regional private equity-backed platforms coming into the industry. Yes, the consolidators are growing, no question about that. But so are the regionals and so are single-store operators.”

Sullivan said high-performing shops have multiple OEM certifications and are focused on culture.

they didn’t have a backlog, they just figured it out.”

Sullivan said she is a “huge supporter” of peer groups, like 20 Groups, and networks. CCG has built a network of nearly 800 like-minded operators across 46 U.S. states, and earlier this year announced it is expanding into Canada. Sullivan said there is power in those operators being able to connect, bounce ideas off each other and share best practices.

Sullivan’s career in the collision repair industry began about 30 years ago in Baltimore, MD, when she went to work for Superior Auto Paints. She worked in every department within the company on her way to rising to become president.

After Superior Auto Paints was sold to a national distributor, Sullivan worked for AkzoNobel and FinishMaster. In those positions, she worked as a vendor partner for CCG when it first came to the market 10 years ago.

“Industry dynamics were changing, consolidation was ramping up. And [CCG] came in with the premise of kind of leveling the playing field for the independent repairers,” Sullivan said. “Their premise was the OE certifications and really improving shop performance. How can you not get behind that?

“I was able to see firsthand what some of those affiliates were experiencing. Whether it was shop performance or performance management or the vendor programs, it was impactful,” Sullivan said. “So when the opportunity came up [to join CCG as CEO]…I was thrilled. It’s a full circle moment for me because I’m working with a lot of customers, a lot of vendors, and a lot of stakeholders that I’ve worked with at some point in my career.”

“Consolidation will continue, but so will the independents. They’ll continue to thrive,” she said. “There’s more pressure on having that exceptional customer service experience. Everyone wants that Amazon-type experience. You know, everything is easy. And our industry is no exception to that. So shops that figure that out, they’ll be successful.”

“I read this quote a long time ago and it stuck with me: ‘Your customer experience will never be greater than your employee experience.’ That’s so powerful,” Sullivan said.

The high performers are focused on their employees, Sullivan said.

“They’re creating an ownership mindset, and they’ve got people on the team that want to contribute,” she said. “They don’t have issues with retention, right? They’re keeping their teams. Their teams are engaged, and there’s something to be said for that with the employees.”

Sullivan said the first time she visited a shop that wasn’t chaotic, it was almost eerie.

“They had figured out how to create processes that minimize that chaos,” she said. “It’s not that they weren’t busy, and it’s not that

dramatically,” she said. “Not only make sure that you’re up to speed on what the trends are, what the changes are, but that your team is and that your organization is positioned for that. You’re not responsible just for yourself, but you’re responsible for those that you serve.”

Sullivan’s second takeaway is to invest in the development of others.

“We’re not fighting each other; we’re all rising together,” Sullivan said.

Sullivan said CCG looks for shops with industry-leading KPIs and OEM certifications. Then CCG’s performance management groups work with shops to help them further improve their businesses.

“One of the biggest things our affiliates really love about the network is these are highperforming operators that have really built solid reputations in their market,” Sullivan said. “They’re very much involved with the community and their name and their legacy is important to them. We have a very nonintrusive model, so you don’t have to change your name. You don’t have to give up everything that you know you’ve built.”

Sullivan said CCG’s affiliates appreciate that model.

“There’s a lot of interest in the network,” she said. “As consolidation continues, people are looking to level the playing field. The company was built on that foundation. And that still exists today.”

Sullivan said in her 30 years in the industry, she has never taken for granted the dedication and commitment of all stakeholders to performing proper repairs.

“I just want to give a shout-out to all those people out there, because they’re really the difference makers,” she said.

Sullivan said her first takeaway is to embrace being a lifelong learner.

“There is always something to learn. This industry is changing

“I read this quote a long time ago and it stuck with me: ‘Your

customer experience will never be greater than your employee experience.’ That’s so powerful.”

MICHELLE SULLIVAN CEO OF CCG

“Understand what the individuals on your team want, what their ‘why’ is, understand where they want to go, and be relentless in helping them get there,” she said. “High performers want to contribute. They love feedback and they love transparency. If you have a high performer on your team, make sure that you’re having regular career path conversations with them so you don’t ever run the risk of losing them.

“But more importantly, they lead the industry,” she added. “So again, that customer experience will never be greater than the employee experience.”

Sullivan’s third takeaway is to build your community and stay connected.

“Industry organizations are a great way to be connected to the overall industry,” she said. “You learn from the organizations and today, more than ever, there is a need for that. And you can find those 20 groups that we talked about and find a way to stay connected.”

Sullivan encouraged listeners to follow CCG on LinkedIn for an exciting announcement set to come out at CCG’s conference April 21. More information on CCG can also be found on its website, certifiedcg.com.

Listen to the full episode at www. autobodynews.com/podcasts or watch it at www.youtube.com/ watch?v=WteWcElj8kA

Drive profitability through efficiency, consistency, and quality repairs with OEC collision shop solutions

Solutions for the Modern Collision Repair Business

Parts Ordering

Repair Planning

Certified Repair

Coaching

Download the Repair Planning Field ReportV3

Discover the ways RepairLogic is improving repair safety by helping repairers adapt to Electric Vehicles and track OEM procedure changes.

www.OEConnection.com

What are you waiting for?

Learn more about our collision shop solutions and how the solutions can help your shop drive consistent and quality repairs.

Two federal agencies recently submitted a joint comment recommending renewing and expanding temporary repairrelated exemptions to a federal law protecting copyrighted content, to allow consumers’ and businesses’ right to repair their own products.

The Federal Trade Commission (FTC) and the Department of Justice’s Antitrust Division (DOJ) submitted the comment to the U.S. Copyright Office, which might recommend the Librarian of Congress renew and expand exemptions to the Digital Millennium Copyright Act (DMCA), passed in 1998, which prohibits circumventing measures that control access to copyrighted content.

In their comment, the FTC and DOJ said renewing and expanding repair-related exemptions would promote competition in markets for replacement parts, repair and maintenance services, as well as allow competition in markets for repairable products. Doing so would benefit consumers and businesses by making it easier and cheaper to fix things they own. Expanding repair exemptions can also remove barriers

that limit the ability of independent service providers to provide repair services.

According to the comment, software “locks” that protect copyrighted content from theft and infringing uses can also be used to prevent third-party repair, by the owner of the product or an independent repairer.

For example, such measures can restrict access to computer maintenance hardware and software programs, leaving only the OEM able to do maintenance and repair work. The FTC and DOJ said that can be used to squash competition for replacement parts, repair and

maintenance, which ultimately limits consumers’ and businesses’ choices and raises costs.

Among the specific DMCA exemptions the FTC and DOJ support renewing is one related to the repair of vehicles. They also support adding a new one to allow vehicle owners or independent repair shops to access, store and share vehicle operational data.

In a statement, Bill Hanvey, president and CEO of Auto Care Association, said his organization supports the joint comment.

“In particular, on behalf of the entire automotive aftermarket, Auto Care Association agrees with the DOJ and the FTC that the Class 7 exemption to allow vehicle owners and repair facilities greater access to vehicle diagnostic and telematics data for monitoring purposes is critically important to lower the cost of repairs, improve access to repair services, and minimize costly and inconvenient delays,” Hanvey said.

The Auto Care Association also launched a new video campaign emphasizing the need to pass a new law, the Right to Equitable and Professional Auto Industry Repair (REPAIR) Act, which was unanimously advanced by the U.S. House Energy

and Commerce Subcommittee on Innovation, Data, and Commerce last November.

In the new campaign, shop owners from across the U.S. share their stories and shed light on the increased challenges independent repair shops are facing with accessing repair data to service their customers’ vehicles.

“You can’t do the simplest job anymore without [needing] to get into the computer system,” said Dwayne Myers, co-owner of Dynamic Automotive, an automotive repair business with six locations in Frederick County in Maryland. “If Congress doesn’t take action on the right to repair, it will only increase what it costs to fix your car. The REPAIR Act has bipartisan support because it really ties back to the American dream. It puts everyone on a fair playing field.”

“The impact to the consumer is that they have less choice and pay more for repairs that take two, three or four times longer,” said Kathleen Callahan, owner of Xpertech Auto Repair, a family-owned automotive repair shop in Englewood, FL. “I support the REPAIR Act because I want to protect my legacy, my customer’s choice, and the independent aftermarket that I’m so proud to be a part of.”

In today’s collision industry environment, many shop owners and managers are finding competent staff are becoming a scarce and valuable commodity. In response, progressive companies are looking for ways to differentiate themselves to be the “employer of choice” in their marketplace, according to Tim Ronak, senior services consultant at AkzoNobel.

One option is to implement a fourday workweek.

“A four-day workweek can be a powerful recruiting tool that positively impacts facility morale, helping to foster an environment to becoming an ‘employer of choice,’” he said.

Ronak and Tony Adams, a business services consultant at AkzoNobel, discussed the potential benefits and challenges of this alternative structure during the AkzoNobel Acoat Selected North American Performance Group event in Orlando, FL, in March. They also presented the idea during a presentation held as part of the Society of Collision Repair Specialists (SCRS) Repairer Driven Education Series at the SEMA Show in Las Vegas, NV, in November 2023.

“It typically involves reducing the workweek from five days to four while maintaining the same number of weekly working hours,” explained Ronak. “However, it can mean different things to different stakeholders.”

In the European Union (EU), for example, the alternative structure can imply four eight-hour days, resulting in a 32-hour workweek. However, in the U.S., Ronak said businesses typically work four 10-hour days to maintain a 40-hour workweek.

Ronak shared information about an EU study conducted in June 2022 that evaluated the merits of a fourday work week. Over six months, 61 organizations reduced their work hours by 20% with no pay decrease.

“They found that it boosted employee well-being without comprising productivity,” he said.

Participating companies reported a 65% reduction in sick days and a 57% decrease in staff turnover. At the same time, 71% of employees reported lower levels of burnout and 39% said they were less stressed compared to the beginning of the trial. This resulted in 92% of the companies planning to continue with a four-day work week; 18 companies said it would be a permanent change in their business.

Ronak noted the work schedule variations implemented by the organizations. While some stopped work entirely for a three-day weekend, others staggered a reduced workforce over a week. A selection of participants designated fewer holiday days and others set an agreement that staff could be called in at short notice. Some decided that a “conditional” four-day week would only continue while performance targets were met.

with the same amount of output, Ronak said they would need to work at 156% efficiency for 50 hours of output and 187% efficiency with six hours of output.

With one less day of coffee or lunch breaks during the week, Ronak said there are fewer stop-and-start intervals, potentially allowing for more productivity.

“The fewer breaks and the longer days seem to drive efficiency,” he said.

Adams then talked about the pros and cons of the alternative work schedule. Potential advantages for employers include increased employee retention and productivity, cost savings, a positive impact on company culture and enhanced employee morale, and a reduced carbon footprint with less commuting.

scheduling complexities.

“It’s a hard shift for some of us serial entrepreneurs who are trying to figure out how to maximize the efficiency of our facilities,” said Adams.

Challenges for employees include longer workdays, the potential for burnout, difficulty adjusting and reduced opportunities for overtime pay.

Adams said there is no one-sizefits-all scenario and encourages owners and managers to consider the pros and cons before deciding what is best for the facility.

“Care must be taken to ensure that facility output is maintained or improved and that formal structure is enforced so customers and vendors are clear regarding facility operating hours,” he said.

The study found most employees used the extra time off as “life admin,” spending the day doing tasks such as shopping and chores and taking care of family obligations.

“Many explained how the extra time off allowed them a proper break for leisure activities on Saturday and Sunday,” noted Ronak.

Ronak shared information about the United Auto Workers contract negotiations in September 2023, which included the demand for a fourday, 32-hour workweek. Although the new structure wasn’t part of the contract terms, the union is reportedly still interested in the idea.

Ronak also addressed the role of efficiency with a four-day workweek and examined whether it can be achieved in fewer hours.

“With a 20% reduction in hours worked, you would need a 25% increase in productivity to maintain the same output as before,” he noted. “How can people at their peak work fewer hours and still create the same output when you shift to four-days?”

He explained 40 hours worked at 125% efficiency generates 50 hours of output; 150% efficiency equals 60 hours of output for 40 hours of effort. Having employees work 32 hours

“We’re all vying for people right now,” said Adams. “It becomes a differentiator in the workplace if everybody around you is working five days a week and you’re able to give employees the gift of 50 more days a year, more time with their families and an extra day to do some activities.”

Advantages for employees include improved work-life balance, increased productivity and focus, and reduced commuting time driving in off-hours.

“We’re giving employees the gift of less commuting, and they’re saving money because they’re driving back and forth four days a week instead of five,” he said.

Another employee advantage he pointed out is technicians having fewer starts and stops.

“Sometimes, we miss the energy burden that technicians go through with the start-stop, start-stop dynamic,” noted Adams.

Overall, the altered work schedule was found to enhance employee morale and satisfaction.

Adams also addressed the challenges of a four-day workweek. For employers, these include extended daily work hours, the potential for decreased productivity and resistance from management, client and customer expectations and issues, including billpayers, implementation costs, and coordination and

For shops evaluating a four-day work week, Adams and Ronak shared these tips:

• Select the specific alternative structure: Decide on a flexible or fixed schedule, implementing a 40hour week with four 10-hour days or a 32-hour week with four eighthour days. Other options include extended hours or multiple shifts.

• Prepare the team: Be transparent when communicating changes with employees. Look into state and federal employment laws, as well as overtime pay rules. Also, evaluate training needs.

• Logistics: When deciding on the best schedule for the facility and how it will be implemented, consider office hours of operation versus production hours of operation.

• Tools: Contemplate work schedule and pay structure tools, including vacations, statutory holidays and sick time.

• Auditing and compliance: In addition to legal and regulatory compliance issues, plan how the business will monitor production targets and approach new team member integration.

Read the case studies from Kena Dacus, owner of Dacus Auto Body & Collision Repair in McPherson, KS; Stephen Bozer, owner of Fix Auto Tempe in Arizona, and Mitch Erlacher, location manager of Stinnett’s Auto Body in Maryville, TN. All three discuss their experiences after implementing a four-day work week.

Three collision repair shop owners talked about what worked — and what didn’t — when they made the move to a four-day workweek.

Kena and Chris Dacus, owners of Dacus Auto Body & Collision Repair in McPherson, KS, implemented a four-day work week in June 2022.

After hearing about the alternative work schedule in the media, Kena and Chris presented the idea to their 20 employees during a regular morning meeting.

“They were worried about burnout and working a 10-hour day,” Kena recalled.

They took a vote and the idea was shot down.

About six months later, gas prices went up and the idea became more appealing. Commuting technicians asked if the team would reconsider a four-day workweek. After another vote, employees agreed to test the concept.

When deciding on the best structure, the Dacuses asked their team for input. At the time, the shop was operating Monday to Friday from 8 a.m. to 5 p.m. with a one-hour lunch. Under the new schedule, the work hours were updated to 6:30 a.m. to 5 p.m. with a 30-minute lunch. The front office staff chose to keep the original hours.

Holiday pay remained the same and employees still receive two week of vacation per year.

One of the key benefits Kena shared pertains to retention and recruitment. Since implementing the four-day workweek 18 months ago, she said there has been zero technician turnover. In addition, it has helped with employee recruitment. In the first nine weeks, they hired three qualified technicians.

“Most of us are used to our technicians getting job offers from other shops,” said Kena. “Now we’re getting technicians coming to us. That’s always a blessing in this environment.”

Overall, morale has improved.

“I think they have a better quality of life and work-life balance,” she said. “The new structure provides an extra day to take care of appointments and household chores they would typically have to fit in during the week.”

The body shop owners have noticed production efficiencies at their facility with less distractions and waste. They’ve also been able to fit in more booth cycles. Two fewer production meetings are held, which has resulted in about 20-30 minutes less meeting time and more production time.

There have also been cost savings. Overtime dollars have decreased about $791.38 per month, which equates to $10,000 per year. Utility savings are approximately $7,500 a year.

“Because we’re paying less overtime, it has allowed us to give back in other ways, like bigger

ourselves from other employers,” said Bozer.

He and the facility manager, Jennifer McKinney, presented the idea to their production staff and received full support.

“Most technicians absolutely loved the idea,” recalled Bozer.

They considered two options: splitting the week and creating two teams or having all employees work one less day for longer hours. Ultimately, they opted for the four-day workweek to keep everyone on the same schedule, except for one technician who still works the standard five-day week, eight hours per day. The remaining employees work Monday-Thursday from 7 a.m. to 6 p.m. with a one-hour lunch break.

Before making the switch, management created a production target with the team over 60 days to validate the actual sales output capability with the standard work schedule.

talent due to a three-day and sometimes four-day weekend along with competitive pay,” he said. “It’s a huge selling tool.”

Other benefits include no cost to make the change and team members spend less time and gas commuting to work.

Overall, morale at the shop is at an all-time high. Bozer said he enjoys walking around the shop on Thursdays and asking if employees are ready for the weekend.

He refers to the time off as a “Goldilocks Day.” Saturdays are usually a catch-up day in a typical five-day week, and Sundays are spent getting ready for the next week. The extra day off — Goldilocks Day — provides real time off.

“You have this day right in the middle, and it’s pretty amazing,” he said. “They return refreshed on Mondays and seem to be in a better mood, which is wonderful.”

bonuses at Christmas time and more benefits,” noted Kena.

Commuting employees have noticed a savings of about a tank of fuel monthly.

“Our employees love the extra day to fish, spend time with family or work on their house/chores/life admin so that they can better enjoy the weekend.”

Most customers don’t realize difference in hours since the office is open on Friday.

Her advice to shops considering implementing a four-day workweek is to have a good process in place and get employees’ buy-in ahead of time.

“It’s not a quick fix and how you implement can make a big difference,” said shared. “Stay open and communicate clearly how PTO, holiday pay, etc. will work before you start.”

A year and a half ago, Stephen Bozer and Shane Orlando, owners of Fix Auto Tempe in Tempe, AZ, evaluated the idea of implementing a four-day workweek after hearing about a shop in Northern California having a positive experience with the structure.

“We wanted to create a better work environment for team members and differentiate

“That became the baseline,” he said. “The staff was very motivated to make sure that we maintained, if not improved, production.”

They also set revenue goals to maintain sales based on historical output with a small reach goal. After achieving that target, the shop implemented the four-day week.

Being open one less day a week has resulted in production efficiencies. The shop has consistently maintained production targets due to the new hours, as well as some changes made to the shop floor to maximize space.

Bozer has found customers are receptive to the idea because they can pick up vehicles after work more easily due to the later hours. Usually, there is someone in the shop on Fridays to answer calls and arrange for customers to pick up vehicles on request.

Since the change, Bozer said they have had zero technician turnover.

“Employee retention is key,” he said. “When we lose somebody, it’s very disruptive to our business.”

He has noticed their job postings receive solid responses since implementing the new structure, especially when he mentions the four-day workweek.

“We have the pick of the local

Mitch Erlacher, the location manager of Stinnett’s Auto Body in Maryville, TN, implemented a fourday workweek in April 2023 after hearing about it in the media.

“I wanted to create more work-life balance and use it as a recruiting and retention tool,” he explained. “I was also hoping it would help with employee engagement.”

After putting the new structure in place, Erlacher found cycle time had increased, CSI decreased and the business wasn’t running efficiently with the change. In addition, employees were frustrated with the shift.

Ultimately, they reverted to the five-day workweek on Jan. 1, 2024.

“Although we are back to the original schedule, we believe the four-day workweek can work,” said Erlacher.

He attributes some of the challenges to opening a new building at the same time as making the change, implementing unlimited personal time off, and not having processes in place.

“You need a solid execution strategy,” said Erlacher. “This includes daily management and having a plan to manage the hours produced per tech.”

For shops considering implementing a four-day workweek, Erlacher recommends having regular conversations with team members to determine how it is and isn’t working and making changes accordingly.

Ask collision repair shop owners and managers where they currently are focusing added resources, and staffing is fairly consistently at the top of the list.

“I kind of feel like the shepherd protecting my flock most of the time to guard off poaching, making sure they’re not getting enticed to go elsewhere,” said Andrew Batenhorst, manager of Pacific BMW Collision Center in Glendale, CA.

Batenhorst noted that at least in his market, it’s not just other shops looking to attract workers.

“The city has jobs with pension programs and health benefits, and they are ramping up [recruiting] efforts as they’re losing a lot of the Baby Boomer generation who have been in those jobs for 40 years,” Batenhorst said. “They’re aggressively luring people in. So that’s kind of a new threat that we’ve not really seen in this market until the last year or two.”

Scott Benavidez, owner of Mister B’s Paint and Body in Albuquerque, NM, is also focused on challenges related to human resources. He helped get a basic collision repair training program launched this year at a high school near his shop.

“We’ll be the first one in the nation to pilot I-CAR’s new program to start training people who may not have even touched a screwdriver,” Benavidez said. “We’re going to see how it works in my local high school here. If we can start them out from the ninth grade to the 12th grade, by the time they get out, they’re going to be beneficial to us. There’s five basic things we want them to learn: Small dent repair, R&I bolted-parts, plastic repair, prep paint and color sand and rub. If one of those kids came in my shop today with that, I’d hire them immediately.”

Benavidez said CCC Intelligent Solutions is putting an estimating system in the school to help students start learning about estimates and parts tracking.

“The Automotive Management Institute is going to do classes for these kids in how to answer the phone, how to talk to a consumer, how to see if vehicles are drivable from the get-go,” he said.

Benavidez said there’s a sizable student population in his area that are unlikely to go to college and want to begin earning right out of high school to help their families. “Hopefully this will help them and help our industry,” he said. “We’re trying to build a program where we move them in steps to get them ready to go into a shop by the time they are juniors and seniors, maybe even apprenticing during the summer. And then we can teach them the rest.”

Will Latuff, president of Latuff Brothers Auto Body in St. Paul, MN, is focusing on developing new technicians in-house.

“We have three employees who are new to us, two right out of trade school and one with little automotive experience, who we have paired up with mentor techs,” Latuff said. “We’re working on systematically increasing their skillsets so that they can become full-fledged techs. And then as we start growing those skills, we will bring on probably at least one more in the next year.”

One change that has made that more feasible to do: Latuff converted all his flat-rate technicians to hourly.

“There were more reasons behind that than just training, but that was one of the barriers to enabling a master tech to become a mentor,” Latuff said. “Because if a tech is dependent on what they produce,

“If we get that off the ground, there’d be more resources for autobody technicians throughout the state.”

— TOM RICCI BODY & PAINT CENTER

they’re not going to be focused on teaching new skills.”

One of the trainees, who is working at the shop while in his first year of trade school, didn’t have much in the way of tools, Latuff said, so the shop got him a basic set tools. “That’s not earth-breaking, but making sure he

doesn’t have to borrow our mentor’s tools is kind of key,” he said.

Also necessary, Latuff said, is having a good plan. “A lot of people

seem to think that the first thing somebody needs to learn is cosmetic dent repair, and it’s absolutely not. They need to learn organization, damage analysis, disassembly, reassembly, panel fitment.”

It’s also important to help guide the mentor techs through the process, he said. “They have a lot of knowledge but don’t always know how to translate that to a trainee,” he said. “You don’t get frustrated with a baby because they don’t know how to walk. It’s the exact same thing when

you bring in new employees. The mentors need to know those trainees don’t know what they haven’t told them. And if you tell them once, they may not remember because they’re trying to absorb so much. So you may have to tell them again and again. You have to have that empathy or that heart to transfer the knowledge.”

Like Benavidez, Tom Ricci, owner of Body & Paint Center in Hudson, MA, is also working to increase the pool of potential entry-level technicians, but he’s looking beyond local schools. He’s trying to get an auto body program established as part of rehabilitation program at a correctional institute in his state.

“I’m involved in the program that’s working to get lower-level criminals back out in the workforce, helping them with re-entry,” Ricci said. “I’ve talked to a couple of people already in regards to trying to get an auto body training program up and running. If we get that off the ground, there’d be more resources for auto body technicians throughout the state.”

Just saying something doesn’t make it so.

Too often I hear collision shop owners say that they’re going to do something – improve customer satisfaction, increase sales or reduce cycle, for example. But when pressed for exactly how they’re going to do that, their answers are often pretty vague.

Ladies and gentlemen, just because you say something is going to happen doesn’t mean it will. That’s a wish, a desire that something will happen, rather than a plan to make it happen. A goal is when you actually have an action plan – preferably in writing – on how to accomplish it.

A good action plan answers: What are you going to do? Why are you going to do it? How are you going to do it? Who will be involved?

Let’s take shop owner “Rob,” who wants to increase his shop’s sales by $400,000 a year. He built an action plan for accomplishing that goal.

One step, he decided, is to capture more necessary but not-included labor operations the shop is already

doing, but not consistently including on estimates or final bills. He and his estimators looked through some of our “Who Pays for What?” survey reports, and decided it’s realistic they can capture one more labor on every job. At 100 jobs a month and a $63 per hour labor rate, that would add $6,300 per month (or $75,600 a year) to the shop’s annual revenue.

So how will they get that extra labor hour per job? The first Thursday of each month, Rob will have a meeting with his blueprinting and sales staff to go over two or three not-included items the shop is doing regularly that could be included on estimates. Together, they will discuss how to negotiate for those items.

Think about that plan: It lays out what is going to happen, who is involved, and when and how they are doing it. That’s a goal, not just a wish.

The other part of Rob’s action plan is to improve the shop’s closing ratio. Right now the shop has a 60% closing ratio. That means it is writing about $900,000

in estimates every month, but only capturing about $540,000 (60%) of that potential work.

Rob sets a goal of improving that closing ratio to 63%. That would mean the shop’s sales would rise to $567,000 per month (63% of $900,000) without needing to get a single additional customer through the door.

How will Rob accomplish that goal? First, he is going to bring in some after-hours sales training for

his team. And every estimate for a job not immediately scheduled by the customer will be put into a file; an estimator or customer service rep will call each of those customers the next day with a script Rob and his team develop to help get that job scheduled. If unsuccessful, that estimate will move into another file for another follow-up call a certain number of days later.

The added labor hour per job will generate an additional $75,600 in revenue over a year. The improved closing ratio will generate an additional $324,000. That puts Rob within $400 of his goal. And it’s not just a wish. He has an action plan for how to accomplish it, with specifics about what will be done and who will do it.

So enough with the wishes. Set goals. Put the plan in writing. Keep it to a manageable four or five action items. And delegate but don’t abdicate; get others involved, but don’t just dump it on them. Then regularly show them how the shop as a team is making good on that plan.

Jack Molodanof answers questions from California auto body shops owners on how to avoid fines by complying with state regulations.

Dear Jack,

The cost of disposing of toxic waste such as solvents, paint, primers, etc. has increased significantly in recent years and I was wondering whether I can charge a hazardous waste fee to my customer?

Signed, Curious Collision Shop

Yes, auto body shops may charge a customer separately for costs associated with the handling, management and disposal of toxic wastes or hazardous substances under California or federal law which directly relate to the servicing or repair of the customer’s vehicle, according to the California Code of Regulations.

However, there are specific requirements that must be followed.

Any fees for handling, management and disposal costs of hazardous waste directly related to a specific job must be itemized separately in the estimate and invoice. If the auto body shop routinely collects a “hazardous waste fee” for a service that creates hazardous waste, such as paints, primers and solvents, the auto body shop estimate and invoice must include the facility’s Hazardous Waste Identification Number, or more commonly known as the EPA Number. It allows registered hazardous waste transporters to lawfully transport the waste to a recycling facility.

Please note that the hazardous waste fee may not act as a source of profit for the auto body shop and furthermore, cannot be charged arbitrarily without a financial analysis of what the true cost is to the collision facility. The hazardous waste fee should be calculated for the auto body shop by a third-party environmental health and safety (EHS) company. Depending on how much hazardous waste the facility generates per year, the EHS company determines a “per repair service” charge that can be passed onto the customer to offset

Encinitas Autobody Repair, a staple in Encintas, CA, for four decades, faces eviction due to a major redevelopment plan. David Cartwright, 75, and his wife Barbara Grace, who have managed the shop together, are now on a quest to find a new location to continue their legacy of automotive services.

The Coast News reported the redevelopment, spearheaded by RAF Pacifica Group’s Adam Robinson, will transform a section of North Coast Highway 101 into The Captain at Moonlight Beach, a mixed-use complex featuring 45 condos and commercial spaces. The Encinitas Planning Commission granted unanimous approval in October 2023.

“We just want to put the word out to see if someone has a place we can find to sublet nearby,” Grace told The Coast News. “We’re a small family operation, but we do services that no one else does, so it would be great if we could stick around.”

the fees in which the shop must pay. Again, this charge, and the EPA Number, must be separately itemized on both the initial estimate and the final invoice.

The information provided in this article does not, and is not intended to, constitute legal advice; instead, all information, content and references are for general informational purposes only.

Molodanof is an attorney, lobbyist and expert in California’s automotive repair industry, representing the largest statewide automotive repair associations in California, including the California Autobody Association. He serves on the California Bureau of Automotive Repair (BAR) Advisory Group, offering valuable input on BAR programs. As a certified BAR Remedial Training Provider, he is authorized to instruct on laws and regulations related to the Automotive Repair Act. In addition to his legal and advocacy roles, he is co-founder of EduTech, a company that offers online BAR educational training courses. Contact him at jack@mgrco.org or 916-447-0313.

The Collision Industry Foundation (CIF) is delighted to announce Axalta, Enterprise and Dedoes Industries have all committed again to the CIF Annual Donor Program, each company’s fourth consecutive donation at the Urgent Care (second highest) tier.

Introduced in 2021, the Annual Donor Program was designed to bring needed recurring resources to CIF, so it can deliver on its mission to “Answer the Call” when those in the industry have been impacted by catastrophic events such as wildfires, hurricanes, tornados or flooding.

For more than two decades through the generous support of corporations and individuals, CIF has been able to assist hundreds of collision repair professionals in need after a disaster. CIF is grateful for Axalta and Enterprise’s continued support of the Annual Donor Program, which will enable CIF to continue its work for disaster relief assistance.

Jerry Sova, who owns another business included in the sale, a cell phone repair kiosk, told The Coast News the sale is expected to close June 24.

The sale also includes a restaurant, Captain Keno’s, and a hotel, the Portofino Beach Inn.

Cartwright is known for his mechanical expertise, particularly in transforming vehicles like his 1971 Chevy Vega station wagon. He said he wants to spend a few more years doing serving the community’s auto service needs.

“Here’s hoping I die with my boots on with a hammer in hand,” Cartwright told the news outlet.

“I came back here in the 1980s (from New Jersey) and was thrilled to get into the auto body business in Encinitas.”

Anyone with information related to space for lease can contact Encinitas Autobody Repair at 760-402-1644.

Bosch’s Mobility Aftermarket division officially launched the Bosch EV Training Tour alongside its supplier, AVI, March 21, in Fort Myers, FL, with a “Breakfast with Bosch” kickoff event. The tour will begin traveling across the country in early July.

The EV Training Tour will hold three one-day, eight-hour courses in cities across the U.S. Each course will have a maximum of 20 attendees. The Bosch-created curriculum will be instructed by a Bosch-certified AVI professional trainer and feature EV repair-related topics including the fundamentals of an electric vehicle, electric motor concepts, power electronics, maintenance and troubleshooting topics and more.

In addition to learning relevant EV maintenance from industry experts in a classroom-like setting, attendees will leverage training aids, built by AVI, to easily access and work with electric and hybrid vehicle systems in a hands-on environment.

Learn more at aviondemand. com.

At Fix Auto Mount Vernon, just north of Seattle, WA, several generations of multiple families have served the drivers of the local area, taking their role as a small, independent business in the community to heart, on National Mom and Pop Business Day — celebrated March 29 — and every day.

Fix Auto Mount Vernon, formerly Dally’s Auto Body, is locally owned and operated by Gloria Hulst and Raymon Bonner. This dynamic team also runs Fix Auto Kenmore.

“Our family members have been involved from the beginning,” said Hulst. “My parents purchased this collision repair facility in 1988. Before that, another family owned it — and they started it in 1935! Our business and its legacy are so

ingrained in Skagit County that, to this day, we advertise that Fix Auto Mount Vernon was Dally’s Auto Body. At one time, we had seven family members working here, and today we have four of our family on the job.”

National Mom and Pop Business Owners Day was established by Rick and Margie Segel, in honor of their parents and the successful hat shop they opened in 1939 and grew into a 10,000-square-foot, $2 million clothing shop. It is a special day to appreciate the long hours, hard work and dedication it takes to run a small business.

The connection with the community has been a key component for Hulst and Bonner and their team, serving those most in need.

“We have always been involved with our community,” said Hulst. “Whether being a drop point for collecting sleeping bags for the homeless, raising money for community events or supporting the Rotary and Helping Hands food bank, we believe that giving back is part of our role as a local business.”

Hulst noted being a locally

owned family business is incredibly hard but rewarding.

“I have always found that business ownership is inviting and rewarding,” she said. “Being able to make decisions that affect our employees and our community make it that much more worthwhile. We want to give back and help inspire the next generation of leaders for our community, from providing a first job opportunity to a 16-year-old, to hiring a young technician and paying for their I-CAR classes, it’s rewarding to be able to give back.”

Fix Auto Mount Vernon is already planning for the next generation of family leadership. Adam Bonner is set to purchase the business and continue the legacy of serving the community as a local, independent mom-and-pop business.

TWC/HO2S/WR-HO2S/CAC/TC/DFIU.S.

2.3L-Group:GFMXV02.3VJW

Evap:GFMXR0125NBV Noadjustments FEDOBDII ABZ

Thecombinedweightofoccupantsandcargoshouldneverexceed

TOAVOIDSERIOUSINJURYORDEATH: •Donotleanagainstthedoor. •Donotuseseatcoversthat Seeblocksideairbagdeployment. owner’smanualformoreinformation.

AVERTISSEMENT

POURÉVITERDESBLESSURES

GRAVESOUMORTELLES: •Nevousappuyezpascontrelaporte. •N’utilizezpasuncouvre-siège quipeutbloquerledéploiementdu Voircoussingonflablelatéral.lemanuelduconducteurpour deplusamplesrenseignements.

Californiaclass/stds: PC/ULEVqualified Group: FGMXV01.80111.2L

Evap:SFI/HO2S/TWCFGMXR0095805 , OBD:II

SRSSIDEAIRBAG COUSSINGONFLABLELATÉRAL (SRS)

TIREANDLOADINGINFORMATION

SEATINGCAPACITY

REAR 2

TOTAL 4 FRONT 2

Thecombinedweightofoccupantsandcargoshouldneverexceed352kgor776lbs. 240kPa,35PSI240kPa,35PSI

TOAVOIDSERIOUSINJURYORDEATH: •Donotleanagainstthedoor. •Donotuseseatcoversthat Seeblocksideairbagdeployment. owner’smanualformoreinformation.

COLDTIREPRESSURE

TIRE SIZE

215/55R1697H

POURÉVITERDESBLESSURES

FRONT REAR SPARE

GRAVESOUMORTELLES: •Nevousappuyezpascontrelaporte. •N’utilizezpasuncouvre-siège quipeutbloquerledéploiementdu Voircoussingonflablelatéral.lemanuelduconducteurpour deplusamplesrenseignements.

WARNING AVERTISSEMENT THIS VEHICLE CONFORMS TO ALL APPLICABLE FEDERAL MOTOR VEHICLE SAFETY THEFT PREVENTION STANDARDS IN EFFECT ON THE DATE OF MANUFACTURE SHOWN ABOVE .

215/55R1697H

T125/85R1699

Conformstoregulations: 2015 Fuel: Gasoline

U.S.EPAclass/stds: LDV/TIER2

SEEOWNER’S MANUALFOR ADDITIONAL INFORMATION

Californiaclass/stds: PC/ULEVqualified Group: FGMXV01.80111.2L

420kPa,60PSI

TIREANDLOADINGINFORMATION

combinedweightofoccupantsandcargoshouldneverexceed352kgor776lbs. 240kPa,35PSIPSI

VEHICLEEMISSIONCONTROLINFORMATION

Conformstoregulations:2016 MY

U.S.EPA:T2B4 LDV

TWC/HO2S/WR-HO2S/CAC/TC/DFI

FEDOBDII Fuel: Gasoline ABZ

California: Not for sale in states with California emissions standards.

2.3L-Group:GFMXV02.3VJW

Evap:GFMXR0125NBV

Noadjustmentsneeded.

Unlock savings and precision fit with genuine parts

• Save time and money: reduce returns by up to 16%

• Faster ordering process

• More accurate orders

• Easier invoice processing

• Live information

• Seamless fit

• Competitive pricing

Order now on CCC ONE®

Please contact these dealers for your Honda or Acura Genuine parts needs.

Barber Honda

Bakersfield

661-396-4235

Dept Hours: M-F 8-5:30 bestchoice@barberhonda com

Capitol Honda

San Jose

408-445-4412

Dept Hours: Mon-Sat 7:30-6; Sun 8-5 sbettencourt@penskeautomotive com

Concord Honda

Concord

925-825-8016

Dept Hours: M-F 8-6 kevin valenzuela@concordhonda com

Galpin Honda

Mission Hills

800-GO GALPIN

818-778-2005

Dept Hours: M-F 7:30-6; Sat 8-2 mteeman@galpin com

Honda of El Cajon

El Cajon

619-440-5851

Dept Hours: M-F 7-6; Sat 7-5 parts@hondaofelcajon com

Honda of Hollywood

Hollywood

800-371-3719

323-466-3205

Dept Hours: M-F 8-6 parts@hondaofhollywood com

ACURA

CALIFORNIA

Acura of Concord

Concord

925-680-4233

Dept Hours: Mon-Sat 7-6 keith�whisten@cacargroup�com

Acura of Fremont

Fremont

888-435-0504

510-431-2560

Dept Hours: M-F 8-6; Sat 8-5 mike ohare@acuraoffremont com

Acura of Pleasanton

Pleasanton

888-985-6342

925-251-7126

Dept Hours: M-F 7:30-6; Sat 8-6 mitch cash@hendrickauto com

Honda of Pasadena

Pasadena

800-433-0676

626-683-5880

Dept Hours: M-F 8-6; Sat 8-4

Honda of the Desert

Cathedral City

760-770-0828

Dept Hours: M-F 7-6; Sat 7-5 mpartridge@honda111 com

Keyes Honda

Van Nuys

818-756-6549

Dept Hours: M-F 8-6; Sat 8-5 malvarez@keyeshonda com

Larry Hopkins Honda

Sunnyvale

408-720-0221

408-736-2608

Dept� Hours: M-Sat 8-5 parts1@hopkinsdirect com

Metro Honda

Montclair

800-446-5697

909-625-8960

Dept Hours: M-F 7:30-5:30; Sat 7:30-4 wholesaleparts@metrohonda�com

Pacific Honda

San Diego

858-565-9402

jgardiner@pacifichonda com

AutoNation Acura

Torrance

310-784-8664

310-539-3636

Dept Hours: M-F 7-7; Sat 8-5 alvaradow1@autonation com

Bakersfield Acura

Bakersfield

661-381-2600

Dept Hours: M-F 7:30-5:30 bakersfieldacuraservice@yahoo com

Marin Acura

Corte Madera

800-77-Acura

415-927-5350

Dept Hours: M-F 8-5:30; Sat 8-4 parts@marinacura com

San Francisco Honda

San Francisco

415-913-5125

Dept Hours: M-F 8-5 partsws@sfhonda com

Scott Robinson Honda

Torrance

310-371-8320

Dept Hours: M-F 7-6:30; Sat 7-5 mluna@scottrobinson com

Selma Honda

Selma

800-717-3562

559-891-5111

Dept Hours: M-F 7-6; Sat 7:30-4:30 hondapartsmgr@selmaautomall com

Larry H. Miller Honda

Boise

888-941-2218

208-947-6060

Dept Hours: M-F 7-6; Sat 8-5

Hinshaw’s Honda

Auburn

253-288-1069

Dept Hours: M-F 7-6; Sat 7:30-4:30 rickb@hinshaws com

Metro Acura

Montclair

800-446-5697

909-625-8960

Dept Hours: M-F 7:30-5:30 wholesaleparts@metrohonda com

Acura of Honolulu

Honolulu

866-931-9086

808-942-4557

Dept Hours: M-F 8-5; Sat 8-4

Johara@lithia com

Tokuda@lithia com

RayleenGarcia@lithia�com

McCurley Integrity Honda

Richland

800-456-6257

509-547-7924

Dept Hours: M-F 8-5:30; Sat 8-4 hondaparts@mccurley net

South Tacoma Honda

Tacoma

888-497-2410

253-474-7541