By John Yoswick, Autobody News

Collision repairers for decades have understood the concept of “judgement times,” having to determine while looking at the vehicle how much labor will be required to repair a particular dent in a panel, for example.

Given changes in the estimating systems in the past year, determining blend time has become another of the items requiring an “on-the-spot evaluation.”

Though the 50% of full refinish time remains the default setting for calculating blend times in the CCC Intelligent Solutions and Solera (Audatex) estimating systems, users can change that percentage, and the two companies changed their guidance to say blend times vary and require a vehicle-by-vehicle evaluation. Mitchell continues to use the 50% formula but has given users the ability to change that percentage in the system.

A committee presentation at the Collision Industry Conference (CIC) in Denver this past summer highlighted how many other collision repair labor operations there are that, like blending, require the judgement or “on-thespot evaluation” by the estimator.

Danny Gredinberg of the Database Enhancement Gateway (DEG) noted there are many notincluded labor procedures that body technicians in shops may be performing. He said the “labor general information” section of the Mitchell P-pages lists 17 bodylabor-related items that would be additions to its published times, including broken glass clean-up and tar and grease removal.

“It should not be inferred that a component with no established labor time has been included in another component’s replacement allowance,” the Mitchell P-pages state.

The Motor Information Guide to Estimating — the basis for the CCC estimating system — lists 43 not-included items in the body section alone, including “road test vehicle” and “anti-corrosion material restoration/application.”

The Solera (Audatex) database reference manual lists 61 bodyrelated “labor exclusions,” including “assembly of new parts that come unassembled,” and “disassembly of recycled parts and assemblies.”

“So there’s many different things you may need to consider in the repair process as an ‘on-the-spot’

By Paul Hughes Autobody News

California lawmakers are running for re-election, but not before they concluded a legislative session Aug. 31 that saw key bills affecting collision repairers, touching every aspect of operations.

Meanwhile, state agencies, notably the California Bureau of Automotive Repair (BAR), continuously craft industry-related rules carrying the force of law.

Gov. Gavin Newsom had until Sept. 30 to sign or veto bills. Days before the deadline, he vetoed key bills involving electric vehicles and ADAS technology. The first mandated battery recycling; the

second required equipment affecting how fast Californians drive.

Below is a roundup of issues covered in law and regulation that are among the most important to body shops.

Autobody News research and material from the California Autobody Association (CAA) underpin what follows. We note if bills failed or passed, were vetoed or signed into law, and key regulations on the way.

SB 615 would require electric vehicle batteries to be disposed of properly. Specifically, it says they must be “recovered and, when possible, reused, repaired, repurposed, or

l CONTINUED ON PAGE 16

By Abby Andrews Autobody News

The Northwest Auto Care Alliance (NWACA) is dedicated to uniting automotive service professionals, including collision repairers, in Washington, Idaho, Nevada, Oregon, Alaska and Montana.

A large part of the mission is providing training and education opportunities to its members.

“We try to keep our members engaged, to keep things fresh,

because the industry changes so fast,” said Micah Strom, collision chair of NWACA and the owner of Modern Collision Rebuild and Service in Bainbridge Island, WA, Strom and Brenda Wolslegel, NWACA executive director, provided an update on the alliance’s monthly, quarterly and annual collision repair education offerings.

Dateline

NWACA emails its Dateline newsletter

l CONTINUED ON PAGE 19

See it at our booth #31017 upstairs, South Hall

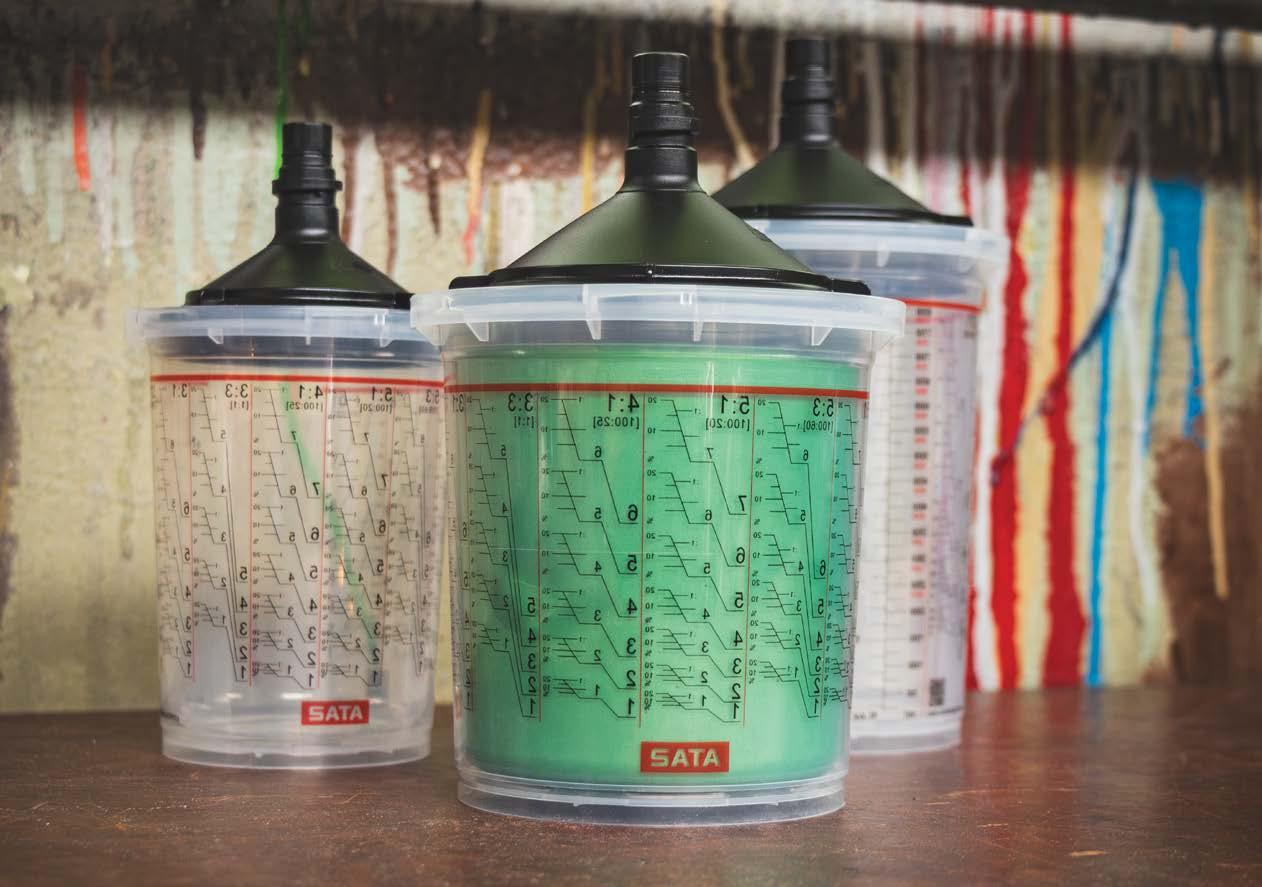

The liner reimagined.

When used with SATA spray guns, there is no need for an adapter.

Particle free premium strainers that click into the lid before painting.

Lids offer a quadruple bayonet safety system

Hard cup, liner and lid are made with high quality materials.

Complete and detailed scale system with an upside-down scale

LCS: .40 liter, .65 liter, .85 liter

Mike Anderson Shops’ Needs from OEM Parts Wholesalers Go Beyond Prices, Discounts 22

Abby Andrews

CAA Revives San Diego Chapter with ‘Who Pays for What?’ Update 36

Connecting Vehicles Could Be Useful in Collision Repair 20

Negotiate with Insurance Companies to Get Compensated for Proper Repairs 30

NWACA Working to Keep Collision Repair Members On Top of Industry Changes 1

Using DRPs to Fuel Your Collision Repair Shop’s Growth 8

Brian Bradley Analysts: Fed Rate Cut Could Drive Brownfield Acquisitions in Collision Repair 26

Elizabeth Crumbly

Mitchell Donates $1.5M in Tech to Boost Collision Engineering Program 42

Why MSOs are Stepping Up to Purchase Dealership Collision Centers 4

Paul Hughes Arkansas MSO Owners Find Out How Much Work Goes into Selling to

Consolidator 18

California Legislature Decides Dozens of Bills Affecting Collision Repair Industry 1

Should Independent Body Shops Care About Growing State-Level Push for Consumer Privacy? 10

Vetoes Press Pause for California Body Shops on ADAS, EV Issues 34

Stacey Phillips Ronak

3M Skills Development Center Celebrates First Anniversary of Educating, Upskilling Technicians 6

Lucid Hosts First Certified Body Repair Network Conference 28

Leona Scott

How Body Shops Can Navigate the Challenges of EV Collision Repairs 44

John Yoswick

Blend Times Now Require ‘On-the-Spot’ Determination 1

Collision Shops, Vendors Can Help Counter Grim Entry-Level Tech Numbers 14

Low-Voltage Batteries in EVs, Hybrids Need Particular Attention in Collision Repair Shops 32

By Elizabeth Crumbly Autobody News

Sales of dealership collision centers pose multifaceted benefits, both for dealerships selling and the MSOs that often purchase. These changes aren’t without challenges, but a consolidating industry means these moves will likely become more common in coming years.

“It’s a slow and steady trend that we’ve seen for many years,” said Madeleine Roberts Rich, senior associate with Focus Advisors, a firm that represents MSO owners as they grow or exit. “The reason is

that the collision repair industry is consolidating. As we’ve seen, there’s a handful of consolidators that are establishing more and more market share primarily through acquisitions.”

When Dealerships Sell

So, why are dealerships selling? It’s primarily to streamline operations and enhance focus on automotive sales, reducing the added management needs for collision repair operations. Keeping up with technology and the hiring competition for highly trained technicians can be prohibitive in keeping a shop going.

“The game is much more expensive than it has been in the past, and the tech workforce really drives volumes,” explained David Roberts, Focus Advisors founder and managing director. “So, if you don’t have a steady volume of vehicles going through your collision repair shop, people are going to look around where they can make more money, and they’ll almost invariably find an MSO in the area that is doing more work.”

And dealerships that find a buyer free up significant funds.

“They have cash that they can then use as capital to invest in their core competency if it’s expanding their existing dealership operations in place or then trying to expand to a new location,” Rich explained. “They

have freed up cash in this liquidity event, and in a high interest rate environment like we’re in, access to cash can be quite important.”

There’s also built-in opportunity for sale of more parts for dealerships as they continue to funnel repairs from vehicle buyers toward shops they’ve sold. This scenario is beneficial when a dealership sells the shop but keeps the real estate in a long-term lease situation.

One drawback Roberts noted in that scenario is that buyers will likely extract regular repair discounts from a dealer, but the volume of business can make up for that factor. Indeed, Rich said, lifetime customers often mean lifetime servicing of a vehicle or multiple vehicles: It’s one more reason to make sure a collision center is in capable hands.

MSOs looking to purchase dealership collision centers get the benefits of having a staffed location with ready equipment, and ostensibly, they start out with dealership customers. That doesn’t mean there aren’t potential hurdles, though.

These purchasers, explained Roberts, need to be sure they’ll really have access to a steady pipeline of customers as dealerships’ modes of operation often differ from those of shops that have been historically focused strictly on repair.

“If you’re an MSO buying a dealer

shop, you really do have to have your act together,” Roberts said. “The dealer is trying to manage a bunch of different things, and if they’ve got a bunch of different nameplates and they’re really into selling new and used cars and servicing those cars, then getting access to repairable vehicles today comes much more through insurance companies. And most dealers don’t have arrangements with insurance companies in which they participate in direct repair programs.”

Making sure a shop is the right fit is also important for an MSO looking

to purchase.

Joe Hudson’s Collision Center, an-Alabama-based MSO, which recently entered the dealership shop acquisition trend by buying Bedford Nissan Collision Center in Bedford, OH, is an example of this factor. Bedford Nissan’s existing certifications made it a fit for acquisition, Joe Hudson’s Chief Operating Officer Cameron Dickson explained in a press release.

“Identifying growth opportunities that align with our standards for quality and outstanding customer service is crucial,” Dickson said. “Bedford Nissan Collision Center’s numerous OEM certifications and I-CAR Gold Class recognition make it an ideal partner. This acquisition allows us to quickly integrate our operations and continue delivering the top-notch service our customers have come to expect.”

Dealership sales are on the rise right now, according to a report released in June by Kerrigan Advisors, an auto buy/sell advisory firm. The first quarter of this year, the firm reported, saw a 38% rise in dealership sales compared to first quarter of 2023.

It’s important for dealers to consider how their collision operations factor into these sales, and transition of body shop ownership can happen in a number of ways. Some dealers just want to be out of the game altogether, and that can mean moving the shop off their premises.

“They just want to sell the business,” Roberts explained. “They don’t get as much for the business, but they repurpose the body shop into more service space.”

In this case, he said, a buying MSO might move the business, its equipment and its employees to an existing shop that has capacity.

Dealers will also participate in the aforementioned long-term lease situation. This, Rich pointed out, makes for a built-in credit tenant and a lowered capitalization rate. Lower cap rates (annual net operating income divided by market value) indicate less risk and higher value for commercial real estate.

But how does a dealership reach this point? Long-term lease rates, Rich explained, are based as a percentage of trailing 12-month sales for the body shop. The valuation of the body shop itself is then based on adjusted EBITDA (earnings before interest, taxes, depreciation and amortization) figures.

Getting accurate numbers through this process is especially important as

the selling of a business is a bespoke thing, and it’s a process worth pursuing fully, Rich said.

“What we, as investment bankers, hate to see is for owner operators to sell themselves short by not fully understanding what their true adjusted EBITDA is,” she explained. “Because with selling a business, it’s not like selling a house where there’s tons of records on Redfin or Zillow.”

Some dealers want to sell the whole business, dealership and all, and in those cases, it can be beneficial to look at chunking up the transaction, as selling the body shop separately can result in more money, Roberts contended.

Separating the body shop from the rest of the sale allows consolidators and MSOs to step into the equation. Sometimes in these situations, the real estate changes hands, and there’s a lease opportunity for the new owner. Body shop acquisition may not be a priority for another dealer looking to acquire the business, so the profit opportunity can be less there.

“If they just want to sell their body shop, the process is different because dealers are always being approached by other dealers that want to buy to bulk up in their market, but they’re not often being approached by people that want to buy their body shop,” Roberts explained.

However a sale takes place, offloading a body shop can be relief for a dealership owner looking to free up cash. And it’s a way for dealers to simplify operations and for MSOs to step up and do what they do best.

“The body shop business and the business of selling cars are very different, and they’re both getting a lot more complex,” Rich said. “So, splitting one’s focus, especially if the body shop, as involved as it is, is only a very small fraction of your annual sales — it’s just going to pull focus. Doubling down on what you do best and then getting a best-in-class operator to run the body shop side is an advantage.”

By Stacey Phillips Ronak Autobody News

Just over a year ago, the 3M Skills Development Center opened its doors in St. Paul, MN, to help educate and upskill the collision repair industry. Since the first class was held in June 2023, more than 55 events

3M is finding the classes are also attracting people from outside collision repair facilities. For example, students from different military bases have been interested in attending the courses.

“We’re fixing cars and they’re fixing planes, automobiles and tanks,” said Spah. “You might be next to

have taken place with more than 1,100 attendees from all experience levels. They include technicians, CEOs and managers, OEM partners, distributors, performance groups and the military.

Adam Spah , application engineering manager at 3M, said the 15,000-square-foot 3M Skills Development Center has been a source of training for students from across the country in 42 U.S. states, as well as Canada, with 80% of attendees from outside Minnesota and the surrounding states.

“It has been an exciting journey over the last 12 months,” said Spah. “The industry is very busy, but proactive business owners and shop managers are realizing the importance of investing in training technicians to increase the quality of work they put in each day, even though it’s a challenge to send a technician away for three or four days.”

The backbone of the Skills Development Center is multi-day hands-on training that focuses on the most updated body repair and paint preparation and refinishing methods. The body repair and paint classes are each held one week a month and offered to anyone who has an interest in taking them, whether that’s a college student, someone working out of their garage or technicians who have been part of the industry for just a few months or more than 30 years.

“We’re really focused on getting people through the classes to help upskill the industry,” said Spah.

around knowledge, skills and abilities so students learn what they need to repair vehicles properly. Within the open enrollment courses, 3M focuses on being product agnostic, hands-on, OEM-aligned and process-oriented.

“You would think that coming into a 3M facility, you’re just going to learn about 3M products, but we keep it very product agnostic, so you could potentially use various brands during the classes,” Spah explained.

With much of the industry training being conducted virtually during the pandemic, 3M has put a high emphasis on 90% of the learning at the facility being hands-on. Rather than looking at a screen and flipping through slides, Spah said students are doing the activities they are taught.

depending on that OEM,” said Spah. “There is also a focus on the science of ‘why’ something is done so students will retain the skills taught.”

Technicians learn the proper OEMapproved techniques for squeeze type welding on various components of a repair.

a bodyman or painter in the class, but we’ll also have somebody from a military base in that same class learning together.”

When training classes aren’t being held, the center typically plans meetings and events with industry organizations, OEMs, vocational technical instructors, collision performance groups, MSOs, distributors and several others.

The Collision Repair Education Foundation (CREF) has brought in students to get a glimpse of the industry and encourage interest in working on vehicles.

“We explain to them that they can make really good money — even six figures — in this industry and have a good career,” said Spah. “Their eyes light up and they get excited.”

The 3M Skills Development Center works closely with OEMs to share information about what is taking place at the facility. Several auto manufacturers have visited over the past year.

“They want to learn what we’re teaching and how they can leverage our high level of education for their technician certification programs,” noted Spah. “We tell them how we dive deep into OEM repair manuals and find that it excites OEMs to know technicians are following the procedures.”

Since opening the center, Spah said there has been a solid increase in demand for open enrollment classes and site visits, which he predicts will continue to accelerate in 2024.

Training classes are centered

“Getting somebody out of their element and focusing on what they’re learning goes a long way,” he explained. “They are more likely to learn and retain the skills as well as the proper technique by doing the repair activities on a physical piece.”

To support the goal of handson training, the facility was built with a flexible layout that can be adjusted to fit the needs of those in attendance. In addition to a traditional classroom space, there is a hands-on work environment that features stations with electrical and air service. A 36-foot GFS XL paint booth is set up with three-stage filtration, which can accommodate 16 painters. There is also a dedicated welding area with stations equipped with fume extraction hoods.

Spah noted only about 40% of technicians look at repair manuals or procedures when they fix vehicles. As a result, 3M educators spend time teaching where to find the OEM procedures and how to fix a vehicle to its pre-collision condition.

“Trainers explain the standard operating procedures (SOPs) to follow to ensure the procedure is done the same way every time,

3M’s trainers are technical engineers with a strong collision repair background. Their backgrounds range from 20-40 years of collision experience, and include I-CAR certified instructors, paint company technical experts, and those with insurance experience. Some have authored several technical articles.

“We know vehicles are becoming more complex so we work closely with trainers to ensure the training is relevant to the cars being repaired,” said Spah.

The training programs complement those available through the online 3M Collision Repair Academy, the 3M Collision YouTube channel and virtual I-CAR Alliance training. In addition, live webinars are held at the facility where students can participate in a real-time Q&A.

Spah said they have noticed an uptick in skills as technicians leave and they’re becoming more efficient.

“They are reporting getting more repair orders through after going through our sessions,” he added.

After a course is completed, 3M asks for feedback from students to continually improve the program.

“The feedback we’ve had with the classes so far has been incredibly positive,” said Spah.

3M also welcomes feedback from the industry to ensure timely and relevant courses are offered. Looking ahead, potential classes include welding certification, front office training and repair planning. Spah said 3M is currently working toward a new curriculum with a new course set to debut soon. Look for new classes in early 2025.

For more information about courses offered through the 3M Skills Development Center, visit www.3M.com.

By Abby Andrews Autobody News

G&C Auto Body was founded in Santa Rosa, CA, in 1972 by Gene Crozat and Leo Gassell. Two satellite locations were opened in the 1990s. When the business was handed down to Crozat’s children, they decided to ramp up the growth. It now has 42 locations in 14 counties in Northern California.

Patrick Crozat, Gene’s son and the current COO of G&C Auto Body, appeared on The Collision Vision podcast, hosted by Cole Strandberg and driven by Autobody News, as part of its “Insurance Talk: Navigating Insurance and Repairs” series, to talk about how Direct Repair Program (DRP) agreements with insurance companies have fueled his family business’ explosive growth.

Crozat said DRPs have been a part of the collision repair industry since he got into it 22 years ago.

He described them as “contractual agreements where in turn for referrals from that insurance partner, you’re going to make concessions where you’re going to look out for the cost of the bill for them, and provide customer service.”

He said DRPs are valuable to insurance companies because they help foster a relationship with a body shop, which is the “face” of the repair process for the customer, while giving the insurance company some control over the customer’s experience.

“To ease the process between the claim and the body shop and the insurance company, I see a lot of benefits to the programs,” Crozat said.

DRPs have been “crucial” to G&C Auto Body’s growth, Crozat said. “I think it would be very, very hard for any body shop owner to grow to multiple locations without DRP relationships. I think it’s always been that way,” he added.

It’s difficult to run multiple stores in the same niche, Crozat said, whether it’s going after luxury brands or referrals from a local dealership.

Crozat said his dad was always an advocate for DRPs. “He wanted it to be a symbiotic relationship between the body shop and the insurance company, and that we’re both working towards taking care of our customer,” he said.

Pros and Cons of DRPs DRPs require a lot more administrative paperwork, and usually include a

discount on the shop’s stated labor rate.

“You are focusing on pleasing a second customer in a way,” Crozat said, referring to the insurance company.

There are often multiple body shops in an area with the same DRP, leading to competition for the insurance company’s referrals.

“I love competition. I think competition is always needed and it drives businesses to excellence,” Crozat said. “If someone owns the market and they don’t have to work hard for it, they don’t have to try and earn it every day. Human nature. I think people will get very complacent and they wouldn’t give the best job that they could do.”

Most of G&C’s DRP partners like to have sit-down meetings with management at least twice a year to review the business, Crozat said. A large MSO like G&C Auto Body then disseminates any information to all of its locations.

G&C has a DRP account manager, who has nine employees under them, each with a specialization. The company has a training website with every DRP’s individual processes, to serve as a reference for employees, and holds monthly training sessions on each DRP for any new hires or anyone who needs a refresher.

Strandberg asked what advice Crozat could give owners of smaller companies looking to build infrastructure like that.

“It all starts with one step,” Crozat said. “It can be overwhelming to look at the big picture.”

certified facilities, it is restricting other repairers from being able to get parts for those manufacturers. Crozat said that led G&C Auto Body to get Tesla certifications at 11 locations, since there are so many Teslas in the MSO’s California markets.

He said when going after an OEM’s certification, form strong relationships with the local dealerships who the vehicles for repair. But it is also key to advertise OEM certifications directly to consumers, in the event of personnel changes at the dealership.

G&C Auto Body updates a “scorecard” weekly showing each shop’s performance in the metrics important to each DRP agreement at that shop.

Technology has made it easier to track shops’ KPIs and other metrics, meaning insurance companies now make referrals based on performance. “That’s what’s going to drive profitability for the insurance company, and that’s going to drive better CSI and lower rental days,” he said.

That has helped G&C Auto Body excel, Crozat said, as it performs well in terms of cycle time and CSI, so insurance companies want to establish a DRP at any shop the company opens.

Strandberg asked if G&C’s DRPs are leading to it being pulled into some of the markets it is growing into

Crozat said there have been instances of an insurance company asking about G&C’s growth plans, and then encouraging entry into a particular market.

“In those conversations they’ll be like, ‘Hey, you know what? We could really use a shop in that area. So let’s start looking at it,’” he said.

Crozat said his company prefers to open locations within a certain distance of each other, to support each other and build out markets. Insurance companies can provide data on how many competitor shops already exist in a set radius.

“It would have been really scary back in the day to do something like that, if you didn’t know if you could get the insurance companies and have that business,” Crozat said.

Crozat’s wife, Tara Crozat, joined G&C Auto Body as a customer support representative. She was then promoted to a clerical lead and then a writer. Now she manages the service writer program, which includes building SOPs and maintaining the training website. She also implemented a training program for new hires interested in becoming estimators.

“She was the most thorough, detailed writer,” Crozat said. “I would look internally at who is a writer in your organization that is on top of everything — very detail-oriented, process-driven and organized.”

Crozat said he thinks DRP agreements will largely remain the same, but maybe with some tweaks.

“I don’t think I’ve seen too much evolution with insurance partner relationships over the years,” he said.

G&C Auto Body has at least six DRPs per facility; some longerserving locations have up to 13.

“We’ve always been an advocate of having every DRP that we can get in our locations, so that we’re not hoping that all of our business comes from one insurance company all the time,” Crozat said. “I would recommend going towards having more DRP partners and growing your business to be able to meet all their needs.”

As more OEMs demand their vehicles are repaired only at

If a store isn’t hitting certain metrics, its estimates are reviewed centrally until they meet the standard, Crozat said.

“It’s continuous coaching until people understand the program and how to win with that insurance contract,” he said.

Overcoming Challenges with DRPs There have been instances where an insurance company hasn’t wanted to pay for a part of the repair process.

“You’re not always going to get what you want with an insurance partner. And that’s what is -- it’s a partnership, and a partnership is everyone gives and takes,” Crozat said.

He recommended maintaining good communication with DRP partners, as it increases the likelihood they’ll work with a shop if a part of the agreement is harming their business.

“Be open and honest and share the numbers with them,” Crozat said. “Maybe they’ll make a concession with you and work with you on it.”

Crozat also recommended talking to them regularly about how the shop can “be a better partner” for the insurance company.

“How am I doing currently? Where could I improve? How can I earn more of your business? And how can I grow with you? See if you can chart that path with the insurance partner,” Crozat said.

“If that path isn’t there, go looking to add maybe more insurance partners, where then you have enough business to be able to open a second location, or to take the building over next door down the street,” he added.

By Paul Hughes Autobody News

A push by individual states to regulate consumer information collected by businesses isn’t yet touching smaller body shops and collision centers, but efforts are gaining steam and there are great reasons for indie operators to know and prepare for local laws.

Act in 2018, and two years later, voters approved a proposition that expanded on CCPA. All regulations were effective by January 2023.

Other states are joining in.

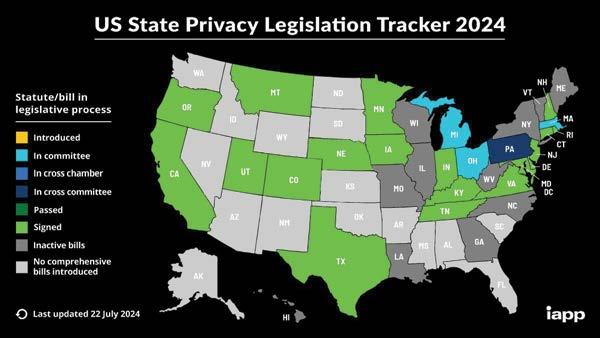

Six states’ laws will have gone into effect this year and last, when Montana’s begins Oct. 1, according to nonprofit International Association of Privacy Professionals (IAPP). Nine

California was first with legislation often presented as “privacy protection” bills dealing with individuals’ data. The state passed the California Consumer Privacy

more are slated to hit in 2025 — six of these by January — with three more in January 2026. Four more states have active bills.

Only about one-fourth of states

haven’t tried to enact privacy legislation.

There is currently no national law, but that’s in the works as well.

“What’s really changing is the statelevel stuff,” said Brad Miller, head of legal at Utah-based ComplyAuto, which develops software to aid companies’ compliance with state and federal regulations.

The changes are more than just new legislation itself. Because it’s happening — or not — one-by-one, there are differences within and among various laws. Multiplied by dozens of states, it gets complicated.

Miller said “privacy” generally refers to “non-public personal information” — but not just the usual suspects. It involves obvious datapoints — insurance, driver licenses, Social Security numbers — but “anything personally identifiable” as well.

Some states let businesses correct a problem before they’re punished; some don’t.

“There are lots of layers to this, and all the laws are different,” Miller said.

A common approach seems to

be good for most shops: smallbusiness exemptions, which also differ state-to-state.

California’s law applies to businesses with more than $25 million in gross annual revenue or information on at least 100,000 residents or households.

Most independent body shops aren’t touched. MSOs and dealerships with shops likely are, and online privacy adds a whole ‘nother slew of considerations.

Roberto Baires owns Micro Tech Resources IT in Northern California. Among his clients are 100 or so body shops. More are concerned with the long-time CARFAX issue — past repairs not being in a vehicle history — than with the state’s stringent customer data privacy rules.

He stressed the limited information shops hold, noting, “customer data they see is in the estimating software, insurance companies, parts procurement, credit cards — they’re the ones managing it.”

“We have to keep some information for lifetime warranty repairs,” said Tiffany Silva, who

The Collision Industry Foundation (CIF) is a non-profit organization dedicated to providing support and assistance to collision repair professionals during times of crisis and hardship.

MISSION

Secure and distribute donations to individuals who have experienced significant losses due to natural disasters or other catastrophic events.

Tax-deductible donations needed to provide assistance: www.CollisionIndustryFoundation.org

co-owns Accurate Auto Body in Richmond, CA. But for the most part, “there’s nothing for me to hold.”

“Shops hold some data, but more of it is physical,” Baires added.

“I’m ‘old-school,’” said Ken Pike , owner of Ken’s Custom Auto Body in Marysville, CA. He collects a name and phone number for estimating but doesn’t keep any customer data. “I charge their credit card and that’s it.”

He’s never had a customer ask about their information.

Silva said her shop has policies in place — where it can exist, what happens if an employee takes a photo of a vehicle — developed with an attorney and IT. “We have data and we protect the data, but it doesn’t come up.”

Miller said if the law applies to a shop, it overlaps with much standard practice, apart from the exemptions.

And Silva’s policy approach is a good step even for shops that don’t strictly “need” it.

With the industry’s increasing complexity, technological advances and customer privacy and data concerns, there are good reasons to be ready to act.

Acquisitions: If a shop might ever

be sold, it’s best to have operations as pristine as possible. Big buyers will have their own method, of course, but keeping data collection clean and in compliance is never bad.

Breaches: Shop relationships with insurance companies, suppliers and dealers, among others, are at risk for hacking, ransomware and other cybersecurity issues. And these attacks are only expected to increase.

Customers: A formal policy developed with the right people and communicated to anyone who walks in the door ups the body shop’s game. It speaks to professionalism, customer care and a strong work ethic.

A policy defines relationships with consumers, third parties and the state. It prevents problems and prepares a shop for service today, and tomorrow.

Miller said federal legislation frequently stalls over particulars; but if not inevitable, it’s also not impossible. And without one, the news is more complex than good, since states passing a different law every time doesn’t make compliance any easier.

“The auto body industry is having to deal with this,” he said. “And new regulations are coming.”

ProColor Collision opened its doors to a new facility in Lynwood, CA, promising enhanced service capabilities for both personal and commercial vehicles. Located strategically off the Long Beach exit of I-710, this center is poised to deliver superior collision repair solutions across the central Los Angeles Basin.

Leading the new ProColor Collision location is Qazi Asad, alongside Obeer Qazi and Saady Qazi

Asad, who has amassed more than 37 years of experience in the auto insurance and collision repair industry, began his management career with ProColor Collision in 2021. His tenure with the company, managing multiple locations owned by franchisee Ashraf “AJ” Jakvani, has provided him a deep insight into the operational excellence and growth opportunities within the network.

“As someone who has seen first-hand what ProColor Collision

offers and the success it brings, I am thrilled to launch the Lynwood location as the first among several planned centers,” Asad said. “The training and ongoing support from ProColor Collision are invaluable, and I am confident they will ensure our success here.”

The Lynwood facility is equipped with state-of-theart equipment, including a large paint booth capable of accommodating a wide range of vehicle sizes. The center is staffed by a team of highly experienced customer service representatives and technicians committed to delivering quality repairs.

“The Lynwood team is already demonstrating their commitment to our core values of customer service, quality repairs, and teamwork,” said Scott Bridges, senior vice president of Fix Network, ProColor Collision. “They are a vital part of our network’s growth in Southern California and nationwide.”

evaluation,” Gredinburg said.

‘Repair or Replace’ Considerations

Andrew Batenhorst of the CIC Estimating and Repair Planning Committee pointed to a series of factors that can play into case-bycase decisions during estimating related to repair versus replace of a damaged panel.

The first, he said, involves reviewing the automaker documentation to look for any guidelines, the types and mil thickness of material involved, limits on the use of heat, whether there are restrictions on access to replacement parts, and what types of tools or consumables would be needed for repair.

“That brings us to accessibility, basically factoring what panels are around where we’re working, how much room we have from the backside, are we going to have any issues with getting the tools onto the panel to do what we need to do to properly straighten it,” Batenhorst said. “If we’re inhibited from doing that, that could lead to a ‘replace’ decision instead.”

Another factor is whether there is damage in a crumple zone that would affect repairability.

“In many cases, that’s a dealbreaker automatically,” he said. “If a crumple zone is affected, going back to the OEM instructions, that may right away warrant the replacement.”

Similarly, an estimator needs to determine if body lines or contours on a damaged part can be recreated accurately.

“The invasiveness of the repair is also very important,” Batenhorst said. “Our approach is always to minimize the intrusiveness to the vehicle, and try to preserve as much of factory e-coating, and limit how drastically we need to go into the car.”

There are refinish considerations, such as how much factory corrosion protection needs to be protected or restored, maximizing the amount of factory paint as possible, and considering whether refinishing or blending of adjacent panels would be involved.

One final consideration is part availability.

“Obviously, there’s a financial or economic decision that gets factored into this,” Batenhorst said. “We are still dealing in many cases with part delays from all the turmoil that’s in the world currently. Sometimes that may cause you to have a different approach to that repair or replace decision that you’re trying to make.”

Despite the prevalence of onthe-spot evaluations required during estimating, many in the industry see resistance among some insurers to move away from strict use of the 50% formula for blending rather than looking at it based on the factors that vary from vehicle to vehicle.

Darrell Amberson of the LaMettry’s Collision chain in Minnesota said changes to such things as the blend formula often take too long to get implemented.

“As an industry, when we have some significant changes come along, we’re notoriously slow,” Amberson said. “It tends to take us years to really evolve to the point where the dust settles and common compensation methodologies are established as the norm.”

He said he’s discouraged by how few insurers have been open to moving away from the old blend formula.

“I get a lot of excuses that are not necessarily based on good logic,” Amberson said. “Right now we have one insurer that’s adjusted its normal pricing. We have some others that are on a case-by-case

basis. But a whole lot of them are just not doing anything.”

He said he agreed repairers need to focus on the variables impacting the blend procedure the paint companies point to, rather than just the outcome of the 2022 blend study by the Society of Collision Repair Specialists, despite the efforts to make the study “accurate, fair and reasonable.”

“I’ve seen many industry changes over the years where we start a conversation and often there’s not much flexibility on the two sides,” Amberson said. “And then after a lot of education and discussions, we tend to evolve and find some kind of common ground. But we don’t do that enough or quick enough.

“We need more discussions like this [at CIC]. We need more activity from the paint companies. We need more insurance companies to come in and really understand the situation and help us all evolve,” he continued. “Too many times there’s a kind of a bullheadedness, ‘We’re just not going to accept a change,’ and that’s not necessarily reasonable.”

Saying he was speaking for a shop owner who couldn’t attend CIC, Andy Tylka of TAG Auto Group said that shop owner sees part of the problem is that 50% of full refinish time is still the default for blending in the CCC estimating system.

“He feels that doesn’t open up the mentality that it is an on-thespot evaluation,” Tylka said. “He is continuing to get responses from insurance companies that assume that the default is the standard. They’re referencing it as the standard, the established formula of CCC. He asked me to [say] that he feels like that 50% needs to go away. It needs to be a forced adjustment on every profile. Because right now it [seems to be] implying that there’s a recommended formula.”

Dan Risley of CCC Intelligent Solutions is the current chair of CIC, and he addressed that comment later in the meeting.

“I think it’s really a continual education process because we have the slider in there for the [user] to choose whatever they feel is necessary as an on-thespot evaluation,” Risley said. “The language is in there referencing the fact that it’s an on-the-spot evaluation. But that said, I heard the point loud and clear, and I’ll make sure I’ll bring that back to our team.”

The ASE Education Foundation is actively calling on automotive industry professionals to volunteer as mentors in an effort to combat the ongoing shortage of qualified automotive service technicians. Mentorships are a critical tool in bridging the skills gap by giving students hands-on experience and industry connections.

Mentors from local businesses provide essential real-world training, enabling students to apply classroom knowledge in professional settings. These mentors work alongside schools and instructors, offering both guidance and feedback to students while helping place them in entrylevel positions within the automotive and transportation industries.

Industry members interested in becoming mentors are encouraged to contact their local ASE field manager, who serves as a liaison between students, schools, and ASE industry partners. A full list of ASE field managers and the areas they serve is available at www. aseeducationfoundation.org.

Axalta Irus Mix is the future for bodyshops. It is the fastest fully automated, completely hands-free mixing machine for the automotive refinish industry. It delivers highly accurate color, maximizing profitability and minimizing environmental impact to help bodyshops meet or exceed key business goals. Axalta Irus Mix, which works with Axalta’s innovative bottles made from 50%

Axalta Irus Mix, with its patented technology, is the fastest fully automated mixing machine on the market - between 15% and 100% faster than anything else available. Refinish customers can save more than 60% on labor time with Axalta Irus Mix compared to manual mixing.

As cutting-edge as Axalta Irus Mix is, it is extremely easy to use. In fact, one of the benefits of Axalta Irus Mix is that a skilled refinisher doesn’t have to operate it; anyone can, freeing up skilled technicians to do other jobs while the paint is being mixed. It is straight-forward and intuitive so after only one training session someone will be very comfortable and confident using Axalta Irus Mix.

Axalta Irus Mix was designed to work with Axalta’s proven bottle system, so there is no need to refill or decant product into special bottles. Additionally, the bottles are fitted with precise dosing lids, delivering accurate color without waste. The computer-controlled dosing enables bodyshops to mix colors in small amounts resulting in less consumption and less waste. And for those tints that are not used frequently, there are four optimized bottle sizes that perfectly match tint popularity. For the bodyshop, this means less money tied up in stock.

Axalta’s bottle system is made from 50% recycled plastic, underscoring Axalta’s commitment to sustainability. Spies Hecker Permahyd Hi-TEC is available in bottles exclusively with Axalta Irus Mix.

Axalta Irus Mix is the final step of Axalta’s simple, three-step Axalta Irus digital color management process: Scan – Match – Mix.

First, refinishers scan the color with Axalta Irus Scan – the newly launched spectrophotometer. This new technology scientifically measures paint color on a vehicle to provide accurate color matches in both waterborne and solventborne basecoat technologies.

Second, match the color using Axalta Nimbus Color, a revolutionary platform that leverages proprietary algorithms to find, sort, and return accurate color formulas.

Then it’s time to mix with Axalta Irus Mix. Axalta Irus Mix enables its users to work more efficiently, profitably and sustainably. Everything about Axalta Irus Mix is technologically advanced. Simply launch the mixing process from a PC or tablet and put the empty mixing cup in Axalta Irus Mix. The mixing formula is wirelessly sent from Axalta Nimbus Color to Axalta Irus Mix and, with a simple push of a button, Axalta Irus Mix does the rest, allowing skilled refinishers to do other, more productive tasks. The mixing cup is removed when finished and ready to be attached to the spray gun. For added convenience, after dispensing, the machine carries out quick automatic nozzle cleaning procedures to avoid blockages.

Axalta Irus Mix is linked to a cloud-based monitoring system that continuously checks its status. Users also have access to Axalta sales, technical and color teams.

Troy Weaver, Senior Vice President, Global Refinish, says, “At Axalta, we strive to be at the forefront of innovation. We constantly look for ways to help our customers to do business better, to enable our customers to work as efficiently as possible and to maximize their profitability. Axalta Irus Mix has done just that – as we have seen with more than 100 machines in use globally. Axalta Irus Mix is ideal for bodyshops and multi-shop owners who are looking to increase efficiency, profitability and to do more jobs per day. It not only reduces bodyshops bottlenecks and frees up refinishers to carry out more profitable, highly-skilled tasks, but also it boosts bodyshops’ capacities, saving them money and helping them become more sustainable. We are delivering technology that truly automates color like never before.”

By John Yoswick Autobody News

George Arrants, vice president of the ASE Education Foundation, doesn’t think the collision industry’s technician shortage is based on a lack of interest in the trades by young people nor too few students entering collision repair training.

“The number of students in a program this year is higher than ever before,” said Arrants, whose organization evaluates and accredits entry-level automotive technology education programs against industry standards. “We see that most of our programs are at capacity or higher. But then for some reason, once we get them in the programs, we think our job is done.”

The problem, he said, is the followthrough during those students’ time in the program and into their first job in the industry. Arrants estimates 1 in 5 graduates of automotive training programs never enter the industry, and about an equal number leave the industry within two years.

I-CAR research has produced even more stark findings: Only 15% of students who enter the industry stay for more than 18 months.

“We’re eating our young,” Arrants said. “These people are interested in our industry. But we bring them into our shops and expect them to be productive. There’s not one of us who was productive our first day on the job. There’s no on-boarding, there’s no mentoring.”

Waiting to employ students only once they finish a program is also an issue, he said.

“If you don’t hire them until after they graduate, the only thing they know is the program they were in,” Arrants said. “That means when they come to you, it’s a whole new experience. And that’s why we lose a lot of them. But we have found that for those students who work in your shops while they’re in school, it’s a more seamless transition. And they stay for decades.”

He said there’s another sad truth about those entry-level technicians leaving the collision industry: “They’re not leaving skilled trades,” he said. “They’re staying in the skilled trades. They’re just not staying with us.”

What else can shops and vendors in the industry do to help collision repair training programs and the students they are training to help stem the flow of potential technicians out of the industry?

Supporting the Collision Repair Education Foundation (CREF) is one good step. CREF provided $136,000 in scholarships to collision repair students last year, and another $678,000 in grants to 110 schools to benefit their collision repair training program. CREF also donated more than $18 million in product donations to the programs, including 78 current model Audi and Volkswagen vehicles to schools.

for more participants in their program advisory committees.

“One of instructors’ biggest pet peeves is an employer, who they’ve never heard from or seen, coming in at the end of the spring semester and saying, ‘I want your best students,’” Eckenrode said. “The instructors look at them thinking, ‘Where have you been for the past school year? I’m going to help those employers and local businesses that

Brandon Eckenrode, executive director of CREF, said any organization within the industry can sponsor uniforms for students at their local school.

“We’ve heard from instructors that when the students have brand new uniforms rather than just wearing street clothes, that has made the biggest impact of all that we’ve given out,” Eckenrode said. “It’s a way for you to connect with the students as it’s you, the sponsoring company, that’s helping distribute the uniforms, and talking to these students, helping make sure that these students look professional while they’re learning. The sponsoring company’s logo is on the front of all the uniforms, so it’s almost a walking billboard for your company.”

CREF can also assist with parts donations.

“Instructors have told us their No. 1 need is donated scrap and spare parts,” Eckenrode said. “We literally have instructors rummaging through the Dumpsters of body shops and dealerships looking for spare parts that they can bring back for their students to work on. I think we can agree that with the number of damaged and slightly used parts that are taken off of customers’ cars, there’s absolutely no reason why instructors should be rummaging through the trash to get these parts.”

He said most schools are looking

different companies that are waiting for them to graduate, and it’s that that motivates them to stay in the collision industry and that program,’” Eckenrode said. “They walk out of those events with a stack of business cards. Some of them walk out with multiple job offers.”

For more information about working with CREF to help a school’s collision repair program, check the foundation’s website.

Shops can also help relieve the industry’s technician shortage by training new entry-level workers inhouse. I-CAR is now making its new I-CAR Academy Program available to collision repair facilities, after launching it for schools earlier this year. The I-CAR Academy program is an early career program to educate and recognize new technicians starting a career in the industry.

I-CAR’s Jeff Peevy said the program is in part a response to what he heard from shops about entry-level technicians they were seeing from school collision repair training programs.

are committed throughout the entire year, not just coming in and trying to cherry pick those best students when they are graduating.’”

Eckenrode noted that in-kind donations made up the bulk of the assistance the foundation provided to schools last year.

“Tools, equipment, supplies, parts, everything that your companies may have, we can find homes for those in local schools,” Eckenrode said. “There are some schools that have 150 students and their total program budget is $3,000, and that is the state of what they have. So it’s an opportunity for us to make sure that they have the items they need to provide a quality technical education.”

He said CREF also continues to hold career fairs around the country.

“These help showcase to these students all the different companies that are interested in them, Eckenrode said. “And what’s great about these events is it’s not just repair facilities. It’s tool and equipment companies, paint vendors, insurance, rental car. Everybody is there to showcase, ‘Hey, we need you.’

“We’ve heard from instructors who say, ‘I’ve had students who are kind of trying out collision repair and they’re not quite sure if they like it, but they come to these career fair events, they see all the

“There was a lot of feedback saying a young person coming out of a school had experienced an inch-deep and a mile-wide training experience,” Peevy said. “And when they were put into the shop environment, they really did not have a high level of proficiency in anything. They had experienced a lot of things, but they could not be put on something to do without having a lot of oversight.”

The new program focuses instead on “what would you have an entrylevel technician do that would make them valuable to your operation from day one, what would make them feel valued from day one,” he said.

I-CAR Academy’s curriculum covers collision repair fundamentals such as safety and tool skills, plastic repair, small dent repair, disassembly and reassembly, and supports a shop using it by including resources on selecting and training a mentor. A badging system recognizes a new technician’s progress.

“Our industry is in dire need of technicians,” I-CAR CEO John Van Alstyne said. “For some, the right starting point is a school, while others excel beginning their career in a shop. Regardless of where a technician enters the industry, they can count on I-CAR Academy to give them a solid and relevant foundation from which to build their future.”

remanufactured, and eventually recycled,” according to a state site on legislation.

The bill passed 62-5 in the Assembly and 33-1 in the Senate, on the last day of the session.

Despite the big majorities — with 14 Republicans absent between the two final votes — Newsom vetoed SB 615 the day before his Sept. 30 deadline.

In his veto message to the Senate on SB 615, Newsom said he agreed with the bill’s intent, but he said the Department of Toxic Substances Control (DTSC), the agency tasked with writing its regulations, would experience “a significant burden...to implement the policy.”

Newsom said “market-based solutions” create jobs, and suggested supporters “explore if a producer responsibility organization” might be a better choice “in sharing the administrative burden required by this policy.”

The bill returns to the California Senate to consider overturning Newsom’s veto.

If it does override, the DTSC by July 1, 2028, will write regs to “interpret

and implement the law,” said Jack Molodanof, a lawyer and lobbyist who works with CAA.

“We were actively engaged in this,” he said.

EV makers are bringing more midpriced models to market and buyers are warming to them as an option. More EVs, more batteries; more batteries, more recycling. Body shops and collision centers will participate in this, if the bill becomes law.

“It’s important consumers are protected and that it’s fair to the industry,” Molodanof said, as regulations take shape via agency action and public comment. “It’s big and complicated; this is new territory.”

Two bills aimed to enact laws involving Advanced Driver-Assistance Systems (ADAS).

The first, SB 1313, prohibits equipping vehicles with devices “designed for, marketed for, or being used for, neutralizing, disabling, or otherwise interfering with a driver monitoring system,” and prohibits people “from using, buying, possessing, manufacturing, selling, advertising for sale, or otherwise distributing” such a device.

SB 1313 passed both houses unanimously, and Newsom signed it

Sept. 25.

The second bill, SB 961, would require most vehicles, beginning with 2030 models, to have equipment that can discern speed limits, and notify drivers if they drive 10 miles over it. Exclusions for motorcycles, large trucks, emergency vehicles and cars lacking GPS were included, and carmakers could have offered alternative ways of signaling drivers.

“[SB 961] was amended several times,” Molodanof said. “SEMA was actively engaged on this” as well. In March, SEMA released a study showing voter opposition to the bill. Its SEMA Action Network also issued a “legislative alert” to marshal opposition. The state Chamber of Commerce also opposed the bill.

SB 961 passed 47-17 in the Assembly and 26-9 in the Senate, with 20 legislators — 18 of which were Democrats — marked absent.

Newsom vetoed the legislation, citing federal vehicle safety standards and noting the National Highway Traffic Safety Administration is considering rules for such new equipment, according to the Associated Press.

Body shops would have seen repairs and calibration for the new “notification” equipment, had the law gone into effect. As it is, and based on

SB 1313, they’ll still need to deal with vehicles potentially arriving in-shop with ADAS-disabling equipment installed.

The state Senate could still consider an override of this veto as well.

“We follow [ADAS] bills,” Molodanof said. “There’s going to be more and more of these.”

Three bills that would have expanded technical education in the state didn’t get out of committee.

AB 377 would have boosted annual career technical education funding 50% to $450 million, according to a CAA summary note.

AB 2273 would have established a paid internship program for high school students pursuing skilled labor jobs, with an initial $12 million appropriation.

AB 1927 would have expanded a state grant program for teachers to include people planning to work at least four years as technical education instructors. Molodanof said budget woes prevented the allocation of new money to programs. California in June enacted a budget for the coming year to close a $47 billion shortfall.

Oscar Moreno, who owns Integrity Auto Collision Center in Fairfield, CA,

Achieve unmatched results with less product and less time. Plus, ® 3D ACA contains no fillers, vir tually eliminating comebacks from reoccurring swirl

Tr y the 3D ACA system today.

employs a B-tech who graduated from the program at Contra Costa College in San Pablo. “It’s a good opportunity for body shops to have [these techs], and we’d like to have more,” he said.

Two bills — one each in the Assembly (AB 2288) and Senate (SB 92) — already signed by Newsom are aimed at addressing labor issues that have grown since 2004’s Private Attorneys General Act (PAGA).

Since then, employee lawsuits against businesses have increased. CAA’s summary said “bills address major problems in the law while protecting workers and limiting shakedown lawsuits that hurt employers.”

The new law requires filing a complaint with state agencies first, before civil actions under PAGA can begin. If an agency investigates and finds citable issues, employers will have an opportunity to correct the problems.

Both bills passed unanimously and Newsom signed legislation into law July 1.

“This was a win for businesses in California,” Molodanof said.

Also a win, he added, was the defeat of SB 1116, which would have provided unemployment benefits to workers who go on strike. Body shops

aren’t union shops but increases in unemployment benefits, Molodanof noted, “increases unemployment insurance costs for all employers.”

The bill passed in the Senate but failed in an Assembly committee.

SB 301 would have offered up to a $4,000 rebate for converting a gasoline-powered vehicle to a zeroemission one. It passed both houses unanimously but was vetoed by the governor June 14.

SEMA issued a press release the next day decrying the veto, given the existence of other, current state efforts, and saying the program would have created 149,000 new jobs and $40 billion in positive economic impact.

“SEMA is profoundly disappointed by Governor Newsom’s lack of foresight in vetoing SB 301,” SEMA CEO Mike Spagnola said in the release.

California is also requiring all new vehicles in the state to be zeroemission by 2035, with staged milestones of roughly one-third by 2026 and two-thirds by 2030.

SB 903 would have banned products containing perfluoroalkyl and polyfluoroalkyl substances (PFAS). PFAS are used in many

automotive products, including gaskets, shock absorbers and bushings, CAA said. The bill didn’t get out of committee.

“This was important and there was a lot of opposition,” Molodanof said. “I’m not sure what they’d have made products out of” if PFAS were prohibited.

Catalytic converters came up a couple times.

The final results included defining vehicle theft crimes to include parts or components, such as the converters. This bill, AB 2536, was passed and signed into law.

Failing, however, was AB 2188, which CAA had backed, and which would have let vehicle owners who have a catalytic converter stolen replace it with an EPA-compliant one, rather than a California Air Resources Board-compliant model.

Also failing were bills exempting 2024 model and later heavy-duty trucks from state emission standards if they meet federal ones; requiring disclosure of tobacco residue in used vehicles when sold and transferred; bringing the DMV and other agencies into “enforcement and compliance activity related to unlicensed and unregulated automobile dismantling” according to a CAA summary; and requiring businesses handling

hazardous materials to report the release or possible release of the material to state agencies.

“Not just legislation but also regulation” affects body shops and collision centers, Molodanof said. BAR is currently working in several areas touching the industry, according to CAA.

Citations and Fines: BAR “has increased the number of citations and fines issued to California automotive repair dealers,” CAA said. Appeals conferences, conducted remotely before a panel of a public member, a BAR rep and an industry rep, are ongoing. Successful appeals remove the citation from the BAR website.

Vehicle Safety Systems Inspection: Licensing of VSSI stations and techs began in March; inspections are underway since July. The previous brake and lamp inspection program ended Sept. 27, and the DMV now no longer accepts these certificates of compliance for registrations. BAR will collect and refund unused certificates. VSSI information is available on the BAR website.

Storage Fees: BAR is proposing l CONTINUED ON PAGE 23

By Paul Hughes Autobody News

Sometimes a “nice problem to have” is not quite true.

Two Steve Halls — father and son — and son and brother Shaun Hall sold their four-unit MSO, Steve’s Auto Body, in northeastern Arkansas to consolidator Joe Hudson’s Collision Centers in September 2023.

The four shops were in Marion, Jonesboro, Paragould and Searcy. In a way, they ended up like eight shops, and, in an unhelpful way, like just one.

Steve Hall Sr. had the first one in Marion by 1999. The others came in five years, between 2010 and 2015. At its sale, the four sites —

“that was our first mess up,” Hall Jr said; a near-monopoly in the market — “the only MSO … we had a great reputation;” inexperienced workforce — “the talent we had, had never done anything that large;” and exponential expense growth — “keeping up with ADAS … changing metals … I-CAR [training.]”

Grouping expenses is a big no-no, but the Halls are by no means unique in the industry here. And while a near-monopoly sounds like a nice problem to have, market dominance bred some carelessness. The busy business has to keep serving the customer; paperwork didn’t get done.

Expense growth is a given, and employment issues — changes wrought by COVID like finding willing techs, then having them miss time for training on new systems -also hit ops.

The shops had no fulltime bookkeeper.

Boiled down: scant attention for financials. “We were just focused on getting things done.”

“It was chaotic,” Hall Jr. said. “We’d created a beast.”

center, taxes — make you want to say, “Are you sure?”

She’s sure.

Hall added to the list: “assets, sales information, land, leases, list of employees and their certifications.”

“This is something all shop owners should do,” Gay said.

Employment issues crop up, again, too.

“Estimator, parts person, whoever closes the ticket, the actual person doing the books, coding it all properly,” Gay said. “You need people who embrace it.”

She said ideally collision centers do this as they go; often they don’t. “There’s always lug nuts that don’t get tightened.”

Steve’s Auto Body created a whole new set of books for each shop, and filed amended tax returns as numbers clarified.

“There was a lot of unwinding to rewind,” Gay said.

“I didn’t want to sell to an MSO that wasn’t like us,” Steve Hall Jr. said. “Joe Hudson — the quality, good reputation, they take care of their employees; they‘re not coming in to just completely change everything.”

Joe Hudson’s has more than 230 locations. This month it entered Ohio, its 17th state, and most recently bought shops in Georgia and Mississippi.

It had 194 shops in 15 states when it bought the Halls’ MSO, which was its entrance into Arkansas. JHCC CEO Brant Wilson said in a press release on the deal the consolidator would be “developing a successful Arkansas market with these new locations.”

Gay called buying a dominant mini-MSO “a platform opportunity for a consolidator.”

Joe Hudson’s website this month lists 12 Arkansas collision shops in its system.

The Halls have seen more health issues, and Hall Jr. said they can spend more time together.

And work slower, doing real estate development. The family kept the land the shops sit on, and lease it to the new owner. Hall Jr. called the lease “awesome.”

Five acres near one of the shops remain in the family; the Halls plan to develop a self-storage facility. They work with the accountant who rebuilt the shops’ financials.

“She’s very black and white,” Hall Jr. said.

regularly outgrowing original spaces; renovated; and adding land, buildings and shop space — totaled some 120,000 square feet, 55 employees and north of $13 million in annual sales.

The brothers joined as growth began.

Opening and expanding multiple shops fast, usually doubling space, means four were like eight. Combining numbers across the four means you could see them as one operation.

Which became a problem.

“We just didn’t know,” Steve Hall Jr. said.

The business was growing, new hires coming onboard, technology spawned new equipment, there were loans for land and building buys —and money was coming in.

The MSO saw 15% gross sales growth annually for the five years from 2018 leading to the exit, Hall Jr. said.

“We were growing so rapidly and didn’t realize it had gotten out of control until we got ready to sell.”

There were four problems: grouping expenses for the shops —

Much work was done in the family: dad on a construction project, Shaun running a store.

“Things got away from us a bit.”

The MSO’s metrics were good, the family said, and made shops an acquisition target, with the usual nosing about by big buyers, including Joe Hudson’s, who’d been calling for about a year, and Caliber Holdings LLC.

Before they saw the problem, the family had decided to sell.

“My dad’s health started turning [and] COVID left a bad taste” on labor, Hall Jr. said. “Big MSOs were buying up shops; we felt it was a good time.”

Consultant Laura Gay of Floridabased Consolidation Coach stepped in.

“It’s hard to keep the books clean, if you’re running a fast-paced, highproduction collision shop,” she said.

“To take it to market,” material has to be structured for the gimleteyed, green eyeshade guys. Gay called the process “forensic financial analysis.”

The list of financial must-haves — multiple income and cost-of-goods accounts, separate labor costing for each area, profitability by profit

monthly to about 2,500 service professionals. It includes a “Collision Corner” column, written by Strom.

Once a quarter, NWACA hosts a Collision Roundtable, a Zoom meeting for collision members and local non-members who want to get a taste of how joining the alliance could benefit them.

Most recently, the Sept. 10 virtual event featured Jim Anderson from Real Shop Coaching who spoke about outside-the-box ideas for marketing a collision repair shop.

Next up, on Nov. 12, Steve Dawson of Hunter Engineering will speak about collision repair alignments. Strom said Dawson led a class on alignments at NWACA’s Collision Training Expo earlier this year.

“The feedback we got on that class was awesome,” Strom said.

On Jan. 14, Aaron Schulenberg of the Society of Collision Repair Specialists (SCRS) will present on the blend study conducted by SCRS in 2022.

PAVE

NWACA is one of four partner organizations collaborating to put on PAVE (Professional Automotive Virtual Education), an annual twoday, virtual-only training event which will be held Feb. 21-22, 2025.

PAVE was born during the COVID pandemic, when in-person events could not be held. Next year’s will be the fifth edition.

“There’s still a need for virtual training because there’s some people who are not in an area where training is readily accessible,” Wolslegel said. “They don’t have to worry about the venue and trying to travel.”

In 2025, PAVE will feature more than 30 sessions, several of which will be geared toward collision repair.

In addition to being able to attend the sessions live, registrants will have 30 days of on-demand access following the event.

Learn more at www.pavetraining. com.

NWACA held its first CTE in 2023. The single-day inaugural event was so well-received, the alliance expanded it to two days this year.

In 2025, the third annual CTE will be held May 2-3 at Clover Park Technical College in Lakewood, WA.

CTE features hands-on training, panel discussions and a trade show.

The agenda for 2025 is far from finalized, but Strom said the event will feature more trainers, some of whom reached out to NWACA to offer to participate. There are also talks of breaking down some of the three-hour training sessions into two 90-minute classes on two different aspects of the repair process.

“We’re not sure how that’s going to work out, but we’re thinking about how to change things up, so people have more choice,” Strom said.

More information about the 2025 CTE agenda will be available closer to the show date.

To learn more about NWACA and how to become a member, or to register for events or the email newsletter, visit www.nwautocare. org.

ASE announced a partnership with Convertible AI to establish artificial intelligence accreditation criteria in the automotive diagnosis and repair sector, a significant step towards integrating advanced AI tools into everyday automotive service practices.

This partnership will focus on three main objectives: assessing AI performance and fairness, examining AI transparency and accountability, and defining ethical guidelines and best practices. The first area involves rigorous testing of AI systems across various automotive scenarios to ensure accuracy and mitigate bias. The second will tackle the transparency of AI-driven diagnostics, aiming to make AI decision processes clear and auditable for technicians. Lastly, the initiative will look at setting ethical standards for AI in automotive services, focusing on privacy, data governance, and regulatory compliance.

With ASE’s 52-year history of promoting excellence through certification and Convertible AI’s cutting-edge technological prowess, this partnership is poised to shape the future of automotive services.

by Abby Andrews Autobody News

CIECA recently hosted a webinar, “Why the Collision Industry Should Be Interested in V2X,” to dip into the emerging world of Vehicle to Everything (V2X) technology and how it could affect road safety, traffic management and even collision repair.

The presentation was led by Arif Rafiq , a transportation industry expert who advises governments on systems developed to manage roads, highways and public transportation infrastructure.

Rafiq spoke about why V2X technology will be critical to the future of mobility, including how it could be applied to collision repair.

Rafiq said V2X is communication between a vehicle — which could be a car, truck or even a burrito delivery robot — and everything around it — other vehicles and the local transportation infrastructure. C-V2X is when the vehicle receives and sends data through the cellular network.

He opened with an imagined scenario: two autonomous cars driving side by side on a road,

approaching an intersection.

Currently, if those cars are built by different manufacturers, “they may have different perspectives on what actually is at that intersection” based on data collected by other cars made by their respective manufacturers. One might think it’s a regular intersection, but the

different perspectives of that same intersection,” Rafiq said. “What’s going to happen when they both reach that intersection? That depends on the intelligence built into the cars. The risk to the occupants has now gone up.”

Rafiq said that scenario is one he is working to avoid in the

other could be more up-to-date and know it’s now a roundabout with an active work zone.

“Now these two vehicles have

future, as autonomous vehicles become more common.

He shared a screenshot of what an autonomous car “sees” for data

collection, not navigation, which it sends “home” to be used to build an HD map that all the same manufacturers’ cars then use for navigation.

“A tremendous amount of data needs to be stored to track every road and intersection in the world,” Rafiq said.

There are three options.

First, all of that data could be stored directly in the vehicle, but it quickly becomes outdated.

Second, the car can sense and interpret all data in real time, similar to an image Rafiq shared from a traffic camera identifying cars, large trucks and people in different colored boxes. But that technology is not perfect and doesn’t always recognize everything correctly.

Third, the data could be delivered to the vehicle as needed.

Rafiq said he thinks the third option “has a lot of merit.” He referred to the earlier example of the two autonomous cars approaching an intersection that recently became a roundabout. If the local government supplied that information on a platform open to the public, it could theoretically be accessible

to connected vehicles as well.

“If [vehicles] are able to read a precise and up-to-date ‘digital twin’ of the transportation infrastructure, then that puts all of us in a better state,” Rafiq said. “No matter which manufacturer is reading this data, it’s authoritative, reliable and up to date.”

Rafiq said he started helping governments in Southeast Asia and later Canada create these “digital twins” for road safety and public transportation management and planning purposes.

A webinar viewer asked if Rafiq has confidence governments would provide that information in a timely manner.

“No, I do not,” Rafiq said. “The technology to do it is there, but we have to take advantage of it. Some do, but not all.”

In late 2023, the U.S. Department of Transportation announced

75% of intersections.

In the U.S., the number of roadway deaths has fallen from a peak of 44,000 in 1975 to 38,000 in 2020.

A better indication in the reduction of roadway deaths is the number of fatalities per 100 million vehicle miles traveled, which fell from 3.35 in 1975 to 1.34 in 2020.

“We’re getting better, but we’ve got lots of work to do,” Rafiq said.

One viewer asked if V2X could be used to validate ADAS calibrations are done correctly.

Rafiq said he thinks it could get there, but right now there is not a place for that kind of data in the current message subset within V2X data, which include those related to basic safety, local geography, signal phase and timing, road

“Collisions will still happen; I’m not saying it will eliminate them,” Rafiq said.

He said there will be an aftermarket to serve V2X data, and the data could be used to treat collisions that do happen with more intelligence.

For example: if an ADAS feature quit working because it was too foggy, leading to a collision, that data could be sent to both the OEM and the local government that’s maintaining the “digital twin,” which could useful for improving autonomous driving.

The data could also potentially provide a detailed audit of a collision, like a “black box” on an airplane.

That information could help quickly identify the precise repairs needed, which could streamline the insurance claims process. It could even be used to optimize health care for people involved the collision.

One hurdle that needs to be cleared before V2X becomes more common is ensuring the security of vehicles owners’ Personally Identifiable Information (PII), which Rafiq said is being worked on now.

“If there was communication of information standardized between vehicles, and between the vehicle and the intersection, we would be saving lives and would have safer roads. That for me is the ultimate reason I’m in this industry,” Rafiq said.