Toufayan Bakeries

TAKING RISKS AND REINVESTING THE PAYOFFS

C O M M I T T E D P A R T N E R

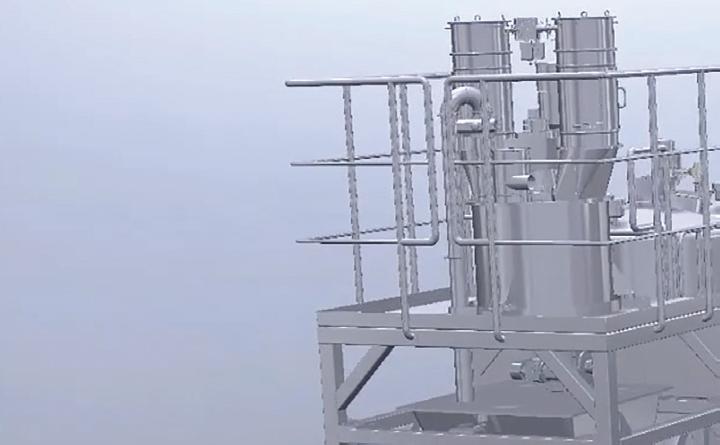

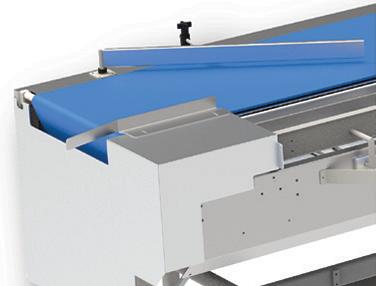

Active Integrated Motion™ (AIM™) technology transforms frozen pizza handling by enabling automation in washdown environments.

Intralox® AIM solutions include sorting, switching, and merging equipment that deliver maximized, reliable throughput and gentle product handling to your pizza packaging lines.

Paul Lattan

President - Principal | 816.585.5030 | paul@avantfoodmedia.com

Steve Berne

Vice President - Principal | 816.605.5037 | steve@avantfoodmedia.com

Joanie Spencer Director of Content - Partner | 913.777.8874 | joanie@avantfoodmedia.com

Paul Lattan

Publisher | 816.585.5030 | paul@avantfoodmedia.com

Steve Berne

Director of Media | 816.605.5037 | steve@avantfoodmedia.com

Joanie Spencer Editor-in-Chief | 913.777.8874 | joanie@avantfoodmedia.com

Jordan Winter Creative Director jordan@avantfoodmedia.com

Olivia Huels Multimedia Specialist olivia@avantfoodmedia.com

Annie Hollon

Managing Editor annie@avantfoodmedia.com

Evan Bail Associate Editor evan@avantfoodmedia.com

Maggie Glisan | Bella Foote

Contributors info@commercialbaking.com

Videos | digital edition

Commercial Baking is published by Avant Food Media, 1703 Wyandotte St., Suite 300, Kansas City, MO 64108. Commercial Baking considers its sources reliable and verifies as much data as possible, although reporting inaccuracies can occur. Consequently, readers using this information do so at their own risk. Commercial Baking is distributed with the understanding that the publisher is not liable for errors and omissions. Although persons and companies mentioned herein are believed to be reputable, neither Avant Food Media nor any of its employees accept any responsibility whatsoever for their activities. Commercial Baking magazine is printed in the USA and all rights are reserved. No part of this magazine may be reproduced or transmitted in any form or by any means without written permission of the publisher. All contributed content and advertiser supplied information will be treated as unconditionally assigned for publication, copyright purposes and use in any publication or digital product and are subject to Commercial Baking ’s right to edit.

Commercial Baking , ISSN 2767-5319, is published quarterly in Feb, Apr, Aug, and Oct, with special issues in Jun, Jul and Dec, in print and digital formats by Avant Food Media, 1703 Wyandotte St., Suite 300, Kansas City, MO 64108.

Application to Mail at Periodicals Postage Pending at Kansas City, MO, and additional mailing offices. POSTMASTER: Send address changes to Commercial Baking, c/o Avant Food Media, 1703 Wyandotte St., Suite 300, Kansas City, MO 64108.

Circulation is tightly controlled, with print issues sent only to hand-verified industry decision makers and influencers. To apply for a free subscription, please visit www.commercialbaking.com/subscription

For advertising inquiries please call 816.605.5037 or 816.585.5030.

20

With its latest expansion in Florida, Toufayan Bakeries writes the script on taking risks and reinvesting the payoffs.

PLUS: Look for QR codes that contain exclusive digital content throughout the issue.

As a manufacturer, we understand it’s important your cracker product reaches consumers in the freshest condition possible. When it comes to handling cracker, snack cake, and baked goods, Benchmark, Kleenline, and Southern’s fully-automated packaging solutions are ideal. Our high performance lines of equipment offer solutions for feeding, carton infeeding, tray loading, product orienting, laning and conveying, pouch packaging, and more. Turn to the company that knows your business, your customers, and has the commitment to be the leading supplier of packaging automation.

Benchmark provides automated food distribution and loading solutions.

Kleenline provides sanitary conveyors for increased line efficiency and superior performance.

Southern provides a complete line of horizontal form-fill-seal pouch packaging solutions.

Visit us at Booth #N-5260 during Pack Expo International 2022!

To find a solution for your production lines, call 706-208-0814 or visit www.benchmarkautomation.net/industry/cracker-packaging-infeeders-loaders/.

Outlook:

Cakes

Outlook:

Market:

Insight:

Cakes

There’s a reason why so many baked goods made our list of the 20 most influential made-with-honey food and beverage products ever formulated. Honey is truly an all-natural sweetener that consumers crave in their breads, cereals, snacks and food bars. We assembled a team of industry experts to name 20 food and beverage products formulated with honey that have changed consumer perceptions, influenced categories and driven revenue growth. Find inspiration in your next new product development by recognizing some of the most influential products ever developed.

Raise your hand if you returned from the International Baking Industry Exposition (IBIE) thoroughly exhausted and completely content. I know I did.

The energy that had been building for the past two years culmi nated in what may have been the most joyous Baking Expo on record — joy of not only reconnecting with those we’ve waited so long to see but also of making new connections face-to-face.

But something else happened at IBIE. It was something almost magical.

Remember the moment in The Wizard of Oz when Dorothy wakes up to discover the world had turned from grey to Tech nicolor? That’s how it felt when the show floor doors opened. Just like that, no one was talking about the past two years anymore. The focus was on the road ahead, and it felt like one paved with yellow bricks.

Big lessons were learned through the pandemic, not the least of which being to expect the unexpected. It’s time to look forward, even if we have no idea what the future holds.

If you’re only making decisions based on current needs, you’re already behind. That’s a pretty scary proposition. But the truth is, those who can at least anticipate the future — whether it’s how the war in Ukraine will end or what will be named tenth major allergen — will be the ones poised at the top when the next crisis hits.

Create pans designed for your bakery’s exact needs and specifications to maximize throughput and increase efficiency.

Achieve maximum product quality and consistency while minimizing your cost per bake by partnering with us to select the right design, coating, release agent, and cleaning schedule for your baking pans.

Work with our experienced team to select the optimal silicone or fluoropolymer coating to ensure great releases.

Reduce your oil budget, increase uptime, and achieve clean releases with our high-quality oils and precision applicator.

Maximize pan life with a cleaning and recoating schedule customized for your bakery’s pan cycles and release agent usage.

Partnering with the Bundy team means that, together, we are developing a plan to make your bakery as successful as possible. We stand behind our products and are committed to the success of every project and every bakery, every day.

For more information about our products and services contact us at +1.800.652.2151 or email info@bundybakingsolutions.com.

“Bakers in Europe are dealing with an energy crisis, and bakers in America are struggling with labor shortages. Efficiency is more necessary now than ever. But we shouldn’t push sustainability to the back burner. Sustainability and efficiency can work together to drive bakers’ success into the future.”

Catalina Mihu | editor-in-chief | baking+biscuit international

While moderating an IBIEducate panel discussion on sustainability

“Obviously innovation is incredibly important. And, in addition to innovation, getting back to what made our business great should not be overlooked. There is stock in thinking about how powerful that can be going forward.”

“BEMA and ABA have both established DEI task forces and working groups in the past year to facilitate communication about it within the industry. We decided that IBIE was the perfect place to bring the two groups together and have the conversation all as one — because it really is about the industry.”

Emily Bowers | VP, education and operations | BEMA

“To this day, I still get down on my hands and knees and will scrub all of our mixers. It’s not because I have to. I do it because when I meet with my employees, I tell them, ‘I’ll never ask you to work harder than me, and I’ll never ask you to do something that I wouldn’t do.’ That’s when you lead by example.”

“Consumers today feel empowered. They can’t control a lot of things outside of their circle, but they can control where and what they eat. There’s a purpose behind their choices, and it’s happening on their terms.”

Shrene White | general manager, emerging nutrition | Ardent Mills During IBIEducate session on regenerative agriculture Photo courtesy of the American Bakers Association

Ridgefield, NJ-based Toufayan Bakeries knows how to get things done. Whether it’s adding a whole new product to the portfolio or taking on a new expansion, the Toufayan family values are always at the foundation.

Take Toufayan Bakeries’ Plant City, FL operation, the company’s third bakery location and site of its most recent expansion. With a new bagel line and a 160,000-sq.-ft. greenfield warehouse addition, the bakery embodies the principles instilled by the family’s patriarch and company chairman, Harry Toufayan.

At first glance, these projects are simply the result of hard work, customer focus and a commitment to reinvest in the business. Then again, tracing back how those values have built this company reads like a movie script depicting the classic mid-century American dream.

By the time Harry started selling pita bread to supermarket bakeries in the early ’70s, his family had been baking for about four decades. The business began as an Armenian bake shop in Egypt before Harry’s parents immigrated to the US, eventually operating a small bakerygrocery below their apartment in West New York, NJ.

A 2021 Baking Hall of Fame inductee, Harry blazed a trail in the industry as one of the first suppliers of traditional pita bread into supermarket delis. If Harry had an idea, it almost assuredly came to fruition.

With its latest expansion in Florida, Toufayan Bakeries writes the script on taking risks and reinvesting the payoffs.

“My dad is a very smart man,” said Karen Toufayan, Harry’s daughter and VP of marketing and sales. “He was in a supermarket waiting for his deli meats and thought to himself, ‘This would be a great place to have my breads. While a customer is waiting for their deli meat to be sliced, they could just grab a package of bread.’ And it just grew from there.”

But Harry isn’t just an “idea man.” He had the foresight and work ethic to execute on those ideas, even the risky ones, and the company has operated that way ever since. In fact, nearing 82 years old, Harry still reports to work at 5 a.m. every day in the Ridgefield bakery.

“When I think about how the company culture reflects the foundation that Harry started, I would say first and fore most, it’s hard work,” said Greg Toufayan, Harry’s son and Toufayan Bakeries’ current owner. “Nothing happens in a bakery without having people willing to put their boots on the ground, who care about what they’re doing and want to make the bread the right way.”

That ethos is what built the company’s reputation as a top flatbread and bagel brand and a marquee co-manufacturer of bread, bagels, cookies and more, with a portfolio topping 100 SKUs in total.

In Florida specifically, Toufayan entered the world of contract manufacturing through a handshake agreement with a major snack brand. While the Orlando facility was deep in its pita and flatbread production, it began producing breadsticks for this new partnership, which skyrocketed the business and expanded the Orlando operation from 50,000 sq.-ft. to its current 230,000.

Engineered with precision in mind, AMF Fusion delivers sanitary, horizontal batch mixers seamlessly integrated with dough handling systems for the perfect mix of durability, cleanability, and performance. With over 60 years of mixing expertise, AMF Fusion offers flexibility with both triple roller bar and sigma arm agitator options as well as a versatile gear-motor bowl tilt system for handling a wide range of product applications and rates. AMF Fusion’s patented Dough Guardian technology works alongside your mixer to deliver real-time actionable insights for maximum control of your dough parameters and the most consistent dough quality. Gentle, automated dough handling systems move dough through your process at high volumes with labor-free trough handling via AMF’s Automatic Guided Vehicle (AGV) to ensure safer, more efficient operations.

with in AMF Fusion delivers horizontal batch mixers with systems for the mix of and performance With over 60 years of AMF Fusion offers with both roller bar and arm as well as a versatile gear motor bowl tilt system for a wide range of and rates AMF Fusion’s Guardian works your mixer to deliver real time actionable for maximum control of your dough parameters and the most consistent quality Gentle, automated move your process at volumes with labor free handling via AMF’s Automatic Guided Vehicle to ensure more efficient operations

Netherlands UK China Canada Mexico

At Toufayan Bakeries — in every location — the bar is always set high. That’s especially true for quality and food safety at the company’s facility in Plant City, FL.

“We have a great quality assurance team out there, led by Rick Smiley,” said Greg Royal, VP of sales and operations.

Being BRC- and GFSI-certified isn’t enough. The bakery earned a gluten-free certification when it began co-manufacturing a gluten-free product for a customer and also has organic and kosher certifications.

Food safety is equally important in Toufayan’s Plant City bakery.

“We consistently have routine meetings where the food safety team gets together and reviews all our opportunities and challenges,” Royal said.

But the team is also active, they walk the talk.

“Every day, you’ll see Rick out on the floor, walking the entire bakery, looking at all four walls, making sure we’re producing safe, quality products for consumers.”

“We take a lot of pride in our contract manufacturing,” said Kristine Toufayan, Harry’s daughter and head of finance for the company. “Without a doubt, the attention that we put into that side of the business is just as important as what we do for our own brand. It comes full circle; we wouldn’t have had the money to rein vest into the bakeries and our own prod uct line if it hadn’t been for that business.”

After significant growth in New Jersey and Florida, the Orlando bakery was at capacity by 2005 producing bagels, buns, pita and breadsticks. Meanwhile, about an hour down the road, an old Archway plant was about to be shut tered. Harry scooped up the facility with a plan to ease capacity in Orlando by shift ing bun production to the newly acquired Plant City bakery, freeing Orlando to focus on flatbread, pita and bagels.

But Harry had another idea. Rather than replacing the Baker Perkins and Reading Bakery Systems cookie lines, he decided it was time to get into the cookie game.

“He looked at the cookie lines and said, ‘We’re going to sell cookies now,’” Karen recalled. “Greg tried to tell him, ‘No, we’re replacing the cookie lines with bun lines,’ but my dad knew this was good equip ment. He came to me and said, ‘We’re going to sell cookies. But don’t worry, we’ll figure it out.’”

Since then, the company has picked up co-manufacturing business for cookies, just as Harry predicted, and it also began manufacturing its own high-end cookie brand, Goodie Girl, at the Plant City bakery.

“[Goodie Girl] is a great brand,” Karen said. “We invested in producing a high-quality product, and it’s paid off. This brand has done really well in the market.”

The operation also added a bun line to ease that pressure in Orlando before the most recent expansion. But as cookie and bun manufacturing hummed along in Plant City, bagel business boomed in Orlando, and the bakery needed more help with capacity. In the spirit of

reinvestment, it was time to make room for a new bagel line in Plant City to ease that pressure.

“Orlando’s success with our largest co-manufacturing contract for bagels created this demand that they contin uously needed to fill,” said Greg Royal, VP of sales and operations. “They were absolutely at capacity, so the idea of a bagel line in Plant City was so that we could keep that business and build on those customer requests to make more bagels every week or even every day. We had the luxury of being able to start a new line because of that very solid base of business.”

This location always had more expan sion in its future, so the time was right to not only install a new line but also add another building on the 30-acre lot.

“When this property was bought, there was additional space that was unoccu pied at the time,” Royal said. “There was an idea that we would outgrow the orig inal building after expanding a couple

Removing eggs from a formula can not only remove an allergen, but also save on costs, make raw material storage easier and simplify the production process.

Brolite’s egg replacers can work as a total egg replacement in yeast raised products and up to 30% in cakes. Even with a partial replacement, a baker can have more consistent costs of ingredients and more supply stability.

Lose the eggs, keep the functionality, supply and cost savings of an egg replacer.

BROLITE PRODUCTS, INC (630) 830-0340 | TOLL FREE (888) 276-5483 | FAX (630) 830-0356

1335 SCHIFERL ROAD, BARTLETT, IL 60103 | 1900 S PARK AVE, STREAMWOOD, IL 60107

times, knowing that there was this nice piece of land that could be developed. We needed to add more space, specifi cally for warehousing, with the bagel line that was coming.”

It was April 2020 when both projects kicked off. While most consumers were in COVID lockdowns and bakeries were in hyperdrive to keep products on store shelves, the team at Plant City was also gearing up to commission the bagel line and start warehouse construction on the other side of the property.

“When we first started talking about this, there was no COVID,” recalled David Van Vugt, corporate engineer, who spear headed both projects. “All we had was a great idea of adding a building so we could put a bagel line in. And the next thing we knew, COVID hit.”

Looking back on a two-year project, the pandemic may well have been the easy part. With construction jobs waning in 2020, the team was able to lock in much of its pricing prior to the raw material shortages stemming from supply chain disruption.

“We got the quotes for the warehouse in January or February, and we were still a little bit hesitant,” Greg recalled. “And then in April, I just said, ‘Let’s do it.’”

Constructing a greenfield building, commissioning a new line and running the four other lines to keep up with unprecedented demand required the kind of commitment and dogged deter mination that comes from the very Toufayan foundation the company was built on. And leading that charge, Van Vugt was cut from the same cloth.

How else could these two concurrent projects finish on time — and on budget?

Today, the completed warehouse is a matrix of packaging materials, ingredients and finished product ready for distribution. Aisles are organized in a grid that resembles a city center with the bustling traffic of seven forklifts keep ing things moving. Still, the building has potential to triple its capacity once the remaining 32-ft.-high racks are installed.

Housing shipping and receiving, the warehouse also acts as a hub to keep production running smoothly. The procurement and supply chain teams schedule two weeks out what mate rials are needed for daily production. And throughout the day, a shuttle runs between the two buildings … “West” for the warehouse and “East” for the production facility.

Between the additional space provided in the West building and strategy from procurement and supply chain, the bakery has a better chance at heading off those raw materials shortages.

“If we get the sense there will be an issue with a certain ingredient, we can order more in advance before the lead times get pushed back,” Royal said. “There are always delays in getting packaging and ingredients, so the benefit of having this much space is that we can store up more in advance and avoid production interruptions.”

What’s more, once the racks are installed, this building could potentially house addi tional production lines should the need for more capacity arise down the road.

and

for a

and gentle

high

for a perfect

to the

of twin-screw

a

pre-dough

of low and high viscous ingredients (even with

to 13,200 lbs/hr. with a

percentage of

In a chicken-or-egg scenario, it’s hard to say which came first for this $24 million project — the bagel line or the ware house. It may have been a relatively even split on the capital investment, but one thing was for sure: “We would not have been able to add the bagel line without this new building,” Royal attested.

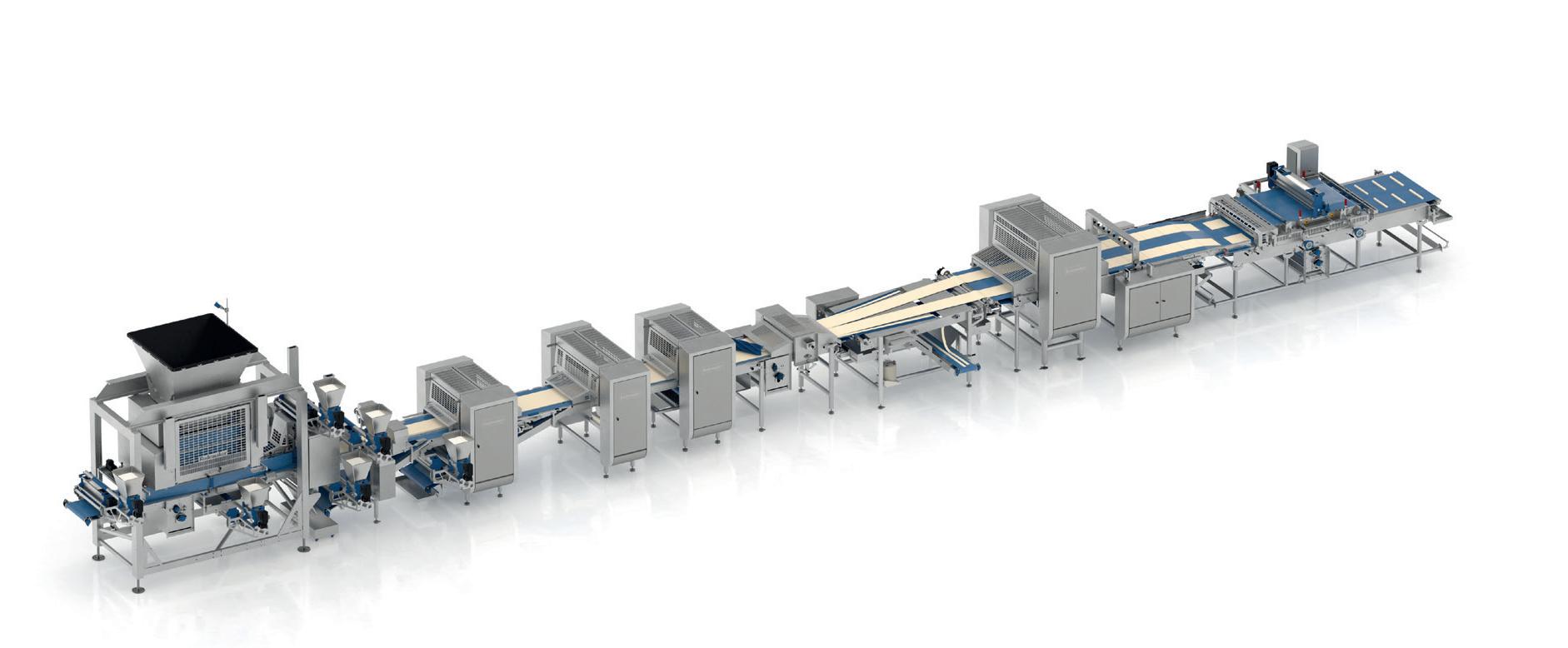

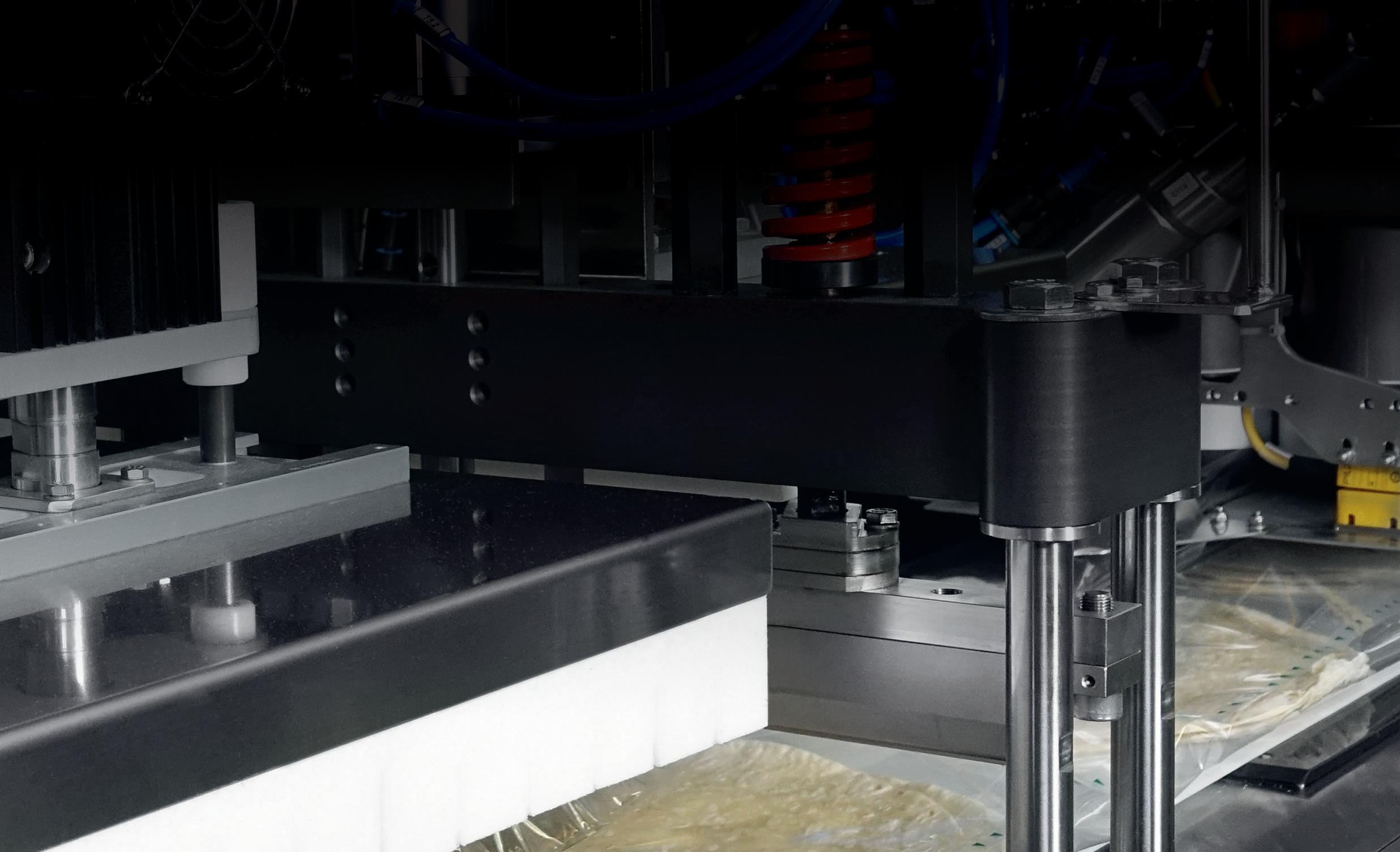

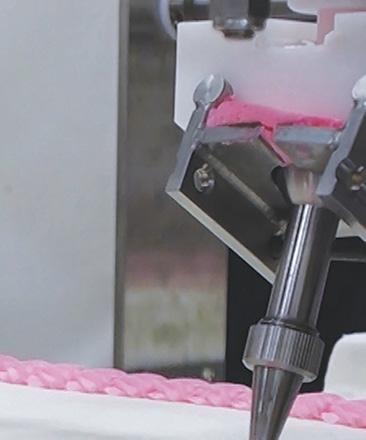

The new building was finished on time, and the bagel line installation was completed about three months ahead of schedule. That’s no small feat consider ing the technology that came together: AMF Bakery Systems mixing, makeup and proofing; ABI forming, conveyance and boiling; an AMF Den Boer tunnel oven; a Stewart Systems overhead raceway cooling conveyor; and Key Technologies shaker conveyors that feed into three packaging leges includ ing slicing from LeMatic, rebuilt UBE baggers and Kwik Lok closures.

Oftentimes, early installation is great news. But in this case, the new line took up about 70% of what had been ware house space in the East building, so the team had to find a way to relocate that storage before its new home in the West building was ready. That meant juggling production schedules, supplier part nerships and local relationships with extreme finesse.

“We met with the fire marshal and the city inspector, and they knew we needed help,” Van Vugt recalled. “We had all this equipment coming in, but the ware house wasn’t ready, and I didn’t have the [certificate of occupancy] yet.”

Relationships with vendors and with the city allowed Van Vugt to expedite enough of the project to gain a tempo rary certificate of occupancy and move storage and raw materials into

“We only get one shot in about 10 years to get this right. So, we had to make it the best we possibly could.”

Greg Toufayan | owner | Toufayan BakeriesThe new Plant City bagel line has increased capacity by 30% over the original production.

TO LEARN MORE, VISIT: KWIKLOK.COM

TO LEARN MORE, VISIT: KWIKLOK.COM

dedicated space in the warehouse and make room for the line installation.

Van Vugt was determined to keep warehouse construction on schedule in concert with a smooth bagel startup and without sacrificing the rest of production. Doing so meant working 16-hour days that often started at 4 a.m. to make sure production was running without a hitch.

“Every day, I had an agenda. And I wasn’t going to stop until it was done,” he said.

The bagel installation’s smooth startup wouldn’t have happened without a combination of trusted relationships and Van Vugt’s instinct. With more than 40 years of bakery experience, he has worked in nearly every facet of

production. If hindsight is 20/20, Van Vugt can see straight through the eye of a needle.

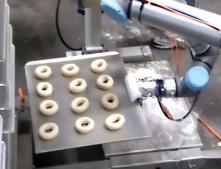

For example, he worked with AMF Bakery Systems to develop system that carries bagels through the proofing process on boards that are then washed and transported back up the line via robots, virtually eliminating downtime on the line.

Internally, the Toufayan team focused on every detail of each machine on the line, ensuring purposeful place ment down to every curve of the conveyor. They even spent time in other bakeries — including some customers — to research the best of the best.

“We only get one shot in about 10 years to get this right,” Greg said. “So, we had to make it the best we possibly could.”

Some might call it “over- engineering,” but a successful startup starts with developing the proper strategy for suppliers to execute.

“Our partners did a great job with manufacturing the equipment,” Van Vugt said. “When we put it in, there wasn’t a lot we needed to do because it was all done ahead of time. They knew what we wanted and the specs we were looking for. So, when it came in, we were pretty much up and running.”

The technology was ready to roll, but there was more to learn in Plant City.

Aside from Van Vugt himself, virtually no one in the plant had experience with bagel production, and the team had to squeeze a big learning curve into a small window. Thankfully, Plant City could rely on a wealth of expertise just down the road in Orlando, where that Toufayan team had nearly 20 years of experience in bagel production.

Years of hard work and dedication in the Orlando bakery is what provided the ability to reinvest in Plant City’s growth, so sharing that expertise was like a passing of the torch.

Knowing a thing or two about dedication, Van Vugt gladly accepted that torch and remained committed to ensuring a smooth knowledge transfer.

“I was out there every day with them,” he said. “I was with the machine opera tors, the mixers, out there with the oven, adjusting speeds on the conveyors or playing with the bake time to get the settings balanced.”

Vital tech support from vendors such as ABI and AMF allowed Van Vugt to essen tially be in several places at once while the line workers were trained in their specific areas.

After just six weeks, the line was running two shifts per day, and it currently runs about 30% faster than the original Orlando line. For Greg Toufayan, it’s a testament not only to the efficiency of the equipment but also to the Toufayan-style work ethic behind the name.

Flexibility, advanced industrial performance and product quality. The M-TA oven has everything covered to give you that competitive edge. It can produce an almost infinite variety of bakery and pastry products in a market that is constantly growing and evolving.

Contact us at info@mecatherm.fr

your industrial bakery simpler

“It’s like a love story; you want to cry at the end. When we smelled those bagels and saw them coming down the line, we knew it was worth it.”

David Van Vugt | corporate engineer | Toufayan Bakeries

“There’s an intense effort that has to be made by people in order for things like this to happen,” Greg said, recalling how aggressively Van Vugt and his team pursued the project to the very end. “That’s how it all got done on time, despite everything.”

A baker’s commitment bears a striking resemblance to unconditional love. Whether it’s Van Vugt soldiering through construction red tape while working 16-hour days or Royal driving 50 miles to meet a colleague on a Sunday for a needed part, commitment is in the Toufayan DNA.

“It’s like a love story,” Van Vugt said. “You want to cry at the end. When we smelled those bagels and saw them coming down the line, we knew it was worth it.”

As Plant City settles into its new digs, Orlando can now reap the benefits to re-build its production lines, taking the pressure off people who had worked such tremendous overtime all those years to set the growth in motion. In turn, the Plant City team can apply key learnings from its installation back to the lines in Orlando.

“It’s a win-win for both bakeries,” Royal concluded.

So, as life starts to feel more like normal for both Florida facilities, what’s next?

Predicting the future can be tricky for a company so comfortable seizing opportunity. Currently, the team is working with The Austin Co. to explore options for future sites while also sharpening focus on the Goodie Girl brand.

Considering all Toufayan Bakeries has accomplished since Harry arrived in New York with his parents, the sky truly seems to be the limit, as long as there’s a dream to achieve … and they stick to Harry’s three simple rules.

“At one time, Toufayan Bakeries was just a small, 750-sq.-ft. shop where my dad wanted to figure out a better way to make a dough ball,” Greg recalled. “And by reinvesting in the business, focusing on customers and putting in hard work, he created a foundation that is the reason why we are so successful today.” CB

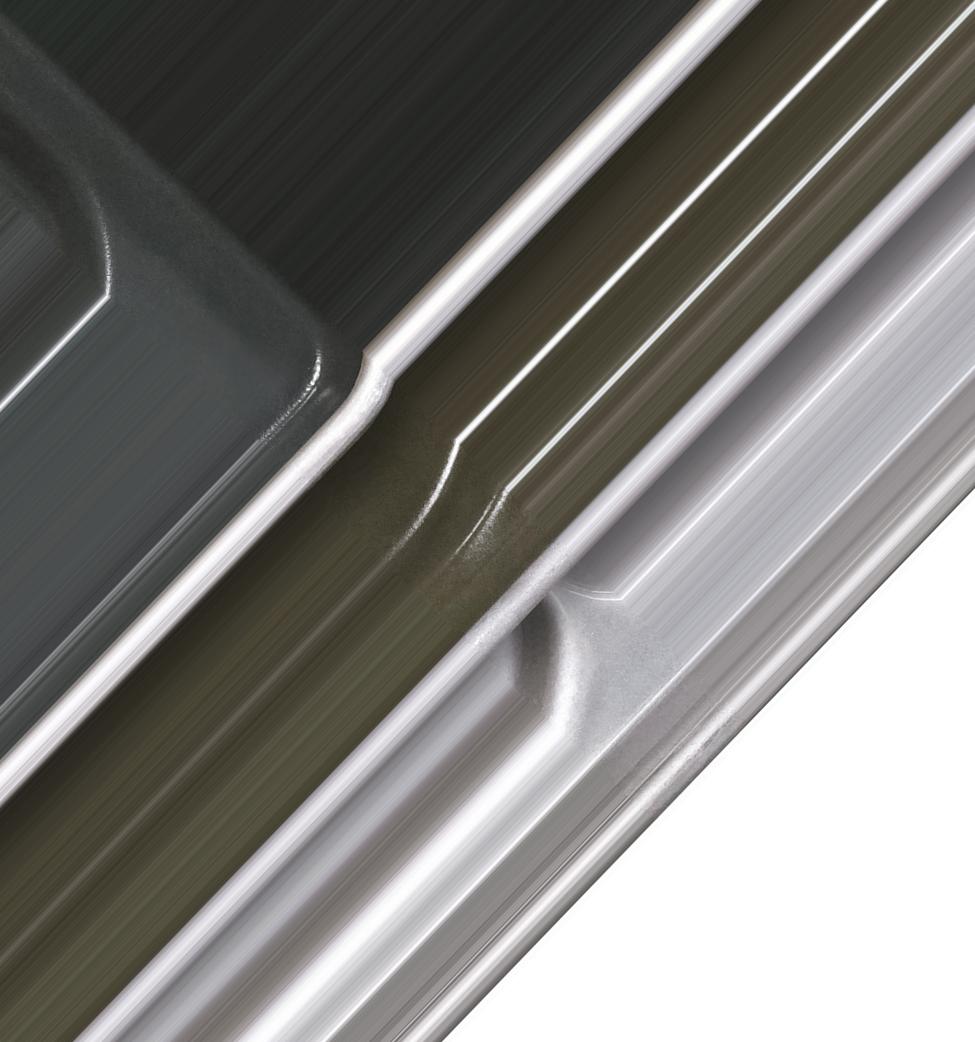

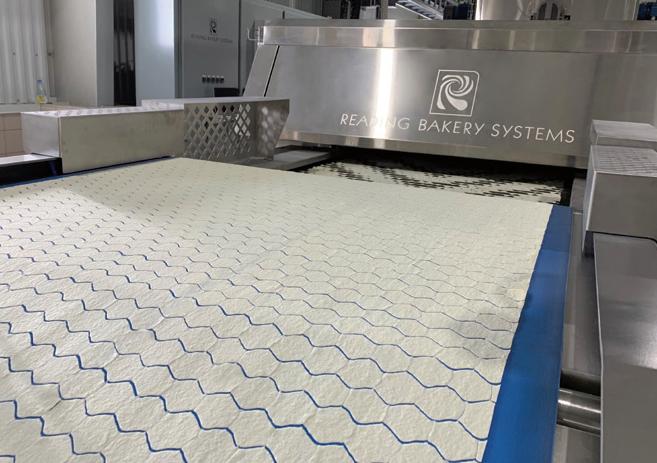

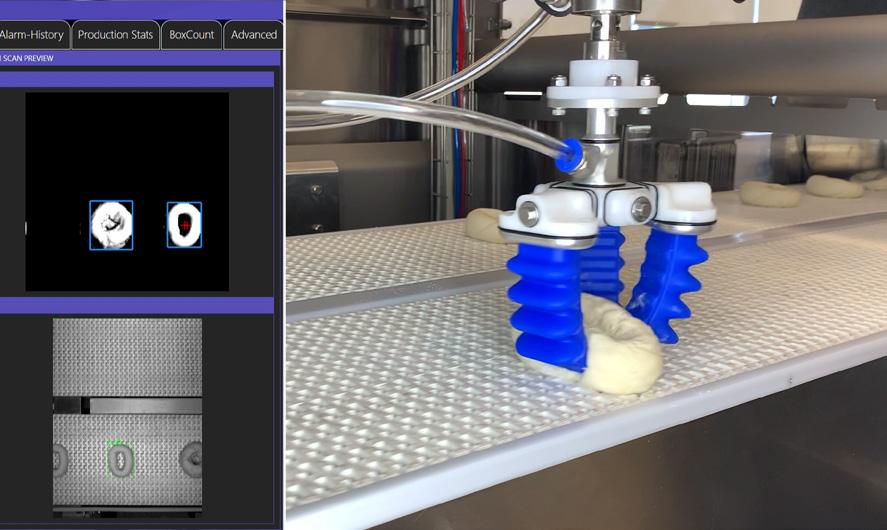

In Plant City, FL, Toufayan Bakeries discovered a veritable “field of dreams” in a 160,000-sq.-ft. facility. After diving into the cookie business with the three existing lines that were in place when Toufayan acquired the bakery in 2005, the company expanded first with a bun line. The plant’s most recent growth includes a new bagel production line and a separate, 160,000-sq.-ft. ware house constructed on the property, both completed on time during the COVID-19 pandemic and supply chain disruption that followed. Below are the supplier innovations that can be found throughout the bakery floor to produce cookies, buns and bagels.

ABI forming, conveyance, boiling system

AMF Bakery Systems mixing, makeup, proofing, oven, robotics

Baker Perkins oven Burford Corp. pan shaker

Combi case erecting

Key Technologies conveyors Kwik Lok closures

Loma metal detection

Shick Esteve Laramore flour reclaim LeMatic slicing

Reading Bakery Systems wirecutting system and oven UBE baggers

The recipe for success is in the ingredients. The Austin Method® is your single-source for site selection, design, engineering, construction, equipment installation, and plant maintenance.

We bring to your table decades of food and beverage experience, innovation, and a partnership you will trust for years to come.

To discuss your project contact John Ruyf at John.Ruyf@theaustin.com.

Whether it’s storing, sifting, metering, weighing or transferring, Shick Esteve is your complete flour reclaim and ingredient automation systems provider.

Hearthside Food Solutions CEO Darlene Nicosia provides a new perspective to the co-manufacturing supply chain.

BY JOANIE SPENCER

BY JOANIE SPENCER

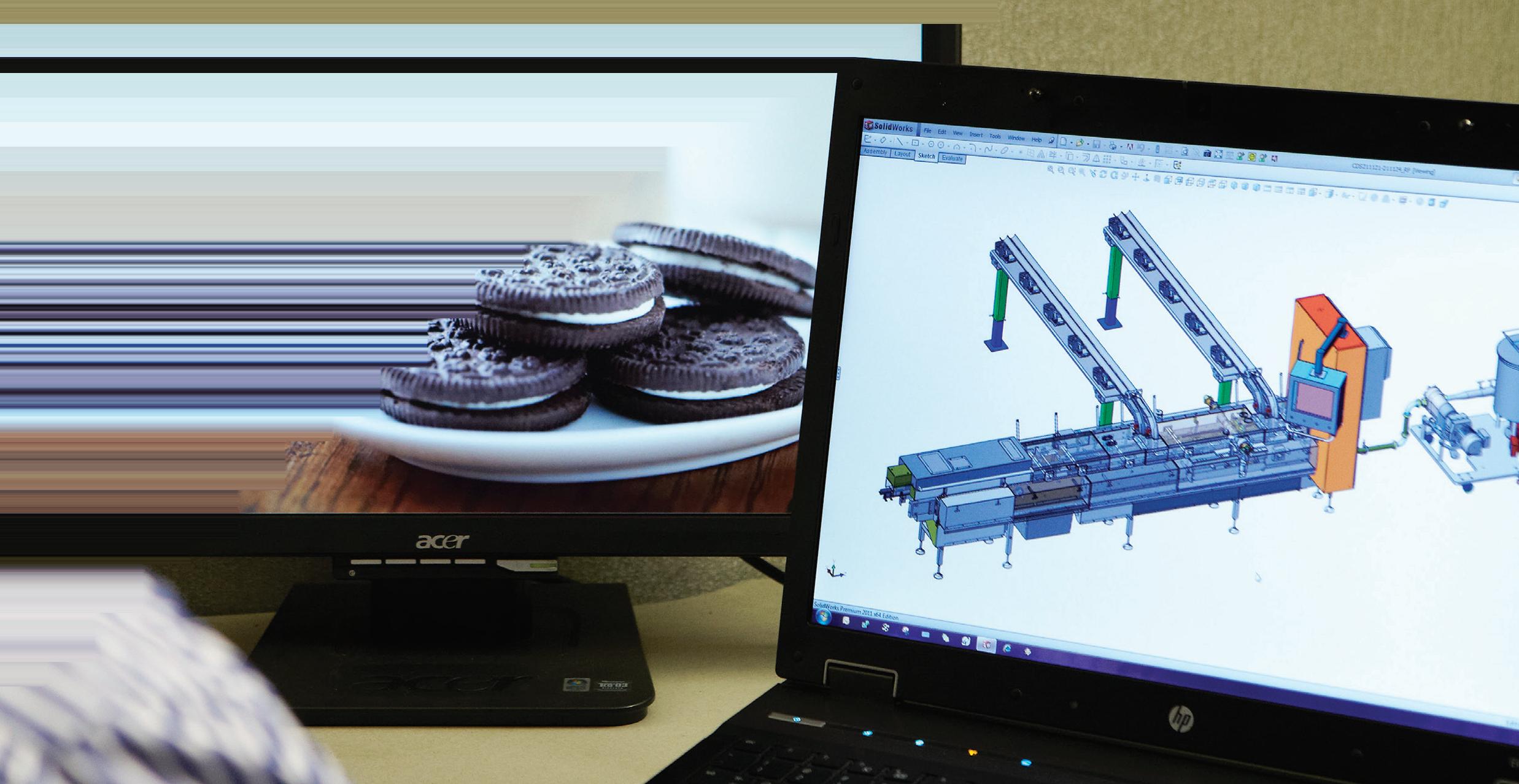

Peek inside Darlene Nicosia’s portfolio, and you might see something of a jigsaw puzzle. But when the pieces are aligned, it’s a manufacturing tapestry of procure ment, logistics, supply chain optimization and analytics, and corporate manage ment, colored with touches of innovation and brand building throughout.

For more than three decades, her career has spanned from Frito-Lay to Kraft to Coca-Cola before joining Hearthside Food Solutions as CEO. In that time, Nico sia has amassed unparalleled expertise in untangling challenges as intimate as inventory and shelf life to ones as far-reaching as digital transformation for global supply chains and implementing the first bio-PET bottle program.

With a Master of Science in management and a certification in computer- integrated manufacturing systems from the Georgia Institute of Techonology, Nicosia sees the world through a bifocal lens. And with the ability to shift from engineering to corporate leadership depending on the need state, her perspective is setting Hearthside up for a bright future, indeed.

“In every role with my career, I was constantly touching multiple layers of the business, end to end, throughout the supply chain,” she said. “I might have been domiciled in a particular functional area, but my work has been expansive and enterprise-wide.”

If manufacturing is like a chain, Nico sia has mastered the art of parlaying her skills from one link to the next. Her engineering, operations and corporate experience with major brands has created a natural transition into the world of co- manufacturing as many companies in bakery — and food production in general — are rethinking their growth strategies, especially with the uptick of R&D

innovation for incubator brands and new products for the mainstays.

“I see contract manufacturing as a neces sary partner in this industry,” Nicosia said. “A lot of companies are really thinking about their future and how they grow, and it’s clear that contract manufacturing is on trend now.”

At first glance, a move from beverage to baking might seem like a leap. But the truth is, there are vast synergies between running a beverage brand and the world’s largest food co-manufacturer.

“There are immense similarities that apply across all categories, even though what’s made at the end of the day is very different,” she said.

Many of those similarities revolve around processes — dosing, mixing, processing, packaging, palletizing and distribution — likely because processes are formulaic. However, what makes them successful is identifying the best practices that can be gleaned. Nicosia has an undeniable knack for drilling down into processes and creating razor-sharp efficiencies, especially when it comes to identifying the right equipment technology to suit the operation. Processes like injection moulding from a cup supplier or second ary packaging for aluminum cans have all bore best practices that can be applied at Hearthside, especially as this world-class company continues its global expansion.

“If you think about people in the roles that really drive this business — the supporting technologies, the disciplines, the skills that are applied — whether it relates to quality, food safety, maintenance or sanitation,” she said, “there’s tremendous opportunity to share best practices.”

At the heart of that sharing is the team.

“Successful leaders at all levels know how to contribute to the goals of the larger enterprise mission,” Nicosia said. “And they manage their teams by building trust and establishing purpose. In my expe rience, I have learned that you don’t just transact at a cost level. You try to under stand how things are made and how we can work together to design to value.”

With leadership in manufacturing for major brands, Nicosia brings the customer perspective to Hearthside, as well as an important view on how consumer demand is impacting the market. Bringing together those two concepts will enable her to become an extension of Hearthside’s customer supply chains.

For a co-manufacturer with a portfolio including some of the world’s top brands, this is a vital trait. Hearthside has a responsibility to deliver the products that its brand customers — and their consum ers — expect. Delivering on those expec tations means Hearthside is protecting its customers’ most valued assets.

When the process is the product Hearthside sells, Nicosia’s leadership becomes a personal investment.

“I have a responsibility to ensure that Hearthside carries our promise to the customer in everything we do,” she said. “We have to add value across their supply chain; we have to help them drive their innovation.”

In that respect, Nicosia takes a 360° understanding of what it takes to deliver on innovation in a complex network of systems, teams and facilities and how global brands assess opportunity, risk and value. These are the strategic conver sations she’s prepared to have with Hearthside customers in terms of where investments need to be made, whether it’s

brand building, breaking into a new market or finding other adjacencies for growth.

“If a customer has to divert dollars into infrastructure for plants and manufac turing, it takes away from their focus on the top line and really building with the consumer,” she said. “That’s where we can be an extension for them; they can do more to build their business while we build the infrastructure to support them.”

These issues are more important than ever, especially with consumer choice driving change often at a breakneck pace. Gone are the days of an 18-month speed to market. Brands need to go from ideation to store shelves practically on a moment’s notice, so long commercialization cycles and inflexible infrastructures have become the antithesis of innovation.

Darlene Nicosia | CEO | Hearthside Food Solutions

“Successful leaders at all levels know how to contribute to the goals of the larger enterprise mission. They manage their teams by building trust and establishing purpose. Teammates solve problems.”

Nicosia’s focus, then, is maintaining the efficiency, flexibility and effectiveness needed to support rapid innovation for these global brands.

“When you have to make choices between investing in consumer-facing brand building and capital infrastructure, those are tough decisions,” she said. “Many companies are looking for asset-light solutions so they can keep the investments focused on growing the top line, and that’s created an even greater need for companies like Hearthside.”

In the chaos that’s ensued since 2020 — and has yet to let up — co- manufacturers like Hearthside are well positioned for growth, though no manufacturer will come out of it unscathed.

From Nicosia’s perspective, there were many companies prior to 2020 that enjoyed long periods of growth and increased category sales. While many did operate at peak performance with no trouble from their supply of raw materials or lean inventories, it’s easy to become complacent when times are good.

While many have learned the hard way about building resiliency into the process through technology investments, physical redundancies and stronger partnerships, Nicosia can still look to the future with optimism.

Of course, there’s no crystal ball to predict what the market will look like or how it will impact the industry, but the era of chug ging along to the status quo is certainly a thing of the past.

And Nicosia is here for that.

“One of my biggest beliefs is that speed wins,” she said. “So, the next phase of growth for this company — and, I think, for the industry as a whole — depends on transformational change.”

That said, transformation can’t be dependent on just one thing. As Nicosia embarks on this journey of growth and innovation with Hearthside, she’s focused on the big picture.

“It’s about technology, processing efficiency, highly adaptable systems and talent coming together,” she explained.

“It’s a matter of really looking at how to partner together and create step change in the industry.” CB

Setting sustainability strategy requires holistic approach.

BY MAGGIE GLISANTune into the news at any given moment, and you’ll likely find a story related to climate change, whether it’s about massive fires, extreme drought or rare weather events. The narratives have become so commonplace that they barely grab people’s attention as they scroll from one headline to the next. Yet the latest research suggests issues pertaining to the environment are, in fact, very much top of mind.

In recent years, transparency and trust have topped the list of Innova Market ing Insights’ top consumer concerns, but in 2022, people have zeroed in on environmental issues

“For the first time ever, more consumers surveyed globally for Innova’s Lifestyle & Attitude Survey say health of the planet is their top global concern, rather than health of the population,” said Lu Ann Williams, insights director at Innova.

It’s a significant shift, and it’s having a big impact on how companies plan for the future. In a recent Deloitte Global survey of 350 executives, 91% said their busi ness felt the impact of climate change, and 84% said they are personally concerned about the impact of climate change on their business.

There is no global standard for sustainability practices, and commercial bakeries run the gamut regarding individual progress for improving energy efficiency, reducing greenhouse gas emissions, improving water effi ciency and reducing waste. That said, there are several tools and resources that can help manufacturers determine where they are, where they need to go and how they need to get there.

Since this is a global issue that impacts every industry and individual on the planet, it’s helpful to take a step back

and look at the big picture, starting with the United Nations’ Sustainable Development Goals (SDGs). Also known as The Global Goals, this set of 17 standards tackles the world’s most challenging issues and outline targets to achieve by 2030.

They include an actionable framework — agreed upon by world leaders — to address environmental concerns includ ing affordable and clean energy, respon sible consumption and production, and clean water. But they also address human rights and social issues like health and wellbeing, gender equality, and safe and inclusive communities.

The SDGs are the cornerstone of Mexico City-based Grupo Bimbo’s ambitious new sustainability goals, which build on more than 15 years of sustainabil ity programs and projects. In the past few years, the company has been

Nearly 25% of US commercial building space is actively benchmarking on Portfolio Manager, the Energy Star program’s online benchmarking tool.Source: US Environmental Protection Agency

recognized by the Ethisphere Institute as one of the most ethical companies, as well as the first company in Mexico to receive clean energy certificates.

The strategy is based on three pillars: Baked for You, Baked for Nature and Baked for Life. Like the SDGs, Grupo Bimbo’s pillars take a broad approach to sustainability, one that focuses not only on the planet but also people and communities.

“The key ingredients are all linked to the purpose of the company, which is to nourish a better world,” said Alejandra Vázquez, Grupo Bimbo’s global sustainability VP. That includes promoting wellness through plantbased diets and nutritional diversity, becoming a net-zero carbon and zerowaste business, advancing regenerative agriculture, and improving the lives of its people and communities.

This broad approach to sustainability falls in line with today’s shopper. Accord ing to a survey conducted by The Confer ence Board in collaboration with The Harris Poll, consumers are increasingly expanding their definition of sustain ability to include issues like fairness and corporate citizenship.

“Our research with The Conference Board reinforces the unique sustain ability inflection point we’re seeing with American consumers,” said Rob Jekielek, managing director at The Harris Poll. “An organization’s environmental footprint and impact still matter, but treat ment of employees and the workforce is rapidly emerging as a new core pillar and proof point for showcasing an organiza tion’s sustainability impact today.”

Vázquez said using benchmarking tools was crucial to helping define short-, medium- and long-term goals. For

example, a target for achieving net-zero carbon emissions by 2050 was devel oped following Science Based Targets initiative’s (SBTi) framework. SBTi is a partnership between environmental non-profit CDP, the United Nations Global Compact, World Resources Institute (WRI) and the World Wide Fund for Nature (WWF).

Benchmarking also helped Grupo Bimbo assess what similar companies are doing and determine how to work together toward these larger global goals.

As a global company operating in 33 countries, it was also important for Grupo Bimbo to establish customized action plans based on environmental, social and governmental standards for each specific region.

“In each one of the organization’s regions, we define a specific roadmap for the overall goals that we need to reach as a company,” Vázquez said. “The speed and the way in which each will reach those goals will depend on the maturity [of sustainability standards in the country]. In some places, we are working toward renewable energy, and in other places, we are working toward electrical vehicles, but all of us are going to hit the goal by 2030.”

Like Grupo Bimbo, Los Angeles-based Aspire Bakeries is using the SDGs as a guidepost as well as broadening its approach to sustainability. Using inputs from internal stakeholders as well as brand, customer and employee expec tations, the company recently outlined five areas of focus which include people, food, planet, sourcing and communities.

The American Bakers Association (ABA) also has a history of meeting members where they are and supporting

As part of its sustainability pillars, Grupo Bimbo is working to become a zero-carbon and zero-waste business.

Our everyday earth-friendly products combine the very latest in plant-based renewable materials with expert design & functionality. You can have your cake and eat it too with our stackable, re-sealable and sustainable packaging. goodnaturedproducts.com

TSXV: GDNP OCTQX: GDNF

TSXV: GDNP OCTQX: GDNF

companies in their sustainability efforts. But the organization is also starting to think more holistically about sustain ability as the commercial baking sector becomes more willing to engage in targeted commitments.

“I think it’s time for us to revamp where we are and seek additional recom mendations for bakers to embrace,” said Rasma Zvaners, VP of technical and regulatory services at ABA. “We run the full gamut of large global companies to small- to medium-size companies that are more regional. Three years ago, you had some that were out front and willing to make statements about their goals, but there may have been some hesitancy from some of the small- and medium-sized companies that simply lacked the resources.”

Fast forward three years, and Zvan ers thinks bakeries are more inclined to commit to specific sustainability targets. That’s in part because of increased pres sure from major retailers like Walmart and Target to meet sustainability spec ifications, but it’s also about the reality of climate impacts (like drought in the Western US) on individual businesses.

One significant way ABA has helped support bakeries’ sustainability efforts is through its promotion of the Environmen tal Protection Agency (EPA)’s Energy Star certification. The national program recognizes participating bakery facili ties that improve energy efficiency by 10% or more within five years, and the top 25% of energy-efficient US manufacturing facilities receive the EPA’s Energy Star certification.

Fifty commercial bread and roll bakeries and 24 cookie and cracker bakeries have received the recognition since ABA began partnering with the EPA in

“For the first time ever, more consumers surveyed globally for Innova’s Lifestyle & Attitude Survey say health of the planet is their top global concern, rather than health of the population.”

Lu Ann Williams | insights director | Innova Market Insights2010. Of the 92 manufacturing plants recognized by the EPA’s Energy Star certification for superior energy performance in 2021, 42 were ABA member facilities, and their efforts resulted in an energy saving of just over 6 million MMBtu.

“Energy Star was an amazing first step for the sector and continues to be a strong program,” Zvaners said. “It has provided a base framework. For those that were starting to think about sustainability early on, it provided a cookbook of ideas.”

Portfolio Manager, the Energy Star program’s online benchmarking tool, has also proven to be an effective resource for commercial bakeries. The tool allows individual companies to input their facility’s energy uses, then calcu lates an energy performance score so they can see where they rank rela tive to their peers. Nearly 25% of US commercial building space is actively benchmarking on the platform.

Although the tool doesn’t allow users to identify competitors by score, it does help bakeries get a sense of where they are excelling and where they can improve based on where they stack up against their peers. Ultimately, that data can help inform strategy. And it can lead to significant cost savings, too.

Another program encouraging better sustainability practices is the US Department of Energy (DOE)’s Better Plants program. As part of the Better Buildings Initiative, Better Plants part ners with manufacturers, as well as water and wastewater utilities, to boost their competitiveness by improv ing energy and water efficiency and also reducing waste and greenhouse gas emissions.

Flowers Baking Co. of Batesville was recently recognized with a Better Practice Award for its energy effi ciency projects, which included boiler, compressed air, LED lighting upgrades, waste heat recovery and variable-fre quency drives for exhaust fans, among other projects. In total, the bakery reduced its annual energy use by more than 13,000 MMBtu.

“When planning equipment upgrades, Flowers Baking Co. of Batesville incorpo rated energy efficiency throughout the project design, reducing energy usage and costs long-term,” said Margaret Ann Marsh, VP of sustainability and envi ronmental at Thomasville, GA-based Flowers Foods. “Across the Flowers network, this program has become a case study in how to look at every operational upgrade project as an energy efficiency opportunity.”

Flowers’ efforts highlight a key takeaway: Reducing your environmental footprint isn’t just good for the planet; it’s good for business. Companies that lean into the challenge and lead with solutions come out with a competitive advantage.

Energy-efficient building improve ments are not the only way to get ahead of the pack, of course. Pack aging is one of the biggest hot-button issues when it comes to sustainability, especially from a consumer perspec tive. According to Innova’s Lifestyle & Attitude Survey, 20% to 25% of consumers adjusted their product choices for environmental reasons such as choosing food with environmen tally friendly packaging.

Karen Reed, global director of market ing and communications at Kwik Lok, said one of the biggest challenges when it comes to meeting packaging

sustainability goals in the US is the lack of federal regulation.

“There’s currently a patchwork of regula tory obligations, and that can be difficult for bakeries to navigate,” Reed said. “As more state legislation is passed, it will become increasingly challenging.”

Zvaners also said that packaging is top of mind right now for ABA members as they sort through state-by-state legislation, but she expects Congress to step in to set some general expectations — much like they did with GMO labeling — that level the playing field at some point in the next few years.

In the meantime, Reed said Kwik Lok is focusing on developing products that give companies options, depending on what their current sustainability require ments and goals are.

“We’re trying to develop a portfolio of options, where people can choose what

works for them right now, knowing that that is going to change rapidly,” she said. “We are paying attention to what’s happening with material science and with regulation, and we see more change on the horizon.”

They say that change is the only constant in life. And with that, consumers will no doubt expect faster progress moving forward. That includes commercial baking companies expanding the defi nition of sustainability and taking a more holistic approach when it comes to goal setting. It also means using competition as a driver for innovation … while keeping the larger picture in mind.

“Success hinges on collaboration,” Reed said. “This is not something any one company’s going to do by themselves. We have to change the whole system. We have to change how we approach our work. We have to create infrastructure, both in our companies and in the places we live.” CB

Time-honored traditions still shape the modern bakery process.

BY BELLA FOOTE

© Natasha Breen on Adobe Stock

BY BELLA FOOTE

© Natasha Breen on Adobe Stock

Fermentation, a crucial element in baking, has and continues to evolve as bakery needs and consumer interest shift.

Where there is civilization, there is fermentation. From the skin of a grape to the palm of a hand, yeast surrounds us always. Humanity has managed to harness this nearly invisible force since as far back as 7000 BCE in Neolithic China, where evidence of an alcoholic beverage made from fermented fruit, honey and rice was discovered. And whether yeast is acquired in the wild or at the nearest grocery store, people have been using it to enhance flavors and reap benefits for thousands of years.

That starter in a bakery’s troughs of the fermentation room harken back to when sourdough was likely discovered — at a time when bread was likely a flat cake with ground seeds — and wild yeast from the surrounding area drifted into the mixture.

In early societies, fermentation was mainly seen as a way of preservation: a necessary survival tactic in the face of extreme conditions. It wasn’t until 1856, when French chemist Louis Pasteur correlated yeast with fermentation that fermentation became somewhat normalized by society. Commercial ized versions of yeast resulted in baked goods with lighter texture and quicker rise time … but with blander flavor. It was, unsurprisingly, around this time that commercial baking companies such as Wonder Bread first began production.

Sourdough — and its starter — is most likely what comes to mind when fermentation intersects with baking. Sourdough starter is composed of lactic acid bacteria and wild yeast, which feed on the carbohydrates in waterhydrated-flour when allowed to ferment and can be used to add dynamic flavor to a variety of baked goods such as pancakes, rolls, croissants, bread, pizza, bagels, risen cakes and so on.

While warmer environments speed up the leavening process, many commercial bakeries — whether a small operation or a multi-million-dollar industry leader — often prefer a longer, colder fermentation period for their baked goods.

“We feel that the slow, cool fermentation times really make that natural yeast work a little bit harder, and when that happens, it brings complexity,” said Jonathan Davis, culinary innovation leader for Los Angeles-based La Brea Bakery, an Aspire Bakeries brand. For years, La Brea Bakery has been a leader in the world of artisan-style breadmaking, first opening in downtown Los Angeles as a small retail shop in 1989. Since then, it has become one of the top artisanal bread suppliers in the nation. Davis has been on the La Brea Bakery team for nearly 30 years and has seen firsthand the benefits of the bakery’s 24-hour ferment on its sourdough.

Sam Zeitlin, owner of Chicago-based Zeitlin’s Delicatessen, a modern Jewish deli, also prefers cold fermentation.

“Our sourdough bread sits on average 30 hours before being baked using Dutch ovens,” Zeitlin said. “Each bagel sits for two days in our fridge before being boiled and baked. We allow the bagels to be proofed without covering so they achieve a robust crust.”

However, some sizeable commercial bakery operations do not participate in a long ferment, despite its essential aid to flavor and texture development. Rather, they rely on a variety of different methods to achieve similar results, all in the name of efficiency.

A longer ferment usually requires time and space, and those factors can ulti mately impact profitability.

“We’re starting to get really interesting consumer questions like, ‘How long is your fermentation?’

… Those questions would never have come up before [the pandemic].”

Jonathan Davis | culinary innovation leader | Aspire Bakeries

“Some commercial bakeries will use vinegar to enhance the sourdough flavor or rely on bought-in ingredients as a shortcut,” Davis suggested.

But these days, consumer demand leaves little room for shortcuts. Despite rising inflation costs, people seem willing to pay more for premium artisan breads that often employ the longer methods. In March 2022, overall bakery department sales rose 10.2% vs. the previous year, according to IRI data.

In a recent trends report from the Inter national Dairy Deli Bakery Association, despite cheaper options in the bread aisle, many consumers are willing to spend the extra dollar or two for attri butes like health and flavor, even in an inflationary environment.

It’s becoming increasingly important to make every piece stand out.

Essential to that is fermentation and, specifically, yeast. Larger companies typically use commercial yeast — either in combination with sourdough starter or in place of it — to produce their baked goods. It’s more easily controlled, requires less time and is more read ily available. While a higher proportion of commercial yeast speeds up the fermentation process, it can also result in less flavor development. However, some bakeries have managed to find a balance.

“We use both non-GMO commercial yeast and sourdough starter, but gener ally less commercial yeast because of the starter,” Davis said. “For example, we like to add sourdough starter to our

French bread because it adds more flavor complexity.”

Zeitlin has also managed to find that ideal balance between sourdough starter and commercial yeast.

“At Zeitlin’s, we use a little sour dough starter in all our bread,” he said.

“We will also add commercial baker’s yeast to our bagels, challah and babka. We like adding instant yeast as a way to provide a more consistent, softer product. This provides the desired texture we want.”

In addition to a renewed interest in artisan-style bread, consumer behavior is trending toward a focus on foods with functional benefits and overall gut health. The impact of fermented food on microbial diversity in the gut and

Do you know about our ability to extend the shelf life of pita from 10 to 21 days? Or that, every day, our expert technical team solves bakery formulation challenges at our Baking Centers around the country? Did you know that Lesaffre has eliminated the need for susceptor boards from microwaveable pizzas and flatbreads? That Lesaffre’s ingredients make tortillas more rollable and enjoyable, all with a clean label?

You may not know Lesaffre for the baking challenges we’ve helped customers overcome — but you’ve likely enjoyed the result in the form of a bread, soft pretzel, snack cake, pizza, donut, or other baked delight.

You may know Lesaffre for our world-class baking yeast and 167-year heritage, but you may not be familiar with our elite technical team and the other innovative ingredients we’ve developed.

Get to know Lesaffre. You may know us for yeast. Now know us for so much more.

overall health is unparalleled, with sourdough and other fermented foods said to aid in digestion as well.

“Slowly fermented sourdough — done the traditional way with starter — imparts more health benefits to the final loaf of bread because the slow action of bacteria and yeast help make the grain in the bread more digestible, much like soaking or sprouting beans,” explained the founders of Yeemos, a family-run company that produces food cultures.

Likely born out of pandemic-induced isolation, many people began started making their own sourdough as the DIY bread craze skyrocketed.

Although some commercial bakers worried that fewer consumers would be purchasing bread if they were making it at home, an opposite phenomenon actually occurred.

“We’re starting to get really interesting consumer questions like, ‘How long is your fermentation?’ and ‘Where do you get your flour from?’” Davis noted. “Those questions would never have come up before. [After making bread on their own], people can appreciate how challenging it is and how consistently we’ve done it for more than 30 years. It’s not easy.”

Sourdough’s popularity, combined with renewed nostalgia, has resulted in many bakers returning to — and finding inspiration from — ancient breadmaking techniques and natural leavening methods.

“There is a lot of interest at the moment in returning to some old varieties of grain that have long since disappeared,” said Stephen Hallam, brand ambassador for Dickinson & Morris and chair of judges

for the Tiptree World Bread Awards, during Troubleshooting Innovation, a Commercial Baking podcast. “But they’re giving different textures to bread. They’re giving different flavors, different appearances. And there’s consumer demand for that.”

Some bakers, for example, are exper imenting with an heirloom wheat flour called White Sonora Wheat, which dates back to the 1600s. This consumer trend has led to experimentation among industry leaders as well.

“We are constantly experimenting with flavor profiles,” Davis said. “A lot of the things we’re looking at are alternative

flours. When we first started, we had one bread flour. Now there are endless variet ies of flours, from all these grains that are available now. And this all greatly impacts the fermentation process.”

Whether people truly yearn for a taste of the past or simply the nuanced complexity of a cold fermented loaf of bread, one thing will remain true: The fermentation process has stood the test of time, and it cannot be bested or cheated. It is something communities have always known and a concept that has been passed down from generation to generation. After all, anything truly excellent requires time, energy and plenty of patience. CB

With decades of deep industry & technical expertise, we bring together food processing insight, best practices, breakthrough equipment solutions and systems innovation, designed to increase efficiencies. We consistently provide on-time deliveries, smooth startups, and optimized processes, all of which ultimately equate to very favorable returns on investment.

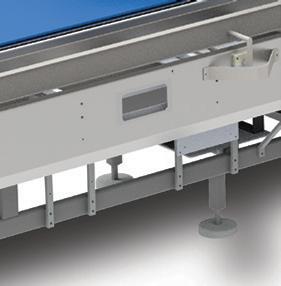

Stewart Systems' new Rack N Stack technology integrates our industry leading pan stacking and unstacking expertise with our Laser Guided Vehicles (LGV) for a custom designed pan handling solution for every bakery application.

The new innovative Rack N Stack design provides a unique modular solution that is flexible and expandable for pan storage and retrieval. Our AGVs automate many areas of your bakery from trough handling through finished goods distribution.

Confidence in a product starts with trusting the people behind it. And no one has more experience than the engineers and operations team behind Shaffer.

For more than 30 years, Shaffer has revolutionized horizontal mixers - from the first open-frame mixer in 1993, to today’s cutting edge sanitary designs and dough cooling technology.

When the bread was cut on Sept. 18 in Las Vegas, the wait for the muchanticipated International Baking Industry Exposition (IBIE) was finally over. Although the show didn’t lose a moment of its three-year cycle — the last Baking Expo having taken place in October 2019 — the COVID-19 pandemic wreaked havoc on nearly every tradeshow in the world, leaving the baking industry to beg the question, “What will happen to IBIE?”

But after a three-year hiatus from traditional in-person events, IBIE bounced back, stronger than ever.

With nearly 20,000 registered attend ees and more than 800 exhibitors, IBIE flooded the North and West Halls of the Las Vegas Convention Center.

After spending the better part of the pandemic working inside strict safety protocols that left most interaction with suppliers to be done remotely, bakers

showed up in force with a record 25% increase in attendance.

Despite continuing international travel challenges due to restrictions still in place for several countries, international baker attendance increased 34% over 2019. Hailing from more than 105 coun tries, international registrations made up more than 27% of baker attendance, with the largest participation from Brazil, Canada, Colombia and El Salvador —

and a record-setting delegation from Mexico.

“IBIE 2022 has exceeded all expecta tions,” said Dennis Gunnell, IBIE chair and president of Formost Fuji Corp. “The Baking Expo has a long history of championing innovation aimed at the changing needs of our bakers, from the advancements on the show floor and IBIEducate presentations to the high-quality buyers walking the aisles.”

Known as the largest onsite tradeshow education offering, IBIEducate delivered more than 100 sessions with nearly 200 speakers, including a full day dedicated to education on Sept. 17 prior to the show floor opening.

Topics ranged from hands-on work shops to seminars centered on business, marketing, plant operations, formulat ing and more. Hour-long sessions took deep dives, while QuickBITES offered attendees 20-minute presentations with insights into some of the most critical issues facing the industry today.

Jordan Winter, creative director for Avant Food Media (parent company to Commercial Baking), walked attend ees through the main components of B Corp certification, asking baking indus try companies an important question: Could you be a B Corp and not know it?

A total of 61 demos took place through out the show floor in both halls.

Two new show features — the Sanitation Pavilion and Cannabis Central — proved to be hits with attendees, with demonstrations livestreamed from Cannabis Central.

Influencers and celebrity bakers including Buddy Valastro, Paulina

Abascal, Coinneach MacLeod (The Hebridean Baker) and more gave demonstrations to standing-room-only crowds in the RBA Bakers Center.

After show floor hours, celebrity pastry chef Duff Goldman performed with his all-chef band, Foie Grock, during Rockin’ Pint Night, presented by AB Mauri. The American Bakers Association (ABA)’s NextGen Baker Forum — sponsored by AB Mauri, Lesaffre, B.C. Williams, Shick Esteve and the Society of Bakery Women (SBW)

— welcomed four esteemed industry CEOs for a panel discussion. Cordia Harrington, CEO of Crown Bakeries; Paul Bakus, president, North America of Puratos; Ryals McMullian, president and CEO of Flowers Foods; and Tyson Yu, CEO of Aspire Bakeries shared their insights and inspiration on leadership during an era of unprecedented change.

“I loved hearing about the challenges each of those CEOs have had to over come, and how those challenges have helped them grow as leaders,” said Lili Economakis, division VP for Aspire Bakeries and NextGenBaker co-chair.

Bettendorf

Bettendorf

Special events, including Donuts with Dawn, took place before the show floor opened. The women’s networking event, hosted by Dawn Foods, showcased commentary from Harrington, along with Carrie Jones-Barber, Dawn Foods’ CEO; Lee Sanders, SVP of government rela tions and public affairs and SBW presi dent; and Brittny Stephenson Ohr, direc tor of product management for Sugar Foods Corp. and chairman of the board for the American Society of Baking.

Other extracurricular happenings included the Wheat Foods Council’s 50-year celebration, where YouTube sensation chef Gemma Stafford presented a livestream demonstration with tips on how to maximize social media presence and a sneak-peak at her newest cookbook, Bigger, Bolder Baking

As bakers grapple to keep up with consumer pendulum swings, a wealth of research was presented during the show, including “Life Through the Lens of Bakery,” ABA’s most recent study conducted by 210 Analytics and sponsored by Corbion.

“It doesn’t matter if people buy a lot of baked goods or just a couple — or what generation they are,” said AnneMarie Roerink, principal at 210 Analyt ics and author of the study. “The important thing is that there’s a permis sibility for baked goods, and that’s a really important starting point from which to build.”

Access to the study is free for ABA members and available for purchase for non-members.

For the first time, the Tiptree World Bread Awards were judged and presented at IBIE. Winners were announced in 16 categories.

Overall Winner: Glorious Bastard by Guy Frenkel, Céor (Santa Fe Springs, CA)

Home Baker: Sprouted Wheat with Figs and Pecan Loaf by Richard Sperry (Salt Lake City, UT)

Specialty Sweet: Pistachio and Cherry Panettone by Diego Cubas, Wynn Las Vegas, F&B Encore (Las Vegas Valley, NV)

Specialty Savory: Forbidden Rice and Sesame Loaf by Sandeep Gyawali, Miche Bread (Austin, TX)

Gluten-Free: Rye-less Rye Buckwheat Sourdough by Mario Librandi, Vegan Mario’s (Oakview, CA)

Pretzel: Bayern Pretzel by Johann Willar, Wynn Las Vegas (Las Vegas)

Challah: Leavened Challah by Johann Willar, Wynn Las Vegas (Las Vegas)

Bagel: Jerusalem Bagel by Khawla Khalifa, Le Paton (Rancho Cucamonga, CA)

Flatbread: Pane Alla Pala by Michael Kalanty, Delfina Restaurants (San Francisco)

Burger Bun: Heirloom Brioche Buns by Guy Frenkel, Céor (Sante Fe Springs, CA)

Ciabatta: Pane alla Pala by Michael Kalanty, Delfina Restaurants (San Francisco)

Baguette: Baguette Tradition by Stephane Grattier, Boulangerie Christophe (Georgetown, Washington DC)

Wholewheat/Wholemeal: Hill Country Hundo by Sandeep Gyawali, Miche Bread (Austin, TX)

Sourdough: Glorious Bastard by Guy Frenkel, Céor (Sante Fe Springs, CA)

People’s Choice: Michelle Nicholson, The Flour Girl (Hebron, CT)

Tiptree Showstopper USA: Brioche feuilletée, by Rich Gardunia, Crave Kitchen Bar (Eagle, Idaho)

As labor shortages persist, diversity, equity and inclu sion (DEI) remains top of mind for baking companies throughout the industry. ABA and BEMA have teamed up with their respective working groups and task forces to bring awareness and share best practices for tapping into DEI initiatives. During the Expo, representatives from the two groups participated in a “fireside chat” in the BEMA-ABA booth as well as on a panel during IBIEducate programming.

Commercial baking companies today have more multi-generational environments than perhaps at any other time. As roughly a quarter of companies (26%) are planning to start educational programs around DEI, according to ABA research, buy-in has become critical.

“In order to get that buy-in, you have to listen to what your people are saying,” said Nathan Norris, director of DEI for Highland Baking Co. and panelist for the ABA and BEMA DEI discussions. “Then you can start building procedures based off of that. It’s the first step to get you on your way for the journey.”

Other panelists included Felisa Stockwell, VP of global people and culture for Dawn Foods, and Christy Pettey, chief people officer for Kwik Lok.

As the world finds more ways of returning to normal, representatives from the iba trade fair — which has a strategic partnership with IBIE — announced its return to in-person during the show, set for Oct. 22-26, 2023 in Munich.

Despite the pandemic’s seemingly insurmountable obstacles, IBIE 2022 was, by all measures, a notable success. Gunnell attributed this success to the enduring commitment of the baking industry.

“During a time when trade events are getting a fraction of their pre-pandemic participation, our industry showed up,” he said.

IBIE 2025 is set for Sept. 13-17 in Las Vegas. The plans are currently underway under the leadership of commit tee chair Jorge Zarate, SVP of global operations for Grupo Bimbo. CB

DOLLAR SALES ($ IN BILLIONS)

CHANGE VS. A YEAR AGO

TOTAL

FINGER SNACK CAKES

SNACK CUPCAKES

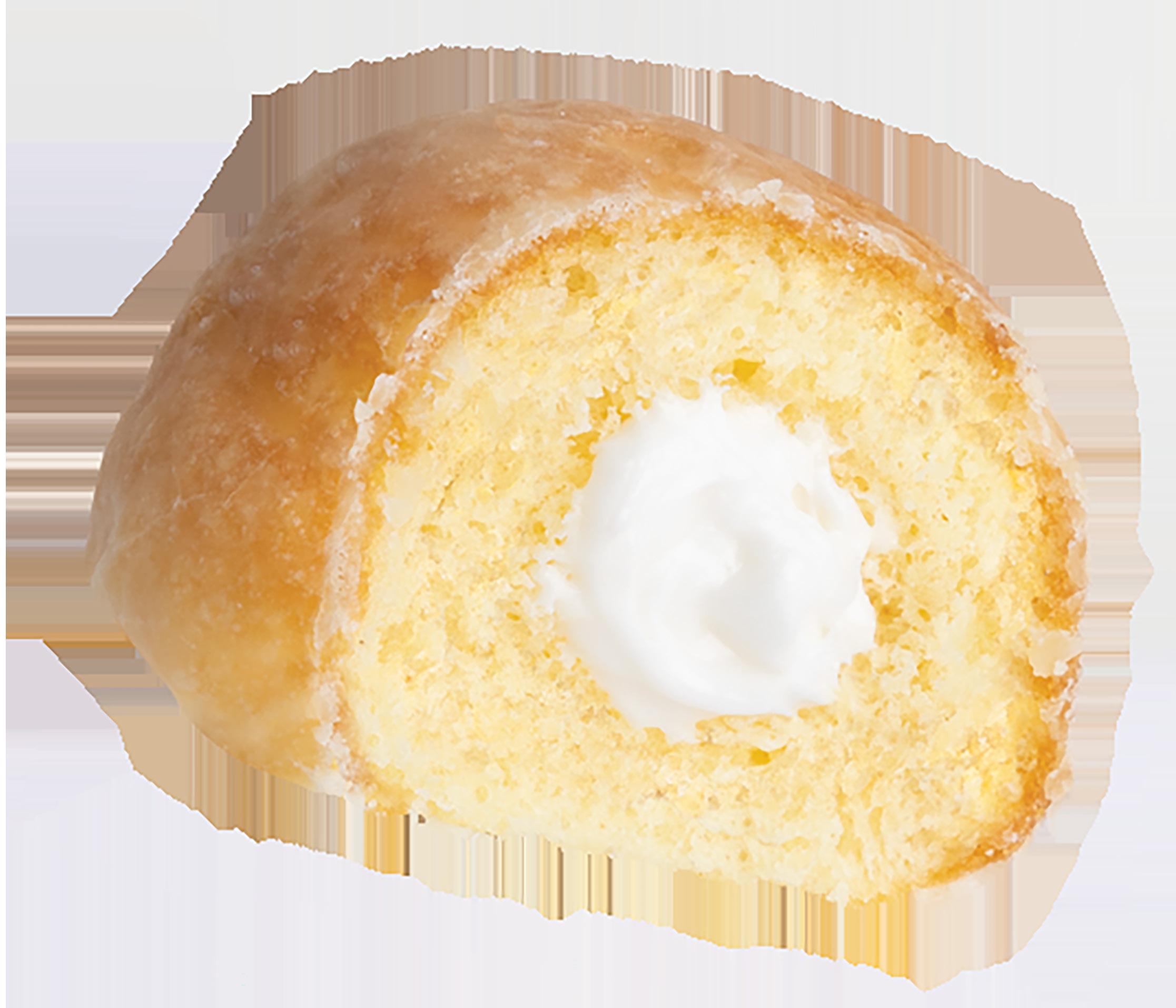

ROLL SNACK CAKES

CHANGE VS. A YEAR AGO

TOTAL

FINGER SNACK CAKES

SNACK CUPCAKES

ROLL

Delicious, convenient and buoyed by nostalgia, snack cakes appeal across generations. Category growth saw a peak in 2020 when snack cakes were sought out as a product of choice. Nearing a post-COVID era, the cate gory is holding its own with $2.03 billion in sales, a 14.1% change vs. a year ago. Unit sales registered 854.10 million, a 0.8% change vs. a year ago.

Finger snack cakes, the most popular form, saw dollar sales of $1.25 billion, a 16.1% change vs. a year ago. This was followed by snack cupcakes at $482.63 million, an 11.4% change vs. a year ago.

Like many categories across the snack ing landscape, snack cakes battle several factors, including unreliable avail ability and inflationary impacts. Likewise, manufacturers are facing record rising input costs, supply chain disruptions and continuing labor issues.

Two years after its peak, the snack cake category is one of many facing the impact of tightening economic belts, partic ularly among lower-income consum ers and those with larger households, the largest consumers of snack cakes. This makes analysis of the category increasingly complex, said Sally Lyons Wyatt, executive and practice leader, client insights for IRI.

“It’s not that consumers aren’t purchas ing snack cakes,” she said. “It’s that consumers must make a choice between purchasing snack cakes and other grocery essentials.”

Because of its convenience and price point, snack cakes index well among two-person households (53%) and middle-income consumers (40%) with stronger saturation among boomers and Generation X. Brand recognition in the category is particularly strong with the top five forming 75% of dollar sales followed by some private label options. A report published by Statista in June found that 74.2 million Americans ate Little Debbie snack cakes in 2020, according to data from a November 2020 survey.

Faced with having less spending money in their pocket, consumers are having to make more strategic choices. That translates into fierce competition for those discretionary dollars in stores and online. The donut category, one of the biggest snack cake competitors, is growing. Seeking out different dayparts to serve, donut producers have turned to innovation to capture new audiences.

For example, donuts with caffeine offer applications during multiple dayparts. Another surprising competitor, rice popcorn cakes have seen growth in part because of the product’s flavor range and healthier profile. But while some consum ers intend to make healthier choices, this is not the majority of buyers in this category. This is evidenced by limited growth regarding claims such as calories per serving, low-fat and plant-based.

From a channel perspective, 2022 has been a banner year for dollar sales. Strong dollar sales with lower units and volume are representative of

consumers spending money on the product but reducing the number of items they buy overall.

In the snack cake category, mass retail is thriving with dollars, units and volume all on the rise. Meanwhile, the dollar channel is doing reasonably well, albeit with some struggles. Lyons Wyatt recommended those in the mass and dollar channels look closely at assort ment and pricing to make sure they’re the right growth engines in terms of dollar sales and volume sales.

The convenience channel is also seeing strong dollar growth but struggling a bit on unit and volume sales. Drugstore is also driving strong dollar growth.

With a nearly 15% uptick in dollar sales, the snack cake category seems to be faring better than some other

GRUPO BIMBO: 10.4%

FLOWERS FOODS: 6.5%

STARBUCKS: 3.5%

HORIZON: 3.3%

MONDELEZ: 3.2%

PRIVATE LABEL: 2.9%

HERSHEY: 1.9%

BRANDS NOT LISTED: 3.7%

snacking categories, according to Lyons Wyatt.

Companies like Collegedale, TN-based McKee Foods — manufacturer of Little Debbie and Drake’s — are capturing interest through influencers. Social media bloggers are using snack cakes as the foundation of their party treats. For example, the Party Pinching blogger uses Little Debbie snack cakes to create seasonal offerings like Fudge Round pilgrim hats, Star Crunch turkeys, Pump kin Spice Latte rolls and Nutty Buddy fall snack mix. Drake’s has capitalized on the non-edible side of nostalgia by selling branded merchandise like t-shirts, cups, socks and wrapping paper emblazoned with the company’s signature cakes.

It’s also important for brands to take notice of label-conscious consumers. Los Angeles-based Aspire Bakeries’ Otis Spunkmeyer brand touts snack cakes made with “No Funky Stuff,” includ ing products that are free from HFCS, PHOs and artificial flavors and colors.

Mexico City-based Bimbo Bakeries manufactures a variety of homestyle pound cakes, muffins, Nito (a chocolate

cream-filled sweet roll with icing) and mantecadas (sweet Mexican muffins.)

Attention spans can be short, so it’s important that snack cake brands continually find new ways to capture consumer attention. Leaning into limited-time offers (LTOs) can keep the category fresh and add a touch of ingenuity to its tried-and-true offerings.

Lenexa, KS-based Hostess Brands is a key LTO player with its prolific Twinkie offerings. The signature sponge cake receives a timely twist with an infusion of pumpkin spice-flavored crème from September to November; red, white and blue sprinkles from May to July; mixed berry crème from December to February; cotton candy-flavored crème from February to April; and a tropical fruit-flavored crème filling in the summer months. Other Hostess LTOs include S’mores CupCakes during June and July and Iced Pumpkin CupCakes in the fall.

That said, product innovation can be greatly impacted when tightening finances also mean fewer consumers seek out premium snack cakes. Premium cakes like Starbuck’s Cinnamon Coffee

Cake, Iced Lemon Loaf, Pumpkin & Pepita Loaf, and Banana Walnut & Pecan Loaf are minorities in the category.

“When looking at price and units, there are some products that can command higher prices, but it’s small compared to a Little Debbie or Hostess-type snack cake,” Lyons Wyatt said. “There is room for premiumization in the category, but retailers and manu facturers need to determine if premium is the best way to go. If consumers see these premium products as a reward, it could work.”

With consumers being more care ful about where and how they spend their food dollars, now is a good time to put more toward pack plans and messaging, as well as tapping into sampling to entice consumers, accord ing to Lyons Wyatt.

“Message up what you’re providing, and do this across the day because late night and morning continue to be opportunities for growth,” she said. “Look at the size and assortment to make sure it’s the right mix for the right consumers at the right place.” CB

Put our latest advancements in baking technology to work for you.