October 2024

October 2024

The “Deregistration” option is available. This allows ESS users to deregister their email address from their previous employer. In the instance where an employee is required to register for Employee Self-Service (ESS) with their new employer, their email address needs to be deregistered from their previous employer’s profile.

The Leave History Summary is available on the leave approval screen. This important feature gives managers the ability to review an employee’s leave history prior to processing their leave application.

When an employee submits a leave application, their “Directly reports to person” will have the option to view the employee’s leave history by clicking on the ‘leave history summary’ button.

By default, users can upload payslip figures after an employee has been terminated provided the calculation setting that prevents uploads for terminated employees hasn’t been enabled.

We received requests to add a quantity column on the final summary on Sheet2 of the Payroll Register report to provide administrators with a consolidated view of all payroll-related quantities, such as basic pay hours.

We’ve enhanced the report to include the total quantity for components with a quantity value. This will make it easier for administrators to verify the accuracy of payroll figures and eliminate error in payments without the need for manual calculations.

A new Company Repository custom form type is now available on the Company Custom Form Configuration screen.

Users can compile and manage a list of additional required information on companylevel screens, which can then be linked to employees through a Company Repository Reference custom field, ensuring that data is captured and stored correctly.

Please note: Custom Forms are only available on Master edition.

Make your payroll pop with new theme colours

Six new colours have been added to the Company Themes tab, expanding our colour palette to eighteen options. This gives companies more flexibility to tailor system theme colours to align with their unique branding specifications.

The new colours are: Blueberry, Tangelo, Acai, Smoothie, Seltzer, Cornbread

The new Organisation Hierarchy Units bulk action template is designed for the swift upload of Organisation Hierarchy Units is accessible under the company “Organization Structure” section.

As we expand our global footprint and launch in different countries we’re creating multiple language options for Pacey. We’re introducing Portuguese (Brazil) as our first additional language, paving the way for an inclusive experience.

Pacey enhancement- Change language option

As we expand our global footprint and launch in different countries we’re creating multiple language options for Pacey. We’re introducing Portuguese (Brazil) as our first additional language, paving the way for an inclusive experience.

At the end of June both Lofti Opperman and Grayson Hopkins went to the Global Payroll awards in Athens to represent the company and gain valuable insights Our entry was bolstered by our ability to run payrolls in 44 African countries using a cloud-based ISO 27001 accredited system . Further, our capabilities and track record of completing integrations with SuccessFactors, Workday, and other related systems, using API’s, certainly contributed to the shortlisting .

Although we did not win the award the insights gained, were extremely valuable . Importantly sometimes it feels coming from Africa that we are always lagging the rest of the world when it comes to the utilization and leveraging of technology. However, our experience proved that our offering across the continent in combination with our API abilities sits at the top tier of what is being done internationally More importantly further technology projects that we have been working on seems directly aligned to problems that need to be resolved globally.

A further congratulations to Payspace our payroll platform that won Transformation Project of the year 2024 .

We stated in our article dealing with the South African salary forecast for 2025 (Click here to view this article) that this request normally sparks a sense of foreboding as it is a clear indication that the annual salary increase process is imminent- with all the associated angst, issues, problems, heated negotiations and hard work that is required.

In Nigeria, this question would spark sheer terror and there is little doubt that Sharon would break out in a cold sweat!

Formulating salary increases in Africa can be a difficult undertaking for organisations but historic economic factors have rendered this an almost impossible task in Nigeria.

South African medical aid members are preparing for another year of significant contribution increases in 2025, with all the largest schemes announcing above-inflation adjustments. Year-on- year consumer inflation in August 2024 was 4.4% ; however medical inflation is significantly greater than this.

It is that time of the year when members can make option changes effective 1 January 2025, but it is crucial for members to carefully evaluate and understand their medical aid plans to avoid being caught off guard by rising costs and changing benefits.

Our recent article, Kenya Salary Increase Forecast for 2025, explained the methodology we adopted to derive a 5.75% salary increase forecast for 2025 – Click Here to read this article.

The Kenyan Monetary Policy Committee (“MPC”) met on October 8, 2024, and it always insightful to examine this committee’s thoughts on inflation, to identify if their economic forecasts are different to ours. Our model is forecasting inflation to average 4.40% in 2025, significantly below 5.00%, which is the middle of the inflation target range.

Power BI, a business analytics service by Microsoft, is a powerful tool that transforms complex data into easy-to-understand reports. It is a user-friendly interface and drag-and-drop functionality makes it accessible for users at any skill level, enabling the creation of stunning visualizations without extensive training.

Are your employee benefits appropriate for your employees and enhancing your Employee Value Proposition?

Allow Axiomatic as an independent intermediary to perform a comprehensive review of your current Employee Benefits.

Benefit from our employee benefit consulting services, leveraging our deep understanding of best practices to optimize your company's medical aid, health insurance, Risk, Retirement and employee assistance offerings.

Our client-centric approach ensures that our solutions are not just tailored to the workforce but also to the unique needs and goals of your company.

Extend your company's commitment to employee well-being across Africa with our international reach and expertise in navigating regional landscapes.

Benefit from the distinctive Axiomatic approach, built around satisfying specific needs and seamlessly integrated with your company’s total rewards structure for unparalleled employee value.

EWA is a technology that integrates with the payroll system enabling employees to access a portion of their already earned salary at any point during the pay cycle.

NO Cost NO MORE Advances Adds to EVP at NO COST Assists staff retention

of surveyed workers would be willing to work longer for an employer offering EWA.

• % of salary that can be accessed during the month.

• Amount of the minimum and maximum loan application

• Number of loan applications permissible during the month

• The period that the “window” for loans is open.

Growing popularity in the US, UK, Singapore, and Indonesia. SA Companies Already Introduced

of surveyed workers are more willing to switch to employers already offering EWA.

PnA, Sasol, Amrod, Bidvest, Smollan, Truworths Group, Sage, Switch Telecom, City Lodge, Sea Harvest, Total Energy, Macsteel, Continental Tires, Spar, Steers…

• The employee applies to Tyme Bank via an app, to open a bank account.

• Apply for the loan on the app.

• An API checks the payroll data.

• The loan is credited to the employee’s Tyme Bank account.

• The loan is deducted on payday.

• No cost to the employer but the employer can set parameters:

o Minimum R2k and maximum R5k per application.

o Total amount to be accessed during the month - no more than x% of salary earned to date.

• Charge = R30 per application.

• Employee does not have to change their salary bank account to Tyme Bank.

Our transport system is cash-based and this constitutes employees borrowing taxi fare to get to work.

In the past, payroll was seen as outdated, relying on old methods and manual processes. However, recent technological advances have transformed payroll into a strategic asset, offering valuable data insights.

Axiomatic specialises in integrating payroll systems with APIs, using middleware to ensure seamless data exchange. This integration boosts efficiency, enhances the Employee Value Proposition, and maintains data accuracy and security.

For tailored, efficient, and secure Payroll Integration Solutions.

With a custom user interface and strong audit controls, Axiomatic balances tradition with efficiency, offering tailored, secure Payroll Integration Solutions. This powerful payroll functionality, combined with key middleware, allows companies of all sizes to overcome data silos by creating robust Applications, Data, and API integration on-premise and in the Cloud, all from a single interface.

Axiomatic recognises that a significant amount of our new business is referred to us by our current clients.

We appreciate these “word of mouth” referrals and want to recognise and reward clients making referrals by introducing our new referral program

Identify a company looking for a professional and expert payroll provider.

Simply, send an email to your Axiomatic contact, detailing the name of the company, the contact person, and the contact.

Axiomatic will make contact. If the prospect signs with Axiomatic, you will receive a Takealot voucher for the amount detailed below

1 to 250

R 1,000.00 $50 251 to 1,000 R 2,000.00

1,001 to 2,500

2,501 and above

R 5,000.00 $275

R 10,000.00 $550

1. It would be helpful if the contact person is aware that Axiomatic will be contacting them. This increases your chances of receiving the referral reward.

2. Axiomatic will follow up on every lead you provide.

3. Once the new company has signed our Proposal, we will notify you that your reward voucher is due.

4. Once the new company’s payroll goes live, you will receive your voucher within 30 days. No. of employees

Axiomatic is excited to announce that we have formed a payroll alliance that extends our coverage of 44 African countries , now includes an additional 37 emerging market countries.

Emerging Markets Payroll (EMP) is a payroll alliance of three specialist Regional Payroll Providers that collectively offer comprehensive payroll support for 80 countries in emerging markets across Africa, Asia Pacific, and Latin America.

Our alliance partners are:

Links International – the company was established in 1999 and provides services across the Asia Pacific region in 20 countries.

Payroll Worldwide – the company was established in 2007 and provides coverage in Latin America in 14 countries.

At EMP, our team of 320+ is committed to streamlining and simplifying your payroll processes in emerging markets using secure cloud-based technology. Further, EMP’s ability to integrate with leading HCMs including Workday, SuccessFactors, and Oracle HCM will ensure a seamless journey for your business.

Looking for a payroll provider who knows the ropes? Axiomatic EMP Services helps you save time and cut costs. Get in touch today for a free consultation.

Contact Us for a Free Consultation!

Hi, I’m Pacey, your employee self-service bot.

I can help you with payroll + HR requests

• Historical payslips: PDF / text format

• Apply for leave

• Approve inbox items

• View current leave balance

• View personal information

1. Register using employee's national identification (ID) number. 2. Pacey will check that their mobile number and identification number matches their profile on PaySpace to verify them.

Pacey uses interactive messages which gives users a simpler and more consistent way to select the options available to them.

achieve significantly higher response rates compared to text-based lists

Pacey will be licensed as an additional service as explained below.

• Companies using Pacey must be on the Premier / Master Edition as this is a self-service feature.

• The license fee will be charged per active employee, which will provide each employee with a predefined number of conversations per calendar month.

• The pricing structure allows customers to choose from 5, 10, 20, or 30 conversations per employee, per calendar month.

• Employees will be limited to the number of conversations the company chooses. Every time an employee starts a new conversation with Pacey, they will be notified of how many conversations they have remaining for the calendar month.

• The Pacey contact number will be shared with customers upon purchasing this module including a QR code that makes it easy for an employee to scan and save the contact.

How can I help you today?

This announcement is only applicable to Business Partners.

We’re thrilled to introduce new features designed to enhance efficiency in company implementations and better support our Business Partners during take-ons

We’re introducing two settings on frequency level that will grant you the ability to configure take-ons according to varying company implementation needs.

Customers may request to insert backdated runs as opposed to processing their values as a YTD total on the Take-On Year to Date figures screen. While processing, you may need these runs to remain open until all processing is approved and finalised.

We’re introducing a frequency setting that enables you the ability to select a date to keep backdated runs open until the specified date has passed.

During Run-by-Run take-ons, customers may request the suspension of system calculations to facilitate the import of specific amounts or quantities to employees’ payslips in order to avoid financial discrepancies with previously recorded totals.

We’re introducing an additional frequency setting that will allow you to select a date where runs prior to this date will not process any system calculations.

Important: No other calculations will occur for runs that are before the specified date where this setting has been enabled.

In addition to this, we have introduced two additional bulk upload options to improve processing efficiency during implementation.

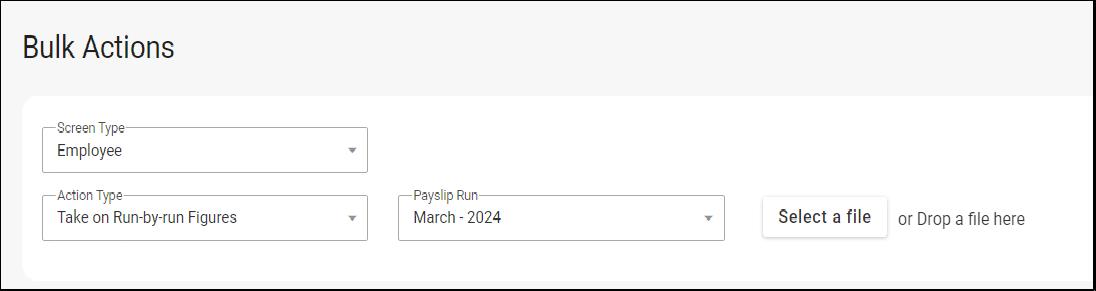

Going hand-in-hand with the setting above that prevents calculations, this new bulk action functionality will allow you to post the final advised amount and quantity that you would like to see on employees payslips per run for the selected frequency. The new Action Type dropdown option will be available under the employee “Payroll Processing” section and will only be shown when a date has been specified in the aforementioned setting.

(Note: The Payslip Run dropdown will display open runs with pay dates that fall before the specified date on the relevant run-by-run setting.)

Here is an example of the fields available on the template:

Important: No figures can be posted directly to payslips on the Edit payslip screen or using the Payslips bulk upload when the setting for run-by run take-ons is enabled.

When companies move over to a different payroll system, the need may arise to bring over arrears balances from the previous system. This bulk upload is necessary to capture the closing recovery amount for recurring deductions during take-ons. Here is an example of the fields available on the template: