How Citizens Bank is Balancing Digital and In-Person Banking BACK BASICSTO Bill CitizensYeeBank SEPTEMBER 2022/armoneyandpolitics.com $5 USD INSIDE: Banking | 40 in Their Forties | Little Rock Touchdown Club

(L Nick Merriweather, Breaux, Loren Marshall Ipsen, Ipsen, Johnson,

(L Nick Merriweather, Breaux, Loren Marshall Ipsen, Ipsen, Johnson,

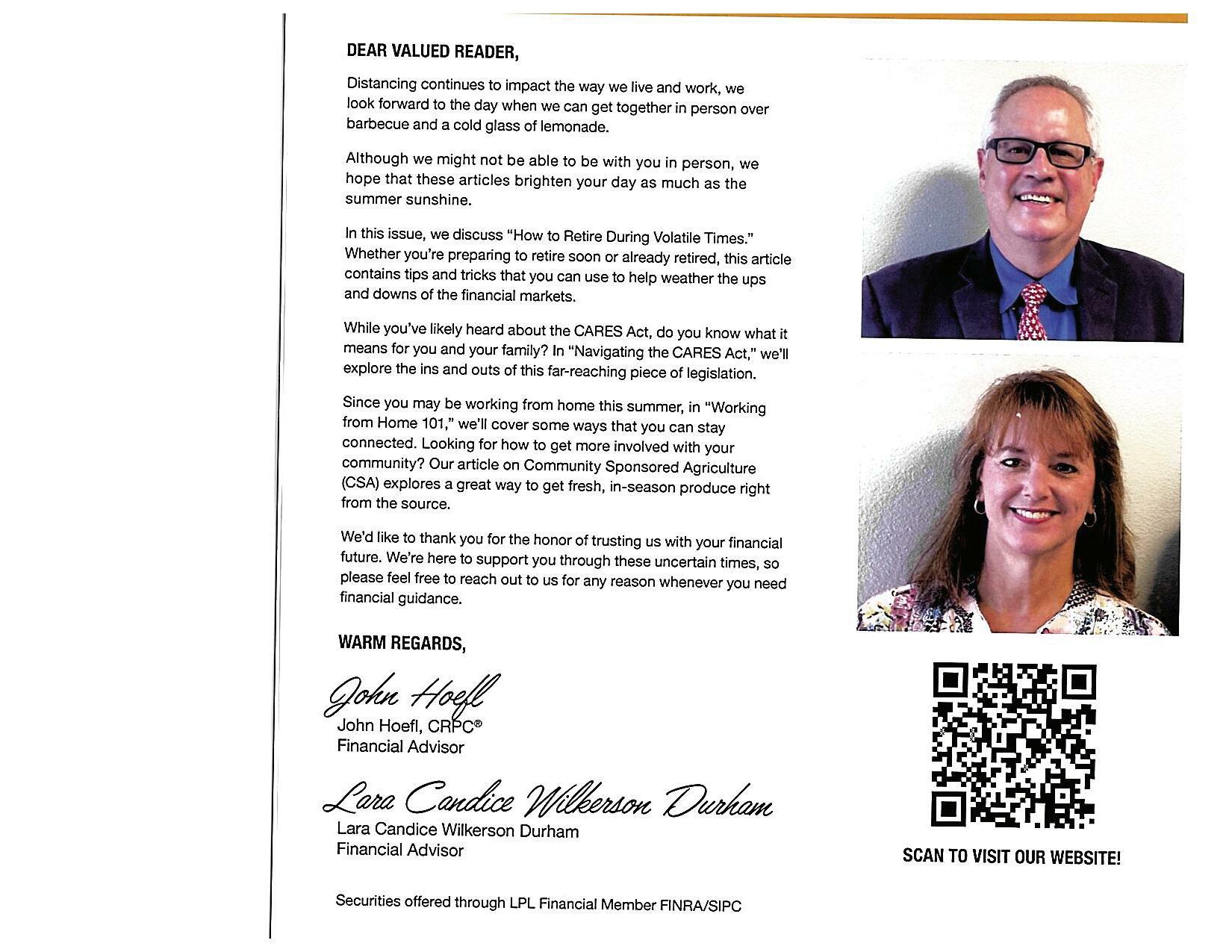

2228 Cottondale Ln Ste 150 Little Rock, AR 72202 501.614.4700 | Toll Free 888.285.6892 ARipsenadvisorgroup.comInsurance#6375183

to R)

Operations Manager; Alaina

Administrative Assistant;

CFP®, CEO; Amy

Chief Compliance Officer; Miles

CFP®, Planning Specialist Experience & Personal Service

Serving all of Central Arkansas | 501.913.8001 Specializing in building one-of-a-kind custom homes and combining leading edge designs with exceptional functionality that speak not only to your aesthetic needs, but to your unique vision, through our remarkable attention to luxury in every detail. Innovation-Redefined. Pushing beyond the predictable to create truly unique custom homes. KellCo Real Estate

Since 1994, Real Estate professional, Tracie J. Kelley, continues to dominate the industry in Central Arkansas from every angle, and her business acumen only prove that point, further!

With a professional team of over 35 members, KellCo Real Estate is driven to deliver exceptional results and unwavering customer service. As President and Chief Executive Officer of KellCo Custom Homes Inc., Energy Air Inc., and KellCo Real Estate Inc., Kelley certainly has the upper hand when providing powerful insights for her clients on any spectrum. “I hold myself, along with my clients, to higher standards and expect to

receive exceptional results.”

If you’re in the market to BUY. SELL. BUILD. DESIGN. RENOVATE. -Tracie J. Kelley and her team has got you covered! An integral part of KellCo Real Estate is Principal Broker, Mary Freeman, who infuses a wealth of knowledge and wisdom into the firm. Mary has served Arkansas since 1984 and delivers outstanding customerTogether,support.theexperts at team KellCo work hard for its clients and delivers only the best at every turn. “Let’s work together and find the right solution for your Real Estate needs,” says Kelley.

SELL. BUILD. DESIGN. RENOVATE.

A HANDSHAKE

As a rm built on relationships, our handshake matters. It means a warm greeting, the privilege of doing business together and knowing you can count on us. A handshake between two brothers, Witt and Jack Stephens, provided the foundation for a family-owned legacy that Jack’s son Warren upholds today. Under Warren’s leadership, Stephens continues to grow as one of America’s largest privately held independent nancial services rms, with of ces throughout the United States and in Europe. Our performance builds relationships with our clients, many of whom have become old friends. It’s why shaking hands with us means just a little bit more.

111 Center Street Little Rock, AR 72201 (800) 643-9691

STEPHENS INC. • MEMBER NYSE, SIPC@Stephens_Inc • Stephens.com

A

A

5ARMONEYANDPOLITICS.COM SEPTEMBER 2022

SIGNATURE MOVE From Northwest to Northeast, to infinity and beyond, Signature Bank is making a name for itself across Arkansas. FEATURES SEPTEMBER 2022 FAIR SHARE The annual Arkansas State Fair is big business. GOOD CITIZENSHIP Citizens Bank adapts to the banking needs of tomorrow while maintaining all the personal banking charm of yesteryear. 14 40 90

PRESIDENT & PUBLISHER

Heather Baker | hbaker@armoneyandpolitics.com

EDITORIAL OPERATIONS MANAGER

Lindsey Castrellon | lindsey@armoneyandpolitics.com

COPY EDITOR/WRITER

Holly Shaw | hshaw@armoneyandpolitics.com

ASSOCIATE EDITOR

Sarah Coleman | scoleman@armoneyandpolitics.com

MANAGING DIGITAL EDITOR

Kellie McAnulty | kmcanulty@armoneyandpolitics.com

STAFF WRITERS

John Callahan | jcallahan@armoneyandpolitics.com

Sarah Coleman | scoleman@armoneyandpolitics.com

Mak Millard | mmillard@armoneyandpolitics.com

Katie Zakrzewski | katie@armoneyandpolitics.com

PRODUCTION MANAGER

Mike Bedgood | mbedgood@armoneyandpolitics.com

GRAPHIC DESIGNER

Lora Puls | lpuls@armoneyandpolitics.com

STAFF PHOTOGRAPHER

Kat Holitik | kholitik@armoneyandpolitics.com

SENIOR ACCOUNT EXECUTIVE

Greg Churan | gchuran@armoneyandpolitics.com

ACCOUNT EXECUTIVES

Tonya Higginbotham | thigginbotham@armoneyandpolitics.com

Mary Funderburg | mary@armoneyandpolitics.com

Tonya Mead | tmead@armoneyandpolitics.com

Amanda Moore | amoore@armoneyandpolitics.com

Colleen Gillespie | colleen@armoneyandpolitics.com

ASSISTANT TO THE PUBLISHER

Jessica Everson | jeverson@armoneyandpolitics.com

ADVERTISING COORDINATOR

Rachel Mercer | ads@armoneyandpolitics.com

CIRCULATION

Ginger Roell | groell@armoneyandpolitics.com

ADMINISTRATION

Casandra Moore | billing@armoneyandpolitics.com

CEO | Vicki Vowell

TO ADVERTISE call 501-244-9700

email hbaker@armoneyandpolitics.com

TO SUBSCRIBE | 501-244-9700

ADVISORY COMMITTEE

Joyce Elliott, Gretchen Hall, Stacy Hurst, Heather Larkin, Elizabeth Pulley, Gina Radke, Steve Straessle, Kathy Webb

CONTRIBUTORS

Jim Cargill, Mark Carter, DeWaine Duncan, Angela Forsyth, Becky Gillette, Dwain Hebda, Mariya Khodakovskaya, Sarah Lane, Ryan Parker

AMP magazine is published monthly, Volume V, Issue 5 AMP magazine (ISSN 2162-7754) is published monthly by AY Media Group, 910 W. Second St., Suite 200, Little Rock, AR 72201. Periodicals postage paid at Little Rock, AR, and additional mailing offices. Postmaster: Send address changes to AMP, 910 W. Second St., Suite 200, Little Rock, AR 72201. Subscription Inquiries: Subscription rate is $28 for one year (12 issues). Single issues are available upon request for $5. For subscriptions, inquiries or address changes, call 501-244- 9700. The contents of AMP are copyrighted, and material contained herein may not be copied or reproduced in any manner without the written permission of the publisher. Articles in AMP should not be considered specific advice, as individual circumstances vary. Products and services advertised in the by

6 ARMONEYANDPOLITICS.COMSEPTEMBER 2022

magazine are not necessarily endorsed

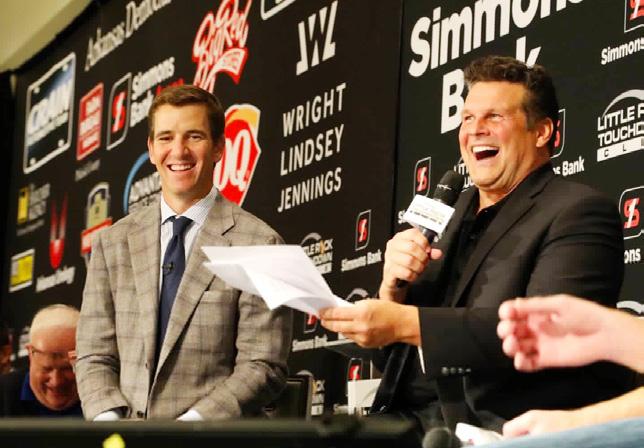

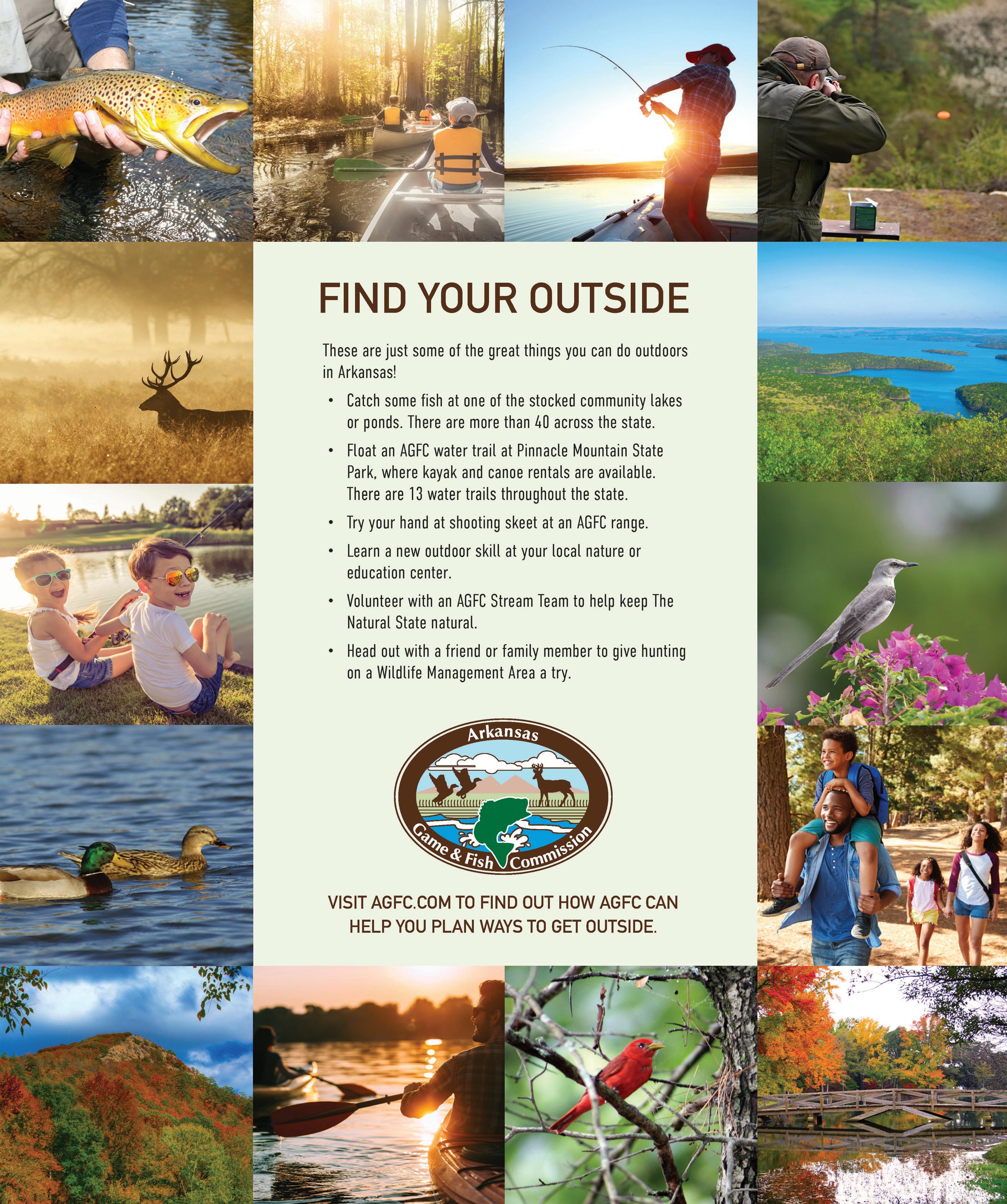

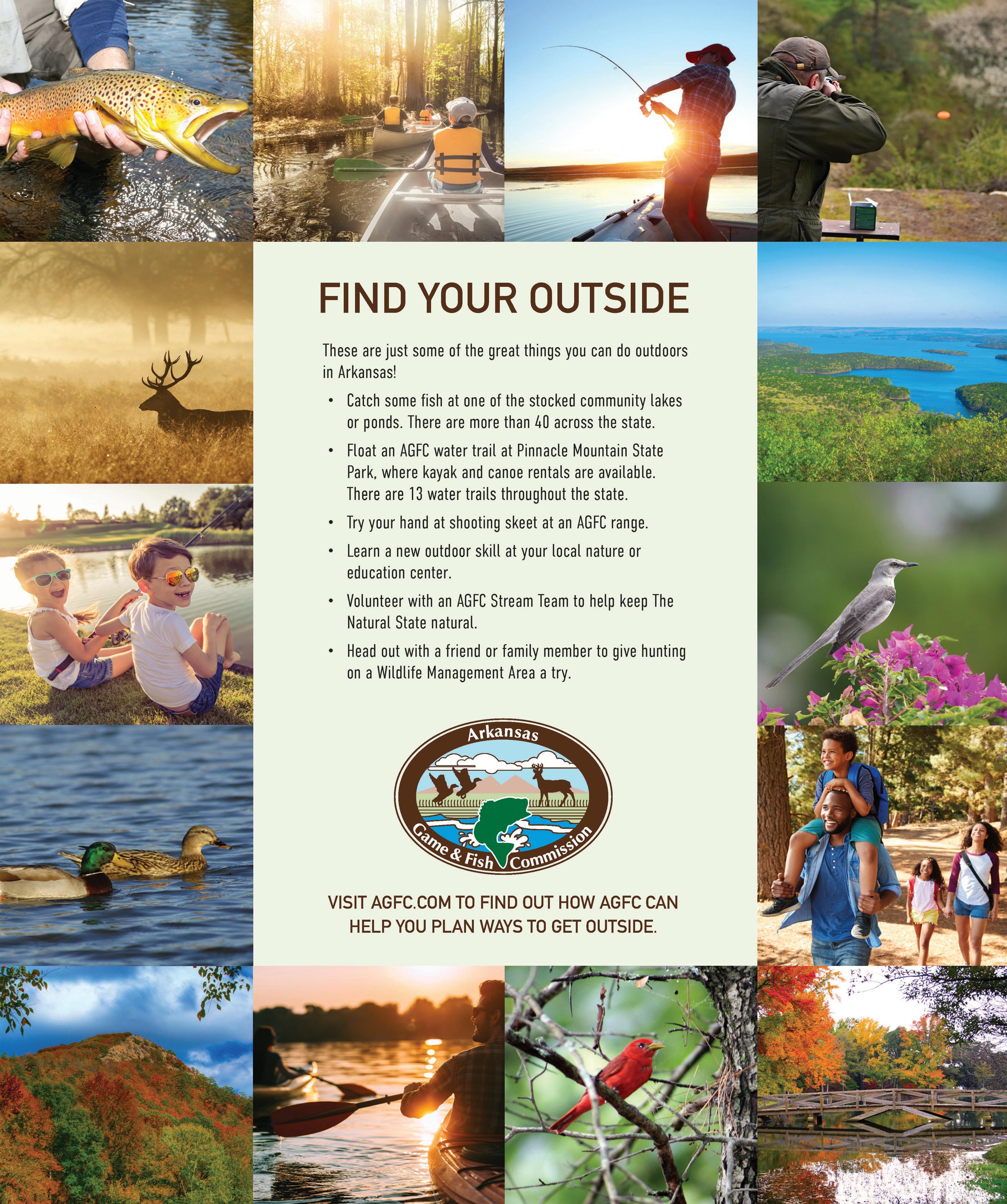

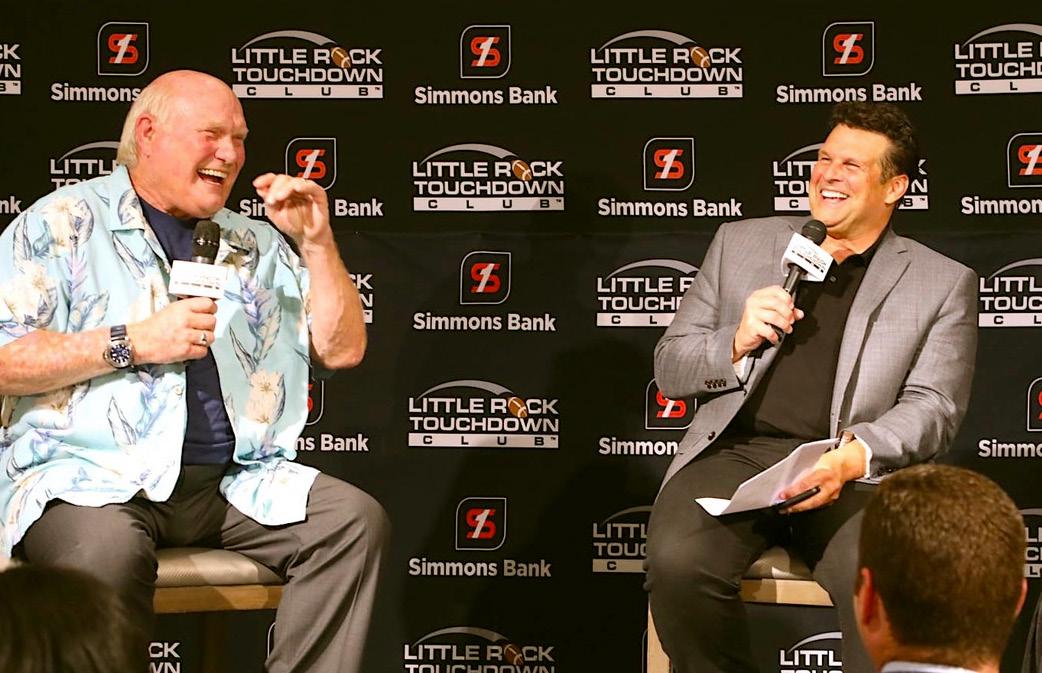

PleaseAMP.recycle this magazine. Lists of Chartered Banks and the Largest Credit Unions in the State By AMP Staff Celebrating 18 Years of the Little Rock Touchdown Club By Mark Carter Our Inaugural Class of 40 in Their ByFortiesAMP Staff As Voted by Our Readers By AMP Staff If Walls Could Talk: The Old and New Bank of Fayetteville By Katie Zakrzewski NIL & The 4th and 25 Fund By Dwain Hebda Our List of Some of Arkansas’ Most Powerful Women in Banking By AMP Staff Arkansas Small Business Owner Helps Wildlife By Becky Gillette The VP and Regional Executive of the Little Rock Branch of the Federal Reserve Bank of St. Louis By Katie Zakrzewski Chartered Banks and the Largest Credit Unions Digs of the Deal Touchdown in Little Rock 40 in Their Forties Best Financial Advisors Show Me The Money Women in Banking Pine Ridge Gardens Meet Matuschka 20 108 98 71 45 104 25 64 36 8 | Plugged In 10 | Viewpoint 11 | Discovery Economics 56 | Exec Q&A 112 | The Last Word September 2022 BANKING HISTORY & POLITICS SPORTS

At Montgomery Heathman and Associates, our team is 100% focused on your oral health. We offer our patients the very best that dentistry has to offer through advanced technologies and procedures. 12501 Cantrell Rd., Little Rock • 501-223-3838 2001 South Buerkle St., Stuttgart • 870-683-2687 heathmanfamilydentistry.com • HeathmanFamilyDental for nominating Dr. Montgomery Heathman one of AY’s Best Healthcare Professionals! Thank You 2021 7

ON

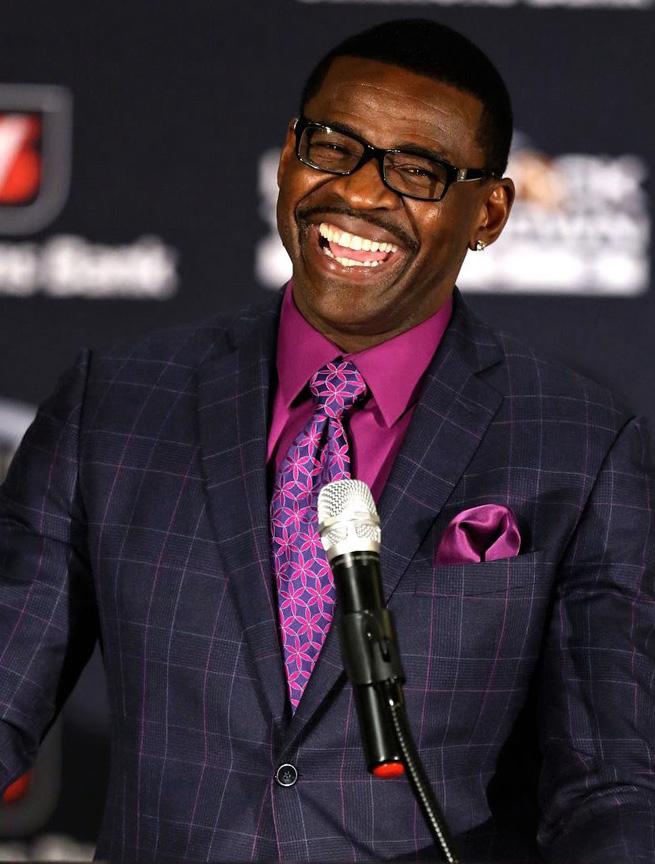

City President Bill Yee was photographed by Ryan Parker at Citizens Bank in Little Rock. Page 40.

FEEDBACK Rubix, public affairs social, cultural announced promotion of Nia McConnell to director of Business Development and Operations.

Kristina Johnson, a University of Arkansas at Little Rock graduate student, grant prevention

FEEDBACK Rubix, public affairs social, cultural announced promotion of Nia McConnell to director of Business Development and Operations.

Kristina Johnson, a University of Arkansas at Little Rock graduate student, grant prevention

8 ARMONEYANDPOLITICS.COMSEPTEMBER 2022

NALLEY JOINS EMPIRE FINANCIAL ARCHITECTS AS VICE PRESIDENT “Congratulations, Lesley! They are lucky to have you!” Tovah D. 2022 FUTURE 50: TIMOTHY BATY, UAMS NORTHCENTRAL FAMILY MEDICINE “Dr Baty! He is a what this profession needs. With physicians like him I am encouraged for the future of medicine!” Tracey McAllister Owens ALTIS CAPITAL PLANNING 463-ACRE DEVELOPMENT IN NORTH LITTLE ROCK “What about affordable housing?” Kathryn Kelly AMP 2022 COMPANIES OF DISTINCTION: HUGG & HALL EQUIPMENT COMPANY “Thank you, Arkansas Money & Politics, for featuring Hugg & Hall.” Amy McManus SPOTLIGHT ON SMALL BUSINESS: IRIANA’S PIZZA IN LITTLE ROCK “Great pizza, great people!” Mark Hedrick TOP ONLINE ARTICLES July 23 - August 23 1. Altis Capital Planning 463-Acre Development in North Little Rock 2. Topgolf Little Rock to be Located Within the Village at Brodie Creek 3. Bank of America to Move Central Arkansas Office Out of Downtown Little Rock 4. Sanders Announces Campaign Senior Staff 5. CBS Sports Ranks Razorback Athletics No. 5 Best in College Sports 6. Chris Ho Named Vice President of Marketing at Oaklawn 7. Little Rock Touchdown Club Reveals 2022 Speaker Lineup 8. FR8RELAY Receives $650,000 from USDA 9. 18 Arkansas Companies Named to Inc. ‘5,000 Fastest-Growing Companies in America’ List 10. Hoping to Fill Father’s Shoes, Phyllis Beard Files as Candidate for Hot Springs City Director PLUGGED IN INSTAGRAM@AMPPOBThink

a

firm aimed at

and brand innovation, has

the

has written a successful

that will help fund a pilot suicide

education program in Arkansas jails. How Citizens Bank is Balancing Digital and In-Person Banking BACK BASICSTO By John Callahan/40 Bill CitizensYeeBank $5 USD INSIDE: Banking 40 in Their Forties Little Rock Touchdown Club

THE COVER

By Lindsey Castrellon

MY 33-YEAR PLAN

Irecently observed my 33rd birthday.

I say “observed” as opposed to “celebrated” because well, not to be dramatic, but a 33rd birthday just sort of happens. It’s kind of like throwing out that bag of mini sweet peppers sitting in the back of the refrigerator: You know the time is coming. You know it’s not going to be pleasant. You feel slightly ashamed and disappointed about all of the wasted opportunities. Still, on that fateful day, you get the courage to rifle through the bag and salvage what you can before dumping the rest in the trash and moving on with your life.

What was I talking about, again? Oh, right.

So, I had a birthday. And this was the year I realized that all of the best things that have happened to me throughout my life were unplanned.

I can vividly recall sitting down at my dining room table one evening to write out my “five-year plan.” I was 21 years old and had just finished my first four years

PUBLISHER’S LETTER

PUBLISHER’S LETTER

of college. I was debating on whether to continue on to graduate school and thought mapping it all out could help me in making my final decision.

1. Find a job that pays 100k a year; 2. Get married; 3. Buy a house; 4. Get a Corgi; 5. Be happy.

Fast forward 12 years, and while I’m not making 100k a year, I am getting paid to do what I love. I did get married, just not to the person I was dating at the time.

COUNT ME IN

Change was the theme of our August issue of AMP, but this month, we’d like to focus on the things we count on to always stay the same. From hometown banking to the State Fair to, of course, football — some things are perfect just the way they are.

We’ll take a look at how Arkansas banks such as Signature and Citizens are managing to maintain all the charm of a local bank while growing and expanding at a corporate rate. And we’ve got a new batch of AMP’s Best Financial Advisors, from which we handpicked five of the best to give us a look inside the industry trends and offer a few helpful tips along the way.

We’re also applauding our 2022 class of Women in Banking, all of whom prove on a daily basis that women have what it takes to not only make it in the financial world, but to make it thrive.

Speaking of thriving, this issue ushers in our first-ever list of “40 in Their Forties,” a group of

Buy a house – in this economy? And as a now mother of two, I can proudly say that kids were nowhere on the list. I did get that Corgi, though.

So, from here on out, I’m planning on not planning at all. Sure, I’ll continue to work hard and hope for the best, but I find I do my best work through improvisation. Gloria Steinem once said, “Dreaming, after all, is a form of planning.” And who am I to argue with that?

By Heather Baker

tried-and-true business professionals who are in the prime of their careers. We’re all about giving credit where it’s due. So often, we see the young bucks being celebrated for all they’re slated to achieve, and rightfully so, but this one is for the leaders who are at the age where they can say they’ve made it. From young to old, from the novice to the veteran, we’re all about giving credit where it’s Ondue.that

note, The Little Rock Touchdown Club turned 18 this year, and we’re admiring how the program has grown to be one of the most successful Touchdown Clubs in the country. And as always, Katie Zakrzewski takes us through the “digs of the deal” with the Bank of Fayetteville.

Arkansas is home to some incredible creations and innovations, and you can count on AMP to highlight the deserving individuals and businesses who help make it that way. We appreciate you reading, and when it comes to our readers, we wouldn’t change a thing.

Hit me up with your comments or suggestions, and share your story ideas with me, at HBaker@ ARMoneyandPolitics.com.

Heather Baker

9ARMONEYANDPOLITICS.COM SEPTEMBER 2022

EDITOR’S LETTER

TAKE the TIME

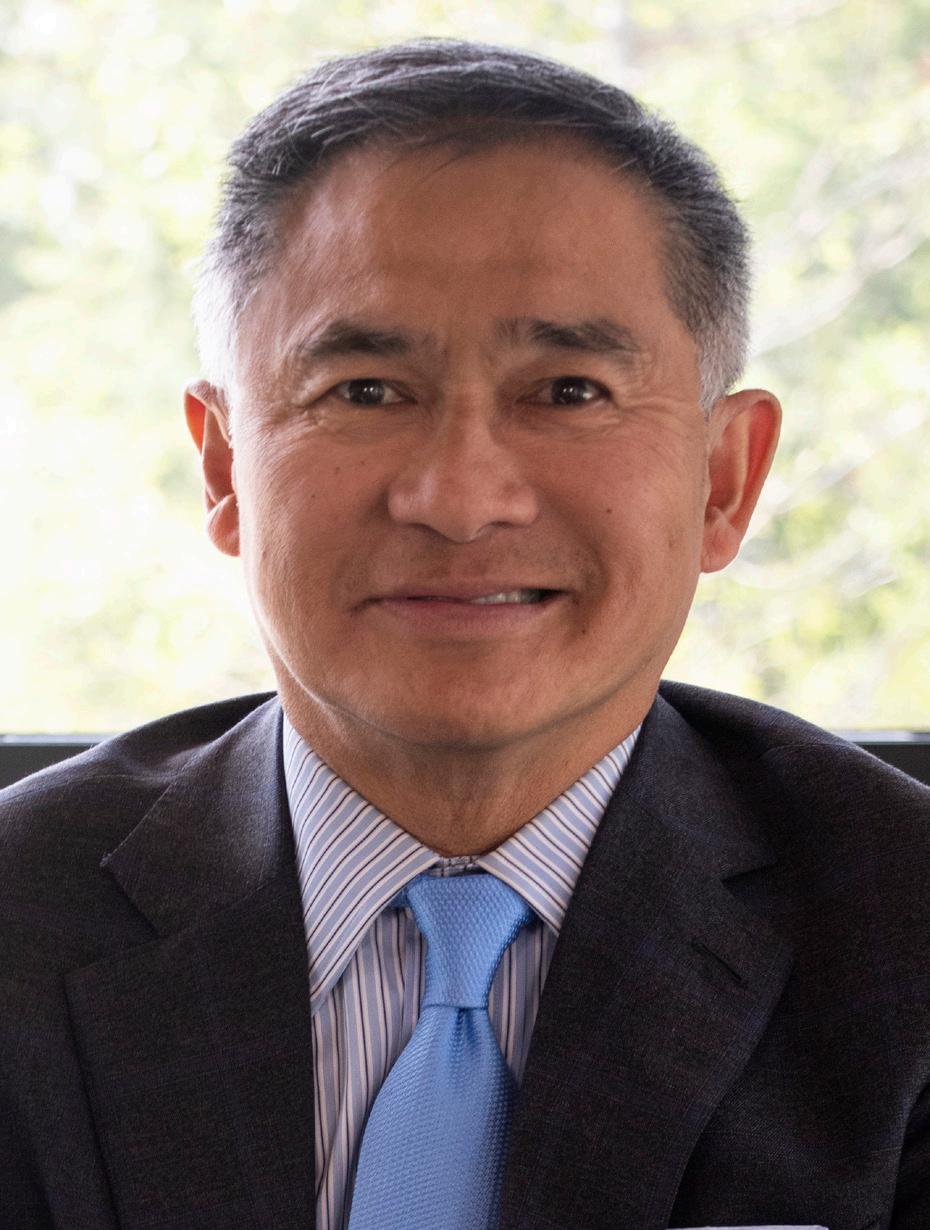

By Jim Cargill, President and CEO of Central and Southwest Arkansas markets, Arvest Bank

This year will mark the end of my 37-year career at Arvest. I’m spending my last days thinking about the work life I’m leaving, the home life that lies ahead of me — and how I’ve bal anced the two over the years. With four and a half weeks of paid time off to spend before my retirement, I’m wondering if I missed an oppor tunity to use it sooner, and to better benefit to me and my family.

Before I make the full-time tran sition from President to Pop, I’d like to leave you with this little tip: Take the time.

In most cases, a company expects a full-time employee to work 2,080 hours a year. For many of us, as we work to excel, impress and earn more responsibility and pay, giving only 2,080 hours is unfathomable. The downside is that we may not be aware of the mental and physical toll even a great job can take. When you have a job that you love, spending 80% of your time on work, 10% on your family and 10% on yourself may not al ways feel like a sacrifice. After all, many of us have close relation ships at work, and our salaries do enrich our households.

As I look at the great benefits I have earned over the years, I am grateful, but I’m now mindful that I may have cut my fam ily short. I could’ve been there more for them, for more games, more dinners, more field trips, more talks. I could’ve relied more on my incredible teammates to handle issues that for whatev er reason, I felt were best handled by me. That practice alone would’ve eased my workload and freed time on my calendar that I could’ve used for something as simple as dinner or game night at home or just a stroll around the neighborhood with my wife.

I’ve been doing better with this and the growing trend of “qui et quitting.”Itdoesn’t mean you quit doing your best work. It means you’re quitting the idea of needing to be available to your job 24/7 and the notion that to succeed, work must be your life. If we’re going to be successful balancing work and home life, we have to intentionally reclaim time of our own, and quiet quitting helps with that.

For example, I’ve decided that outside of an emergency situ

ation, I’m not taking work calls or responding to emails after 6 p.m. If I have a thought about something that I want to accom plish the next day, I make a note, but I’m no longer texting my assistant at 1 a.m. I wait until our workday starts. And I’m taking my vacation time. In fact, I took a week off just before writing this article.

I know some of you may be thinking “Sure you can do that. You’re a CEO.”

If you’re feeling stressed or on the verge of burnout, have a conversation with your manager or mentor. Just recently, I’ve rehired several people who went to other organizations and dis covered that the culture at the new company wasn’t what they’d hoped and their departure from Arvest could’ve been avoided by working with their managers to achieve the work/life they wanted.These conversations are especially important since the pan demic tethered many of us more closely to our jobs as worked from home. A silver lining is that companies have been forced to be flexible – as much as each industry allows – if they want to re main competitive in the job market. Pre-pandemic, many manag ers scoffed at the idea of letting folks work from home, expecting productivity to tank, but research has shown the opposite.

The final point I want to make is about self-care, another top ic that’s been front and center since the pandemic started. Many companies offer counseling services. For many years, I shied away and when I did finally use the service provided by Arvest, I kept it secret for a long time. But I can say from personal experi ence, it makes a difference.

By sharing this, I hope to inspire long-lasting change within our organization, which is already a great place to work. It’s nev er too late to make a change, and even though I’m at the end of my career, I hope my colleagues, family and friends have noticed the change in me.

Jim Cargill is President and CEO of Arvest Bank in Central and Southwest Arkansas, overseeing Arvest’s retail, consumer and com mercial banking operations. Arvest was included in Forbes magazine’s 2022 Best-in-State Employers list. Cargill and his wife, Kathleen, re side in Little Rock and enjoy spending time with family. They have two adult children, Kelly and Ben, and two grandsons, Thomas and Charlie.

10 ARMONEYANDPOLITICS.COMSEPTEMBER 2022

VIEWPOINT

THE STATE OF COMMUNITY BANKING IN ARKANSAS

The biggest lesson in com munity banking from 2022 is how fast things are changing. Two years into the pan demic, so many ideas the industry took for granted have changed, from long-held assumptions about customer demographics to the perceived value of brick-and-mor tar locations in relation to overall growth. It’s a new world out there for banking, and many of the old rules just don’t apply.

Even in confusing times, the re ality remains that banking customers have to be confident that their money is safe, their bank is stable and well-run and that bank leadership is keeping up with evolving industry standards without chasing every shiny object. That’s particularly impor tant for customers who choose community or regional financial

institutions.Betweenrecord inflation, a looming recession and the ongoing threat of COVID, America’s economic future might seem rather murky right now. But there are a few trends for community bank ing in Arkansas that my team at Citizens Bank sees as notable for the industry, both locally and nationally.

THE SHIFT TO DIGITAL BANKING IS HERE TO STAY

Our customers were already moving steadily toward digital banking before COVID hit, but closed lobbies and social dis tancing put that shift into overdrive. An Ipsos-Forbes Advisor poll released in March found that a whopping 78% of Ameri cans with bank accounts now prefer digital banking, with slight ly more preferring to bank through apps than websites. This means community banks must continue to invest in their digital offerings, going beyond the traditional online banking model of balance reporting, transaction listing and transfers. Digital adoption across all demographics has opened the door for in novation and a stack of services to meet all customers’ banking needs digitally.

BUT THE BRANCH EXPERIENCE IS STILL IMPORTANT Americans love digital banking, but they are still visiting branch es. Arkansans tend to adapt slowly to national trends. In many more rural communities, the in-person visit is still very much how people bank, so brick-and-mortar does have a place. PostCOVID, inflation and the economy are on nearly every custom er’s mind. Many of those who still come to the bank might wel come a little financial guidance in nervous economic times. In Arkansas, the community bank can still be that trusted source.

OLDER CUSTOMERS TRIED DIGITAL BANKING, AND LOVED IT

While older Americans have historically resisted banking on line or through an app, COVID restrictions forced many in the senior demographic to overcome their technology jitters. Once they did, they took to digital banking in a big way, demolishing the idea of tech-phobic Baby Boomers. A Harris poll released last year found that 72% of U.S. banking customers aged 70+ say they use digital banking.

SMART GROWTH – “IF YOU BUILD IT, THEY WILL COME.”

Because of the likely permanent shift to digital, banks that enter a market with a furious branch-building flex might be dump ing capital into spaces few people will use. Branches are needed to serve the still-significant percentage of customers who prefer a more personal touch. But at Citizens Bank, we believe smart growth and sound stewardship in today’s world means building brick-and-mortar locations in step with growth milestones and our local customers’ needs. Finding the right balance between digital and brick and mortar is the new table stakes for commu nity banks nationwide. By leveraging the best technology, pro viding excellent customer service and making strategic moves in brick-and-mortar, community banks can create long-lasting success to reach their business goals and meet the needs of their customers.

A native of Little Rock, Sarah Lane serves as EVP and Chief Retail Officer for Citizens Bank, headquartered in Batesville. A 24-year vet eran of the banking industry, Lane has been with Citizens Bank for four years.

By Sarah Lane, EVP and Chief Retail Officer, Citizens Bank

By Sarah Lane, EVP and Chief Retail Officer, Citizens Bank

11ARMONEYANDPOLITICS.COM SEPTEMBER 2022

VIEWPOINT

WHAT EARTHLY NANOMATERIALSCARBON-BASEDCANDOFORINTERGALACTICFARMING

By Mariya Khodakovskaya

For the next 50 years, the world’s farmers will have to feed more peo ple than ever. Global population has risen to approximately 7 billion, leav ing only 1.7 acres of agricultural land per person. With the population expanding and farmland shrinking, growers are com pelled to become more productive. Few feel the weight of this responsibility more acutely than Arkansas farmers.

According to the Arkansas Farm Bu reau, agriculture yields $16 billion in annual revenue for Arkansas – one of the few states where the average per capita farm income exceeds nonfarm per capita income. Every square inch of the state’s 14.5 million acres of farmland is essential to our nation’s, and the plan et’s, food security.

As a professor of plant biology at UA Little Rock, Dr. Mariya Khodakovskaya leads a team of researchers focused on improving plant productivity and stress tolerance. Her approach leverages the unique properties of nanomaterials and applies them to plants.

“The discovery of carbon-based and biodegradable nanomaterials offers con siderable potential for the enhancement of agricultural production,” said Dr. Kho dakovskaya, who also serves as director of the Applied Science Graduate Program at Donaghey College of Science, Technol ogy, Engineering and Mathematics.

Khodakovskaya’s breakthroughs in leveraging nanomaterials began in 2008, when she realized how specific prop erties of carbon-based nanomaterials (their small size, absorption ability, pen etration ability and chemical stability) could affect plants. In particular, the amount of nanomaterial is linked to spe

cific plant responses.

“I considered what might happen when tomato seeds were placed on a growth me dium infused with carbon nanotubes,” ex plained Khodakovskaya. “Would exposed seeds even germinate in a ‘nanoenviron ment?’ Surprisingly, we found that toma to seeds exposed to low doses of carbon nanotubes germinated more quickly and at a higher rate. Carbon nanotubes also accelerated tomato growth and flower production. This discovery permanently altered the path of my research and raised many more intriguing questions.”

Khodakovskaya was especially inter ested in seeing if the same positive effects would occur in other plant species. Ulti mately, she needed to know the exact bio logical mechanisms driving the positive effects of nanomaterials on plant systems. The answers could have profound im pacts: The creation of a new type of plant growth regulator that would boost plant productivity and enable us to address the increasingly critical global food demand.

To unearth the answers, Khodakovs kaya’s team is working to enhance the tolerance of agricultural plants to envi ronmental (abiotic) stresses using biotech nology and nanotechnology. Environmen tal stresses, like high or low temperature, water deficit, flood, salinity and heavy metals limit crop productivity and qual ity. “These stresses drastically affect the growth, development and productivity of crops, and may reduce the performance of the crops and reduce yield by 50% to 70%,” Khodakovskaya said.

Since discovering the unique ability of carbon-based nanomaterials to boost seed germination and plant growth, UA Little Rock has become the leading institution

in the establish ment of new applications of carbon nanoma terials in plant agriculture. The research not only stands to improve crop production on Earth, but one day may improve stress tolerance in plants developed for the exploration of Mars, where “environmental stress” takes on a whole new meaning.

“Our recent research with the Arkansas Space Grant Consortium and NASA holds the potential to solve the problem of how to feed astronauts during long-term space exploration missions,” Khodakovskaya revealed, demonstrating yet another oth erworldly benefit provided by Arkansas’ extraordinary research community.

Dr. Mariya V. Khodakovskaya is a mem ber of the Arkansas Research Alliance (ARA) Academy of Scholars and Fellows. She is known for her pioneering work in crop im provement by the application of a wide range of carbon-based nanomaterials. In 2014, she formed a startup company, Advanced Plant Technologies, LLC. Since 2008, she has been a principal investigator or co-principal in vestigator on grants totaling more than $10 million. Her research has been supported by grants from the USDA-NIFA, NSF-EPSCoR, NASA-EPSCoR, Arkansas Science and Tech nology Authority (ASTA), Arkansas Soybean Promotion Board, biotechnological industry, the Arkansas Space Grant Consortium and ARA. To learn more about Arkansas research, please contact visit www.ARAlliance.org.

12 ARMONEYANDPOLITICS.COMSEPTEMBER 2022 DISCOVERY ECONOMICS

Grand Opening Block Party? Sí! Join us as we celebrate opening the only dedicated bilingual bank in Arkansas. The Banco Sí! Community Block Party will have something for everyone, including great food and fun festivities with these community partners: ARKANSAS ARKANSASALUMNIASSOCIATIONALUMNILATINOSOCIETYASSOCIATION OF ASIAN ARKANSASBUSINESSESLATINAS EN BICI ARKANSAS SMALL BUSINESS AND WOMEN’SNORTHWESTPROGRAMCOMMUNITYNORTHWESTIENGAGEEFORALLLATINOSCONEXIÓNCOMMUNITYDEVELOPMENTTECHNOLOGYCENTERCLINICDENEGOCIOSNORTHWESTARKANSASNORTHWESTARKANSASAMNORTHWESTARKANSASARKANSASCOLLEGELIFEARKANSASSHELTER SALVADOREÑOS UNIDOS PARA SERVE2PERFORM’SARKANSAS LATINXNA UAMS COMMUNITY HEALTH & VENTUREUPSKILLRESEARCHNWANOIRE 114 S 1st 4pmSeptemberDowntownStreetRogers23rd-7pm WHEN & WHERE 4pm - 5pm Networking & Ribbon Cutting 5pm - 7pm Community Block Party START TIMES WWW.BANCOSI.BANK877.888.8550 CONTACT FOOD PROVIDED BY: LA LUNA (SALVADORAN) THE 120 TAPAS BAR (SPANISH) TULA HAVANA(MEXICAN)TROPICAL GRILL (CUBAN) LA LOTERIA (MEXICAN SNACKS)

Signature Bank is Making a Name for Itself Across Arkansas INSERT SIGNATURE

By Angela Forsyth

It all started with a bornand-bred Arkansas na tive, a dream and a notso-humble beginning. Gary Head, founder, president and CEO of Signature Bank of Arkansas, began his career at a bank owned by the Walton fam ily, where he was promoted to president right out of college. Although happy in his position, Head had an entrepreneurial itch. So, he left the job to start a loan production office for a bank in Harrison. Still, his eyes were focused on a bigger plan – his own bank. In 2005, Head and a team of local bankers opened Signature Bank of Arkansas, with the largest raise of capital in the history of the state. And in true Arkansas fashion, the $45 million was raised at a Fayetteville bar on Dickson Street.

In its first three years, Signature Bank of Arkansas grew quickly from zero to $700 million in total assets. But the road from 2005 to today wasn’t always as easy as those early days. The great recession of 2007 to 2009 hit Signature

Signature Bank President and CEO Gary Head. (AY Media Group)

Signature Bank President and CEO Gary Head. (AY Media Group)

14 ARMONEYANDPOLITICS.COMSEPTEMBER 2022

BANKING

as it did most other banks across the country. It was rough. “We got beat up and had to fight our way through,” Head re called. “We had to go raise more capital to recapitalize after that beating, and we successfully did.” Signature not only survived; it came back better.

Today, the bank’s assets are greater than $900 million, and Signature has grown from its original location in Fayetteville to nine locations across the state. These include well-estab lished branches in Rogers, Bentonville and Springdale, as well as more recent additions eastward in Jonesboro, Har

rison and Brinkley. Additionally, Signature has ventured into completely new territory in American banking with a niche idea. The bank’s newest division, Banco Sí!, will cater to the growing Spanish-speaking population of Northwest Arkansas.

According to Head, what he learned through the crisis of 2009 was the value of patience. So many banks did not survive the financial downturn. The FDIC closed more than 400 failed institutions in the few years that followed the crash. “Some people who were in big trouble in 2009

Photos courtesy of Signature Bank of Arkansas

Photos courtesy of Signature Bank of Arkansas

15ARMONEYANDPOLITICS.COM SEPTEMBER 2022

are some of my wealthiest clients today because they didn’t quit,” he noted. “They just kept on going, and we kept on with them.”

While 2009 may have been the year for learning patience, 2020 became the year for learning the importance of online banking. When COVID-19 shut down bank lobbies, the Signature team was glad it had already established a strong internet banking system long before. Customers learned to depend on their phones for mobile transactions, and now that the lobbies have reopened, inside traffic is still low because customers prefer the flexibility and convenience mobile banking offers.

“What changed particularly with COVID is the way [in which] people want to be communicated to,” said Signature COO Brant Ward. “Customers prefer to make transfers and deposit checks digi tally. I think that’s the demand now,” he added. Amazon and Walmart have changed the landscape with customer expectation.” Signature does not plan to develop its own in-house technology, as such, but the idea is to stay in line with reasonable expectations.

As much as Signature pushes ahead in digital offerings and on

16 ARMONEYANDPOLITICS.COMSEPTEMBER 2022

The plan is to keep investing in online banking technology while continuing to find holes where Arkansas residents are underserved. BANKING

line accessibility, it continues to focus on “meeting people where they are.” Some customers still prefer the option to come inside and do business face to face. Signature’s brick-and-mortar locations encourage that. “At the end of the day, this is a community bank built on people in the community,” Ward said.

FUTURE GROWTH

For Signature, meeting people where they are doesn’t mean continuing to open innumerable branches. “We are not a branch-rich strategy,” Chief Strategy Officer Scott Sandlin explained. “We are focused on serving markets. You won’t find us having a branch location on every corner. You will find us having a really nice representation in the market with a great website and a great mobile experience.”

The plan is to keep investing in online banking technolo gy while continuing to find holes where Arkansas residents are underserved. It’s a fill-in-the-gaps strategy vs. expansion strategy, and seems to be working. In the last six years, Sig nature has seen tremendous growth. “If you go back and look at 2016 — where we were as far as asset size and where we are today — we’re getting close to doubling that num ber,” Sandlin said.

Ward explained that Signature’s business model favors having decentralized markets with autonomy. Each market gets to flex its own personality based on the community it serves — whether that’s getting involved with the biking scene in Bentonville or the Children’s Safety Center in Fay etteville. This also means patiently and strategically open ing branches only when they’re needed, and only when the time is right. In the instances of the Harrison and Jonesboro locations, bankers in those areas identified the need for a community bank and reached out to Signature.

The Harrison location had its grand opening on June 23 and Jonesboro is currently working out of a temporary location. Signature hopes to grow and expand that mar

ket into a more permanent space in the next 18 months. Banco Sí will hold its grand opening Sept. 23 at its location in downtown Rogers.

“Around 2015 we started growing again,” Ward explained. “We were looking around for complementary communities when Rogers was started in 2018. As we were looking, bank ers came to us from markets we felt were complementary to what we do, which is why all three [that is, Harrison, Jones boro and Rogers] are coming online at the same time. Tradi tionally you would try to stag ger these launches. But, when the right people come, you have to go with them.”

The Signature family also includes two locations in Brin kley. There, Signature pur chased a 100-year-old bank and left it with the Brinkley signage to honor its long-standing his tory and its already established community. How do Signature leaders know when it’s the right time and the right place to invest? Ward said some re search on population growth and estimates enter into the process. But ultimately, it in volves “sitting down with a person face to face.” When a banker approaches Signature with an idea for a new location, they spend time having con versations and “getting a good feel for the person” who will be

Brant Ward

Scott Sandlin

Brant Ward

Scott Sandlin

17ARMONEYANDPOLITICS.COM SEPTEMBER 2022

leading that market.

For now, the state of Arkansas is pro viding Signature with as much growth as the bank could possibly desire, with no immediate plans to expand beyond state borders. There are still gaps to fill within the state, about which Ward said, “K Banco Sí!/ former Bank of Rogers building eeping an eye on the ball with the non-markets is top priority.” Sandlin explained that the creation of Signature’s newest endeavor, Banco Sí!, came from the realization of a hugely underserved community in North west Arkansas.

BANCO SÍ!

As a division of Signature, Banco Sí! is devoted to the Spanish-speaking commu nity that up to this point, has been over looked. The bank plans to create econom ic growth and provide access to banking services, capital and funds, especially for small and midsize businesses, for a group that traditionally has not had equal access to these opportunities in the state. In an earlier interview, Vice President of Mar keting Tori Bogner noted that the name Banco Sí! (meaning “Yes Bank” in Span ish) was chosen to send a positive mes sage to the Latino community who “has historically been told ‘no’ where finances areBancoconcerned.”Sí!will officially open its doors in downtown Rogers in a historic build ing. Erected in 1906, the edifice originally housed Rogers’ first financial institution, The Bank of Rogers. The interior of the space will honor the building’s original mahogany features, marble baseboards and mosaic tile floor. Banco Sí! will be fully staffed by bilingual team members equipped to serve new customers, as well as existing Signature customers wishing to conduct busi ness in Downtown Rogers.

President of Multicultural Banking Francisco Herrero, who has been leading the formation of this division, ex plained they have been focusing on attracting and bringing in the right bilingual talent to serve customers in Rogers. That means not just hiring bilingual employees but, more importantly, fielding a team willing to serve by spending

quality time with individuals.

Although Banco Sí! has not yet officially launched, the di vision has been operating on a smaller scale from its Pinna cle location on the other side of Rogers, to which the initial response has been overwhelmingly positive. Word of mouth has spread, and business has grown through referrals to the point that Banco Sí! will already boast a promising number of members when it opens at its new location.

“First and foremost, our customers in the community are

Banco Sí!/ former Bank of Rogers building

Banco Sí!/ former Bank of Rogers building

18 ARMONEYANDPOLITICS.COMSEPTEMBER 2022

BANKING

telling us that they want to have service without the lan guage barrier, whether it’s in English or Spanish,” Herrero said. “This means being very intentional and spending time with each person who really understands their needs.” An other need Herrero has heard from customers is the desire for more financial education: How to build financial secu rity, credit-building tools, support with housing, how to ac cess capital and funds for business startups and how to sup port existing small business growth.

With Banco Sí!, Herrero plans to provide local residents with information about the diversity of options available for fulfilling those funding needs, whether via one-on-one con versations or through community events open to the public. “What we ended up finding,” he explained “was that un derserved customers — those in our community who didn’t have good access or equal access to banking services and capital funds — were those who have a language barrier to overcome.”Signature

hopes to continue growing the Banco Sí! di vision with more locations, but for now, focus remains on getting the Rogers location just right and ironing out kinks with this original location. This might be a first in the Unit ed States to have a bank solely dedicated to bilingual bank ing. The marketing VP joked that she had to make sure she had the proper dimensions when she went to a trophy shop to have the FDIC signs printed in Spanish and English, be cause the FDIC couldn’t provide them with existing signage in Spanish.

“First and foremost, our customers in the community are telling us that they want to have service without the language barrier, whether it’s in English or Spanish.”

Tori Bogner

Francisco Herrero

Photos courtesy of Signature Bank of Arkansas

19ARMONEYANDPOLITICS.COM SEPTEMBER 2022

CHARTERED BANKS IN ARKANSAS

BANK NAME

CITY ASSETS

Arvest Bank Fayetteville 26,606,972

Bank OZK Little Rock 26,562,353

Simmons Bank Pine Bluff 24,431,679

Centennial Bank Conway 18,591,797

First Security Bank Searcy 8,333,173

Farmers Bank & Trust Company Magnolia 2,376,803

First National Bank Paragould 2,307,212

Southern Bancorp Bank Arkadelphia 2,068,294

First Community Bank Batesville 2,056,045

First National Bank of Fort Smith Fort Smith 1,875,559

Encore Bank Little Rock 1,815,558

Farmers & Merchants Bank Stuttgart 1,746,580

First Financial Bank El Dorado 1,544,123

Citizens Bank Batesville 1,236,233

Chambers Bank Danville 1,230,710

Relyance Bank, National Association White Hall 1,148,074

Anstaff Bank Green Forest 986,343

First Arkansas Bank and Trust Jacksonville 962,767

Legacy National Bank Springdale 955,561

Signature Bank of Arkansas Fayetteville 895,327

Evolve Bank & Trust West Memphis 777,087

Diamond Bank Murfreesboro 749,306

Generations Bank Rogers 743,472

FNBC Bank Ash Flat 692,865

Malvern National Bank Malvern 646,073

Stone Bank Mountain View 590,941

First Western Bank Booneville 585,291

First National Bank of Eastern Arkansas Forrest City 561,149

Citizens Bank & Trust Co. Van Buren 555,156

Bank of England England 551,436

Fidelity Bank West Memphis 546,054

First State Bank Russellville 516,150

CS Bank Eureka Springs 490,797

First Service Bank Greenbrier 482,713

Eagle Bank and Trust Company Little Rock 478,193

Central Bank Little Rock 405,166

Cross County Bank Wynne 377,675

Merchants & Planters' Bank Newport 363,346

Partners Bank Helena 361,175

Armor Bank Forrest City 353,554

20 ARMONEYANDPOLITICS.COMSEPTEMBER 2022

BANK NAME

CITY ASSETS

The Union Bank of Mena Mena 348,430

Farmers Bank and Trust Company Blytheville 332,074

First State Bank of DeQueen De Queen 311,726

Today's Bank Huntsville 298,271

Bank of Little Rock Little Rock 294,814

First State Bank Lonoke 294,187 Bank of 1889 Berryville 286,830

First National Bank of Lawrence County at Walnut Ridge Walnut Ridge 273,960

Farmers Bank Greenwood 273,633

Union Bank & Trust Company Monticello 271,256

United Bank Springdale 259,270

Commercial Bank & Trust Company Monticello 255,952

Horatio State Bank Horatio 249,545

First National Bank at Paris Paris 239,443

Peoples Bank Magnolia 232,445

Petit Jean State Bank Morrilton 229,645

Smackover State Bank Smackover 214,071

FBT Bank & Mortgage Fordyce 206,752

Premier Bank of Arkansas Jonesboro 206,695

First National Bank of Izard County Calico Rock 204,248

Peoples Bank Sheridan 202,815

Merchants and Farmers Bank Dumas 197,647

Bodcaw Bank Stamps 187,344

Bank of Salem Salem 177,643

Bank of Delight Delight 163,693

Bank of Cave City Cave City 161,092

Warren Bank and Trust Company Warren 156,608 McGehee Bank Mcgehee 145,774

Riverwind Bank Augusta 129,921

Piggott State Bank Piggott 121,995

First State Bank of Warren Warren 116,569

Gateway Bank Rison 110,708

Connect Bank Star City 110,313

Logan County Bank Scranton 95,054

RiverBank Pocahontas 94,083

First Naturalstate Bank Mcgehee 92,940

Priority Bank Fayetteville 92,858

Bank of Bearden Bearden 86,231

Bank of Lake Village Lake Village 75,955

Home Bank of Arkansas Portland 71,053

Security Bank Stephens 64,933

Riverside Bank Sparkman 63,106

Merchants & Planters Bank Clarendon 44,475

Community State Bank Bradley 29,896

21ARMONEYANDPOLITICS.COM SEPTEMBER 2022

LARGEST CREDIT UNIONS IN ARKANSAS

CREDIT UNION NAME

HEADQUARTERS ASSETS

Arkansas Federal Credit Union Little Rock $1.73 Billion

Telcoe Federal Credit Union Little Rock $450.83 Million

Success Credit Union Blytheville $172.42 Million

Mil-Way Federal Credit Union Texarkana $168.9 Million

Arkansas Best Federal Credit Union Fort Smith $143.22 Million

Fairfield Federal Credit Union Pine Bluff $103.21 Million

Arkansas Superior Federal Credit Union Warren $86.82 Million

Timberline Federal Credit Union Crossett $86.21 Million

Diamond Lakes Federal Credit Union Malvern $82.65 Million

UARK Federal Credit Union Fayetteville $79.39 Million

Pine Bluff Cotton Belt Federal Credit Union Pine Bluff $67.65 Million

Alcoa Community Federal Credit Union Benton $61.06 Million

Pine Federal Credit Union Pine Bluff $58.45 Million

River Valley Community Federal Credit Union Camden $55.01 Million

TruService Community Federal Credit Union Little Rock $47.28 Million

Hurricane Creek Federal Credit Union Benton $42.55 Million

Baptist Health Federal Credit Union Little Rock $38.85 Million

UP Arkansas Federal Credit Union North Little Rock $31.06 Million

Subiaco Federal Credit Union Subiaco $30.99 Million

United Arkansas Federal Credit Union Little Rock $29.41 Million

Patterson Federal Credit Union Arkadelphia $29.03 Million

Dillard’s Federal Credit Union Little Rock $27.73 Million

Two Rivers Federal Credit Union Arkadelphia $17.94 Million

Lion Federal Credit Union El Dorado $17.83 Million

River Town Federal Credit Union Fort Smith $16.9 Million

Source: Credit Unions Online

22 ARMONEYANDPOLITICS.COMSEPTEMBER 2022

theLeadingway.

Simmons Bank congratulates Claire McClellan, Lisa Chrzanowski and Stacey Martin on being named to the prestigious Arkansas Money & Politics’ 2022 Women in Banking list. Their leadership and teamwork help move your business and our community forward.

For more than 100 years, we’ve worked hard to meet each of our customers’ unique needs. Everything from buying a home, starting a business or simply having the ability to manage your money safely and securely, anywhere you happen to be.

All accounts

Claire McClellan

Lisa Chrzanowski

Stacey Martin

Claire McClellan

Lisa Chrzanowski

Stacey Martin

23ARMONEYANDPOLITICS.COM SEPTEMBER 2022

subject to approval. NMLS #484633

SUBSCRIBE NOW Go to armoneyandpolitics.com and click on the subscribe tab. Special Offer $28 a year! Get the latest on Arkansas AWARDSDESIGN NOVEMBER 2022

WOMEN IN BANKING2022 WOMEN

The executives named to Arkansas Money & Politics’ list of 2022 Women in Banking were nominated by readers. In a male-dominated industry, their perseverance, hard work and expertise have propelled them to influential positions in Arkansas banking and finance. We’re proud to recognize them in this month’s issue.

JANICE ACOSTA

SVP, Wealth Management Division Manager Relyance Bank

JANICE ACOSTA

SVP, Wealth Management Division Manager Relyance Bank

HEATHER ALBRIGHT President of Arkansas Market Bank of America

Heather Albright serves as President of Bank of Amer ica Arkansas. As the senior executive for the State of Arkansas, she is respon sible for connecting clients, teammates and communi ties to the full power of the franchise. In ad dition to being president of BoA Arkansas, Albright is a senior vice president and se nior relationship manager in middle mar ket at BoA. Albright joined BoA in 2005 as a senior credit products analyst. Prior to that move, she was a portfolio account adminis trator in the brokerage accounting group at Stephens Inc. in Little Rock.

Having earned her undergraduate degree in Economics and Finance from Arkansas Tech University, she later pursued her Mas ter of Business Administration (MBA) from University of Central Arkansas. She also holds FINRA certifications for Series 7 and Series 63 securities licenses.

In 2018, Albright was named the market integration executive for the Arkansas market, supporting the company’s busi ness integration referral efforts. An active member of the Arkansas Leadership Team and of the Bank of America Leadership, Education, Advocacy & Development for Women, she also co-leads the Little Rock Power of 10 group. She also volunteers with several local organizations, including Junior Achievement, Arkansas Foodbank, Economics Arkansas and Our House.

NATALIE BARTHOLOMEW

Community President, Northwest Arkansas First Community Bank

Natalie Bartholomew is the community president in Northwest Arkansas for First Community Bank. She is a career banker with 21 years of experience in a variety of areas of banking –including lending, deposit operations, cul

ture building and marketing. Bartholomew has a passion for philanthropy and sits on various boards and committees that serve the Northwest Arkansas region. She was recognized as the 2015 Young Woman of the Year by the Greater Bentonville Area Chamber of Commerce for the NWA Business Women’s Conference, and was a member of the 2020 ICBA Forty Under 40 Class. She received both her bachelor’s and master’s degrees from the University of Ar kansas and is an alumna of the Graduate School of Banking in Boulder, Colorado.

Bartholomew launched the Girl Banker blog in November 2017, to create a voice for women in banking and working moms. In addition to advocacy for women in bank ing, she has a passion for educating young women about the banking industry and highlighting those who started their ca reers at a young age. The Girl Banker has since been featured in American Banker, the Northwest Arkansas Business Journal, the ABA Bank Marketing newsletter and a variety of financial industry newsletters. Subsequently, she has also visited 12 states to speak about the Girl Banker platform and has participated in a variety of webi nars and podcasts. In 2019, Batholomew launched the Girl Banker podcast.

MICHELE BEASLEY

Consumer Loans

Telcoe

MATUSCHKA LINDO-BRIGGS

VP, Regional Executive Federal Reserve Bank of St. Louis – Little Rock Branch

JULIE BRISTOW

Mortgage Lender, Jonesboro Market

First Security Bank

LATRICIA HILL-CHANDLER

Chief DEI Officer

Southern Bancorp

LaTricia Hill-Chandler is the latest addition to the executive team of South ern Bancorp, an Arkan sas-based Community Development Financial In stitution (CDFI). In July, she was named its chief Diversity, Equity and Inclusion officer, selected to lead the com

pany’s commitment to representation, fair ness and belonging among its employees, customers and communities. Hill-Chan dler has three decades of experience in the DEI field; prior to joining Southern, she led similar efforts at Walmart and Arvest Bank.

LISA CHRZANOWSKI Senior VP/Specialty Credit Officer

Simmons Bank

Lisa Chrzanowski currently serves as senior vice presi dent and specialty credit officer for commercial and industrial lending for Sim mons Bank. For 18 years prior to being with Sim mons, Chrzanowski served as senior vice president and senior credit products officer for a large national financial institution. She graduated with a bachelor’s degree from the University of Illinois at UrbanaChampaign and a Master of Business Ad ministration from Purdue University. She currently serves on the Advisory Board for the Salvation Army of Central Arkansas.

ALLISON COX Chief People Officer Encore Bank

TABITHA EDDINGTON Community President, Harrison Market

First Community Bank

Tabitha Eddington is the community president for First Community Bank in Harrison. In her role, Ed dington oversees and man ages all operations of the Harrison area market for the financial institution. She opened that bank’s location in 2019.

With 21 years of experience in the banking industry, Eddington earned her bachelor’s degree in Finance from the University of Central Arkansas. An active member in her community, she currently serves as presi dent of the Harrison School District PTA council; chairperson for the City of Harri son Homeless Committee; board member with the Harrison Public Schools Founda tion; member of the Harrison Rotary Club; and chairperson of the fundraising com mittee for Camp Jack, a local veteran’s re source center. BANKING

26 ARMONEYANDPOLITICS.COMSEPTEMBER 2022

WOMEN IN

Valerie Erkman SVP/Chief Information Officer

Nicole Matsoukas SVP/Chief Officer

27ARMONEYANDPOLITICS.COM SEPTEMBER 2022 Congratulations

Information

We are honored to work beside Nicole and Valerie. They lead by example, and are one of the reasons we have been named one of the country's best credit unions. Thank you, Nicole and Valerie, for your leadership. 800.456.3000afcu.org 2022

STEPHANIE EDWARDS

Senior VP of Operations Bank of England Mortgage

Stephanie Edwards joined the Bank of England Mort gage family in 2014. Shortly after joining, she became the director of operations and now serves as the se nior vice president of op erations. Edwards has brought more than 29 years of extensive mortgage expertise to the Bank of England Mortgage team. It is her commitment to excellence, caring and passion to assist its customers in achieving their homeownership dream that makes her excel in what she does. Her mortgage journey started in St. Louis with several industry leaders, including CitiMortgage, Wells Fargo and Washington Mutual; roles included risk, channel chief underwriter and operations. Edwards had accepted an opportunity in Houston, Texas, as service delivery director and eventually returned home to Little Rock to work for Bank of England Mortgage.

VALERIE ERKMAN

SVP & Chief Marketing Officer Arkansas Federal Credit Union

Valerie Erkman, senior vice president and chief mar keting officer for Arkansas Federal Credit Union, is an experienced marketing and communications profes sional. With a career that started in marketing at Alltel, Erkman has spent over 25 years working in the finan cial and telecommunications industries. She is skilled in ecommerce, lead genera tion and conversion, brand management, direct marketing, multi-channel market ing, corporate communications, change management and coaching for excellence. Erkman has a bachelor’s degree in Jour nalism from the University of Arkansas at Little Rock. She lives in Little Rock with her husband, Nez, and son, Nico.

ALANA GIRARD VP/Deposit Application Project Manager Generations Bank

According to her col leagues, Alana Girard has been raised in banking. As a small child, she tagged along as her mother, Char lene, who worked at the branch in Junction City. De cades later, she now serves as the deposit application project manager, is known as the guru of all things deposits and plays a vital role in back-end operations of the bank. Her colleagues say that if ever comes a question or an issue, she is one of the first people to call, due to her vast knowl edge and kind disposition. Girard is always happy to let others take the spotlight and is adept at working with Generations’ cus tomers to find the best solution or support our team as they do so. Girard represents what all women in banking strive to be –kind. When you’re having an issue and call Alana Girard, you know you’re never going to be bothering her, and you will walk away more knowledgeable than before.

JANETTE HAYES VP/Director of Retail Operations Generations Bank

Janette Hayes’ colleagues believe she is a wonderful addition to the 2022 Wom en in Banking list because she represents the best of community banking. Hayes was recently awarded with her 40-year Milestones in Banking award from Arkansas Bankers Association. Dur ing those 40 years, she has worked for a handful of institutions and brought along compassion for her customers everywhere she goes. According to her colleagues, Hayes is known in the Siloam Springs community to be a competent banker who customers trust to lead them along the right path. She currently serves as the director of Retail Operations for the bank, overseeing all of Generations’ 11 branches, treasury management and Hispanic com munity outreach.

SHARON INGRAM Assistant Vice President U.S. Bank

CARA LANK SVP, Chief Credit Officer Stone Bank MEGAN LEE Chief Product Officer Smiley Technologies

Megan Lee, chief product officer, is responsible for working collaboratively with clients and internal stakeholders to lead prod uct development, design and implementation ef forts. She is also responsible for managing conversion teams as needed. Lee joined Smiley Technologies in 2012 as a member of the customer support team, after gradu ating from the University of Arkansas Lit tle Rock with a Management Information Systems degree in 2011. Over her tenure at Smiley Technologies, she has also per formed the roles of business analyst and conversion manager while developing ex pertise in conversions, loans, general led ger and debit cards.

STACEY MARLAR

SVP & Director of Retail Deposits, West Region Southern Bancorp

Stacey Marlar joined Southern Bancorp after graduating from Hender son State University in 1999, later attending the Barret School of Banking.

She has held many roles during her time with the CDFI, working up the ladder from teller and deposit op erations manager, to branch manager and finally her current position, director of re tail deposits. In this role, Marlar leads the region’s deposit staff, programs and op erations. The Clark County native is also very active in her community, including as a member of the Economic Development Corporation of Clark County.

28 ARMONEYANDPOLITICS.COMSEPTEMBER 2022

WOMEN IN BANKING

29ARMONEYANDPOLITICS.COM SEPTEMBER 2022 Congratulations Arkansas Money & Politics 2022 Women in Banking Christie Turner Senior Vice President / Lending Thank you for making such an incredible impact on our team and customers! fsbmybank.com Congratulations, Megan Lee 2022 We are honored to work alongside you, Megan. Thank you for all you do for Smiley and our partners. Chief Product Officer 2022

STACEY MARTIN

SVP & Director of Brand Partner ships and Community Marketing Simmons Bank

Stacey Martin is senior vice president and direc tor of brand partnerships and community Marketing at Simmons Bank. Martin and her team have spear headed local marketing ef forts. Under her direction, they have also activated Simmons Bank’s growing spon sorship portfolio, including Simmons Bank Arena in North Little Rock and Team Simmons Bank golfers – most notably PGA TOUR 2021 Rookie of the Year and 2022 FedEx St. Jude champion, Will Zala toris. Martin leads the bank’s efforts at the Korn Ferry Tour’s Simmons Bank Open in Nashville, Tennessee, and the inaugural Simmons Bank Cup held in Memphis in 2021. She and her team are also proud to support activation and marketing for Sim mons Bank’s presenting sponsorship of women’s athletics at ten universities in the bank’s footprint, a first-of-its-kind partner ship in the space.

NICOLE MATSOUKAS

Chief Information Officer Arkansas Federal Credit Union

Nicole Matsoukas, a 34year veteran of Arkansas Federal Credit Union, has held key management po sitions in the credit union’s account research, call cen ter, strategic Initiatives and information technology departments. As chief information officer, she holds responsibility for organizational project management, strategic initiatives and in formation technology to include all data centers, help desks, voice and data com munication networks, host systems, imag ing systems, computer networks, comput er program development and computer system operations. Matsoukas has a bach elor’s degree in Business Management from Park University.

CLAIRE MCCLELLAN SVP, Director of Marketing Simmons Bank

Claire McClellan is the senior vice president and director of Marketing lead ing all product marketing, customer communication, marketing technologies and brand insights at Simmons Bank, connecting both internal and exter nal customers through strategic initiatives, such as a recent partnership with Disney Institute. McClellan’s efforts have been re cently recognized by the American Bank ers Association, with a campaign winning the 2022 Brand Slam Out-of-the-Box Idea award. Her team has fostered new market ing capabilities, ranging from customer engagement channels through the launch of Simmons’ marketing automation sys tem, text marketing and a customer feed back channel to other behind-the-scenes technologies that enable Simmons Bank to build upon customer relationships and develop brand insights.

TAMMIE NEAL

Chief HR Officer Signature Bank of Arkansas

Tammie Neal’s first taste of banking came from work as a part-time teller for a small community bank during her senior year of high school. In 2004, she became one of the first 20 team members of the then-fledgling Signa ture Bank of Arkansas. Neal’s skills quickly landed her appointment as director of hu man resources. Over the last 17 years, she has worked closely with the C-Suite, Board of Directors and Shareholders of White River Bancshares. In those 17 years, she has also shepherded the growing number of team members, from 20 to almost 200 – of which a significant number started in the first half of 2022. She has led the hiring and onboarding of 48 new bankers over the last eight months alone, including moving into two new market areas and building an entirely new, bilingual team for Banco Sí! Such accomplishments have resulted in Neal’s recent promotion to chief human re sources officer.

MARNIE OLDNER

Chief Executive Officer Stone Bank

CATHY HASTINGS OWEN Chairman Eagle Bank & Trust KATHRYN PANNELL

SVP, Director of Treasury Management Citizens Bank MICHELLE REESOR

Executive VP, Director of Risk Management

First Community Bank

A seasoned banker with 35 years of experience in the industry, Michelle Reesor is the executive vice presi dent, director of risk man agement for First Commu nity Bank. As one of the bank’s original 14 employees, she took a leap of faith, along with 153 shareholders, to establish a locally owned and managed community bank that would put the needs of its customers and community first. In her position, Reesor’s responsibilities in clude, but are not limited to, overseeing the bank’s risk management function; strategic planning; project management, including entrance into new markets, branch construction and opening; bank acquisitions; and policy formulation. She is a member of the bank’s executive com mittee and product development team; she also serves on numerous other bank

Reesorcommittees.isa

graduate of Lyon College in Batesville and the School of Banking at Louisiana State University. Invested in community service, she serves on the board of directors for the University of Arkansas Community College at Bates ville’s board of visitors and is a past board member for United Way of Independence County.

SARAH SALSBURY

Private Banking Officer, Bank of Fayetteville Farmers and Merchants

30 ARMONEYANDPOLITICS.COMSEPTEMBER 2022

31ARMONEYANDPOLITICS.COM SEPTEMBER 2022 2022

JANTEL STAMPS

Vice President, Small Business Banker

Bank of America Arkansas

Jantel Stamps serves as the local small business banker for the state of Arkansas. In this role, she provides finan cial solutions to small busi nesses in the community to help them grow, manage and protect their businesses. Through lis tening, planning and insight, Stamps is a strategic partner for businesses and helps them focus on their priorities. She provides credit financing and all other banking solu tions. She stands by her clients daily, giving them the power to realize their personal and business financial goals, and help im prove their financial lives.

Stamps is on the leadership team and has held several roles with the bank as a Finan cial Center assistant manager, relationship manager, personal banker and teller. She currently resides in Little Rock with her twin daughters, Mariah and McKenzie, and has been part of the Bank of America fam ily for over 15 years.

SANDY STRAESSLE SVP Retail Banking, DEI Officer Stone Bank

ALI KING SUGG Board of Directors

First Arkansas Bank & Trust

DONNA TOWNSELL SVP, Director of Investor Rela tions

Home Bancshares/Centennial Bank

LORRIE TROGDEN

President & CEO Arkansas Bankers Association

Lorrie Trogden serves as the President and CEO of the Arkansas Bankers As sociation. She has a Bach elor of Arts in Political Sci ence from the University of Central Arkansas, a Master of Science in Operations Management from the University of Arkansas, and is an ASAE-certified Association Executive.

Trogden serves as the Chairman of the Board for the Graduate School of Bank ing at Madison, Wisconsin; a trustee for the Graduate School of Banking at Louisi ana State University; Economics Arkansas Executive Committee; Arkansas Capital Corporation Executive Committee; State Alliance of Banking Associations Execu tive Committee; American BankPAC Board of Directors; and the American Society of Association Executives Government Rela tions Committee.

CHRISTIE TURNER SVP/ Commercial Loan Officer First State Bank

Christie Turner is a senior vice president and commer cial loan officer with First State Bank. As a relation ship-driven banking profes sional with over 15 years of experience in positions of increasing responsibility, Turner delivers exceptional results through leadership, portfolio management, business devel opment, relationship management and market growth strategies. Prior to joining First State, Turner served as SVP and pri vate bank manager for Signature Bank of Arkansas. Her passion for helping others, along with her diverse banking back ground, makes Turner a strong resource for her clients.

TARA WALKER Loan Officer Bank of Little Rock Mortgage

JENNIFER WILLIAMS

SVP & Regional Deposit Opera tions Director, Central Region Southern Bancorp

A long-time and dedicated member of the Southern Bancorp mission, Jenni fer Williams brings more than 30 years of experience to her new role of deposit operations director of the community development bank’s Central Region. She was promoted to that position in June after previously serving as regional deposit operations manager for its markets in Arkansas, Sevier and Mississippi coun ties. In the director role, Williams oversees all deposit operations in the region.

LINDSAY WILMOTT Chief Operations Officer Generations Bank

Lindsay Wilmott first joined what would later become Generations Bank in 2006 as a part-time teller while finishing up her bach elors degree. According to her colleagues, at the time, Wilmott had dreams to become a math teacher, but when graduation came around, she found herself reluctant to leave banking. After conversations with Jon Harrell, CEO/Chairman of Genera tions Bank, it was decided Wilmott would join the bank full time. Over the next few years, Wilmott would move into a head teller role, until her branch was acquired in 2010. She worked alongside Sandy Fergu son, previous AMP Power Women in Bank ing recipient, to move into the loan depart ment. Together, they established the bank’s first loan operations department, which Wilmott led while simultaneously work ing as the bank’s compliance officer. In 2017, Wilmott was appointed to the role of chief operations officer, making her the youngest executive of the bank. Now, she is still the youngest executive of the bank and one of three women serving within its C-suite.

ASHLEY WISER

Chief Operating Officer Chambers Bank, Danville

Ashley Wiser is the chief op erating officer at Chambers Bank in Danville, Arkansas. In this role, she oversees the bank’s retail, deposit and branch operations, as well as quality assurance, busi ness development, treasury management and operations support services depart ments. Wiser also collaborates with mem bers of the executive management team to plan deposit goals and work toward estab lishing and attaining the overall goals of the bank.

32 ARMONEYANDPOLITICS.COMSEPTEMBER 2022

WOMEN IN BANKING

33ARMONEYANDPOLITICS.COM SEPTEMBER 2022

CONGRATULATIONS!

2022 We are proud of you, Natalie, Michelle and Tabitha. Thank you for your leadership, determination, and the examples you’re setting. Here’s to the women who make us who we are, and their impact that reaches beyond banking.

Tabitha Eddington CommunityHarrisonPresident, Natalie Bartholomew Community President, Northwest Arkansas Michelle Reesor EVP | Director of Risk Management

Tabitha Eddington CommunityHarrisonPresident, Natalie Bartholomew Community President, Northwest Arkansas Michelle Reesor EVP | Director of Risk Management

34 ARMONEYANDPOLITICS.COMSEPTEMBER 2022

firstcommunity.net

1-888-780-8391

STATE

STATE

35ARMONEYANDPOLITICS.COM SEPTEMBER 2022 SEEKLEISUREMOREMISSISSIPPIRIVER

PARK When life gets hectic, it’s time to retreat somewhere with a slower pace. AFMC – Your proven health care collaborator. © 2022, AFMC, INC. ALL RIGHTS RESERVED. in AFMCTV Check out Visit afmc.org/Solutions to find out more. Put our experience and solutions to work for you: • Customer service call centers • Practice transformation and telehealth implementation • Pandemic and public health services – testing, vaccine clinic administration • Virtual conference hosting

From News to Acting to Politics to Banking LindoMatuschkaBriggs

To Shares Her Career Journey

By Katie Zakrzewski | Photos by DeWaine Duncan

say that Matuschka Lindo Briggs is successful would be an understatement.

As Vice President and Regional Executive of the Little Rock Branch of the Federal Reserve Bank of St. Louis, Briggs has accomplished a phenomenal amount in her career.Born in Panama City in Central America, Briggs shared that her first language is Spanish. She learned English in second grade and became a naturalized U.S. citizen during high“Myschool.dad was in the Air Force, and I was raised a mili tary brat,” Briggs explained. “Although we were military, we did not travel much.”

Briggs’ family lived in Panama, then Sacramento, then returned to Panama.

“We came back to the United States for good and landed in Enid, Oklahoma. I graduated from high school there be fore going to college at William Woods University in Ful ton, Missouri. Back then, it was an all-girls school,” Briggs recalled. “I received a bachelor’s degree in Journalism and Communications and minored in Political Science. I re ceived my MBA at Washington University in St. Louis.”

Briggs has been married to her husband, Malcolm Briggs, for nearly 30 years. The two met working for NBC in St. Louis. They have two adult children, a son in Chi cago and a daughter in Fort Worth, Texas.

Briggs’ began her career as a television reporter for NBC affiliate WHO13 in Des Moines, Iowa. From there, she went to St. Louis to work for KSDK-TV. When she chose to marry the sportscaster at the NBC station, the station’s

37ARMONEYANDPOLITICS.COM SEPTEMBER 2022

owner, Gannett, had a nepotism clause at the time — mean ing that one of them had to leave. Matuschka left the station and started freelancing.

“I did radio for local stations, including ESPN. I freelanced as a reporter for a few cable television stations, then took a few years off after my second child was born,” she shared.

When she jumped back into the workforce, Briggs con tinued to freelance as a reporter as well as dabble in acting, appearing in a few movies and many commercials. “Nothing that would win me an Emmy,” she said.

“I usually ended up on the cutting room floor when it came to acting. But, I met great people and had so much fun. Getting makeup done in the trailers and hearing behind-thescenes scoops about the cast was my favorite part.

“Then, I dabbled in politics as a press secretary for a gu bernatorial candidate. Though I loved the position, the 24hour news cycle helped me decide that politics was not for me. I have a ringtone from those days that still makes me

That feeling of empowering others led Briggs to un derstand the importance of financial access for all. As she continued through various roles at the Fed, Briggs noticed they all revolved around relationship building, community development and helping in sharing in the transparency of all that the Federal Reserve Bank does.

This work caused Briggs to have a eureka moment.

“I realized how many people did not have access to save money and build assets — that they were not pro vided with safe and affordable banking options,” she said. “The chance to connect consumers with traditional banking and financial access for all grew to be an im portant mission for me. In my community development role, I began to work closely with Bank On.”

The Bank On movement is designed to improve the financial stability of America’s unbanked and under banked by making safe, low-cost transaction accounts accessible to all. The St. Louis Fed and Cities for Finan cial Empowerment (CFE) Fund established the Bank On National Data Hub (BOND Hub) to show metrics from financial institutions related to Bank On account open ings, account usage and consistency, and online access.

The 24-hour news cycle helped me decide that politics was not for me.

It’s important to collect data to find out how the Bank On movement is doing, Briggs explained.

“We work closely with financial institutions to un derstand how these accounts bring customers into the financial mainstream through accounts that have few or no fees, desirable services like direct deposit, debit cards and online banking,” she said. “With these metrics, we can gauge how customers access their money in ways that help them avoid fees from check cashing and other alternative services. We will be releasing our 2021 BOND Hub report at the end of this year, with almost double the financial institutions we had last year.”

of working with politicians in Wash ington, D.C., and doing a host of political reporting, as well as having a strong communications background, brought a great opportunity for Briggs at the Federal Reserve Bank in St. Louis in 2015.

The U.S. Treasury then had a product called myRA, or My Retirement Account. Working through the St. Louis Fed, Briggs’ role was to help organizations provide a free way to save for their employees with myRA. The impact of provid ing a product that could help low-to-moderate income indi viduals and part-time employees who were not provided a 401(k) was inspiring to Briggs.

“I was making a difference in people’s lives, and not only could I see it, but they were also telling me how much they appreciated it. People who had never saved before were learning to ‘Set it and forget it.’ Some were saving as little as one dollar a week, but it was a start and very empowering for them,” she said.

Briggs explained that the Federal Reserve relies on data and research, which reflects what has happened in the“Mypast.role is to connect with leaders in the community, businesses, banks, government and nonprofits to gain real-time information on what is happening in Arkan sas,” she said. “I then share what I learn with our presi dent, Jim Bullard, so that he can inform monetary policy. He shares his views during meetings of the Federal Open Market Committee, which sets the federal funds rate.”

Briggs also works on projects geared towards help ing the community.

“I also convene the people to promote what the Fed is here to do – promote stable prices and maximum employment,” she said. “I look forward to building rela tionships throughout the state to advance the economic well-being of the region, coupled with my own passion of focusing on workforce development in Arkansas.

“I am looking to work with other leaders to help high school students with options for post-secondary educa tion. There are vocational occupation opportunities for those who do not want to go to a four-year college, but they don’t know what’s out there and what they might be

38 ARMONEYANDPOLITICS.COMSEPTEMBER 2022

nauseous.”Thecombination

BANKING

good at if we don’t show them the various trades. We need to start earlier and provide events with hands-on learning, training and cer tification opportunities before students graduate from high school.”

Briggs shared that she loves her role because every day brings a new opportunity, as well as the hope and promise that comes with it.

“I am still very much like an investigative reporter trying to find out what is going on throughout the state,” she said. “Depending on where in the state I am working that day, I try to do some or all the following: Visit a Bank to review what bankers are seeing in their institution with lending and stakeholders as well as with their employees; stop and visit the mayor and the chamber to see what new economic developments they are working on or pain points happening in their town; make a presentation about what I do, the free resources available at the Fed, and exchange economic information.”WhenBriggs has spare time in between helping the Fed and her community, her hobbies include reading, watching movies and go ing to the theatre. She loves to travel and learn about different cul tures and countries as well as all the various attractions the United States has to offer.

“I also enjoy tennis and pickleball, but the pandemic slowed that down and forced me to go outdoors more and fish with my husband. Fishing is my new hobby, and I love it!”

But at the end of every day, Briggs likes to reflect on the progress

the Fed has made and where she sees the Little Rock branch in the future.

“We need to grow and strengthen engagement so that leaders in Arkansas will trust me to help share their story. I hope that by working with the Fed and the Little Rock branch, we can help to maximize the quality of participation in our economy across the state and throughout our entire footprint of the Eighth District,” she said. “In five years, I look for ward to many more people using the abundance of free economic resources, such as our free teaching materials at economiclowdown.org and our abun dance of economic research at stlouisfed.org.”

Briggs shared that she is honored to be in Little Rock serving the majority of Arkansas.