SEPTEMBER 2023/armoneyandpolitics.com $5 USD INSIDE: Achievers in Their Forties | Best Financial Advisors | Women in Banking

growth, iconic Arkansas bank maintains community spirit

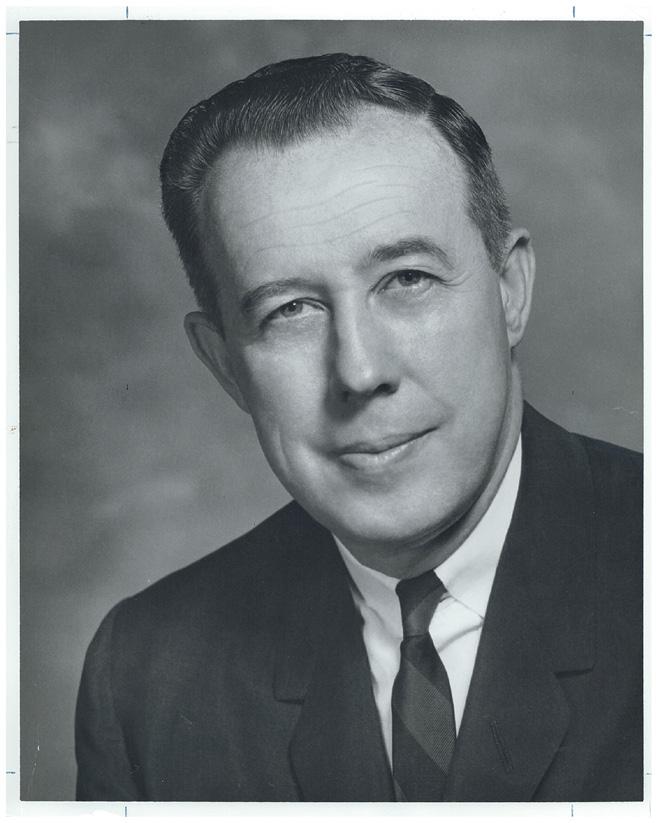

Chairman George Makris @120 Simmons

Despite

Executive

2409 West Dewitt Henry Drive //P.O. Box 1113 //Beebe 501.882.2600 // 800.597.2425 // resumes@stalliontg.com DELIVERING AMERICA

ArkansasStateFair.com

Jason Prather, JD, LLM

Matt Jones, JD, CFP ®

Jason Prather, JD, LLM

Matt Jones, JD, CFP ®

Generations of farmers, ranchers, homeowners and ag investors have relied on AgHeritage Farm Credit Services for loans and financial services.

We can help you live the life you’ve chosen.

AgHeritageFCS.com

FARM | CONSTRUCTION | AGRIBUSINESS | LIVESTOCK | LAND | HOME

THAT TIME OF YEAR

The State Fair is just around the corner, and while its lights and glitz grab the attention, the annual fall kickoff packs an economic punch as well.

LET’S HEAR IT FOR THE GIRLS

While the money sports like football and basketball dominate the headlines, Jordyn Wieber’s Gymbacks are cultivating their own strong following.

5 ARMONEYANDPOLITICS.COM SEPTEMBER 2023

FEATURES SEPTEMBER 2023

SIMMONS AT 120 Simmons Bank hits 120 years this year, and Dwain Hebda looks at the iconic institution’s history and impact on Arkansas and the region.

16

152

140

The banking and finance industries are more open to women, especially in leadership positions, and Arkansas is home to many strong female execs.

AMP’s list of Achievers in Their Forties shines a light on those professionals at a midpoint in their careers who are positioned for more.

PRESIDENT & PUBLISHER

Heather Baker | hbaker@armoneyandpolitics.com

EDITOR-IN-CHIEF

Dwain Hebda | dwain@armoneyandpolitics.com

SENIOR EDITOR

Mark Carter | mcarter@armoneyandpolitics.com

ASSOCIATE EDITORS

Sarah Coleman | scoleman@armoneyandpolitics.com

Mak Millard | mmillard@armoneyandpolitics.com

EDITORIAL COORDINATOR

Darlene Hebda | darlene@armoneyandpolitics.com

STAFF WRITERS

John Callahan | jcallahan@armoneyandpolitics.com

Sarah DeClerk | sdeclerk@armoneyandpolitics.com

MANAGING DIGITAL EDITOR

Kellie McAnulty | kmcanulty@armoneyandpolitics.com

ONLINE WRITER

Kilee Hall | khall@armoneyandpolitics.com

PRODUCTION MANAGER

Mike Bedgood | mbedgood@armoneyandpolitics.com

GRAPHIC DESIGNERS

Lora Puls | lpuls@armoneyandpolitics.com

A memo to women looking to have a seat at the Arkansas legislative table at all levels of government: your time is now.

Jenna Kelley | jkelley@armoneyandpolitics.com

SENIOR ACCOUNT EXECUTIVE

Greg Churan | gchuran@armoneyandpolitics.com

ACCOUNT EXECUTIVES

Mary Funderburg | mary@armoneyandpolitics.com

Colleen Gillespie | colleen@armoneyandpolitics.com

Karen Holderfield | kholderfield@armoneyandpolitics.com

Jona Parker | jona@armoneyandpolitics.com

Dana Rodriquez | dana@armoneyandpolitics.com

EXECUTIVE ASSISTANT

Jessica Everson | jeverson@armoneyandpolitics.com

ADVERTISING COORDINATOR

Bethany Yeager | ads@armoneyandpolitics.com

CIRCULATION

Ginger Roell | groell@armoneyandpolitics.com

ADMINISTRATION

billing@armoneyandpolitics.com

In Northwest Arkansas, Signature Bank’s Spanish-first offshoot is pacing right along with the region’s growing Hispanic community.

On the outside, there’s not much that differentiates traditional banks and credit unions, but the latter remain under the radar in Arkansas.

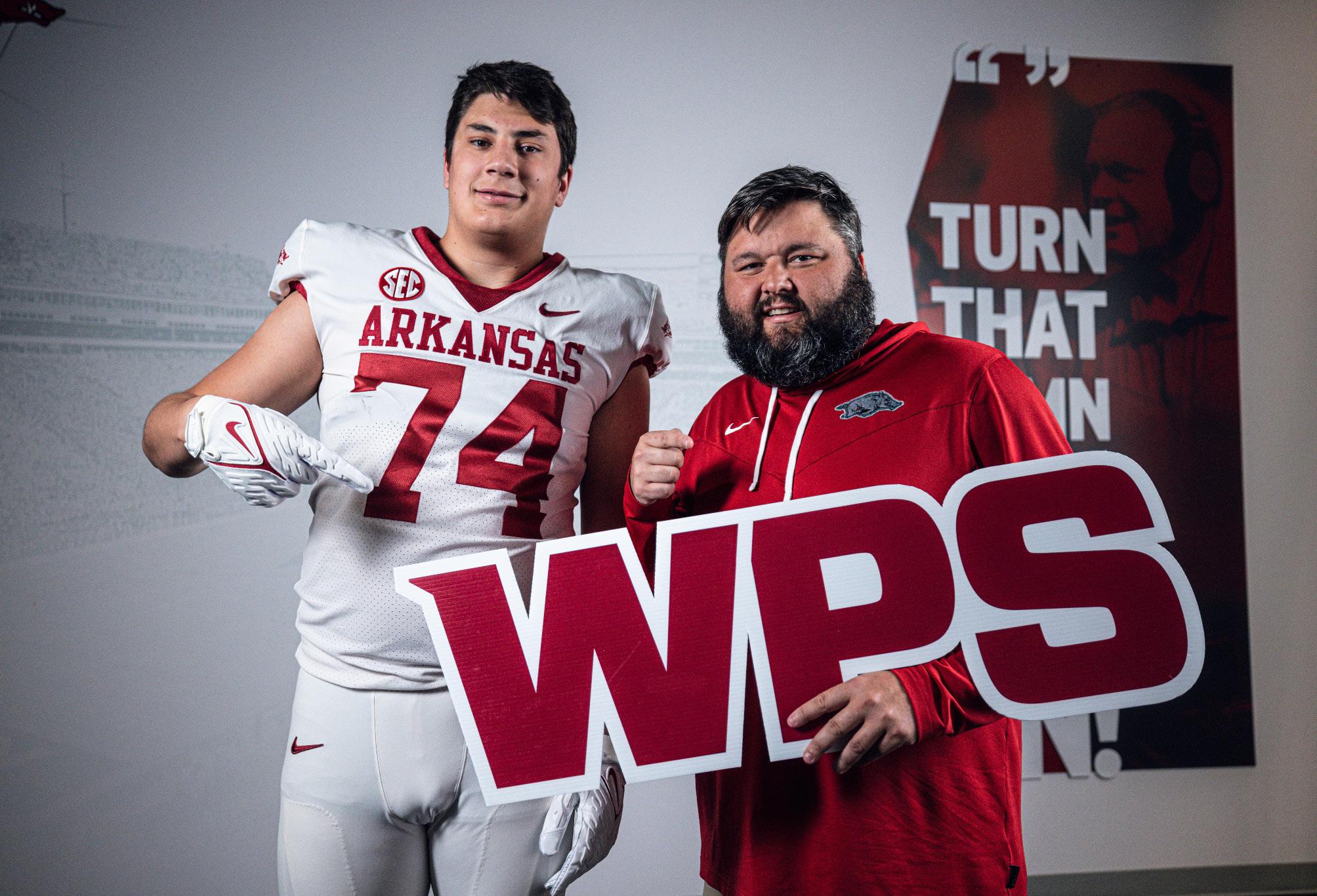

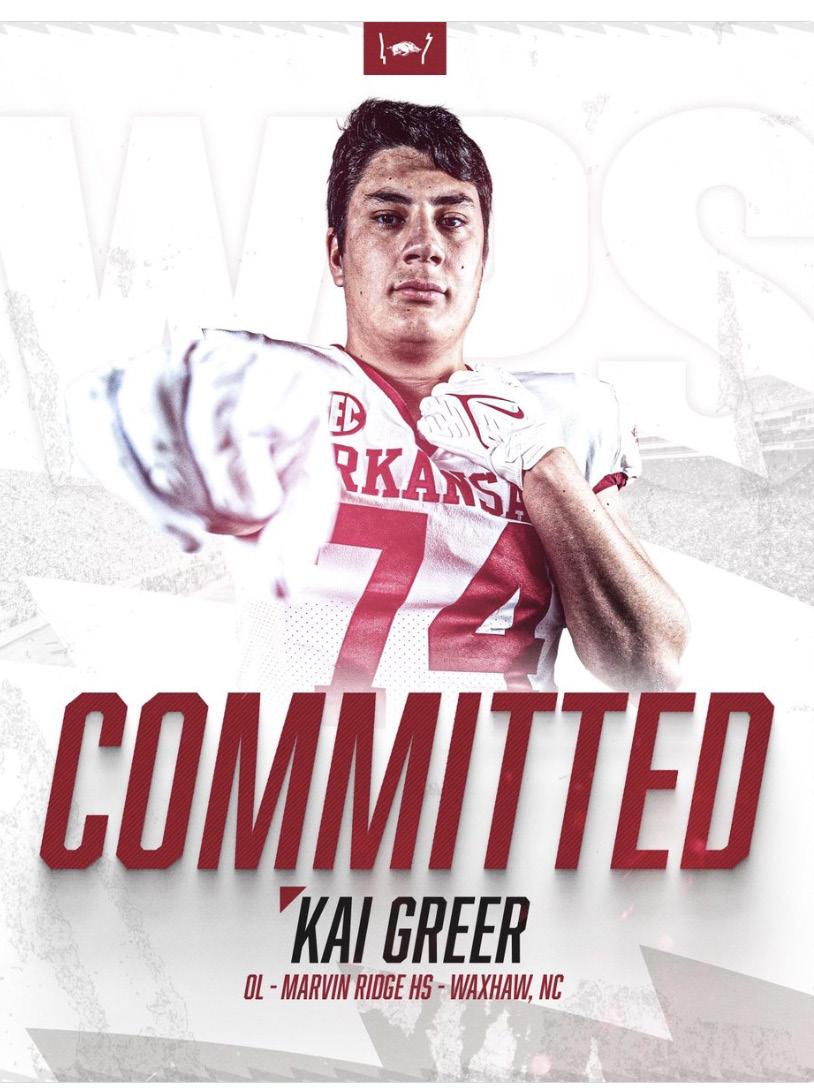

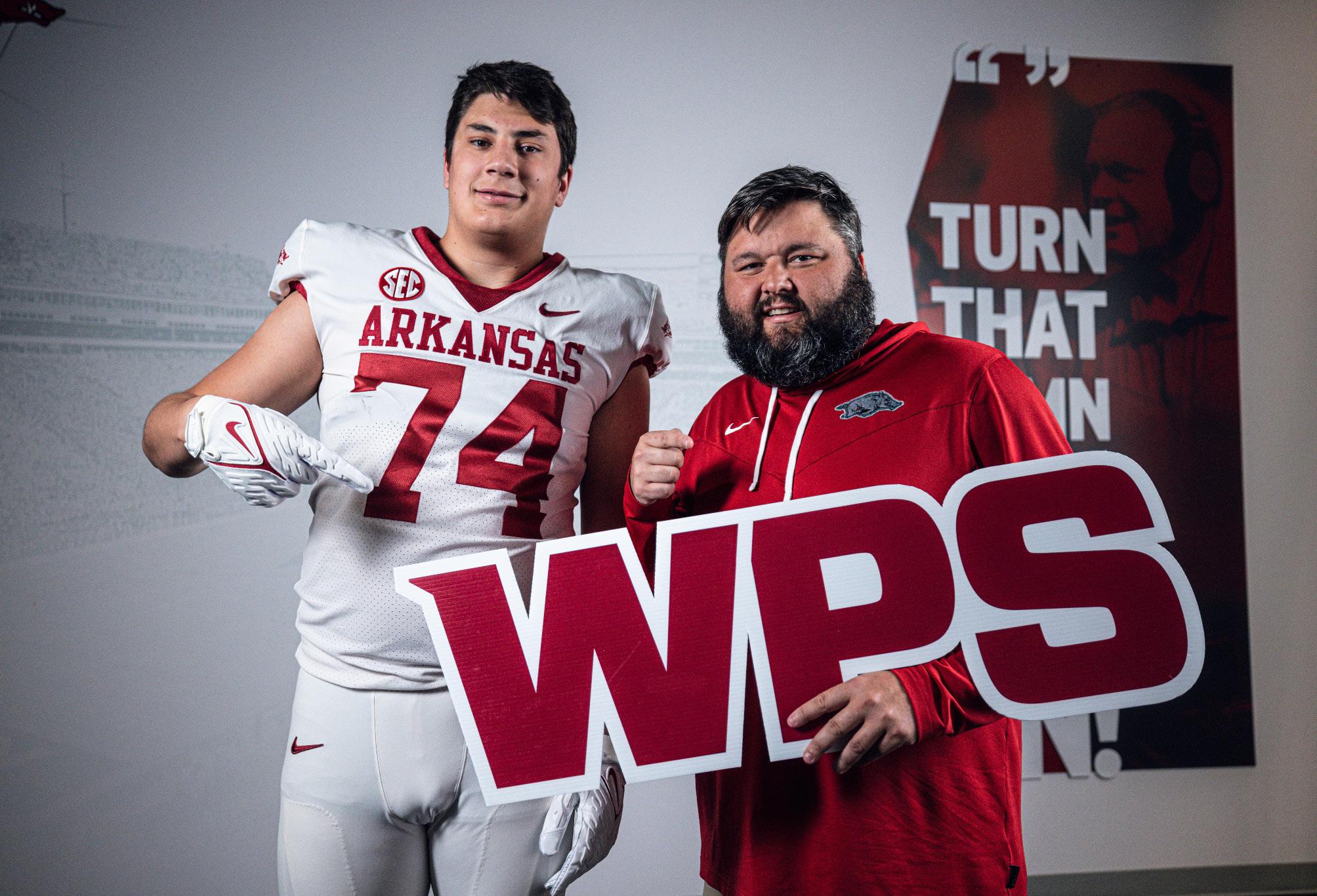

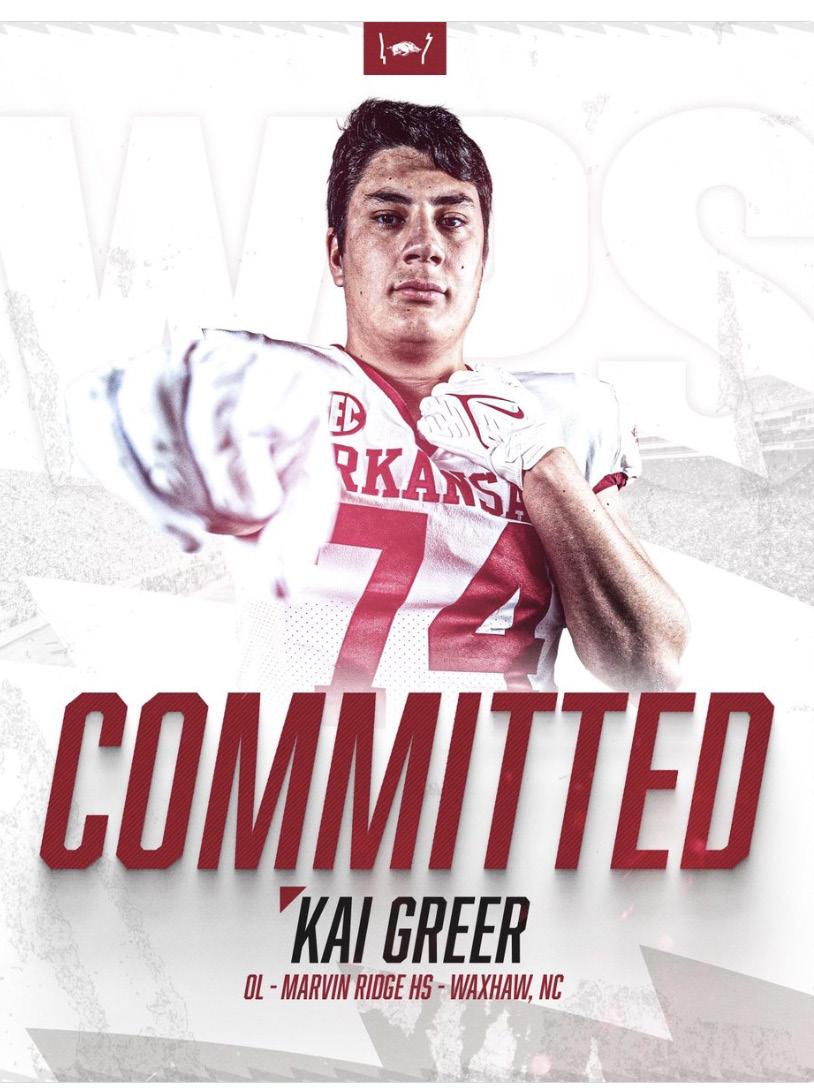

The Arkansas staff was on a recruiting roll heading into September, harkening back to Sam Pittman’s days as

CEO | Vicki Vowell

TO ADVERTISE call 501-244-9700 email hbaker@ armoneyandpolitics.com

TO SUBSCRIBE | 501-244-9700

ADVISORY COMMITTEE

Susan Alturi, Scott Hamilton, Tommy Keet, Bobby Martin, Shannon Newton

CONTRIBUTORS

Angela Forsyth, Becky Gillette, K.D. Reep, Nichole Singleton, Kai Caddy, Jason Burt, DeWaine Duncan, Kenneth Heard, Dustin Jayroe, Steve Spencer, Brian Umberson

An influx of diverse professionals, generational changes and new tech have ensured that the financial planning industry is not the same as it used to be.

The UA debuted Big Red’s Club this month in the Fayetteville opener. The north end zone rooftop bar is expected to be a big hit with fans.

6 ARMONEYANDPOLITICS.COM SEPTEMBER 2023 AMP magazine is published monthly, Volume VI, Issue 5 AMP magazine (ISSN 2162-7754) is published monthly by AY Media Group, 910 W. Second St., Suite 200, Little Rock, AR 72201. Periodicals postage paid at Little Rock, AR, and additional mailing offices. Postmaster: Send address changes to AMP, 910 W. Second St., Suite 200, Little Rock, AR 72201. Subscription Inquiries: Subscription rate is $28 for one year (12 issues). Single issues are available upon request for $5. For subscriptions, inquiries or address changes, call 501-244-9700. The contents of AMP are copyrighted, and material contained herein may not be copied or reproduced in any manner without the written permission of the publisher. Articles in AMP should not be considered specific advice, as individual circumstances vary. Products and services advertised in the magazine are not necessarily endorsed by AMP. Please recycle this magazine.

Generational farms, in Arkansas and across the nation, are declining in number as individual farms get bigger and require fewer workers. Women in banking Credit unions Financial planning Growing with its community #ARGirlsLead More to come Open for business Recruiting rush Financing the farm 36 60 64 52 132 91 148 144 30 8 | Plugged In 10 | Viewpoint 12 | Discovery Economics 136 | Arkansas Visionaries 160 | The Last Word

OL coach on the Hill.

BANKING ACHIEVERS IN THEIR FORTIES POLITICS SPORTS

September 2023

12501 Cantrell Rd., Little Rock • 501-223-3838 2001 South Buerkle St., Stuttgart • 870-683-2687 heathmanfamilydental.com • HeathmanFamilyDental Thank You for honoring us through the years as one of AY’s Best Healthcare Professionals! HEATHMAN FAMILY DENTAL 7 2021 Are You Smiling? Since 2000, our team has been 100% focused on your oral health. We offer our patients the very best that dentistry has to offer through advanced technologies and procedures. We provide personalized dental care with compassion and skill in order to provide a great treatment experience. Transform your smile at Heathman Family Dental WE OFFER: • Veneers • Crowns • Smile Makeovers • Implant Restorations & Restorative Services • Family & Cosmetic Dentistry for All Ages • Adult & Pediatric Services • BOTOX Injections and more!

ON THE COVER

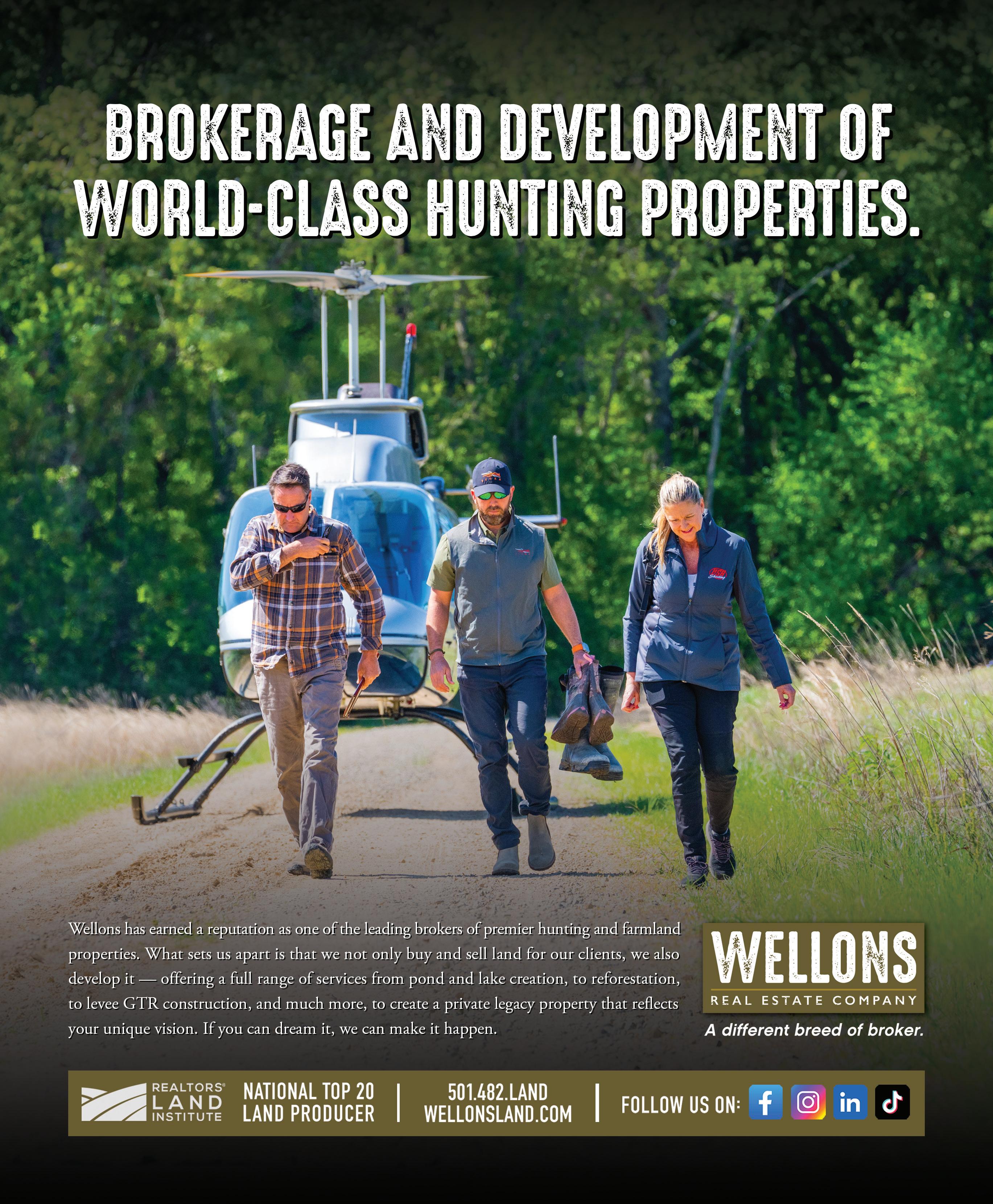

Banking is the focus of the September issue, and one of Arkansas’ largest and oldest banking institutions, Simmons Bank, is celebrating 120 years.

Page 16

FEEDBACK

PGA TOUR CHAMPIONS TO DEBUT 2024 EVENT IN LITTLE ROCK

“I don’t think people understand how great this is. The Champions Tour is who we all grew up watching!”

Aaron Deitz

BOYS & GIRLS CLUB CHOOSES YURACHEK AS 2023 LEADER OF THE YEAR

“Congratulations. Well deserved. Thank you Hunter.”

Randall McChristian

ARKANSAS VISIONARY: JOHN FLAKE - UPON THIS ROCK, HE DID BUILD

“Great article on John Flake admire him so much.”

Jane Phillips

DIGS OF THE DEAL: MAXINE’S TAP ROOM — A LIVING HISTORY

“I wish I could have met her. My parents were regulars in the early 60’s. My Mom named me after her. My middle name is Maxine.”

Hope Manwarren

JAYLIN WILLIAMS, ISAIAH JOE LEAD BASKETBALL CAMP FOR FORT SMITH YOUTH

“My son got to go to one of the basketball camps and got to play and talk with Jaylin. He said he was really nice and funny!”

Felicia George Leister

ARORA NAMES FLOWERS AS FIRST FINANCE OPERATING OFFICER

“Excellent! Congratulations Tasha!”

Felicia George Leister

TOP ONLINE ARTICLES

May 23 - June 23 1

8 ARMONEYANDPOLITICS.COM SEPTEMBER 2023

Digs of the Deal: Maxine’s Tap Room 2 Little Rock Woman Now Highest-Ranking Female in ATA International 3 Sportsman’s Warehouse Opens First Arkansas Location 4 Little Rock Touchdown Club Reveals 2023 Speaker Lineup 5 Best of AMP 2023 6 Silver Dollar City Superfan Canaan Sandy 7 Walton Medical School to Apply Holistic Approach 8 Arkansas Game and Fish Foundation Banquet Honors Conservationists 9 PGA Tour Champions to Debut 2024 Event in Little Rock 10 Jaylin Williams, Isaiah Joe Lead Basketball Camp for Fort Smith Youth PLUGGED IN @AMPPOB INSTAGRAM

The Boys & Girls Clubs of Central Arkansas have selected University of Arkansas Athletic Director Hunter Yurachek as the Club’s 2023 Leader of the Year.

SEPTEMBER 2023 armoneyandpolitics.com INSIDE: Achievers in Their Forties Best Financial Advisors Women in Banking Despite growth, iconic Arkansas bank maintains community spirit Executive Chairman George Makris @120 Simmons

The Clinton Foundation has welcomed Joy Secuban back to the Clinton Presidential Center to serve as director of programming and exhibitions.

By Mark Carter

REMEMBERING ALEX COLLINS

My favorite memory of Alex Collins comes from the Liberty Bowl in December 2015, his last game as a Razorback and the Hogs coming off big road wins over Ole Miss and LSU.

This was the best of Bret Bielema’s Arkansas teams, and the future looked oh-so-briefly bright.

The last of Collins’ three rushing TDs that night was testament to his talent. If a Georgia or Alabama back had made the same play in the same manner in a national playoff game, ESPN would still be running replays a decade later.

The Hogs had flirted with breaking the game open all night, but Kansas State was a pesky gadfly. Collins capped a long fourth-quarter drive by running through and outfighting three K-State defenders inside the 10. Simply refusing to be denied, he crossed the goal line standing up, and his final score as a Razorback iced the game.

Collins’ trademark move after a score had always been to immediately jog to

PUBLISHER’S LETTER

the official in the back of the end zone and hand him the ball before heading to the sideline. You know — act like you’d

something out of character for his affable yet low-key self. After handing the ball to the ref, he flashed a dab. A much deserved one. A framed photo hangs in the man cave.

Alex Collins wouldn’t be denied. Not in Oxford that 2015 season, when Collins scooped up a backwards, fourth-down desperation “heave” from Hunter Henry and converted a first down that enabled the Hogs ultimately to escape with an overtime win. Not a week earlier in Baton Rouge. His second-quarter, 80-yard scamper up the gut set the tone in what would be a 31-14 rout in an empty-but-for-Hogfans Tiger Stadium. And not when his distraught mom pulled the letter of intent to Arkansas off the fax machine on signing day in 2013.

been there before. It’s a move he took with him to the NFL and a big part of what endeared him to me and many others.

But that December night in Memphis, No. 3 altered his post-score routine after that final touchdown and did

Thinking of former Razorback greats in the past tense, of course, became a sad exercise this summer. Let’s hope we’re done with it for a while.

Alex Collins was one of my favorite all-time Razorbacks, and we lost him much too soon.

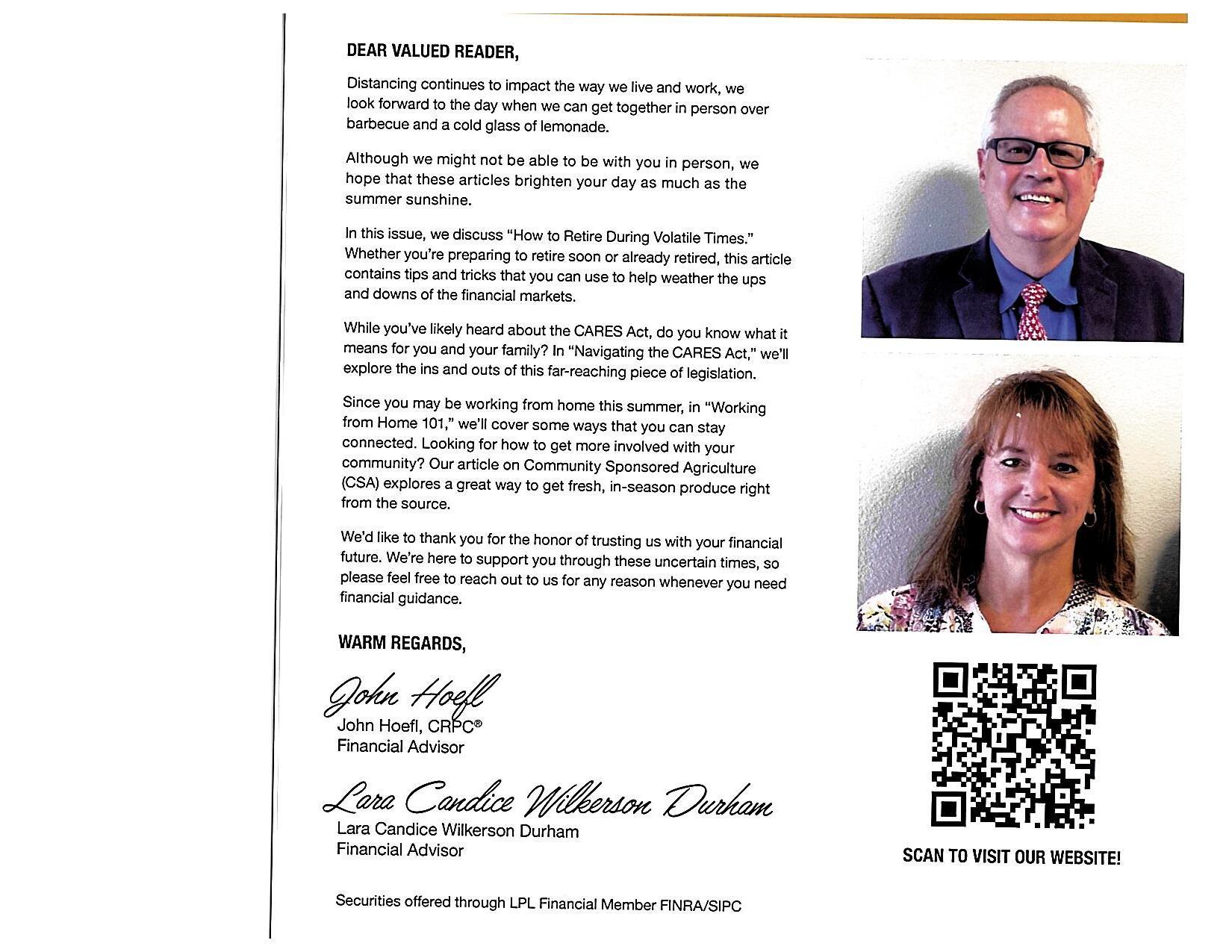

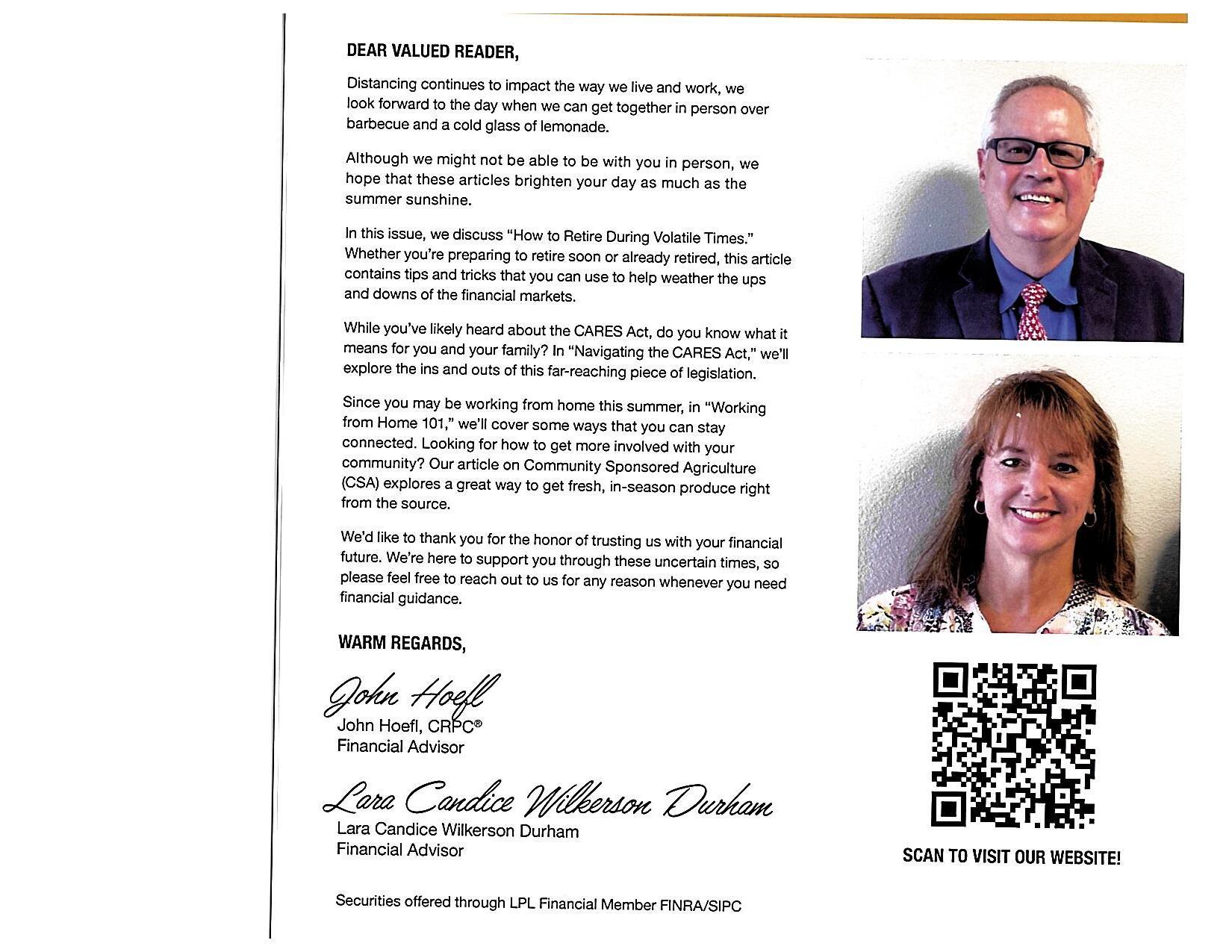

By Heather Baker

By Heather Baker

COME FOR THE BANKING; STAY FOR THE FINANCE

It’s hard to believe after the August we just endured, but fall is right around the corner. For Arkansas Money & Politics, that means banking and finance in the September issue.

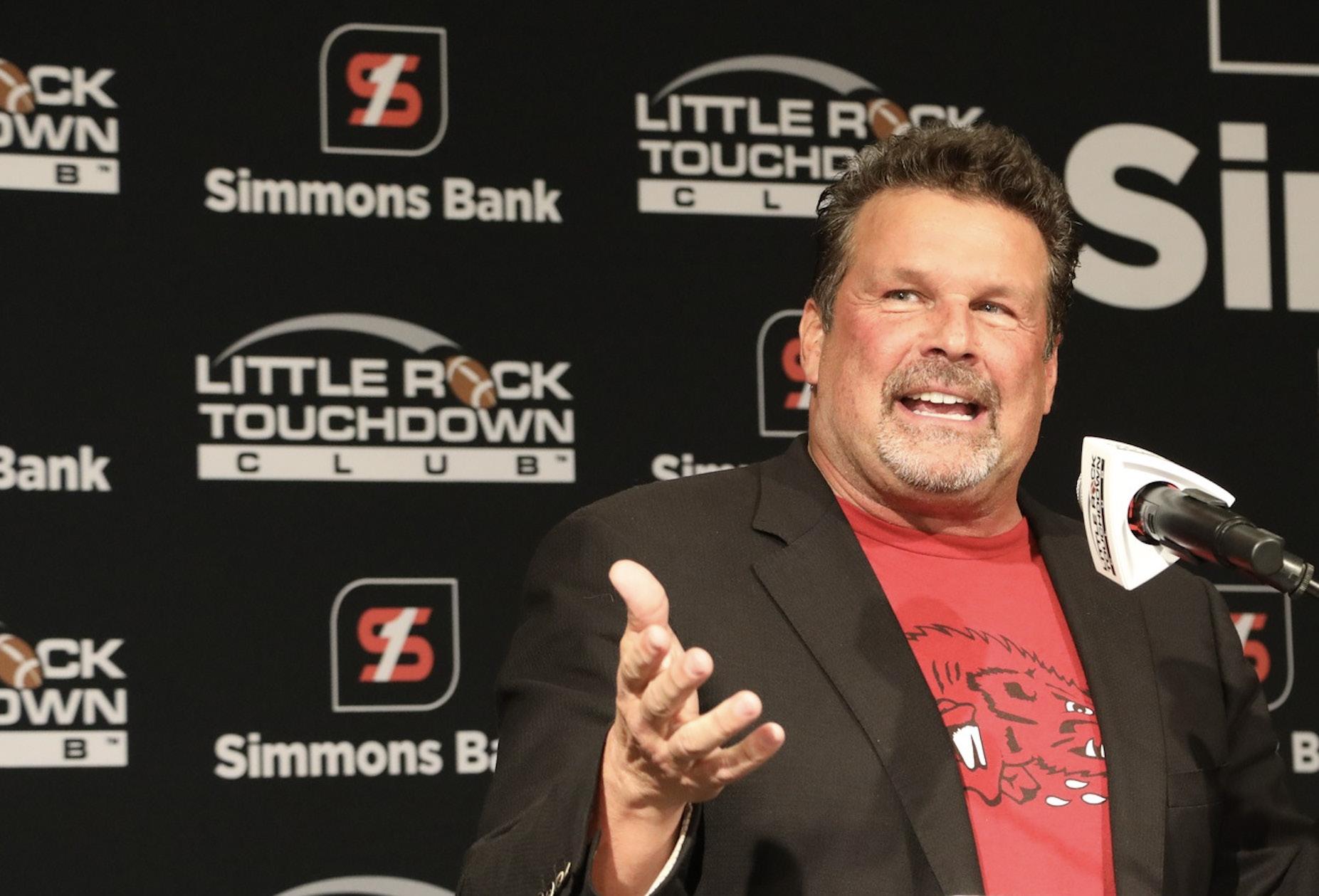

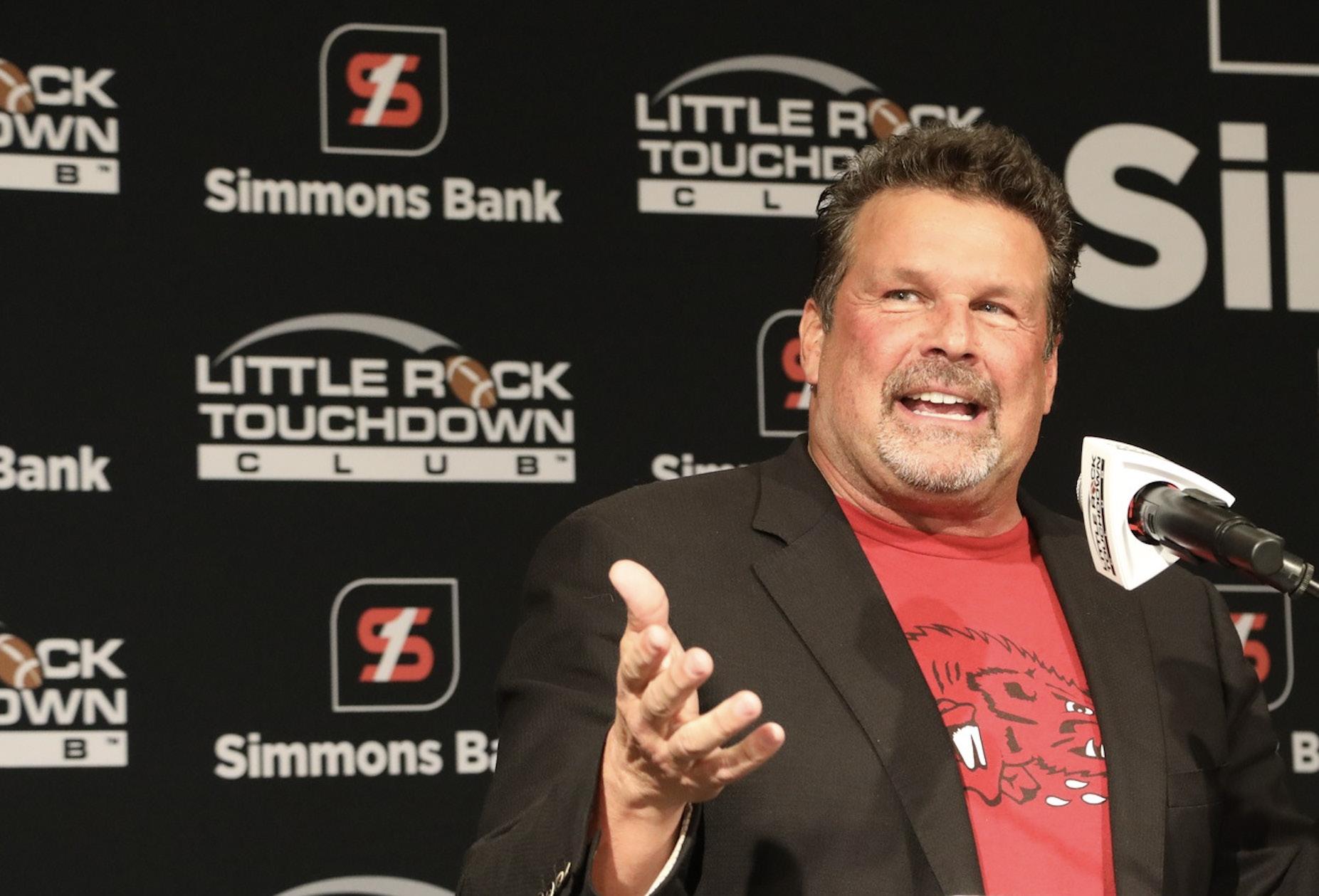

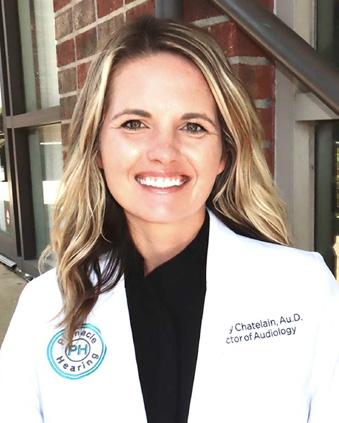

We’re lucky to live in a strong banking state with such quality institutions — large, medium and small. Lucky to have banking legends like George Makris, executive chairman of Simmons Bank, which celebrates its 120th anniversary this year.

Mr. Makris was gracious enough to have his picture taken for me at the announcement of the Simmons-sponsored PGA Champions Tour event that will take place at Pleasant Valley in Little Rock starting next year. Simmons sponsors the field at War Memorial Stadium, has the naming rights to Central Arkansas’ magnificent multipurpose arena, and now it will have its name attached to a PGA event. To put it simply, pretty cool.

Also inside this issue, we list FDICinsured banks in the state by market share and the state’s largest credit unions, visit Pine Bluff to chronicle 120 years of Simmons

Bank and look at how Signature Bank of Arkansas is serving Northwest Arkansas’ growing Hispanic community through Banco Sí.

We’ll also feature our annual list of Achievers in Their Forties and the state’s top financial advisors, as voted by AMP readers; talk to some of those advisors about the volatile market and what to expect; and we’ll shine a spotlight once again on women in banking.

Plus, it’s almost State Fair time, and the September issue goes behind the scenes of the business of the fair. We’ll take a look at the new Big Red’s Club, which debuts this month at Razorback Stadium in Fayetteville.

There’s so much more packed into this September issue of AMP. Get your banking and finance fill inside and enjoy the magical run of football, fairs and cooler temps as we get closer to fall proper.

Thank you for reading. We appreciate your faith in us. Hit me up with story ideas, questions or comments anytime at HBaker@ARMoneyandPolitics.com.

9 ARMONEYANDPOLITICS.COM SEPTEMBER 2023 FROM THE EDITOR’S DESK

Heather Baker and George Makris

LITHIUM BOOM HEADED OUR WAY

By Brian Umberson

I’ve spent time in south Arkansas selling new technologies, lab testing and products to the oil field and aerospace companies, so I’m grinning with Arkansas pride that a new energy storage material — lithium — could improve the state and even the world.

Lithium is the new efficient energy to store solar- and wind-generated electricity in your house. Lithium batteries are more efficient and lighter than typical batteries, thus they will improve electric cars just like they improved cell phones. ExxonMobil thinks Arkansas contains 4 million tons of lithium that could create batteries for 50 million electric vehicles (EVs). Let that sink in.

Historically, lithium was derived from various brine and ore sources. The oldschool processes of strip mines or evaporation of large pools of brine water typically threaten the environment to varying degrees. The typical evaporation pools require 18 months to process and extract the lithium, thus the process cannot respond to moderate demand increases. Environmental issues have limited most projects and processes because of the unknown impacts of these new greenfield projects. Recently, an environmentally friendly process has emerged that utilizes brine from wells to extract lithium.

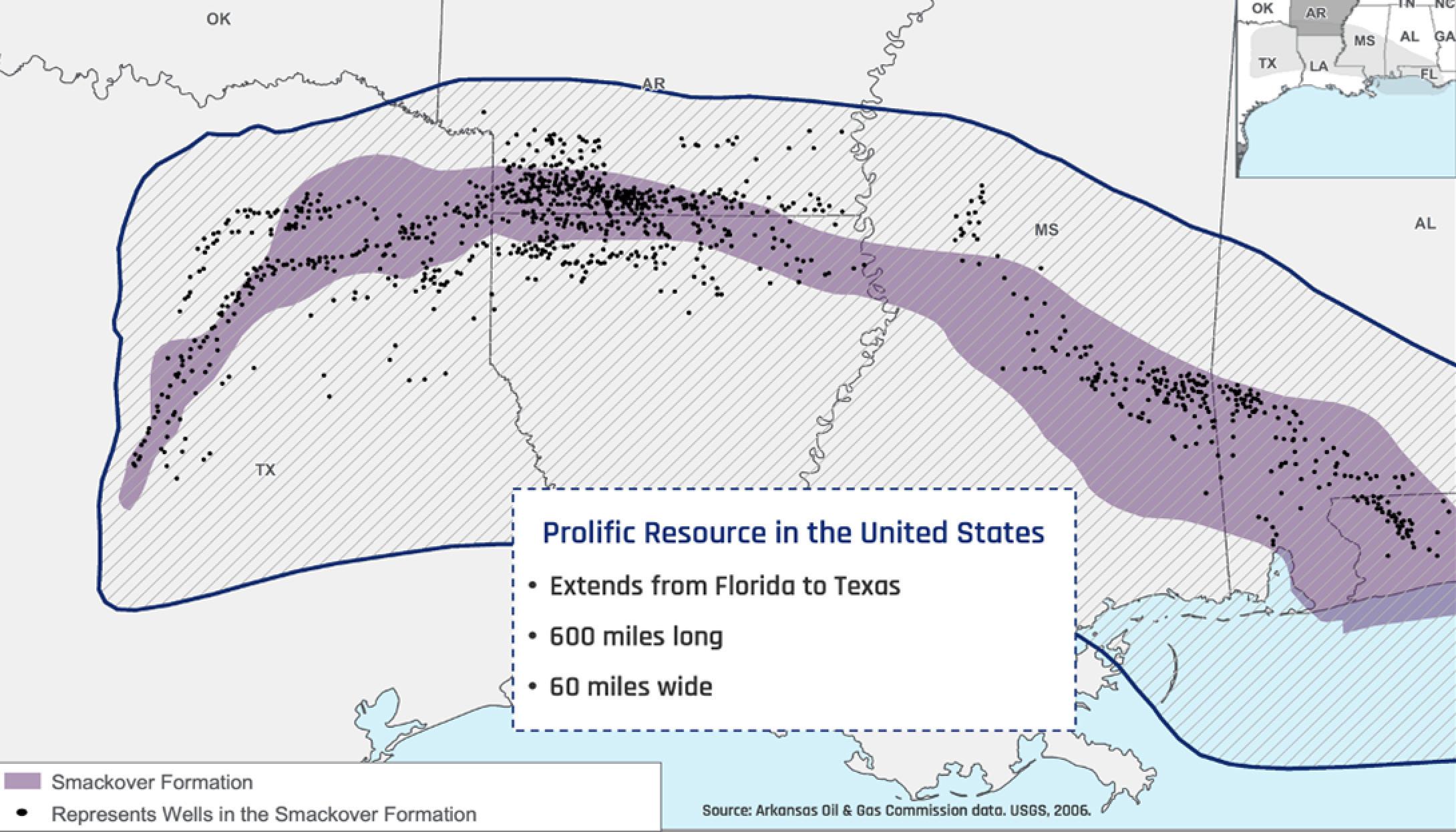

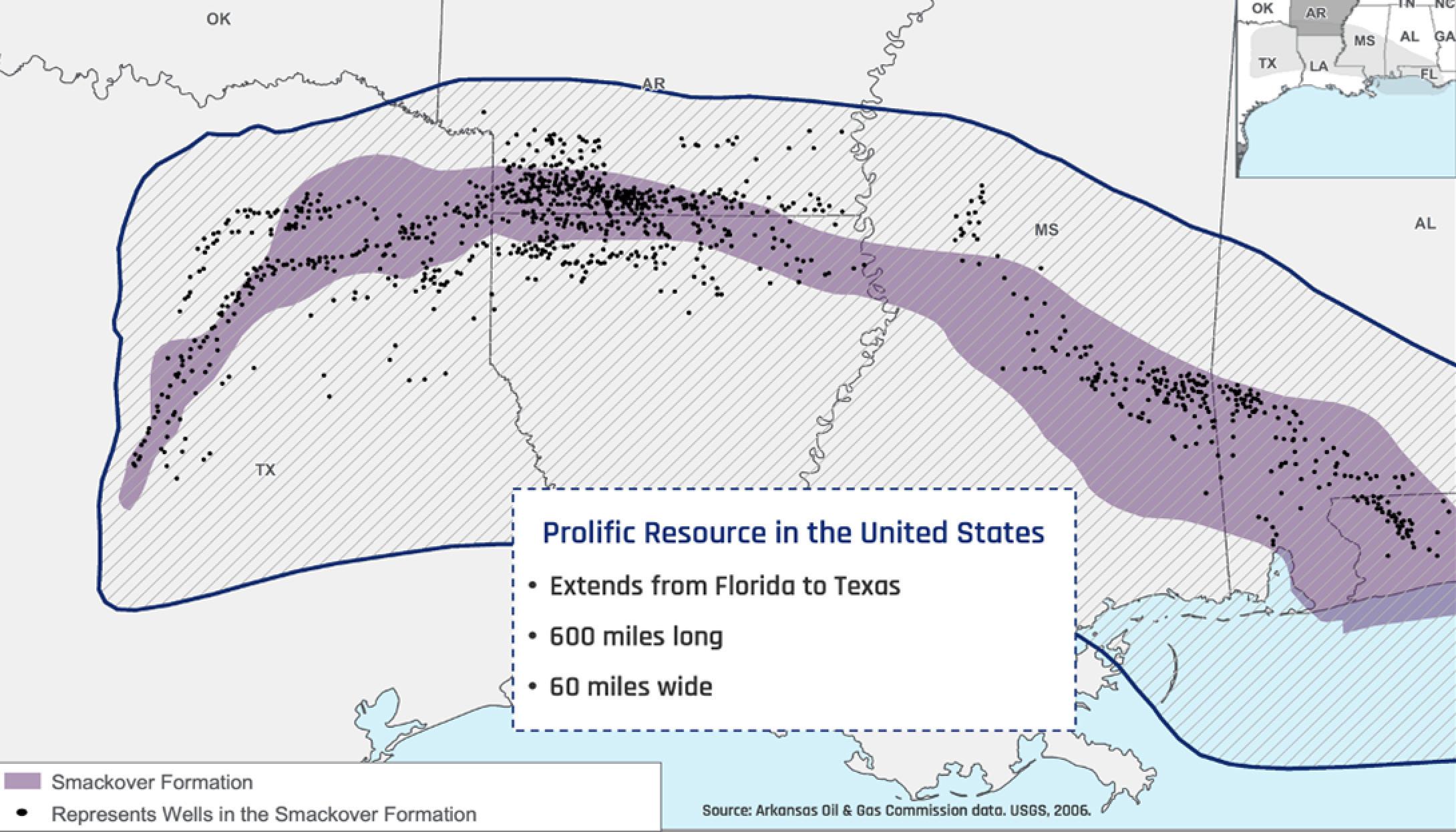

The new brine well-based process is how Arkansas becomes a major player in lithium. We are the global leader in bromine production, which is related to south Arkansas’ oil and gas wells. The 100-yearold Smackover formation has existing oil, gas and brine/bromine infrastructure that is going to be used to energize the lithium boom. Arkansas has an existing system of wells and pipelines for bromine that are a known quantity and proven. Since the 1950s, Arkansas companies have developed protocols and systems to protect the environment from bromine production.

Arkansas could change our nation’s energy dependency. About 95 percent of the world’s lithium comes from Australia,

Chile, China and Argentina. The National Renewable Energy Laboratory (NREL) says only 1 percent of the lithium used in the United States currently comes from a domestic source (a lithium brine operation in Nevada).

The legitimacy of the boom appears to be confirmed now that ExxonMobil has joined Standard Lithium (SLI) and Tetra in announcing projects in El Dorado and Magnolia. SLI’s Southwest Project alone is estimated to have total capital expenditures of $1.3 billion. SLI is ahead of the pack by validating a proprietary process of direct lithium extraction (DLE) and should be first to reach commercialization. SLI has 150,000 acres of leases, a Koch Industries technology license and the Lanxess agreement and the top bromine field in the world. Lanxess Corp. owns Arkansas’ largest brine processing facilities, and the agreement enables SLI to reduce risk by using existing permitted processing infrastructure to fast-track commercialization.

Tetra Technologies announced plans to build a $500 million lithium production facility. It is not unreasonable to expect Exxon to spend as much as SLI for capital expenditures. The main players are already connected in various ways. First ExxonMobil paid $100 million for 120,000 acres of leases in the Smackover play. Then it joined Tetra to develop more than 6,100 acres in Arkansas. Tetra had already leased more than 27,000 acres in Arkansas to Standard Lithium and also is working with Saltwerx, a subsidiary of ExxonMobil. The SLI connectivity continues as Tetra currently buys bromine from SLI partner Lanxess.

Furthermore, Standard Lithium has proven two concepts of direct lithium extraction in Arkansas — SLI’s proprietary LiSTR process and a co-developed process with Koch Technology Solutions (KTS). The Lithium Selective Sorption (LSS) process is the product of the SLI-KTS collaboration,

and Standard Lithium has regional exclusivity for the LSS process in the Smackover formation. SLI’s feasibility study of the production process will conclude in 2024, with construction commencing in 2025 and first production expected in 2027.

The SLI process starts with “brine entering the production facility to be pre-treated and then processed via the co-developed Koch Technology Solutions’ LSS direct lithium extraction process. After purification and concentration, final conversion to a lithium hydroxide product would use a modified chlor-alkali electrolysis process. After lithium extraction, the lithium-depleted brine will be returned to the resource area by a pipeline system to the network of brine injection wells.”

Spin-off initiatives

The new technology-induced lithium boom in Arkansas could spin off initiatives that create diverse values. We can increase the value for south Arkansas with the addition of battery manufacturing facilities for the likes of Tesla, EnerSys, Romeo Power, Clarios, A123 Systems, Microvast, Lithion, etc. Manufacturing of mobile phone batter-

10 ARMONEYANDPOLITICS.COM SEPTEMBER 2023 VIEWPOINT

Brian Umberson

ies account for a large portion of revenue for many companies. The manufacturing facilities are not always capable of running large batteries on the same production lines as the small batteries used for consumer electronics. Therefore, these companies may need to expand their facilities or build new facilities to produce battery “walls” for homes or batteries for EVs cars.

We can increase value with geothermal power from bromine wells that are twice as deep as average Arkansas oil wells with temperatures around 250 degrees Fahrenheit or more. We have numerous wells in Arkansas at 20,000-plus feet that could produce enough heat for electricity generation. Bromine-rich brines are typically recovered around 7,000 feet in the Smackover formation and still reach the surface at around 212 degrees. An experimental geothermal energy-recovery plant was built near El Dorado in the late 1970s to investigate the usage of waste geothermal brine from the Great Lakes Chemical Corp. for electrical power production. It is entirely possible that deeper wells and new technologies have emerged during the last 40 years to improve heat conversion.

Geothermal could make the Arkansas lithium zone as green as possible and provide revenues that reduce risk. Per the U.S. Department of Energy (DOE), geothermal brines beneath the Salton Sea in southern California are a domestic lithium source, but low lithium productivity and environmental concerns limit the potential. The Salton Sea’s commercial risk is reduced by 11 geothermal power plants generating green electricity.

The limiting factor for geothermal has been high upfront costs for drilling wells that may not be hot enough. Arkansas already has thousands of wells that negate the upfront costs, and we know which wells are hot enough. Data from the U.S. Greenhouse Gas Emissions and Sinks (GHGI) for abandoned oil and gas well activity shows the U.S. had about 2.2 million abandoned wells in the 2021 GHGI inventory.

Geothermal is green enough that the DOE Geothermal Technologies Office is investing in abandoned wells or co-production via its Wells of Opportunity initiative. Abandoned oil and gas wells need to be deep enough to heat water; active oil and gas wells often encounter extremely hot water, and co-production captures that heat to generate electricity.

Future considerations

The Murphy family deserves tremendous respect for what it has done to change El Dorado. The downtown has become cool for a small Southern town thanks to the Murphy Arts District, Haywood Hotel, restaurants, concerts, oil history displays, etc. Downtown El Dorado has become a cool environment with a great quality of life that is unique to the city. El Dorado’s upward trend comes at an opportune time to provide the best base camp for the energy companies investing in south Arkansas. El Dorado is nice enough that the execs and their expense accounts will flock to the area and the Haywood Hotel.

With all those acres of leases, the Lanxess agreement and the top bromine field in the world, SLI projects should commercialize faster, reducing upfront costs and providing more competitive marketentry pricing. SLI’s early revenues should enable evergreen financing or at least attract better investment and financing. Could the rural electric co-ops in Arkansas collaborate with the lithium producers to create electricity via geothermal energy?

ExxonMobil has budgeted $17 billion through 2027 to invest in technologies for low-carbon emissions and develop lowcarbon technologies. What is its next move after spending $100 million on leased acreage? When does Exxon announce construction of a production site? On the other hand, does it use some of its large budget to buy SLI and get a turnkey production infrastructure, enabling it to get on the market first? Does Exxon see the value of the Lanxess agreement to use existing permitted wells, the co-developed IP and the Koch corporate name to de-risk investment?

Plus, the landowner in the lithium zone is going to benefit too. Lawyers in south Arkansas are going to be busy helping landowners benefit from the lithium boom via the Strohacker Doctrine. Arkansas oil and gas laws on file at the University of Arkansas at Little Rock documents Strohacker, which legally enabled mineral deeds: “…. the intention of the grantor should be ascertained by reference to ‘substances commonly recognized as minerals’ at the time of the conveyance.” The doctrine enabled landowners to get royalties for bromine after its discovery in the 1950s. It should apply to lithium, as well, and that is what lawyers will litigate.

History does repeat itself. Smackover was put on the map in 1922 when a wildcatter hit oil without geological engineering or seismology. The Union County town was nationally known for oil, but the best was yet to come with a new technology. In 1936, exploration teams using new seismic-enhanced technology discovered a great oil and gas formation that came to be known as the Smackover Formation. Today, the formation isn’t as productive as it was, but another new technology is going to resurrect the Smackover formation for round 3.

Brian Umberson is a native Arkansan who has worked with startups in the fields of biotech diagnostics, foodborne pathogens, oil and gas microbes, medical devices and diagnostics, as well as the automotive, steel and aerospace segments. A National Science Foundation ICorps mentor, he works with the Arkansas Association for Food Protection, the International Avian Influenza Summit and Bio+Nano+Ark.

11 ARMONEYANDPOLITICS.COM SEPTEMBER 2023

BUILDING THE RESEARCH COMMUNITY

BY INTRODUCING

SCIENCE TO THE UNDERSERVED

By AMP Staff

Dr. Antiño Allen’s path to becoming a world class physician, scientist and researcher at the University of Arkansas for Medical Sciences was anything but conventional. When he was in college, a mentor recommended that he shift his focus to biology, a suggestion that has provided Allen with a lifetime of greater purpose.

After graduating cum laude from Jackson State University and earning his master’s and doctorate degrees at Indiana University, Allen served tours of duty with the U.S. Army between 2004 and 2010. He would draw on that real-life experience as a postdoctoral fellow at the University of California at San Francisco.

It was his military experience that opened Allen’s eyes to the value of diversity. “The Army brings people together from all kinds of backgrounds,” he said. “Not only did I learn how to work with a diverse group of people, I came to understand the value of how a variety of perspectives can help solve problems.”

An Arkansas Research Alliance (ARA) Academy member, Allen’s research focuses on the effects of radiation on brain function, specifically on normal tissue response, cognitive impairment and neurogenesis. But his passion is building a research and science community comprised of talented people who do not always receive opportunities to develop their interest in innovation and discovery.

Allen leads the Summer Research Institute (SRI), a program administered by the UAMS Division for Diversity, Equity and Inclusion that provides practical laboratory and science experience to underserved high school juniors, seniors and college students who are interested in pursuing careers in research and health care. While SRI gives young scientists valuable experience in the laboratory, the program curriculum extends well beyond microscopes and petri dishes.

“Science is so much more than what happens in the lab,” Allen said. “We teach you how to write an abstract. How to create a poster. How to give a talk. The essential skills needed to become scientists.”

Allen noted that while these skills are useful for a career in science, they are also critical to succeeding in business, which is why it is important for students to have mentors from a variety of positions and perspectives.

Mentors participating in SRI are UAMS faculty members spanning a variety of departments, from cancer biology and nursing to public health, pharmaceuticals and bioinformatics. Allen underscores how important it is to show SRI students the rich diversity of career opportunities in science.

“I love working in the lab. It puts a smile on my face,” he said. “But the lab isn’t for everyone. There are so many career fields in Arkansas that require a background in science, and a key aspect of SRI is to expose young people to those opportunities.”

Through SRI, Allen, whose research is recognized with numerous awards and grants, is helping to build a stronger science community in Arkansas and populating that community with Arkansans who do not always have the clearest path to a science degree or training.

“Think how difficult it is for a first-generation college student to pursue a post doctorate without resources, without mentorship,” Allen said, recalling the mentor who directed him to biology so many years ago. “There are many science careers in Arkansas. We just want to make sure that everyone has the chance to seize those opportunities.”

As the name implies, the Summer Research Institute is made available to students every summer. Online applications open in November. Each student receives a stipend, and the program starts in May and concludes in August.

Discovery Economics is a monthly feature highlighting the work of the Arkansas Research Alliance (ARA) Academy of Scholars and Fellows, a community of strategic research leaders who strive to maximize the value of discovery and progress in the state. ARA recruits, retains and focuses strategic research leaders to enhance the state’s competitiveness in the knowledge economy and the production of job-creating discoveries and innovation. Learn more at ARalliance.org.

12 ARMONEYANDPOLITICS.COM SEPTEMBER 2023 DISCOVERY ECONOMICS

Dr. Antiño Allen

Know Your Worth and Show Your Work: A

Why You Should Have Routine Business Valuations

lmost every business owner I know understands that their business is the largest asset they will ever own. Seeing as it’s often the truth, that’s good. The shocking thing, however, is that most of those same people will never have that business valuated to determine exactly what it is worth.

When you think about it, this makes no sense at all. We live in a world where we can check our retirement and investment accounts by the minute and get email updates on the value of our homes, but for some reason, we don’t think to monitor the value of an asset that can be worth much more than both of those combined.

I have performed hundreds of business valuations in my career. In my experience, almost every business owner thinks they know the value of their business, and in most cases, they are very wrong. Sometimes, they misunderstand the process of determining value. Perhaps they incorrectly assess the risks associated with their business. Either way, the end result is the same: a mistaken – and possibly dangerous – assessment of their overall financial situation.

The reality is that business valuation is a complex process because it attempts to ascribe value to an ever-changing and dynamic situation. Every business is unique and must be evaluated as such. I have seen multiple businesses whose structure, cash flow, assets and market were nearly identical, but whose values at the end of the day were very different. That is why my colleagues and I at Pinnacle Advisors go through such a rigorous analysis process in our engagements.

At this point, you might be asking yourself: How often should I have my business valuated? That too depends on your unique position. In general, you should assess the value at a regular interval as determined by the rate of growth you are experiencing. A business in a period of rapid growth might need a valuation every two or three years. By contrast, a business that has plateaued in its growth and is focused on maintaining its market position might only need to assess value every five to seven years.

In either case, this valuation process serves multiple important purposes. First, it provides feedback to the stakeholders regarding the effectiveness of the current operation. There is no stronger indicator of success than being able to show that your day-to-day decisions are having a tangible, positive impact on the value of the business.

Having a consistent rotation of “spot checks” will also help

tremendously if you find yourself in a position where you need to be absolutely sure of the value of your business. I am engaged regularly to perform valuations for civil and criminal litigation; unfortunately, that means I constantly encounter business owners who are completely in the dark about what their business is worth.

There is also the long term to consider. Every business owner dreams of the day when they have an opportunity to sell their business or pass it down to the next generation. However, studies show that 70 percent of business owners who sell their business report feeling strong regret within one year. While this is often the result of a lack of planning for the next phase of life, that seller’s remorse can also be driven by the lingering fear that you’ve made a bad deal or sold your business at a price below its actual value. If you have regularly updated valuations on the front end, you’ll be better equipped to make a deal you can be proud of – now and in the future.

Here’s the bottom line when it comes to your bottom line: Know the value of your business, and know the metrics that go into that value. Don’t let your largest asset become your largest regret.

Victor Werley CFP, ChFC, CDFA, CVA, MAFF, CFE, CEPA, is a financial consultant in Little Rock and the founder of Pinnacle Advisors. Werley has been practicing for more than 20 years and has managed hundreds of business transitions for himself and his clients. He has spoken to numerous groups in the business and legal fields about business valuation, how to structure good business deals and many other topics. He is passionate about small businesses and helping the economy of Arkansas.

SPONSORED CONTENT www.pinnacleadvisor.net | (501) 327-6277 LITTLE ROCK • CABOT

Victor Werley

14 ARMONEYANDPOLITICS.COM SEPTEMBER 2023 IT Support You Can Trust Stress-Free IT Support that takes care of your Computers and Phones 501-758-6058 5105 McClanahan Dr., Suite J-3 North Little Rock The name you can trust to build The name you can trust to build quality, Renewable energy projects. quality, Renewable energy projects. Visit: armoneyandpolitics.com/nominations NOMINATE AMP’S POWER WOMEN 2023 Arkansas Money & Politics understands and appreciates the value of having women in positions of power. Our December issue will feature profiles on the Arkansas Power Women who are leading and making significant contributions in their careers, community and society. Nominate a woman in Arkansas who deserves to be recognized for her time, efforts and character.

rkansas is a strong banking state, home to banking institutions and industry professionals whose collective mission is to strengthen their respective communities. Inside, Arkansas Money & Politics shines a spotlight on banks, bankers, credit unions and financial advisors who make The Natural State such a strong banking state.

BANKING

A

UPER SIMMONS

Born in Pine Bluff, Simmons Bank celebrates growth and looks to the future

By Dwain Hebda

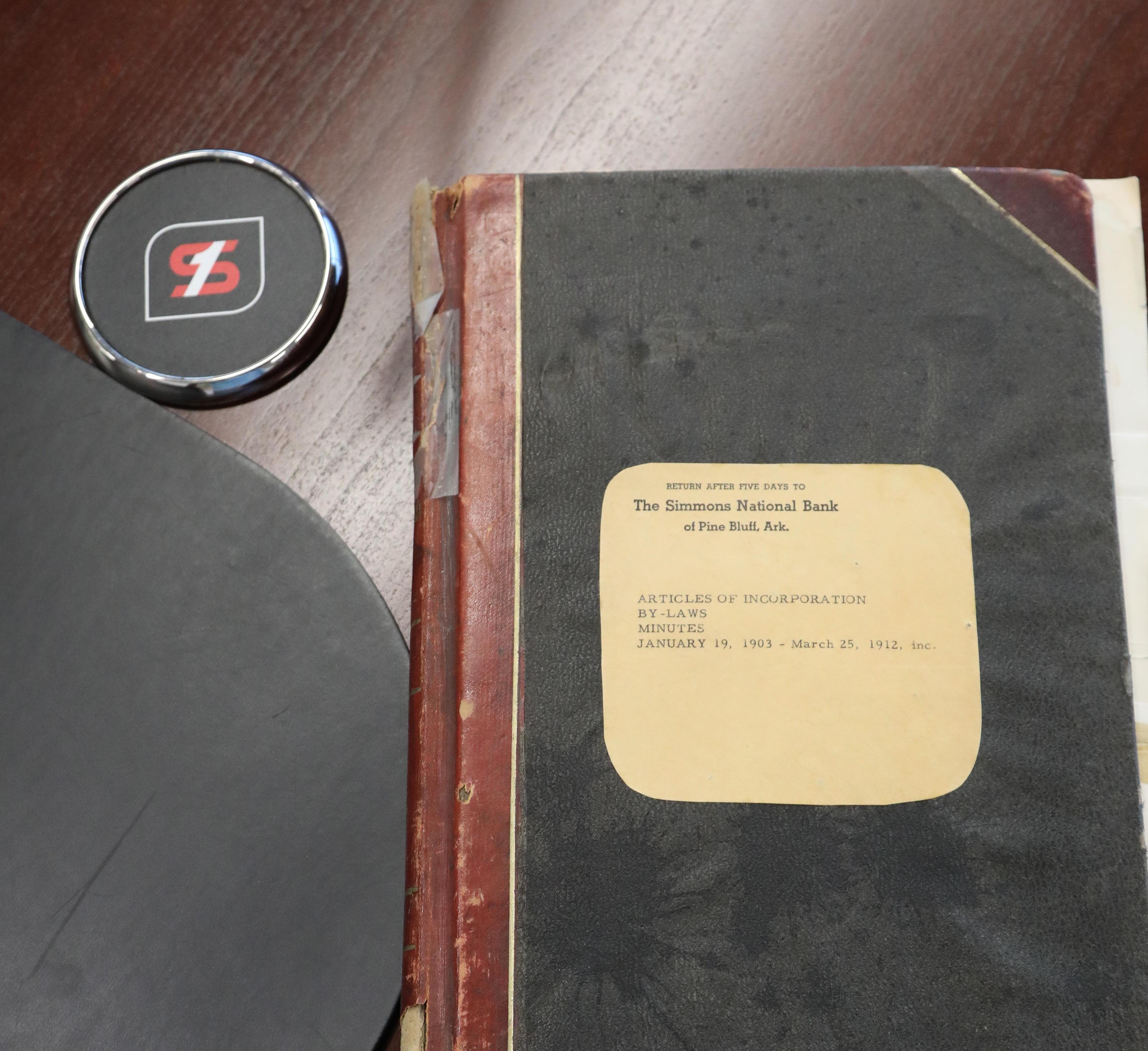

On a sun-washed day in Little Rock, George Makris is looking back through the past. Seated at a conference table in his glass-encased office overlooking downtown, the executive chairman and chairman of the board of Simmons First National Corporation examines with delight a couple of relics that have recently surfaced.

Both antiques — a pocket-sized passbook circa 1920 and a fragile hardbound notebook from 1903 containing the company’s original articles of incorporation — elicit a look of fascination bordering on delight. As testament to the story of

Simmons Bank, each tells, in its own way, of the faith and confidence behind the bank, beginning with its visionary founders, sustained by customers large and small through 120 good and lean years, and carried forward today by more than 3,200 Simmons associates.

“The customers we have depend on stability, seeing the same people,” Makris said. “To sit across the table from someone and lay your entire financial life out in front of them and say, ‘Help me achieve my goals,’ is important to them.

“As we’ve grown, we’ve had to have that balance between this is where we are today, this is our base business, how do we take care of that? Then, how do we go out and offer our products and services to new customers? We can’t choose one or the other. We’ve got to have both.”

Simmons Bank has achieved that balance exceptionally well over its century-plus history, growing into an entity the founders might scarcely have imagined. Per the company’s 2022 annual report, Simmons reached $22.2 billion in total deposits, a number that has

ARMONEYANDPOLITICS.COM SIMMONS AT 120

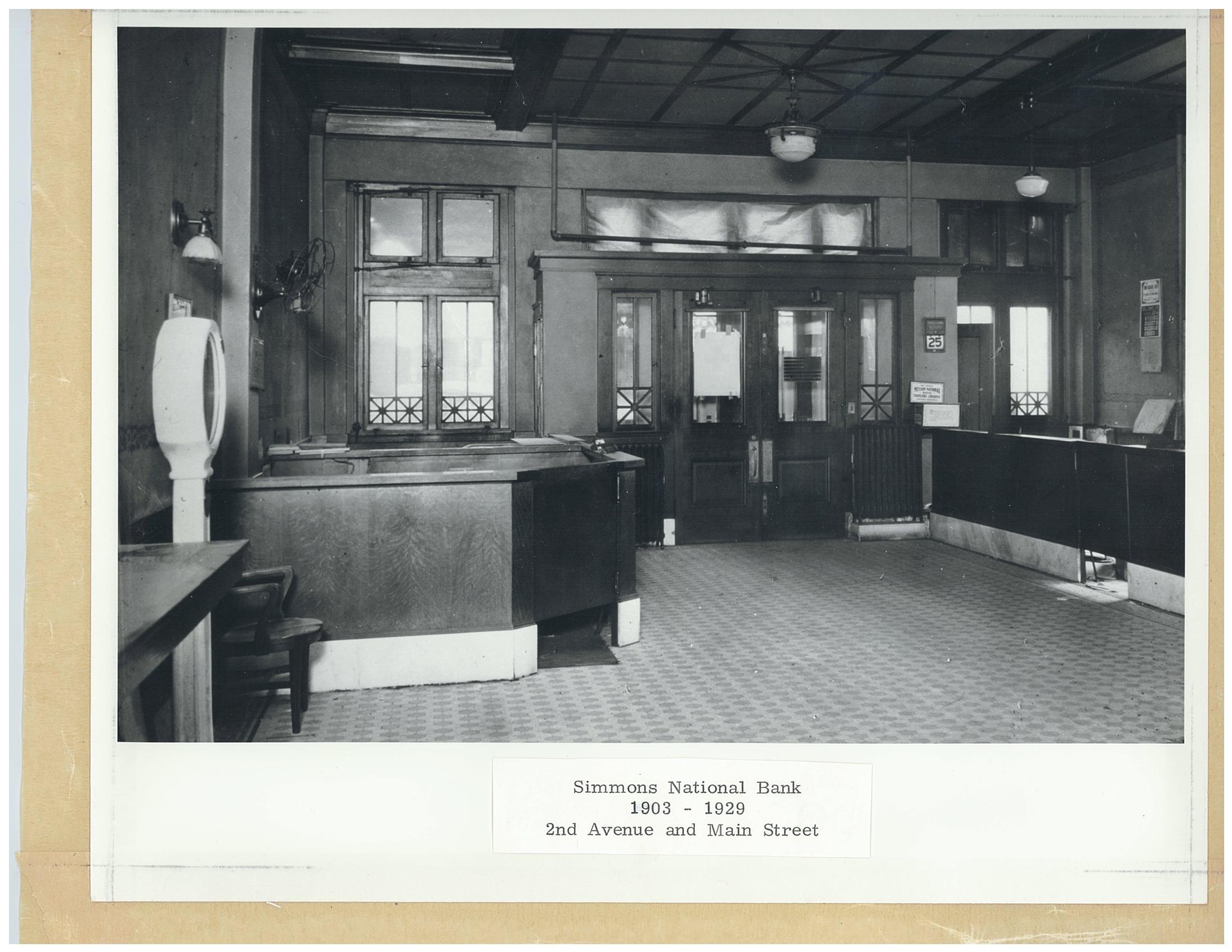

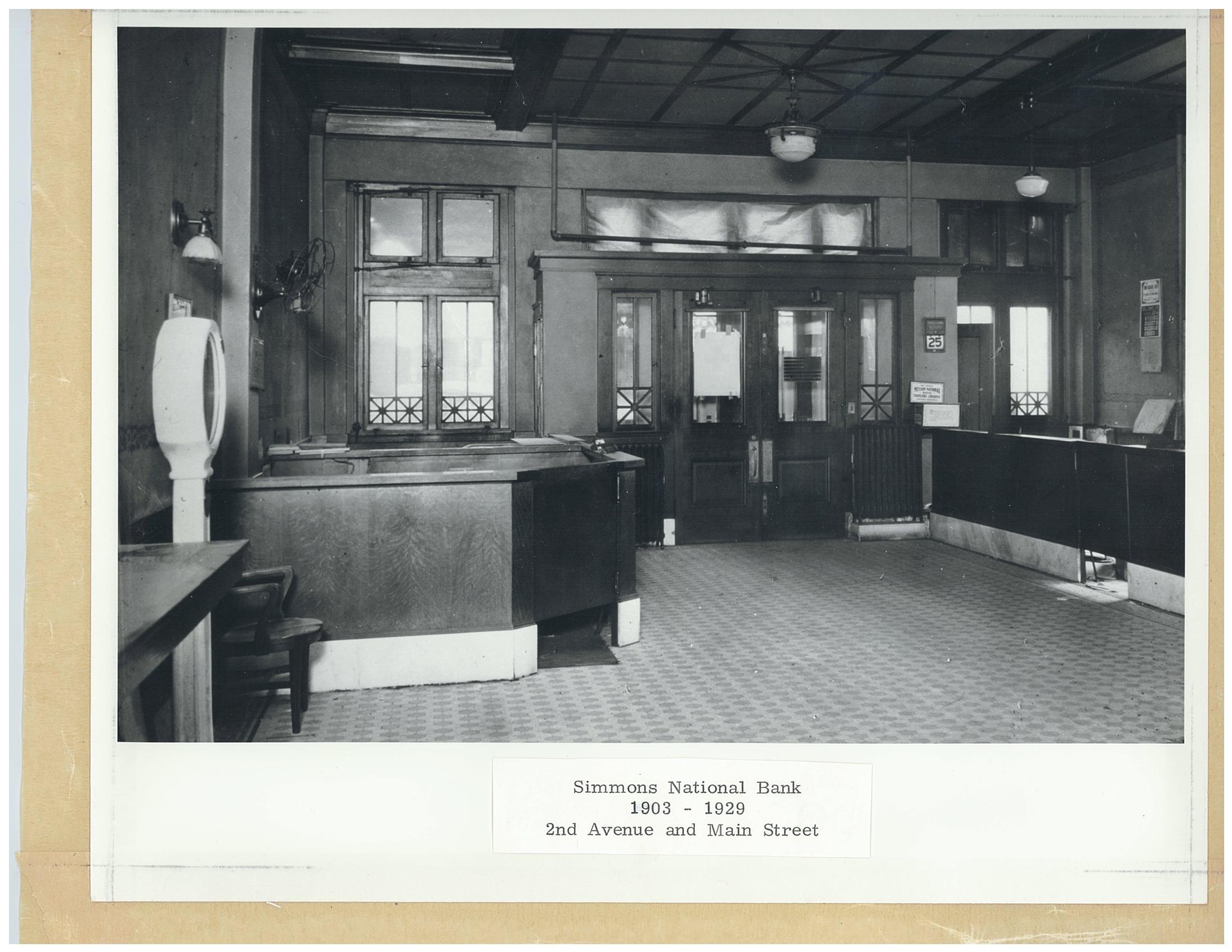

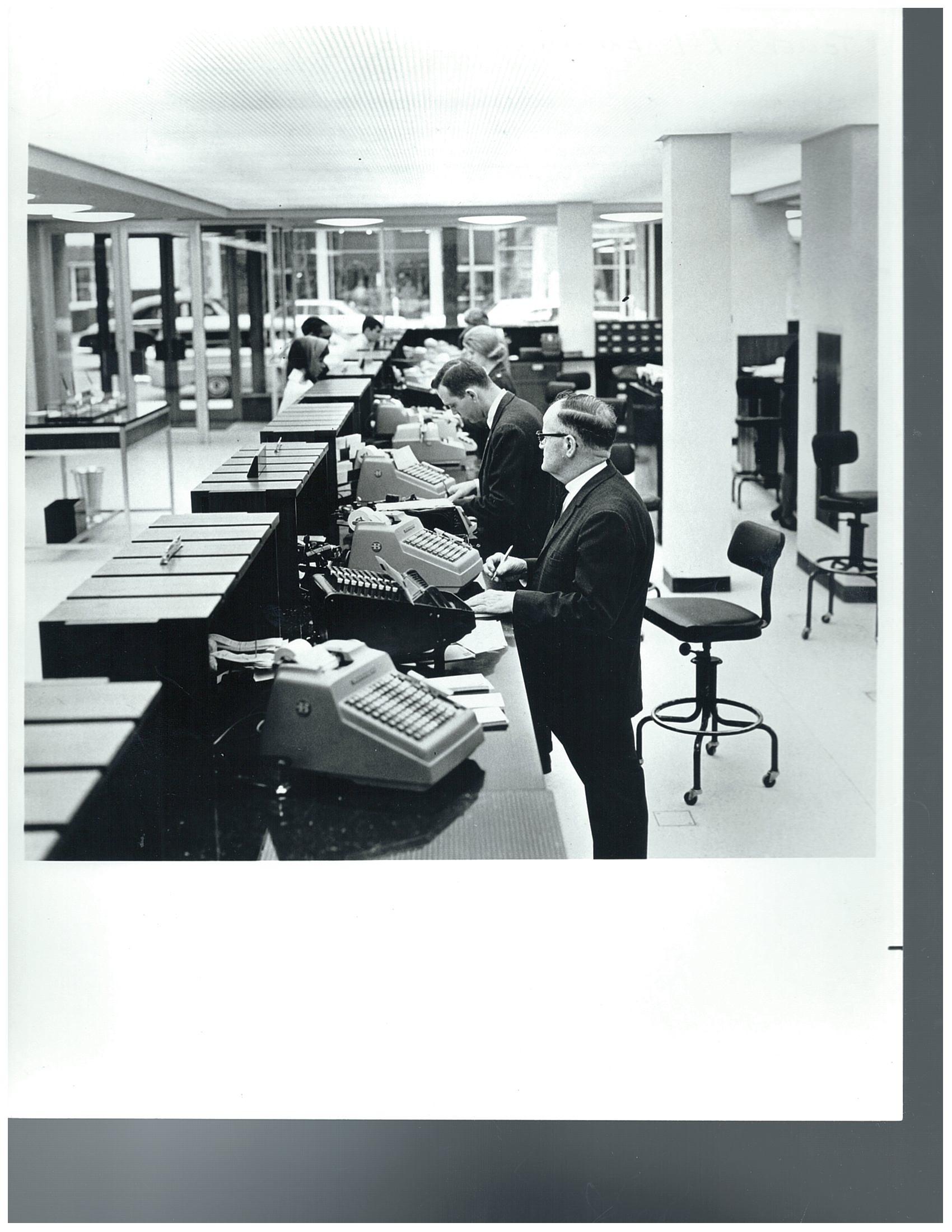

Interior shot of original Simmons Bank lobby located in the Talbot Building, Second and Main streets, Pine Bluff.

increased nearly tenfold just since 2012.

Put in historical context, the bank that showed a $3,000 profit in its first year — about $104,000 today — reported $256 million in net income, $27.5 billion in total assets, $3.3 billion in total capital and $2.7 billion in market capitalization last year. It is the growth achieved in just the past decade that is perhaps most striking: Simmons’ average increase across those four categories is a staggering 735% since 2012.

Fueling that growth has been Simmons’ aggressive merger streak, which numbers 14 acquisitions over that time. Bob Fehlman, CEO, said Simmons’ success in M&A, as with everything else, is rooted in its small bank spirit.

“One of the most important things is getting to know the people that own and run the [prospective merger] company, and that comes back to culture,” he said. “Before we talk price, before we get down into due diligence, we get to know the management team

17 ARMONEYANDPOLITICS.COM SEPTEMBER 2023

Simmons Bank leadership past and present includes (top photo, left to right) Bob Fehlman, Tommy May and George Makris. At left, Louis Ramsay Jr., the bank’s seventh president, who served from 1970 to 1983.

and some of the board members. The culture is critical.

“When we find a bank that fits in our footprint that really makes sense and that has culture that matches us, then we come in and look at whether it makes sense financially and how to pay for this and how to make it profitable. Those are things we can figure out as time goes on, but if the culture’s not there, that’s our biggest risk, I believe.”

On Monday, March 23, 1903, Simmons National Bank opened its doors for the first time at temporary quarters in the back of Cotton Belt Savings and Trust Co. in Pine Bluff. The first president, Dr. J.F. Simmons, was a longtime physician in town. He was joined by several prominent businessmen in the formation of the bank, as well as the

An accounting of the first year’s business showed $227,000 in loans, $38,000 in cash and an additional $15,000 in bonds purchased by the bank. By the end of the decade, the bank reported a $24,000 profit as

TECHNOLOGY

It had online banking and a mobile-banking platform that were extremely basic. The bank wanted to really make big changes in that.

“A lot of banks our size would’ve looked up

Madea said. “We need to have a story on how we can leverage these emerging technologies for the good of Simmons Bank. That’s the really fun part.”

18 ARMONEYANDPOLITICS.COM SEPTEMBER 2023

Alex Carriles, Executive VP/Chief Digital Officer

The “new” Simmons Bank headquarters at Fifth and Main streets in Pine Bluff, opened in 1930.

SIMMONS AT 120

Ann Madea, Executive VP/ Chief Information Officer

On January 25, 1930, the Pine Bluff Commercial printed its “Simmons Edition” commemorating the bank’s move to a grand new building at Fifth and Main streets in Pine Bluff. Described therein as a “magnificent new 11-story bank and office building,” the issue went to great lengths to extol the standing of Simmons Bank in the community and the lengths it took to erect its headquarters, announced in 1928 and completed in 1929. Among the juicy tidbits were that nearly 40 firms played a role in its construction and 3,000 gallons of paint were applied to its walls.

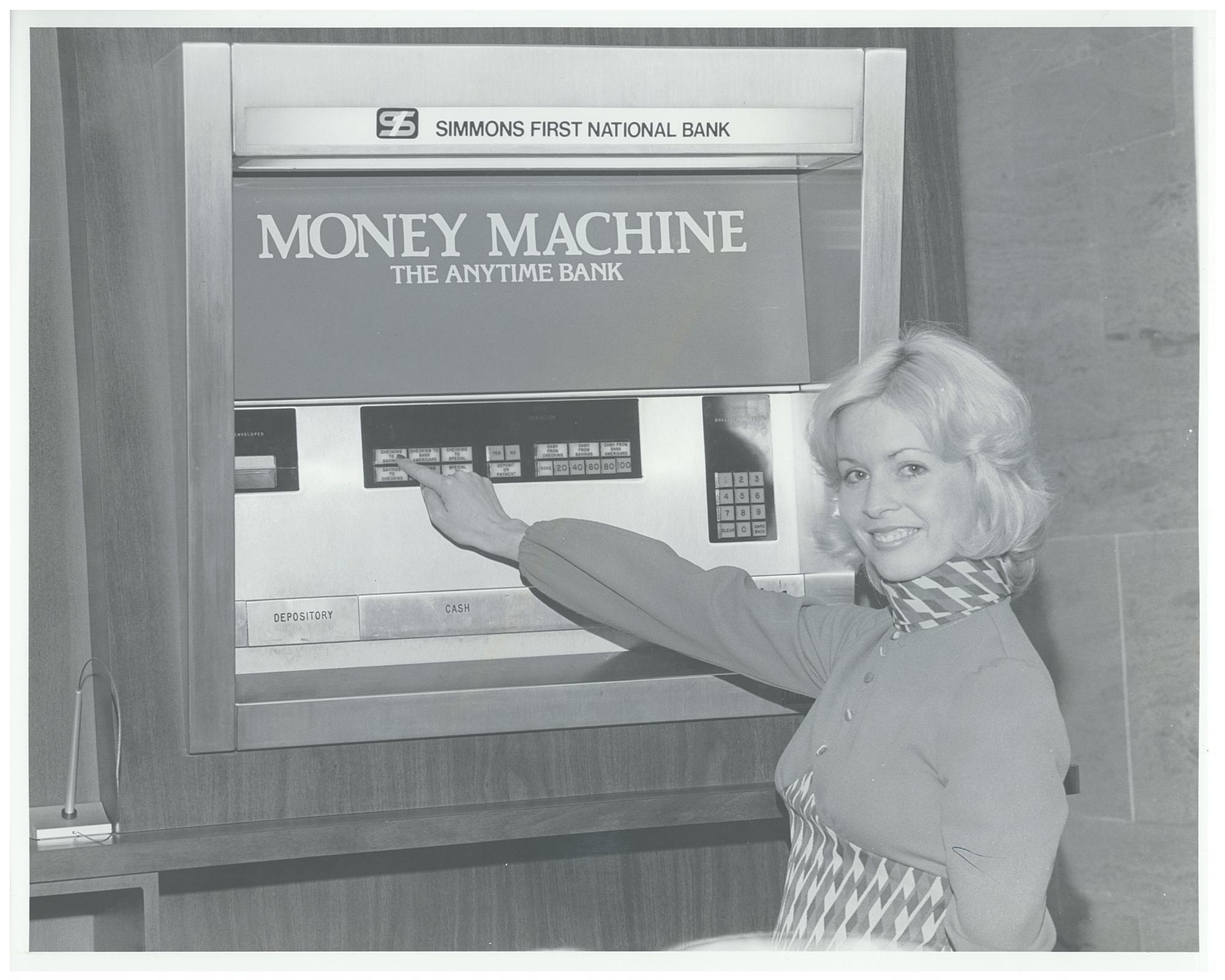

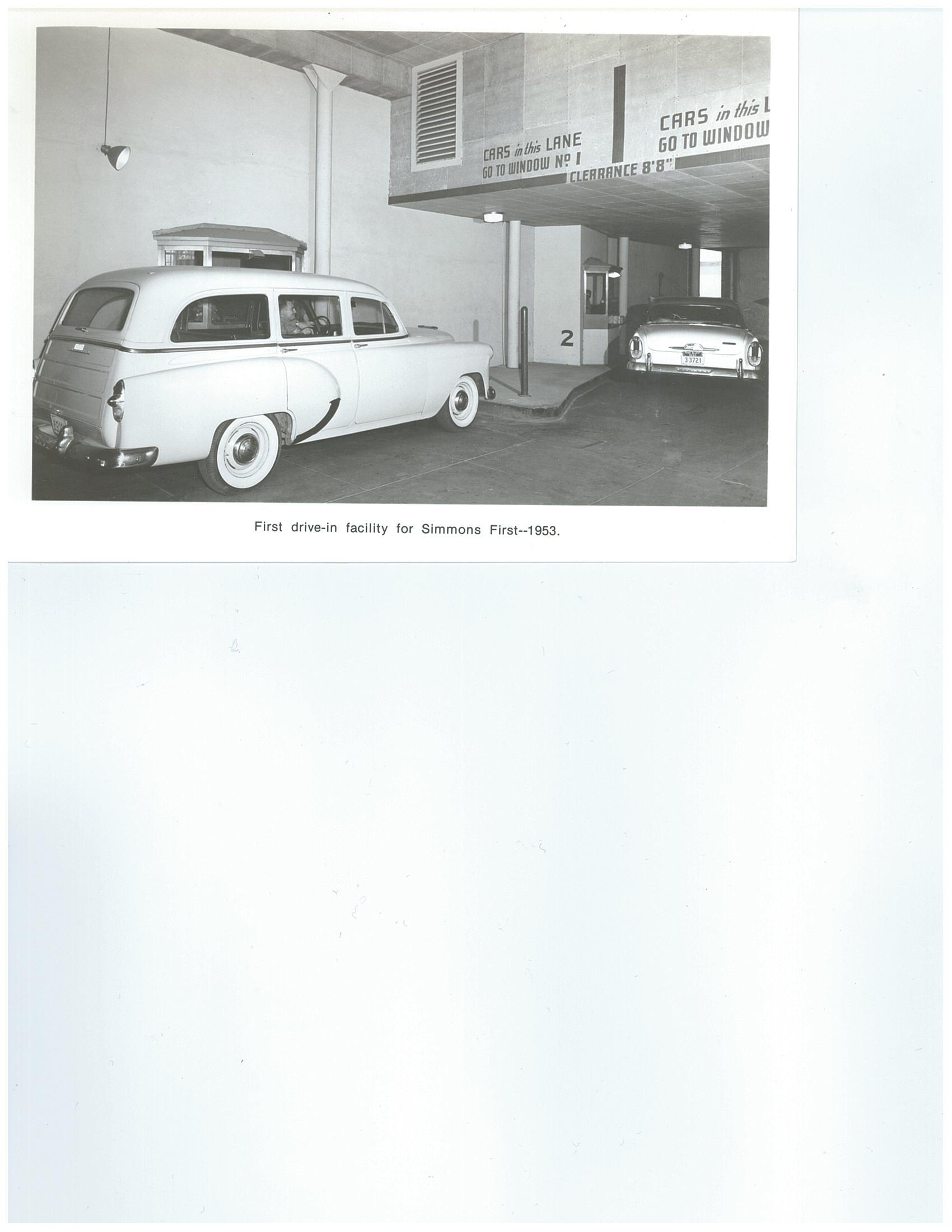

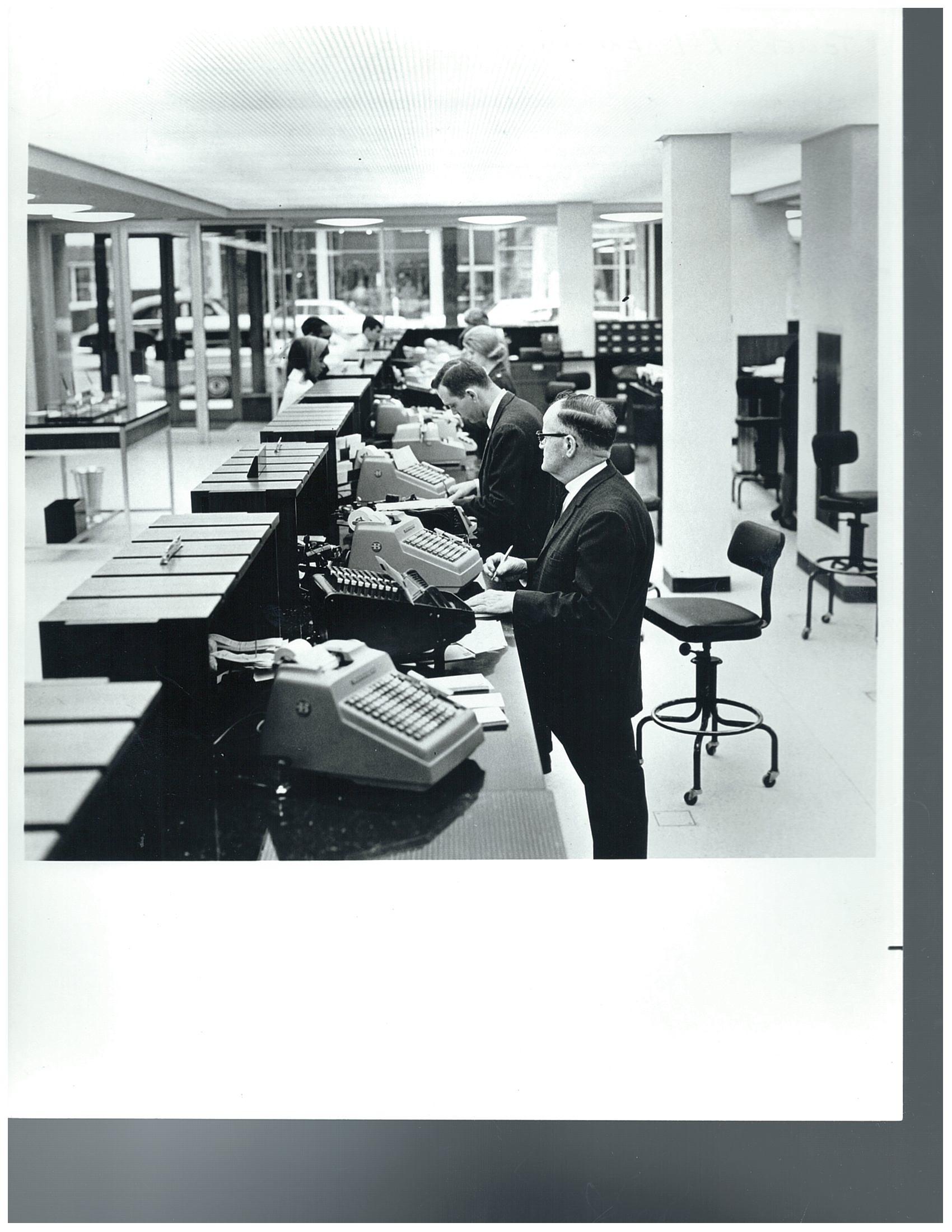

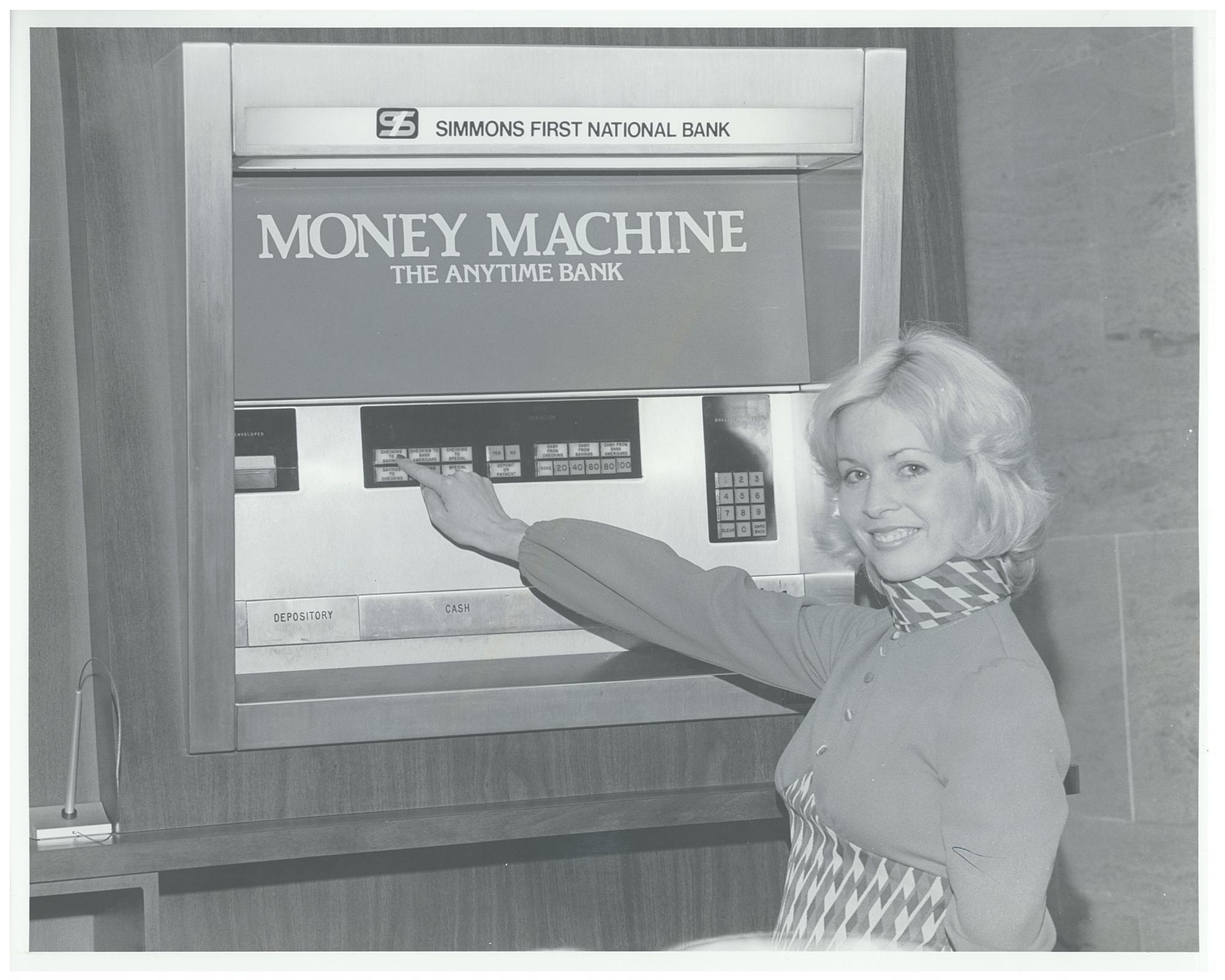

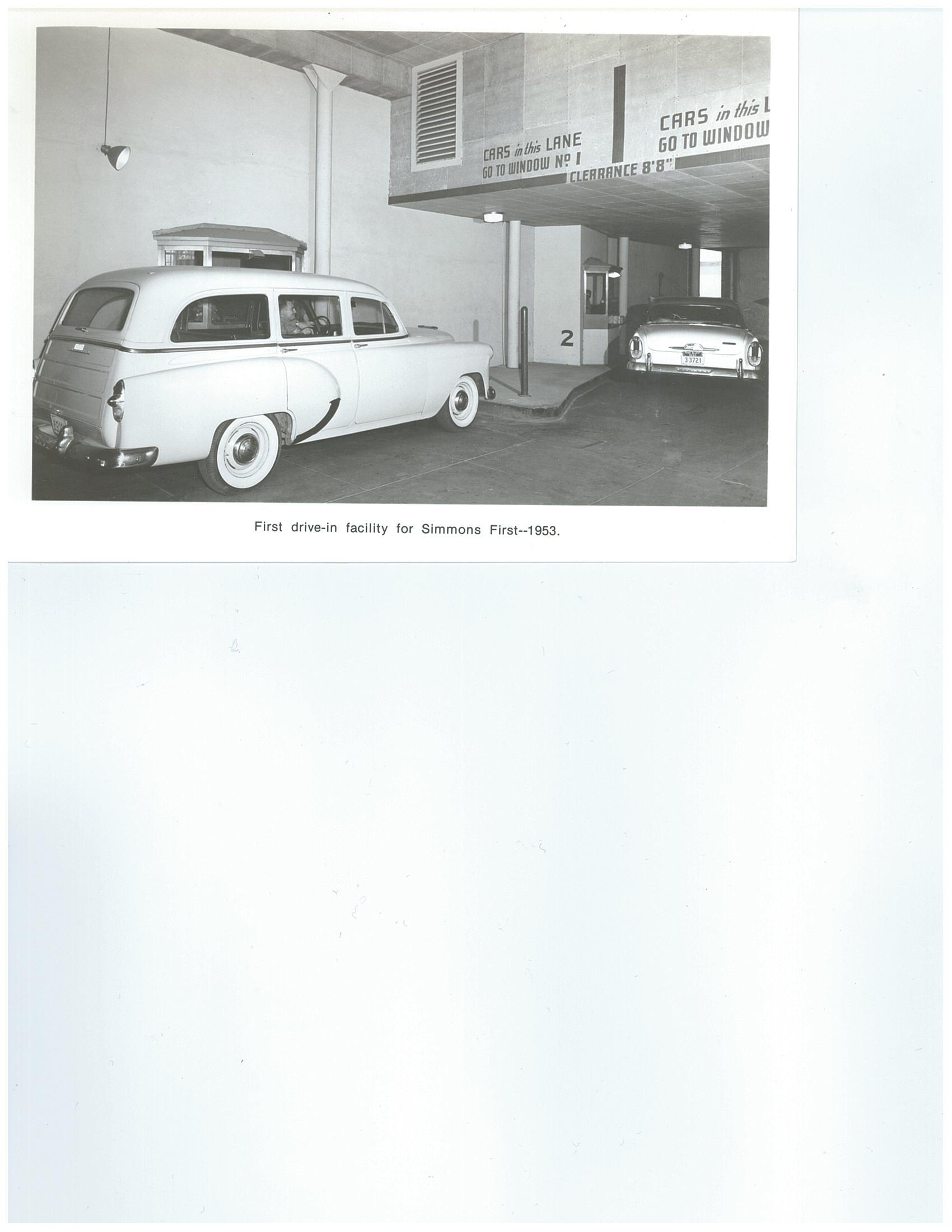

By the bank’s 50th anniversary in 1953, Simmons’ structure began to take on elements familiar to the banking industry today, including branches, acquisitions and even the company’s first drive thru. In January 1958, the first “computer” in Arkansas banking was installed, an IBM 407 Electric Accounting Machine, for handling the large number of cotton warehouse receipts handled by the institution. In 1964, thanks to the installation of a new IBM 1240, the first computer-generated and printed bank statements were mailed. The building itself got a modernization about this time, as news photos of the head-to-toe remodeled headquarters from 1971 attest.

Marketing the bank was always in high gear, but never to such lengths as in the 1970s, when it was common to award premiums, or merchandise, with the opening of new accounts. The first one Simmons rolled out, a wig promotion, was a resounding success. Reporting of the day noted women turning out in droves to open new accounts and, upon doing so, unabashedly trying on wigs right in the bank lobby. Various tableware items were next, and they were also a great success. Reproductions of famous paintings followed, as did a promotion that awarded grandfather clocks for large deposits.

By the mid 1980s, the bank had entered a difficult stretch, and the search was on for a leader to turn the institution around. They found it in Tommy

COMMUNITY BANKING/AG LENDING

Freddie Black and Chris White may have opposing surnames, but their backstories are cut from the same cloth. Both are products of smalltown Arkansas, where agricultural interests are the lifeblood of the community, and both were attracted to Simmons Bank for its support of Arkansas’ rural areas.

“We are different. We approach our business differently,” Black said. “Most banks have zero ag expertise and don’t even want to think about making an ag loan. We think we’re really good at it.”

In fact, Simmons ranks in the top 25 in the country in terms of ag loans, Black said, and there is plenty of runway for growth because the bank has entered new markets.

“There’s so much ag in Texas, and Missouri is also a huge ag state,” he said. “We’ve been welcomed in those spots because nobody else is talking to people about it.”

White said relationship-building in new areas has also been in overdrive to help customers in newly-acquired markets get acquainted with Simmons.

“We are very outbound now,” he said. “We want clients to know we’re in business with them. We’re going to be their partner, even during bad years.”

White said the bank demonstrated this commitment during the COVID-19 pandemic by processing PPP loans, an effort that often stretched staffers well past so-called “bankers hours.”

“Our bank really made a huge effort to help people in our communities,” he said. “I know I was scared to death if I didn’t stay up at night and do ten more PPP applications because somebody might not get their money. Where a lot of big banks said they didn’t have time to do them, we got a lot of new relationships out of it.”

19 ARMONEYANDPOLITICS.COM SEPTEMBER 2023

* * * * * * * *

Freddie Black, Community and Agricultural Chairman

Chris White, Executive VP/ Chief Community Banking Officer

The digital age dawned at Simmons Bank in the late 1950s and grew steadily into designated computer rooms in the 1970s (shown), personal computers in the 1980s and online, internet and mobile banking options today.

doubling your inventory. It wasn’t that we were going to save a lot, but we were wanting to send a message. A lot of what we did was sort of for show, but it worked. Even today, I have people say something to me about us tear-

RISK MANAGEMENT

Tina Groves, Executive VP/ Chief Risk Officer

For 31 years at Simmons Bank, during which time she went from staff internal auditor to her current role four years ago, Tina Groves has had a front row seat to changing times and the changing tactics of bad actors.

“My department handles financial crimes, which would include fraud and money laundering,” she said. “It also deals with regulatory consumer affairs, risk management and quantitative analytics.

“One of the biggest risks we have in the bank are third-party relationships, where even if they are the cause of a problem, we’re held accountable for it. My department handles all of that.”

Many areas of criminality are far more sophisticated than they used to be, while others, Groves said, have reverted back to more analog tactics. This keeps the department on its toes to meet whatever the bad guys can try.

“The fraud area is a really interesting example,” she said. “We had really whittled our fraud down to very, very small numbers through a good transaction monitoring system, good controls in place on the front line and great fraud detection for our debit cards and credit cards.

“Then, in 2022, they started stealing all these checks out of the mail, and fraud went through the roof. It was very low-tech fraud. That’s kind of a flip; what’s old is new again.”

At its heart, risk management has not changed that much, Groves said — just the requirements that have to be met and the tools used to do the work. She said during her three-decades-long march to becoming Simmons’ top cop, she has not only grown her technical skill set substantially, but honed her leadership and communications skills, as well.

“Simmons feels like home to me, especially that building in Pine Bluff where I started,” she said. “It would make me happy to go to work there and made Simmons feel very much like family to me.”

20 ARMONEYANDPOLITICS.COM SEPTEMBER 2023

One of the things I learned, is it’s not always what you do it’s the message you send.

SIMMONS AT 120

W.E. Ayres, (left), 9th bank president (left) and Tommy May, 10th president.

ing those notepads in half and taking the coffee cups.”

May attacked the asset mix with similar ferocity, instilling a steely con servative attitude toward lending and investments. Within a few years, Sim mons’ balance sheet gained traction enough to allow it to get into the merg ers and acquisitions fray. Beginning in 1990, when Simmons purchased a string of failed branches of First American Federal Savings, the com pany went on a steady buying spree that slowly expanded its footprint in Arkansas. The little bank from Jeffer son County was starting to think and act like a bank several times its size.

In 1992, the bank’s credit card would unexpectedly push the in stitution into the national spotlight. The Simmons Visa charged an interest rate of just 8.5%, which led to features by the Wall Street Journal, New York Times, “Nightline” and “Good Morning America” all extolling the Delta bank with the big ideas. Calls skyrocketed after the exposure; in one 17-hour period following an appearance on “Primetime” with Diane Sawyer, call volume jumped from about 24,000 to more than 400,000.

“It was unusual for a bank the size and scale of Simmons to be a credit card issuer. Certainly that would not necessarily have been expected out of a bank headquartered in Pine Bluff, Ark.,” said Marty Casteel, Simmons board member, who spent 34 years with the bank and had a ringside seat to the phenomenon.

MARKETING & CHARITABLE/COMMUNITY EVENTS

On Aug. 31, Arkansas dignitaries joined Simmons Bank executives when they announced bringing a PGA Champions Tour to Little Rock. The tournament is slated to attract thousands of spectators who will spend millions during their visit, not to mention expose many visitors to the Simmons name.

It is the latest in a long line of events created to promote the brand while helping the community, something that, on Elizabeth Machen’s watch, has been raised to an art form.

“We pride ourselves on community,” she said. “A key part of our marketing structure is to empower local leaders to be able to respond quickly to those community requests that are important. Then we bring in nice air cover with our larger sponsorships.”

In just the 10 years Machen’s been aboard, Simmons Bank’s marketing has gone from a three-person department to a well-oiled and diversified corps

of expertise. The strategy blends Simmons brand promotion via marketing with alignment of spon sored events and properties that matter most in lo cal markets such as North Little Rock’s Simmons Bank Arena and Simmons Bank Liberty Stadium in Memphis, Tenn., to name a couple.

“It is important to us that we still maintain a healthy local allocation of marketing spend,” Machen said. “We want to empower local leaders because they’re the ones approached in the local coffee shop or getting hit up at lunch. We don’t want their answer to always be, ‘Let me check with corporate.’

“We’ve also supplemented our mergers and acquisitions with good core sponsorships to show we are a legacy brand, a strong brand that has a nice community aspect to it, as well. That’s community banking; that’s being there for the community organizations that depend on you and supporting the groups that need you.”

21 ARMONEYANDPOLITICS.COM SEPTEMBER 2023

Elizabeth Machen, Executive VP/ Chief Marketing Officer

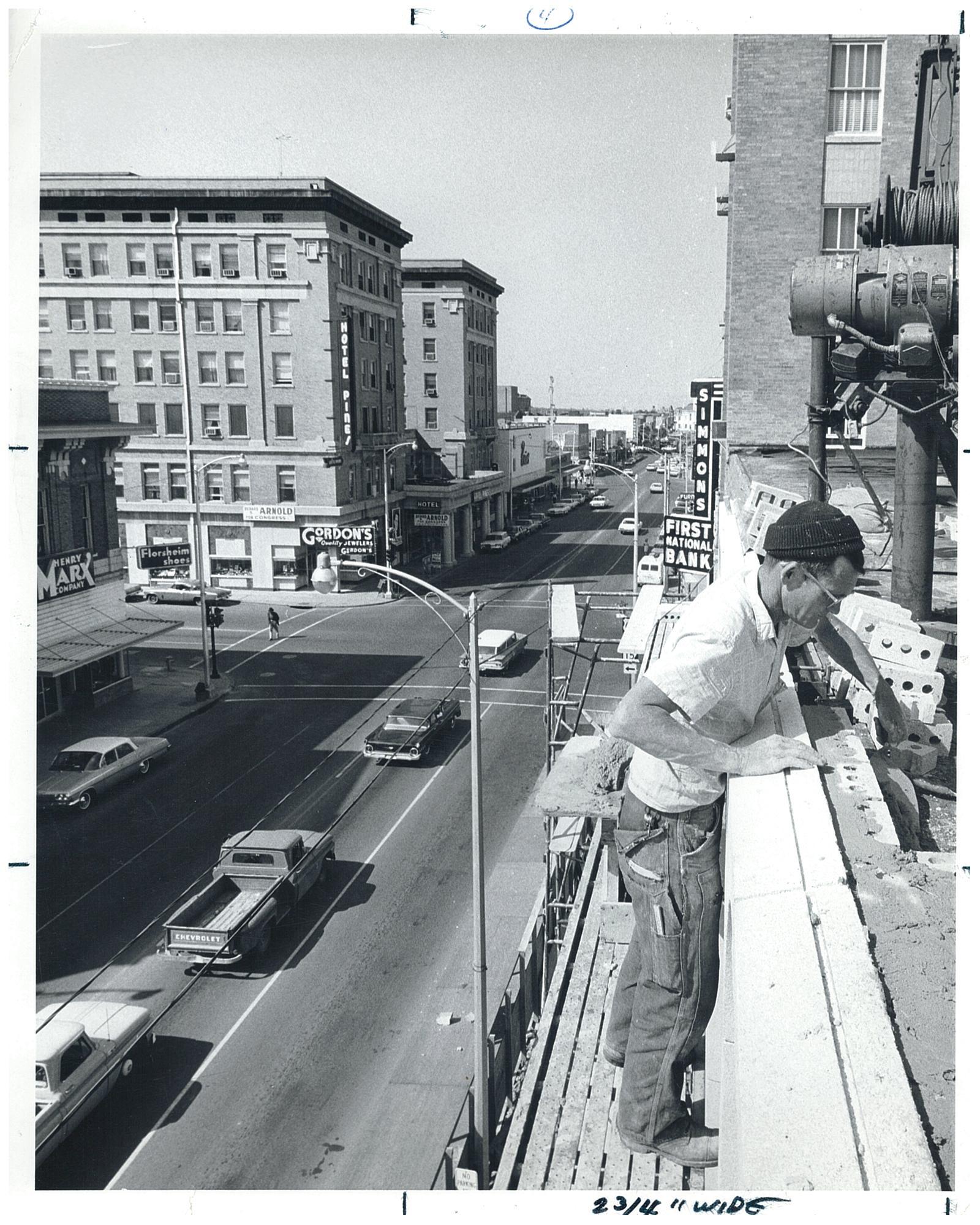

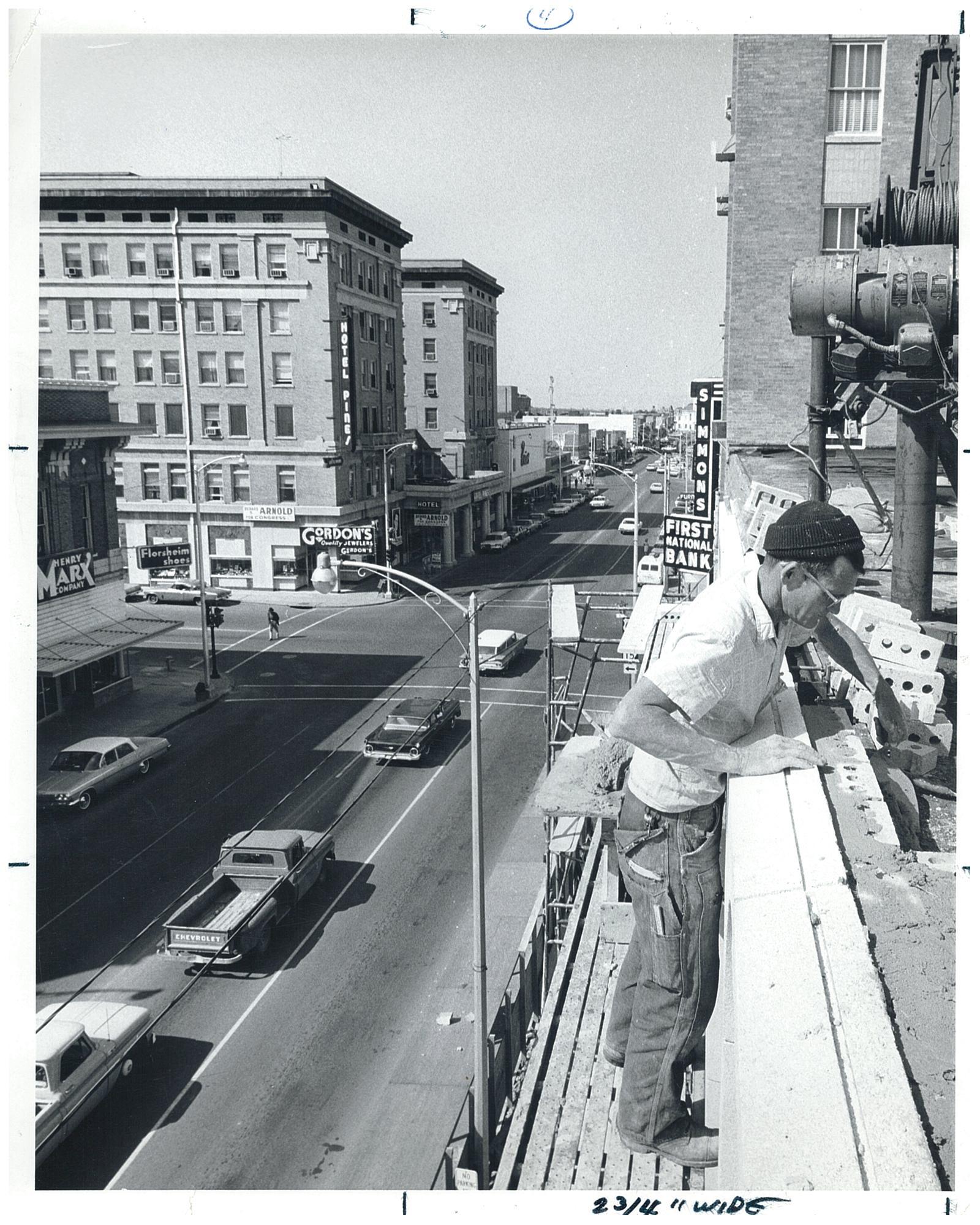

At left, Wayne Stone (right) and R.A. Martin, greet a group of youngsters. Stone served as Simmons Bank’s 6th president and Martin was vice president and secretary of the board. Below, a mason does brickwork on the bank’s headquarters building.

DATA OFFICE DIVISION

Lisa Hunter, Executive VP/ Chief Data Officer

Lisa Hunter, Executive VP/ Chief Data Officer

Technology is not only convenient; it is highly effective at gathering data. As industries continue to evolve in their understanding of this resource, technology has brought to the forefront a new category of executive tasked with strategically leveraging its data. Enter Lisa Hunter, a 27-year employee who became Simmons Bank’s first chief data officer in 2021.

“The role of the data office is to provide governance in the collection and use of our data,” Hunter said. “Once it’s clean and useful, we can ensure the decisions we’re making using that data are reliable, good and sound.”

Hunter said a number of misconceptions exist about her department’s function, and she is quick to note Simmons Bank neither sells its data nor uses it to target single account holders. Rather, data is viewed in such a way as to help decipher trends and opportunities.

“We are focusing on our core banking data more than anything,” she said. “We use it from a product and services standpoint, analyzing how our customers use our products and services, and then trying to improve upon them for the customer.”

Data can also evaluate internal processes, such as gauging traffic at a given drive thru or branch to assess if more resources are needed to cut wait times. These are also studied by Hunter’s department in the ongoing quest to boost the customer experience.

“If we know how we’re spending our time with customers, it can help us be a better advisor to them, which is really what the bank wants to be,” she said. “This is what that data allows us to do, anticipate customers’ needs, and then respond to those needs.”

22 ARMONEYANDPOLITICS.COM SEPTEMBER 2023

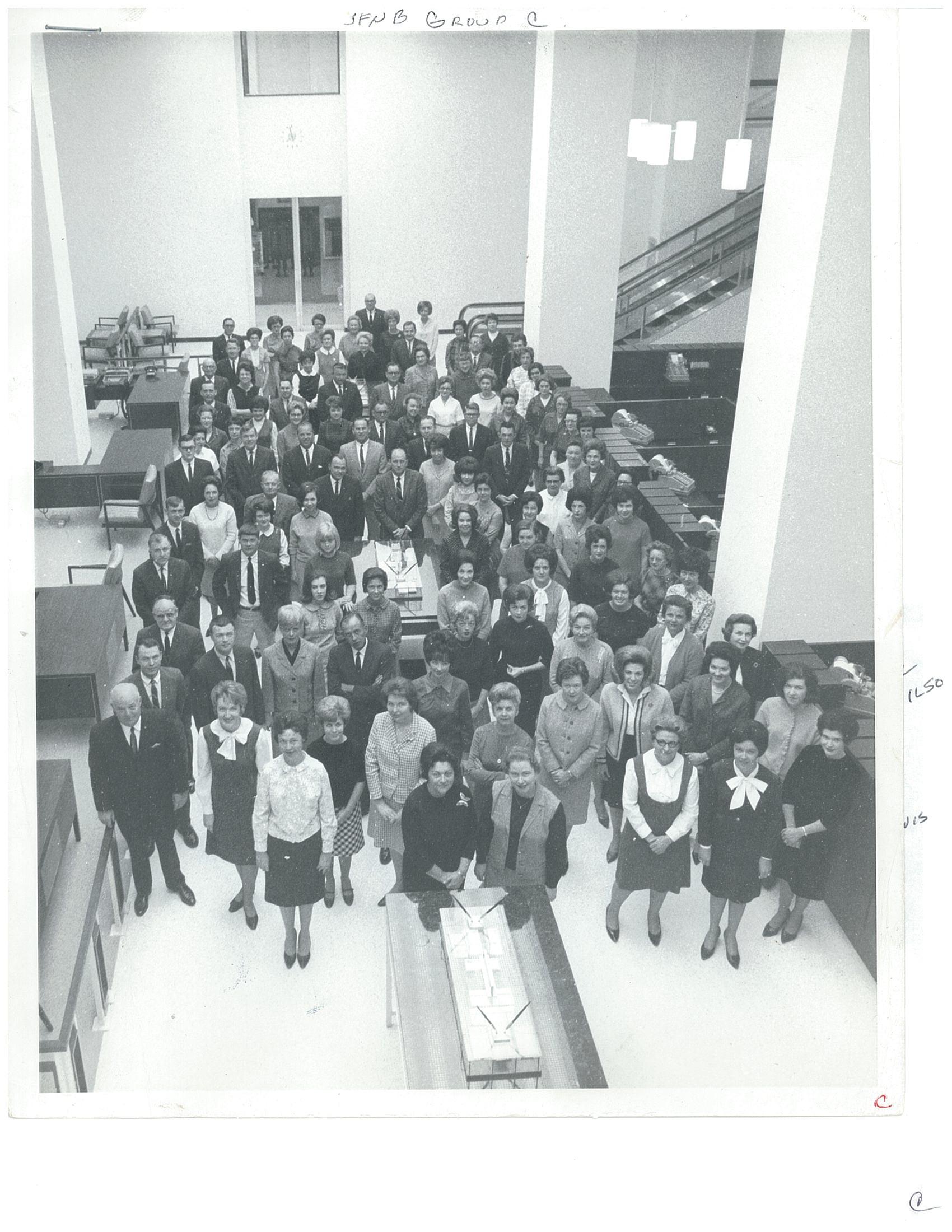

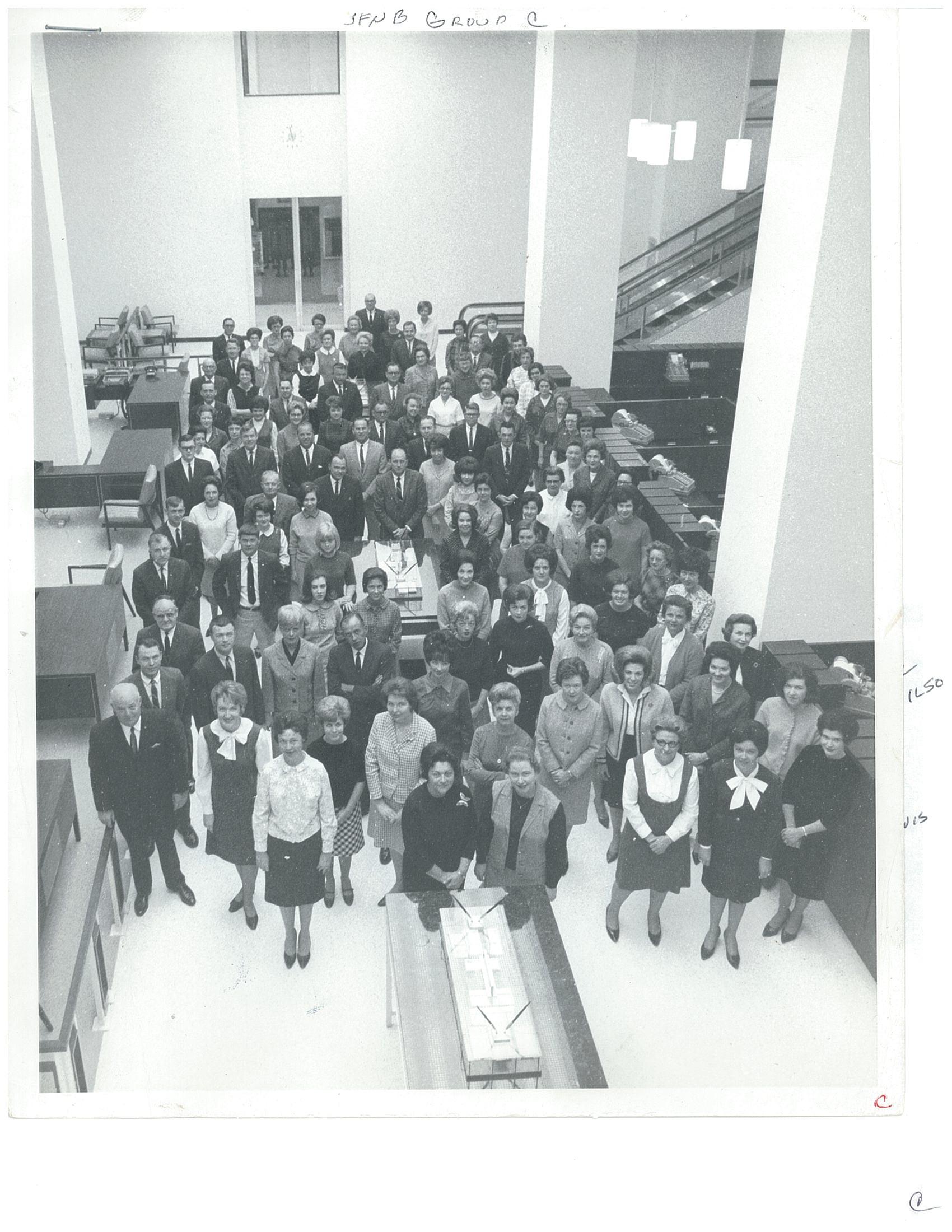

A common thread that runs through many employees’ stories is that of a culture of hiring the best people, empowering them

SIMMONS AT 120

Simmons Bank’s employees have always been at the heart of the company’s success. Here, associates gather for a group shot in the company’s remodeled headquarters.

“[Credit cards] offered a high-yielding asset. It offered an opportunity to build our loan portfolio throughout Arkansas and beyond, and it’s proven beneficial to us with goodwill and name recognition. It also says a lot about Simmons in that we did something you wouldn’t necessarily have expected us to be able to do.”

Casteel, who served as chairman and CEO of Simmons First National Bank from 2013 until 2020, said the credit card venture was representative of the executional skill the bank has always demonstrated, adhering to a simple fundamental operating philosophy. He described the underlying strategic vision as having the self-control to stick to core beliefs balanced with the boldness to act decisively when opportunities came along that fit the big picture.

“[Our philosophy] talks to the importance of having a solid bal-

ance sheet first,” he said. “That matters, as does every decision as it applies to building a strong balance sheet, which is paramount to long-term survival and the success of any organization.

“At the same time, as in the instance of offering credit card products and the other opportunities Simmons has taken advantage of on our acquisition track in recent years, I think we have proven to be conservatively aggressive. We are not afraid to be aggressive, but we’re going to be aggressive within conservative metrics that are in place and that we are going to manage and control.”

May retired in 2013 after being diagnosed with ALS, having grown the once-struggling Simmons Bank to about $4 billion in assets. Since then, he has continued to play an integral role as chairman of the Simmons First Foundation. In this way, he is creating a charitable legacy for the Simmons brand in much the same way his “Do Right” rule continues to serve as a mantra for bank employees.

23 ARMONEYANDPOLITICS.COM SEPTEMBER 2023

* * * * * * * *

Bank officials recently unearthed a ledger containing the bank’s original Articles of Incorporation and various meeting minutes. The dates on these pages are from 1910, the year the bank exceeded $1 million in resources.

REGULATORY COMPLIANCE

Before riding herd over 35 Simmons employees sifting through mountains of regulatory requirements, Sharmane Andrews was on the other side of the process as a bank examiner. Almost eight years ago, she joined Simmons Bank, an institution she reviewed and audited in her previous professional role.

“My unit deals with everything regulatory, from the Community Reinvestment Act and Fair Banking to regulatory data collection,” she said. “I have a complianceoperations team, which is the regulatory check-the-box-as-they-go-down [group]and makes sure we comply with all the regs. I also have what I call my compliance-policy group, and they are like my business-loan liaisons. They help the business loans design their procedures and their policies to meet any kind of regulatory questions.”

Under the Community Reinvestment Act, Simmons is required to invest time, resources and expertise in any part of the community

where it takes in deposits. This has led to financial literacy classes and bank accounts specifically developed for the underbanked and unbanked.

“We typically assess the needs of the community, and from that, we sometimes design products specifically for that community,” she said. “Meeting our obligations through CRA makes sure we are addressing the needs of low-to-moderate income geographies and individuals.”

Andrews’ department dovetails into a larger attitude of community service at Simmons, which has resulted in company programs and benefits that allow employees to volunteer. An active supporter of Ronald McDonald House Charities of Central Arkansas, Andrews said this perk is particularly meaningful to her.

“I just love what I do. I love community service, and I love working with the organizations that I volunteer with personally,” she said. “I also love the fact that this bank supports that.”

“I believe that every institution in the city is important, but none are more important than banking, not only for your contributions, but for being willing to invest in the community,” he said. “I brag on Simmons because our philosophy is we’re going to make a difference in the communities that we are in today.

“‘Do Right’ was sort of a thesis statement. I don’t care where an idea comes from; if it’s not the right thing, don’t do it. If you’re the CEO, you’ve got to send the message not only verbally, but in your own actions. I truly tried to do that.”

Also in 2013, longtime director George Makris succeeded May in his current role and, like his predecessor, found the bank at a crossroads of whether to advance through acquisitions or succumb to other suitors. The $53.6 million cash purchase of Arkansas-based Metropolitan Bank, which completed in November of that year, left no doubt as to what side of that decision the Pine Bluff institution had come down on.

“Scale matters in most every business, and banking is not immune to that theory. I would say though, at our size and in the markets we serve, we have all the capacity we need to be extremely successful,” Makris said. “I’m very comfortable we can accomplish what we need to at Simmons Bank at our current size. I think we’ll grow when we get back to a normal marketdriven economy at double digits a year, whether we buy banks or not. And when we do buy banks, we’re going to take that line, and it’s going to move up to a new plateau, and then we’ll start up again. We could be $50 billion in five to 10 years.”

Makris said growth is sometimes addition by subtraction, bypassing certain services today to maintain other, longer-lasting relationships that are more profitable over time. National lending, for example, provides a short-term opportunity for revenue but falls short of Simmons’ cultural yardstick for customer relationships.

“A lot of banks our size and even smaller buy participation in national shared credits,” he said. “Think about Tyson Foods. They have a credit line with I don’t know who, but let’s say JPMorgan Chase. Well, JPMorgan Chase parcels out a piece of that business to small banks. Those small banks don’t have any say-so. They just put it on the books, and when they draw on the line of credit, they make some money.

“Well, we don’t do that. We are face to face with our customers. We’re their financial advisors. We understand their business. We understand their growth plans. We have plenty of capacity for companies who want to do business that way.”

Simmons’ array of potential opportunities continues to widen as its acquisitional activity broadens its reach in out-ofstate markets. Its acquisition of Houston-based Spirit of Texas Bank, which completed last year, was a particularly good get as it brought one of Fortune’s 100 Fastest-Growing Companies into the fold, bringing in $2.7 billion in deposits and $2.3 billion in loans. It also gained 37 branch locations and strong representation in growth-rich metros Dallas, Fort Worth, Houston, San

24 ARMONEYANDPOLITICS.COM SEPTEMBER 2023

* * *

*

Sharmane Andrews, Senior VP/ Chief Compliance Officer

* *

* *

Antonio and Austin.

In one fell swoop, Simmons doubled its presence in Texas without sacrificing culture or ethos in the process, and the industry has taken note. As Fehlman observed, the highprofile deal has kept a line of potential merger partners at the company’s front door.

“What we really want is to be the acquirer of choice, and over the last 10 years, most all of the acquisitions came to us, or it was mu tual,” he said. “We’ve got, especially in our markets, a good reputation of coming in and really working with the management team and keeping their culture because it matches our own. Those are the banks we’re looking for, not somebody looking to cash out a deal.

“I think going forward, we’re going to be more opportunistic. Troubled banks mean having to clean things up, so it would have to be of significant financial benefit for us to take over a troubled bank. We would rather take over a healthy, strong bank, and I think there’s going to be pent-up demand as soon as we get on the other side of this economy.”

A common thread that runs through the Simmons story is its penchant for hiring the best people, empowering them to do their jobs today and preparing them for the challenges of tomorrow. There are many backstories to be found among employees, and not all of them trend along the lines one might expect. Pat Anderson, who has worked there 44 years, is a prime example of the company’s long-held attitude of hiring talent in whatever field it can find it.

“When I went to work here, I had never taken a finance class or banking class,” he said. “We had a government-guaranteed lending program, and that was where I started. Got some commercial back ground training, did some single-family residential lending for a while. Then I went into commercial loans, and I ended up over our commercial loan department.”

Anderson ascended to the level of regional chairman and commu nity president for various markets before attempting to retire a few years ago. Company leadership would not allow it, making him Sim mons’ first athletic director in charge of its suite at Baum Stadium in Fayetteville. There, he puts his considerable personality to use host ing bank guests at Razorback baseball games.

“It’s been a wonderful place to work because of the culture,” he said. “The people I worked for coming up gave me the freedom to try things, to make mistakes and learn from my mistakes. Just the fact that I was given some leeway to do my job with guidance as I needed it made a huge difference in my life. I still keep in great communication with my mentors, and they still help me. I’ve been really blessed.”

25 ARMONEYANDPOLITICS.COM SEPTEMBER 2023

*

* * * * * * *

we understand their growth plans and we have plenty of capacity for companies we do business with.

Drive-thrus were another banking innovation. Simmons Bank’s first one opened in 1953 (top) and soon became a standard feature at branch locations.

Amna Osmankovic, financial analyst, and Nedima Kamberovic, commercial portfolio manager, have a lot in common. Both were volleyball prodigies in their native Bosnia and Herzegovina, where they played against one another, and both earned scholarships to play for the University of Arkansas at Little Rock. There, they both learned of Simmons Bank’s reputation as a good place to work, and today, they are starting their careers as Simmons employees.

“I had no idea where I was going to be, and I didn’t see myself being in banking,” said Kamberovic, “but this opportunity widened my horizons and made me realize there is more to banking than taking deposits and giving out money. This opportunity is helping me understand where I want to be.”

Osmankovic got her first glimpse of Simmons from the inside through a

HUMAN RESOURCES

special internship program Simmons has for female athletes in the 10 schools in markets where it maintains a sponsor agreement. Tim McKenna said the threeyear-old program has resulted in numerous interns and several hires.

“We set a goal to try to have at least one hire out of each university,” he said. “We had offers to athletes from every one of the 10 schools. We’ve had hires, at least one, in eight out of the 10. We have several universities where we’ve had multiple hires, such as UA Little Rock.”

McKenna said the drive to encourage participation in the program stems from the positive qualities athletes tend to bring to the workplace.

Tim McKenna, Senior VP/Talent Acquisition & Human Resources Operations

“Some of the top characteristics we look for in a good hire are things that definitely stand out with athletes,” he said. “Time management is pretty important, being able to juggle many things happening at one time. We see scholarship athletes as used to having to manage tough class loads, multiple workouts a day and interning on top of that. The ability to deal with adversity is another definite plus. Both Nedima and Amna had to deal with some tough injuries and bounce back, and that translates well to the business world.”

Osmankovic praised the internship program for getting her career on track by giving her a chance to utilize the intangible skills she developed on the volleyball court.

“Being an athlete really takes a lot of your time in college,” she said. “A lot of companies don’t like to hire for just the technical skills that you have. Being a good employee is much more than having those technical skills because most of them can be taught on the job. The important thing is the soft skills that you gain that not all people have. I think that’s a big part of life.”

26 ARMONEYANDPOLITICS.COM SEPTEMBER 2023

Simmons Bank associates and former collegiate athletes Nedima Kamberovic (left) and Amna Osmankovic.

The same mentality that brought Anderson into the fold in 1976 is still there today. Kaylei Gober originally came aboard as an intern with a program the company has for female collegiate athletes. After earning her degree in marketing and management from the Univer sity of Central Arkansas, where she ran track, she came to work there full time in 2022.

“I did have a plan in college, and it was not banking,” the Prescott native said. “Once I found out more about Simmons and I was in formed about all the different opportunities, it completely changed my mind.”

Now part of the banker foundation program, Gober rotates through different departments to figure out which provides the best career fit. She has also been assigned a mentor and has access to an executive sponsor with whom she meets regularly to talk about career mapping and gain advice on professional development.

“Simmons has so much to offer, and there are so many people wanting to help,” she said. “I love how ea ger they are to help me succeed. I’ve come to learn that banking isn’t just about loans and deposits; there’s so much more oppor tunity. I know I have a lot of room to grow.”

Sandwiched between the old guard represented by Ander son and the fresh faces of Gober’s generation are thousands of Simmons employees who perform the day-to-day work in the trenches to advance the bank’s reputation and bolster its legacy. Those people include Roshelle Brown, assistant vice president/ branch manager, who has worked there for 23 years and whose voice still rings with pride when talking to her customers.

“The first thing I have to brag about is Simmons has been Simmons Bank since 1903 and has never changed hands,” she said. “We’ve never gone under. There’s never been a negative report about Sim mons Bank. Simmons is a very strong bank that cares deeply for the customer base.”

Brown said she has seen a lot come and go, but she still sees her role as a leader as fundamentally unchanged. That is, take ownership of the cus tomer’s needs with a helpful, servant-like attitude and an entrepreneurial mindset while teaching others to do the same.

“What I tell people all the time is, the main thing that you’re gonna get when you come to Sim mons, the thing that sets us apart from everybody else, is me as your personal banker,” she said. “I stand behind what I do, and I have customers who have been my customers for 20-something years as a result. It doesn’t get any better than that.”

Technology, branch ing amenities have all changed through the years, but not Simmons Bank’s drive for growth and commitment to the

ARMONEYANDPOLITICS.COM

CUSTOM BUILT WEBSITES We can give you a MILLION DOLLAR LOOK without breaking the bank. 3948 Central Avenue | Suite D | Hot Springs (Dogwood Landing Shopping Center next to Starbucks) 501.282.3927

Trusted by five generations. And counting. For 120 ye ars, we ’ ve wor ked ha rd to ma ke ou r c u s tom e rs’ fi n a n cial goals be c o m e re alit y, wh e t h e r t hose goals look li ke b uying a ho m e , s t a r t i n g a busin e ss , se n din g a chil d to c olleg e – or simply h av i n g g rea ter c onfid e n c e w he n it c o m es to m anagi n g yo u r mon ey. Stop by a branch to talk with an advisor. simmonsbank.com/locations Subject to credit approval. Simmons Bank NMLS #484633.

FARMING FOR

Dillon Butler produces nearly 15 million pounds of chicken a year at his family poultry farm in Northwest Arkansas.

A fourth-generation farmer, Butler has seen his operation grow over the years, going from a few chicken houses when his great-grandfather ran the business to 109 houses on 16 farms spread across a 40-mile radius in Siloam Springs.

They used to raise 26,000 chickens per house but have expanded the sizes of the houses to hold between 45,000 and 50,000 in each chicken house.

He has to expand, Butler said, in order to make a living.

Higher interest rates on loans, rising equipment and maintenance costs, and increased utility bills have all put a crimp in the farming economy. As a result, new small startup farms are dwindling in the state and being replaced by multiple-family-owned businesses or corporate farms.

According to the Arkansas Department of Agricul- By

Kenneth Heard

30 ARMONEYANDPOLITICS.COM SEPTEMBER 2023 BANKING

More than ever, bigger operations necessary to succeed

Generational farms like those found in the

ture, farmland has increased across the state, but the number of farms has decreased over the past 10 years, indicative of the trend of larger farming operations.

In 2011, there were 46,000 farms in Arkansas farming on 13.7 million acres. Ten years later, the numbers show 42,000 farms toiling on 14 million acres.

“It’s more difficult now than it ever was,” Butler said. “It’s getting so tight. It used to be you could work at a chicken house and work another job in town. Now we’re seeing more and more fulltime operators. You have to do that to make a living.

“You’re starting to see the ‘mom and pop’ grocery stores fading out,” he said. “The same is happening with the smaller familyowned farms. They’re getting larger.”

Butler said while some farmers he knows have considered selling their farms and getting out of the business, he will not. His great-grandfather began his poultry farm in 1958 with two chicken houses.

“I’ve been in it since I was born,” Butler, 31, said. “There’s an opportunity here, but you’ve got to work it.

“We’re not getting out of it,” he said. “It can be debt-heavy, and farmers can owe banks a lot of money, but this is what we’ve wanted to do.”

Jim Whitaker, co-owner with his brother Sam Whitaker of a fifth-generation rice, soybean and corn farm in

McGehee, said farming has to be run more like a business now than ever.

“It’s not just a lifestyle,” he said.

In the 1980s, people could begin with a loan of about $100,000 to purchase land and the needed equipment to start farming.

“That same amount now wouldn’t buy one tractor,” Whitaker said. “There are so many costs that have gone higher. Seed, fertilizer, equipment. We all feel it. The cost of living is going up, but the margin of profit isn’t.”

31 ARMONEYANDPOLITICS.COM SEPTEMBER 2023

Arkansas Delta are becoming more scarce.

“YOU’RE STARTING TO SEE THE ‘MOM AND POP’ GROCERY STORES FADING OUT. THE SAME IS HAPPENING WITH THE SMALLER FAMILY-OWNED FARMS.”

Dillon Butler

National figures also reflect the change in farming. In 1935, there were 6.8 million farms in the U.S. In 2021, the latest U.S. Department of Agriculture figures available, there were 2.01 million farms. However, the average size of farms is now 445 acres, up from 440 in 1970.

“We’ve been seeing this for a long time,” said Ray McCartney, a commercial lender with Centennial Bank in Fayetteville. “Most prices have not gone up much in 50 years, but expenses have.

“Starting up in farming is really difficult,” he said. “Fifty years ago, banks did a lot of agricultural lending. Now, we see fewer people dedicated to agri lending. Fewer banks do that.”

Interest rates range between 7 percent to 10 percent on farm loans, he said, with land being the biggest expense. In previous years, the rates were between 3.5 percent to 4 percent.

According to a University of Arkansas Division of Agriculture study, mid-sized family farms with annual sales between $350,000 and $1 million had the largest share of Farm Service Agency funds going out to beginning farmers.

Butler said it could cost a poultry producer between $1 million and $5 million to get started, based on the size and number of chicken houses needed. Houses generally are 60 feet wide by 300 feet long.

Still, McCartney said, farmers are continuing to go out of business. Years ago, he said, there were almost 300 cattle farms in the four Northwest Arkansas counties he worked in. Now, he added, there are only a “handful” remaining.

“The only way to make it is to get bigger to make more sales,” McCartney said.

Gar Lile, a land broker with Lile Real Estate in Little Rock, said farmers feel the need to buy more land in hopes of getting better yields and making more revenue to pay farm loans.

“When I was a kid, you could farm on 500 to 700 acres successfully,” Lile, 61, said. “Now, farmers feel pressure to get 3,000 to 5,000 acres.

“The lion’s share is still a way of life, but that way of life is only doable if they can carry that level of debt over every year.”

The best way to get into farming is through the multi-generational farms in which owners inherit the land from their relatives, he said.

Butler said when he was in high school, he would put a 40hour work week at the farm.

“When you got home from school, working on the farm was like a break from homework,” he said, “but that was the way it was when I was growing up.”

That kind of on-the-job experience suits farmers better than those who earn agricultural degrees and start up farming.

“Now you have to know where every dollar is going,” he said. “Sometimes, you have to prioritize your needs in order of importance. Upgrades to our house or the roads may have to be secondary. You have to be careful.”

Utility expenses used to take up about 30 percent of a farm’s profits, Butler said. Now it is more like 40 percent to 50 percent.

32 ARMONEYANDPOLITICS.COM SEPTEMBER 2023

“FARMING HAS BEEN A WAY OF LIFE, NOT A JOB.”

Parts and maintenance costs have also increased. Butler said it recently cost $2 to buy an o-ring for his water pumps. Now, those same rings cost $8 each.

Other, unpredictable factors also play havoc with farmers. The market prices fluctuate or the government may place tariffs or embargoes on some products, limiting what farmers can make from their crops.

And there’s weather. Arkansas has seen severe droughts over the past decade, along with heavy, crop-flooding rains.

In 2018, a tornado ripped through one of Butler’s farms, destroying five of his six chicken houses.

“You can’t be a farmer without having faith,” he said. “If the Lord wants you to do something, he’ll find a way for you to do it.”

Lile sees a silver lining. He said the federal government is supportive of farmers and has helped farmers through hard times with crop subsidies and some lower-interest loans as incentives to remain in the business.

“Farming still has a good connotation,” he said. “I’d rather be introduced as a farmer than a real estate broker. There’s so much pride in being a farmer.”

There are solid loans available, McCartney said, provided farmers can maintain some level of profitability. Farming apprenticeships are available to help give beginning farmers that needed on-the-job experience.

“The only way to do it is to get bigger to make more sales,” he said. “I don’t see farms getting any smaller.

UNPREDICTABLE FACTORS ALSO PLAY HAVOC WITH FARMERS. THE MARKET PRICES FLUCTUATE, OR THE GOVERNMENT MAY PLACE TARIFFS OR EMBARGOES ON SOME PRODUCTS, LIMITING WHAT FARMERS CAN MAKE FROM THEIR CROPS. AND THERE’S WEATHER.

“It’s a shame,” McCartney added. “All a guy wants to do his whole life is to farm. His life is his farm. If there’s no one to help and provide land, like family members, it will be tough to start. Farming has been a way of life, not a job.”

33 ARMONEYANDPOLITICS.COM SEPTEMBER 2023

From 1935 to 2021, the number of U.S. farms decreased from 6.8 million to 2.01 million, and the costs to run them — to maintain hay balers or irrigate rice fields — have risen dramatically.

At First Security, we’ve been investing in our home state since 1932, growing deep roots and even deeper relationships. So we are especially proud to have members of our team recognized for the outstanding work they do in our communities. Congratulations, Andrea and Michelle, on your dedication to helping Arkansans bank better!

Bank

recognizes Robyn Staggs, Global Commercial Banking Senior Relationship Manager, for being honored by Arkansas Money & Politics among their annual Women in Banking cohort.

At Bank of America, our purpose is simple – to help make financial lives better, it’s who we are and what we do. It’s what Robyn does every day as she extends her abilities and resources within our local community.

We’re proud to call Robyn our teammate and celebrate her well-deserved recognition as a one of Arkansas Money & Politics 2023 Women in Banking honorees.

34 ARMONEYANDPOLITICS.COM SEPTEMBER 2023

Member FDIC

Michelle Phillips Commercial Loan Officer NMLS 2486921 Conway

Congratulations

Andrea Lewis Assistant Vice President Community Reinvestment Act Officer Business Development Little Rock

Visit us at bankofamerica.com/about. ©2023 Bank of America Corporation | MAP522931 | ENT-217-AD

of America

Arkansas Banks support Arkansas Communities

Banks across Arkansas touch every community in a variety of ways.

Banks are economic drivers with 80,805 employees and $8.5B in total compensation and benefits, in fields ranging from finance to customer service to information technology. There are 113 banks operating in Arkansas with over 1,299 branches.

Financial expertise from Arkansas’ community bankers helps the smallest businesses and the largest corporations. Banks made $6.6B/447.4K in small business loans and $546.9M/11,960 in small farm loans last year.

And when we give back to the communities we serve, we really give back. In 2022, our bank employees contributed over 132,400 volunteer hours to local projects and banks made $47.1M in community donations.

Congratulations! Scan or visit hopecu.org/makeithappen to open your account today.

35 ARMONEYANDPOLITICS.COM SEPTEMBER 2023

The ABA is proud to do its part to make Arkansas communities strong. www.arkbankers.org Federally Insured by NCUA Equal Housing Lender NMLS #653874 All Loans Subject to Approval Insured All Loans Subject to Approval Housing

Industry sees focus on Banking 2023

community, tech, women execs

By Mark Carter

Banking has enjoyed quite an evolution over the millennia. From barterers, money changers and Knights Templar to marble floors, smartphone apps and, for you Harry Potter nerds, security dragons.

While no one foresees the massive stone columns and marble floors of old making a comeback, much less the giant steel vault doors behind which sat bundles of cash, the immediate post-COVID era has hastened a return to banking in person, and at least in states like Arkansas, a return to true community banking.