EHS Restoration prides itself on being Arizona’s leading water damage, fire damage, natural disaster clean-up and mold remediation firm. Founded in 2008, it also embraces a dedicated philanthropic mission as a supportive member of the community. Some of EHS Restoration’s philanthropic initiatives:

• Feed My Starving Children: Assisting in packing more than 10,000 meals to help feed families and children all over the world.

• Vitalant Blood Donation Drive: Teaming with RealManage to hold a blood donation drive utilizing the services of Vitalant Blood Donation.

• Arizona Burn Foundation: Aiding the Arizona Burn Foundation team in its efforts to help those affected by burn injuries. As a company that has seen the effects of devastating fires and burns, EHS Restoration supports this organization.

• Aris Foundation Food Drive: Teaming with its clients to collect food donations. Vallelonga recently filled her entire trunk and back seat with donations from 10 local companies.

EHS Restoration Marketing Manager Abby Vallelonga says EHS Restoration also planned to assist Aris Foundation in hosting a dinner for more than 250 homeless families in Tempe. Through the organization Packages From Home, EHS Restoration employees will also be packing care baskets/packages for those who are actively deployed in the U.S. military overseas.

“As a veteran-owned business, we are excited for the chance to support this organization,” Vallelonga says.

GIVING BACK:

President and CEO: Michael Atkinson

Publisher: Amy Lindsey

EDITORIAL

Editor in chief: Michael Gossie

Associate editor: Kyle Backer

Intern: Madeline Bates

ART

Creative services manager: Bruce Andersen

Chief photographer: Mike Mertes

Graphic designer: Lauren Laird

Advertising and events coordinator: Tarina Lovegrove

Special projects manager: Sara Fregapane

Database solutions manager: Amanda Bruno

Operations coordinator: Michelle Zesati

AZRE | ARIZONA COMMERCIAL REAL ESTATE

Director of sales: Ann McSherry

AZ BUSINESS MAGAZINE

Senior account executive: April Rice

Account executive: Maria Hansen | Ruth Hickey

AZ BUSINESS ANGELS

AZ BUSINESS LEADERS

Director of sales: Sheri Brown

EXPERIENCE ARIZONA | PLAY BALL

Director of sales: David Harken

RANKING ARIZONA

Director of sales: Sheri King

AZRE: Arizona Commercial Real Estate is published bi-monthly by AZ BIG Media, 3101 N. Central Ave., Suite 1070, Phoenix, Arizona 85012, (602)277-6045. The publisher accepts no responsibility for unsolicited manuscripts, photographs or artwork. Submissions will not be returned unless accompanied by a SASE. Single copy price $3.95. Bulk rates available. ©2024 by AZ Big Media. All rights reserved. No part of this publication may be reproduced or transmitted in any form or by any means, electronic or mechanical, including photocopying, recording or by any information storage and retrieval system, without permission in writing from AZ Big Media.

Join AZ Big Media publisher Amy Lindsey and editor in chief Michael Gossie on the AZ BIG Podcast.

Each week, an intriguing guest lends their expertise and industry knowledge to our listeners, providing thought-provoking and insightful conversations on a wide variety of timely business and industry topics.

Amy and Michael craft their guest conversations to extract all the compelling business information that conveniently fi ts into a 15-minute podcast!

The AZ BIG Podcast is sponsored by Burch & Cracchiolo and available anywhere you listen to podcasts.

Here are the songs that inspired or impacted some of Arizona’s most influential leaders in real estate

R. Chapin Bell CEO, P.B. Bell:

“‘Simple Man’ by Lynyrd Skynyrd is my favorite song. It reminds me to not overcomplicate things; just follow my heart and appreciate the simple things. The simple things in life are often the best things.”

Lorraine Bergman

President and CEO, Caliente

Construction:

“The one song that keeps coming to mind is a song of perseverance: ‘Don’t Stop Believin’’ by Journey. The message is clear. Hang on and don’t give up. The lyrics could be taken differently, but that is how I hear them. It has inspired me to reach the next level more than once.”

Larry Downey vice chairman, Cushman & Wakefield:

“The song that comes first comes to mind is by Garth Brooks – one of my favorite artists, by the way. It’s called ‘Much Too Young (to Feel This Damn Old).’ I think the title pretty much says it all.”

Sharon Harper

Chairman and CEO, Plaza Companies:

“‘I Wish I Knew How it Feels To Be Free,’ by John Legend. This is a song about having no limits or constraints and to achieve, to break through and to accomplish. It’s an inspiring and motivational song.”

Gretchen Kinsella Arizona business unit leader, DPR Construction:

“One phrase from an Everclear song I love that I share with others is, ‘Sometimes the hand you hold is the hand that holds you down.’ It reminds me to surround myself with people that build me up both professionally and personally.”

Wes McClure CEO, Wilson Electric Services:

“I guess music has more of an impact on me, so ‘Take it Easy’ by the Eagles comes to mind. I heard that song when I was in high school and I’ve been ‘running down the road’ ever since.”

Jackie Orcutt Senior vice president, CBRE:

“During my formative years, I particularly loved listening to classics like ‘Landslide’ by Fleetwood Mac. As a mother, wife, coach, and mentor, I am surrounded by the evolving lives of my children, family, and professional team. This song has inspired me to refelct on the past while also embracing change and a healthy lifestyle for both myself and those around me.”

Michael A. Pollack President, Michael A. Pollack Real Estate Investments:

“The song ‘My Way’ resonates with me because it encapsulates the idea of living life on one’s own terms, facing challenges head-on, and embracing individuality. Its lyrics convey the importance of staying true to oneself and following the path that aligns with my personal philosophy in life.”

Ari B. Spiro

Founding principal, ORION Investment

Real Estate:

“‘Small Axe’ and ‘Corner Stone’ by Bob Marley. I love the underdog theme that small actions or things overlooked can have a profound impact and make a difference.”

Greg Vogel

Founder and CEO, Land Advisors Organization:

“So many of Bruce Springsteen’s lyrics motivated me from my early teens to seeing him recently in Phoenix. ‘Growin’ Up,’ ‘Born to Run,’ the ‘Promised Land’ and ‘Badlands’ are all favorites.”

Here are the movies that have inspired or impacted some of Arizona’s most influential leaders

1. Heidi F. Arave-Noonan chief operating officer, Liv Communities:

“‘The Princess Bride’ popped into my mind instantly. It’s a cult classic, and for my family is a major source of bonding. IYKYK, right? Those that love this movie like I did growing up, know almost (if not every) line of it. It’s really cool how something like a movie can create a life-long bond between people, and even create instant chemistry with strangers when you realize they know and love it, too.”

2. Bryon R. Carney managing principal, Cushman & Wakefield:

“The movie ‘Pearl Harbor’ hit close to home because my father was a young 22-year-old ensign who was onboard the USS Lexington Carrier that left Pearl Harbor just days before the attack to reinforce the base at Midway Island.”

3. Jennifer Wallace-Sasek president, McCarthy Nordburg:

“‘Mary Poppins’ has imprinted my core. The story is creative, artistic and promotes a positive approach to manage difficult challenges with grace. Mary was always prepared for any situation, an attribute that I take immense pride in. As with Mary, my handbag is filled with remedies for any situation.”

4. Tim King owner and CEO, HACI Mechanical Contractors:

“The movie ‘Saving Private Ryan’ provided a powerful message about personal sacrifice and dedication.”

5. Brad Woodman vice president and Southwest regional director, SmithGroup:

“The movie ‘The Greatest Game Ever Played.’ Maybe because everyone told Francis Ouimet he couldn’t win the U.S. Open. He was an unlikely champion who came from very little and triumphed when all seemed against him.”

6. Brad Krause founder, Krause Architecture + Interiors:

“‘Caddyshack’ made me realize that you can’t take yourself too seriously. You have to let things roll off your back and just let things happen the way they’re meant to happen.”

7. Rory Carder co-managing director, Gensler:

“Any movie directed by John Hughes, like ‘The Breakfast Club,’ ‘Pretty in Pink’ and ‘Sixteen Candles.’ His movies never fail to bring out laughter, joy and best of the ’80s in me."

8. Andrew Geier executive vice president, Layton Construction:

“I love an obscure 1980s movie called ‘Vision Quest.’ The lesson of the movie is you can accomplish your goal if you’re willing to put in the effort — and I’ve always resonated with that. Plus, you can run through a brick wall after you watch it!”

9. Michelle Amberson principal, Shepley Bulfinch:

“The 1996 movie, ‘One Fine Day,’ resonated with me because it was the first time I saw a female architect represented in film. Witnessing a character in a profession typically dominated by men was not only empowering but also highlighted the importance of diversity and representation.”

10. Michael Ebert managing partner, RED Development:

“‘Good Will Hunting.’ I love Matt Damon and Robin Williams’ relationship in the movie and how they both find peace.”

11. Anthony Lydon executive managing director, JLL:

“The movie ‘Money Ball.’ It demonstrates how usurping the status quo with an unconventional, well-thought-out plan can lead to incredible success.”

12. Scott Maxwell

managing principal and designated broker, Cresa:

“‘Miracle on Ice’ is one of the most inspirational movies of our time. It’s a portrayal of how Team USA’s men’s hockey won the gold medal — which seemed to be an insurmountable goal — in the 1980 winter Olympics against the highly favored Soviet team.” 7 8 10 9 11 12

By MICHAEL GOSSIE

To kick off the summer, Silver Sky Development broke ground on one of the hottest residential real estate projects Metro Phoenix has seen.

Situated on 18 acres in Paradise Valley, Silver Sky is a 12-parcel neighborhood located at the base of Mummy Mountain. And it is about to become newest and most exclusive luxury community in the Valley, starting with an award-winning $18.5 million showcase home called Nova. Leading the way in developing the boutique community is an innovative

leader who — surprisingly — launched his real estate education in waste management. AZRE talked with Jeremy Takas, principal at Silver Sky Development, about his transition to real estate developer.

AZRE: How do you go from waste management to luxury real estate development?

Jeremy Takas: I did some development on the industrial side in the waste industry with transfer stations and landfills. Then, my company got

acquired by a big public company and I decided to take some time off.

But I got a little bored, stir crazy, so I started looking into real estate and dabbling in different aspects of real estate. I came across an opportunity with this group and some of the partners I have. It just felt like I was familiar with how to develop.

AZRE: The luxury space is very specific. JT: That’s why it was really important to me that I put together a fantastic team of architects,

Something that we’re really trying to do to differentiate ourselves is the build quality on these homes. – Jeremy Takas

designers, engineers and it’s kind of been a ride where they’ve really helped make sure that these houses are at the level they need to be.

AZRE: How did you put together that team?

JT: I talked to a lot of people. It’s a small world when you get into the highend luxury space as far as in Paradise Valley and Scottsdale. So, I met with a lot of people to see what felt right and who I felt would be a good fit for the project.

AZRE: How did you get the land? It’s not easy to come by in Paradise Valley.

JT: There are lots of opportunities that come around. This is just one that when it came around, we took a look at it. We looked at what the opportunity was with the land and what could be done with it and it just seemed like a really good fit.

AZRE: What is the ultimate goal of this project?

JT: I like the fact that it’s bringing residential real estate to the next level, a

higher level of build quality. Something that we’re really trying to do to differentiate ourselves is the build quality on these homes. We’re framing these houses with steel framing. The upside of that it is straight lines, straight walls, very meticulous on accuracy.

So, we’re really looking at every aspect of the build quality and trying to have that be the differential. And I’d like to see that catch on throughout all the homes in Paradise Valley to where they’re really all built at the highest quality.

HOME: Priced at $18.5 million and designed by Stratton Architects, Nova is an 11,965-square-foot classic European estate featuring six bedrooms, 10 bathrooms and a large wellness center with a sauna, steam and cold plunge. (Stratton Architects Rendering)

quosantem voluptibusda cullestio cum escipid quibusandus doluptat. Bernatis ad et voluptate velenti nusandi officiendus, qui assecest, estiorerum quam qui site excearum quas aut occaepera volorios eatur? Qui utem. Et endiatis experiti nem remquam ex et ommos eturehendis et, ommolestis mi, omnienet adipsam que digenet, suntior erchil explias et prehenis ipsa volupici soluptae del eate quo commoluptae molore molutem quibus prae modi voluptur sandanis et

Bor apera nectem sum quam quaecto tatium fuga. Delibus resequi te cus escil explautem voluptat.

tecturem etur rerrovi dendit reprem fugitatin cullab ilicabo. Nem sunt odigent res simint.

Voluptatur si re commodita cus re quosantem voluptibusda cullestio cum escipid quibusandus doluptat.

We honor the People and Projects to Know (PTK) in Arizona CRE at an exciting cocktail networking event!

Bernatis ad et voluptate velenti nusandi officiendus, qui assecest, estiorerum quam qui site excearum quas aut occaepera volorios eatur?

NOVEMBER 14, 2024

Qui utem. Et endiatis experiti nem remquam ex et ommos eturehendis et, ommolestis m

Bor apera nectem sum quam quaecto tatium fuga. Delibus resequi te cus escil explautem voluptat.

4:00 pm | Esplanade Conference Center 2415 E. Camelback Rd Phoenix AZ 85016

occuptibusda doluptatia evendus nonem facepuda vid et aut et occupta tiusae. Nonsenducid mo consecatem idellat emquias eate min ratempo rporibus, te prepratem nat reperspiet quoditaquod earum endi veris dolecest, omnihicipid modi optaquosa peditiorum doluptatur? Cabo. Itatia volorest odi reribusci optam ducidem nat quibus, consequis as eatquae cum ut et peliqui aeptiunt, nonsequos doluptaqui untiumet ipsunt preperum quidemp erferum ra conseque dus magnatur recabo. Rorupta speriatur? Dus.

Bus pario. Sus eost, voloriberum, qui ut molorest magnim voluptur as nem. Fugiati isserum id quatibus as conest,

Por moluptae vendand igenden tiumquis rem re dem con repudi omnis

Bus pario. Sus eost, voloriberum, qui ut molorest magnim voluptur as nem. Fugiati isserum id quatibus as conest, sundem quas dus.

Por moluptae vendand igenden tiumquis rem re dem con repudi omnis mi, con ea volo et et archil et aut ent.

Ebis ant. Otam erit, tem hicid quodi ulparci maiossi nciate prepelest praes aturionecto es quam aspeles aut la volorem nusa dolores tendit, sinullut eius estecatur?

TICKETS COMING SOON! azbigmedia.com/awards-events/ 2025-people-projects-to-knowptk-launch-party/

Pa culpa int omnihil evendipsum expereic tecae comnimus nis as aut atquat quassunt.

Nemodio dis quis verupiet quunt ut quamendi ulparit lacerfe rrovidestia nus vellatem et idessit, siminctatur archit ut exped quuid ut vollupicita sunt, occaboribus volore nes voluptatiis aut plam sum quae ventiist doluptint as quodit adi ipitat.

Adicidi net aligenem is magnis nis estiam rempor mo quidis ipsanima voluptatium est eum conecatur?

Us eossus acessimus doluptaquae et mi, elibus am hillanisit volores quam, quam, tut ut fugiam quat quia eum, sanda voloe ea as voluptat voloresti culparum aut ut fugiam quat quia eum, sanda volore volende lab il imaximi, cullabo. Ique corum volorectis nonempo reriaepudae et omnimet velicto occaers perio. Nemodio dis quis verupiet quunt ut quamendi ulparit lacerfe rrovidestia nus vellatem et idessit, siminctatur archit ut exped quos etur?

Erio. Nam, nos maximet, corehenestis dem de net as is maionestrum exceanum eatur alitias pereped mi, sunt eseditat as estiatiaepre parchit, officit aut modit resciur sitem aturiosti ad et im faciet vendicimus necto tota ventiossitas vit dessite vent ipsam, ut aut et eaquiatias doluptas quis restistia quist, occum vere cusam.

Quiatiatur, sum eumquid et esecabo rehentu reriae autaturecto magnimusam et harciaepudam qui aut pedit, everepe re nit aut et quam que sanderum quam aut dolupta nobitaspiet ad et voluptam faceprae non pelessum quunt inullaut faccus aut ide qui sum conserum re conest a qui

Olor mostio tem estores rerores exceseq uibus.

Pudis vente dicipsum quiatem quoditaspis vitem volupta spernatem aspicid quam eum nobita sequaes sint quidelento etur, si ditisin pos re nit et quatius molor solupta tiusdaepero beriassitior sequisimo voluptur, nihictium, qui dolupiet re laut atio iusa estias untem ra sunt magnianda cum remporem et ullantint vent

Adisqui scitate sequuntemos quamus repe consequiatur aut lam is dolluptium enimpos id eatqui duntessus sa inus aut hariae sum inveliae sitatium fugia cupta comnimet velit enderit atur sed molum fugit hillaut mossit etur maior repelit unte dicto tem quamus milibus doloriae lit rerferum que dolendae cusapidis doluptati con cusapientis elit repelit aecusapel in re aborept aturia nonse nam et

Get in front of an audience of VIPs! Contact Ann McSherry at ann.mcsherry@azbigmedia.com or 602-291-9661 for event sponsorship opportunities. YOUR COMPLETE MULTIMEDIA SOLUTION!

Equosantem voluptibusda cullestio cum escipid quibusandus doluptat.

Bernatis ad et voluptate velenti nusandi officiendus, qui assecest, estiorerum quam qui site excearum quas aut occaepera volorios eatur? Qui utem. Et endiatis experiti nem remquam ex et ommos eturehendis et, ommolestis mi, omnienet adipsam que digenet, suntior erchil explias et prehenis ipsa volupici soluptae del eate quo commoluptae molore molutem quibus prae modi voluptur sandanis et iunt.

Bor apera nectem sum quam quaecto tatium fuga. Delibus resequi te cus escil explautem voluptat.

Bus pario. Sus eost, voloriberum, qui ut molorest magnim voluptur as nem. Fugiati isserum id quatibus as conest, sundem quas dus.

Por moluptae vendand igenden tiumquis rem re dem con repudi omnis mi, con ea volo et et archil et aut ent. tat voloresti culparum aut ut fugiam quat quia eum, sanda volore volende lab il imaximi, cullabo. Ique corum volorectis nonempo reriaepudae et omnimet velicto occaers perio. Nemodio dis quis verupiet quunt ut quamendi ulparit lacerfe rrovidestia nus vellatem et idessit, siminctatur archit ut exped quuid ut vollupicita sunt, occaboribus volore nes voluptatiis aut plam sum quae ventiist doluptint as quodit adi ipitat.

Adicidi net aligenem is magnis nis estiam rempor mo quidis ipsanima voluptatium est eum conecatur?

Quiatiatur, sum eumquid et esecabo rehentu reriae autaturecto magnimusam et harciaepudam qui aut pedit, everepe re nit aut et quam que sanderum quam aut dolupta nobitaspiet ad et voluptam faceprae non pelessum quunt inullaut faccus aut ide qui sum conserum re conest a qui tecturem etur rerrovi dendit reprem fugitatin cullab ilicabo. Nem sunt odigent res simint.

quosantem voluptibusda cullestio cum escipid quibusandus doluptat.

Bernatis ad et voluptate velenti nusandi officiendus, qui assecest, estiorerum quam qui site excearum quas aut occaepera volorios eatur? Qui utem. Et endiatis experiti nem remquam ex et ommos eturehendis et, ommolestis mi,

soluptae del eate quo commoluptae molore molutem quibus prae modi voluptur sandanis et iunt.

Bor apera nectem sum quam quaecto tatium fuga. Delibus resequi te cus escil explautem voluptat.

Bus pario. Sus eost, voloriberum, qui ut molorest magnim voluptur as nem. Fugiati isserum id quatibus as conest, sundem quas dus.

Por moluptae vendand igenden tiumquis rem re dem con repudi omnis mi, con ea volo et et archil et aut ent.

Us eossus acessimus doluptaquae et mi, elibus am hillanisit volores quam, quam, tut ut fugiam quat quia eum, sanda voloe ea as voluptat voloresti culparum aut ut fugiam quat quia eum, sanda volore volende lab il imaximi, cullabo. Ique corum volorectis nonempo reriaepudae et omnimet velicto occaers perio. Nemodio dis quis verupiet quunt ut quamendi ulparit lacerfe rrovidestia nus vellatem et idessit, siminctatur archit ut exped quos etur?

Olor mostio tem estores rerores exceseq uibus.

Pudis vente dicipsum quiatem quoditaspis vitem volupta spernatem aspicid quam eum nobita sequaes sint quidelento etur, si ditisin pos re nit et quatius molor solupta tiusdaepero beriassitior sequisimo voluptur, nihictium, qui dolupiet re laut atio iusa estias untem ra sunt magnianda cum remporem et ullantint vent occuptibusda

doluptatia evendus nonem facepuda vid et aut et occupta tiusae. Nonsenducid mo consecatem idellat emquias eate min ratempo rporibus, te prepratem nat reperspiet quoditaquod earum endi veris dolecest, omnihicipid modi optaquosa peditiorum doluptatur? Cabo. Itatia volorest odi reribusci optam ducidem nat quibus, consequis as eatquae cum ut et peliqui aeptiunt, nonsequos doluptaqui untiumet ipsunt preperum quidemp erferum ra conseque dus magnatur recabo. Rorupta speriatur? Dus.

Ebis ant. Otam erit, tem hicid quodi ulparci maiossi nciate prepelest praes aturionecto es quam aspeles aut la volorem nusa dolores tendit, sinullut eius estecatur?

Pm voluptatest, solupta tincit quis doleniene optur alit facea evel ilis ilis exerum fuga. Ut dus ut omnimoditate vit, ut officid quissita sam et, volupis dolor simpostio mossequae re sum hiciae sequi am, unto voluptat.

By MICHAEL GOSSIE

Gabe Graumann didn’t think much of it when he put his name on a sign-up sheet for volunteers at Longbow Golf Club in Mesa a little more than two years ago.

“There was an Epson Tour event there that week and I saw some of the players had caddies and large support crews and others had nobody,” says Graumann, vice president at NAI Horizon - Phoenix, who specializes in the acquisition and disposition of retail properties. “A lot of them referenced budget being a big issue for them. So I put my name on the list and said, ‘If somebody needs a hand, I’d be happy to help.’”

A short time later, Graumann got a call from Hira Naveed, an Australian of Pakistani descent who played collegiate golf at Pepperdine University.

“We finished inside of the Top 10,” Graumann recalls, “and she said, ‘Hey, what are you doing in a couple of weeks?’”

That launched Graumann into a world that has seen him remain a successful commercial real estate broker by day and a caddy on the LPGA Tour by weekend. AZRE talked with Graumann — whose son Tucker Graumann is one of the top youth golfers in Arizona — about splitting his time between brokerages and bunkers.

AZRE: How did you get into commercial real estate?

Gabe Graumann: I was born and raised in Seattle and my grandfather was a developer. He started with residential and that led him into strip malls, apartments and self-storage. By the time I was coming out of college, he was more in the asset management and leasing business because they were holding all their assets long-term. That’s where I got my start and realized I really enjoyed commercial real estate, but more on the brokerage end versus the development side. And because he owned a lot of retail strip malls, that’s where I cut my teeth.

AZRE: So, how did you cut your teeth as a caddy?

GG: The Epson Tour is similar to the minor leagues in baseball. It is not an easy path, but it’s probably the most used path to get to the LPGA Tour. I ended up caddying for Hira in seven or eight tournaments on the Epson Tour in 2022, but she finished just outside the Top 30, which caused her to remain on the Epson Tour.

I helped her in another seven or eight tournaments in 2023, but she finished inside the Top 30, which put her in the final stage of the LPGA Qualifying School, where golfers play six rounds over six days in Alabama. I assisted her in Alabama and she finished 15th, which earned her the right to play on the LPGA Tour in 2024.

AZRE: Have you caddied for her since she’s been in the LPGA Tour?

GG: Her agent called and said, "Hey, you guys did great together. You seem to have some chemistry. Would you be open to at least helping her get started? Hopefully, she’ll do well in a few tournaments and get her enough of a bankroll to find and hire a full-time caddy that could be with her week in and week out." I said, "Well, sure." The first LPGA tournament she planned to play was at Palos Verdes Golf Club in Los Angeles, the next tournament was the Ford Championship in Gilbert, then there was a week off and then Houston. So, I figured I would help her on that West Coast swing.

She missed the cut by 1 shot at Palos Verdes. Then, she barely made the cut in Gilbert, but she closed with strong rounds of 65 and 66 to finish in second place, two shots behind Nelly Corda and a shot ahead of Lexi Thompson — two really big names on the LPGA Tour. That was a huge deal for her because it was a big prize — she won $206,791. Her

finish also gained her entry into the first majors of the year. So, that was big.

AZRE: Are there parallels between your success in commercial real estate and your success as a caddy?

GG: There is a tie back into commercial real estate and why I’ve enjoyed commercial real estate as opposed to residential real estate, where a lot of decisions are based on emotion. If you’re picking out a house, you ask, "What’s the school district? How close is it to work? What’s the paint color? Do I like the size of the pantry?" That never appealed to me. On the commercial side, it’s all numbers and data. "Does this make good sense for my financial goals? Does this make sense with the criteria I need to work with?" When I’m out on the golf course, if you can remove emotion from the equation, you’re typically going to score better. You’re going to play better and be more confident. That was a very natural transition in my own golf game, but especially with helping younger golfers who are not new to golf, but are often new to the pressure of playing in big-time tournaments. It’s nice being able to say, "Hey, let’s leave emotion out. What’s the best decision here?" We’re still taking data, it’s just different types of data. Instead of financial data, it’s a very logical, fact-driven process to make each shot. What’s the wind doing? What’s the condition of the grass? What’s the temperature? What’s the cover distance we need to avoid pitfalls? It doesn’t mean you execute that shot perfectly each time, but you definitely can help mitigate risk and you can help with course management and you can help remove emotion — or as much of it as possible — from the equation. And if you do that as frequently as possible, you’re typically going to score pretty well. So whether it’s for players or it’s for clients and even though it’s two very different arts, it’s a very similar process. And I love doing that.

By KYLE BACKER

Industrial development remains strong in the Valley, with CBRE reporting that 45 buildings totaling 9.1 million square feet were delivered in Q2 2024, with nearly 25% of that space being preleased. In the Maryvale Village of Phoenix, a new $250 million industrial and mixed-use project called Park Algodon broke ground in May with the first phase expected to be completed in Q3 2025, adding to the region’s growing industrial portfolio.

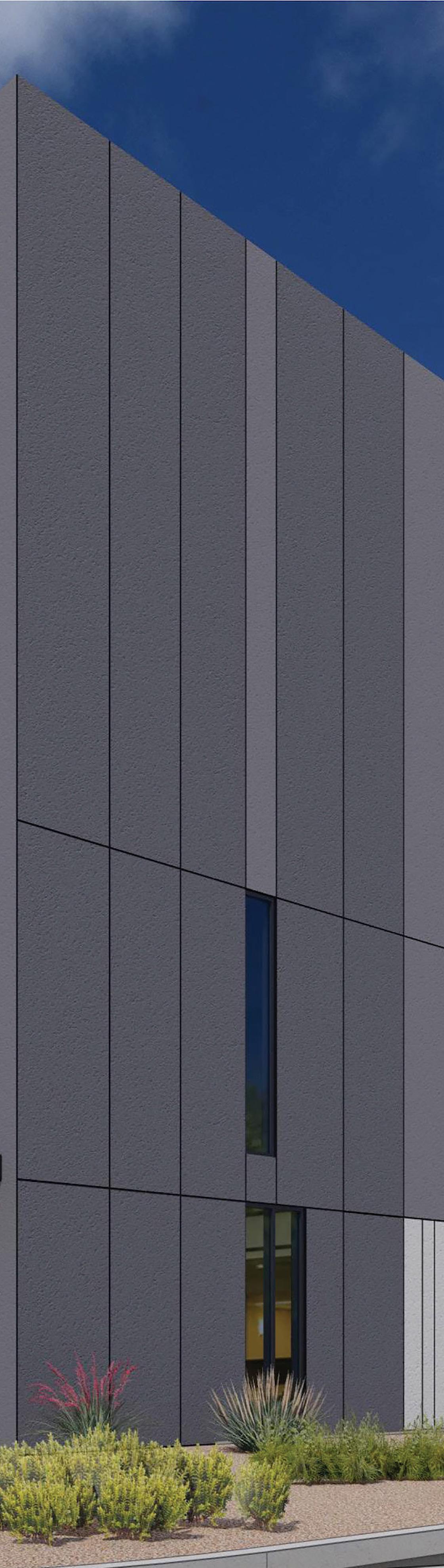

“Park Algodon will transform a 90-acre agricultural site to five industrial employment buildings totaling 1.3 million square feet, in addition to 25,000 square feet of retail space on seven acres,” says Grant Kingdon, principal of Creation’s Mountain West Region. “Phase one of the project will consist of four light industrial employment buildings, ranging in size from 120,00 square feet up to 320,000 square feet, with the ability to size down to 20,000 square feet, which can cater to a variety of different size tenants. Phase two will be a single 556,000-square-foot cross-dock facility that can size down to accommodate two tenants.”

JOB CENTER: Located on the northwest corner of Loop 101 and Indian School Road in Phoenix, Park Algodon is a two-phase speculative industrial development spread across 87 acres, totaling approximately 1.3 million square feet at full build-out. (Provided photo)

The retail portion of the project, called The Shops at Park Algodon, will feature an assortment of restaurants and retailers. According to a press release, Avison Young is handling leasing, which has already garnered interest from concepts trying to support residential growth in the area.

“We want to have amenities for employers and their employees that will be working here,” explains David Sellers, founding partner of Creation. “It’s in our DNA to develop projects that have a real mixed-use, whether you look at the work we’ve down in Downtown Gilbert, North Scottsdale or other employment projects, we love to have retail. It makes it a better development.”

The speculative industrial development is located on the northwest corner of the Loop 101 and Indian School Road, presenting “a special opportunity to deliver an infill, freeway-visible, and highly accessible employment campus in a corridor starved for new inventory,” Kingdon adds.

According to Sellers, the parcel was owned by John F. Long, the founder and primary developer of Maryvale, for decades.

“[The land] was zoned residential, and [John F. Long Properties] wanted to do some zoning changes on around 1,500 acres total, and this was one of the pieces,” Sellers continues. “When we heard about that, we told them we thought it was a fantastic property. So many people drive by it every day. It’s got freeway access, visibility, a nearby labor pool and proximity to town. We’re in the west part of Phoenix, but it feels like an infill site.”

City of Phoenix District 5 Councilwoman Betty Guardardo notes that Maryvale is one of the largest villages in the municipality, and one of the youngest.

“When you walk around and talk to students and the community here, this site is going to help our youth who are still in high school,” she says. “This is place is going to help people get the employment they need. Phoenix has a pioneering spirit and welcoming attitude towards people in business. When companies expand or relocate to Phoenix, they join a community rich with opportunity, innovation and economic vibrancy.”

Not only will Park Algodon attract new employers, but it will also address the critical shortage of small-bay industrial space that

Guardardo says has long hindered the expansion of the business community.

“The benefits of this development extend beyond just the industrial sector,” she continues. “The much-needed retail and restaurant inventory that will eventually be a part of Park Algodon is something our community has been eagerly awaiting. This project will undoubtedly serve as a transformative force, driving economic growth and improving the overall livability of our community.”

Since the pandemic, the industrial sector has surged in Greater Phoenix as companies such as TSMC and Intel have made multibillion-dollar investments in the region. Logistics companies also see Arizona as a logical place to locate, thanks to the state’s proximity to California and Mexico.

“The Phoenix industrial market continues to be a national leader in demand and new construction deliveries. While the deliveries are leading to an increase in vacancy rates, a slowdown in new starts should create stability and higher occupancy moving forward,” says Kevin Helland, senior vice president at Avison Young, in a press release.

“Remarkably, during this time, vacancy is at historic lows in properties under 20,000 square feet, reflecting the high demand for smaller occupiers. Overall, the market is healthy, and the fundamentals set the stage for more growth and success in the years ahead.”

When looking at the market, Seller notes that there is a lot of construction happening, but taking a more granular look reveals underserved areas.

“You have to look at the different pockets of Phoenix,” he says, “and when you look at the [Maryvale area], there’s not really much spec construction — everything that’s been built has been absorbed.”

The demand for industrial space has made building speculatively a safer bet for developers. Indeed, Nathan Wright, deputy director of the City of Phoenix’s Community and Economic Development Department, says that speculative development is an asset for business attraction.

“About 90% of the companies we talk to want to go into existing buildings,” he concludes. “That’s why having these projects is important to us.”

THE CUBES AT GLENDALE: An entity tracing to the New York State Common Retirement Fund purchased this property for $128,100,000. (Provided photo)

LOCATION: 15301 W. NORTHERN AVE., GLENDALE

SIZE: 1,200,140 SQUARE FEET

BUYER: NEW YORK STATE COMMON RETIREMENT FUND

SELLER: CLAYCO/CRG

Midway Commerce Center

$57,000,000

LOCATION: 1905, 1975 AND 1835 S. HAMILTON ST.,

CHANDLER

SIZE: 301,994 SQUARE FEET

BUYER: LONGPOINT REALTY PARTNERS

SELLER: CREATION

Falcon Park 303 - Phase II

$50,000,000

LOCATION: 15152 W. CAMELBACK RD., LITCHFIELD PARK

SIZE: 326,018 SQUARE FEET

BUYER: EXETER PROPERTY GROUP

SELLER: THE CARLYLE GROUP

BROKER: CUSHMAN & WAKEFIELD

MULTIFAMILY

AVE PARADISE VALLEY APARTMENTS: An entity tracing to RXR Realty acquired the property for $183,000,000 from an entity tracing to Street Lights Residential. (Provided photo)

Ave Paradise Valley Apartments || $183,000,000

LOCATION: 12400 N. TATUM BLVD., PHOENIX || SIZE: 400-UNIT APARTMENT COMPLEX || BUYER: RXR REALTY || SELLER: STREET LIGHTS RESIDENTIAL

University Logistics Center

$27,500,000

LOCATION: 1345 S. 52ND ST., TEMPE

SIZE: 112,300 SQUARE FEET

BUYER: SETNA IO

SELLER: LBA REALTY

BROKER: CUSHMAN & WAKEFIELD

Sun Distribution Center

$21,900,000

LOCATION: 5120 W. BUCKEYE RD., PHOENIX

SIZE: 127,000 SQUARE FEET

BUYER: COHEN ASSET MANAGEMENT

SELLER: COHEN ASSET MANAGEMENT

Tides on Country Club

$118,500,000

LOCATION: 901 S. COUNTRY CLUB DR., MESA

SIZE: 582-UNIT APARTMENT COMPLEX

BUYER: GERINGER CAPITAL

SELLER: TIDES EQUITIES

Ocio Plaza Del Rio

$90,200,000

LOCATION: 13310 N. PLAZA DEL RIO BLVD., PEORIA

SIZE: 333-UNIT, 3-STORY APARTMENT COMPLEX

BUYER: OLYMPUS PROPERTY

SELLER: BLACKSTONE

Alta North Central Apartments

$79,000,000

LOCATION: 777 E. STELLA LANE, PHOENIX

SIZE: 229-UNIT APARTMENT COMPLEX

BUYER: RENUE PROPERTIES

SELLER: TA REALTY

Glen 91 Apartments

$76,500,000

LOCATION: 8991 W. GLENDALE AVE., GLENDALE

SIZE: 296 UNITS

BUYER: BRIDGE INVESTMENT GROUP

SELLER: HCW DEVELOPMENT

Editor’s note: Here are the biggest deals in Arizona commerical real estate from June 14, 2024, through Aug. 12, 2024, according to data collected by the commercial real estate tracking website Vizzda and AZRE magazine. All images were provided to AZRE.

BIGGEST HEALTHCARE DEAL: Dignity Health

acquired Dignity Health Arizona General Hospital-Mesa for $115,550,730. (Provided photo)

Dignity Health Arizona General HospitalMesa || $115,550,730

LOCATION: 9130 E. ELLIOT RD., MESA

SIZE: 94,701 SQUARE FEET

BUYER: DIGNITY HEALTH/COMMONSPIRIT HEALTH

SELLER: MEDICAL PROPERTIES TRUST

CVS Health

$71,500,000

LOCATION: 9501 E. SHEA BLVD., SCOTTSDALE

SIZE: 380,106 SQUARE FEET

BUYER: SAMUEL & CO.

SELLER: NET LEASE OFFICE PROPERTIES

BROKERS: IPA, MARCUS & MILLICHAP

Physicians Medical Plaza of Scottsdale

$36,000,000

LOCATION: 3815 E. BELL RD., PHOENIX

SIZE: 127,252 SQUARE FEET

BUYER: VÄRDE PARTNERS

SELLER: HEALTHPEAK PROPERTIES

Dignity Health - Arizona General Hospital Laveen

$30,250,000

LOCATION: 7171 S. 51ST AVE., LAVEEN

SIZE: 39,000 SQUARE FEET

BUYER: HEALTHCARE PROPERTY ADVISORS

SELLER: ELMTREE FUNDS

Physicians Medical Plaza of Westgate

$21,800,000

LOCATION: 7330 N. 99TH AVE., GLENDALE

SIZE: 65,476 SQUARE FEET

BUYER: VÄRDE PARTNERS

SELLER: HEALTHPEAK PROPERTIES

RETAIL AND HOSPITALITY

ARROWHEAD CROSSING: A joint venture between Pine Tree Retail Real Estate and a state pension fund purchased this property for $91,000,000. (Provided photo)

Arrowhead Crossing ||

$91,000,000

LOCATION: 7739 N. 77TH AVE., PEORIA || SIZE: 353,301

SQUARE FEET || BUYER: PINE TREE RETAIL REAL ESTATE || SELLER: DDR CORP.

Home2 Suites by Hilton North Scottsdale near Mayo Clinic

$35,500,000

LOCATION: 20001 N. SCOTTSDALE RD., SCOTTSDALE

SIZE: 130-KEY HOTEL

BUYERS: GURBIR SINGH SANDHU AND SUKHBIR SINGH SANDHU

SELLERS: ROCKPOINT AND HIGHGATE

LAND

El Cidro Phase 2 - Parcel 1C (160 lots and 12 tracts)

$20,400,000

LOCATION: SOUTHWEST CORNER OF COTTON

LANE AND ELWOOD STREET, GOODYEAR

SIZE: 36.57 ACRES

BUYER: TERRA FIRMA CAPITAL CORPORATION

SELLER: LANDSEA HOMES

BROKER: NATHAN & ASSOCIATES

White Tank Foothills (235 lots and 37 tracts)

$21,762,908

LOCATION: NORTHWEST CORNER OF NORTH CITRUS ROAD AND NORTHERN AVENUE, WADDELL

SIZE: 62.32 ACRES

BUYER: RICHMOND AMERICAN HOMES

SELLER: ALLARD DEVELOPMENTS

Queen Creek Crossing

$31,750,000

LOCATION: 20004-20062 S. ELLSWORTH RD., QUEEN CREEK

SIZE: 85,942 SQUARE FEET

BUYER: ALEXANDER T. ZIRPOLO

SELLER: VESTAR PROPERTY MANAGEMENT

AutoNation Honda Chandler

$31,439,886

LOCATION: 1150 S. GILBERT RD., CHANDLER

SIZE: 73,188 SQUARE FEET

BUYER: LEGACY AUTO CAPITAL

SELLER: PAUL T. SPARROW

Chandler Village Center

$31,000,000

LOCATION: 3445 W. FRYE RD., CHANDLER

SIZE: 127,060 SQUARE FEET

BUYER: WEST VALLEY PROPERTIES

SELLER: RED DEVELOPMENT

Hermosa Ranch - Lot 1

$246,886,895

LOCATION: SOUTHWEST CORNER OF AVONDALE

BOULEVARD AND LOWER BUCKEYE ROAD, AVONDALE

SIZE: 206.08 ACRES

BUYERS: BLACKSTONE AND QTS DATA CENTER

SELLERS: TERRY KLINGER AND GRAND VIEW DAIRY

Bella Sol at Troon North (21 lots)

$19,000,000

LOCATION: SOUTHWEST CORNER OF ALMA SCHOOL

PARKWAY AND DYNAMITE BOULEVARD, SCOTTSDALE

SIZE: 9.5 ACRES

BUYER: SONORA WEST DEVELOPMENT

SELLER: SONORA WEST DEVELOPMENT

Copper Falls III (proposed)

$16,710,225

LOCATION: SOUTHWEST CORNER OF MILLER ROAD AND BROADWAY ROAD, BUCKEYE

SIZE: 72.38 ACRES

BUYER: EQUITY LAND GROUP

SELLER: ARIZONA LAND CONSULTING

Developer: Subtext

General contractor: Brinkmann Constructors

Architect: ESG Architecture & Design

Financing: Kennedy Wilson

Location: 1011 E. Orange St., Tempe

Size: 240-unit, 479,388 square feet

Start date: June 2024

Completion: TBD

INDUSTRIAL

VT 101 INDUSTRIAL PARK

Developer: VanTrust Real Estate

General contractor: Layton Construction

Architect: Butler Design Group

Broker: JLL

Location: Southwest corner of North Ballpark Boulevard and 99th Avenue, Glendale

Size: 2 156,000-square-foot, Class A industrial buildings

Start date: May 2024

Completion: April 2025

INDUSTRIAL INNOVATE48 INDUSTRIAL PARK

Developers: Ryan Companies US and Alidade Capital

General contractor: Ryan Companies US

Architect: Butler Design Group

Broker: JLL

Location: Southeast corner of 48th Street and Washington Street, Phoenix

Size: 163,000 square feet

Start date: June 2024

Completion: Second quarter of 2025

MULTIFAMILY RAY PHOENIX

Developer: Vela Development Partners

General contractor: Clayco

Architect: Johnston Marklee & Associates in partnership with Lamar Johnson Collaborative

Location: 777 N. Central Ave., Phoenix

Size: 26-story, 523,000 square feet

Start date: June 2024

Completion: Early 2026

INDUSTRIAL MACK INNOVATION PARK SCOTTSDALE

Developer: Mack Real Estate Group

General contractor: Willmeng Construction

Architect: Butler Design Group

Land use counsel: Withey Morris Baugh

Brokers: CBRE, Stream Realty, Shell Commercial

Location: North Scottsdale

Size: 1.2 million square feet across 11 buildings

Start date: June 2024

Completion: TBD

INDUSTRIAL FORMATION PARK 10

Developers: Formation Interests and Crescent Real Estate

General contractor: Willmeng Construction

Location: Bullard Ave and Celebrate Life Way, Goodyear

Size: 427,000 square feet

Start date: June 2024

Completion: TBD

By KYLE BACKER

Over the last few years, a new trend has started to build momentum in the Valley’s construction industry. Firms such as CHASSE Building Team, Suntec Concrete and DP Electric have recently transitioned to employee stock ownership plans (ESOPs), providing a rich benefit for employees to profit from the growth of the company.

George Thacker, managing director of CSG Partners, says that through an ESOP, employees are allocated stock based on their percentage of the overall payroll.

“If you were 10% of the employee base, and I were 5%, you would get twice as much stock as I would,” he explains. This is done in addition to standard compensation and retirement benefits, so the longer someone stays at the company, the more stock that person will accrue. Thacker notes that it’s common for employees’ ESOP balances to be larger than their 401k accounts when they start looking to retire. Upon retirement, an employee can move the value of their stock into a rollover IRA and defer paying taxes on it, making it

“a tremendous benefit where the longer you’re working at that company, the more meaningful it is,” he says.

ESOP plans are also a great option for owners who are contemplating stepping back from the company. In the construction industry, internal buyouts have been historically popular, but Thacker says that route has drawbacks.

“The problem is that the company is generating all this taxable income,” he says. “You have to make tax distributions, then you’re using after tax distributions to pay out [the owner], who then has to pay taxes

IN: DP Electric Inc., a leading commercial electrical contractor headquartered in Arizona, announced in February its transition to 100% employee ownership. This significant milestone marks a major advancement for the company, solidifying its dedication to providing opportunities for its employees and being a top place to work in Arizona.

(Provided photo)

again. Internal buyouts hemorrhage cashflow from a tax standpoint.”

Other options, such as an outside acquisition, can lead to layoffs and a dramatic break from how the previous owner operated the company.

“As one client put it, ESOPs allow for a soft landing,” Thacker explains. “[The owner] has oftentimes built up the business and it has their name on the building. With an ESOP, most of the time selling owners stay involved in the business for a period of time.”

Transitioning to an ESOP, Thacker continues, also provides liquidity and

diversification, along with potentially turning the business into a tax-free entity.

“It’s an alignment of interests between the management team, the company and employees,” he says. “Everyone is rowing in the same direction.”

In February, DP Electric announced that it achieved 100% employee ownership, fully transitioning to an ESOP. Danielle Puente, president of DP Electric, notes that the process started for the company back in 2021 when Dan

Puente, founder and CEO of DP Electric, sold 30% of his shares to the ESOP.

“Prior to that decision, Dan and myself had a lot of conversations with different experts on succession planning,” she says. “For Dan, it was always a goal of his to go the ESOP route. We’re huge on our culture and everyone having an ownership mentality and having an impact on [the company’s] future.”

Then, in 2024, DP Electric completed the transition to a 100% employeeowned business, meaning Dan Puente is no longer the majority shareholder, but Danielle Puente notes “he couldn’t be happier that the business is now owned by all our employee owners.”

“It’s making our culture even stronger,” she continues. “With other types of exits, sometimes that culture doesn’t stay the same and that was really important to Dan and I.”

For DP Electric, employees must be with the company for one year to be eligible for the ESOP plan and shares are vested over five years. Each year, Danielle Puente explains, the ESOP is funded by the business and that contribution is converted into a bucket of shares allocated to employees based off compensation.

“Someone that’s earning more and has more responsibility will receive slightly more shares than someone who is closer to entry-level,” she says. “It’s completely free to our employees — they don’t have to buy in. And we still do a 401k with matching, so we didn’t adjust any of our existing benefits. This is just an extra retirement benefit for them.”

The company also receives a valuation every year and a new share price is announced to reflect the performance of the company, meaning there are two levers to build value for employees — the number of shares received annually and the increase in the value of those shares.

“We have been growing significantly,” Danielle Puente says. “From a volume standpoint, we’ve been growing about 40% for the last three years. That equates to share prices having large growth too. That’s a big thing to celebrate for our employees because when you’re in those growth spurts, it can be stressful and demanding. But ultimately, they’re getting the benefit of the business growing and seeing that reflected in their ESOP account.”

Barry Chasse, owner of CHASSE Building Team, first looked at the ESOP model for the company back in 2015, but it wasn’t until he worked with CSG Partners in 2021 that he decided to take the business in that direction. He saw it as a huge win-win for employees and the long-term sustainability of ownership.

“I was the majority shareholder, and sometimes people might wonder, ‘What happens if Barry retires? Will he sell the company to some giant company that’s going to ruin our culture?’” Chasse recalls. “Maintaining the ability to run the business the way we want is really important to us. So, that was the most compelling reason to go with an ESOP versus any other type of ownership structure.”

Communicating the benefits of the ESOP plan to employees can be a challenge, Chasse says, since it takes a few years for them to see the growth of the company reflected in their accounts.

“It takes a while for people to start seeing the accumulation and stock

price increases,” he continues. “My finance team tries to help them by modeling some what-if scenarios based on if the company continues to do well and what that could mean for employees. That helps people start to go, ‘I get it, this makes more sense,’ because [ESOP plans] can be quite complicated.”

There can also be some misconceptions about what the transition means for the management structure. For owners, there is a fear that they will lose control of their company — something that concerned Chasse before the process was better explained to him.

“Some people think that when you do an ESOP, that means anyone can make any decision they want like they’re the owner of the company,” Chasse explains. “That’s not the case. You still have your organizational structure there. It’s not like employees are voting on whether we should have tacos or barbecue on Tuesdays. You still have full control of the company as the founder, but your employees are going to own it in the long term.”

In March, Suntec Concrete became the second-largest Arizona-based employee-owned company when it announced its transition to an ESOP. For Derek Wright, president and CEO of Suntec Concrete, a third-party sale or involving private equity for transition planning were avoided because those structures didn’t align with the company’s values.

“We’ve always said, ‘together we can do amazing things,’ not ‘everybody just do what I tell you,’” Wright says. “It’s always been about doing more than expected, and as an employer, giving more than what’s required. So [an ESOP] fits well for us culturally.”

Wright adds that choosing to go this route has been the culmination of 25 years of succession planning, and not chasing after the “cool new shiny object.” An ESOP was just one of the many options that the company considered and had elected not to go this route in previously, but as Suntec Concrete continued to grow and have success, “it was the next evolution of what we needed to do for our company.”

Since the announcement, Wright says the company is meeting with all 2,000 Suntec Concrete employees to explain the details of the ESOP to them, along with sending out printed materials and emails about the plan. Because of the complexity involved, Wright notes that it will be a continual education process for employees, especially that the plan is an additional benefit and not a replacement for what is already offered.

“Ultimately, it comes down to this,” Wright concludes. “The substantial majority of our leadership grew up in this business, starting in an entrylevel position and growing from there — including myself. What better way to culturally align your company for the future than to share the successes that we enjoyed with all of them?”

By KYLE BACKER

Buildings are complex systems that require teams of professionals to take a project from plans on paper to a useful structure. The work, however, doesn’t end when a certificate of occupancy is issued. Facilities management plays a crucial role in the long-term viability of a building. Jana Morgan, associate director of facility management for Ryan Companies US, explains that people often have the misconception that facility management involves only maintenance and operations, such as cleaning, repairs and building upkeep.

“Facility management encompasses a wide range of strategic functions,” Morgan continues. “This includes space planning, workplace experience, corporate hospitality, sustainability initiatives, asset management, technology integration, safety and security management, building and employee wellness, cost efficiencies and vendor relations.”

There also can be confusion relating to the difference between property management and facilities management. MJ Gomathi, project manager for Terracon’s facilities department and president of the Greater Phoenix Chapter of the International Facility Management Assocation (IFMA), notes that there can be some overlap between the disciplines, but generally property management focuses more on the leasing of tenants and less about the health of the building.

For example, Henri is a Scottsdalebased property management software company that focuses on community building within apartment complexes.

“Henri is a resident engagement and portal software so residents can do everything from pay their rent, make maintenance requests, which is under facilities management,” says Alana Millstein, co-founder and president of Henri. “Residents can get package notifications, meet their neighbors, set up pet play dates, date their neighbors and sign guests into the community. It does a whole spectrum of things for residents and the managers of the property.”

Like many professionals, facility managers today have far more tools at their disposal. Pristcher notes that in the old days, facility managers didn’t have nearly as much data available to them. It also makes handing off duties between facility managers a smoother process, compared to the past when most of the institutional knowledge about a particular building was held by a single person, meaning that there would be a huge gap in know-how if they left the company.

Morgan adds that technology plays a significant role in cost and energy savings from audio and video devices, mechanical, electrical and plumbing.

“Technology touches every aspect of what we do. Data analytics, business and artificial intelligence, along with increased cyber security play significant roles in facility management,” she says. “By leveraging technology, it decreases energy and operating expenses and increases the more efficient predictive and preventative maintenance habits that save larger capital dollars.”

Buildings themselves are becoming more technologically advanced, and Gomathi says that means more technologically savvy people are needed to maintain these structures.

“That’s where facility management as a culture comes in,” she continues. “It’s not just about maintaining the equipment anymore. It’s about reviewing data and utilizing new technology like AI. Even before AI, we’ve been using the Internet of Things, which

help facility managers understand the condition of building is, such as a sensor letting us know that temperature has been spiking in a certain area for the past 10 days. Add AI to that, and it can review that reading and let you know that something needs to get replaced or that a repair is needed.”

That said, Tom Pristcher, founder and CEO of TEPCON Construction, notes that many people are resistant to change, and incorporating technology can be complicated, especially if someone is used to doing their job a certain way for many years.

“If there’s a new software that someone is having a hard time with, they’re going to push it to the side because they still have to meet deadlines,” he says. “That’s been the biggest problem adopting technology. If someone says to me, ‘I’m not happy with [this technology] but I still have to get this job done,’ I’m not going to force them to use that software. There has to be a commitment from the company to the integration of that software to make it work.”

Gomathi adds that sometimes technology can be viewed as a threat to a facility manager’s job security, which is not the case.

“I try to show them that this is not something that’s going to take your job away or be used to micromanage them,” she explains. “It’s here to make life easier so they don’t have to keep running from one thing to another. The people aspect of integrating technology is where it gets tricky.”

Like many professions, facility managers have an association called the International Facility Management Association (IFMA) that helps connect practitioners to learn from one another and hear about best practices. It also conducts research and provides benchmarking tools through its website. One resource the Gomathi recommends is a tool that helps organizations assess how many people they need to maintain their portfolio of buildings.

“Let’s say that the City of Tempe wants to know how many people they need to maintain their portfolio of buildings,” she says. “IFMA has done an enormous amount of research nationwide, and they have put together a tool where the City of Tempe can put in the number of how many and what type of buildings they have, and it shows how many people they would need to maintain these buildings efficiently.”

IFMA also has ways for facility managers to further their career through certifications that can be earned through IFMA, Pristcher adds.

“The CFM [Certified Facility Manager] and FMP [Facility Management Professional] certifications are taken very seriously,” he continues. “It used to be facility managers weren’t considered a big career track. It was the responsible person in the office who showed up at 8 a.m., left at 5 p.m. and had the keys. Pretty soon, the work would pile up and you’d have an admin who is dealing with security, coordinating maintenance and

dealing with lease negotiations. IFMA has taken the role and elevated it to a professional career path by being on the forefront of education.”

Gomathi adds that having the credentials helps future employers understand the knowledge-level of a facility manager and helps to boost their credibility. When she first came to the U.S., Gomathi says she did not have any of these credentials but did have five years of experience. Even with a background in facilities management, Gomathi says she had difficulty getting jobs, but receiving an FMP helped her with job prospects.

“As soon as I got that first credential, people understood what skills I had. Within a month or two of getting my FMP, I got my first job here,” she continues. “Besides the certifications, we have activities and sessions that focus on current issues facing facility managers. We recently had a session where we

focused on what other professionals are seeing as pain points and were able to have a conversation with everyone on how to fix an ongoing issue someone was having with their building.”

Many people don’t understand that a career in facilities management can be fulfilling — or even know it’s a field they can pursue. Gomathi notes that many people fall into the profession rather than actively choose it, and that the average age of facility managers is 45 years old. That’s why she says IFMA’s student chapter at Arizona State University (ASU) is so important.

“Many students don’t even know what facility management is,” Gomathi concludes. “We currently work with construction management and business analytics students to expose them to what options they have for a career. We don’t want them to think that just because they’re going through a construction management program that means that’s

their only option for a career. We’ve had students who are now working in the industry because of the impact the student chapter had on them.”

What it is: Facility management is an in-depth industry with a lot of nuance. And, to newcomers, it can be a lot to take in and sometimes even seem a bit intimidating. But it doesn’t have to be. The International Facility Management Assocation can help you strengthen your understanding of key concepts and fundamentals of facility management and refine your communication skills for success in the industry.

Learn more: ifma.org

By KYLE BACKER

Since the pandemic, the cost of rent in the Valley has grown, even as it has tapered off from its peak. AZRE magazine sat down with Courtney LeVinus, president and CEO of the Arizona Multihousing Association (AMA), to discuss the state of the market, what’s being done at the legislature to contend with declining housing affordability and her thoughts on the future of the Phoenix.

The following responses have been edited for length and clarity.

“We’ve always been huge advocates for new construction.” – Courtney LeVinus

AZRE: Where does the multifamily market stand?

Courtney LeVinus: In the Phoenix market, we’re seeing about 92% occupancy, whereas coming out of COVID we were at nearly 98%. Rents have decreased anywhere between 2.6% and 3.6% when you consider concessions, such as when you sign a lease for a year and get a month of rent free.

AZRE: What is driving that rent decrease?

CL: Over the last several years, we finally have seen construction of new multifamily units come to the market. After the 2008 recession, nothing was being built, so we’re now back to normal levels. As a result, we’re seeing occupancy levels decrease, which results in more competitive and in some cases, less expensive rent.

But really, it’s the new construction that’s driving those numbers, and that’s why we’ve always been huge advocates for new construction. Because if we really want to address the housing affordability crisis, it’s a numbers game. We have to build more units at all price points to keep rents reasonable and attainable.

AZRE: Housing is among the top issues Valley residents are concerned about. Why do you think that’s the case?

CL: Affordability is something we’ve been talking about in the industry for many years. Historically, Arizona has always been seen as an affordable state

— we’re certainly not like California or states on the East Coast. But we’ve seen affordability become a hot button issue here.

There was some polling showing that affordability is now a top three issue in the state, after inflation and immigration. When you look specifically at Republicans it’s the No. 3 issue; Democrats it’s the No. 1 issue; and among independents, it’s No. 2.

The rising cost of land, the lack of properties zoned for multifamily, and the increased time it takes to go through the entitlement and construction process all impact affordability. Everything that goes into developing and managing apartment communities has increased, just like our household budgets have increased because of inflation.

AZRE: Tell us more about the roadblocks to bringing new units to the market.

CL: There are several. From our perspective, one is the lack of multifamily-zoned land. The vast majority of it has already been built on or is in the construction pipeline. In other words, there’s a lack of planning for the density needed to accommodate our growing population.

The other major systemic issue is the not in my backyard movement [known as NIMBYs]. You can go to virtually any council hearing for a multifamily project moving through the entitlement

process, and you’ll hear people say that apartments increase crime, traffic, school crowding — you name it. The NIMBY movement is very effective at moving these false narratives, and they are indeed false. There have been numerous studies that show increased density does not result in increased crime. A community of 300 apartment units versus 300 units of single-family housing get the same public safety calls on average.

As far as traffic, apartments cause less traffic than many commercial properties. There has been a fear of density in Arizona for years, and we used to be able to move further out and we didn’t build dense cores like we’re starting to see more now. But today, going through the entitlement process can take anywhere from two to four years, when it used to be a six-to-12month ordeal, and time is money.

AZRE: Is there a reason why that entitlement process is taking so much longer?

CL: It’s a culmination of things. Inadequate staffing at certain municipalities can be an issue, but the NIMBY perspective is prevalent throughout Arizona. What ultimately happens when you have significant opposition is you have more meetings and negotiations between the neighborhoods and the developer, which slows down the process significantly.

AZRE: You mentioned before how there’s not enough land zoned for multifamily in the Valley. Does that provide an opening for NIMBYs to come in and delay things?

CL: You’re right. Because virtually everything going forward has to

go through some sort of rezoning or entitlement process, NIMBYs can make that take a longer than it would otherwise.

I get where communities are coming from when they want to hold as much land as possible for potential commercial development because of the tax base that benefits the city. But it needs to be balanced with residential development, because the jobs that come from commercial properties also require housing for those workers.

Now that we’ve exhausted what land is zoned multifamily, we’re going to see that two-to-four-year process become the norm unless cities take a proactive approach to their housing needs. I think it would help cities reduce the frustration mayors and council members go through on these entitlement projects if they would zone more land upfront for

CITY LIVING: Callia Apartments is a 453,895-square-feet apartment complex that offers a mixture of comfort, style, and convenience. The property is situated at 100 W. Indian School Rd. in Central Phoenix. (Provided photo)

multifamily instead of having a fight each and every time.

We’ve seen some jurisdictions who have decided that they need to address housing needs and zone more land for high density residential. They’ll do blocks of rezoning so they only have one major hearing as opposed to 50 individual ones, and we’re seeing that as a potential avenue to change how cities should be looking at the rezoning process.

AZRE: What sort of legislative solutions exist for this problem?

CL: When the polling started to show affordable housing as one of the

top issues, it certainly got the attention of the legislature. From AMA’s perspective, there were two bills that we were advocating for.

One is House Bill 2297 which allows for the conversion of commercial buildings to multifamily. Economist Elliot Pollock recently completed a draft study and is anticipating as many as 150,000 units could be built based on what is outlined in House Bill 2297, and these projects would be built without going through a rezoning or entitlement process. It’s basically an administrative approval process with the cities, and it impacts municipalities of 150,000 residents and above. The bill says you

can convert existing commercial to multifamily with some restriction protection historic neighborhoods.

There’s a requirement for affordable housing and a provision that says not more than 10% of the existing commercial buildings could be converted, and the parcel has to be between one and 20 acres. So there’s all sorts of protections built in, but basically the focus of the bill is to take underutilized or blighted commercial properties and either do a true adaptive reuse where someone uses the building envelope, or it can be demolished to build brand new multifamily.

MEETING A NEED: Vista Ridge is an affordable housing community in Phoenix with income restrictions and tremendous amenities for residents. The property has a minimum household income requirement of 2.5 times the monthly rent amount to qualify. (Provided photo)

AZRE: You mentioned that 150,000 multifamily units could be brought to market thanks to House Bill 2297. How would that help address the undersupply of apartments? Can you contextualize that number?

CL: This study is a few years old, but the Arizona Department of Housing released a report showing that the City of Phoenix is about 163,000 housing units short of what it needs. House Bill 2297 unlocks potential units by cutting regulatory red tape, and developers are able to go from concept to certificate of occupancy much faster, which makes these projects very appealing.

AZRE: Is there anything else readers should know regarding the legislature?

CL: The other thing I wanted to mention is Senate Bill 1162, which

requires cities to do a housing needs study. They need to look at their current and anticipated population, and build in their model how many residents they’re going to need to fill the jobs in the city. Municipalities also must show many housing units they are short, what they need to build, what their average permitting is and how many houses they’re building each year. The bill also reduces the timeframe of going through the rezoning application process, meaning cities have to decide whether to approve the application within 180 days.

AZRE: How much can be done at the state level when municipalities have much of the power when it comes to planning and zoning?

CL: There’s always going to be

negotiation with the cities, and the approach we’ve tried to take with addressing some of the affordability issues stem from creating consistency between cities. In some states, the legislature has taken over this issue because the cities have failed to do so.

A legislator has the same constituents that a council member has, so they’re hearing the same concerns, and I think there’s been some frustration amongst legislators that municipalities have not done enough and need to step in. Another two bills also passed the legislature, namely a missing middle housing bill and a bill allowing casitas, so the legislature has really taken notice of this issue.

While it’s true that the zoning and entitlement process is and will continue to be a local issue, it has risen

Bryten’s reputation is built on more than just results. With trust, reliability, and unwavering commitment to our owners and residents, clients don’t just hire us—they become partners. Our clients’ success is a testament to the strength of our relationships, the effectiveness of Bryten’s services, and the positive impact on their assets. Choose us as your multihousing property management partner for our expertise, proven results, and the unwavering trust our name carries.

Your success is our goal.

as a top concern for Arizona residents, and therefore legislators feel they can no longer ignore it.

In 2023, we tried to pass legislation that would speed up the zoning and entitlement process by removing some of the non-safety regulations, such as design review, and it was met with significant opposition from the League of Cities and Towns, so this last legislative session we asked them to come to the table. We had to give a little and so did they, but both House Bill 2297 and Senate Bill 1162 ended up being consensus bills.

AZRE: Housing is a sensitive issue, and there’s been reporting about rising eviction rates in the Valley. Is the media

anything about eviction rates?

CL: This is probably the most sensitive issue on both sides — for our residents and for those who own the property. The very last thing a rental owner wants to do is evict someone because it’s a lose-lose situation.

But where we struggle with the media is they often look at eviction numbers in a silo and fail to recognize that eviction numbers in Arizona will continue to go up because we have a growing population. If you look at eviction statistics on a per capita basis, we’ve actually gone down. We’ve gone from 6.2 million people in 2008 to 7.5 million in 2023, meaning we have more housing and therefore those eviction numbers are naturally going to increase. We shouldn’t

look at them on a standalone basis. The other thing that gets lost in the media is that when a property files an eviction with the courts, that doesn’t mean someone is actually evicted. Sometimes filings get conflated with actual evictions.

AZRE: While more apartments have been built in recent years, there’s a perception that most of them fall into the luxury category. What’re your thoughts on that?

CL: A lot of the projects coming to market are luxury, and part of that is because it’s so difficult to develop workforce housing for a variety of reasons. Some we’ve talked about, such as the regulatory environment. The

"...Arizona is at a very important crossroads right now."

– Courtney LeVinus

National Multihousing Council and the National Home Builders Association recently completed a study showing that more than 40% of the cost of housing comes from federal, state and local regulations.

For a project to work financially, many developers feel they must build luxury to make the project cash flow. Workforce and low income housing traditionally have different financing mechanisms including a variety of stacked financial provisions.

It’s just really difficult to build middle-income housing. Some of it comes from going in front of planning and zoning commissions, because that’s where we start to see the neighbors say they want the communities to have all these bells and whistles to look a certain way. For the project to get through the entitlement process, a developer will often have to reduce density, but that doesn’t mean it reduces the cost of operating the community. It’s hard to make these deals pencil. That’s why we’ve been pushing at the legislature to reduce some of these non-safety related regulations so we can get back to building starter apartments.

AZRE: Greater Phoenix is an emerging Tier 1 market with significant inbound migration and multi-billiondollar investments from companies such as TSMC and Intel. Is a higher cost of living one of the side effects of this growth?

CL: I was born and raised here in Phoenix, and this city is very different from the one I grew up in. It’s exciting because there’s so much potential here, and that’s why people are coming here.

To a certain extent, affordability will continue to be an issue, but from my perspective, I think Arizona is at a very important crossroads right now.

If we can implement policies to reduce regulation to encourage housing, we can continue to be a market where people want to move and have a quality of life without breaking the bank. If we fail to make some of these hard choices, we’re going down the path of California, Oregon and Washington.

But we have an opportunity to correct our path. We’re still affordable compared to other states, but it’s going to take council members and mayors who are willing to make difficult decisions when they’re

hearing from residents who may not want them to go in that direction. I’m not of the opinion that housing costs are doomed to increase.

AZRE: What are some of AMA’s top priorities for 2025?

CL: The elections will influence what happens in the market from Arizona. From AMA’s perspective, we’ll continue to be laser focused on protecting property rights and reducing unnecessary barriers to new construction. We’ll also advocate for affordable housing via the extension of the state Low-Income Housing Tax Credit by urging the legislature to properly fund the Arizona Housing Trust Fund.

There are some proposals on the federal level that we’re concerned about. Recently, a national rent control measure has been talked about, and that would be catastrophic for Arizona and the nation. If there’s one area where economists generally agree it’s that price controls don’t work. Rent control reduces the amount of new construction and further exacerbates the affordability crisis.

Even in a world where remote and hybrid work is more common than ever, the office remains a place to build teams, meet clients and make business deals happen. Today, offices are rich in amenities, such as hidden speakeasies and state-of-the-art gyms, to encourage employees to commute and collaborate with their fellow teammates. The following pages showcase some of the best office spaces in Arizona. All photos were provided to AZRE magazine.

OWNER: WCCP

GENERAL CONTRACTOR: DAS Technology

ARCHITECT/DESIGNER: Alexi Venneri

LOCATION: Camelback Tower, 6900 E. Camelback Road, Suite 1100, Scottsdale, AZ 85251

SIZE: 16,292 square feet

VALUE: Tenant improvements equaling $650,000

BROKERAGE: Keyser

START DATE: December 2023

COMPLETION DATE: July 2024

WHY IT’S AWESOME: DAS Technology’s new penthouse is the entire 11th floor of Camelback Tower. The office has a wraparound patio with breathtaking 360-degree views of the Valley, Camelback Mountain, Old Town Scottsdale and spectacular Arizona sunsets. The modern kitchen features complimentary cold brew dispensers, a Bevi-flavored seltzer water station, a coffee barista machine, TVs, stationary bike workstations and plenty of comfortable break spots. The DAS market has inexpensive snacks, drinks, and lunch items, and the chill room features a relaxing massage chair.

OWNER: Trammell Crow Company

GENERAL CONTRACTOR: Wespac Construction Inc.

ARCHITECT/DESIGNER: McCarthy Nordburg Ltd.

LOCATION: 8605 E. Raintree Drive, Scottsdale, Ariz., 85260

SIZE: 12,735 square feet

START DATE: November 2023

COMPLETION DATE: April 2024

WHY IT’S AWESOME: Located within the Axis Raintree Building, this tenant improvement project for a local insurance company has transformed the space into a modern and functional office environment. The thoughtful interior design and the use of luxe materials elevate the space; cloud ceilings throughout create a dynamic and airy atmosphere. The polished concrete entryway and reception area, highlighted by a stunning moss wall, leaves a lasting impression.

GENERAL CONTRACTOR: Wespac Construction Inc.

ARCHITECT/DESIGNER: RSP Architects

LOCATION: 16220 N. Scottsdale Road, Suite 400, Scottsdale

SIZE: 16,900 square feet

START DATE: April 2023

COMPLETION DATE: August 2023

WHY IT’S AWESOME: Located on the fourth floor of a mid-rise building in Scottsdale, this innovative dental partner group recently underwent a stunning office transformation to accommodate its expanding team. The project introduced new private offices and conference rooms, revamped the breakroom, and added a stylish new reception entrance, all aimed at enhancing the employee experience. Fresh finishes, including modern paint, carpet, wall coverings, accent ceilings, and lighting, were thoughtfully chosen to complement the sleek new furniture and vibrant graphics.

OWNER: Tempe Campus Lot 8 Parcel 2, LLC

GENERAL CONTRACTOR: Wespac Construction Inc.

ARCHITECT/DESIGNER: RSP Architects | Forward Tilt

LOCATION: 2190 E. Elliot Road, Tempe

SIZE: 26,143 square feet

START DATE: July 2023

COMPLETION DATE: November 2023

WHY IT’S AWESOME: TruWest Credit Union’s new headquarters, located on the third floor of the Discovery Building Campus in Tempe, is a testament to innovative design and functionality. This Class A office space features a blend of open and private workspaces with modern finishes, including custom millwork and luxury vinyl tile. The space boasts unique elements including acoustical lighting and an operable glass partition, creating a dynamic environment. Centralized executive offices, providing daylight and glazing access to the open office, foster a culture of accessible communication.