THE GREEN FINANCE MARKET NEEDS TO BE

n 8th September, the UK lost a symbol of strength, leadership and grace. Bridging & Commercial’s deepest condolences go to the Royal Family and the countless people who loved Her Majesty The Queen Elizabeth II. “It is a source of great pride to me that the leading role my husband played in encouraging people to protect our fragile planet lives on through the work of our eldest son Charles and his eldest son William. I could not be more proud of them,” the Queen said at COP26, after Prince Philip’s death. This ESG Issue is dedicated to her. It’s been one year since The Sustainability Issue of Bridging & Commercial and, while there has been progress in the lending sector (and I am purposely grouping the wider mortgage market with this, as it’s not just down to our industry), we are still far behind where we need to be to make significant change—and in time. This is why members of the newly formed ESG Forum, made up of specialist lending pioneers in sustainable finance, have been getting together regularly to solve the multiple conundrums of bringing ecofriendly housebuilding into the mainstream. I was invited to chair the latest discussion [p52] on how to commercialise the green finance space in a bid to accelerate its adoption, accessibility, and profitability for developers.

Elsewhere, we look at whether the mammoth task of retrofitting the UK’s old and draughty housing stock is indeed feasible by the government’s nearing deadlines [p36]. Considering that price rises are predicted to continue into 2023, the undertaking is clearly in jeopardy. With more homes set to be built in areas prone to flooding, we also ask if the insurance industry is ready and able to cope [p96].

As climate change brings about more devastating weather—as seen recently in Pakistan—insurers around the world need to act now .

We’ve not neglected the ‘G’ in ESG, either: you can read Global Counsel’s Felicity Hall’s column on good governance [p30]. In particular, why board composition and pay and the risks surrounding lobbying and responsible political engagement have seen significant attention over the past 12 months. We also take a look at formal and fun activities that firms are doing to improve their social stance—in the hope this inspires you to do the same [p68].

In addition, we interview a number of Islamic finance providers about the ways in which ESG is built into their propositions [p75]; talk to Arc & Co’s Georgie Crocker on how funds are under the most scrutiny to provide transparency over their sustainability investment criteria [p88]; and, following two high-profile broker acquisitions, we ask Begbies Traynor Group about its plans for the future and how the new division will be able to arrange finance for a wide variety of renewable technologies and offer advice on sustainability solutions for all businesses [p18].

Despite the majority of the conversation currently centred on the sweeping changes around the cost of living crisis, base rate rises and, most recently, scores of lenders pulling or repricing products due to market volatility, the importance of ESG has never been greater. We hope you find it helpful to read about what other companies are doing to improve their efforts in this regard and that it helps shape or enhance your own. As the Queen famously said: “It’s worth remembering that it is often the small steps, not the giant leaps, that bring about the most lasting change.”

Beth Fisher Editor-in-chief

Plans to reform energy efficiency ratings in Scotland are sparking questions over the existing EPC system. Industry experts weigh in on the use and transparency of its data, and whether it reflects current issues, technology and markets—or needs a revamp. While it may still be the best tool out there, is it now an outdated green herring?

Given the global climate challenges we face, continual development and improvement of the ways in which we measure efficiency and carbon emissions are critical. EPC scores are a very useful tool for both property professionals and the general public, allowing people to easily identify the relative performance of a property. However, they are based on an estimate of what it costs to heat a home, rather than the carbon emissions generated. The underlying science behind EPC ratings hasn’t changed since the methodology was last updated in 2012, but the technology has evolved rapidly, and energy efficiency is as hot a topic as ever. Therefore, it is important to keep the software that calculates EPCs as up to date as possible, factoring in the latest technologies being used within the construction industry—whether for new-build developments or retrofitting homes and commercial buildings. Also, look closely at the carbon emissions on buildings, not just energy efficiency—the ultimate goal is to address both.

The EPC process was created many years ago, and the issue is it is now being used as a solution for something that it wasn’t designed for. However, it is still the best tool and widely used in the market to understand the housing stock in the UK. When it comes to improving the EPC rating system, there are two main areas that need to be considered. First, it should be based around the reduction of carbon emissions. Second, the cost of improvements and energy need updating, so that the recommendations are more relevant to consumers and they understand the impact of improving a property in relation to emissions and prices. A review of the SAP methodology and costings needs to happen and be implemented as soon as possible to avoid homeowners and landlords making changes to properties now that won’t have the desired longer-term results.

Where EPCs really fall down is their inability to show the true carbon impact of a property, as they take no account of the embodied carbon. A newly built, well-insulated home could quite feasibly be awarded an EPC A rating because of its energy efficiency—but this’d be entirely misleading if the property was packed with embodied carbon. The climate impact of the construction process would be totally overlooked, making the EPC little more than a green herring. That’s why I feel EPCs are no longer fit for purpose; they are meaningless as a rating of a property’s green credentials, and a would-be buyer or tenant who wants to choose a home with a lower carbon footprint can learn nothing from them. Moreover, EPCs do nothing to encourage property developers, builders or their supply chain to build more sustainably. If the government is serious about helping the construction industry get to net zero, the EPC system needs to be reformed. You can only manage what you can measure, and we need a more robust benchmark that takes into account both operational and embodied carbon.

The EPC system is not necessarily outdated, but it can drive short-term thinking. With the introduction of more data points and consideration of additional factors, a more precise scoring can be provided. We need greater precision and an openness to work in conjunction with more modernised scoring systems. For example, the Building Research Establishment Environment Assessment Method (BREEAM) certification exists to assess the long-term sustainability of a project, apply a rating and make recommendations on how it can be improved. The system sets the standard for best practice in sustainable design and is more forwardthinking in considering how the property is designed to mitigate environmental impact, rather than simply looking at what that impact is likely to be. Likewise, in the near future, we could see steps taken to combine sustainability and efficiency ratings to provide a more wellrounded ecological score for new builds or refurbishments.

The system, if not outdated, is certainly flawed. It is very reliant on who assesses the property, and the algorithms used to decide the final score produce inconsistent and, at times, incongruous results. The issue is that the rating is based on the cost of energy used, not on the actual carbon emitted, so the current system can punish developers, landlords or homeowners for installing heat pumps, as they use more electricity and liquefied petroleum gas, which are costlier. The debate is whether the EPC rating system ought to be improved or replaced. I think the latter is unlikely—with all the EPC regulation coming into play, scrapping the system would cause huge upheaval, so it’ll be a question of working within the system we have. Energy consumption and efficiency are critical, but so are the methods used for heating or powering the home. This is where more up-todate calculations are needed so the scoring system truly reflects the energy sector and climate change landscape.

The SAP EPC methodology is in need of significant reform— especially as governments are increasingly using EPC ratings as a target for policy and regulatory development, far exceeding their original intention. The EPC calculations result in three performance metrics—estimated cost, energy use and carbon emissions of the building itself. In housing, the overall EPC rating is based on cost alone, not the latter two metrics—and it is the least reliable of the three, since real-life energy bills are highly dependent on energy price fluctuations, which are not considered by EPCs. A greater emphasis needs to be put on the data that is already recorded—especially the CO2 emissions and energy usage parts of the EPC. These two metrics should be more visible to consumers and their relative ratings should be based on absolute figures, rather than abstract numerical scales. Consumers should also be able to manipulate the EPC data to tailor it to their own personal circumstances and, in doing so, create a more realistic dataset for that property and its occupier. This is why RICS is calling for significant investment in the digitisation of EPCs and the way consumers can benefit from its data. To achieve this, the information underlying the EPC calculations must be made publicly available.

EPCs are often criticised as inaccurate when a comparison is made to actual running costs, but this is due to two main factors: occupancy is not taken into account; and the methodology— and therefore assumed fuel prices—is out of date. Given the dynamic nature of energy costs, which we’re likely to see continue, the procedure needs a mechanism to adapt more frequently. The same is true of emissions factors for electricity, which are not as dynamic as prices, but have changed significantly since the last revision 10 years ago, and are becoming more important as we focus on the transition to electrification of heat in line with government strategy. Enabling more regular changes to both the methodology and underlying fuel costs and carbon industry will allow the EPC to adapt better to market changes. In relation to accuracy, consideration should be also given to quoting a percentage saving in fuel bills rather than absolute values for predicted savings. Finally, the EPC is a static document, with a set of recommended improvements and associated savings that assume all preceding recommendations have been implemented, so it doesn’t allow for a pick ‘n’ mix approach when considering a package. The government should allow the sharing of the underlying data for an EPC, so property owners can use thirdparty services to better model a package of improvements for them, as well as potentially enabling such modelling through the EPC register itself.

high-profile

new

is

a

Begbies Traynor Group (BTG) was founded in 1989 and started off as an insolvency practice, which subsequently diversified into corporate finance and property consultancy, and now supports this with a nationwide network of over 100 offices. The 33-year-old business forms part of Begbies Traynor Group PLC, an AIMlisted professional services consultancy providing solutions for businesses, financial institutions and professional advisers in corporate recovery, restructuring and turnaround, corporate finance, real estate consultancy and forensic accounting.

In a move to grow further and bolt on more complementary services to its clients, BTG acquired its first brokerage, nationwide firm MAF Finance Group, in May 2021. As part of the purchase, MAF—previously known as Midlands Asset Finance—became part of the group bringing comprehensive industry expertise spanning construction, engineering, manufacturing, healthcare, agriculture and renewables, fleet management, vehicle leasing, supplier finance and property.

MAF—which arranges facilities for new asset purchases, including equipment, vehicles and property, as well as refinances and restructuring existing loans—has a team of finance experts with managers in the East and West Midlands, Lincolnshire, North East, North West, and London and the South East.

Two months later, BTG bought London-based brokerage Mantra Group. The business consists of a commercial finance (real estate and trading businesses), regulated mortgage and BTL, and insurance brokerage, all in-house with a national presence.

The plan is for Mantra and MAF Finance Group— which currently have around 80 staff between them and are expected to organically grow in headcount and number of customers—to retain their brands while sitting within the newly formed division, BTG Funding Solutions. Now they are part of the same group, both can offer or introduce business across a wide range of sectors, including real estate (such as residential and commercial mortgages, BTL, bridging and development finance), construction, engineering and manufacturing, haulage, healthcare, agriculture, renewables, and vehicles.

The two brands will work together on their cross-sales strategy to offer extra services to existing and new clients.

When asked why MAF decided to be purchased, its managing director Dave Chapman explains they were looking at the next stage of growth and how they can now catapult to a much higher level. “BTG was a good fit for MAF as it leaves you to get on and run your business while offering support in areas, such as marketing, if required. It also provides a national network of offices and accountancy connections which was attractive,” he states.

From BTG’s viewpoint, the two brokerages can help balance cyclical and non-cyclical income streams and further strengthen the group’s relationships.

“The joining up of MAF and Mantra means we’ve got a combined powerhouse of lenders we deal

with. So, the accumulation of our lending looking forward will be pushing about £1bn,” says Dave.

“We’ll be doing more business across the group and helping more clients,” he adds, pointing to BTG’s “massive accounting connections across the UK” where the group has secured a lot of its business over the past three decades.

Nimesh Sanghrajka, managing director at Mantra, comments that, being based in London, and with most of its business South-centric, the BTG affiliation automatically gives the brand a wider national presence. “There are various complementary businesses within the BTG stable, namely corporate finance, advisory and valuation. The potential to retain, scale and grow the Mantra brand under the BTG banner was too attractive to turn away.”

“To complement the purchase of MAF was also very appealing,” he continues. “MAF has a well-established asset finance and renewables business which we can plug into our existing clients. Furthermore, we can offer their borrowers regulated mortgages and insurance services so we can operate in a wider market.”

In terms of the division’s focus on ESG, MAF’s renewables asset finance expertise can be utilised to work with a whole variety of businesses to help them reduce their energy costs, something Dave has seen greater demand for over the past year. “Everyone is now starting to get on board with renewable strategies, with energy costs going through the roof.” For example, MAF is providing clients with renewable energy audits to look at current practices to see how they could be improved. It can also find finance for equipment, such as solar panels, solar battery storage, electric vehicle charging, wind turbines, ground source heat pumps, air source heat pumps, biomass boilers, combined heat and power, smart meters, and voltage optimisers.

When asked about the importance of specialist finance advice during a volatile and constantly changing market, Dave replies that both MAF and Mantra are “trusted advisers” and can offer wholeof-market solutions across a diversified product range, with access to a wide panel of lenders. “We have strong relationships with funders and can help clients get their transactions completed, whether they are more vanilla or slightly up the risk curve due to market conditions. We are specialists in what we do with many years’ experience.”

BTG Funding Solutions—described as a “vehicle for future growth” and which sits alongside BTG insolvency, BTG advisory, and Eddisons—also has its eye on future purchases that make business sense and offer a natural synergy between the two brands. “If we do bring in some other acquisitions in the finance brokerage space, and they don’t fit within neither MAF or Mantra’s brands, then we can put those under BTG Funding Solutions,” comments Andrew Dunn, group marketing and business development partner at BTG.

In the meantime, the focus will be on a smooth integration of MAF and Mantra within BTG Funding Solutions and implementing a clearly defined crosssales strategy in a bid to promote additional services and help more SMEs achieve their goals and grow.

Amid the tumult of recent times, Aspen Bridging’s equity funding position supports growth plans as the lender launches a new rate card and expands its bridge-to-let range with a new semi-commercial offering

Words by andreea dulgheru

Words by andreea dulgheru

the start of this year, Aspen was determined to grow its book by 50% over the year and to build on its reputation as a funding partner of choice in the bridging market. In February, it unveiled its new bridge-to-let offering, designed to offer wider flexibility and lower ERCs to fill market gaps and continue the firm’s growth.

It seems to be a success so far — the lender has surpassed its target of growing its overall loan book by 50% within the first seven months of this year, partly due to having grown its average bridging loan size to £1m, but also because one-quarter of all deals done in 2022 so far were completed using the bridge-to-let proposition.

As the Bank of England and the government appear at loggerheads, and as base rates are rising and set to climb further, I ask Aspen’s director Jack Coombs how this affects the lender’s outlook and what its plans are for the next 18 months.

“We have recently had positive meetings at executive and board level and are delighted to say the group plans to maintain the current exciting growth trajectory over the next 18 months,” said Jack.

“We recognise that the UK has an undersupply of housing, high levels of homeowner equity, and most borrowers are on fixed rates. In addition, there are always good developers and investors with strong projects who ought to be supported.

“Being in the fortunate position of being equity funded, we at Aspen are determined to offer our support during this time, just as we previously did during Covid both through our conventional and our CBILS offerings.”

The business has overhauled its rates and products for October to ensure it can offer practical and flexible solutions to introducers and borrowers—especially in light of the change in offerings and appetite across the marketplace.

Several core areas have defined Aspen’s lending this year, including refurbishment

and development exits (including structural projects with several million pounds of works cost), no valuation (supporting rapid requirement of funds), and foreign national purchases. It is the firm’s intention to continue focusing on these specific products to meet rising demand due to where the market is heading.

For refurbishment and development exits, where Aspen has written 40% of its loans this year, the lender expects to see developers opting to take bridging and bridge-to-let loans to help purchase, fund works and provide sales exits periods, as smaller competitive development facilities are harder to come by.

In this core sector, Aspen is now offering 75% LTV at 0.79% per month, as well as providing 100% of works funding in arrears. In addition, the lender will increase the LTV to 80% to save a good quality deal.

Meanwhile, its no-valuation product, which is offered at 0.79% at 70% LTV, has contributed to 25% of all deals completed since the beginning of 2022—which, according to Jack, are generally completed in less than 10 working days. “[The no-valuation product] is working incredibly well for us, and it’s quite an important point in a market where the average bridging completion times are getting slower and as some term lenders are pulling offers within days of completion,” says Jack.

Foreign nationals have made up 20% of Aspen’s client base over the last 12 months, in particular those from Asia and Africa. The lender expects this will continue, particularly as the weaker pound and the strong fundamentals of London property make for an attractive proposition to international investors, while term offerings in the space are currently being redefined. Aspen has made a point of charging these borrowers the same as UK nationals.

Across all of the above areas, Aspen is also offering its stepped rate product, which has comprised almost half of the bridging loans written this year, with rates of 0.49% for the first six months.

There is also no lack of appetite for larger deals—indeed a full 60% of the live book is made up of deals over £1m.

According to Jack, the bridge-to-let range launched in February was a “big door opener” for the lender, as it boosted the number of active introducers the firm works with. “The bridge-to-let product spikes brokers’ interest, and then they find out that we have a suite of excellent bridging products. Thanks to this, we’ve seen our introducer base grow significantly throughout this year,” he expands.

Aspen’s bridge-to-let terms run for either 18 months or two years and are split equally between the retained bridge initial period and the serviced BTL. However, depending on their needs, the borrower can move onto the BTL loan up to three months earlier or later, or exit at any point with limited ERC’s typically of only 1% and falling to 0% in the final month.

This two-year offering is even more relevant now due to rising BTL rates, and, given the greater need for flexibility with regard to whether to sell or refinance, is particularly helpful.

The residential product range, which has been relaunched with pay-rates of 5.49% at LTVs of up to 75%, has been used to support heavy works projects across England and Wales, including a £5.2m project in Bath.

Now, the finance provider is taking a step further by bolstering its offering with a range designed specifically for semicommercial properties. The solution— which was launched in September—offers loans between £200,000 and £2m up to 70% LTV. The product will cover properties where class E commercial makes up to 50% of the floor plan by area and will also permit heavy works to take place during the bridging finance element.

Jack states this product is designed “to both contribute to the revitalisation of the high street and meet the demand expressed by brokers and borrowers for a flexible product in this space”.

Rates for the semi-commercial bridgeto-let loan start from 0.79% per month for the bridging portion and 5.99% for the remaining BTL finance.

The product, like all of Aspen’s range, is available to individual borrowers, as well as limited companies and foreign nationals

with a good credit score. While some explicable credit issues are acceptable, depending on the case, the company primarily targets experienced borrowers.

I was also curious to learn how the specialist lender’s ESG strategy is reflected in its ambitions. As part of its goal to reduce its carbon emissions, Aspen has pledged to plant a new tree for every case completed, working with the Lincolnshire Wildlife Trust. The initiative aims to reduce the firm’s overall scope 1 and 2 emissions to below net zero this year, and is expected to result in the removal of over 200 tons of CO2 by 2025.

“Our Aspen Green Commitment pledge is part of a strategy to raise awareness of our green credentials and aspirations in that market. We are also always open to fund more green projects, and we expect the new semi-commercial bridge-to-let

product will contribute, alongside our existing heavy refurbishment offering, towards improving EPCs on properties we lend against up and down the breadth of the UK,” says Jack. He adds that the lender is considering introducing green incentives and discounts for energy efficiency improvement works as it continues to adapt its offering based on market conditions and demand.

The business also has big plans for its team. Having recruited six employees across its underwriting, credit, and risk divisions so far this year, the lender plans to hire more staff to ensure it can continue to meet its time-based service excellence targets—with loans being completed this year in as little as five days and with over half of the deals being completed within 20 working days of submission. A key part of the recruitment drive is

Jack Coombs, director at Aspen Bridging

its graduate scheme, which Jack notes has contributed significantly to Aspen’s success. “Over 30% of the staff that we’ve got in our team are graduate hires, and some of our best underwriters and credit analysts have come from [this] scheme. I wouldn’t change this approach for the world, and we look forward to welcoming the new intake in 2023,” he adds.

And, with a bigger team comes the need for a larger office; in October, Aspen signed a 10-year lease on new premises which adds 40% to Aspen’s previous floor space to accommodate the expanding company.

As we talk about the lender’s plans for the near future, Jack’s pride in how much the business has achieved to date is clear. “We are really excited about the development of Aspen over the past few years. The aim when we launched the company was twofold: first, to offer a quality service, useful products and competitive terms to our customers and, second, to provide S&U PLC—our listed parent—with meaningful diversification of the loan book and earnings.

“We are pleased, particularly given the support of the broker community and winning this year’s Bridging & Commercial award for Product of the Year for our bridge-to-let offering, to be meeting our first goal of providing a quality service and competitive products.

“This year, we are also firmly en-route to achieving our second aim of diversifying our loan book, and expect to be able to do so truly within the next two years. We will continue to offer clients and brokers alike a certain and trusted lending partner.”

At MS Lending Group we are committed to delivering the best service to our clients.

We have also made a commitment to ESG.

MORE ABOUT OUR PRODUCTS

HOW WE CAN HELP YOU!

&

our details.

our

a picture of you planting the

on

TAG US, & we will also plant a tree on your behalf.

Companies and financial institutions have long been aware of the financial and reputational importance of good governance. Most are likely to have attended to this many years before they began considering the significance of environmental or social issues.

The overarching concept of ESG is now, to some degree at least, in the mainstream across all sectors of the UK economy. Yet, amid this clear shift, E, S and G of ESG have not always been given equal weight.

With the warnings around the scale and likely effects of climate change becoming more bleak every year, it is regarding the environmental aspects of ESG where businesses, including in specialist finance markets, have tended to find themselves coming under the most pressure. This has led many to focus the development of their ESG strategy around issues such as greenhouse gas emissions and resource use.

When it comes to the S of ESG, a step change in focus on the issues was predicted in the wake of the Covid-19 pandemic.

As we enter the perfect storm of an energy and cost of living crisis, this is a narrative that continues to build momentum and gain prominence in business decision-making.

The governance aspect of ESG, on the other hand, has often felt somewhat removed. As a concept, it tends to receive much less media attention than social and certainly environmental issues.

But, while governance does not have quite the same excitement surrounding it, it is certainly no less important.

Included within the governance bracket are a wide variety of matters, ranging from the overarching management of ESG risks to the composition and structure of executive boards through to accounting and audit, as well as bribery and corruption.

As with all ESG issues, some governance topics are more material to certain businesses than others. Two areas where there has been a significant level of attention over the past year—and which are highly relevant for the specialist finance sector—include board composition and the management of risks surrounding lobbying.

Under board composition, stakeholders and regulators alike are increasingly fixated not just on the composition of boards but also on the extent to which they further progress on subjects such as diversity and inclusion (D&I).

In the UK, the FCA has been extremely active in supporting D&I progress among regulated firms, publishing new transparency rules in April this year and consistently noting D&I as an area of focus within its strategy documents.

In addition to how a board is composed, we have seen a substantial shift in pressure on how executives are paid. In general, two metrics guide this debate: the first is the magnitude of remuneration; and the second the incentives.

On the latter, there has been a rapid increase in linking executive remuneration to ESG performance, in particular among some of the largest UK businesses and financial institutions.

For most companies, ESG measures in executive incentive plans have tended to focus on easily quantifiable issues such as the number of health and safety incidents, rather than driving executives towards improving their performance against harder-to-measure ones such as greenhouse gas emissions.

Over time, however, we can expect more businesses to consider and include a wider range of ESG matters in incentive plans.

A final pressure point for boards is around the overall management of ESG risks. There has been a particular

emphasis on this from global companies over the past year as the EU has proposed a corporate sustainability due diligence directive, a piece of legislation designed in part to make business leaders more accountable over ESG issues. Similar legislation is being called for in the UK by investors.

In the meantime, businesses’ ESG reports are starting to include clearer information on accountability within companies, with an increasing number of sustainability specialists being appointed at board level.

Many of these trends are earning significant traction in the mainstream of the UK economy. But, as with the concept of ESG as a whole, one can with reasonable comfort assume that expectations for the specialist finance market will need to align quickly.

It is not just how boards are structured, however, that is gaining attention regarding governance, but also how businesses push to influence governments and policymaking.

Business ethics relating to traditional financial risks, such as market manipulation or money laundering, have long been a concentration point of regulators and wider stakeholders. Now, we are increasingly seeing more interest in the lobbying positions companies and

Words by felicity hall

Associate director of climate and sustainability at Global Counsel

Governance—the G in ESG—concerns the very oversight and reputation of a company but receives little publicity, despite a sharp evolution in the issues it covers

financial market participants are taking on ESG issues.

These have been grouped broadly under the topic of responsible political engagement, where much of the motivation has been on the lobbying activities of industry in relation to the achievement of national and international climate goals.

To help with this, in March this year, the Global Standard on Responsible Corporate Climate Lobbying was launched. It aims to commit firms and investors to ethical practice in this area, including disclosing any support given to trade groups who may campaign on their behalf, and ensuring companies take action if lobbying is in conflict with the achievement of the Paris Agreement goals. Governance might feel like the familiar old hand of ESG, but the dynamics within the issues it covers are changing quickly.

For those operating in the specialist finance sector, staying abreast of these offers opportunities. After all, good governance not only includes robust risk management, but is also a way of improving social and environmental performance by ensuring that ESG is fully woven into the fabric of the business.

Precise Mortgages introduced a new range of refurbishment BTL mortgages this summer, including two options charged at preferential interest rates to reward clients carrying out energy-efficient upgrades. Colin Barrett, group mortgage proposition director, walks us through the products and explains why the lender has chosen to go down this route

mortgage once the improvement work has been done, provided that the property meets the expected valuation following refurbishment. The BTL mortgage can be taken out at up to 80% LTV based on the post-work valuation of the property. Landlords can usually choose whether to pay the interest on the bridging finance during the refurbishment work or keep their costs down by adding it to the BTL mortgage once the property is lettable. They also have the reassurance of knowing how much they will be paying on both parts of the loan from the start of the process, along with a secured exit for the project as both the bridging and BTL offers are issued simultaneously. This can obviously be a real benefit in a rising interest rate environment as it allows borrowers to lock in rates upfront.

We are of course not newcomers to refurbishment BTL lending. This simply builds on our established products by incorporating an environmental element. We still offer a standard refurbishment product, which might for

refurbishment of a property that already has an EPC rating of C or above, or is awarded such a rating after the work has been carried out.

What type of landlords can these deals be suitable for?

These products suit a wide range of BTL clients, but they hold the greatest appeal for SME landlords looking to improve their properties to optimise rental yields, rather than very large investors with huge portfolios. As a rule of thumb, we would say they have most appeal to those planning on spending anything from one to four months on the works.

What considerations did you take before launching the BTL refurbishment range?

As a group, we are committed to delivering a positive impact on the environment, accelerating the transition to a low-carbon economy and achieving operational net zero by 2030. Part of that commitment entails innovating and designing products that enable and support our customers to act in more environmentally conscious ways. The BTL refurbishment products aim to do just that but, before launch, it was

of their properties, but that engagement levels were not as high as they could be. So, along with offering these products, we know we have a job to do in raising awareness.

What advantages do landlords have by using a refurbishment BTL mortgage rather than dipping into capital reserves or using a straightforward remortgage to fund their projects?

Every individual landlord client will make their own decision about how to fund property improvements to optimise capital value, and those decisions will of course be informed by a range of factors, including the structure of their property portfolio, their capital position, their financial forecasts and so on.

But, for landlords who are looking to borrow to finance a property refurb, this selection of products allows them to keep all of their investment costs associated with the one property. There is no minimum term on the bridging element, all of the rates are agreed upfront and there is a consistency of process, which keeps it simple and easy to manage.

to the launch of the new range—numbers have been significantly higher than forecast overall. But, to date, there has been more interest in the standard product and less in the energy efficiency and EPC C+ loans than we had anticipated. There has been roughly a 50/50 split between the standard and the other two combined, when we were expecting more landlords to opt for the energy efficiency loan—not least because it is relatively easy to qualify for but also because it’s cheaper. This tells us we have further to go on the education piece while acknowledging that energy efficiency options won’t necessarily suit every one of a broker’s landlord customers.

Why did you include the standard option? Why not simply give borrowers the choice between two products to encourage energy efficiency? It was and remains very important to us not to exclude groups of landlords and/ or properties from our lending. The last thing we want to do is become complicit in creating a class of sub-prime properties out there. One outside risk of the current EPC framework under consideration is that more landlords may turn away from older

buyers into older, less energy-efficient properties. As standards tighten, those first-time buyers could potentially become trapped in these properties a few years down the line if lenders can’t or won’t lend on them. That is just one imagined scenario, but something as an industry we need to be mindful and realistic about. So, as lenders, we need to encourage and facilitate borrowing that supports energyefficient improvements but not impose these products on all borrowers.

What are the benefits a lender such as Precise Mortgages can bring to brokers and their customers compared to other funders?

We are not new to this part of the market. Precise has been successfully offering refurbishment BTL loans for four years. So this latest range, with its focus on environmentally friendly property upgrades, modifies and builds on very well-established foundations. We know what we are doing from the experienced underwriter dedicated to each case to the BDM guiding the whole process. This means brokers and their clients can be assured not just of our expertise, but

also of our consistency of service and communication, which are key to making a project run smoothly. We have great relationships with the valuers and conveyancers involved who are teed up to jump on each case immediately. The same valuer carries out the bridging and BTL elements, enhancing that reliability of service. The conveyancing fees are discounted, which is good news for the client, and we pay two procuration fees— one on each part of the deal—which is good news for the broker.

How important is the role of mortgage lenders in the fight against climate change?

I believe that any effort to steer the industry towards improving the housing stock of the UK is to be advocated for and, as borrower demand for environmentally facing products increases, we have a duty to meet that demand.

For more information, contact your local BDM: www.precisemortgages.co.uk/ ContactUs/SalesTeam

yarker

yarker

Ensuring homes meet energyefficiency targets is a huge undertaking compounded by tight deadlines, major upfront costs, and a lack of finance products. With price rises predicted to continue into 2023, the task of upgrading our housing stock could be in jeopardy

Retrofitting buildings is expected to play a significant role in meeting the government’s net-zero target of 2050. In its 2021 proposal paper, the Department for Business, Energy and Industrial Strategy stated this included phasing out the installation of gas boilers by 2035, making heat pumps an affordable alternative, and giving homes an energy-efficiency upgrade. For the latter, this included additional funding of £1.75bn for the Home Upgrade Grant and Social Housing Decarbonisation Fund, with the aim to get homes up to a minimum EPC rating of C. This will be a significant endeavour. According to the government’s own data, the UK has around 30 million buildings, which account for 17% of national emissions. Yet, the attention and noise around retrofitting has not been matched by progress. Energy-efficiency retrofits are “significantly off track” according to the 2022 report to parliament from the Climate Change Committee. For instance, in 2021, only 54,000 heat pumps were installed—which equates to 3% of all gas boiler replacements required to meet the UK’s targets. Though the Climate Change Committee noted progress had been made on the policy front, with the government providing clear support for retrofitting, its report found “key policy gaps remain”.

The sheer scale of retrofitting the UK is the main problem for the industry. The BEIS insists in its net-zero strategy that “buildings will need to be almost completely decarbonised” by 2050. For context, the BEIS estimates 86% of homes in the UK use natural gas boilers and, according to the most recent data in 2019, 60% of English homes had EPC ratings of D or lower. Also, due to their age, British homes lose heat up

“THE MAINSTREAM LENDERS HAVE LITTLE TO NO INTEREST IN THE RETROFITTING MARKET AS THE LOAN SIZES TEND TO BE SMALLER, MORE FIDDLY AND VERY LABOUR INTENSIVE. THAT IS WHERE THE SPECIALIST MARKET COMES INTO ITS OWN”

to three times faster than those in Europe.

“The sheer vastness of the work required is a challenge,” says Tanya Elmaz, head of intermediary sales at Together. “Adapting our existing infrastructure to deal with building disruption during installation will certainly prove a challenge. It’s not straightforward to design plans and make adaptations that work around and for existing structures. It would be great if we could start from scratch, but that is of course not possible.”

Wates Group retrofits properties on a large scale and, from personal experience, the company’s environmental sustainability director Bekir Andrews knows getting owner-occupiers to act will be difficult. “There is a real paucity of good information out there, and this makes it difficult for individual homeowners to understand what their options are,” says Bekir, who points to issues with regard to the roll-out of energy-efficient technology that is vital to retrofitting.

“Around 600,000 heat pumps need to be installed each year by 2028 if the UK is to make the transition away from gas boilers and meet its net zero targets, yet only around 35,000 were installed in 2021. The scale of the task ahead is enormous and definitely needs to be looked at more closely.”

Time is not on retrofitters’ side. Although the government has set deadlines for retrofitting—landlords must ensure properties are at least EPC C-rated for new and existing tenancies by 2025 and 2028, respectively—these are not set in stone.

“The government has remained tightlipped on whether these dates will change,” remarks Paul Brett, managing director of intermediaries at Landbay. “With the first proposed deadline less than three years away and more than half of stock D-rated or worse, prospects for achieving these well-intentioned goals are slim.”

Lack of knowledge around EPC ratings and how they are measured could also be an issue. Assetz Group CEO Stuart Law says the data used in this framework needs to be reviewed. “A key issue is that the way EPCs are measured has not kept up pace with the market. The certification needs to be updated to give results that are more accurate.”

EPC reform aside, knowledge about the ratings and their importance is lacking.

According to research from Shawbrook, 15% of landlords are unaware of the UK’s 2025 deadline, with 27% having no knowledge of what their property’s rating was. “As such, one of the major challenges

facing the PRS is a significant knowledge gap, with a substantial proportion of landlords simply not knowing if or what level of work will be needed in order for their properties to meet the minimum C rating,” says Emma Cox, managing director of real estate at Shawbrook.

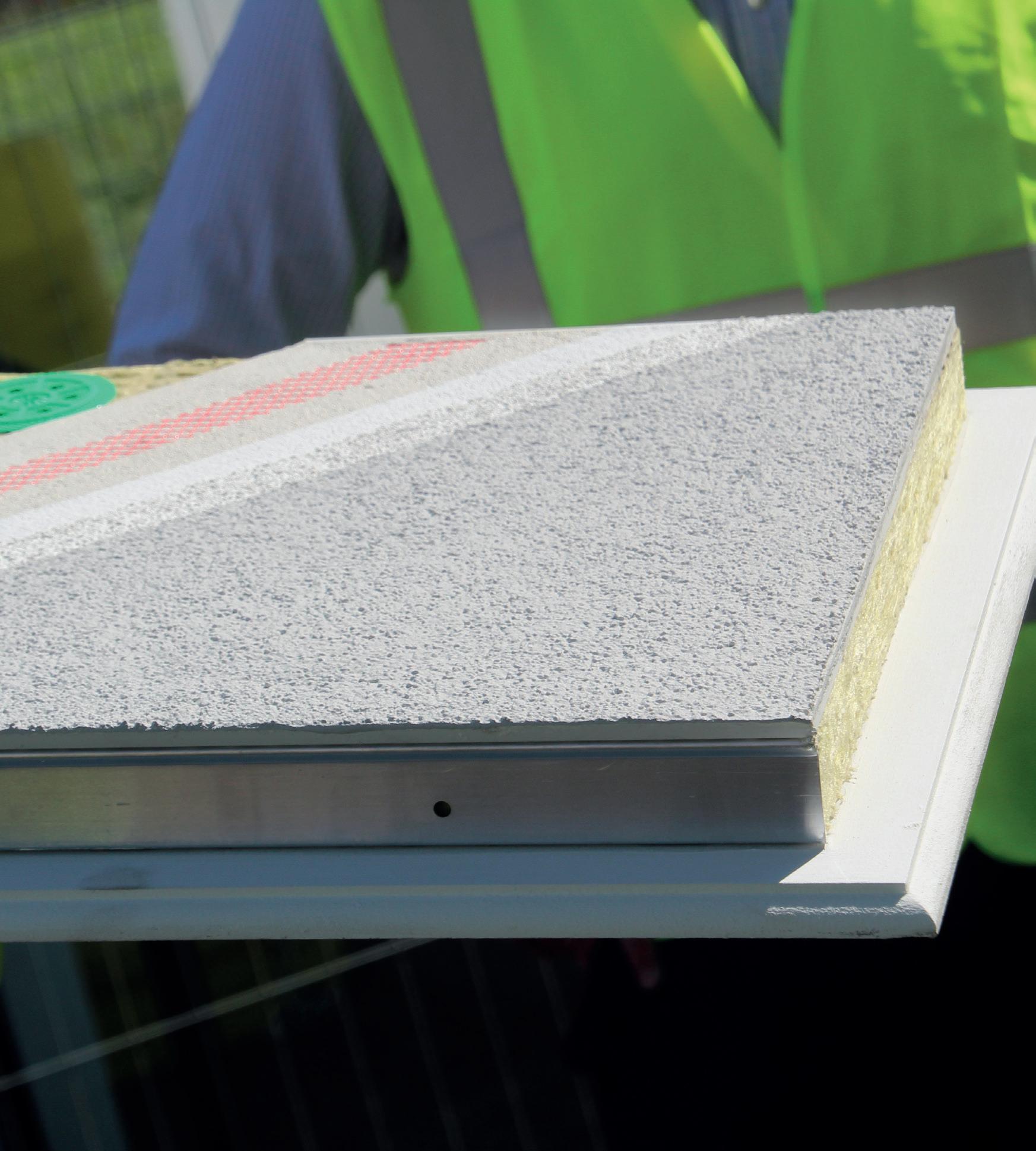

The retrofitting outlays can be significant. In a research paper, the BEIS found the cost of external wall insulation can range from £7,000 to £9,000 for a small semi. Continuing with a small semi as an example, floor insulation can cost up to £9,800 and replacing windows with double glazing can range from £3,900 to £10,700. And these figures were from 2017—before inflation began to surge.

As Wates’s Bekir highlights, heat pump installation is a major area of concern.

Putting them in place is a focal point of the BEIS’s strategy, but more needs to be done to accelerate their rollout.

The upfront cost of heat pumps is the main issue, according to Barny Evans, director of sustainability at planning and development consultancy Turley. “Although there is evidence that heat pumps may be cheaper to run, they’re more expensive to buy,” he says, explaining a heat pump can cost around £8,000 outright, while a boiler will typically cost around £2,000.

“You need to be financially comfortable to be able to afford the retrofit, which limits accessibility,” Barny adds. “There are also issues surrounding the supply chain,” he highlights, explaining a “huge increase” in trained installers, retailers, and ancillary providers is needed.

Though retrofitting homes can help with energy efficiency and improve finances over the long term, high upfront costs can be a barrier for many households, especially given the worsening cost of living crisis in the UK. “An obvious challenge is the cost of retrofitting and, with inflation rising the way it is, many people will not be able to afford home improvements,” says Paul. “With energy prices rising to eye-watering levels now and in the foreseeable future, it is a good time to upgrade homes for energy efficiency in order to bring down bills. But that is easier said than done if you don’t have the finances—unless you can borrow.”

Paying for retrofitting may be a bitter pill to swallow for those with squeezed finances, but such improvements can bring financial benefits. “The cost of living crisis should encourage retrofitting as it improves the payback,” states Barny. “It is more financially economical and would

help shield homeowners from rising energy costs. Unfortunately, retrofitting is a slow-burn activity that requires sustained investment, industry standardisation, monitoring, and political support.”

Of course, homeowners are not the only ones enduring this dilemma.

Shawbrook’s research found 31% of landlords have only just enough money to cover retrofitting costs, with 14% admitting they could not afford this.

Despite this financial pressure, some landlords are still proceeding to make their assets meet the standards, says Shawbrook’s Emma: “The cost of living crisis has, however, appeared to have provided the impetus for landlords to make changes, with over half having done so in the past six months and the vast majority of them deciding to take action because of the current financial pressures.”

Many homeowners and landlords will naturally be forced to consider borrowing money for these projects. A lack of finance products designed for retrofits is an obstacle but also an opportunity for lenders to capitalise on a budding market.

Though there are government grants available, Together’s Tanya expects some landlords to exit the sector as retrofitting becomes too big an ask. This creates opportunities, however, as property investors choosing to stay in the industry will be committed to the long-term viability of their assets and will therefore want to bring them up to the required standard.

“Landlords need to look at the current EPC document and identify what they will need to do to bring their properties up to the required standard,” says Tanya.

“The key to the success of the retrofitting target lies in educating them on what is required and readily available. Lenders have an opportunity and a responsibility to showcase the support that is available in order to help the UK meet this initiative.”

There is room for assistance from private lenders, with SPF Private Clients director Amadeus Wilson describing a “gaping hole” for specialists to fill. “One is forced down the second-charge route which is more expensive and prohibitively so in terms of redemption charges,” he says.

“The mainstream lenders have little to no interest in this market as the loan sizes tend to be smaller, more fiddly, and very labour intensive. That is where the specialist market comes into its own.”

However, finance providers have been slow to provide such support for borrowers.

Optimistically, Glenhawk’s commercial director Michael Clifford points out that, if lenders fully understand the opportunity in the market, new products will soon follow. “The industry really needs to educate itself on what steps can be taken to provide meaningful assistance in improving EPCs in our housing stock,” he says. He argues this will become more relevant due to the government’s recent updates to EPC assessment methodology.

Michael adds: “Solutions for borrowers will then follow and I expect this will centre on two areas: allowing developers who are working in the area access to better rates, slicker service, and higher leverage; and giving residential investors and homeowners the ability to access the equity held within their assets in innovative and cost-effective manners.”

This could lead to a greater uptake of green mortgages. These offerings are designed to increase the appeal of energy-efficient properties, with lenders giving borrowers cashback and/or better rates based on the underlying asset’s EPC rating. Green mortgages can also be designed to reward homeowners conducting retrofitting work.

These solutions are already increasing in popularity, according to LiveMore managing director of capital markets and finance Simon Webb. As a result, it is something the lender is intending to look at as part of its product development plans. “Green mortgages are gaining in popularity, and this is an area that we intend to look at in the future, possibly through a cashback or a reduction of our standard rate,” says Simon. “We believe green mortgages can encourage customers to address the energy efficiency improvement potential of their homes, and we want to be part of that.”

Retrofitting may be getting more attention from developers and lenders alike, but the scale of change required and the economic backdrop remain significant issues according to Glenhawk’s Michael. “The UK has the oldest housing stock in Europe; more than half the country’s homes were built before 1965, more than one-third were built before 1945, and one-fifth were built before 1919,” he emphasises. “There are not sufficient finance options available to support the level of retrofitting requirements of the country and meet government targets. With the expectation of recession and price rises moving into 2023, there is also a risk that this will be inadequately addressed in the coming months and years.”

committed to future-proofing

investments, providing

sustainable solutions to

their energy efficiency.

why we’ve launched our new Energy Efficiency Discount, rewarding investors with a reduced arrangement fee for properties with an Energy Performance Certificate (EPC) rating of ‘C’ or above.

the real world.

High-speed loans but at a high priceWords by darren woon

Equitable charges can be expensive, but the fact they can be completed quickly makes them an attractive or at least practical option in today’s economy

Equitable charges can be a quick way of raising a loan against a property, but they can be costly due to them coming with fewer possession rights should a borrower default.

They are often made when legal charges are unobtainable, but are known to have been set up when the formalities of the legal process were not adhered to correctly. With consent from legal charge holders not being required, one might deduce that the equitable route can be a faster, easier option in some circumstances.

However, as William LloydHayward, group chief operating officer at Brightstar, quickly points out, it does come with higher risk. “Holding an equitable charge does not give the owner the power of sale,” he says, although it is possible to obtain this with a court order.

“This increased risk may be reflected in higher costs of borrowing, so brokers should consider whether the convenience is worth the potential extra cost in order to meet their client’s requirements.”

James Lennon, founding director at Tapton Capital, agrees: “From the lender’s perspective, an equitable charge provides watered-down possession rights compared to your typical second-charge loan. With an equitable charge, a lender would be unable to appoint LPA receivers to enforce in a default scenario and must instead get a possession order via the courts, which can take 6-18 months, depending on their backlog. This is typically why LTVs offered for these products are lower and rates are higher.”

Gemma Taylor, director at Rocket Bridging, notes that interest rates for this product are typically between 1.5-2% per month.

“In the worst case scenario,” James continues, “the lender must ensure they can redeem

their loan in full, with the associated interest and legal costs, over a much longer timespan compared to enforcing a second legal charge.”

Gemma also acknowledges the uncertainty that these charges bring. However, as director of a company that prides itself on getting deals done “at rocket speed” , she sheds some light on the solutions that equitable charges provide to borrowers. “First charges are the premium stake,” she explains. “Second charges sit behind the firstcharge debt but, to raise one, in most cases, consent is required from the first-charge holder.

“The problem lies for borrowers when the first-charge holder will not allow a second charge to sit behind them or, more often than not, the debt providers

take too long to provide consent for what the borrower needs. This is particularly relevant when it comes to bridging. Borrowers are paying for speed to complete. Waiting for a deed of postponement can sometimes take weeks, if not months.”

How it works

Gemma explains a bit more about the process: “We cap our risk to a maximum of 50% LTV on residential properties—once we deduct the [first-charge] debt, that is the amount we’d

“EQUITABLE CHARGES ARE OUR LEAST PREFERRED LOANS AND, FOR OBVIOUS REASONS, OUR MOST EXPENSIVE BRIDGING PRODUCT”

Explained

consider lending up to.”

She gives an example of a £1m BTL property about to go on the market for sale. It has a long-standing mortgage of £250,000 and a customer behind it with a clean credit history. “The borrower requires £150,000 net to put towards another investment property and is unable to wait until the sale of the BTL,” she explains, “ordinarily, a second-charge bridging loan would suffice; however the BTL mortgage provider, as a policy, does not allow second charges. A second charge would therefore breach the borrower’s mortgage contract. In such an instance, Rocket would lend the funds using an equitable charge.”

However, all cases must be reviewed holistically.

Gemma adds : “What do the assets and liabilities of the borrower look like? Their credit history? Ultimately, what’s the probability of their exit strategy [being successful]?”

Gemma highlights that, in addition to the property charge, the borrower would also provide 100% personal guarantees and debentures over their business.

But, just as one wouldn’t go on a roller coaster without restraint, James points out that it is always best to err on the side of caution when velocity and danger play their parts so well. “It’s important to check if the primary lender’s charge contains a negative pledge,” he says. “This is a clause that prohibits the borrower from securing any further debt with third parties against the properties without the prior lender’s written consent. If the borrower decided to go ahead with an equitable charge loan against a property where the primary lender’s charge contains a negative pledge, they run the risk of being in breach of contract with the primary lender.”

With all the risk that it brings, is there a future for this type of product? The answer, according to Will, lies in our economy.

“As [it] faces huge pressures over the coming months, having every type of lending available for clients could be

even more important to keep our economy moving in an upward direction,” he explains.

“Equitable charges are our least preferred loans and, for obvious reasons, our most expensive bridging product,” Gemma concludes. “In some instances, we can appreciate that it isn’t worth the borrower remortgaging, and we can understand their frustrations where they feel like they’re stuck between a rock and a hard place—a need to grow and having a healthy amount of equity to leverage against stored in their portfolio.”

Gemma strongly advises that mortgagee applicants check if their lender will allow second charges in the first instance. While the majority of banks fall into this category, not all of them do.

Will this change in the short term? “I suspect not, but there may be demand for more equitable charges if the response time of banking services becomes more protracted, especially when borrowers are wanting to capitalise on auction purchases, where they are committed to a timeframe to complete.”

Aurius-DF from Apak Group, a Sopra Banking Software company, is the only solution specifically designed to meet the needs of the Development Finance market.

Lending for Development Finance presents unique challenges:

• the flexibility demanded by the highly changeable nature of the projects being funded

• the need to monitor complex deals to make sure they stay within their agreed parameters

• the involvement of brokers and multiple third party professionals

• the requirement for close management of the relationship with the developer

• the di culty of producing clear, consolidated business information in order to be able to manage risk and predict cash flow

Meeting these challenges is vital to a successful Development Finance lender in order to manage risk and increase e ciency. This helps control the cost of managing these complex loans which ultimately increases the margins available in this competitive and dynamic market.

Based on Apak’s Aurius platform, Aurius-DF meets the business needs of Development Finance lenders by providing market specific functionality, including:

• Loan Schedule Modelling (both pre-approval and in-life)

• Facility Limit, Advance Limit and Loan Tranche Management

• Tracking of involved Brokers, Third Parties and Professionals

• Guarantees and Security Monitoring (including tracking constantly moving LTVs)

• Notes and Diary Management

On top of the Development Finance specific functionality, Aurius-DF clients benefit from access to all the underlying Aurius platform capabilities:

• Open API access through the Aurius connectivity suite

• Configurable, embedded workflow and document management

• Tried and tested accounting, payments and transaction handling

Delivered using a cloud-based Software as a Service model, unlike traditional software delivery models, lenders have a low cost of entry and pay based on the amount of business handled by the solution.

Continue the conversation and contact us at apak.info.team@soprabanking.com

Tanya Elmaz, Together’s Head of Intermediary Sales for Commercial Finance, says: “With upcoming minimum EPC rating requirements set to meet sustainability targets, many properties could become redundant and their value could plummet. Giving landlords access to smart finance options could help your clients future-proof their portfolio.”

“New government rules surrounding EPC ratings are due to come into effect in 2025, which will require landlords to take more responsibility for the energy efficiency of their rental properties.

“Anything which improves the conditions for tenants in rental accommodation and the positive environmental impact is progress. However, the impact this could have on landlords and their existing stock of underachieving properties is proving to be of concern to many.

“A large number of these properties – many of which are older, popular characterful buildings – could become too expensive to bring in line with the new regulations, which may see them at risk of becoming redundant. This poses a number of issues.

“Firstly, it would greatly impact the value of these assets and expected return on investment for landlords. This could affect their ability to keep up repayments on their buy-tolet mortgages if their income is depleted. Secondly, having unused buildings – particularly given the current shortage of housing in the UK – would actually be environmentally, economically and socially unsustainable.

“With 60% of the UK’s current housing stock still rated D or below, the scale of the challenge is clear. In this ESG issue of Bridging & Commercial magazine, we explore how bridging finance can help landlords meet the Government’s targets to support the sustainability and energy efficiency of the UK’s rental properties. And why, for landlords and property investors, we’re making access to finance as straightforward as possible.

“I’ve invited Lorenzo Satchell, our Specialist Account Manager in the South, to explain the upcoming changes, and how bridging finance could support the nation’s landlords in bringing older properties up to date.”

Tanya Elmaz Head of Intermediary Sales for Commercial Finance

To help the UK achieve its carbon reduction targets and improve energy efficiency standards, the Government introduced the Energy Performance Certificate (EPC) almost 15 years ago. Whenever a property in the UK is sold or rented out, it must have a certificate showing its energy efficiency performance based on factors such as insulation, heating and how much energy it uses.

A property will get an overall rating on a scale running from A to G. A is the best, and G is the least efficient. Generally speaking, older properties have lower ratings because they lack (for instance) cavity wall insulation or double glazing unless these have been retro-fitted.

The proposed Minimum Energy Standards for rented properties will shift from an E rating to a C rating under the new rules, and making changes isn’t optional. The new regulations will be introduced for new tenancies first from 2025, followed by all tenancies from 2028.

If a landlord’s property is found to fall short of the required rating, they could face a fine of up to £30,000. Plus they’ll have an unlettable property on their hands, which will mean a property standing empty – and a loss of rental income for the owner.

“Older properties have always been a favourite with buyto-let landlords, whether it’s two-up, two-down terraces offering the perfect first home for young professionals or larger Victorian villas prime for converting into houses in multiple occupation (HMOs).

“But where older properties may offer more room for development (and potentially a greater return on investment), new regulations around energy ratings may mean older rental properties suddenly look far less attractive to the landlord looking for a good return.

“While data shows that homes built before 1900 generally have an E rating or lower, all is not lost if your client does have older homes in their portfolio, or has their eye on a historic property. With a little time and money, older homes can be brought up to the required standard, and the improvements they make could even make their property more attractive to potential tenants.

“If they’re adding to their portfolio and don’t have sitting tenants, improvements that increase the energy efficiency of a property – like installing a new boiler and double glazing – can be lumped in with other renovation work and factored into any potential borrowing, all in one go. Plus, if they’re considering liquidating some of their stock over the next few years, a property with a better EPC rating is likely to attract a better price and more attention from buyers who aren’t up for renovating themselves.

“We’re also seeing more first-time landlords taking an interest in older properties. Those currently renting in London, for example, might not have the deposit (or the income) available to purchase an expensive first home in the city, but can afford a property which is suitable to let further afield. We’ve experienced cases recently where these first-time landlords decide to purchase a property they can add value to (such as an older building with a low EPC rating) and let it out for a while, providing them with a second income and the opportunity to grow their deposit for their own home in London in the future.

“While insights suggest a lot of landlords are buying new builds which already meet the energy efficiency standards instead of holding out for a doer-upper at auction, there

are challenges, in both availability and yield.

“Landlords buying off plan, or choosing an almost-new property that’s ready to move into, are competing not only with other landlords but with private homebuyers who don’t have an appetite for DIY, and will most likely pay a premium for the convenience. And with prices continuing to rise, it’s unlikely that the yield on a new rental property will be as strong.

“Let’s not forget we’re talking about sustainability here too. Ensuring older properties are still usable and don’t become redundant means these buildings aren’t going to waste, which could potentially prevent more Greenfield land being built on. Furthermore, it means cities with a high supply of period properties –like the host of Victorian buildings which can be found around London, Leeds and Liverpool, for example –can remain vibrant communities for future generations to enjoy.”

“According the latest research, landlords cited the cost and accessing the right finance as some of the biggest barriers to achieving a C rating across their existing portfolio. Many have also raised concerns over the loss of rental income whilst work is being completed.

“Making less intrusive improvements, like adding cavity wall insulation or switching to LED lighting, could provide one solution. It would mean your landlord clients don’t have to uproot existing trustworthy tenants, whilst moving in the right direction towards hitting the 2025 requirements.

“Whether your client is looking to do some general upgrades and include energy efficiency measures into the cost, or need to do a whole raft of improvements just to bring their property up to scratch, short term funding like a bridging loan could prove the right solution.

“Securing a bridging loan against a rental property, or another property in their portfolio could allow them to make the necessary investment (if they’ll need less than 12 months to complete the required work). After they’ve made the improvements, and potentially increased the value of the property, you could help them refinance onto a new buy-to-let mortgage.

“Our specialist underwriters and intermediary team will work closely with you or your packager to understand their circumstances and make a common-sense lending decision.

“If you’re keen to learn more about funding for EPC requirements, whether bridging or a term product, we’re here to help. Simply get in touch with your packager or speak to our sales team on 0161 9337 101.”

For professional and intermediary use only.

Lorenzo Satchell Regional Account Manager –London and the South.“However, making the necessary changes to rental accommodation can still be costly – particularly as research puts the average upgrade bill at £6,000 to £10,000 per building.

Eco-friendly loans are not yet mainstream, but market forces and regulation are likely to push them there in the near future. So how do lenders and brokers stay one step ahead?

Words by BETH FISHER Photography Alexander chai

Words by BETH FISHER Photography Alexander chai

Since March this year, specialist lenders pioneering in sustainable finance have been getting together to solve the multiple conundrums of bringing eco-friendly housebuilding into the mainstream.

The ESG Forum has been recruiting finance providers that are leading the way in this sector to share ideas and generate answers to difficult questions in this emerging space.

Since its formation, it has attracted other green finance marketplace participants and, eager to widen this, recently launched the Green Finance Marketplace Charter to promote eco-friendly finance to intermediaries and borrowers, and show the options that are available.

Lenders and brokers that sign up will be making one simple commitment that, wherever possible, they quote a green alternative alongside standard loan options—something that is rarely commonplace. The number of those doing this will be a measure of success.

The founders of the forum include development lender Atelier’s co-founder and CEO Chris Gardner, head of business operations Reece Lake, marketing manager Charlotte Wright and ESG assurance manager Smithi Sharma. They were joined by BTL lender Landbay’s MD of intermediaries Paul Brett, PEbacked development lending platform Precis Capital’s COO Daljit Sandhu and Manchester-based bridging provider MS Lending Group’s CEO and founder Michael Stratton and MD Rob Goodall. In recent weeks, a number of other high-profile lenders have also agreed to join the group, which is set to be announced soon.

The day after temperatures in the UK exceeded 40°C for the first time ever, we gathered in a chilled meeting room at 80 Charlotte Street—a £200m-plus BREEAM excellent, LEED bold and EPC B-rated building—to discuss how commercialising the green finance market could accelerate its adoption, accessibility and profitability for developers.

Beth Fisher: Since last year’s Sustainability Issue, what progress, if any, have we seen in this space?

Chris Gardner: I guess the brutal answer is not enough. I think that the economic uncertainty, the war in Ukraine, and uncertainty over house prices have taken over the agenda. There was some momentum, but circumstances have overtaken that. There’s a certain irony there; we have an energy crisis and building sustainably with reductions in operational energy use and carbon are the kind of things the market needs at the moment.

BF: Michael, you brought out some ESG offerings earlier this year. What are your thoughts on the number of sustainable products in the market?

Michael Stratton: I don’t think there are enough. More lenders are getting on board but, from our perspective, it’s a massive educational piece. When we speak to a lot of the intermediaries we’re dealing with about our products, a large proportion aren’t particularly aware of ESG—for example, what different products [lenders] have got. Obviously, we’re in the bridging space. A lot of them concentrate on vanilla bridging. We need to try and educate them on not just what we do, but the wider piece within the industry itself with regard to the importance of ESG.

Paul Brett: I agree with Chris’s sentiment that not enough is being done. However, just us having these conversations and forums—it had to start somewhere. I think the hurdle for the industry is to get that creative orientation. There’s not enough creative thought about how to actually drive this forward—and that’s the biggest challenge. It’s getting that boulder going, isn’t it? It needs so much momentum to get it to start rolling—and we’re only just doing this.

BF: In terms of the problems that developers are facing right now, you’ve got supply and labour issues as a result of Brexit, Covid and the war in Ukraine. What obstacles do SME developers need to overcome in terms of building sustainably?

Daljit Sandhu: Viability. We’re already pressured due to the factors you’ve just mentioned. Adding

on another layer of cost to build sustainably just makes it unviable.

PB: That’s a really good point. If you’re a developer, you would be asking yourself, “How can I drive risk out of my development on cost, execution, and exit?” In an uncertain market, taking the safe route and sticking to what you know is a very compelling channel to go down. If you’re thinking about building sustainably and talking about new technologies and methodologies, you are taking on a certain amount of supply chain risk among other things.

MS: The planning system in this country is a major barrier for small developers to get sites off the ground. Huge delays actually prevent [developers] having that green model. Awareness is a key issue, but I think the planning process across the UK is a painful one and causing huge problems across the industry.

BF: Do you think there are solutions or incentives that the government could put in place to get quicker planning approvals on sustainable developments?

Rob Goodall: The planning backlog is still there [from Covid]. But it’s simple things like the discharge of conditions taking far too long. Once you’ve got the financial application, the discharge of conditions could take a further 4-12 weeks. A lot of the time, it’s down to staffing levels. I don’t think it’s necessarily a case of making planning any easier. I believe it’s down to resources more than anything else.

CG: What we do see in planning is quite a lot of the inconsistent application of sustainability requirements that are often at odds with the development that’s being proposed. Section 106, for example, is now becoming so complex and onerous to execute, it’s almost like getting a planning approval subject to a 106 is the start of a journey—not the end. To add to Rob’s point, anything with planning is going to take weeks and weeks, and therefore the best way they could deal with that would be through more resource. Building regulations can now be outsourced. You can have third-party companies doing the monitoring on building regs—we’d quite like to see that on planning, too. Do we have an understanding of what

proportion of residential property is deemed outside A, B and C?

DS: If it’s new build, it will definitely be A, B or C.

CG: Definitely?

DS: The new-build industry just doesn’t have an issue with EPCs. They do have an issue with other things, like gas boilers or ventilation. But, if it’s new build, it very safely meets that standard.

CG: I’ve spoken to a couple of brokers who have said that some new builds are rated D.

Reece Lake: It is possible to end up with a D on something like a permitted development scheme, but certainly not on a new build. If you’re building to the standards—unless you’ve done something odd—I would be very surprised if you [don’t] get an A, B or C.

DS: There’s an issue with existing housing stock. We cannot achieve net-zero targets unless we tackle the 19 million homes that are not new build and will need some form of retrofit. So, that’s an actual issue. The regulation has just come in; we’ve got the Future Homes Standard—the bulk of which will come in 2025—the first part of it just came out in June. So, there is some regulation… It’s just been very slow.

BF: Retrofitting existing UK housing stock is much more sustainable than building new, in terms of how much carbon it produces, but there are so many difficulties around this. You could have an old property worth £300,000 that might take north of five figures to bring it up to an EPC rating of C or above.

DS: Yes. It’s an average of £20,000 per house.

BF: Considering the amount of old housing we have, how is this going to move forward without actual funding behind it?

DS: Well, there are two things: the government must play a role, but they’ve fallen short; they’ve put in place schemes and then withdrawn them. The latest one will tackle 90,000 homes, where they’re offering grants to retrofit boilers. It’s just not enough. What they’re trying to do, which is quite right, is stimulate

the private industry to innovate and think, “If every single house in the UK is going to have a heat pump boiler, that obviously makes good commercial sense, so let’s invest and innovate”. Where the government can play a role is stimulating this with grant funding. I don’t think there’s a world in which they’re going to subsidise every single house in the UK. I don’t think that’s even viable. So private industry has to step up.

PB: This is an enormous commercial opportunity for somebody who can get it right. For me, this is the bit that’s missing and part of the reason why we wanted to create this forum, to think about how we can actually commercialise and mobilise this. As a consumer, developer or financier, if you work in the commercial space, it’s far easier. If you look at the progress that’s been made there with sustainability, building techniques, retrofitting and all the other kinds of good stuff, it is leagues ahead of residential. Why is that? Because it doesn’t have the granularity of residential. It doesn’t have as many issues around affordability. The problem is there isn’t one unified standard that people can aim for. What exactly does building sustainably mean? I think that’s a big challenge as well. You’re not going to get to net zero on retrofitting any time soon. It’s going to be a process of reduction. I think a lot of people have this unrealistic notion of that target. That is the eventual goal, but there needs to be intermediate steps.

BF: The thing is, we’re already far behind on what we need to do. Discussing that it could take 50 years to get to that ultimate goal is quite scary.