LOOMING IN THE SHADOWS

+ The morphosis of the commercial property market p16

+ The morphosis of the commercial property market p16

Why make bridging difficult. Talk to Somo today.

To help you push ahead in 2024 we’ve made significant changes to our bridging finance offer including:

• Unregulated bridging loans available from 0.75% p.m.

• Minimum bridging loan size reduced to £100,000 for first and second charges

• Lending extended to cover all mainland Scotland with no postcode restrictions

Email: bridging@utbank.co.uk

Telephone: 020 3862 1002

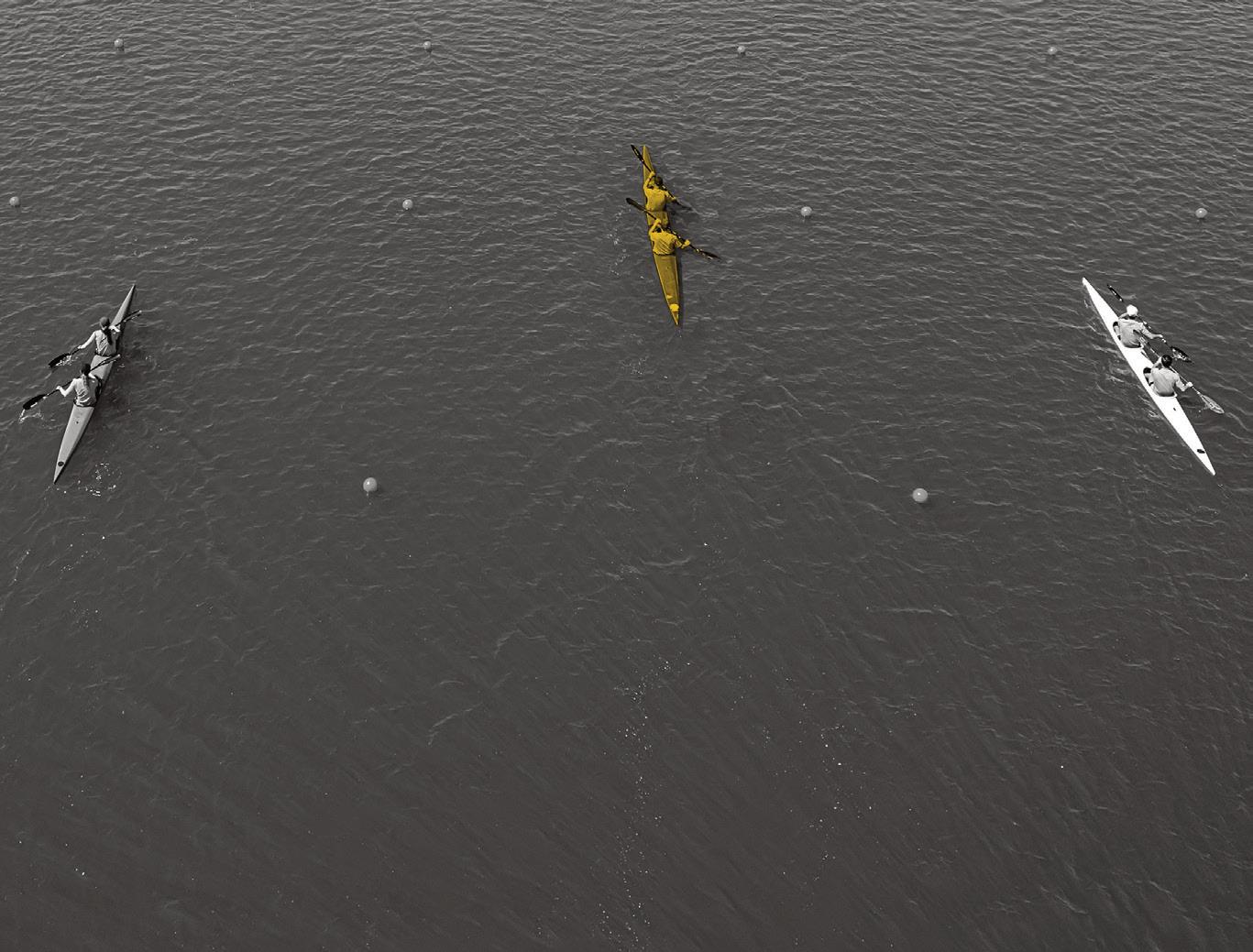

There’s no denying that the commercial real estate market has suffered many hits over the past few years, as the macroeconomic challenges—including Brexit, Covid and volatile interest rates—have taken a toll on this sector. Nevertheless, here it is still standing, and with positivity slowly returning to the commercial real estate market, as reflected in RICS’s latest commercial property sentiment index.

With the commercial lending market being at a critical juncture, according to UK Finance, it is time to take an in-depth look at this sector’s good, bad and ugly to see what may be in store for this resilient market this year and beyond—which is exactly why we have dedicated this issue primarily to the commercial market, and its many sub-sectors.

As the latest research from Bayes Business School revealed new commercial lending has hit a 10-year low, and with 42% of £170bn of outstanding commercial loans due to be refinanced within the next 12 months, could this refinancing wave potentially cut the sector’s legs right as it’s trying to get back up? We set out to discover the answer to this burning question and uncover the dangers commercial property investors could soon face, with the help of several industry experts [p60].

On the back of the recently expanded permitted development rights, we also take an in-depth look at commercial-to-residential conversions with Octane Capital, to highlight the trends seen in this market and identify what makes a successful conversion project [p16]. We also uncover the hidden difficulties of investing in care homes—a sector that has seen a popularity boost over the past few years. Plus, Ortus Secured Finance’s CEO Jon Salisbury discusses his extensive career in the commercial finance sector, and shares his insights on how to remain successful in this market [p74].

As a special surprise for all our readers, we are bringing the magic of this year’s B&C Awards to print, with a unique and extraordinary spread to bring you back once again into the world of Alice in Wonderland—we hope this will add a sprinkle of magic into your world, and bring a smile to your face!

Andreea Dulgheru Deputy editor

Andreea Dulgheru Deputy editor

Unlock your project’s potential with MSP Capital’s Ground-Up Development Loan. From standard deals to complicated lending, we’re here to assist you and your clients. Call us on 01202

Working alongside developer clients, we provide up to 65% LTV against the land value, plus 100% of your build costs. Unlocking up to 70% of the Gross Development Value.

“There’s

still a huge shortage of housing in the UK and, until that changes, things won’t improve as quickly as they could—after all, no one would build low-quality property if there was no demand for smaller, and therefore cheaper housing” p16

10 16 23 27 39 46 49 60 74 89 100 104

The commercial finance edition

Putting your money where your mouth is

The commercial market is getting a makeover

Beware the secret minefield

Hard work pays off / Ushering bridging into a new era

It’s getting tech-y in here

91% of brokers are still losing sleep

Commercial refinances: a ticking time bomb?

Jon Salisbury / Emma Ross

The blame game continues

Follow in our footsteps

Dawn Trustam

Fixed-rate commercial range

• loans between £250,000-£10m

• 75% maximum LTV

• 2% arrangement fee

• 1.5% procuration fee

• fixed- and variable-rate options available

• facilities available for commercial owner-occupied and investment properties

• available for sole traders, partnerships, LLPs and limited companies

• upto10.12%perannumROI

• minimum£1,000investment

• allowsinvestorstopart-ownrealestateassets

• capitallreturnsearnedfrombothrentalincomeandpotential growth

INTERBAYCommercialinvestorloans

• exclusivemortgageratesavailableviaSelectbrokers

• availableforcommercialandsemi-commerciallandlordsandinvestors

• ratesfrom6.19%forcommercialfirst-chargeowner-occupiedloans,and from6.39%forcommercialinvestors

• pricingfrom6.74%forsemi-commercialfirst-chargefacilities

• cashbackavailableonselectedsemi-commercialproducts

• £150,000minimumloansize

Commercial and semi-commercial loans

• £150,000 minimum loan size

• loans up to £35m

• fixed rates from 7.24% for commercial and from 6.34% for semi-commercial

Commercialmortgages

• loansbetween£150,000-£10m

• availableforUKlimitedcompanies,LLPs,partnershipsandsoletraders

• 80%maximumLTVforcommercialowner-occupiedmortgages

• 75%maximumLTVforcommercialinvestmentmortgages

• 2%arrangementfee

• loantermsbetween5-25years

• fixed-andvariable-rateoptionsavailable

MFSCommercialandsemi-commercialtermBTLmortgages

• loansbetween£150,000-£1.5mperunit

• loansupto£10mperultimatebeneficialowner

• 70%maximumLTV

• 130%ICRforallcustomergroups

• deferredinterestorrolled-monthsoptionsavailable

• availableforowner-occupiedpremises,retail,office,servicedapartments,PBSA,first-timecommercial landlordsandmore

HTBsemi-commercialmortgage

• two-andfive-yearfixed-rateoptions available

Commercialbridgingloans

• loansbetween£100,000-£2m

• maximum65%LTVofpurchaseprice/ marketvalue

• pricedfrom1.09%

• retainedinterest

• alltypesofcredithistoryconsidered

• ratesfrom6.19%fortwo-yearfixesand 6.59%forfive-yearfixes

• 75%maximumLTV

• 125%minimumICR

Catalyst Property Finance has recently secured a new £750m funding line to boost its shortterm bridging and refurbishment products. With new fuel in the tank, the lender is now gearing up to bring a suite of new initiative to market, as it aims to double its loan book

WORDS BY CHLOE WHELANIn April, Catalyst Property Finance made waves by announcing it has secured a new three-year, £750m funding line. The property lender now has three active funding lines to be deployed, including funds from an institutional-grade credit platform based in the US, alongside investments from several HNWI and its own cash reserves.

According to Catalyst’s CEO Chris Fairfax, the firm will deploy the £750m facility by improving its loan-making process, widening its credit policy and increasing capacity as it aims to double its loan book and take on additional risk. Put simply, the new funding line, together with its existing tranches, will allow Catalyst to say “yes” to more loans. “Every area of the Catalyst product range is being sharpened,” Chris explains.

Catalyst’s new US line highlights a broader trend of international interest being shown in the UK private credit market, Chris explains.

“The UK market is attracting investment from all areas of the world,” he remarks. “Over the past five years, large American credit investors have significantly increased their appetite for this risk. They are attracted due to both historical and forward-looking bridging loan asset-class performance and the risk-adjusted yield.”

Chris and his team considered many variables—including credit risk appetite, interest payment terms, advance rate, pricing, process tools and approach to valuations—when selecting a funding partner. However, his primary concern was whether the partner could support the competitiveness of the firm.

“Ultimately, what we are looking for is for funders to provide finance terms that allow Catalyst to be relevant in a saturated market,” Chris says. “There’s little point in having capital that’s cheap but narrow on credit, or flexible but exceptionally expensive. It’s about finding a good fit and there are a lot of great funders out there.”

While Catalyst’s new funding line originates from overseas, Chris doesn’t have plans to internationalise the lender’s product offerings. “As much as my team members drop subtle hints about Miami, for example, for now we remain focused on England and Wales,” he explains.

Catalyst has already begun deploying funds for new initiatives, including a ‘go Dutch’ proposition by which it offers to pay 50% of valuation fees upfront for bridging borrowers. The limited offer is available on all qualifying

“Each new initiative is a blank canvas; we won’t just follow the crowd, that’s just not in our DNA”

Catalyst bridging loans, up to a maximum contribution of £1,500 including VAT.

Valuation fee refund promotions are relatively common in the specialist property lender market. However, Catalyst’s offer is distinctive in that the contribution is paid upfront, as opposed to other initiatives that tend to provide the refund only after the successful completion of the loan.

Catalyst also plans to improve its low-LTV unregulated bridging products after feedback from brokers suggested the lender fell short in this area.

The new facility will also fuel a recruitment drive across most areas of the business to support anticipated growth following the recent appointments of a new senior internal BDM, a servicing administrator, a senior credit analyst, and a credit administrator.

Catalyst’s ambitious expansion plans come amid a difficult few years for commercial property, as the underlying businesses that support the market—including retail, hospitality and offices—struggled.

Retail and hospitality faced well-documented challenges as Covid-19-related lockdowns forced widespread closures, compounded by consumers cutting back on discretionary spending in response to subsequent cost of living pressures. In another post-pandemic trend, office vacancy rates remain stubbornly high with working from home continuing for many employees.

However, Chris notes signs of improvement in some areas of the property market. While all property capital values fell by 0.4% in the first quarter of this year, according to CBRE, this decline was driven solely by offices, the capital values of which fell by 1.7%. By contrast, capital values increased in both the retail and industrial subsectors.

Additionally, even within the offices subsector, Q1 was marked by a 49% increase in under offers for central London office space compared with the previous quarter, with

tenants and investors displaying a preference for new, high-quality developments.

“Areas such as warehouses and distribution sheds are appealing,” Chris notes regarding market performance in the past 12 months. “The primary office sector is starting to see signs of improvement, as we have seen a slight shift in the WFH culture, with more office work, albeit flexibly. The hospitality and leisure sectors continue to experience challenges due to inflation and the increasing cost of living, which is likely to continue,” Chris adds. “Broadly, luxury assets buck the trend as consumers remain able to support these types of businesses.”

While the macro environment has proved challenging, Chris says his team continues to consider the same key factors in every area of lending. “We need to have confidence in the security value, sufficient time for the loan, a reasonable exit strategy and to consider the enhanced volatility of the underlying asset.”

Looking ahead, Chris hopes the latest cash injection will help it deploy more loans, widen its credit policy and support the infrastructure that Catalyst needs to achieve its goal of doubling its loan book in a disciplined way.

“We have worked with our funding partners to establish areas of risk we believe are sensible for the medium term and made adjustments to present terms which have a greater chance of being recommended by our broker partners.”

These ambitions will come off the back of Catalyst’s broader goal of providing distinctive value for borrowers and mortgage intermediaries, Chris states. “As a team, we talk about our targets in terms of providing meaningful solutions to borrowers, enriching relationships with our broker partners and managing our loan portfolio,” he offers. “In 2024 and beyond, we will continue to build on Catalyst’s foundation of disrupting the market. Each new initiative is a blank canvas; we won’t just follow the crowd, that’s just not in our DNA.”

It’s no secret that bridging finance has become considerably more mainstream in recent years. While traditionally seen as a very specialist product, our customers are now utilising the fast, flexible finance bridging provides for a variety of uses

Flipping a property for profit

When flipping a property, often buyers don’t need long-term financial solutions like a mortgage. Many of our customers are using bridging loans to fund the purchase and renovations, complete the work within a specified timeframe (typically months) and repay the loan once the upgraded property sells.

a broken property chain

A property chain is often reliant on needing the funds from the sale of an existing property to purchase the next home. A break in that chain, where a buyer pulls out or delays a deal, can be frustrating for the seller as they won’t be able to move until their sale is complete.

Lots of customers use bridging loans to access the necessary funds to purchase their new home, repairing the chain break. It also gives them time to sell their existing property for the right price, without feeling pressured to sell quickly below market value.

EY’s 2024 Bridging Market Survey found that refurbishment is still the most popular use for bridging finance, and this certainly tallies in with what we have seen. That said, the application of this finance is far more versatile, and it’s worth keeping up-to-date on what it can offer you or your customers. Here are some of the most common applications we are seeing from our customers:

Waiting on guaranteed funds to come in

Similar to sellers experiencing a chain break, there are individuals who are looking to buy, but are in income limbo. Their money might not be tied up in property, but could be in the form of an inheritance, divorce settlement, income payment or other investment asset that they are expecting to come to fruition.

These processes can take several months to complete, but circumstances may mean that the individual needs to move to a new property quickly. A bridging loan allows someone to buy the property now and repay the loan once they receive the expected funds or secure longer-term finance.

Improving the EPC rating and energy efficiency of a property

A bridging loan can allow a property owner to fund improvements, such as adding wall and ceiling insulation or installing heat pumps or solar panels, that would raise its EPC rating and reduce energy costs. In addition to highlighting energy efficiency, a high EPC rating could also add considerable value to a property and be a positive contributing factor for potential buyers.

New owners transform run-down dogs home after securing £400,000 loan

A Gloucestershire mum transformed a rundown kennel and cattery, and is now ‘living the dream’ as she prepares to expand thanks to finance from Together.

We provided an initial short-term bridging loan 12 months ago for the purchase of the kennels, called Elmview. She now plans to use the funding to continue to renovate the kennels, and wants to eventually expand dog rescue—this will include the addition of six new kennels for Elmview, which will help Aura Dogs through the season.

Together was to give her the initial short-term loan, and when she proved that the kennels were a great success, we were more than happy to extend her term to allow her business to continue to thrive.

A bridging loan can be used if an individual or business has existing debt on a property and needs to quickly replace it. For example, the existing finance could be about to run out before repayment is possible, resulting in costly penalties.

In a business scenario, there may be times when owners need to raise capital quickly. A bridging loan can help to quickly pay off an unexpected tax bill, buy raw materials to fulfil a large order, or take advantage of a business opportunity.

Renovating a residence for rental, or a business property before trading

Using a bridging loan to purchase and renovate a rental property serves two main purposes. Firstly, landlords can quickly purchase and renovate their property so it’s in a habitable shape for tenants to move, thus creating income. It also allows landlords to address any problems with the building that a lender might have, like structural issues, making it easier to get a long-term BTL mortgage at a lower rate. Similarly, a bridging loan can be used by businesses looking to revamp their property before trading. When the business doesn’t have funds upfront to pay for the necessary improvements, they can use a bridging loan to complete them. Once they start trading, the money generated can be used to repay the loan and any accrued interest.

Case study 2

‘I’m in!’ Dragon’s Den winner reveals £10m expansion plans for his glamping business

A dad of two who won investment from TV’s Dragon’s Den used a bridging loan of £1.6m to expand his glamping business.

The entrepreneur has now revealed he’s bought a second site, La Mancha Hall, a mid-18th century 5,200 sq ft Grade II-listed mansion with outbuildings, set in ten acres of land including formal gardens and protected woodland.

He was able to buy the new site thanks to investment from Together and said he had major ambitions to create a business worth more than £10m over the next two years.

quickly on an opportunity to purchase

With a bridging loan, business can quickly secure the property or land they need to meet their growth ambitions, and then pay back the loan and accrued interest once assets are sold or expected profits are generated. Additionally, having the ability to act as a cash buyer is advantageous when a vendor needs a quick sale and is prepared to sell the property or land at a discount.

With a bridging loan, the buyer can secure the property before the 28-day completion deadline, ensuring they don’t miss out on their opportunity. Once purchased, they can renovate the property up to the standard required to either secure long-term finance or to sell the property for profit.

charge, cross-charge and second charge bridges with multiple exits available | Any property type considered across England, Scotland & Wales.

only

The chronic undersupply of residential homes, the large number of vacant commercial properties on the back of the pandemic and relaxed permitted development rights (PDRs) have turned commercial-to-residential conversions into an attractive opportunity for property investors. Octane Capital’s managing director for sales, Richard Deacon, director of structured finance, Alex Tyrwhitt, and director of credit Matt Smith, discuss this trend and its evolution in depth

Words by ANDREEA DULGHERU

Words by ANDREEA DULGHERU

“Commercial landlords are recognising that the occupiers and operators no longer need that large ground-floor unit or the ancillary space in the upper floors, so they’re sweating these assets the best they can”

At the beginning of the year, Octane surprised us with a new look following its rebrand. While the firm’s logo and proposition have seen a refresh, the lender’s ethos remains the same: to provide specialist finance and help clients get their projects from plan to profit.

According to the team, one of Octane’s most popular products is its refurbishment option, which offers loans up to £15m at maximum 70% LTV—potentially higher for select cases—and covers 100% of refurbishment costs. Matt tells me that over the past 18 months, the lender has seen a significant increase in commercial-to-residential conversions, particularly of offices into new homes.

While permitted development conversions of offices into residential homes have been trending for approximately 10 years, Alex explains that the initial market surge eased a few years ago as investors got to grips with the new rules and regulations being implemented. “A lot of the stock that was easily convertible was done quite early on. There’s also been a lot of legislative changes over the last few years in terms of minimum space sizes and the quality of what’s being built. That paused things for a period, while people came to terms with what the new landscape looked like, and to find those opportunities that hadn’t been developed yet.”

Aside from residential-to-HMO conversions—which, according to Richard, are the most popular types of projects the lender is funding—Octane has seen significant demand for one specific type of conversion scheme: semi-commercial-to-residential change of use projects in which owners look to halve the commercial space on the ground floor and transform the rest into ground-floor flats, in addition to residential units above.

“Structurally speaking, the retail market has changed. A lot of the traditional retail units on the high street are now oversized, because most retailers don’t carry a lot of stock anymore. Commercial landlords are recognising that the occupiers and operators no longer need that large ground-floor unit or the ancillary space in the upper floors, so they’re sweating these assets the best they can,” explains Alex.

There is a significant amount of vacant commercial space across the UK—including roughly 130 million sq ft of office space, according to Cluttons. Nevertheless, Richard, Matt and Alex explain that not all such spaces are fit to be turned into homes.

“When commercial-to-residential conversions first started, you had fairly ugly buildings being converted pretty poorly at low cost in town, and delivering small units. Often times, developers found they couldn’t let the homes once completed, so they ended up in some sort of agreement with a local authority to provide temporary or council housing. There is a large amount of this type of existing stock currently in the market,” Alex elaborates.

Matt cites conversions of out-of-town business parks as representative examples of such unsuitable schemes. “Aesthetically from outside, they still look like offices,” he explains. “Yes, you get 200 car parking spaces, but people don't want to be out of town. They are looking for homes near train stations, town centres, hospitals, universities etc. Plus, people are living low-cost; they haven’t got two cars to park, they’ve got two legs to walk to the station.”

This is why the trio believes finding the right location, and understanding what type of property is in demand for a particular area, is essential preparation.

The structure of the commercial asset being converted is also a key factor to be considered. For properties that do not fall under the recently relaxed PDRs—which now cover particular commercial units, including offices and agricultural buildings—the person undertaking the conversion must obtain the necessary planning permission; not an easy task considering the severe delays that planning departments are experiencing. Moreover, commercial landlords and investors undertaking a conversion scheme may find deleterious materials in the fabric of the building, such as asbestos or high alumina cement

(HAC), the latter of which can compromise structural integrity. That would lead to additional costs for their removal, or make the project unviable.

Office buildings may also need external alterations to make them more aesthetically pleasing and usable for the residential client, as commercial properties are often designed with different priorities in mind. “Purposebuilt office buildings are not necessarily the most attractive,” says Alex. "You’re always looking at the physical aspects of a building. Also, internally, does it subdivide well into multiple units? Quite often, a lot of office buildings can have very wide floor plates—so how does that look when you translate it into X number of flats that you try and fit into the same space?”

There are a multitude of factors that Octane will look at when considering which deals to fund, including location of the asset and local demand for the type of property being converted. The lender is equally open to providing specialist finance for projects that already have planning approval and for those without. For the latter, it can offer a planning bridging loan and then transfer the client onto a refurbishment facility to carry out the conversion.

However, the team tells me that two factors are particularly important for the firm: the experience of the overall team of contractors undertaking the conversion project and the marketability of the finished product. “The sizes of the flats, for example, will have a bearing on how we value the property and structure a loan around it,” Alex elaborates. “If a flat is under 30 m2, it would fall below minimum space standards for individual mortgages, so that would have an impact on how marketable those units are. It just goes back to funding the schemes in the right locations, which have that underlying demand and lend themselves to being occupied by private tenants or bought by owner-occupiers.”

“People don’t want to be out of town. They are looking for homes near train stations, town centres, hospitals, universities etc. Plus, people are living low-cost; they haven’t got two cars to park, they’ve got two legs to walk to the station”

“For the people that we lend to, the quality of the property matters, not just because they’ll be looking to fill their buildings with tenants or sell their units, but also because they want the property’s economic life to be extended. You don’t want to cut

an

While some have welcomed the PDR changes, arguing they breathe new life into unused commercial properties, some experts have raised concerns about these types of conversions leading to the delivery of poor-quality housing. Among the sceptics are University College London professor of spatial planning and governance Ben Clifford. However, Alex believes that such conversions have seen an increase in quality over the years, partly driven by regulatory changes, such as new minimum space requirements.

“Equally, for the people that we lend to, the quality of the property matters, not just because they’ll be looking to fill their buildings with tenants or sell their units, but also because they want the property’s economic life to be extended. You don't want to cut costs converting something from an office to residential, only to have to replace things in the building within five years because you installed poor-quality boilers or some cheap laminate flooring that will start peeling off in the first three years. While you might be saving £5-10 per sq ft, the reality is you've just got to replace it every three to five years, so it doesn't make financial sense to do that,” Alex explains. “If the finishes are beautiful, hotel-like, you can charge a higher rent and, generally speaking, you get a higher-quality tenant,” adds Richard.

office

to

costs converting something from

only

residential,

to have to replace things in the building within five years because you installed poor-quality boilers or some cheap laminate flooring that will start peeling off in the first three years”

The improved quality of commercial-to-residential conversions is also a result of investors’ continued interest in boosting their properties’ energy efficiency, despite the previously proposed MEES rules for domestic properties having been scrapped. “We are seeing a lot more conditions attached to planning consents by local authorities that require certain levels of sustainability credentials to be met, or environmentally friendly products to be used,” says Alex. “Pretty much every consent I’ve looked at recently has had a requirement for EV charging points in car

parks, and/or solar panels on the roof. There's so much new technology coming out in terms of sustainability and it's improving all the time. Our clients use it and we love to see that. It’s a huge part of the market for sure, and it's something that we look at when assessing conversion projects.”

Nevertheless, Matt argues there is still room to further improve the quality of commercial-to-residential conversions. He believes this will be driven by increased demand for high-quality residential properties from tenants and buyers, as well as by the tightening of the building control regulations. “The problem is there’s still a huge shortage of housing in the UK and until that changes, things won’t improve as quickly as they could—after all, no one would build low-quality property if there was no demand for smaller, and therefore cheaper housing,” he adds.

Looking ahead, the trio expects to see continued interest in commercial-to-residential conversions over the next 12 months and beyond. “We’ll continue to see more of these projects as town centres are going to be reshaped—that’s not something that’ll happen overnight, but rather something that will occur over the next 15-20 years. It’s an interesting and very diverse market, and it's one that you really need to understand to lend into,” Alex concludes.

Max Lewis, chief investment officer and cofounder of specialist bridging lender Hilco Real Estate Finance (HREF), discusses some of the less known difficulties facing the care home investment sector, and looks at this market’s future prospects

“While care home businesses can be very profitable and operate in a market benefiting from structural growth, the seismic hit the sector took during Covid will take some time to recover from”

The care home sector continues to attract the attention of a broad pool of investors, given the combination of favourable demographic trends and the potential for higher profits than more mainstream real estate assets. However, with the sector having faced multiple challenges in recent years, operators and brokers are now finding that they are also facing some obstacles in the form of limited access to finance.

Even before care home operators entered the stormy waters caused by Brexit and Covid, rising costs, particularly in terms of salary inflation (and outright shortages of staff) was a persistent problem. This has been exacerbated by the April 2024 landmark government policy which saw an increase to the national minimum and living wages. With the adult minimum wage having risen by 70% in real terms since its introduction 25 years ago, according to the Low Pay Commission, this is usually one of the biggest expenses in a high-labour environment like a care home, with operators telling us that wages often account for at least half of gross revenues. Regardless of the challenges, many care home operators are looking to a brighter future given the UK’s ageing population and the need for greater numbers of highquality care facilities. Although keen to invest in expansions and improvements to deliver the comfortable, high-spec facilities residents and their families are demanding, care home owners are finding that securing the funding they need to realise these plans is far from easy.

While care home businesses can be very profitable and operate in a market benefiting from structural growth, the seismic hit the sector took during Covid will take some time to recover from. We’ve witnessed the combination of low admission rates and high mortality result in severe occupancy drops for many operators, and ramping back up to full occupancy will not happen overnight. Faced with cost pressures and depressed occupancy, the recent rise in interest rates has been a further significant burden for leveraged owners.

This uncertain environment has led to the retreat of many funders, in particular mainstream banks, which appear to be nervous following adverse news headlines. Having become more complicated to underwrite, care home businesses have simply become regarded as ‘non-core’ to many traditional lenders. Banks appear to have pulled away from all but straightforward residential mortgages and, unfortunately, it seems that the care sector is another casualty of their shrinking lending activities. As a result, care home operators have a much narrower pool of active lenders from which to choose, and many are discovering that the banks with whom they have had long-term relationships are now looking to exit this sector.

In this difficult landscape, a care home group which has banked with the same lender for decades might now find themselves unable to refinance with the firm due to its exit from the care sector. In the worst instances, borrowers are even finding that they are being ‘un-banked’, with the original lender having sold their loans to a more aggressive creditor. One operator we came across found that, despite having had a long-term relationship with their bank, their debt had now been sold to a hedge fund with no interest in or understanding of the sector. The new funder simply wanted their money and threatened to appoint receivers immediately if the loan was not repaid—these funders tend to be inclined to enforce more quickly than a mainstream lender.

Given the sector’s challenges, borrowers seeking either to refinance or to fund new acquisitions face a challenge complying with the covenants of a normal commercial lender. A lender will typically require evidence that their loan can be serviced from the borrower’s operating profits, with a margin of safety. For example, a debt service cover ratio of 2x would mean that a borrower needs to evidence that they have regular monthly free cash flow equal to 200% of the monthly loan cost. The typical evidence required is two years of prior accounts. The combination of volatile occupancy and rising operating costs, combined with higher interest rates, makes it hard for many operators to comply with such covenants.

Faced with higher operating costs, a logical response for care home owners is to invest in upgrading their properties to achieve higher revenues. However, funding for such capital expenditure can be difficult to obtain, especially if it will mean a short-term period of reduced occupancy. We’re also hearing that while a new home used to take around 18 months to reach full occupancy, this is now often taking twice that time. From a funding perspective, the difficulty is that while operators may be able to secure development finance and later loans once the home has become a stabilised asset, there is a gap in the middle where the business is unlikely to meet the criteria of a mainstream lender.

While consolidation remains a key growth strategy for many in the sector, as evidenced in a 2023 report by BDO, the care home businesses which represent the most attractive acquisitions for operators are often those with some problems, such as low occupancy, low fees, high overheads, poor management etc. While a new operator would obviously seek to fix these issues, the added risk is off-putting to many potential lenders, and it could take some years for the care home to reach full occupancy and be in a position to service the loans. This is where a specialist bridging lender would really add value, not only recognising the business’ longer-term potential, but, crucially, being able to roll-up the interest with the repayment of the loan.

In particular, ICR calculations are proving to be an issue. These are lender covenants requiring borrowers to have profits (normally measured as earnings before interest and taxes, or EBIT) that exceed the monthly interest cost by a given amount. For example, a loan might require a borrower to maintain EBIT of at least twice the interest amount. A borrower who is regularly servicing their loan may, therefore, still fall into default.

It’s important to look at how the figure is calculated, and also whether a single bad month or quarter would put the borrower in breach. ICRs are measured in different ways, sometimes by looking at past trading or forward projections; however, as care homes have seasonal fluctuations (for example, mortality tends to increase in the winter, resulting in falling occupancy), it is vital that borrowers understand the criteria. While these types of covenants are commonly waived, they can be enforced if a lender elects to do so in order to trigger a default.

As an experienced team with deep understanding of the care sector, there are four key criteria we consider when assessing lending to a care home business—however, it’s not necessary for a home to meet all four in order to secure finance. We assess every single potential deal on its own individual merits and do not rigidly exclude any scenario. This flexible approach is the only one in our view that can effectively meet client borrower demands and capture all the nuances present in the highly specialised care sector.

In our view, the most attractive deals require: a modern home offering a good quality of accommodation; a sufficiently affluent location with a substantial percentage of private paying residents; an undersupply of care home beds in the area with a limited pipeline of new developments; and an experienced operator with a good track record.

Nevertheless, it’s possible to borrow without meeting all four criteria—for example, as a new operator or against a home in a less affluent location.

Looking to the future, we are confident that the care home sector offers huge potential for the right operators and investors. Specialist bridging lenders can provide care home businesses a number of vital benefits including swift decision-making and taking the time to understand the specific circumstances of the lend; no need to service the debt monthly; and the ability to look beyond recent weak lending history. While bridging lending is not a long-term solution, it can be a useful tool when acquiring, selling or repositioning an asset such as a care home.

The long-term trend of an older population with people living longer and having more complex care needs, won’t change any time soon. The key question for this year will be around the ability for operators to pass on fee increases in order to offset rising costs. This will undoubtedly result in some challenging conversations, both with private residents and local authorities.

As Roma Finance celebrates its 15 th anniversary, its founder and managing director Scott Marshall takes us on a trip down memory lane that starts at the lender’s humble origins and continues all the way to the thriving, multi-million-pound specialist lender

Words by ANDREEA DULGHERUoma Finance has solidified its spot as a significant player in the specialist finance market—particularly as the business is celebrating its 15th anniversary this year, showcasing its resilience and longevity. However, for Scott, Roma is more than just a lender: it is a true testament to his perseverance and ambition.

The Manchester-based lender was born at the end of 2008, one of the toughest times for a finance company as the UK faced the storm caused by the global financial crisis. This timing was made even worse by the fact that at the time, Scott lost his job as credit risk director at Lancashire Mortgage Corporation (now part of Together), where he had worked for almost six years.

Being made redundant is a disastrous and stressful situation that nobody wants to find themselves in, particularly when they have a family to care for and bills to pay, like Scott. However, he saw it as an opportunity to pursue a different route, one that would provide the

“I always wanted to have my own lending business, but the actual reason why I set up Roma after being made redundant was just because I needed a contingency plan”

thrill and challenge that he was looking for.

“My wife was devastated, and was worried about how we were going to make a living and take care of our three young girls, but I remember telling her that I felt it was the best thing that had ever happened to us,” Scott recalls. “Sometimes when you have a job [that you’ve been in for a while], things can become stale and you need a push to press the restart button. In the nine months before I was made redundant, I felt stagnant and that I needed a new challenge. So when I lost my job, to me this was the start of a new beginning.”

With only a strong intuition that this was the right path for him, and with tremendous pluck, Scott set up Roma Finance as a secret side hustle to his full-time job handling global procurement at an IT firm. He gave his company a portmanteau name created from those of his grandparents, Rose and Max. “I always wanted to have my own lending business, but the actual reason why I set up

Roma after being made redundant was just because I needed a contingency plan. My wife said I couldn’t be reliant on the IT job for our future, and advised me to have something else in the background if I found myself in the same situation again,” reminisces Scott.

A matter of perseverance

At the beginning, Roma Finance handled underwriting for a number of clients, primarily Jonathan Samuels’ business Drawbridge Finance—which later became Dragonfly Property Finance—all while doing his regular day shifts at the IT company. However, this was short-lived, as after about a year, the underwriting work started to dry up.

Knowing this was not a sustainable way to keep going, Scott pondered the next steps and decided that, with his lending experience, his knowledge of the market and his extensive contacts book, he wanted to give lending

a go himself. And so, during a two-week family holiday that should have been spent in the sun, Scott researched and successfully completed all the steps needed to turn Roma Finance into a specialist lender.

While on paper the firm was open for business, Roma Finance lacked two essential things to make it as a specialist finance provider: customers and cash.

To solve the first issue, Scott would spend each lunch break allocated as part of his IT job—which he continued to do until 2014—in his car, calling every broker he knew to arrange finance deals. “Most people were taking their lunch at the time, so I’d then get a load of phone calls in the afternoon that I couldn’t take because I was at my desk doing the IT job. This meant I had to call people back in the evenings, but they often wouldn’t be available then. It was very difficult.”

The first deal came three months later, in November 2020—a £75,000 second-charge mortgage for a London diamond dealer who was looking to use the funds for business purposes. “The only option in the market at the time for a second-charge mortgage was Blemain Finance (now Together); the cheapest rate they did was 11.9%, and the shortest term was seven years, but the customer wanted a five-year loan,” recalls Scott.

Determined to beat Blemain’s offer and secure this deal, he promised the borrower the £75,000 over a five-year term priced at 11%, which the diamond dealer accepted. With the help of a lawyer friend—Richard Buchalter, owner of Richards Solicitors—who

helped him sort out the legal documents for the unregulated loan and who agreed to take his fee from the loan completion fund, Scott completed his first deal on 15th December 2010. The only problem? Roma Finance did not have any funds to lend.

With five weeks remaining to raise the necessary money for the loan, Scott chose to take equity out of his own home, which covered part of the total facility. The rest of the funds were provided, surprisingly, by his boss from the IT company.

This all started with a fateful carpool ride with his manager Alan, during which Scott opened up about his Roma Finance business, and was advised to speak to the company’s top boss, who turned out to be the manager’s brother. “I went and sat in front of the boss and told him everything. Long story short, he said he’d put the rest in for the £75,000 secured loan. From that one conversation, the stars were aligned and he became my business partner,” says Scott.

With his boss becoming its first investor, Roma Finance went on to complete several more different loans over the course of five years. During that time, Scott split most of his days between his IT day job and working at Roma Finance. To help with the workload, Scott hired the lender’s first member of staff, Daniel Hill, in January 2014. “We spent the first three months of 2014 mapping out the market, looking at competitors, where opportunities were in the market at the time, and coming up with a business plan to decide which niche within the property

“I didn’t start taking a wage until October 2014, so the irony is that I was the second employee in my own business”

market we were going to attack,” says Scott. “Funnily enough, Daniel was officially the first Roma Finance employee—I didn’t start taking a wage until October 2014, so the irony is that I was the second employee in my own business.”

That was also the year when Scott realised he was spreading himself too thinly, and when he was forced by circumstances to choose between his IT job and his work at Roma Finance. “I was working 14-16 hours a day, six-and-a-half days a week, without drawing a wage at all. By the end of August, having two jobs became too much for me. I knew Roma Finance was my future, so I handed in my notice from the IT company,” Scott elaborates. “The odds of making it work were really stacked against us in the early days. I wasn’t a wealthy guy, I had to feed my family, and I had to run the business on a shoestring budget. It was proper hard work and graft to get it working, and Roma’s success is testament to the belief that I had in myself, the trust that my business partner had in me, and the hard work that Daniel put into the business in the early days.”

Taking things to the next level

Two years later, in 2016, Roma Finance evolved further after securing its first official funding line with RBS—a £10m facility with an accordion to £25m—which boosted the firm’s capability to provide residential and commercial bridging finance. This was put into

place shortly after Scott’s meeting with the bank’s portfolio director at the time, Warren Mutch, who was impressed by Roma’s thick lending manual put together with the help of late industry heavyweight Benson Hersch.

“After we had dinner that Thursday evening, I showed Warren our branded lending manual in a Tesco’s car park, of all places, and he loved it. He told me he’d speak to RBS’ credit team and let me know within a week if this was something they could take forward. Instead, I got a call the next day, saying the bank had an appetite to work with us,” recounts Scott.

The two businesses started the due diligence for confirming the funding line in March 2016, which was credit approved in May. However, as the funding deal was progressing through legals, one big thing happened: the Brexit referendum.

“I remember waking up the following Friday morning, asking myself: what do I do now? In the end, I decided to pare back all the LTVs by 5% across the board at Roma Finance, because we didn’t know what the future would look like,” Scott tells me.

The funding line was completed on 11th July, two weeks after the monumental political vote to pull the UK from the European Union. With that line in place, Roma Finance was propelled into the specialist finance sector.

“I’m looking to grow the firm and create something of value for its shareholders, staff, our funding partners and our customers. We have not even scratched the surface of what we can do”

A year later, the lender secured its second funding line, this time with Cambridge Building Society, which was initially allocated for bridging business. The relationship with Cambridge Building Society remains strong to this day, with a new £120m lending facility agreed in October last year.

Fast-forward to the present day, and Roma Finance is a completely different business compared with the one-man operation it used to be back in 2009. The company now boasts 60 team members and 10 funding lines, and provides finance for an average of 100 deals per month.

Roma Finance’s proposition has evolved with each new funding line added to its roster. Now, the lender offers residential bridging, auction and refurbishment finance, development exit loans and development finance up to £3m.

Over the years, the firm has strongly embraced and embedded fintech into its processes to further improve its lending capabilities. The technology solutions the lender has implemented include open banking technology, fintech to extract data from a

borrower’s passport chip, and its bespoke processing channel, RomaFLOW. This was created to speed up the application-to-completion process and make submissions easier for brokers. “We’ve always tried to be a market leader and pioneer in our sector,” says Scott.

Looking ahead, Roma Finance is working on securing its 11th funding line. “The next funding will take us to another level in terms of loan book size, customers and technology,” Scott states.

Above all, he is determined to continue taking the business to new heights. “I'm looking to grow the firm and create something of value for its shareholders, colleagues, our funding partners and our customers. We have not even scratched the surface of what we can do.”

Property valuations are our business. We ensure valuations are more accurate and your lending decisions are clearer.

This is why we created Knowledge Hub, a library of short one-to-two-minute videos, bringing together our know-how and experience. We answer many of the commonly asked questions about valuations, property and the market.

Visit the Knowledge Hub at vas-group.co.uk, or to propose a topic for us to cover.

See how VAS can add value to your valuations. Call our team on 01642 262217 or email info@vas-group.co.uk

Pictured (L-R): Matt Mawdesley and Richard Lawton

Pictured (L-R): Matt Mawdesley and Richard Lawton

A new specialist lender has entered the market, one that promises to redefine bridging finance through the power of fintech: Morpheus Lending. The mastermind behind the new firm, Matt Mawdesley, and the finance provider’s operations director Richard Lawton give me an exclusive overview of Morpheus’ digital-only lending process and its plans to disrupt and innovate the market

“I think there’s a better way to do bridging: the process can be automated, and the customer and broker journey can be improved via digital tools to ultimately do things quicker and more efficiently”

Over the years, bridging finance has embraced technology in some shape or form— whether that’s AVMs and desktop valuations, broker portals or simple e-signatures—to enhance the lending process. However, one firm is ready to take this to the next level.

A brand-new finance provider that made its entrance into the market in mid-May— celebrating the launch with a fabulous party in Manchester. Morpheus Lending was created with one goal in mind: to revolutionise bridging lending by creating a digital-only bridging finance provider.

The idea all started back in September last year, when Matt Mawdesley was approached by chartered accountant Lee Jones and Sandeep Malhotra to launch a new bridging lending firm.

For Matt, who had just left his role as head of strategy and innovation at Together, this was the opportunity to do things better. “The bridging space hasn't seen much innovation from a product or a digital perspective for many years. I think there’s a better way to do bridging: the process can be automated, and the customer and broker journey can be improved via digital tools to ultimately do things quicker and more efficiently. So I told them that if we’re going into the bridging market, we should do something different and build a real USP centred around leveraging digital tools,” says Matt.

Having lived and breathed fintech for the past three-and-a-half years, Matt used all the skills and knowledge gained from his last role to turn this idea into reality. For the following few months, he scoured the market to find the best fintech solutions available that he could use at his new lender. “If you take ID verification, firms like Onfido have spent hundreds of millions of pounds building a very specific, very specialised platform that allows safe, secure identification—so, in my opinion, there is no point trying to replicate that. If there's market-leading technology out there, leverage it and bring it into the company.”

To create the perfect platform, Matt combined all these outsourced fintech solutions with in-house-build tech, plugging them all together into a seamless, end-to-end digital journey for all users and customers. “We’ve gone through lots of testing and spoken to lots of brokers and customers already, so we are ready to go.”

With the end-to-end tech platform completed, and funding secured from a broad range of HNWIs, the last piece of the puzzle was to find the right personnel. “What I wanted was to build the best team and provide them with the best technology in the market. If you put the right tech tool with really good operators, that’s how you succeed,” says Matt.

For him, there was one person that was perfect to take on the role of operations director: none other than Richard Lawton, former head of bridging at OSB Group. Having been introduced to Matt by a mutual acquaintance, Richard became instantly fascinated by the idea behind Morpheus. “All throughout my working life, I’ve always searched for new ways to make the broker and customer journey better by doing small tweaks here and there. When this opportunity came, I realised this

“This is something truly market-leading, and completely different that the bridging sector has not seen before”

was a chance to improve the bridging market. This is something truly market-leading, and completely different that the bridging sector has not seen before,” says Richard.

In addition, Morpheus is backed by a strong team of board advisers and non-executive directors, which include Together’s former chief risk officer Steve Miller, HSBC’s head of growth lending Roland Emmans, and Connells Group’s chief information officer Tom Pirrie.

Morpheus Lending offers unregulated bridging finance of up to £750,000 at maximum 75% LTV, with initial loan terms up to 12 months. The firm will lend against residential, semi-commercial and commercial properties in England and Wales.

Currently, the proposition is open to a select number of broker partners, with Morpheus looking to expand this panel in the coming months. “What we’re doing is very new, and because of the nature of the platform, it requires some training and onboarding from brokers.

“The benefits of being a small, agile new lender is that we can make changes quickly. Week on week, we’ll constantly be getting feedback from customers and brokers, and make changes to the platform to make it better over time”

Therefore, we are picking probably half a dozen advisers who are bridging specialists or large players in the market, who’ve got great experience and credibility, and want to partner with us to provide a leading customer experience to their clients. We want brokers who are going to suggest changes and tell us how to improve things, to make this the best platform and tool in the market,” Matt elaborates.

The entire lending process is carried out digitally through Morpheus’ custom-built platform and mobile app. Using the firm’s chatbot interface, the broker can pitch a deal to one of the lender’s team members. If the deal fits the criteria, the adviser is invited to provide all the necessary information for this case through Morpheus Bots, the firm’s automated software for data collection. Borrowers may also be invited to supply any additional information needed via the Morpheus mobile app.

Once the broker submits the application, it is immediately delivered to the underwriter, who begins the due diligence process. At the same time, a series of information requirements is sent out automatically by Morpheus’ platform. “All communication happens on the interface,” explains Matt. “If there’s any additional queries that appear, they automatically go to the broker or the customer who gets a pop-up notification on their app to submit the information, which gets automatically sent to the underwriting team.”

All legal processes are also handled digitally. Once the deal is approved, the lender’s external law firm will leverage the Morpheus platform to complete all legal tasks, and any signatures can be obtained electronically. “What we've

also built at the back end is a digital Land Registry submission process, which allows all Land Registry documentation to be electronically submitted. This means that everything can be done within one digital platform, with no paper, no wet signatures, and no printing, faxing or scanning,” says Matt.

The goal of the end-to-end digital platform is to streamline the bridging lending process, automating simple and often time-consuming tasks to allow the lender’s team to focus on the most important parts of the process: assessing deals and providing bespoke bridging finance. In simple words, the fully digital process is designed to increase speed in bridging without losing the flexibility offered by specialist finance.

“Specialist lending will never be fully automated. What we’ve done is get rid of all those inefficient manual processes to free up underwriters and brokers to make a decision quickly for our customers,” says Matt.

The platform also streamlines communication between all parties, and the various aspects of data collection, as the broker, borrower, lender and other third parties all utilise the same Morpheus platform to get the deal done—thus reducing the time lost chasing documents or information via email or other, more traditional methods.

Despite all people involved in a deal being on the same platform, Matt confirms there is no risk of confidential information being made public accidentally, as communication between each party is private unless one of them specifically authorises the information to be shared.

While it is hard to estimate how long the end-to-end lending journey will take, both Matt and Richard hope deals will be completed within

10 days on average. However, Matt emphasises that a lot of this depends on the adviser utilising the platform. “The power is in the hands of the broker. If they have all the information required from the customer and they respond quickly, we'll complete the case fast. However, if they want a slow deal, that’s absolutely fine. What the platform was designed to do is facilitate a quick completion if everyone is incentivised to do that. Of course, humans can be slow, and if the broker or customer doesn’t interact promptly, then naturally, things will slow down.”

With the business now officially launched, Morpheus is focused in the short-term on growing and scaling in a sustainable manner. That means focusing on completing quality deals and ensuring the platform is constantly kept up to date, rather than aiming for ambitious lending targets. “The benefits of being a small, agile new lender is that we can make changes quickly. Week on week, we’ll constantly be getting feedback from customers and brokers, and make changes to the platform to make it better over time. Of course we’ll do deals and scale, but I want to do that in a controlled and cautious manner. If you go to market and quickly try to sell, sell, sell, in my opinion that drives the wrong behaviour. We will be focused on building a valuable proposition for customers and brokers,” concludes Matt.

With reduced rates and instant Heads of Terms powered by our portal, get your customers the decisions they need at the right price through the Mortgages Portal.

Mortgages made simple Search LendInvest Mortgages

Unregulated lending is provided by LendInvest BTL Limited (Company No. 10845703) and LendInvest Bridge Limited (Company No. 11651573), which are wholly owned subsidiaries of LendInvest plc.

LendInvest plc is a limited company registered in England No. 08146929. Registered office at: 8 Mortimer Street, London, W1T 3JJ.

Borrowing through LendInvest and its affiliates involves entering into a mortgage contract secured against property. Your property may be repossessed if you do not repay your mortgage in full.

Words by BETH URE

Words by BETH URE

The property technology market is growing and is projected to be worth £25.7bn by 2030. We look at how proptech and fintech can be incorporated at different stages of commercial real estate investment—from finding sites and finance to property management—and highlight some major players driving innovation in this sector

Sourcing the capital for a commercial real estate investment can be a tall order, particularly for investors who are new to this. However, one fintech firm is trying to make this easier: Finloop. The company provides software that borrowers and investors can use to secure, manage and close commercial real estate loans.

Borrowers can create a free account to gain direct and immediate access to more than 1,600 international lenders and negotiate with them. The software also offers solutions to manage the deal once the terms have been agreed.

Users can create financing requests on Finloop’s secure and flexible workspace which automates repetitive tasks, thus saving borrowers time and freeing them up to focus on the more complex aspects of commercial real estate financing, such as structuring the deal.

Moreover, the platform’s centralised online dashboard means investors can see all their projects and portfolio data in one place, helping them to streamline decision-making.

Finloop—which operates in English, French and German—is also able to connect users with the whole European commercial real estate debt market.

The software is exclusively available for commercial real estate assets, helping professional property investors, landlords and developers to understand quickly what lender options are available to secure a purchase, release funds to move onto the next stage of their property project or to finance real estate developments. Investors can also gather multiple terms sheets with just one financing request on the platform, saving time and reducing complexity.

When identifying the right site for commercial property investment, entrepreneurs must consider a wide variety of factors, including location, planning and sustainability issues. Making the right choice reduces risk and heightens upside potential, so optimising this decision is crucial—this is where several fintech and proptech solutions can come in to help.

One such company is LandTech , a firm that helps investors find and assess land to secure sites faster and improve margins. Its software can also be used to manage and track sites across teams. Its mobile app allows investors to manage prospective sites while they are out and about, making it suited to property professionals who are often on the go.

LandTech finds parcels of land with access to grid capacity, handles landowner negotiations, secures funding for projects and explores off-market land. It also has a partnership with Zoopla to offer Hometrack data, which provides a valuation estimate and includes site-sourcing tools with an analysis of market trends to help property professionals achieve the maximum financial returns.

Another solution available to UK commercial property investors and developers is Nimbus Maps . This company helps investors find and assess sites quickly. The web platform provides property information for commercial developers in one place, including ownership, property sizes and uses, values, planning applications and constraints, availability and local market trends.

The platform also checks the financial and planning viability of sites, providing information on commercial property listings so investors can assess comparable evidence within an area alongside current quoting prices, allowing them to anticipate the possible success of both the site and the proposed development.

It provides the information from a variety of sources, including Historic England, the Valuation Office Agency, Companies House and the National Grid, so investors do not need to check these sites individually. Commercial occupiers can also use the platform to map their property requirements and connect with property owners to make deals.

These solutions, when deployed well, may increase the return that can be achieved by providing as much data as possible to inform investment decisions.

Once investors have found the commercial finance providers they want to work with and loans have been arranged, some may seek help to manage their repayments, or for a way to streamline multiple loans.

Sopra Banking Software offers automation for commercial facilities to improve efficiency, lower risk and increase time to value. Sopra works with commercial lending automation experts in Europe, the Americas and Asia to provide advice to guide users in the best ways to close loans quickly and keep costs low.

The firm is also working with industry and customer groups to ensure the software is aligned with emerging regulatory requirements.

The platform is built for commercial lending and includes a self-serve portal that is brandable and customisable for businesses. It can be used for direct loans, guarantees, equity investments and syndicated loans, and those with multiple facilities can use the software to keep track of all these on a single platform.

Sopra works with multiple currencies, allowing lenders to provide funding in one currency and collect in another, and can be adapted to suit the specific terms of a facility and simplify complex loan structures.

Users can access a central dashboard to view and manage their loans and add rules, products, scoring and pricing to provide workflow-driven efficiency and comply with loan requirements.

Similarly, Fiserv’s fintech proposition allows banks, credit unions and mortgage originators to underwrite and service loans more quickly. The firm’s loan director software automates these tasks, supporting unsecured facilities, equity and small business lending.

It includes configurable workflow options that allow users to assign individual deal applications to specific loan officers, a cross-sell engine to boost revenue and compliance features that help user organisations stay up to date with regulations.

The firm serves more than six million merchant locations globally, with nearly 1.6 billion issuing accounts on file. It works with 10,000 financial institution clients.

It also offers integrated default management solutions that help determine the best loss mitigation strategies for institutions and their borrowers, as well as secure electronic document exchanges, which reduce the use of paper, save time and lower costs.

Fiserv also provides operational support to help user organisations scale their operations and IT support for its own and others’ products.

Commercial property management comes with a unique set of challenges, including specific contractual obligations, and service and notification agreements, all while regulatory requirements continue to evolve and change.

Arthur offers tools for a range of management requirements, from the day-to-day tasks to finances and communications. The software includes an automated events feature to keep everything up to date and a flexible payment module to manage any rent schedule. It also has several dedicated apps, including one for communication with occupiers that can be used alongside email and text. There is a separate app for occupants to report issues for repairs and maintenance, and for owners to send rent reminders. In addition, Arthur offers advanced tenant referencing to ensure property managers choose the right tenants for their buildings.

The software is also designed to speed up occupant onboarding by allowing potential occupiers to apply online with bespoke forms, storing deposit registration information and sharing relevant documents with your occupants and handling deductions and returns. This helps owners keep track of registered deposit amounts and software updates help them stay compliant with changing regulations.

Another similar company is Vention, which offers management and accounting platforms, broker solutions and mobile apps for property managers, working with more than 500 clients worldwide.

Its custom real estate software offers real-time residence management with tenant and lease tracking, communication through tenant portals and social media channels and full-service solutions for streamlined lead generation.

The cloud-based software can integrate with routine property management tools, from invoicing to document management. Vention also creates websites for property managers with mobile responsiveness and designs that are easy to maintain. It uses multiple listing services/internet data exchange software so managers can keep up to date with information on the housing market.

Moreover, the firm’s real estate software teams use artificial intelligence (AI) and machine learning to help managers automate workflows and improve efficiency, including through providing chatbot support for clients.

As energy efficiency regulations are introduced and clients are becoming more concerned with the quality of the commercial assets they rent, measuring a property's sustainability and safety is crucial for managers.

This is where IES comes into play. This is a tech company with a range of products aimed at improving the sustainability of buildings, including a cloud-based platform, IES Live, which provides managers with information on a building’s energy usage.

The platform also offers an energy management dashboard which tracks and reports on key performance indicators, a simulated energy benchmark specific to the building and main- and sub-meter breakdowns. It assesses the indoor environmental quality by tracking carbon dioxide levels, temperature and humidity against pre-set acceptable comfort ranges to identify problem spaces at sensor, room, area and floor level. The platform also tracks energy consumption and costs against occupancy.

IES also provides historic data on the building, allowing managers to compare current performance with optimal data to target issues. The software will also give managers actionable insights to make improvements.

It also shows the savings over time provided by net-zero building investments, such as double-glazed windows, so investors can track their return on investment.

Meanwhile, fintech company VergeSense offers an occupancy intelligence platform to provide information on how the spaces in portfolios are being used, with the aim of helping property managers to optimise their workspaces.

While office occupancy rates are continuing to rise, they still remain below the pre-Covid benchmark. In addition, hybrid working has affected which days office spaces are likely to be occupied. VergeSense offers entryway sensors for businesses to capture anonymously how many people are entering and leaving spaces with 95% accuracy. Property managers can then examine the data to determine the total occupancy of their buildings, people count distribution and occupancy by day of the week.

Using this data, property managers can reduce costs and improve employee experiences—VergeSense analyses 67 million sq ft of space in 43 countries around the world. The technology can be used to replace badge and WiFi indicators, and the company claims it provides a more accurate people count.

n 6th June, we welcomed around 750 of the most esteemed specialist finance industry experts to the 17th annual B&C Awards, proudly presented in partnership with West One.

Our guests were transported through the looking glass into the whimsical world of Alice in Wonderland, and were enchanted by a magical journey filled with mystical music, captivating actors, and our take on the Mad Hatter's tea party.

This was also the return of our daytime event in June after quite a long time, to the excitement of both our guests and our team as well—after all, summer is the ideal season for post-Awards ice creams, shisha, and plenty of dancing!

Much like Alice's adventures, this event symbolised the boundless creativity within the specialist finance sector. Beyond the costumes and croquet, Wonderland teaches us that nothing is impossible, reflecting the spirit

of innovation and adaptability in our industry.

In May, our rigorous judging panels intensely deliberated and made challenging decisions, all to ensure that this year's winners truly exemplify excellence. Their hard work has uncovered the best and brightest in our field, and we're confident that the awards represent the leaders who are setting the course for our market’s future.

This year, we were elated to partner with West One, whose support has been instrumental in bringing Onederland to life. We also want to give a special thanks to Octane Capital for sponsoring our fabulous bar, and to Fairbridge Capital for hosting the official After Party, where the fun continued long after the final award was handed out.

From our entire team, we thank you for your support and enthusiasm in celebrating the industry’s achievements, and we hope you were delighted by the magic we brought on the day.

BEST BRIDGING

NEWCOMER—BROKER

Winner: Word On The Street

Highly commended:

Diamond Property Finance

BEST BRIDGING

NEWCOMER — LENDER

Winner: Blue Shield Capital

Highly commended: StreamBank

BEST SURVEYOR

Winner: Capital Value Surveyors

Highly commended: Anderson Wilde & Harris

SPECIALIST BTL BROKER OF THE YEAR

Winner: Aria Finance

Highly commended: Dynamo

SPECIALIST BTL LENDER OF THE YEAR

Winner: Lendco

Highly commended:

BEST SPECIALIST FINANCE PARTNER

LARGE LOAN LENDER OF THE YEAR

Winner: West One

Highly commended: Pluto Finance

BEST SPECIALIST DISTRIBUTOR

Winner: Synergy Commercial Finance

Highly commended: Positive Lending

BEST SPECIALIST BANK

Winner: Hampshire Trust Bank

Highly commended: OSB Group

BEST SOLICITOR

Winner: Gunnercooke

Highly commended: JMW Solicitors

BEST DEVELOPMENT BROKER

Winner: Arc & Co

Highly commended: Pure

Structured Finance

BEST DEVELOPMENT LENDER

Winner: West One

Highly commended:

Hampshire Trust Bank

ESG COMPANY OF THE YEAR

Winner: Fieldfisher

Highly commended: Lightfoots

Best Bridging Newcomer - Broker

Specialist BTL Lender of the Year

Best Specialist Distributor

Best Specialist Bank

Best Bridging Newcomer - Lender

Best Solicitor

Best Specialist Finance Partner

Best Bridging Newcomer - Broker

Specialist BTL Lender of the Year

Best Specialist Distributor

Best Specialist Bank

Best Bridging Newcomer - Lender

Best Solicitor

Best Specialist Finance Partner

Best Bridging Broker

Bridging Lender of the Year

Best Dressed

Underwriter of the Year

Specialist Product of the Year

Marketing Partner of the Year

Lender Relationship Manager of the Year

Best Bridging Broker

Bridging Lender of the Year

Best Dressed

Underwriter of the Year

Specialist Product of the Year

Marketing Partner of the Year

Lender Relationship Manager of the Year

UNDERWRITER OF THE YEAR

Winner: Krisha Karunananthan, Funding 365

Highly commended: Christina Rogers, Allica Bank

SPECIALIST PRODUCT OF THE YEAR

Winner: Ultimate Finance (100% BMV)

Highly commended: Octane

Capital (Variable Rate Bridging)

REGULATED BRIDGING

BROKER OF THE YEAR

Winner: FinSpace Group

Highly commended: Master Finance Specialist Brokers

REGULATED BRIDGING

LENDER OF THE YEAR

Winner: MT Finance

Highly commended: Spring Finance

MARKETING PARTNER OF THE YEAR

OSB Group

BEST COMMERCIAL BROKER

Watts Commercial

Highly commended: Wharf Financial

COMMERCIAL LENDER OF THE YEAR

Allica Bank

Highly commended: Together

LENDER RELATIONSHIP

MANAGER OF THE YEAR

Winner: Shrena Patel, Octane Capital

Highly commended: Mia House, Hampshire Trust Bank

SERVICE EXCELLENCE — BROKERS

Winner: Clifton Private Finance

Highly commended: Propp

SERVICE EXCELLENCE — LENDERS

Winner: Funding 365

Highly commended: MT Finance

EDITOR’S CHOICE LENDER OF THE YEAR

Winner: Market Financial Solutions

BEST BRIDGING BROKER

Winner: Propp

Highly commended: FinSpace Group

BRIDGING LENDER OF THE YEAR

Winner: Funding 365

Highly commended: Together

BEST DRESSED

Winner: Rosalia Lazzara, CEO at Manuka Media

OUTSTANDING CONTRIBUTION AWARD

Winner: Danny Waters, Enra Specialist Finance

“It’s an honour to receive this award and to be recognised by your peers for the work that you do. It’s also a reflection of the effort we put in every day to ensure that we are the specialist market’s go-to lender. Every day we strive to offer the best products, provide the best service, and develop deeper relationships than our rivals—and that will never change”

Danny Waters, CEO at Enra Specialist Finance

VENTURE DOWN THE RABBIT HOLE TO THE B&C AWARDS 2024

Proudly providing the Borrower First lending experience for 15 years

Bridging | Refurbishment | Auction | Conversion

Development | Developer Exit | Below Market Value

Commercial | Residential

As sparks of optimism are starting to appear in the commercial real estate and lending markets, could the refinancing surge looming in the shadows thwart the sector’s longawaited recovery?

Words by ANDREEA DULGHERU

Words by ANDREEA DULGHERU