Q uarterly M arket R eport REMUERA

Despite the ups and downs experienced in recent times, the luxury sector of the real estate market has continued to diversify and often defy expectations.

From London to Miami, Los Angeles to Auckland, and throughout the rest of the world’s major markets, demand for luxury properties has largely continued to grow, albeit at a slower rate. As a consequence, the level of available stock has been declining. Which is something we’ve noticed - as reflected in Remuera’s latest sales data - over the past quarter.

Conservative results aside, it has to be said that the mood is one of ‘cautious optimism’.

This was a sentiment backed by the Reserve Bank recently. Not only did they restrict the latest rise in the Official Cash Rate (OCR) to just 0.25 basis points, they also indicated that it had peaked –leading a number of industry commentators to suggest that this cycle is now drawing to a close.

The Reserve Bank’s latest OCR move is expected to exert downward pressure on fixed mortgage rates, which is favourable news for both existing mortgage holders and potential house buyers. Moreover, with migration surging and the number of buyers outstripping the number of available listings, a supply-versus-demand imbalance is emerging, with an increasingly topheavy distribution. This imbalance is generating increased competition, which gives vendors too, a reason to feel more confident in the way the market is moving.

In such a limited supply market, buyers find themselves having to compete more fiercely for properties. This is a scenario that is playing out in our auction rooms, where the sales success rate has now more than doubled from 30% early in the year, to 65% at present. The number of bidders is on the increase too, and for the first time in many months, we are witnessing buyers audibly celebrate in the auction room when they are successful in purchasing their new home.

The fear of overpaying appears to be dissipating. And once the market hits its lowest point, it is anticipated to stabilise. It has to be said, the spikes experienced throughout the Covid years (starting late 2020 and peaking in 2021/22) were unprecedented.

The art to navigating these testing times requires a critical and analytical approach, an understanding of the complexities around the economy and housing market, and a willingness to align expectations accordingly. It is crucial to consider the factors propelling these fluctuations and, most importantly, identify the opportunities that arise from them.

If you are thinking about selling your property sometime soon, our advice is to consider looking at the lack of listings this winter as your window of opportunity. Our team knows this area and the luxury sector like no-one else, and we are able to capitalise on the preferences, trends and demands in this dynamic and fast-evolving environment. Please do not hesitate to get in touch with us, as always, we would be delighted to help.

P: 09 524 0149 | E: remuera@barfoot.co.nz

P: 09 524 0149 | E: remuera@barfoot.co.nz

When it comes to making property decisions, you can be sure our recommendations will be made with you in mind.

1ST QUARTER RESULTS FOR ALL SALES

TOTAL SALES Oct 22 - Dec 22

MEDIAN SALE PRICE

1ST QUARTER 4TH QUARTER 1ST QUARTER 4TH QUARTER

Jan 23 - Mar 23

$1,900,000

$2,075,000

YEAR TO DATE YEAR TO DATE

Apr 22 – Mar 23

TOTAL SALES Apr 21 – Mar 22 452 275

Apr 21 – Mar 22

$29,000,000

SALES OVER Oct

$4M+

2022-2023 15 Jun Jul Aug Sep Oct Nov Dec Jan Feb Mar Apr May 12 9 6 3

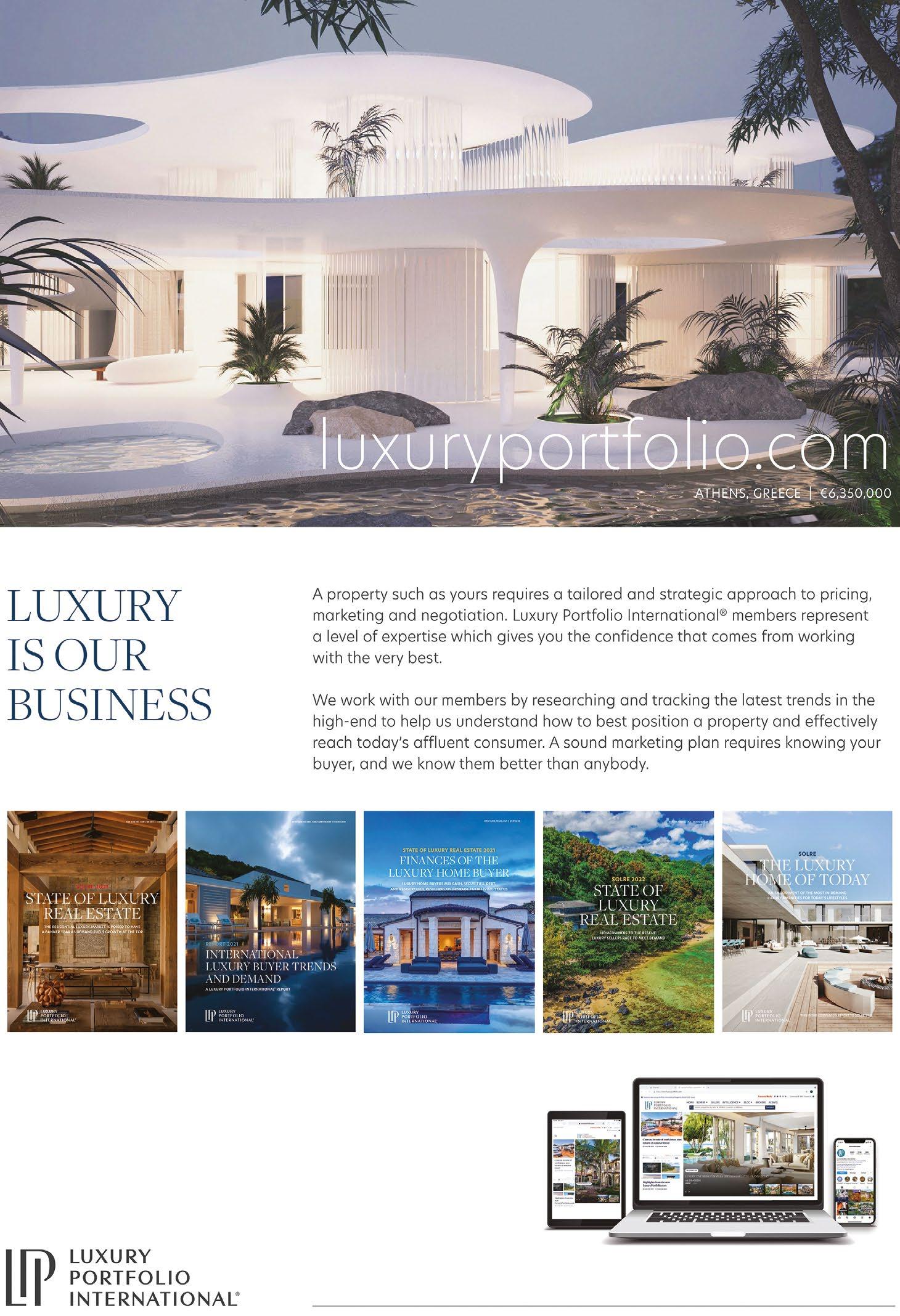

When you’re marketing properties of the very highest standard, we know that one size doesn’t fit all, which is why we deliver a customised service that’s as unique as you and your home.

What makes us the luxury specialists? 417

Here at Barfoot & Thompson Remuera, it’s not just property that we are passionate about. It’s people too.

In fact, all that we do here revolves around our clients; getting to know them on an individual basis, nurturing long-term relationships, and ensuring that every experience for them is a rewarding and positive one.

remuera@barfoot.co.nz

We get a phenomenal amount of repeat business at our branch, which is testimony to our bespoke approach.

According to the 2023 edition of the State of Luxury Real Estate (SOLRE) report “we observe that the global wealthy are living in a state of adaptation to changing –and often unpredictable –circumstances.”

“Adaptability is the defining spirit of buyers currently, and confidence is its currency. The worldwide wealth outlook is positive over the next five years. Breakout growth among ultra-high-net-worth individuals is creating a global upper-middle class. These concurrent trends set an encouraging tone for the year ahead:

> Consumers are aware of the potential headwinds from their local economic conditions to the fragmented political landscape to ever-present concerns over climate change and COVID-19.

> These consumers are resilient in the face of these concerns. Most see their own fortunes improved in late 2022 and expect 2023 to be an even stronger year for them.

> Luxury real estate remains a solid investment in a time of upheaval with financial investments. Owners and buyers expect values to rise in 2023 and investment-property purchase expectations remain at 2022 levels. Our scope of research has evolved to meet the changing demands of the industry. The focus remains on the top 5 percent income earning households, and this year we have expanded our point of view to include 28 global markets across six continents, representing the opinions of 90 percent of the world’s affluent class.”

Mickey“And the most successful people are those who accept and adapt to constant change. This adaptability requires a degree of flexibility and humility most people can’t manage”

“It is not the strongest of the species that survives, nor the most intelligent that survives. It is the one that is the most adaptable to change”

Alam Khan President, Luxury Portfolio International

-PAUL LUTUS, AUTHOR

-CHARLES DARWIN, NATURALIST

“Enjoying success requires the ability to adapt. Only by being open to change will you have a true opportunity to get the most from your talent”

-NOLAN RYAN, MLB HALL OF FAMER

The State of Luxury Real Estate (SOLRE) 2023 is a consumer-oriented investigation that gathers insights from affluent individuals worldwide.

The study focuses on individuals in the top 5 percent income bracket across 28 countries and six continents, who earn at least USD $250,000 per year. The research, which began in 2021, has involved over 14,000 prosperous individuals and over 100 luxury real estate professionals from the LPI network.

This report highlights the luxury home buyer segment, comprising individuals who are highly likely to purchase a luxury home within the next three years based on their current socio-economic status and their intention to buy real estate valued at USD $1 million or more.

Interviews were carried out in October and November of 2020, 2021, and 2022. The findings accurately represent the global affluent class with a confidence level of 95 percent.

TOTAL AFFLUENT CONSUMER INTERVIEWS: 2,944

AMERICAS: 950

North America: 456

United States, Canada, Mexico

Latin America: 494

Brazil, Chile, Colombia, Costa Rica

EMEA: 951

Europe and UK: 601

France, Germany, Switzerland, Italy, Spain, Russia, United Kingdom

Middle East/Africa: 350

United Arab Emirates, Saudi Arabia, Egypt, South Africa

ASIA PACIFIC: 1,044

East Asia: 504

China/Hong Kong/Taiwan, Japan, South Korea

South Asia: 180

India

S.E. Asia and Australasia: 360

Singapore, Indonesia, Australia, New Zealand

TOTAL LUXURY HOME BUYERS INTERVIEWED: 1,143

In a competitive context where luxury buyers are asked to rank order their preferences, the reality is that each of these categories holds significant importance. However, a clear hierarchy emerges when they are compared side by side.

Certainly, each market and buyer will have their own sense of priority order, but as a global class this is what matters most.

Investment quality (return on investment, stability of investment)

Natural beauty (great scenery and natural setting)

Family oriented (great parks, schools, other children)

Sustainability features (construction materials or in-home technology)

Wellness features (spaces or amenities dedicated to well-being)

Extensive privacy (few or distant neighbors, gated community)

New construction (recently made residence, neighborhood)

Community oriented (great restaurants, night life, lively social scene)

“37% of luxury home buyers expect to purchase in the city center, where investors outnumber primary home buyers. This dynamic is predicted to cause investment grade properties to come off the market more quickly while dwellers search for turnkey residences the results being an increase in home prices for city center luxury properties.

Luxury buyers are interested in city living for a variety of benefits. What they will not sacrifice is the quality of schools whether public or private and access to parks and nature. Bonuses of being city centre include culture and medical facilities. Parking is the real treat for this buyer.”

Through three years of SOLRE research, a clear pattern has emerged, indicating a growing preference for single-family homes among luxury buyers.

This particular housing type remains the dominant segment of the market, aligning with the shifting demographics of these buyers who prioritise familyoriented spaces. On the other hand, shared-wall living arrangements like townhouses and condos/apartments have experienced a gradual decline, witnessing a decrease of over 15 percent since 2021.

Branded hotel and high-rise penthouse residences, meanwhile, have remained consistent over time, primarily attracting affluent emptynesters rather than up-and-coming high-earners.

Branded hotel or resort residence (with access to its amenities)

High-rise Penthouse apartment (top floors in a large building)

Townhouse (a single-family home that shares a wall with another)

Condominium / Apartment (single unit within a larger building; shared walls)

Single-family home/landed residences (built on a single lot, no shared walls)

“More than half of luxury home buyers (61%) view their next home purchase as a ‘legacy property for their heirs,’ and an equal amount want the ability to age in place (66%).

Part of their legacy may include housing multiple generations of family (76%), single floor living capability and even a place to receive medical professionals for non acute treatments (such as hydration, level testing and regular checkups).

Two thirds of buyers also have sensitivities to light or sound, suggesting another level of renovation that may be needed in busy areas.

Luxury buyers are seeking homes that can do it all. They are planning for the long haul even if life takes them to other places later on.”

Sourced from State of Luxury Real Estate 2023

76% 66%

64% 63%

Features for people sensitive to light or sound

Multi-generational living spaces Ability to remain forever (“age in place”) An in-home health practice area

Sourced from State of Luxury Real Estate 2023

$4M+ JAN -MAR 2023

A luxurious living home in a prestigious Remuera street. It has a minimalist design, including four bedrooms, master with ensuite, two bathrooms, a garage with a workshop and swimming pool.

Price $5,050,000

CV $4,750,000

Land 1181

Sold January 2023

A stunning brand new property in an excellent location that features five bedrooms, four bathrooms, three garaging, pool and north facing garden. Perfect for extended families.

Price $6,250,000

CV $3,550,000

Land 667

Sold March 2023

A beautiful, private, and elegant mansion, on an elevated position, that includes six large double bedrooms, four bathrooms and a stunning poolside.

Price $6,300,000

CV $5,200,000

Land 957

Sold March 2023

| $4M+ JAN -MAR 2023

Sensational position on the ridgeline, this coveted property sits on a generous 1370sqm freehold flat corner site with North to West orientation. A perfect opportunity to explore in a highly sought-after location.

Price $6,600,000

CV $7,400,000

Land 1370

Sold January 2023

The previous pages show a summary of sales in Remuera with property values $4M+ made by all agencies during Jan to March 2023.

Our sales data includes information submitted by the selling agency and may include some private sales. Where details of a particular sale may not have been able to be fully verified, it may be omitted from our reports.

Please do not hesitate to contact any of our sales team if you would like more information, we would be delighted to help you with your real estate needs.

Every reasonable effort has been made to ensure the accuracy of the information presented. Land and floor sizes are approximated, sourced from REINZ, Auckland Council or other public sources and may contain inaccuracies. Barfoot & Thompson Limited (REA2008) accepts no responsibility should the contents of this market report prove to be incomplete or incorrect.

A stunning property stretching out over the Orakei with 4,489m2 of north-facing land, bathed in all day sun. This property is to be demolished and conveniently located for a multi lot development.

Price $4,600,000

CV $8,100,000

Land 4489

Sold February 2023

Barfoot & Thompson is committed to getting your property in front of as many buyers as possible - even across the country and the world.

When you choose to work with us, you have the benefit of our national and international partner network to leverage during your sale or purchase.

A global network of over 550 premier real estate firms with 136,000 sales associates at your service to not only market your property, but also provides more opportunities to connect buyers through referrals. Member companies generate more than 1.1 million transactions valued at USD $405 billion annually. Should you wish to purchase property overseas, we have trusted colleagues that can offer you the same high level of service and care you would expect from us here at Barfoot & Thompson - anywhere in the world.

Our marketing and negotiating skills are well proven with our focus being on providing valuable, insightful, knowledgeable and respectful real estate services to you. Your needs are what drives us—we understand the one size doesn’t fit all, which is why we deliver a bespoke service that’s as unique as you and your home. As we value the same things as you do, you can be assured we’ve got all the right measures in place to ensure your privacy and security.

Successful selling relies on unparalleled market knowledge, superior negotiating skills and a lot of hard work. We are focused, professional real estate experts with years of experience in every kind of market.