5 minute read

MARKETS

2021: MAJOR CHANGES TO THE JAPANESE BIOMASS MARKET

The Japanese biomass market is on the cusp of some major developments that will change the dynamics of the market in the coming years. BY RACHAEL LEVINSON

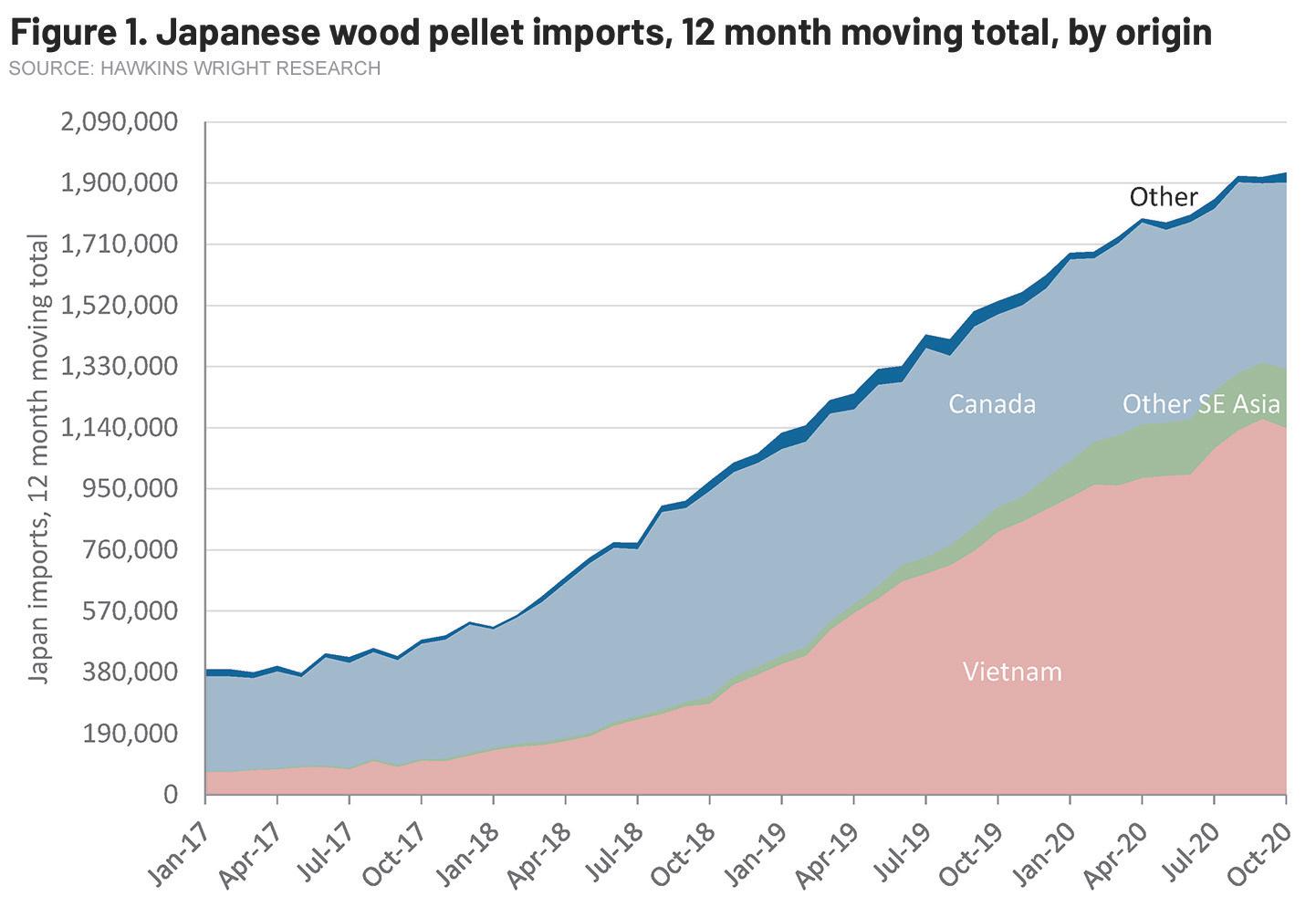

While Japanese biomass demand continued strong growth in 2020, upcoming policy changes will impact trade flows, supply and demand. Hawkins Wright estimates Japanese wood pellet demand was 1.8 million metric tons (MT) in 2020, up 20% on the year with little sign of slowing. We forecast wood pellet demand will grow 33% in 2021 and have identified over 4 gigawatts (GW) of woody biomass capacity in the pipeline (Figure 1). Japan’s Ministry of Economy, Trade and Industry has approved nearly 8 GW of woody biomass capacity under the feed-in-tariff (FiT), but many projects are not at an advanced development stage. Not all the 70-plus projects we have identified are expected to make it online, but approximately half are already under construction or financed.

Introduction of Sustainability Criteria

Potential changes to sustainability criteria in Japan could have a significant impact on available palm kernel shell (PSK) supply. METI is considering introducing new criteria for agricultural byproducts, including PKS, and is examining the lifecycle greenhouse gas (GHG) emissions of wood pellets and wood chips. Under the current FiT rules, biomass power project developers are required to provide evidence in their business plans that their feedstocks will be sustainably sourced, legal and traceable. There is no legal requirement, at present, mandating the use of Forest Stewardship Council or Programme for the Endorsement of Forest Certification-certified wood, but there is a general acceptance—endorsed by lenders—that imported wood pellets should have chain-of-custody systems in place.

METI established a biomass sustainability working group to examine the technical aspects of sustainability for agricultural products. It has proposed criteria and recommended which certification schemes meet the requirements.

With regard to PKS, METI's latest guidelines, if adopted, could have a substantial effect on PKS availability. There is very limited uptake of sustainability certification for palm oil plantations in Indonesia and Malaysia; thus, sourcing acceptable PKS could become challenging and costly. In addition, the COVID-19 pandemic has significantly slowed progress in obtaining sustainability certification in Malaysia and Indonesia.

A limited quantity of certified PKS supply could push end users to look for alternative biomass sources and may drive demand for wood pellets. However, some end users who had planned to rely solely on PKS do not have the infrastructure and equipment, such as covered storage spaces, to handle white wood pellets. Therefore, there may be an opportunity for other biomass that can be stored in a similar manner to PKS, such as wood chips and black wood pellets.

The same working group began to examine the lifecycle GHG

emissions of wood pellets and wood chips in 2020. It is investigating whether existing sustainability certification schemes such as the Sustainable Biomass Partnership could be used to prove compliance with any standards introduced. We expect more detailed information on the issue early this year.

US Shipments of Wood Pellets

In December, U.S. pellet producer Enviva made its first shipment of wood pellets from the U.S. South to Japan. It sent 28,000 MT from Florida to the Japanese port of Iwakuni. The shipment marks the first of many for the world’s largest pellet producer.

Enviva has a large portfolio of Japanese offtake contracts commencing in the next few years, meaning it will soon gain a sizeable share of the Japanese market. Other established U.S. producers are keen to follow in its footsteps and create a presence in Japan.

The commencement of U.S. contracts supplying Japan will change trade flows in the coming years. Traditionally, the Canadian west coast has been the preferred choice for Japanese end users. Its proximity to Japan versus the U.S. and Europe, coupled with proven, secure and sustainable supply, made suppliers there the obvious choice for new users looking for long-term supply contracts. However, since the spot market developed in Japan, Southeast Asian producers have been increasing their share (Figure 2). For the first time in 2020, Vietnam overtook Canada as the largest supplier of wood pellets. But growing demand in Japan, backed by the need for secure, reliable supply contracts, has given the U.S. an opportunity to tap the market.

Despite west coast Canadian supply providing a bridge between the Asian and European industrial markets for several years, there has been little interaction between the two markets. In the past, some Canadian volumes contracted to Europe were diverted to South Korea because of the low European spot prices and higher Korean prices at the time. More recently, low Asian spot prices in 2019 enticed a couple of Malaysian and Vietnamese cargoes to make their way to Europe. The start-up of trade between the U.S. and Japan could open the opportunity for more interconnection between the Asian and European markets. Coal Phase Out Looking further ahead, METI’s plans to phase out the country’s inefficient coalfired power plants by 2030 could provide opportunity for increased biomass use. In early July, METI began drawing up a new framework to ensure inefficient coal-fired power plants were closed by 2030 as part of Japan's strategic energy plan. Japan had already introduced the Energy Savings Act, which will require all existing large power plants to achieve a minimum level of generating efficiency of 41% by 2030. But METI has now tasked a new working group with identifying how to phase out the inefficient coal plants (less than 38%), while ensuring stability of power supply. The exact policy framework is yet to be worked out but could include financial compensation, incentives, a carbon tax or a combination.

Low-efficiency coal power plants might be able to extend their lifetime by cofiring biomass to increase their apparent efficiency. The potential use of biomass cofiring and cogeneration to help meet efficiency targets will be considered by METI. Currently, biomass fuel can be deducted from the assumed energy input of the power station when calculating efficiency. METI will also discuss whether biomass cofiring should be subject to lifecycle GHG or other sustainability measures. The cofiring of hydrogen and ammonia have also been mooted as possible routes to compliance.

Japan is the fastest-growing industrial biomass market globally. Therefore, it is as important as ever that all market participants keep a watch of how potential changes could alter the amount and type of biomass it consumes in the coming years.

The changes happening in the Japanese market, as well as the evolving Korean market, made it an ideal time for Hawkins Wright to revise and update its popular Biomass Demand in Japan and South Korea report. For a more detailed analysis of these markets, please get in touch.

Author: Rachael Levinson Biomass Research Manager, Hawkins Wright rachael@hawkinswright.com www.hawkinswright.com