Great Britain in Thailand Export & Import Opportunities

Magazine of the British Chamber of Commerce Thailand Issue 1 2017

RUGBY SCHOOL IS COMING TO THAILAND Opening for 2 - 10 year olds in September 2017 and for 11 - 17 year olds in September 2018. Boarding will begin in September 2018. www.rugbyschoolthailand.com For further information, please call +66 (0) 2656 0055 or email us at enquiries@rugbyschoolthailand.com

BCCT Board of Directors 2017

CHAIRMAN

Simon Matthews ManpowerGroup Thailand T: 02 2634 7273 matthews@manpower.th.com

VICE CHAIRMEN

Simon Landy

Colliers International Thailand T: 02 656 7000 simon.landy@colliers.com

Christopher Thatcher Anglo-Thai Legal Co., Ltd. T: 081 803 7377 christhatcher1@gmail.com

David Cumming

ONYX Hospitality Group (Amari Watergate Bangkok) T: 02 653 9000 david.cumming@amari.com

DIRECTORS

Ali Adam

Arcadia (Thailand) Co., Ltd. T: 02 108 1822 ali@arcadia-engineering.com

Mark Bowling

Pattaya Realty Co.,Ltd. T: 038 412 301 mark@pattayarealty.com

Billy Chomsakorn

British Airways PLC T: 001 80044 15906 billy.chomsakorn@ba.com

Viriya (Boyd) Chongphaisal GlaxoSmithKline (Thailand) Limited T: 02 659 3000 viriya.x.chongphaisal@gsk.com

John Christie Ek-Chai Distribution System Co., Ltd.

T: 02 797 9000 john.christie@th.tesco.com

Stephen Frost Bangkok International Associates Ltd

T: 02 231 6201/6455 sfrost@bia.co.th

Kate Manning

Adelphi Digital Consulting Group T: 02 662 1499 kate.manning@adelphidigital.co.th

Carl Sellick

Lucy Electric (Thailand) Limited T: 033 684 333 carl.sellick@lucyelectric.com

Kelvin Tan HSBC T: 02 614 4000 kelvin.tan@hsbc.co.th

Summer Xia

British Council T: 02 657 5678 summer.xia@britishcouncil.or.th

HONORARY TREASURER

John Sim

PKF Tax and Consulting Services (Thailand) Ltd.

T: 02 108 1591-96

john.sim@pkf.com

2 The Link Issue 1/2017

Contents This Edition 10 12 10 Trade Secretary leads drive to boost UK exports 11 ASEAN focus for firms in north west England 12 Post Brexit boom for UK inward investment 14 Brexit poses no barrier to UK investment in Thailand 16 Creating a corridor for investment and business growth 11 14 16

Issue 1/2017

The Link is published by the British Chamber of Commerce Thailand.

Advertising enquiries: Greg Watkins

Email: greg@bccthai.com

Editor: Dale Lawrence

Email: dalelawrence2008@gmail.com

Front cover design: GSBI

Production: Scand-Media Corp., Ltd

The views expressed by individual authors are not necessarily those of the British Chamber of Commerce Thailand or of the publisher. Reproduction in whole or in part without written permission from the British Chamber of Commerce Thailand is strictly prohibited.

British Chamber of Commerce Thailand 7th Floor, 208 Wireless Road

Bangkok 10330, Thailand

Tel: 02-651 5350/3 Fax: 02-651 5354

Website: www.bccthai.com

Email: greg@bccthai.com

Greg Watkins, Executive Director

4 The Link Issue 1/2017

Contents Every Edition 6 Executive Director’s Message 8 Chairman’s Message 22 News from the IPR SME Help Desk: IP protection in Thailand for the tourism industry 26 Member News: HSBC Global Report 42 By the Numbers 44 Chamber News: BCCT Annual Report 2016 56 Chamber Events: BCCT One-Day Workshop 61 Comings & Goings 68 Final Word: Eternal optimism 26 44 56 22

We offer a British-style education for an international community, from Nursery through to Graduation. Find out how our approach to learning and outstanding teaching staff enable us to develop global citizens who shape their world through independence, empathy, creativity and critical thinking. Contact us at admissions@patana.ac.th | Tel: +66 (0) 2785 2200 | www.patana.ac.th Bangkok Patana School O F BRI T I S H IN T ERN A T IONAL EDU C A T IO N CELEBRATING 60 YEARS Bangkok Patana is a not-for-profit, IB World School, accredited by CIS and NEASC

SIMON MATTHEWS

Sterling Partner

Chairman’s Message

Welcome to the first issue of The LINK in 2017. I am honoured once again to have been elected to serve as your Chairman and I express my sincere thanks to all those who supported me and the Chamber throughout 2016.

I am very pleased that Simon Landy and Chris Thatcher have been elected as BCCT Vice Chairmen. Simon will continue to represent the Chamber at the Board of Trade as well as serving as Chairman of the Overseas Business Network committee. Chris’ many duties in 2017 will include chairing our Events committee. David Cumming continues as Chairman of our Tourism committee and I am also pleased that John Sim will continue as Treasurer, thus ensuring that we continue to be financially sound.

I am delighted to welcome two new board directors, namely Summer Xia of the British Council and Kate Manning from Adelphi Digital. I am confident that they will help us to make 2017 another fantastic year for our Chamber. I would also like to thank Executive Director Greg Watkins and the BCCT team for their great work in 2016 and for their continued support in 2017.

Sustaining Partners

As we look ahead there are some key areas that your Board will continue to focus upon.

• Membership: To use our membership survey and other tools to continue to improve engagement and provide services and value to meet our membership needs with a renewed focus on retention

• Advocacy: To build on progress made in 2016, working closely with other foreign chambers of commerce, the European Association for Business and Commerce (EABC) and the Board of Trade of Thailand in order to best represent BCCT members in seeking change to the key issues that face them

• Events: Events are the main touch-point with many members. With feedback received from our surveys we will work on improving our events and seek to achieve the best balance between business/educational and more social themes, between income – generating and free or subsidised events, between Bangkok and upcountry and, ultimately, between quantity and quality

• Department of International Trade: To work closely with DIT Bangkok and in the UK (through the Executive Director’s position on the OBNi Project Board), UK ASEAN Business Council, British Chambers of Commerce, specific trade associations and chambers of commerce in UK in order to grow the number of UK companies exporting to and investing in Thailand and introduce these companies to the wide range of services our members can offer

• Investment: With financial stability and a healthy balance sheet we will look again at how to invest back to our members

I will update you throughout the year on the progress we are making with these initiatives.

In closing I would thank you for your continued support in 2017. The BCCT exists because of you, its members. As such I would encourage you to provide feedback and comment on any issues that you wish to raise or to be raised on your behalf.

Let us know how we can improve our service to you, our valued members. Lobby us at our many events throughout the year or email any member of the Board of the Directors. Contact details are published on page 2 of this magazine.

I look forward to hearing your views.

6 The Link Issue 1/2017

Supporting Partners

Executive Director’s Message

What a start to the New Year! At the AGM in January we welcomed two new board directors – Kate Manning, Group Commercial Manager - Adelphi Digital Consulting, and Summer Xia, Deputy Director - British Council. Both are hitting the ground running.

Kate has established a new BCCT Young Professionals Group and Summer is working with us on BCCT/British Council event collaboration that includes the return of Thai language presentations after a 10 year hiatus.

From time to time, members ask what BCCT is doing in terms of advocacy i.e. supporting members through bureaucratic hurdles and seeking positive change to laws and regulations. BCCT is active in many ways:

• The first and most direct way is by assisting individual members. This could be a discussion on the best way to address a specific issue based on our long experience. It could be sign-posting to a specific person in a government department who has undertaken to respond. It might involve recommending contact with another member who could act as a mentor in resolving a specific issue.

• BCCT engages fully with the Thai public and private sectors on a bilateral basis. BCCT Vice Chairman Simon Landy is the only non-Thai representative on the Thai Chamber of Commerce/Board of Trade Executive Committee and reports to the BCCT board on a monthly basis. Engaging with the Thai Chamber of Commerce/Board of Trade has been the most effective way of achieving positive change.

• We have Honorary Advisers who are, with two exceptions, senior Thai nationals who on request help us to better understand and navigate our way through specific issues.

• BCCT works closely with other foreign chambers in Thailand e.g. the American and Australian Chambers on advocacy issues. We are currently working together on more effective engagement with the Board of Trade and its seven sub-committees.

• BCCT has played a positive role in the evolution of the European Association for Business and Commerce (EABC) including EABC’s future now that the 6-year EU-funded project has ended. BCCT members either Chair or are active in each of EABC’s twelve sector advocacy groups and BCCT Treasurer John Sim is also the EABC Treasurer. I personally attend many EABC meetings and see value in a multi-country advocacy platform that also gives BCCT members an opportunity to access a wider European network in Thailand.

- BCCT intern (Kieran Taylor) has analysed UK’s exports to Thailand and Thailand’s imports from the world over the last 20 years in order to identify specific sector trade gaps where our exports are falling but Thailand’s imports of the same product are rising. He has also stripped out the key detail of Thailand’s current trade agreements with the US, China, Japan and Australia. We will use this data to move towards a bilateral FTA or bilateral sector treatments via the ……

• Thai UK Business Leadership Council – formed last year on business-tobusiness and government-to-government platforms in order to improve trade between Thailand and the United Kingdom. Major British and Thai corporates are represented on the Council. BCCT plays a supporting role on the main Council and in the three sub-committees: Ease of Doing Business; Export Opportunities; and Technology. This is the most likely way of push for a bilateral trade agreement or individual sector treatments.

March was a very busy month with the successful inaugural Thailand International Business Awards and the popular Life and Style Garden Party – possibly the last time that the latter event will be held on the current British Embassy site.

8 The Link Issue 1/2017

GREG WATKINS

At KIS International School all students can shine. The midsize, caring community allows KIS students to be con dent and to be appreciated as an individual, with unique dreams and strengths. The school is a full IB school, o ering the International Baccalaureate Programmes for all age groups (IB Primary Years Programme, IB Middle Years Programme and IB Diploma), ensuring an academically rigorous curriculum that not only prepares students to be successful at university, but also teaches important life skills. KIS, it’s all about Knowledge, Inspiration and Spirit. Check out the students’ videos to learn more about their passion www.kis.ac.th

“With the power of imagination, characters can actually y o the page” Jun, Grade 11.

Tel: +66 (0)

Email: admissions@kis.ac.th

nspiring ndividuals

2274 3444

Trade Secretary leads drive to boost UK exports T

he government is urging businesses to make 2017 the year of exporting as it encourages them to seek new markets and seize the demand for British goods and services. Exports contribute over £511 billion to the UK’s GDP and with a renewed focus on international trade the government has identified opportunities in more than 20 sectors spanning over 50 countries for UK businesses. The Department for International Trade (DIT) is now developing almost 200 high value exporting campaigns to target these markets and sectors and help companies to make their mark abroad.

International Trade Secretary Dr. Liam Fox said, “With a new year comes new opportunities and I want to encourage businesses big and small, up and down the country, to take advantage of them. From technology in India to aerospace in the USA there’s no shortage of demand and UK businesses have the knowledge, skills and expertise to truly add value and make the UK a partner of choice. We are worldleaders in many sectors such as financial services and technology.

“My department has already identified more than 50 countries that could benefit from British expertise and we are continuing work on exploring more export opportunities with other nations. We have a real opportunity to build on this country’s wide range of successful exports, reach out to new markets and help more businesses achieve their exporting potential.”

DIT is helping companies to achieve success by making representations to overseas buyers and governments, organising key meetings and missions, showcasing UK products to overseas buyers and providing direct financial support through UK Export Finance. The department is also working closely with its network of 44 Business Ambassadors and 20 Trade Envoys to identify prospective markets, to promote the strengths of the UK and to secure more business. Recent UK successes include:

• £500,000 deal to export Air Traffic Control software to Latin America

• £100 million deal to export solar farm technology to Africa

• £5 million deal to export a television programme to the United States

• £50 million deal to build an amusement park in China

Potential business opportunities identified recently by the DIT include renewable energy projects in Kenya; advanced manufacturing in Brazil; infrastructure projects such as airports and railways in Hong Kong and mainland China; construction in the Philippines; technology to India, Japan and Mexico, and healthcare to China and the Gulf states. The work of the DIT sits alongside efforts to increase the number of companies exporting and follows on from the launch of a new digital hub: www.great.gov.uk.

* For expert guidance on exporting, visit: https://www.exportingisgreat.gov.uk/

10 The Link Issue 1/2017 COVER STORY

Dr. Liam Fox

ASEAN focus for firms in north west England

Companies in north east England are looking to ASEAN for new business opportunities, according to Brian Dakers, International Trade Manager with the region’s Chamber of Commerce.

He told the Evening Chronicle newspaper that the Chamber had 48 member businesses exporting to at least one ASEAN market, with most generating sales in two or three countries.

Brian Dakers added that ‘the products cover a wide spectrum, but there’s particular success in consumer products, predominately food and drink, which is increasingly popular in these markets, due to the increased appetites of the indigenous populations and the number of European migrants settling or holidaying there. With enviable growth rates enjoyed by a number of the markets and an emphasis on diversifying the economy an undoubted consequence, this trend looks set to continue, offering significant possibilities for consumer-based products, as well as those operating in a variety of business areas, such as education.

“There is also significant demand for more engineering products, such as those used subsea, as well as in the marine industry more broadly,” he added.

In a wide ranging interview with the Evening Chronicle, Brian Dakers suggested that ‘ASEAN is a market of surprises – one where things might not always be as they seem’, prompting his recommen-

dation for solid research before venturing into the unknown.

He added, “It is always worth scratching below the surface of a perception you might hold of the market, to see what the figures mean for your product or service. One example of this was a business I advised who had dismissed Indonesia as a market at first, due to the fact the country is over 80 per cent Muslim. This seems logical if you’re selling a product at odds with Islamic beliefs, until you consider that the remaining 20 per cent of the population of Indonesia equates to more than 50 million people.”

The Link Issue 1/2017 11 COVER STORY

Brian Dakers

Post Brexit boom for UK inward investment T

he UK has secured more than £16 billion in foreign investment since the formation of the Department for International Trade headed up by Secretary of State Dr. Liam Fox. The UK’s continued reputation as an attractive place to invest and do business with is helping boost jobs and industry across the country, with new deals worth billions agreed in the last five months.

Since its creation in July, the Department for International Trade (DIT) has helped secure more than £16.3 billion worth of foreign direct investment across the UK in key sectors including property development, infrastructure and renewable energy.

Dr Fox said, “Recent major investments show how much the UK is valued as an innovative businessfriendly country, and will continue to be as we leave the EU. But the benefits of foreign investment have much more impact for local communities across the UK, transforming local industry, creating jobs and tackling issues like housing and clean energy.

“Britain remains truly open for business and that’s why my department is supporting businesses in the UK and across the world to attract investment to boost our economy. Long-term business investments like these are a clear vote of confidence in the UK and our strong economy post-Brexit.”

Following a record year for foreign direct investment in 2015/16, when almost 1,600 jobs a week were created through international investments, the new department has helped to broker investment safeguarding and creating jobs in sectors from mineral extraction to financial services.

In addition to a series of high profile investments in the UK, with global brands committing to new UK sites, DIT’s work to support new investment often helps the growth of smaller UK firms outside of London:

• DIT helps to create exporting entrepreneurs –the majority (80%) of businesses the department

helps to export abroad has fewer than 250 employees

• Since 2011, 80 percent of the 712,000 jobs secured or created through foreign investment were outside of London, proving that foreign investment mostly benefits the UK’s regions

12 The Link Issue 1/2017 COVER STORY

Brent Cheshire

Regenerating local industry

Australian company Peak Resources is to boost heavy industry in the Tees Valley with a planned £100 million investment in a new minerals refinery. The investment will also help put the UK at the forefront of electric car development, as the refinery will produce the critical raw materials needed for the electric and hybrid drive motors.

The company cited the support from DIT and the Tees Valley Combined Authority, as well as the government’s ‘progressive stance on maintaining competitive corporate fiscal regimes’, as key factors in the decision to set up in the UK.

Renewable energy

Foreign investment from Denmark’s DONG Energy, also confirmed in December 2016, will boost the UK’s leadership in renewable energy development in a multi-national venture based in Scotland.

Campbeltown in Scotland is to be the site of the UK’s first offshore wind towers in a deal involving companies from Denmark, Germany and South Korea securing hundreds of jobs in coming years. International Trade Minister Greg Hands met with the companies in South Korea in November.

DONG Energy has committed to creating 30 skilled jobs in Northwich with a new £60 million recycling and energy plant able to service 110,000 homes.

DONG Energy’s UK Country Chairman Brent Cheshire said, “The UK is the world leader in offshore wind and a growing market for DONG Energy. We plan to invest £12 billion here by 2020 and this

is creating long-term highly-skilled jobs, supporting a thriving UK supply chain and helping the UK to continue as a leader in renewable energy.”

Fifty percent of the Race Bank offshore wind farm off the Norfolk coast has been divested to Macquarie, underlining how DONG projects and the UK are seen as an attractive place to invest.

“We placed a number of very significant contracts with UK firms in 2016 right across the country and we expect this to continue in 2017. The supply chain for offshore wind continues to grow from strength to strength, ranging from offshore foundations to turbine blades, electrical substations to cranes,” added Brent Cheshire who also serves as Managing Director of DONG Energy Wind Power.

This year the company will open a waste treatment facility in Northwich that will separate household waste from recyclable materials and, at the same time, generate green energy.

Housing

Foreign investment is also tackling the UK’s housing shortage following a recent commitment from Chinese construction firm CNBM which is to invest some £2.5 billion into the development of 25,000 modular homes in the UK.

These pre-made homes, costing around 20 percent less to build than traditional bricks and mortar, will provide an affordable option for potential homeowners, local authorities and housing associations. The investment will also create over 1,000 jobs in six new factories in Scotland, Wales and England with support from the Department of International Trade.

COVER STORY The Link Issue 1/2017 13

“ ”

The UK is the world leader in offshore wind and a growing market for DONG Energy. We plan to invest £12 billion here by 2020 and this is creating long-term highly-skilled jobs, supporting a thriving UK supply chain and helping the UK to continue as a leader in renewable energy.

Brexit poses no barrier to UK investment in Thailand

With UK businesses continuing to explore opportunities in the ASEAN region, what is the likely impact of BREXIT on UK investment in Thailand? We asked Colin Kinghorn, Chief Operating Officer at Ipsos Business Consulting in Bangkok, for an objective assessment.

Q: Does Brexit pose barriers or opportunities for UK investors in Thailand?

Brexit will free Britain from trade restrictions with Thailand which will enable the two countries to negotiate trade deals which are advantageous for both parties.

The two countries have committed to speeding up trade talks to develop economic cooperation and boost trade and investment. While the details of a bilateral free trade agreement will take time to work out, strategic partnerships in specific areas can be implemented more easily and quickly.

For example, the Thai-UK Business Leadership Council was launched in July 2016 to facilitate companies in both private sectors in building new and innovative partnerships, and to encourage both governments to promote trade and investment.

The economy in Thailand has strengthened in recent years and increasing amounts of government spending will build confidence and increase the willingness of companies and consumers to spend.

The strategy to stimulate growth combined with an attractive investment climate for British companies will undoubtedly offer opportunities to investors in the coming months and years.

Q: Does the Thai government’s US$25 billion infrastructure budget provide UK companies with new business opportunities?

Colin Kinghorn

14 The Link Issue 1/2017 COVER STORY

In 2016, the Thai cabinet approved an infrastructure action plan and projects, including roads, mass transit, railways, and sea and air transport upgrades across Thailand. The government aims to boost the Thai economy and leverage its competitiveness in the long run by improving transportation connectivity.

This presents a need for investment in the construction, transportation and energy sectors. UK businesses may therefore look to cooperate and support on engineering, equipment and know-how, for example in aviation technologies for the high-growth airline industry in Thailand.

Thailand is considering improving legislation like Public-Private Partnerships (PPPs), which could be an opportunity for UK companies to more easily enter the Thai market so that they can participate in construction and related consultations.

Examples would be cooperating on projects such as the Laem Chabang Port expansion, improving the mass transit system in Bangkok Metropolitan Area, and the double-track railway project in northern Thailand.

Q. Are exchange rates posing a real barrier to business investment and expansion in Thailand?

The exchange rates are likely to fluctuate for the foreseeable future, until the markets get clarity on the terms of the United Kingdom’s exit from the European Union. A lower exchange rate is likely to have positive benefits for the United Kingdom’s government’s effort to reduce the national debt.

It will also increase the sterling value of UK firms’ profits. The counter side of this is that UK business will find it increasingly difficult to source raw materials at the same cost from overseas markets. Nobody knows what the post-Brexit trade arrangements are

likely to be and as such business should expect uncertainty for around two years. The challenge for the UK government will be to use what economic levers they have to try to keep any devaluation within a reasonable limit.

That said we believe that Thailand, and other south east Asian markets still hold a great deal of untapped opportunity for UK companies, particularly for consumer goods, where ‘brand UK’ is still held in high regard. The devaluation of sterling allows British manufacturers to be more competitive on the value that they offer.

Similarly, companies manufacturing in Thailand for export to other non-UK markets should also be able to benefit from the increase in the sterling value of profits. We see potential opportunity for British companies in services, chemicals and paper, electric and electronic products, and agriculture amongst others.

Our view is that these industry sectors will benefit from a devalued sterling, so long as the currency valuation does not suffer from extreme volatility.

Colin Kinghorn is Chief Operating Officer at Ipsos Business Consulting: Asia Centre Building, Floor 21 & 22

173 Sathorn Road South 10120, Bangkok, Thailand

Phone : +66 2697 0104

Mobile : +66 8780 36900

colin.kinghorn@ipsos.com

http://www.ipsosconsulting.com

The Link Issue 1/2017 15 COVER STORY

“

”

Thailand is considering improving legislation like Public-Private Partnerships (PPPs), which could be an opportunity for UK companies to more easily enter the Thai market so that they can participate in construction and related consultations.

Creating a corridor for investment and business growth

Thailand is seeking to establish the country’s Eastern Economic Corridor as a business hub within the ASEAN Economic Community. The potential benefits for UK businesses were highlighted at a recent presentation made by Dr. Verapong Chaiperm, Governor of the Industrial Estate Authority of Thailand.

Addressing a sub-committee of the

recently formed Thai-UK Business Leadership Council, Dr Chaiperm explained that the Eastern Economic Corridor (EEC) embraced five key provincial locations, namely Chachoengsao, Chonburi, Sriraja-Laemchabang, Pattaya – Sattahip – U-tapao and Map Ta Phut – Rayong.

The EEC is seen as providing outstanding potential for the further development of modern automo-

tive, smart electronics, tourism/ medical, bio-agriculture and food processing. The EEC is also targetting, along what is described as a ‘new S curve’, robotics, aviation and logistics, biofuels/bioeconomy, digital and full medical services.

The key factors to deliver success along this corridor are the allocation of more land for industrial purposes;

16 The Link Issue 1/2017

About the Thai-UK Business Leadership

Thai-UK Business Leadership Council was created in 2016 when Trade Envoy to Thailand Mark Garnier MP and Thailand’s Special Envoy Khun Virasakdi Futrakul invited senior business leaders from Thai and British companies to work together for the benefit of mutual trade and investment opportunities.

The two envoys made the announcement at the launch event at Lancaster House, London. The purpose of the Council is to seek creative ways to encourage Thai and British businesses to build new and innovative partnerships as well

as to encourage the governments of both countries to foster bi-lateral trade and investment. Working to an agenda set by the private sector and not by either government the Council is working on behalf of all businesses.

Speaking at the event, Mark Garnier said that there was a natural fit between the commercial and economic goals of Thailand and the United Kingdom. “Thai companies are looking for technology and investment opportunities in areas where the UK offer is truly worldclass. UK companies are eager to

build new partnerships both in Thailand and with Thai companies in third countries.”

KhunVirasakdi added, “For our two Kingdoms trade leads the flag, our economic cooperation precedes and strengthens our diplomatic relations throughout history and we hope that it will continue as we head into the fifth century of friendship. With the support of Thailand-UK Business Leadership Council, the value of our trade and investment could be expanded greatly. Thailand pledges its full support for the Council.”

solid legal and regulatory framework; incentive packages; solid infrastructure; availability of human capital; application of technology and sound logistics.

The development of the EEC will include the construction of a double track railway from Ladkrabang to Laemchabang; improved roads; expansion of U-tapao airport and max-

imum use of the deep sea port facilities on the eastern seaboard.

Dr. Chaiperm told the sub-committee members that this development embraces investment totalling some THB 1.5 trillion over a five year period with annual economic growth achieving five per cent.

This figure includes THB 215 million

to upgrade U-tapao airport; THB 158 million for high-speed trains; THB 64.3 million for the doubletrack railway; THB 35 million for motorways as well as substantial investment in tourism, ports and urban development.

Crucially, the plans target major employment opportunities with up to 100,000 new jobs coming on stream

The Link Issue 1/2017 17

in the industrial and service sectors. Forecasts indicate that U-tapao airport could be handling up to 10 million travellers as economic expansion drives demand for more air services to south east Thailand.

The airport is operated by the Royal Thai Navy and handles a limited number of commercial movements, most notably from no-frills carrier Thai Air

Asia and from Bangkok Airways. Thai AirAsia launched four new routes from U-tapao airport to Chiang Mai, Udon Thani, Singapore and Macau

The EEC is also projected to improve the lifestyles of those living and working in the region as a direct result of attracting inward investment and the improvement in transport, healthcare, the environment and creation of new jobs.

Boosting British trade

Department for International Trade (DIT) helps UK-based companies succeed in the global economy. We also help overseas companies bring their high-quality investment to the UK’s dynamic economy.

DIT offers expertise and contacts through its extensive network of specialists in the UK, and in British embassies and other diplomatic offices around the world. We provide companies with the tools they require to be competitive on the world stage.

Responsibilities

DIT in Thailand helps companies in Britain increase their competitiveness through overseas trade in Thailand. We also offer professional, authoritative and personalised assistance to help companies in Thai-

land locate and expand in the UK.

Services

DIT offers dedicated, professional, personalised assistance to help you locate and expand your business in the UK, read about our investment services or contact us to find out more.

Sourcing products or services from the UK

DIT helps overseas businesses to source UK products and services and connect with UK partners. Read about our services for overseas businesses.

Export from the UK

DIT can assist you on every step of the exporting journey in both the UK and overseas, read about our exporting services or contact us to find out more.

For more details about the role of the Industrial Estate Authority of Thailand, please visit: http://www.ieat.go.th/en

Industrial Estate Authority of Thailand, 618 Nikhom

Makkasan Road Makkasan, Ratchathewi, Bangkok 10400

Tel: 02 2530561 Fax. 02 2526582

Email: investment.1@ieat.mail.go.th

Export opportunities

DIT provides free international export sales leads from its worldwide network. Search for export opportunities.

Events

DIT and its partners stage events in the UK and abroad to help companies looking to export. You can browse scheduled events and register for alerts.

Contact Christopher Pook

Regional Director for DIT and FCO

Prosperity, South East Asia at the Department for International Trade Thailand

14 Wireless Road

Pathumwan, Bangkok 10330

Email: Thailand.dit@fco.gov.uk

Tel: +66 (0) 2 305 8333

18 The Link Issue 1/2017

Air travel boost in 2016

The International Air Transport Association (IATA) announced full-year global passenger traffic results for 2016 showing demand (revenue passenger kilometres or RPKs) rose by 6.3 percent compared to 2015 (or 6.0 percent if adjusted for the leap year).

This strong performance was well ahead of the 10 year average annual growth rate of 5.5 percent. Capacity rose 6.2 percent (unadjusted) compared to 2015, pushing the load factor up 0.1 percentage points to a record full-year average high of 80.5 percent. A particularly strong performance was reported for December with an 8.8 percent rise in demand outstripping 6.6 percent capacity growth.

“Air travel was a good news story in 2016. Connectivity increased with the establishment of more than 700 new routes. A US$44 fall in average return fares helped to make air travel even more accessible. As a result, a record 3.7 billion passengers flew safely to their destination. Demand for air travel is still expanding. The challenge for governments is to work with the

industry to meet that demand with infrastructure that can accommodate the growth, regulation that facilitates growth and taxes that don’t choke growth. If we can achieve that, there is plenty of potential for a safe, secure and sustainable aviation industry to create more jobs and increase prosperity,” said Alexandre de Juniac, IATA’s Director General and CEO.

International passenger traffic rose 6.7 percent in 2016 compared to 2015. Capacity rose 6.9 percent and

load factor fell 0.2 percentage points to 79.6 percent. All regions recorded year-over-year increases in demand. Asia Pacific carriers recorded a demand increase of 8.3 percent compared to 2015, which was the secondfastest increase among the regions. This pace is considerably ahead of the five-year growth average of 6.9 percent. Capacity rose 7.7 percent, pushing up the load factor 0.4 percentage points to 78.6 percent.

“Our freedom to connect through air travel drives prosperity and enriches societies. That freedom can only be given its fullest expression when governments facilitate the movement of people and goods. Security and competitiveness, of course, must always be top of mind for governments. The four billion people who will travel by air this year are an opportunity to build an even better world through the positive impacts of globalisation – mutual understanding, innovation and business opportunities among them. Aviation is the business of freedom and we must defend its social and economic benefits from barriers to travel and protectionist agendas,” added Mr de Juniac.

More good news for aviation sector

The International Air Transport Association (IATA) has announced global passenger traffic results for January 2017. The figures show that demand (revenue passenger kilometres or RPKs) rose by 9.6 percent compared to January 2016. This was the strongest increase in more than five years.

Results were influenced by traffic associated with the 2017 Lunar New Year celebrations held in January this year, as opposed to February in 2016. IATA estimates the holiday-related travel contributed up to half a percentage point in extra demand growth.

Alexandre de Juniac, IATA’s Direc-

tor General and CEO, said that 2017 had enjoyed ‘a very strong start with demand at levels not seen since 2011’.

He added, “This is supported by the upturn in the global economic cycle and a return to a more normal environment after the terrorism and political ‘shock’ events seen in early 2016.”

The Link Issue 1/2017 19

Alexandre de Juniac

Good news from the UK? Nah!

By Paul Gambles

The world’s attention is seemingly hyper-focused on the latest occupant of the 16 bedroom, 35 bathroom 55,000 square foot property at 1600 Pennsylvania Avenue that was once briefly occupied and then set alight by British soldiers in the last successful foreign military incursion into the American nation’s capital. In particular, it seems fascinated by his determination to express himself in a previously un-presidential way in 140-characters (often mainly or entirely CAPITALS). While this has been going on, some supposedly good economic news has quietly crept out in the UK. So why hasn’t the government been pushing the positive headlines?

Would you believe it? The Monty-Python-sounding Office of Budget Responsibility has reported that the UK government made a surplus in January and, between April 2016 and January 2017, borrowed 22 percent less than in the same period in 2015-16.

Not only that, the Office of National Statistics has reported that the average house price in the UK increased by 7.2 percent during the 2016 calendar year – continuing the strong growth seen since the end of 2013.

So, hats off to Philip Hammond and a large round of applause to Theresa May and the rest of her government. That’s the economy nailed, right?

Wrong. Very wrong. Wronger than the fakest of fake news.

Firstly, the idea that a government should make a surplus is just a load of alternative facts. The recent cases of Australia, Chile, Denmark and Sweden have all shown that, in the currently prevailing global economic environment, when governments reduce their debt levels or even make a surplus, GDP growth drops and unemployment tends to increase.

Believe it or not, a government budget doesn’t function like a private company or an individual’s credit card. It is supposed to run at a deficit.

In a modern post-feudal world, the government is there to pass laws and provide services, to protect

its nationals at home and abroad and to enable them to live their lives. That’s not the same as interfering or what misguidedly is usually referred to as “the nanny state” but governments can influence employment and prosperity by influencing how money circulates.

For developed economies, that tends to mean consumption, which then also helps increases the government treasury through income tax, corporation taxes and VAT.

But increasing consumption on a sustainable basis means increasing net incomes. Net incomes are primarily influences by relative productivity and relative dispersion of income. If a government consistently invests and effectively invests, it can influence both factors – at least up to a certain point.

The opposite is also true as well.

Austerity policies, especially when coupled with lowinterest rates and hair-brained quantitative easing programmes, tend to represent the final stage of a long process in which education and infrastructure lose out. It starts with businesses generally paring back work force expansion until it becomes work force reduction while also initially reducing the real rate of increase and then actually decreasing salaries. For a while (from about 1980 until the GFC almost 30 years later), this could be papered over by higher personal levels of borrowing

20 The Link Issue 1/2017

The&opposite&is& also& true&as&well.& A usterity&policies,&especially&when& coupled&with&low interest&rates&and&hair brained&quantitative&easing& tend&to&represent&the&final&

and bust& property&cycle,&whereby&people&indebt&themselves&to&massive&levels,&only&for&prices&to&come& they&end&up&in

and 2016 and has risen by just 1.6 percent since 2010 (per the Office of National Statistics).

The fact of the matter is that, from an economic standpoint, hard or soft Brexit isn’t yet an economic impact of any obvious consequence. Even though some commentators insist on drawing economic conclusions of its effects so far, the UK hasn’t pulled out of the European Union just yet. Any analysis until it actually happens is pure speculation. Whatever trade treaties are signed under whatever terms, the fate of the UK – like that of many other countries – is determined much more by the denouement of what seems to have become an almost perpetual debt crisis, followed by a continued depression.

but eventually consumption takes a hit. The final stage of this has played out very visibly in the Eurozone periphery since 2009. Or Japan since 1990!

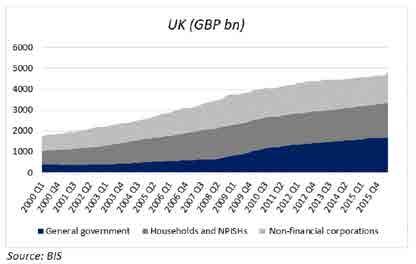

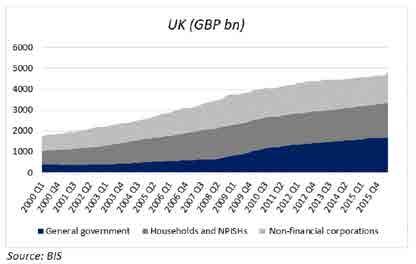

Lest&we&forget,&it&was&crazy&mortgage& schemes&and&other&forms&of&private&debt& that&were&the&catalyst&for&the&global& financial&crisis&in&the&first&place.&Those& have&only&increased&since&(see& chart)&and&until&they’re&tackled&properly,& Property& 400&years&of&data)&in&the& long&term&increased&by&roughly&the&rate& of&general&inflation.&If&you&think&about& house&prices&should&be&most&closely&linked&to&wage&inflation&than&any& hey&are&really&a&reflection&of&broad&affordability&of&the&property&buying&classes& of&the&day.&Every&prior&increase&in&house&prices&over&and&above&the&rate&of&inflation&has&

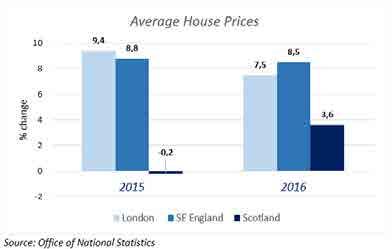

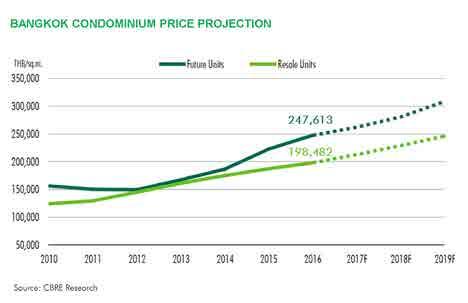

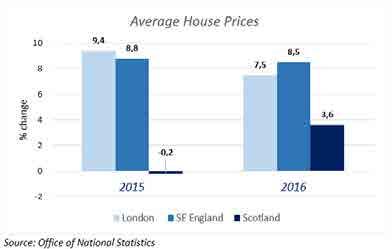

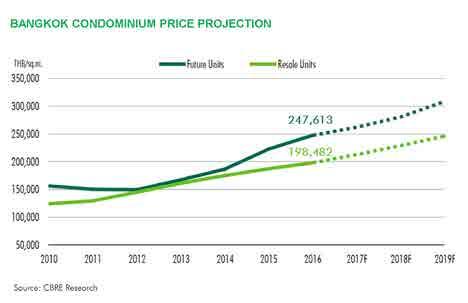

House price figures can be a handy smokescreen. The most widely quoted figures are a broad national average and therefore potentially misleading like all averages (last year London prices went up 7.5 percent and South-East England prices rose by 8.5 percent but Scotland’s rise was just 3.6 percent and in 2015 the disparity was even greater with Scotland experiencing a decrease in the average price - see chart).

The more intrinsic problem with rising house prices is that the notion that they’re a signal of a healthy economy is total rubbish. Since the 1980s, the UK has been on a boom-and-bust property cycle, whereby people indebt themselves to massive levels, only for prices to come crashing down and they end up in negative equity.

Lest we forget, it was crazy mortgage schemes and other forms of private debt that were the catalyst for the global financial crisis in the first place. Those debts have only increased since (see chart) and until they’re tackled properly, they certainly won’t go away. Property prices have (per 400 years of data) in the long term increased by roughly the rate of general inflation. If you think about this it makes sense – house prices should be most closely linked to wage inflation than any other factor as they are really a reflection of broad affordability of the property buying classes of the day. Every prior increase in house prices over and above the rate of inflation has reverted to mean – either by an outbreak of inflation or a collapse in property prices or some combination of the 2 that meets in the middle.

A much more reliable view of how a nation is faring economically is consumer spending. The amount of goods sold in the UK rose by seven percent between 2014 and 2016. However, that appears to be mainly because it fell due to a combination of deflation (those central bank policies again!) and retailers’ desperation to sell (just to try to survive in a very subdued UK retail sector). In fact, the overall amount spent in retail hardly moved between 2014

A depression is a recession that begins at a time when there exist extreme levels of private-sector debt (and, therefore, generally also an overleveraged, acutely fragile banking system and stratospheric asset prices). The UK is probably already in one and has been for quite some time. It’s just that no-one is talking about it.

That situation could well last years, unless the amounts of private debt are cleared. There are a few possible ways to do this. Once the crisis begins, the UK government could allow banks to fail, guarantee individuals’ deposits and cancel debts – as was done in Iceland post-GFC.

Alternatively, the UK’s eventual exit from the EU could prompt other members to follow suit and thus cause an uncontrollable global financial collapse, forcing the global economy to start from scratch, debts written off.

The final, ghastly, alternative is a third world war; something which, just a couple of months ago, seemed the kind of nightmare scenario caused by eating too much cheese before bed. However, given that Theresa May has been seen holding the hands that control the nuclear football as well as the Twitter caps lock, more and more mainstream commentators are admitting that such a prospect grows more plausible by the day.

Imagine that: Britain failing to react to financial collapse and imminent military danger, pleading desperately to America for help. Modern Britain could look more like a re-run of 1939 than 2017.

Paul Gambles is co-founder of MBMG Group – a professional research and advisory firm that provides seamless advice to individuals, corporations and institutional clients.

Tel: +66 2665 2536

Email: info@mbmg-group.com

Linkedin: MBMG Group Twitter: @MBMG_Group Facebook: /MBMGGroup

The Link Issue 1/2017 21

healthy&economy&is&total&rubbish.&Since&the

1980s,&the&UK&has&been&on&a&boom

IP protection in Thailand for the tourism industry

Tourism in Thailand continues to offer many lucrative opportunities to European SMEs. Thailand remains one of the most popular tourist destinations in the Asia Pacific region due to its white sandy beaches, abundant tropical nature, inexpensive accommodation and well-developed transport and communication infrastructure.

Underpinned by the recent efforts of the government and private sector stakeholders to market Thailand around the globe, the industry has grown to become one of the country’s most productive and sustainable industries, contributing a total of EUR 69 billion towards the economy in 2014, making up more than 19 percent of the GDP of Thailand.

SMEs engaged in tourism need to pay special attention to protecting their intellectual property (IP) rights, because despite recent improvements in Thailand’s IP legal framework, IP infringements are still relatively common in the country. IP rights are a key factor for business success and neglecting to register them in Thailand could easily end SMEs’ business endeavours in the country. Thus, a robust IPR strategy is needed when entering the lucrative market of Thailand.

Brand protection is key factor of success

Branding is crucial for the tourism sector as it allows companies to differentiate themselves from the rest, creating a niche market and an individual appeal that will translate into more tourist arrivals. In tourism, sec-

tor ‘destination branding’ is equally important to company branding. Destination branding often relies on a logo and a tagline, such as the Swiss resort St. Moritz using the tagline ‘Top of the World’; the Tourism Malaysia campaign of ‘Malaysia, Truly Asia’, and the Tourism Authority of Thailand recent campaign of ‘Discover Thainess’.

SMEs are strongly advised to register their brand name, logo and tagline as a trade mark in Thailand to protect their brand because IP rights are territorial and European trade marks do not enjoy automatic protection in Thailand.

There is also some additional protection for unregistered ‘well-known trade marks’ in Thailand, provided that the mark is ‘well-known’ in Thailand. A wellknown mark can be protected through initiation of a legal action for ‘passing off’.

22 The Link Issue 1/2017

News from the IPR SME Help Desk

Khun Thosapone Dansuputra is Director-General of Thailand’s Department of Intellectual Property.

The law against ‘passing off’ is intended to prevent other traders from unfairly riding on the reputation and success that a company has built for its trade mark. Furthermore, the current Thai Trademark Act prohibits registration of trade marks that are similar to wellknown marks.

However, Thai authorities normally require a trade mark registration certificate to initiate trade mark enforcement proceedings, so it is still very important to register trade mark in Thailand.

Thailand adopts the ‘first-to-file’ system, meaning that the first person to register a trade mark owns that mark. It is particularly important for the SMEs to register trade mark in Thailand because trade mark piracy due to ‘bad faith’ registration is a problem.

‘Bad faith’ registration means that a third party, not owning the trade mark, registers European SME’s trade mark, thereby preventing the legitimate owner from registering it. These unscrupulous companies normally try to resell the trade mark to its owner at an inflated price.

In Thailand a trade mark may be composed of a photograph, drawing, device, brand, name, word, text, letter, numeral, signature, combination of colours, figure or shape of an object, sound, or any combination thereof. Additionally, three-dimensional signs can also be registered as trade marks in Thailand.

Trade marks are registered at the Department of Intellectual Property of the Ministry of Commerce and registration costs between EUR 50 and EUR 420 for one class, depending on how many items of goods and services are registered. This also excludes agent fees. SMEs should bear in mind that they need to be represented by an agent when registering their trade mark in Thailand.

SMEs should also keep in mind that trade mark application form and other relevant required documents must be submitted in the Thai language or accompanied by a Thai translation.

Protecting your brand in Thai language

As the registration of a trade mark in original Roman characters does not automatically protect the trade mark against the use or registration of the same or similar trade mark written in local Thai script, it is highly

advisable to additionally register a version of your trade mark also in Thai script.

If there is no existing name for SME’s brand in Thai script, it is possible that one will be adopted by local consumers either by way of translation or by transliteration and not necessarily with the right connotations or image that the SME would wish to convey.

As Thai script has its unique characteristics a SMEs’ local equivalent trade mark should be carefully developed with the help and guidance of trade mark, marketing and PR experts as well as native speakers and translators.

Protecting your internet domain name

Most companies engaged in tourism rely upon websites to attract customers and thus protecting online domain name is of utmost importance for the SMEs. It is advisable to register internet domain names in Thailand because a registered Thai domain name will prevent others from using that company name or brand name as their website name.

Internet domain name registration is also important because cybersquatting still persist in Thailand. Cybersquatting means that a third party registers a domain name that is identical to European company’s product or trade mark name with the purpose of selling the domain names back to the rightful owner at a premium price.

Internet domain names can be registered with the Thai Network Information Centre (THNIC) and this should be done together with trade mark registration in Thailand, as THNIC requires trade mark registration certificate to register the internet domain name for SME’s brand. It is also possible to register internet domain name based on company registration, using the name of the company.

Internet domain name registration typically costs around EUR 25 per year – a much cheaper option than having to solve domain name disputes.

It is advisable to monitor similar domain names and protect your domain name in case of confusion or cybersquatting, as registered Thai domain names are often the key to business growth locally and thus cybersquatting and other online IP infringements can seriously hurt SMEs’ business.

The Link Issue 1/2017 23

News from the IPR SME Help Desk

News from the IPR SME Help Desk

Enforcing your rights

Entering a new market and protecting IPRs also means being ready to enforce or defend these rights in order to ensure that business objectives are met and therefore budget planning for enforcement is the key to a successful business strategy.

When European SMEs identify infringement they should actively enforce their rights in Thailand through the various avenues available. If SMEs manage to build a reputation for being litigious then unscrupulous companies will be less likely to infringe their rights in the future.

In a case of IP infringement in Thailand there are three main avenues of enforcement that SMEs may consider: administrative actions, civil litigation and criminal prosecution. However, administrative actions and civil litigation can be ineffective or costly and criminal proceedings are oftentimes preferred. In many cases, however, mediation via the Thai Department of Intellectual Property should be considered as a viable option - particularly for SMEs facing budget constraints.

Helika Jurgenson South-East Asia IPR SME Helpdesk

The South-East Asia IPR SME Helpdesk supports small and medium sized enterprises (SMEs) from European Union (EU) member states to protect and enforce their Intellectual Property Rights (IPR) in or relating to South-East Asian countries, through the provision of free information and services. The Helpdesk provides jargon-free, first-line, confidential advice on intellectual property and related issues, along with training events, materials and online resources. Individual SMEs and SME intermediaries can submit their IPR queries via email (question@southeastasia-iprhelpdesk.eu) and gain access to a panel of experts, in order to receive free and confidential first-line advice within 3 working days.

The South-East Asia IPR SME Helpdesk is co-funded by the European Union.

To learn more about the South-East Asia IPR SME Helpdesk and any aspect of intellectual property rights in South-East Asia, please visit our online portal at http://www.ipr-hub.eu/.

More tourism records for Thailand

Ministry of Tourism and Sports reports international visits to Thailand exceeded 32.58 million, an improvement of 8.91 percent during January to December 2016. Ministry data indicates that Thailand attracted 32,588,303 international visits last year, compared to 29,923,185 in 2015.

The data is based on holders of foreign passports and ID cards passing through international checkpoints (land, sea and air). ID holders may travel from Malaysia, Laos, Cambodia and Myanmar on border passes that are valid for up to seven days.

Tourism and Sports Minister, H.E. Mrs Kobkarn Wattanavrangkul, said that tourism revenue reached THB 2.51 trillion in 2016, an increase of nearly 11 percent on the previous year and thus exceeded the Minis-

try’s target of THB 2.4 trillion. The Ministry calculates that the total is divided between international markets (THB 1.64 trillion) and domestic tourism (THB 870 billion).

Source markets within ASEAN delivered 8,658,051 tourists to Thailand, an increase of 9.31 percent on 2015.

With Thailand continuing to place special emphasis upon specific tourism segments such as sports, weddings and health and wellness the Ministry is forecasting that the country’s tourism receipts in 2017 will reach THB 2.71 trillion.

The Minister is also keen to promote lesser known tourism ‘gems’ in rural areas throughout the Kingdom.

24 The Link Issue 1/2017

Kobkarn Wattanavrangkul

Britain in South East Asia (BiSEA)

Tel: +60 3 2163 1784

Fax: +60 3 2163 1781

Email: info@bmcc.org.my

Website: www.bmcc.org.my

Chairman: Andrew Sill

Executive Director: Aurelia Silva

CAMBODIA

British Chamber of Commerce in Cambodia

British Embassy Phnom Penh

27-29 Street 75, Sangkat Srah Chak, Khan Daun Penh

Phnom Penh 12201

Tel: +855 (0) 12-323-121

Email: director@britchamcambodia.org

Website: www.britchamcambodia.org

Chairman: David Tibbot

Executive Director: Ritchie Munro

MYANMAR

British Chamber of Commerce Myanmar 4th Floor, 192, Bo Myat Htun St. (Middle Block)

Pazundaung Township

Yangon, Myanmar

Email: info@britishchambermyanmar.com

Website: http:// www.britishchambermyanmar.com

SINGAPORE

British Chamber of Commerce Singapore 39 Robinson Road, #11-03

Robinson Point, Singapore 068911

Tel: + 65 6222-3552

Fax: + 65 6222-3556

Email: Info@britcham.org.sg

Website: http://www.britcham.org.sg

President: Bicky Bhangu

Executive Director: Brigitte Holtschneider

INDONESIA

British Chamber of Commerce in Indonesia

Wisma Metropolitan I F/15, Jln. Jend. Sudirman Kav. 29 - 31, Jakarta 12920

Tel: +62 21 5229453

Fax: +62 21 5279135

Email: busdev@britcham.or.id

Website: http://www.britcham.or.id

Chairman: Adrian Short

Executive Director: Chris Wren

President: Mr. Peter Beynon FCA

Project Director (OBNi): Ms Chloe Taylor

THAILAND

British Chamber of Commerce

Thailand (BCCT)

7th Floor, 208 Wireless Road

Lumpini, Pathumwan, Bangkok 10330

Tel: 66-2651-5350-3

Fax: 66-2651-5354

Email: greg@bccthai.com

Website: www.bccthai.com

Chairman: Simon Matthews

Executive Director: Greg Watkins

MALAYSIA

British Malaysian Chamber Of Commerce (BMCC)

Lot E04C1, 4th Floor, East Block

Wisma Selangor Dredging

142-B Jalan Ampang

50450 Kuala Lumpur, Malaysia

PHILIPPINES

British Chamber of Commerce of the Philippines

BCCP Business Centre

8F W Fifth Avenue Building 5th Avenue corner 32nd Street, Bonifacio Global City, Taguig 1634, Metro Manila, Philippines

Tel: +63 2 556 5232

Fax: +63 2 519 6889

Email: info@britcham.org.ph

Website: www.britcham.org.ph

Chairman: Chris Nelson

VIETNAM

British Business Group Vietnam

Ho Chi Minh City, G/F 25 Le Duan Blvd. District 1, Ho Chi Minh City, Vietnam

Tel: +84 (8) 3829 8430

Fax: +84 (8) 3822 5172

Email: info@bbgv.org

Website: www.bbgv.org

Executive Director: Peter Rimmer

Chairman: Kenneth M Atkinson

Hanoi, 193B Ba Trieu, Hai Ba Trung

District, Hanoi, Vietnam

Tel: +84 (4) 3633 0244

HSBC Global Report

ASEAN outlook for 2017

ASEAN GDP growth should average 4.4 percent in 2017, according to HSBC Global Research. But the company’s analysts are quick to state that ‘flat growth does not mean boring growth’. The Philippines and Vietnam will top the consumption and investment ranks while Malaysia and Thailand appear relatively weaker on a number of fronts.

According to Su Sian Lim, Economist at HSBC in Singapore, GDP growth in ASEAN looks poised to average around the mid-4 percent handle. Indeed, the same is also likely to be repeated in 2018. On a GDP-weighted basis, we expect growth for the six economies of Indonesia, Malaysia, Thailand, the Philippines, Singapore and Vietnam to average 4.4 percent in 2017, and 4.5 percent in 2018 – the slowest pace of growth since the 2009 global financial crisis.

This is a little lower than the 4.9 percent we predict for Asia as a whole over the two years, though it almost dovetails with HSBC’s growth projection for Asia exChina and Japan. Beneath this very flat and unremarkable growth trend for ASEAN, however, lies quite a diverse range of projections for the individual economies.

The relatively mature Singapore economy is expected to see the smallest expansion this year within the Asia Pacific alongside Japan with GDP growth of just 1.2 percent. Huddled around the middle of the pack are Thailand, Malaysia and Indonesia, each with projected growth rates of around 3-5 percent for this year.

At the more robust end of the growth spectrum, however, sit Vietnam and the Philippines (sandwiching China). These economies are projected to grow at 6.4 percent and 6.5 percent, respectively. According to HSBC estimates these will be the only two economies within ASEAN growing (moderately) above their long-term trend. With most ASEAN economies set to continue experiencing tepid – not to mention uncertain – external demand, much of the differentiation in growth will boil down to the resilience of private consumption and total investment (both private and public).

Even though economists at HSBC Global expect domestic demand growth to slow to 3.9 percent from 4.4 percent this year, while export growth for the region more than doubles to 1.5 percent from 0.7 percent, the latter is still weak by historical comparison.

Consumption weak in Malaysia and Thailand

A closer look at the forecasts reveals that the larger ASEAN economies of Thailand and Malaysia are also likely to cause some drag on the regional domestic demand outlook. Private consumption growth in Thailand is expected to slip to 2.4 percent this year, as expenditure patterns normalise following an unusually strong expansion of 3.1 percent in 2016.

The pent-up demand seen last year amid a more stable political and economic environment is unlikely to be repeated this year, with wage growth barely keeping up with the low rate of inflation.

The increase in allowable income-tax deductions in 2017 will help only at the margin, providing some relief to middle-income workers but little for the lowincome. Meanwhile, Malaysia could see an even more pronounced slowdown in consumption, from 5.6 percent in 2016 to 3.7 percent this year.

Wage growth has been losing steam, and labour market softness has been increasingly evident. This is also the case in Thailand and Singapore, though their unemployment rates remain among the lowest in ASEAN.

26 The Link Issue 1/2017

Member News

Su Sian Lim

BOI sets sights on ASEAN markets

Thailand’s Board of Investment (BOI) plans to open its representative offices in Myanmar and Vietnam in 2017 and in Indonesia in 2018, as part of the country’s strategy to expand investment in ASEAN member nations.

According to the official Board of Investment website, Deputy General Secretary Chokedee Kaewasang said with its strong economic growth, rich natural resources and high-quality human resources

ASEAN will create competitive ad-

vantage. ASEAN member states, especially Cambodia, Laos, Myanmar and Vietnam, are actively opening up to attract more foreign investment flows.

In the first nine months of last year, Thailand’s investment in ASEAN hit THB 197.7 billion (nearly US$5.5 billion), accounting for 55.33 percent of the country’s total investment abroad. Overseas BOI offices are responsible for providing detail information related to market, economic growth, investment policy, opportunity, law and business culture in host countries.

For two years now, Malaysia’s unemployment rate has crept gradually higher, to 3.6 percent as of November 2016, a multi-year high. Potentially, cash hand- outs for current and retired civil servants in January, and a possible snap election in H1 2017, could lift consumption temporarily.

But a soggy Malaysian ringgit and large debt overhang are also factors that are likely to keep consumer confidence depressed. Although borrowing momentum has slowed, Malaysian households will still have to work through paying off debt equivalent to nearly 90 percent of GDP ‒ the highest not just in ASEAN, but in Asia. Household debt in Thailand and Singapore is not that much lower either, at an elevated 75-80 percent of GDP.

In contrast, consumer spending in Indonesia and Vietnam is expected to pick up this year, the former from 5.0 percent to 5.2 percent and the latter from 5.9 percent to 6.4 percent. Consumption in the Philippines is projected to be even faster, at 7.1 percent ‒ rather impressive, considering it is only a slight moderation from last year’s election-driven surge of 7.3 percent.

Very little of the consumption growth in these countries will be driven by household debt, which is set to remain below 20 percent of GDP. Instead, consumption will continue to be supported by robust labour market and wage conditions, which have been tightening for some time.

Employment in the manufacturing sector, particularly in the Philippines and Vietnam, has held up well despite weak demand globally, though these job gains have perhaps been over-reliant on electronics. In the Philippines, further support to consumption will continue to come from remittances by overseas Filipino workers (OFW).

Most Thai investors are interested in the Myanmar market thanks to its high economic growth and abundant natural resources, and convenient shipping routes. Thailand’s total investment in Myanmar in the first three quarters of 2016 hit THB 14 billion (US$ 388.5 million).

According to Thailand’s Foreign Investment Service Centre many Thai entrepreneurs have selected Vietnam and Myanmar as their strategic investment destinations, especially in textiles and agricultural product processing.

Indeed, should US economic growth accelerate to 2.3 percent in 2017 and 2.7 percent in 2018 as we expect (from 1.6 percent in 2016), remittances could receive a larger boost, not only from potentially stronger OFW wages but also a more favourable exchange rate as the US dollar appreciates.

Plans for Thailand

In Thailand, the government plans a budget deficit of THB 450 billion (approx. 3% of GDP) for FY18, given high-level spending for infrastructure projects. The sum appears large but is still below the expected level for FY17. Separately, the State Enterprise Policy Office said document-filing for the Thailand Future Fund – the state infrastructure fund – will likely be completed in March, after which a public offering will follow.

The initial THB 40-50 billion raised will go into funding 2-3 expressway projects. Meanwhile, the Board of Investment (BoI) said projects seeking investment promotion in 2016 totalled THB 584 billion, up 56 percent from 2015 when the BoI’s schemes were first changed to focus more on higher-technology and innovation.

The BoI said 70 percent of the 1,576 applications received had been approved, and about 33 percent were started. Much of the foreign interest (by application value) were in the automobiles, electronics and electrical appliances sectors, as well as petroleum and chemical products.

The Link Issue 1/2017 27

Member News

Expansion plans for Dusit Thani Bangkok

Dusit Thani Public Company Limited, owner of the iconic Dusit Thani hotel in Bangkok, is to re-develop the site at the corner of Silom and Rama 4 roads.

Having secured a 30 year extension to the lease on the existing plot from the Crown Property Bureau and acquired access to a further 24 rai the company has announced plans to create a mixed-use real estate development with an estimated project value in excess of US$ one billion. The development in partnership with Central Pattana PCL will include a new-look Dusit Thani hotel, residences, retail areas and office space.

Chanin Donavanik, Chairman of the Executive Committee at Dusit Public Company Limited, said, “Built in 1970, Dusit Thani Bangkok was the first iconic landmark of modern Bangkok. It has been a prominent feature of Bangkok’s skyline for almost half a century and symbolised the beginning of the city’s transformation into one of the world’s greatest metropolises in the era of globalisation.

Mrs. Suphajee Suthumpun, Group Chief Executive Officer at Dusit Thani Public Company Limited, said, “Dusit Thani has been granted the rights to extend the lease agreement with an additional plot of almost 24 rai. This project will build on our unique Thai heritage while utilising

space in the area to its full potential. Our goal is to develop a project that benefits both tourists and the general public. This land lies at the heart of the business and retail district as well as at the intersection of multiple mass transit systems such as the BTS and the MRT.”

No room for sentiment in Bangkok

According to the latest Office Market Sentiment Survey by JLL the outlook for most office markets in Asia Pacific is positive with strong demand across the region from Melbourne and Sydney to Bangalore and Bangkok.

Among the top sectors fuelling the demand for office space in 2017 are technology, professional services, pharmaceutical and real estate firms.

“The demand for space in much of the

region is being driven by domestic companies seeking to enter or expand into prime CBD as well as growth in sectors such as technology and pharmaceutical,” said Jeremy Sheldon, Managing Director - Markets & IPS at JLL Asia Pacific.

Bangkok has seen robust demand from e-commerce, call centre and IT firms for new office space and this trend is expected to continue in 2017. The pharmaceuticals industry is another to watch. In August 2016, Thailand’s Board of In-

vestment approved a five-year waiver of corporate income tax for pharmaceutical firms in a bid to strengthen its position as a medical hub.

The global pharmaceutical market is expected to be worth US$1.3 trillion in 2018. With Asia outpacing other continents in terms of population growth, this means a bigger market for medical products and solutions upon which pharmaceutical companies will be eager to capitalise.

28 The Link Issue 1/2017

Member News

Dusit Thani launches Thai cooking classes

Dusit International has rolled out a new Thai Cooking Class giving participants the chance to learn how to make a selection of Thailand’s most famous dishes. The new classes are open to hotel guests and visitors at selected Dusit Hotels and Resorts worldwide.

Each session is conducted by an experienced Thai Chef de Cuisine and includes a choice of three authentic recipes, followed by a sitdown lunch or dinner. Among the available recipes are signature favourites such as Khao Pad Gai, Pad Thai Goong, Tom Yam Goong and Chicken Satay.

“Since 1949, Dusit International’s mission has been to graciously deliver Thai hospitality to the world and we’re always looking for new and exciting ways to do just that,” said Mr. Lim Boon Kwee, Chief Operating Officer - Dusit International. “Our new Thai Cooking Class continues this tradition by offering an intimate, informal,

educational and fun experience which celebrates the kingdom’s culture and cuisine while giving participants the chance to learn how to make three impressive dishes. It’s a great afternoon for budding chefs of all ages, with thoroughly delicious results.”

In Thailand the cooking classes are available at Dusit Thani hotels in Bangkok, Phuket, Pattaya, Hua Hin and Chiang Mai. Overseas hotels offering the classes include Dusit Thani properties in Manila, Dubai and the Maldives.

Sixth Form students at Shrewsbury International School (pictured above) are setting their sights on exciting futures at some of the world’s leading universities and colleges. Students have already secured over 230 university offers to top institutions in the UK, USA, Canada, Thailand, China, Japan and the Netherlands. Whilst the full list will not be known for a few more months, 2017 is already shaping up to be another very successful year for Shrewsbury’s graduating students and Higher Education team.

The Link Issue 1/2017 29

Member News

Optimism levels remain low in Thailand

Findings from Grant Thornton’s most recent quarterly global survey of 2,600 businesses in 37 economies reveal that emerging and developed Asia Pacific economies are travelling in different directions when it comes to their respective outlooks for 2017.

The optimism among developed APAC economies fell to net -16 percent in the last quarter of 206 whilst the emerging APAC rose from 42 to 53 percent. The optimism of businesses in Thailand dropped to 16 percent.

The Grant Thornton International Business Report (IBR) shows that almost all sub-categories for Thailand also dropped in Q4 2016: sell-

ing price expectation (12% to 8%), export expectation (22% to 8%), research & development (34% to 24%) and employment expectation (28% to 12%). Investment in plant and machinery increased (16% to 24%). Perhaps unsurprisingly, the major constraints cited for Thailand’s businesses were economic uncertainty (48%), shortage of orders (42%) and energy costs (40%).

Andrew McBean, Partner at Grant Thornton in Thailand and specialist in ASEAN markets, commented, “There is a striking split in the direction of travel between business leaders in emerging and developed Asia Pacific countries. Part of the reason for this could be the likely scrap-

ping of the Trans-Pacific Partnership (TPP), out of which developed economies – like those of Australia and New Zealand – stood to gain the most. However, China is looking to implement its own regional economic partnership, which could fill some of that gap. As we’ve seen with the ASEAN Economic Community agreed in 2015, the high levels of optimism in emerging economies reflect what can happen when closer economic ties are in place.

“In Thailand, the IBR survey results show that the main factor contributing to the optimism drop is the volatility of the economy last year, which is still an ongoing concern. We’ve seen a lot of changes across the world such as the Brexit and the US election with new trade policies so businesses are not clear yet. These could cause the investment from the private sector to slowdown as well.

So in short, the government needs to find a way to help build investment confidence among the private sector and foreign investors. There also needs to be an economic plan in place to prevent obvious risks that may result from those changes as well as risks that continue to have an affect throughout the year. Infrastructure projects tend to have a low disbursement to the general public at the beginning but more benefit once the infrastructure has been built so the benefits are more longer term.”

Thailand’s Minister of Education Theerakiat Charoensettasin presented National Outstanding Youth Awards to Harrow Bangkok students as part of the nation’s annual Children’s Day celebrations. Pictured, left to right, are Khun Khanitha Prawichen (Thai Principal), Paul (Year 12), Pearl (Year 13) and Pao Pao (Year 11) with Karen Prout, the school’s Head of Sixth Form.

The Grant Thornton International Business Report (IBR), launched in 1992 initially in nine European countries, now provides insight into the views and expectations of more than 10,000 businesses per year across 37 economies. More information: www.grantthornton.global

30 The Link Issue 1/2017

Member News

Investment opportunities in new world cities

New World cities feature strongly amongst the top 30 global investment markets, according to JLL. Despite economic uncertainty and geopolitical challenges, commercial real estate investment activity remains robust and is anticipated to rebound in 2017 according to new analysis published by the company.

The JLL report states that global investment volumes are projected to climb back towards US$700 billion this year, up from US$650 billion in 2016, returning to levels recorded in 2014 and 2015.

The trend is supported by increased institutional allocations directed toward commercial real estate as they are focused on higher-yield opportunities, in addition to new sources of capital that are being unlocked around the world from countries such as China, Taiwan and Malaysia.

“New capital targeting real estate is only part of the story; experienced real estate investors are also allocating more money to direct real estate opportunities,” said David GreenMorgan, JLL Global Capital Markets Research Director. “As these groups tend to be well-versed in allocating capital, they are able to direct large sums of money into the sector relatively quickly.”

According to JLL, cross-border investment globally could account for more than 50 percent of all activity by 2020 as inter-regional flows grow. One of the most striking trends in commercial real estate is the rise of China as a major player in global real estate markets. As of the third quarter 2016, China had overtaken the United States as the world’s largest

cross-border purchaser of commercial real estate assets.

Real estate reigns as global asset class

The last two real estate cycles have seen an extraordinary rise in the amount of capital targeting the asset class across the world. Growth in the sector over the last 10 years has been impressive, but real estate still lags behind the bond and stock markets in terms of total U.S. dollars. To continue its rise as a preferred asset class, a further improvement in transparency is essential. JLL’s 2016 Global Transparency Index pointed to steady improvement in the majority of countries, which is an encouraging sign for investors.

As increased demand has placed stress on core urban assets in cities like New York, London and Paris, competitive pricing and lack of prod-

uct in the marketplace has investors looking to New World cities. This group is comprised of mid-sized cities which typically excel in high-tech and high-value sectors supported by robust infrastructure, a favourable quality of life and transparent business practices, which combine to boost momentum and real estate market activity.