A PUBLICATION FOR MEMBERS AND FRIENDS OF THE NEW CAR DEALERS ASSOCIATION OF BC The Battle for In-Vehicle Infotainment Supremacy PAGE 12 FEATURE STORY ROAD TO THE FUTURE A Q&A with James Tan, of ICBC PAGE 14 WINTER 2023 ISSUE › NCDA: Propelling Progress in BC’s Auto Industry › Car Buzz: Lavish Luxury and Top Technology › Uncovering Cybersecurity Risks INSIDE NEW CARS SOLD IN BC SEP 13,739 OCT 12,653 2022 NOV 11,958 DEC 12,057 YTD 161,470 (-13% FROM YEAR PRIOR)

IT’S YOUR JOB TO TAKE CARE OF OUR NATION’S AUTOMOTIVE NEEDS.

The Canadian Automobile Dealers Association is working with your regional and provincial associations to represent your interests at the highest levels.

To learn more about how CADA is working for you, visit CADA.ca

IT’S OUR JOB TO MAKE SURE OUR NATION TAKES CARE OF YOURS.

We’d love to hear from you!

Our vision is for member dealers and the dealer franchise system to be seen by the public as the best choice to fulfill all their automotive needs.

We are a small but dedicated and hardworking team of individuals serving all members of the New Car Dealers Association of BC. Should you have any questions, concerns or issues, or if you have any ideas for our organization to pursue, our staff is available to listen and help. Get in touch with us by phone or email at our Langley office.

Signals is THE flagship publication for the NCDA, the industry association that represents over 400 new car and truck franchised auto retailers in BC.

#380–8029 199 Street, Langley, BC V2Y 0E2 Tel: 604-214-9964 // Fax: 604-214-9965 newcardealers.ca // info@newcardealers.ca

NCDA Staff

Blair Qualey President & CEO bqualey@newcardealers.ca 604-214-9964 Ext. 228

Shakira Maqbool Manager, Finance & Administration smaqbool@newcardealers.ca

Joshua Peters Manager, Member Services jpeters@newcardealers.ca

Ofir Sapoznikov Membership and Operations Coordinator info@newcardealers.ca

Roni Sapoznikov

CleanBC Go Electric Vehicle Rebate Program Administrator goelectric@newcardealers.ca

Duy Le CleanBC Go Electric Vehicle Rebate Coordinator goelectric@newcardealers.ca

Vancouver International Auto Show

Eric Nicholl Executive Director enicholl@vanautoshow.ca 778-968-0440

Have a topic or story suggestion? Email us! And for article and ad submissions and rate card details, please contact:

Joshua Peters | 604-214-9964 Ext. 225 jpeters@newcardealers.ca

For subscriber inquiries, please contact: info@newcardealers.ca

Janet Gairdner, Associate Group Publisher 818 Broughton Street, Victoria, BC V8W 1E4 jgairdner@blackpress.ca

Published in Canada

The contents of Signals, such as text, articles, opinions, views, graphics, images, and the selection and arrangement of information (the “Content”), are protected by copyright and other intellectual property laws under both Canadian and foreign laws. Unauthorized use of the Content may violate copyright, trademark, patent, and other laws. You must retain all copyright and other proprietary notices contained in the original Content on any copy you make of it. Disclaimer: Information contained within Signals is for general information purposes only and may not be entirely complete or accurate. Use of Signals’ content is done so at your own risk.

Canadian Publications Mail Product Sales Agreement No. 40030593.

CONTENTS COLUMNS FEATURED ARTICLES 8 9 4 President’s Message 6 New Members 7 Member News 8 Government Advocacy 9 Industry Round-Up 10 Car Buzz Lavish Luxury, Top Technology and Sweet Drives 18 Legal Line Shareholders’ Agreements: What Are They Good For? 26 Special Olympics BC Meet Athlete Francis Stanley 12 Trends The Battle for In-Vehicle Infotainment Supremacy 13 Looking to 2023 VSA outlines priorities for the upcoming year 14 Cover Story On The Road To The Future: A Q&A With James Tan, ICBC’s VP of Claims 20 Highway Expansion Begins Replacement of Glover Road crossing 22 Uncover Cybersecurity Risks All businesses face threat of cybercrime 24 Significant Changes Made to the BC Workers Compensation Act Bill 41 ups employers’ responsibilities INSIDE THIS ISSUE 10 14

On the Cover:

The battle for infotainment supremacy. (Photo: Adobe Stock)

3 newcardealers.ca

Photo courtesy BC Government.

News From the Front Seat

As I prepare the first Signals message of 2023, I find myself reflecting on the various challenges our sector has faced over the past several years—beginning with the COVID-19 pandemic, subsequent supply chain issues, low vehicle and parts inventories, the inability to stage auto shows and the multitude of other issues.

At the same time, I can’t help but be optimistic and excited at the prospect of the year ahead as the impact of many of these challenges begin to moderate and we get back to engaging in-person with our members.

Reports of improving availability of microchips and other parts leading to growth in new vehicle inventory levels for many brands is very welcome news.

At the same time, a softening of demand, particularly on the used side, will create new challenges, as will the state of the economy. Higher interest rates will continue to impact the sector this year, especially as the Bank of Canada continues to adjust rates.

NCDA at international events

The new year kicked off with a return to in-person events, including the NADA Convention in Dallas, Texas during the third week of January and the CADA Summit in mid-February.

These events provided attendees with the latest news and developments facing the

retail auto sector.

The NCDA was represented at both signature events, and we returned with the latest information and insights, which will help guide our important work on behalf of dealer members.

Luxury tax

Our national association, CADA, continues to work with MNP and all provincial dealer associations on the botched roll-out of the federal luxury tax from last fall.

The administrative rules related to this tax continue to provide challenges, as answers from CRA and government remain unclear, and concerns grow around how luxury tax audits will turn out for many dealers.

On the topic of luxury taxes, the fact that the $55,000 purchase price threshold has not adjusted for many years means many standard vehicles are today captured by the tax, including vans and larger SUVs that families rely on to shuttle children around.

Likewise, it now encompasses many pickups that are required by many businesses and individuals, including those who live and work in resource communities.

With the average price of a new vehicle now bumping up against this threshold, an adjustment by the BC government is overdue. I remain hopeful that our new finance minister and the BC government will recognize the

PRESIDENT’S MESSAGE

2022-2023 New Car Dealers Association of BC Board of Directors

“Enjoy this issue of Signals I encourage you to read this edition of Signals, in which you will find articles on the latest economic trends, shareholder agreements, a sit-down Q&A with ICBC and more. From all of us at the NCDA, we wish you and yours all the best for a happy, healthy and prosperous 2023.”

BLAIR QUALEY PRESIDENT & CEO, NCDA

Blair Qualey President & CEO NCDA

Mike Hacquard WOLFE AUTO GROUP SURREY LANGLEY

James Carter Past Chair CARTER GM N. SHORE

Joey Prevost MACCARTHY MOTORS TERRACE

Anthony Lunelli Chair KELOWNA SUBARU

Peter Sia NORTHLAND NISSAN PRINCE GEORGE

Peter Heppner Past Chair PRESTON GM LANGLEY

Peter Trzewik GAIN GROUP VANCOUVER ISLAND

Ben Lovie Vice Chair OPENROAD AUTO GROUP

Jared Williams JACK CARTER NORTH STAR CHEV BUICK GMC

Erik Jensen ROYAL BANK OF CANADA Member at Large

Justin Gebara COLUMBIA CHRYSLER RICHMOND

Darren Johnson FIRST CANADIAN FINANCIAL GROUP Member at Large

Ann Marie Clark Treasurer STEVE MARSHALL FORD LINCOLN / FAMILY FORD VANCOUVER ISLAND

4 Signals Magazine Winter 2023

Kai Hensler WEISSACH GROUP VANCOUVER

unfair nature of this levy and finally address it, perhaps in the February 26 budget.

BC Throne Speech

On February 6, I was honoured to attend the BC Throne Speech at the invitation of our local Langley East MLA, Megan Dykeman.

There is no question there are many challenges ahead for government as it seeks to tackle serious issues on the social and economic front, and we look forward to working with those involved and playing a constructive role.

CleanBC Go Electric Passenger Vehicle Rebate program

The NCDA remains privileged to administer the new car dealers’ CleanBC Go Electric Passenger Vehicle Rebate program on behalf of the province, and in doing so, help to support BC’s leadership role in achieving the highest Zero Emission Vehicle adoption rate in North America.

I want to extend a special thank-you to all dealer members for their patience as we worked through program changes and a significant update to the program’s back-end IT systems.

At the outset, application processing and payment times were much slower than we would have liked, but the good news is we are getting back on track and dealers should see payment times speeding up. As always,

members should let us know if there are any questions or concerns around the administration of this very important program.

ZEVS at the Legislature

On May 8, we look forward to once again bringing the latest Zero Emission Vehicles available to consumers in the province to the Parliament Buildings at the BC Legislature. This highly popular event provides a unique opportunity to showcase the latest technology to MLAs and ministers and their staff.

Stay tuned for more EV events

I join many of our Signals readers who were disappointed upon learning we wouldn’t be able to hold a Vancouver International Auto Show this March.

However, I am excited at our work to create smaller, regional educational events for consumers and elected officials alike; these will be hands-on, experiential events with ride-and-drive components to educate and inform attendees on the ins and outs of the electric transition and ownership of zero-emission vehicles. Stay tuned for more details.

Chairman’s Tour

Speaking of regional events, the NCDA team is working on dates for the continuation of

our Chairman’s Tour, which will include stops on Vancouver Island, the Fraser Valley, the Kootenays and Northern BC.

The tour will present an opportunity for our chairman, Anthony Lunelli, and me to connect with members, answer questions and provide updates on the latest developments on key government advocacy work, in addition to our efforts with ICBC, SkilledTradesBC and other work to support our dealer members.

Enjoy this issue of Signals

I encourage you to read this edition of Signals, in which you will find articles on the latest economic trends, shareholder agreements, a sit-down Q&A with ICBC and more.

From all of us at the NCDA, we wish you and yours all the best for a happy, healthy and prosperous 2023.

Sincerely,

Blair Qualey, President and CEO New Car Dealers Association of BC bqualey@newcardealers.ca

2022-2023 New Car Dealers Foundation of BC Board of Directors

Heather Headley Past Chair PACIFIC HONDA N. VANCOUVER

David Jukes FIRST CANADIAN FINANCIAL GROUP

Marnie Carter Founding Chair CARTER AUTO FAMILY

Moray Keith DUECK AUTO GROUP VANCOUVER/RICHMOND

Anthony Lunelli Chair & Treasurer KELOWNA SUBARU

John MacDonald ADESA RICHMOND

Blair Qualey President & CEO NCDA

Joey Prevost MACCARTHY MOTORS TERRACE

James Carter CARTER GM N. SHORE

Sharon Rupal OPENROAD LEXUS PORT MOODY

Amanda Chrinko WESTWOOD HONDA COQUITLAM

Peter Sia NORTHLAND NISSAN PRINCE GEORGE

Ryan Jones MARV JONES HONDA MAPLE RIDGE

2022-2023 New Car Dealers Foundation of BC Board of Directors

Heather Headley Past Chair PACIFIC HONDA N. VANCOUVER

David Jukes FIRST CANADIAN FINANCIAL GROUP

Marnie Carter Founding Chair CARTER AUTO FAMILY

Moray Keith DUECK AUTO GROUP VANCOUVER/RICHMOND

Anthony Lunelli Chair & Treasurer KELOWNA SUBARU

John MacDonald ADESA RICHMOND

Blair Qualey President & CEO NCDA

Joey Prevost MACCARTHY MOTORS TERRACE

James Carter CARTER GM N. SHORE

Sharon Rupal OPENROAD LEXUS PORT MOODY

Amanda Chrinko WESTWOOD HONDA COQUITLAM

Peter Sia NORTHLAND NISSAN PRINCE GEORGE

Ryan Jones MARV JONES HONDA MAPLE RIDGE

5 newcardealers.ca

John Wynia Vice Chair HARBOURVIEW VW VANCOUVER ISLAND

Welcome to Our New Members

NCDA Associate Members provide vital products and services to dealer members, resulting in greater cost effectiveness, environmental responsibility and general efficiency.

CAPRICMW’S BENEFITS DIVISION

CapriCMW’s Benefits Division is a full-service consulting team specializing in group benefits and retirement solutions. Since 1991, its team has served as advisors to clients within all sizes of the automotive sector. When working with CapriCMW’s Benefits Division, clients get direct, personal service from a dedicated, experienced benefits advisor and team. As a uniquely independent, employee-owned company, CapriCMW‘s Benefits Division does not have insurance-carrier ownership. It provides professional, impartial advice and negotiates terms with the best interests of its valued clients in mind.

CapriCMW is a CADA 360 benefits partner for Canada’s new car dealerships. It currently works with over 50 dealerships across BC. See more online at CapriCMW.ca.

BAKER TILLY WM DEALER ACQUISITIONS

Baker Tilly offers services in the buying and selling of automotive dealerships, offering comprehensive, tailored services and solutions that make a critical difference to the outcome of a transaction.

Its specialists have extensive experience with facilitating the transaction process for sellers and buyers, overseeing deal negotiations and asset valuation, as well as mergers and acquisitions. Its team has built close relationships with a solid network of potential buyers and top dealer groups in Canada and the US, including at the manufacturer level.

For more information, visit: bakertilly.com/specialties/mergers-and-acquisitions

NEW MEMBERS

• Creditor Life, Disability & Critical Illness Insurance • Mechanical Breakdown Plans • Appearance Protection Products We provide protection to Canadian families for when “what if?” becomes “what now?” Darren Johnson Regional Manager 250-217-5955 djohnson@firstcanadian.ca Financial Group 320 Sioux Rd, Sherwood Park, AB T8A 3X6 Toll Free: 1-800.561.3242 Thanks to the NCDA’s Official Supplier (exclusive provider of credit life and credit disability insurance, mechanical breakdown coverage and chemical products to BC’s new car dealers): First Canadian Financial Group. Certificate The New Car Dealers Association franchised dealers throughout exists to provide CarCareerBC and operates the Vancouver Blair Qualey 6 Signals Magazine Winter 2023

Propelling Progress in BC’s Auto Industry

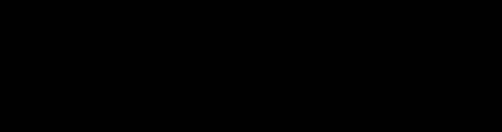

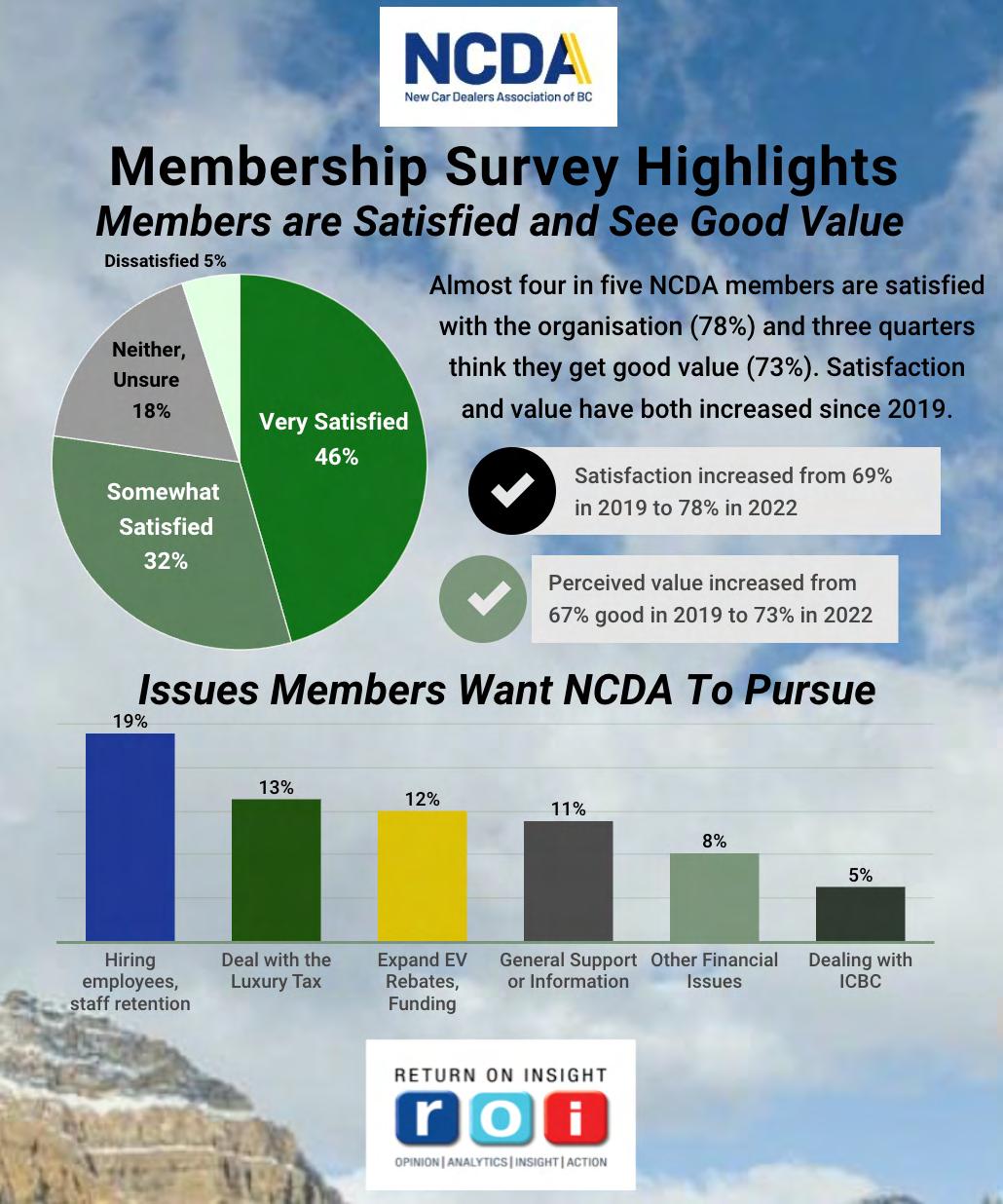

Latest survey shows increase in satisfaction and perceived value of the NCDA

BY BRUCE CAMERON, RETURN ON INSIGHT

It’s been almost three years since the NCDA last did a survey of members. To say that a lot has changed in the sector since November 2019 is an understatement. The industry has faced COVID-19 lockdowns, serious supply chain issues and surging inflation since the last membership survey was completed.

The latest update, undertaken by Return On Insight for NCDA in November 2022, shows that while a lot has changed, the priorities of members have remained fairly consistent. The importance of dealing with industry-wide taxation issues, negotiating and maintaining government programs and advocating for the industry with ICBC all remain high.

Member satisfaction with the NCDA has improved despite the challenges the industry has faced. Roughly four in five members give the organization high marks in late 2022 (78 per cent, up from 68 per cent in 2019). And three out of four members say they are getting good value for their membership dollars (73 per cent).

Among the reasons for the high value and satisfaction ratings is appreciation for the NCDA’s work to ensure that COVID-19 relief programs were in place and benefiting member companies. But the big increase in satisfaction in the past three years relates to the NCDA addressing one of the members’ top concerns: the luxury tax. Satisfaction with the NCDA on dealing with the luxury tax has increased 23 percentage points in three years.

The work of the NCDA also garners praise on other important initiatives, like giving members access to good legal and tax advice (up 19 points) and advocating with ICBC (up 14 points in two years). Satisfaction with how NCDA communicates with its members, helps keep EV programs and rebates in place, and holds the VSA accountable all improved since 2019.

Members also outlined some concerns the NCDA could focus upon in 2023, like improving the CleanBC program and helping dealerships address employee attraction and retention challenges.

A majority of members (58 per cent) think the CleanBC program could be improved, particularly by loosening and/or extending eligibility requirements.

Finally, if you’re wondering how many of the members read this

encouraging (at least for those who put it together): four out of five read it at least occasionally and the majority of those readers think it is easy to read, with good industry coverage and an appealing layout.

The NCDA takes the input of its members very seriously, and as president and CEO Blair Qualey noted, “We will continue to apply your input to improve our level of communication and member satisfaction.”

MEMBER NEWS Reserve and save in the Park’N Fly app. Use discount code 1120302. Download today parkny.ca/app PNF-NewCarDealers-7.25x2.qxp_Layout 1 2023-01-11 5:51 PM Page 1

magazine, and what

news

they think of it, the

is

7 newcardealers.ca

2023 Means New Premier, New Cabinet and New Name for the BC Liberal Party

NCDA continues its work on behalf of new car dealers

The final weeks of 2022 signalled a seismic shift at the provincial government level as David Robert Patrick Eby, MLA from Vancouver-Point Grey, was formally sworn in as BC’s 37th Premier at an event in the Musqueam Community Centre. Days later, he went on to appoint his first cabinet.

The new Premier combined a mix of veteran ministers with some fresh faces in key ministerial roles. Overall, there are 15 women and 13 men in ministerial positions (including the Premier) at the cabinet table. This fulfills the Premier’s promise of a gender-balanced cabinet.

The most unexpected move Premier Eby made was giving former Finance Minister Selina Robinson (Coquitlam-Maillardville MLA) a new post: she is now the Minister of Post-Secondary Education and Future Skills. Katrine Conroy, the former Minister of Forests is now Finance Minister. One of Minister Conroy’s biggest challenges in 2023 will be how to spend the current $5.7-billion surplus, which needs to be allocated for spending before the end of the government’s fiscal year on March 31.

Some things to watch for in the legislature this spring include the next throne speech and budget. The throne speech on February 6 marks the start of the new spring session, followed by BC budget day on February 28. Look for the government to continue its focus on the issues of affordability, housing and inflation. One of the main challenges hindering the economy’s full recovery revolves around supply-chain problems.

The opposition BC Liberals, under leader Kevin Falcon, will undergo a change in the long-time party name this year. Liberal members overwhelmingly voted in favour of changing the name to BC United Party. After passing the proposed name change with a “yes” vote of 80 per cent in mid-November, the BC Liberals officially passed a membership vote to change their party constitution and rebrand themselves as the BC United Party.

NCDA advocacy

Throughout last year, the NCDA advocated on behalf of its members, voicing opposition to large tax increases and regulatory measures that impact dealership businesses. Most notably, we continued to advocate for an increase in the threshold at which the luxury tax kicks in, removal of this tax on work trucks and consideration of the ultimate elimination of the luxury tax on vehicles altogether. And because BC is one of only two provinces in which there is both a federal and provincial luxury tax on vehicles, we are asking the two levels of government to align their respective levies, so consumers aren’t paying a double tax. In a positive vein, we continue to work with government to ensure the ongoing success of consumer incentives like the CleanBC Go Electric Program.

For the third year in a row, the Select Standing Committee of Finance (made up of all new members of the legislature) recommended in its report to the Finance Minister that government:

• Continue to invest in clean and renewable energy sources to expedite the transition to a net-zero economy;

• Maintain full funding for CleanBC’s Go Electric BC Program and carefully examine

hydro infrastructure to ensure that BC’s electric grid will be able to support the transition to electric vehicles; and

• Review the luxury tax structure, threshold, and policies to ensure it applies only to luxury items.

Ride and Drive

Great news! On May 8 the NCDA will be back in Victoria for our annual “Ride and Drive” day in Victoria. We will have test drives available this year, and the event also provides an opportunity for the NCDA to promote the economic benefits and the issues the association and industry are facing. We look forward to meeting with many of the new and established ministers for thoughtful discussion and an opportunity to advocate for our issues.

Stay tuned, as this year will be an eventfilled year for BC’s new car dealers. We will continue the process of proactively engaging all elected members and government members who sit around the cabinet table—aiming to educate them on your issues and the value of BC’s strong dealer network.

MAY 8 GOVERNMENT ADVOCACY

Former Premier John Horgan and NCDA President Blair Qualey at the EV Day in Victoria, June 2022.

8 Signals Magazine Winter 2023

News From Around the Province

40 Under 40 honours for Ryan D’Souza

Ryan D’Souza, president of Jim Pattison Lease, has been named to Business in Vancouver’s prestigious 2022 Forty Under 40 awards, along with 39 other business leaders in the city.

Each of the 40 recipients are featured in BIV’s annual Forty Under 40 Magazine and will also be honoured at an in-person awards gala on February 26.

On his LinkedIn profile, D’Souza is described as: “A results-driven leader with experience and proven successes in mergers and acquisitions, business men-

Canfor permanently closes pulp line at Prince George mill

Canfor Pulp Products says it will phase out and permanently close the pulp line at its mill in Prince George, BC.

This will lead to a loss of about 300 jobs and result in an annual reduction of 280,000 tonnes of market kraft pulp.

The specialty paper facility at the site will continue to operate.

“In recent years, several sawmills have permanently closed in the Prince George region due to reductions in the allowable annual cut and challenges accessing cost-competitive fibre,” said Kevin Edgson, president and CEO, Canfor Pulp, in a press release.

“This has had a material impact on the availability of residual fibre for our pulp facilities and we need to right-size our operating platform. As a result, we have made the very difficult decision to shut down the pulp line at Prince George Pulp and Paper Mill and will continue to operate the specialty paper facility.”

The pulp line is expected to close by the end of the first quarter of 2023.

The Canfor announcement was one of several developments that have occurred in the forest sector in recent weeks. Each of these will have a tremendous impact on local economies and jobs, and members of the NCDA say their thoughts are with those impacted.

torship, operations management, business development, revenue generation, vendor relations, contract negotiation, change management, and customer satisfaction.”

He has worked in various positions at Jim Pattison Lease for over 11 years. Asked to name a career highlight in the BIV feature, he said, “It’s an honour to have the opportunity to lead a founding company within the Jim Pattison Group, Canada’s largest privately held company. I feel exceptionally fortunate to help expand Jim Pattison Lease’s legacy nationally and internationally.”

Read more at biv.com/magazine/forty-under-40-2022.

Ryan joins other automotive leaders like Adil Ahamed (2019 recipient) and Mike Trotman (2011) as a recipient of this prestigious award.

Phil Leong named interim head, as ICBC president and CEO departs for helm of BC Ferries

ICBC’s board of directors is announcing that its president and CEO, Nicolas Jimenez, is leaving ICBC effective February 3, to become the president and CEO of BC Ferries.

“It is a day of mixed emotions to be saying goodbye to Nicolas after almost a 20-year career with ICBC,” said ICBC board chair Catherine Holt.

“We look back on his contributions to ICBC with admiration and appreciation, especially for his years as president and CEO and the remarkable transformation he and his leadership team led for BC’s public auto insurer.

“Under Nicolas’ leadership, ICBC has overcome significant challenges to deliver one of the most affordable and care-based insurance models in Canada. He has also developed a supportive and collaborative culture, which will help ensure ICBC has a stable but innovative future.

“While Nicolas’ departure is a loss for ICBC, we are delighted to see him moving on to BC Ferries, where he will be leading another important public service and a great organization with a rich history. We wish him nothing but success in his new role.”

Jimenez joined ICBC in 2003 and worked in a variety of senior roles in insurance, corporate development, driver licensing and road safety, prior to being named president and CEO in July 2018.

Before joining ICBC, Jimenez worked in strategy and public sector management, which included roles in the Parliament of Canada, the Privy Council Office (Government of Canada), BC Hydro and IBM.

The ICBC board has appointed chief financial officer, Phil Leong, as interim president and CEO. Leong has been with ICBC since 2008, working in progressive leadership roles within the finance division. Leong was recently named as Business in Vancouver’s CFO of the year at its 2022 C-Suite Awards.

The ICBC board of directors will be conducting a process to identify a permanent president and CEO.

INDUSTRY ROUND-UP

Ryan D’Souza

Phil Leong

9 newcardealers.ca

Lavish Luxury, Top Technology and Sweet Drives

And some EV news: get set to charge with Cadillac Canada

2022 Volvo XC60 Recharge

Volvo’s XC60 has been updated for 2022 with changes more than skin deep. External updates are subtle, the most obvious being a new grille and new bumpers. The new “Recharge” plug-in model has a larger rear motor and a higher-capacity battery, good for a total combined output of 455 hp and an increased 58-km electric-only range.

The elegant, high-quality interior benefits from supremely comfortable seats, a relatively roomy back and cargo hold. The improved Google auto infotainment system now features Apple CarPlay, although it still has a bit of a learning curve. Overall, the XC60 is a legitimate competitor in this crowded segment.

Pricing starts at $64,950.

2023 Acura Integra

Acura has brought the beloved “Integra” name back to its luxury lineup, offering a higher-end four-door hatchback that replaces the ILX. Sharing the award-winning platform as the latest 11th-generation Honda Civic, the Integra mostly lives up to its reputation of being a more upmarket car that is still fun to drive.

Power comes from a 200-hp 1.5-litre turbocharged four-cylinder, also shared with the Civic lineup. Combined with an available 6-speed manual, many tech features, impressive fuel efficiency and great handling, this sporty model from Acura adds flair, affordability and refinement to the driving experience.

Pricing starts at $36,850.

2023 Mercedes-Benz C 300 4MATIC Coupe

The all-new redesigned Mercedes-Benz C 300 4MATIC takes compact luxury and sportiness to the next level, offering a powerful 255-hp 2.0-litre turbocharged four-cylinder engine, aided by an EQ Boost 48volt mild-hybrid system that eliminates turbo lag.

Inside, you’ll find all the latest driver assistance and cabin technology combined with luxury you’d expect from a Mercedes—lots of padding, chrome accents, piano-black trim, quality stitching and the latest MBUX infotainment.

The C 300 feels tight and controlled through turns, aided by the 4MATIC all-wheel-drive system and the available AMG sport suspension, which is stiffer and has a lower ride height compared to the standard version.

Pricing starts at $56,700.

2022 RAM 1500 Limited HEMI eTorque

The RAM 1500 pickup is one of the most liveable pickups, able to satisfy the most demanding commercial driver while providing surprising levels of comfort and tranquility. Enjoy a comfortable ride, thanks to its rear coil-spring suspension, optional air springs and smooth 395-hp 5.7-litre HEMI V8. The optional eTorque 48-volt mild-hybrid system improves fuel economy and adds 90-lb-ft of torque.

Handling is secure and responsive, and the four-wheel-drive system can remain engaged indefinitely for all-season surefootedness. The lavishly furnished cabin is quiet with generous rear seat room. The enormous 12-inch Uconnect infotainment system is easy to use.

Pricing starts at $74,411.

CAR BUZZ

10 Signals Magazine Winter 2023

Cadillac LYRIQ

In advance of its new LYRIQ electric vehicle and as its charging network expands, Cadillac Canada has partnered up with Qmerit and FLO to provide eligible customers with the flexibility to charge their vehicles in a way that best supports their lifestyles.

The “Charged By Cadillac” program will either cover the cost of a standard Level 2 (240v) charger at customer’s residence, or provide $750 in FLO public charging credits upon the purchase/lease of a 2023 LYRIQ. This gives customers potential access to the largest number of public charging stations in Canada, with 65,000 charging plugs across North America.

Cadillac has partnered with Qmerit, a nationwide network of experienced EV supply installers, to help assess the needs of customers who choose the Level 2 home-install option. Check with your local Cadillac dealer for more details on the program.

2023 Jaguar I-PACE EV400

The introduction of the I-PACE marks a major turning point in the Jaguar’s storied history. It’s a luxurious, fun-to-drive electric vehicle that challenges Tesla’s tech and luxury prowess. The I-PACE has a quiet cabin and high-quality interior materials, making it feel like any conventional car built by a luxury carmaker.

Enjoy sporty, agile handling and smooth, instant acceleration from its 394-hp dual-motor electric powertrain. Range of 381 km from the 90-kWh battery may be less than other EVs on the market but it’s still enough for daily commutes or most road trips.

Pricing starts at $102,800.

CALL 250.384.7304 / 1.888.882.6688 FAX 250.384.7308 / 1.888.727.6688 OFFICIAL SUPPLIER TO AUTO DEALER SUPPLIES & PROMOTIONAL PRODUCTS Ad License Plates • Balloons • Banners • Bucko-Banners • Contracts • Decals • Domed Decals • Envelopes • Fasten ers Flags • Key Keeper Systems • Key Tags • License Plate Frames • Markers • Mirror Cards • Option Stickers • Pennants • Signs Swooper Flags • Vinyl Numbers • Warranty Cases • Window Graphics • Windshield Stickers... and much more! Shop online at michaelmason.ca

Content and images courtesy of Andrew Ling.

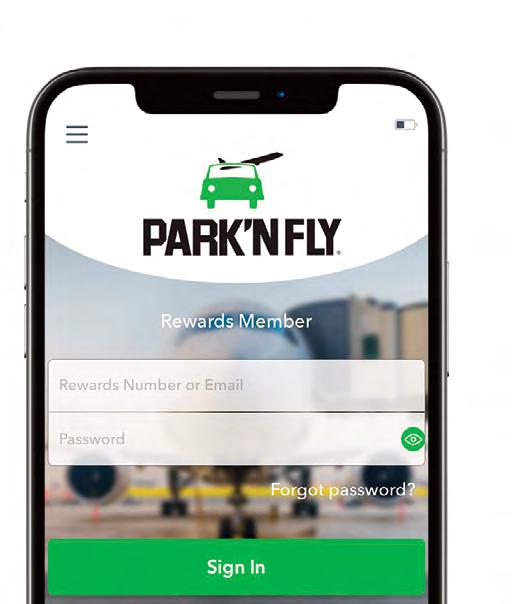

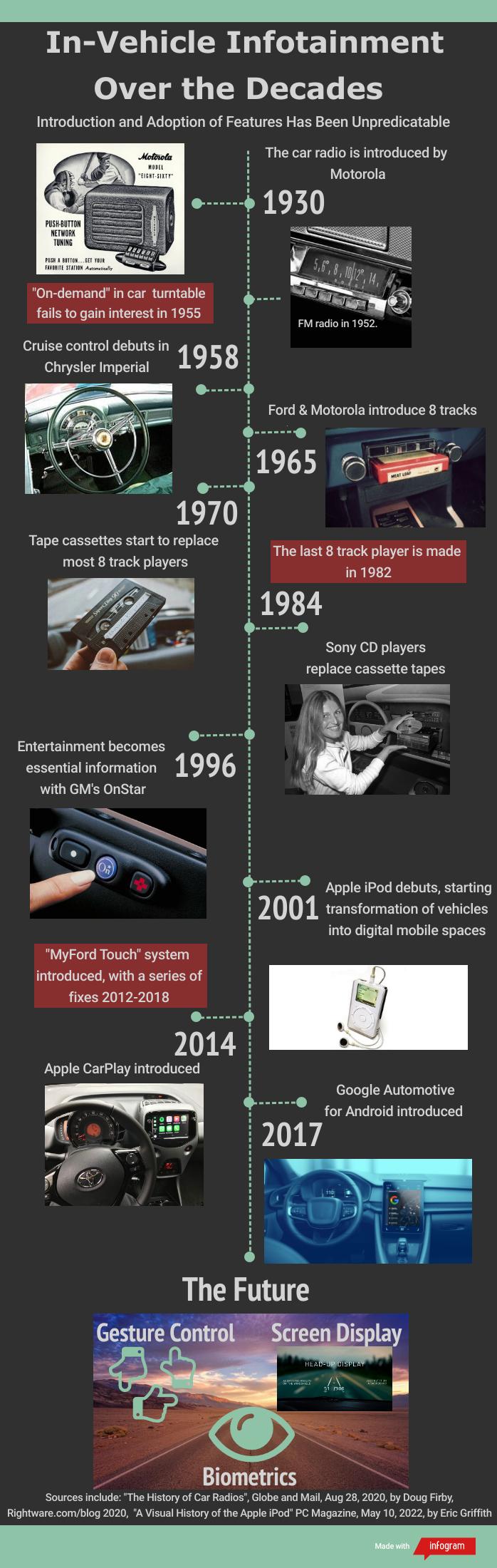

The Battle for In-Vehicle Infotainment Supremacy

BY BRUCE CAMERON, BLACK PRESS CONTRIBUTOR

It’s been a century since the first attempts were made to install music into motorized vehicles (which, at the time, had to be hand-cranked). In 1930, the first car radio, by Motorola, came with the lofty price of $130 added to a $540 base vehicle price. That’s a whopping one quarter of the total cost of the vehicle. If adding a sound system to a vehicle was such a novelty today, the equivalent cost would be around $10,000!

That first car-radio system weighed hundreds of pounds and required a separate battery and suppressor on the spark plugs to operate, meaning there was a real trade-off between music and motoring performance. These days, music- and video-streaming services are expected features, but over the past 90 years, progress has not taken a straight line.

Take for instance the first “on-demand” music system introduced by Chrysler in 1955, in partnership with CBS. It was called the Highway HiFi Phonograph and it carried up to 14 medium-sized records (bigger than the 45-rpm records and smaller than the 33-rpm format vinyl). The problems were numerous, including the price tag (about 10 per cent of the total vehicle price), the fact that they only played in the car, and the fatal problem that they were prone to breaking down.

Reliability and price remain crucial issues when it comes to in-vehicle infotainment today. Ford decided a decade ago to develop its own system, called MyFord Touch, and although it has been part of many models since, it has run into reliability challenges that have taken time and money to fix. Perhaps this is why many OEMs are strengthening and expanding collaboration with music and tech companies to offer new products.

The list of partnerships is growing as OEMs seek to stay competitive in the infotainment space. The two main heavyweights in the battle for supremacy are Apple (Apple CarPlay, introduced in 2014) and Google (Android Auto, launched in 2017). Soon Amazon may enter the fray, and SONY has a partnership with Honda that will be ready for market in 2026.

Analysts predict future innovations will include HUD (heads-up displays), gesture control and biometrics.

Heads-up display of important navigation and safety issues was introduced in the late ’80s by General Motors, but major improvements are coming. Continental AG out of Germany won an award at the Consumer Electronics Show in Las Vegas in January for its new Scenic View HUD system, which “brings vivid, exciting display technologies to a vehicle in a way that prioritizes safety,” said Jens Brandt, head of Continental AG’s user experience division.

At the same show, biometric innovations were integrated with HUD to allow people to start the vehicle by simply looking at the windshield, and to even sing karaoke if inspired. These increasingly complex systems need to be seamlessly integrated for independent and autonomous driving, tied into the safety systems and easy to use.

Gesture control may supplant other touchscreen features as automakers experiment with haptics and hand movements to minimize distractions, keep eyes on the road and control all on-board systems at the flick of a wrist. BMW has been a trailblazer in this space, and Hyundai is quietly winning awards for its augmented reality HUD systems with gesture control.

We’ve come a long way from hand-cranking the ignition.

TRENDS

12 Signals Magazine Winter 2023

We’ve come a long way

Looking to 2023

VSA outlines priorities for the upcoming year

BY IAN CHRISTMAN VSA PRESIDENT AND CEO

As we enter 2023, the VSA is wrapping up its last quarter of 2022-23 and gearing up for the start of its fiscal year on April 1, 2023. Here are some things the VSA will be focusing on in 2023.

The VSA is finalizing its online dispute resolution platform (called Connector) in partnership with the Justice Education Society.

Soon, consumers will have an online platform that will connect them directly with dealers to discuss and resolve their complaints. To support this, we are creating an online guided pathway, called “My Self Help,” where consumers can ask specific questions and get information specific to their concerns, so they can deal directly with the dealer.

Thank you to the members of the New Car Dealers Association (NCDA) who helped evaluate these platforms and provided great feedback for user-experience changes. We

aim to launch these by March 31, and over the next year the VSA will monitor, adjust as needed and assess their use.

The VSA will also be working on more stakeholder outreach and increasing consumer contacts. We already started this with both industry and consumer surveys in January 2023, asking about the services the VSA provides and how we can improve on them. We are also revamping our website to make it more user friendly, updating our website salesperson’s portal, and creating a consumer online complaint portal so consumers can file and track the progress of their complaints.

The VSA’s new logo (seen here) and branding will launch alongside the new website. To

Continued on page15

Sell and source inventory anywhere, anytime.

Sell and source inventory anywhere, anytime.

Unsure if you want a digital real-time auction, to casually browse, or go in and kick the tires yourself?

Unsure if you want a digital real-time auction, to casually browse, or go in and kick the tires yourself? With TradeRev and ADESA* – you don’t have to choose just one. With platforms both digital and physical, the power is in your hands. It is your highway to sell – buckle in and let us help move your business forward.

With TradeRev and ADESA* – you don’t have to choose just one. With platforms both digital and physical, the power is in your hands. It is your highway to sell – buckle in and let us help move your business forward.

* ADESA refers to ADESA Auctions Canada Corporation, ADESA Montreal Corporation, and/or ADESA Quebec Corporation. © 2022 Nth Gen Software, Inc. **Additional terms and conditions may apply. Contact TradeRev or ADESA for details. Get started at TradeRev.com or adesa.ca/godigital**

* ADESA refers to ADESA Auctions Canada Corporation, ADESA Montreal Corporation, and/or ADESA Quebec Corporation. © 2022 Nth Gen Software, Inc. **Additional terms and conditions may apply. Contact TradeRev or ADESA for details. Get started at TradeRev.com

adesa.ca/godigital**

or

13 newcardealers.ca

Q&A

A Q&A with James Tan, ICBC’s VP Claims Customer and Material Damage Services

On the Road to the Future

SIGNALS: As a public sector organization that is responsible to the people of British Columbia, there are any number of priorities, challenges and opportunities ahead for ICBC in 2023. Can you highlight a few of these for our readers?

JAMES TAN: Affordability is a big focus for us. Inflation is impacting everyone across the country. In many other Canadian markets, we’re seeing insurers pass these higher costs on to customers. Here in BC, we’re holding basic rates the same for the next two years. We’re able to do that primarily due to our new Enhanced Care system of insurance that took effect in 2021. And that’s a good thing for BC drivers; it means they get better care and more affordable insurance.

We’re also looking for opportunities to enhance the experience our customers have when they do business with us. We want our values—of being straightforward, supportive and knowledgeable—to be front and centre. We’re increasing our focus on having a better understanding of customer expectations, with an eye to improving communications and consistency, and being more intentional in the investments we make across all our channels, including online.

SIGNALS: With the current challenges related to the economy, changing technology and increasing pressure on the repair industry, how do you see ICBC supporting the industry moving forward?

JT: Our partnerships with new car dealers and the vehicle repair industry are extremely important. The truth is we need each other, especially when market conditions are as tough as they have been in the last few years. Like any relationship, ours has had its ups and downs.

Collaboration is key as we find ways to improve our programs and processes which benefit our partners and our mutual customers.

We know the industry has been facing challenges and we recognized the need to adjust rates. Last year, we made two adjustments to our labour rate—a three per cent increase in July and an adjustment equivalent to a 10 per cent increase in November and December.

SIGNALS: One significant challenge facing the repair sector is the ability to have enough trained people to meet current and future needs. Does ICBC have a role in helping to ensure a healthy industry with enough trained people to repair vehicles?

JT: ICBC has invested in a new Apprentice Support Program and is focused on helping our collision-repair partners with labour shortages and training. Launched late last year, it focuses on providing apprenticeship support and training. We developed it to help businesses grow and prepare apprentices for the jobs of tomorrow. ICBC is investing over $1.5 million into the pilot program over the next six years.

We know this alone can’t solve all the challenges, but we want to be part of the solution. There are many existing public programs too. I’d encourage apprentices

COVER STORY

14 Signals Magazine Winter 2023

and repair facilities to check them out. For instance, repair facilities may be eligible for tax credits and other supportive initiatives like the BC Employer Training Grant. You can learn more about these programs through SkilledTradesBC at skilledtradesbc.ca.

SIGNALS: Technology is rapidly changing with new vehicles. In some cases, technology can help keep drivers safer and that is recognized through insurance premium savings. How do you see technology further changing the landscape when it comes to the insurance industry?

JT: I don’t have to tell you that today’s new vehicle technologies are amazing and very advanced: from sensors that warn you when a cyclist is approaching to cameras that alert

VSA priorities

Continued from page 13

you to a change in the speed limit, and electric- and hydrogen-powered cars. New car dealers in BC are selling and repairing even more advanced vehicles each year. There are just so many ways to reduce crashes and improve our lives. Fewer crashes mean lower claims costs, which helps keep premiums low. More importantly, it means fewer British Columbians getting injured. That’s good news for everyone.

However, we also recognize that technology drives complexity in the repair process, and our partners know that means continuous learning and training. It’s why we’re investing in the Apprentice Support Program, and why we’ll keep looking for ways to collaborate with those who have a stake in this industry thriving.

SIGNALS: What is ICBC doing to help reduce crashes and make roads safe?

JT: As a Crown corporation, we’re different from other insurers in BC because part of our mandate includes reducing crashes and improving road safety. BC drivers, pedestrians and cyclists have benefitted from safer roads due to more than 30 years of ICBC’s innovative road safety programs.

The longtime foes of speed, distracted driving and impaired driving remain the leading causes of fatal crashes in BC. Collaborating with the province, police and community partners, we run a number of road safety campaigns every year to raise awareness and improve driving behaviours. And that’s in addition to the approximately $8 million we invest in road improvements across the province each year.

SIGNALS: I think many people may have pre-conceived ideas about ICBC. If there is one thing that you would like to share with our readers, what would it be?

JT: I don’t think most British Columbians are aware of how many partners ICBC works with, including our partnership with the NCDA (we love the auto show and we’re saddened by the news it had to becancelled over the previous years, although we are excited about the prospect of new test drive experiential events in 2023). Our partners’ perspectives are invaluable and our collaboration helps to pave our way forward. Partnerships will always be central to improving the products and services we provide British Columbians.

promote all this, the VSA will soon be launching a social media campaign.

Over the past year, the VSA has been developing our dashboard metrics to better extract data from our systems. This will help us make better decisions and allocate resources where they need to be and therefore reduce regulatory burdens on others in the industry. This coming year, the VSA will be proving out and employing that data.

As we come out of the COVID-19 era and get out into the field more, the inspection team will be focusing on reviewing legal requirements and best practices with dealers. If we can proactively assist dealers with their compliance, we can reduce the number of substantiated com-

plaints and, hopefully, the time, effort and cost for everyone involved. A compliant transaction leads to a better customer experience and customer satisfaction. Many of you already reach out to our advertising standards officer, Christina Walker, and we encourage you to continue doing so.

Overall, the VSA will continue to focus on its purpose of “building public confidence in the motor dealer industry in BC by engaging and educating industry and consumers, and by ensuring a safe and reliable motor vehicle buying experience” to meet the mandate set by the BC government.

15 newcardealers.ca

Protect Your Business From Unauthorized Access

Introduction to cyberattacks and trends to watch for in 2023

Any threat to an organization with the possibility of large financial loss, damage to reputation or legal action must be taken seriously. Cyberattacks are more than inconvenient and costly—they can spell the end for an unprepared business. According to IDC Futurescape, by the end of 2022, nearly 65 per cent of the global gross domestic product will be digitized. The shift to digital technology has created new risks that are constantly evolving.

Cyberattacks are poised to strike more often and with more gravity than traditional risks.

This shift to a digital economy, along with the increase in remote work, due to the pandemic, means businesses need to adapt to the changing nature of the workplace and larger reliance on digital technology. Greater prevalence of digitization opens the door to many common cyberattacks, including software like malware and ransomware. Other types of attacks include phishing, where an attacker pretends to represent a trusted company to trick a user into clicking a link or opening an attachment, or spoofing, where a cyber-criminal impersonates another user or trusted device to spread malware, steal information or attack network hosts.

“Brute force” attacks occur when an attacker attempts to decode en-

crypted data by trying as many potential passwords as quickly as possible. A “denial of service” attack floods a website with more traffic than it can handle, making legitimate business transactions impossible.

Current trends in cyberattacks show some negatives, and one important positive.

Negative trends right now include an increase in ransom demands, an expansion in the new tactics being deployed by hackers and a particularly large impact on small businesses, due to the ease and profitability of automated attacks.

On a positive note, the increase in active insurance partners who help prevent cyberattacks and protect businesses means those who hold cyber policies experience less than one-third as many claims as the broader cyber insurance market.

HUB International partners with Cyberscout, a market-leading cyber insurance service provider who offers businesses the means to better understand their exposure to cyber risk and, in the event of an incident, expertise and guidance to fix the situation. To learn more, contact Wayne LeGear at 604.269.1944 or wayne.legear@hubinternational.com, or visit hubinternational.com

YOUR INSURANCE PORTFOLIO:

SPONSORED CONTENT 16 Signals Magazine Winter 2023

Top Five Fraud Prevention Myths

These myths could be hurting your business

It’s important to keep in mind that there is no “silver bullet” when it comes to fraud prevention. Here are some of the common myths about fraud prevention that could actually be hurting your business:

1. CVV or AVS numbers protect you against chargebacks. While those three numbers on the back of credit cards are an important part of verifying a payment, they do not count as proof that the cardholder gave you permission to use their card number. Collecting CVV and AVS numbers alone does not protect you from chargebacks, whether you’re using a secure online payment page or taking the number over the phone. The best way to authenticate a cardholder’s identity is to layer fraud prevention tools into your payment system instead.

2. The payment terminal is secured. Yes, payment terminals provided by a processor like Moneris are secured for transactions, but unless you have purchased a specific “unattended” solution, do not leave your payment terminal unattended. Unfortunately, some

people will just walk away without paying or, worse, more advanced fraudsters may try to tamper with the device.

3. You can’t fight chargebacks. Despite there being over hundreds of thousands of chargebacks per year, only 15 per cent of merchants try to fight them. While on one hand, it is good to think critically about whether you want to fight a chargeback—since there are fees for investigating—80 per cent of chargebacks tend to be fraud-related. In those cases, the business actually has a good case for fighting chargebacks, especially if: you have a clearly stated refund and cancellation policy; you provided a receipt at purchase; you have proof that a delivery was made; you have 3-D Secure 2.0 which verifies the cardholder’s identity.

4. Fraud prevention tools aren’t worth the extra cost. There are a lot of overhead costs to running a business, so why not skip fancy fraud-prevention tools? But how you process transactions—whether in-person or online,

keyed in manually or via tap payment, with fraud tools or without—influences how much you pay per transaction, based on how risky the situation is. Transactions that are more prone to fraud are going to cost more, so consider seriously how much you are saving in monthly fees when you are paying more per transaction and likely are on the hook when fraud happens.

5. My Moneris device is PCI DSS compliant so that means I’m compliant too. All Moneris payment solutions are compliant with the Payment Card Industry Data Security Standard (PCI DSS)—the industry standard for accepting and processing credit card information safely—however, proper compliance requires the business to also take action. There are 12 principle requirements in PCI DSS, so make sure you review and understand all the measures and what actions you need to take.

For more guidelines and helpful references on fraud prevention techniques, make sure to visit moneris.com/fraud

Driving sales and growing your business has never been easier with best-in-class payment technology from Moneris. You’re not just a business – you’re a staple in your community. And just like you’re always there for your customers, we’re always here for you with leading-edge in-store & online payment technology that can help you grow your shop. For more information, visit Moneris.com or give us a call at 1-866-319-7450 C M Y CM MY CY CMY K NCDA Ad w_Print Marks.pdf 1 2022-05-30 4:52 PM

SPONSORED CONTENT 17 newcardealers.ca

Shareholders’ Agreements: What Are They Good For? (Many Things!)

BY MATTHEW WANSINK, SENIOR COUNSEL, CLYDE & CO CANADA

It is likely no surprise for dealers to hear that the current industry trend seems to be towards consolidation, often by a large dealership group acquiring one of its smaller competitors.

However, another developing trend is that of collaboration, where smaller and regional dealers, which might otherwise be competitors, combine resources to jointly own and operate a dealership or dealerships. Of course, there continues to be the well-known experience of family-owned dealerships, where members of the same family share in the ownership and operation of the business.

In both—collaboration between dealers and the family-owned dealership model—a shareholders’ agreement is key to ensuring a smooth and successful ownership experience.

A shareholders’ what?

At its most basic, a shareholders’ agreement (or a unanimous shareholders’ agreement for federal companies and some other provincial jurisdictions, other than BC) is a contract between two or more shareholders of a company, which establishes the rules and regulations by which: (i) the shareholders will own, sell and vote their shares; and (ii) other management and strategic decisions will be made.

This second management serving function exists because most shareholders’ agreements also contain provisions addressing the appointment of directors, and rules around how those directors will exercise their authority, with respect to certain business functions. A shareholders’ agreement is so critical to a company’s ownership and operational structure that, to the extent permitted by legislation, most agreements contain a “supremacy clause,” stating that, where a shareholders’ agreement conflicts with the company’s Articles of Incorporation (“Articles”), the terms of the shareholders’ agreement win out.

It is hard to overstate the importance of a properly drafted shareholders’ agreement. This flows from the reality that the relationships and dynamics between shareholders, when operating a dealership, are constantly

evolving and may not always be aligned.

A shareholders’ agreement is an important tool in this relationship, as it plays the part of “referee” by making sure everyone follows the same previously agreed-upon rules, and by helping the parties get back on the same page before conflicts have an opportunity to spiral. Where a shareholder decides to leave the company, or where a dispute is of such a nature that a continued relationship is unworkable, the shareholders’ agreement defines and governs when and how that decoupling will occur, thereby minimizing any adverse impact on business operations.

Reasons, give me more reasons! Dispute resolution

As briefly introduced above, the daily operation of a dealership can lead to business disputes between shareholders and directors. Where there is no mechanism to deal with these disputes in a timely and mutually agreeable way, they can be time-consuming and costly for the company on the one hand, and detrimental to ongoing relationships between the shareholders and directors on the other.

When faced with this risk, a shareholders’ agreement is a comparatively inexpensive way to minimize opportunities for disputes and to resolve them when they occur by defining and providing mechanisms for what parties can and cannot do, and how certain decisions should be made.

This guiding framework largely eliminates the ability and need for the shareholders—especially those with more resources compared to other shareholders—to engage in more costly and oppressive measures (for example, litigation) as a way to settle disputes, and ensures that everyone’s attention and focus is on promoting the success and development of the dealership.

Guide management decisions

Despite common misconceptions, shareholders have very few functions and powers associated with the day-to-day running of a

business. Under BC’s Business Corporations Act (the “Act”), the shareholders’ main function is to elect a slate of directors, which then has the authority to govern the normal business operations of a company.

So, as long as directors are discharging their duty to act in the best interests of the company, a shareholder’s authority is, in the absence of a shareholders’ agreement, otherwise pretty limited. However, a well drafted shareholders’ agreement can provide additional oversight and authority to shareholders, thereby holding the directors accountable for certain actions.

Additionally, the agreement may obligate them to seek shareholder consent before strategic decisions are made, whether those be financial, employment, acquisition or other decisions. This is particularly important in cases where not all shareholders have the right to appoint a director to the company’s board of directors, as may be the case with a minority or “silent” shareholder.

Protect interests

In contrast to giving minority interests a voice, as just discussed, there are situations where it may be in a dealership’s interests to allow a majority shareholder an opportunity to take steps it deems necessary, without having to obtain consent from other shareholder(s).

Thankfully for shareholder relations, this is usually limited to scenarios of the sort where a majority shareholder has decided to dispose of its shares in the company. As such, a shareholders’ agreement often includes a “drag-along” provision. A drag-along provision enables majority shareholders to force minority shareholders to join in the sale of a company so they cannot prevent the deal from going ahead.

Most drag-along clauses also contain terms that ensure: (i) minority shareholders receive the same price for their shares as the majority shareholder; (ii) shares must be sold for at least the fair market value of the shares; and (iii) a majority shareholder cannot force the sale to a third party until the other

LEGAL LINE DEALER OPERATIONS—SPOTLIGHT

18 Signals Magazine Winter 2023

shareholders are first given the right to purchase the majority shareholder’s shares (often called the right of first refusal).

As we have also learned, a shareholders’ agreement often affords protection to minority shareholders that would not otherwise be the case if the parties simply relied on a company’s Articles or the Act, usually by requiring that all shareholders approve certain strategic business decisions.

In addition to this veto power, and in contrast to the drag-along rights of the majority shareholder(s), minority shareholders can be granted a “tag-along” right. A tagalong clause obligates a third-party buyer of the majority shareholder’s shares to also purchase the minority shareholder’s shares if the minority shareholders so choose. Like the drag-along clause, a tag-along requires the purchase to occur at the fair market valuation of the shares, and only after the other shareholders have waived their right of first refusal.

Breaches and defaults

Finally, and related to the right of first refusal, as well as tag-along and drag-along rights,

are provisions addressing the consequences of a shareholder’s default of their obligations under the shareholders’ agreement.

In addition to any general restrictions on the sale or transfer of shares, it is important to include provisions allowing the company, or the non-defaulting shareholders, to re-purchase the shares of a defaulting shareholder. A default can either be something: (i) overtly prejudicial to the operation of the dealership, as in the case of a shareholder breaching a duty of confidentiality or a non-solicitation of client provision; or (ii) outside a shareholder’s control, such as their death, disability or insolvency.

In either type of circumstance, a properly drafted shareholders’ agreement will have a mechanism and process for dealing with the repurchase of shares for both intentional and innocent defaults, as well as include terms dealing with any restrictions that may be leveled upon a shareholder while they remain in default.

The most common of these restrictions is the shareholder’s loss of: (i) voting rights; (ii) ability to participate in shareholders’ meet-

ings; (iii) right to receive certain company information; or (iv) representation on the dealership’s board of directors. In the case of an intentional default, a shareholder may also be required to sell their shares at a discount to the fair market value of those shares.

Summary

The above list is by no means a complete discussion of items covered in a shareholders’ agreement. It is intended to illustrate the numerous and important matters that can be addressed when determining the rights and obligations of a dealership’s shareholders and directors. Additionally, shareholders’ agreements should not be regarded as a “oneand-done” solution. As a dealership and the relationship between its shareholders evolves and changes, the parties should periodically revisit their agreement to ensure it accurately reflects their current intentions.

Should you have any questions, please do not hesitate to contact Clyde & Co Canada LLP’s Business Law Group. Visit: clydeco. com/en/locations/americas/vancouver

WE’VE GOT YOU COVERED Protect your dealership with trusted legal counsel We can assist you with: • Employment Contracts • Policies & Manuals • Wrongful Dismissal • Human Rights • Investigations Get in touch today Christopher Drinovz cdrinovz@kswlawyers.ca | 604-507-6192 Michael Weiler mweiler@kswlawyers.ca | 604-336-7423 • Occupational H&S • WorkSafeBC • Union Certication Advice • Collective Bargaining • Labour Arbitration & more CHRISTOPHER

MICHAEL

19 newcardealers.ca

DRINOVZ Partner, Lawyer

WEILER Lawyer

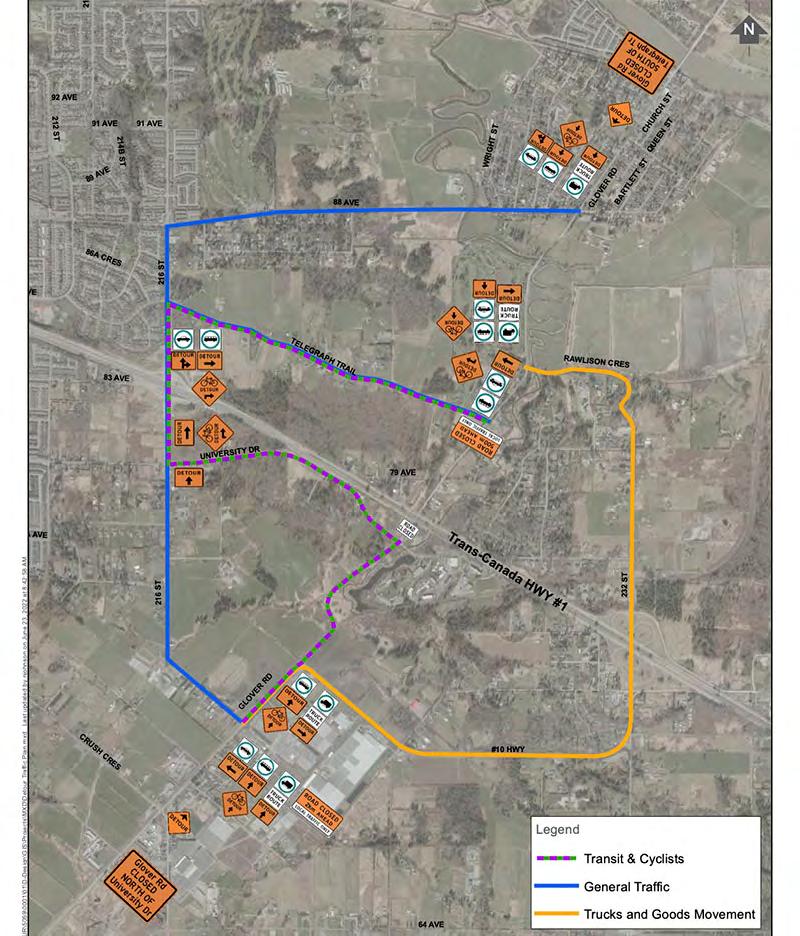

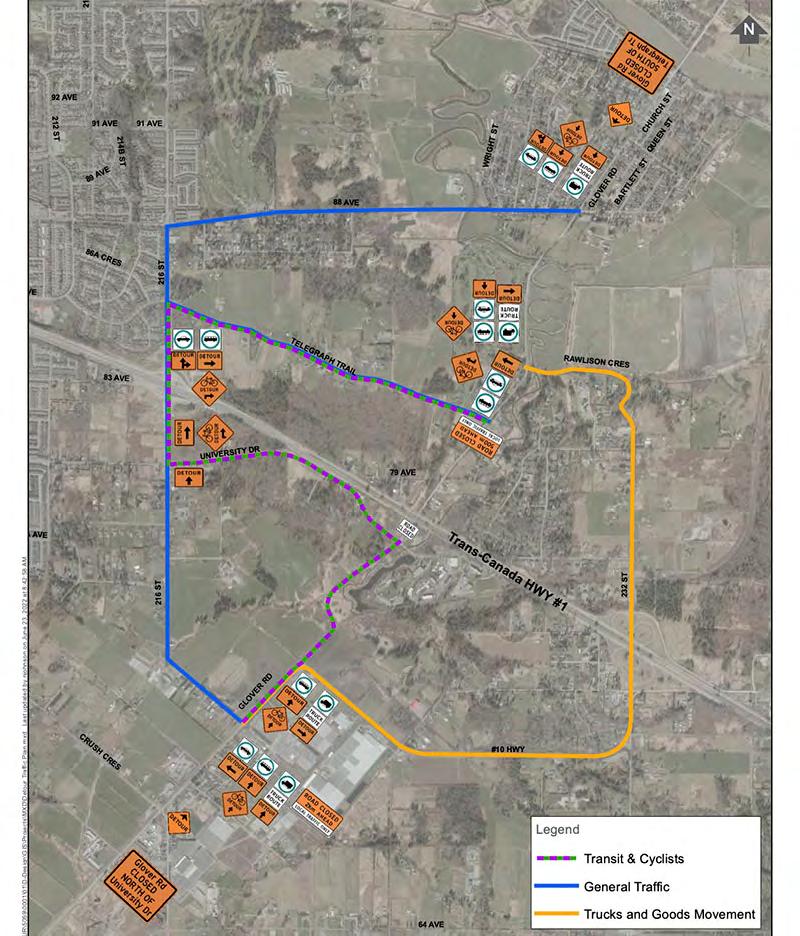

Highway 1 Expansion Begins With Replacement of Glover Road Crossing

Roadwork marks the first of the project’s three major contracts

Construction is underway on the province’s Highway 1 216th–264th Street Widening Project, which will help relieve congestion for drivers and accommodate more sustainable transportation options for all travellers.

This Highway 1 widening project is located in the Township of Langley between the new 216th Street interchange and the 264th Street (Highway 13) interchange.

This segment of highway operates at capacity during peak periods and contains vertical clearance issues for commercial vehicles. The 232nd Street interchange configuration no longer works well under current traffic volumes, and will only get worse as volumes increase.

The replacement of the Glover Road crossing is a key component of the project, and is the first of the project’s three major works contracts.

Ground was broken in November at the project site by Rob Fleming, BC’s minister of transportation and infrastructure; John Aldag, MP for Cloverdale-Langley City; Megan Dykeman, MLA for Langley East; and Eric Woodward, mayor of the Township of Langley.

“As one of the fastest-growing communities in British Columbia, improving travel along Highway 1 is so important to residents of the Township of Langley,” Dykerman said. “The upgrades to the overpass and the new crossing at Glover Road are the first phase of widening Highway 1 through the Township of Langley and will benefit drivers, cyclists and pedestrians alike.”

As part of this replacement project, the height clearance of 4.3 metres at the existing crossing will be improved to current standards to a minimum height clearance of 5.2 metres. This will improve safety and ensure that more commercial and oversize vehicles are able to travel on this route. The nearby CP Rail overhead and the 232nd Street interchange will also be replaced with higher structures as part of the overall Highway 1 216th–264th Street Widening Project.

“The Glover Road crossing replacement is a major milestone as part of our government’s commitment to widen Highway 1 in the Fraser Valley. These needed upgrades will help get goods moving smoothly along this important trade corridor and make it easier for people to get to work and back home again to their families,” said Fleming.

Completion of the Glover Road crossing is anticipated in summer 2024. The other components of the widening project are expected to

be tendered this winter, with work starting by spring. This includes replacement of the existing railway crossing just east of Glover Road, the replacement of the 232nd Street interchange and widening Highway 1 from 216th to 264th to add an extra lane in each direction.

“The Township of Langley has been working with the province for years on these long-needed improvements to Highway 1,” said Woodward. “Given our long collaboration on this project, it’s exciting to see work underway to help the movement of goods, improve road safety and address increasing traffic volumes in the region.”

The Highway 1 216th–264th Street Widening Project is valued at $345 million. The Government of Canada is contributing as much as $95.9 million, the Province of BC is contributing $225.58 million and the Township of Langley is contributing the remaining $23.37 million.

The federal contribution is part of the larger $108.9-million Trans-Canada Highway 1 high-occupancy-vehicle lane extension project under the New Building Canada Fund’s Provincial-Territorial Infrastructure Component — National and Regional Projects.

Dave Earle, president and CEO of the BC Trucking Association, said, “Our association is supportive of improvements to Highway 1 through the Langley area, which will improve the reliability of commercial transport. Widening the highway and adding lanes for HOV travel will decrease some of the congestion, which will improve overall safety and make the movement of goods by truck more efficient.”

“As one of the fastestgrowing communities in British Columbia, improving travel along Highway 1 is so important to residents of the Township of Langley. The upgrades to the overpass and the new crossing at Glover Road are the first phase of widening Highway 1 through the Township of Langley and will benefit drivers, cyclists and pedestrians alike.”

20 Signals Magazine Winter 2023

– Megan Dykeman, MLA for Langley East

New Car Dealers CleanBC Go Electric Vehicle Rebate Program

Highlights from 2022

The NCDA is honoured to have administered the CleanBC Go Electric Rebate Program on behalf of the Province of BC since its inception in 2010. In total, consumers have experienced more than $200 million in rebates. Today, there are more than 80,000 zero-emission vehicles on BC highways, and our dealers are proud of the role they play in being part of a solution that is good for the economy and good for the environment.

New milestone reached for EV uptake BC continues its leadership position in North America for EV sales on a per capita basis (over 17 per cent of new vehicle sales are EVs, according to the latest data as of Q3 2022). Rebates are more important than ever in encouraging EV uptake. Also important is access to charging stations in places where people live, work and play, as well as ongoing education and awareness about the benefits of EV ownership.

CLEANBC GO ELECTRIC

Scan to inquire Western U.S. Import Stores Available • Top sales performers • Strong community reputation • Excellent market, Auto Mall NBB is a proud member/sponsor of the NCDA of B.C. NationalBusinessBrokers.com info@nationalbusinessbrokers.com 949-770-7451 Scan to inquire Western U.S. Import Stores Available • Top sales performers • Strong community reputation • Excellent market, Auto Mall NBB is a proud member/sponsor of the NCDA of B.C. NationalBusinessBrokers.com info@nationalbusinessbrokers.com 949-770-7451 Scan to inquire Western U.S. Import Stores Available • Top sales performers • Strong community reputation • Excellent market, Auto Mall NBB is a proud member/sponsor of the NCDA of B.C. NationalBusinessBrokers.com info@nationalbusinessbrokers.com 949-770-7451 Scan to inquire Western U.S. Import Stores Available • Top sales performers • Strong community reputation • Excellent market, Auto Mall NBB is a proud member/sponsor of the NCDA of B.C. NationalBusinessBrokers.com info@nationalbusinessbrokers.com 949-770-7451 Scan to inquire Western U.S. Import Stores Available • Top sales performers • Strong community reputation • Excellent market, Auto Mall NBB is a proud member/sponsor of the NCDA of B.C. NationalBusinessBrokers.com info@nationalbusinessbrokers.com 949-770-7451 Scan to inquire Western U.S. Import Stores Available • Top sales performers • Strong community reputation • Excellent market, Auto Mall NBB is a proud member/sponsor of the NCDA of B.C. NationalBusinessBrokers.com info@nationalbusinessbrokers.com 949-770-7451 Top 10 paid-out vehicles, Q4 2022 CleanBC Go Electric submitted claims—total applicants Year BEV ER-EV FCEV PHEV Grand Total 2020 8843 16 2345 11204 2021 11999 20 4236 16255 2022 9070 10 9 2993 12082 Grand Total 29912 46 9 9574 39541 New Vehicles Added to the Program • Subaru Solterra AWD • Lexus RZ BEV s New Model 3 562 Bolt, 175 RAV4, 33 Escape, 42 Leaf, 51 Mustang, 53 Prius, 56 Cooper BEV, 64 IONIQ 5, 77 Kona, 98

The CleanBC Go Electric Program’s VW ID.4 parked on February 6 in front of the Legislature, where the NCDA was represented in Victoria at the Throne Speech and opening of the 4th session of the 42nd BC Parliament.

21 newcardealers.ca

Uncover the Cybersecurity Risks Hiding in Your Dealership

All businesses face threat of cybercrime

Running a successful dealership means striking a balance between investing in increasing sales and investing in other departments, such as IT.

One of the threats facing all businesses, including dealerships, is cybercrime—and your dealership being targeted is a matter of when, not if. Investing in cybersecurity is necessary to protect the entire enterprise, and to get the most out of your spending starts with an assessment.

The first thing to look at is which pieces of data and information are the most important to protect. These are “crown jewels,” data which, if compromised, would bring significant financial and/or reputational harm to your dealership. Cost-efficient cybersecurity requires you to focus on the crown jewels, because protecting all your data equally is too expensive and time-consuming.

Your clients’ personal and financial data tops the list. Protecting employee passwords and devices would be next. Data regarding product prices, employee compensation, emails, inventory and parts suppliers, et cetera, may seem crucially important on the surface, but a breach of this data is not likely to cause substantial harm to your dealership.

The next step is to look at where your dealership is most exposed: don’t just consider which types of attacks are most frequent, but which are the most likely to be successful.

Fraud

A common example of fraud is where an attacker fakes an identity as one of your suppliers, then alters the payment information to redirect funds. Victims lose twice here; they lose funds to a fraudster and become delinquent to their true supplier.

Third parties

Another area of exposure is through third parties, like insurers. Sensitive information gets passed between your dealership and your vendors; one mistake and your data can become compromised, leaving your dealership open to a breach. Internal staff

Finally, your staff can be a source of a cyber breach. You should include a review of your internal cyber awareness training.

Insurance

Does your policy include provisions for cybersecurity? Some policies do, others don’t.

Cyber awareness training

The most cost-efficient investment you can make is simply ensuring your staff understand these fundamentals:

Continued on next page

SPONSORED CONTENT

You deserve maximum performance from your business. For more than 20 years, MNP has been helping auto dealerships of all sizes provide for the present and plan for the future. The right advisor can help you navigate the challenges of a competitive industry and drive consistent results. Chris Schaufele, CPA, CA National Dealership Services Leader 604.536.7614 | chris.schaufele@mnp.ca Unlock your auto dealership’s full potential MNP.ca

22 Signals Magazine Winter 2023

Continued from page 22

• understanding what constitutes a strong password, and using it;

• recognizing email phishing attempts;

• securing hardware like company laptops and phones;

• keeping company data off personal devices; and, using secure wi-fi.

Incident response plan

If you are the victim of a cyber incident, a crisis response plan can be the difference between minimal damage and worst-case scenarios. Your plan should provide a step-by-step outline of how to react to a cyber incident: how to shut down devices, contact external counsel and keep damage to a minimum.

Technology

Part of your assessment should be to make sure you have the right cybersecurity tools for your dealership. That doesn’t always mean the most expensive or sophisticated; you can save money by having the appropriate software for your need, and the right staff and processes behind it.

MNP Digital offers a leading team of cybersecurity advisors who intimately understand dealerships. When you’re ready to conduct your assessment, MNP is here to work alongside you, to make sure it gets done right.

To learn more, contact Chris Law, Partner at MNP Digital, at 604.817.4852 or chris.law@mnp.ca.

Clarify Group Inc. Enough? Are you www.clarify.group To learn more contact Darren Slind dslind@clarify.group 647 294 3033 What describes a great customer experience? TEFF. Transparent, Efficient, Flexible and Facilitated. Would customers describe your brand experience that way? From retail standards, EV readiness to TEFF assessments, in-dealership coaching and measurement, Clarify has the tools and expertise to get you there. After all, satisfying customers is TEFF. ARE YOU HAPPY WITH YOUR F&I PER-CAR AVERAGE? Our products have no maximum mark-up and no start-up costs It is easy to bundle with other programs you already offer There is no waiting period - Claims can start as soon as the contract is signed Worry-Free Programs - Our live warranty team will take care of all the claims across Canada & US thesmartprogram.ca WE CAN HELP YOU GROW YOUR PROFITS EXPONENTIALLY! PARTNER WITH US! Lee Klingspohn C:778-239-1567 lee@TheSmartProgram ca Joe Craven C:778-840-9670 joe@TheSmartProgram ca BC EAST BC WEST 23 newcardealers.ca

Significant Changes Made to the BC Workers Compensation Act

Bill 41 ups employers’ responsibilities

BY CHRIS DRINOVZ, KSW LAWYERS EMPLOYMENT, LABOUR & DISABILITY GROUP

With the many recent significant changes to the workers’ compensation system, it has never been more important to understand an employer’s obligations under the BC Workers Compensation Act (WCA). Bill 41-2022: Workers Compensation Amendment Act (No. 2) (Bill 41) received royal assent on November 24, 2022, and contains further amendments to the WCA that increase employers’ obligations to injured workers.

By way of background, since 2018, the BC Ministry of Labour has commissioned five lengthy and comprehensive reports reviewing various aspects of the compensation system. In the summer of 2020, the provincial government started implementing some of these recommendations through amendments to the Workers Compensation Act. The amendments included increased worker benefits, COVID-19-related amendments, as well as new tools added for criminal prosecutions for serious health and safety violations.

Most of the amendments introduced with Bill 41 originate from the Workers’ Compensation System Review by Janet Patterson, a 517-page report released in October 2019, containing 102 recommendations. It expanded on the “worker-centered approach”—Patterson is a former labour lawyer with a strong connection to the BC Federation of Labour.

Duty to accommodate and return injured workers to work

Most notably, the Bill 41 amendments establish a new legal duty requiring employers to re-employ injured workers and make any necessary changes to the work or workplace to accommodate their successful return to work, up to the point of undue hardship.

This new duty to accommodate is separate from any obligations under BC’s Employment Standards Act, any employment or collective agreements, or the existing accommodation duty under the Human Rights Code, meaning employees will have the option of filing a claim with the Workers’ Compensation Board or a complaint with the Human Rights Tribunal (or possibly both) in connection with termina-

tion and accommodation issues relating to a work-related illness or injury.

In particular, employers and workers will be required to work together, as well as with the Workers’ Compensation Board to facilitate the worker’s return to their pre-injury work, if possible, or to other suitable work if not.

The reciprocal duty to cooperate between the employer and the worker includes:

• contacting each other as soon as practical after the injury and maintaining communication;

• identifying suitable work for the worker that, if possible, restores the full wages the worker was earning pre-injury;

• informing the board of the worker’s return to or continuation of work; and

• responding to any requests of the Workers’ Compensation Board.

If the parties cannot come to a resolution on their own, they can each lodge complaints to the Workers’ Compensation Board for failure to cooperate, and the board must make a decision on the matter within 60 days.

Duty to maintain employment

This duty applies only to employers with 20 or more workers, and in respect of workers who have been employed by the employer for at least 12 continuous months, and who have been unable to work as a result of a work-related accident.

The duty to maintain employment includes:

• Where a worker is “fit to work,” but cannot carry out the essential duties of their preinjury work, the employer must offer the worker the “first suitable work that becomes available.”

• Where a worker is fit to carry out the essential duties of their pre-injury work, the employer must either (a) offer the same pre-injury work to the worker, or (b) offer the worker alternative work “of a kind and at wages that are comparable to the worker’s pre-injury work and wages from that work.”