Demystifying Accounts for Small Businesses.

The must have guide for non-financial business owners and decision makers

Simple explanations, tools, tips and strategies to help your transform your business growth capability

Elaine Herlihy

Simple explanations, tools, tips and strategies to help your transform your business growth capability

Elaine HerlihyJoin Elaine Herlihy, a seasoned chartered accountant, as she takes you on a transformative journey through the intricacies of financial accounts With more than a decade of industry experience, Elaine's passion and unwavering dedication lie in empowering non-financial managers to grasp and navigatethecomplexitiesoffinance

Drawing upon her extensive work with clients from diverse backgrounds, Elaine possesses a profound understanding of the unique challenges faced by small businesses Now, she brings her expertise and perspective directly to you through thiscompellingebookseries

Unlock the secrets of finance and accounts with Elaine's expert guidance, as she breaks down complex concepts into clear, accessible language From financial statements to budgeting and beyond, this series equips non-financial managers everywhere with the essential knowledge and skills needed to confidently tackle financialmatters

Immerse yourself in this invaluable resource authored by Elaine Herlihy herself, and embark on a transformative journey towards financial literacy Let this ebook series be your trusted companion in demystifying finance and accounts, empowering you to make informed decisions and drive success in your professionalendeavors

Let's begin by playing a little word association game What's the first thing that comes to your mind when you hear the word "finance?" Is it long, boring meetings? Or is it perhaps complicated spreadsheets filled with numbers that look like they're dancing a complex waltz? Maybe it’s the anxiety of dealing with financial jargon that seems as if it was designed specifically to make your head spin?Ifyouthoughtofanyoftheabove,thencongratulations,you'renotalone!

But what if I told you that, contrary to these perceptions, finance can be made accessible, relatable, even enjoyable for everyone, including non-finance professionals like you? That's precisely the goal of this chapter, and indeed, this entireebookseries

Just like riding a bicycle or learning to swim, it might seem daunting at first, but once you get the hang of it, you'll wonder why you were ever afraid and burying yourheadinthesandinthefirstplace!

Finance is a lot like a mirror It reflects the activities of every part of a business, from marketing and sales to operations and human resources Every decision made, every action taken in an organisation has a financial impact Understanding finance gives you the ability to 'read' and understand this mirror, providing you with valuable insight into the healthanddirectionofyourbusiness

For many businesses, the main goal is typically to maximize the wealth of its owners or shareholders. This is achieved by successfully managing resources to increase the company's value. Good financial management is crucial to achieving this objective, and that's where you come in. As a non-financial manager or leader in a business, you play a pivotal role in steering the course of your organisation. You're making important decisions daily, and these decisions have financial implications, whether you're aware ofthemornot.

Having a grasp of finance won't just help you understand how your decisions impact the company's bottom line, but it will also make you a more effective leader. By understanding the financial implications of your choices, you can make better, more informed decisions that can lead to improved performance and value creation for your organisation.

It starts with understanding the three key financial statements: the balance sheet, the profit and loss (sometimes called the income statement), and the cash flow statement These are the trinity of financial management, providing a comprehensive snapshot of a company's financial health at any given point in time We'll be diving deeper intotheseinthesubsequentchapters

But finance isn't just about these financial statements It's also about understanding key concepts like profitability, liquidity, efficiency, leverage, and investment return It's about being able to analyse these concepts, understanding what they're telling you, and then using that understanding to guideyourdecision-makingprocess

On this exciting journey, we're going to break downthefinancialjargon,bustthemyths,and simplify the complex concepts But more than that, we're going to make finance something that you, as a non-financial manager, can use as a powerful tool in your toolkit We're going to make finance your new secretweapon

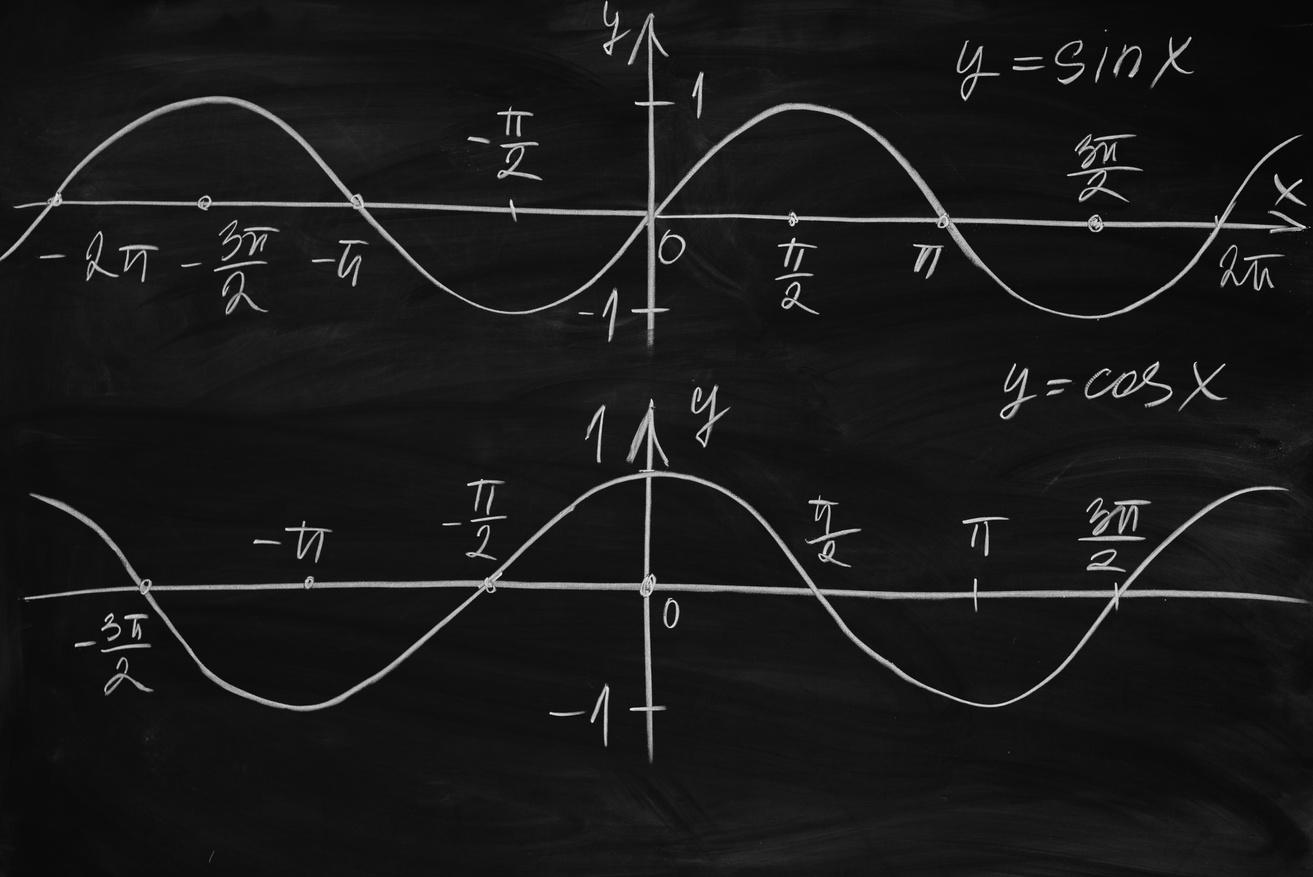

Myth 1: "You need to be a math whiz to understand finance." Not at all! While it's true that finance involves numbers, most of the math is basic arithmetic So don't worry, there won't be any need for differential calculushere

Myth 3: "Finance is too complex for nonfinance folks." False. Finance can certainly seem complicated at first, but that's just because it's unfamiliar With the right approach, it can be understood by anyone, andthat'swhatthisebookseriesaimstodo

Myth 2: "Finance is boring." Well, that depends on how it's presented Sure, if you're just staring at rows and columns of numbers, it can seem tedious But think of it this waythose numbers are telling a story about your business Andwhodoesn'tloveagoodstory?

Myth 4: "Accounting and Finance are the samething" False It can be a bit confusing since these two fields often intersect and share several similarities However, they are distinct disciplines each with its own functionsandfocus

Two sides of a coin

Accounting is a discipline that involves recording, interpreting, classifying, analysing, reporting, and summarising financial data Its main purpose is to track a company's financial transactionstoprovideanaccuratepictureofthecompany'sfinancialhealth

4.

FinancialAccounting: This form focuses on the reporting of an organisation's financial information, including the preparation of financial statements, to the external users suchasinvestors,regulators,andsuppliers

Management Accounting: This form focuses on the measurement, analysis, and reportingofinformationthatcanhelpmanagersinmakingdecisionstofulfillthegoalsof anorganisation.

Accounting results in the production of financial statements such as the balance sheet, profit and loss report, and statement of cash flows There are different types of accounting includingfinancialaccounting,managementaccounting,taxaccounting,andauditing 1 2 3.

Tax Accounting: This form helps businesses follow rules set by tax authorities. It includes tax planning and preparation of tax returns. Remember though this is tax avoidancenottaxevasion!

Auditing: This is the independent examination of a company's records and transactions to ensure accuracy, honesty and conformity with laws, regulations and accounting standards.

Finance, on the other hand, is a broader concept that describes the management of funds, including activities such as investment, borrowing, lending, budgeting, saving, and forecasting

Corporate Finance: This deals with the sources of funding, the capital structure of corporations, and the actions that managers take to increase the value of the firm to theshareholders

Investments: This involves identifying the best investment opportunities, creating a balancedinvestmentportfolio,andmanagingrisk

Finance focuses more on the planning and direction of financial resources and investments It involves evaluating the risks and returns of different investment options, planning for short and long-term needs, and making decisions about how to allocate resources 1 2 3

Financial Markets and Institutions: This involves looking at the global financial environment and understanding how money, interest rates, and commodities are traded

While accounting mainly focuses on the past and records the company's financial transactions, finance is forward-looking and uses the data from the accounting records to make future financial decisions for a company. As a manager, understanding both these fields can help you in strategic planning, decision-making, risk management, and overall better management of yourbusinessorteam

Revenue:Thisisthetotalamountof moneyyourcompanyearnsfromits operations,typicallyfromthesaleof goodsandservices It'soften referredtoasthe"topline"because it'susuallylistedfirstonanincome statement.AlsoknownasSalesor Turnover

Expenses:Thesearethe costsincurredbyyour companyintheprocessof generatingrevenues,suchas wages,rent,marketingcosts, andutilities

Profit:Alsoknownasnetincome, profitistheamountofmoneyleft overafterallexpenseshavebeen subtractedfromrevenue Thisis oftenreferredtoasthe"bottom line "

DirectCostsorCostof Goods:Costsspentto maketheproductyousellor theserviceyouprovide

CashFlow:Thisreferstothe inflowandoutflowofcashinyour business Positivecashflow meansmorecashiscomingin thangoingout,asignofahealthy business

OperatingExpenditure(OpEx): Thisisthemoneythata businessspendsonaday-todaybasisforrunningits operations,likesalariesand rent Thisisalsoreferredtoas "Overheads"or"IndirectCosts"

IncomeStatement:Also knownasaprofitandlossor P&L,thisshowshowmuch profitorlossacompanyhas madeoveraperiodoftime

BalanceSheet:Afinancial statementthatreportsa company'sassets,liabilities, andshareholders'equityata specificpointintime

CapitalExpenditure(CapEx): Thesearefundsusedbya companytoacquire,upgrade, andmaintainphysicalassets suchasproperty,buildings, technology,orequipment

Budget:Afinancialplanfora definedperiod,oftenone year Itgreatlyenhancesthe successofanyfinancial undertaking.

FixedAssets:Theseareresources ownedbyacompanythatcanbe convertedintocash,providefuture benefits,orreduceliabilities Assets canbebothtangible(physical,like buildingsandequipment)andintangible (non-physical,likepatentsand trademarks)

Capital:Thisisthemoney investedinabusinessthatallows ittobuywhatitneedstooperate Itcancomefrominvestments, profits,orloans.

CurrentAssets:Resources ownedbyacompanythat areexpectedtobeusedor convertedtocashwithin oneyear Suchitemslike stock,cash,moneyowed fromcustomers

Currentliabilities: Obligationsthatacompany needstopayoffwithinone year Theseincludethings likemoneyowedto suppliers,shorttermloans, PAYE/VATduetoHMRC

ReturnonInvestment(ROI):This measuresthegainorlossgeneratedon aninvestmentrelativetotheamountof moneyinvested Itisusedtoevaluate theefficiencyofaninvestmentor comparetheefficienciesofdifferent investments

Longtermliabilities: Obligationsthatacompany needstopayoffinone yearstimeormore This couldincludepaymentsfor aloanthatareduein12 monthsplus

Equity:Alsoknownasnetassetsor shareholders'equity Insimple terms,it'stheamountthatthe owners(shareholders)would theoreticallygetifallassetswere soldandalldebtspaidoff

Liquidity:Ameasureofthe easewithwhichanasset,or security,canbeconvertedinto readycashwithoutaffectingits marketprice

Double-entry bookkeeping is a fundamental concept in accounting where every financial transaction impacts at least two accounts - one account gets a debit entry, while another gets a credit entry.

These entries are of equal amounts, maintaining a balance in the accounting equation,whichis:

Assets=Liabilities+Equity.

It's crucial to note that the debit and credit terms don't carry their usual connotations of positive and negative or good and bad They're simply accounting terms Double entry is one of the hardest concepts in accounting to get your head around, as it goes against whatmakessense.

The table below helps explain whether you debit or credit each of the 4 account types to increaseordecreaseit

Debit

Credit

Debit

Credit

Liabilities

Assets Expenses

Credit

Debit

Credit

Debit

Assets and Liabilities are from the Balance Sheet and Revenue and Expenses are from theProfitandLossAccount We'llgointothisinmoredetailinlaterchapters

Assets: When an asset account increases, it's recorded as a debit When an asset accountdecreases,it'srecordedasacredit

For example, if a company purchases new equipment with cash, the 'Equipment' account (an asset) would be debited (increased), and the 'Cash' account (also an asset) would be credited(decreased)

Expenses: Expensesareincreasedbydebitsanddecreasedbycredits

For instance, if a company pays rent for its office, the 'Rent Expense' account would be debited(increased),andthe'Cash'account(anasset)wouldbecredited(decreased).

Liabilities: When a liability account increases, it's recorded as a credit When a liability accountdecreases,it'srecordedasadebit

For example, if a company borrows money from a bank, the 'Bank Loan' account (a liability) would be credited (increased), and the 'Cash' account (an asset) would be debited(increased)

Let'sbreakitdowninadifferentway:

Imagine you own a business and you purchase a piece of equipment for £5,000 In the worldofdouble-entrybookkeeping,twothingshappen: 1 2

Your "Equipment" account (an asset) increases by £5,000 This is a debit because assetsincreasewithdebitentries

If you paid in cash, your "Cash" account (another asset) would decrease by £5,000 Thisisacreditbecauseassetsdecreasewithcreditentries.

So, you can see that there are always at least two entries (double-entry), and the total debitsequalthetotalcredits

This method gives a complete picture of all financial transactions and helps to check the accuracyofaccounts Tosumup,indouble-entrybookkeeping,everytransactionaffects at least two accounts, and the total debits must equal total credits This ensures the accounting equation (Assets = Liabilities + Equity) remains balanced If it doesn't balance,itindicatestheremaybeanerrorintherecord-keeping.

Here'sthetableagainforyou

These basic terms and principles form the foundation of finance and accounting They are key to understanding how money is managed and utilised, be it by individuals or businesses

Mastering these will not only allow you to understand the world of finance better but alsoenableyoutomakeinformeddecisionsaboutmanagingresources

Remember, as a non-financial manager, your role in finance is not to become an accountant or financial analyst, but to understand the financial implications of your decisions and to communicate effectively with the financial professionals in your organisation

This is just the beginning of your financial education As we delve deeper into the following chapters, we will start exploring each of these aspects in detail, teaching you how to interpret financial information, make projections, and understand the financial impactofyourmanagerialdecisions

Welcome aboard this nautical adventure! The ocean of finance may be as vast and complex as the sea, with currents as unpredictable as the movement of whales, but understanding the basic navigation tools will guide you safely through these waters.