8 minute read

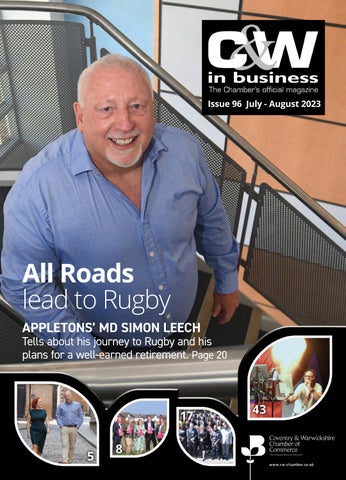

All roads lead to Rugby

For more than 30 years, Simon Leech has been one of the most recognised faces in business in Rugby.

In fact, you could be forgiven for thinking that he is a born and bred Rugbeian such is the role he has played in the town for the last three decades.

But Leech – who is due to retire this year after being at the helm of well-known insurance company Appletons, previously Perry Appleton – had a more protracted route to Rugby, via Hull, Southport and Australia!

“I was born in Hull,” he said. “And that’s where I grew up apart from a period aged six to 12 when we lived in Australia.”

His family was the archetypal ‘Ten Pound Poms’ who, in the 1960s, headed down under to try to make enough money to then return to England and be able to buy a house.

His dad worked in a mine and, over six years, built up enough capital to stay true to the plan, go back to Hull and get a place in the countryside.

But it was enough time in Oz to make a lasting impression on Simon and teach him a valuable life lesson.

“I remember quite a lot about Australia,” he said. “We didn’t see a TV while we were out there. We got up in the morning, pulled a pair of shorts and a t-shirt on, went to school – mainly bare-footed – and then didn’t get back until teatime. After tea, you went back out until it was dark.

“We were playing sport, in swimming pools, on bikes, climbing hills, firing catapults at lizards – just anything you could think of that involved playing outdoors.

“Then, after six years we were coming home.

“I can remember coming back by boat – it took several weeks. We went through the date line and stopped off at places like Tahiti.

“We arrived back in England right at the end of 1969. We were back in Hull. My dad stayed in Australia for six more months but he had raised enough money to buy a house in England.

“I’ve thought about this a lot and I think they should have stayed. I was proper Aussie by then, so much so that my nickname at school when we came back to England was Skippy!

“It made me realise that’s it good to have a plan but when you do something over a long period of time it doesn’t mean you can’t amend it. My parents often said: ‘why did we come back?’ They’d built up a life out in Australia, we as kids were happy and they came back to England simply because that was the plan.

“It’s on my bucket list to go back there for a holiday. I want to see where I lived but I’ll time it for when there is a British Lions rugby tour!”

Simon, it’s fair to say, hadn’t done too much planning himself for life after school.

He left at 18 and says he wasn’t clever enough to go down his chosen path of forensic science or veterinary surgery.

“I was told it was pointless so I left school and I got offered two jobs straight away,” he said.

In a ‘Sliding Doors’ moment, Leech had the opportunity to go into insurance or accountancy with businesses which, by total fluke, were based opposite one another in Hull.

His decision would lead to 45 years in a sector that he grew to love, a move to the place he would eventually call home and also the meeting of his future wife – all life-changing stuff based on the way the two businesses sold him a job.

“In the accountancy interview, they kept pressing on me how important it was to do the exams and go to college,” he said. “At 18, that didn’t really excite me! On the insurance side, it sounded more varied. They wanted you to do the exams but it didn’t seem to be the sole focus.

“So, I chose insurance and I didn’t know what I was letting myself in for. I joined Commercial Union, which is now a part of Aviva.

“They’d just started a new learning programme where, over two years, the intake around the country would learn a little bit about everything.

“Every time you went into a department, you’d go on a course that would take a week and at the end of the week you’d do an assessment and then go into that team. Then you’d move to a different department and repeat.

“You went around every division and, by the time you’d done two years, you had done a bit of everything and then went through an assessment that would look at your strengths and weaknesses, which would arrow the direction of your career.”

Simon was earmarked for the commercial team and he was eager to get started but his anticipation of a company car and a client-base of his own were not immediately forthcoming.

Within 18 months, however, he was off and running and was looking after a group of previously ignored brokers, which led to an uptick in business.

“I’d be mentioned in dispatches to the rest of the team,” said Leech. “They were being asked how come ‘a kid like Simon’ was going out and getting business with these brokers when the old guys had never bothered with them.

“I was given a lot of stick by the older blokes because I was showing them up. It gave me the opportunity to say that I wanted my own patch, with my own brokers.”

But there was no such opportunity in Hull and so he applied to other offices around the country and, eventually Simon and by now, his first wife, moved across from Hull to the North West.

“I ended up in Southport and my wife moved to the Liverpool office,” he said.

“We had three years there and had a fantastic time. We got a cheap mortgage from Commercial Union so I got a nice house on the sand dunes of Ainsdale! My wife was happy in her job and it was great but I started to get itchy feet.

“I wanted to be the one out meeting the clients but that was the job of the broker so I started to look around and got chatting to some brokers I dealt with, essentially asking them for a job!”

An opportunity came up in Northampton with a company called Perry Hawkings, which wanted to add an insurance offer to its financial services business.

“I was 27 and full of confidence, full of BS,” said Simon. “I met them and told them I could do everything and, after the first interview, they told me to come back with a business plan on how it would work.

“I drove back to Southport with no idea what they meant! I’d met three guys I’d never seen before, in a town I’d never been to before, and none of them knew anything about insurance.

“So, I worked out a budget that would be cost neutral to me. We set up a separate company called Perry Hawkings (Insurance Services) Ltd and then the idea was that I’d just go and find some clients.

“There was one flaw in my business plan. I hadn’t considered that just because you’ve got a client that buys pensions and investments with you, it doesn’t mean they will buy insurance through you.

“They might have just renewed or they have a broker who has a team of 25 people. They were asking why, essentially, they should buy from a one-man band.

“I saw a lot of people but wrote very little business.”

An office move to Rugby from Northampton in 1987 would be a defining moment in the company’s history and in Simon’s life and career.

He was in charge of the office refurbishment and opening, which was attended by local media and regional professional services businesses.

The power of networking – which would eventually lead to Chamber membership and Simon becoming the regional branch chair for several years – was becoming apparent.

“I joined Roundtable,” he said. “And, to my dying day, I’ll say it was one of the best things I ever did from both a personal and a business point of view.

“I made great friends and have also done lots of business that way. Just like when we joined the Chamber.

“People say to me now that I’ve got a great business that I’ve built up over the years but they don’t know the difficulties we had in those early years. We were bumbling along on the bones of our backside for so long but eventually we started to get referrals and it took off.

“I knew the power of getting out and meeting people. I’d go to the opening of an envelope if it meant I could do some networking.

“The insurance side got bigger and bigger and so did financial services.”

Perry Hawkings merged with H Appleton & Son in 2000, which strengthened the insurance offer and led to an office move to prestigious premises in Rugby with the overall business employing more than 20.

As well as growing the business, Leech was regularly speaking up on business issues in the town in his role as Chamber branch chair, including leading a campaign to improve the Catthorpe Interchange.

“Of course, there are advantages to the business when you have a role like that,” he said. “But I was doing it because I was keen to play a role in improving the town and the borough.”

In late 2018, Simon’s fellow shareholders in what was now Perry Appletons decided they want to sell their shares in the insurance side of the business.

It led to the company being acquired by a national business called Ethos – just as the country was heading into lockdown.

Soon after, every member of staff in the Ethos group was sent an email to say they needed to attend an urgent Teams meeting at 5pm on a Friday afternoon.

“I was thinking ‘whoa’,” he said. “We’re in lockdown, we’ve recently been acquired and we’re suddenly being asked to go on a call.

“It turned out it was our MD announcing that Ethos themselves was being acquired by Ardonagh Group and the reason they were telling us on a Friday was that it was going to be announced to the Stock Market on Monday morning.”

Ardonagh, it turned out, is a huge international insurance firm employing more than 10,000 people worldwide and meant Simon would see out his final days in business in a company 500 times the size of the one he was used to.

“In this last three years, there have been far more advantages being part of a bigger group than if we’d have been on our own during Covid,” he said. “It would have been an even tougher time.

“All of the decision making was taken for us around working from home. Laptops had become a major issue because everyone wanted to get hold of them and couldn’t but our group had thousands of them and distributed them out to everyone in the team.”

And, in the blink of an eye, he’s now all set for retirement.

“I’m a new grandad, I have a big garden and I’ve got a place in Mallorca so I will definitely not get bored,” he said. “I’ve been doing this since 1987 with this company and nine years prior to that with Commercial Union, which isn’t a bad stint.

“Okay, the first year with Perry Hawkings didn’t go anywhere near to plan – the amount of business we did was negligible – and my inexperience shone through, but I think it all ended up working out quite well in the end.”