MALAYSIA: OPPORTUNITIES FOR UK BUSINESSES

Venturing into the Heart of Southeast Asia

Britain in South East Asia

The world is a better place when we exchange what we have.

If not for the trade of eggs and rice, two villages would never have discovered egg fried rice. At Standard Chartered, we believe that wonderful things can happen when trade brings the world together. That’s why we’ve been using our position as a leading trade bank across Asia, Africa and the Middle East to drive global trade for over 160 years. And we continue to do so, even in uncertain times.

See how we’re using our distinctive international network to keep trade flowing at sc.com/hereforgood

Contents 4 Message from Country Director, Department for International Trade, UK 5 Message from Executive Director, BMCC 6 Who we are 7 Why Malaysia? 8 Malaysia - An overview 10 Diverse Blend of UK companies in Malaysia 13 Opportunities for UK businesses 14 Technology 15 Oil and Gas 16 Renewables 18 Advanced Manufacturing 19 Infrastructure 21 Healthcare 24 Education 26 Food & Drink (F&D) and Retail

Message from Country Director, Department for International Trade, UK

I am delighted to provide this foreword on behalf of the Department for International Trade team at the British High Commission in Kuala Lumpur. Our job is to promote and facilitate bilateral trade and investment, with primary focus on increasing UK exports of goods and services to Malaysia. We do this mainly by introducing UK exporters to potential clients and stakeholders, by providing bespoke market research, and through the delivery of events. We also tackle barriers which prevent UK companies from accessing opportunities in the market. UK Export Finance offers its full range of products in Malaysia, including transactions in Malaysian Ringgit, and Sharia-compliant lending.

The United Kingdom and Malaysia have a deep historical and modern relationship, including in business. Malaysia is the UK’s second largest market in South-east Asia. Over 6000 UK companies export goods and services to what is considered a relatively open market, ranked 12 by the World Bank against “Ease of Doing Business” criteria. A large number of British firms have invested here: some, like HSBC, Standard Chartered, Shell and Prudential have been here for generations. In a sign of things to come, BAE Systems (cyber), Ideagen (software development), and Digital World Vision (media) have also chosen Malaysia as their base for operations in the wider region.

This higher middle-income country with a growing population of 32m, offers a wide variety of opportunities to UK companies willing to invest in the development of relationships. There’s strong recognition of and respect for UK brands, across industrial and consumer sectors. English is the language of business and the administrative and legal systems are based on the UK’s. However, companies new to the market will face tough price competition and should realise that very positive negotiations do not always quickly lead to contracts.

DIT’s ongoing export campaigns are focused on Technical & Vocational Education, EdTech, and Trans-national Education; AI, FinTech and Cyber Security; Digital Health and Clinical Partnerships; Rail, Airports and Construction; and Defence & Security. Our delivery partner, the British Malaysian Chamber of Commerce (BMCC), is responsible for helping UK companies in all other sectors. They are currently running initiatives in Oil & Gas Decommissioning; Renewable Energy; and in High Quality Consumer Goods.

Of course, at the time of writing, this part of the world like the UK and everywhere else is fighting Covid-19 and the future remains unclear. The Malaysian government has up to now managed to keep the number of cases under control, including by closing the border to visitors. As the situation eases, I am confident that British businesspeople will be able to travel more freely into and out of Malaysia, to take forward relationships developed online over recent months.

DIT and BMCC would be delighted to help your company. Please don’t hesitate to get in touch.

Deborah Clarke Country Director, Department for International Trade, British High Commission

4

Message from Executive Director, BMCC

Since 1963, BMCC as a bilateral trade organisation has been playing a pivotal role in supporting both UK and Malaysia businesses. The BMCC thrives to provide businesses with high quality networking platforms, branding and exposure opportunities, trade services as well as industry advocacy, serving as a voice to the business community, comprising of large multinational companies (MNCs), as well as small to medium enterprises (SMEs).

Malaysia’s numerous often global headline catching economic endeavours have been a testament to its ambitious appetite to become an internationally recognised player. A country that can be described as one that continuously yearns to punch above its weight across the multitude of home-grown industries, with an unwavering attitude that has fuelled its modern era development thus far. Malaysia’s business etiquette and cultural values are derived from the relationship of Asian traditions with the inherited virtues of British governmental, legal and educational systems adopted as a result of the intimate past shared by both countries.

The on-going robust bilateral trade and investment relations between the UK and Malaysia that has been nurtured through a long historical context continuously creates a vast array of opportunities for businesses of both countries. Despite the challenging environment caused by the global pandemic in 2020, Malaysia continues to remain a resilient and preferred destination for British export and investment.

Being the official Overseas Partner Delivery (OPD) in Malaysia for the Department for International Trade, the BMCC through our trade team is proud to be a part of the achievements in supporting and guiding UK companies. We are even more ready now to support UK businesses expand to Malaysia especially during these uncertain times. Our trade team members who are equipped with relevant knowledge and experiences across industries are ready to advice and support UK companies who are seeking opportunities to the market, including facilitating business matching with local partners. As emerging markets compete to make their mark in the global arena, Malaysia will continue to become a regional powerhouse in the years to come. BMCC eagerly invites UK companies and is ever-willing to play an active role towards providing relevant services in realising these flourishing ventures.

This tailor-made publication serves as a guide to showcase Malaysia as a country of good opportunities for UK businesses and provide a clearer understanding for companies keen to expand their businesses into this strategic part of Southeast Asia.

Jennifer Lopez Executive Director, British Malaysian Chamber of Commerce

5

Who We Are

Established in 1963, the British Malaysian Chamber of Commerce (BMCC) has been driven by the sole ordinance of advancing bilateral trade relations between the United Kingdom and Malaysia. Over the past five decades, the BMCC has been a catalyst in providing businesses with networking events, branding and exposure, trade services and industry advocacy. Today, with a network of 270 member companies across a wide range of industry sectors, the BMCC has firmly rooted itself as one of Southeast Asia’s most prolific Chambers.

Key offerings of the Chamber :

Networking & Events

Diverse selection of industry driven and social events annually to broaden your network

Branding & Exposure

Branding avenues on multiple platforms to elevate profile

Trade Services

Tailor-made support services for British companies looking to bring their business to Malaysia

Industry Advocacy

Bridging the gap between Government and industry by facilitating sector-based dialogues

Venturing into an overseas market can be a challenging task especially when a company is unfamiliar with that market. Our experienced sector specialists are able to aid new UK ventures into Malaysia by offering professional advice to mitigate any qualms a company may have on operating in our market. Each response is tailor-made with the utmost relevance and accuracy, and serves as a preliminary introduction to doing business in Malaysia.

To learn more about the services we offer to help kick start your business in Malaysia or elevate it to the next level, contact our Trade team at: trade@bmcc.org.my +603 2163 1784

The BMCC is the official delivery partner of the Department for International Trade (DIT), UK in Malaysia.

6

Why Malaysia?

Vibrant Business Environment

Market-oriented economy

Affinity towards British-made Goods & Services

Well-developed financial system

Wide use of English especially in business

Legal & accounting practices similar to UK

Low cost of doing business

Educated Workforce

Talented, young and educated workforce

Multilingual workforce speaking 2 or 3 languages (English is the second language)

Harmonious industrial relations with minimal trade disputes

Supportive Government Policies

Pro-business policies

Responsive Government

Attractive tax & other incentives

Liberal exchange control regime

Intellectual property protection

2nd most developed nation in Southeast Asia

Developed Infrastructure

Network of well-maintained highways and railways

Well-equipped airports and seaports

High quality telco network and services

Fully developed industrial parks including free industrials zones, technology parks and multimedia super corridors

2019: Best Countries to Invest in or Do Business In Award 2019: Protecting Minority Investors 2019: Most Visited Cities 2019: Fastest Growing Emerging Market Economies 2019: Ease of Doing Business 2019: Most Competitive Economy CEOWORLD magazine Awarded by Oxford Economics The World Bank IMD World Competitiveness Yearbook (WCY) Euromonitor International The World Bank 1st Global Ranking 22nd 12th 10th 5th 2nd 7

Malaysia: An Overview

As one of the emerging markets in Southeast Asia, Malaysia has become the gold standard for developing countries in the region. Malaysia’s multifaceted economy has a thriving service and manufacturing industry that has been cultivated and fostered by foreign direct investments which continues to create and sustain a plethora of investment and business opportunities.

With a stable political landscape, a legal and educational system that is compatible with that of the UK and overall economic maturity, Malaysia is a conducive investment destination that remains significantly unsaturated.

Key Highlights: 05 Your gateway to ASEAN 04 Skilled talent pool and continuous government efforts to upgrade on talent 03 Strong focus on digital infrastructure and transformation 02 Shift to more service, knowledge & innovation-based economy 01 Domestic consumption a key driver of growth 8

The BMCC is a member of the BiSEA (Britain in South East Asia) network, a group of 10 British Chambers and Business Groups in the South East Asian region. The geographic footprint of BiSEA provides a strong network in the region, to further facilitate opportunities for UK businesses.

Strategically located in the heart of South East Asia, Malaysia is a preferred gateway for companies when it comes to accessing other ASEAN markets. Having established strong relationships with fellow British Chambers & Business Groups in ASEAN through the BiSEA network, the BMCC serves a vital purpose. We function as the preferred business partner for UK business in Malaysia, and as a validated contact in ASEAN to provide guidance, information, and services.

Population 32 Million Languages English, Malay, Mandarin GDP US$ 358 Billion GDP Growth 4.3% (2019) Income Per-Capita US$11,373 Inflation 0.88% (2019) Unemployment 3.3% (2019) Labour Force 15.2 Million

Britain in South East Asia 9

A Diverse Blend of UK Companies in Malaysia

10

Opportunities for UK Businesses

Technology

The advancement of technology plays a vital role in providing for the modern day requirements of consumers and businesses as well as contributing to the growth of Malaysia as an industrialised nation. Being one of the most technologically developed countries amongst industrialising nations in the ASEAN region, the government’s persistent drive to engage modern technologies has proven to be a great advantage since the early 1990s. Moreover, to ensure that the ICT industry in Malaysia continues to flourish, the government is intensifying efforts to digitalise the economy with a target date of 2020. There is significant growth and opportunity in Big Data Analytics, IoT, Cyber Security, Artificial Intelligence, 5G, Fintech, eCommerce, Smart Cities and Cloud and Data Centres.

Current Development:

• Big Data Analytics (BDA): Malaysia is one of the few countries with a structured roadmap to tap into the value of BDA. With support from the Malaysia Digital Economy Corporation (MDEC) to drive BDA in Malaysia, the ASEAN Data Analytics eXchange (ADAX) was established - a regional platform to bring together innovative talent development models to showcase the latest BDA technologies.

• 5G in Malaysia: On April 2019, the first 5G test bed was held in Putrajaya and Cyberjaya. The test was carried out to explore the practical uses and methods to implement 5G as well as to learn and iron out policies, regulations and spectrum planning of 5G.

Government Initiatives:

• Malaysia is home to over 200 industrial estates and parks. Specialised parks include (23 halal parks, Kulim Hi-Tech Park, Technology Park Malaysia and Rubber City etc), 18 Free Industrial Zones (FIZs), a Digital Free Trade Zone (DFTZs) and a Multimedia Super Corridor (MSC) - a special economic zone and high-technology business district.

• Malaysia Tech Entrepreneur Programme (MTEP) is an initiative by MDEC and the Government of Malaysia to attract tech-savvy and aspiring entrepreneurs from around the globe to Malaysia to setup startups and expand their businesses in the ASEAN region.

• A National AI Framework is being devised to develop an AI eco-system, which will act as a catalyst for the adoption of technology to drive efficiencies across key industries.

The UK is supporting Malaysia by sharing knowledge, feeding into the development of strategies and action plans which should create more opportunities for UK companies.

Opportunities for Global Players:

• A 5G Task Force has been established, and early priorities include working with other Ministries and agencies to attract 5G players to participate in the test bed programme. There are opportunities for foreign companies to demonstrate 5G technologies, and those with applications which can effectively utilise a 5G platform.

• Banks are now seeking mobile banking applications.

• Cloud computing has opened opportunities for more applications for integration.

• There are major opportunities for foreign companies to assist in the delivery of cybercrime/police training, wider talent development, and in educating citizens and industries.

• Also opportunities for industries catering to Islamic banking and insurance, and Islamic-based applications such as halal tracking and halal product supply chain.

| Opportunities for UK Businesses 14

Oil and Gas

Accounting for 20% of the national GDP, the oil, gas and the alternative energy sector plays a vital role in Malaysia’s economy. The growth rate of this industry is expected to be at 5% annually. All oil and gas resources in Malaysia are vested in the state-owned oil company, PETRONAS.

Opportunities for Global Players:

• Oil Storage & Trading:

Malaysia is setting up its own oil storage and trading hub across the country to complement the storage and trading hubs in Singapore.

• Rejuvenation & Recovery:

Heavy investments have been made into technologies that will allow the extraction of oil from wells that have been considered matured.

• Decommissioning:

It is the next wave of opportunity for Malaysian oil and gas (O&G) players. More than 20 platforms around Malaysia could be decommissioned in the next five years and the work involves safe plugging of the hole in the earth’s surface and disposal of the equipment used in offshore oil production.

• Remote Monitoring (Integrated Operation): This should allow experts residing in any part of the world to be connected and reduced additional manpower requirement on the rig.

• Well services, intervention and stimulation services: Malaysia welcomes more self-operated companies for these types of services to be established in the country. Most of the oilfields are ageing with depleting oil production. In order to prolong the brownfield activities, Enhanced Oil Recovery (EOR) and Increased Oil Recovery (IOR) are promoted.

• Offshore fabrications:

Wellhead platforms (WHP), which almost saw a doubling in number of projects and marine vessels, are expected to see a rise in demand for anchor handling tug supply (AHTS), platform supply vessels (PSVs), straight supply vessels (SSVs) and other forms of support vessels.

Opportunities for UK Businesses | 15

Renewables

The Ministry of Science, Technology and Innovation (MOSTI) announced that the country had set a target of 20% of the country’s electricity to be generated from renewable sources by 2025. To achieve this target, it is estimated Malaysia will need RM33 billion (US$8 billion) worth of investments in its renewable energy sector. Malaysia is also set to expedite the potential of its green industry and renewable energy sector in 2020 to attain its objective as South East Asia’s green technology hub.

In line with the aspiration, the government has adopted go-ahead and enterprising initiatives such as improving the Net Energy Metering (NEM) using one-to-one offset basis and Solar Leasing Policy through Supply Agreement of Renewable Energy (SARE).

Opportunities in Alternative Energy for Global Players:

• Global players specialising in Renewable Energy and Energy Efficiency should take the advantage of the benefits from the Green Growth Sector in the country e.g. Feed in Tariff (FiT) and Tax Incentives for Green Industry.

• Companies involved in Waste to

Energy Thermal Plant (WtE) should also take the opportunity and offer their expertise as the Malaysian government is keen to provide support to address the issue of an overcapacity of Municipal Solid Waste (MSW) in the country.

• MOSTI has also set some ambitious renewable energy goals, including a strong determination in reaching the Paris Agreement targets. While half of the equation means expanding installed capacity of Renewable Energy (RE), the other half of the equation means adopting energy efficient practices to conserve energy and make the most use of available RE. In the short run, this could reduce the demand for fossil fuel generated electricity, but in the long run, RE will require to be efficiently used.

The renewable energy policies also had a further boost in Budget 2020 through the Green Investment Tax Allowance (GITA), and Green Income Tax Exemption (GITE). Tax incentives will also be introduced to companies implementing solar leasing activities with income tax exemption of 70 percent for up to 10 years.

The initiatives proved that the government’s vision is in line with the global prospect on renewable energy as according to Deloitte analysis for 2020 Renewable Energy Industry Outlook, the renewable energy industry is primed to enter a new phase of growth in 2020. This is also in line with the Shared Prosperity Vision 2030 (WKB 2030) which also stresses on renewable energy and green economy as two of the 15 proposed Key Economic Growth Activities.

The implementation of the Malaysia Energy Supply Industry 2.0 (MESI 2.0) plan could drive the country to achieve the target. According to the plan, renewable energy generators do not need to sell electricity to Tenaga Nasional Berhad (TNB), the national utility company. The green energy trading could be done through the grid which would create higher competition.

With a series of measures taken by the government to increase public-private partnership and private financing, the country might witness more investments coming from private players in the renewable energy sector which could ultimately propel the growth of the sector and the country might achieve its 2025 target.

| Opportunities for UK Businesses 16

A T X T R A T E G I Z E , W E

O F F E R C U S T O M I S E D

T R A I N I N G P R O G R A M S

D E S I G N E D T O H E L P

Y O U E N H A N C E Y O U R

T E A M ' S S P E C I F I C

S K I L L S E T S

W a n t s o m e t h i n g w i t h a l o c a l f l a v o u r ? T r y o u r

S e k a m p u n g L e a d e r s h i p p r o g r a ml e a d e r s h i p l i f e l e s s o n s f r o m t h e h e a r t o f t h e k a m p u n g . O r m a y b e y o u w a n t t o b e a b l e t o u n l e a s h t h e p o w e r o f u t i l i z i n g d a t a f o r

d e c i s i o n m a k i n g , o u r D a t a S t o r y t e l l i n g p r o g r a m h a s y o u c o v e r e d

S o m e o f o u r c l i e n t s i n c l u d e g l o ba l s e m i c o n d u c t o r m a n u f a c t u r e r s , m u l t i n a t i o n a l p h a r m a c e u t i c a l c o m p a n i e s & m u l t i n a t i o n a l t e c h n o l o g y c o m p a n i e s

L e a d e r s h i p , e m p l o y e e e n g a g e m e n t , r e m o t e t a l e n t m a n a g e m e n t & m o r e , w e ' r e b o u n d t o h a v e s o m e t h i n g t h a t m e e t s y o u r n e e d s

C o n t a c t u s t o f i n d o u t m o r e

X t r a t e g i z e T e c h n o l o g i e s S d n B h d

0 4 - 2 9 3 0 7 2 2 | e n q u i r y @ x t r a t e g i z e . c o m

3 S - 1 2 - 0 9 , P e r s i a r a n K e l i c a p , S e t i a T r i a n g l e ,

1 1 9 0 0 B a y a n L e p a s , P e n a n g , M a l a y s i a

Advanced Manufacturing

The Malaysian economic outlook remains resilient with domestic demand anchoring growth. The GDP expansion of 4.7% (y-o-y) in 2019 is expected to continue with marginal improve to 4.8% in 2020. Notwithstanding the steady economic performance, the balance of risks to outlook remains on the downside as Malaysia has a high degree of openness. In 2020, manufacturing sector is expected to grow 4% with Manufacturing Production Index and sales expanding 4.1% and 6.1% respectively. This is due to steady improvement in the export-oriented industries coupled with sustained expansion in the domestic-oriented industries. Interestingly in the last 5 years, the manufacturing sector has contributed about 23% to the country’s GDP.

Current Development (2019 statistics):

• Malaysia’s foreign direct investment (FDI) momentum will continue to pick up in the upcoming year, following the rise in the country’s realised FDI by nearly RM11bil or 68.4% year-onyear (y-o-y) in the first six months of 2019 alone.

• In 2019, bilateral trade between Malaysia and UK was valued at RM16.44 billion and 66% of exports from the UK to Malaysia are

contributed by manufacturing subsector products such as machinery, equipment and parts, E&E, chemicals and chemical products, transport equipment as well as metal related products.

Government Initiatives:

• Amid a global economic slowdown, geopolitical upheaval and prolonged trade tensions, Malaysia welcomes investors including promoting incentives to boost investor’s confidence and ensuring continuous economic growth.

• Among others, Malaysia has launched the National Policy on Industry 4.0 (Industry4WRD) in 2018, aimed at driving the country towards becoming the Industry 4.0 hub in Southeast Asia.

• The Industry4WRD policy, which is aimed at increasing productivity in the manufacturing sector per person in Malaysia by 30% from RM106,647. This would elevate the absolute contribution of the manufacturing sector to the economy by 54% to RM392 billion from RM254 billion.

Opportunities for Global Players:

• In line with Malaysia’s National Policy on Industry 4.0, the government has emphasised the following manufacturing sectors to partake in the Industry 4.0 adoption:

a. Electrical & Electronics

b. Machinery & Equipment

c. Chemical

d. Aerospace

e. Automotive

• Sub-sectors under Electrical and Electronics (E&E) – flexible hybrid electronics, machinery & equipment - robotics & factory automation, chemical & chemical productsdownstream petro-chemical sector, medical device - testing equipment will be prioritised and any foreign expertise on these subsectors are also welcome.

Did you know?

Overall sales value for Malaysia’s manufacturing industry in 2019 which is a total of (RM 866 billion) had grown by 5% compared to 2018.

| Opportunities for UK Businesses 18

MInfrastructure

alaysia is optimistic to emerge as an important infrastructure hub in and beyond Southeast Asia. For few decades, it has started creating excellent transport links in rail, road and air, to improve connectivity in the region. There are opportunities for British expertise in the rail sector in particular, both in the development of passenger and freight systems. Besides, there are innumerable mega projects which are expected to kick off as these remain as one of the key drives of the nation’s economic development.

Current Development:

• In Budget 2020, the government had allocated RM 43.2 billion out of RM297 billion for the sector’s public construction and infrastructure sector.

• In 2020 the construction sector is expected to grow further to 3.7% due to acceleration and revival of mega projects as well as the building of affordable homes.

• Development of rural areas in upgrading its roads, bridges, electricity and water supply.

• Civil Engineering subsectors including large petrochemical, transportation, and utility projects remain the key driver of growth for the sector.

Opportunities for Global Players:

• Bandar Malaysia Infrastructure

• Klang Valley MRT Line 3 – Circle Line (MRT3)

• Penang Transport Master Plan (PTMP)

• Pan Borneo Highway Sabah (PBH)

• East Coast Rail Link subcontracts

• KL Singapore Highs Speed Rail (HSR) – Fast Train

• Sarawak Coastal Highway

• Expansion of Sandakan and Kota Bharu airports

• Malaysia Vision Valley

• Rail Transit System (RTS) Johor - Singapore

• Sarawak Rail Project

Opportunities for UK Businesses | 19

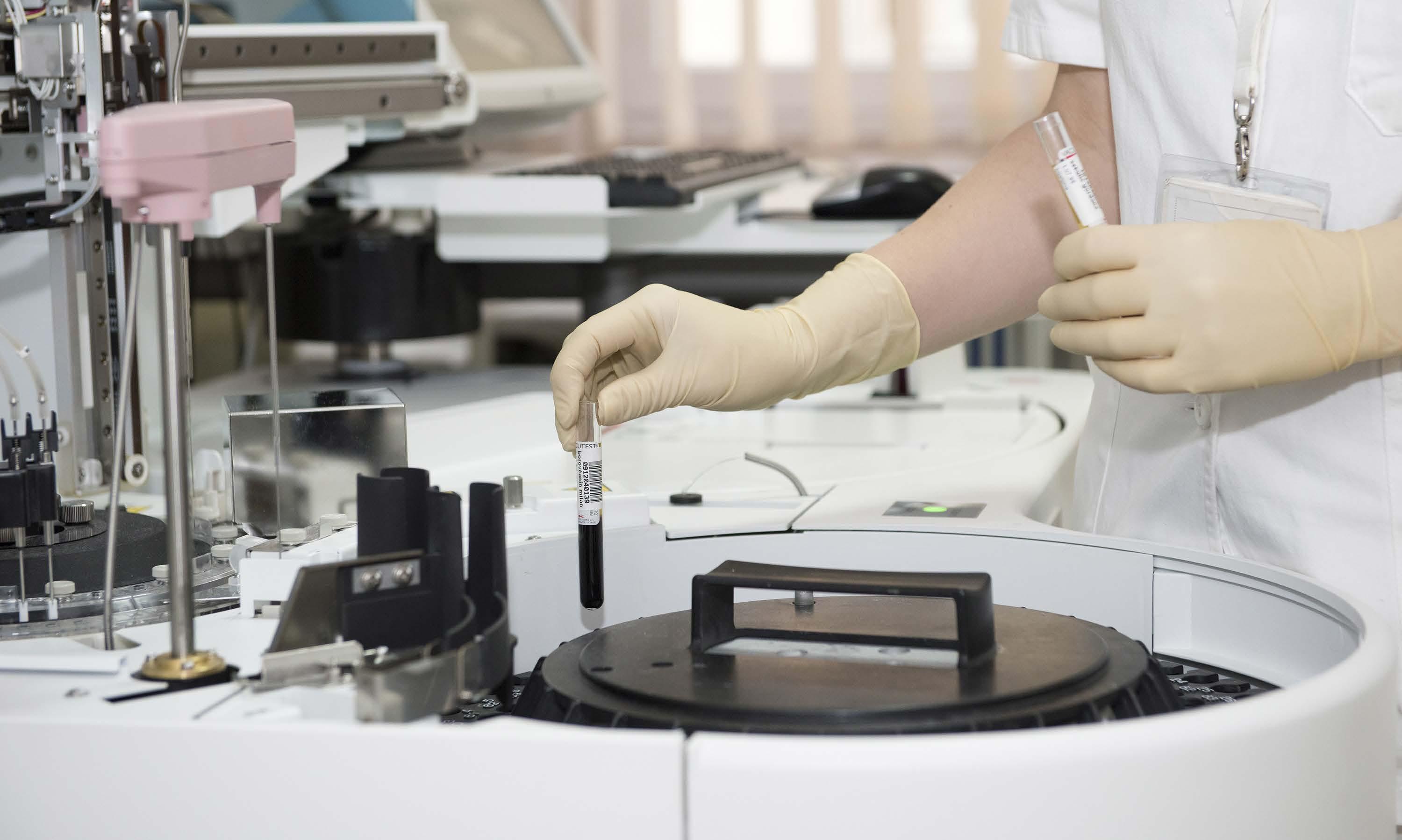

Healthcare

With the rise of Malaysia’s middleincome class, there is a growing national as well as international demand for the provision of high-quality healthcare. Opportunities exist particularly in education and training, where links with the UK are already strong; in clinical services, where the UK is again seen as a leader; and in digital health.

Current Development:

• A popular destination for many pharmaceutical players due to strong support from the Government. Companies like Pfizer, Oncogen Pharma and GlaxoSmithKline (GSK) are some examples of pharmaceutical MNCs that are already in Malaysia.

• A major hub in the region for medical devices. International medical device giants like Abbott, Agilent, B. Braun also have made Malaysia their offshore manufacturing location. In March 2019, biopharmaceutical company AstraZeneca announced plans to invest more than RM500mil (US$125mil) in Malaysia over the next five years for a new headquarters and to roll out new robotic and cognitive technology.

• Digital healthcare: advance medical devices, cloud hospital, mobile health services.

Government Initiatives:

• Malaysia Year of Healthcare Travel 2020 (MYHT) was launched in conjunction with the national Visit Malaysia 2020 campaign.

Opportunities for Global Players:

• Private hospitals and specialist facilities are looking to further upskill their Doctors and nursing staff to gain market share, especially in areas such as cardiology and fertility treatment.

• Private hospitals are increasingly looking at digital solutions, from integrated patient record keeping to telemedicine including remote support to medical tourists. Escalating medical insurance costs and inadequate public sector investment are driving innovations in the private service delivery, particularly through the development of mobile apps.

Opportunities for UK Businesses | 21

BUILDING TRUST. ENSURING COMPLIANCE. ™

ISO 37001 ABMS IS VOLUNTARY, BUT REGULATORY COMPLIANCE IS MANDATORY!

ISO 37001 Anti-Bribery Management System will continue to set the pace for a globally recognised "adequate procedures" standard and, for now, the most powerful "assurance" tool that public and private sector organisations can use in their defence strategy is ISO 37001 ABMS certification.

Anti-Bribery Anti-Corruption (ABAC®) Center of Excellence Sdn. Bhd. is an independent certification body established for Anti-Bribery Management System, providing ISO 37001 training and certification, accredited by the United Kingdom Accreditation Service (UKAS), making it the leading certification body specialising in global anti-bribery and anti-corruption, risk and compliance management system standards.

We operate through a global network of certified ethics and compliance professionals, qualified auditors, financial and corporate investigators, certified fraud examiners, forensic analysts and accountants. ABAC® offers a complete suite of solutions designed to help organisations mitigate the internal and external risks associated with operating in multi-jurisdiction and multi-cultural environments while assisting in the development of frameworks for strategic compliance programs.

Global Leader in Risk, Compliance and Anti-Bribery Management Systems Powered by: 10613 Accredited by: MANAGEMENT SYSTEMS MANAGEMENT SYSTEMS DISCOUNT FOR BMCC MEMBERS GET CERTIFIED NOW! 35WITH % 10% for Non-members For more details, contact: Jareen Kaur e: jareen.kaur@abacgroup.com m: +603 2178 6137 t: +601 0261 1262

GROWING LEARNING GROWING SCHOOLS

Our growing group of private schools located in the UK, the USA, Spain, Chile, Costa Rica, Ecuador, Colombia, the United Arab Emirates, Qatar, Malaysia, Mexico and Peru educate children and students from 2–18 years of age. We have now expanded to 46 schools delivering multiple curricula and building on local brands and reputations with around 45,000 students and 7,000 staff located across the globe.

To find out more about our schools in Malaysia, scan the QR codes below ® International Schools Partnership 45,000 Students

7,000 Sta 46 Schools 12 Countries 14 Curricula Ipoh – Penang – Setia Eco Park Setia Eco Gardens - Setia EcoHill Tropicana Aman tenby.edu.my

Education

Education truly is at the heart of the bilateral relationship between the UK and Malaysia. That is evident in the hundreds of partnerships between UK and Malaysian universities, colleges and schools; and in the number of UK educational institutions with campuses in Malaysia. In addition to ongoing collaborations in higher education, growth opportunities include TVET, curriculum enrichment and instructions for schools including Education Technology, English Language Training, and capacity building for educators.

Current Development:

• Malaysia is also becoming an ‘Educational Hub’ of the ASEAN region. International students currently contribute approximately RM5.9 billion a year to the economy.

• Over the past few years, the Government has been working to improve international student management including the issuance of student visa applications which can be made and tracked online.

• The UK is already greatly contributing to Malaysia’s education goals, with 5 UK universities having local branch campuses. Malaysia also has a thriving Transnational Education (TNE) sector which is worth around £895 million a year.

Government Initiatives:

• The Mid Term Review of the 11th Malaysia Plan (2016-2020) states new priorities as empowering human capital and promoting greater collaboration on industry-led TVET programmes. The Government aims to double the percentage of students enrolled in local TVET institutions from 10% to 20% over the next five years.

• An R&D budget of £55 million has been allocated to Malaysia’s five leading universities to develop links between the world’s leading higher education institutions and industry. The National Advisory Council for Education and Training are aiming to increase the enrolment on life-long learning programmes by 10%, which includes distance learning, parttime courses, e-learning and skill enhancements.

International students studying in Malaysia

2016: 172K (schools, higher education institutions & language centres)

2025: Target 225K

Job creation expected by allocation of funds

1.5 Million Jobs created

Education opportunities in light of Covid-19:

• Transnational Education (TNE) Partnerships - There is strong demand for international education in Malaysia, with the UK as the leading study destination but with the current pandemic and economic situation, more students are anticipated to be staying on to do full TNE degrees as opposed to articulating overseas. Hence, this opens up opportunities for more TNE collaborations. The UK’s strong academic ties with Malaysia means that universities can leverage research partnerships and expand more in-depth academic collaborations as opposed to just focusing on student recruitments.

• Increase in demand for online resources and qualifications at all levels and streams of education. Corporates are investing more on online Continuous Professional Development programmes to upskill their workforce.

• Training Teachers to be digitally competent and to be highly imaginative in using technology. Skills required include Big Data, AI based teaching programme in K-12 core subjects.

| Opportunities for UK Businesses 24

60% of those jobs will require TVETrelated Skills

Food & Drink (F&D) and Retail

The Malaysian F&D sector reflects the country’s diverse multi-cultural population. The government’s continuous efforts to increase food production and liberalise trade have meant that most Malaysians today have access to a wide selection of local and imported F&D products. In the process, the F&D sector has developed into one of the most significant contributors to the Malaysian economy with revenues amounting to RM139 mil in 2018 and an annual growth rate of 7.6%. The rise of private consumption and lifestyle changes are expected to become major drivers for the F&D sector in Malaysia. Considering the overall growth of the sector, the future of Malaysia’s F&D sector is promising. Malaysia is certainly an attractive destination for UK companies seeking to expand their F&D business in the Asian region.

Current Development:

Halal Food Processing & Distributing

• With a Muslim majority population in Malaysia of more than 60%, the halal food industry has a strong appeal in the country.

• Halal foods are prepared in a distinct manner which adheres to Islamic teachings, and the global halal food industry generates billions each year.

• Recognising its potential, Malaysia aims to be a key player in the industry by becoming a hub for producing, marketing, certifying, and referencing for halal food products.

Liquor & Spirits

• Despite Malaysia being a Muslim majority country, the government permits the retail of alcohol to nonMuslims in the country. Alcohol sale is regulated in the country. However, these regulations are not intrusive.

• In fact, the World Health Organisation (WHO) has ranked Malaysia as the 10th largest consumer of alcohol products with an annual spending of RM2 billion on alcoholic drinks.

Government Initiatives:

• On the other hand, e-commerce in Malaysia has also contributed to Malaysia’s GDP continuously over the years, with the sector contributing about 8% or RM115.5 billion in 2018

according to the Department of Statistics Malaysia.

• With a growing middle-class population and the Malaysian government’s initiative to expand e-commerce, the retail industry is looking towards an upwards trend, including a growing number of food delivery service providers like Grab Food, Food Panda, etc.

Opportunities for Global Players:

• Growing demand for halal food as well as demand for healthier food options.

• F&D and Retail are growing in the e-commerce area.

• Food delivery services are in demand.

• Strong demand in food ingredients such as customised formulations required by food manufacturers, functional ingredients, natural food additives and flavours.

• Retail industry is seeing an upward trend in skincare products, cosmetics as well as luxury retail.

| Opportunities for UK Businesses 26

DISCLAIMER

This guide was produced by the British Malaysian Chamber of Commerce Berhad (BMCC). Whereas every effort has been made to ensure that the information given in this document is accurate, neither the British Malaysian Chamber of Commerce nor its Departments (BMCC Trade Team) accept liability for any errors, ommisions or misleading statements, and no warranty is given or responsibility accepted as to the standing of any individual, firm, company or other organisation mentioned.

You may reuse this information (not including logos and images) free of charges in any format or medium, under the condition to acknowledge the source of information i.e (BMCC) in your product of application.

© 2020 British Malaysian Chamber of Commerce Berhad

British Malaysian Chamber of Commerce Berhad

4th Floor, East Block, Wisma Golden Eagle Realty, 142B Jalan Ampang, 50450 Kuala Lumpur.

trade@bmcc.org.my

+603 2163 1784

www.bmcc.org.my

Follow us @BMCCMALAYSIA

2020/21 ISSUE