1634 N CAPITOL ST NW | WASHINGTON, D.C. O F F E R I N G M E M O R A N D U M

---- Disclaimer ----

As the Maison Kesh Hotel is currently unfinished (offered at C of O), however will have many members of the same design team architect as The Hoxton, Chicago, all interior photos displayed throughout the Offering Memorandum are related to The Hoxton, Chicago and are merely used for a visual representation of how the soon-to-bedelivered Maison Kesh Hotel will look upon delivery, as there will be extremely like-type designs, aesthetics, and FF&E packages.

BROKER OF RECORD Dan Hawkins Managing Director 240.204.5139 dan.hawkins@berkadia.com Jake Pietras Associate Director 410.940.9497 jake.pietras@berkadia.com Fiorella Furlato Real Estate Analyst 215.328.1311 fiorella.furlato@berkadia.com Justin Storer Real Estate Analyst 301.202.3542 justin.storer@berkadia.com Andrew Coleman Senior Managing Director 240.204.5132 andrew.coleman@berkadia.com Bobby Meehling #BR40000206 Katelyn Reynolds Senior Real Estate Analyst 213.399.3390 katelyn.reynolds@berkadia.com Lindsey deButts Senior Director 240.204.5131 lindsey.debutts@berkadia.com

INVESTMENT SALES FINANCING

The Hoxton, Chicago

The Hoxton, Chicago

4 Executive Summary 10 Washington, DC Overview 14 Investment Highlights 28 Property Overview 38 Market Overview 60 STR Trend Set Overview 68 Financial Overview

EXECUTIVE SUMMARY

THE OPPORTUNITY

Berkadia Hotels & Hospitality has been exclusively retained in connection with the solicitation of offers to acquire the fee simple interest in the soon-to-bedelivered (Summer 2023), 97-room Maison Kesh Hotel (the ‘Hotel’ or ‘Asset’).

A luxury, independent/boutique lodging asset strategically positioned in the Historic Bloomingdale District of Northwest Washington, DC, the Hotel will be encompassed by a vibrant mix of Victorian-style architecture, colorful row houses, a rising cohort of middle-high class residents, and a growing, yet eclectic mix of small business, local restaurants, coffee shops, and boutiques, resulting in status as one of the Nation’s Capital’s most coveted neighborhoods according to the Washington Post and the location of the opening title sequence for Netflix’s highly viewed and award-winning political Thriller – House of Cards.

Within a 1.5 mi. Radius

5 Hospitals | 1,885 Hospital Beds

4 Universities | +18,000 Students

+$13.7 Billion of Projects In-Planning / Under Construction

47,970 Multi-Family Units | 5,266 Under Construction

Bloomingdale District Stats

Average Household Income ($153,731) is Approximately 95% Higher than the National Average

Designated as an Historic District in 2018 and is Listed on the DC Inventory of Historic Sites and in the National Register of Historic Places

MAISON KESH HOTEL | WASHINGTON, D.C.

6 KESH HOTEL | WASHINGTON, D.C. EXECUTIVE SUMMARY

Bloomingdale Median Home Price ($1,067,010) is 78.5% Higher than the DC Average and and 94.2% Higher than the National Average

72% of Bloomingdale

Residents have an Associate, Bachelor, and/or Graduate Degree (12% Higher than the DC Average)

Once delivered, the Hotel will be ideally situated just steps away from the confluence of Florida Avenue NW and North Capitol Street, less than a quarter-mile from one of NW Washington, DC’s primary eastern entry points which serves nearly 50,000 vehicles per day – New York Avenue. Moreover, with numerous Metrobus routes throughout the neighborhood, proximity to Union Station (+100,000 daily users | $10 billion potential expansion), and a location bounded between the Shaw-Howard University Metro station on the Green and Yellow lines, in addition to the Rhode Island Avenue-Brentwood station on the Red Line, the Asset’s multi-modal location will easily connect guests to NoMa, Union Market, Mt. Vernon, the 2.3 million SF Walter E. Convention Center, and all of downtown Washington, DC which attracted approximately 20 million visitors in 2022 (24.6 million in 2019). Moreover, while 2022 visitation represents a +6% YoY increase, Washington DC is highly anticipated to attract even more visitors in 2023, as business/corporate travel continues to rebound in tandem with a continued leisure boom and international ‘revenge travel,’ specifically stemming from China.

U.S. Hotels Ready for Revenge Travel - Hotel Management

Click for additional information

At the Asset level, offered unencumbered of brand and management, a new owner will be able to implement an operator of their choosing along with a customized business plan which leverages the Hotel’s brand-new, boutique product offering in conjunction with a highly curated, heavily positioned F&B experience in a rapidly growing residential enclave to drive outsized top-line gains and an impressive market penetration upon stabilization. Furthermore, a new owner will benefit from broad optionality to affiliate with one of Marriott, Hilton, Hyatt, or IHG's premier ‘soft brands’ and their respective distribution systems at a minimal incremental cost to further enhance the Asset’s anticipated market capture. When paired with the brands’ desire to increase their footprint in a nationally recognized top 25 US lodging market, there remains the possibility that a major brand may provide substantial ‘key money’ to prospective buyers, resulting in more attractive returns for a new owner.

7 BERKADIA HOTELS & HOSPITALITY

7

1634 North Capitol Street NW | Washington, D.C.

MANAGEMENT

Modus Hotels (Unencumbered)

REAL PROPERTY ID

3101-0118

EVENT SPACE

1,120 SF

FOOD & BEVERAGE

On-Site Restaurant & Lounge (Ground Floor w/ Patio), Rooftop Bar, Sundry/Convenience Store

AMENITIES

Modern Fitness Center, Outdoor Courtyard

Complimentary High-Speed Wi-Fi, Digital Key

PARKING

5 STORIES

Summer

2023

ANTICIPATED OPEN DATE

97

BUILDING AREA 37,330 SF LAND AREA .27 Acres (11,700 SF)

3 Spaces On-Site; Valet TENURE Fee Simple LABOR

GUESTROOMS

MAISON KESH HOTEL | WASHINGTON, D.C.

Non-Union

9

The Hoxton, Chicago

WASHINGTON, DC OVERVIEW

BY THE NUMBERS

Construction & Development Government Infrastructure Population & Demographics $1.3B $3B $10B $640M $1.1B $1B AMAZON’S NATIONAL LANDING HQ IN ARLINGTON UNION STATION RENOVATION & EXPANSION BURNHAM PLACE CAPITAL CROSSING DEVELOPMENT THE WHARF PHASE II OVERHAUL VIRGINIA TECH INNOVATION CAMPUS – POTOMAC YARDS REDEVELOPMENT OF FORMER FANNIE MAE HQ CAMPUS $2.5B 45.3M PASSENGERS (2022) 6.3M 2.3M $109K 2.4M $120K 6.6M 2022 POPULATION TOTAL HOUSEHOLDS MEDIAN INCOME 2027 POPULATION 2027 HOUSEHOLDS 2027 MEDIAN INCOME 39 6,246.9 1,010.2 MEDIAN AGE TOTAL SQ. MILES PEOPLE PER SQ. MILE (Projected) (Forecasted) (Forecasted) 4.1% INCREASE 2.7 PERSONS PER HOUSEHOLD | 4.1% INCREASE NATIONAL AVERAGE: 100.0 COST OF LIVING SCORE: 151.2 10.8% INCREASE 22% OF THE WORKFORCE $257 LODGING $79 MEAL / INCIDENTAL 714,700 JOBS SUPPORTED Metro System Amtrak 297M Annual Passengers (Rail & Bus) +5M Annual Passengers (Union Station / DC) PER DIEMS:

WASHINGTON, DC METRO MAISON KESH HOTEL | WASHINGTON, D.C. EXECUTIVE SUMMARY

24.6M

Visitors & Tourism Education

CORPORATE EMPLOYERS 14,140 University of Maryland 13,900 Booz Allen Hamilton, Inc. 12,480 Verizon Communications Inc. 12,200 General Dynamics Corp. 11,420 Albertsons Companies Inc. (Safeway) 11,400 Amazon Inc. 18,210 Medstar Health 18,000 Inova Health System 14,970 Deloitte 14,840 Marriott International Inc.

EMPLOYERS INDUSTRY BREAKDOWN OFFICE SPACE Business PROFESSIONAL & BUSINESS SERVICES 24% GOVERNMENT 21% EDUCATION & HEALTH SERVICES 13% TRADE, TRANSPORTATION, & UTILITIES 12% LEISURE & HOSPITALITY 9% OTHER SERVICES 6% MINING, LOGGING, & CONSTRUCTION 5% FINANCIAL ACTIVITIES 5% INFORMATION 2% MANUFACTURING 2% LODGING 35.5% FOOD & BEVERAGE 30.3% ENTERTAINMENT 14.9% SHOPPING 11.4% TRANSPORTATION 7.9% WASHINGTON, DC 170M SF @15.8% Vacancy 1.4M SF Under Construction DC METRO

520M SF @ 15.7% Vacancy

7.3M Under Construction

INSTITUTION UNIVERSITY OF MARYLAND TOP 20 HIGHER LEARNING INSTITUTION +280 DEGREES OFFERED GEORGETOWN UNIVERSITY

MAJOR

TOP

LEISURE & HOSPITALITY JOBS SUPPORTED

285,900

TOP 100

+290K STUDENTS

ANNUAL VISITORS 2019

1.8M DOMESTIC OVERSEAS VISITOR SPENDING BREAKDOWN $

22.8M

8.2B

INVESTMENT HIGHLIGHTS

Luxury Boutique Hotel Offered at Certificate of Occupancy

(Summer 2023 Opening) in One of the Nation’s Preeminent Lodging Markets

Anticipated to deliver in Summer 2023, the 37,330 SF Maison Kesh Hotel - a historic repositioned firehouse plus new construction - will provide a new owner with the rare opportunity to acquire a brand-new, luxury / boutique lodging asset at Certificate of Occupancy within a perennial Top 25 US Metropolitan Lodging Market which benefits from high barriers to entry – Washington DC. Boasting highly customized facilities and a tailored amenity base, sophisticated visual finishes, and a distinctive product offering upon completion, the Hotel is anticipated to ramp swiftly to stabilization with outstanding top and bottom-line performance, providing a new owner with an institutional-grade hotel that will deliver inherent value to a new owner throughout their hold period.

1

HIGHLIGHTS MAISON KESH HOTEL | WASHINGTON, D.C. 16

INVESTMENT

The Hoxton, Chicago

17 BERKADIA HOTELS & HOSPITALITY

The Hoxton, Chicago

The Hoxton, Chicago

The Hoxton, Chicago

The Hoxton, Chicago

Substantial Ancillary Revenues Stemming from a Highly Curated Food & Beverage Experience

Enhanced with a Panoramic Rooftop Lounge & Impressive Local Demographics

The Maison Kesh will feature a contemporary and highly curated, full-service restaurant and bar with more than 200 seats on the ground floor of the Hotel. Moreover, guests’ food and beverage experience will be augmented by an eclectic atmosphere with floor-to-ceiling glass windows and additional seating on an adjacent outdoor patio. When coupled with a sought-after, +120-seat rooftop bar encompassed by glass hedging on the fifth floor of the Hotel, guests and neighborhood residents alike will enjoy unobstructed, 360-degree, panoramic views of the Capitol Dome and all of Washington, DC throughout all seasons of the year.

When considering the neighborhood’s impressive and rapidly growing demographics, in addition to proximity to a multitude of local Universities, a new owner is expected to drive approximately $206 in F&B POR at stabilization, significantly enhancing top-line performance for the Hotel while adding revenue diversification.

2 INVESTMENT HIGHLIGHTS

The Hoxton, Chicago

Berkadia Food & Beverage Projections

Projections

+200-Seat Ground-Floor Restaurant

+120-Seat Rooftop Bar & Lounge

Berkadia Anticipates the Hotel to Stabilize with a $206 F&B POR

Bloomingdale Average Household Income ($153,731) is 95% Higher than the National Average

47,970 Multi-Family Units

(5,266 Under Construction) within a 1.5-Mile Radius

+18,400 Students (4 Universities) within a 2-Mile Radius

$4.8 $5.4 $5.8 $5.9 $6.0 $1.2 $1.5 $1.7 $1.8 $1.8 25.0% 27.5% 30.0% 30.0% 30.0% 0.0% 5.0% 10.0% 15.0% 20.0% 25.0% 30.0% 35.0% $0.0 $1.0 $2.0 $3.0 $4.0 $5.0 $6.0 $7.0 $8.0 2024 2025 2026 2027 2028 NOI MARGIN REVENUES (M$) Berkadia

Beverage

F&B Revenue ($M) F&B NOI ($M) $5.4 $5.8 $5.9 $6.0 $1.2 $1.5 $1.7 $1.8 $1.8 25.0% 27.5% 30.0% 30.0% 30.0% 0.0% 5.0% 10.0% 15.0% 20.0% 25.0% 30.0% 35.0% 2025 2026 2027 2028 NOI MARGIN Berkadia Food & Beverage Projections F&B Revenue ($M) F&B NOI ($M) NOI Margin The Hoxton, Chicago

Hoxton, Chicago

Food &

The

Clean Offering Unencumbered of Management and with a Non-Unionized Workforce

Offered unencumbered of management and upon delivery of the luxury boutique Hotel, a new owner will have the ability to implement an operator of their choosing and customized business plan which leverages the Hotel’s brand-new, sophisticated product offering and unique amenity base to position the Hotel in the top-tier of the competitive set once stabilized. Moreover, with an efficiently programmed building layout – only 1,120 SF of meeting space and no pool – and a non-unionized workforce, potential buyers will be able to staff the hotel according to their customized operating model, providing margin upside and the ability to drive profitability, resulting in strong cash flow and attractive exit capitalization opportunities.

Optionality to Affiliate with an Industry-Leading Brand or ‘Soft’ Brand

While a new owner will have the optionality to operate the future Hotel as an independent/boutique lodging asset, offered unencumbered of brand, a potential buyer will have the ability to affiliate with one of the industry’s leading brands, inclusive of their ‘soft’ brands, such as Marriott, Hilton, Hyatt, and IHG and their respective distribution systems to maximize top-line performance. Furthermore, with a desirable and rapidly growing location in the nation’s Capital and the brands’ desire to increase their respective footprints in the submarket, there remains the possibility that a major brand may provide substantial ‘key money’ to prospective buyers, resulting in more attractive returns for a new owner.

MAISON KESH HOTEL | WASHINGTON, D.C.

3

INVESTMENT HIGHLIGHTS $10.6 $12.0 $13.0 $2.0 $2.7 $3.3 $3.3 $3.4 19.3% 22.6% 25.0% 0.0% 5.0% 10.0% 15.0% 20.0% -$1.0 $1.0 $3.0 $5.0 $7.0 $9.0 $11.0 $13.0 $15.0 2024 2025 2026 2027 2028 NOI MARGIN REVENUES (M$) Berkadia Financial Projections Revenue ($M) NOI ($M) NOI Margin $10.6 $12.0 $13.0 $13.4 $2.0 $2.7 $3.3 $3.3 19.3% 22.6% 25.0% 25.0% -$1.0 $1.0 $3.0 $5.0 $7.0 $9.0 $11.0 $13.0 $15.0 2024 2025 2026 2027 REVENUES (M$) Berkadia Financial Projections Revenue ($M) NOI ($M) NOI Margin $10.6 $12.0 $13.0 $13.4 $13.6 $2.0 $2.7 $3.3 $3.3 $3.4 19.3% 22.6% 25.0% 25.0% 25.0% 0.0% 5.0% 10.0% 15.0% 20.0% 25.0% 30.0% -$1.0 $1.0 $3.0 $5.0 $7.0 $9.0 $11.0 $13.0 $15.0 2024 2025 2026 2027 2028 NOI MARGIN REVENUES (M$) Berkadia Financial Projections Revenue ($M) NOI ($M) NOI Margin

4

Highly-Accessible, Multi-Modal Location within One of Washington, DC’s Fastest Growing Neighborhoods

Upon delivery, the Maison Kesh Hotel will boast a highly visible, easily-accessible, multi-modal location with prime frontage in the rapidly-growing Bloomington neighborhood of Washington, DC. Just a block north of the confluence of North Capitol Street and Florida Avenue – approximately a quarter-mile from New York Avenue – hotel guests will be provided with walkability to some of Bloomington and NoMa’s most frequented demand generators and amenities. Additionally, within a mile of several Metro bus stops, the Noma-Gallaudet Metro rail station (+4,000 daily riders), and Union Station which is currently reviewing a potential $10 billion expansion, the Hotel’s dynamic location will provide guests with seamless access throughout all of Washington DC and the greater Mid-Atlantic region. Lastly, the Hotel will be situated approximately a 15-minute drive from Reagan National Airport (DCA), allowing guests to easily access one of the region’s primary transportation hubs that served a record 23.9 million passengers in 2022.

5

INVESTMENT HIGHLIGHTS

Centered Among a Robust Mix of Diversified Demand Channels 6

CORPORATE OPERATIONS

• 17 Fortune 500 HQ’s in Washington, DC

• Notable Proximate Companies (Bank of America, Wells Fargo, Wolfram Mathematica, Advantage Financial)

• 18.4M SF of Office Space within a 1-Mile Radius (224K Under Construction)

• 2.3M SF Walter E. Washington Convention Center

HIGHER EDUCATION INSTITUTIONS

• Howard University (9,689 Students)

• Trinity Washington University (1,800 Students)

• Gallaudet University (1,558 Students)

• Catholic University of America (5,366 Students)

GOVERNMENT

• Washington DC is Home to all 3 Branches of the US Government

• 714,700 Government Jobs Supported in Washington DC (22% of the Regional Work Force)

• New SEC Headquarters (0.25-Miles Away | 2025 Anticipated Delivery)

MEDICAL

• MedStar Washington Hospital Center (926 Beds)

• Children’s National Hospital (328 Beds)

• Howard University Hospital (300 Beds)

• Washington DC VA Medical Center (194 Beds)

• MedStar National Rehabilitation Hospital (137 Beds)

ENTERTAINMENT & LEISURE

• Union Market (+55 Vendors and Retailers

+15,000 Weekly Visitors)

• Audi Field (20,000 Seats)

• Nationals Park (41,339 Seats)

• Capital One Arena (20,356 Seats)

• National Mall (+25M Annual Visitors)

• Smithsonian Institutions (14.9M Visitors as of July 2022)

MAISON KESH HOTEL | WASHINGTON, D.C.

23 BERKADIA HOTELS & HOSPITALITY

INVESTMENT HIGHLIGHTS

Primed to Capitalize on Over $13B of Local Development 7

1. Union Station Renovation & Expansion

Cost: $10 Billion

Description: The $10 billion plans to modernize the nation’s second-busiest rail hub include a major reconfiguration of the bus terminal to align with a new train hall, adding wider rail platforms, a new bus terminal and updated concourses lined with shops and restaurants, and improved accessibility to Metrorail, buses, taxis, ride-hailing services, streetcars and parking.

2. Burnham Place

Cost: $3 Billion

Description: Burnham Place, a proposed 3 million SF development, will be built above Union Station’s rail yard, providing direct access to a newly expanded and improved station facility. The development will feature a mix of 1.5 million SF of first-class office space, over 1,300 residential units, 100,000 SF of retail space, and hotel space, as well as parks and plazas.

3.

McMillan Sand Filtration Site

Cost: $720 Million

Description: The $720 million, 25-acre redevelopment of the former McMillan Reservoir Sand Filtration Site includes 860,000 SF of medical office, 467 apartments, a 52,000 SF supermarket, 146 townhomes and a central park and community center.

4. 7 New York Avenue

Cost: Not Disclosed

Description: A redevelopment of the former Covenant House location, this new project will deliver 116 residential units primarily consisting of micro units.

5. 1 Florida Ave

Cost: Not Disclosed

Description: Aria Development is replacing a former Exxon Mobile gas station at the corner of North Capitol Street and Florida Avenue, bringing a new 13-story-pluspenthouse building with 388 units and a swimming pool to the site.

6. The 202

Cost: Not Disclosed (developer received a $69.4M loan)

Description: Located in the NoMa neighborhood and adjacent to the Union Market district, the 202 will deliver a 16-story high-rise apartment building with 254 units and 3,800 square feet of retail. The building will include a mix of studio, one-bedroom, and two-bedroom units. Residents will enjoy a rooftop club room, pet facilities, fitness center, and shared workspaces.

7. Capitol Point North

Cost: Not Disclosed

Description: JBG Smith has submitted plans for a +700,000 square foot mixed-use development on the 1.5-acre site at 55 and 75 New York Avenue. The property is currently home to a McDonald’s and a three-story office building. The development would include 805 residential units along with over 30,000 square feet of retail and restaurant space as well as a penthouse-level restaurant/bar.

8. Financial Plaza (New SEC Headquarters)

Cost: Not Disclosed

Description: The General Services Administration signed a 1.23 million SF lease with Douglas Development Corporation for a new Securities and Exchange Commission headquarters to be constructed which will house approximately 4,500 SEC employees. The triangular site, bounded by New York Avenue, North Capitol Street and First Street NE, can also accommodate another 600,000 square feet of office or 600 residential units.

9. District of Columbia Housing Authority Development

Cost: Not Disclosed

Description: The multi-phased development will include an estimated 1,200 apartments and is slated to include a minimum of 244 affordable units, at least half of which would be deeply affordable for residents making 30 percent of the median family income and below.

10. Lacebark Alley

Cost: Not Disclosed

Description: Lacebark Alley will consist of a new three-building complex comprising of mixed-use space including 220 residential apartments, 366,000 SF of class A office space, 53,000 SF of on-site retail, and a 9,000 SF art centric plaza.

MAISON KESH HOTEL | WASHINGTON, D.C. 24

25 BERKADIA HOTELS & HOSPITALITY

INVESTMENT HIGHLIGHTS

Impressive Top-Line Trajectory (+107% Y-o-Y RevPAR Growth) with Further Recovery Upside

As displayed in the chart below, year end 2022 RevPAR ($128.38) for the proposed competitive set is approximately 85% recovered when compared to year end 2019 benchmarks ($150.80), representing an impressive 107.1% growth rate when compared to the year end 2021 period. A new owner will be able to leverage these tailwinds in conjunction with a brandnew, luxury/boutique product offering, prime location within one of nation’s capital’s fastest-growing neighborhoods, and multifaceted growth via a returning office/government workforce, expanding convention calendar, anticipated ‘revenge’ travel from China, and multi-billion-dollar construction pipeline to achieve outsized gains in top-line performance as the Hotel stabilizes in the submarket.

• A complete return of Chinese travelers to the United States to 2019 levels (2.83M visitors | $33.5B in visitor spending) is anticipated by the second quarter of 2023 – hotel AVE

• On February 1, 2023, the House of Representatives passed the ‘SHOW UP Act of 2023’ – a bill aimed at rolling back pandemic-era telework policies – which would “require federal agencies to reinstate their pre-pandemic telework policies and require any expansion of telework to be certified by the Office of Personnel Management (OPM).”

– Social Security Legislative Bulletin

• CoStar anticipates Washington, DC RevPAR in 2024 to exceed 2019 levels by 9% - a new owner's first fiscal year of operations

MAISON KESH HOTEL | WASHINGTON, D.C.

8

STR Trend Report Berkadia's Comp Set Projections 2019 2020 2021 2022 Delta (Y-o-Y) 2023 2024 2025 2026 2027 2028 2029 Occupancy 79.7% 35.6% 52.0% 70.5% 35.6% 74.0% 77.0% 80.0% 80.0% 80.0% 80.0% 80.0% ADR $189.21 $125.83 $119.14 $182.03 52.8% $190.22 $197.83 $204.76 $210.90 $217.23 $223.74 $230.45 RevPAR $150.80 $44.81 $61.98 $128.38 107.1% $140.76 $152.33 $163.80 $168.72 $173.78 $178.99 $184.36

The Hoxton, Chicago

The Hoxton, Chicago

The Hoxton, Chicago

The Hoxton, Chicago

The Hoxton, Chicago

The Hoxton, Chicago

The Hoxton, Chicago

The Hoxton, Chicago

PROPERTY OVERVIEW

MAISON KESH HOTEL | WASHINGTON, D.C. Guestroom Breakdown UNIT MIX 87 Kings 10 Queen / Queens 97 Total KESH HOTEL | WASHINGTON, D.C. PROPERTY OVERVIEW

The Asset will boast two premium, two-story guestrooms with spiral staircases.

The Hoxton, Chicago

Upon the Hotel's anticipated delivery in Summer 2023, the Maison Kesh will boast the most modern and innovative product offering in the submarket, with 97 state-of-the-art guest rooms available, ranging from intimate 111 SF rooms to more spacious quarters in excess of 300 SF. Featuring tastefully designed and highly-customized spaces, the modern, yet minimalist guestrooms will be equipped with plush bedding, luxury duvet covers, cloudlike pillows, nightstands, fashionable decor, compact 'hanging' desks, spanning flat screen TV's, a mini-bar, and much more.

The Hotel will feature high-end Waterworks fixtures, fittings, and accessories in the bathrooms.

The Hotel will also feature well-appointed bathrooms with stand-up showers, a large, well-lit vanity, marble countertops with ample storage underneath, fluffy white towels, and deluxe bath and body amenities.

31 BERKADIA HOTELS & HOSPITALITY

31 HOSPITALITY

The Hoxton, Chicago

The Hoxton, Chicago

The Hoxton, Chicago

Food & Beverage

Upon entering the Hotel, guests and visitors alike will be welcomed by a +200-seat, full-service restaurant with wooden flooring, floor-to-ceiling glass windows, and an oversized open kitchen on the ground floor of the old fire house, offering an authentic aesthetic that can't be simply designed, but rather honed and built upon for a unique dining experience which is hinged upon a tasteful, three-meal -a-day menu.

Moreover, featuring a fifth floor rooftop bar (+120 seats) encompassed by glass hedging and offering panoramic views of the nation's capital (including unobstructed views of the Capitol Dome), the Hotel will offer a unique epicurean experience and is highly anticipated to serve as a local 'hotspot' for nearby residents.

PROPERTY OVERVIEW

MAISON KESH HOTEL | WASHINGTON, D.C.

The Hoxton, Chicago

The Hotel is currently undergoing negotiations with H2 Collective (Hilton Brothers) - a DC-based hospitality group behind some of the most popular and renowned food and beverage venues in the Washington, DC area.

The Hoxton, Chicago

The Hoxton, Chicago

The Hoxton, Chicago

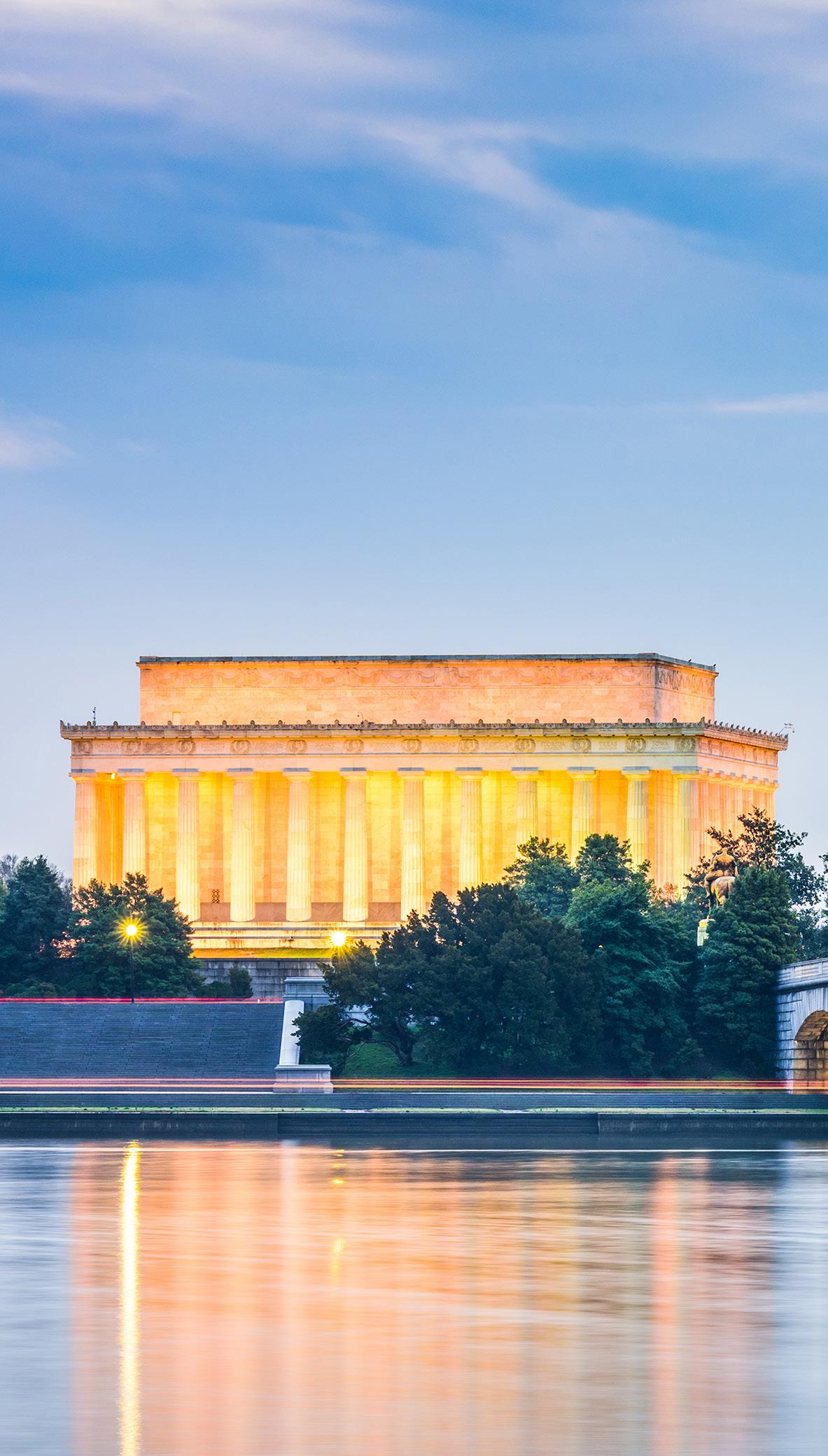

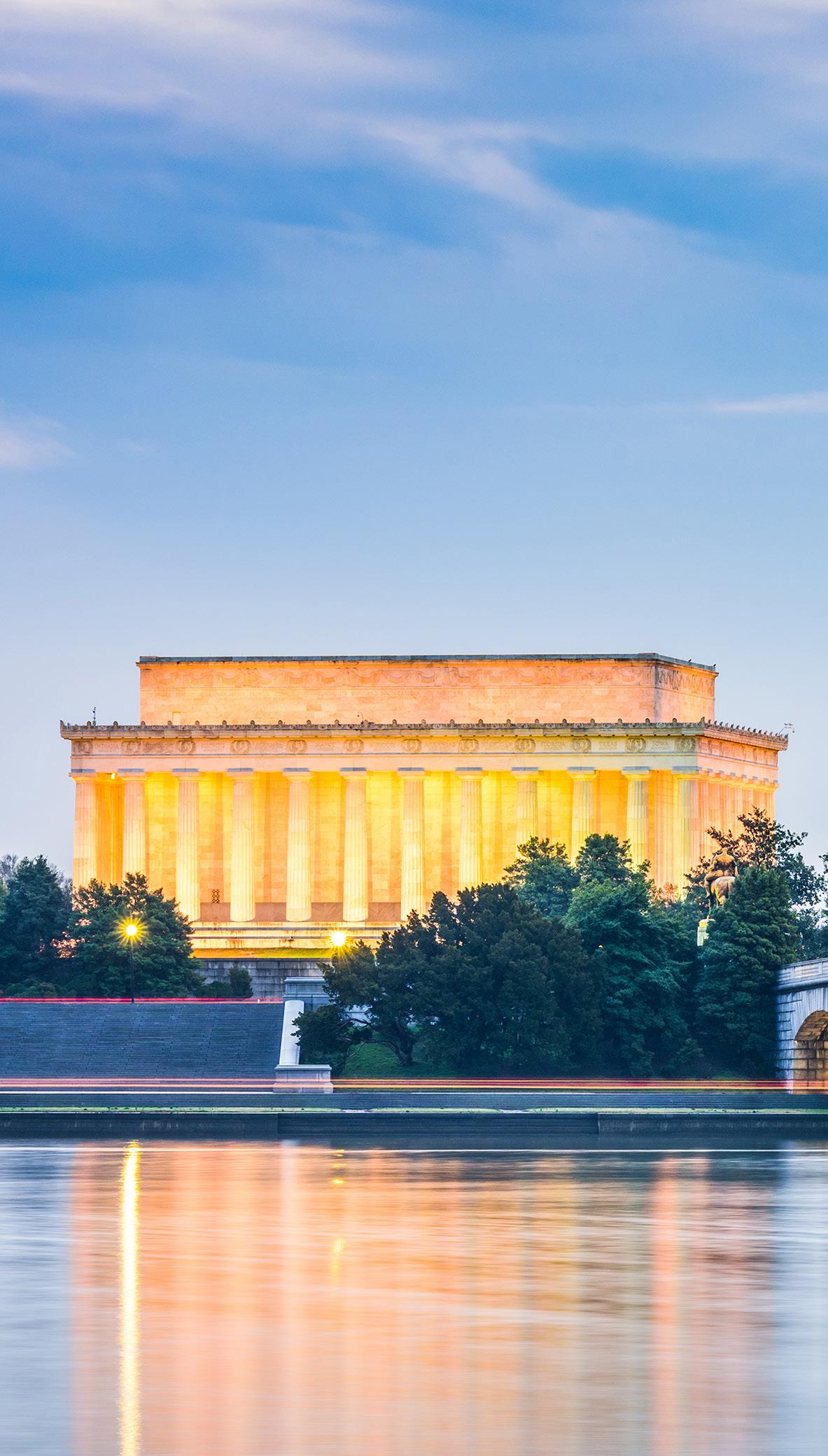

The Capitol

The Hoxton, Chicago

The Hoxton, Chicago

The Hoxton, Chicago

The Capitol

Meeting & Event Space

The Maison Kesh will offer approximately 1,120 SF of modern meeting space spread throughout a myriad of event rooms, in addition to a communal courtyard area. Furthermore, the Hotel will feature high-speed HSIA connections, state-ofthe-art audio-visual equipment, and catering services, among other advanced technologies/ equipment, allowing the Asset to accommodate small to mid-sized business meetings, training sessions, birthday parties, and a wide range of other social, educational, governmental, and corporate events.

MAISON KESH HOTEL | WASHINGTON, D.C.

MAISON KESH HOTEL | WASHINGTON, D.C.

PROPERTY OVERVIEW

The Hoxton, Chicago

35 BERKADIA HOTELS & HOSPITALITY

The Hoxton, Chicago

The Hoxton, Chicago

The Hoxton, Chicago

The Hoxton, Chicago

Property Tax Summary

Commercial properties in Washington, DC undergo a general reassessment annually, in which the income approach is the primary valuation methodology used. To determine real property taxes, the millage rate is applied to 100% of the assessed value.

*The values displayed above solely represent the property as it currently stands and do not yet account for a completely delivered building. See the ‘Property & Other Taxes’ line-item in the Pro Forma for an estimate of future annual tax payments which reflect a fully completed Hotel property.

MAISON KESH HOTEL | WASHINGTON, D.C. PROPERTY OVERVIEW

Property ID Land Improvements 2023 Assessed Value 3101-0118 $4,391,830 $0 $4,391,830

Building & Parking Details

Construction

Structural Frame Stick on podium

Foundation Poured concrete slab

Floors Engineered wood

Exterior Walls & Façade Masonry and stucco

Roof Flat deck roof with waterpro of membrane cover

Windows Thermal windows in aluminum frames

Doors Glass, wood and metal

Mechanical

Cooling Individual VTAC units in guestrooms, central system in public areas

Heating/

Elevators Two (2) passenger elevators; two (2) material lifts

Fire Protection 100 percent sprinklered

Security Exterior and interior monitors

Other

Floor Covering Carpet, tile and wood

Walls Painted drywall & wall vinyl

Ceiling Drywall & acoustical tiles

Lighting Fluorescent & incandescent

37 BERKADIA HOTELS & HOSPITALITY

37 HOSPITALITY

MARKET OVERVIEW

Corporate

The local downtown Washington, DC market features numerous high-profile and Fortune 500 offices spread across high-growth, essential, and prominent industry clusters including aerospace and defense, technology, healthcare, real estate, legal, public relations, engineering, financial services, and government, among many others. The city’s renowned urban core and robust office footprint is well-complimented by the city’s 170 million SF of office space (1.4M SF under construction).

17

FORTUNE 500 HQ’S

170M SF OF OFFICE SPACE

40

MARKET OVERVIEW

MAISON KESH HOTEL | WASHINGTON, D.C.

Located in the heart of Washington, DC and boasting 2.3 million SF of total space, the Walter E. Washington Convention Center is among the foremost venues along the East Coast for a wide range of events from international policy conferences and industry conventions to pop-culture festivals, black-tie fundraisers, and even presidential inaugural balls, uniting locals and visitors from around the world to experience the best of the nation’s capital. The center is also noted for its extensive permanent collection of contemporary art, the largest of any convention center in the United States and one of the largest public art collections in Washington outside of a museum.

37 EVENTS ON THE BOOKS (2023)

2.3M TOTAL SF

703K SF OF EXHIBIT SPACE

52K SF BALLROOM 5 EXHIBIT HALLS

77 INDIVIDUAL MEETING ROOMS

41 BERKADIA HOTELS & HOSPITALITY

Government

714,700 JOBS SUPPORTED

22% OF THE REGIONAL WORK FORCE

MARKET OVERVIEW

MAISON KESH HOTEL | WASHINGTON, D.C.

Metro DC is home to the three branches of the US government and is anchored by the White House and United States Capitol in the city’s urban core, providing thousands of essential employees for the hospitality industry to capitalize on during a year-round basis. Federal, state, and local institutions in this sector make up the second-largest industry in Greater DC, employing approximately 714,700 residents metro-wide and accounting for more than 22% of the regional workforce.

Some of the most prominent federal agencies within the region include the Internal Revenue Service, US Department of Agriculture, US Department of Energy, and the US Census Bureau, among others. As a result of the significant footprint of high-profile government organizations and their associated per diem rates, the hotel sector often enjoys stability during times of economic volatility due to a higher ADR floor.

43 BERKADIA HOTELS & HOSPITALITY 43

Higher Education

One of the country’s preeminent research institutions founded in 1867, Howard University is a private, federally-chartered, historically black university and the only HBCU to be ranked among the top 100 Best Colleges by U.S. News & World Report. The 256-acre campus, often referred to as ‘The Mecca’, is also home to several Historic landmarks, such as Andrew Rankin Memorial Chapel, Frederick Douglass Memorial Hall, and the Founders Library.

• 256-Acre Campus

• 9,689 Students

• +1,200 Faculty Members

• 13 Schools & Colleges

• +140 Academic Programs Offered

• $1.5B Annual Economic Impact

Trinity Washington University is a private Catholic university offering a comprehensive education with five schools. The university enrolls more than 1,800 students in its undergraduate and graduate programs in the College of Arts and Sciences, School of Nursing and Health Professions, School of Education, School of Business and Graduate Studies and School of Professional Studies. Trinity enrolls more District of Columbia residents than any other private university in the nation, with more than half of Trinity’s students being residents of Washington, DC. The ‘Trinity Tigers’ compete at the Division III level, competing in basketball, soccer, softball, tennis, and volleyball.

• 26-Acre Campus

• 1,800 Students

• 5 Sports Teams

44 MAISON KESH HOTEL | WASHINGTON, D.C.

44 KESH HOTEL | WASHINGTON, D.C. MARKET OVERVIEW

Gallaudet University

Gallaudet University is a private federally chartered research university in Washington, DC and a global leader providing higher-education for the deaf and hard of hearing. Gallaudet competes in 16 Division III intercollegiate varsity sports.

• 99-Acre Campus

• 1,558 Students

• +690 Faculty Members

• +40 Undergraduate Programs

• +25 Graduate Degree Programs

• $232M Endowment

Catholic University of America

The Catholic University of America (CUA) is a private Roman Catholic research university in Washington, DC. A pontifical university of the Catholic Church, it is the only institution of higher education founded by U.S. Catholic bishops. Established in 1887 as a graduate and research center following approval by Pope Leo XIII, the univer sity began offering undergraduate education in 1904. The CUA Cardinals compete in 25 Division III sports.

• 176-Acre Campus

• 5,366 Students

• 793 Faculty Members

• 250+ Academic Programs

45

Medical

MedStar Washington Hospital Center is the largest and busiest hospital in Washington, DC, serving as the central hub for the region’s most advanced medical care. The hospital is ranked as one of the nation’s top 50 hospitals for cardiology and heart surgery.

• 926 Beds

• +6,100 Total Jobs Supported

• +400,000 Annual Patients

Opened in 1870, Children’s National was one of the first children’s hospitals in the U.S. and is the only exclusive provider of pediatric care in the Washington, DC metro area. The hospital provides comprehensive pediatric specialties and subspecialties to infants, children, teens, and young adults aged 0 – 21 throughout the region and features an ACS verified level 1 pediatric trauma center, the only one in the District of Columbia.

• 328 Beds

• +6,000 Total Jobs Supported

• Ranked #1 in Newborn Care U.S. News & World Report (2022)

MAISON KESH HOTEL | WASHINGTON, D.C.

MAISON KESH HOTEL | WASHINGTON, D.C.

MARKET OVERVIEW

Howard University Hospital (HUH) is a private, nonprofit institution in Washington, DC and an affiliate of Howard University. HUH is the nation's only teaching hospital on the campus of a historically black university. Physicians and other health professionals are engaged weekly in activities and services in the local community, including medical presentations, free health screenings, educational workshops, and health fairs.

• 300 Beds

• +100,000 Annual Patients

The Washington DC VA Medical Center is the region’s only health care system that specifically provides health care services to veterans. The medical center is also home to an adjacent 120-bed community living enter, which provides Veterans with geriatric long-term, hospice, and palliative care.

• 194 Beds

• +2,500 Jobs Supported

• +1,000,000 Annual Patients

Utilizing its research partnership with Georgetown University School of Medicine, MedStar National Rehabilitation Hospital is the region’s largest acute rehabilitation hospital.

• 137 Beds

• +1,200 Jobs Supported

• +2,000 Annual Patients

47 BERKADIA HOTELS & HOSPITALITY

Entertainment & Leisure

Union Market is the epicenter of culinary creativity in DC with over 55 local vendors as well as shopping, dining, arts, entertainment, and community events year-round.

55+ VENDORS AND RETAILERS

8 OFFICE SPACES

+400 ANNUAL EVENTS

+15,000 WEEKLY VISITORS

25K SQUARE FEET

MARKET OVERVIEW

49 BERKADIA HOTELS & HOSPITALITY

20,356 SEATING CAPACITY

Capital One Arena is home to the NHL's Washington Capitals, the NBA's Washington Wizards, and the Georgetown Hoyas men’s basketball team. Since its opening in 1997, the arena has hosted more than 4,500 events and over 47 million fans.

MAISON KESH HOTEL | WASHINGTON, D.C.

MARKET OVERVIEW

41,339 SEATING CAPACITY

51 BERKADIA HOTELS & HOSPITALITY

Anacostia

Navy Yard

Washington, DC,

Park is home to Major League Baseball's Washington

Since its completion in 2008, it was the first LEED-certified green major professional sports stadium in the United States. The stadium boasts a seating capacity of 41,339.

Located along the

River in the

neighborhood of

Nationals

Nationals.

MAISON KESH HOTEL | WASHINGTON, D.C. CSt.NW 3rd St. 3rd St. 5th St. 7th St. 9th St. 10th St. 3rd St. 4th St. 6th St. 7th St. 9th St. 10th St. 14th St. 12th St. 12th St. 14th St. 15th St. DSt.NW ESt.NW GSt.NW FSt.NW FSt.NW GSt.NW CSt.NW DSt.NW CSt.NE DSt.NE ESt.NW MassachusettsAve.NW North Capitol St FSt.NW PennsylvaniaAve. PennsylvaniaAve. PennsylvaniaAve. MarylandAve.SW MarylandAve.SW Washington Ave. SW JeffersonDr. IndependenceAve. JeffersonDr. IndependenceAve. IndependenceAve. MadisonDr. ConstitutionAve. ConstitutionAve. GALLERYPLACE/ CHINATOWN GALLERYPLACE/CHINATOWN UNIONSTATION ARCHIVES-NAVY MEMORIALPENNQUARTER FEDERALTRIANGLE SMITHSONIAN (12TH&JEFFERSONDR.) L’ENFANTPLAZA FEDERALCENTERSW SMITHSONIAN (12TH&INDEPENDENCEAVE.) METROCENTER NATIONAL GALLERY OF ART (N.G.A.) (WEST) (EAST) WASHINGTON MONUMENT U.S. CAPITOL U.S. BOTANIC GARDEN AMERICAN INDIAN MUSEUM AIR & SPACE MUSEUM HIRSHHORN MUSEUM ARTS AND INDUSTRIES SMITHSONIAN CASTLE (VISITOR CENTER) RIPLEY CENTER FREER GALLERY SACKLER GALLERY AFRICAN ART MUSEUM NATURAL HISTORY MUSEUM PORTRAIT GALLERY and AMERICAN ART MUSEUM POSTAL MUSEUM AMERICAN HISTORY MUSEUM AFRICAN AMERICAN HISTORY and CULTURE MUSEUM 1st St. N.G.A. SCULPTURE GARDEN HIRSHHORN SCULPTURE GARDEN RIPLEY GARDEN ROSE GARDEN HAUPT GARDEN CAROUSEL POLLINATOR GARDEN URBAN BIRD HABITAT VICTORY GARDEN COMMON GROUND: OUR A MERICAN GARDEN 8th St. 8th St. 1Mile 1Mile ¼ Mile ¼ Mile ¼ Mile ¼ Mile ½ Mile ½ Mile ½ Mile ½ Mile ¾ Mile ¾ Mile ¾ Mile NATIONAL ZOOLOGICAL PARK 3001 Connecticut Avenue NW, 20008 RENWICK GALLERY 1661 Pennsylvania Avenue NW, 20006 UDVAR-HAZY CENTER 14390 Air & Space Museum Pkwy., Chantilly, VA, 20151 5.3 miles from the Castle 30-minute walk from the Castle; 1.5 miles 29.3 miles from the Castle METRO LINES GreenYellowLine LineOrangeSilverLine Line RedBlueLine Line NORTH-FACING VIEW 5 miles from the Castle ANACOSTIA COMMUNITY MUSEUM 1901 Fort Place SE, 20020 Produced by the Smithsonian Office of Visitor Services 22.1M TOTAL VISITORS IN 2019 Renowned Smithsonian Museums MARKET OVERVIEW

SMITHSONIAN AMERICAN ART MUSEUM

• Holds one of the world's largest and most inclusive collections of art, from the colonial period to the present, made in the United States

• 2 million visitors in 2019

NATIONAL AIR AND SPACE MUSEUM

• Features three virtual reality adventures and five flight/ride simulators

• 3.2 million visitors in 2019

• Seven permanent exhibits are on display covering more than 161,100 SF

NATIONAL MUSEUM OF NATURAL HISTORY

• 4.2 million visitors in 2019

• Spans 1.5 million SF, including 325,000 SF of exhibition and public space

• The museum is responsible for the acquisition and maintenance of over 145 million artifacts and specimens

HIRSHHORN MUSEUM AND SCULPTURE GARDEN

• 891,100 visitors in 2019

• Features mostly post-World War II art in a unique, 60,000 SF exhibition space

• The two-level, outdoor Sculpture Garden covers 4 acres

53 BERKADIA HOTELS & HOSPITALITY

NATIONAL MUSEUM OF AFRICAN AMERICAN HISTORY AND CULTURE

• 2 million visitors in 2019

• Offers more than a dozen unique and inspiring collections

• The museum has more than 36,000 artifacts, with about 3,500 on display

• The museum spans 350,000 SF in a 10-story building, making it the world’s largest museum dedicated to African American history and culture

SMITHSONIAN NATIONAL ZOO

• 1.8 million visitors in 2019

• 163-acre site

SMITHSONIAN INSTITUTION

BUILDING "THE CASTLE"

• 965,500 visitors in 2019

• Completed in 1855, “The Castle” is the signature building of the Smithsonian and is home to the Smithsonian Visitor Center which offers highlights of each of the Smithsonian’s museums

NATIONAL MUSEUM OF AMERICAN HISTORY

The National Museum of American History is among the most visited of the Smithsonian Museums.

• Over 2.8 million visitors are recorded annually

• Responsible for the care and maintenance of more than 1.7 million artifacts and 22,000 linear feet of historical documents

• The museum occupies 300,000 SF of space and has 12 permanent exhibits

MARKET OVERVIEW

MAISON KESH HOTEL | WASHINGTON, D.C.

NATIONAL PORTRAIT GALLERY

• Over 23,000 items are in the gallery’s collection

• Other than the White House, the National Portrait Gallery has the only complete collection of Presidential portraits

• Approximately 1.5 million people visit the National Portrait Gallery each year

55 BERKADIA HOTELS & HOSPITALITY

Transportation

Union Station is a superbly restored historic, mixed-use, intermodal transportation and shopping center located just blocks from the U.S. Capitol. The nation’s second-busiest train station trailing only New York City’s Penn Station – guests are easily connected to the entire Mid-Atlantic region. Moreover, with a $10 billion potential expansion, and a $1.2 trillion infrastructure bill recently put into place, much of which will be targeted on Amtrak projects throughout the Mid-Atlantic and Northeast US, there remains potential for significantly more travelers visiting the DC Metro region over the coming years.

100K DAILY USERS

$10B POTENTIAL EXPANSION

56 MAISON KESH HOTEL | WASHINGTON, D.C.

MARKET OVERVIEW

Reagan National Airport (DCA)

Offering nonstop flights to 96 domestic and six international destinations, Reagan National Airport (DCA) served a record 23.9 million passengers in 2022 and recently completed more than $1 billion of improvements, adding a new 14gate, 230,000 SF concourse, as well as two new security checkpoint buildings in April 2021.

23.9M PASSENGERS IN 2022 (RECORD TRAFFIC)

US Washington Metrorail (Rail + Bus)

US Washington Metrorail provides safe, clean, reliable transit service for more than 600,000 customers a day throughout the Washington, DC area. Hospitality guests and residents alike can utilize the second largest rapid transit system in the United States which served over 300 million passengers in 2019 – a number primed to grow substantially as there are plans for up to $20 billion of improvements currently being reviewed.

57 BERKADIA HOTELS & HOSPITALITY

Notable Local Developments

Burnham Place

Union Station Renovation & Expansion

50 Massachusetts Avenue Northeast

$10 Billion

Start: Late 2023

Anticipated Finish: 2040

Developer(s): Amtrak, Union Station Redevelopment Corporation

The $10 billion plans to modernize the nation’s second-busiest rail hub include a major reconfiguration of the bus terminal to align with a new train hall, addIng wider rail platforms, a new bus terminal and updated concourses lined with shops and restaurants, and improved accessibility to Metrorail, buses, taxis, ride-hailing services, streetcars and parking

14-acres encompassing the Union Station rail yard between K Street and 1st and 2nd Street NE

$3 Billion

Start: Not Disclosed

Anticipated Finish: 2030

Developer(s): Akridge

Burnham Place, a proposed 3 million SF development, will be built above Union Station’s rail yard, providing direct access to a newly expanded and improved station facility. The development will feature a mix of 1.5 million SF of first-class office space, over 1,300 residential units, 100,000 SF of retail space, and hotel space, as well as parks and plazas.

McMillan Sand Filtration Site

25-acre site at North Capitol Street, Michigan Avenue, and First Street NW

$720 Million

Start: 2022

Anticipated Finish: Not Disclosed

Developer(s): EYA, Jair Lynch, Trammel Crow

The $720 million, 25-acre redevelopment of the former McMillan Reservoir Sand Filtration Site includes 860,000 SF of medical office, 467 apartments, a 52,000 SF supermarket, 146 townhomes and a central park and community center.

7 New York Ave

7 New York Avenue Northeast

Cost Not Disclosed

Start: 2022

Anticipated Finish: Not Disclosed

Developer(s): Akridge

A redevelopment of the former Covenant House location, this new project will deliver 116 residential units primarily consisting of micro units.

1 Florida Ave

1 Florida Avenue Northeast

Cost Not Disclosed

Start: 2021

Anticipated Finish: Not Disclosed

Developer(s): Aria Development

Aria Development is replacing a former Exxon Mobile gas station at the corner of North Capitol Street and Florida Avenue, bringing a new 13-story-pluspenthouse building with 388 units and a swimming pool to the site.

MARKET

OVERVIEW

The 202

202 Florida Avenue Northeast

Cost Not Disclosed (developer received a $69.4M loan)

Start: 2022

Anticipated Finish: 2023

Developer(s): MRP Realty

Located in the NoMa neighborhood and adjacent to the Union Market district, the 202 will deliver a 16-story high-rise apartment building with 254 units and 3,800 SF of retail. The building will include a mix of studio, one-bedroom, and two-bedroom units. Residents will enjoy a rooftop club room, pet facilities, fitness center, and shared workspaces.

Capitol Point North

1300 First Street Northeast

Cost Not Disclosed

Start: Not Disclosed

Anticipated Finish: 2024

Developer(s): JBG Smith

JBG Smith has submitted plans for a +700,000 SF mixed-use development on the 1.5acre site at 55 and 75 New York Avenue. The property is currently home to a McDonald’s and a three-story office building. The development would include 805 residential units along with over 30,000 SF of retail and restaurant space as well as a penthouse-level restaurant/bar.

Financial Plaza

60 New York Avenue Northeast

Cost Not Disclosed

Start: 2022

Anticipated Finish: 2025

Developer(s): Douglas Development Corporation

The General Services Administration signed a 1.23 million SF lease with Douglas Development Corporation for a new Securities and Exchange Commission headquarters to be constructed which will house approximately 4,500 SEC employees. The triangular site, bounded by New York Avenue, North Capitol Street and First Street NE, can also accommodate another 600,000 square feet of office or 600 residential units.

District of Columbia Housing Authority Redevelopment

1133 North Capitol Street Northeast

Cost Not Disclosed (land purchased in 2019 for $67 million)

Start: 2022

Anticipated Finish: 2024 (Phase 1)

Developer(s): MRP Realty, Ares Management

The multi-phased development will include an estimated 1,200 apartments and is slated to include a minimum of 244 affordable units, at least half of which would be deeply affordable for residents making 30 percent of the median family income and below.

Lacebark Alley

1250 First Street Northeast

Cost Not Disclosed

Start: Not Disclosed

Anticipated Finish: 2024

Developer(s): JBG Smith, Brandywine Realty Trust

Lacebark Alley will consist of a new three-building complex comprising of mixed-use space including 220 residential apartments, 366,000 SF of class A office space, 53,000 SF of on-site retail, and a 9,000 SF art centric plaza.

STR TREND SET OVERVIEW

STR Trend Set Analysis

The Maison Kesh’s proposed competitive set includes six nearby hotels totaling 1,192 rooms. Prior to the impact of the COVID-19 pandemic, the proposed competitive set demonstrated historically robust top-line performance, realizing a $150.89 RevPAR for the year end 2019 period, which consisted of 79.7% Occupancy and $189.21 ADR.

As of the year end 2022 period, the proposed competitive set achieved a $128.38 RevPAR, consisting of 70.5% Occupancy and $182.03 ADR. However, as top-line benchmarks – primarily Occupancy – continues to build off an impressive 107% YoY RevPAR increase – a new owner will be able to leverage the Hotel’s brand-new, boutique product offering and highly coveted amenity base/F&B outlets, in conjunction with a prime location in a burgeoning submarket of Washington, DC to command a premium in both rate and occupancy, leading to an outstanding RevPAR penetration at stabilization.

STR TREND SET OVERVIEW

62

MAISON KESH HOTEL | WASHINGTON, D.C.

The Hoxton, Chicago

Occupancy (%)

RevPAR

Note: The year end 2017 period was an inauguration year which typically includes increased Occupancy, ADR, and RevPAR figures.

January February March April May June July August September October November December Total Year Jan YTD 2016 60.1% 71.6% 89.6% 92.9% 79.3% 87.4% 87.1% 84.8% 82.1% 83.3% 72.3% 64.5% 79.7% 60.1% 2017 68.2% 75.7% 86.9% 91.0% 86.0% 89.5% 90.3% 81.6% 84.9% 88.3% 80.6% 70.6% 82.8% 68.2% 2018 63.7% 72.3% 88.5% 91.3% 86.6% 89.4% 88.0% 80.3% 74.8% 83.7% 74.3% 67.3% 80.0% 63.7% 2019 56.6% 68.9% 86.9% 90.7% 87.7% 89.4% 88.6% 85.1% 78.1% 85.2% 74.0% 64.7% 79.7% 56.6% 2020 59.3% 70.9% 32.8% 13.6% 25.0% 33.4% 41.2% 28.8% 31.2% 35.4% 28.1% 24.4% 35.6% 59.3% 2021 59.8% 43.9% 43.1% 50.1% 49.4% 51.6% 55.3% 52.3% 46.4% 56.7% 59.2% 55.8% 52.0% 59.8% 2022 40.2% 47.0% 68.7% 77.5% 77.3% 80.0% 82.8% 78.4% 76.2% 79.7% 68.9% 67.9% 70.5% 40.2% 2023 57.8% 57.8% Avg 57.9% 64.5% 72.1% 75.6% 72.8% 76.7% 78.3% 70.8% 68.8% 74.6% 65.7% 59.7% 69.8% 57.9% ADR ($) January February March April May June July August September October November December Total Year Jan YTD 2016 $137.49 $168.07 $213.40 $226.29 $217.83 $209.06 $165.51 $146.32 $204.52 $223.18 $181.49 $142.46 $188.79 $137.49 2017 $207.00 $170.66 $232.96 $224.53 $224.01 $216.37 $177.04 $152.18 $190.58 $238.24 $168.84 $123.97 $195.71 $207.00 2018 $132.27 $154.23 $212.58 $234.17 $223.55 $223.22 $163.82 $148.06 $191.72 $224.69 $165.65 $140.56 $187.82 $132.27 2019 $142.94 $151.94 $217.07 $215.40 $232.03 $216.12 $166.43 $141.09 $208.47 $229.43 $175.11 $133.19 $189.21 $142.94 2020 $143.03 $164.92 $216.18 $110.40 $99.43 $100.11 $104.87 $104.77 $97.61 $95.19 $91.94 $87.14 $125.83 $143.03 2021 $122.36 $104.09 $89.12 $95.40 $105.03 $111.87 $126.67 $131.40 $136.84 $157.60 $126.11 $109.82 $119.14 $122.36 2022 $121.44 $126.68 $164.50 $207.39 $219.04 $209.56 $166.98 $149.83 $207.19 $237.03 $168.92 $145.23 $182.03 $121.44 2023 $143.95 $143.95 Avg $145.07 $153.16 $199.87 $208.07 $207.38 $198.79 $159.89 $143.42 $187.80 $212.70 $161.68 $129.54 $177.31 $145.07

($) January February March April May June July August September October November December Total Year Jan YTD 2016 $82.67 $120.29 $191.14 $210.21 $172.80 $182.76 $144.13 $124.13 $167.92 $185.88 $131.29 $91.95 $150.39 $82.67 2017 $141.13 $129.22 $202.55 $204.38 $192.63 $193.60 $159.84 $124.19 $161.90 $210.47 $136.02 $87.47 $162.09 $141.13 2018 $84.21 $111.52 $188.06 $213.91 $193.57 $199.67 $144.08 $118.89 $143.40 $187.98 $123.16 $94.54 $150.35 $84.21 2019 $80.85 $104.71 $188.57 $195.36 $203.54 $193.15 $147.45 $120.00 $162.76 $195.48 $129.62 $86.22 $150.80 $80.85 2020 $84.80 $116.92 $70.82 $14.99 $24.86 $33.48 $43.22 $30.22 $30.43 $33.74 $25.81 $21.30 $44.81 $84.80 2021 $73.23 $45.66 $38.42 $47.77 $51.86 $57.70 $69.99 $68.75 $63.43 $89.33 $74.66 $61.29 $61.98 $73.23 2022 $48.86 $59.59 $113.07 $160.79 $169.28 $167.72 $138.20 $117.41 $157.90 $188.96 $116.44 $98.57 $128.38 $48.86 2023 $83.26 $83.26 Avg $84.02 $98.80 $144.18 $157.24 $151.02 $152.42 $125.22 $101.55 $129.25 $158.72 $106.25 $77.37 $123.75 $84.02

Property Location Rooms Opened Hampton Inn Washington-Downtown-Convention Center Washington, DC 228 March 2005 Cambria Hotels Washington, DC Convention Center Washington, DC 182 May 2014 Homewood Suites Washington DC Convention Center Washington, DC 160 May 2016 Courtyard Washington DC US Capitol Washington, DC 218 April 2009 Hilton Garden Inn Washington DC US Capitol Washington, DC 204 April 2011 Hyatt Place Washington DC/US Capitol Washington, DC 200 June 2014 Total 1,192 64

KESH HOTEL | WASHINGTON, D.C. STR TREND SET OVERVIEW

MAISON

65 BERKADIA HOTELS & HOSPITALITY

Hampton Inn WashingtonDowntown-Convention Center Cambria Hotels Washington, DC Convention Center Homewood Suites Washington DC Convention Center Location 901 6th Street NW Washington, DC 899 O Street NW Washington, DC 465 New York Avenue NW Washington, DC Year Built/ Renovated March 2005 May 2014 May 2016 Rooms 228 182 160 F&B Complimentary Breakfast, Sundry/Convenience Store Complimentary Breakfast, Social Circle, Sundry/Convenience Store Complimentary Breakfast, Sundry/Convenience Store Meeting Space 432 SF 1,240 SF 0 SF Fitness Room Business Center Indoor Pool Fitness Center Business Center Fitness Room Business Center

STR TREND SET OVERVIEW

STR Trend Set Comparison MAISON KESH HOTEL | WASHINGTON, D.C.

67 BERKADIA HOTELS & HOSPITALITY Courtyard Washington DC US Capitol Hilton Garden Inn Washington DC US Capitol Hyatt Place Washington DC / US Capitol 1325 2nd Street NE Washington, DC 1225 First Street NE Washington, DC 33 New York Avenue NE Washington, DC April 2009 April 2011 June 2014 218 204 200 The Bistro, Sundry/Convenience Store The Garden Grill, Sundry/Convenience Store Complimentary Breakfast, The Placery, Sundry/Convenience Store 2,755 SF 3,009 SF 1,600 SF Indoor Pool Fitness Center Business Center Indoor Pool Fitness Center Business Center Outdoor Pool Fitness Center Business Center 67 HOSPITALITY

FINANCIAL OVERVIEW

Pro Forma

IMPORTANT INFORMATION & DISCLAIMER: The information contained herein is assumed to be correct and market-supported. Output produced from this model should not be considered an appraisal. Projections are forecasts and are not to be considered fact. The information contained in this file is privileged and confidential; it is intended only for use by Berkadia® and their clients. This file may not be reproduced physically or in electronic format without the express written consent of Berkadia. Not responsible for errors and omissions.

70

KESH

2024 2025 2026 2027 2028 Rooms 97 97 97 97 97 Available Rooms 35,502 35,405 35,405 35,405 35,502 Rooms Sold 24,141 26,554 27,970 27,970 28,047 Occupancy 68.0% 75.0% 79.0% 79.0% 79.0% ADR $220.01 $231.01 $240.83 $248.06 $255.50 ADR % Change 5.0% 4.3% 3.0% 3.0% RevPAR $149.61 $173.26 $190.26 $195.97 $201.84 RevPAR % Change 15.8% 9.8% 3.0% 3.0% Revenue Amount Percent Amount Percent Amount Percent Amount Percent Amount Percent Rooms $5,311,432 50.2% $6,134,300 51.0% $6,736,075 51.7% $6,938,158 52.1% $7,165,881 52.5% Food & Beverage $4,846,796 45.8% $5,411,092 45.0% $5,785,179 44.4% $5,871,957 44.1% $5,976,365 43.7% Other Operated Departments $421,562 4.0% $468,325 3.9% $498,235 3.8% $503,217 3.8% $509,642 3.7% Miscellaneous $7,232 0.1% $8,034 0.1% $8,547 0.1% $8,633 0.1% $8,743 0.1% Total Revenue $10,587,022 100.0% $12,021,751 100.0% $13,028,037 100.0% $13,321,964 100.0% $13,660,631 100.0% Departmental Expenses Rooms $1,210,984 22.8% $1,371,954 22.4% $1,488,479 22.1% $1,533,133 22.1% $1,583,454 22.1% Food & Beverage $3,635,097 75.0% $3,923,042 72.5% $4,049,625 70.0% $4,110,370 70.0% $4,183,455 70.0% Other Operated Departments $242,398 57.5% $257,579 55.0% $264,065 53.0% $266,705 53.0% $270,110 53.0% Total Expenses $5,088,479 48.1% $5,552,575 46.2% $5,802,169 44.5% $5,910,208 44.4% $6,037,019 44.2% Gross Operating Income $5,498,543 51.9% $6,469,177 53.8% $7,225,868 55.5% $7,411,756 55.6% $7,623,612 55.8% Undistributed Operating Expenses Administrative & General $698,328 6.6% $731,241 6.1% $760,491 5.8% $783,305 5.9% $809,015 5.9% Information & Telecommunications $104,315 1.0% $107,151 0.9% $110,365 0.8% $113,676 0.9% $117,407 0.9% Franchise Fees (1) $478,029 4.5% $552,087 4.6% $606,247 4.7% $624,434 4.7% $644,929 4.7% Sales & Marketing $376,268 3.6% $394,002 3.3% $409,762 3.1% $422,055 3.2% $435,908 3.2% Repairs & Maintenance $262,918 2.5% $288,420 2.4% $302,841 2.3% $311,926 2.3% $322,164 2.4% Energy Costs $226,860 2.1% $244,339 2.0% $254,113 2.0% $261,736 2.0% $270,327 2.0% Total Undistributed Operating Expenses $2,146,718 20.3% $2,317,240 19.3% $2,443,819 18.8% $2,517,133 18.9% $2,599,750 19.0% Gross Operating Profit $3,351,825 31.7% $4,151,937 34.5% $4,782,049 36.7% $4,894,623 36.7% $5,023,861 36.8% Fixed Charges Insurance $108,446 1.0% $111,395 0.9% $114,736 0.9% $118,178 0.9% $122,057 0.9% Property & Other Taxes $457,069 4.3% $480,890 4.0% $500,126 3.8% $515,129 3.9% $532,037 3.9% Management Fees $317,611 3.0% $360,653 3.0% $390,841 3.0% $399,659 3.0% $409,819 3.0% Total Fixed Charges $883,126 8.3% $952,937 7.9% $1,005,703 7.7% $1,032,967 7.8% $1,063,913 7.8% EBITDA $2,468,699 23.3% $3,199,000 26.6% $3,776,346 29.0% $3,861,656 29.0% $3,959,948 29.0% Reserve for Replacement $423,481 4.0% $480,870 4.0% $521,121 4.0% $532,879 4.0% $546,425 4.0% Net Operating Income $2,045,218 19.3% $2,718,130 22.6% $3,255,225 25.0% $3,328,778 25.0% $3,413,523 25.0%

MAISON

HOTEL | WASHINGTON, D.C.

(1) Franchise Fees reflect amounts typically associated with a Marriott, Hilton, Hyatt or IHG 'soft-brand' product.

71

BERKADIA HOTELS & HOSPITALITY

The Hoxton, Chicago

MAISON KESH HOTEL | WASHINGTON, D.C. KESH HOTEL | WASHINGTON, D.C. INVESTMENT SALES FINANCING BROKER OF RECORD Dan Hawkins Managing Director 240.204.5139 dan.hawkins@berkadia.com Jake Pietras Associate Director 410.940.9497 jake.pietras@berkadia.com Andrew Coleman Senior Managing Director 240.204.5132 andrew.coleman@berkadia.com Bobby Meehling #BR40000206 Katelyn Reynolds Senior Real Estate Analyst 213.399.3390 katelyn.reynolds@berkadia.com Lindsey deButts Senior Director 240.204.5131 lindsey.debutts@berkadia.com Fiorella Furlato Real Estate Analyst 215.328.1311 fiorella.furlato@berkadia.com

Chicago Justin Storer Real Estate Analyst 301.202.3542 justin.storer@berkadia.com

The Hoxton,

DISCLAIMER & CONFIDENTIALITY AGREEMENT

The material contained in this document is confidential, furnished solely for the purpose of considering investment in the property described therein and is not to be copied and/or used for any purpose or made available to any other person without the express written consent of Berkadia Real Estate Advisors LLC and Berkadia Real Estate Advisors Inc. In accepting this, the recipient agrees to keep all material contained herein confidential.

This information package has been prepared to provide summary information to prospective purchasers and to establish a preliminary level of interest in the property described herein. It does not, however, purport to present all material information regarding the subject property, and it is not a substitute for a thorough due diligence investigation. In particular, Berkadia Real Estate Advisors LLC, Berkadia Real Estate Advisors Inc. and Seller have not made any investigation of the actual property, the tenants, the operating history, financial reports, leases, square footage, age or any other aspect of the property, including but not limited to any potential environmental problems that may exist and make no warranty or representation whatsoever concerning these issues. The information contained in this information package has been obtained from sources we believe to be reliable; however, Berkadia Real Estate Advisors LLC, Berkadia Real Estate Advisors Inc. and Seller have not conducted any investigation regarding these matters and make no warranty or representation whatsoever regarding the accuracy or completeness of the information provided. Any pro formas, projections, opinions, assumptions or estimates used are for example only and do not necessarily represent the current or future performance of the property.

Berkadia Real Estate Advisors LLC and Berkadia Real Estate Advisors Inc. and Seller strongly recommend that prospective purchasers conduct an in-depth investigation of every physical and financial aspect of the property to determine if the property meets their needs and expectations. We also recommend that prospective purchasers consult with their tax, financial and legal advisors on any matter that may affect their decision to purchase the property and the subsequent consequences of ownership.

All parties are advised that in any property the presence of certain kinds of molds, funguses, or other organisms may adversely affect the property and the health of some individuals. Berkadia Real Estate Advisors LLC and Berkadia Real Estate Advisors Inc. recommend, if prospective buyers have questions or concerns regarding this issue, that prospective buyers conduct further inspections by a qualified professional.

The Seller retains the right to withdraw, modify or cancel this offer to sell at any time and without any notice or obligation. Any sale is subject to the sole and unrestricted approval of Seller, and Seller shall be under no obligation to any party until such time as Seller and any other necessary parties have executed a contract of sale containing terms and conditions acceptable to Seller and such obligations of Seller shall only be those in such contract of sale.

For more information on these and other Berkadia® exclusive listings, please visit our website at www.Berkadia.com

Berkadia®, a joint venture of Berkshire Hathaway and Jefferies Financial Group, is an industry leading commercial real estate company providing comprehensive capital solutions and investment sales advisory and research services for multifamily and commercial properties. Berkadia® is amongst the largest, highest rated and most respected primary, master and special servicers in the industry.

© 2023 Berkadia Proprietary Holding LLC

Berkadia® is a trademark of Berkadia Proprietary Holding LLC

Investment sales and real estate brokerage businesses are conducted exclusively by Berkadia Real Estate Advisors LLC and Berkadia Real Estate Advisors Inc. Commercial mortgage loan origination and servicing businesses are conducted exclusively by Berkadia Commercial Mortgage LLC and Berkadia Commercial Mortgage Inc. Tax credit syndication business is conducted exclusively by the Tax Credit Syndication group. In California, Berkadia Real Estate Advisors Inc. conducts business under CA Real Estate Broker License #01931050; Adrienne Barr, CA DRE Lic. # 01308753. Berkadia Commercial Mortgage LLC conducts business under CA Finance Lender & Broker Lic. #988-0701; and Berkadia Commercial Mortgage Inc. under CA Real Estate Broker Lic. #01874116. This proposal is not intended to solicit commercial mortgage loan brokerage business in Nevada. For state licensing details, visit: https://www.berkadia.com/licensing/

73 BERKADIA HOTELS & HOSPITALITY

73 HOSPITALITY

a Berkshire Hathaway and Jefferies Financial Group company DC METRO | CHICAGO | RALEIGH | BOSTON MIAMI | TAMPA | ORLANDO | SCOTTSDALE | SAN DIEGO

Hoxton, Chicago

The

The Hoxton, Chicago

The Hoxton, Chicago

The Hoxton, Chicago

The Hoxton, Chicago

The Hoxton, Chicago

The Hoxton, Chicago

The Hoxton, Chicago

The Hoxton, Chicago

The Hoxton, Chicago

The Hoxton, Chicago

The Hoxton, Chicago

The Capitol

The Hoxton, Chicago

The Hoxton, Chicago

The Hoxton, Chicago

The Capitol

MAISON KESH HOTEL | WASHINGTON, D.C.

MAISON KESH HOTEL | WASHINGTON, D.C.