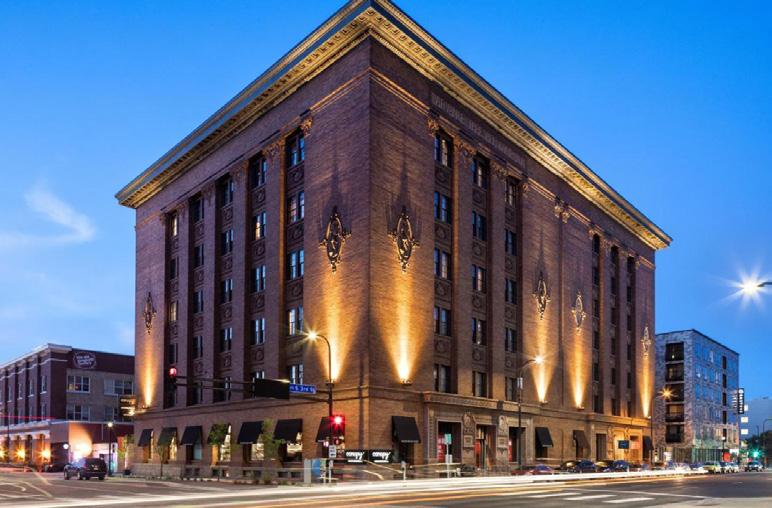

Berkadia’s Hotels & Hospitality Group is pleased to offer, on an exclusive basis, the opportunity to acquire the fee-simple interest in the Autograph Collection Elliot Park Hotel (the “Elliot Park Hotel,” “Hotel” or “Property”). Opened in September 2018, the 168-key Hotel is part of Kraus Anderson’s (KA’s) broader mixed-use development, which includes 100,000 SF of office space (home to KA’s headquarters), 307 high-end apartment units, Finnegans House (microbrewery and event venue), and a two-level underground parking garage.

With best-in-class product and significant performance runway to stabilization following the recent construction of the Hotel, there is a unique opportunity for a buyer to capitalize on a newly built asset in a rapidly recovering MSA.

The newly constructed Elliot Park Hotel opened in September 2018 and remains in like-new condition given its pandemicrelated closures and low occupancy experienced since reopening.

The Hotel has yet to receive enough runway to fully stabilize due to its opening less than two years before the onset of COVID-19. As the Property has started to begin its recovery, marked by the trailing city-wide recovery, new ownership stands to benefit from all upside cash flow potential through stabilization.

Kraus Anderson has redeveloped its downtown headquarters block into a mixed-use, live-work-play development, consisting of the company’s headquarters, a 17-story high-end apartment building, Finnegans House, and an underground parking garage. The Hotel’s integral location within the KA Block allows it to capitalize on the built-in demand generators within the development.

The Hotel boasts an A+ location within Elliot Park – one of Minneapolis’ oldest neighborhoods that has been revitalized through recent development projects, A+ Location Within

The state of Minnesota is home to 16 Fortune 500 companies, six of which are situated in the city of Minneapolis. Both public and private capital have continued to make long term bets on the city, seeing an influx of redevelopment projects over the past few years, referenced as the Big Build. This push consists of $2 billion in projects, notably the opening of the new U.S. Bank Stadium and Commons Park, the new stadium neighborhood of Downtown East, and a significant renovation to Target Center.

7

The Hotel is being offered unencumbered of management and debt, along with being a nonunion operation and fee simple, providing true flexibility and optionality to a new investor.

8

The Elliot Park Hotel offering represents a rare opportunity to acquire a recently delivered, full-service, premium-branded Hotel, at a substantial discount to replacement cost as well as at a discount to recent trades in Minneapolis.

The 168-key Elliot Park Hotel is situated within Kraus-Anderson’s mixed-use full block development and opened its doors in September 2018.

Guests can enjoy the Hotel’s premium guestroom product, featuring 13 suites, on-site restaurant Tavola Italian Kitchen & Bar, fitness center, over 3,000 square feet of meeting space, valet parking, and complimentary Wi-Fi. The Property is conveniently located within walking distance of the top leisure attractions in the Minneapolis CBD, along with being in close proximity to the six Fortune 1000 company headquarters downtown.

The Hotel’s 168 guestrooms, inclusive of 13 suites, offer guests Scandinavian-inspired design, a large walk-in shower with separate bath, Keurig coffee maker, and complimentary Wi-Fi. Guestrooms range from 320 to 971 square feet across the Hotel’s four room types.

Tavola Italian Kitchen & Bar is Elliot Park Hotel’s on-site restaurant, serving traditional Italian cuisine in an upscale urban setting. Located off the lobby, Tavola is open daily for breakfast, lunch, and dinner.

Elliot Park Hotel offers 3,005 square feet of meeting space across three rooms and can accommodate up to 288 guests in its largest space. Each room is outfitted with high-speed Wi-Fi, state-of-the-art audio-visual equipment, and video-conferencing capability.

Outside of the Hotel’s meeting space, the neighboring microbrewery, Finnegan’s House, features additional event space, with a maximum capacity of 400 people in its largest offering. Although the Hotel does not operate the meeting space, Elliot Park Hotel benefits from encouraging its rental as the Hotel can capture the corresponding room blocks.

The Minneapolis-St. Paul region features a strong, multi-faceted economy and is considered one of the nation’s most economically robust regions, thanks to its strong base of 16 Fortune 500 headquarters and vast concentration of financial services, manufacturing, consumer goods, and inventive research and development companies. Further strengthened by a highly skilled and diverse workforce, the ‘Twin Cities’ are an ideal location for business operations of all types and sizes.

+155,000

FINANCIAL SERVICES JOBS

+318,000 BUSINESS SERVICES JOBS

Source: Fortune 500, 2022 (*As of March 31, 2022)

MINNEAPOLIS MSA → HOME TO 35 COMPANIES WITH REVENUES EXCEEDING $1 BILLION

Metro Minneapolis or ‘Medical Alley’ is home to the world’s #1 health technology innovation cluster. With over 750 headquartered healthcare life science companies, the highest concentration of medical device jobs in the nation, and the fifth-lowest operating cost among life science clusters in the nation, the Greater MSP region is the global epicenter of life science innovation and commercialization.

+750 HEALTH AND LIFE SCIENCES FIRMS

$731M INVESTED METRO-WIDE SINCE 2017

Nearly 300,000 JOBS SUPPORTED INDUSTRY-WIDE

“Silicon Valley of Healthcare”

MINNESOTA RANKS #2 IN THE NATION FOR MEDICAL TECHNOLOGY PATENTS GRANTED (+100,000)

BIRTHPLACE OF THE PACEMAKER AND IN-EAR HEARING AID

MINNESOTA HAS THE HIGHEST CONCENTRATION OF MEDICAL TECHNOLOGY WORKERS IN THE NATION

MAYO CLINIC HOSPITAL, ST. MARY’S - ROCHESTER, MN

14% METRO-WIDE GROWTH IN MEDICAL TECHNOLOGY EMPLOYMENT SINCE 2017

HOSPITAL IN THE NATION

(7 Years Straight)

University of Minnesota

Medical Centre

743 Beds

Abbott

Northwestern Hospital

646 Beds

Hennepin County

Medical Centre

473 Beds

Regions Hospital

454 Beds

The Minneapolis metro is the host to six professional sports teams who compete across five sports venues, including the Target Center, Target Field, U.S. Bank Stadium, Allianz Field, and the Xcel Energy Center. The 39,500-seat Target Field is home to Major League Baseball’s (MLB) Minnesota Twins and has established itself as one of the premier sporting venues in the country. The National Football League’s (NFL) Minnesota Vikings play at the recently constructed U.S. Bank Stadium, where more than 72,000 fans come to cheer on the home team.

The Twin Cities are home to some of the finest colleges and technical institutes in the country, including 36 colleges and universities as well as a variety of technical and community colleges, like Anoka-Ramsey Community College, North Hennepin Community College, and Normandale Community College.

+215,000 STUDENTS METRO-WIDE

• Offers 170 Undergraduate Degree Programs and 200 Graduate and Professional Degree Programs

• 52,380 Students

• Supports nearly 24,000 Jobs Metro-Wide Generating an $8.6B Annual Economic Impact

• $1.15B in Research Funding (2021)

• Offers 52 Degree Programs, 12 Certificate Programs, and over 1,900 Courses

• 41,070 Students

• +1,500 Faculty

Minneapolis – St. Paul International Airport (MSP) provides daily departures to 27 international destinations and 136 destinations within the U.S. and served 25.2 million passengers in 2021, a nearly 70% YoY increase, indicating a strong recovery from pandemic-impacted travel (record 39.6 million passengers served in 2019). Ranking as the 13th busiest U.S. airport by passenger traffic in 2021 and 17th for aircraft operations, MSP Airport is also a base for hometown carrier Sun Country Airlines and is Delta Air Lines’ second-largest hub.

#3

‘BEST LARGE US AIRPORTS’ THE WALL STREET JOURNAL (2022)

The 3,400-acre transportation hub comprises a major economic powerhouse, supporting more than 86,900 jobs, $15.9 billion in business revenue, $3.7 billion in personal income, $2.5 billion in local purchases, and $546 million in state and local taxes.

• Delta restarted its daily service to London Heathrow (LHR) in April 2022 after a two-year hiatus

• Condor Airlines relaunched its non-stop flight to Frankfurt, Germany, (FRA) on June 1, 2022

• Sun Country launched its first-ever service to Canada, with a new route between MSP and Vancouver which began June 15, 2022

• Air Canada launched a new year-round, daily flight from MSP to Montreal-Trudeau International Airport (YUL) in Summer 2022

• Delta will join Allegiant and Sun Country in adding a non-stop route from MSP to Destin, Florida and the Florida Panhandle in Spring 2023

MSP AIRPORT ANNUAL PASSENGER TRAFFIC IS PROJECTED TO RETURN TO PRE-PANDEMIC LEVELS (~40 MILLION) BY 2024Source: Metropolitan Airports Commission (MAC)

The Minneapolis Big Build is a collection of $2 billion in projects that are transforming the city by adding new facilities, green space, and public amenities. Minneapolis has already begun its transformation with the redesign of the city’s signature street, Nicolette, the opening of the new U.S. Bank Stadium and Commons Park, and a major renovation to Target Center. Most recently, the opening of the Dayton’s Project and RBC Gateway have added office, retail, multifamily, hospitality, and entertainment space within the CBD. Collectively, the projects included in the Big Build are cultivating an even more vibrant, live-work-play city.

$2B

Approved in March of 2022, the Bloomington City Council and Bloomington Port Authority authorized a redevelopment and financing agreement for Mall of America’s ‘Phase II’ expansion plans. According to the plan, the water park would be built at the north side of the mall, next to the JW Marriott, along with a skyway connected to a 1,300-space parking ramp. Eventually, a water park hotel would be built, and the connected parking structure would add another 1,100 spaces. The fourth phase of the plan would allow for the construction of an entertainment venue, hotel complex with event spaces, and a multi-level office campus. The first phase is expected to open in the fall of 2023 with the grand opening tentatively planned for late 2024.

$422M EXPANSION

ANTICIPATED TO ATTRACT AN ADDITIONAL 20M ANNUAL VISITORS

+100% ANNUAL ECONOMIC IMPACT ($4.3B ESTIMATED)

Development has been underway at Viking Lakes since 2016 and is expected to continue through 2026. As of early 2022, the 200-acre, mixed-use development in Eagan is home to the NFL’s Minnesota Vikings headquarters and practice facility; practice stadium; the $98 million, 320-room Omni Viking Lakes Hotel; a medical office building; and a portion of the 1,000-plus residential units that will eventually emerge. At build-out, Viking Lakes will have a total of about three million square feet of corporate offices, retail, medical space, and multifamily residences.

• 200-Acre Mixed-Use Development

• Total Cost → $3B

• 3M SF of Total Space

$2.8B

RAIL LINE EXPANSION

In November 2018, the Twin Cities Met Council received approval to begin construction on its $2.8 billion Southwest Light Rail Transit (SWLRT) extension. Groundbreaking for the entire project was in December 2018. In August 2021, the first rail for the SWLRT Green Line Extension was laid in the suburb of Hopkins and will extend light rail service 14.5 miles from Downtown Minneapolis to Eden Prairie with 16 stations along the way. As of spring 2022, about 60% of the track and bridge work was completed. Upon final delivery, the light rail extension is expected to spur significant job growth, provide access to employment, and prompt further economic development in communities along the line. SWLRT is expected to begin passenger service in 2027.

Downtown Minneapolis → Eden Prairie (20-minutes West of Bloomington)

$788M

MIXED-USE DEVELOPMENT

Dallas-based AECOM has formed a public-private alliance with Ramsey County to develop RiversEdge, a nineacre site overlooking the Mississippi River in St. Paul. The $788 million project will include a mix of Class A offices, apartments, retail, entertainment, and hospitality uses across four towers ranging from 15 to 29 stories. The $278 million first phase, anticipated to be ready by 2023, will deliver 132,000 square feet of public space and trail connections, two towers with a 168-key hotel, 56 condo units, 350 rental apartments, 11,500 square feet of retail, and 500 parking spaces. Phases two and three will bring two office / retail towers with additional parking. The development will create a total of more than 5,000 construction and permanent jobs and generate more than $15 million in property tax revenue annually.

5,000

NEW JOBS

Elliot Park Hotel’s current competitive set includes six nearby properties totaling 1,363 keys. Elliot Park is one of three Marriott-branded hotels within the set, and the latest Autograph-branded property. As the third newest in the set, the Hotel has garnered strong rates, with an ADR penetration of 100.1 as of YE 2022, and continues to build towards outperforming occupancy.

IMPORTANT INFORMATION & DISCLAIMER: The information contained herein is assumed to be correct and market-supported. Output produced from this model should not be considered an appraisal. Projections are forecasts and are not to be considered fact. The information contained in this file is privileged and confidential; it is intended only for use by Berkadia® and their clients. This file may not be reproduced physically or in electronic format without the express written consent of Berkadia. Not responsible for errors and omissions.

RYAN LINDGREN

Managing Director

312.888.5438

ryan.lindgren@berkadia.com

MELISSA TSOURMAS

Associate Director

312.845.1889

melissa.tsourmas@berkadia.com

MILES MATALON Analyst

312.845.3083

miles.matalon@berkadia.com

RALPH DEPASQUALE

mauricio.rodriguez@berkadia.com

The material contained in this document is confidential, furnished solely for the purpose of considering investment in the property described therein and is not to be copied and/or used for any purpose or made available to any other person without the express written consent of Berkadia Real Estate Advisors LLC and Berkadia Real Estate Advisors Inc. In accepting this, the recipient agrees to keep all material contained herein confidential.

This information package has been prepared to provide summary information to prospective purchasers and to establish a preliminary level of interest in the property described herein. It does not, however, purport to present all material information regarding the subject property, and it is not a substitute for a thorough due diligence investigation. In particular, Berkadia Real Estate Advisors LLC, Berkadia Real Estate Advisors Inc. and Seller have not made any investigation of the actual property, the tenants, the operating history, financial reports, leases, square footage, age or any other aspect of the property, including but not limited to any potential environmental problems that may exist and make no warranty or representation whatsoever concerning these issues. The information contained in this information package has been obtained from sources we believe to be reliable; however, Berkadia Real Estate Advisors LLC, Berkadia Real Estate Advisors Inc. and Seller have not conducted any investigation regarding these matters and make no warranty or representation whatsoever regarding the accuracy or completeness of the information provided. Any pro formas, projections, opinions, assumptions or estimates used are for example only and do not necessarily represent the current or future performance of the property.

Berkadia Real Estate Advisors LLC and Berkadia Real Estate Advisors Inc. and Seller strongly recommend that prospective purchasers conduct an in-depth investigation of every physical and financial aspect of the property to determine if the property meets their needs and expectations. We also recommend that prospective purchasers consult with their tax, financial and legal advisors on any matter that may affect their decision to purchase the property and the subsequent consequences of ownership.

All parties are advised that in any property the presence of certain kinds of molds, funguses, or other organisms may adversely affect the property and the health of some individuals.

Berkadia Real Estate Advisors LLC and Berkadia Real Estate Advisors Inc. recommend, if prospective buyers have questions or concerns regarding this issue, that prospective buyers conduct further inspections by a qualified professional.

The Seller retains the right to withdraw, modify or cancel this offer to sell at any time and without any notice or obligation. Any sale is subject to the sole and unrestricted approval of Seller, and Seller shall be under no obligation to any party until such time as Seller and any other necessary parties have executed a contract of sale containing terms and conditions acceptable to Seller and such obligations of Seller shall only be those in such contract of sale.

For more information on these and other Berkadia® exclusive listings, please visit our website at www.Berkadia.com

Berkadia®, a joint venture of Berkshire Hathaway and Jefferies Financial Group, is an industry leading commercial real estate company providing comprehensive capital solutions and investment sales advisory and research services for multifamily and commercial properties. Berkadia® is amongst the largest, highest rated and most respected primary, master and special servicers in the industry.

Berkadia® is a trademark of Berkadia Proprietary Holding LLC

Investment sales and real estate brokerage businesses are conducted exclusively by Berkadia Real Estate Advisors LLC and Berkadia Real Estate Advisors Inc. Commercial mortgage loan origination and servicing businesses are conducted exclusively by Berkadia Commercial Mortgage LLC and Berkadia Commercial Mortgage Inc. Tax credit syndication business is conducted exclusively by the Tax Credit Syndication group. In California, Berkadia Real Estate Advisors Inc. conducts business under CA Real Estate Broker License #01931050; Adrienne Barr, CA DRE Lic. # 01308753. Berkadia Commercial Mortgage LLC conducts business under CA Finance Lender & Broker Lic. #988-0701; and Berkadia Commercial Mortgage Inc. under CA Real Estate Broker Lic. #01874116. This proposal is not intended to solicit commercial mortgage loan brokerage business in Nevada. For state licensing details, visit: https://www.berkadia.com/licensing/