# of total units 318 Style Low-rise Type Multifamily

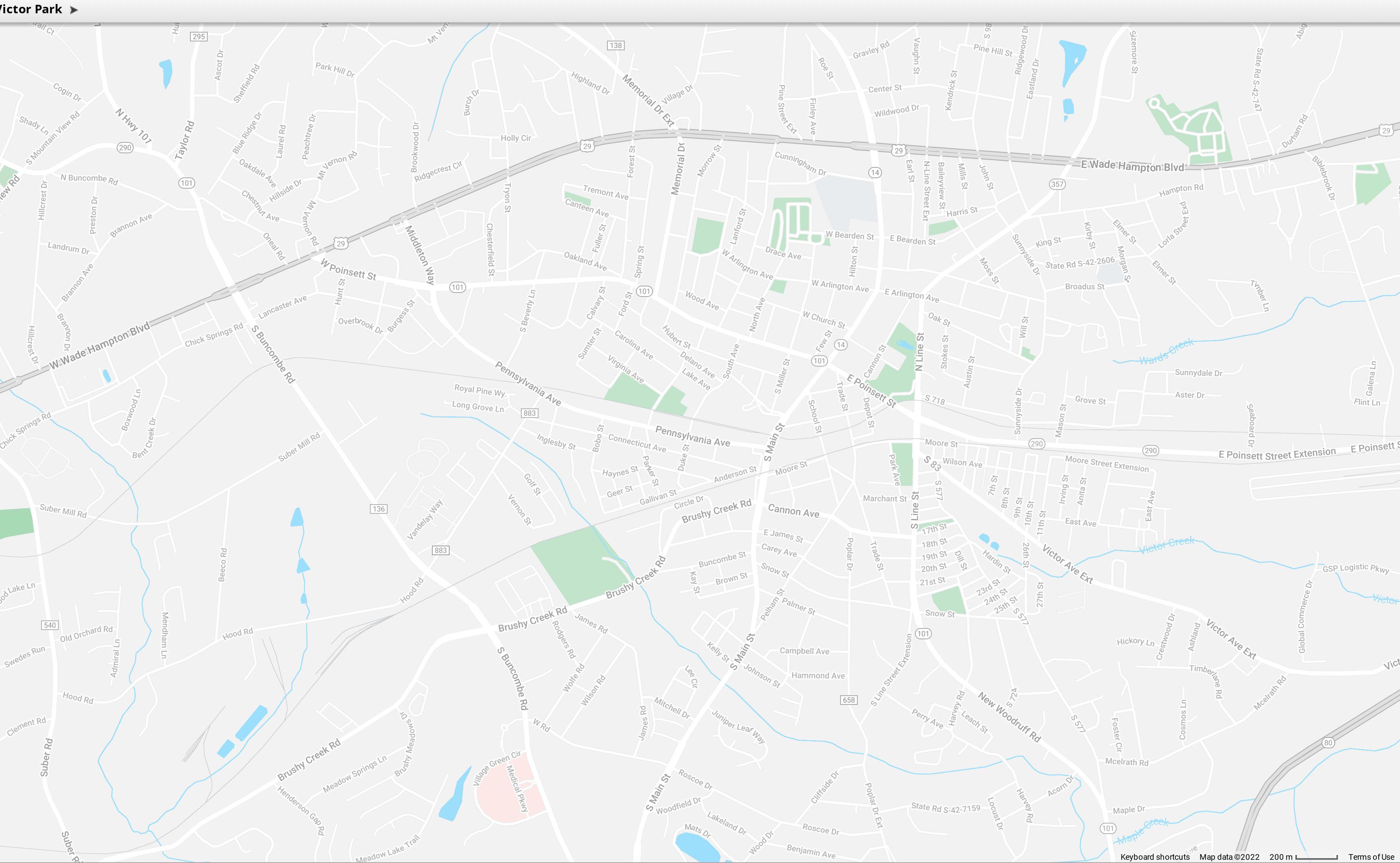

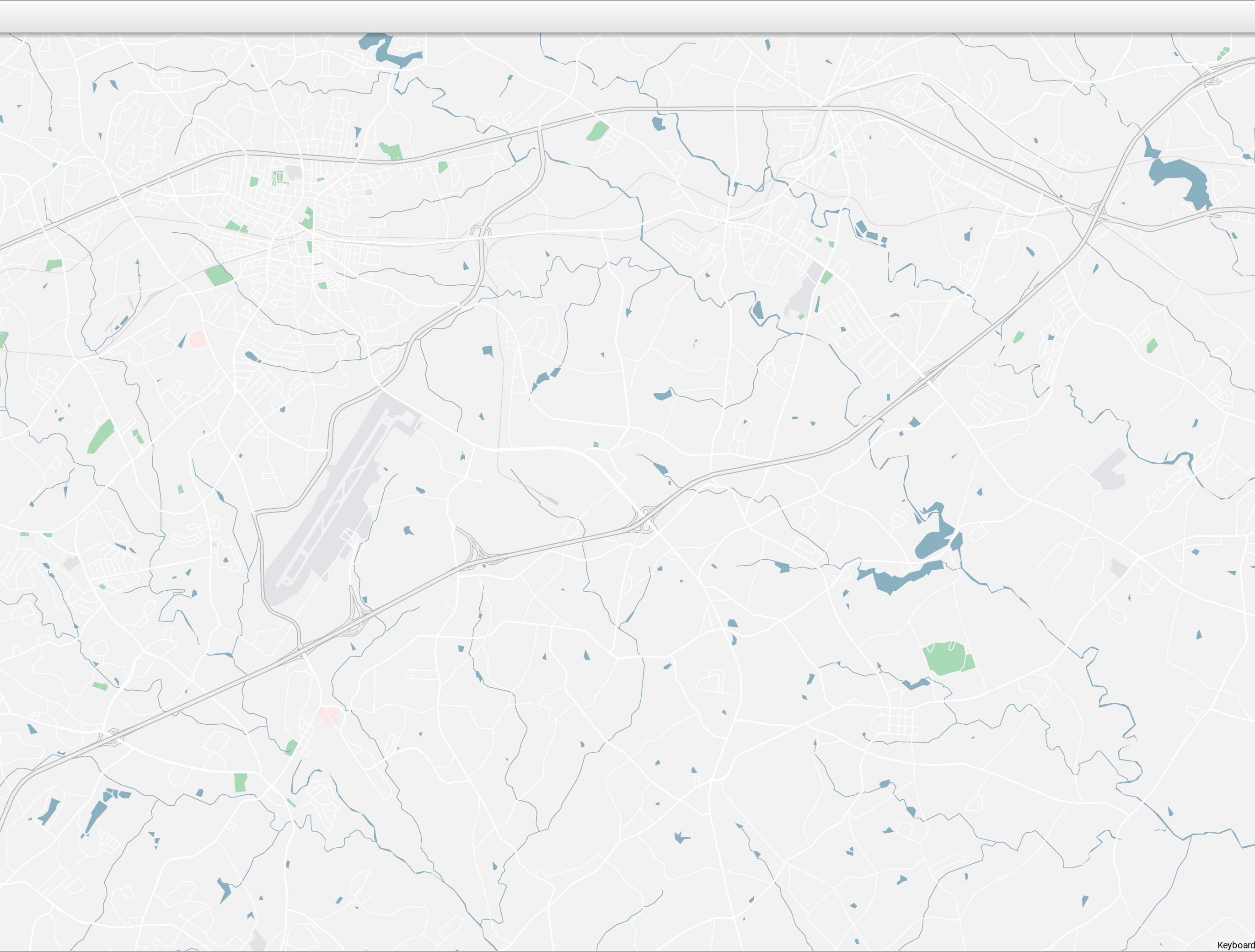

Distance from Downtown 0.7 Miles SE of the city’s center and 15 miles NE of Downtown Greenville

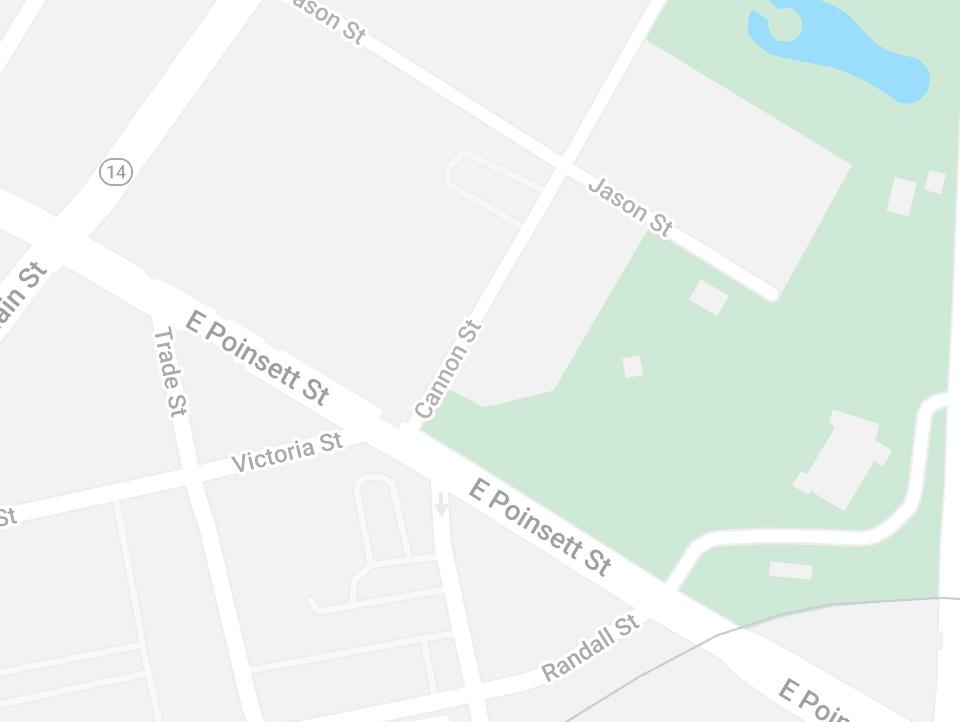

Location Along Victor Ave., between S. Line St. and 26th St.

Year built 2022 – slated to complete in november 2022

# of total buildings 11 (Including leasing office / clubhouse)

# of stories/floors in each building Four story

Exterior building materials Brick and siding

Roof type Pitched roofs with shingles

Acres of land 20.93 acres

Density 15.19 units per acre

Pets allowed Yes

Major street exposure U.S. Route 29 / Wade Hampton Blvd.

Views Man-made lake

Located in the Heart of Downtown Greer on the Former Victor Mill Site

Professionally Landscaped with Manicured Grass, Plants, Young Trees, Brick-Paved Courtyard, and Man-Made Lake

Near the 12-Acre Greer City Park Featuring an Amphitheater for Public Concerts and Ceremonies, Large Water Fountain, Pond, Playground, Green Space, and Walking Track

Convenient Access to Interstate 85, State Route 80, U.S. Highway 29, Public Transportation (Greenlink Bus Line), and GSP International Airport

Open and Airy Floor Plans with Rustic, Artisan-Style Design

Beautifully Appointed with High-End Finishes Including Stainless Steel Appliances, Granite Countertops, Wood-Style Flooring, Custom Light Wood Cabinetry, Signature Hardware, Tiled Kitchen Backsplash, Undermount Sink with Gooseneck Faucet, and Upgraded Lighting

Modern Kitchen with Electric Stove with Glass-Top Range, Refrigerator, Built-In Microwave, Dishwasher, Kitchen Island / Breakfast Bar, and Plenty of Cabinet and Counter Space Full Size Bathroom with Tub and Shower Combination / Walk-In Shower

Lighted Ceiling Fans, Nine Foot Ceilings, Plush Bedroom Carpeting, and Mini Blinds Generous Closet Space

Large Windows Allowing in Abundant Natural Light In-Unit Washer and Dryer Select Units Feature Concrete Floors, Private Patio / Balcony / Juliette Balcony with Glass Panel / Sliding Glass Doors, and Enclosed Garage with Direct Access

298 UNITS

Built : 2018 Distance : 1.35 Occupancy : 96% RSF : 325,004 Avg SF : 1,091 Avg Rent : $1,466 Avg Rent/SF : $1.34

318 UNITS

Built : 2022 Distance : Occupancy : 25% RSF : 264,896

Avg SF : 833 Avg Rent : $1,506 Avg Rent/SF : $1.81

246 UNITS

Built : 2019

Distance : 5.87 Occupancy : 94% RSF : 260,430

Avg SF : 1,059

Avg Rent : $1,592 Avg Rent/SF : $1.50

242 UNITS

Built : 2016 Distance : 6.81 Occupancy : 100%

RSF : 269,962

Avg SF : 1,116

Rent : $1,402

Rent/SF : $1.24

266 UNITS

Built : 2019 Distance : 8.52 Occupancy : 87% RSF : 284,710 Avg SF : 1,070 Avg Rent : $2,987 Avg Rent/SF : $2.79

UNITS TYPE UNIT SF TOTAL SF MARKET RENT RENT/SF MONTHLY MARKET RENT ANNUAL MARKET RENT

6 Studio 478 2,868 $1,225 $2.56 $7,350 $88,200

8 Studio 646 5,168 $1,175 $1.82 $9,400 $112,800

4 Studio 670 2,680 $1,226 $1.83 $4,905 $58,860

318 833 264,896 $1,506 $1.81 $478,980 $5,747,760

Potential Reach (High) $69,000,000

Competitive Offers (Mid) $68,000,000

Strong Price Support (Low) $64,000,000

Debt Service Coverage(I/O) 1.51

Debt Service Coverage (Amortizing) 1.25

Scheduled Market Rent

$5,920,193 $493,349

Less: Loss to Lease ($29,601) ($2,467)

Subtotal Gross Potential Rent (GPR) $5,890,592 $490,883

Less: Physical Vacancy 5.00% ($294,530) ($24,544)

Less: Concessions 1.00% ($58,906) ($4,909)

Less: Non Revenue/Model 0.27% ($15,840) ($1,320)

Less: Employee Unit 0.10% ($5,891) ($491)

Less: Bad Debt 0.50% ($29,453) ($2,454)

Less: Down Unit $0 $0

Net Rental Income $5,485,973 $457,164

Economic Occupancy % 6.87%

Effective Rent/SF (GPR Less Concession Loss) $1.83

Plus: Utility Reimbursements

$190,266 $15,856

Plus: Other Income $63,600 $5,300

Plus: Parking Income $0 $0

Plus: Fee Income $188,510 $15,709

Total Other Income $442,376 $36,865

Total Operating Income (EGI) $5,928,349 $494,029

OPERATING EXPENSES ANNUAL MONTHLY /UNIT % OF EGI /SQ FT.

Apartment Prep/Turnover $39,750 $3,313 $125 0.7% $0.15 Administrative $79,500 $6,625 $250 1.3% $0.30

Marketing & Promotion $63,600 $5,300 $200 1.1% $0.24

Contracted Services $127,200 $10,600 $400 2.1% $0.48

Repairs & Maintenance $95,400 $7,950 $300 1.6% $0.36 Payroll $436,508 $36,376 $1,373 7.4% $1.65

Utilities $318,000 $26,500 $1,000 5.4% $1.20

Other Controllable Expenses1 $0 $0 $0 0.0% $0.00 Other Controllable Expenses2 $0 $0 $0 0.0% $0.00

Total Controllable Expenses $1,159,958 $96,663 $3,648 19.6% $4.38

Management Fee $177,850 $14,821 $559 3.0% $0.67 Insurance $111,300 $9,275 $350 1.9% $0.42

Real Estate Taxes $955,688 $79,641 $3,005 16.1% $3.61

Other Taxes & Assessments $0 $0 $0 0.0% $0.00

Other Non-Controllable Expenses1 $0 $0 $0 0.0% $0.00

Other Non-Controllable Expenses2 $0 $0 $0 0.0% $0.00

Total Non-Controllable Expenses $1,244,838 $103,737 $3,915 21.0% $4.70

Total Operating Expenses $2,404,796 $200,400 $7,562 40.6% $9.08

Net Operating Income $3,523,553 $293,629 $11,080 59.4% $13.30

Replacement Reserves $79,500 $6,625 $250 1.3% $0.30

Net Operating Income after RR $3,444,053 $287,004 $10,830 58.1% $13.00

UNIT TYPE SIZE (SF) TOTAL UNIT COUNT % OF MIX IN-PLACE RENT IN-PLACE RENT PER SF MAX RENT ACHIEVED

MAX RENT ACHIEVED PER SF MARKET RENT MARKET RENT PER SF

POST-RENO MARKET RENT

POST-RENO MARKET RENT PER SF

Studio 478 6 2% $1,162 $2.43 $1,185 $2.48 $1,225 $2.56 $1,225 $2.56

Studio 646 8 3% $1,095 $1.70 $1,200 $1.86 $1,175 $1.82 $1,175 $1.82

Studio 670 4 1% $1,169 $1.74 $1,335 $1.99 $1,226 $1.83 $1,226 $1.83

1 Bed / 1 Bath 579 40 13% $1,253 $2.16 $1,320 $2.28 $1,308 $2.26 $1,308 $2.26

1 Bed / 1 Bath 580 60 19% $1,279 $2.20 $1,395 $2.41 $1,347 $2.32 $1,347 $2.32

1 Bed / 1 Bath 697 8 3% $1,410 $2.02 $1,460 $2.09 $1,395 $2.00 $1,395 $2.00

2 Bed / 2 Bath 865 8 3% $1,493 $1.73 $1,495 $1.73 $1,574 $1.82 $1,574 $1.82

2 Bed / 2 Bath 933 49 15% $1,611 $1.73 $1,705 $1.83 $1,589 $1.70 $1,589 $1.70

2 Bed / 2 Bath 933 71 22% $1,521 $1.63 $1,610 $1.73 $1,545 $1.66 $1,545 $1.66

2 Bed / 2 Bath 958 18 6% $1,572 $1.64 $1,690 $1.76 $1,554 $1.62 $1,554 $1.62

3 Bed / 2 Bath 1,048 6 2% $1,725 $1.65 $1,725 $1.65 $1,725 $1.65 $1,725 $1.65

3 Bed / 2 Bath 1,205 8 3% $1,995 $1.66 $1,995 $1.66 $1,995 $1.66 $1,995 $1.66

3 Bed / 2 Bath 1,206 24 8% $1,878 $1.56 $1,965 $1.63 $1,842 $1.53 $1,842 $1.53

3 Bed / 2 Bath 1,206 8 3% $0 $0.00 $0 $0.00 $1,800 $1.49 $1,800 $1.49 WA/Totals

Property: The Lively Victor Park

Competitive Offers: $69,000,000 Rehab Budget: $0 Total Cost: $69,000,000 Property NOI: $3,457,903

Underwritten Debt Terms

PRODUCT: 10-YEAR FIXED

Interest Rate Type: Fixed Supplemental Loan Mezzanine Debt Preferred Equity Loan Amount: $39,780,000 Loan Amount Loan Amount Investment Amount LTPP 57.7% Combined Loan $39,780,000 Combined Loan $39,780,000 Combined Debt / Pref $39,780,000 LTC 57.7% LTPP 57.7% LTPP 57.7% LTPP 57.7% Underwritten NOI: $3,444,053 LTC 57.7% LTC 57.7% LTC 57.7%

Term (years): 10 Max LTV 80% Max LTV 85% Max LTV 90% Interest Only (years): 10 Min DSCR 1.25 Min DSCR 1.05 Min DSCR 1.05

Amortization (years): 30 Interest Rate Type:

Interest Rate Type: Minimum Annual Return (%):

Prepayment: Yield Maintenance Interest Rate Interest Rate

Minimum Annual Return ($):

Spread (bps): 175 IO Period (years) IO Period (years) Total Return

Index: 10yr UST Amortization (years) Amortization (years) Amortization

Index Rate: 3.90% Loan Term Loan Term Investment Term

Interest Rate: 5.65% Annual P&I: $0 Annual P&I: $0 DSCR:

Annual P&I: $2,755,493 I/O DSCR (w/ amortizing 1st)

I/O DSCR (w/ amortizing 1st) I/O DSCR 1.51 Amort DSCR (w/ amortizing 1st) Amort DSCR (w/ amortizing 1st) Amortizing DSCR 1.25

Product: Existing Loan Product: 5-Year Fixed 7-Year Fixed 10-Year Fixed 3-Year Float 5-Year Float 7-Year Float 10-Year Float Originating Lender xyz Interest Rate Type: Fixed Fixed Fixed Variable Variable Variable Variable Master Servicer abc Loan Amount: $45,090,000 $47,290,000 $39,780,000 $55,200,000 $55,200,000 $47,290,000 $39,780,000 Special Servicer abc LTPP 65.3% 68.5% 57.7% 80.0% 80.0% 68.5% 57.7% Loan Type: CMBS LTC 65.3% 68.5% 57.7% 80.0% 80.0% 68.5% 57.7%

Original Loan Amount $10,000,000 Max DCSR Loan (Actual) $45,090,000 $47,290,000 $39,780,000 $47,290,000 $39,780,000

Current UPB $10,000,000 Max LTV Loan $55,200,000 $55,200,000 $41,400,000 $55,200,000 $55,200,000 $55,200,000 $41,400,000 LTPP 14.5% Max Debt Yield Loan: $38,270,000 $38,270,000 $38,270,000 $38,270,000 LTC 14.5% Underwritten NOI: $3,444,053 $3,444,053 $3,444,053 $3,444,053 $3,444,053 $3,444,053 $3,444,053

Origination Date 8/1/2015 Term (years): $5 $7 $10 $7 $10 $7 $10 1st Pmt Date 9/1/2015 Interest Only (years): $1 $2 $10 $2 $5 $2 $5 1st Amort Pmt Date 9/1/2018 Amortization (years): $30 $30 $30 $30 $30 $30 $30

Open Prepay Date 8/1/2020 Prepayment: Yield Maintenance Yield Maintenance Yield Maintenance 12mth LO; 1% after 12mth LO; 1% after 12mth LO; 1% after 12mth LO; 1% after Prepayment Yield Maintenance Max LTV: $1 $1 $1 $1 $1 $1 $1 Maturity Date 8/1/2022 Min DSCR (Actual): $1 $1 $1 N/A N/A $1 $1 Term Remaining (years) 5 Max Debt Yield: N/A N/A N/A $0 $0 $0 $0 I/O Period Remaining (years) 2 Spread (bps): $271 $254 $175 $375 $500 $265 $273 Interest Rate Type: Fixed Index: 5yr UST 7yr UST 10yr UST 30-Day LIBOR 30-Day LIBOR 30-Day LIBOR 30-Day LIBOR Interest Rate: 4.15%

$2,362,022 $2,007,424 I/O DSCR 8.22 I/O DSCR 1.79 1.74 1.51 1.54 1.17 2.48 2.87 Amortizing DSCR 5.93 Amortizing DSCR 1.30 1.25 1.25 1.09 0.94 1.46 1.72

Refinance Scenario

Interest Rate Sensitivity

Refinance Year 99 5.15% $26,580,000 $27,810,000 $24,500,000 $31,140,000 $30,910,000 UW NOI #N/A 5.25% $26,350,000 $27,570,000 $24,300,000 $30,850,000 $30,620,000

Cap Rate 6.00% 5.35% $26,120,000 $27,330,000 $24,110,000 $30,560,000 $30,330,000

Refinance Valuation #N/A 5.45% $25,900,000 $27,090,000 $23,920,000 $30,280,000 $30,050,000

Max LTV 75% 5.55% $25,670,000 $26,860,000 $23,730,000 $30,000,000 $29,780,000

New Loan Term (years) 7 5.65% $25,460,000 $26,630,000 $23,550,000 $29,720,000 $29,510,000

Interest Rate 5.00% 5.75% $25,240,000 $26,410,000 $23,370,000 $29,450,000 $29,240,000

Interest Only (years) 1 5.85% $25,030,000 $26,190,000 $23,190,000 $29,190,000 $28,970,000

Amortization (years) 30 5.95% $24,820,000 $25,970,000 $23,010,000 $28,920,000 $28,720,000

Min DSCR 1.25 6.05% $24,620,000 $25,750,000 $22,830,000 $28,660,000 $28,460,000

Refinance Loan Amount #N/A 6.15% $24,410,000 $25,540,000 $22,660,000 $28,410,000 $28,210,000

One-Mile Radius Three-Mile Radius Five-Mile Radius Spartanburg County Greenville-AndersonMauldin, SC MSA

2022 Estimated Population 9,129 34,671 84,083 337,571 954,423

Projected 2027 Population 9,499 36,170 87,899 348,810 986,600 Population Change (2022 - 2027) 4.1% 4.3% 4.5% 3.3% 3.4%

2022 Estimated Median HHI $41,098 $56,041 $64,454 $55,240 $59,128

Projected 2027 Median HHI $47,142 $63,393 $72,744 $62,824 $67,926

Median HHI Growth (2022 - 2027) 14.7% 13.1% 12.9% 13.7% 14.9%

Key Renter Age Group (18 to 35) 21% 21% 22% 23% 23% Households Earning $100,000+ Annually 11% 21% 28% 21% 26% Bachelor's Degree or Higher (Age 25+) 13% 26% 32% 24% 30%

Single-person Households 32% 27% 24% 26% 26% Renter-Occupied Housing Units 45% 33% 27% 27% 28% White-Collar Workers 37% 54% 60% 56% 61%

Workplace Establishments 275 1,022 2,025 7,400 21,628

FTE Employees* 4,550 16,579 33,656 161,503 354,860 *Full-Time Equivalent Workplace Employees

4.5% FORECAST POPULATION GROWTH over the next five years, compared to the Greenville MSA of 3.4%

MEDIAN HHI IS PROJECTED TO REACH $72,744 BY 2027, a 12.9% increase from 2022

28% of households earn $100K OR MORE ANNUALLY

RENTER VS OWNER MEDIAN HOUSEHOLD INCOME

Renter: $38,177 | Owner: $69,249

– 22% OF RESIDENTS in the key renter age group of 18 to 35

– 27% RENTER-OCCUPIED housing units

60% OF WORKERS IN WHITE-COLLAR POSITIONS

– 32% of residents (age 25+) possess a BACHELOR’S DEGREE OR HIGHER

– Education and health services @ 21% is LARGEST EMPLOYED POPULATION

– Manufacturing @ 18% is SECOND-LARGEST EMPLOYED POPULATION

– Wholesale and retail trade @ 14% rounds out the TOP THREE LARGEST EMPLOYED SECTORS

65 OVERALL MARKET RESILIENCY, COMPARED TO 50 NATIONWIDE*

Volatility: 100 Demand: 51 Cost of Living: 47 Employment: 61

*The higher the score, the better a market’s ability to withstand an economic downturn (Source: Berkadia Pyxis)

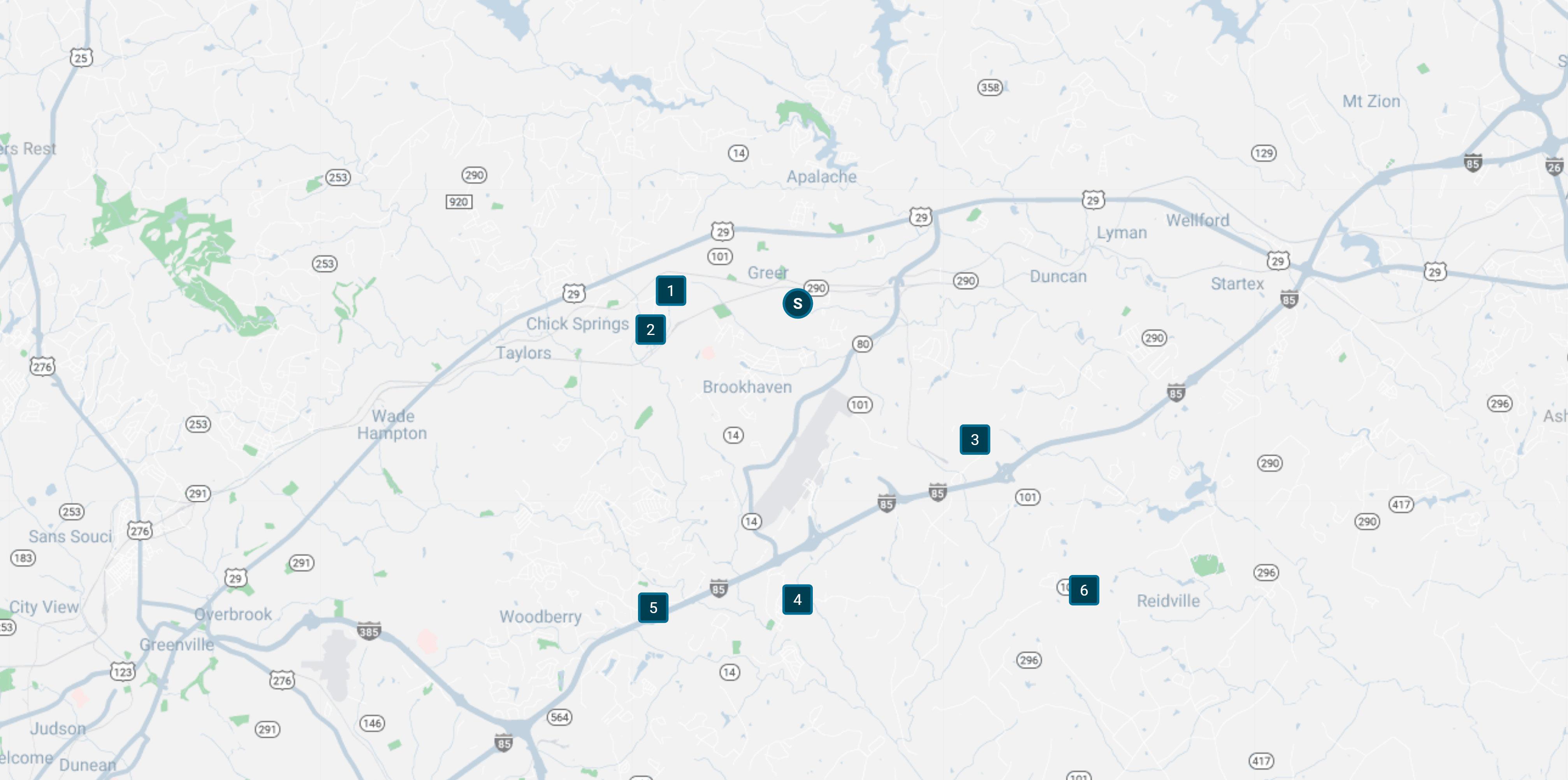

Among the six apartment submarkets in the Greenville metropolitan service area, the Lively Victor Park apartment community is in the North Greenville submarket, according to RealPage.

At the end of the third quarter of 2022, the submarket contained 19,803 market-rate apartments, representing 28% of the total existing inventory metrowide.

Multifamily construction consistently added new units in the submarket for the past 10 years, where nearly 2,865 market rate units came online since 2012, a 15% inventory expansion

COMPANY NAME ADDRESS

CITY STATE ZIP # EMP DISTANCE

1 BMW 1400 Highway 101 South Greer SC 29651 11,000 3.6

2 Bencore Logistic Systems, Inc. 2501 Highway 101 South Greer SC 29651 800 7.1

3 Honeywell International 400 S Buncombe Rd Greer SC 29650 645 2.7

4 Mitsubishi Polyester Film, Inc. 2001 Hood Road Greer SC 29652 600 3.1

5 Pelham Medical Center 250 Westmoreland Road Greer SC 29651 446 6.1

Note: Employee counts are estimates

Source: Upstate SC Alliance

HONEYWELL AEROSPACE (2.7 MI.)

400 S Buncombe Rd, Greer, SC 29650

Major center for the company’s machining, special processes, maintenance repair, and overhaul services for both commercial and military aircraft

One of several Honeywell divisions that maintains a footprint within the state

MITSUBISHI CHEMICAL CORPORATION (3.1 MI.)

2001 Hood Rd, Greer, SC 29650

BMW (3.6 MI.) 1400 Highway 101 South, Greer, SC 29651 PELHAM MEDICAL CENTER (6.1 MI.) 250 Westmoreland Rd, Greer, SC 29651

The material contained in this document is confidential, furnished solely for the purpose of considering investment in the property described therein and is not to be copied and/or used for any purpose or made available to any other person without the express written consent of Berkadia Real Estate Advisors LLC and Berkadia Real Estate Advisors Inc. In accepting this, the recipient agrees to keep all material contained herein confidential.

This information package has been prepared to provide summary information to prospective purchasers and to establish a preliminary level of interest in the property described herein. It does not, however, purport to present all material information regarding the subject property, and it is not a substitute for a thorough due diligence investigation. In particular, Berkadia Real Estate Advisors LLC, Berkadia Real Estate Advisors Inc. and Seller have not made any investigation of the actual property, the tenants, the operating history, financial reports, leases, square footage, age or any other aspect of the property, including but not limited to any potential environmental problems that may exist and make no warranty or representation whatsoever concerning these issues. The information contained in this information package has been obtained from sources we believe to be reliable; however, Berkadia Real Estate Advisors LLC, Berkadia Real Estate Advisors Inc. and Seller have not conducted any investigation regarding these matters and make no warranty or representation whatsoever regarding the accuracy or completeness of the information provided. Any pro formas, projections, opinions, assumptions or estimates used are for example only and do not necessarily represent the current or future performance of the property.

Berkadia Real Estate Advisors LLC and Berkadia Real Estate Advisors Inc. and Seller strongly recommend that prospective purchasers conduct an in-depth investigation of every physical and financial aspect of the property to determine if the property meets their needs and expectations. We also recommend that prospective purchasers consult with their tax, financial and legal advisors on any matter that may affect their decision to purchase the property and the subsequent consequences of ownership.

All parties are advised that in any property the presence of certain kinds of molds, funguses, or other organisms may adversely affect the property and the health of some individuals. Berkadia Real Estate Advisors LLC and Berkadia Real Estate Advisors Inc. recommend, if prospective buyers have questions or concerns regarding this issue, that prospective buyers conduct further inspections by a qualified professional.

The Seller retains the right to withdraw, modify or cancel this offer to sell at any time and without any notice or obligation. Any sale is subject to the sole and unrestricted approval of Seller, and Seller shall be under no obligation to any party until such time as Seller and any other necessary parties have executed a contract of sale containing terms and conditions acceptable to Seller and such obligations of Seller shall only be those in such contract of sale.

For more information on these and other Berkadia® exclusive listings, please visit our website at www.Berkadia.com Berkadia®, a joint venture of Berkshire Hathaway and Jefferies Financial Group, is an industry leading commercial real estate company providing comprehensive capital solutions and investment sales advisory and research services for multifamily and commercial properties. Berkadia® is amongst the largest, highest rated and most respected primary, master and special servicers in the industry.

© 2022 Berkadia Proprietary Holding LLC

Berkadia® is a trademark of Berkadia Proprietary Holding LLC

Investment sales and real estate brokerage businesses are conducted exclusively by Berkadia Real Estate Advisors LLC and Berkadia Real Estate Advisors Inc. Commercial mortgage loan origination and servicing businesses are conducted exclusively by Berkadia Commercial Mortgage LLC and Berkadia Commercial Mortgage Inc. Tax credit syndication business is conducted exclusively by the Tax Credit Syndication group. In California, Berkadia Real Estate Advisors Inc. conducts business under CA Real Estate Broker License #01931050; Adrienne Barr, CA DRE Lic. # 01308753. Berkadia Commercial Mortgage LLC conducts business under CA Finance Lender & Broker Lic. #988-0701; and Berkadia Commercial Mortgage Inc. under CA Real Estate Broker Lic. #01874116. This proposal is not intended to solicit commercial mortgage loan brokerage business in Nevada. For state licensing details, visit: https://www.berkadia.com/licensing/ ATS274330