RECLAMATION & CLOSURE

Harnessing technology to improve revegetation outcomes

Non-native species used in mine reclamation

WHO CAN ANSWER MY HEAVY-HAUL QUESTIONS?

ALBERTA’S COAL PHASE-OUT: PROS AND CONS

JUNE/JULY 2023 | www.canadianminingjournal.com | PM # 40069240

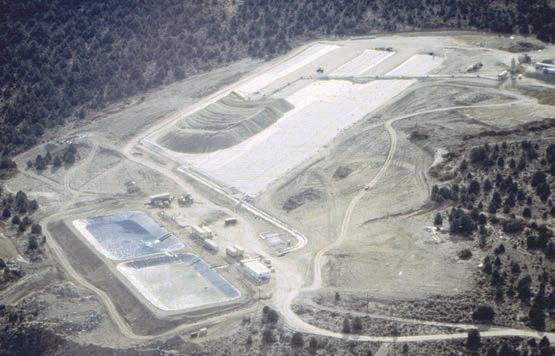

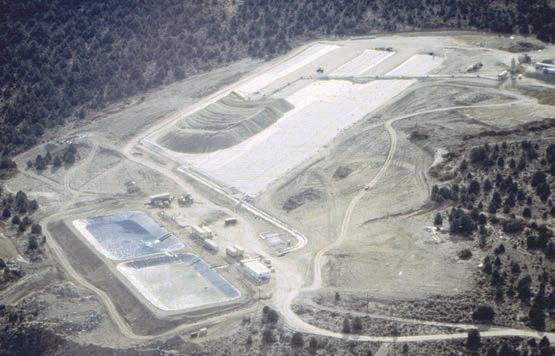

We’ve designed and built heap leach projects since heap leaching was first developed in the early 1970’s.

EVERY HEAP IS DIFFERENT.

There are still a lot of failures – due to permeability, heap stability, or lack of respect for the topography – KCA can ensure that your heap starts up quickly, and works as designed. We are not just design engineers – we acted as EPCM contractors on the heaps in these photos – if you want experience and innovation on your side, call us for your next project.

CARL

DAN

WWW.KCARENO.COM CALL

OR

(US) 775- 972-7575

FEATURES

ESG

9 ESG risk management can be a differentiator for mining companies.

RECLAMATION & CLOSURE

13 Restoration: Harnessing technology to improve revegetation outcomes.

16 Non-native species used in mine reclamation: Benefits and risks.

19 A pathway to deploy innovative mine water technology.

MINING IN ALBERTA AND SASKATCHEWAN

22 Alberta’s coal phase-out: Pros and cons.

24 Orano’s Cluff Lake project: A milestone for uranium mining.

MINING IN NORTH AMERICA

26 Mining for critical minerals in North America.

MAINTENANCE AND TRANSPORTATION

28 Who can answer my heavy-haul questions?

32 Understanding alternative methods for fueling a fleet: Wet hosing versus onsite fuel tanks.

SAFETY & TECHNOLOGY

34 Searching for safety: Boost safety and efficiency in quarries with diagnostic tools.

35 Microwave processing of ore.

DEPARTMENTS

4 EDITORIAL | Conserve and revegetate: Reclamation and closure simply explained.

6 FAST NEWS | Updates from across the mining ecosystem.

8 LAW | Where to next: Resource nationalism.

11 MIN(E)D YOUR BUSINESS | Canadian funding to advance mining’s ESG projects.

37 ON THE MOVE | Tracking executive, management, and board changes in Canada’s mining sector.

www.canadianminingjournal.com

Front

CREDIT: JODYADOBE IMAGES

Coming in August 2023

Canadian Mining Journal’s August issue will feature our annual ranking of the Top 40 mining companies in Canada by revenue. We will also provide views on crushers, conveyers, screens, and a review on development projects of merit across Canada.

For More Information

Please visit www.canadianminingjournal.com for regular updates on what’s happening with Canadian mining companies and their personnel both here and abroad. A digital version of the magazine is also available at https://www.canadianminingjournal.com/digital-edition/

cover image: Nootka Lupin is a species that is common in western North America. Certain annual lupins can uptake arsenic in the root system and have been studied as an option for bioremediation.

13 19 JUNE/JULY 2023 VOL. 144, N O .5

CANADIAN MINING JOURNAL | 3 28

Tamer Elbokl, PhD

Conserve and revegetate: Reclamation and closure simply explained

We are currently witnessing huge technological advances that are changing every stage in the mining industry from prospecting and exploration to reclamation and closure. Reclamation process minimizes the adverse environmental effects of surface mining and returns the mine lands to a near natural state as possible as an open space, wildlife habitat, or even agricultural or commercial development. The process has gone a long way in the last decade. Canada has set an ambitious goal to conserve and revegetate 30% of the country’s land mass by 2030, and the Canadian mining sector has an opportunity to contribute to this shared goal. Additionally, Budget 2019 invested $49.9 million over 15 years ($2.2 billion on a cash basis starting in 2020–2021) to create the Northern Abandoned Mine Reclamation Program to address the largest and highest risk abandoned mines in the Yukon and the Northwest Territories. Meanwhile, Environment and Climate Change Canada’s Federal Contaminated Sites Action Plan continues to provide funding for the remediation of the other smaller mines and contaminated sites in the North under the responsibility of Crown-Indigenous Relations and Northern Affairs Canada.

This issue features articles on mine reclamation and closure; mining in North America, Alberta, and Saskatchewan; and more. You can learn more on the latest revegetation technology by reading Jenny Fortier’s article on page 13. A report on page 16 discusses the benefits and risks of using several non-native species in mine reclamation. Flip to page 26 to learn more about critical minerals in North America.

Diane L.M. Cook discussed the pros and cons of Alberta’s coal phase-out on page 22, while the article on page 24 provides an update on Orano’s decommissioned project in northwestern Saskatchewan. Orano Canada’s Cluff Lake uranium project has reached the end of its mining life cycle through remediation. This comes after a decade of the site being fully decommissioned and open to the public. This issue also features articles on maintenance and transportation, safety, and technology on pages 28 to 36.

On a separate topic, despite receiving a lot of kudos during PDAC (Prospectors and Developers Association of Canada) 2023 for our February-March 2023 issue and its Women in Mining feature, including the cover image, we also received some negative feedback regarding our choice of the cover image for different reasons varying from using an AI (artificial intelligence) generated image to using a too-rugged looking model in the image. Of note, the image was chosen by our highly experienced female staff, along with some consultation from female leaders in the industry, who wanted to portray a strong woman breaking the final frontier of mining, working underground. However, we apologize to those who saw the image differently and were offended by the choice we made. We promise to be more careful in the future on sensitive issues.

Finally, our August issue will be devoted to our annual ranking of the Top 40 mining companies in Canada by revenue. We will also provide reviews on crushers, conveyers, screens, and a review on development projects of merit across Canada. Relevant, novel editorial contributions can be sent to the Editor in Chief until July 7, 2023. CMJ

JUNE/JULY 2023 Vol. 144 – No . 05

225 Duncan Mill Rd. Suite 320, Toronto, Ontario M3B 3K9

Tel. (416) 510-6789 Fax (416) 510-5138 www.canadianminingjournal.com

Editor in Chief Dr. Tamer Elbokl TElbokl@CanadianMiningJournal.com

News Editors Marilyn Scales mscales@canadianminingjournal.com

Production Manager Jessica Jubb jjubb@glacierbizinfo.com

Advisory Board

David Brown (Golder Associates)

Michael Fox (Indigenous Community Engagement) Scott Hayne (Redpath Canada)

Gary Poxleitner (SRK)

Manager of Product Distribution

Allison Mein

416-510-6789 ext 3 amein@glacierrig.com

Publisher & Sales

Robert Seagraves

416-510-6891 rseagraves@canadianminingjournal.com

Sales, Western Canada

George Agelopoulos

416-510-5104 gagelopoulos@northernminer.com

Toll Free Canada & U.S.A.: 1-888-502-3456 ext 2 or 43734

Circulation Toll Free Canada & U.S.A.: 1-888-502-3456 ext 3

President, The Northern Miner Group Anthony Vaccaro

Established 1882

Canadian Mining Journal provides articles and information of practical use to those who work in the technical, administrative and supervisory aspects of exploration, mining and processing in the Canadian mineral exploration and mining industry. Canadian Mining Journal (ISSN 0008-4492) is published 10 times a year by Glacier Resource Innovation Group (GRIG). GRIG is located at 225 Duncan Mill Rd., Ste. 320, Toronto, ON, M3B 3K9 Phone (416) 510-6891.

Legal deposit: National Library, Ottawa. Printed in Canada. All rights reserved. The contents of this magazine are protected by copyright and may be used only for your personal non-commercial purposes. All other rights are reserved and commercial use is prohibited. To make use of any of this material you must first obtain the permission of the owner of the copyright. For further information please contact Robert Seagraves at 416-510-6891.

Subscriptions – Canada: $51.95 per year; $81.50 for two years. USA: US$64.95 per year. Foreign: US$77.95 per year. Single copies: Canada $10; USA and foreign: US$10. Canadian subscribers must add HST and Provincial tax where necessary. HST registration # 809744071RT001.

From time to time we make our subscription list available to select companies and organizations whose product or service may interest you. If you do not wish your contact information to be made available, please contact us via one of the following methods:

Phone: 1-888-502-3456 ext 3; E-mail: amein@glacierrig.com

Mail to: Allison Mein, 225 Duncan Mill Rd., Ste 320, Toronto, ON M3B 3K9

We acknowledge the financial support of the Government of Canada.

4 | CANADIAN MINING JOURNAL www.canadianminingjournal.com

FROM THE EDITOR

DEEPLY INVESTED IN MINING.

Updates from across the mining ecosystem

• EXPLORATION | Seabridge hunting for new discoveries at Iskut

• URANIUM | Fission advance FEED at Patterson Lake South

Seabridge Gold is drilling at its 100%-owned Iskut property in the hopes of making new copper-gold porphyry discoveries in British Columbia’s Golden Horseshoe. Iskut is located only 20 km from the company’s massive KSM copper-gold project.

The initial work will be on the Snip North target and expand to the Bronson Slope target. Three helicopter-borne drills are on site, and two additional units will arrive in coming weeks. The program calls for 12 to 15 diamond drill holes totaling at least 12,000 metres.

The company says regional geophysical surveys and surface geology continue to confirm a district-scale structural feature that connects the Quartz Rise, Bronson Slope and Snip North targets. All the recognized mineral occurrences at Iskut are interpreted as high-level expressions of copper-gold porphyry systems aligned along this regional structural trend. The trend has similar characteristics to the one that hosts a cluster of porphyry systems Seabridge has defined at the KSM project.

The Iskut property covers 22,238 hectares straddling the Iskut River in the Pacific Coast range about 110 km east of Stewart, B.C. Seabridge acquired the property in 2016 when it made an all-share offer for SnipGold. CMJ

Fission Uranium has kicked off its summer drill program to advance the front-end engineering design (FEED) work at its wholly owned Patterson Lake South (PLS) uranium property in the Athabasca basin of Saskatchewan. A two-stage program with 12 holes is planned.

Two holes for a total of 440 metres will be drilled to confirm geotechnical parameters of the rock mass and discontinuities. The information will be used in planning the underground mine infrastructure.

Seven test holes and three monitoring holes for a total of 500 metres will be drilled for hydrogeological assessment of the potential to expand the tailings management facility (TMF) northward into the aggregate borrow pit. If the results support this goal, the TMF will be enlarged to treat the same volume as considered in the feasibility study over a larger area, which would reduce the ultimate berm height. Either option is expected to reduce long-term rehabilitation costs as well as provide operational flexibility and cost efficiency. CMJ

• GOLD BONANZA | New Found Gold drills 105 g/t over 27 metres, including 757 g/t

New Found Gold continues its successful drilling program at the Queensway gold project near Gander, Nfld. The latest bonanza grades come from the newly discovered Iceberg zone, one of 14 zones discovered on the property.

Hole NFGC-23-1210 returned 105.32 g/t gold along its 27.1 metre length beginning at 59.8 metres below surface. The length included intersections of 59.0 g/t over 0.85 metre, 22.82 g/t over 0.45 metre, 39.92 g/t over 3.15 metres, 38.92 g/t over 3.15 metres, 159.61 g/t over 1.05 metre, 234.69 g/t over 7.3 metres, and 756.96 g/t gold over 1.0 metre, ending at 81.4 metres below surface.

The Iceberg zone is currently drill-defined over a strike length of 550 metres and represents the eastern extend of the Keats-Baseline fault zone, the same that that hosts the Keats Main zone. At the time of writing, New Found was in the midst of a 500,000-metre drill program at the Queensway project, and approximately 55,135 metres of core is awaiting assay results. CMJ

6 | CANADIAN MINING JOURNAL www.canadianminingjournal.com

FAST NEWS

A visible gold bonanza in core from the Iceberg zone of the Queensway project CREDIT: NEW FOUND GOLD

The Iskut project in B.C.’s Golden Triangle CREDIT: SEABRIDGE GOLD

Drilling at the PLS uranium project CREDIT: FISSION URANIUM

Hand protection for mining hazards 800-265-7617 superiorglove.com/mining

Where to next: Resource nationalism

By Sander Grieve

In the resource business, sometimes, one wrestles with certain subjects that can leave you questioning your own sanity. You talk to smart people about interesting issues regularly. Many of them are good at a variety of disciplines, geology, geophysics, construction, project estimation, supply chains, demand forecasting, off-taking, and, eventually, simple math. You listen to people talk about ideas, such as electrification, net-zero and the advertized imperative of driving electric cars. Then you talk to smart people about what makes electric cars go. Where is it? How much is forecasted to be? Who owns it? How might you get your hands on it? What does it cost? What might it cost in the future when you need it?

This is where it gets hard. This is the point at which math leads you to conclude there is a big problem coming, and it is coming fast. The Organization for Economic Cooperation and Development (OECD) expects lithium demand to rise to 42 times current levels by 2040, and graphite by 25 times. On the way to what many see as a modern-day utopia, it is going to take a lot of stuff to get there, and that “stuff” is in short supply.

At which point do we arrive at the business end? As we pursue the questions of where, what, and how much of certain resources we will need to “run the future,” we cannot help but come to the stark realization that we need to hang on to what we have and take control, directly and indirectly, over ownership, exploitation, and sale of critical resources. For several decades, foreign investment in critical minerals was welcomed, the belief was that the owner cannot move the resource, so ownership is not the most crucial factor. As the timing around development, off taking, and sales arrangements have become more important, governments have now arrived at the table looking for direct interest. The toolkit includes the following:

> 1 Foreign investment reviews and divestiture orders: Canada, an open economy, with a huge reliance on foreign direct investment, recently went “all in” on restricting investment. The government published new advice on critical minerals with an advertized hostility to state-owned enterprises (SOEs). As though to make the point more directly, they ordered three divestments by minority shareholders in lithium companies. The investors in question were Chinese SOEs. What does this mean for a country reliant on foreign direct investment? What does it mean for the future opportunities to finance companies in Canada? We are implementing a no-fly list, but without transparency on how future financing needs will be met and what the impact will be on valuations.

> 2 State ownership: Chile, Zimbabwe, and Mexico have publicly announced that lithium will be nationalized. This is the most aggressive of all responses, but it is likely to spread as countries seek security that they alone will control the critical mineral opportunities inside their borders.

> 3 Export controls: Export controls are on the rise as host countries look to benefit from their resources and, more importantly, leverage them into domestic supply and vertical integration of their economies up the value chain of the battery economy. The OECD identifies total export controls on industrial raw materials surging from 3,337 to 18,263 between 2009 and 2020. The message is increasingly clear; you might own it, but you cannot have it.

> 4 Public incentives: The Government of Japan has announced that it will subsidize up to 50% of the cost of mine development and smelting projects undertaken by Japanese companies in critical minerals. The subsidies will include geological surveys and technical reports as to feasibility. A key condition will be a commitment to continue operations for no less than five years. Enforcement of this condition remains a new frontier for state action.

This is not a regional or novel development. You can find incentives everywhere from Canada’s critical minerals flowthrough tax credit program to the U.S. government’s $1.6 billion commitment to support raw material production from mining through smelting.

Two generations ago, we were a nation obsessed with stopping foreign money at the border for fear that we would be hollowed out; a branch plant economy. Now, we, along with many other countries, are desperately scrambling to redeploy the tactics of protectionism with a new goal. The future suddenly will be dictated by the oldest rule; “he who has the gold rules.” However, this time, the gold is replaced with copper, nickel, manganese, indium, rare earth elements, helium, lithium, cobalt, graphite, and potash. CMJ

8 | CANADIAN MINING JOURNAL www.canadianminingjournal.com

LAW

“The government published new advice on critical minerals with an advertized hostility to state-owned enterprises (SOEs).”

SANDER GRIEVE is a partner, head of the mining industry team at Bennett Jones.

ESG risk management can be a differentiator for mining companies

ESG (environmental, social and governance) is a concept that has gained in popularity over the last decade in virtually every industry. In the mining sector, ESG has built upon the previous work in the sector to “go-green” by encapsulating these three issues of interest into a framework that is designed to allow the firm, its investors, its insurers, and others to ascertain the impacts its activity is having on the planet, people, and profit.

Traditionally, risk has been categorized into a few buckets: operational, financial, and a rather nebulous bucket called nontechnical risk, wherein environmental and social risk was placed. Over time, this third bucket, which has had a cloak over it for decades has started to be referred to, still vaguely, as “sustainability performance.” Now, ESG is the nomenclature used to describe risks deemed less material. Much of the early work on this new

framework has focused on: setting benchmarks, identifying areas of ESG non-compliance, and providing reports back to shareholders on performance.

Currently, ESG risk management is largely like getting last year’s weather report and saying, “trust us; we know when it will snow next.” Through new approaches in real-time data collection and analysis, ESG risk management can be transformed from an after-action report into a transparent up-to-the-minute pulse checks on critical controls performance.

A recent conversation with Michael Hartley, InterKnowlogy’s managing director of mining and energy, helped shed light on how companies that choose to manage ESG risk in an open and transparent way stand to gain competitive advantage over those that do not. InterKnowlogy is a California-based tech firm that focuses on data visualization solutions to enable

By Steve Gravel

better decision making. For Hartley, context is everything.

Context helps frame managing ESG risks as part of a system of interconnected components that impact each other rather than as disparate parts working independently from one another. Systems and organizations that are context-rich are typically complex and require a “systems thinking” approach rather than a “component thinking” approach to effectively manage risks.

Hartley has crystalized the difference between firms that adopt effective ESG risk management and those that do not in an apt metaphor. We need to look at the way we curate ESG risk data the same way we look at produce. Produce is made up of perishable items, they are only good for so long. “If you come to my banana shop and you say you want these six bananas and I say, come back in two

JUNE/JULY 2023 CANADIAN MINING JOURNAL | 9

ON PAGE 10

CONTINUED

PHOTO: VLADIMIR/ADOBE IMAGES

ESG

months and those same six bananas will still be waiting for you,” Hartley said. “Would you still want them then?” he added.

This is how we are treating decision makers now as we tend to not give them data on what is happening, but rather data that was collected two months to two years ago and expect them to make decisions that are operationally respon-

sible. To be an early adopter of comprehensive ESG risk management can differentiate companies in the eyes of investors, insurers, and even host governments in which mining companies operate. Companies that do not implement transparent platforms to manage ESG risk will fall behind others that do in a climate where ESG performance can mean the difference between gain-

ing a supply contract and not.

For the generational opportunity that stands before us in critical minerals and battery metals, reframing mining companies not as customers as they are traditionally thought of, but as an integral part of the supply chain is a helpful notion to understand how ESG should be considered by these firms. Mines are used to being the end customer. They are used to looking at firms that make up their supply chain and querying them for a variety of performance metrics that include ESG performance. This is how mining companies should now look at themselves: as vendors that supply a commodity to a specific end-user/group of consumers.

The same scrutiny they apply to their supply chain is now, more than ever, going to be expected of them. More specifically, Hartley suggested looking at the auto parts manufacturing sector for cues on how mining companies should be thinking of transparently offering up to date risk performance metrics to their end-users. Tier-one suppliers undergo rigorous vetting and performance tracking to become and remain part of automotive manufacturers supply chains. The new reality is that the materials being extracted by mining companies are closer than ever in proximity to the consumer. As such, more light is being shined on the supply chain, and companies that demonstrate ESG performance will have an advantage.

In the end, having policies and procedures and a well written sustainability report is like having a shelf with two bookends, but the middle of the shelf is empty. The approach InterKnowlogy employs is to pull relevant data sources internally and externally to measure and communicate risk exposure and control performance for issues such as extreme weather events and contractor management and knit it all together for real-time enterprise ESG risk management. There is no other way to come to terms with types of data that operational decision makers, investors, shareholders, and insurers are going to require going forward. Utilizing the latest data analytics and visualization technologies can empower operational decision makers and external stakeholders by making ESG risk information up to date, accessible, and useful. CMJ

10 | CANADIAN MINING JOURNAL www.canadianminingjournal.com

Steve Gravel is the manager of the Centre for Smart Mining at Cambrian College.

® ™ C M Y CM MY CY CMY K 5-15_CMJad_insertV1.pdf 1 5/11/23 7:01 AM ESG

By Cody Ryckman and Ailsa McCulloch

Canadian funding to advance mining’s ESG projects

One of the biggest challenges the mining industry faces is securing initial investment as well as sustaining capital throughout the life of a mine. Fortunately, today in Canada, there is now more federal, provincial, and municipal funding available to advance mining projects than ever before. The grant and loan opportunities come from a variety of agencies at both the federal and provincial levels. There are huge opportunities on the table right now.

Given the federal sustainability goals, there is ample opportunity for mining companies to secure funding to meet their decarbonization and energy transition goals. However, it can be difficult to pinpoint available funding opportunities that focus on social elements. In other words, the “S” for “social” in ESG. Mining companies can apply for grants and low interest loans to support strong economic growth, Indigenous partnerships, and communities. This is especially true given the emphasis in Budget 2022 and Budget 2023 on creating a clean economy, creating good middle-class careers, and ensuring economic prosperity.

Let’s explore some of the new funding available for the mining industry in Canada.

Funding for strong economic growth

Thanks to the 2022 Canada

Critical Minerals Strategy, there is extra attention on the Canadian mining industry too. The global focus on net-zero and a green economy means the mining industry will need more people.

1 | Youth employment and skills strategy (YESS): The YESS “is the Government of Canada’s commitment to help young people, particularly those facing barriers to employment, get the information and gain the skills, work experience, and abilities they need to make a successful transition into the labour market.” There are multiple funding opportunities within YESS, across 11 federal departments and agencies.

2 | Union training and innovation fund (UTIF): The UTIF, through Employment and Social Development Canada (ESDC),

JUNE/JULY 2023 CANADIAN MINING JOURNAL | 11

PAGE 12

CONTINUED ON

MIN(E)D YOUR BUSINESS/ESG

Nickel is one of the 31 critical minerals identified in the Canadian Critical Minerals Strategy. CREDIT:

STANTEC

aims to fund innovative approaches to apprenticeship in Red Seal trades. Though this fund closed in late 2022, many affiliated funds with similar objectives are accepting applications.

3 | Jobs and growth fund: This “provides funding to businesses and organizations to help create jobs and position local economies for long-term growth.” Within this fund, Western Economic Diversification Canada has earmarked $217 million to build resiliency, transition to a green economy, and create jobs.

The future of mining depends on skilled young people choosing a career in mining. The good news is that the industry’s focus on innovation, automation, and sustainability means there are new career paths in mining that did not exist previously.

Funding for Indigenous partnerships

A significant component of the Critical Minerals Strategy is proactively building partnerships with Indigenous communities. For a mining project to proceed, Indigenous connection and consultation is paramount. Here are a few of the several funds available:

1 | Strategic partnerships initiative (SPI): Indigenous Services Canada leads the SPI. Its goal is to “help Indigenous communities participate in complex economic opportunities.” It provides funding for clean energy projects in Indigenous, rural, and remote communities across Canada. These initiatives

can span many years, have regional economic impacts, and serve multiple communities.

2 | Climate change and health adaptation program: This program, through Indigenous Services Canada, “is designed to build capacity for climate change and health adaptation by funding community-designed and driven projects.” It supports initiatives that focus on human health and a changing climate. It also examines areas such as food security, access to safe drinking water, and the impacts of extreme weather events.

3 | First Nations and Inuit summer work experience program: This program “provides youth with summer employment opportunities where they can gain work experience and develop important skills.” These skills include communication, problem-solving, and teamwork. The aim is to allow youth to learn about career options while earning an income. They might also choose to gain a university or college education. There are many opportunities to build partnerships with Indigenous communities across Canada. This is crucial for every industry, but it is particularly important for the mining sector.

Funding for communities

Connected communities need strong infrastructure, and our modern infrastructure needs mined materials. Beyond traditional infrastructure funding, there are also grants for mining companies to build renewable energy infrastructure. For example, funds exist for or designing charging infrastructure.

1 | Natural infrastructure fund: The NIF has major implications for mining. “The $200-million Natural Infrastructure Fund supports projects that use natural or hybrid approaches to protect the natural environment, support healthy and resilient communities, and contribute to economic growth and jobs.”

2 | The low carbon economy fund: This fund exists to support “projects that help to reduce Canada’s greenhouse gas emissions, generate clean growth, build resilient communities, and create good jobs for Canadians.” The fund will invest $2.2 billion over seven years.

Whether a mine is advancing traditional or renewable infrastructure projects, there are likely funds available to support the work.

Finding funds for your mining project

Much of Canada’s sustainability, energy resiliency, economic growth, and domestic manufacturing goals rely on mined materials. In fact, it would be hard to find a project that does not incorporate at least one aspect of strong economic growth, Indigenous partnerships, or communities. Canada’s funding programs and tax incentives can change the game. This is especially true for junior mining companies. As mine operators consider enhancements to existing mines, or even developing a new mine, it would be wise to work with teams who can help. CMJ

Cody Ryckman is innovation and technology lead at Stantec; mining, minerals, and metals, Calgary, AB, and Ailsa McCulloch is Canada west lead, Stantec North American funding program, Vancouver, B.C.

12 | CANADIAN MINING JOURNAL www.canadianminingjournal.com

MIN(E)D YOUR BUSINESS/ESG

By Jenny Fortier

RESTORATION:

Harnessing technology to improve revegetation outcomes

By 2030, it will be necessary to revegetate at least one billion hectares of land worldwide to reach the United Nation’s sustainable development goals. Canada has set an ambitious goal to conserve and revegetate 30% of the country’s land mass by 2030. As global leaders in sustainable resource development, the Canadian mining sector has a unique opportunity to contribute to these shared goals.

The goal of revegetation is to recreate a functional and diverse ecosystem that resembles the original pre-industrial conditions as closely as possible. Plant communities can be established through sowing seed, planting seedlings, or allowing the area to be recolonized slowly over time. Planting seedlings is often impractical for larger sites due to the higher cost of plant materials, labour, and shipping. Allowing areas to recolonize naturally can be prohibitively slow, is often not in-line with compliance requirements, can inadvertently give invasive species an opportunity to dominate open sites, and may simply not be successful in sites with a long history of industrial use. Sowing native seed, termed seed-based restoration, is often the only practical option for revegetation of larger sites. Seed-based restoration refers to the practice of sowing seed of varieties native or endemic to an area with the goal of recreating a functional and diverse ecosystem that resembles the original pre-industrial conditions.

Although nine out of 10 revegetation projects in Canada utilize nonnative grass seed mixtures, the benefits of employing native species are undeniable.

> Native plants have adapted to their local conditions over thousands of years and have the best chance of long-term survival, especially on challenging sites.

> Native plant species help to increase biodiversity as insects, small mammals, and birds all have a relationship with native plants. They rely on them for food and shelter, and many require the presence of one or a handful of native plants for survival.

> A site revegetated with natives can act as a seed bank assisting in the colonization and increasing the biodiversity of surrounding sites.

> Many native grasses have been shown to help ward off the spread of invasive plant species, which is especially relevant for degraded sites which are more susceptible to invasives.

CANADIAN MINING JOURNAL | 13

RECLAMATION

BEAUDOIN

WILDFLOWERS,

»

An experimental plot sown with coated seed in 2018 is still thriving. In the experiment, a coated black-eyed susan seed was applied to a challenging site with drought conditions and heavy clay. CREDIT: CHASE

(NORTHERN

SUDBURY, ONT.)

RECLAMATION

> The deep and fibrous roots of native grasses, wildflowers, and shrubs are the best natural tool against soil erosion and sedimentation.

> Native plants, with their robust root networks, can remove pollutants from the soil before they reach larger water bodies.

> Native grasslands are excellent carbon sinks and can sequester an average of 100 tonnes of carbon per acre.

It is encouraging to see a trend towards native seeds being increasingly prescribed as part of mining, construction, landscaping, and restoration projects. Unfortunately, low seedling germination rates, especially on sites with a long history of industrial use, present a major challenge for restoration practitioners. The typical conditions of mining or industrial sites are inhospitable to seed survival. These sites are often characterized by acidic or basic conditions, low or absent organic matter, a soil layer that lacks nursery species and compacted soil, high soil erosion, and hot and dry microclimates at the soil layer. Fortunately, there are several technologies that can help to increase germination success, especially on difficult sites. One such technology is the process of seed enhancement, which involves using innovative techniques and products to maximize germination rates and seedling survival.

Seed coating is a type of seed enhancement that holds a lot of promise for the restoration sector. Seed coating, in its simplest form, is the process of applying additional materials to the surface of the natural seed coat. This practice can be used to modify the physical properties of seed and/or for the delivery of active ingredients. Seed coating is administered to increase germination, survival, and make application easier. Coating seeds has also been shown to decrease predation, as the coating serves to confuse predators as the seed no longer looks or smells like a seed. The physical modification of seed aims to improve seed handling and flowability when seed is broadcasted by standardizing seed weight and size. In the case of many native species which often have small, high-value, difficult to source, or morphologically uneven seeds, seed coating is particularly advantageous.

Above: A close-up of Northern Wildflowers proprietary seed coating. The standard recipe includes a mixture of natural minerals and a plant-based binder, making it completely natural and safe for the environment. The coating has a tough outer shell, which will withstand the mechanical force of broadcasting. However, once the seed is sown, the coating will quickly dissolve during a rain event, leaving behind a pocket of rich natural minerals that will support germination.

CREDIT:CHASE BEAUDOIN (NORTHERN WILDFLOWERS, SUDBURY, ONT.)

Seed enhancements have gotten a bit of a bad reputation due to the public’s association of seed technology with large agrochemical companies and the assumption that coatings will contain chemicals that are harmful to the environment. Although this can be the case for many of the more conventional coatings on the market, which are applied to commercial seed crops like

Above: A seed-based restoration project on a mining site in northeastern Ontario implemented by Erocon Environmental Group. For this project, a native seed mix with high wildlife value that would maximize biodiversity was prescribed. The mix contained butterfly host plant species and species that provide important winter food sources for waterfowl and small mammals.

CREDIT: DWIGHT CHORNEY (EROCON ENVIRONMENTAL GROUP, GOGAMA, ONT.)

cereals, corn, pulses, and soy, this was not traditionally how seed coatings were used. In fact, for over 100 years, farmers have been coating their own seed to increase yields and shelf-life and improve handling, using natural minerals like clay or lime.

The restoration community is taking a different, more mindful trajectory, in its use of seed enhancements. In this space, both industry and the international research community are creating seed enhancements that are environmentally minded and specifically tailored for application in habitat restoration. One such example is the completely biodegradable, environmentally friendly, and microplastic free proprietary seed coating recipes that were developed for the restoration sector at Northern Wildflowers (Sudbury, Ont.). The standard recipe utilizes a mixture of seven natural minerals and a plant-based binder, making it completely natural and safe for the environment. The coating is designed to have a tough outer coating, which will withstand the mechanical force of broadcasting. However, once the seed is sown, the coating will quickly dissolve during a rain event, leaving behind a pocket of rich natural minerals that will support germination.

14 | CANADIAN MINING JOURNAL www.canadianminingjournal.com

There are several naturally derived products that can be used to coat seeds to ensure better survival, these can include simple products like chilli pepper powder, lime, various minerals, nutrients, and natural fungicides. Several more sophisticated, natural products can also be applied to seed coatings. Natural plant hormones like gibberellic acid (GA3) can be incorporated to trigger germination or promote faster growth, or the plant hormone kinetin can be applied to help increase seed emergence in high salt environments. Other examples include the application of natural acids to break down tough seed coats, or the application of alginate, which is derived from seaweed and acts a hydrogel, attracting and absorbing water, thereby increasing seedling success in dry environments.

A specific seed coating recipe of minerals and compounds can be developed to address the unique challenges of a specific site and project. For example, a client might be looking to seed on a five-hectare orphaned mine site in northern Saskatchewan. The site has challenging conditions with high winds, acidic soil and due to project constraints, the client is seeding in the spring. Additionally, although spring seeding is common, fall is the ideal time to sow native seed. Most native species have seed with a built-in dormancy mechanism that prevents them from germinating until the winter has passed. This means most seed sown in the spring will remain dormant until the following spring, making them susceptible to predation, disease, erosion, and rot in the meantime, which further reduces germination success. For this project, a customized seed coating recipe can be developed to optimize success on site. The coating recipe might include the following:

> lime, which is a natural mineral with the ability to buffer acidic conditions;

> gibberellic acid, which is a natural plant growth hormone that will encourage seeds to break dormancy and germinate soon after spring application;

> and a thick, heavy encrusting layer of natural minerals which will make the seed heavier, making them less likely to be blown away, which will also increase the ease of handling and broadcasting.

A seed second coating technique termed conglomeration can also be applied to small seeds, where several seeds are formed into a larger ball, which is held together by a binder and clay. The group of seed “conglomerated” together actually have been shown to have higher germination rates compared to smaller seeds germinated individually. Tiny seeds often struggle to germinate against the crusty layer that can form on dry or degraded soil. Conglomeration is particularly beneficial when applied to native goldenrods, and asters, which are key restoration species but are challenging to establish due to their tiny seed and naturally low germination rates.

In conclusion, Canada and the world have embarked on an ambitious journey towards revegetation, recognizing the crucial role of restoring and preserving our natural ecosystems. This presents a remarkable opportunity for the Canadian mining sector to actively participate and lead in sustainability efforts. Fortunately, there are numerous promising seed technologies available that can simplify and enhance the revegetation process. By embracing seed-based restoration and leveraging these advancements, the Canadian mining sector can display its commitment to environmental stewardship and fulfill its social responsibilities, while simultaneously fostering a greener and more sustainable future for all. CMJ

Jenny Fortier is a biologist with over 15 years of experience in habitat restoration and is the founder and CEO of Northern Wildflowers Inc., a native seed grower and supplier based in Sudbury, Ont.

For more information about our services please contact: www.slmarketing.ca Dave Fusek 647-999-9288

JUNE/JULY 2023 CANADIAN MINING JOURNAL | 15

There is a remarkable opportunity for the Canadian mining sector to actively participate and lead in sustainability efforts.

• Buyers of Scrap Metal • Mobile Processing • Clean-Up Services RAILSE RV ICES EMERGENCY RESPONSE

By Steve Skjonsby

Non-native species used in mine reclamation:

Benefits and risks

Tailings reclamation is a critical process that involves restoring land upon completion of the mining process and best started early in the mine operation. Historically, hardy vegetative species were selected on their merit to thrive in difficult conditions and help stabilize the surface. However, some of these hardy plants have later become invasive species, causing ecological and economic harm. In this article, we will discuss the utilization of several hardy vegetation species that have become invasive species and the importance of selecting appropriate natural vegetation for land reclamation.

spread rapidly and is now considered an invasive species in several regions, including Ontario. Autumn olive can grow in poor soil conditions and produce abundant fruit, which birds and other animals can spread. Although it can be difficult to control, measures such as late season cutting and spraying have proven effective.

grows incredibly fast on tailings, and the wood is incredibly durable and highly prized. However, it is also incredibly invasive and can outcompete native species, reducing biodiversity. Black locust can be controlled through mechanical means, such as cutting or burning, or through the use of herbicides.

Black Alder is a species that was brought from Europe and is an Ontario invasive species. It was originally used for erosion control at mine sites but has since spread to other areas. Black alder can tolerate wet and acidic soils, making it an ideal species for land reclamation. However, it can also spread rapidly and outcompete native species, reducing biodiversity. Control measures for Black alder include cutting or pulling the plants and preventing seed production.

16 | CANADIAN MINING JOURNAL www.canadianminingjournal.com

RECLAMATION PHOTO FROM LEFT TO RIGHT: 1+2; ONTARIO INVASIVE PLANT COUNCIL, 3; JAG IMAGES/ADOBE STOCK, 4: STEVE SKJONSBY, 5; EMILE/ADOBE STOCK, 6; WWW.WOODYINVASIVES.ORG

Autumn Olive is a species that was once used extensively for erosion control, especially in western North America. This species is native to Asia but was introduced to North America in the 1830s. It has since

Black Locust is another hardy plant that has become an invasive species. This species was utilized to regenerate the Vale tailings area in Ontario because it

Autumn olive.

Scots Pine is a species that is often seen on entrances to older mine sites and was once champion to restore abandoned farmland in central Ontario. Scots pine can easily outcompete other conifers.

Norway Maple is not necessarily planted in mining locations but was extensively previously used in Toronto to replace dead elm trees. Norway maple is a popular ornamental tree that can grow in a wide range of soil and climate conditions. However, it is also invasive and can outcompete native species, reducing biodiversity. Control measures for Norway maple include cutting or girdling the tree and using herbicides.

BLACK LOCUST Eastern Canada Disturbed areas, Intolerant

(Sudbury), Prairies open fields

BLACK ALDER Eastern Canada, Wetlands, riparian Shade tolerant

British Columbia areas

AUTUMN OLIVE Eastern Canada Disturbed areas, Tolerant

open fields

NORWAY Ontario, Quebec Urban areas, Tolerant

MAPLE disturbed sites

COMMON All Canadian Forests, wetlands, Shade tolerant

BUCKTHORN provinces riparian areas

JAPANESE Eastern Canada Forest edges, Tolerant

HONEYSUCKLE disturbed areas

KUDZU Ontario, Quebec Forest edges, Tolerant

disturbed areas

NOOTKA LUPIN British Columbia Roadsides, Tolerant

meadows

SCOTS PINE Ontario, Quebec Urban areas, Tolerant

disturbed sites

NON-NATIVE All Canadian Wetlands, Tolerant No

PHRAGMITES provinces riparian areas (COMMON REED)

Japanese Honeysuckle is another species that has become invasive. It was introduced and advocated by the United States Soil Conservation Service as the best action to prevent erosion. However, it can spread rapidly and outcompete native species, reducing biodiversity. Control measures for Japanese honeysuckle include cutting or pulling the plants and preventing seed production.

CONTINUED ON PAGE 18

JUNE/JULY 2023 CANADIAN MINING JOURNAL | 17

SPECIES AREA OF CONCERN PREFERRED SHADE TOLERANCE NITROGEN FIXING COLD TOLERANCE FLAMMABILITY HABITAT HAZARD

Tailings reclamation is a process that involves restoring land upon completion of the mining process.

Yes –35°C Moderate

Yes –25°C Low

Yes –25°C High

No –40°C Moderate

No –35°C High

Yes –25°C Low

–30°C High

Yes

–25°C

Yes

Low

No –50°C High

–30°C High

Table 1. Examples of non-native plant species utilized for reclamation.

Nootka Lupin is a species that is common in western North America and was brought to certain areas in northern Europe for erosion control. It became

Non-native Phragmites is perhaps one of the fastest spreading invasive grasses observed in Canada. The tall reed-like grasses thrive in wetlands and drastically reduce biodiversity in ecologically

These grasses were originally examined for their ability to bioaccumulate heavy metals on tailings areas – but thankfully the concept was not imple-

Awareness is key to preventing the introduction and spread of invasive species. It is important for mine reclamation specialists and government staff to research and choose appropriate plant species for their specific needs in a comprehensive risk assessment. They should also be aware of the potential risks of introducing non-native species and take steps to prevent their spread, which includes future monitoring of plant populations.

However, it is important to note that not all non-native species are invasive and harmful. Some have been successfully introduced and are now an integral part of many ecosystems. The key is to carefully assess the potential risks and benefits of introducing a species before doing so and to monitor its impact over time.

In conclusion, the use of non-native species for land reclamation has been both beneficial and detrimental. If possible, utilize native plant species for reclamation. While these plants were once chosen for their ability to thrive in harsh environments and provide important ecological benefits, many have since become invasive and harmful to native ecosystems. CMJ

www.canadianminingjournal.com

RECLAMATION

Steve Skjonsby is a freelance writer.

Preventable.Prevented. .com

Black locust. CREDIT: STEVE SKJONSBY

TO

7; J.T. FISHERMAN/ADOBE

8;

PHOTO FROM LEFT

RIGHT:

STOCK

STEVE SKJONSBY

Leveraging

B.C.’s new

technology readiness levels permit:

innovative mine water technology A pathway to deploy

Developing a successful mine water management and treatment strategy is a critical aspect of every mining project. The plan needs to be protective of the environment, address the project needs, and pass regulatory approvals. It is the regulatory approvals that have often been the cause of confusion and frustration, as it can be difficult to come to a unified understanding of which technologies are currently considered best practices. Despite an ever-growing arsenal of water treatment technologies available to deploy, few can gain regulatory approval. Most mining jurisdictions use best achievable technology (BAT) processes, which are very useful in identifying which types of technology could treat the water. However, there is a feasibility aspect of the BAT process, which requires the technology to be “proven.” The lack of a clear definition of “proven” has typically been a matter of contention for permitting processes.

The new implementation of technology readiness levels (TRLs) for major mine projects in British Columbia is bringing clarity to the deployment of water treatment technologies and source control mitigation strategies.

In a regulatory context, TRLs are tied into step 3 of the BAT assessments, which are required for joint application information requirements (JAIR). There is a direct financial correlation

between the cost of water treatment during mine operation, the cost of reclamation after closure, and the water treatment technology selections.

The TRL framework can be leveraged throughout the mine lifespan. Using the technology readiness assessment (TRA) guidance gives developers a clearer understanding of their site-specific conditions and enables them to mitigate risk scenarios. Through the provision of a common reference point, they also help expedite communication planning and stakeholder liaison to instill confidence throughout the project’s permitting process and into the lifetime of the mine.

An overarching challenge will be determining whether the application of the TRA guidance will be consistent across all types of water treatment, or if there will need to be different approaches taken for passive versus active treatment.

What is a TRL? And how are they determined?

First developed by NASA in the 1970s, the TRL scale was designed to measure and assess the maturity level of any given technology.

The process of advancing through TRLs is commonly referred to as “technology maturation,” a typical example of which fol-

JUNE/JULY 2023 CANADIAN MINING JOURNAL | 19 CONTINUED ON PAGE 20

RECLAMATION & CLOSURE/WATER MANAGEMENT

By Monique Simair

CREDIT: MAVEN WATER AND ENVIRONMENT

An in-ground demonstration constructed wetland treatment system. Image adapted from https://www.mavenwe.com/learn.

RECLAMATION & CLOSURE/WATER MANAGEMENT

lows: fundamental research (levels 1 and 2); research and development (levels 3, 4, and 5); pilot and demonstration (levels 6, 7, and 8); and early adoption (level 9).

Innovation, Science, and Economic Development (ISED) Canada provides broad guidance for the use of TRLs, intended to be applied to all types of technologies. The B.C. TRA guidance documents have based much of the discussion around TRLs on information publicly available from ISED and linked it to the B.C. regulatory processes for water treatment and source control at major mines.

In the fall of 2022, the B.C. Ministry of Energy, Mines, and Low Carbon Innovation (EMLI) and the B.C. Ministry of Environment and Climate Change Strategy (ENV) jointly released two documents to guide TRL selection and advancement within the mining sector. Entitled “Technology readiness levels interim guidance for major mines in British Columbia” (TRL guidance; v02.00, 2022) and “Interim technical guidance document for the technology readiness assessment” (TRA guidance; v02.00, 2022), these documents guide as to how to assess the TRL (i.e., the TRA process) for both source control measures and effluent water treatment systems for major mines in the province. This is unique in Canada as they discuss the level of technology maturity required for a treatment or control measure to be included in various stages of permitting a major mine project.

The B.C. TRL guidance documents provide clear indications of the TRL required for different permitting levels. One of the guiding principles of TRLs is the testing environment of a technology. In essence, a TRL is only valid for the specific operational environment for which it was tested. If a developed technology is to be deployed in an operational environment that is different from the one it was tested for, the technology would decrease in TRL and must go through testing and maturation again.

This TRL guidance is a key step forward in integrating more modern water treatment technologies into the regulatory process for major mines. It also provides clarity on progressing new and emerging technologies into full-scale implementation.

A technology readiness assessment (TRA) is a tool used to assess the readiness of a technology throughout its research and development. The TRA guidance document provides information on how to apply the TRA.

The guidance document defines it as a “systematic, evidence-based, process” with the primary objectives to identify risks and information gaps in the advancement of a technology, in addition to determining the TRL of the technology (v02.00, 2022).

According to the TRA guidance document, the TRA is not a requirement of any mines act (MA), environmental assessment act (EMA), or environmental assessment act (EA) regulatory processes. Rather, it is suggested to occur before these undertakings. The document states that:

“A TRA is independently initiated and developed by the proponent. A proponent can decide when and how to engage EMLI, ENV, EAO (environmental assessment office), and/or Indigenous groups in the development of a TRA but is not required to involve any additional parties. However, it is recommended that a proponent conduct a TRA before including an emerging technology in a MA, EMA, and/or EA regulatory process, as the outcomes of the TRA may help inform a proponent of the tech-

nology readiness and could help inform the regulatory review process” (v02.00, 2022).

These documents make it clear that undertaking a TRA will be beneficial to expediting permitting and review processes by avoiding the pursuit of potentially non-feasible technologies. While a lower-level TRL technology could be pursued, the timelines (and uncertainties) associated with bringing the technology to implementation should be considered in the context of the project timelines and risk tolerances. Based on this, a TRA may be well-suited to be undertaken in concert with a BAT assessment to ensure the efficiency of both processes.

Working with site specificity

TRLs level 5 and higher are linked to B.C. permitting processes and are all required to have information gathered “under relevant site-specific conditions,” but herein lies a challenge, as it is unclear what will be considered relevant or site-specific.

Active treatment systems typically gain regulatory permits faster because they “actively” modify (control) the site-specific conditions. A range of site-specific dynamic variables can be controlled using heat and reagents. For example, the pH range can be modified before entering the core steps of a water treatment plant, or a temperature range can be fixed with heating. This removes a large amount of the uncertainty associated with the site-specific variations. In contrast, “passive” treatment systems must have their foundational designs modified to accommodate and address site-specific differences.

This means that even if a passive treatment technology has previously been implemented at full-scale at other sites, the TRL will be lowered from a level 8-9 to a 5-7 when looking to implement at a different location, as it needs to be modified for the site-specific conditions at the new site. As such, longer timelines need to be considered for the implementation of such technologies. There is also a risk as to whether a technology can be advanced through multiple TRLs for a specific site. This could be a major hurdle for getting the more passive, lower greenhouse gas-emitting water treatment technologies permitted.

One potential solution to this challenge is to design a hybrid of active and semi-passive water treatment, sometimes referred to as an enhanced passive treatment (EPT) system. The emergence of EPT systems is intended to be a “happy medium” between active and passive. While an EPT system will have higher capital expenditures than a passive system, the day-today operating expenditures are significantly less than an active system, and the timeline to implementation is much faster and less risk-prone than passive treatment.

An EPT system is intended to operate passively but is designed and built with the ability to turn on active features. For example, flow control or reagent additions can be implemented in response to changes in treatment needs (e.g., change in flow or chemistry) or system upsets. This could help to place boundaries on the range of variables needed to gather site-specific information.

Collecting data for “site-specific relevancy” is one of the greatest challenges for all water treatment systems. Although it is often expected that testing on-site will be most relevant, if a treatment system is being designed for a different phase of the mine life, it may not be possible to undertake the testing early enough to advance the technology in time for implementation.

20 | CANADIAN MINING JOURNAL www.canadianminingjournal.com

In these situations, simulated environment testing is a useful tool. These apply to TRL 3-6 but could also be supportive of TRL at higher levels that require further development of their risk management plan.

In simulated environments, the ability to control factors such as temperatures, lighting conditions, humidity levels, flow rates, and chemistry variables enables the rapid collection of information to identify potential risks for further optimization. This information gathering process greatly contributes to the development of a comprehensive risk management plan.

Relevant site-specific information is also important to gather on-site when possible. Skid-mounted mobile EPT pilot-scale testing units enable site-specific customization and optimization and can be integrated with other technologies for treatment train validation. An example of these units being implemented for a constructed wetland treatment system (CWTS) at the Rainy River gold mine in Ontario is shown in the picture. These are often well-paired with off-site controlled environment testing to expedite the testing programs and focus the parameters for testing on-site. These testing units would be relevant to TRL 5, 6, and possibly 7.

Although the B.C. guidance documents do not provide a clear definition of the required size for “near full scale” at TRL 7, this concept is synonymous with what others have previously referred to as “demonstration scale.” At this stage, the system is typically in its near-final configuration and is being implemented on-site in a manner like how the full-scale system would be implemented. An example of this is a CWTS that has been operating at the Minto copper mine in the Yukon since 2016.

Closing thoughts

Technology readiness levels (TRL) have been a useful tool in many sectors, and it is exciting to see them being clearly connected to permitting and regulatory processes for major mines in B.C. While there are areas requiring additional clarification, such as determining how similar a “relevant” site or application must be and defining how much site-specific data is needed, there is at least now a foundation of mutual understanding and language from which to move these conversations forward.

While the technology readiness assessment (TRA) may take additional up-front time, co-ordinating it with best achievable technology assessments may save proponents substantial amounts of time and effort that could be spent pursuing non-feasible technologies. An overarching challenge will be to determine whether the application of the TRA guidance will be

consistent across all types of water treatment or if different approaches need to be taken for passive versus active treatment.

The emergence of hybrid technologies, also known as semi-passive or enhanced passive treatment, holds the potential to bridge this gap and accelerate the maturation of technologies required for closure and/or with a lower carbon footprint across the TRL scale. These hybrid approaches offer promising solutions that can expedite developing and implementing innovative technologies in the water treatment sector. CMJ

JUNE/JULY 2023 CANADIAN MINING JOURNAL | 21

Monique Simair is CEO and principal scientist at Maven Water and Environment.

Mobile pilot-scale constructed wetland testing on-site at a mine in Ontario conducted by Maven Water and Environment. CREDIT: MAVEN WATER AND ENVIRONMENT

ALBERTA’S COAL PHASE-OUT:

pros and cons

According to the International Energy Agency (IEA), coal is the second largest fossil fuel in the global energy mix, its primary use is to produce steel and cement, and it is the largest source of electricity generation and a significant fuel for industrial use. It is also the largest single source of global carbon dioxide emissions, which accounted for approximately 40%, or 15 billion tonnes, of global CO2 emissions in 2021.

Based on this statistic, it is easy to understand why 196 countries – including Canada – are working toward meeting their global pledges to reduce their emissions to net-zero by 2050 with most of these emissions reductions to come from phasing coal out of their energy mix.

However, despite emissions reduction targets, the IEA says the current energy crisis has forced some countries to increase their coal use. Coal demand is set to grow by 1.2%, reaching an all-time high and surpassing 8.0 billion tonnes for the first time, and it will plateau at this amount through 2025. Coal used in electricity generation was expected to grow by just over 2% in 2022.

The IEA says Canada’s coal production rose 4.8% to 47 million tonnes in 2021, with most of the increase in metallurgical coal, which accounted for approximately 57% of the country’s output. Coal

production in Canada was expected to rise by 3.6 million tonnes in 2022. However, the IEA forecasts Canada’s coal production to decline to 45 million tonnes by 2025 due to reduced thermal coal production in response to slower domestic demand.

Phasing out coal might be a boon to the global environment, but it could be a stake to the coal industry, specifically Alberta’s coal industry.

Government of Alberta

In 2015, Alberta released its Climate Leadership Plan. One of the four key pillars of this plan is to end pollution from coal-fired electricity and develop more renewable energy. The plan mandated all coal-fired power plants either cease operations or eliminate all emissions by 2030 to help the province achieve its climate goals and drive innovation in the province. All these plants will have closed or be converted to natural gas by the end of 2023, seven years ahead of schedule.

As of 2016, the Alberta energy regulator estimates Alberta’s coal reserves to be 33.1 billion tonnes – 29.3 billion tonnes of sub-bituminous coal and 3.8 billion tonnes of bituminous coal. According to government of Alberta data from 2022, there are currently only five active coal mines in Alberta – one sub-bituminous coal mine (Genesee) and three bitumi-

nous coal mines (Coal Valley, Grande Cache, and Vista) and one small scale sub-bituminous coal mine (Dodds) that produces coal for local use.

There were 13.2 million tonnes of coal produced – 4.7 million tonnes of sub-bituminous coal and 8.5 million tonnes of bituminous coal. Of that coal produced, 700,000 tonnes of metallurgical coal, 12.4 million tonnes of thermal coal, and 8.5 million tonnes of bituminous coal were produced. Most of the coal produced in Alberta is exported to Asia.

The socioeconomic benefits of Alberta’s coal industry include high paying jobs to more than 7,000 Albertans who live in small towns throughout the province. The coal industry also provides revenue in the form of royalties and corporate and personal income tax to all levels of government. In 2022, coal revenue was estimated to be approximately $46 million for coal royalty and coal corporate income tax combined. Although these elevated numbers are attributed to the high energy prices in 2022, in 2021, the Alberta coal industry produced $162 million in real gross domestic product.

With the transition from coal to natural gas, Alberta is seeing a major drop in CO2 emissions, as natural gas-fired power plants emit less than half of the CO2 emissions coal-fired power plants do; therefore, natural gas is a much cleaner burn-

22 | CANADIAN MINING JOURNAL www.canadianminingjournal.com MINING IN ALBERTA

By Diane L.M. Cook

Alberta LNG has the capacity to replace coal-fired electricity while reducing emissions at the same time,” said Pete Guthrie, Alberta’s Minister of Energy.

While the benefits of phasing out coal are clear, the disadvantages are less clear as coal is used for more than just generating power in Alberta.

Coal Association of Canada

energy mix and as feedstock in products like steel and cement, until something else can replace coal.

ing fossil fuel than coal.

According to the province, the primary benefits of phasing out coal-fired electricity generation are the climate, environmental, and health outcomes. Specifically, a reduction in carbon dioxide emissions and a reduction or elimination of harmful air pollutants such as particulate matter, mercury, nitrogen oxides, and sulphur dioxide.

Based on national inventory reports, total Alberta greenhouse gas emissions were 256.5 million tonnes in 2020, representing a 27.8-million-tonne decrease in total provincial emissions from 2015. Electricity sector emissions were 29.3 million tonnes in 2020, representing a 17.1million-tonne decrease from 2015.

According to the provincial government, the phase out of coal electricity generation, which were baseload power plants, have primarily been replaced with natural gas fired power plants. This has helped to reduce emissions in the electricity sector significantly, and companies are now looking at CCUS to further reduce emissions.

The province’s abundance of natural resources and industry innovation has helped speed up phasing out coal. Another benefit of phasing out coal is that it created room in the market for significant investment by the private sector in renewables development. Renewables offer a cleaner, cheaper alternative to coal-fired power, and it is predicted that over 80% of renewable investment will take place in Alberta over the next five years.

“The phasing out of coal for Alberta’s electricity sector is beneficial not only for Albertans but people around the world. We have the highest standards of responsible energy production across the globe.

The world is not getting off coal anytime soon. According to the IEA, coal reserves would be adequate to satisfy more than 100 years of current levels of consumption worldwide. The complete phase out of coal would have detrimental effects not just for Alberta’s coal industry but for emerging markets and industrializing countries that rely on coal exports from Alberta for their power generation and feedstock for other sectors.

According to Robin Campbell, president of the Coal Association of Canada, the provincial and federal governments’ new coal emissions regulations will create a market gap that will be filled with inferior-quality coal from countries other than Canada.

“Alberta’s foothills and the eastern slopes of the Canadian Rocky Mountains hold major deposits of very high-grade coking coal, and its thermal coal is considered extremely high-quality and has a low sulphur content relative to world standards,” added Campbell.

The global population is expected to reach 9.8 billion by 2050. This increase in population will result in more global demand for coal which is required for more energy production to build infrastructure, transportation, and housing. New buildings will require more steel and cement, which are derived from metallurgical coal.

“Alberta’s coal is responsibly and ethically produced with excellent environmental stewardship, and with new extraction technologies, producing coal is still critical today and in the future to meet global needs,” says Campbell.

Campbell also says Alberta’s phase-out of coal will eradicate the province’s coal industry. He added, “The phase-out of coal in Alberta will result in a tremendous loss of jobs, forever change the landscape of many small coal mining towns, result in an enormous loss of government revenue and taxes, as well as the loss of a high-quality product (coal) that is still in high global demand today and is expected to be decades into the future.”

The jury is still out on whether every country should phase out coal from their

In summary, the IEA says the current situation in energy markets underscores the huge challenges of reducing emissions while maintaining energy security. Renewable energy options, such as solar and wind, are the most cost-effective new sources of electricity generation in most markets, but despite their impressively rapid growth in recent years, they have not yet brought about a decline in coal’s global emissions. Experts have warned that meeting net-zero emissions targets by 2050 might be an ambitious goal.

According to a Forbes article, only natural gas can be a close substitute for the coal-fired base load and provide the same reliability. Solar and wind are intermittent and fluctuate based on sun and wind conditions and cannot provide steady base load power. Moreover, natural gas fired power plants are flexible and can easily and quickly adjust output to fluctuations in demand – ramp up production to meet peak demands or ramp it down when demand falls – for example, during evening hours.

Weather-dependent, intermittent renewables are lacking this flexibility. In fact, wind is more likely to blow at night rather than at peak afternoon hours. This makes renewables a hard sale as an ideal and exclusive coal substitute. And until science comes up with a solution such as energy storage that can break away from the problem of intermittency, renewables will not be able to compete with either natural gas or coal for the dominant role in the U.S. electric energy mix.

But renewables are an important element of the energy mix as they resonate strongly with the environmental policies and climate change mitigation strategies. There is also a good chance that, as technological changes including grid flexibility, efficiency gains and breakthrough in energy storage take place and renewables overcome the issue of intermittency, they may become a viable competitor in the future.

However, for Alberta’s future in the coal industry, Campbell says, “The $1.36 billion taxpayer dollars that the Alberta government is paying power companies to close or convert their coal-fired generating electricity plants by 2023 instead of 2030 could have been invested into emissions reduction technology instead of phasing completely off coal.” CMJ

JUNE/JULY 2023 CANADIAN MINING JOURNAL | 23

Diane L.M. Cook is a freelance mining writer.

Orano’s Cluff Lake project

A milestone for uranium mining

ince through the ICP. Currently, only the Contact Lake gold property and several satellite sites of the historic Beaverlodge uranium project have been successfully transferred.

In addition to an assurance fund to cover costs related to unexpected events, as part of the ICP, Orano will provide funds for long-term environmental monitoring and maintenance of the site, and engagement with rightsholders. The process is also designed to ensure the health, safety, and well-being of future generations by meeting national and international standards and requirements.

In making its decision to revoke Orano’s licence, CNSC considered oral and written submissions from the company, CNSC staff, and twelve public intervenors. Its Participant Funding Program (PFP) allocated resources and invited interventions from Indigenous groups and communities, members of the public, and stakeholders.

After producing over 28,123 tonnes of uranium concentrate during its operation from 1979 to 2002, Orano Canada’s Cluff Lake project has reached the end of its mining life cycle through remediation. This comes after a decade of the site being fully decommissioned and open to the public.

On May 11, 2023, following a virtual public hearing held two months prior, the regulating body of the Canadian Nuclear Safety Commission (CNSC) announced its decision to revoke the uranium mine licence held by Orano for the Cluff Lake project of northwestern Saskatchewan within Treaty 8 territory.

Orano began pursuing this application in 2020 with the intention to transfer the site to the Government of Saskatchewan’s Institutional Control Program (ICP),

which is designed to ensure properties are monitored and managed in perpetuity. Additionally, the CNSC granted an exemption from licensing to the province to enable the acceptance of the site into the ICP.

Orano Canada, a subsidiary of the French nuclear energy company, the Orano Group, and headquartered in Saskatoon, Sask., has been exploring for uranium, developing mines, and producing uranium concentrate for over 55 years. The company operates the McClean Lake mill, an advanced facility which allows for processing of highgrade uranium ore without dilution.

This transfer marks a significant milestone for Canada’s mining industry as Cluff Lake will be the first modern uranium site to be transferred to the prov-

Additionally, an independent funding review committee considered the applications and the CNSC awarded up to $201,699 to six organizations for their participation including the following: the Saskatchewan Environmental Society, Birch Narrows Dene Nation, Clearwater River Dene Nation, Athabasca Chipewyan First Nation, Métis Nation Saskatchewan, and the Ya’thi Nene Land and Resource Office representing seven Athabascan communities.

After reviewing all technical submissions and these interventions, the CNSC concluded that the Cluff Lake project met the established decommissioning objectives and criteria. Furthermore, the site is considered passively safe for the long term. The CNSC determined that exempting the province from licensing does not pose unreasonable risks to

24 | CANADIAN MINING JOURNAL www.canadianminingjournal.com By Orano Canada staff MINING IN SASKATCHEWAN/RECLAMATION & CLOSURE

Aerial photo of the Cluff Lake uranium project in northwestern Saskatchewan postdecommissioning, fall 2019. CREDIT: ORANO CANADA INC.

the environment, health and safety of persons, national security, or international obligations.

The success of Cluff Lake is a point of pride for Orano, because at the beginning of the site’s operational phase Canada’s current decommissioning standards were still in their infancy with modern reclamation standards not being introduced until the late 1990s.

“The best demonstration of responsible mining is the remediation management,” Nicolas Maes, president of Orano Mining said in a statement. “The decision of the CNSC is recognition of Orano’s expertise in sustainable mine closure, which is part of our DNA,” added Maes.

Ongoing environmental monitoring shows that Cluff Lake’s decommissioning was successful with water quality meeting objectives, and the fish, animals, and plants harvested on site are determined to be safe for consumption.

“I am grateful to our dedicated staff for their commitment to this project from the first days of exploration in the 1970s, through operations, decommissioning, and monitoring to today ensuring that the project was responsibly managed such that the land is now available for

local traditional use,” Jim Corman, president and CEO of Orano said.

“We are also appreciative of the Indigenous, Métis, and other community members who shared their knowledge of the lands. We have many employees who remember the days of working at Cluff Lake and we celebrate the successful decommissioning of the project,” added Corman.

The transfer of the project site to Saskatchewan’s ICP demonstrates a successful transition from mining operations to environmentally-sound decommissioning and reclamation. As Canada continues to play a significant role in meeting the world’s demand for uranium, it is important that such transitions and present operations are carried out in a similarly responsible manner.

Although, most of the decommissioning and reclamation activities usually occur after the completion of the operating phase of the project, Orano actively pursues “progressive decommissioning and reclamation” efforts at the McClean Lake operation.

“We do as much work as possible reclaiming the former working areas at site while we are still operating,” Corman said.

Stop DangerousTramp Metals