Frédéric

(Biocoop): “The

Montse Mulé Cardona,

Editor|redaccion@bioecoactual.com

Frédéric

(Biocoop): “The

Montse Mulé Cardona,

Editor|redaccion@bioecoactual.com

The World’s Leading Trade Fair for Organic Food and natural and organic cosmetics BIOFACH is here again, bringing together a strong, committed and optimistic community, with the strength that comes from the conviction of working in the sector that promotes the ecological transformation that the planet needs. It’s a hub for the international organic food industry and provides a platform for innovation, networking and knowledge-sharing. The fair takes place in Nuremberg from 11 to 14 February

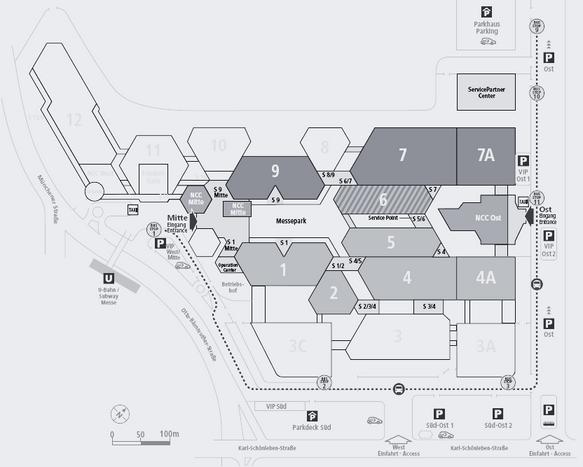

The configuration of this edition has allowed a more compact structure that facilitates the movement of visitors and has fully integrated VIVANESS into BIOFACH.

The event offers stakeholders across the entire value chain a comprehensive inside view of the many issues relevant to the organic sector, and offers a twin opportunity: on site in Nuremberg and on the platform BIOFACH digital.

Providing more details about this edition, Dominik Dietz, the Exhibition Director for BIOFACH 2025, explains: “The SustainableFutureLab is an interactive forum for leading-edge issues affecting the organic commu-

The configuration of this edition has allowed a more compact structure that facilitates the movement of visitors

nity, and will offer interesting discussion slots about organic topics, sustainability, innovation and trends. And we are extending our offering for start-ups, new products and innovations by adding new interactive formats and presentation options in the exhibition halls.”

On two stages, the Innovation stage and the Presentation stage, exhibitors and experts will be presenting sustainable solutions and product innovations. Visiting the BIOFACH Novelty Stand in Hall 4A you will find the most innovative products and solutions and you also can vote for the prestigious Best New Product Award.

Next to the Novelty Stand in Hall 4A we’ll meet International Newcomers & Start-ups and German Young Innovators in Hall 9. This pavilion is subsidised by the German Ministry for Economic Affairs and Climate Action (BMWK).

Out-of-home catering has tremendous potential for promoting a sustainable transformation of the food system. The previous edition meeting point HoReCa–GV & Gastro has evolved and provides even more room for dialogue as the special “Organic Out-of-home (OOH)” area. Dr Marisa Hübner, physician doctor and transformation designer in the field of communal catering, explains “Out-of-home catering has the opportunity to promote a sustainable food culture”. Live cooking panels, examples of best practice and many presentations will help to spread healthy, sustainable and tasty food contributing to health and climate protection.

“The opportunities are there–now we have to use them,” says Dr. Hübner. With creative menus, using plant-based alternatives or cleverly combining regional ingredients, costs can be reduced and quality increased at the same time. With creativity, innovation and collaboration, the industry can become a role model for healthy and environmentally friendly nutrition.

“OOH is a highly significant lever for achieving the goal of 30 percent organic by 2030. At the special

‘Out-of-Home Catering’ space, at the corresponding congress forum, as part of a Trend Tour on the topic and elsewhere, innovative concepts and products will be introduced that make institutional catering fit for the future,” says Dominik Dietz, Exhibition Director of BIOFACH.

Veganism, alternative proteins and wholefoods in Hall 9

The planetary health diet is a concept of increasing importance to caring for the planet. It involves promoting the consumption of vegetables, fruits, legumes and nuts and reducing meat consumption as much as possible to achieve the transition to a plant-based diet.

Congress 2025: Yes, we do!

“Yes, we do! How to effect change in the organic food segment”, is the theme of the Congress. It highlights the fact that the organic sector, with dedication and conviction, day to day, is key to offering solutions to the global food supply, fighting environmental destruction and biodiversity loss. Not theorising, but doing it in its everyday practices all around the world.

Ravi R. Prasad, Executive Director of IFOAM Organics International, explain: “Amidst the urgency of global challenges like the climate crisis and food security, the organic sector is presenting workable solutions. Ecological practices not only offer an alternative, but also a proven

route to resilience and sustainability worldwide.”

The three pillars of the transformation are sustainability as a determining factor in the financial landscape, the public sector as a driver for more organic food and the use of compelling stories to market organic food.

Tina Andres, Chair of the German Federation of Organic Food Producers (BÖLW) comments: “Organic practices have an immense potential for sovereign, sustainable and future-proof food systems, which are currently facing enormous challenges. All players in the ecological value chain must adapt, reinforce and clarify their responses and demands to the community and policymakers. The congress theme for 2025 is an invitation to work together on effective policies for change. In this context, green finance, institu-

“Yes,

tional catering and communication are the key levers.”

The Congress also focuses on the need of investments to transform the global food system and will provide participants with a detailed snapshot to help the industry formulate policy requirements.

Participants will have access to the contents online. Parts of the congress will be streamed live and will be available as video on-demand for several months afterwards.

ORGANIC MARKET

Rohan Grover is the Chief Executive Officer of Nature Bio Foods. A seasoned professional, Rohan has been instrumental in driving the significant growth of the organic food industry in India through Nature Bio Foods. With over fifteen years in the food industry, he’s established himself as a forerunner in sustainable agribusiness and the organic food sector. Rohan has pioneered Nature Bio Foods’ expansion into new territories, including the establishment of business centres in Europe and Africa, and played a pivotal role in making inroads into the US market.

What is the state of the global organic food ingredients market?

The global organic food ingredients market has been on a noteworthy journey of growth, particularly during the COVID-19 pandemic, which brought an initial surge followed by a slight dip. However, by 2024, the market has regained momentum, driven by a significant shift toward sustainability and transparency in agriculture. The market’s expansion is supported by over 96 million hectares globally dedicated to organic farming, reflecting substantial consumer demand for products that are health-conscious, ethically sourced, and sustainable. Nature Bio Foods (NBF) has been a leader in this movement, effectively managing significant tracts of organic farmland in countries like India and Uganda, and focusing on delivering the finest in-

“The global organic food ingredients market has been on a noteworthy journey of growth”

Enric Urrutia,

gredients to meet this growing global demand.

What are the main challenges you are facing and in which regions do you expect major growth?

NBF is currently navigating a complex landscape of challenges spanning economic, environmental, and logistical issues. Geopolitical tensions threaten global trade as they disrupt international trade routes, which are crucial for Europe’s organic market as it depends majorly on imports. Evolving EU regulations also present uncertainties; we hope that regulatory updates remain practical and adaptable for businesses.

Rising ocean freight costs further complicate the scenario, exacerbating the cost of imports. Additionally, climate change leads to erratic weather patterns, escalating temperatures, and consequently, a heightened risk of infestation—all of which threaten agricultural productivity and quality Despite these hurdles, Europe continues to be at the heart of the organics sector, presenting major growth opportunities due to rising consumer awareness and a robust market infrastructure. Similarly, Africa emerges as a promising market, with vast arable lands yet to be fully utilized for organic farming, offering significant potential for expansion.

How do you ensure traceability throughout the supply chain?

NBF has emphasized transparency and authenticity as central pillars since its inception, inviting partners and customers to witness firsthand the origins of the crops. In today’s market, where consumers are increasingly concerned about the ethical and sustainable sourcing of their food, NBF has responded by making its supply chains among the most transparent in the world with 100% traceability.

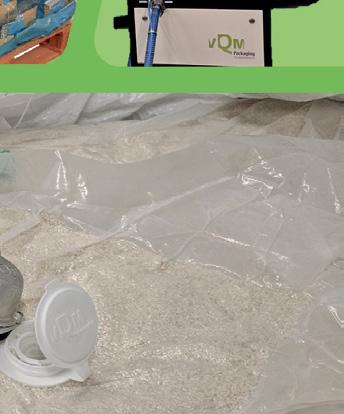

This is achieved through innovative solutions like the TraceOrigin platform, which meticulously documents every detail from the fields directly to the cloud. A digital application layer built upon this data allows manufacturers, distributors, and consumers to trace every grain back to its farm of origin with complete transparency by scanning a QR code

printed on every big bag that leaves NBF’s warehouses.

Taking traceability a step further, NBF has integrated Virtual Reality technology into its efforts. Customers can now virtually visit partner farms to see how their food is grown and processed, providing a valuable experience when in-person visits are not feasible. This blend of technology and commitment to sustainability ensures that NBF maintains the highest standards of ethical sourcing, giving partners full visibility into the supply chain.

Recently, you opened a new facility in Rotterdam. How is Nature Bio Foods expanding in Europe?

The new Nature Bio Foods facility in Rotterdam, strategically located in Maasvlakte, utilizes advanced CO2 treatment to prevent pest infestations, ensuring that our organic products are stored without contamination. This location, right at the port, minimizes logistical movements and costs, aligning with our sustainability goals. Additionally, our state-of-the-art cleaning lines guarantee that our products are 100% clean and ready for immediate use, enhancing operational efficiency. Positioned as the gateway for about 35% of Europe’s organic ingredients, this facility significantly improves our service delivery across the continent, enabling NBF to offer true pricing and better service without additional logistical burdens. The facility’s design also focuses on minimizing environmental impact and maximizing energy efficiency, further demonstrating our commitment to sustainability and setting new standards in the organic food industry

How is the global market connected and what could be improved in terms of efficiency?

Today’s global market is deeply interconnected, underscoring our role as global citizens. As organic farming expands in regions like Asia, Africa, and South America, we are witnessing a rise in the production of organic rice, lentils, and cereals. These products are now reaching a quality that are matching those grown in Europe, thanks to adherence to stringent global standards and improvements in local farming techniques.

While the quality of organic products from regions like Asia, Africa, and South America now matches European standards, these areas are actively enhancing their infrastructure to support the growth of the global supply chain. Continuous improvements in logistics and facilities demonstrate their commitment to overcoming obstacles, which are crucial to maintaining a smoother flow of supply.

This proactive approach not only mitigates risks but also showcases the region’s capabilities and dedication to maintaining a steady and secure supply of the finest organic products to the global market.

Nature Bio Foods is at the forefront when it comes to addressing these challenges. By enhancing international collaborations and streamlining trade processes, NBF aims to enhance the stability and efficiency of global operations, ensuring the consistent delivery of the finest organic products from these emerging regions to the global market.

The Organic World Congress takes place just once every three years, bringing together farmers, scientists, businesses, certifiers, policy makers and other representatives from across the vibrant spectrum of the global organic movement. It’s an important chance to discuss, debate and agree on pivotal issues for the organic sector, reach common understanding on the big issues we face, and find ways to collaborate effectively to drive the changes that we need to see in global agriculture and the communities that support it.

Regenerative agriculture was inevitably a hot topic in the halls and the meeting rooms of the Congress. The lively discussions and debates culminated in a statement on regenerative agriculture which was recommended

The statement addresses some of the key issues and important perspectives that should be considered, as interest and support for regenerative agriculture continues to rise up the public, policy and agricultural agendas. The statement is intended as a starting point and invitation for further discussion on effective pathways for the true transformation of agriculture, with both food for thought and some key suggested actions within it.

The statement recognises regenerative principles and practices as being at the heart of organic agriculture and welcomes serious regenerative actors as natural allies that can bring inspiration to improve organic practices and ensure that organic standards, certification, practices and policy are the best guarantee of regenerative ap-

proaches and outcomes. However, the statement also recognises the risks of greenwashing and calls out the problematic misuse of the regenerative term in relation to minor adjustments of broadly degenerative approaches, which can lead to the diversion and distraction from approaches with meaningful impact at a time that we need to be acting fast to address the crises of our times.

The statement also reaffirms the value of organic as a platform in the market, in policy and for farmers, recognizing the multiple benefits it delivers, the efficacy of the standards and certification system that underpin it and the commitment to continuous improvement. The statement helps to emphasise that–rather than being separate–the organic sector is at the heart of truly regenerative agriculture and has a hugely important role to play in delivering regenerative ambitions in the world.

www.opta-eu.org

Food processing is an integral part of our daily lives. The majority of food products that we eat are processed to some extent, from freshly baked bread to pure fruit juice. There are some 86,000 organic processing companies rooted in European regions, generating wealth and quality jobs in the

An example of an innovation-minded company located in the Belgian R&D landscape, Meurens Natural supplies the organic processing industry with non-refined cereal and dried fruit extracts produced through environmentally friendly processes.

Innovation is at the core of the company: its research and development team is dedicated to developing tailor-made ingredients for its customers.

The main stumbling block to overcome? “A level playing field with our international competitors” says Benedicte Meurens, CEO of Meurens Natural.

“In an increasingly global organic market, European companies need the tools to remain competitive”.

green economy. They transform the organic agricultural commodities that are produced in the EU and transform them into high quality foods that meet the needs of consumers, at home and abroad. In doing so, they preserve the valuable natural properties of the raw materials through

HiPP, a family-owned company that has been a pioneer in promoting organic farming for almost 70 years, is one of the largest processors of organically grown raw materials worldwide. HiPP is driven by respect for the environment and the preservation of nature, people and the economy.

HiPP high-quality organic products are highly appreciated in foreign markets and are now available in more than 60 countries. “Exporting to various foreign markets has allowed the company to diversify and remain resilient in difficult times,” said Stefan Hipp, CEO.

What do we need to continue growing worldwide? “We need more trade agreements to achieve automatic acceptance in export markets of products that have been produced according to EU organic standards. This will reduce bureaucracy and certification costs.”

gentle processing methods. Organic processors are as diverse as the gastronomic traditions and flavours which make up a part of the identity and cultural heritage of European regions. Three flagship companies explain their model and what would make their journey easier.

It is above all the variety of German bread and baking traditions that makes it unique: with more than 3,000 different types of bread shaped by the geography and climate of the individual regions, Germany has bread to suit every taste. In Fulda (Hessen), Bio Breadness has rethought the standards in bread making. Combining the old principles with the most modern technology, it has developed a unique concept for pure and honest bread of the highest quality, with 100% natural ingredients, without any artificial additives and baked on a stone oven floor.

What do we need to improve the company’s prospects? “More tools and less rules” says Andreas Swoboda, Managing Director. “It may sound cliché, but the reality of organic companies is a multiple layer of European, national and regional obligations. SMEs simply cannot cope with the regulatory burden and the cost it entails”.

The UK organic market has emerged strongly from the cost-ofliving crisis, with a shared determination to meet the challenges and opportunities ahead. The most recent supermarket data available delivers an upbeat message for the sector, revealing how its recovery from the impacts of the cost-of-living crisis has led it to outperform non-organic in 2024. Organic food and drink sales now show strong growth both in value and unit sales, with sales value increasing 6.4% in the year up to August, compared to 5.4% growth for non-organic.

Market analyst NielsenIQ’s latest key data insights highlight the key trends and motivations of shoppers looking for more healthy and sustainable choices.

Today consumers are becoming accustomed to the higher cost of living, with 29% saying that it is their biggest concern compared with 57% two years

ago. Health and wellness is also a growing concern, with 28% of consumers now saying it’s important compared with just 11% in November 2022. 69% of shoppers now say they actively look for sustainable/eco certifications or logos when buying food and drink.

Mike Watkins from NielsenIQ said: “There is also an opportunity to inform and educate about the need for changes in how we produce food

and in supporting the supply chain as part of helping UK food security. Organic is part of this journey.”

Just last month the President of the European Commission, Ursula von der Leyen, was advised in a key report that informs Europe’s future vision for agriculture that organic farming is the only regulated sustainable system that already delivers environmental and climate protection whilst reconciling na-

ture protection and farmers’ income.

Soil Association Certification

Commercial Director Alex Cullen said: “With a newly elected government, there’s cause for optimism around support for organic and how we get more of it into the hands and mouths of people across the country. But it is critical that we learn the clear lessons from Europe.”

With increasing pressure on businesses to look beyond a reduction in GHGs and meet consumers and regulatory asks to decrease their wider impact on the ecosystems, with its whole-system approach, organic remains well-placed to deliver. Meanwhile growth in organic in the UK can deliver further confidence in the market. Delivery of increasingly robust evidence of public good delivery, consumer understanding, and easing of cross-border obstacles will continue to be key to unlocking further growth.

EU policies and politics have a big influence on the operations of organic and conventional businesses. More and more policies directly and indirectly impact your day-to-day operations by shaping regulatory frameworks, market dynamics, and growth opportunities.

The best known to many in the organic sector is the EU organic regulation (EU) 2018/848 which defines what can be sold and imported as organic, what ingredients can be used in organic food production and how products can get the EU organic label.

Another example is the legislative proposal on so-called “New Genomic Techniques” or new GMOs which proposes to adapt the current regulatory framework on genetic engineering. This proposal will have far reaching consequences for all food and farming – from traceability and food labelling to producers’ freedom of choice.

Without going into too much detail on all EU policy developments, proposals like the development of a sustainable labelling framework, substantiating green claims, promotion policies and a revision of the criteria for sustainable public procurement offer opportunities and potential threats to your business.

EU policies are their own area of expertise, so we are there to do the work for you. As the voice of the European organic movement, we collect input from all sectors of the organic supply chain across Europe and actively engage and represent organic in EU policymaking. By ensuring your voice is heard, we work towards

EU policies that foster growth and innovation. In short, we are making Europe more organic.

How do we do this? Different sectors are represented in our organisation through dedicated interest groups: farmers; processors; certification and integrity; and retail. They formulate policies and positions relevant to their sector, discuss topics relevant to their sector and exchange best practices among peers and with the other sector representatives.

Our interest group of organic farmers (IGOF) is actively shaping the European organic movement’s position on the future Common Agricultural Policy (CAP) and discusses topics like inputs used in organic farming and animal welfare. One step further along the supply chain, the interest

group of organic processors and traders (IGOP) actively provides input so we can advocate for a regulation that meets the sector’s needs. They provided valuable input on the organic regulation (EU) 2018/848’s delegated and implementing acts, and discussed the ingredients permitted in organic products, like flavourings, additives and other ingredients listed in annexes VIII and IX.

Closest to organic consumers is our interest group of organic retailers. They discuss how they can ensure specialised organic retail’s continued growth, contribute to our official positions on food policy issues, like unfair trading practices and explore how taxation can bring the external cost of food closer to its true cost. Last but not least, in the interest group on organic certification and integrity (IGOC), sector representatives from across the EU collaborate on European positions on certification issues such as the organic control system and organic import regime. They also work together to ensure the supply chain’s integrity and exchange to better harmonise the EU’s control requirements, share national interpretations and best practices.

Our members’ contributions in these interest groups gives us the knowledge to advocate for EU policies that consider the day-to-day realities of organic operators across Europe. For our members they provide a platform to exchange with peers and with other sectors along the supply chain and get firsthand information about EU developments.

There are different ways to gain an edge about legislative developments at EU level that will impact your business.

To get to know us, you could consider joining one of our events for organic businesses. At this year’s edition of BIOFACH, our “business day” on 11 February provides a creative

By ensuring your voice is heard, we work towards EU policies that foster growth and innovation

space for business leaders to address pressing challenges and share best practices. Last year’s edition focused on crisis mitigation strategies and this year we will cover sustainability reporting in the organic sector.

If you are not at BIOFACH, you have another chance to meet us at the Organic Food Forum in November 2025. The forum serves as a valuable platform for exchanging ideas and fostering collaboration among organic and partly organic businesses. Discussions at the event will focus on prominent topics and trends shaping the organic industry today

You can also connect with us at the European Organic Congress (EOC), our flagship event and the leading event for organic food and farming in Europe. While not exclusively for organic businesses, this event provides unparalleled opportunities for networking, gaining insights into trends and regulations, exploring new markets, increasing visibility and learning through workshops and excursions. You can find these events at www.organicseurope. bio/events-page.

If you would like to get your company in the know, you can consider becoming a member of IFOAM Organics Europe. Membership offers numerous benefits, including the chance to become a part of our sector interest groups, access to exclusive insights, discounted events rates, opportunities to connect with like-minded businesses and business leaders, and the ability to shape the future direction of the organic movement.

If you are not in a position to become a member but are convinced of the work we do, you can support us with an in-kind contribution or sponsorship. Besides getting visibility, your support helps ensure we can continue advocating for you and keep organic high on the EU’s political agenda.

IFOAM Organics Europe is the European umbrella organisation for organic food and farming. With almost 200 members in 34 European countries, our work spans the entire organic food chain and beyond: from farmers and processors organisations, retailers, certifiers, consultants, traders, and researchers to environmental and consumer advocacy bodies. Visit www.organicseurope. bio for more information or contact info@organicseurope.bio.

The Organic World Congress (OWC) in Taiwan has not been the biggest of its kind. However, the conference marks an invaluable milestone and perfectly managed to take the pulse of the remarkable progress towards Organic 3.0. The last 20 years have shown one big trend for organic development: Upwards! More farmers, more area, more trade, more consumption. The trend is not only quantitative as expressed in statistics, but can also be felt in the quality of the observed transformations and contents of the debates. Here are a few personal reflections from an OWC participant perspective.

Congress speakers increasingly view the food system as a whole and examine whole territories rather than single operations and technical issues. They focus on the impacts on people and the environment.

Organic is not alone anymore. Powerful concepts with similar goals, such as agroecology and regenerative

organics, have emerged. Some circles (e.g., the UN system or big private sector investors) prefer to promote these terms. The organic movement welcomes synergies more and more.

Policymaking gains importance. Many countries successfully report on official organic targets, public procurement policies, public consumer information campaigns, research investments, or subsidies for environmental services. Organic and agroecology pol-

An ethical project

GreenLand Organic is a family-owned business dedicated to producing and selling organic products from the province of Málaga (Andalusia).

Organic products

We offer citrus fruits, subtropical fruits, oils, nuts, and more, directly from our farm with a commitment to quality, sustainability, and fair trade. Our mission

To provide our consumers with insights into the stories behind our food. www.greenland-organic.com

icies are no longer limited to regulating production practices and labeling rules. They are used to reach overall policy goals such as the SDGs or climate change mitigation strategies.

Organic regulations become less harmonized, and requirements become more demanding. Recognition based on equivalence gets under pressure. New group certification requirements raise the concern that certain value chains (e.g., cocoa or coffee) are

expected to be undersupplied in the coming years.

Gender, youth, and indigenous groups get more attention. Their concerns are better recognized, and their cases are generally more supported.

Overall, the OWC 2024 was a hub for transformative ideas and connecting global leaders. The program featured four key themes: 1) Organic culture and lifestyle, 2) Knowledge and practice sharing, 3) Growing organic markets, and 4) Policies for scaling up organics and agroecology. Pre-conference events showcased Taiwan’s organic heritage through bio-tours and cultural exchanges. Key insights revealed a rising interest in localized food systems, regenerative agriculture, and consumer-driven markets for organic products. The General Assembly of IFOAM Organics International got its governance, and the movement prepared for the next three years until the 22nd Organic World Congress 2027 in the Philippines.

In the lush, green forests of Java, Indonesia, local smallholder farmers grow a variety of tropical crops; spices, coffee and of course, you will find the quintessential coconut palms. Except in this case, there are no coconuts hanging high up in the trees, but beautiful flowers.

Each day, farmers climb these coconut trees to harvest nectar by skillfully slicing the delicate flower buds that would otherwise develop into coconuts. The nectar is then cooked on a stove and transformed into granulated coconut sugar; a healthier alternative to most commercially available sweeteners.

The production of coconut sugar has long been a traditional practice in Indonesia. The sugar is a main ingredient used to produce kecap manis, a typical sweet soy sauce and staple condiment in Indonesian cuisine, and production is deeply rooted in the country’s cultural and agricultural heritage.

Working conditions of the farmers and their living income have significantly improved

Granulated coconut sugar, however, with its refined texture and higher quality, is considered a premium variation, setting it apart from traditional forms of coconut sweeteners.

Committed to developing sustainable, thriving, organic value chains, Tradin Organic approached a local partner in Indonesia more than 10 years ago, offering technical and financial assistance to boost capacity and process coconut nectar into highquality, granulated sugar with organic premiums for the global market.

The partnership developed into a highly collaborative supply chain

with multiple partners, including dedicated processing facilities, ensuring the highest quality product, full traceability and organic integrity from farm to customer. Multiple certifications, such as EU Organic and Fairtrade, guarantee minimal impact on the environment, protection of biodiversity, and fair working conditions. And any coconut sugar derivatives are repurposed into coconut syrup, minimizing waste and maximizing value.

Ongoing success has resulted in the collective partnership growing in scale by over 400% since the start in 2012. Working conditions of the farmers and their living income have significantly improved, and community investments also increased.

And the story continues! In 2024, Tradin Organic secured a grant from the Dutch RVO’s Social Sustainability Fund for a 3-year project, enhancing livelihoods for an additional estimated 2,275 farmers, while securing a sustainable supply of responsibly sourced coconut sugar

Tradin Organic: Making Organic Everyone’s First Choice

Would you like to know more about the coconut sugar project in Indonesia, or any of the other products in our portfolio of over 150 ingredients, sourced from more than 70 countries? Come find us at our Booth 311 in Hall 5. Our team is happy to meet you and answer any of your inquiries!

We’re also hosting several sessions diving into different aspects of the organic value chain from farm to fork. Scan the QR code for an overview of activities happening in our booth. See you soon!

Two years ago I transferred from the international organic EU-lobby to the development of organic regional cooperations. Essentially, a transfer from the never ending discussions about the causes and levels of residues in organic to the inspiring task of creating networks at a regional level between a wide range of actors. The concept of organic regions and cities has been become established in several EU-countries over the past few years. And, it is increasingly taken seriously - because it works.

The power of cooperation between committed regional and local actors is unstoppable. It can be seen as a direct reaction to the seventy years of globalization and cost-efficiency production in agri-food business, that has caused so many negative impacts for our planet, environment and health. These are exactly the challenges that regions and cities face today. In our conversations with local political leaders, it is clear they feel a responsibility to find solutions to

the inherent contradictions between intensive farming production and efforts to protect a healthy environment for their community.

Most of the products and profits of harmful intensive production leave the region, but the damage – like soil-degradation, biodiversity loss, air pollution and health costs – falls on the local environments and communities. Those negative impacts are

important motivators for regional governors to embrace the concept of organic regions and cities. The concept is driven by an ambition to increase empowerment and of connection of different actors.

A very good example is in catering, the area in which Michaël Wilde and I experienced our first regional project “BioLokaal Catering Brabant” The catering companies in the project

were already very committed to serving healthy and sustainable food. So, when a group of ten municipalities and private companies asked them to offer more organic, they were able to speed up from 2.5% to 12.5% in just three months and are now on target to achieve 50% organic and/or local in 2026.

Many more project ideas have been developed over the past year as part of our responsibilities for coordinating and facilitating the development of the “Bio Regio Brabant” organic region, which is soon likely to be named the first official organic region in the Netherlands. In 2025, more regions in the Netherlands will initiate Bio Region actions and projects. It is a perfect example of ‘bottom-up’ empowerment of regional governments, organic networks, conventional businesses, NGOs, health care institutes and schools brought together to serve local societal needs with the benefits of healthy regional organic food and farming.

Visit us 11-14 February 2025, Hall: 7, Stand: 361

350 farmers from South Tyrol have been dedicated to the cultivation of organic apples for generationsa lasting commitment to quality and a guaranteed year-round availability.

In 2024, inflation led to a reduction in food spending among the French, and the share of organic products in their shopping baskets similarly declined. This share dropped to 5.6% in 2023, compared to 6% in 2022. Despite this, organic products were less affected by inflation compared to conventional goods, with price increases of 8% for organic products versus 12% for conventional products—a 4-point difference between organic and conventional agriculture.

After several years of decline, the consumption of organic products appears to be stabilizing. While organic product sales still struggle to recover in large and medium-sized stores (GMS), they have started to rise again in direct sales and specialized stores, signaling a shift in consumer behavior.

In September 2024, the Agence Bio published market data for the first half of the past year. The report highlighted that while large and medium-sized stores saw a decline in sales value in the first half of 2024, specialized stores and direct sales experienced continued growth. Sales in specialized stores rose by 8.4%, while direct sales saw an increase of 3%. This reflects a growing preference for alternative retail formats, despite the overall slowdown in mass retail.

This decline in organic product sales in GMS led to an 8.7% reduction in the number of organic product references available on shelves during the first half of 2024, compared to a much smaller 0.2% de-listing for all mass consumer products. This reduction has put more pressure on producers, particularly farmers, who are experiencing a downgrading of their products, which directly impacts their income.

A survey conducted by UFC-Que Choisir examining the price differences between organic and conventional products across nine major retailers, has revealed significant price gaps. The consumer association also looked into the price differences between average shopping baskets for organic versus

conventional products, providing valuable insights into the affordability of organic food for the average French consumer. Eating healthy, especially when opting for organic products, can be an expensive choice. While most French consumers are aware of the ecological and health benefits of organic products, three-quarters of them report not consuming organic items due to their high prices. This price barrier continues to be one of the main factors preventing wider organic product consumption in France.

For its survey, UFC-Que Choisir tracked the lowest prices for organic products both in-store and online, across 17 different categories. Except for fruits and vegetables, all the organic products analyzed came from

store brands. This allowed the survey to observe notable price differences between retailers. The survey found that the price differences between organic and conventional products were not as significant across all retailers. For example, Lidl’s organic premium is relatively low at just 59%, whereas Monoprix’s organic premium is much higher at 86%. Other retailers such as Casino, Intermarché, Coopérative U, Auchan, Aldi, E.Leclerc, Carrefour, and Lidl show varying price differences, with Monoprix having the largest gap and Lidl the smallest.

Monoprix shows an 86% price gap between organic and conventional products, followed by Casino with a premium of 78%, Intermarché at 73%, Coopérative U at 68%, Auchan at 67%, Aldi at 64%, E.Leclerc at 64%, Carrefour at 63%, and Lidl at 59%. These price disparities reflect the varying strategies employed by retailers in pricing their organic products, influenced by their sourcing methods, private-label offerings, and marketing approaches.

When comparing a basket of 17 products, Monoprix stands out with the most expensive option at €116, while Lidl offers the cheapest basket at €88. Casino ranks second with a basket priced at €116. Auchan, Carrefour, and U all offer baskets priced at €99. Aldi and Intermarché come next with a basket cost of €98, and

E.Leclerc follows at €91. These variations in basket prices demonstrate the considerable range in pricing strategies between different retailers.

The rise of private-label organic brands in mass distribution has been particularly evident in large retailers like Carrefour. Carrefour offers around 1,200 references under its Carrefour Bio brand, contributing significantly to its organic product range. Lidl, aiming to provide the “best” prices for a wide selection of organic products, offers more than 350 items in its stores. Aldi, while offering a more limited range, still provides a selection of organic products at competitive prices, particularly in its French stores.

In addition to these large retailers, other initiatives have been launched by brands like Intermarché and Coopérative U, who have actively participated in the Agence Bio national campaign. Both are committed to promoting the consumption of French organic products, which aligns with growing consumer interest in supporting local and sustainable agriculture.

Biocoop, with 741 stores, and Naturalia, holding an 11% market share with 228 outlets (compared to Biocoop’s 44%), are seeing encouraging signs of recovery. This rebound is attributed to their focus on promotions, price stability, and innovative loyalty programs. For example, Monoprix’s subsidiary, Naturalia, has been offering loyalty programs since 2022, including subscriptions starting at €4.90 per month. Subscribers benefit from a 10% discount

on all store items, making organic products more affordable for loyal customers.

Some smaller specialized stores, however, have struggled to survive and have been absorbed by larger, more resilient brands. For example, the 16 La Vie Saine stores were acquired by Marcel & Fils in July 2022. However, some smaller networks, such as L’Eau Vive based in Isère and Naturéo, have successfully emerged from the crisis. They have adapted by expanding their offerings, improving

customer engagement, and focusing on product quality.

In the first quarter of 2024, networks from large brands like Bio c’Bon and So.bio (part of the Carrefour Group) also faced significant challenges. The crisis prompted restructuring, with several Bio c’Bon stores closing and others being transformed into Carrefour City locations. Despite these challenges, many independent networks and cooperatives—such as Biomonde, La Vie Claire, and Satoriz—have managed to weather the storm and are seeing an influx of customers returning to their stores.

In economic terms, a cycle consists of four phases: expansion, slowdown, recession, and recovery. The French economy, supported in part by the Olympic and Paralympic Games, is projected to have experienced a modest growth of +1.1% in 2024. France is set to have surpassed the symbolic threshold of 4 billion euros in turnover for organic products in 2024.

Frédéric Faure is the Vice-President of Biocoop, the leading specialist organic retailer in France with over 740 stores accross the country.

Biocoop was founded in 1986. How has it become the leading distributor of organic products in France?

First of all, it hasn’t been as simple as that. We’ve been through many crises of growth, of market, of conscience. We’re almost 40 years old,

Ariadna Coma Journalist|bio@bioecoactual.com

and over these four decades, our model of militant retailer has established itself as the leader in specialised distribution in France, and has always been more convincing than the others.

Firstly, because of the uniqueness of our model, which is the only one of its kind in France, bringing together farmers, shops, employees and consumers in a single cooperative.

Secondly, because of its high standard offering and internal specifications that go beyond French and European organic specifications, and which take into account the social virtues of a food product (fairness, size of companies, etc.). The heterogeneity of its sales outlets in terms of their geographical location, size, etc.

And finally, through its customers, committed and ready to follow the Biocoop brand and recognise its commitment.

Cooperation has been an integral part of Biocoop from the very beginning.

I’ll try to focus on a few key facts: Firstly, employees of the cooperative, the shops and the farms can be Biocoop Employee Members. This means that they have a real say in the governance of the cooperative. We try to work with other cooperatives and build economic and affinity partnerships with this type of business. Our farmers are also members of cooperatives, which is compulsory.

We are also a company that functions like any other, with general management and operational support departments. On the other hand, we have to comply with the spirit of our cooperative and prove that our operations are carried out within a framework that suits our members. We define our offer, struc-

ture and logistics through various commissions and committees that bring together elected members and employees of the cooperative to guide the cooperative’s operational choices.

What values drive Biocoop’s philosophy and activities?

Our charter answers your question so well that I’ll let it speak for itself: “The aim of our network of Biocoop shops is to develop organic farming in a spirit of fairness and cooperation”.

In partnership with producer groups, we create fair trade channels based on respect for demanding social and ecological criteria.

We’re committed to the transparency of our activities and the traceability of our supplies. As a member of professional bodies, we monitor the

quality of organic farming. Our Biocoop shops are places where people can exchange ideas and raise awareness about responsible consumption. And I can tell you that we are genuinely putting this into practice, and it’s not easy every day! But our collective and complementary spirit is our strength.

What are the challenges and opportunities the organic market in France is facing?

In my opinion, the biggest challenge is to preserve our organic, fair trade and French quality sectors, in a market that has suffered a major setback at a time when everyone believed that organic farming was going to progress, driven by individuals who understood that it was the right way to produce, eat and take care of the planet. In fact, I think this is the case all over Europe.

The market is picking up again and in a few years, the supply side of the industry will be under pressure again, because production is shrinking with a great deal of inertia (you

don’t set up a farm and convert to organic in the blink of an eye). Preserving our production and processing facilities is a big challenge. Finally, and this is more of a prayer than a prediction, I hope that we’re still showing the best possible way forward in a world that needs sustainability and robustness. Not just trade, but fairer trade. In figures, Biocoop is doing well, with positive growth of +8% to date* compared to last year. (*Interview conducted in November 2024).

What is the situation of the organic sector in Europe?

As I was saying, the European market has behaved in much the same way as that of our British, Belgian, Dutch, German and Italian neighbours. Very strong expansion (+20%) with a great deal of interest from supermarkets in a buoyant market. This has had an amplifying effect. Then an

unprecedented downturn in the market following the management of the health crisis and the ensuing downturn in household consumption. We then went to -20%.

Fortunately, this did not last, and the market recovered, but it left deep scars on the organic landscape, especially upstream. Right now, we’re all back on track, with growth more or less the same, slightly higher than

inflation, and volumes down slightly. The number of specialist distributors has fallen, and supermarkets have withdrawn. We have a market that’s picking up again, because people haven’t forgotten that we were proposing concrete solutions to the problems of the future, particularly climate change.

How do you think the European organic sector will evolve?

What I believe is that organic farming is a matter of course. And that after a new wave of mistrust on the part of the leaders, who are still very worried about the profound changes taking place in society, a new awareness will emerge. The public, whom you call consumers, have not given up on us as much as we might have feared. And those we had deeply convinced even supported us during this period. Since the way we look at food, health, agricultural production and our relationship with the Earth are all key to a desirable and happy future, I’m convinced that we have a bright future ahead of us. Days of change. Those of organic farming.

The development of organic in Austria can be described as an impressive success story. Both, organic shares in agricultural production and organic sales in food retail, amount to the highest values within the European Union. The organic share in agricultural production has been over 25 percent for decades, and organic sales in the food retail sector have risen continuously and now amount to 11 percent. The decisive success factor for this development was the harmonious growth of agricultural organic land with a simultaneous increase in organic purchases.

Today, Austria is one of the leading countries in terms of the proportion of organically farmed land, with almost 28 percent organic share. Over the past three decades, the organic sector has developed from a market niche to a central part of Austrian agriculture and the food market.

Consumers can expect a wide variety of organic food in every su-

permarket. Organic food continued to enjoy great popularity even in times of high inflation and price increases. In 2023, sales in the organic sector increased by 5.3 percent whereas in the long term, organic sales have grown by more than 50 percent since 2019. Despite the crisis, organic food was able to maintain the coverage among the consumers

at a high level of 98.1 percent. Younger consumers under the age of 30 in particular and the 50+ generation are increasingly turning to organic. Organic sales increased by 1.8 percent in the first half of 2024.

The highest organic shares in food retailing are the dairy sector with fresh milk at 28.3 percent in terms of value, followed by plain yoghurt at 25 percent.

For consumers, the decision whether to buy organic or conventional food depends increasingly on the benefits and values attributed to organic.

To ensure that consumers are able to distinguish organic food when shopping, the AMA organic seal was developed 30 years ago as a state identification mark for organic food – long before the European Union made the green leaf mandatory as a common symbol for organic products.

Today, the AMA organic seal is the Austrian state seal of approval for organic food. It can be voluntarily added to the EU organic logo on product packaging and ensures 100 percent organic origins of the raw materials used and additionally indicates organic foods of a particularly high quality. This primarily refers to a number of consumer-related parameters in connection with food safety and quality.

The century-old company Jabones Beltrán is attending the international trade fair for natural and organic personal care in Nuremberg, showcasing its latest innovations in certified organic cleaning and solid cosmetics.

As consumers are seeking cleaner and more sustainable formulas, solid cosmetics have emerged as one of the most popular choices. This convenient format, which includes products such as shampoos, conditioners, deodorants and soaps made with concentrated natural ingredients, eliminates the need for plastic packaging. In addition, their compact size makes them easy to transport, reducing the carbon foot print associated with shipping.

range of solid body washes and sham poos with an innovative product: id

solid shampoo designed for dogs, cats, and other domestic animals. Due to a formula rich in carbohydrates, proteins, minerals, and vitamins enriched

dishwashing detergents, this product comes with a reduced water footprint. Its concentrated formula naturally cleans, degreases, and disinfects all kinds of kitchen utensils, taking care of the most sensitive skin and hands.

Jabones Beltrán is a family-owned company based in Castellón, Spain, Mediterranean Coast, founded in

1921. Its efforts to combine tradition and innovation made it in 2011 the first national manufacturers to produce and certify soaps and detergents under the Biobel brand (Ecocert). Fourteen years later, it is the leading brand in the Spanish market, has an extensive catalog for laundry and household products, and will take advantage of BIOFACH to present its new products in solid and zero waste formats.

The company has a presence in several European countries and is immersed in the implementation and search for new markets. For all visitors interested in quality, innovative and reliable organic products, Hall 5 stand 5–155 is a must-see. They can make an appointment (export@jabonesbeltran.com) or visit the stand to discover and collect samples of the entire range and judge for themselves.

As we step into 2025, the demand for ethical and high-performing natural beauty continues to shape one of the most dynamic sectors in the industry. From sustainability claims to AI-driven personalisation, the natural beauty market is evolving to meet the expectations of increasingly informed consumers. Valued at $13.17 billion in 2023, and with projected growth of 4.4% in 2024, the sector’s trajectory shows no signs of slowing. While Europe and North America concentrate 85% of natural product care sales, real growth is expected in Asia, with new launches being the key driving factor

What drives today’s consumers?

Consumer concerns about the safety of petrochemical synthetics in cosmetics has been the long-term primary driver behind the natural beauty boom. While retailers are actively marketing clean beauty brands, the expansion of sales channels has

played a pivotal role in making these products more accessible than ever – particularly, through the surge in online retailing since the coronavirus pandemic.

Gen Z is a key demographic driving innovation, as they prefer creative experiences such as AI-powered virtual try-ons and interactive storytelling in marketing campaigns. Their influence is evident in the rise

of product launches that prioritise creativity and engagement.

However, affordability remains a challenge. Rising inflation and cost of living pressures are affecting consumer spending power. Meanwhile, the sustainability narrative continues to resonate, but greenwashing persists, especially in regions like Asia, where use of self-declared “natural” logos prevails. Underscoring this use is the lack of an official definition for popular product specific claims like “natural” and “organic”, as well as the general growth of environmental claims. The increased risk of greenwashing underlines the importance of transparency as a pathway to offer trust to consumers. Third-party certification still offers a verifiable basis to support product claims, but the adoption rates remain inconsistent. In Europe, 55% of natural personal care products are certified – accounting for two-thirds of natural and organic cosmetic sales in Germany and France – whereas in North America, the largest market globally, only about 8% of products are certified.

Sustainability as a non-negotiable: While “sustainability” is often dis-

missed as buzzword, its importance remains undeniable. In fact, it has become a must for brands, as consumers increasingly expect eco-conscious and socially responsible practices. Studies show that over 30% of consumers prefer brands that align with their social or political values, while 25% actively boycott brands that fail to meet their ethical expectations. However, sustainability claims must go beyond marketing slogans and be substantiated with scientific evidence to build credibility and trust.

Wellbeing and high-performance products: The demand for products that enhance emotional wellbeing, and comfort is set to grow in 2025. Consumers now expect highperformance products that offer both tangible benefits and long-term value. For instance, 40% of French adults believe that a beauty product that lasts a long time indicates that it is good value for money

The role of Artificial Intelligence (AI): AI is pushing the boundaries of beauty innovation. Hyper-personalisation is gaining traction, with technologies enabling tailored skincare products and AI-driven consultations. Notably, despite affordability being a key factor in purchase decisions, 28% of US consumers report being willing to pay more for hyper-personalised beauty products. Additionally, AI is expected to boost online sales significantly. In India, 78% of consumers familiar with AI say it makes it easier to shop for products online.

K-Beauty: Korean Beauty has revolutionized beauty standards. Known for its innovative formulations, light textures, and multi-step rituals, K-beauty remains a favourite, particularly among younger audiences. In 2022, South Korea was the fourth-largest exporter of cosmetics

globally, surpassing Italy and on par with Germany, and behind France and the United States.

Besides the evolving market and consumer trends, at a policy level, the end of 2024 saw the start of the new European Commission. With the new political priorities in-place and competition back on the agenda, the first 100 days of the mandate look set to present a Clean Industrial Deal, a Circular Economy Act, and a new chemicals package including a simplification of REACH – the EU chemicals legislation. Furthermore, an EU

Biotech Act is anticipated to make it easier to bring biotech from the laboratory to the factory and then onto the market. In support of these actions, an updated bioeconomy strategy is expected to support the establishment of a single market for sustainable products underpinned by innovation, bio-based materials, standardisation, product footprinting and labelling.

Outside of emerging files, in 2025 we can expect the EU Cosmetics Regulation (CPR) to:

• Start a ‘fitness check’ evaluation from Q2.

• Continue discussions on how a constituent(s) of natural complex substances (i.e., plant extracts including essential oils) that receive a CMR 1 harmonised classification and labelling under CLP will be treated under Article 15(2).

• Deal with management of substances with potential endocrine disrupting properties under the

CPR, particularly those classified in category 1 for human health under CLP.

• Aim to align the 2022 Commission Recommendation covering the definitions of nanomaterials.

• Evaluate consumer information by digital labelling.

Nevertheless, in terms of a timeline, any discussions started to evaluate the CPR in 2025 would not result in immediate changes since any potential publication would be from 2029 at the earliest.

In terms of existing files from the last political mandate we can also expect the outcome of the Green Claims Directive file and the entry into force of the Packaging and Packaging Waste Regulation.

Overall, the new year looks set to be key to setting the foundations shaping the future framework for natural and organic cosmetics innovation, compliance and communication as we move towards to 2030.

Lukas Nossol is the Head of Communication for Dennree and BioMarkt Verbund (BioMarkt association), the leading Central European familyowned organic business. Dennree celebrated in 2024 its 50th anniversary. “The anniversary gave us the opportunity to look back on our humble beginnings and be proud of what we have achieved so far. 2024 was full of activities with employees, partners and customers. All together, we are very proud of what we have achieved so far”, shares Mr. Nossol.

When does a product become a Dennree product?

As a specialist organic food retailer in the BioMarkt Verbund, we attach great importance to organic quality and variety in our product range. Both are once again reflected in our own brands dennree, Gustoni and Königshofer, which are of great importance to us. With our own quality organic lines we are now broadly positioned across categories: Königshofer offers

(Dennree): “We put all efforts towards 100% organic as the only way to go”

a large selection of meat and sausage products as well as eggs, Gustoni offers Mediterranean food of the highest quality and dennree products enable our customers to buy organic for their daily needs thanks to their excellent price-performance ratio.

All of our products reach at least the EU Organic Standard and around a third of our own-brand products are certified by organic farming organisations, including Bioland, Naturland, demeter, Biokreis and Bio Austria. Bioland and Naturland account for the largest share. Our total of around 1,000 private label products are very popular with our customers -not least because they cover a wide range of preferences thanks to the breadth and depth of our range.

How do you offer advice and service to retailers and independents?

At BioMarkt Verbund, we are around 530 independent BioMarkt stores and Denns BioMarkt stores in Germany and Austria. We want to develop the organic movement for the future and see the diversity of independent shop owners as crucial part of the sector. Thus, we have developed several services and tools specialised for the administration of organic stores. Operating several hundred stores on our own, we are retail specialists and openly provide knowhow to our partners.

Everyone is talking about bitters. We are picking up on this trendy topic with this new product line. Although bitters are essential for a balanced diet, they are rarely found in modern foods. With bitter tea, bitter powder, or bitter spray, bitter substances can be integrated into everyday life.

How has BioMarkt developed and what are its growth prospects?

We are very satisfied with the development of the BioMarkt network. We are the home base for organic specialists in the whole value chain. As leader in the organic sector, we still put all efforts towards 100% organic as the only way to go. At the same time, we see a steady increase in our customer base and their loyalty and trust levels towards organic.

Transparency is key.

Together with our partners in the BioMarkt network, we develop weekly offers and marketing campaigns in a democratic manner. Together, our long-standing partners and we share common values and the drive to make a diet with organic food possible for everyone. Transparency is also important in our relationship with our customers. The customer should be able to recognise ingredients, origin and reliable labels. With our editorially produced magazines Kreo and Kreomi (for children), we offer our customers added value and important background knowledge.

How does Dennree contribute to a fair value chain?

First of all, our products are produced completely organically, which

has a great impact at the regions of origin. Farmers and nature’s health increases without conventional inputs. To implement the EU Supply Chain Act, we have invited all suppliers to share data with us via an electronic database. We also have fixed contractual agreements with our own-brand suppliers in particular, regarding quality and social standards. In the end the biggest challenge for us is to communicate the added values of products to customers, achieving an understanding of higher prices.

What strategies are most effective in encouraging consumers to purchase organic products?

As organic speciality stores, we want to inspire our local customers about the diversity of organic and the organic concept. As equals, we share the common conviction of treating nature and what surrounds us with care. Our clear values are our drivers. Our value driven efforts are perceived on a rational basis as well as on an emotional basis.

Which are the biggest opportunities and challenges for 2025?

Climate change is still one of most challenging tasks we have to face. Together with a volatile market and politics - it will be a challenge to secure raw materials in quality and quantity.