BY GRAEME WOOD GWOOD@GLACIERMEDIA.CA

Each year, provincial lawmakers gather in Victoria with the organization that regulates B.C. accountants and last April was no different, with a breakfast hosted by then-newly appointed Minister of Post-Secondary Education and Future Skills Lisa Beare . Beare’s ministry is tasked with overseeing the Chartered Professional Accountants of British Columbia (CPABC)—the training, licensing and regulatory body for the province’s 40,000 CPAs and 6,000 CPA candidates and students.

In March, CPABC had proposed an amendment to the Chartered Professional Accountants Act, the profession’s enabling legislation, to add “protection of the public interest” to its legislated objectives.

The amendment was not only to align the act with other professional regulatory bodies—it was in response to the 10 recommendations money laundering inquiry commissioner Austin Cullen directed at the CPABC in June 2022

“These are changes that the chartered professional accountants are very excited about because they believe they are already doing this work,” said Beare in committee last April.

“The expectation is for CPABC and the ministry to continue the fantastic work that they do together already.”

However, not mentioned anywhere in the public record is how, while Beare was lauding CPABC for its “fantastic” regulatory record, Canadian and U.S. regulators were busy unleashing an unprecedented wave of enforcement actions against Vancouver accounting firms that audit the books of B.C. public companies.

Since March 2021 , the U.S. Public Company Accounting Oversight Board (PCAOB ) has levied hundreds of thousands of dollars’ worth of fines and numerous practice restrictions against eight B.C. firms that are responsible for the lion’s share of

enforcement action not shown on B.C. accountant licensing body’s site

audits of B.C. public companies.

In June, the PCAOB—the U.S. regulator for audits of U.S.-listed public companies—sanctioned a ninth Vancouver firm.

The PCAOB censured, restricted or in some cases banned these firms from operating in the United States under settlements in which they did not admit nor deny the violations alleged by board investigators.

No other jurisdiction outside of the United States has come close to meeting that level of scrutiny and enforcement by the PCAOB for serious violations that it asserts—if left unchecked—would imperil the integrity of U.S. investment and capital markets.

“No matter where they are located, PCAOB-registered firms must follow PCAOB rules and standards,” said PCAOB chair Erica Y. Williams on June 18 , following findings against the ninth B.C. firm. “Failing to do so puts the investing public at risk and will not be tolerated.”

When Glacier Media inquired about this unprecedented confluence of regulatory actions against Vancouver accounting firms, CPABC CEO Lori Mathison declined an interview.

Ministry staff cancelled a scheduled interview with Beare, who also declined an opportunity to speak to Glacier Media about the amendment and CPABC’s record of protecting the public from errant accountants.

“National and international regulators have lifted the lid off a serious systemic problem,” said David Baines, who for more than three decades monitored accountant regulations in B.C., particularly in relation to the public markets, as a business columnist for The Vancouver Sun

“Nearly every accounting firm that audits B.C. junior companies has come under regulatory fire. Equally worrisome is that the reaction of CPABC officials and their political overseers seems to be: ‘No problem here.’”

U.S. regulator hands out bans, US$ 445,000 in fines to B.C. firms

The first of the nine B.C. firms penalized by the PCAOB since the spring of 2021 was Morgan and Company LLP, which was censured and fined US$ 25 ,000 in March 2021 for careless auditing of two public companies, including partnering with an unregistered Mexican accountant to audit a Canadian mining company.

In September 2021 the regulator revoked the registration of WDM Chartered Professional Accountants and barred its sole managing partner Mike Kao from being associated with a registered public accounting firm after failing to improve quality control standards following multiple warnings from inspectors. A US$ 10 , 000 was also imposed.

Months later, in December 2021 , the board fined Dale Matheson Carr-Hilton LaBonte LLP US$50,000 and censured it for deficient audits on two Canadian companies. Specifically, when the U.S. Securities and Exchange Commission told the firm its audits needed to meet PCAOB standards, the firm simply amended the same audits to say they had, when in fact nothing changed.

The same month, Harbourside CPA LLP was fined US$ 10,000 and censured for filing errors.

In September 2022 , the board revoked the registration of Hay & Watson and its principal Essop Mia . The authorities also barred Mia from becoming or remaining “associated with any issuer, broker or dealer in an accountancy or a financial management capacity” in the U.S. and jointly fined them US$50,000 for altering and backdating documents for an audit of an Ontario-registered oil and gas company, among other accounting violations. Mia did not cooperate with the board’s investigation, according to the PCAOB

A year later, in September 2023, the board revoked the registration of North Vancouver accounting firm K.R. Margetson Ltd. and its sole director Keith Margetson . They were censured and the firm was fined

US$ 30 , 000 after inspectors found multiple violations of accounting rules deemed to be “reckless” if not purposeful.

A month later, in October 2023, Smythe LLP faced the biggest fine yet—a US$175,000 penalty for poor standards in auditing four public companies, including two operating in Canada. In particular, Smythe LLP accepted the audits of unregistered auditors of client subsidiaries from Mexico and Argentina. The board also censured the firm and ordered it to complete remedial actions.

In November 2023 , the board imposed a US$ 35 , 000 fine on Manning Elliot LLP, which was also censured and ordered to take corrective policy measures. The firm had failed to disclose nine reportable events concerning three disciplinary proceedings brought by the Canadian Public Accountability Board (CPAB)— the Canadian counterpart of the PCAOB that specifically regulates auditors for Canadian-listed public companies.

The lastest firm to face penalties was De Visser Gray LLP, which was fined US$60,000 and censured for poor quality control standards, failing to correct “significant deficiencies in its system” and conducting non-compliant audit methodologies that were first flagged in 2019 and continued in 2022 , when investigators checked back in with the firm.

CPAB also took disciplinary action last year against several of the B.C. firms that have been penalized by the PCAOB.

Smythe LLP is prohibited from accepting any new audits, and both Manning Elliot LLP and Dale Matheson Carr-Hilton LaBonte LLP are each prohibited from accepting new high-risk files. WDM Chartered Professional Accountants is prohibited from accepting new mediumand high-risk files.

CPAB did not administer fines.

CPAB terminated Hay & Watson’s public company audit registration and directed the company to cease all ongoing audits of B.C. public companies on June 23, 2023.

Hay & Watson became just the second B.C. firm to be terminated by CPAB following the April 15, 2019 termination of Jackson & Company, whose principal Anthony Jackson has since been suspended from the investment markets for participating in a consulting scheme deemed abusive to the capital markets.

No accounting of U.S. enforcement by CPABC

All of the above B.C. accounting firms are licensed by CPABC in order to offer other services to the general public, such as business audits, financial assessments and personal income tax filings.

However, anybody checking the CPABC website for the regulatory record of any of these firms would find no mention of the enforcement actions taken by the U.S. regulator, and although CPABC has taken some minor enforcement action against some of those firms, it has withheld their identities from public view. For example, the undated CPABC disciplinary notice “ 2022 - # 15 - A Member and Firm,” states the respondents failed to comply with U.S. auditing standards and, recognizing that they had already incurred significant penalties, CPABC only issued a reprimand and $1,500 fine.

The respondents are not named, but the information in the notice aligns precisely with the US disciplinary action against WDM and its sole managing partner, Kao.

A lso in 2022 , CPABC announced reprimands against two other firms whose identities are not disclosed, but whose violations align precisely with Habourside CPA and Dale Matheson Carr-Hilton LaBonte. Similarily, notice “ 2023 - #19 - A Member” does not identify the respondent, but cites violations that align exactly with Hay & Watson and its principal, Mia. CPABC issued a reprimand and fined the firm an additional $1,000.

POLITICS | The areas of trade, migration and defence are most likely to see change

BY GLEN KORSTROM GKORSTROM@BIV.COM

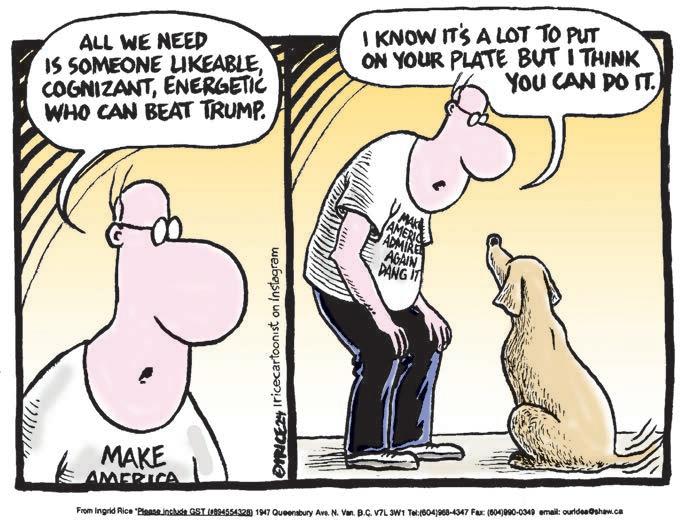

Polls have shown former president Donald Trump widening his lead over President Joe Biden since the June 27 election debate, in which Biden’s performance was widely panned.

The results suggest an increased likelihood that the Republican candidate will win the Nov. 5 presidential election.

Whoever leads the U.S. has a significant impact on Canada.

As former Canadian prime minister Pierre Trudeau told an American audience in a 1969 speech: “Living next to you is in some ways like sleeping with an elephant. No matter how friendly and even-tempered is the beast, if I can call it that, one is affected by every twitch and grunt.”

His son, Prime Minister Justin Trudeau , had a rocky relationship with Trump during the latter’s 2017-21 presidency, and has recently made unenthusiastic comments about the prospect of a second Trump term.

“It wasn’t easy the first time and if there is a second time, it won’t be easy either,” Trudeau told the Montreal Chamber of Commerce in a January speech.

University of British Columbia (UBC) political scientist Stewart Prest told BIV that a Trump

election win could cut two ways for Trudeau, who is slated to run for re-election next year despite the fact that his Liberal party has fallen far behind the Pierre Poilievre -led Conservatives in the polls.

“A Trump win could give more momentum to Mr. Poilievre, as another indication of the success of the right, and more right-leaning and culturally right arguments,” Prest said.

“On the other hand, if Trump were to win and take office in early 2025 and things go really badly, then that might become a problem for Mr. Poilievre, who would have to justify and say that he’s not going to create a version of that here in Canada.”

Politically, a Trump win has the potential to most rattle Canada on issues such as the economy and trade, immigration and migration, and security and defence.

Economy and trade Trump has a reputation for being more of a protectionist than a free trader.

His first term in office saw him threaten to tear up free-trade agreements and he levied new tariffs on various countries, including Canada.

This alarmed Canadian politicians, given that about three-quarters of Canada’s goods

exports—equivalent to more than one-quarter of the country’s GDP—go to the U.S.

The Canadian government successfully convinced Trump to renegotiate the decades-old North American Free Trade Agreement, which resulted in what is known in Canada as the Canada-United States-Mexico Agreement (CUSMA).

That agreement loosened Canadian dairy restrictions and forced Canada to provide U.S. dairy farmers access to about 3 .5 per cent of the country’s $16 billion annual domestic dairy market.

The U.S. has since increased exports of some milk products to Canada.

“The U.S. won some concessions from Canada, but Canada did a pretty strong job of holding the line on the dairy market,” Prest said.

New CUSMA provisions also related to data and intellectual property, restricting Canada’s ability to require that servers or “computing facilities” be located in Canada, and restricting its development of domestic policies related to data and IP. The agreement also imposed stricter labour and environmental standards.

Like NAFTA, CUSMA is at risk under a Trump presidency.

Canada, the U.S. and Mexico must by July 1, 2026, confirm in

writing that they want to continue the agreement. Any of the countries deciding not to renew their participation creates uncertainty, the risk of another protracted renegotiation or the possibility of less-free trade.

Tariffs are another risk.

Trump imposed a 25-per-cent tariff on steel imported from a range of countries, including Canada. He also imposed a 10-percent tariff on aluminum from Canada and other countries.

This led Canada to impose those same tariffs on U.S. steel and aluminum. Both of those tariffs have been removed.

Trump this year said he would impose a 60-per-cent tariff on Chinese imports and a 10-per-cent tariff—or more—on all imports from all countries.

A 10-per-cent tariff on exports to the U.S. would subtract $7 billion from Canadian GDP annually, representinga 0.3-per-centdecline from the status quo, according to a recent BDC report.

“This drop in economic activity would translate into the loss of around 20,000 jobs in Canada,” the report said.

Central 1 Credit Union chief economist Bryan Yu told BIV that both Trump and Biden are more protectionist than previous presidents, but that tariffs could be a bigger risk under Trump.

“There would absolutely be a lot more of a challenge with a lot of discussions around higher tariffs for all the trading partners, including Canada,” he said.

Prest agreed.

“There’s going to be a number of big industries that have the Trump administration’s ear and we can expect those interests to be vociferously defended,” he said.

Immigration and migration

Trump took a tough line on immigration, migration and all other kinds of entry into the U.S. from the start of his presidency.

One week after his Jan. 20, 2017 inauguration, Trump launched an executive order widely described as a Muslim ban. He restricted entry into the U.S. from five majority-Muslim countries, including Iran, Syria, Libya, Yemen and Somalia. The ban also included nationals from North Korea and Venezuela.

The impact of that since-rescinded order was that Canada likely received more visitors, and more people wanting to be accepted as refugees or immigrants. If Trump retakes the White House and repeats this tough stance, there may once again be more visitors to Canada. That has the potential to elevate already-soaring prices for hotel rooms and homes in Vancouver.

BY NELSON BENNETT NBENNETT@BIV.COM

Based on the track records of both U.S. former president Donald Trump and current President Joe Biden, if Canadians could vote in the November presidential elections in the U.S., it might be in their best interest to vote for the Democratic nominee chosen to replace Biden in the presidential race.

Some Canadians have, in fact, already voted for Biden—with their

feet. In 2022, more than 126,000 Canadian citizens moved to the U.S., according to Statistics Canada —the highest number in a decade.

“No matter what happens in the outcome of the election, I think this should be a wakeup call for British Columbia,” said Bridgitte Anderson, president of the Greater Vancouver Board of Trade (GVBOT).

“Last year, more people moved out of B.C. for another province than moved here. But if you look at the numbers in Canada, writ

large, more people have moved out of Canada to the U.S. than we’ve seen in a decade as well.”

Some of those Canadian émigrés would have taken their businesses with them.

“The cost of scaling and running a business in B.C., compared to the U.S., is becoming untenable, and that’s why we’re seeing businesses and individuals leave,” Anderson said.

Who sits in the Oval Office matters a lot for Canadian businesses, especially those that export goods

and services to the U.S.

BDC notes that Canada exports 75 per cent of its goods and services to the U.S., and is therefore vulnerable to “Buy American” protectionism.

While both Biden and Trump administrations proved protectionist, Trump was a far more aggressive and unpredictable isolationist.

“What has characterized Biden’s administration is a much more normal, predictable kind of approach to trade,” said Dennis Darby, president of the Canadian

Manufacturers and Exporters (CME).

One part of Canada-U.S. trade that was hurt under Biden was energy. On his first day in office, Biden killed the Keystone XL pipeline, which had economic ramifications for Alberta oil producers as it helped maintain a discount for Alberta crude and also deterred investment in the province.

“The last eight years, for both the Trump and Biden administration, we’ve seen an increasingly protectionist approach,” Anderson said.

Perhaps Trump’s biggest campaign promise was to deter illegal migration by building a wall between the U.S. and Mexico—and force the Mexican government to pay for it. That did not happen, though some parts of the wall were constructed.

Much of the U.S.-Mexico border remains without a partition, and illegal migration across that border is once again a hot-button issue in the election campaign.

Trump gave Immigration and Customs Enforcement (ICE) agents more power to enforce laws and detain unauthorized immigrants.

Controversially, he launched what he called a “zero tolerance” policy at the border, leading to children and parents being separated while detained.

He also attempted to end a program that allowed people who entered the U.S. as children and who had lived there for more than five years to have a two-year deportation deferment—a challenge that the courts blocked.

Many who oppose Trump fear that he will ramp up efforts to keep foreigners out of the U.S. That could lead to more of those people seeking refuge in Canada, said Irene Bloemraad, a professor and co-director of UBC’s Centre for Migration Studies.

U.S. politicians have so far failed

to pass a Development, Relief and Education for Alien Minors (DREAM) Act.

If Trump steps up deportations or detentions, so-called “DREAMers” could try to immigrate to Canada, or claim refugee status here, Bloemraad said.

Despite Canada having a Safe Third County Agreement (STPA) with the U.S., people could claim in court that U.S. detention policies are “cruel and unusual,” and that the U.S. is no longer a safe country for deportees. That could prompt Canada to accept them as asylum seekers, Bloemraad said.

While it is illegal for U.S. employers to hire undocumented workers, there is little enforcement because there is little political will to go after employers, she added.

That status quo is unlikely to change under Trump, whose Trump Organization has been accused of hiring undocumented workers, Bloemraad said.

“Trump is obviously someone who is very pro-business, and he is not someone who believes in government regulation of business,” she said.

Canada and the U.S. last year tweaked their STPA to close a loophole that enabled migrants to claim refugee status in Canada without fear of being sent back to

the U.S. if they entered Canada at irregular entry points, such as any non-official border crossings. Refugee claims from people arriving at Canadian airports then surged.

“I’m not sure that a tweak in Canadian regulations is going to be enough to stop you [from trying to come to Canada] if you truly fear deportation back to your homeland,” Bloemraad said.

A Trump presidency may deter some foreigners from wanting to study in the U.S., she added. That could prompt a rise in international student applications in Canada.

It is also possible that convention planners could look more favourably at Canadian cities if they fear that some delegates will not be able to attend a U.S. event.

The number of Mexicans entering Canada through B.C. surged during the Trump presidency pre-pandemic. While some of those visitors may have chosen to visit Canada instead of the U.S. because they were turned off by the U.S. president, a bigger factor for most was likely that Canada ended visa requirements for Mexicans starting on Dec. 1, 2016 Mexican travellers to Canada through B.C. jumped to 13,573 in December 2016, according to Destination British Columbia . That was up 69 1 per cent from the same

month in 2015. A future increase under a Trump presidency is unlikely given that Canada in February reinstated visa requirements for most Mexican travellers.

Mexican visits to Canada have since substantially declined on a year-over-year basis.

Security and defence

Trump is expected to lead the U.S. to be less active in global organizations than Biden.

The former caused angst among allies earlier this year when he said that he would encourage Russia to “do whatever the hell they want” to any North Atlantic Treaty Organization (NATO) country that doesn’t pay two per cent of GDP on defence—including Canada.

Canadian defence spending has long fallen short of that threshold, which is a guideline and expectation of members in the 32-country military bloc. Trump’s campaign rhetoric has prompted renewed efforts in Ottawa to have Canada increase that spending. So has Russia’s war in Ukraine, and heightened military spending among European allies.

“By 2029-30, we expect that our defence spending will reach 1.76 per cent of GDP,” Canadian National Defence Minister Bill Blair said in May.

Trudeau, on July 11 , then

outlined his timeline to meet the two-per-cent spending goal, though without many details.

Prest thinks more Canadian spending on the military is likely if Trump wins the White House.

“On elements that we would more normally think about as being Canadian domestic policy, [Trump] may take more of an interest in lobbying the Canadian government,” he said.

That meddling in Canadian domestic policy could also extend to how it regulates U.S. technology companies, Prest said.

Trump has a reputation for being unpredictable and pushing boundaries in world affairs. He said in July that Taiwan should pay the U.S. for military protection and accused it of stealing America’s semiconductor business. This raised questions over how the U.S. would respond if China invaded Taiwan.

That unpredictability is also in part why some fear he may put into effect an initiative organized by the activist U.S. conservative think tank Heritage Foundation, known as Project W2025

The project suggests many policy proposals aimed at reshaping the U.S. government to consolidate power under the president.

What Trump would do with enhanced power, and how it would affect Canada, is anyone’s guess.■

would likely be better for the B.C. and Canadian economies from a trade perspective

“And we’ve seen these massive tax breaks through personal tax cuts and also the Inflation Reduction Act (IRA).”

The original draft of the act— which provides massive tax credits and incentives for electric vehicle manufacturing and other clean energy technologies—raised fears that Canadian manufacturers would be frozen out of the American electric vehicle and battery manufacturing space.

“We were very fortunate, and did a lot of work, to get the Inflation

Reduction Act to include [the] manufacture of vehicles in North America,” Darby said.

The IRA provided such massive production subsidies for manufacturers to locate or relocate to the U.S. that Canada’s Justin Trudeau government found itself in a business bidding war, and ended up offering $31 billion in production subsidies and investment tax credits to get its share of the EV manufacturing pie. This approach, Anderson said, is “risky.”

“What the Trudeau government

has done is it put all its eggs in one basket, in one sector,” Anderson said. “And that is a very risky approach.”

From a Canadian diplomatic and economic standpoint, Biden had been easier to deal with than Trump, and the general attitude of the White House towards trade relations with Canada will matter a great deal when the Canada-United States-Mexico Agreement (CUSMA) comes up for review two years from now.

“There are several thorny points

that could emerge,” said economist Werner Antweiler, chair of International trade policy at the University of British Columbia’s Sauder School of Business.

“One concerns the automobile market, which faces challenges from potential imports from China. The U.S. has already applied tariffs on EV imports from China, and Canada has launched a countervailing duty investigation. And there are also concerns that Mexico could become a staging platform for Chinese

manufacturers, which could put strains on the CUSMA relationship,” he said.

Anderson added that, on tariffs, B.C. businesses know what a Trump administration has said it will do. How a new administration would handle such issues is unclear.

“CUSMA could be quite significant when it’s opened up for review in 2026, and it could be quite negative for our economy, and that might be regardless which president is elected.”■

BY ADAM CAMPBELL ACAMPBELL@GLACIERMEDIA.INC

BCgig workers and consumers face an uncertain future due to new regulations.

In June, the provincial government finalized regulations to deliver fair treatment for app-based ride-hailing and delivery workers across British Columbia. These adjustments are expected to come into effect on September 3, 2024, and will apply to those working for apps such as Uber, Uber Eats , SkiptheDishes and DoorDash

In recent years, gig workers raised concerns about the nature of their work, such as low and unpredictable pay, lack of coverage through WorkSafeBC , lack of pricing transparency, unfair account suspensions and tip protection.

Following various meetings with the provincial government and even a strike warning from several gig workers, new regulations will include:

Establishing a minimum wage of $20.88 for workers;

Additional compensation of $0.45 per kilometre for ride-hailing and $ 0.35 per kilometre for delivery; Coverage and compensation benefits from WorkSafeBC , including rehabilitation services from work-related injuries; Further destination and pay transparency;

Prohibiting companies from withholding or deducting tips; and

Improved suspension and termination policies.

In a news release, Minister of Labour Harry Bains said he supported these changes and highlighted the need for “basic fairness.”

“Everyone working hard to support their families should have basic protections so if they’re injured on the job, they won’t lose their homes,” said Bains. “That is what we are doing with these regulations—providing fair pay and basic protections for these workers.”

A local perspective

BIV spoke to Joy Nahirnick, a Victoria-based part-time Uber driver who said she believes the regulations—especially the new destination and pay transparency—are positive.

“Absolutely, I think they’ll be good changes,” said Nahirnick.

“Uber seems to be a fair employer; my experience with them has been lovely,” she said.

“Sometimes it’d be nice to know where you’re going when you pick up a client, right? If I only have an hour, and they want to go an hour and ten minutes, I’m going to be late for another call.”

Nahirnick continued by mentioning these benefits will mostly support her colleagues who drive for the app full-time.

“There’s a few people I know that are using this as a full-time employment, and these regulations are quite helpful to them,” said Nahirnick. “What if they suddenly lost their source of income? Now they’re guaranteed a wage and they’re more protected in that position.”

However, the new regulations have raised concerns about the future of the province’s gig economy, as similar regulations in Seattle implemented earlier this year appeared to cause greater harm than good for workers.

Shortly after app-based minimum pay and paid sick time

We are cautiously pessimistic; there hasn’t been a proper nancial analysis on the cost implications of what this does [ ]

IAN TOSTENSON CEO AND PRESIDENT, B.C. RESTAURANT AND FOODSERVICES ASSOCIATION

drivers reported that the ordinances positively impacted them.

delivery, if we decide to skip a restaurant because it’s too expensive, we won’t get in our car and go—we’re probably going to do something else. This is a lost opportunity and we’re worried.”

When asked if Vancouver could see the same repercussions as those seen in Seattle, Tostenson said he doubts it could be any different.

“People love ordering their food in Seattle, and we have the same economic pressures as they do,” he said. “The bottom line is, there is going to be a cost increase here, and they’re going to be passed on somehow.

ordinances went into effect on January 13 in Seattle, data from Uber showed a 30-per-cent decrease in UberEats order volumes, with delivery drivers spending 30 per cent more time waiting for delivery requests.

Data from DoorDash indicated a clear correlation, with consumers placing around 30,000 fewer orders on the app. Independent grocers also suffered the blow of decreased demand. Washington Food Industry Association CEO Tammie Hetrick stated that digital sales for independent grocery stores fell by 10 per cent to 12 per cent shortly after the policies took effect.

This plunge in demand not only meant less work for drivers, but a decline in revenue for restaurants—many of which rely on app-based platforms for business.

According to an article by Seattle’s KUOW, Spice Waala , an Indian street food restaurant established in 2019 experienced a significant blow from the ordinances.

Uttam Mukherjee, the owner of the eatery, told KUOW that delivery orders declined by 40 per cent following the new pay rates, as companies like UberEats imposed an extra US$5 fee to each order. Most strikingly, the price of their kathi rolls—a house best seller—doubled from US$ 10 to US$20 in a matter of months.

Nevertheless, some Seattle

According to KUOW, one delivery driver saw pay increase by 25 per cent, while another driver reported getting compensation while waiting for orders to be filled.

Ian Tostenson, CEO and president of the B.C. Restaurant and Foodservices Association (BCRFA), said he feels “cautiously pessimistic” about B.C.’s new regulations.

“A lot of it is really good, such as the increase in minimum wage and the coverage from WorkSafeBC,” said Tostenson. However, he said a real problem that could cut both ways is accounting for and reimbursing expenses.

“If I’m a driver and I’m being reimbursed per kilometre for 1,000 or 2,000 kilometres on my mileage, that’s going to cost a lot of money to these companies,” he said. “What hasn’t been factored in, is a lot of these drivers write this off on their income tax.

“The drivers that I talked to find this more beneficial, and once they’re reimbursed, that option is taken off the table. The big unknown is how much this will cost companies.”

Tostenson added that even multinational businesses are unable to survive if they have to absorb exorbitant costs.

“Ultimately someone’s going to pay, it could be our restaurants being charged a higher percentage for their service, or it could flip, and the consumers could be charged more for delivery,” said Tostenson.

“When it comes to food

“I wish we’d all collectively—industry and service providers and government—done some financial modelling here.”

According to the BCRFA, consumer behaviour shifted dramatically during COVID. Pre-pandemic, overall sales from food delivery sat at 12 per cent, but have risen to upwards of 30 per cent today.

“It’s a much more important part of the market that we have to pay attention to,” he said. “We acknowledge the fact that drivers work hard, and we don’t want to lose them either. I don’t know if we’re doing it the right way here.”

BIV reached out to Uber, which responded with a news release from June.

“At Uber, we support government policies that protect the flexibility and independence of app-based work while offering tailored benefits and protections,” it stated.

“However, the B.C. government is driving up costs for residents and reducing demand for local restaurants and earning opportunities for workers. We encourage the government to reconsider the consequences for British Columbians who rely on rideshare and delivery.”

Uber has not provided exact figures regarding how much consumers will pay, stating they will review regulations closely.

The future of the province’s gig economy is difficult to predict, but experts suggest an increase in costs and a decrease in demand could be on the horizon. ■

5

NP affnity-group.ca

8 Beanworks Solutions Inc 311 Pender St

9

NP thoughtexchange.com

Smokey Bay Seafood Group

896 Cambie St Suite 309,VancouverV6B 2P6 P: 604-568-4310F: 604-688-8630 smokeybay.com

Localization Inc

BRYAN YU

HHomer St Suite 310,VancouverV6B 2X1 P: 855-438-5106F: NP globalme.net

Blackbird

trevali.com

in the Greater Vancouver area increased by 8.3 per cent in June following a decline of 6 5 per cent in May—boosting overall provincial performance. This was also the largest monthly gain since May 2023, but it’s too early to call a rebound.

offcer, SarahMcNair human resources director, RoryMcGuire, chief creative offcer

RicusGrimbeek, president and CEO, Russell Ball, executive vice-president and CFO

888-865-6402F: NP canadadrives.ca

ousing market activity in B.C. picked up pace in June, following months of low sales volume. Seasonally adjusted MLS home sales in B.C. came in at 6,166 units, increasing by 2.8 per cent month to month, following a 2 3-per-cent increase from April to May.

Merchant Growth2 1500 Georgia St W Suite 2000,VancouverV6G 2Z6 P: 778-870-8418F: 604-681-0916 merchantadvance.com

3131 Production Way,BurnabyV5A 3H1

Chilliwack recorded a third back-to back gain in sales, with an increase of 5.3 per cent in June. In Kamloops, sales also rose by nearly three per cent.

P: 800-956-4326F: 604-251-3173 peregrine.build

Vancouver Island sales were up by 3.9 per cent. Most other regions recorded declines.

19 Marwick Internet Marketing 38142 Cleveland Ave,SquamishV8B 0A7 P: 604-390-0065F: NP marwickmarketing.com

20 Traction on Demand 2700 Production Way Suite 500,BurnabyV5A 0C2 P: 604-620-6040F: NP tractionondemand.com

Sources: Interviews with above companies and BIV research. USD converted to CAD using Bank of Canada's average yearly rate depending on company's fscal year-end. Companies must have had $50,000 in sales in 2015 and $1 million in 2019 to qualify. Other companies may have ranked but did not respond to information requests by deadline. NP Not provided 1 - Converted from USD 2 - Formerly Merchant Advance Capital

Year over year, sales were down by 14.3 per cent in the province and still near recessionary lows. Despite this, home values in the province increased by 1.4 per cent in June.

Regional real estate board results were mixed. Home sales

data volatility. Home prices on Vancouver Island rose by 2.4 per cent in June, a consecutive monthly increase of equal magnitude. Kamloops home values were up by 6.8 per cent during the month. In Okanagan-Mainline and South Okanagan, home prices increased by 0 5 per cent and 1.6 per cent, respectively. In contrast, prices fell in Chilliwack (down 2 1 per cent) and the Kootenay (down 2.4 per cent) and dropped slightly in the Fraser Valley (down 0.2 per cent).

MaryDemers operations director, Crista-lea Kirk, director of strategy, CassandraDevlin director of business development, Theresa Thomson, chief operating offcer

The average home price in B.C. increased during the month to slightly over $1 million, the highest value since the most recent peak in May 2023 and 6 2 per cent shy of the all-time peak in February 2022. Greater Vancouver home values increased by 2.3 per cent to $1.3 million, reaching the highest value on record in the region. However, this could retrace given

, founder and CEO, MikeEpner president, ErrolOlsen CFO

New residential listings in B.C. increased by 4.2 per cent in June to make up for losses in the previous month. Market conditions remained balanced with a salesto-new-listings ratio of 45 8 per cent—down slightly from 46.5 per cent in May. Although market momentum remains weak, the first interest rate cut during the month incentivized more buyers to jump off the sidelines. We expect sales to speed up in

the fourth quarter, given underlying demand from population growth, although affordability constraints may weigh down market performance.

B.C. building permits plummeted in May following the record-breaking gain in the previous month. Building permit values in the province fell by 50 7 per cent to reach a seasonally adjusted $1.5 billion, after a 77.6-per-cent increase in values in April. Due to substantially reduced permits issued in both the non-residential and residential sectors, May’s significant decline contributed the most to the national dip in building permit issuances. That said, unadjusted for seasonality, year-to-date permits were up by 15.3 per cent compared to the same period in 2023. Monthly permit numbers tend to fluctuate widely, but the 12-month moving average has remained range-bound since

2022. Construction and borrowing costs are still elevated, disincentivizing activity in the sector. It will take multiple rate cuts to see a substantial boost in activity.

Residential building permits in B.C. more than halved during the month and were valued at $982 million. This decrease was due to far fewer multi-family permits being issued—down 59 3 per cent in May. Single-dwelling residential permits also declined for the second consecutive month, down by 12.3 per cent. Non-residential permit values decreased by 44.1 per cent, reaching $532 million as all subcategories saw lower permits during the month.

Permits in Vancouver dropped by nearly 67 per cent and were down year over year by 31 6 per cent. ■

Bryan Yu is chief economist at Central 1.

TheBCExpor tAwardsare theprovince’s most prestigiousawardspayingtribute to thesuccess andinnovativeapproachesofBCexpor tcompanies.

Ex tendingacrossindustries, theawardsrecognize achievements in 10 differentc ategories includingWomen -led Companyand Indigenous-led Company.

BY NELSON BENNETT NBENNETT@BIV.COM

Compared to the nearby $ 18 billion LNG Canada complex on which it will piggyback, the $5.5 billion Cedar LNG project in Kitimat is small.

But it’s a very big deal for the Haisla First Nation and, indeed, Indigenous communities generally, as it will be the first multibillion-dollar industrial project built in Canada in which the majority owner is a First Nation.

It may help blaze a path for another First Nations-backed liquefied natural gas (LNG) project—the Ksi Lisims LNG project near Prince Rupert—which is supported by the Nisga’a First Nation . In September, Haisla Chief Crystal Smith will travel to Japan as part of a trade mission organized by Energy for a Secure Future to talk about Cedar LNG and the increasingly important role First Nations are playing in the LNG, resources and energy sectors.

“Japan is very interested in Canadian LNG,” said Shannon Joseph , chair of Energy for a Secure Future. “They’re interested in it from an energy security standpoint, but they’re also interested in it from an environmental standpoint. Japan

CONTINUED FROM PAGE 3

This sort of non-disclosure has potentially negative implications for consumers, said Baines. For example, Mia is barred from conducting public audits in the U.S. and Canada, but he remains free to provide other accounting services to B.C. clients. Anybody checking the CPABC website for his regulatory record would have no indication that he has been in any regulatory trouble.

The anonymization of CPABC’s enforcement proceedings is a practice that is not in line with other B.C. professional regulatory bodies, and not in line with its new legislated public interest

is looking at us and looking at what we’re going to export and getting in on it.”

On June 25 , the Haisla and their industry partner Pembina Pipeline Corp. (TSX:PPL; NYSE: PBA), made a final investment decision (FID) on Cedar LNG, which will be a floating LNG terminal in Kitimat with a capital cost of $5 .5 billion.

At 50 1 per cent, the Haisla are Cedar LNG’s majority owner; Pembina Pipeline owns 49 9 per cent.

Smith said the Haisla are demonstrating that First Nations are capable of taking on major economic development endeavours, which necessarily means taking financial risks.

“For Indigenous communities—regardless of the sector—this project being the first of its kind is showing Indigenous communities how it can be done,” Smith told BIV.

Prime Minister Justin Trudeau has praised the Cedar LNG project as “the world’s first Indigenous majority-owned liquefied natural gas export project.”

One observer suggests the prime minister’s moral support for the Cedar LNG project may need to be translated into financial support as well. Richard McCandless , a former B.C. government civil servant who now

blogs about public policy issues, thinks the project may require government backing.

Forty per cent of the project will be financed through equity investments (20 per cent or $950 million each for Haisla and Pembina), and 60 per cent through debt financing.

The Haisla will borrow their share from the First Nations Finance Authority (FNFA), and the Federal Export Development Corp. will provide a $ 400 million to $ 500 million loan to Cedar LNG.

Based on population numbers, McCandless estimates that the Haisla’s equity share in the project amounts to $2.26 million per adult Haisla member. And he questions the FNFA’s ability to loan close to $1 billion to a single project.

“This would be, by far, the largest loan it has made to date, and would add a high degree of concentration risk to its loan portfolio,” McCandless told BIV. “Can they take on a $950 million loan to the Haisla?”

He suggested senior governments may need to backstop the project, and one source of funding may be the federal government’s new $5 billion Indigenous loan guarantee program.

“If the size of the loan from the FNFA proves too onerous,

one can expect that one or both levels of government will step in and provide some form of financial support,” McCandless said. “I just figure there is going to be more government money going into this thing than we were led to believe initially.”

Heather Exner-Pirot , director of natural resources, energy and environment for the Macdonald-Laurier Institute , expects the project is on sound footing.

“The fact they went ahead with FID means to me they have sufficient and serious interest from buyers,” she told BIV. “Japan and South Korea are both looking for additional and diversified sources, and Canada would be on top of their list.

“LNG demand from southeast Asia is going to provide substantial growth and market for Cedar for the long term. I don’t expect they will have trouble finding buyers willing to enter into long-term contracts that would backstop the ability to enter into favourable financing agreements.”

Cedar LNG is something of an offshoot of the LNG Canada project. When the Haisla were negotiating with LNG Canada for their support and for a benefits agreement, the Haisla were shrewd in securing an offtake agreement that gave the Haisla

400 million cubic feet per day of natural gas from the Coastal GasLink pipeline.

This eliminated a major cost barrier for any coastal LNG project in B.C.—the multibillion-dollar expense of building a pipeline to get gas from northeastern B.C. to the coast.

Unlike LNG Canada, which is being built in Kitimat on a 400-hectare footprint the size of 550 soccer fields, Cedar LNG will be a floating LNG terminal, and will take up little land. It will be built by Samsung Heavy Industries and Black and Veatch in Korea, and then towed to Kitimat.

The plant will produce three million tonnes of LNG per year, or about one-fifth the initial annual export capacity of LNG Canada’s two-train plant: 14 million metric tonnes per annum.

The project is expected to generate $ 257 million in GDP spending over a four-year construction phase, and annual GDP contributions of $ 85 million in the operational phase. It will generate 500 jobs during construction and 100 ongoing during operation. ■

objective, according to Baines. Self-regulatory organizations, such as the Mutual Fund Dealers Association of Canada and the Investment Industry Regulatory Organization of Canada (which have since merged to form the Canadian Investment Regulatory Organization), routinely disclose the identifies of respondents. So does the Insurance Council of BC and the Law Society of BC (except in exceptional circumstances). The same is true for various government regulators, including the BC Securities Commission . Spokesperson Kerri Brkich wrote to Glacier Media that

“CPABC’s primary mandate is to protect the public.”

Brkich stated that most enforcement actions from its investigation committee are resolved via an agreed settlement wherein the committee “considers if named publication is in the public interest.”

The CPABC states that these rules are dictated by the act. And, according to Brkich, “decisions against named publication must be supported by a majority of the public representatives on the investigation committee.”

Glacier Media asked to speak to the CPABC public

representatives but was told it could not due to “privacy reasons.”

The CPABC also contends it can’t speak to any specific case, even those that have concluded, again for privacy reasons.

“CPABC is required to comply with the confidentiality provisions in Section 69 of the CPA Act, so we are unable to comment on any specific matters related to individual members or firms above what is in the public domain,” stated Brkich.

Baines characterized this response as “nonsense.”

“CPABC decides what should be put in the public domain,

not the legislation, and m ost CPABC enforcement actions are characterized by a dearth of information, anonymization of respondents, and ultra-light sanctions. The dominant impression I get is that that CPABC’s enforcement policies and practices are keyed to protecting members, not consumers. The idea that Victoria exercises any real oversight is an illusion, and a delusion.”

Read a follow-up report on biv.com on July 23 about how anonymizing disciplinary actions against B.C. accountants and firms raises accountability and consumer protection concerns. ■

1

Bank of

1055 Georgia St W,VancouverV6E 3S5 P: 800-769-2511F: NP rbc.com

650 Georgia St W Suite 3400,VancouverV6B 4N7 P: 778-668-2995F: NP scotiabank.com

604-687-7526F: NP assantevancouver.com

595 Burrard St,VancouverV7X 1L7

P: 877-225-5266F: 604-665-2610 bmo.com

6

604-643-7300F: NP canaccordgenuity.com

604-623-6777F: 604-682-1026 nbfwm.ca

604-654-7270F:

Broadway W,VancouverV6J 1Y3

604-732-6551F: 604-732-6553 rgfwealth.com

ROB SHAW

After four trips to Ottawa, four meetings in B.C. and eight increasingly fruitless phone calls spread out over 19 months in office, Premier David Eby has made up his mind about Prime Minister Justin Trudeau: The guy is neither a friend, nor an ally, when it comes to the BC NDP government.

That was the takeaway from comments Eby made during July’s meeting of premiers in Nova Scotia, in which he outlined in remarkably candid fashion the slow-motion cratering of the relationship between himself and the prime minister. Eby publicly likened his relationship with Ottawa to

“beating our head against a wall.”

“We have built relationships. We have done the work. There is no question the federal government understands our frustrations or concerns, our anxieties—direct communications with the prime minister, with ministers, correspondence. It has not mattered.”

The result has been to watch Ontario and Quebec get special funding agreements with Ottawa on priority B.C. files, to have letters and phone calls go unanswered by Trudeau, to get cut out of the loop on major announcements and to languish while waiting for funding commitments on large projects like the Massey Tunnel replacement.

As if to illustrate the point, on the same day the premiers were meeting, Trudeau announced details of a $30 billion, 10-year public transit funding program that could dramatically affect the financial situation of TransLink and BC Transit.

“We’ve been calling for that for a long time from the federal government,” said Eby, who was blindsided by the move.

“Nobody knows what the content of the announcement is. Nobody knows how the fund will be structured. Nobody knows whether it’s about capital or operating expenses. These are all things we should have been talking about in advance, so that we could help them use those tax dollars that all Canadians pay for in the most effective way possible.”

The stiff-arm to the face from Ottawa is occurring not just in public, but privately too.

Eby publicly complained in June he couldn’t get answers from Ottawa as to why several flood-ravaged Fraser Valley communities were rejected for federal disaster prevention funding. The prime minister wouldn’t take his call, he said. So he went public. A few days later, Trudeau did call back and asked Eby to put in writing his concerns. Eby sent a letter with

six specific requests on June 20. A month later, he said he’s yet to receive any response from the prime minister or any federal ministers.

“It is really weird,” Eby said in an interview July 17. “It’s astonishing. And especially on things like the Massey Tunnel.”

It’s one of the reasons Eby said he’s not only chosen to back Newfoundland’s legal challenge on the fairness of federal equalization payments to provinces, but he’s also researching whether B.C. should launch its own lawsuit.

John Horgan also tried to make friends with the federal Liberals in order to advance B.C.’s interests. Horgan ran flak for Trudeau for months in advance of a federal election, loaning him credibility by allowing alignment on popular BC NDP items like the Metro Vancouver SkyTrain expansion and $10-a-day childcare.

Horgan’s reward was to be hurled under the bus by the prime minister’s office during

a premiers’ meeting on health care, and later to have news of his retirement leaked out to the Ottawa press corps before British Columbians even knew the premier was leaving.

For taking the hits with minimal public complaints, Trudeau eventually appointed Horgan as Canada’s ambassador to Germany.

Eby, though, wants no such patronage post. He’s in the fight of his political life ahead of October’s provincial election, and trying to show progress on key files—many of which require federal approval, funding and support.

“I’m excited to work with you,” Eby said upon meeting Trudeau for the first time in Richmond in December 2022. That excitement is long since over. Only frustration and bitterness remain. ■

Rob Shaw has spent more than 15 years covering B.C. politics, now reporting for CHEK News and writing for Glacier Media.

These corporate claims were filed with the B.C. Supreme Court registry in Vancouver. Information is derived from notices of civil claim. Civil claims have not been tested or proven in court.

DEFENDANT

Larry Yau

PLAINTIFF

Spanish Mountain Gold Ltd.

CLAIM

Declarations that former CEO and CFO Yau breached fiduciary duties, committed the tort of civil fraud and had been unjustly enriched. In addition, the recission of a severance agreement and a declaration that Yau must repay all compensation received under a severance agreement. The plaintiff also seeks a tracing order related to unapproved housing benefits and some other court orders. This relates to revelations found in the corporate books after Yau was terminated that allegedly showed he breached various duties to the

plaintiff and committed fraud.

DEFENDANTS

Ackeeu Lee and Michael Parker and Sprezzatura Restaurants (Kingsway) Ltd.

PLAINTIFF

Evco Building Group Ltd.

CLAIM

$623,366.96 for unpaid bills related to Eyco providing work and materials for construction on a property at 265 Kingsway in Vancouver.

DEFENDANTS

Eiffage Innovative Canada Inc. and Aviva Insurance Co. of Canada

Aviva and Compagnie D’Assurance Du Canada and Trisura Guarantee Insurance Co.

PLAINTIFF

Peter’s Bros. Construction Ltd.

CLAIM

$555.652.69 for debt and damages for breach of contract related to work performed by the plaintiff that the defendants did not pay for.

DEFENDANTS

Honeybee Development Group Ltd. and 1272406 B.C. Ltd. and 1350008 B.C. Ltd. and 1352540 B.C. Ltd. and

Creekshore Developments Inc.

PLAINTIFF

The AMSA Holdings Inc.

CLAIM

$350,000 plus 16 per cent annual interest from Nov. 9, 2023, and declarations related to a property. This relates to a loan that was not repaid.

DEFENDANT

Sen Lin aka Jimmy Lin

PLAINTIFF

Telus Health Solutions Inc.

CLAIM

Damages for breach of contract related to misappropriated funds and misappropriated gift cards, estimated to be worth at least $192,275.

DEFENDANT

BC Hydro

PLAINTIFFS

0955659 BC Ltd. and Shahram Younesi

CLAIM

$300,000 in damages for 21 months remaining in a two-year fixed-term contract between the parties, plus $100,000 in aggravated and moral damages, as well as punitive dam-

ages and “bad faith” damages. This involves an employment dispute in which the plaintiff alleges there was a two-year contract that was terminated three months in.

DEFENDANTS

Seca Marine Inc. and Olympic Motors Corp. and Canadian Bailiff Services Ltd.

PLAINTIFF

PDC Business and Tax Inc.

CLAIM

A declaration that PDC is the lawful owner of a boat free and clear of claims by Seca Marine and Olympic Motors, plus other orders.

DEFENDANTS

Perkins+Will Canada Architects Co. and Jensen Hughes Consulting Canada Ltd. and Introba Canada LLP

PLAINTIFF

Kabam Games Inc.

CLAIM

Damages against P+W for breach of an agreement plus damages against P+W, Jensen Hughes and Introba. This relates to Kabam contracting the defendants for improvements, including to a fire safety system.

Following work, that system does not comply with the building code.

DEFENDANTS

GMB Consulting Inc. and Hyung Kim aka Damien Kim

PLAINTIFF

Geri Partnership dba Golden Eagle Farms

CLAIM

US$61,075 for an outstanding amount owed under an agreement that the plaintiff sell to the defendant and store frozen blueberries.

DEFENDANT

Raider Contracting Ltd.

PLAINTIFF

Crevaux Holdings Ltd.

CLAIM

$204,382.07 for four months’ worth of lost rent and an overpayment, plus damages for breach of contract and negligence.

K biv.com TO VIEW PAST LAWSUITS, GO TO BIV.COM/DIGITAL AND REVIEW PREVIOUS EDITIONS OF BIV ’S PAPER

Businessin Vancouver isseeking B.C.’s outstanding entrepreneurs, executives,managersand professionalsinpublic,private andnon-proft sec tors forits 2024 Fortyunder40 awards. We look foracross-sectionofimpressive peoplefrom awide rangeofindustries we coverwhohave risen the ranksoftheir companiesorindustries at a relatively youngage.

Winnerswillbechosenbasedonsuch values asachievementsinbusiness, experienceand innovation,vision,leadership,and community involvement. Winnerswillbeprofledina DecemberissueofBusinessin Vancouverand honoured at agala awards reception.

Ken Sim

Peter Armstrong

Don Mattrick

Rick Hansen

Susan Mendelson

Yves Potvin

Bev Briscoe

Frank Giustra

Bob Rennie

Terry Hui

Dorothy Grant

Chip Wilson

Paul Lee

Brian Scudamore

Wendy Lisogar- Cocchia

Darren Entwistle

Thomas Gaglardi

Cybele Negris