NJ CORRENTI, FOUNDER AND CEO, NICHOLAS AIR

» Complete Interiors Engineering and Program Management

• VVIP Completions

• Regional Conversions

• Business Jet Reconfigurations

• Special Mission Interiors

• Freighter Conversions

» Integrated Monuments and Systems

• Galleys

• Lavatories

• Cabinets

• Sideledges

• Liners

• Partitions

• Showers

• Water and Waste

• Oxygen and ECS

» Primary Structural Modifications

• Floorbeams and Seat Tracks

• Frames and Stringers

• Fuselage Skin Penetrations

» Electrical and Avionics Systems

» Connectivity (Starlink, GoGo, OneWeb)

DAVID VANDERZWAAG CEO

Phone: +1 204 228-4331

Email: david.vanderzwaag@airhawke.com

President

We go into 2025 with the uncertainties of the US Presidential election resolved and at least a reasonable chance that President Trump might be able to facilitate an early end to the war at the heart of Europe.

Should that happen operators in Europe will breathe a sigh of relief. No pilot likes to have their navigation systems interfered with by warring parties jamming GPS. Peace will be a huge boost to business aviation in Europe, should it happen.

Nevertheless, businesses across the sector are indeed pushing ahead and seizing sensible opportunities to grow. Being positive and making positive decisions tends to lead to good outcomes.

We at BAM will be pushing ahead with enthusiasm. This year in September we will be hosting BAM’s inaugural Business Maintenance Conference at the Heathrow Hilton, Terminal Five.

We’re still inviting speakers for the event, so for more news and to participate or sponsor, please contact either Max (max@bizavltd.com) or Roger (roger@bizavltd.com). We will also be hosting our usual Networking events at the main business aviation shows, so again, please get in touch for sponsorship opportunities.

We’d like to take this opportunity, as usual, to wish all our readers and supporters a very happy and prosperous 2025.

HARRINGTON

all enquiries, please contact Max Raja at max@bizavltd.com or on +44 (0)203 865 3736

Nicholas Correnti, the founder and CEO of NICHOLAS AIR, on the challenges of being one of the sector’s leading privately owned operators

for

Chris Moore, formerly President of SD and the new CEO of Gogo and Satcom Direct, on the merger

The importance of

Alice Horváth-Muška, Chairman of Atmospherica Aviation, on what it takes to amass 6000 charter hours as an operator

Telling it like it is

Jim Balzer, Chief Operating Officer, and Chris Hicks, Director of Sales and Marketing at AMP, on the company’s successes in

Richard Prechtel, founder of the activelaw Aviation Desk and partner of the law firm, on building Germany’s largest aviation law firm

Lauren Stout, recently appointed National Sales Manager at High Tech Finishing, on her ambitions for the company and her new role

David McCown, President of the Americas at Chapman Freeborn, on growing the company’s charter operations

Shafiul Syed, CEO of Royal Jet, on building a global Brand

60 Stacking Up

Greg Jarrett, co-founder and CEO on the latest developments in STACK. aero’s BOS business operating system

66 Relationships are key

David Winstanley, CEO, London Biggin Hill Airport, on building a successful relationship between regional airports and their communities

72 NBAA 2024

Photo gallery from the Hard Rock Cafe Las Vegas

78 Redefining Private Charter

Dafne Isasi, Founder and CEO of ZURAjet, on revolutionising private jet charters

Skylink Services Ltd is part of the Skylink Group of Companies. The company is well-established and provides ground handling services for General Aviation Aircraft in Cyprus. We began operations in 1992, filling the gap in the Executive Aircraft ground handling market, at both international airports of Cyprus, Larnaca and Pafos.

P.O.Box 43012, CY 6650 Larnaca - Cyprus

T: +(357) 24 84 09 00 • F: +(357) 24 66 58 05

E: flightops@skylink.com.cy

T: +(357) 24 64 33 34

F: +(357) 24 64 35 99

Nicholas Correnti, the founder of NICHOLAS AIR, talks to Anthony Harrington about the challenges of being one of the sector’s leading privately owned operators

Founded in 1997 by Nicholas Correnti, NICHOLAS AIR has redefined private aviation by delivering an unparalleled experience rooted in unmatched service and southern charm. From the very beginning, the company has held a steadfast commitment to being both the Owner and Operator of the youngest fleet in the industry, a principle deeply embedded in its DNA. No other brand matches the level of investment NICHOLAS AIR makes in hospitality—a difference that Members consistently notice and appreciate with every experience. By continually pushing the envelope to offer a product unlike anything else in the industry, NICHOLAS AIR sets a new standard in private aviation, fostering lasting relationships and ensuring every journey is as exceptional as the destination.

“ Over the last 27 years we have taken a responsible path to our growth. The goal is to be an oak tree. While slow to grow it has deep roots and can weather the storms.”

“ “We have never taken private equity and remain 100% privately owned and operated.”

AH: You have always taken a methodical approach to business, plotting the path ahead based on averages rather than peaks, which is where many operators go wrong. What is your take now as we start looking to 2025?

NJ: Many companies placed mass aircraft orders exp ecting this “post covid” demand to be the new norm. The tide always goes out and I believe these companies will be left with a significant amount of excess capacity, forcing them to discount their programs. This causes an adverse effect on the entire industry as many operators shift their focus away from quality to quantity by luring in business with low rates

that is not sustainable. You cannot expect to get the lowest price while expecting the highest safety and quality.

We have and will always use a methodical approach to our growth and will not let the high tide fool us as we know how gravity works.

AH: The private jet industry has always seen its fair share of volatility. What is it about NICHOLAS AIR that has allowed its steady growth year after year?

NJ: Over the last 27 years we have taken a responsible

path to our growth. The goal is to be an oak tree. While slow to grow it has deep roots and can weather the storms. Many companies grow too fast, borrow huge sums of money, hoping the customer comes. Unfortunately, when a storm comes, they’re wiped away. We have never taken private equity and remain 100% privately owned and operated. We know aviation and that’s what we focus on. We’re not focused on making sure the numbers look good for a shareholder or PE firm, which normally means sacrificing quality to chase the bottom line.

AH: The question of how much capacity a private operator needs, and judging when the time is right to buy another jet is a tough one. What is your take?

NJ: Again, it’s a very methodical approach using all the data we have collected from the last 27 years. We pretty much have it fine-tuned, and we know exactly when we need to add capacity.

AH: How have things been for the company over the course of the last year? What have the major challenges been, and what would you count as your biggest ‘wins’ this year?

NJ: The biggest challenge remains parts shortages, esp ecially interior/cosmetic components. It has been very frustrating to see aircraft manufacturers produce and sell aircraft knowing they cannot service them. ATC and FBO staffing shortages have also been a challenge as they can lead to delays.

The biggest win has been our ability to successfully navigate the challenges and protect our members from any impact. I believe this is why we continue to see a 98% + retention rate of our membership base. We listen to our members. The service is for them, and they drive our business.

AH: Looking around at the big and medium players in business aviation, do you feel that overall people are managing their businesses better now? In other words, is a bad crash less likely to happen?

NJ: I do not. I believe there are multiple at risk. As I said e arlier, when you borrow large sums of cash, place large aircraft orders and try to grow too fast, the focus shifts to quantity and not quality for shareholder purposes. This is the high-end luxury service business, and if you’re not focused on the quality of your service, what’s the point.

AH: Tell us about the business. I have heard that you purposefully cap the membership. Why is that?

NJ: Yes, the goal is to remain around 1,000 national members. This ensures we “know our members” and they’re not just another number. We know their families, business, pets and acquaintances. This business is personal. We have a lot of demand for our jet card program so we take a very selective approach to who can join. We’re not here to just take your money. We want to know who you are and ensure that we’re not only a good fit for you, but that you’re a good fit for us.

“ “Anyone that jeopardizes safety shouldn’t be in the business--period. It should be a given that safety is first and foremost.”

AH: You have one of the youngest, if not the youngest, air fleet in the industry. What else differentiates you from the competition?

NJ: The goal has always been to have a young and fresh f leet. We obviously have many members that come from other operators and the most common compliment we receive is that our planes and our pilots are par to none. Our planes are the storefront, and our pilots are the customer service agents, and we do not spare any expense in these areas.

AH: With safety being one of the biggest concerns in aviation, what steps does NICHOLAS AIR do differently to ensure your members feel at peace when flying with you?

NJ: Safety is always a concern to the consumer. However, I do not believe it should be promoted with flashy 3rd party safety ratings that anyone can get by writing a check. Anyone that jeopardizes safety shouldn’t be in the business--period. It should be a given that safety is first and foremost and our history proves our commitment to safety. |BAM

“ “The goal has always been to have a young and fresh fleet.”

“ “We obviously have many members that come from other operators and the most common compliment we receive is that our planes and our pilots are par to none.”

Iceland is a pivotal hub for transatlantic travel at the crossroads of Europe and North America, making Iceland Jet Center the go-to partner for fuel stops, diversions,

At , Iceland Jet Center’s

an oasis of luxury and comfort at its primary hub. With operations spanning all major airports across the country, Iceland Jet Center ensures seamless, handling services around the clock, 365 days a year. Iceland’s enhances the expertise and readiness of Iceland Jet Center’s team. Known for its , particularly during the winter months, Iceland’s conditions demand adaptability—a quality the country excels in. The nation’s resilience in the face of unpredictable weather and natural events, such as , speaks to its preparedness and

Operating in this dynamic environment, Iceland Jet Center provides reliable services regardless of the circumstances.

Chris Moore, formerly President of SD and the new CEO of Gogo and Satcom Direct, talks to Anthony Harrington about the merger of the two companies

AH: Chris, can you take us through the events leading up to the acquisition of SD by Gogo?

CM: Somewhere around the start of 2024 we started t alking about it being time to sell SD. It had been on the owner’s mind for a while, and it was approaching the right time for him to sell. So, we engaged the bankers, JP Morgan, to act for us and we went into a formal sales process in May and June.

We did some pitches to potential buyers. One of the first of these was with Gogo. They were very interested and saw a lot of synergies between our two businesses, and some areas, such as our military and government arm, where they could gain synergies and scale dramatically.

Our two companies have worked together and have talked a lot over the years. Until Gogo Galileo came along, the two businesses were not really, directly in competition with each other. We do activations on SWIFT and Iridium with Gogo and interoperate with them. With Gogo’s broad reach into the smaller to mid-size jets with their extremely successful ATG and AVANCE products, and our expertise across large and long-range aircraft and international footprint, the synergy was huge.

“ “ We did some pitches to potential buyers. One of the first of these was with Gogo.”

As is well reported across the sector, Gogo completed the acquisition of Satcom Direct in early December for $375 million in cash and five million shares of Gogo stock. Additionally, there is a potential for an extra $225 million tied to performance thresholds over the next four years. That was satisfactory to both parties, so Gogo and Satcom Direct now offer a multi-orbit, multiband portfolio including narrow-band, L-band, Ka- and Kubands, ATG and next year, 5G. SD’s Plane Simple antenna series will be added to the Gogo hardware portfolio. So, the company will have an excellent multi-orbit story for our customers.

Although we reached agreement between the two companies back in June and signed the deal in September, it only closed on 4th December because it had to go through the Department of Justice and all the regulatory authorities.

What they saw was that the coming together of Gogo and SD did not materially reduce competition in the market. At the same time, it made the combined entity stronger as it competes against new market entrants.

AH: I heard from some market players that Gogo was going to end its ATG service. Is that correct?

CM: Absolutely not. ATG is a great and cost-effective option

GOGO AVANCE L5 AND DDA ANTENNAS

GOGO SCS AND FDX

GOGO SCS AND HDX

for operators who fly predominantly in North America. With the small form factor Gogo Galileo HDX, the best-in-class fullduplex, FDX, LEO satellite systems on the horizon and the Plane Simple series, which already has great traction with OEMs like Gulfstream, Dassault and Bombardier, we have a full portfolio of offerings for every aircraft size and mission. We see GEO and ATG staying primary for some customers, with our LEO and GEO, or LEO and ATG offerings working in tandem.

It means customers will be more multi-orbit capable than ever, and we will offer intelligent routing. Some customers who are large connectivity users during flights will use GEO for, say, watching Netflix, while a different area of the jet may be using LEO for a Teams meeting.

On top of that, SD adds software for flight tracking and engine data management. The antenna for our 5G rollout is already available and installed on a number of aircraft in preparation for service launch. Gogo 5G ATG will be multi-megabit capable, and we are excited to offer this leap in ATG performance to our customers flying within the continental USA.

AH: How are you planning to manage the fact that each of the two organizations has its own router offering?

CM: Both the SDR and AVANCE routers already have commonality in functionality, both are multi-bearer capable for example today. It is extremely important to us that all of our existing customers are able to reap the benefits of our combined portfolio as soon as possible. One of our first priorities is

determining a path to a common feature set so that no matter which router is installed in your aircraft you can take advantage of, for example, the ease of install of the Gogo Galileo antennas.

AH: So, for those customers who want it, you will be able to provide a lot of redundancy as far as inflight connectivity is concerned?

CM: Absolutely. As you know, SD has a very strong government and military arm. Everything there is cyber security protected and completely synced with alternative/ redundant services. In military circles, this is called PACE, or Primary Alternate Contingency and Emergency.

Within a few months, business jets will have a similar capability. This is how aviation has long worked anyway, with redundant systems capabilities. LEO and GEO services enable us to bring the best capabilities from the best systems at the right time. This is what we see our product offering to customers is and it is a very strong story.

AH: You have two different pricing and sales structures to deal with. What is that looking like now?

CM: Fortunately, SD and Gogo pricing were very much on par. We are moving towards the position where we will be able to present customers with a single Gogo bill. The pricing is still being sorted out, but it will be price-competitive with the type of aircraft we are dealing with. The new product portfolio will enable us to address everything from a turboprop to a 787. It’s a great story for the smaller jets which will now be

able to get a lot more capability, bringing them more in line with the experience offered on large business jets.

AH: How interested is Gogo in SD’s government and military side of the business?

CM: They are, of course, very keen and that was a good part of the attraction forthem. SD’s military and government subsidiary is a $100 million plus business in its own right. It is also a rapidly growing segment. SD is spreading far beyond the US government. It recently had big wins with the Swiss and the Canadians, plus a number of NATO countries are interested. Haydon Olsen runs the military side. He has been with SD for three years now and has done very well. SD sold its teleports operation and is now solely focused on military aviation. That has played very well for the company.

At the same time, SD’s cyber security business is going from strength to strength. When we launched the business in 2017, everyone said we were nuts, but now everyone is aware that you are just as much at risk from a cyber security attack in a jet at 40,000 feet as you would be in your office. There is the same need for strong protection. So, that is a strong asset for the combined business.

Gogo was also very interested in SD’s extensive international footprint. They have been recruiting for their international business lately, but SD is already in 13 countries. Gogo Galileo will be attractive to the international markets.

AH: It is very early days in your new role, Chris, with you taking over as CEO of Gogo from Sergio on his retirement. How’s it going?

CM: My approach is the same now as it was as President of SD. I look on myself as a consultant to the rest of the business. I work closely with them all. My view has always been that if you help everyone out as needed and let them get on with it when things are going well, the business will be successful. We’re now some 10 days in. I will be moving to Colorado, Gogo’s HQ, shortly and colleagues are being super friendly and helpful.

Fortunately, our two cultures align well together. Gogo is very focused on customer support, as is SD, so that works well. It is all very collaborative. Another thing that is really helping us is that the customers, on both sides, have been very supportive and welcoming. So, the future looks very bright and I am really looking forward to 2025. |BAM

“ Fortunately, our two cultures align well together. Gogo is very focused on customer support, as is SD, so that works well. It is all very collaborative.”

Alice Horváth-Muška, Chairman of Atmospherica Aviation, on what it takes to amass 6000 charter hours as an operator

Q: Alice, I believe Atmospherica’s entry into the charter market was somewhat unusual. Can you take us through it?

AHM: Sure. Atmospherica did not start as a private jet operator. It was built half on the owner’s hobby of being a pilot and half on the fact that, as part of the CTR Group (C=Cement, T=Transport, R=Real Estate), we have operations in the Czech Republic, Slovak Republic, Hungary and Germany and our managers needed to fly quite a bit. So, until 2010, that was what Atmospherica mainly did.

“ The company’s former activities are now just a very small part of what Atmospherica does today. We now have four Phenom 300E aircraft, and a brand-new Praetor 600.”

However, it was clear that we were not using the aircraft anything near 100 percent of the time, so we started to charter the aircraft also commercially. As this developed, the appetite to do more chartering grew.

At that time, we had two Diamond Twin Star aircraft, a Piper Meridian and then we acquired a Citation Mustang, which we still have. That aircraft is solely for internal company and the owner’s use today.

The company’s former activities are now just a very small part of what Atmospherica does today. We now have four Phenom 300E aircraft, and a brand-new Praetor 600. Before this, we also had two Hawker 900 XP aircraft that we sold due to their age and unavailability of spare parts and we also operated a Challenger 300 for 7 years for another owner.

Today we are the owner of our whole modern fleet with an average age of just 2.5 years!

We have two more Phenom 300E aircraft on order that are due for delivery in September 2025. We are also looking for another Praetor 600 to have at least two to complement each other.

So, being a charter operator became one of the major pillars of CTR’s business, representing the “T” in “CTR”, standing for Transport. We have grown really rapidly in recent years. The biggest change was when we completed the fleet of four Phenoms 300E to unify the fleet and sold our two Hawkers in 2022 to operate just modern and new aircraft

Q: So, how are things now? Are you going to continue to grow rapidly?

AHM: Right now, we have a real regulatory issue with adding another aircraft beyond those we already have. Let me explain. The Regulatory Authorities are concerned about aircraft emissions. They exempt small fleets below 10,000 tonnes from paying the emissions levy, but as soon as you cross that boundary, all of a sudden, we would be hit with something of the order of a 700,000 Euro

Praetor Interior

“ We are currently doing some 2,000 charter flights a year, flying to some 200 different airports.”

emissions levy, depending on the current price for emission allowances.

This means that adding another aircraft to our fleet would take us over the 10,000ton threshold and we would have to pay emissions for the whole fleet. There is no way we could simply apportion that charge to our charter customers because that would make us uncompetitive with respect to competitors with small fleets who are not facing the emissions charge.

It is a very unfortunate way of doing things. A far better approach would have been not to create this 10,000-ton threshold, but instead, to charge all aircraft operators for their emissions, regardless of the fleet size and produced emissions. That would have been fair and everyone would pass the charge on to the charter customers, just as they pass on fuel and operating costs. It is a

real barrier to growth for smaller charter operators as you need quite a lot of aircraft to bare these additional costs.

I must emphasise that I am absolutely in favour of governments taking measures to try to mitigate the impact of climate change, but this measure could have been better designed. We must hope that the Regulators come to see this.

Q: How strong is demand now?

AHM: I would say that after peaking in 2022 after COVID, prices have come back down to a normal level and the market is stable. Inflation too, has stabilised and we can now make very precise plans for next year.

We are currently doing some 2,000 charter flights a year, flying to around 200 different airports. What allows us to keep our fleet utilisation high is that, unlike many companies that are managing aircraft for owners, we have no owners setting limits and making rules about pricing. We want the maximum utilisation we can get for our aircraft so we price according to demand. We can drop the pricing in winter when demand is lower and raise it in summer when demand is higher.

Q: What are your channels to market, and how do you generate sales?

AHM: We have chosen to mainly work with the broker

“ What allows us to keep our fleet utilisation high is that, unlike many companies that are managing aircraft for owners, we have no owners setting limits and making rules about pricing.”

community, we just have very few direct clients. If we would hunt for direct clients we would get into competition with the brokers and that could damage our relationships. As we maintain great relationships with them and our cooperation works well, we would never want to risk this.

We visit our main brokers regularly to exchange feedback and news. For their part, they know that we will never leave their clients stranded on the tarmac. If we have an AoG situation we will charter another aircraft elsewhere, if we do not have an aircraft available within our own fleet to recover the AoG. They know that we will uphold their reputation with their clients and that retaining that trust is vital to our success. Also, an absolutely transparent and fast communication as well as constantly performing a perfect service and having pleasant

“ We are waiting now for Gogo to release Gogo Galileo in 2025, at which point we will be installing it in our Praetor 600. We will have a single fee for it therefore our clients will not be usage dependent.”

crews, are part of maintaining these strong relationships. We are doing our best to be a most reliable partner.

Q: Is high-speed wi-fi in the cabin important to you?

AHM: It is very important, at super-midsize jets it is a “must have”. We are waiting now for Gogo to release Gogo Galileo in 2025, at which point we will be installing it in our Praetor 600. We will have a single fee for it therefore our clients will not be usage dependent. So there will be no risk of a client getting a huge bill because his children have logged onto Netflix or some online game during the flight.

We are also going with Gogo Galileo because of the high speed of 60 Mbps and the great coverage.

I would add that going with a single fee is very much part of our philosophy to ensure that clients, and indeed, the broker community, are not hit with high surprise charges. For example, we also do not charge anything for de-icing the aircraft

I was at a recent operator conference where the host asked the delegates who charges de-icing already on the positioning leg. I was astonished when some 70% of the audience raised their hands!

Since we are focused on brokers, the Avinode platform is very important for us. There are many new platforms out

PREMIUM AVIATION LEATHER FOR YOUR WORLD CLASS CLIENTS

there upcoming and we join every one that makes sense from our perspective, but Avinode is still key.

I am very proud of the fact that Avinode’s system accords us a price accuracy of 100%, which means that there is virtually no difference between the price the broker sees on Avinode and the price that we quote. This is key for authenticity and trust as we are not fishing with low prices and then, at a later point, quoting higher. It is also proof of our skill in setting very accurate pricing profiles for our aircraft at Avinode.

Another important fact is that Avinode shows that our average reaction time, night and day, to respond to charter requests is only six minutes. Obviously, a request at night will take slightly longer than a daytime request, which will probably be answered in a minute or two. But a six-minute average is very commendable.

Q: How important is catering for your company?

AHM: Catering is huge. In this day and age, flying safely from A to B is just normal and is obviously expected. What differentiates you as an operator is the quality of the experience in the cabin, and catering plays a big role here. We

have a very detailed catering menu and we work very closely with our caterers. We give them a very precise description of what we expect a dish to look like and the ingredients that should be used. We send them our instructions with photos and we monitor the standard of food they supply very closely.

We know from cross comparisons from when we have to charter other operators’ aircraft, that our catering budget is one of the highest in the industry. It is a huge differentiator for us and really helps to ensure client satisfaction. If you are paying virtually the price of a new car for a flight, you have the right to expect a great deal, and we try to ensure that we deliver to the client’s complete satisfaction.

Q: So, how confident are you, looking ahead to 2025?

AHM: Very confident. Demand is stable and we are moving forward in enlarging our fleet further. On the 21st of November, we just won the “2024 Air Charter Excellence Award” in the category “Executive Passenger Charter Operator of the Year (18 seats or less) – this is a great honour and commitment as well. We have to continue to deliver a great service to prove every day that we deserved this price and honour, as it is the embodiment of our hard work. |BAM

AvfuelZero provides a bold leap forward in sustainability, redefining the aviation landscape with its simplified, five-step approach. Our in-house experts are on hand to guide your sustainability journey, seamlessly integrating new aviation technologies into your operation to help you reach net zero.

Jim Balzer Chris Hicks

Jim Balzer, Chief Operating Officer, and Chris Hicks, Director of Sales and Marketing at AMP, talk to Anthony Harrington about the company’s successes in 2024

AH: Jim, can you tell the readers a bit about your area of responsibility in AMP?

JB: I run the operations side of the business. As you know, we specialise in aircraft maintenance, and that is a field I seem to have been in forever.

CH: Just to add something here, Jim is very well known and liked across the industry, and has a reputation for telling things like they are, with no BS or nonsense.

JB: That’s exactly the principle our company was founded on. We understand that nobody really wants to bring their aircraft into an MRO facility—they’re there because they have to be. That’s why we strive to make the experience as seamless as possible. We break down all the available options, guide them through the decision-making process, and do everything we can to ensure the best possible outcome for our clients.

CH: Before Jim became partners with Brian Allen to run AMP, along with Dennis Moore, who has been our CEO since 2019, he ran the maintenance for a Part 135 operator. In that position, maintenance is not where you are looking to make money, it is where you are trying to save money. So Jim has seen the maintenance business from both the operator’s and the MRO’s perspectives.

JB: That’s true, and it helps me understand our clients’ challenges. At the end of the day, maintenance is about trust and delivering value without compromising safety.

AH: How much of a challenge is it for you that business jet parts are so much more expensive than commercial airliner parts? I imagine that is something that annoys customers continuously.

JB: Once again, it is what it is. You can’t blame the OEMs that much. There is a huge difference in the cost structure

“ Jim is very well known and liked across the industry, and has a reputation for telling things like they are, with no BS or nonsense.”

Chris Hicks

when you are building 10,000 airliners versus 300 business jets. The OEMs just do not have the economies of scale to drive the cost of parts down to the levels that you see in commercial aviation.

As Chris said, I’ve been in their shoes: a Part 145 manager and a DOM for a Part 135 operator, where saving money is paramount. I apply that cost-focused perspective directly to the work we do for our clients.I also have the unique advantage of having served as a DOM for a Part 91 owner, where balancing schedules with costs is a constant challenge.

That said, I have to admit, I appreciate the OEMs. The prices they charge for maintenance often drive customers our way, creating opportunities for us to deliver cost-effective solutions. In the end, it’s all about finding ways to help our clients succeed.

AH: What are some of the ways in which you can demonstrate fairness and openness to an owner or operator when it comes to the cost of maintenance?

JB: You can keep it simple by focusing on giving fair value for money. If someone has a 30-year-old aircraft we are not going to turn a maintenance event into an attempt to give the customer a new aircraft.

•Aircraft Finance

Registration

Transaction Advisory

Claims & Litigation

Law for AOCs, MROs, and Aircraft Suppliers

There are times too, when a customer has a tight budget, where we will say look, this is the cost of the parts we’ve found. However, if you are not happy with our price, feel free to see if you can find the equivalent parts cheaper – which almost never happens and further grows their trust in us. However, above all else, maintenance is a safety issue and cutting corners is not going to get you a safe aircraft.

Another thing I would say is that the customer has to see that you care about his or her issues. If the customer does not believe that you care, you lose no matter what you do.

AH: You guys do a number of pre-purchase inspections every year. How is that going?

JB: Whenever you do a pre-purchase inspection there is always a conflict of interest between the buyer and the seller. So you have to decide who you are working for. What I tell people is that I am not working for either party. I am working for the aircraft. That is my sole concern, to ensure that the report is as correct as it can be.

AH: Is it easy to spot any elephant traps when doing these inspections?

JB: Generally, I would say yes. The key is to know your product and to know where to look to see if there is anything off or hidden that needs to be brought to light. You have the log books and the Form 337 records. The latter is used by the FAA to document any major repairs and alterations to the aircraft. They help you find any hidden issues.

“

The key is to know your product and to know where to look to see if there is anything off or hidden that needs to be brought to light. You have the log books and the Form 337 records.”

Jim Balzer

CH: What is important here too, is that we partner with a company, Blue Tail, that digitizes the records for the owners. We don’t charge for this. It is part of the package. As you can imagine, it helps us to get through the logbooks and the records so much faster than would be possible with paper records.

JB: We get the logbooks back in two days, and the rest of the supporting documents follow. One of the huge benefits of this is that so often, three weeks after a prepurchase inspection, someone will phone up with a query on this or that. It always happens when you’ve already packed up the logbooks and the rest of the documents and shipped them off. With digitized records, you have them all right there!

AH: I believe the aircraft transaction market took a bit of a dip after its post-Covid peak. How are things now?

CH: It has picked up a fair bit in the last quarter and seems to be holding steady again. The fact that the Presidential election is now over seems to be encouraging people to spend money again. And then there is the depreciation issue, which always drives a lot of business around the end of the year. With Trump winning, the depreciation ruling looks set to continue for the next few years at least. That has been a great driver of pre-buy inspections.

AH: Have the supply chain issues that plagued the industry during and post-C ovid now worked their way out of the system?

JB: These snarl-ups still come and go. We see this particularly in aircraft tyres. The manufacturers produce them in batches, so you go from a glut to none and then back to plenty. It is still very difficult right now to find carbon for brakes. Windshields, I would say, have gotten a lot easier to find. But like I say, these issues come and go.

AH: What about older aircraft?

JB: Parts are definitely getting harder to get on older aircraft. Plus, we are having obsolescence issues, with some OEMs not wanting to produce parts for or repair aircraft that have a lot of years on them. One consequence of this is that we are seeing a lot of parting out of aircraft going on right now.

AH: At AMP, you like to focus on what you are good at. What do you do if a client wants some interior refurbishment done while his/her aircraft is in your hangar?

JB: We work with a local refurbishment shop that we are partnered with. This means that we can do any refurbishment that the client needs. We also have strategic partnerships with avionics companies and a paint facility. Our philosophy has always been to focus directly on what we do best, but we have the management know-how to get everything done for the client that needs doing, through trusted partners. |BAM

Richard Prechtel, founder of the activelaw Aviation Desk and partner of the law firm, talks to Anthony Harrington

AH: Richard, what led to your decision to set up the Aviation Desk within activelaw, specialising in aircraft transactions?

RP: I’ve been working in the aviation industry for more than 12 years now, and I started the Aviation Desk some five years ago. Before that, I worked in a law firm that specialised in aviation law. Then, seven years ago I left and did M&A transactions for two years with activelaw, but my interest in aviation drew me back. So, when my colleague David Meixner from my old firm joined us five years ago, we set up the Aviation Desk with the idea of focusing on the legal aspects of aircraft transactions.

AH: How easy was it getting back into aviation law and starting up a new practice?

RP: Actually it was pretty easy. I wasn’t entirely happy with t he setup of the firm I had been working with, which is why I left. But when my colleague and I got together and decided to launch our own practice, we created a nice marketing package and sent it off to all our former contacts. We didn’t have great expectations as to what would materialise, since the billionaire circle is pretty closed, but within two weeks we had our first client. The second client arrived four weeks later and we were off and running.

“ Today, I can say that we are the biggest business aviation law firm in Germany, and we have reached this position in just five years!”

Today, I can say that we are the biggest business aviation law firm in Germany, and we have reached this position in just five years!

From the outset, we focused on providing a complete service when it came to aircraft transactions, which included all the documentation for the financial transactions, purchase agreement, registration and operation. Around 60 to 70 percent of our client base today consists of business jet owners and large companies who are involved in operating, buying and selling their aircraft, while perhaps 30 percent of our business deals with suppliers to the sector.

This year we started to expand the business. We have two more lawyers who joined the practice. One aviation insurance specialist, who worked as an internal lawyer in the claim department of a big aviation insurance, and another

internal lawyer, who worked in the law department of Air Berlin. We want to get a foothold with aircraft insurer´s and in the airliners market. We did our first two airline leasing agreements involving Airbus airliners, and finance of two smaller aircrafts for another carrier. This gives us yet another arm to the business and looks very exciting.

Of course, the airline business is different again from business aviation, but our banking and finance partner understands the airline world and is very specialised in it.

AH: There are a lot of pitfalls in aircraft transactions. What is your view of the complexities involved?

RP: I would say that 95 percent of the transactions are usually quite similar, since there is a kind of industry standard on how to structure such a transaction. Not for nothing it is said that every deal is different, the remaining five percent can create significant issues. You have to tackle this 5% fast and find a pragmatic solution with the other parties involved.

Tax, for example, can be complicated. Aircraft are big ticket items so you really want to avoid incurring a VAT charge if at all possible. Depending on the locations of the buyer and seller, the transaction can get complicated really quickly.

For example, we did a helicopter purchase for one of our clients that had a purchase option in his leasing agreement, which the client exercised. He had already transferred the helicopter from France to Germany during the tenure of the leasing agreement, via a leasing company located in Ireland. So, it was in effect two deliveries. One the second the option was taken from the Irish leasing company to the same company, and the second was from the leasing company to our client, when he got the title on closing. Avoiding incurring VAT was really complicated.

AH: Aircraft transactions are pretty much ‘as is’ deals, are they not? So you need to be pretty sure, as the buyer, that everything is in order.

RP: Absolutely. This is very much a buyer-beware situation. The scope of pre-purchase inspection is a very big part of the negotiation. We take a great deal of care over this side of things. The other thing that makes for complications, of course, is the personalities that you deal with. The clients are ultra-high-networth individuals, and since nearly all transactions are cross border they will have a different culture background.

“ The scope of pre-purchase inspection is a very big part of the negotiation. We take a great deal of care over this side of things.”

Of course, most of the time you are not dealing with the billionaires themselves but with the family office manager. He just wants to get through the transaction as swiftly and as efficiently as possible. So, he will say, do everything you need to do, and I will sign off on it, no problem.

When you deal with big corporations, you are straight away dealing with their law department, and their export controls department. The odds are that they are going to be completely unfamiliar with aircraft transactions. So everything takes twice as long as you have to explain every step of the way what you are doing and why it is necessary. And they are not going to sign off on anything until they understand it 150 percent.

AH: It is often said that time is the enemy of any transaction. The longer it drags out, the more likely it is to fail. Do you find that?

RP: Definitely, the iron must be forged while it is still hot. Sometimes you have to deal with a hesitant buyer. However, the dynamic has really changed in the industry over the last two years. 95 percent of my clients are German so we do a lot of inbound and outbound transactions. The German and European economies have weakened somewhat over the last year or so, and this in turn makes buyers vacillate. They’re really torn between staying liquid and buying a jet.

AH: How has business been for you over the last year?

Then again, when you are dealing with a billionaire and you tell him you need a document returned the next day, they are probably not going to understand what the urgency is. So you have to take care to avoid them getting prickly because they think you are rushing them and not showing sufficient respect.

We had a transaction where seller wanted the transaction rushed through. The deal was: Okay, I will sell for good price, but I want the money in my bank account in four weeks. So then we have to push really hard to ensure that the documentation does not get stuck somewhere for days on end. And then you run into the other party saying: “Don’t rush me, I’m not about to sign this in an hour! Does seller know how he is talking to?!”

RP: We have done very well and despite a weaker buyer´s market in Germany, we are definitely having our best year to date. We have 38 transactions completed so far and we could well see a few more deals close before the end of December. We have three transactions rushing through right now because of the depreciation bonus structure for aircraft in the USA. These deals have to be closed in December for the buyer to get the depreciation bonus.

AH: Are you optimistic, despite the ongoing global conflicts?

RP: Yes, definitely. The war between Russia and Ukraine has not really affected the US, which still constitutes a very safe and active market for business jets in particular and the European economy in general. So, a lot of German industry has pivoted their focus towards the US and North America generally, which led to a lot more transactions in that direction. |BAM

“ We have done very well and despite a weaker buyer´s market in Germany, we are definitely having our best year to date.”

Lauren Stout, recently appointed National Sales Manager at High Tech Finishing, on her ambitions for the company and her new role

Q: Lauren, what led you to join High Tech Finishing as National Sales Manager and can you tell us about your previous position?

LS: I joined HTF on the 1st of October this year. I was looking for a change and a friend of mine, Amanda Taylor, at HTF actually brought the opportunity to my attention. We’ve been friends for a decade and it was something I was keen to take advantage of.

Before joining HTF I was a senior interior designer at Flexjet. I was actually a designer with Constant Aviation before they merged with Flexjet. My task at Constant was to meet with the retail customers and to try to win business. I oversaw projects from the initial sale through to the design of the jet interior for the clients. Then, of course, after the merger, I was solely doing designs for Flexjet’s own interiors.

“ Before joining HTF I was a senior interior designer at Flexjet. I was actually a designer with Constant Aviation before they merged with Flexjet.”

“ What we sell on is our quality, professionalism and the very high degree of customer service and satisfaction that we provide.”

Q: How different is your current role?

LS: Now I am fully engaged with sales, along with some marketing activities, and helping the company with its social media presence. I’m also designing some of our new booths for trade shows. There will also be some design-minded metallic showpieces as part of what we offer to clients.

Q: So now you will be working with Amanda?

LS: Very much so. Amanda gets the sales done but she says that it will be great to have a design-minded person with her, representing HTF.

Q: You’ve had a few months to get the feel of things. How are you enjoying it?

LS: I love what I have seen so far. What has really got to me is the tremendous family culture and feel HTF has. On my first trip to the company, the President gave me a tour of their operations. He shook everyone’s hand as we went along, and knew everyone’s name. That’s how they are. The men and women working in the various shops really respect him, and that only comes when the culture in an organisation is absolutely right.

“ What has really got to me is the tremendous family culture and feel HTF has.”

Q: Have you got to meet some of the customers yet?

LS: Absolutely. I’ve already met with quite a few customers. That has been great fun and really different for me. For the last 13 years, I’ve been going to NBAA as a designer, listening to sales pitches from suppliers. Now I’m on the other side of the fence and it’s a great change of perspective.

Q: HTF’s metal plating and finishing work is highly technical. How are you coping?

LS: I am learning every day. It is a lot to take in, and a lot to learn, but the sales team, Amanda and the VP, Rick Niefield, have really taken me under their wing to teach me about the technical side of the business.

Q: How have you found the selling experience?

LS: Selling can be challenging, in that although we have a very wide range of materials and styles, you are basically plating surfaces, from the smallest widgets to the largest pieces. So, what we sell on is our quality, professionalism and the very high degree of customer service and satisfaction that we provide.

“ We have upwards of sixty different styles, including polished, satin and matt finishes and any number of different coloured gold and nickel finishes. We also have an excellent black chrome that we offer.”

We have upwards of sixty different styles, including polished, satin and matt finishes and any number of different coloured gold and nickel finishes. We also have an excellent black chrome that we offer. It has been a real eye-opener to see how plating technology has evolved. As to the actual selling, I have several deals in progress, so fingers crossed!

Q: Do you work out of the office or from home?

LS: I work from home and go and visit customers. That was one of the huge attractions of the job for me. As a designer for Flexjet, I was pretty removed from the end customer, so it has been tremendous to be able to get out to see folks. Everything I’ve seen so far makes me very optimistic about my role and it’s great to be a part of such an excellent team. |BAM

David McCown, President of the Americas at Chapman Freeborn, talks to Anthony Harrington about his focus on growing the company’s charter operations

AH: David, could you refresh the readers on how Chapman Freeborn became the organisation it is today?

DM: The company started back in London in 1973, and it was initially marketing a fleet of Hercules freighter aircraft. Our early charters transported oil and gas equipment, automotive parts, fresh produce and humanitarian aid. In the late 80s, we operated our first music tour charter, and from there we have continued to diversify and grow into the leading global air charterer we are today.

We now have over 400 team members around the world. We have over 30 offices in multiple regions, including the Middle East, Africa and Asia. We have also developed further in the cargo business to the point where we now control capacity through our acquisition of Magma Aviation, which has a fleet of Boeing 747, 737 and an Airbus A321-200 aircraft dedicated to cargo charter.

AT ROVANIEMI! JET A1 available through JETFLITE Dedicated FUEL TRUCK for OUR CLIENTS! 24/7/365 FULL SERVICE FBO IN HELSINKI HANDLING | HANGAR | TECH SUPPORT | VIP fbo@jetflite.fi

Tel +358 20 510 2700

JETFLITE is proud to announce a chain of ground handling services at the Lapland airports.

For this winter season full services are now available at:

EMAIL: fbo@jetflite.fi

On top of our everyday VIP class service, we will have dedicated DE-ICING TRUCKS for business jets.

No more waiting at the end of the line!

Tel +358 20 510 2700

Other lines of business have developed out of that, via acquisitions. For example, we acquired Intradco Global, which has a unique niche business focused on animal transport. We transport every kind of animal, from exotic creatures to racehorses and endangered species.

As I say, it’s very much a niche business but it dovetails very well with our charter business in some respects. For example, multi-millionaire racehorse owners need to get to major international and inter-state race meetings, along with their racehorses, and you can see how that works together. It’s not a massively growing business but we have a real corner on that market, and it is a unique sales proposition for us and helps to differentiate us from the competition.

We also have an onboard courier charter business where we will provide an individual to deliver whatever the client wants, door to door. It might be an industry, a fashion prototype or just a favourite dress that the owner forgot back home and needs for an event.

AH: So, let’s talk about your current global position. DM: We have evolved both in terms of geographic reach and our product portfolio. Although cargo charter is our dominant business, over the last four years in particular we have been pushing hard to expand our private jet charter business.

AH: You were acquired back in 2019 by the Avia Solutions Group, how is that going?

DM: As you probably know, Avia Solutions Group is a g lobal holding company. It has over 250 subsidiaries engaged in aircraft maintenance, pilot training, ground handling and fuelling, aviation IT solutions and business aviation. Avia Solutions Group has become the world’s largest provider of ACMI aircraft, with over 230 airliner aircraft in its combined fleets.

Avia operates some 12 AOCs around the world and has a portfolio of MROs to support a global network of large airliners leased to airlines and other leasing companies. As a company, Chapman Freeborn is now extending its business lines into the ACMI leasing business.

AH: You say private jet chartering is now once again a major focus for the organisation. How is that going?

DM: My background is predominantly in the passenger business, and the reason I joined Chapman Freeborn was precisely to help drive our passenger charter business. We recognise that by comparison with our position in cargo charter, we are still a modest player in the passenger charter space. However, we are investing heavily in growing that side of the business globally. The aim is to both seize a significant share of that market and to have a more diversified business model. Building on this, our approach to growth in private

jet chartering is very client-focused. We listen closely to what corporations and high-net-worth individuals want from their aviation partners: reliability, flexibility, and a seamless experience. For instance, during the pandemic, we observed a surge in demand for private travel as individuals and companies prioritized safety and convenience. That period gave us valuable insights into how we can cater to both seasoned private jet users and those exploring it for the first time. Today, we’re leveraging those lessons as we expand into new regions and enhance our offerings.

AH: How difficult is it for a large company such as yours, to compete against individual brokers? These folks are often disparagingly referred to as ‘bedroom brokers’ since they have next to no overheads, working from home.

DM: ‘Bedroom brokers’ get a bad knock in the industry, but we partner with a lot of smaller brokers. A lot of them come from larger organisations or large operators and have decided to work for themselves and move into a different space. They still have their network of relationships, people who charter frequently and want to work with them.

They will come to us and say, look, I have these clients who are still working with me but I’d rather not do the transactions and the money transfers and have all the logistics hassles. So, they work with us on commission. We do all the fulfilment side and that brings us significant business.

Of course, what is not helpful is when you have individuals out there who haven’t got a clue what they are doing and are trying to make some money playing at being a charter broker. That leads to mistakes, folks being left on the tarmac, and highly disgruntled clients. It can have a knock-on effect on the reputation of the whole industry.

“

“Our approach to growth in private jet chartering is very client-focused. We listen closely to what corporations and high-networth individuals want from their aviation partners: reliability, flexibility, and a seamless experience.”

What we see sometimes in the US market where we have Part 135 versus Part 91 rules, is that an individual broker who doesn’t know what he or she is doing, ends up booking a client on an aircraft that is not licensed to carry passengers commercially. A perfect example was that dreadful incident in 2004 with a crash out of Teterboro, where the broker had put clients on an aircraft flown by a crew that was not Part 135 certified for that aircraft.

AH: So, let’s talk a bit about the sales channels available to you.

DM: In addition to the growing sales team and our increasing marketing efforts a big part of this business is the referrals we get from a wide range of sources. These leads can come from players in the travel industry, for example, or from the very guys we’ve just been talking about, the singleperson brokers. We work hard to be flexible to add value to the network of clients that they have and to provide the right financial incentives for them to work with us.

We work a lot with air charter operators and other brokers too. For example, these operations might have core competence with their domestic market but when a client wants to travel to multiple international destinations, that takes these operators/brokers out of their comfort zone. We work with them to provide additional lift capacity on more complex missions. This cooperation also leverages our broad product offering, including cargo.

A great recent example I can share was with an air charter operator, that came to us with a request from one of their customers who needed to move 100 rescued dogs out of Gaza

“ “A great recent example I can share was with an air charter operator, that came to us with a request from one of their customers who needed to move 100 rescued dogs out of Gaza to New York.”

to New York. We did this for them, which just goes to my point that we work with operators and brokers in a variety of ways.

Also, given the breadth of our product offering, we engage in a lot of cross-selling of our services. For example, we may start doing private jet supplemental lift for a company’s executives, but then they realise that we do cargo as well, and soon we are doing that for them too. This happened a lot with the supply chain disruptions we saw during and after Covid, where our cargo services were needed to help companies solve supply chain issues. In short, we work hard at leveraging the variety of services that we can offer.

ANewEraatHarrodsAviation’sLutonFBO

AsHarrodsAviationenters into2025,theyarethrilledto announcethenewnamefor theirexistingLutonFBO,The Omnia.

ANameReflectingExcellence Omnia,fromtheLatinmeaning ‘all’,payshomagetothe completeHarrodsAviation experience,anFBOwhereevery detailhasbeenconsideredto catertotheuniqueneedsofthe world’smostdiscerning travellers.

AGatewaytotheFuture HarrodsAviationis continuouslyinvestinginits facilities,servicesand partnershipstoremainatthe forefrontoftheprivateaviation industry.

Fromtheirbespokepetservices tobeingthefirstFBOinthe UKtoachieveIS-BAHLevel3 certification,theyare committedtoexcellencein everydetail.Inanincreasingly changingindustry,where‘full service’sometimesfeelslikeit’s athingofthepast,Harrods Aviationarecommittedto deliveringremarkablelevelsof serviceandexceedingall expectations.

The Omniaembodiesthis ethos,standingasasymbolof everythingHarrodsAviationis; afullserviceFBO,delivering excellenceandtailored offeringstomeettheneedsof everyclient,everytime.

Therenamingsetsthetonefor ayearfilledwithexciting initiativesandevents,designed tohonourthelegendary heritageofHarrods’pastand renewedvisionforthefuture. 2025willbeayearto remember.

AH: How is business right now?

DM: Business aviation is now a growing part of our operations, and we are having our best year ever in the Americas. While the charter business as a whole has been somewhat softer this year compared to last year in the US, we are bucking that trend, largely due to the investment that we have made in our team and in our sales and marketing efforts.

In my opinion, in the Americas, the sector is going to continue to see softness compared to the highs it enjoyed during Covid, but business will still be up by comparison with the pre-Covid years. The trend is encouraging, and not just for Chapman Freeborn.

With respect to the Americas market vs. other regions, we do not see the same level of ‘flight shaming’ that is prevalent in other regions, say in Europe. The US has definitely moved on from the 2010 flight shaming of the top motor industry CEOs when they flew into Washington on their private jets to ask for government bailouts.

We need to be mindful of the importance of emissions mitigation, but everyone in the industry is working in the right direction on that. Also, I think it is important to keep in mind that business aviation, and aviation in general is only a small part of global emissions, estimated at about 5%. Th is includes

scheduled commercial airlines, cargo, and even military usage. Business jet use accounts for less than one-half of one percent. So, even if everyone stopped flying private, that would only account for under one percent of global emissions.

I am very confident that this industry in general, and private charter in particular, has a great future. We are seeing so much by way of technological advances and new platforms looking to make private jet travel more efficient operationally.

This is a service industry and there are plenty of folks with money out there who can afford to fly private. Also, there are a good many aspirational people trying to get into flying private, and there are many companies trying to meet those needs. Some of these services i.e. sale by seat/shared flights do commoditise business aviation somewhat and therefore that approach delivers a very different experience. However, at Chapman Freeborn we are focused on the tailored trip-by-trip approach, delivering a high-quality experience, and that is what corporates typically look for. It’s about reliability and value.

I am very optimistic about Chapman Freeborn’s future in private aviation. Given Chapman Freeborn’s extensive logistics and service experience, we are bringing our knowhow to the private jet charter market to deliver a reliable, first-class, experience for our charter customers. |BAM

“ While the charter business as a whole has been somewhat softer this year compared to last year in the US, we are bucking that trend, largely due to the investment that we have made in our team and in our sales and marketing efforts.”

Award-winning Concierge Cybersecurity & Privacy PlatformTM designed to protect you and your family.

The truest form of opulence is not what you show the world, but what you can keep to yourself. Introducing an exclusive membership for the discerning few who understand that the greatest luxury is in the sanctity of privacy. BlackCloak concierge personal cybersecurity services are designed to protect your most valued assets and provide peace of mind.

Shafiul Syed, CEO of Royal Jet, on building a global Brand

Q: Shafiul, can you tell us something of what brought you to your latest position, as CEO of Royal Jet.

SS: I was interested in aviation from my earliest years. At the age of 18, I joined British Airways. They sponsored me through university. I spent 18 years with BA. Latterly I was running Africa for BA and was variously in Morocco, Tangiers, Egypt and Nigeria. So that gave me the travel bug. When I left BA I managed various airlines around the world, and now I am here with Royal Jet. This will be my fourth month with the company.

Q: So, it’s all still very new to you. How are you enjoying it?

SS: I’m delighted to be here, of course. Royal Jet has a tremendous reputation and a great history. It was founded 21 years ago. It has all the basics sorted and delivers an excellent experience for customers. Safety and security are paramount priorities. Now the challenge is to grow this company into different geographies and different segments.

Q: You have a lot of BBJs in your fleet?

SS: Yes, we do. We have the biggest BBJ fleet in the world, with nine of our own BBJs. Plus, we have two Bombardier Global 5000s and we manage a range of aircraft, all the way from a 787 down to a Challenger 605, with a constantly evolving fleet of managed aircraft. At the moment the managed fleet too, stands at 11 aircraft.

We are a global brand, so while the majority of our owners are in the Middle East, we have owners in Africa and elsewhere as well.

Q: What is the charter demand like for BBJ?

SS: You have to break down that demand a bit. The North Amer ican demand for charter had gone quiet. Europe is in something of a slowdown, but the rest of the world is growing quite fast. Here in Dubai, demand is growing like crazy. So, because of geography and geopolitics, we are right in the centre of it all. The UAE is friends with everyone, so that gives us a tremendous reach. And if you look at the global southern hemisphere, some of the HNWIs there want something different from Western culture, so Middle Eastern culture is very appealing to them.

What is important too, is that Abu Dhabi has its own brand, which is all about being timeless, sophisticated and elegant. Those three words really resonate with me. Royal Jet prides

“ We have the biggest BBJ fl eet in the world, with nine of our own BBJs. Plus, we have two Bombardier Global 5000s and we manage a range of aircraft, all the way from a 787 down to a Challenger 605, with a constantly evolving fleet of managed aircraft.”

itself on being a cut above the rest of the competition so the branding is perfect for us. So, what we are really looking to do is to grow our footprint and to offer our services to other customers in this space.

Q: How is that progressing?

SS: Last month we did a trial in Malaysia, plus we do roadshows so people can come and see and feel the Royal Jet experience for themselves.

Q: What of your FBO?

SS: We have our Royal Jet VIP Lounge here at Abu Dhabi Air port, of course. Last week we had the Formula 1 circuit here in Abu Dhabi. That was an incredible experience, and our team performed magnificently. The entire ramp was full

“ We’ve just announced at MEBAA that we are placing an order for three ACJs, so we are growing both our own fleet and looking to expand the managed fleet globally.”

and everything was managed smoothly and seamlessly. I was very proud to be part of that process.

It was a great testament to the professionalism of our team, but then again, they are accustomed to working at this level. We had the NBA basketball teams come through a few months back. That again, involved large aircraft with lots of people.

difficult destinations. We’ve flown into military zones and de-militarised zones. We know how to fly our customers securely and safely to wherever they need to go.

Q: What are your growth plans?

SS: We’ve just announced at MEBAA that we are placing an order for three ACJs, so we are growing both our own fleet and looking to expand the managed fleet globally.

A lot of our operations involve Heads of State and Royal Family flights. We are experts in handling flights to

This whole private jet business is a huge enabler for the UAE leadership and business leaders throughout the Middle East. It enables them to get to wherever they need to be, and the deals that are done have a huge impact on humanity generally. The same in Africa. For example, we took the President of Kenya to Camp David to meet with President Biden. Private jets expedite so much of what goes on behind the scenes. It is difficult to overestimate how important the contribution of this sector is to the world. With the clientele that we have, time is of the essence, and we respect that. |BAM

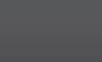

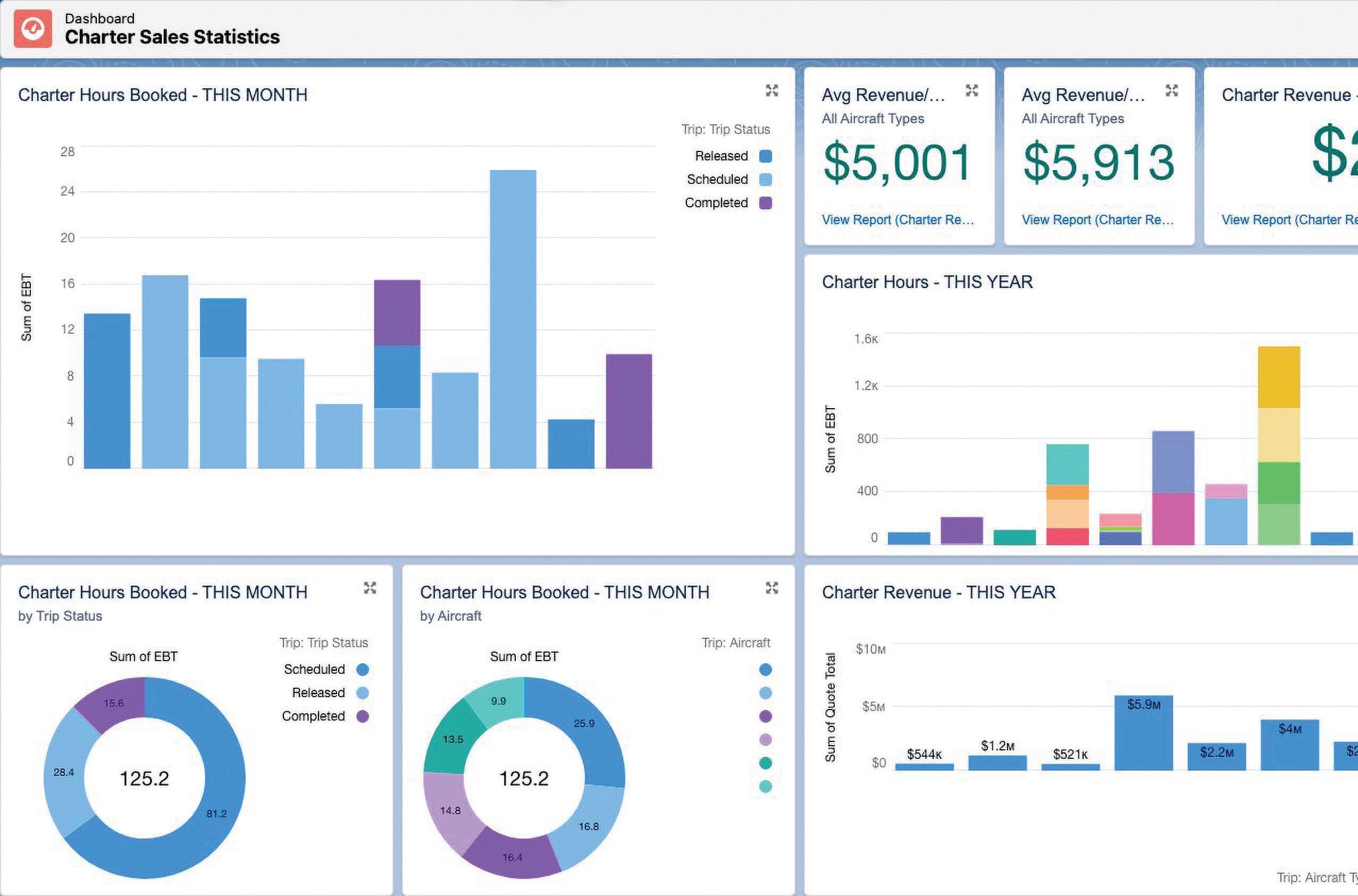

STACK.aero has developed a powerful business operations system, known as BOS, for charter brokers and operators. By aggregating and integrating the diverse tools regularly used to manage a charter process, the system saves time and money and improves efficiencies. Greg Jarrett, co-founder and CEO, updates our Global Correspondent, Jane Stanbury, about the latest developments.

JS: Greg, it’s been a while since we spoke. I understand STACK.aero has grown significantly in the last twelve months. Can you give us an update?

GJ: We are constantly strengthening our digital platform as we evolve its functionality, interface, and resources in response to customer feedback, changing market trends, and needs. It’s already proving to be a phenomenal resource and time saver that helps our clients generate more revenue. The market is recognizing the value we bring, and we’ve more than tripled our customer base comparing 2024 with 2023. Flight departments, OEMs, charter brokers and charter operators all now feature on the customer roster.

JS: What about the system is appealing to the customers? Why does anybody sign up for yet another software platform?

GJ: Our Business Operating System, BOS, is similar to an enterprise resource management system. It streamlines business operations by enabling customers to easily access the multiple tools they use daily. I’m talking about features that support customer relationship management, simplify aircraft sourcing, generate customer-facing documentation, streamline administration and manage charters, and much more in a single platform. For example, if you’re a broker wanting to respond to a trip request, instead of flipping

between an Excel sheet, a CRM, and a PDF to create a quote, all the information is stored in a single database. Should a client request a charter, you can immediately pull up their personal details and preferences to generate a quote and provide them with options; if they confirm, BOS manages the workflow through the whole process from the initial trip request to invoice generation and even delivers in-depth reporting and analytics. The charter broker only has to populate a few fields to set the process in motion. If you’re an operator, BOS tracks prospects, digitizes the clients likes and dislikes, and builds a comprehensive picture of the customers. The platform is continuously streamlined as we improve the functionality, integrate new features that add value, and continuously enhance the existing functions. We know that users appreciate having a single source of truth for all their data and process management. It’s a game-changer for many.

JS: You talk about adding value to the industry; how are you doing that, and why does it matter?

GJ: Our system enables business aviation to function seamlessly. We sometimes forget that without passengers, there would be no business aviation industry, which makes it imperative that we have systems that make chartering a jet a smooth, painless experience. Simplifying the process gives the brokers and operators more time to focus on the client and their evolving needs. It also allows our customers to better understand their clients by spotting trends and patterns in their

“ Trip requests, quotes, and bookings generated in STACK.aero automatically align with data held by FL3XX.”

travel behaviour. BOS users can also interrogate their business processes to identify areas for improvement, weaknesses in the system or potential sales opportunities. Having worked in the sector, we know pulling a charter trip together takes significant time; our system guarantees saving hundreds of hours. We have one client who shared that using BOS reduces the time spent on managing charter bookings by up to 70%, that’s a lot to give back to the customer or the business.

JS: Those are impressive numbers, but it must be challenging to convince a customer to switch from their multiple tools to BOS.

GJ: Switching software can be daunting… no two ways about it, but it is important to note that we are not reinventing the wheel; we’re just making them all run more smoothly together by breaking down silos between software and optimizing the best-in-class solutions from the industry. Our platform was designed by people who have worked in the industry for decades, and we know where the pain points are, so with BOS, we’re making sure that it is intuitive and easy to adopt. We’re not asking people to learn a completely new system but providing a way to use the systems they like, e.g. Salesforce more efficiently and securely. Moving a business operation to a modern, cloud-based software like ours offers significant advantages, particularly in a fast-paced industry like BizAv. We’re not saying don’t use the systems you are familiar with; we’re saying use them more smartly

and intuitively so they can be scalable. We effectively tailor the system to meet the customer needs and even support customers who want their own features integrated to support the unique elements of their business.

JS: So you’re not building new features but optimizing familiar tools by aggregating them and then integrating

them with others. I know that Avinode is linked to the system; what other third-party systems have you added this year to support customers?

GJ: We build our own functionality and aggregate and integrate tools to add value. The integration with FL3XX, the digital aircraft operations platform, is a good example. Trip requests, quotes, and bookings generated in STACK.

For more than 30 years, AERO Specialties has remained dedicated to industryleading quality and impeccable service.

More importantly, we are hyper-focused on our customers. Their success is our success. If it matters to our customers, then it matters to us.

aero automatically align with data held by FL3XX. Our mutual customers take advantage of the two-way flow of information. It automates much of the data input, reduces errors and creates more complete customer profiles. We’ve also integrated elements of Tuvoli’s FlyEasy software, which enables our charter broker and operator customers to seamlessly receive real-time trip requests from the FlyEasy widget embedded in customer websites. This allows our users to respond quickly with relevant offers. Finally, a good example of how we evolve the system in response to the changing face of business aviation is our plan to integrate with the aviation sustainability solutions provider Azzera. Rather than build a new system, we identified the CELESTE B2B Software-as-a-Service (SaaS) platform as optimal for integration. BOS users can simultaneously manage the

commercial process and related carbon management through a single user interface.

JS: I imagine you still want to include many elements in the platform. What is next for STACK.aero?

GJ: We designed BOS with our customers at the centre of the business, and that’s what we will continue to do. Like any great software, we’ll never be finished creating a platform where the sum is greater than the individual parts; we continue to deliver a powerful tool that enables our users to put their customers at the centre of their business. We are currently exploring integrating further software platforms that will enrich the database, researching the most efficient way of incorporating a payment acceptance system, and exploring where AI will add benefits. |BAM

From BBJs to all Gulfstreams and Globals to smaller aircraft such as Dassault Falcons, Pilatus and Learjets, this state-of-the-art electric tug is suitable for all. With a capacity of up to 75 tons, it offers powerful performance in a very compact form. The fully automatic nose wheel pick-up and radio remote control streamline your ground handling. The robust hydraulic lifting platform ensures a firm and secure hold of the nose wheel at all times. Designed for maximum maneuverability and efficiency, each Mototok is agile, energy efficient and perfect for tight hangar spaces. This next generation tug is revolutionizing the way you move your fleet of aircraft on the ground.

Get ready to elevate your operations!

David Winstanley, CEO, London Biggin Hill Airport, on building a successful relationship between regional airports and their communities

“ Our fantastic bi-annual Futures Week introduces young people to the wide range of careers available within the aviation sector, offering hands-on experiences that inspire the next generation of aviation professionals.”

Q: Why are regional airports important in their communities?

DW: Regional airports are vital to their communities because they act as economic hubs, creating high-value jobs and supporting local businesses. They drive regional economic growth, provide opportunities for innovation, and are integral to the social fabric through their partnerships and outreach initiatives. By fostering strong ties with local residents and organisations, regional airports ensure mutual growth and development.

Q: How has London Biggin Hill Airport evolved, and how has its economic impact benefited local communities?

DW: Over the last 30 years, London Biggin Hill Airport has de veloped from being a historic World War Two airfield to also become a globally recognised hub for business aviation and aircraft technology. This evolution has been guided by a strategic focus on benefiting both the airport and the surrounding community. Findings from Lichfields’ report on London Biggin Hill Airport’s economic footprint reveal that, currently, our contribution to the UK economy is approximately £200 million GVA annually. Importantly, 72% of this is captured within our local area, benefitting local stakeholders, businesses and residents. It is a source of

great pride that in 2022/23, businesses at the airport spent £28.5 million within Bromley, directly supporting other local companies. With planned investments, we hope to make more impact, with potential for GVA to rise to £636 million.

Q: How do regional airports support education and employment opportunities?

DW: Regional business aviation plays a significant role

in generating employment opportunities, particularly in specialised fields. At London Biggin Hill, we have around 1800 on-site jobs and support nearly 2700 when the supply chain is considered. More than a third of our staff are drawn from the London Borough of Bromley, with nearly half residing within Greater London. To put it into perspective, we support 88 jobs for every 1000 movements.