28 minute read

The Way It Was: The War Amps Changed The Battles They Fought

THE WAY IT WAS When The Front . . . Came Home

By Andrea Grimes

Advertisement

Quoting Sir Robert Borden, “The world has drifted far from its old anchorage and no man can with certainty prophesy what the outcome will be.”

The Great War brought Canada into the world stage. Some of our young lads from the farms and factories of Essex County were heard to say “Join up, beats having to marry that girl down the road and besides, it will be over by Christmas.”

When going over the top and into the wire, some of our lads became battle-hardened Veterans realizing all too soon that war was indeed hell!

Battles lost — victories gained — and those horrific causalities our soldiers experienced were the results of the residual effects of artillery barrage, bayonet wounds and mustard gas burns. Wounds to the extremities were so severe that thousands of soldiers had to have limbs amputated.

As traumatic as it was, amputation saved the lives of many men as it often prevented infection caused by gangrene that festered in gunshot and shrapnel wounds.

Some of our lads, no longer “combat-ready”, were coming home torn inside out from the stains and strains of war. It took everything they had to adapt to their new reality as amputees, wondering — would dealing with this be worse than dodging bullets or sitting in rat-infested trenches filled with sewage?

For some Veterans, reclaiming a sense of purpose was more than just having the right attitude, as some viewed the return to civilian life with trepidation. Men who lost a leg or an arm had to take on a new identity struggling with more than just physical limitations.

They thought to themselves: “How am I going to get through this being reminded that I am half a man of no use to anyone”?

As amputees, thousands of men struggled emotionally for the rest of their lives, existing in the public eye as permanent visual reminders of the inhumanities of war. Now it would be the “all hands to the wheel” approach to recover a measure of functionality with self-respect.

In laying the foundation for post-war recovery, a group of forward-thinking Canadian war amputees established The War Amps (view: WarAmps.ca) on September 23, 1918.

The organization built exclusive resources to provide “duty of care” accommodations for our returning amputee Veterans making the transition from soldiers to civilians.

“Our organization has successfully adapted to changing the attitudes of how society perceives amputees,” indicates Rob Larman, Director of The War Amps “PLAYSAFE” and “DRIVESAFE” Programs, based in the Key Tag Service office in Scarborough. “Over the years, our diverse membership (including Veterans) has advocated for one another, helping them to reach their full potential by focusing on the positive.”

Pictured is the late WWII Veteran, Major Fred Albert (F.A.) Tilston who served with The Essex Scottish Regiment. Photo courtesy of Library and Archives Canada, P3684.

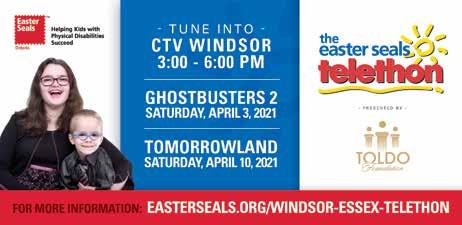

easter seals

The War Amps Key Tag Service celebrated its 75th anniversary January, 2021. Since amputee Veterans started the Key Tag Service in 1946, The War Amps have returned more than 1.5 million set of lost keys to their owners.

“One such Veteran was Major F.A. Tilston who, in 1945, established his post-military career in the capacity as a Civilian Liaison Coordinator. He took immense pride in being instrumental in developing our ‘Child Amputee Program’ (CHAMP) and was involved in The War Amps Southwestern Ontario branch located in London, Ontario.”

For courage displayed under enemy fire at the “Battle of the Hochwald” (refer to: EKScot. org/history-galleries/concise-history), Tilston was presented the “Victoria Cross”, the highest and most prestigious medal for conspicuous gallantry that can be awarded to British and Commonwealth forces. In 1994, the Major F.A. Tilston Armoury and Windsor Police Training Centre was named in honour of WWII Veteran Major F.A. Tilston, VC, of The Essex Scottish Regiment.

In April 1957, Tilston became President and CEO of Sterling Drug Company, 1019 Elliott Street West in Windsor and later directed the company’s move to Aurora, Ontario in 1958. With a keen sense of dedication and pride, Tilston continued his support of The War Amps until his death in 1992.

In speaking to a tradition of duty and service, there are opportunities to respect how the values of integrity and courage foster a commitment to defending our Canadian values of democracy. For all the right reasons, our Veterans own this privilege. As a civilian Veterans Advocate, Andrea Grimes was presented with the “Queen Elizabeth II Diamond Jubilee Medal” and the “Governor General’s Medal” recognizing her volunteer service to Veterans and the military families of our Canadian Armed Forces, as well as with military family service-support organizations to include, North Wall Riders Association, Windsor Veterans Memorial Service Committee, Military Institute of Windsor, the Royal Canadian Naval Association, the Korean War Veterans Association and the Canadian Historical Aircraft Association.

FOOD FOR THOUGHT FOOD FOR THOUGHT

Syd’s Sandwich Co., 559 Pelissier Street, Windsor

By David Clark Photos courtesy of Kara Kristof

Anew and welcoming business in downtown Windsor, Syd’s Sandwich Co., has been purveying its best offerings successfully, since opening its doors in October 2020.

With its predecessors, Elias Deli and Malic’s Restaurant & Delicatessen, now closed, we may be missing that deli comfort food source when it comes to sandwiches, especially Corned Beef.

Enter Syd’s — “Windsor’s Newest Home of the Corned Beef Sandwich” — a real treat waiting for you and your hefty appetite. That beef sandwich you crave is stacked high, sliced thin, steamed, and loaded with Swiss cheese and mustard on toasted rye bread.

This restaurant is carving out a solid reputation as the sandwich nook you need to frequent when you crave that familiar taste between two rye slices. It’s a rock star!

According to an up-and-coming millennial, Sydney (a.k.a. Syd) Filiault, Owner/Operator of Syd’s: “We are a family run business where all our food is homemade on site and locally sourced. We provide a healthier take on comfort food. We are proud to shop locally for the freshest possible food around.”

Most of Syd’s produce comes from Leamington and a few suppliers in the city, including: Steimar Bread, Galati Cheese and Brenner Packers Ltd., who help to keep the meals heading out the door to happy customers.

Now on to the important stuff, Syd’s popular sandwiches give it to you deli-style and stacked. Of course, as mentioned, the favourite is the Corned Beef on rye as is the Reuben with a healthy portion of sauerkraut.

The tangy Pulled Pork is hand-rubbed and slow-cooked served with creamy carrot/ cabbage slaw on a fresh brioche bun with lots of exotic flavours.

“The Corned Beet is our vegetarian take on the Corned Beef,” expresses Filiault. “It is loaded with beets, sauerkraut, Swiss cheese and other mouth-watering ingredients.”

For that tender fillet, there is the Grilled Chicken with Syd’s sauce, basted and grilled.

“We make different soups every day,” says Filiault. “Check the website: SydsSandwichCo.com for something new and exciting.”

You will find soup you have never heard of and the familiar favourite Chicken Dumpling, and others, ranging from the French Onion to Sweet Potato Basil.

The specials at Syd’s are plentiful and deliver a lot of value for your dollar. Look into the Cheesy Baked Mac and Cheese topped with optional pulled pork. The taste is off the charts!

“We make many different quiches ranging from Spinach to Chili and Cheddar,”

This is one big reason why they keep coming through the door, quite simply the Corned Beef.

The juicy and loaded Pulled Pork is yet another ultimate comfort food at Syd’s.

Filiault adds. “All are good choices to keep you going on a cold winter day.”

Some of the healthiest choices on the menu include the Stuffed Pepper Soup and the daily soup of the day. All recipes are low in sodium.

The healthy sandwich selections are the Veggie, Grilled Chicken and Tuna. Syd’s also offers Gluten Free and Vegan varieties on the menu.

Coming from her partner’s mom, dig into the flavoured Cheesecake Jar. And you can also find lots of beverages available, many local, including Soda Pop Bros. and Gord’s Kombucha. Syd’s Lemonade is always a great choice too.

Syd’s offers takeout, delivery, and walkins are always welcome.

Customers can order by phone or online with curbside pickup too. For delivery, orders can be placed on: SydsSandwichCo.com or through Jubzi.com.

A charitable activity, “Jubzi gives a five percent donation from every order to The Downtown Mission of Windsor, something we care deeply about,” Filiault comments.

For Filiault and her family they believe their love language is food.

“My family and I have been talking about a sandwich shop with Corned Beef on the menu for a very long time,” explains Filiault. “My significant other, Mitchell Demarse was the one who found the physical location for Syd’s, showing us the potential and shared the opportunity with my family and myself.”

As you have read she definitely has an entrepreneurial mindset and is a proud Alumnus of the Odette School of Business at the University of Windsor.

Aesthetically pleasing, the Stuffed Pepper Soup is warm and cozy, a top winter retreat available for takeout.

As for the future, depending on COVID-19 restrictions, Filiault is working on a catering menu that will include items from the main menu and more. For now, she will continue to build the business with daily specials and upgrades to the menu greeting all who enter the shop with great sandwiches and a smile.

For further information regarding menu items check the website listed in this article earlier or go to: Facebook.com/SydsDeli.

Federal And Provincial Governments Lend A Helping Hand To Businesses

Critical financial support for those hit hard by the COVID-19 pandemic, aims to help companies continue operations, protect jobs, cover costs and play a role in our economic recovery

Businesses of all sizes and in all sectors across the Windsor Essex region have been severely affected financially by the year-old COVID-19 global pandemic.

But, there is relief available under a variety of programs funded by the Province of Ontario and the Government of Canada.

Rakesh Naidu, President and Chief Executive Officer of the Windsor-Essex Regional Chamber of Commerce, says the various government financial grants and programs have been helpful, but can’t fully replace lost revenues.

“Margins are so razor-thin in many businesses that if you take away 10 to 15% of the revenue, then businesses owners end up dipping into savings or taking out loans to pay their bills,” Naidu comments. “It became a cash flow deficit very early on in the pandemic so wage subsidies and business account loans were essential to help businesses stay afloat.”

According to Naidu, a recent survey conducted by the Canadian Chamber of Commerce estimates that one in six businesses will not survive the pandemic and will close permanently.

“I fear it could be worse,” he adds. “Locally, in addition to the lockdown and closures, we’re also dealing with the impact of the border closure for the past 12 months and that has had an impact on local businesses as well.”

The provincial government’s financial commitment to help businesses survive during an unprecedented world-wide health crisis, includes $1.4 billion to launch the Ontario Small Business Support Grant to help small businesses that are required to close or significantly restrict services under the province-wide shutdown, with grants starting at $10,000 and up to $20,000.

The Ontario government has also committed $869 million in additional investments for the hospital sector for supplies and equipment to address the surge in COVID-19 cases, including testing, swabs, saliva tubes and test kits, bringing the total increase in funding to hospitals since 2019-20 to $3.4 billion.

There’s no doubt, it’s been a challenging year for business owners. However, there is a ray of hope with all the government relief programs available so entrepreneurs can make it through to a more stable period. Our quick rundown now of what you can apply for online may have you waving your hands in the air with joy!

There’s also $609 million to support the procurement of additional Personal Protective Equipment (PPE), critical supplies, equipment and continued support for essential supply chain operations; $398 million in additional support to respond to the impact of COVID-19 in the long-term care sector and $235 million in additional supports to protect children and staff in childcare and early years settings.

In addition, the federal government had spent $240 billion by early December on more than 100 new and existing programs and measures to help individuals, businesses, organizations and government entities survive the pandemic.

“I dread to think what it would have been like without these programs,” Naidu expresses.

Biz X magazine reached out to a number of experts in a variety of sectors to help area businesses understand what is available to help them survive and come out the other end of the pandemic still standing.

Highly Affected Sectors Credit Availability Program Regional Relief and Recovery Fund

Through this program (HASCAP), the

Business Development Bank of Canada

is working with participating Canadian financial institutions to offer governmentguaranteed low-interest loans up to $1 million.

Severely affected businesses (for example, a chain of hotels or restaurants with multiple locations under one entity) could be eligible for up to $6.25 million. Applications opened February 1, 2021.

Craig Hoover, Senior Manager in R&D and government incentives practice at Baker Tilly Windsor LLP. Photo courtesy of Baker Tilly.

“My gut feeling is there will be lots of stimulus from the government to spur economic growth and we have the expertise to help our clients access these funds,” says Craig Hoover, a Senior Manager at Baker

Tilly Windsor LLP.

HASCAP will also help businesses with their day-to-day operating costs during the COVID-19 crisis, allowing them to invest in their long-term prosperity.

The program is available to businesses across Canada in all sectors that have been hit hard by the pandemic. This includes restaurants, businesses in the tourism and hospitality sectors and those that rely on in-person services.

To be eligible, a business needs to show year-over-year revenue decline of at least 50% in three months, within eight months prior to their application.

Companies must also be able to show their financial institutions they have previously applied for either the Canada Emergency Wage Subsidy or the Canada Emergency Rent Subsidy.

Source: Craig Hoover, Baker Tilly Windsor LLP (BakerTilly.ca).

Ontario Small Business Support Grant

Many small businesses are struggling right now due to the government restrictions imposed to help stop the spread of COVID-19.

Ontario has introduced several programs to help these businesses through this tough time. The Ontario Small Business Support Grant is one of these programs and was introduced in January 2021.

The grant is intended to help small businesses with the impact of the provincewide shutdown that came into effect on December 26, 2020.

If you are a qualifying small business that was required to close or significantly restrict services because of the shutdown, you can receive between $10,000 and $20,000 of grant money from the Ontario government.

To be eligible, businesses must have less than 100 employees and must have had a decrease in revenues of at least 20% when comparing the month of April 2020 to April 2019. The government decided to use April as the basis because similar shutdown restrictions were in effect at that time and it feels that the impact of the latest shutdown would likely be similar.

There are also provisions for new businesses established after April 2019.

Applications for this and other programs may be completed using the links provided on the Ontario government website: Ontario.ca.

Source: Jennifer Hunt, Chapman, Sanger & Associates LLP., Chartered Professional Accountants (LSCA.ca).

The Regional Relief and Recovery Fund (RRRF) provides financial assistance to businesses and social support organizations that are unable to meet eligibility criteria for other assistance programs. The fund provides interest-free loans to help support fixed operating expenses in situations where revenues have decreased due to the COVID-19 pandemic.

The goal of the fund is to provide support to enable businesses to continue operations and keep paying their employees. The RRRF can help close the remaining financial gap that many local businesses and other organizations experience from other federal relief measures, by providing additional support.

The RRRF was recently updated for southern Ontario, through FedDev Ontario, to include increased contribution and non-repayable (grant) amounts. RRRF conditionally-repayable loans have now increased from $40,000 to $60,000.

Repayment forgiveness is based on repayment of the loan portion prior to December 31, 2022. If eligible, the amount of repayment forgiveness is 25% on the first $40,000, plus 50% on amounts between $40,000 and $60,000. RRRF interest-free loans may provide up to $1 million and can significantly reduce financial pressures because no payments are required until January 1, 2023.

To qualify, applicants must be a Canadian or provincially incorporated business, co-operative or Indigenous-owned business located in southern Ontario with 1 to 499 employees. Economic development organizations and social development organizations engaging in commercial activities are also eligible.

A requirement of the fund is that the business is expected to have already applied to other relief measures for which they are eligible, including CEBA (Canada Emergency Business Account). The RRRF will consider eligible

Adrian Visekruna, a Senior Manager at KPMG specializes in R&D and Government Incentives programs. Photo courtesy of Sooters Photography Studio.

costs not covered by these other programs.

The fund provides support for costs such as payments for existing equipment and machinery, salaries and benefits, and operating expenses such as utilities and rent. RRRF support is meant to be complementary to other COVID-19 relief measures and will therefore not duplicate any support provided by other government sources.

Ineligible costs are those which are not directly related to the business’ fixed operating expenses, such as mortgage payments, refinancing, new capital expenditures or land acquisitions.

Applications can be submitted up to March 31, 2021; however, applications will be reviewed as they are received until the fund has been fully committed. For more information, visit: FedDevOntario.gc.ca.

Source: Adrian Visekruna, KPMG LLP (KPMG.ca).

Canada Emergency Business Account

The Canada Emergency Business Account (CEBA) is an interest-free loan provided by the government to support businesses during the COVID-19 pandemic.

A portion of this loan is considered forgivable provided the loan is paid back by the deadline. This of course is subject to conditions set by the Government of Canada.

Further information can be found by logging on to: Ceba-Cuec.ca.

Businesses could originally apply to receive a CEBA loan of up to $40,000. The federal government has since authorized an expansion of an additional $20,000 for qualified businesses. The deadline to apply for a CEBA loan of $60,000 or the $20,000 expansion is March 31, 2021. Up to 33% of the CEBA loan amount is forgivable.

Let us assume for arguments sake your business received a CEBA loan in the amount of $40,000. The forgivable amount for that loan would be $10,000 provided of course that the remaining $30,000 is repaid in the time frame that has been set by the government.

The forgivable amount of the CEBA loan, even though it may be forgiven at some time in the future, is still taxable in the year that the loan was received.

For instance, your business has received a $40,000 CEBA loan in 2020. Your deadline for repayment of that loan is some time in 2022. That $10,000 forgivable amount must be claimed as income on your 2020 tax return assuming you have a December 2020 year-end.

There is an election that, if filed in 2020, will provide for a deferment. The business that received the loan must reduce their nondeferrable expenses by $10,000 in 2020.

Essentially, by doing this, the business would eliminate the income inclusion in 2020 for the amount of the loan that is considered forgivable.

Should a CEBA loan recipient fail to repay the loan by the deadline that has been set, then there may be no portion of the loan that would be forgivable.

Chandra Sekhar Kancheti, Managing Partner at Maurice Morneau Tax. Photo courtesy of Vikas Vattikonda.

For example, you have received a $40,000 CEBA loan with a repayment date of December 31, 2022. By the repayment date, you will be required to pay $30,000 with the extra $10,000 being forgivable. If you have not repaid the $30,000 by December 21, 2022 then the $10,000 would no longer be forgiven. The full amount of $40,000 would be due.

If the CEBA loan is deemed unforgivable, the recipient of the loan can claim a deduction for the previously included income on their taxes in the year that the CEBA loan is repaid.

Source: Chandra Sekhar Kancheti, Managing Partner, Maurice Morneau Tax (MauriceMorneauTax.com).

Canada Emergency Wage Subsidy

The federal government has extended the Canada Emergency Wage Subsidy (CEWS) to June 30, 2021. At the time of writing, in midFebruary, only details for claim periods up to March 13, 2021 have been announced.

The program has changed significantly since it was first rolled out by the federal government, back in March of last year.

Originally, certain employers (taxable corporations and trusts, individuals, registered charities, non-profit organizations and certain partnerships) were required to have experienced a decrease in certain qualifying revenues of 15% in March 2020 and 30% in each period after that, until rules changes came into effect in July.

Qualifying revenues generally include sales or other inflows of cash that arise from an employer’s normal business activities in Canada for a given period.

The decrease in revenue was, and still is, determined by comparing monthly revenue either on a year-over-year basis (April 2020 to April 2019) or to the average qualifying revenue for the months of January and February 2020 (April 2020 to average January and February 2020).

If the eligible employer experienced the required revenue drop, they would qualify for a subsidy equal to 75% of their qualifying wages.

Effective July 5 the 30% revenue reduction rule went away and going forward an employer would simply have to experience a drop in revenue that was greater than 0% for a given period.

However, the rules to determine the subsidy rate also changed and would now be tied to the actual revenue decrease as opposed to the fixed 75% rate available previously.

A “safe harbour” rule was also introduced to ensure employers would be provided the most favourable result through the transition period. Meaning that, if under the new rules the subsidy rate was less than what they had received previously, they could continue to use the old rules through to the end of August.

As well, the subsidy rate is now made up of a base wage component and, for those employers hardest hit by the pandemic, a “topup” component.

The maximum subsidy rate available under the new rules, was initially increased to 85% if an employer qualified for the top-up.

For the period December 20, 2020 to March 13, 2021, the wage subsidy has again been modified so that the maximum top-up percentage has been increased to 35% from 25% for a maximum subsidy rate of 75%.

Find further details on: Canada.ca/en/ revenue-agency/services/subsidy/emergencywage-subsidy.html.

Source: Michael Piccolo, Roma & Associates Professional Corporation (RomaAndAssociates.vpweb.ca).

Canada Emergency Rent Subsidy

The Canada Emergency Rent Subsidy (CERS) provides financial assistance for

eligible fixed property expenses, including rent and interest on commercial mortgages until June 2021. CERS replaces the previous Canada Emergency Commercial Rent Assistance (CECRA) program that expired on September 26, 2020. CERS is paid directly to the retailer and is proportional to revenue reduction.

The maximum “base rate” subsidy of 65% is reached at a revenue reduction of 70% or more and is proportionately reduced to 40% assistance at 50% revenue reduction. Hence, each percentage point of revenue reduction between 50% and 70%, generates 1.25% assistance on eligible rental expenses.

The rate of assistance drops to 0.8% on each point of revenue reduction between 0% and 50%.

Expenses eligible for the CERS subsidy include, commercial rent, property taxes (including school taxes and municipal taxes), property insurance, and interest on commercial mortgages.

The sales tax component on these expenses (most typically on the insurance portion) are not eligible expenses. This would be true for lease agreements entered into before October 9, 2020 (and lease agreements that are continued thereafter).

Eligible expenses for any given location are $75,000 per qualifying period with maximum eligible expenses of $300,000 for affiliated entities per qualifying period.

Any size of company will qualify for some assistance (presuming revenue reduction) and larger/more expensive locations are not excluded as was the case for CECRA. These changes help address two of the retail industry’s primary issues with the previous CECRA program. Reference periods are the same as those for CEWS.

The applicable rate of assistance will be determined by the change in an eligible entity’s monthly revenues, year-over-year, for the applicable calendar month. For example, November 2020 compared to November 2019. Alternatively, an entity can choose to calculate its revenue decline by comparing its current reference month revenues with the average of its January and February 2020 revenues.

Once you have chosen between these two options, you must use that method consistently for the three periods covered by these rules, i.e., until December 19, 2020 and do so for both CERS and CEWS (if you are also claiming CEWS).

As with CEWS, you have the option, in any qualifying period, to use either the current month’s revenues or the previous month’s revenues as the basis for the CERS application.

In essence this is a “better of” outcome for retailers and ensures at least two consecutive months of assistance at the same level.

For more information, visit: Canada.ca and follow the links.

Source: Retail Council of Canada (RetailCouncil.org).

COVID-19 Energy Assistance Program

The Province of Ontario is providing $9 million to help residential customers who are struggling to pay their energy bills as a result of COVID-19.

The province is also providing $8 million to support small businesses and charitable organizations who are struggling to pay their energy bills as a result of COVID-19.

Residential consumers may be eligible for up to $750 in support towards their electricity and natural gas bills under the CEAP program, while small business owners may be eligible for up to $1,500 under CEAP-SB.

Both are one-time on-bill credits for eligible customers.

“Residential customers with overdue balances will likely qualify, as will small businesses with similar overdue balances,” says Robert Spagnuolo, Director of Customer Service for EnWin. “Available amounts would cover overdue balances up to those specified limits.”

Applications generally take 10 days to process, explains Spagnuolo.

“We are actively encouraging our small businesses, charitable organizations and residential customers who need help, to visit our website and fill out an application form,” he adds. “These programs are only available while funds last so customers should act now.”

Starting in January 2021, available credit amounts increased and more businesses became eligible to access funding.

Contact your utility at: EnWin.com or UnionGas.com to find out how to apply.

More information is also available from the Ontario Energy Board at: OEB.ca.

Source: Province of Ontario and EnWin Utilities.

Federal Lockdown Support

Lockdown Support is extra rent assistance offered to businesses that are subject to a lockdown under a public health order, and it is part of the Canada Emergency Rent Subsidy (CERS) program.

A top-up CERS subsidy of 25% will be available for retailers who are temporarily shut down or “significantly limited” by a mandatory public health order. The trigger for this subsidy will be a public health order issued by a federal, provincial or territorial government, or by a municipality or regional health authority.

The top-up subsidy, also referred to as Lockdown Support, is retroactive to September 27, 2020 and eligibility will continue until June 2021. The rules below were in place until December 19, 2020.

Details for the top-up subsidy between December 20, 2020 and June 2021 will presumably be forthcoming toward the end of this year.

The public health order must stipulate the cessation of some type or types of activity at the location (you cannot self-select in this regard) and the cessation must last for at least one week. Moreover, if a complete shutdown

is not ordered, it must be a cessation that reduces revenues at that location by at least 25% relative to the relevant pre-pandemic period.

For example, a retail store that is ordered to close down its location in a mall, but continues to provide online sales and curbside pick-up, could qualify, as long as its in-store sales normally accounted for at least 25% of its revenues.

Reductions in hours of operation or imposition of physical distancing rules would not qualify for the top-up.

Locations that are ineligible for the CERS base subsidy (because they have seen no revenue reduction) will not qualify.

To be clear, retailers are not required to be eligible for the maximum base subsidy, just some portion of the base subsidy, in order to qualify for the top-up.

The 25% top-up subsidy means the amount of eligible expenses that will be paid, not 25% of the base subsidy. So, for example, a retailer that has seen a revenue reduction of 40% and had also been subject to a public health order that has “significantly limited” its operations for a month.

For more details refer to: Canada.ca and follow the links.

Source: Retail Council of Canada (RetailCouncil.org).

PPE, Property Tax and Energy Cost Rebate Grants

The Ontario government is expanding the number of small businesses that can apply for the Main Street Relief Grant to help offset the costs of purchasing Personal Protective Equipment (PPE) to cautiously and gradually reopen in parts of the province.

Small businesses with two to 19 employees in all eligible sectors — expanded from two to nine employees — including those in the arts, entertainment, and recreation sector, can now apply for up to $1,000 in financial support.

This one-time grant reimburses main street businesses for up to $1,000 in PPE costs incurred since March 17, 2020. Eligible businesses for the Main Street Relief Grant now include those with two to 19 employees in the following sectors — retail trade; accommodation and food services; repair and maintenance; personal and laundry services; gyms and yoga studios; and arts, entertainment, and recreation.

The grant can be used to help cover the costs of a variety of PPE, including installing plexiglass or purchasing gloves and masks. Eligible businesses can apply for this grant and others, including the Ontario Small Business Support Grant and property tax or energy cost

Welcome

KPMG in Windsor is proud to welcome our newest KPMG Enterprise Tax Partner, Dan Dwyer. Dan is client-focused and brings practical advice to complex business issues.

Connect with Dan Dwyer

T: 519-251-3536 E: danieldwyer@kpmg.ca Linking our know-how and joining forces.

© 2021 KPMG LLP, an Ontario limited liability partnership and a member firm of the KPMG global organization of independent member firms affiliated with KPMG International Limited, a private English company limited by guarantee. All rights reserved. 10911 rebates — through a simple online application.

Small business owners can go to the website: Ontario.ca/smallbusiness to learn about the many supports available.

These include resources to find Ontariomade PPE through the Workplace PPE Supplier Directory, tools to build or expand their online presence through Digital Main Street, tailored local support through the Small Business COVID-19 Recovery Network, and free financial advice.

Source: Province of Ontario (Ontario.ca).

On The Road To Recovery

We are at a critical point in the pandemic, economically and health wise.

Though we are at a crossroads and the future cannot be predicted (perhaps more lockdowns?), all in all, there are numerous programs and grants designed to help businesses work their way through the pandemic until the economy returns to a new normal.

They won’t replace everything that’s been lost, but they might provide a glimmer of hope moving forward.