Partners

August September

Property Council of Australia (Victoria Division)

Level 7, 136 Exhibition Street

Melbourne Victoria 3000

Phone: 03 9650 8300

Fax: 03 9650 8693

Email: vic@propertyoz.com.au

Website: www.propertyoz.com.au

EDITOR

Danni Addison

Phone: 03 9650 8300

Email: daddison@propertyoz.com.au

Property Victoria is published bi-monthly. The Publisher reserves the right to alter or omit any article or advertisement submitted and requires indemnity from the advertisers and contributors against damages or liabilities that may arise from material published.

WARRANTY AND INDEMNITY

Advertisers and/or advertising agencies upon and by lodging material with the Publisher

twitter.com/propertyozvic

for publication or authorising or approving at the publication of any material INDEMNIFY the Published, servants and its agents against all liability claims or proceedings whatsoever arising from the publication without limiting the generality of the forgoing to defamation, slander of title, breach of copyright, infringement of trademarks or names of publication titles, unfair competition or trade practices, royalties or violation of rights or privacy AND WARRANT that the material complies with all relevant laws and regulations that publication will not give rise to any rights against or liabilities in the Published, servants or agents and in particular nothing therein is capable of being misleading or deceptive or otherwise in breach Part IV of the Trade Practices Act 1974.

COPYRIGHT

No part of this publication may be reproduced, stored in a retrieval system, or transmitted in any form or by any means electronic, mechanical, photocopying, recording or otherwise without permission of the Publisher.

www.propertyoz.com.au

DESIGN

Blick Creative

1st Floor/382 Queens Pde

Clifton Hill VIC 3068

www.blickcreative.com.au

DISPLAY AND CLASSIFIED ADVERTISING

Danni Addison

Property Council of Australia (Victoria Division)

Level 7, 136 Exhibition Street

Melbourne VIC 3000

Phone: 03 9650 8300

Fax: 03 9650 8693

Email: daddison@propertyoz.com.au

MAJOR PARTNERS

shape t he present — enrich the future

SuSTAINABILIT y PARTNER

DESIGN PARTNER

Ithas been famously said that cities are humanity’s greatest inventions. What makes them great is that they are, by their very nature, eternal. They are living entities; always growing, constantly moving and forever evolving.

Like people, cities are often relied upon by others for their success. If a city is productive and functional, it is of great value to those who live around and within it. If a city is inefficient and disorganised, then the reverse tends to be true.

In a nation like Australia, where our major cities host over three quarters of the population and produce 80 per cent of the nation’s economic output, city health remains critical to the wellbeing of us all.

In Victoria, no city is more important to our future than Melbourne. Home to 4.2 million people and over 70 per cent of Victorian GDP, Melbourne represents the heartbeat of our state.

At present, our most important city is going through a complex stage in its personal development. In many ways, Melbourne is like a sprouting teenager. Its body shape is changing (growth areas and infill), its wardrobe isn’t fitting as well as it used to (roads and rail) and from time to time, it is struggling with the stress of changing circumstance (congestion). Put simply, it is having a challenging time growing up!

When you look at the development of other worldly cities, the challenges of rapid growth are obvious. According to the author of Living in the Endless City, Ricky Burdett, within the next 38 years, 75 per cent of the world’s population will be living in cities. Over six billion people!

All over the world, cities are growing fast. Small ones are becoming large, and large ones are merging with their neighbours. Whereas once two cities could happily coexist 50km apart, today, they are merging into one continuous urban zone with two CBD’s at opposite ends of their mass.

It is within this context that Melbourne must now consider its future. Melbourne is clearly not facing the massive challenges facing the world’s mega-cities, but it is experiencing the highest numerical growth rates of any capital city in the country. Whereas in 2012 Melton and Sunbury are recognised as satellite cities of Melbourne, within 30 years, they will be better known as the outer suburbs. Much like the Frankston’s and Dandenong’s of old, Melbourne will eventually make them its own.

In order to ensure Melbourne retains its uniqueness during this special phase in its development, it is essential that our planners get our growth plans right. At present, the Baillieu Government is in the midst of developing a new metropolitan planning strategy for Melbourne. The point of this strategy is to establish a deliverable long term growth vision for our city.

From the Property Council’s point of view, we believe two key things will be necessary for Melbourne to remain a successful and livable city over the long term.

First, it must ensure the needs of its growing population are continuously met. This includes an effective public transport system; reliable public services, affordable housing choices and plentiful open space to encourage interaction, connectivity and idea sharing. Like a developing human being, a stable foundation will be a key ingredient for success.

The second essential requirement is the ability to attract and retain talent. Just as individuals compete amongst themselves for jobs, opportunities and incomes, cities compete for skilled labour, fame and

Jennifer Cunich Executive Director, Victoria Divisioninvestment. In order for a city to survive and thrive, it must remain competitive with its peers. Success attracts success. Consequently, a city which hosts an abundance of talent will invariable have an easier time attracting and retaining it.

So globally speaking, how does Melbourne measure up? Are we the healthiest and most attractive city we can be? Or are we falling behind, relying on past glories and self-satisfaction to help us get by?

The answer unfortunately, is somewhere in between. Melbourne is in okay shape, but we are far from what we could be.

So what can we do to make things better?

On the 7th of September 2012, the Property Council will be hosting its third annual Growth Summit. A key theme of the event will be how to successfully manage the complex priorities of growth, prosperity and liveability. We think it is the one of the greatest public policy challenges of our time.

Professor Ricky Burdett, head of the London School of Economics’ Cities Program and author of Living in the Endless City, will be our keynote speaker. He will be addressing the issue directly. As Melbourne plans for its long term future, it is important to remember that we have a great deal to look forward too. Our city has the potential to be amongst the most impressive in the world. As a result, all Melbournians must take an active role in shaping its future. After all, even though the city may be one of humanity’s greatest inventions, it doesn’t mean it cannot be improved.

Jennifer Cunich Executive Director, Victoria Division Property Council of Australia

This march towards urbanisation represents one of the most remarkable civilisational evolutions in human history. It also represents one of the most disruptive.

Fishermans Bend is a bold vision for urban renewal. It is one of Melbourne’s greatest competitive offerings and will carry this city into the coming decades in ways we can’t yet imagine.

But Fishermans Bend needs some guidance, a few questions answered and an ongoing commitment from government to see it through.

The Property Council has developed a plan for Fishermans Bend and in it we outline what we believe should be the top priorities for the precinct. The task ahead is huge, but if we’re going to get the most out of Fishermans Bend for Melbourne as a city, these are the crucial things that need to be worked out upfront.

An agreed vision for the future of Fishermans Bend must be clear from the beginning. It must be developed in conjunction with the community, public and private stakeholders and the investors who will make Fishermans Bend a reality. Clear governance arrangements will be critical. Currently, two local governments have interests across the precinct. This combined with the Victorian Governments’ interests, will inevitably lead to conflict and inconsistency.

A single approval authority must be established with the responsibility to oversee all areas of development assessment and approval in line with the agreed vision for the precinct. This authority should report directly to a single minister. We also believe a single local government should have responsibility for the precinct in alignment with the Central City Zone structure. This will only be effective if municipal boundaries are redrawn and will take some political courage.

A comprehensive audit of the entire precinct is required to understand the overall status of Fishermans Bend – what is or isn’t developable, the current land uses, if existing infrastructure has the capacity to cope with growth. An overall audit of this magnitude is absolutely necessary and it needs to be done now. This information must be made publicly available to fully inform commercial decisions in and around the precinct.

A clear development plan for Fishermans Bend should outline the development stages to ensure existing and planned infrastructure assets are used efficiently. The development plan must respond to the size of the precinct, acknowledge it cannot be developed all at once, and consider the flow-on effect of rezoning on land values, land supply and market drivers.

The Victorian Government should take a ‘shop-front’ approach to attracting investment into Fishermans Bend. A one-stop-shop for information and engagement must be established early so that stakeholders and investors are able to access information and engage with government in an efficient and informed manner.

Hard infrastructure needs to be planned for at the precinct level. This will be central to the success of Fishermans Bend, its integration with Melbourne and the liveability its future community will enjoy.

A transport plan must be developed that outlines the public transport required to service Fishermans Bend and how this public transport will link into Melbourne’s existing network. It also needs to be aligned to the precinct’s development plan so that a solid transport network evolves as and when it’s needed.

Community infrastructure such as schools, child care, sporting facilities, street lights and policing requirements are vital to the life of a community. Population projections and other forecasts should form the basis of government planning so that community infrastructure is delivered as and when the community grows. The Victorian Government must establish clear development rules for the provision of future community infrastructure based on population trigger points.

The big question of how infrastructure – both hard and soft – will be funded in Fishermans Bend must be answered up front. The Victorian Government should establish fixed and equitable infrastructure funding mechanisms which provide certainty to the property industry and

do not undermine housing affordability objectives.

Considerations such as open space requirements, heritage values and environmental considerations need to be established and locked in time. The goal posts should not be changed once they are set. Business stakeholders, the community and future governments need a fixed framework to work within if Fishermans Bend is to evolve to the highest standard possible.

The Victorian Government must develop a transparent action plan for either relocating or compensating the existing land users in the Fishermans Bend precinct. These existing uses include business, industrial and even the freight and logistics route that runs through the middle of Fishermans Bend.

The entire Fishermans Bend precinct should be compatible for embedded energy prior to redevelopment in order to avoid modern technology lying idle. Invest in precinct-wide decentralised energy should be made upfront. In addition, an easy and cost effective process for the private sector to invest in decentralised energy technologies must be established.

Rome wasn’t built in a day. And yet we forget that cities need time to reach their full evolution. Critics of bold visions for urban renewal would do well to remember this. With good planning, realistic expectations and a certain and transparent modus operandi, Fishermans Bend will be the legacy its designers want it to be.

For Fishermans Bend, it’s time to get stuck into the detail and there’s no time like the present.

is set to receive an overhaul of its commercial, residential, industrial and rural planning zones. The reformed zones are intended to enable the planning system to act as an economic lever and provide new mechanisms for communities to achieve a balance between defined areas of future growth and neighbourhoods where character is important to protect.

By consolidating and reducing the Victoria’s existing zones the aim is to provide major red tape reduction and productivity benefits, provide easy transition for employment areas into higher density employment in mixed use areas and for Victoria to become the most competitive state for retail and commercial development.

• Consolidates existing Business 1, 2 and 5 Zones

• New purpose for zone: “to create vibrant mixed use commercial centres for retail, office, business, entertainment and high density residential uses.”

• Makes retail a ‘no permit required’ use, with no conditions or floorspace restrictions

• Office - no permit required, removes floorspace conditions. Allows greater density of employment in existing employment areas.

• Education centre - no permit required, removes conditions which prohibit primary or secondary schools

• Exhibition centre (art galleries, museums) - becomes a ‘no permit required’ use, without conditions.

• Accommodation (including dwellings) becomes a ‘no permit required’ use, without conditions.

• Consolidates existing Business 3 and 4 Zones

• New purpose for zone: “to develop commercial areas for offices and appropriate manufacturing and industrial uses that do not affect the safety and amenity of adjacent sensitive uses.”

• Allows transition to higher employment densities in existing employment areas

• Office - becomes a ‘no permit required’ use, and removes floorspace conditions.

• Retail generally will be a ‘permit required’ use, except:

» Supermarket becomes ‘no permit required’ for smaller supermarkets of 2000sqm or less.

» Larger ones will required a permit.

» Smaller shops will be allowed in conjunction with supermarket developments without permit, and otherwise will require a permit.

» Allows greater variety of retail with Food and drink premises,

» Restricted retail and Trade supplies becoming ‘no permit required’ uses.

• Accommodation (excluding dwellings) becomes a ‘permit required’ use – to allow consideration of tourism developments or similar by councils.

Residential Zones

• Residential 1, 2, and 3 zones the be replaced with new residential zones

» Neighbourhood

Residential Zone

» General Residential Zone

» Residential Growth Zone

• Changes to Low Density, Residential, Mixed Use and Township Zones

• The Neighbourhood Residential Zone will focus on urban preservation, with a default density of a maximum of two dwellings per lot, and default height controls of nine metres.

• The Residential Growth Zone aims to support housing growth and diversity; allowing for a mixture of townhouses and apartments with underground parking and with a discretionary three storey height control.

• The Residential Growth Zone will focus on modest urban growth.

The Property Council will be lodging a submission with the Victorian Government in September 2012 as part of the consultation process.

For more information, contact Felicity Cunich on 03 9650 8300 or at fcunich@propertyoz.com.au

Industrial Zones

• Remove default 500sqm cap on office space

• Industrial 3 Zone - Supermarket becomes ‘no permit required’ for smaller supermarkets of 2000sqm or less. Larger ones will require a permit. Smaller shops will be allowed in conjunction with supermarket developments

ICD

Thiess

Blick Creative Associate

GJK Facility Services Associate

Michael Page International Associate

Net Balance Associate

Workplace Focus

TASMANIA

Cumulus

Ms Geraldine Berzins

Mr Matthew Dalmau

Mr Mark Schiffer

Mr Elias Stamas

Mr Dave Storey

Ms Astrid Edwards

Ms Priscilla Swiger

Mr Peter Walker

Correction Note: The address for Allied Pickfords in Victoria has been updated to Unit 3, 148-152 Bangholme Road, Dandenong. More information can be found at www.alliedpickfords.com.au

Asher Judah has been appointed as Property Council’s Victorian Deputy Executive Director. Asher joined Property Council in June 2012 having worked for over a decade in the construction, development and agribusiness sectors. With a strong background in industry associations, Asher has extensive experience in the policy, media and government relations fields. During his time with the Master Builders Association, Asher managed their $500,000 State Election advertising campaign which was instrumental in securing $750m worth of residential stamp duty cuts. Asher is also a published author.

Geoff Gourley, global social entrepreneur, has joined NuGreen Solutions, an innovative national company that finances and manages sustainable projects. Over the past decade Geoff has been active in delivering asset repositioning, retro

fitting and energy efficiency upgrades of commercial assets, advocating innovative green building initiatives that reduce greenhouse emissions and deliver economic benefits.

According to Geoff, “the timing is right for business to adapt to a low carbon economy and NGS assists owner’s upgrade their assets and helps businesses of all sizes become more energy efficient and saves them money, adapting makes economic and environmental sense.”

Gabrielle Kuiper has been appointed Senior Advisor, Climate Change, Energy and Environment in the Prime Minister’s office in Canberra. Dr Kuiper will advise on the portfolios of climate change, energy efficiency and environment.

Dr Kuiper was previously head of environmental sustainability for the ANZ bank, has also held roles with VicUrban and Investa, and is a former member of the Property Council’s Sustainability Development Committee.

David Hartney has been appointed as Maddocks’ newest partner in the Development team. David joined the firm in August 2011 and is involved in all areas of real estate development including retail, industrial, office and residential. He is energised by real estate development because it is such a dynamic environment. David loves structuring and negotiating deals in a way that manages risk and provides solutions to allow real estate development to happen. Being Melbourne born and bred, he takes great pride in seeing the developments he has been involved in across the city.

Planningzone reform will not lead to a free-for-all across Victoria as suggested by Michael Buxton (The Age, 15 July 2012).

In fact, the proposed zoning amendments will do the exact opposite if they are enforced correctly. For almost two decades, communities, planners and developers have been calling for greater certainty in regard to local planning powers.

The proposed reforms seek to provide that certainty by designating clear areas for development and by protecting those areas deemed sacrosanct. If embraced by local councils, these reforms can be used to shape local communities the way locals want. They should be given a chance to succeed.

Jennifer Cunich, Letter to the Editor, The Sunday Age, 22 July 2012

Almost650,000 extra residents moved to Melbourne in the 10 years to June 2011 according to ABS data released in July 2012.

Property Council of Australia (Victoria) executive director Jennifer Cunich said more infrastructure was needed for Melbourne to keep pace with its rapid growth.

Ms Cunich said toll roads and government partnerships with the private sector were among ways to accelerate investment.

Wes Hosking, Herald Sun, 1 August 2012

TheProperty Council’s latest Office Market Report released on 2 August 2012 told a story of rising vacancy rates in Melbourne.

The Property Council’s Victorian executive director Jennifer Cunich said the local market’s long-term health was now “highly dependent” on the future tenant demand. “As a legacy of the GFC, Melbourne’s developers have become dependent upon precommitments to secure project funding,” she said. “Consequently, attracting future tenants to Melbourne remains vital to the sector’s future.”

Nick Leneghan, Australian Financial Review, 2 August 2012

•

•

• Tax Depreciation

• Project & Contract Administration

• CAPEX & Maintenance Forecasting

• Expert Witness Reporting / Defect Reports

• Asbestos & Hazardous Materials Registers / Assessments

• Environmental Investigations (PSI / DSI)

• NABERS & BEEC

Between the launch of Ricky Burdett’s latest book Living in the Endless City and his role as Chief Advisor on Architecture and urbanism for the London 2012 Olympics, Property Victoria caught up with Ricky to get his thoughts about the future of the world’s mega-cities and what this could mean for Australian cities.

Q1.In the next 25 years, 75 per cent of the world’s population will live in cities. What is the greatest challenge for humankind as the way we interact with each other continues to evolve and our use of the world’s resources is further concentrated?

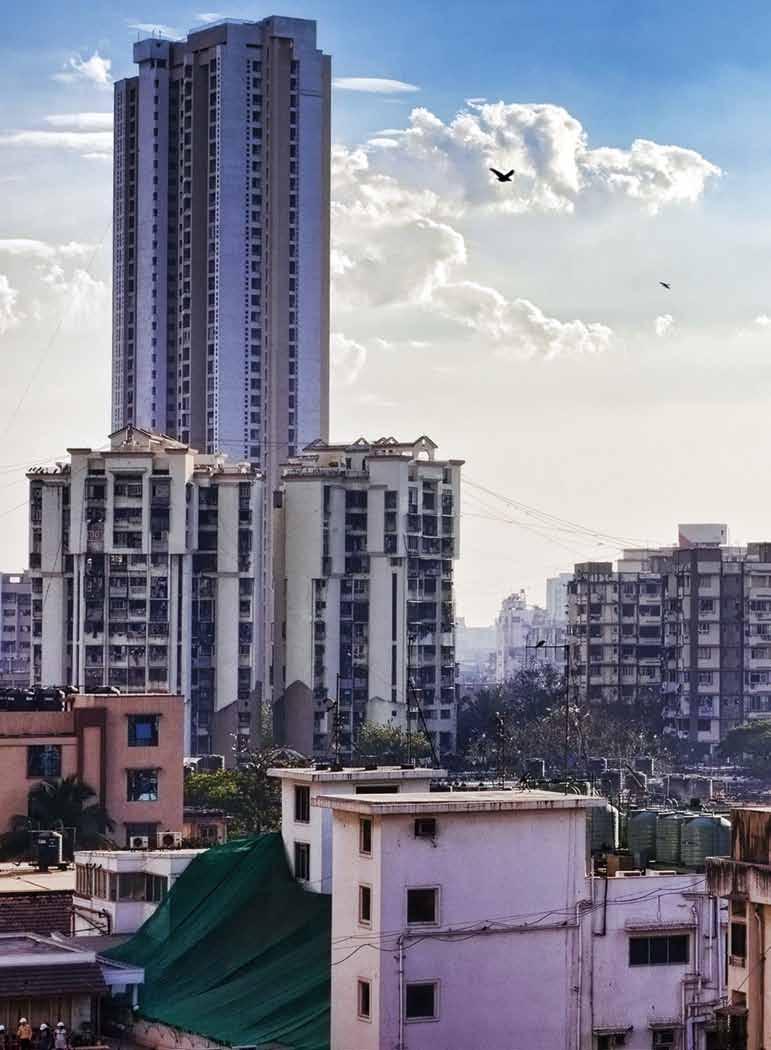

It is not only the scale but also the pace of urbanisation that is unprecedented. Some cities in India and Africa – Lagos, Mumbai and Dhaka - are growing at rates of 40 or more people per hour (London, by comparison, is growing at just over one person per hour after a long period of decline). This is adding populations of over 200,000 to areas that were only villages a few decades ago. This rate of change poses massive challenges for planners, politicians and residents alike.

How do you provide the basic infrastructure – electricity, sewers, clean water, housing, schools and hospitals –to create dignified conditions for new generations of urban residents? Especially in emerging economies which today consume low levels of energy per capital? This is the greatest challenge of the next 25 years. Yet, I am optimistic. History has shown us that we can get this right. Most mature industrial cities in Europe and North America expanded dramatically in the 19th century, albeit at a slower pace.

The lessons of Idelfonso Cerda in Barcelona, Baron Hausmann in Paris and the 202-year-old Manhattan Grid are

Ricky Burdett Professor of Urban Studies, London School of Economics

Ricky Burdett Professor of Urban Studies, London School of Economics

sustainable models of urban expansion which have stood the test of time. The common factor that underlies these very different urban systems is a belief in a compact and continuous form of urban development, one that is resilient and flexible and that can be sustained by efficient forms of public transport. While today cities consume over 60 per cent of world energy and contribute to 75 per cent of global CO2 emissions, they have the potential to be less demanding on the world’s resources if they are planned and managed as dense, well-connected urban metabolisms. This is the model of the 21st century city.

With this rise in increasing urbanization, and particularly the rise of ‘mega-cities’, is there a new form of urbanism emerging? Is the ‘mega-city’ just a larger version of the historic city or is the ‘mega-city’ a new type or form of urbanity?

Clearly, the emergence of what Edward Soja has identified as ‘mega-city regions’ of over 30 and 40 million people are changing the impact of cities on the face of the earth. These are concentrating in the Pacific Rim, India and parts of Africa. It is worth remembering, nonetheless, that the United Nations projects that the greatest growth will be in cities of less than one million people over the next decade or so.

But large cities, mega-cities of over ten million, are not in themselves problematic. It is a question of physiognomy rather than scale. Tokyo’s greater metropolitan area of over 36 million is still today one of the most efficient in the world, with average commuting times at less than an hour and over 80 per cent of the population taking public transport to go to work.

Los Angeles, by contrast, has much longer commuting times due to its sprawling structure with over 80 per cent using private cars to get to work. Mexico City and Sao Paulo present equally problematic scenarios with populations of 14 and 22 million respectively. But hyper-dense Hong Kong contains about 8 million people in a very tight footprint where average commuting distances are 11 minutes and only 6 per cent of the population uses a car to get to work.

Therefore there is no one model of the 21st century mega-city. What is becoming prevalent, though, is that 21st century ‘global’ cities – like Mumbai, Sao Paulo or Lagos – are becoming more and more socially unequal. In these regions, up to 60 per cent of the urban residents live in slums, in conditions where the underclass sustains the global status of these emerging economies, as Saskia Sassen has observed. To my mind, the greatest risk in these cities is that if they continue to grow with the same proportion of slum-dwellers they will soon become socially dysfunctional or, worse, cauldrons of social discontent. For example, Mumbai is set to overtake Tokyo as the world largest city by 2050. If 60 per cent remain slum-dwellers, Mumbai will have the combined populations of Paris, London and New York living in unacceptable urban conditions next to some of the richest families in the world. This is not only morally problematic, but socially irresponsible, and planning can play an important role in setting a democratic agenda.

Melbourne is often regarded as the world’s most liveable city. As the world’s cities rapidly grow and change, how can a city’s liveability be maintained and is liveability the only hallmark of the success of a city?

I am about to visit Australia for the first time, so really cannot comment with any authority on individual cities. But I know from the work of Rob Adam, Greg Deas and Jan Gehl how much investment has been made in making ‘parts’ of your cities more liveable.

Continued next page >

But, one has to face up to the reality that Australians enjoy space and that this understandable notion – born from a visceral attachment to the very DNA of your country – has costs when it comes to urban form.

The level of sprawl, car-dependency and dispersion in the Australian city is significant and, despite recent successes, there seems to be far more to do to deal with these profound behavioural and structural challenges.

At the London School of Economics, we have been studying cities like Stockholm and Copenhagen, which offer exceptional models of ‘first-world’ green leadership. Portland, Seattle and Toronto in North America have also shown that it is possible to counter the classic ‘gas-guzzling’ American way.

But low-cost, low-infrastructure solutions of cycle-ways and cheap bus rapid transport systems in Bogota, Curitiba and Medellin, or the inventive higherdensity housing typologies of other South American cities offer promise and lessons for of all us interested in creating sustainable urban environments.

In the end, I am very sceptical of any form of city rankings which, by definition, are culturally biased and necessarily simplistic. Frankly, most European cities which come out on top – Zurich, Geneva or Malmo – are hardly the most exciting places to live in for younger people in search of passion, challenges and excitement.

As Richard Sennett has pointed out in his writings, cities require complexity to be successful; they must be inclusive and tolerant without becoming homogenous

and uni-dimensional. If Melbourne is going that way, then it deserves its Oscar status!

On Friday 7 September 2012, the Property Council will be hosting its third annual Growth Summit. A key theme of the event will be how to successfully manage the complex priorities of growth, prosperity and liveability. We think it is the one of the greatest public policy challenges of our time.

Professor Ricky Burdett, head of the London School of Economics’ Cities Program and author of Living in the Endless City, will be our keynote speaker.

For more information and to reserve your place visit www.propertyoz.com.au/vic

Friday 7 September | Peninsula at Atlantic, Docklands

Napier & Blakeley is Australia’s leading acquisition technical due diligence consultant and in the last 2 years has advised Vendors and Purchasers on over $10 billion of real estate transactions and capital expenditure planning nationally.

Itis now universally recognised that cities are of first order importance as a matter of public policy not only in this country but also around the globe. This is increasingly obvious in Australia where three quarters of our population now live in cities above 100,000 people. It is clear that Australia’s national wellbeing is increasingly dependent on its major cities. Cities have contributed 80 per cent of Australia economic growth during the past five years. However for much of our history since European settlement, the material significance of our cities has tended to be ignored or understated in public discourse. This is an issue that needs to be addressed.

The importance of especially metropolitan cities in a national economy as well as their strategic role in global nodes in international markets has lead governments to review their role in cities. The importance of cities is such that the OECD has suggested that nearly all public policies directly or indirectly affect urban development.

The federal government and the Council of Australian Government have recently been reviewing the state of our cities in the context of the Australian federation. It is now widely acknowledged that Australia has been underspending on

infrastructure and will need to spend much more in the future to deal with the pressures now apparent; they include rapid population growth, impacts of climate change and the need to continue to expand our exports using efficient road and rail infrastructure and accessible ports and airports. There also will be increasing cost pressures associated with personal transport as shortages of oil impact on the price of petrol, demanding much more significant investment in public transport. The ever-increasing scale of our low-density cities also makes very costly maintaining equitably the quality of life of an expanding and ageing population These factors are resulting in a debate on how Australia might pay for increasing infrastructure demands. Federal responsibility for infrastructure and urban capital funding has now been faced sparely in the hands of Anthony Albanese and his Department of Infrastructure and Transport Consultation with the States is being coordinated by COAG’s Council on Transport and Infrastructure which has also been tasked to follow through the COAG Reform Councils recommendations on the planning of Capital Cities. The Department is now considering a report from an Infrastructure Finance Working Group which is suggesting a stronger emphasis on ‘user pays,’ the monetarisation/privatisation of existing State capitals assets and various forms of

co-funding as between government and the private sector, as well as suggesting the Commonwealth take a tougher approach to States and Territories to enable better utilisation of Commonwealth funds. It is important to consider these suggestions within a broader context and across a longer time frame.

The reality is that Australia cannot continue to grow its population at the present rate and remain with the settlement pattern that we have inherited from colonial times. Of course financing is important but a narrow technical debate about financing without new ideas for Australian cities would be sterile and lead us nowhere new. The real challenge is to determine a more sustainable settlement pattern not as focused on our fragile coastline, not based on only increasing the footprint of existing cities, rather one that uses whatever capital resources are available to build a more sustainable settlement pattern. Above all else we need to be creative and innovative in an effort to build cities over the next century using a combination of old and new technologies, rail and broadband which can shape a more dynamic urban future. Whatever we do will in the long run cost billions; let us make sure that those billions do really make a difference.

2012

Brian will be speaking at the Property Council’s Growth Summit 2012 on 7 September 2012

For more information and to reserve your place visit www.propertyoz.com.au/vic Friday 7 September | Peninsula at Atlantic, Docklands

No force is more important in the Asia Pacific region than the rapid process of urbanisation currently transforming many countries. China for example is rapidly becoming an urban nation as a result of ongoing migrations of people from rural areas.Brian Howe AO

Victoria is nearing the 160th anniversary of the arrival of the first Chinese immigrants seeking their fortune in Victoria’s goldfields.

Since then, Melbourne has benefitted from an active, diverse and entrepreneurial Asian-connected business sector that has grown significantly. But it is only now, decades later that this Asian based investment is having a meaningful impact on Melbourne’s housing market.

From those humble and sometimes tumultuous beginnings a mutually prosperous relationship has formed between Melbourne and Asia and now this is best reflected in the entrenched Asian influence within our economic, social and cultural lives.

Melbourne’s deeply rooted familiarity with Asia has positioned us well to take advantage of the paradigm shift in favour of the East.

Despite the perception that the influence of offshore capital within our economy is well advanced, it remains in its relative infancy in the residential development context. It is only now, in the current apartment cycle in particular, that the true impact of Asianheritage and offshore capital on market activity is becoming apparent.

There has been nearly $475 million worth of development site transactions in Melbourne’s Central City Region (CCR) (CBD, Docklands, Southbank and St Kilda Road) involving Asian-connected developers and investors since mid-2008. Approximately $275 million of those deals have involved offshore based entrants with little or no previous exposure to either the Melbourne residential market or similar markets overseas. The balance of transactions (being approximately $200 million), have involved entities with existing ties to the city, either locally based but with direct parent company support offshore, or investors supported by offshore capital.

The quantum of this relatively new investment demonstrates the depth of the connection between Melbourne and Asia. It also highlights the importance of existing relationships that have given confidence to offshore investors and been leveraged into acquisitions. Notably, the extent of offshore activity in Melbourne has not been replicated to the same extent in other Australian capital cities. This is partly due to the relatively inactive interstate apartment markets over the same period, but is primarily a dividend of Melbourne’s attributes and city structure which has universal appeal.

Melbourne is on the cusp of a cultural shift in the nature of CCR apartment delivery. The proportion of new CCR apartment supply delivered by new Asian-based developers will increase from zero in 2009-11 to circa 40 per cent in 2015 and is likely to exceed 60 per cent when we include Asian-connected developers with established roots in Melbourne.

Beyond Melbourne’s inner suburbs, offshore based entities have directed their investment toward mixed-use, apartment and townhouse developments. This expansion in activity across the broader metropolitan region demonstrates an increasing understanding of Melbourne’s property market and the alternate opportunities in more ‘locally fundamental’ markets beyond inner city apartments.

Offshore capital flow to Melbourne’s greenfield housing market is not yet significant enough to be meaningful. Whilst current activity does represent a logical step forward, it is mostly restricted to entities with a stronger local presence and understanding of the timelines and diverse issues involved at the urban fringe.

Offshore investment has not been restricted to the conventional ‘development play’. Development funding from offshore banks has followed new entrants against the background of longstanding relationships in their countries

of origin; structured funds (without a development mandate) are looking to place senior debt and more sophisticated capital into deals sponsored by local developers; and strategic alliances in the form of joint ventures and other development agreements are emerging between offshore and local players.

There is a great deal of momentum building around Melbourne’s engagement with our Asian neighbours and this engagement will be most meaningful if it occurs beyond the opportunism presented by the cyclical nature of the property market.

We have an opportunity to pursue a higher order, more culturally intelligent form of engagement with Asia. If we are able to master this form of engagement, it will play an increasingly prominent role in the business environment and evolution of Melbourne as a city.

Business players in Melbourne and throughout Australia must understand what motivates offshore capital. We have to accept that these ventures are not always propelled by the same set of drivers which motivate us. This will be critical to successfully attracting investment in Melbourne and will go a long way toward retaining Melbourne’s competitiveness in a global market where capital is scarce.

Melbourne’s property industry is playing a lead role as it works to attract new capital markets. Be it through apartment development, investment in the wider housing market or through commercial property, the reality is that we are just at the beginning of the Asian Century.

Victoria is changing. The economic landscape has seen exponential growth over the last 15 years and has shifted dramatically.

The Property Council’s 2012 Growth Summit will focus on the strengths and opportunities brought by change and how this will drive a new economic future in Victoria.

Key sessions include:

• State of the State with Brian Howe AO, Stephen Mayne and Tim Colebatch;

• Victoria’s New Economic Paradigm with Jim Minifie, Grattan Institute and Mark Wizel, CBRE

• Infrastructure – Policy to Reality with Dorte Ekelund, Major Cities Unit; Corey Hannett, Regional Rail Link Authority; and Professor John Stanley, UNSW

• Rebalancing Melbourne – Opportunities of the West with Lachlan Bruce, Regional Development Victoria and Vince Haining, Maribyrnong City Council; and

• Make My Melbourne Work with Minister Matthew Guy, George Pappas, Alan Stockdale and Peter Lewis.

Don’t miss this opportunity to engage with industry leaders as Victoria takes the next big steps into a new era and secures the state’s ongoing growth.

Keynote Speaker

Ricky Burdett

Professor of Urban Studies

London School of Economics and Chief Adviser on Architecture and Urbanism for the London 2012 Olympics

Brian Howe

AO, Professorial Associate Centre for Public Policy, University of Melbourne

Stephen Mayne

Founder

Crikey.com.au and Maynereport.com

1. Experience the ultimate in thought leadership

2. Hear about the opportunities of a growing Victoria

3. Understand the drivers behind Victoria’s changing economic landscape

4. Explore new policy frameworks and what they really mean

5. Network with like-minded industry leaders

Jim Minifie Productivity Growth Program Director Grattan Institute

Dorte Ekelund Executive Director

Major Cities Unit, Department of Infrastructure and Transport

• No need to vacate premises

• No need to dismantle workstations

• No extra storage required

• No need to disconnect power and communication cabling

Save up to 50% on recarpeting your office.

Glenn Bailey, Managing Director of Nationwide Modular Carpets says the trend of occupied office carpet replacement is growing rapidly in Australia.

Bailey has 15 years’ experience in occupied office carpet replacement. Using the InterfaceFLOR unique RenovisionsTM workstation lifting system and modular carpets, Nationwide Modular Carpets provide visually stunning, environmentally friendly flooring solutions affordably and efficiently.

“Clear communication with the client is the key to success prior, during and after the carpet replacement has been completed. Carpet can be replaced systematically in stages should the capital not be available, particularly in areas that present an OH & S risk. Building owners get the added benefit of replacing the old carpet with environmentally sound products ensuring that they receive 100% Green Star rating points.”

Glenn Bailey, Managing Director of Nationwide Modular Carpets

To find out how Nationwide Modular Carpets can replace your office carpet without employee downtime contact:

Pty Ltd ACN 131781667 ABN 30 703 908 827 PO Box 5160, South Melbourne, Victoria 3205. p 1300 552 021

f 1300 852 019

e info@nationwidemodularcarpets.com.au

w www.nationwidemodularcarpets.com.au

Thenew Victorian landholder duty model pushes Victoria further away from the standard position adopted in other states, particularly NSW and WA. The Victorian new landholder duty provisions came into effect on 1 July 2012 and make substantial changes to the range of transactions subject to duty in Victoria.

The Duties Amendment (Landholder) Act 2012 implements the move from land rich duty to landholder duty.

Land rich duty applied before 1 July 2012 and imposed duty on acquisitions of shares in private companies or units in unlisted unit trusts that held:

• $1 million or more of Victorian land assets; and

• Land made up 60 per cent or more of the value of assets in the private entity. Landholder duty removes the 60 per cent threshold. That means that entities that only hold an incidental amount of land will now become taxable. That extends the base away from property entities into retailers, manufacturers and other industries where land is only a small component of the asset-base.

Like land rich duty, landholder is payable at 5.5 per cent on the value of the underlying land, once the acquisition thresholds are reached.

Like most other states, duty is now imposed on takeovers of listed entities once 90% of the securities are acquired. This is at a concessional 0.55 per cent rate of duty.

Where Victoria differs from the other states is that:

• The acquisition threshold for unit trusts is set at 20 per cent, but for companies it is 50 per cent. No other state imposes landholder duty without a consistent acquisition threshold for companies and unit trusts.

• Duty is now payable at 0.55 per cent on the value of underlying Victorian land

Nicholas Cliffton Deloitte Australiaassets on a public float of a company or unit trust. No other State imposes this form of duty.

• The $1 million land holding threshold is lower than the $2 million threshold applying in our competitor states of NSW, Qld and WA.

• Economic entitlements are now taxable. This is effectively a new head of charge and no other state imposes this form of duty.

• The “just and reasonable” test is now removed. While it is easy to make fun of a tax that now is payable regardless of whether it is unjust or unreasonable to impose duty, this also means that taxpayers have a much reduced ability to challenge landholder duty assessments. The imposition of duty on acquisition of economic entitlements to land means that classic approaches such as land development agreements are now potentially dutiable. The compliance costs will increase as many transactions are potentially dutiable, even where there is no intention to avoid duty. The taxation of economic entitlements also has a major impact on investment in Victoria, not least in the area of Islamic financing –which relies on the creation of economic entitlements rather than interest payments. The Property Council argued for a uniform approach and will continue to lobby to bring Victoria in line with the other mainland states.

Nicholas Cliffton is a member of the Property Council’s Taxation Committee. This article is the personal view of the author and is not the official view of Deloitte Australia and should not be considered professional advice.

As we progress through the Property Council’s 2012 Mentor Program and prepare for 2013, it is worth reflecting on what it means to be a mentor and the important role that mentoring plays in a person’s career.

Two popular definitions of “mentor” include:

• a person who advises; and

• a person who aids another in achieving a goal. Both definitions go to the heart of what mentors do and the valuable role they play in someone else’s life, both professionally or personally.

For those of us who have spent decades in the property industry, it is worth taking a moment to reflect on the important people who have helped to positively contribute to our own personal or professional development. These people may have helped us develop a new skill, build confidence, consider a different perspective, clarify career aspirations or provide inspiration to achieve personal or professional goals.

Quite often, mentoring is not a conscious decision by an individual to influence our thinking. For example, many of us may recall a conversation or relationship, which has provided us with encouragement or support, or has stimulated or motivated us in a meaningful way. Indeed, it is sometimes the subtle commentary and information that has been passed on to us that has had the greatest impact on our careers. What we are trying to do at Property Council is formalise this advice so that there is an established relationship between mentor and mentoree. This imposes a clear structure, to ensure that the advice that was provided so freely and willingly is provided within a clear and established framework.

As a mentor, sharing our own personal experiences may provide an enormous window of opportunity into the industry for the mentoree. In such a challenging and changing world, the ability to draw on the experience of an industry professional and seek guidance is invaluable to the mentoree’s own career and at times personal development.

Watching the development of the mentoree over time and reflecting on the mentoree’s progress throughout the journey is incredibly rewarding. To know that in some small way you, as a mentor, have contributed to these achievements is very gratifying.

My initial proposition was whether being a mentor is pleasure or pain. From my experience, there is absolutely no doubt that it is the former. For a relatively small time commitment by the mentor, the benefits far outweigh any conceivable pain…undoubtedly!

If you care to learn more about mentoring opportunities or to be a mentor please visit the website: www.propertyoz.com.au/mentorprogram or contact Georgia Lloyd on glloyd@propertyoz.com.au

Thanks again to our program partners. Communications partner Profiling partner

For those who have never considered mentoring previously, one would be surprised at the level of satisfaction the mentor gains from the relationship. upfront consulting

StephenMayne is a business journalist and governance advocate who recently resigned from Manningham City Council to run for a council position at the forthcoming City of Melbourne elections. In the lead up to the Property Council’s Growth Summit 2012, Property Victoria asked Stephen to give us his ideas about the big issues for Melbourne. There aren’t too many councils which take applicants to VCAT for under-developing a site. But at Manningham City Council we have been determined to deliver on the vision to intensely develop the land around Westfield Doncaster, which is now the fifth most valuable shopping centre in Australia.

Bring on the 4000 apartments so more of the 15 million annual Westfield visitors each year can walk to the centre. And bring on much-needed associated infrastructure investment, such as Doncaster Rail and the path finding proposal for a $6 million sewerage treatment plant that will deliver a third pipe solution to numerous new apartment towers.

This may sound excessively prodevelopment, but at the same time Manningham has fought tenaciously to protect our green wedges and low density residential zones. John Alexander complains that Sydney has built out the vast majority of its private tennis courts but in Manningham we still have a staggering 1400!

It has not been easy being the loudest defender of high rise development on Doncaster Hill since 2008 but the rationale is pretty straight forward. The vision has been clear for a decade and everyone knows where they sit on height limits, zones, set-backs and car-parking.

In order to cope with Melbourne’s annual population growth of about 80,000, councils need to be given residential growth targets. At Manningham, we knew it was 460 new dwellings per year and we actively identified designated areas along main roads and near activity centres to handle this growth.

These areas contained only 13 per cent of our resident population and it gave great certainty to the other 87 per cent which VCAT has respected.

The challenge is holding the line when objectors line up. Developers in Doncaster have been largely silent as officers and councillors copped a media beating from a noisy minority.

With good communications from all stakeholders, you can win the argument but confidence in the system breaks down if transparency fades or the goal posts are moved.

Victoria’s VCAT system dramatically reduces corruption because power is vested in the hands of independent and

Stephen Mayne Founder crikey.com.au and maynereport.com

Stephen Mayne Founder crikey.com.au and maynereport.com

professional arbitrators. It’s a good lowcost system, even if third party appeal rights frustrate some developers.

However, the same doesn’t apply with the Planning Minister whose call-in powers are way too extensive. If the Minister wants to play God, there should be far more comprehensive public explanations of his interventions. The City of Melbourne has considerable planning expertise yet no power to determine any application greater than 25,000 square metres. This should be changed.

Public cynicism is further exacerbated by Victoria’s failure to improve its political donations system, similar to recent measures in NSW and Queensland. I’m more than happy to support sensible development on its merit which complies with the rules laid down, but when former politicians pop up as lobbyists or donations start to flow, it just makes it harder to resist the squeaky wheel elements.

Driving

Stephen will be speaking at the Property Council’s Growth Summit 2012 on 7 September 2012

For more information and to reserve your place visit www.propertyoz.com.au/vic

Friday 7 September | Peninsula at Atlantic, Docklands

There is absolutely no doubt that Tasmania is facing tough times.

The release of the fourth quarter results from the Property Council ANZ Property Confidence Survey show that despite a statistical bounce of negative 13 index points, Tasmania still sits at negative 86 index points (100 index points is considered neutral). Tasmania sits at only one index point from the bottom of the national pack.

The survey points to serious issues for the industry as respondents see construction stall across residential, tourism, retail and office sectors with retirement living being the only sector predicting an increase in construction activity for the quarter. Hardly any surprises there given Tasmania has the fastest ageing population in the country.

The survey points to what the industry already is acutely aware of - a drop away of residential development of 25 per cent with a corresponding fall in commercial

construction of around 20 per cent. This is coupled by a record vacancy rate for Hobart of around 700 properties.

The survey also points to the same confidence sapping issues which have consistently dogged respondents. Issues such as state and federal political environments, domestic economic conditions and the ever increasing burden of the planning system continue to undermine the industry’s confidence.

This pessimistic view for the Tasmania’s property sector reflects weak economic activity in the state with negative trend state final demand (-0.6 per cent in the year to March 2012), the unemployment rate increasing to 7.3 per cent in May 2012 (from a low of 5.1 per cent in August 2011) and house prices 7.5 per cent lower in the year to June.

A subdued outlook for the Tasmanian economy for 2012-13 and weak construction activity expectations will present some further downside risk to

Mary Massina Executive Director, Tasmania Division

Tasmania’s property industry through the remainder of 2012.

This negative sentiment, combined with a lack of Government reform in key areas such as planning, is directly impacting on the decisions made by an important economic driver to the state’s economy.

In addition, the impending start of the new regressive stamp duty regime in October is also weighing on investors’ minds, who are already dealing with a high cost market. The property industry wants more than the Government’s rhetoric on key microeconomic reforms such as planning, water and sewerage and local government, it is vital that there is also commitment and delivery.

Concerns about the industry’s future lead to the Housing Industry Association, Master Builders and the Property Council calling for a meeting with the Premier, Deputy Premier and the Minister for Economic Development and Infrastructure.

A comprehensive discussion agenda was provided to the Government encompassing key issues such as the need for reform in local government, regulations, planning and state taxation as well as the onerous burden being placed on the industry in the form of poorly drafted legislation such as the then proposed Residential Building Work Quality (Warranties and Disputes) Bill

On both sides there was acknowledgement of the frank and honest discussion. The Premier has offered to meet again with relevant departmental officials.

It is the intention of the biggest private sector industry, which is a significant generator of revenue and economic activity for the State, to ensure that all three political parties acknowledge the economic importance of the industry and commit to

a reform agenda that addresses industry needs and eliminates barriers to further investment.

Opponents and critics of the local government reform campaign said the issue would never be embraced by the Tasmanian community.

Local and state politicians said that the community would never support local government reform. Well they were wrong.

Latest EMRS polling demonstrated that 55 per cent of Southern Tasmanians supported the creation of a greater Hobart Council as proposed by the Southern Councils’ own regional authority.

This is not surprising given as in the last 11 years, there has been an 8.4 per

cent unadjusted annual increase in local government rates and charges with little or no increased service and infrastructure delivery.

The issue of reform is now firmly on the political landscape and has become a BBQ stopper. It is the first time in 15 years that this issue has gained significant momentum.

Over the past month the Tasmanian Division with assistance of the Tasmanians for Reform (TFR) Coalition members has been hitting the road at the request of councils to discuss the issue of local government reform.

So while there has been movement by councils to at least contemplate the reform issue, the three political parties have displayed a remarkable lack of courage to act on an issue which has widespread community support.

The Property Council along with TFR members are committed to ensuring that maximum pressure is applied to all local and state politicians to act on local government reform because the economy needs it, the community wants it and the politicians know it has to occur.

Speakers:

Joost Bakker, By Joost

Proudly partnered by:

Speakers:

Peggy Lui, JUCCCE

Mark Dreyfus, Parliamentary Secretary, Climate Change and Energy Efficiency

Sam Sangster, Places Victoria

Proudly partnered by:

Speakers:

Luc Kamperman, Veldhoen + Company

Wendy Geitz , Independent Workplace Consultant

Greg McCourt, Lend Lease Project Management & Construction

Proudly partnered by:

Moderator:

Bryce Moore, Moremac Property Group

Speakers:

Peter Seamer, Growth Areas Authority

Andrew Whitson, Stockland

David Turnbull, City of Whittlesea

Proudly partnered by:

Speaker: Tom Elliott

Proudly partnered by:

Speaker:

Tim Bamford, Major Projects Victoria

Ben Delaney, Major Projects Victoria

Proudly partnered by:

Fairfax Media House

Moderator: Sue Say, Urbis

Panel:

Susan MacDonald , Mirvac

Nicolle Austin, Stockland

Bernadette Gooda , ALDI Stores

Proudly partnered by:

Speakers:

Iqbal Jumabhoy, SilverNeedle Hospitality

John Dalton, Tourism Victoria

Proudly partnered by:

Speaker:

Mary Massina , Property Council of Australia

Interviewer:

Alex Johnston, Southern Cross News

Proudly partnered by:

Future Directions is a well-established networking group for young property professionals and students interested in the property industry. The Future Directions group provides a platform to network with like-minded contemporaries, to develop networking skills and existing networks, all in a fun and informal environment.

Future Directions events are run to ensure attendees gain a greater understanding of the property industry, including exposure to sectors of the industry that participants would not usually be exposed to. Future Directions attendees can always expect to walk away from these forums with a greater understanding of the property industry and the Property Council.

Future Directions advocates for the future leaders of the industry. The group is strengthening the future of the property industry, and allowing young professionals the opportunity to get ahead and pave a pathway to becoming a more significant player with the Property Council and the industry as a whole.

“Looking back on my time on the Future Direction committee, I found it to be a solid base for gaining industry information and also to develop and expand my industry network. Contacts made back then are still contactable today,” Justin Zumpe, past Future Directions Committee member.

Want to get involved in Future Directions? Or, have someone on your team that would benefit? Contact Brooke Attrill on 03 9650 8300 or battrill@propertyoz.com.au

Julia Hicks Assistant Design Manager, Grocon PCL Future Directions Committee ChairProudly partnered by:

Tuesday 21 August Retail in the Spotlight including breakfast with David Slade, Topshop Director

ZINC @ Federation Square

7.30am - 12.30pm

Thursday 23 August Future Directions Carbon Tax Panel Citiclub 113 Queen Street

6.00pm for 6.30pm - 8.30pm

Friday 7 September Growth Summit Peninsula at Atlantic Central Pier, 116 Harbour Esplanade, Docklands

Friday 7 September Growth Summit Keynote lunch Living in the Endless City with Professor Ricky Burdett

Tuesday 11 September Professional Development Retail Leases Act, Half Day Course

Friday 21 September Our annual AFL lunch With the panel from Marngrook Footy Show

Tuesday 9 October Professional Development Property Industry Induction

Friday 12 October Shine a Light - Annual Gala Ball Supporting Property Industry Foundation

Tuesday and Wednesday 16 and 17 October Professional Development Building Services Fundamentals

8.00am - 4.00pm

Peninsula at Atlantic Central Pier, 116 Harbour Esplanade, Docklands

12 noon for 12.15pm - 2.00pm

Minter Ellison Lawyers Rialto Tower

8.00am - 1.00pm

Palladium at Crown

12 noon for 12.30pm - 2.30pm

Property Council Boardroom Level 7, 136 Exhibition Street

8.30am - 4.00pm

Peninsula at Atlantic Central Pier, 116 Harbour Esplanade, Docklands

7.00pm - 1.00am

Telstra Conference Centre Level 1, 242 Exhibition Street

8.30am - 5.00pm

Wednesday 24 October Inaugural Women’s 9 Hole Golf Day Burnley Golf Course Cnr Madden Street and Loyola Grove, Burnley

11.30am Registration

• Christmas Lunch will be held on Friday 14 December 2012

• End of year Future Directions will be held on Thursday 6 December 2012

The new South Australian State Aquatic Centre features a FINA compliant 10 metre completion pool and dive / water polo pools as well as seating for 4,500 spectators.

The dramatic design is innovative whilst still respecting the functionality and importance of the facility, both as elite sports and training centre and its legacy as a community sports facility and landmark for the City of Adelaide and the people of South Australia. The SAALC opened to the public on Tuesday, 26 April 2011, after the first event, the Australian Age Championships, held from 18 - 23 April 2011.

For further information visit us at www.pta.com.au

*in association with woodhead architects