10 minute read

Property development in the gun

The ATO has sharpened its focus on SMSFs investing in property developments. ASF Audits head of education Shelley Banton details the concerns of the regulator with regard to this issue.

The ATO has increased its focus on non-complying property development arrangements owned directly and indirectly through SMSFs.

More specifically, it is looking at property development arrangements that divert profits to an SMSF using a special purpose vehicle (SPV). These arrangements are complex and contraventions can quickly occur.

SMSF Regulator’s Bulletin (SMSFRB) 2020/1 initially outlined the ATO’s concerns centred on an SMSF entering a scheme with either a related or unrelated party involved with purchasing and developing property to sell or lease.

Since then, the regulator has acknowledged SMSFs are entering into new arrangements outside the scope of SMSFRB 2020/1 and has responded by setting a new high bar as outlined in Taxpayer Alert (TA) 2023/2.

The starting point: SMSFRB 2020/1

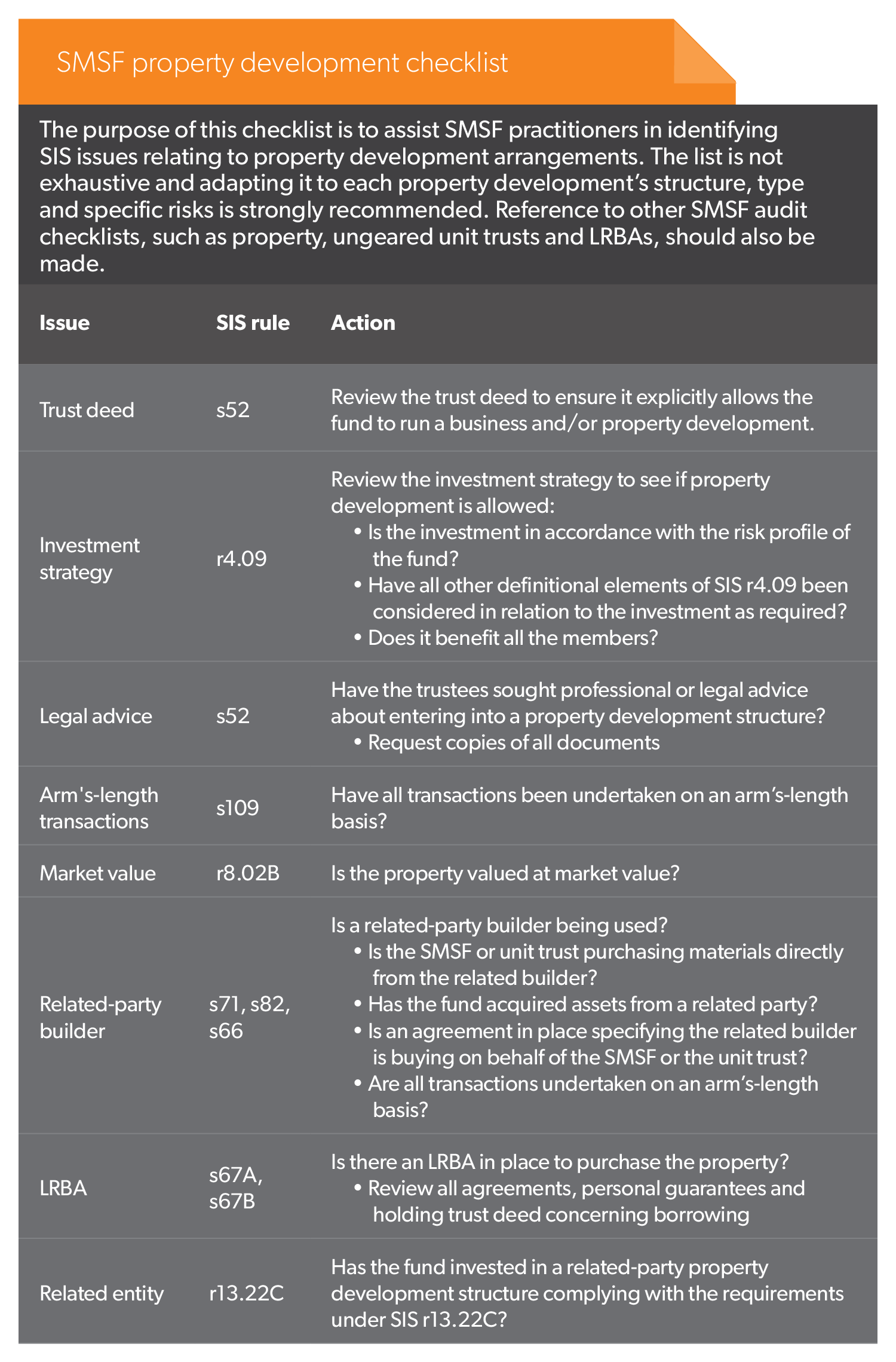

The ATO’s initial concern was SMSFs investing in property development arrangements to divert income into super, creating potential breaches of the sole purpose test and other Superannuation Industry (Supervision) (SIS) issues (refer to checklist).

The problem is specific related and unrelated-party property development arrangements, such as joint ventures (JV), partnerships and ungeared related entities, can fail and may lead to the investment ending up as an in-house asset (IHA).

The ATO has also warned SMSF trustees about other SIS compliance issues, including the following questions:

1. Does the investment meet the requirements to provide retirement benefits for members and beneficiaries under section 62 of the SIS Act?

2. Are fund assets valued at market value under SIS Regulation 8.02B and are SMSF assets kept separate from the trustee’s assets personally as SIS Regulation 4.09 requires?

3. Is there an IHA issue and does it exceed the 5 per cent limit set by SIS Act section 71?

4. Does the limited recourse borrowing arrangement (LRBA) fail to meet the exemptions in section 67A and section 67B of the SIS Act?

5. Does the arrangement result in a loan or financial assistance to a member or relative covered by SIS Act section 65?

6. Does the arrangement include the fund acquiring assets from a related party addressed by SIS Act section 66?

7. Has SIS Regulation 6.21 been satisfied whereby payments have been made under the arrangement where the member does not meet a condition of release in contravention of the payment standards?

8. Are all the terms and conditions of the arrangement on commercial terms as per section 109 of the SIS Act or do they benefit the other party?

In-house assets

One of the problems with property development is SMSF trustees’ understanding of whether other entities involved in the arrangement are related parties.

The reason is it could taint the project from the beginning. Where the property development investment is an IHA of the fund, trustees must calculate the proportion of the SMSF’s total assets that is attributed to this investment on 30 June each year.

If the IHA in the SMSF exceeds 5 per cent of the fund’s total assets, trustees must prepare a written plan to divest the asset, bringing it below this limit by the end of the next financial year.

Related entities exception

SIS Regulation 13.22C allows an SMSF to invest in a related ungeared entity, making them a popular option for property development investments.

SMSF trustees must ensure the asset meets the conditions of this regulation when it is acquired and continuously while the fund holds it, including that:

1. The only assets in the entity are cash and property.

2. The entity cannot borrow or give a charge over its assets.

3. The entity can only lease out business real property to a related party.

4. The related party lease must be legally binding and enforceable at all times.

5. All related-party transactions must be at market value.

6. Once the entity meets the SIS Regulation 13.22C conditions, it must comply with the requirements in SIS Regulation 13.22D in that:

a. it must meet Regulation 13.22C at all times,

b. it cannot operate a business through the trust, and

c. all transactions must be at arm’s length.

Failing to meet SIS Regulation 13.22C

It can be challenging for SMSFs to meet and maintain these conditions while undertaking property development investments.

Where the exceptions available under SIS Regulation 13.22C cease to exist, all investments held by the SMSF in that related entity, including all future investments, become an IHA of the fund.

The fund must prepare a plan and reduce the IHA level to 5 per cent or less within 12 months because the asset can never be returned to its former exempted status, even if the trustee fixes the issue.

Where the SMSF cannot reduce the asset to below the required 5 per cent limit, the property may have to be sold and the entity wound up.

Running a business

The ATO will consider all the facts and circumstances to determine whether an ungeared related entity is running a business and fails to meet SIS Regulation 13.22D.

There is a difference between an ungeared related entity involved in a one-off property development venture and the same entity holding several property development ventures operating simultaneously.

Again, where SIS Regulation 13.22C ceases to apply, the investment will forever lose its exempt status from being an IHA.

Borrowing to fund a property development

An SMSF can borrow to fund the purchase of real property, shares or units in a property development entity through a limited recourse borrowing arrangement (LRBA) allowed under section 67A and section 67B of the SIS Act.

The rules state the acquirable asset must be an asset allowed under SIS and:

1. The property development entity is not a related party or,

2. If it is a related party:

a. It must be acquired at market value and covered by one of the in-house asset exceptions or

b. The asset is acquired at market value and would not result in the SMSF exceeding the 5 per cent limit on inhouse assets.

Where there is an LRBA over shares or units and an event causes the 5 per cent IHA exception to cease, such as not purchasing the units or shares at market value, the SMSF will also be in breach of section 67 of the SIS Act.

The reason is that while the nature of the shares or units does not change, they are no longer considered a single acquirable asset if not purchased at market value.

LRBA risk factors

The benchmark for an LRBA not at arm’slength terms is a hypothetical borrowing arrangement at arm’s length, which can be almost impossible to obtain.

Several other risk factors give rise to non-arm’s-length income (NALI) where the arrangement is not on commercial terms and they are:

1. Making repayments and the ability to repay.

2. Arrangements that provide security to a lender.

3. Related-party fees outside the ordinary course of commercial arrangements.

Joint ventures

Firstly, SMSFs must ensure that property development via a JV is not an investment in a related party but an investment in the property being developed. Otherwise, it becomes an IHA.

Next, where an SMSF receives income above its input into the arrangement, the income from the JV may be classified as NALI.

Lastly, the ATO has further concerns surrounding SIS Act section 65 breaches and has said the following situations would cause them concern:

1. The fund invests in the related-party property development because of a cashflow issue.

2. The JV employs a related party to provide services as a means of ensuring employment or the remuneration is more than the market value.

3. The fund finances elements of the property development on non-arm’s-length terms.

TA 2023/2

The ATO released TA 2023/2 because trustees used SMSFRB 2020/1 as a property development investment guideline and then developed new arrangements outside the scope of that bulletin.

As a result, the ATO no longer reviews these arrangements in terms of specific structures, with the new focus on SPVs owned directly or indirectly by the SMSF.

The target is now the “controlling mind” that makes the decisions for one or more property development groups, such as deciding on the project and establishing an SPV for that purpose.

What is a controlling mind?

While there is no explicit definition of a controlling mind in TA 2023/2 or the SIS rules, a controlling mind is typically the members of their respective SMSFs.

It means the definition of a related party or a Part 8 associate of the SIS Act is no longer the rigid criteria for identifying potential compliance breaches in property development schemes.

The ATO dealt with related-party rules in SMSRB 2020/1 and has now introduced the concept of a controlling mind with a broader application.

Where the controlling mind is the members of their SMSFs, the SPV contracts with related entities are owned by the controlling minds.

Non-arm’s-length dealings

TA 2023/2 clarifies that any non-arm’slength dealings by any party regarding any step in relation to a scheme can give rise to NALI.

Regardless of how the entity is structured or the transactions undertaken, not only are the income and franking credits considered NALI, but also, depending on the facts, any capital gain on disposal of the property.

The tax commissioner may also “make a determination under Part IVA of the Income Tax Assessment Act 1936 in relation to the imputation benefit or tax benefit arising under the arrangement”.

The types of arrangements the ATO is concerned about regarding NALI include:

1. The fund may acquire shares in an interposed entity at an arm’s-length price, but the interposed entity may not have acquired shares of another entity at an arm’slength price.

2. The interposed entity could arrange to sub-contract the property development on non-arm’s-length terms to increase profits and ultimately benefit the fund.

3. The interposed entity borrows money from another entity on non-arm’s-length terms with a nil interest rate.

The ATO clearly warns that any scheme will be subject to scrutiny, not just those identified under TA 2023/2.

Other ATO action

Where a trustee is involved in non-complying property development schemes, the commissioner can disqualify them from acting as a trustee or a director of a corporate trustee under section 126A of the SIS Act or issue a notice of non-compliance under SIS Act subsection (40)(1) to the fund.

Promoters of these arrangements can also be subject to severe penalties under Division 290 of the Tax Administration Act. Tax agents involved in these schemes will be referred to the Tax Practitioners Board to consider whether there has been a breach of the Tax Agent Services Act 2009.

The ATO has also identified that where the SPV is a company, the SMSF may receive tax offset refunds concerning the dividends received under the tax offset rules in the Income Tax Assessment Act 1997.

Documentation is essential

Documentation becomes an essential source of evidence to prove transactions are on commercial terms.

It becomes more complicated when many related parties are involved in a property development venture, especially where one is the controlling mind.

The alternative, however, is the inference the parties are not dealing with each other at arm’s length.

Ensure all records are kept and made available in case the ATO comes knocking, which could be as simple as obtaining a similar quote provided to an unrelated third party showing the rates charged for all services and works are on commercial terms.

Conclusion

The ATO’s focus on SMSF investments in property development schemes has resulted in new obligations and responsibilities for fund trustees.

As long as property remains a soughtafter investment, SMSF professionals must keep ahead of the legislation to ensure funds with property development investments continue operating compliantly.

On the other hand, it will be up to SMSF trustees to determine whether property development is a good idea or a compliance nightmare.