9 minute read

Economic impact on borrowings

The recent rise in inflation and interest rates has significant implications for related-party limited recourse borrowing arrangements. Smarter SMSF technical and education manager Tim Miller details the effect of the economic landscape on SMSFs with these types of loans in place.

As far as superannuation rates and thresholds are concerned, inflation can have both a positive and negative impact. On the positive side we see an increase in the general transfer balance cap resulting in higher pension commencement values and greater capacity to make non-concessional contributions. However, on the negative side we see related-party limited recourse borrowing arrangements (LRBA) take a big hit with interest rates jumping more than 3 per cent for those with variable interest rates. On the back of COVID-19, will this be the straw that breaks the camel’s back for many SMSF trustees?

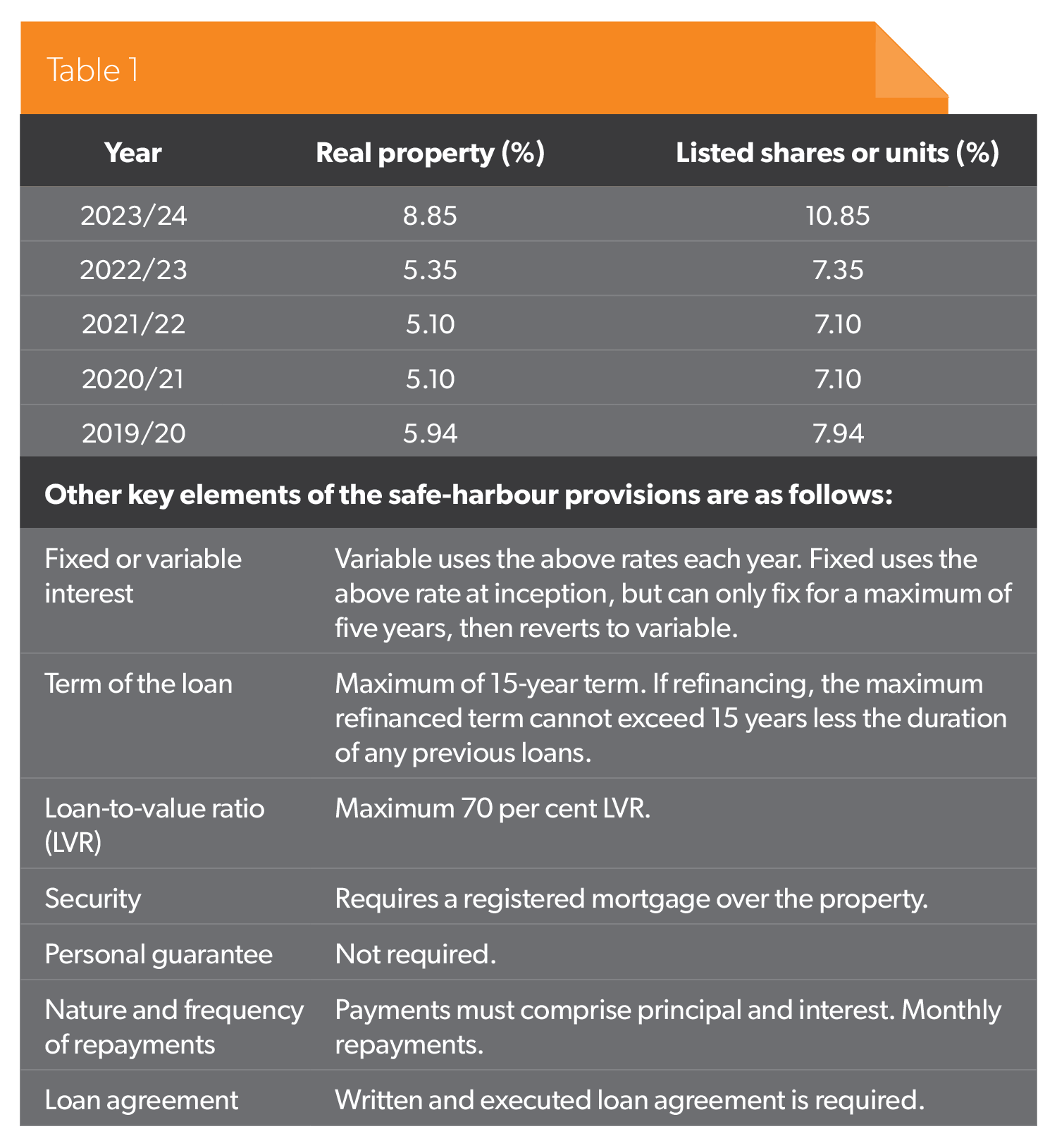

SMSFs that comply with the safe-harbour terms, outlined in Practical Compliance Guideline (PCG) 2016/5 Income tax arm’s-length terms for limited recourse borrowing arrangements, must be aware the ATO uses the May published rate each year from the Reserve Bank of Australia’s Indicator Lending Rates for banks providing standard variable housing loans for investors to determine the appropriate interest rate (see Table 1).

This article outlines what unitholders’ agreements should typically contain and why they should be considered where there is more than one unitholder, including a related party.

Fixed or variable

There may of course be some comfort for any fund that established an LRBA in accordance with PCG 2016/5 in the past few years and fixed the interest rate at commencement. As noted in the table, the safeharbour provisions provide for a fund to fix the interest rate at commencement for a maximum of five years for property and three years for stock exchange-listed shares or units. For some that will provide temporary relief, but for those coming out of their fixed period they will need to be aware of the immediate rate hike.

What funds need to evidence

Any change in respect to repayments by the fund should be documented, including consideration of the fund’s investment strategy regarding the ongoing cash-flow needs of the fund.

Failure to stay within the safe-harbour terms set out within PCG 2016/5 may result in the income generated from the asset being taxed as non-arm’slength income (NALI). The ATO has previously provided guidance in respect to this topic through the release of:

• Taxation Determination (TD) 2016/16 – Income tax: will the ordinary or statutory income of a self-managed superannuation fund be non-arm’slength income under subsection 295-550(1) of the Income Tax Assessment Act 1997 (ITAA 1997) when the parties to a scheme have entered into a limited recourse borrowing arrangement on terms which are not at arm’s length? and

• Law Companion Ruling 2021/2 – Non-arm’s-length income – expenditure incurred under a non-arm’slength arrangement.

A hike in interest rates will be a double whammy for many SMSFs that may still be feeling the pinch of extra repayments coming out of the relief measures introduced as a result of COVID-19.

Division 7A and LRBA

The complexity of an LRBA loan is compounded where the arrangement is financed through a related entity who must also comply with the requirements of Division 7A of the ITAA 1936.

Division 7A rules provide strict requirements that must be met, including meeting the minimal annual repayment or having the entire loan potentially treated as a dividend and, by virtue of being deemed a dividend from a private company, will most likely result in NALI.

As a result, some related-party LRBAs will traditionally have to meet both criteria of Division 7A and PCG 2016/5.

The ATO identifies there are three criteria a borrowing needs to meet to be considered a complying loan rather than a dividend:

• the interest rate must be at least equal to the Division 7A benchmark interest rate,

• the term of the loan must not exceed 25 years (where the loan is secured by a mortgage over real property), otherwise seven years, and

• there must be a written agreement in place.

The current benchmark interest rate, which is the RBA’s indicator lending rate – the bank variable housing loans interest rate for owner occupiers, is 8.27 per cent.

The upshot being an SMSF related-party loan that meets the terms of PCG 2016/5 will meet the Division 7A requirements to be considered a loan.

Refinancing the loan

With the sudden sharp rise in interest rates, many SMSFs may be contemplating refinancing their loan. Care must be taken if attempting to refinance a related loan with another similar-type borrowing. There is nothing requiring an SMSF to use the terms of PCG 2016/5, however, to ensure a loan does not result in NALI, TD 2016/16 obliges the trustees measure the terms of the loan against a hypothetical arm’s-length borrowing the trustees could or would have entered into. Further, PCG 2016/5 says the trustees must demonstrate the terms of the borrowing replicate the terms of a commercial loan that is available in the same circumstances.

Therefore, if the SMSF trustees are going to replicate commercial lenders, they need evidence indicating the lender would have been willing to lend to the fund, and not just evidence of what is possibly available in the marketplace. It is worth noting not all lenders will assist in the refinancing of related loans.

Intermediary LRBAs

One possible option available may be via the use of an intermediary LRBA. Here the holding trust rather than the SMSF trustee borrows money as the principal from the lender to acquire the asset. The fund must maintain the borrowing, so is responsible for the loan.

The ATO released SPR 2020/1, which excludes these arrangements from being an in-house asset subject to the arrangement meeting certain requirements.

The intermediary LRBA is an arrangement entered into by the parties that meets the following requirements:

1. a holding trust is established with members of a fund being the only trustees or shareholders and directors of the corporate trustee (holding trustee),

2. the trustee of the fund is a beneficiary of the holding trust,

3. the holding trustee holds an acquirable asset (the asset) on trust for the trustee of the fund, who is beneficially entitled to the asset,

4. the asset is a single acquirable asset (as defined by Superannuation Industry Supervision (SIS) Act 1993 section 67A(1)) the trustee of the fund is allowed to acquire,

5. the holding trustee enters into a borrowing as principal with a lender with the borrowing secured by a mortgage over the asset,

6. the contract or deed of borrowing, referred to in paragraph (5), between the holding trustee and the lender may not limit the lender’s right of recourse, under the contract or deed, to only the asset in the event of default,

7. the lender may require personal guarantees to be given as part of the intermediary LRBA,

8. the arrangement is established by a legally binding deed(s) under which the trustee of the fund and the holding trustee agree, for:

a) the trustee of the fund to maintain all borrowing obligations entered into by the holding trustee in respect of the borrowing referred to in paragraph (5),

b) the trustee of the fund is absolutely entitled to any income derived from the asset, less fees, costs, charges and expenses incidental to the acquisition, holding or management of the asset,

c) the trustee of the fund has the right to acquire the legal title of the asset on completion of the borrowing referred to in paragraph (5),

d) the rights of the holding trustee or any guarantors against the trustee of the fund in connection with default on the borrowing referred to in paragraph (5) is limited to the asset,

9. the documentation referred to in paragraph (8) in connection to the borrowing referred to in paragraph (5) is disclosed to the lender at the time of the borrowing.

Essentially, an intermediary LRBA overcomes the challenge of some lenders not contemplating a loan where the borrower does not hold title of the underlying property and also does not have to be limited in recourse, which can be attractive to potential lenders, but SPR 2020/1 acknowledges the involvement of an SMSF must be disclosed, meaning any recourse is against the guarantors rather than the fund.

Paying out an LRBA

If an asset is being disposed of, the sale proceeds will be used to discharge the loan and any remainder will be paid to the SMSF. All borrowed monies under the LRBA must be repaid, that is, the loan cannot be retained and used to acquire another asset.

When the loan is fully repaid, the SMSF has the right to obtain legal ownership of the asset from the holding trustee. It is important to note this is not considered an acquisition of an asset from a related party.

As there is the potential for stamp duty to be triggered when legal ownership is transferred, particularly where the arrangement was not correctly structured, there is actually no obligation under the super laws to transfer the asset from the holding trust to the SMSF. SPR 2014/1 – SMSF (Limited Recourse Borrowing Arrangements – In-house Asset Exclusion) Determination 2014 dictates that no breach of the in-house asset (IHA) provisions occur. However, if a fund elects to retain the asset in the holding trust after the loan is repaid, the LRBA restrictions continue to apply. This means certain transactions would be prohibited or alternatively will result in the asset being deemed an IHA, such as changing the asset’s character, for instance, subdivision. Further, ongoing costs of maintaining the holding trust would need to be considered.

If transferring the asset from the holding trust to the SMSF, related documents such as leases, rates notices and the like may have to be updated to reflect the new legal owner and the trustees must ensure the mortgage over the property is also removed.

Conclusion

Key concepts for LRBAs haven’t change since 2010 and they play a fundamental role in the ongoing compliance of SMSF borrowing arrangements.

It’s important to ensure any related-party borrowings through any entity, company or trust comply with both the safe-harbour and Division 7A rules and if trustees are contemplating an intermediary LRBA, that they understand them.

Finally, when a loan is to be paid out, understand the options available to ensure any compliance issues and potential stamp duty problems are avoided.