10 minute read

Contribution cap strategy intricacies

The superannuation rules give individuals a significant amount of flexibility as to how they can make the most of their contributions caps. However, to do so successfully the relevant boundaries must be observed, Cooper Partners director and head of SMSF Jemma Sanderson writes.

Over the past few years, we have seen some substantial beneficial outcomes from a contribution perspective as introduced by the federal government.

Some of these include:

1. The removal of the work test from age 65 to age 67 since 1 July 2021.

2. The removal of the work test for salary sacrifice and non-concessional contributions (NCC) to age 75 since 1 July 2022.

3. The extension of the bring-forward NCC contribution provisions up to the year an individual attains age 75 since 1 July 2022.

4. A reduction in the downsizer contribution age to 55.

This is in addition to the medium to long-standing rules and strategies we have had for some years, such as:

1. Carry-forward concessional contributions since 1 July 2018.

2. Contribution reserving within an SMSF.

3. Withdrawal and recontribution strategies.

This article will concentrate on the opportunities and planning regarding the carry-forward concessional contribution provisions and the interaction between total super balances and the NCC bring-forward rules.

Carry-forward unused concessional contributions

Since 1 July 2018, individuals have been able to carry forward their unused concessional contributions cap over a rolling six-year period, the current financial year and the previous five, where their total superannuation balance (TSB) as at 30 June of the year prior to the contribution is less than $500,000. The ability to carry forward only applies to an individual’s unused cap from 1 July 2018.

In 2023/24, it will be the first opportunity for taxpayers to be able to use the current year’s cap, and the previous five years would take them back to 1 July 2018. Therefore, someone could have an available contribution cap in the 2023/24 of $157,500 as shown in Table 1.

The full amount of $157,500, or lesser amount made up of the 2023/24 cap and a portion of a prior year’s unused cap, would be available if the following criteria are met:

1. The TSB at 30 June 2023 is less than $500,000 (this is not an indexed threshold).

2. The individual can meet the work test if they are between age 67 and 75.

3. The individual has sufficient taxable income to claim the relevant contributions amount as a deduction.

4. The contribution is received within the fund by 30 June 2024.

5. The correct process is followed for deductibility (section 290-170 of the Income Tax Assessment Act 1997 – notice and acknowledgement).

Using the carry-forward provisions can be of benefit in the following situations:

• the individual has sold an asset and made a substantial capital gain they wish to manage,

• the member hasn’t been working for the past few years,

• the person has a business that was in startup phase where no contributions were made and now is starting to generate some reasonable profits,

• the superannuant has only recently moved to Australia so won’t have used the cap during their first few years in the country as they were ineligible to do so, seeing they were not a resident at that time, and

• non-working spouses with trust distributions.

It is important to note there are several other elements to take into account when looking to take advantage of carried-forward unused concessional contributions. These include:

1. Remembering to include the contributions already made over the period in the calculation of the available amount. To this end, the TSB report on the ATO tax portal is a useful starting point, however, it may be incomplete if 2023 financial statements are yet to be recorded. It is always worthwhile ensuring all of the contributions have been checked off over the period to confirm there is no excess amount without relying completely on the portal information.

2. A person’s TSB does not have to have been under $500,000 for each year over the six-year period, but only at the prior 30 June in the year that you want to make the top-up contribution.

3. The member does not need to have been an Australian resident over the six-year period, but only the year they are wanting to manage their tax position in Australia.

4. An individual does not have to be under 18 in each year a carry-forward amount is available in order to claim the deduction in the year they turn 18. However, preservation always needs to be considered before any substantial contributions might be made for young people.

5. Division 293 tax will apply to any concessional contribution as it is the low-rate contributions for the person, so could reduce the benefit of implementing such a strategy.

6. Once 30 June 2024 passes, any unused amount from 2018/19 will no longer be available.

TSB and NCC cap bring-forward provisions

Table 2 highlights the NCC bring-forward rules, which will need to be applied where an individual makes an NCC greater than their single-year cap, and the TSB thresholds pertaining to those caps for the 2023/24.

The table provides the basic criteria for someone to be able to make an NCC and consider whether it will be in excess of their cap or not. If the individual has no NCC cap available, it doesn’t mean they can’t make a contribution. Instead it means they will have an excess that then needs to be dealt with under the relevant provisions if they put more money into their fund.

The TSB is very important in determining an individual’s NCC cap for a particular year. However, this can be challenging to navigate in situations such as:

• at the time a contribution is intended to be made, the individual may not know what their TSB was at the prior 30 June, particularly where:

o they have multiple superannuation accounts, and/or

o the financial statements for their SMSF haven’t been prepared yet, meaning member balances for the prior year have not been finalised,

• if the member does not know their TSB and they are approaching age 75, it can prove difficult to know what to do as dealing with an excess that may arise from a contribution should they end up with a higher TSB than expected can be problematic,

• since the shift of the work test from the Superannuation Industry (Supervision) legislation to the income tax provisions, there is no mechanism to reject a contribution where, for example, the work test is not met. If the individual exceeds their contribution cap, the fund has limited circumstances where it can reject the contribution and must pay it back only through the excess contribution refunding provisions,

• as contributions can be received by a fund up to 28 days after the end of the month in which the individual turned 75, and at a minimum be classified as NCC, then there are risks of excess contribution scenarios where the intention may be to claim a tax deduction, but the work test isn’t met, and

• members may wish to be making their contributions to superannuation as soon as possible at the commencement of a year in order to optimise the benefit of having the money invested in the super environment.

A further consideration is the actual bringforward period available to an individual isn’t a function of the contribution they make (with reference to Table 2), but their TSB at the 30 June before the contribution is made. As an example, if the TSB was $1.75 million, being between $1.69 million and $1.79 million, then the individual has an NCC cap of $220,000 and a two-year bring-forward period is applicable.

If the TSB was $1.65 million, that is, less than $1.68 million, then even if a $220,000 contribution was made, the individual still can bring forward three years of their NCC cap because their TSB was less than $1.68 million. It is irrelevant what the contribution was.

It is also very important to review in detail the contribution history of the individual member and not just the current year and previous two years. This ensures when advising members to make contributions, a full picture of the position is available.

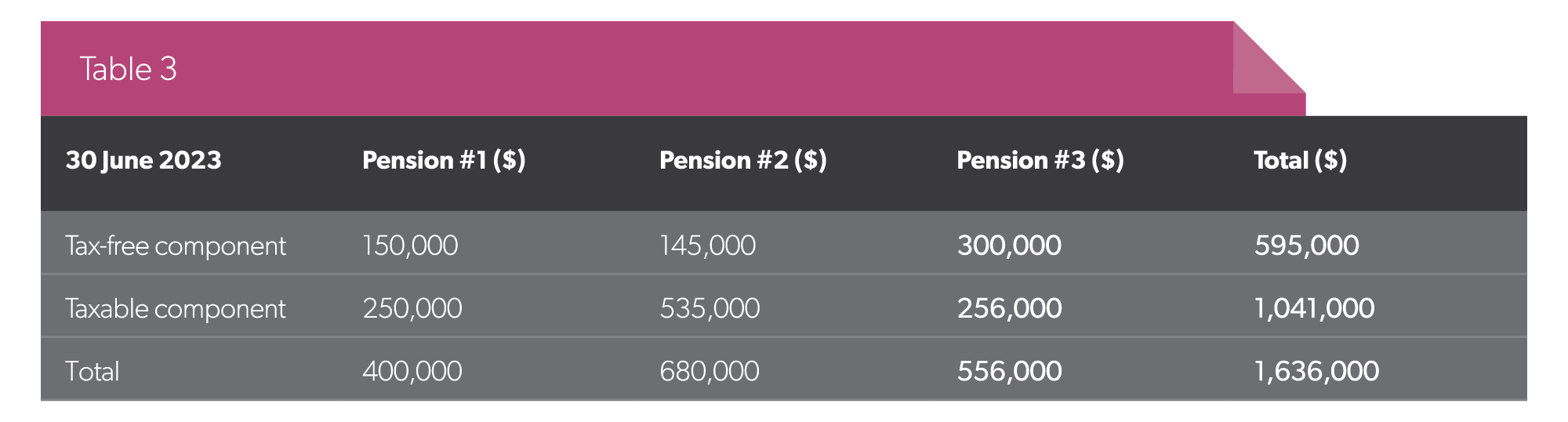

Example: Han, 68, has benefits in super at 30 June 2023 as in Table 3.

Han has some funds available outside superannuation he would like to contribute to super. How much could he contribute in 2023/24?

Han’s contribution history is as in Table 4.

Han has some funds available outside superannuation he would like to contribute to super. How much could he contribute in 2023/24?

With a cursory look at Han’s contribution history for the current year, 2023/24, and the previous two years, it may be concluded that because of the $120,000 contribution in the 2022 financial year, Han triggered a bringforward period in that year and therefore there is only $100,000 available to contribute in 2023/24.

However, Han is eligible to contribute $330,000 in the 2024 financial year, due to the following:

• looking further back, Han made a $180,000 contribution in the 2020 financial year,

• as his TSB at 30 June 2019 was less than the current lower threshold at that time of $1.4 million, Han would have triggered a three-year bring-forward period,

• that would then apply for 2019/20, 2020/21 and 2021/22,

• therefore, the contribution in 2021/22 of $120,000 was serving out that period to make complete the full $300,000 over the period from 1 July 2019 to 30 June 2022,

• as his TSB at 30 June 2021 was less than $1.7 million, the upper TSB threshold at that time, then he would have been eligible to make the $120,000 top-up,

• the contribution in 2022/23 was not more than the single NCC cap and therefore no consideration required of a bring-forward period, and

• as Han’s TSB at 30 June 2023 is less than $1.68 million, then he has the full $330,000 available to contribute in 2023/24.

This example highlights the benefit, and need, of looking further back into the contribution history than the current year and previous two years.

A few other considerations include:

1. Ensuring the TSB at the previous 30 June in the second or third year of the period needs to be less than the upper TSB threshold in order to make a top-up.

2. To watch out for certain amounts that count towards the TSB, but are dismissed. The main one is a pension account that has reverted from a deceased spouse before 30 June. This automatically becomes the recipient’s own pension account and therefore counts towards the TSB. It doesn’t matter there are no transfer balance cap implications for 12 months with reversionary pensions because this threshold is governed by a different set of provisions. The TSB is impacted immediately on death.

There are many opportunities to make contributions to superannuation and build up as much as possible in this structure. However, it is always preferable to remain within the contribution caps due to the practical implications of dealing with an excess.