7 minute read

More than a single-asset journey

Exchange-traded funds covering a single asset class or theme are very popular among SMSF trustees, but BlackRock Australasia head of wealth solutions James Kingston notes the use of multiasset ETF offerings can provide greater flexibility and efficiency to better manage your SMSF portfolio.

Exchange-traded funds (ETF) are listed funds that typically invest in asset classes such as stocks and bonds. They aim to provide access to several securities in one single trade, enabling investors to gain access to a diversified pool of assets that can cover a broad range of sectors and geographies by tracking the performance of a representative index (such as the S&P/ASX 200 for Australian stocks).

While single-asset-class ETFs provide exposure to a particular asset class, multi-asset ETFs provide access to multiple asset classes in one fund to manage risk, or potential loss, and achieve long-term growth. Professionally managed by an investment house, they determine the optimum mix of assets to achieve investor risk and return goals, investing in Australian as well as global securities to gain international diversification.

Investing with multi-asset ETFs can present a compelling case for investors who:

1. want to use it as the core part of their portfolio and then hold other investments (such as stocks) to personalise their remaining investment strategy, and

2. want to start their investing, savings or SMSF journey with the purchase of a single ETF.

Using multi-asset ETFs as a core portfolio holding

For the investor who wants a well-managed investment portfolio, but also wishes to benefit from an allocation to other securities, using a multi-asset ETF as a ‘core portfolio’ holding may be a consideration.

iShares offers two quality multi-asset ETFs to help cover more bases cost effectively within an SMSF – the growth-orientated iShares High Growth ESG ETF (ASX: IGRO) and/or the more balanced option, the iShares Balanced ESG ETF (ASX: IBAL).

Let’s consider this approach for two different investors and why it might be beneficial, in particular for an SMSF trustee.

Investor 1:

Abigail is starting an SMSF and wants to use a multiasset ETF as a foundational exposure, which she will supplement with some of her own stock ideas.

She is a long-term investor looking for a minimum investment timeframe of at least five years, with a medium to high risk/return profile, and so is interested in a growth multi-asset ETF such as IGRO. She also wants to invest in the top five stocks on the Australian Securities Exchange (ASX). Her allocation towards IGRO and stocks will depend on her risk appetite. In this example, we explore what her portfolio looks like if she allocates 50 per cent or 75 per cent to IGRO and the rest of the portfolio to those five stocks (equally weighted).

As displayed, using multi-asset ETFs as a foundational exposure in the portfolio provides added protection to mitigate against potential losses and better manage risk, compared to a portfolio with only the top five stocks, particularly during equity market sell-offs (see Chart 1).

Investor 2:

Karim is seeking capital growth and wants to invest some of his savings using both multi-asset and single-asset-class ETFs.

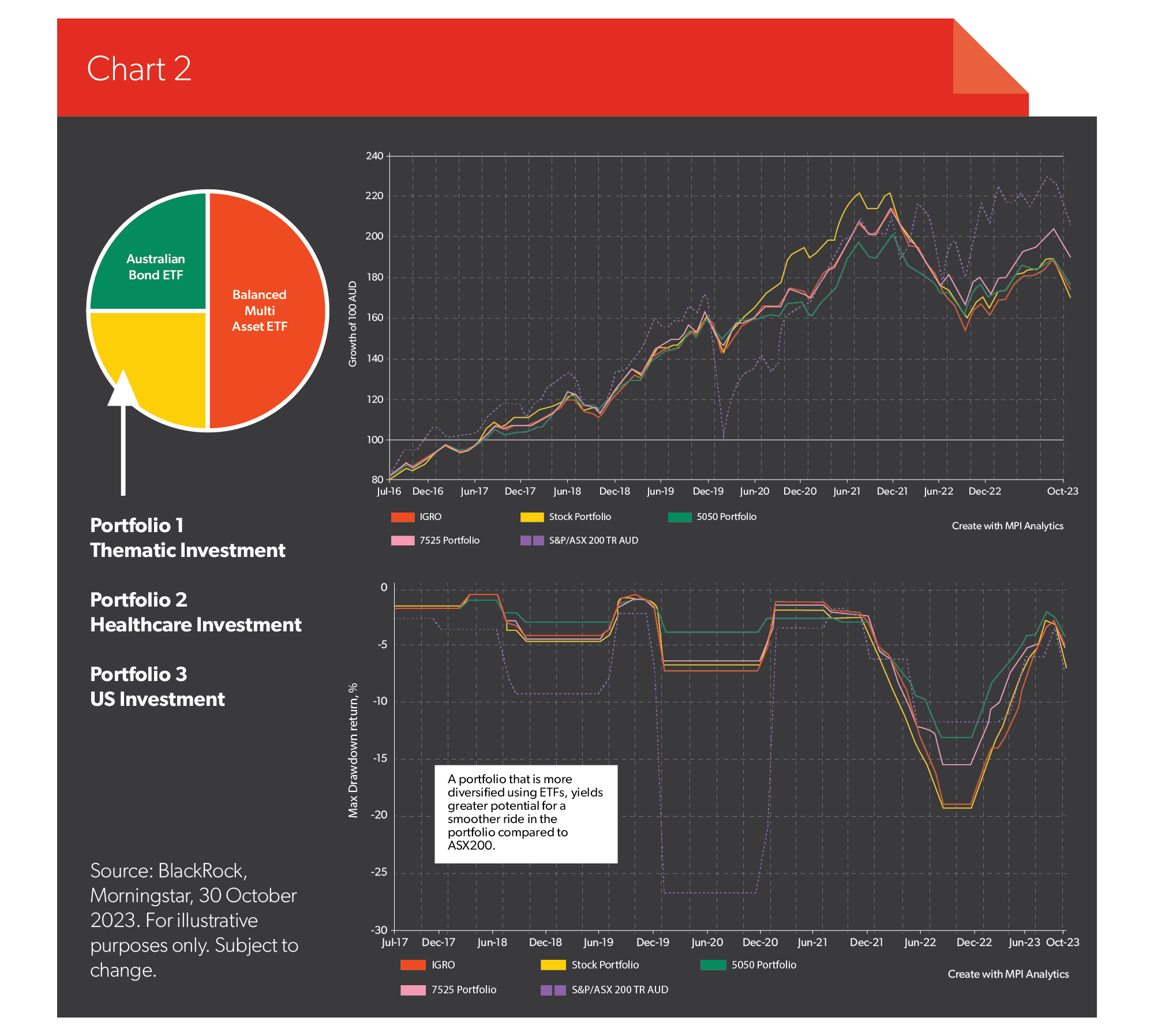

He is an experienced investor with a medium risk/return profile looking for a minimum investment timeframe of five years and is more interested in a balanced multi-asset ETF, but would also like to invest in individualasset-class ETFs based on some ideas and themes he likes. He is considering a few different options on how to do this.

As he is focused on the balanced risk profile, he considers using a fixed income ETF alongside his other ETF ideas so as to maintain the same asset class mix as the balanced multi-asset class ETF he has used. The result is an investment portfolio that looks similar to the multi-asset ETF in terms of overall risk, but he is still able to express his own ideas and preferences.

As illustrated, a portfolio using a multi-asset ETF (such as IBAL) and single-asset-class ETFs has greater potential to experience less return volatility as well as large drawdowns compared to the S&P/ASX200 Index (see Chart 2).

Riding the rollercoaster

Investing in individual companies can be rewarding, but doing so can also carry significant risks. Share price can be driven by issues related to a particular company alone or can be more macro focused, related to the Australian economy or global equity markets.

Chart 3 demonstrates how the return for the top five stocks on the ASX has fluctuated over the past 10 years. The black line is the performance of the S&P/ASX 200.

A single investing solution through one trade

One measure of risk is the ability to withstand the highs and lows of your investment portfolio. An investor’s risk appetite and time horizon (the length of time they want to invest) will determine whether this volatility can be withstood.

Managing these fluctuations can potentially be achieved using a multi-asset ETF. For instance, investing in IGRO gives you exposure to a 90 per cent allocation to stocks or equities and a 10 per cent allocation to bonds. With IBAL you’ll be investing in around 50 per cent equity holdings and 50 per cent fixed income.

It is worth noting multi-asset ETFs are not designed to outperform the broad equity market. Instead, they are designed to have holdings in multiple asset classes so if equity markets were to perform negatively, the other asset classes held, such as fixed income, would offset some of those losses.

In general, the more equity exposure a multi-asset ETF has, the more potential there is for stronger performance, however, this comes at greater risk of larger negative returns. Multiasset ETFs have performed better in terms of potential losses relative to the broad Australian equity market, but in some instances other relevant factors can mean both bonds and equities can deliver negative returns, as we saw in the first half of 2022.

Prepare for the unexpected using multiasset ETFs

In these examples we have considered how a new investor can build their portfolios, however, the reverse is also true. Multi-asset ETFs can potentially also help existing investors diversify their portfolios and manage risk more effectively. Allocating to a multi-asset ETF like IGRO or IBAL potentially enables investors to be better prepared for tomorrow’s unexpected markets.

It is important to note the IGRO offering is likely to be appropriate for a consumer with a minimum investment timeframe of five years, seeking capital growth and/or income distribution, with a medium to high risk/return profile. The consumer will likely use the product for a whole portfolio solution or less.

The IBAL ETF is likely to be appropriate for a consumer with a minimum investment timeframe of five years, seeking capital growth and/or income distribution and/or capital preservation, with a medium risk/return profile. The consumer will likely use the product for a whole portfolio solution or less.

This material has been prepared by BlackRock Investment Management (Australia) Limited (BIMAL) ABN 13 006 165 975, AFSL 230 523. This material provides general advice only and does not take into account your individual objectives, financial situation, needs or circumstances. Before making any investment decision, you should obtain financial advice tailored to you having regard to your individual objectives, financial situation, needs and circumstances. This material is not a financial product recommendation or an offer or solicitation with respect to the purchase or sale of any financial product in any jurisdiction. For more information BIMAL’s Financial Services Guide, along with relevant Product Disclosure Statements and Target Market Determinations are available from www.blackrock.com/au.