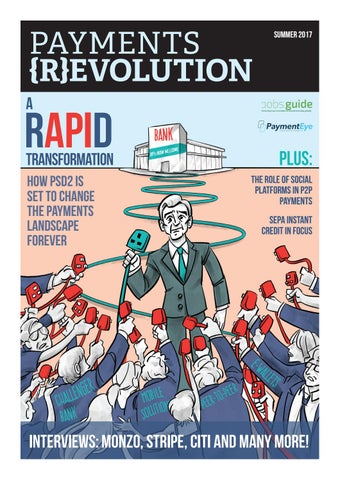

PAYMENTS {R}EVOLUTION A

RAPID

TRANSFORMATION How PSD2 is set to change the payments landscape forever

SUMMER 2017

Connecting buyers and sellers of financial technology globally

Plus: The role of social platforms in P2P payments SEPA instant credit in focus

Interviews: Monzo, Stripe, Citi and many more!