22 minute read

Industry News

from CCR March 21

AroundtheIndustry

RETAIL

Burlington Stores

Burlington Stores plans to open another 1,000 stores over the long run, more than doubling its current tally.

Toys R Us

Brand management firm WHP Global has bought a controlling stake in Tru Kids, the parent of Toys R Us, with plans to open branded US stores likely in time for the holiday shopping season. Tru Kids acquired Toys R Us and its related brands in 2017 after the retailer filed for Chapter 11 bankruptcy protection.

Dick’s Sporting Goods

Dick’s Sporting Goods plans to unveil a new 100,000-square-foot store prototype, Dick’s Sporting Goods House of Sport, in Rochester, New York.

Target Stores

Target is reportedly one of a list of companies considering a move into the soon-to-be-vacant Macy’s department store on Chicago’s iconic Magnificent Mile, a district traditionally known for high-end retailers and brands. Macy’s plans to vacate its 323,812 square feet that span all eight floors and the mezzanine level of Water Tower Place, which has lost other shops during the pandemic.

Dollar Tree

Co-branded Dollar Tree and Family Dollar stores could grow to several hundred locations in the coming years, as the sister companies look to build on pandemic-fueled momentum to achieve better results in rural communities.

Dollar General

Dollar General will open a 6,000-square-foot urban concept store in downtown Minneapolis next year. The DGX Minneapolis location will feature the retailer’s more upscale format, with grab-and-go food selections, pet products, groceries and toiletries.

Payless

Payless has opened a store in North Miami, Florida that will feature augmented reality, interactive touchscreens and other features. In August, the brand indicated it could open hundreds of stores in the next five years.

Fanatics

Sports apparel retailer Fanatics has raised $320 million in a new funding round that it will use to further its international growth efforts, grow vertical commerce and explore new acquisition opportunities. The company launched Fanatics China in February, a division the company predicts will grow to be worth more than $1 billion.

RESTAURANT

Famous Dave’s

A Famous Dave’s franchisee in Minnesota will open the chain’s first fast-casual Quick ‘Que barbecue concept this fall. The casual dining chain’s new format will feature a drive-thru, and be more affordable and potentially more profitable for franchisees.

Red Robin Gourmet Burgers

Red Robin Gourmet Burgers is planning a bigger rollout of Donato’s pizza, which is expected to generate $60 million in annual sales, and will keep in place the streamlined menu adopted in response to the pandemic.

The Twelve Thirty Club

Veteran restaurateur Sam Fox is set to unveil the first phase of The Twelve Thirty Club, a 30,000-square-foot Nashville project funded by investors, including Justin Timberlake. The three-story space will include two lounges set to open in April and an upscale 400-seat eatery likely to debut in August.

Cava

Mediterranean chain Cava is poised to grow its presence in suburban markets with a real estate portfolio acquired with the purchase of Zoe’s Kitchen in 2018. The pandemic led many people to relocate from cities to less-populated areas, and Cava converted seven Zoe’s locations to Cava units last year and expects to do 12 more in 2021.

Foxtrot Market

Foxtrot Market, a fast-growing chain of upscale, delivery-focused corner stores and cafés with eight locations in Chicago and Dallas, is expanding to the East Coast with the opening of two stores in Washington, DC.

Fuzzy’s Taco Shop

Fast-casual chain Fuzzy’s Taco Shop has created a smaller format set to debut in Minneapolis. Fuzzy’s Taco Shop Taqueria locations will be less than half the size of the chain’s typical restaurants and feature a streamlined menu that will offer franchisees a more affordable growth option.

El Pollo Loco/LA Mex

El Pollo Loco is embarking on a three-year strategy to enter new markets, continue digitization and develop an asset-light model. The company plans to remodel 55 units and build six new ones this year with its L.A. Mex design.

Checkers & Rally’s

Checkers & Rally’s is undergoing complementary kitchen and exterior makeovers that could help the company maintain its edge as other businesses recognize the value of a drive-thru model.

Sprouts Farmers Market

Sprouts Farmers Market has revealed plans to add about 20 new locations across the country this year, including 10 more stores in Florida and four smaller-format stores that will average about 25,000 square feet each. The grocer also plans to open new produce distribution centers in Orlando, Florida and Aurora, Colorado.

Amazon Fresh

Amazon plans to open at least 28 more Fresh grocers in the US. The grocer confirmed five new stores will open in Long Beach, California, Woodland Park and Paramus, New Jersey, and Seattle and Bellevue, Washington.

HOSPITALITY

Sapphire Bay

The Sapphire Bay mixed-use project on Lake Ray Hubbard in Dallas will include a 500-room hotel and conference center with more than 100,000 square feet of event space. Hyatt Hotels will operate The Sapphire Bay Resort & Conference Center, which is scheduled to open in 2023.

American Life Hotel

The proposed 30-story American Life Hotel Project that would replace the empty lot where the former Jergins Trust Building once stood moved one step closer to reality in Long Beach, California.

Hilton Hotels/Curio Collection

The Valley Hotel, a stylish 129-room property in Homewood, Alabama, has become the latest addition to Hilton Worldwide’s prestigious Curio Collection portfolio.

Jungle Island

Plans to redevelop Jungle Island in Miami into a new resort featuring a 300-room hotel are underway. The resort also will have adventure attractions, water slides, a zipline course, a four-story parking garage and an expanded event space.

Hilton Worldwide

Hilton Worldwide plans to add nine hotels by 2026 to the 14 it lists in Egypt, with three new brands in the mix. The additional 1,700 rooms will be a 28% increase for Hilton in the Arab world’s most populous nation.

Choctaw Casino

A $500 million overhaul of the Choctaw Casino and Resort in Durant, Oklahoma is underway and will feature more than 800 new hotel rooms, additional dining and retail space and a lazy river when completed this spring. The project, which will double the size of the casino-resort, is expected to bring 1,000 jobs to the facility.

Marriott International

Marriott International has completed the Dallas/Plano Marriott at Legacy Town Center in Texas. The $3.6-million renovation includes its meeting and event spaces.

Treehouse Hotel

The affiliate of Starwood Capital Group, SH Hotels & Resorts, plans to open its Treehouse Hotel in Miami in 2023. This will be the brand’s first US location.

Hilton Hotels & Resorts/Playa Hotels & Resorts

Hilton Hotels & Resorts and Playa Hotels & Resorts will open their second all-inclusive property in Playa del Carmen, Mexico, in May. The boutique adults-only Yucatan Resort Playa del Carmen, Tapestry Collection by Hilton, joins the Hilton Playa del Carmen, with both managed by Playa.

Hyatt Hotels

Hyatt Hotels’ three independent brands will have openings in several new countries by 2025, including Japan, Finland, Mexico and Thailand. Sixteen properties have planned 2021 debuts in locations ranging from California to China, and a number of 2020 openings were posted by The Unbound Collection by Hyatt, Destination by Hyatt and JdV by Hyatt.

Small is the new big. But is it really?

What does the future hold for smaller store formats?

Macy’s did it. So did Target. And Kohl’s. Take a look around the industry and you will see the rising prominence of smaller store formats, which many brands found as an affordable way to expand into major cities and other urban areas pre-pandemic. But looking ahead, do they make sense? While you seek the answer, consider this: Along with the fact that small-format locations hinder a retailer’s ability to carry inventory, in today’s pandemic-defined landscape, smaller shopping radiuses breed uncomfortable quarters. Social distancing anyone? So, in today’s “small is the new big” retail environment, to go small, you have to offer something nobody else has. Unique service. Unique merchandising. Speed and convenience. And if you cannot keep it in the store, boost your online and curbside pickup presence. It will be interesting to watch how the trend plays out.

They said it

— Jan Freitag, national director for hospitality market analytics for CoStar Group, on when the hotel sector should expect to see some help in 2021

— McDonald’s CEO Christopher Kempczinski on the fast-casual’s strategy for 2021

— Saks Fifth Avenue CEO Marc Metrick on why affluent consumers spent more on luxury goods during the pandemic, despite the reduced need for new fashions and other indulgences

Voices

New survey highlights women’s experiences and opinions about working in the industry

Anew survey shows that while women typically are not the first thing you think of when the construction industry is mentioned, the presence and desire to be there continues to shine. According to Levelset’s “Survey of Women in Construction: 2021,” despite being underrepresented—and in some cases because of it—78% of women say they love their jobs. The report, which surveyed 1,001 women working in construction, also showed that 59% say they work in companies where fewer than 1 in 20 women are in leadership roles. Overall, the survey shows that women believe construction is a good career choice, with only 15% disagreeing that the industry provides good opportunities. Interestingly, when it comes to finding industry guidance—man or woman— two out of three industry women say they would like a mentor, with 45% not having access to one.

For a complete look at the report, visit www.levelset.com/survey/ women-in-construction.

The numbers game

150 The number of hotels that are under construction in Dubai, UAE, with 79 slated to open this year, according to TopHotelProjects. Rove Hotels and Millennium Hotels are among the companies with the most projects in the pipeline.

100 The number of cities and towns that restoration projects home improvement retailer Lowe’s plans on supporting to celebrate its 100th year in business. The chain, which began as a single small-town hardware store, is investing $10 million into the initiative.

1.6 The amount, in billions, that Publix is allocating toward capital projects in 2021. The grocer currently has 20 new stores under construction in five states.

200 The number of stores that Tim Hortons plans to open in China. The expansion plan also includes the debut of a new line of products for retail channels this year.

1,000 The number of locations Burlington Stores plans to open, more than doubling its current tally. The retailer is making expansion plans, while others are scaling back because it senses opportunity and because it has a new, smaller store prototype.

EONTM MODEL EL3

Three Phase Centralized Emergency Lighting Inverter Now Available Up To 55 kW!

LED Fixture / Driver Compatibility

High peak overload capability of 1700% to accommodate inrush current from LED fixtures / drivers while fed from the AC power source, or even while in battery mode.

Full Compliance With NFPA 101

Computer-based, self-testing / self-diagnostic emergency lighting system with data-logging and remote communications via BACnet, MODBUS, and Ethernet.

Compact, Space-Saving Footprint

Physically smaller than comparable three-phase emergency lighting inverter products, without compromising performance or serviceability.

10 kW – 55 kW Download a brochure and specifications today!

UL 924 Listed — Emergency Lighting Equipment C-UL Listed to CSA C22.2 No. 141-10; 141-15

www.controlledpwr.com/EON_1

Turning the page…

Dodge Data’s Chief Economist Richard Branch on the difference a year can make.

When Richard Branch gazes out at today’s commercial and residential construction markets he sees industries primed to head in one of two directions. We don’t have to tell which two those are. As Chief Economist at Dodge Data & Analytics, it is Branch’s job to track, analyze and forecast construction activity—no easy task today. So, as the country waits for additional details on the Biden Administration’s $2 trillion dollar “Build Back Better” infrastructure plan, we asked Branch to share some of his insights. How will a new infrastructure plan help, if passed?

If approved, it could create a large injection into state and local coffers, which would allow them to undertake significant investment in a diverse list of project types from public works, to transit systems and rural broadband.

How prevalent is construction to the economy's viability moving forward?

It is a critical part. Be it roads and transit systems to carry goods and people across the country or schools to educate our youth, the construction sector is a vital key to unlocking further growth in the economy.

What’s the overall vibe for 2021’s construction market?

package were to be passed by Congress in 2021, it could be the catalyst for strong growth in the years ahead. starts value in Q4 just 9% lower than the end of 2019. But much of that is due to The overall economy will pick single family and warehouse up speed as more Americans activity. When those two become vaccinated, but it will sectors are removed, the be difficult for the construc- value of starts would still be tion sector to take advantage off 21% from 2019’s peak. of that acceleration. Growth in activity will be hampered What sector holds by an overhang of space, Richard Branch the most promise? growing budget gaps for First, much of the growth in state and local governments, the residential sector last and rapidly rising material costs. There year was outside of major urban areas as will be bright spots from single family and homebuyers sought less density during warehouse construction starts. the pandemic and greater affordability. This was fueled by a rising number of Where has the pandemic left us? Americans who have the flexibility to work The pandemic and economic fallout have from home. This shift to the suburbs and left the industry in a deep hole. From beyond should lead to increased activity for 2019 through Q2 2020, the total value of schools, healthcare and public works projconstruction starts fell 22%. Progress was ects that need to support this demographic made by the end of last year, with the total shift. Additionally, if an infrastructure

Lightning round — Looking ahead

Dodge Data & Analytics’ Chief Economist Richard Branch gives us his rapid-fire assessment of which categories hold the most promise (Answers include: Strong, Good, Fair, Hopeful):

> Public works — Strong > Transit/ high-speed rail — Good > Renovations — Strong > Renewable energy — Fair > Data centers — Fair > Healthcare — Hopeful > Restaurant — Hopeful > Retail — Hopeful > Hospitality — Hopeful, but probably unlikely

The seekers

Despite pandemic-induced job losses, labor market tightness persists

By Anirban Basu

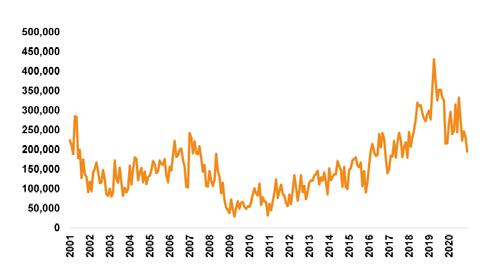

The “Job Opening and Labor Turnover Survey (JOLTS),” a Bureau of Labor Statistics (BLS) product that supplies data regarding labor market churn, indicates an ongoing tightening of the nation’s construction labor market. This is surprising for several reasons. First, between January 2020 and January 2021, industry employment fell by more than 200,000 jobs. Second, after expanding rapidly during the third quarter of 2020, the broader economy stalled in the fourth quarter of 2020 and the beginning of 2021. Finally, a number of industry-specific leading indicators, including Associated Builders and Contractor’s Construction Backlog Indicator, and the Architecture Billings Index, suggest lingering softness in demand for construction services.

Nonetheless, JOLTS data indicate that construction firms are clinging to their workers more aggressively, with layoff activity declining during late last year. This represents a departure from labor market dynamics registered in the first few months of 2020. In March 2020, as the pandemic imposed its will on American society, contractors slimmed down their workforces as project work slowed or came to a standstill. More than 600,000 construction workers were laid off or discharged during that month alone, more than 50% above the level registered during the previous worst month on record (April 2009). April 2020 was even worse, with 709,000 workers, or 10.8% of the total construction workforce, laid off or discharged. Despite the availability of steppedup unemployment insurance benefits from the federal government at that time, many construction workers clung to their jobs. The number of construction workers who quit reached a six-year low in April 2020, but has since rebounded to roughly normal levels. Indeed, JOLTS’ data indicate that the construction labor market has returned toward normalcy with astonishing rapidity. For example, both total hires and job openings were down only slightly on a year-ago basis by 2020’s conclusion.

Presently, the number of job openings is equal to 2.6% of construction employment (195,000 unfilled positions). While that is the lowest proportion registered since December 2017, it is higher than the average proportion of job openings observed from 2014-2017. It also is higher than any month during the 2008-2013 period, indicating that job openings are low by recent standards but not especially low in the context of the past decade. When the pandemic began, some thought (and hoped) that the massive job

Job openings

Source: Bureau of Labor Statistics

Rate of Construction Lay Offs and Discharges

When the pandemic began, some thought (and hoped) that the massive job losses observed in March and April would mitigate the skilled labor shortages that have frustrated construction firms for years. That simply has not happened to any meaningful degree.

losses observed in March and April would mitigate the skilled labor shortages that have frustrated construction firms for years. That simply has not happened to any meaningful degree. The return toward normalcy also is apparent in the quits rate, which shows that contractors are struggling to find and retain skilled labor. In December 2020, there were 13,000 more workers who quit their construction jobs than were laid off or discharged by their employers. This was just the 17th month in the past 20 years during which quits exceeded layoffs and discharges—a clear indication of labor market tightness. There is more. In the midst of a gut-wrenching, economy-destroying pandemic, average hourly earnings of construction employees reached their highest level on record in January 2021 ($32.11), and average weekly hours worked rose to their highest level since 2019’s third quarter. This is what one might expect from a strong economy operating under normal circumstances, not one facing a lingering pandemic and elevated unemployment. At the time of this writing, the construction unemployment rate is a still lofty 9.4%. How can it be that contractors are clinging to workers and still cannot fill many available positions during the midst of a pandemic? One possible explanation revolves around regional disparities. Parts of the US like the Southeast, Texas, Colorado and segments of the Mid-Atlantic region have surging residential marketplaces and reasonably stable levels of nonresidential activity. Other areas, like the Northeast and certain parts of the Midwest, where much of the industry’s job losses have occurred and where population has been stagnant or declining for years, are home to an abundance of unemployed construction workers. In other words, the job openings are concentrated in certain regions while idle labor is concentrated in others. CCR

3 Things to Watch

1. Will workers come back? According to the Census Bureau, more than 60% of construction workers who lost their jobs during the Great Recession left the industry by 2013. Many of these workers found positions in other industries, while others retired altogether.

2. Will the nonresidential segment catch up? The residential construction market has surged to unprecedented heights, with residential spending surpassing $700 billion in December 2020 (seasonally adjusted, annual rate), the highest level ever recorded and 20% higher than in December 2019. Nonresidential spending, on the other hand, is down almost 5% year-over-year, with the hot single-family construction market driving both labor and materials costs higher.

3. What about public construction? Thus far, public construction has held up well thanks in large measure to pre-existing backlog and construction’s enviable status as an essential industry. But with state and local government finances compromised by the crisis, it is conceivable that public work will dry up absent a federal stimulus package, resulting in more worker availability but fewer contracts.

Anirban Basu is the Chief Construction Economist for Marcum LLP, a leading national accounting and advisory services firm dedicated to helping entrepreneurial, middle-market companies and high net worth individuals achieve their goals.

Workforce. Workplace. Marketplace.

Why investing in diversity, equity and inclusion moves our industry forward By Indria Hollingsworth

As a passionate diversity professional advocating for equity in the marketplace, workplace, workforce and society in general, I have a certain perspective on inclusion and access to the construction industry that may surprise some people.

But first, the facts. According to the Bureau of Labor Statistics, only 10.9% of construction professionals are women, 30% are Hispanic or Latino, 6% are Black, and just 2% are Asian. While the US does not collect data of LGBTQI+ representation in the workforce, in the UK, only 2% of the construction workforce identify as part of the LGBTQI+ community. This does not represent the general population and means that the commercial construction industry—and our clients and partners—is not yet taking full advantage of the skills, perspectives and experiences the workforce has to offer. At JE Dunn, where I work from our Dallas office as the South Central Region Diversity, Equity and Inclusion Manager, we believe and have found that diversity and inclusion fosters innovation and creative thinking. Critically, we do more than say that diversity and inclusion matter. Our accelerated, applied approach is designed to help our employees continue to flourish in their careers. Not only do we recognize the value of having well-rounded professionals lead a diverse set of projects, but through the collaboration of innovative thoughts and ideas, we are able to promote a culture of inclusion where everyone feels like a valuable contributor to the company’s success.

And I can tell you firsthand: That makes all the difference in the world. At JE Dunn, diversity and inclusion is not simply a box to check; it’s a part of the creative culture we are proud to be recognized for. When looking inward at our workforce, even with a robust campus recruiting strategy, we realized it did not adequately reflect the communities where we live and work. With limited diverse construction talent, we decided to build our own talent pipeline. Because we are recruiting from a limited pool of diverse construction talent from the same schools as our peers, we enhance our recruitment strategy to include intentional recruitment efforts at historically black colleges and universities. We also are proud to work nationally and regionally on scholarship commitments. But we are not solely focused on diversity and inclusion for the JE Dunn pipeline alone. JE Dunn recently was one of only six companies—and the only construction company—in Houston awarded in the Houston Business Journal’s “Outstanding Supplier

Diversity” category for its annual “Diversity in Business Awards.” This is a proud moment and I want to tell you why. We have what we call a three-pillar strategy for diversity and inclusion: workforce, workplace and marketplace. To enhance our approach in building a diverse workforce, we partner with organizations across the nation that invest in diversity and inclusion—engaging with them consistently to help us identify and attract diverse talent. But we know that we do not and cannot operate in a silo. JE Dunn exists in an ecosystem of talent and a larger culture that affects access and professional development in construction. That is why we are proud to have a longstanding commitment to helping minority-owned and women-owned businesses succeed. Our “Minority Contractor Development” Program is a series of classes and activities designed to educate and equip minority and women contractors for success, help grow their businesses and launch a partnership with companies like JE Dunn. The program is free of charge for participants for around a dozen businesses that are selected through an application and interview process. Just one recent example of how this program can manifest. At the George Bush Intercontinental Airport in Houston, we achieved 40% MBE trade partner participation when only 38% was required. We have successfully achieved high levels of participation across industries, including the public sector. We received a major kudos from Mark Praigg, Business Advisor with the Houston MBDA Business Center, who said, “There are firms that we think are sincere about their diversity and inclusion efforts and JE Dunn was one of them. I saw JE Dunn is receiving a major contract at the airport. What really impressed me was the number of MBEs and WBEs you have engaged for the project including four of our clients. This shows a real commitment on JE Dunn’s part.” It is important to note that we do not do diversity and inclusion work for the praise or the points. We invest in this work and do our best to lead in the space because we think it is right—right for our company culture, right for the industry, right for the communities where we are honored to serve and right for the people whose lives we seek to enrich. Building a diverse and inclusive workforce pays dividends for everyone and I am thankful to be building a bigger table, as they say. So here’s what may surprise you. Diversity and inclusion are not critically important to construction companies, our clients and the larger ecosystem in which we work because of the way it makes people feel. It makes the planning, build and business outcomes better. It makes our perspectives more informed and our teams stronger. Does it feel good? You bet it does, but that is not what makes it so important. Diversity and inclusion make the industry more robust. CCR

Leadership matters

I want to thank JE Dunn national and Houston leadership as well as community stakeholders invested in the MCD program John H. Martínez-D., Ingrid Robinson, Milton Thibodeaux and Lindsay Pittard, and the business owners in Houston’s inaugural class: Linda Marroquin, Yvette Solis, Trisha Lira, Mike Homma, DELGADO ERNESTO, Michael Fontaine, PMP, Tania Harris, Sierra Alston, Lucious Barnum, Raj Karimi, Shaun Castillo and Hjardeir Dunn.

Indria Hollingsworth is the South Central Region Diversity, Equity and Inclusion Manager, in JE Dunn Construction’s Houston office.