Beverage packaging trends Soda ash TECH FOCUS: What next for float glass? Is this your own copy? Subscribe online at www.asianglass.com AG22-6 Indonesia: Benders and shapers Plus news, views, interviews and more… Exclusive interview with Philipp Zippe, CEO of Zippe

™ THE

OF CONVEYOR CHAIN www.pennine.org sales@pennine.org +44 (0) 1484 864733

FUTURE

We see a world designed with smarter, safer and more energy-efficient glass. We’re innovating the technology for you to make this a reality.

All about glass processing: www.glastory.net

info@glaston.net | www.glaston.net | www.glastory.net | www.gpd.fi

Machinery, services and solutions designed with the future in mind for the architectural, automotive, solar and appliance industries.

Machinery, services and solutions designed with the future in mind for the architectural, automotive, solar and appliance industries.

Regulars

6 Welcome

Goodbye 2022, Hello 2023.

8 Headline News

Openings, closures and industry moves from across Asia.

14 Global View

Our eye on the international arena.

20

People and Places

Movers and shakers, ups and downs.

26 Batch

Raw material news and updates.

32 Comment & Analysis

Mining experts believe that if cyber security is not addressed as a priority and protection against increasingly sophisticated attacks is not implemented, lives may be at risk.

Features

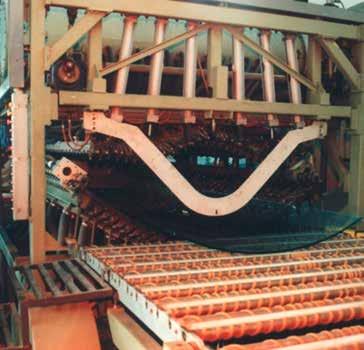

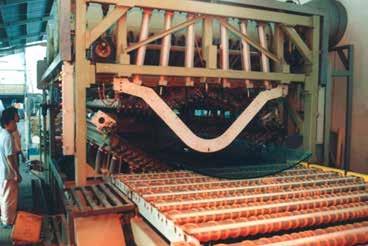

34 Indonesia: Benders and shapers

Sources in the Indonesian glass industry have reported an improved outlook for the year, reports Jahir Ahmed, citing a rise in demand for processed glass in the automotive, construction, and furniture industries.

42 Beverage packing trends

In some segments of the beverage industry, producers of container glass face stiff competition from alternative forms of packaging, including PET bottles and metal cans, notes Yogender Singh Malik.

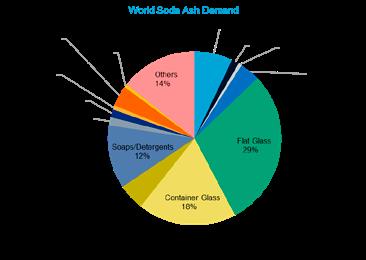

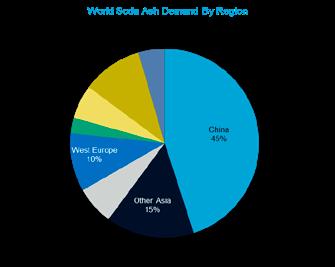

50 Soda ash

It seemed that the soda ash market had just about recovered from the impact of COVID-19 when it was negatively affected by the war in the Ukraine, writes Marguerite Morrin, executive director, global soda ash, chemical market analytics by OPIS, a Dow Jones company.

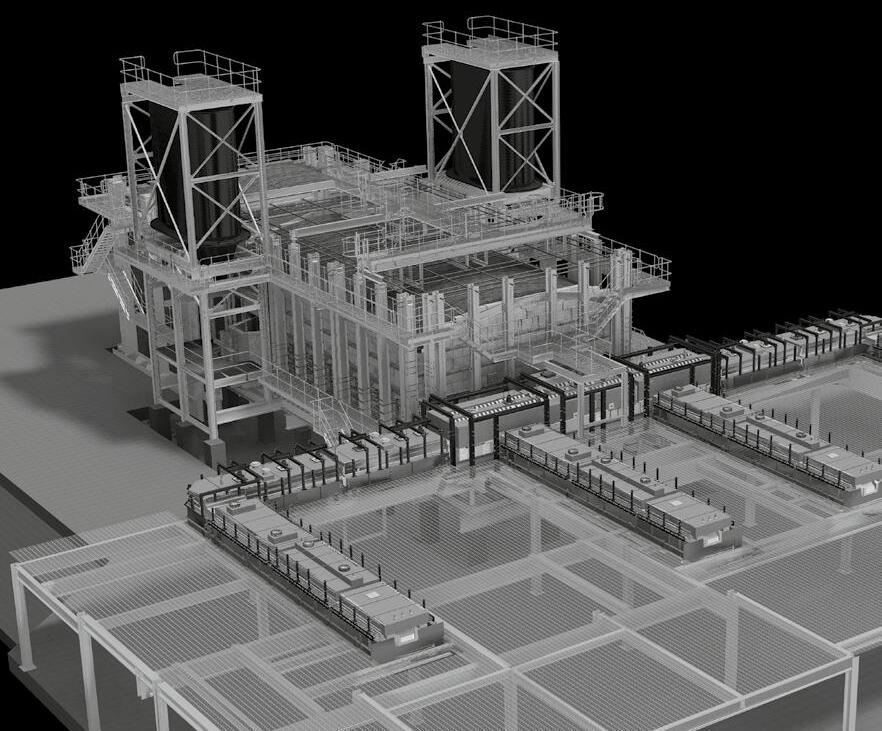

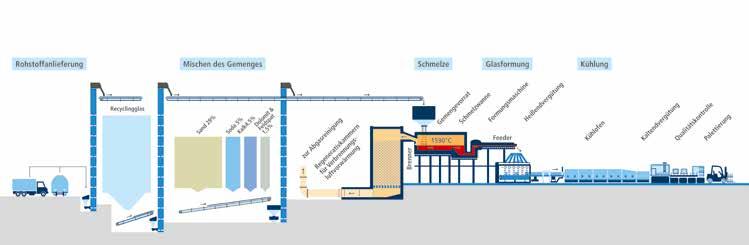

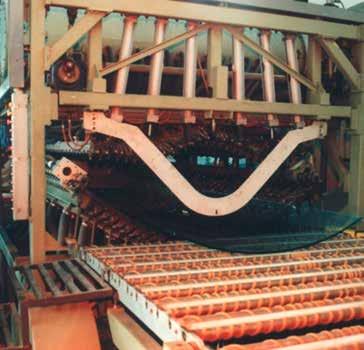

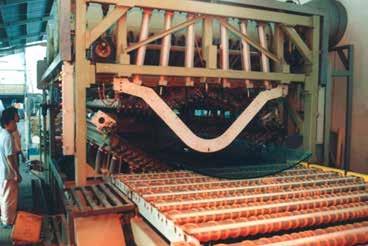

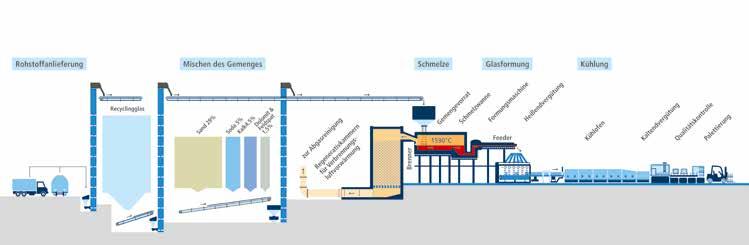

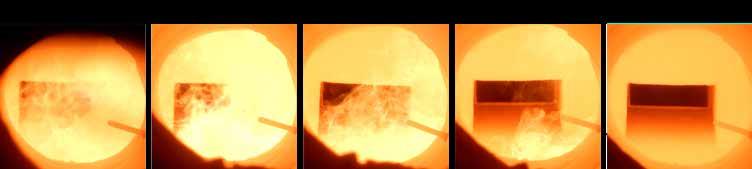

56 TECH FOCUS: What next for float glass

With climate change progressing and carbon neutrality needed by 2045, switching to more renewable energy sources and more advanced technologies is becoming increasingly important, says a glasstec report.

Anaylsis

62 In Focus

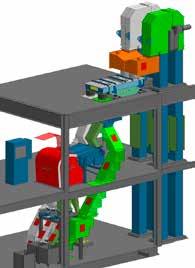

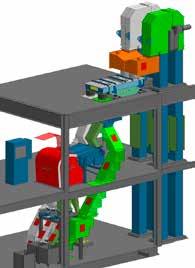

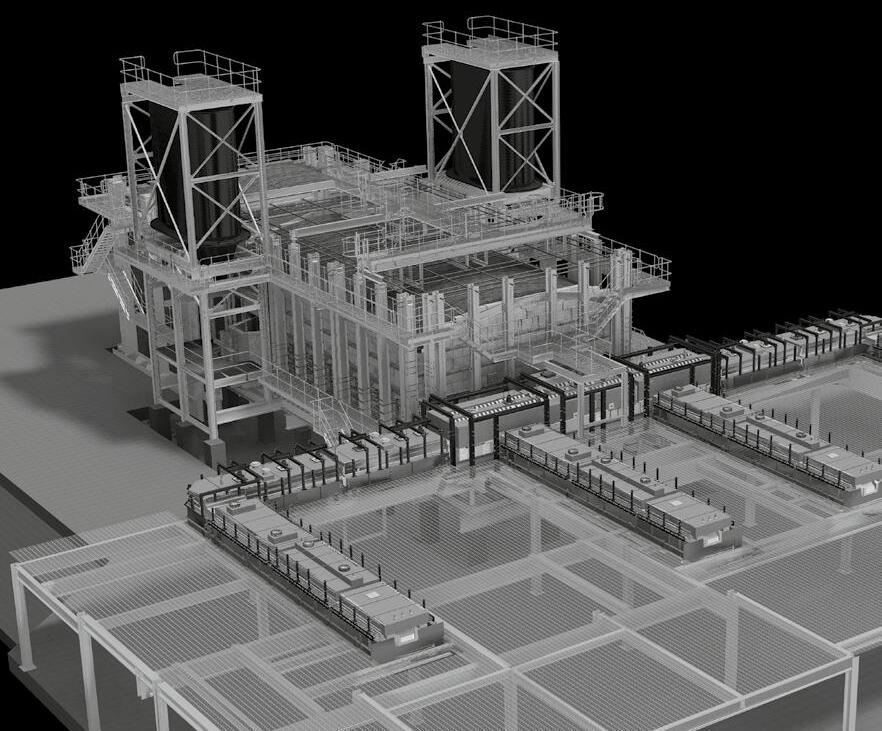

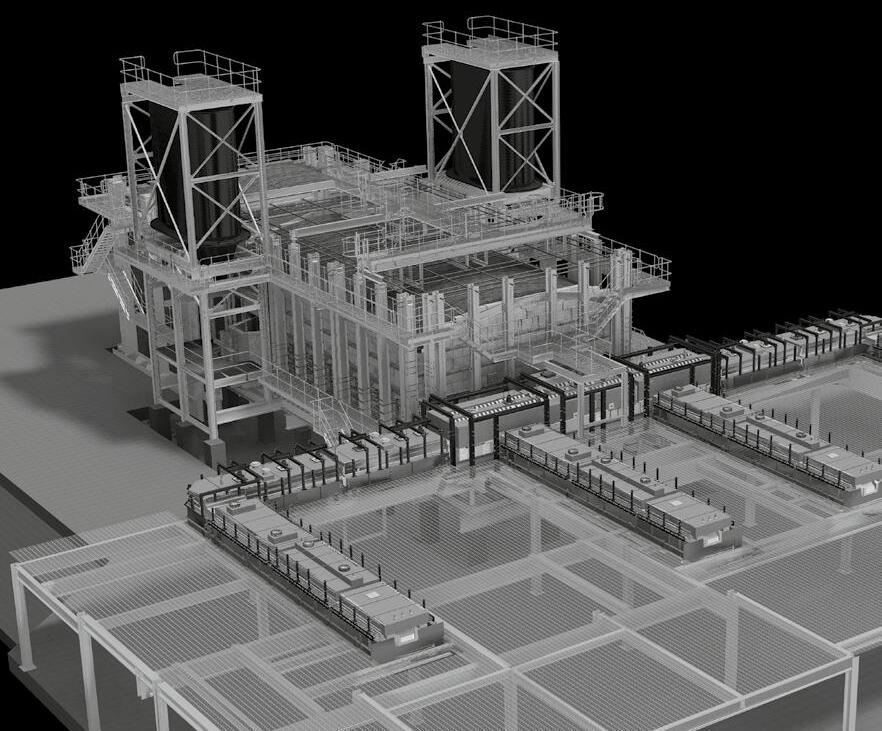

Founded in 1920, the name of this German company is synonymous with different technologies in the batch and cullet processing industries. In an exclusive interview with Asian Glass, Philipp Zippe, CEO of Zippe, discusses how his company has consistently delivered on its promises for over a century.

66 Window

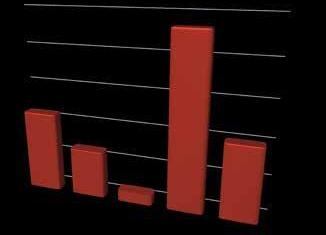

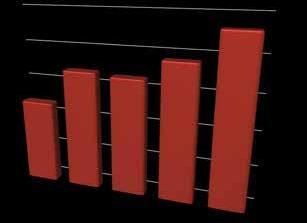

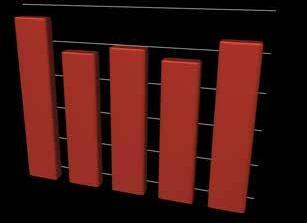

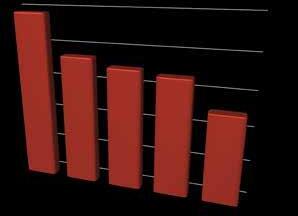

As insight into Indonesia’s glass trade for the period of 20172021.

68 Refractory Zone

News and developments from the refractory supply industry.

asianglass AG 22-6 www.asianglass.com 2

42

Contents: AG 22-6

Your favourite magazine is now available at the App Store… download today to see your first sample issue! Asian Glass: now for mobiles, ipads and androids 34

For humans, it’s obvious. For NEO too.

NEO Artificial Intelligence for defect recognition

Insight Asia

Redwave Qi

Introducing the first fully automatic quality control system for mobile containers

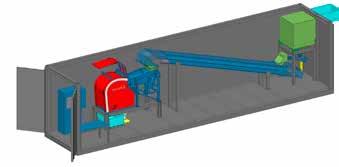

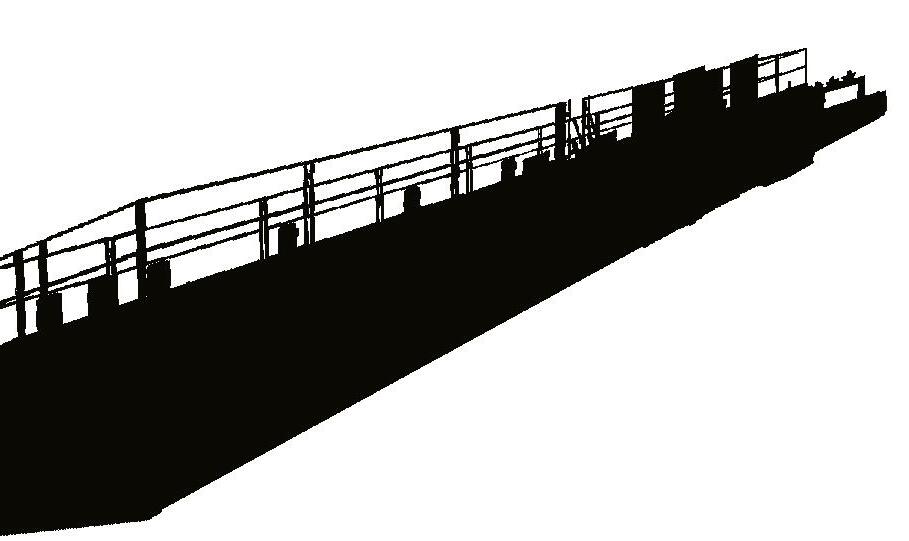

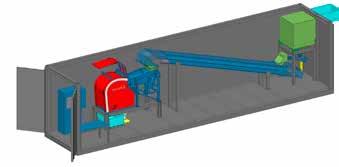

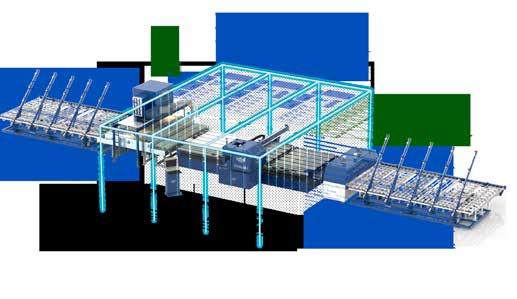

For more than 25 years, Redwave has developed ground-breaking solutions for the recycling industry. The company has recently delivered to a major German glass manufacturer the first fully automated quality control system in mobile container design, along with sorting machines and sorting systems for extracting recyclable material. The container solution is quick and easy to install, and its flexible design facilitates both future adaptations and rapid location changes.

Wiegand-Glas, one of Germany's largest family-owned glass producers, took possession of Redwave's Qi in October 2022, the world's first quality control system designed to integrate into a mobile shipping container. The major raw material in glass production is cullet, and high-quality cullet is essential for strong final products. Contaminants such as ceramics, stones or porcelain can result in massive

financial losses. In addition, there may be additional impurities in heat-resistant and non-melted glass-ceramic particles that can slip into the cullet, causing weaker glass and a greater likelihood of shattering. The Redwave Qi is a mobile container-housed quality control system that Wiegand-Glas invested in for the purpose of avoiding these impurities.

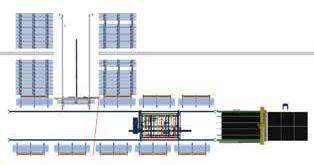

Designed to be independent, this system can be configured as either a mobile or stationary unit and can also be integrated into existing systems of sorting. A Redwave Qi analyser is used to determine the quality of cullet at the beginning of glass production by examining, controlling, and evaluating the material that is to be processed. Through the testing of the material composition, Redwave Qi is able to provide valuable information regarding the quality of input material. By performing this step, it is possible to detect undesirable impurities that may later result in weaknesses in the final product.

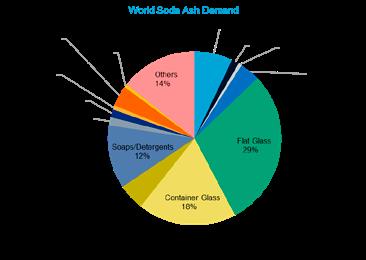

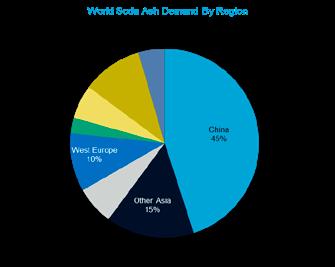

Welcome

Soda ash is one of the world’s most abundant natural resources. Additionally, it is one of the most basic industrial chemicals and an integral component of many everyday products. It has a wide range of applications in several different industries, including glass. About half of all soda ash is consumed by the glass industry: flat glass for the housing, commercial building and automotive industries as well as container glass for consumer products. Other glass-related uses include lighting, fibreglass insulation, glassware, display screens for consumer electronics and solar panels. However, in recent years, the soda ash market has seen extreme volatility. Events in 2020 set the stage for today’s soda ash industry. There was a sharp decline in demand in 2020, followed by a strong recovery in 2021, to the point where demand in 2021 exceeded that prior to COVID. The soda ash market has, however, experienced extreme volatility in recent years, not least as a result of the conflict in Ukraine. According to market experts, this volatility may continue into the new year, but the market will stabilise towards the middle of the year after a period of turbulence. That is very welcome news for our industry, indeed.

Indonesia: Benders and shaperrs

CONTACT DETAILS

EDITOR

Editor Isaac Hamza

Email: ihamza@asianglass.com

Direct line: + 44 (0) 208 123 1540

ADVERTISING

AND DESIGN

Advertising Sales

Paul Russell

Email: prussell@asianglass.com

Direct line: + 44 (0) 208 638 0619

Valerie Adamson

Email: vadamson@asianglass.com

More than 80% of the total container glass demand is derived from the beverage packaging industry. The fortunes of the container glass industry are therefore closely tied to the fortunes of the beverage packaging industry. In most countries, the growth of the beverage market has led to a steady increase in the demand for glass containers, but Yogender Singh Malik notes that container glass producers face intense competition in some subsectors of the beverage industry, including PET bottles and metal cans. Through his review, we can gain a better understanding of how the container glass manufacturers are surviving and sometimes even thriving.

The Zippe company is among the world’s leading manufacturers of batch and cullet plants for the glass industry. For more than 100 years, it has designed and implemented more than 600 batch plants and more than 1,000 cutting plants in accordance with customer requirements.

Philipp Zippe, CEO, Zippe takes us behind the scenes of a company that consistently delivers on its promises for more than a century in this issue’s exclusive interview.

Last but not least, as the year comes to an end, we at Asian Glass would like to express our gratitude to all of our readers, as well as to all of our advertisers, contributors, and well-wishers. You have been an integral part of our success - and we owe it all to you. Here’s wishing you a

Direct line: + 44 (0) 208 133 5273

Production and design Tim Mitchell www.piernine.co

OVERSEAS OFFICES

Bangladesh Jahir Ahmed jahir@asianglass.com

India Yogender Singh Malik yogender@asianglass.com

Sri Lanka Rohan Gunasekera rohan@asianglass.com

RESEARCH

Research Manager

Andy Skillen

Isaac Hamza Editor

Email: askillen@bowheadmedia.com

HEAD OFFICE

27 Old Gloucester Street, London WC1N 3AX, UK.

Directors: Valerie Adamson & Paul Russell.

Asian Glass (ISSN: 1475-6501), is published by Adamson-Russell Communications Ltd, registered in the UK No. 13652192.

6 asianglass AG 22-6 www.asianglass.com

Beverage packaging trends Soda ash TECH FOCUS: What next for float glass? Is this your own copy? Subscribe online at www.asianglass.com AG22-6

Plus news, views,

and more… Exclusive

Covers_CURRENT.indd 2 16:42 News, Views, Analysis and much more! www.asianglass.com

interviews

interview with Philipp Zippe, CEO of Zippe

NO.1 IN SPEED AND FLEXIBILITY MAXIMISE YOUR PROFIT

H i PERFORM

COMBINE SPEED AND FLEXIBILITY WITH SUPERIOR LIFETIME

+ High production speed

+ Fast job changes

+ Reduced downtimes

+ Robot option

+ Clean design

www.heye-international.com

HEADLINE NEWS ASIA

Ras Al Khaimah industrial audit sees companies sign-up

United Arab Emirates

Ras Al Khaimah Municipality has launched an energy audit programme for the industrial sector. The programme will help industrial companies identify energy saving opportunities that will make them more environmentally friendly and competitive.

Companies such as RAK Ceramics, Stevin Rock, RAK Rock, Falcon Technologies, RAK Ports, Union Cements, Eternity Technologies, and Future Architectural Glass among the first signatories signed agreements with Ras Al Khaimah Municipality during the RAK Energy Summit to take part in the programme. The industrial sectors initially supported in the programme are cement, ceramics, quarries, glass, building materials, metal fabrication and packaging.

On the occasion of launch,

Munther Mohammed bin

Shekar, director general of Ras Al Khaimah Municipality said: “The programme will support local industrial companies in identifying opportunities for energy savings and reduction of emissions, that will help them remain competitive over the long run. I encourage all the industrial companies in Ras Al Khaimah, for whom energy is a main cost, to participate in this initiative.”

Participating industries will receive an energy audit, conducted by expert energy auditors, and will periodically share progress of implementation with Ras Al Khaimah Municipality. Audits are procured at scale with the support of Ras Al Khaimah Municipality, while Rakbank provides a credit facility to dilute the cost of the audit over time along with evaluating for any

other financial support that such companies may need.

Until now, Ras Al Khaimah Municipality has empanelled a total of seven expert industrial auditors using a competitive tender process. Participating companies can choose any of the empanelled auditors to conduct an energy audit, including onsite measurements and assessment of energy saving opportunities. Reem Office of Ras Al Khaimah Municipality will support both parties during the whole process by facilitating data collection and logistics as well as by providing technical support.

In addition to the energy audits, the programme will also include knowledge sharing sessions with energy efficiency experts as well as suppliers of technologies and services. These sessions will enable local industries to learn

and follow best-practices and use state-of-the-art technologies to become more energy efficient and contribute to achieving wider sustainability targets.

This initiative is part of the Energy Management programme of Ras Al Khaimah Energy Efficiency and Renewables Strategy 2040, and is in line with several strategies and policies, including Operation 300bn of the Ministry of Industry and Advanced Technology, and the UAE Circular Economy Policy.

Visitor influx at Eurasia Window, Door and Glass Fairs

Turkey

The Eurasia Window, Door and Glass Fairs, which are included among the largest and most prestigious industrial events in the region, was held at the Istanbul Tüyap Fair and Congress Center from 12 -16 November 2022.

The 23rd International Window, Window Shade, Facade Systems and Accessories, Profile, Production Technologies and Machinery, Insulation Materials, Raw Materials and Auxiliary Products Fair brought together leading firms in the industry operating in the fields of window manufacturing machinery and technologies, window profiles, profile manufacturing machinery, window mechanisms, window side industry, facade systems, insulation materials, raw materials and auxiliary products with numerous decision-making

industry professionals.

The fairs, held in collaboration with the Window and Door Sector Association (PUKAD), Window Producers Quality League Association (PUKAB) and Entrepreneur Aluminum Industrialists and Business People Association (GALSIAD), were visited by 60,128 people from 126 countries, including 13,143 visitors from abroad and 46,985 local visitors from Turkey.

Ali Muharremoğlu, managing director, Reed Tüyap Fuarcılık, stated: "The Eurasia Door, Window and Glass Fairs were concluded with a record-high attendance figure. Leading firms from the industry exhibited their latest innovative solutions in the fields of door, window and glass manufacturing. This year our participants were also extremely pleased with the interest shown

in the auxiliary products and solutions at the aluminium and shading special sections. We have seen professional visitors from 126 countries establish key business contacts during the fairs."

The Eurasia Door Fair gathered visitors for the 14th time, and the Eurasia Glass Fair for the 12th time. The Eurasia Door Fair, where the industry's leading manufacturers of interior door and door systems, locks, panels, panels, partition systems and accessories exhibited their products and services, met with its visitors for the 14th time; and the Eurasia Glass Fair met with its visitors for the 12th time with glass products and applications, productionprocessing technologies and machines, and complementary products and chemicals.

See you again between November 11 - 15, 2023…

The Eurasia Door, Window and Glass Fairs will open its doors again between November 1115, 2023, presenting a wide range of opportunities for establishing key business contacts.

Asian Glass: mobiles, ipads & androids

8 asianglass AG 22-6 www.asianglass.com

Borosil Renewables acquires 86% of Interfloat Group

India

India’s largest solar float glass producer, Borosil Renewables has acquired an 86% stake in Interfloat Group, Europe’s largest solar glass manufacturer.

Interfloat Group is based in Germany and Lichtenstein and has been serving customers in the solar industry since 2008. It operates through Glasmanufaktur Brandenburg GmbH (GMB), which has a production facility near Berlin, and Liechtensteinbased Interfloat Corporation, which supplies the glass to the

European market.GMB operates a solar glass plant with a production capacity of 300 tonnes/day.

With this acquisition, Borosil Renewable’s solar glass manufacturing capacity will grow 66% to 750 tonnes/day.

Company’s total capacity would increase to 1,300 tonnes/day with the commissioning of a new furnace with a capacity of 550 tonnes/day in India over the next two months.

This acquisition will make a wider range of solar glass available

to BRL's expanded customer base in Europe.

“The overseas wholly owned subsidiaries of the Company [Borosil Renewables], namely, Geosphere Glassworks GmbH and Laxman AG, have completed the acquisition of 86% stake in GMB Glasmanufaktur Brandenburg GmbH (GMB) and Interfloat Corporation (Interfloat), respectively. Consequently, both GMB and Interfloat have become step-down subsidiary companies of the company.

“Borosil is committed to investing in manufacturing in Europe and will be increasing capacity at GMB’s Tschernitz plant at an appropriate time in the near future.

“This means that BRL and Interfloat will be able to supply significantly higher volumes of solar glass to their present and new customers by improving the serviceability as a result of the production from two locations now,” stated a company statement published on the stock exchange.

Competition Commission of India puts on hold HNGL acquisition

India’s largest container glass producer, Hindustan National Glass Limited’s ( HNGL) acquisition has been put on hold by the Competition Commission of India ( CCI), a few days after the committee of creditors (CoC) showed a green light to the proposed resolution plan.

CCI has invalidated details furnished by AGI Greenpac and has asked the company

to submit more details. These details are sought by the competition commission when the market share of the acquiring company is more than 15% in the domestic market.

In the last week of October, HNG's CoC approved the plan of the company's acquisition by the second largest container glass producer, AGI Greenpac for INR 22,130 million.

HNG owes INR 17,100 million to a group of 12 creditors, led by the State Bank of India (SBI). The insolvency proceedings were initiated in October 2021 by DBS Bank which has an exposure of INR 4,680 million.

Earlier, AGI Greenpac was known as Hindusthan Sanitaryware & Industry. Its resolution proposal got 98% votes of the CoC, followed by

88% to the Uganda-based Madhwani group.

AGI Greenpac offered INR 18,510 million upfront and INR 3,650 million in the form of deferred payments to the lenders. An amount of INR 60 million was proposed to be paid to the employees of HNG.

The plan was given a go-ahead by SBI, Edelweiss, DBS, LIC and other important CoC members.

Yalova's Ekomat project, a first in Turkey, gets underway

India Turkey

The Ekomat project, which is being implemented for the first time in Turkey with the support of the BIRCAM Foundation, the GCA, and Park Cam, has been launched in Yalova, which was chosen as the pilot city. It is the goal of the project to create awareness about recycling and to collect numerical data for waste management setup prior to the implementation of the mandatory deposit system.

Yalova Governor Muammer Erol, Yalova Deputy Mayor Mustafa Tutuk, Bircam Foundation President Ömer Kızıl, Park Cam General Manager Semih Özbey and GCA General Manager Abdullah Gayret attended the opening ceremony

at the Yalova Raif Dinçkök Cultural Center.

The Ekomat Project details were explained by Gayret and Özbey, and the first bottles were recovered following the protocol. Ekomat, which is supported by the Turkish Environment Agency and whose pilot city is Yalova, is financed by the glass packaging manufacturers GCA and Park Cam, and the waste management operations are carried out by the BIRCAM Foundation. Gayret explained that the main objective of the EKOMAT project is to contribute to recycling, since glass is a material that is limitlessly recyclable, while at the same time raising consumer awareness of

this issue. "With Ekomats, we will reduce the demand for new raw materials to be used in production, and at the same time, we will create recycling awareness in the society. With this project, we experience the pride and joy of being an example to the whole of Turkey.”

Özbay said: “We love our country and we want to leave a more livable world to our children, who are our future. We are also aware that if we do not make important individuals for the environment today, it will be too late tomorrow.

“As Park Cam, we have made significant expenditures on recycling activities since the day we were founded. We created sustainable

glass waste management models by establishing the Bircam Foundation with Beypazarı, Uludağ, Kınık and Sarıkız mineral waters. It is our most valued project at EKOMAT, we look forward to your participation.”

Kızıl said: “As part of the Ekomat project, an end-to-end integrated waste management system will be provided. Thanks to the national software we developed, the occupancy rates will be monitored with the integration of vending machines into the software.

"When they reach a certain occupancy rate, the field team will be messaged and instructed to empty the vending machine.”

9 www.asianglass.com AG 22-6 asianglass

Glass for Europe brings sustainability to Glasstech Asia

Singapore

Glasstech Asia reassembled in Singapore from 26-28 October for the first time after several years of COVID-19. Alongside the fair gathering hundreds of actors of the South-East Asian industry and the 2022 International Year of Glass celebrations by the Singapore glass association, the 2022 Asia Façade and Glass Conference was organised. Its main theme was sustainability, both in the industry and in architecture and buildings.

Glass for Europe was called upon to address these topics and explain the European vision and work in the field, considering the

leading role of Europe’s industry in this regard. Glass for Europe’s Secretary General, Bertrand Cazes, made a presentation on the 2050 vision of the flat glass industry in a climate neutral Europe and how this vision supports the industry’s sustainability efforts to keep glass as material of first choice for the design of genuinely sustainable buildings.

Bertrand also moderated an exciting panel discussion with Glenn Carlton from Guardian Glass, Jayrold Bautista from DOW and Johannes Kreissig from the German Sustainable Building Council, on how to enhance

sustainability considerations in the design and construction of facades is South-East Asia.

Reflecting on the German experience and the realities of the South-East-Asian markets, the panel touched upon the importance of raising awareness on whole life-cycle carbon assessment, of product transparency and verified environmental declarations and of safeguarding affordability. The panel discussion concluded that sustainable buildings ought to be breathable buildings both for the planet and for their occupants that are achievable and

scalable worldwide.

The event also offered the opportunity to meet with with Gan Pay Yap, Chairman of Singapore Glass Association, and enlarge Glass for Europe’s network building new ties with representatives of Glass associations from Vietnam, Indonesia and Malesia.

Vibrantz Technologies to sell DipTech digital printer business

Israel/United States

Vibrantz Technologies today announced that its DipTech subsidiary based in Israel has entered into an agreement to sell its digital printer business to Kerajet. The digital ink business is not part of the sale. The deal is expected to close within the next 60 days.

“This sale allows Vibrantz to redouble our focus on the production and development of digital inks for Kerajet and other digital printer manufacturers,” said D. Michael Wilson, Vibrantz president and CEO “It also

helps ensure our unmatched glass expertise and capabilities continue to grow in support of the digital printing market.”

“Kerajet’s expertise in the ceramics market and two decades of experience in digital printers well positions the company to take over DipTech’s digital printer business,” added Matthias Bell, president of Performance Coatings at Vibrantz.

Vibrantz will provide further information to DipTech customers upon the closing of the transaction. Until that time, customers should continue transacting with DipTech

as usual.

Founded in 1998 and headquartered in Castellon, Spain, Kerajet is a designer and manufacturer of advanced digital printers for ceramics, textiles, tableware, PVC, fibre cement and other applications using different kinds of inks, depending on the final product.

Vibrantz provides specialty chemicals and materials around the world. The company serves over 11,000 customers and its products and technologies are used in a broad range of

applications and consumer products. It specialises in particle engineering, glass and ceramics science, and colour technology, and offers specialty mineral and chemical additives for batteries, electronic components, and construction, dry powder pigments for paints and coatings, thermoset plastics, thermoplastics, glass coatings, and porcelain enamels. It is based in Houston, Texas, and employs over 5,000 people across 65 manufacturing sites across six continents.

NSG operates second float glass plant in Argentina

Japan/Argentina

The NSG Group has announced that the construction and operation of the second float glass plant has been completed.

Located in Los Cardales, Argentina, the new plant is operated by Vidriera Argentina S.A. (VASA), a joint venture subsidiary with over 80 years of experience.

The investment was made in 2018 in order to meet the growing demand for architectural and automotive glass in Argentina, as well as supply the market in South America, which continues to grow. It was originally planned to begin operations at the beginning of 2020, however due to the turmoil in the global economy, which includes the spread of COVID-19, the start of operations has been delayed.

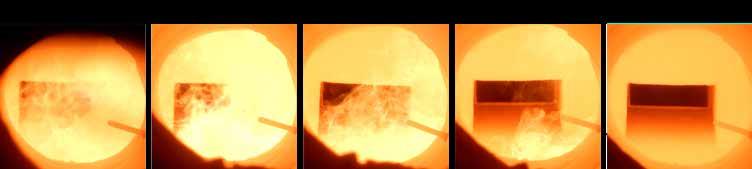

After the construction work was successfully completed, the furnace was warmed and production of glass began on 8 October.

In spite of a challenging macroeconomic environment, glass demand continues to outpace supply due to a continued increase in construction activity. The NSG Group views the region as a promising market in which to demonstrate its business capabilities.

NSG Group promotes "Expansion of Value-Added Business" and "Transformation into more profitable portfolio of business" as part of its mediumterm management plan titled "Revival Plan 24 (RP24)". One of the Group's strategic investments will be the operation of a new

float line in Argentina and South America, where the Group has established a strong position for many years.

The NSG Group is a global supplier of glass and glazing systems offered through its three main business segments, Architectural, Automotive, and Creative Technology.

Architectural Glass manufactures and supplies architectural glass as well as glass for solar energy and other sectors.

Automotive Glass serves the original equipment (OE) and aftermarket replacement (AGR) glazing markets.

Creative Technology comprises several discrete businesses, including lenses and light guides for printers and scanners, and

specialty glass fibre products such as glass cords for timing belts and glass flakes.

Founded in 1938, VASA is a joint venture of NSG (51%) and SaintGobain (49%) that is Argentina's only supplier of float glass. VASA's Llavallol plant currently operates one float line, one rolled line, one silvering line, two laminated lines for architectural glass, and an offline cutting facility for automotive glass.

10 www.asianglass.com asianglass AG 22-6 News

Dimensional measurement for glass containers—simplified.

• Accurate. Fast. Intuitive. Powerful, simple job creation and editing

Pre-defined container measurement routines

automated feature recognition and job setup in seconds

AGRINTL.COM +1.724.482.2163

Phoenicia and Airovation Technologies sign MOU

Israel

The new MOU will see Airovation’s groundbreaking technology implemented into Phoenicia’s plant to turn the factory’s CO2 emissions into raw materials used in the glass making production process. By creating this circular economy, the two parties hope to not only reduce the carbon footprint but enable the Phoenicia to be less dependent on imports. A glass manufacturer, developer, and supplier since 1934, Phoenicia produces, develops, and supplies

glass. The factory is located in the Lower Galilee, in the fast-developing industrial area of Nazareth, enabling easy and fast deliveries to local customers and to Haifa Port, which serves more than 30 different destinations worldwide. Phoenicia's float line is designed to produce low iron float glass and specialty glass. Airovation Technologies provides original, patented air purification and carbon capture systems. The core technology has been developed at The Hebrew University of Jerusalem

over a period of over ten years and is designed to efficiently and economically capture and convert CO2 into valuable mineral endproducts in the form of carbonate and bicarbonate minerals and oxygen. The technology can also be used to purify indoor air spaces by oxidising microbiological threats, such as viruses and bacteria, while converting harmful gases into oxygen-enriched clean air. A key technological advance is the generation of superoxide

Cobalt Blue participates in Korean delegation

Australia/South Korea

Cobalt Blue again participated in the Australian Critical Minerals Delegation to South Korea, with this visit held on 11-14 October. The Delegation was led by Senator the Hon Don Farrell (Australian Minister for Trade and Tourism) and his counterpart, Minister Lee

(Korean Minister for Trade, Energy and Industry).

Government and industry representatives from the South Korea and Australia acknowledged the strategic importance of securing critical minerals supply chains to support the development of clean

energy applications.

Bruce Blunden represented Cobalt Blue Holdings Limited on the Delegation, where he shared information on the opportunities for a long-term supply of ethical cobalt for battery applications from the Broken Hill Cobalt Project.

AIS reports unaudited second quarter results

India

Asahi India Glass Limited (AIS), which manufactures and delivers glass products to retail and institutional customers, announced its unaudited financial results for the second quarter ended 30 September at its Board Meeting.

Sanjay Labroo, CEO and managing director of AIS, said: “I am happy to share that we

posted our highest absolute sales figures this quarter, which were backed by a very strong and steep demand recovery in the automotive segment.

“However, our operating profits remained almost flat during the quarter, resulting in a compression in EBIDTA margins. This was a result of inflation over the last quarter,

especially in our automotive glass business which also witnessed very high volatility in model mix of the increased demand, leading to some operational inefficiencies versus our internal budgets.

“I am also glad to update that our new project for setting up a greenfield float glass plant is progressing quite well, and we

radicals in situ, which are among the strongest oxidisers known to science. The company develops solutions for indoor air treatment as well as carbon capture in industrial settings.

Blunden said: “Taking part in the Delegation provided many occasions for us to present and discuss the Broken Hill Cobalt Project.”

target to commence operations in Q2 FY 24-25.”

AIS was established in 1986 and is one of the leading players in the automotive and architectural glass segments. It holds a market share of approximately 72% in Indian passenger car glass and has an established track record over the past three decades.

Glasstech Asia and Fenestration Asia 2022 celebrate success

Singapore

Glasstech Asia and Fenestration Asia concluded successfully on 28 October. In total, more than 2000 attendees from over 28 countries attended the event which held the fair alongside an all-inclusive variety of side events such as the inaugural Asia Façade & Glass Conference, Singapore façade tour, international year of glass exhibition Through the Looking Glass, buyer-seller meetings, as well as an annual networking gala dinner.

Michael Wilton, CEO and managing director of MMI Asia, said: “The importance of this event and its success shows a promising trajectory for the glass and façade sector. The personal touch of

having face-to-face discussions remains undisputed as the most effective way to set growth in the industry.

“With more plans to integrate Glasstech Asia and Fenestration Asia into the global BAU Network, I foresee an exciting future in providing the industry with increasing opportunities to share their story with a wider global audience.”

Gan Pay Yap, chairman of Singapore Glass Association, said: “The success of this edition does not only represent a restoration of industry norms, but the revival of close knitted connections made possible by regional platforms

such as Glasstech Asia and Fenestration Asia.

‘The Glass Hub of Southeast Asia’, Glasstech Asia is an annual rotating exhibition that focuses on all things related to glass. A combined event of the 18th edition of Glasstech Asia and Fenestration Asia was held at the Sands Expo & Convention Centre in Singapore from the 26th to the 28th of October, this year. This three-day event featured exhibitors from the Southeast Asian glass and glazing sector, ranging from glass manufacturing, processing, and machinery to accessories, raw materials, and finished glass products.

The next Glasstech Asia - the 19th International Glass Products, Glass Manufacturing, Processing & Materials Exhibition, and Fenestration Asia – the 6th International Windows, Doors, Skylights, Curtain Wall & Facade Technology Exhibition, will take place from 29 November-1 December 2023 at the IMPACT Exhibition and Convention Centre in Bangkok, Thailand.

12 www.asianglass.com asianglass AG 22-6 News

Image Credit: Yoav Weiss, Airovation Technologies, Airovation Technologies

13 www.asianglass.com AG 22-6 asianglass News Contact Ramsey at www.ramseychain.com, sales@ramseychain.com, (704) 394-0322 • Guard Links with Fully Recessed Pin Heads • 100% Hardened Alloy Steel Construction • Staked to Decrease Chain Elongation • Special Side Links For Easy Connection • Pre-Stressing for Reduced Chain Elongation • Available in ½” and 1” Extended Pitch ACTUAL PHOTOS OF SENTRY SINCE 1923 SENTRY 2-PI N CHAIN. FOR LONGER LIF E & HIGHE R SPEEDS. Ramsey’s 100% Steel Sentry 2-Pin Chains:

Global View

Glass Focus Awards 2022 winners revealed

The winners of the Glass Focus Awards 2022 were unveiled at a black-tie dinner hosted at the Sefton Park Palm House in Liverpool on 17 November.

Companies from across the glass supply chain gathered to celebrate the International Year of Glass and the milestones of the previous 12 months at the event which saw Pilkington NSG crowned Company of the Year for the first time.

The flat glass manufacturers also won the health and safety action award while Saint-Gobain Glass UK and Ardagh Glass Packaging were both double winners on the night. The former took home the Design of the year – flat glass and Strengthening business through people awards with the latter awarded the Sustainable practice and Marketing impact categories.

Other winners included Beatson Clark’s Dana Godfrey winning the Rising Star award, Encirc securing the Innovative

solution prize and Stoelzle Flacconage’s One Gin coming out on top in the Design of the year – container award.

British Glass CEO Dave Dalton said:

“It has been another testing year for the glass sector and while may of the problems we have faced still persist, it is a great pleasure to gather everybody together at the Glass Focus Awards again to celebrate all the achievements our great industry has accomplished.

“As always, the level of entries for each of the categories has been spectacular and wide ranging. From showcasing our talent for innovation and our status as pioneers on the journey towards net zero to the beautiful designs we see every day on our bottles and buildings and the unrivalled talent that makes up our workforce, it is a reminder of why the glass industry stands in a class of its own.

“We are all extremely proud of

the work we have done over the last year, and we look forward to continuing to build on our successes in 2023 and beyond.”

The full list of winners from the Glass Focus Awards 2022 are:

Design of the year – container (sponsored by Packaging Innovations): One Gin by Stoelzle Flaconnage Ltd

Design of the year – flat (sponsored by Glass International): The Spark by Saint-Gobain Glass UK

Innovative solution (sponsored by Glass Technology Services): Cooling system improvements by Encirc

Health and safety action (sponsored by Grayling): Vehicle and pedestrian GAP analysis tool by Pilkington NSG

Strengthening business through people (sponsored by Glass Worldwide): Complex cold repair by Saint-Gobain Glass UK

Rising Star (sponsored by the Worshipful Company of Glass Sellers): Dana Godfrey at Beatson Clark

Marketing Impact (sponsored by awesome.): The Glass making process by Ardagh Glass Packaging

Sustainable Practice (sponsored by Glass Futures): Water saving initiative by Ardagh Glass Packaging

British Glass Company of the Year: Pilkington NSG

Stakeholders mark UN International Year of Glass in 2022

The United Nations designated 2022 as the International Year of glass, the first time a manmade material was chosen for worldwide attention. On 16 November, Glass Alliance Europe marked the occasion with an event gathering policy makers and stakeholders at the Representation of the Free State of Bavaria to the European Union in Brussels.

Opening the event, Maive Rute, Deputy Director-General, DG GROW, European Commission, said: “Glass can play an important role as a material, helping to enable our green and digital transition and supporting our society in achieving long-term sustainability and prosperity. The glass industry has a long and rooted tradition in Europe, and we must work to ensure that it is able to continue operating in our continent at competitive conditions.”

Barbara Schretter, Director of the Representation of the Free State of Bavaria to the

European Union added that “Europe is home to many glass producers who are helping to turn Europe into a prosperous and sustainable economy and society.”

Speaking on how glass can enable a world without waste, Aurel Ciobanu-Dordea, director of circular economy, DG ENVI, European Commission welcomed “the glass industry efforts to deliver on the EU’s Circular Economy Action Plan to ensure that waste is prevented, and the resources used are kept in the EU economy for as long

as possible.”

Glass plays a key role as a high-tech material vital to the energy performance, safety, security and comfort of our homes, offices, buildings and cars and is essential to make Europe fit for sustainable living.

Anne-Katharina Weidenbach, energy efficiency expert at the Cabinet of Commissioner Simson (DG Energy), was among the panellists to discuss how glass will contribute to sustainable living and will be crucial to green energy production in Europe.

The glass industry is committed to ensuring that greenhouse gas emissions from glass production drop substantially in the next decades. MEP Monika Hohlmeier along with UNIDO’s Managing Director Gunther Beger highlighted the challenges of decarbonisation and the importance of sharing best practices emerging from the glass industry’s roadmaps towards a climate neutral Europe.

Asian Glass: mobiles, ipads & androids

14 asianglass AG 22-6 www.asianglass.com News

United Kingdom

Belgium

LEHRn°

GLASS MACHINERY

Pochet and Fives announce strategic partnership

France

The Pochet Group, a French luxury packaging specialist in the beauty sector, is joining forces with Fives, a global industrial engineering group, to reduce carbon emissions while producing eco-friendly glass.

A division of the Pochet Group, Pochet du Courval, which has been shaping and decorating glass for 400 years, has announced a goal to reduce its CO2 emissions by 50% by 2033 through the use of decarbonised glass. A flagship industrial site in Normandy, France, the Guimerville plant produces and decorates more than one million

glass bottles and jars every day for top-end perfume and beauty companies.

The Guimerville plant will be built with an electric furnace manufactured by Fives, a wellknown name in all-electric melting technology. The

furnace, a Prium E-Melt coldtop vertical melter, is one of the most advanced technologies available to significantly reduce CO2 emissions. The melter is designed based on Fives’ significant electric melting operational experience.

Benoit Marszalek, Pochet du Courval’s chief operating officer, said: “The investment, supported by Pochet Group's private shareholders, falls in line with the company's strategy to reduce environmental impact and will require both technological and human transformation. “This electric

furnace will be the very first French furnace dedicated to luxury bottles enabling us to offer carbon-free glass to perfume, skincare and makeup brands that will deliver tomorrow’s beauty,” said Alexandre Brusset, vicepresident of glass at Fives, said: “Fives is committed to providing innovative solutions based on our proven technology to electrify glass process. We help the industry partners to meet their objectives in terms of decarbonisation, as well as to train technicians and operators at the plant level.”

Companies sign agreement establishing Packaging Alliance Europe

Luxembourg

Industrial Packaging Group and Treffpack Beteiligungsgesellschaft announced the signing of an agreement for combining their shareholdings into a new holding called Packaging Alliance Europe SA.

Over the past five years, Gaasch Packaging and Treffpack have gradually increased their cooperation. Using a common growth strategy and joint investments, both companies laid the groundwork for the next logical step, which was recently formalised with the creation of Packaging Alliance Europe. All operational companies will preserve their identity and day-to-day organisation, while benefiting from alliance-wide expertise and guidance.

Peter Börner from Treffpack Beteiligungsgesellschaft said: “Dorothée Kuhnert and I believe in the strength and sustainability of a family enterprise. Representing the fifth and sixth generation in the business we are very pleased to partner up with IPG and the Gaasch and Henckes families in Packaging Alliance Europe.

“Together, we represent a very strong European provider of packaging solutions. We are here to stay and grow together with our customers and manufacturing partners.

Jean-Christophe Gaasch, managing director at Gaasch Packaging said: "This transaction strengthens our joint position in the Western European primary packaging wholesale market.

“After more than five years of close collaboration with Treffpack, Véronique Henckes, Sébastien Hottlet and I are fully convinced that we share the same values of trust, reliability and long-term commitment.

“Our family shareholders and committed staff fully support Packaging Alliance Europe as the sustainable continuation of our history of more than 100 years.”

To date, Packaging Alliance Europe includes member companies operating from offices in Germany, Belgium, Luxembourg, United Kingdom, Denmark, Sweden, the Netherlands and France under the following names: Treffpack, Gaasch Packaging, Pattesons Glass, Nova-Pack, Ursan Verpakkingen, Dijkstra Vereenigde,

Premium Glass, EPG Service.

Altogether, the companies generated a traded turnover exceeding €200 million in 2021. The closing of the transaction is expected to be finalised before the end of the year.

TreffpackBeteiligungsgesellschaft is the private holding company of the families behind CE Gätcke’s Glas Gesellschaft and F. Dau & Sohn with a history going back to 1873. The companies operate from Hamburg under the Treffpack brand.

Industrial Packaging Group SA is the holding company of Gaasch Packaging and its sister companies. In the business since 1906, the group constitutes one of the leading privately held European wholesalers in the primary packaging industry.

Saint-Gobain signs PPA with Spanish energy supplier

France

Saint-Gobain has signed a Power Purchase Agreement (PPA) with the top energy supplier in Spain, Endesa.

This 11-year agreement will start in 2024 and will cover around 55% of Saint-Gobain’s Spanish electricity needs. The electricity supplied by Endesa will be generated by its renewable portfolio: wind, solar and hydroelectric power.

This agreement will enable a reduction in CO2 emissions of roughly 39,000 tonnes per year.

This is the second renewable energy supply agreement signed by Saint-Gobain in Spain. Together, the two agreements will cover 65% of the Group’s electricity needs in Spain. It is a major step in the Group’s fight against climate change and towards its commitment to reach carbon neutrality in 2050.

Under this agreement, Endesa will supply Saint-Gobain 150 GWh of renewable energy annually, which corresponds to the supply of about 43,000 Spanish homes with

renewable energy every year.

This announcement follows the recent signings by Saint-Gobain of two important renewable electricity supply agreements in Poland and North America, increasing the share of renewable electricity to more than 60% for the entire Group. It comes after the recent endorsement by the Science Based Targets initiative (SBTi) of the Group’s greenhouse gas emission reduction targets as consistent with the organization’s

new Net-Zero Standard and the Paris Climate Agreement. Saint-Gobain designs, manufactures and distributes materials and services for the construction and industrial markets. Its integrated solutions for the renovation of public and private buildings, light construction and the decarbonisation of construction and industry are developed through a continuous innovation process and provide sustainability and performance.

16 asianglass AG 22-6 www.asianglass.com News

High Speed and High Quality

New standards for the production of insulating glass units with thermoplastic spacers

� Most accurate TPA material application

� Permanent support of all center glasses

� 20% higher output due to vertical lift over

www.lisec.com

TPA

Pilkington makes 50 millionth sq ft of glass at St Helens

Pilkington United Kingdom Limited, part of the NSG Group, has manufactured its 50 millionth square metre of specialist glass at its advanced coating line in St Helens, as the site marks 10 years since production began.

The milestone was passed after the manufacturer ramped up production to meet consistently high demand from building designers and the construction sector over the last year.

The volume of glass produced by its OLC1 off-line coater at Cowley Hill in the town is enough to cover 7000 football pitches.

This total includes glass that prevents heat from escaping through windows, such as Pilkington K Glass S, a lowemissivity glass designed to

provide the highest Window Energy Rating (WER) performance and Pilkington Optitherm S1 Plus which is helping building designers meet increasingly tougher regulatory requirements for insulation.

The line also manufactures its Pilkington Suncool range of solar control glass that helps to prevent overheating in buildings by limiting the amount of energy transmitted by the sun through glazing.

The company expects to see higher demand for solar control glass in the UK as building designers mitigate against the increasing frequency of heatwaves, and work to meet new Part O regulations for overheating in new homes.

OLC1 uses advanced glass

coating technology to apply added performance to float glass produced on Pilkington UK’s UK5 production line at Greengate, St Helens. UK5 recently achieved three world first trials of hydrogen and biofuel to fire a glass furnace as part of the industry’s journey towards decarbonisation.

Neil Syder, managing director at Pilkington UK, said: “Demand for advanced coated glass that helps to deliver better energy performance to buildings is growing as building regulations tighten and developers go above and beyond to meet their own environmental targets.

“Advanced coated glass is also solving new challenges thanks to R&D breakthroughs, from antimicrobial glass that helps to

sanitise healthcare and transport settings, to glass with a special UV pattern that helps to protect wildlife by being visible to birds.

“Our OLC1 line at Cowley Hill has played an integral role over the last 10 years supplying glass that helps specifiers in the UK and internationally to give added performance to their projects, from schools in Dudley to skyscrapers in Dubai. It’s set for another busy 10 years as industry demands more performance from glass to meet major challenges like net-zero.”

The milk bottle is UK's most iconic glass packaging

United Kingdom

The everyday glass milk bottle has been voted by leading experts as the most iconic glass packaging in the UK.

Seeing off competition from popular classics such as Heinz Tomato Sauce and Coca Cola, the single pint reusable glass milk bottle won out thanks to its instantly recognisable shape, perfectly suited design and enduring sustainable, made-to-bereused credentials.

As part of the UN International Year of Glass 2022 celebrations, experts from the worlds of packaging, retail, manufacturing

and plastic-free living were brought together to choose the UK’s top 10 glass bottles and jars.

Waqas Qureshi, news editor of Packaging News, said: “It was a thoroughly informative judging session, with the panel assessing contenders for their iconic status, as well as their sustainability and user-friendly credentials. It was fitting that while we all had different suggestions for the final top ten, we were unanimous in choosing the simple glass milk bottle for the undisputed winner”.

Also on the panel was Jenni Richards, federation manager at

British Glass: “I found the process of choosing my top 10 iconic glass bottles and jars difficult as there are so many wonderful contenders.

“Even easily distinguishable classics such as Ribena, Orangina, Marmite and Jack Daniels didn’t make it into our final shortlist. I think the milk bottle absolutely deserves its number one spot. Milk is synonymous with child nutrition and what better to convey such a pure liquid in than in safe, chemically inactive glass.”

Iain Ferguson, an award-winning environmental consultant who was environmental manager at

The Co-Operative supermarket said: “The judging was great fun, and there were so many possible containers that we could have chosen from. Even deciding between the iconic entries on our shortlist was difficult. However, the top two entries virtually chose themselves – the glass milk bottle and the Moët and Chandon Champagne bottle. While they are at different ends of the price scale, they are both associated with important events – breakfast and celebrations. I'm looking forward to seeing whether the general public agree with us."

Corning introduces Corning Gorilla Glass Victus 2

United States

Corning Incorporated unveiled its newest glass innovation, Corning Gorilla Glass Victus 2. A new glass composition allows Gorilla Glass Victus 2 to provide improved drop resistance on rough surfaces, including concrete, the most abundantly engineered material in the world. However, the scratch resistance of Gorilla Glass Victus remains the same.

David Velasquez, vice president and general manager, Gorilla Glass, said: “Smartphones are the centre of our digital lives, and the requirement for exceptional scratch and drop resistance has only increased with our growing reliance on clear, damage-free

displays. Surfaces matter, and rough surfaces like concrete are everywhere.”

Corning’s extensive research has shown that 84% of consumers across three of the largest smartphone markets – China, India, and the US – cite durability as the number one purchasing consideration behind brand itself.

“We challenged our scientists not only to create a glass composition that was durable enough to better survive drops from waist height onto rougher surfaces than asphalt, but to improve cover-glass performance for larger and heavier devices,” said Velasquez.

“With more sophisticated and varied designs, today’s smartphones are nearly 15% heavier, and screen sizes are up to 10% larger, than they were four years ago – increasing both the stress on the cover glass and the probability of damage. Gorilla Glass Victus 2 redefines tough for consumers and OEMs.”

In lab tests, Gorilla Glass Victus 2 survived drops of up to one metre on a surface replicating concrete. Competitive aluminosilicate glasses from other manufacturers typically failed when dropped from half a meter or less. In addition, Gorilla Glass Victus 2 continued to survive drops up to two meters on

a surface replicating asphalt and maintained scratch resistance up to four times better than competitive aluminosilicate.

Gorilla Glass Victus 2 is currently being evaluated by multiple customers and is expected to reach the market within the next few months. It has been designed into more than 8 billion devices by more than 45 major brands.

Corning Incorporated is an American multinational technology company that specialises in specialty glass, ceramics, and related materials and technologies including advanced optics, primarily for industrial and scientific applications.

18 asianglass AG 22-6 www.asianglass.com News

United Kingdom

Biesse is listed among the Best Managed Companies

The first award marks Biesse's fifth consecutive win - placing it in the Gold category - of the ‘Best Managed Companies’ award, the prize instituted by Deloitte Private with the participation of ALTIS Università Cattolica del Sacro Cuore, ELITE-Gruppo Euronextthe ecosystem that helps small and medium-sized businesses to grow and access private and public capital markets - and Confindustria Piccola Industria.

“These shining examples of Italian entrepreneurship were assessed according to the parameters of strategy, skill and innovation, commitment and corporate culture, governance and performance measurement, sustainability, supply chain and internationalisation, and were officially presented with their awards at Palazzo Mezzanotte, the headquarters of Borsa Italiana-Euronext, on 4 October”.

“We are delighted to receive this important recognition, which once again confirms the value of our work. This award falls within a highly positive period for our group, as the latest financial documents show - although we know, now more than ever, that it is essential to remain cautious with regard to the immediate future, in light of the many unknowns that the international scenario represents. In order to compete in a market that is increasingly changeable, we have launched a deep-rooted process of renewal of the group

over the last two years, with a view to rendering it leaner and more efficient, simplifying its processes, and ensuring that it can adapt rapidly as new contexts arise”, emphasised Pierre La Tour, CFO of Biesse Group, at the award ceremony.

Biesse also received the "Italy's Best Employer" award, following the company's inclusion in the rankings drawn up on the basis of the survey conducted by expert analysts from Statista in collaboration with Corriere della Sera, which lists the companies with the highest level

of satisfaction among employees in Italy. Biesse comes in third place in this ranking (with a score of 7.97) with regard to the engineering and systems design sector. “It's not just about smart working: employees are looking for values, well-being and training”this is what has emerged from the analysis conducted on the Italian companies in the study.

The eventual solution is hybrid fur naces operating at up to 80% electricity BUT small steps increase electric boost to reduce the CO2 then superboost. GS and FIC are THE companies to supply CFD modelling of your flexible future fur naces.

19 www.asianglass.com AG 22-6 asianglass News

Italy GLASS SERVICE Tying Technology Together

FIC ...the pathway to a cleaner future www.fic-uk.com +44 (0) 1736 366 962 The World,s Number One in Fur nace Technology FIC (UK) Limited Long Rock Industrial Estate, Penzance, Cornwall TR20 8HX, United Kingdom Are you looking to the future for CO2 reduction? Then look no further than FIC... FIC GREEN ad 2022_Layout 1 03/12/2022 08:38 Page 3 Asian Glass: mobiles, ipads & androids

People and Places Appointment

Corinna Lovati has been appointed sole director of Lovati SRL to pursue a global renewal focused on modernisation and innovation.

“I am very happy and proud of this new role. The goal is to continue to be recognized as a leading company of Italian excellence in the world of manufacturing machines for flat glass processing.”

Lovati’s, important technical figure, Rolando Locatelli, in addition to providing attentive and timely assistance to customers, continues to follow the software and electronic design part, and is also responsible for machines production.

“The company is experiencing a good time of global renewal. I will go on to be a reference between customer and company and follow step by step all the production dynamics. My focus

Jim Nixon has been appointed as Quanex's first vice president of innovation and new markets.

In this role, Nixon will develop and lead an enterprise-level innovation strategy, advance new product and market possibilities, drive revenue and EBITDA growth and ensure a return on investment for new market product launches. He will also lead strategy development, sales, new product development and market growth for Quanex Custom Mixing (formerly LMI Custom Mixing).

George Wilson, president and CEO, Quanex, said: “We couldn’t be happier to welcome Jim to this senior leadership role as we continue exploring new ways to drive value for our customers and shareholders.

“Jim will be instrumental in our efforts to develop innovative new polymer solutions, expand our capabilities and diversify into new markets.”

Nixon joins Quanex with more than two decades of industry experience, serving in various operational and leadership roles of increasing responsibility. Most of his career has been focused on successfully growing LMI Custom Mixing, which Quanex acquired in 2022, where he served

is also on the development of software and electronic components for which we are planning important innovations for the future.”

Lovati is a manufacturer of glass processing machines.

We are specialised in the design and construction of machines for the processing of shaped glass, from simple manual grinders to the most sophisticated numerical control machining centres. Over 80 years of tradition and continuous innovation.

Lars Wismer (49) has been appointed to lead glasstec, the world's leading trade fair in the glass industry, as well as A+A, the International Trade Fair for Safety, Security and Health at Work, effective December 1, 2022.

In addition to overseeing these leading trade fairs, he will also be responsible for the international Glass Technologies portfolio, including glasspex and glasspro trade fairs for the Indian market, as well as the international Occupational Safety & Health portfolio, including TOS+H, CIOSH and OS+HA.

Wismer said: “I look forward to being back onboard at Messe Düsseldorf again and to working with a strong team to further expand the leading position of the two leading trade fairs and the international portfolios."

The event professional has been working as a senior project manager for 16 years. He also has extensive experience in the management and marketing of large, international events. His most recent position was as Executive Director Sports of D.SPORTS Events, Sales, PR/

Communication and Marketing at D.LIVE GmbH & Co. KG.

Petra Cullmann, executive director at Messe Düsseldorf, said: “I am delighted that we have been able to win back Lars Wismer for Messe Düsseldorf. He has many years of expertise in managing international events in Germany and abroad,”

The next glasstec will be held at the Düsseldorf Exhibition Centre in Germany from 22 to 25 October 2024.

as the general manager for the last 21 years.

Nixon said: “I’m looking forward to helping this team identify new opportunities to innovate, in both new and legacy markets.

“I’m confident that through the combined abilities of Quanex’s polymer and extrusion expertise, and the state-of-the-art technology at Quanex Custom Mixing, we’re going to do some great things and create significant new growth for Quanex.”

Nixon holds a bachelor’s degree in chemical engineering with a minor in economics from Case Western Reserve University, and a master’s degree in business administration from Ashland University.

In his new role, Nixon will report directly to Wilson and will serve as a member of Quanex’s strategy council. He will share his time between Cambridge, Ohio, and Akron, Ohio.

Wolfgang Böhm has assumed the position of Technical Director at Zschimmer & Schwarz KG Chemische Fabriken effective 1 December 2022. This position entails responsibility for the areas of production and technology, logistics, purchasing, environmental protection, and occupational safety at the Lahnstein site. During his career, he has held various management positions in the fields of production and technology at Hoechst, Clariant and Allessa.

"I am looking forward to my new assignment, which will involve further developing the Lahnstein site and setting new trends with my know-how and experience," said Böhm. "Together with my colleagues in management and our employees, I would like to share the success story of

Zschimmer & Schwarz."

"With Wolfgang Böhm, we are strengthening the management at the Lahnstein site with an experienced expert who will provide new impetus in his area of responsibility and thus further advance Zschimmer & Schwarz in the implementation of efficient processes," said Felix Grimm, COO of Zschimmer & Schwarz Chemie. "We warmly welcome Wolfgang Böhm and look forward to working together."

20 www.asianglass.com asianglass AG 22-6 News

Corinna Lovati

Jim Nixon

Wolfgang Böhm

Lars Wismer

Darko Šlogar

Darko Šlogar has been appointed by Vetropack Group, a European manufacturer of glass packaging, to lead their Croatian operations, starting on 1 January 2023. He succeeds Tihomir Premužak, who passed away unexpectedly in August.

Šlogar has already been acting as interim site manager of Vetropack Straža since Premužak’s passing. The company is also moving into new offices in Zagreb.

Šlogar draws on more than three decades of experience in glass manufacturing. Born in 1963, the father of two studied at the Faculty of Mechanical Engineering and Naval Architecture at the University of Zagreb. Following graduation in 1987, he began his professional career at Straža glass factory, now Vetropack Straža, as an expert in technological advances in production. Among his responsibilities was the establishment of a new mould construction department. He moved from marketing to sales in the early 1990s before being promoted to the position of director of marketing and sales in 2001.

Obituary

During his career, the new general manager became involved in a variety of activities, including teaching computer science and technical drawing as a part-time teacher for the training of glass workers. Additionally, he served as mayor of the Croatian municipality of Hum na Sutli for a period of time. Šlogar said: "I am proud to have worked for this forward-thinking company for such a long time, especially since it is also an important employer for the region. Shaping the future of this growing site is a challenging task that I look forward to.”

"With the new presence in an office building in Zagreb, we are counteracting bottlenecks at the plant in Hum na Sutli. This shows the positive development of the company. In this respect, I look to the future with great optimism," he added.

Awards & Honours

Envelon wins Product Design of the Year

Envelon has been named Product Design of the Year at the Architecture MasterPrize 2022, held at the Guggenheim Museum in Bilbao, Spain, on 24 November. The company's technology enables buildings to integrate photovoltaics to achieve carbon neutrality with alternative renewable energies. In contrast to traditional rooftop solar systems, Envelon uses architectural building façades as the way to integrate aesthetics and performance, as shown by the award-winning designs of architect Peter Kuczia.

A solar façade, developed by Envelon, integrates architectural design with solar energy in a durable and application-flexible glass facade, transforming conventional buildings into sustainable power plants.

High-performance and costeffective BIPV systems are available in a wide variety of

attractive colours and have been successfully installed on large-scale buildings. In order to reduce technical complexity, Envelon has been engineered on a simple, modular basis in order to turn the building's façade 'ON' with electrifying architectural elements.

Kuczia said: “Thanks to the Envelon System, the facade material – in addition to its conventional technical, protective and aesthetic functions – adds value to the building by converting sunlight to electricity."

A key objective of Envelon is to drive the vertical energy revolution. An important part of this effort involves a flexible, 360-degree approach that encompasses not only the production in Hamlar, Germany, but also custom project design for the respective locations and turnkey installation.

Vitro Architectural Glass announced the passing of longtime colleague and friend Joe Sennese on 7 November at the age of 55 after a long battle with cancer.

In a statement, the company said: “Sennese’s legacy of humble service to our customers and architects in the Chicago and Great Lakes region has inspired countless Vitro team members and endeared him to all who knew him.”

Sennese began his career with Vitro, formerly PPG Glass, in 2005 as an architect representative. He quickly advanced his career in the glass business by becoming a national architectural manager before leading the architectural representatives in the Eastern US as Vitro’s director of architectural development. In June 2022, Sennese was appointed manager of product sales and business development.

Glenn Davis, vice president of international sales and sales development at Vitro, said: “Joe was an invaluable part of our team and served as a mentor to so many in the industry

throughout his career,”

“We’re all deeply saddened by his loss and we’re thinking of his family in this difficult time.”

To honour Joe’s legacy, Vitro contributed to the Amyloidosis Foundation in his name.

Asian Glass would like to take this opportunity to offer condolences to Sennese's family and friends.

Consequently, building owners, architects, and planners are able to benefit from holistic project management, professional support, and a reliable collaborative relationship.

Envelon offers frameless façade panels, made of highquality glass elements, to meet

the needs of architects and builders. By providing customised façade kits or turnkey solutions, high quality and reliable handling can be ensured.

A thin internal glass coating releases the potential of colours, creating solar facade panels that are vibrant throughout the day.

22 www.asianglass.com asianglass AG 22-6 News

Joe Sennese

From left: Andrea Steigerwald, head of corporate marketing and communications of the Grenzebach Group, Hans-Peter Merkelin, CEO, Grenzebach Envelon, and Peter Kuczi, architect.

News PSR CORD DISPERSAL SYSTEM Proven and guaranteed. www.parkinson-spencer.co.uk

Phoenix Award names Hua as Glass Person of the Year

The Phoenix Award Committee announced Li Sheng Hua as the 50th recipient of the Phoenix Award and ‘Glass Person of the Year 2022’

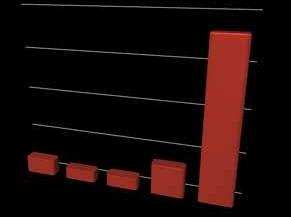

Li Shen Hua is the founder of Huaxing Glass in 1978. Under his leadership, Huaxing has grown from a small glass factory into the largest group producing container glass in China with an annual production capacity of more than three million tonnes, or about 16% of the total output in the country. The group has 13 factories across China. Today, Huaxing has 34 glass furnaces and 167 production lines.

Li served as executive chairman of China Daily Glass Association for several years.

Being the China daily glass industry leader, he has won the China Light Industry Meritorious Enterprise Prize for six consecutive years.

The Phoenix Award Committee has also selected Li to receive this year’s prestigious Phoenix Award in recognition of his outstanding achievements in the glass industry and his leadership in pollution reduction in China.

Li was among the first to respond to the call to reduce industrial pollution in China.

In 2007, he introduced a series of actions to transform Huaxing into green and environment friendly production units in response to

Places

the country's promotion of energysaving and emission reduction.

Through his effort, Huaxing Glass was named the ‘Green Label Enterprise’ and received an environmental credit for the achievement. It also set the benchmark of environmental protection in Guangdong Province for advanced energy-saving and safety production enterprises.

He has promoted the principle of quality and set up two national quality inspection centres in Central and Southern China respectively to enhance the quality of the company’s products and effectively promoted the rapid upgrading of product quality in the glass industry. The company is also an active member of the China Quality Inspection Association.

Li will receive his award from Kevin Lievre, the PAC 2022 Chairperson, at the occasion of a future Banquet. The Banquet and Award Ceremony will be conducted in China as soon as travel restrictions permit.

Ireland - The Keep Well Glass Quilt Project

An exhibition of glasswork collaboratively created by 50 glassmakers is now on display at the National Museum of IrelandCountry Life, located in Turlough Park in Castlebar, County Mayo.

Designed by members of the Glass Society of Ireland, the display is entitled 'A Breath of Fresh Air, The Keep Well Glass Quilt Project'.

The project was undertaken during the third wave of COVID-19 and the twelve weeks that followed the lockdown.

Confined to within five kilometres of their homes and studios, 50 glassmakers came together virtually to collaborate on a large glass quilt.

Professional and amateur glassmakers are represented in the artwork, as well as all

techniques of glassmaking, from traditional cutting, glass painting, kiln working, etching, engraving and lampworking.

In making their individual pieces, each glassmaker interpreted their own ideas around what the theme meant to them. Themes include, nature, poetry, textiles, patterns, mental health, capturing actual air, and emotional responses.

As each piece was added to the artwork, a unique story of a unique time evolved. Testimonies emerged from participants on how this project was critical to their creative process and well-being at a very difficult time.

Each of the four provinces of Ireland is represented, bringing the whole island together in one

Encirc named ‘BITC NI Responsible Business of the Year’

Glass container manufacturer and filler, Encirc, has been awarded the ‘NI Responsible Company of the Year’ accolade at the BITC NI Responsible Business Awards, marking the first time Encirc has won the award.

The company, initially created in 1998 in Derrylin Northern Ireland, has been a pillar of the community in County Fermanagh, NI, since its inception. Now part of the Vidrala Group, Encirc has three sites in England, Northern Ireland and Italy and is a well-known name in the production of sustainable packaging, creating more than four billion glass containers a year while continuing to innovate and drive forward the manufacturing sector to be more sustainable and inclusive.

In 2022, Encirc and its parent company Vidrala became one of the first organisations of its kind to have its Science Based Targets approved by the SBTi (Science Based Targets Initiative), ensuring the company operates in a way which helps prevent the planet’s temperature from rising more than 1.5°C compared to pre-industrial levels.

At the same time, the company announced its ambition to be the first glassmaker to create net-zero glass containers. From its original site in Derrylin, Northern Ireland, Encirc will be supporting its parent company in reducing its Scope 1 and 2 greenhouse gas emissions by 47%, and its Scope 3 emissions by 28% by 2030, helping prevent the worst effects of climate change whilst also future-proofing the company.

Encirc is also active as a BITC climate champion, and member of its Environmental Leadership Team. The glass bottle manufacturer supports BITC with speaking slots aimed at the wider industry, outlining how it is acting on the climate emergency, and inspiring others to drive change in their organisations.

It also works heavily within its local communities through its HOCAM (Helping our Communities Achieve More) programme, partnering with schools and colleges to raise awareness of diversity issues, sustainability considerations and career opportunities.

collaborative piece. Some of Ireland’s best glassmakers are represented in The Glass Quilt, making this artwork a unique and historic portfolio of Irish artists and their generosity of community spirit

during a difficult time.

The project was made possible by the support of the Health Service Executive ‘Keep well’ campaign and Design and Crafts Council Ireland.

24 www.asianglass.com asianglass AG 22-6 News

under control – all the time Data – the deciding factor Visit youniverse.tiama.com to arrange a demonstration It‘s having ALL the right data, at the right time, at the right places. YOUniverse gives you more process control and helps you to foresee problems early and to take the right decisions quickly, With open-protocol software solutions, linking hot and cold end sensors to your production machinery, you make the most of the data in your plant, you improve glass quality, you reduce wastage and increase productivity. Make your life easier - with YOUniverse.

Almatis expands its tabular alumina plant in India

Almatis, a group company of OYAK, celebrated the official opening of its fully integrated tabular alumina facility in Falta, India.

The opening ceremony, attended by members of the local government and trade organisations, as well as many customers, marks another milestone in the history of Almatis.

This investment is the first of its kind in India, adding a completely new sintered tabular processing plant to the existing sizing facility. Almatis India operations is now fully independent in their sourcing and supply chain requirements for the Indian market.

Almatis CEO Anιl Sonmez stated in his welcome speech, said: “Almatis is proud to have established the first integrated

tabular operation in India and is committed to being a reliable supplier and partner to our customers. This is a significant milestone showing Almatis commitment to being a reliable supplier and partner to our customers and also for tabular alumina supply to the Indian market.”

Many experts from other Almatis plants around the world brought in their long experience and deep knowledge to now produce in India the accustomed reliable quality.

The history of Almatis business activities in India goes back to 1995 when a joint venture was founded by Alcoa and Associated Cement Companies Limited India (ACC). In 2007 Almatis purchased

the remaining stake in the JV to form a 100%-owned subsidiary.

With sales offices in Kolkata and Singapore, technical support from a local R&D lab in Kolkata, and support from the Almatis global network, Almatis India operations is well positioned to meet the increased demand of the refractory and steel markets for the upcoming years.

Almatis, which is part of the OYAK Group of Companies, processes aluminum oxide (alumina) and produces and sells special alumina. It has been developing, manufacturing and supplying specialty alumina and alumina-based products for more than 100 years. Alumina is a key input for many industries including

refractory, ceramics, and glass. The company has nine production centres, six sales offices, and six application-product development laboratories located throughout the world. Besides its headquarters in the Netherlands, the Group has factories in the United States, Germany, the Netherlands, Japan, China and India, and sales offices in the US, Germany, India, Japan and China.

Ardagh Glass Packaging – Africa additional capacity investment

Ardagh Glass Packaging – Africa

(AGP – Africa) announced a further extension of its Nigel production facility in Gauteng, South Africa.

This investment in a third furnace (N3) follows the recently commissioned Nigel 2 (N2) expansion and will further increase the facility’s capacity to provide sustainable glass packaging to support customers’ current and projected demand growth over the

next few years.

N3 will be a replica of the N2 expansion completed earlier this year and will similarly incorporate a new furnace and additional production lines. It will also provide significant energy, water efficiency and environmental benefits, representing another important step in AGP – Africa’s journey to decarbonise the glass production process and reduce emissions.

This capital investment will further bolster government’s economic recovery plans in Ekurhuleni, Gauteng, offering additional job opportunities and increased ancillary supply-chain benefits in the community.

The investment, which is backed by long-term customer contracts, is in line with Ardagh’s commitment at the time of acquisition to invest in the