REALTOR PRODUCTION WORKBOOK

OFFERING MANY BENEFITS TO OUR PARTNERS INCREASE YOUR INCOME REFERRALS DURING AFTER RETENTION MORE SALES Experience that shows you can INCREASE your income by 30% A Referral Practice Experienced Loan Officer Home Promos Newsletters & Brochures Pre-ApprovalHomebuyers WorkbookClient Option Plan Realtor Production Workbook Open House Partner Financing Comparison

Eventually 90% Will List With a Realtor HOME MARKETING FUNNEL SOLD • Overpriced • Seller not willing to provide financing terms to increase sales probability (Points & Closing Costs paid by Seller • Too many required repairs • No appraisal as a sales tool. Will not sell FHA or VA, if in that price range. • No seller financial counseling • No action taken Realtor Marketing Network Advertising Company Sign Sales Person Word of Mouth Professional Open House Company Tour Home AppraisalMultiple Listing Servies 24 Hr Availability 24 Hr Availability Home Warranties Home Feature Sheets Pre-Approved Buyers Motivated Seller Seller Counselling Session Online Service Relocation Pre-Qualified Buyers Home Magazines 3rd Party Negotiation 50% of buyers will not negotiate directly with the seller Guaranteed Sales Programs

NEWLY RENOVATED HOME IN THE HAMPTONS $850,000 Loan Programs Conventional 30 Year Fixed Down Payment % 20% Down Payment $170,000 Loan Amount $680,000 Interest Rate 6.125% APR 6.341% Principal & Interest $4,132 Real Estate Taxes $807 Hazard Insurance $213 MI/PMI $0 Condo/Coop/HOA $84 Total Mo. Payment $5,236 All figures are estimates and subject to change at any time. See below for additional disclosures. 10417 Callicut Spring Ct Huntersville NC 28078 5 Beds / 4 Baths / 4232 SF MLS 3898576 NFM Lending is not affiliated with any real estate companies. You are entitled to shop around for the best lender/real estate company for you.The status of this listed property is subject to change at any time. Please contact us for status or to inquire further. MLO licensing information: . Element Home Loans is a Division of NFM, Inc. dba NFM Lending, NFM NMLS #2893. NFM is an Equal Housing Lender. For NFM, Inc’s full agency and state licensing information, please visit www.nfmlending.com/licensing. NFM, Inc.’s NMLS #2893 (www.nmlsconsumeraccess.org). NFM, Inc is not affiliated with, or an agent or division of, a governmental agency or a depository institution. GA license # 17414. Copyright © 2022. Brad Roche NMLS ID# 135191 Branch Manager Cell: 704-929-7718 broche@elementhl.com https://elementhl.com/broche/ Element Home Loans 400 North Harbor PL Suite G/H Davidson, NC 28036 Pam Abdgley Your Info Here

OPEN HOUSE FOLLOW UP • Postcard of home visited. Sent as a thank you. • Text $500 off cost of any home for visiting • Homebuyer Privilige Membership $7500 Online Savings • Home Financing Comparisons • Same Day Credit Approval

PRE-QUALIFICATION FRAMEWORK Borrower Gross Monthly Income: $ Hourly $__________ Hrs. Per Week: Salary: $ Co-Borrower Gross Monthly Income: $ Hourly: $___________ Hrs. Per Week: Salary: $ Min. Monthly Balance _______________ _______________ _______________ _______________ _______________ _______________ _______________ Total:______ ________ How Much Money Have You Saved For Your Total Investment? Gift $ Sale $ Savings $ Total $ ____________ Credit Rating Good ___ Fair ___ Bad ___ 760+ Top Tier 720 Tier 2 700 Tier 3 680 Tier 4 660- Tier 5 Attention: Borrower’s Name: Co-Borrower Name: Address: City: ______________________________________ State: __________________ Zip: Employer (last 2 yrs.): ____________________________________________________ Yrs: ______________ Co-Employer: __________________________________________________________ Yrs: SSN: ___________________________________________ Co-SSN: Home Phone: ______________________________ Work Phone: Current Monthly Rent: ______________________ Comfortable Payment: ____________________________ INCOME CREDITCASH TO CLOSE

BUDGET WORKSHEET

FIRST-TIME HOMEBUYER

CATEGORY MONTHLY BUDGET AMOUNT MONTHLY ACTUAL AMOUNT DIFFERENCE INCOME: Salary/Wages (after taxes) Alimony, Child Support, VA Benefits Other Income EXPENSES: HOUSING: Rent Renters Insurance Electricity/Gas/Oil Water/Sewer/Garbage Cable/Internet Telephone (Land Line, Cell) SAVINGS & INVESTMENTS: Savings & Investments FOOD: Groceries Dining Out FAMILY OBLIGATIONS: Childcare Child Support/Alimony HEALTH & MEDICAL: Insurance (medical, life, long term care) Unreimbursed Medical Expenses, Copays TRANSPORTATION: Gas/Maintenance/Repairs/Insurance Other Transportation DEBT PAYMENTS: Credit Cards Student Loans Car Loan Other Loans OTHER EXPENSES: Clothing Church/Charity Education Hobbies/Subscriptions/Dues Recreation/Vacation/Entertainment Pets SAVINGS OR SHORTAGE

WHAT TO BRING TO A MORTGAGE APPOINTMENT

REALTOR ___ Purchase Agreement. Legal Description ___ Previous Title. Survey. Special Assessments. BORROWERS ___ Copy of social security card & drivers license ___ Names & addresses of employers for the past 2 years ___ W-2, 1040 tax returns for 2 years ___ Resident & landlord addresses for 2 years ___ Pay stubs ___ Name, address & act. #’s of creditors, balances, name & address ___ Checking & savings act. #’s, balances, name & address ___ Most recent 2 months bank statements ___ Current home, lender’s name, address, & act. #. ___ Divorce decree, if applicable ___ Sale of present home copy of purchase agreement & net sheet of sale ___ Check for appraisal and credit report fees (ask Realtor for amount) ___ Self Employed- most recent 2 years. 1040 tax returns, YTD profit & loss statements If you have any questions or concerns about any of the items listed above please don’t hesitate to call.

Jacob Roche NMLS #2223194 Element Funding Mortgage Partner jroche@elementhl.com Cell: 704.604.1512 400 N Harbor Pl, Suite G Davidson, NC 28036 Buying $400,000 vs. Renting My Property (Mecklenburg County, NC) Estimated Cashflow Monthly P & I $2,158 $2,600 $4,144 Prop. Tax / Ins. $512 $50 $80 Maint. & Repairs $50 $0 $0 Monthly Exp. $2,720 $2,650 $4,224 Total Cashflow $296,633 $363,929 Interest Rate 6.000% APR 6.157% Annual Rental Increase 6%* Buying Yr1 Rent Yr1 Rent Yr9 $2,720 $2,650 $2,809 $2,978 $3,156 $3,346 $3,546 $3,759 $3,985 $4,224 Years Cashflow Difference $67,296 Appreciation Gain $163,147 Starting Home Value: $400,000 Historical Appreciation (Avg./Yr): 3.87% Estimated Value After 9 Years: $563,147 Amortization Gain $51,155 Original Loan Amount: $360,000 Remaining Principal Balance: $308,845 Cost To Sell $33,789 Real Estate Commission: 6% Based on $563,147 Future Value after 9 Years Tax Benefit $40 Standard Deduction $25,100 in 22% Tax Bracket Benefit Above Standard Deduction after 9 Years Net Gain by Buying a Home $244,483 $-9,180 $11,599 $35,161 $61,664 $91,274 $124,169 $160,535 $200,569 $292,497 $244,483 Initial Closing Costs -$3,366 Appreciation Gain $163,147 Cashflow Difference $67,296 Amortization Gain $51,155 Cost To Sell -$33,789 Tax Benefit $40 Element Home Loans is a Division of NFM, Inc. dba NFM Lending, NFM NMLS #2893. NFM is an Equal Housing Lender. For NFM, Inc’s full agency and state licensing information, please visit http://www.nfmlending.com/licensing. NFM, Inc.’s NMLS #2893 (http:// www.nmlsconsumeraccess.org/). NFM, Inc is not affiliated with, or an agent or division of, a governmental agency or a depository institution. GA license # 17414. Copyright © 2022. Loan and monthly payment buying scenarios used for informationa purposes only and may not be specific to your situation. Rates expressed may not be available at this time. This document should not be construed as investment or mortgage advice or a commitment to lend. Your results may vary. There are no guarantees, promises, representations and/or assurances concerning the level of accuracy you may experience. For actual and current terms and rate information, please contact your lender directly. APR of 6.157% assumes a 6% simple fixed interest rate assuming $13,151 in fees included in APR. Monthly principal and interest payment based on a fully amortizing fixed interest loan of $360,000 with 360 monthly payments at the assumed simple interest rate (Current as of 9/12/2022). *Lender is not a tax consultation firm. Please seek advice from a tax professional.Source: MBS Highway, Zillow Economic Data. Monthly expenses may or may not include condominium or HOA fees if applicable; your payment may be greater. 1 / 1 Powered By MBS Highway BUYING $400,000 VS RENTING

BUYERS TOTAL INVESTMENT

Down Payment Closing Costs Escrow Reserves

Total Investment SALES PRICE

Down Payment Closing Costs Escrow Reserves Total Investment

3,000 1290 820 5,110 $100,000 5,000 2150 820 7,970

4,500 1935 1230 7,665 $150,000 7,500 3225 1230 11,955

6,000 2580 1640 10,220 $200,000 10,000 4300 1640 15,940

7,500 3225 2050 12,775 $250,000 12,500 5375 2050 19,925

9,000 3870 2460 15,330 $300,000 15,000 6450 2460 23,910

10,500 4515 2870 17,885 $350,000 17,500 7525 2870 27,89

12,000 5160 3280 20,440 $400,000 20,000 8600 3280 31,880

13,500 5805 3690 22,995 $450,000 22,500 9675 3690 35,865

15,000 6450 4100 25,550 $500,000 25,000 10750 4100 39,850

16,500 7095 4510 28,105 $550,000 27,500 11825 4510 43,835

18,000 7740 4920 30,660 $600,000 30,000 12900 4920 47,820

19,500 8385 5330 33,215 $650,000 32,500 13975 5330 51,805

21,000 9030 5740 35,770 $700,000 35,000 15050 5740 55,790 CLOSING GUIDE DOWN

10,000 4,300 2666 16,966 $100,000 20,000 8,600 5,332 33,932 15,000 6,450 3999 25,449 $150,000 30,000 12,900 7998 50,898 20,000 8,600 5332 33,932 $200,000 40,000 17,200 10664 67,864 10,750 6665 42,415 $250,000 50,000 21,500 13330 84,830 12,900 7998 50,898 $300,000 60,000 25,800 15996 101,796 15,050 9331 59,381 $350,000 70,000 30,100 18662 118,762 17,200 10664 67,864 $400,000 80,000 34,400 21328 135,728 19,350 11997 76,347 $450,000 90,000 38,700 23994 152,694 21,500 13330 84,830 $500,000 100,000 43,000 26660 169,660 23,650 14663 93,313 $550,000 110,000 47,300 29326 186,626 25,800 15996 101,796 $600,000 120,000 51,600 31992 203,592 27,950 17329 110,279 $650,000 130,000 55,900 34658 220,558 30,100 18662 118,762 $700,000 140,000 60,200 37324 237,524

3% DOWN CONVENTIONAL

5%

BUYERS TOTAL INVESTMENT Down Payment Closing Costs Escrow Reserves Total Investment SALES PRICE Down Payment Closing Costs Escrow Reserves Total Investment

25,000

30,000

35,000

40,000

45,000

50,000

55,000

60,000

65,000

70,000

10% DOWN CONVENTIONAL CLOSING GUIDE 20% DOWN BUYERS TOTAL INVESTMENT

21,000 9030 5599 35,629 9030 5599 14,629 9783 6065 38,598 9783 6065 15,848 10535 6532 41,567 10535 6532 17,067

BUYERS TOTAL INVESTMENT 3.5% Down Payment Closing Costs Escrow Reserves Total Investment SALES PRICE 0% Down Payment Closing Costs Escrow Reserves Total Investment 3,500 1505 933 5,938 $100,000 0 1505 933 2,438 5,250 2258 1400 8,907 $150,000 0 2258 1400 3,657 7,000 3010 1866 11,876 $200,000 0 3010 1866 4,876 8,750 3763 2333 14,845 $250,000 0 3763 2333 6,095 10,500 4515 2799 17,814 $300,000 0 4515 2799 7,314 12,250 5268 3266 20,783 $350,000 0 5268 3266 8,533 14,000 6020 3732 23,752 $400,000 0 6020 3732 9,752 15,750 6773 4199 26,721 $450,000 0 6773 4199 10,971 17,500 7525 4666 29,691 $500,000 0 7525 4666 12,191 19,250 8278 5132 32,660 $550,000 0 8278 5132 13,410

$600,000 0

22,750

$650,000 0

24,500

$700,000 0

FHA FHA & VA CLOSING GUIDE VA BUYERS TOTAL INVESTMENT Estimates are a range for total investment and should consult with your loan officer for exact estimates, range may vary by area ©2022 NFM, Inc. dba Element Home Loans. ®Trade/service marks are the property of NFM, Inc. and/or its subsidiaries. Equal housing lender. Make sure you understand the features associated with the loan program you choose, and that it meets your unique financial needs. Subject to Debt-to-Income and Underwriting requirements. This is not a credit decision or a commitment to lend. Eligibility is subject to completion of an application and verification of home ownership, occupancy, title, income, employment, credit, home value, collateral, and underwriting requirements. Refinancing an existing loan may result in the total finance charges being higher over the life of the loan. Not all programs are available in all areas. Offers may vary and are subject to change at any time without notice. For Arizona originators: AZ# BK-0934973. In Alaska, business will only be conducted under NFM Lending and not any of our affiliate sites. NFM NMLS# 2893 NMLS #135191

This is a brokered product, subject to change at any time. Make sure you understand the features associated with the loan program you choose, and that it meets your unique financial needs. Subject to Debt-to-Income and Underwriting requirements. This is not a credit decision or a commitment to lend. Eligibility is subject to completion of an application and verification of home ownership, occupancy, title, income, employment, credit, home value, collateral, and underwriting requirements. Not all programs are available in all areas. Offers may vary and are subject to change at any time without notice. ©2022 NFM, Inc. dba Element Home Loans. ®Trade/service marks are the property of NFM, Inc. and/or its subsidiaries. Equal housing lender. Make sure you understand the features associated with the loan program you choose, and that it meets your unique financial needs. Subject to Debt-to-Income and Underwriting requirements. This is not a credit decision or a commitment to lend. Eligibility is subject to completion of an application and verification of home ownership, occupancy, title, income, employment, credit, home value, collateral, and underwriting requirements. Refinancing an existing loan may result in the total finance charges being higher over the life of the loan. Not all programs are available in all areas. Offers may vary and are subject to change at any time without notice. For Arizona originators: AZ# BK-0934973. In Alaska, business will only be conducted under NFM Lending and not any of our affiliate sites. NFM NMLS# 2893.

RATIO LOAN • 20% Down Gift Funds Acceptable, 700 Credit Score • 25% Down Gift Funds Acceptable, 680 Credit Score • Cash Out Refinance or Purchase • Second Home and Primary Residence • 12 Months Reserves • 30 and 40 Year Fixed Rate terms • Interest Only Option Available • 12 months from Credit Event • US Citizen, Non Perm Resident Alien, Perm Residence Alien • 6% Seller Contribution

THE OPTION MORTGAGE PLAN

20 pts.

DECORATING

LANDSCAPING

5 pts. Outstanding 4 pts. Average 0 pts.

IMPROVEMENTS (EXTERIOR) InsulaUon pts. ppts.

FINANCIAL (SALES PRICE)

150 pts. Listed @ Appraised Value -25 pts. Listed $1,000 - $3,000 over Appraised Value -50 pts. Listed $3,000 - $10,00 over Appraised Value 5 pts. Will Accept Land Contract (cash-out, 7 yrs. or longer)

3 pts. Will Accept Land Contract (3-5 yrs. cash-out) 5 pts. Will Accept Land Contract (1 yr. cash-out or less)

0 pts. Will Accept Land Contract (Commission Down Only)

25 pts. Listed Below Appraised Value ($1,000-$3,000) 35 pts. Listed Below Appraised Value ($3,000-$5,000) 50 pts. Listed Below Appraised Value ($5,000-$10,000) 20 pts. Seller will sell FHA or VA if in that price range LIMITS +20 or -20

5 pts. Seller’s Home may qualify for MCC Program ($60,000 or under)

Sale Probability Rater

CONSTRUCTION QUALITY

5 pts. Brick – Plaster 4 pts. Cedar – Dry Wall 3 pts. Aluminum 2 pts. Frame 1 pt. Block

IMPROVEMENTS (KITCHEN)

15 pts. New 5 pts. Dishwasher 4 pts. Uploaded 3 pts. Same as Built

FINANCIAL (SELLER CONCESSIONS)

DISCOUNT POINTS

20 pts. Will pay 1-3 Discount Points to lower borrower’s rate of interest

CLOSING COSTS

20 pts. Will pay $100-$2,000 toward buyer closing costs

10 pts. Will pay $500-$1,000 toward buyer closing costs

REPAIRS

15 pts. Will pay all Required Repairs

10 pts. Will pay $1,000-$2,000 of Repairs 5 pts. Will pay $500 or less of Repairs 5 pts. Will pay for New Well & SepUc or Hookups Required

MECHANICAL CONDITION

5 pts. Major Component New 4 pts. Major Component less than 3 years old 3 pts. Major Component in good condiUon 1 pt. 1 Major Component needs work

IMPROVEMENTS (BATH)

15 pts. New 4 pts. Updated 2 pts. Same as Built

HOME WARRANTY

5 pts. Included -5 pts. Not Included FUTURE DEVELOPMENT

5 pts. Extra Land for Development 3 pts. Extra Room to Finish 0 pts. Project Completely Developed

UTILITIES

5 pts. City Sewer, Water, Gas, Curb & GuYer, Cable 3 pts. Water or Sewer & Gas

0 pts. No Sewer or Water &

APPLIANCES

2 pts. Stove 2 pts. Refrigerator 2 pts. Washer 2 pts. Dryer

2 pts. Air CondiUoning 0 pts. Dehumidifier

AMENITIES

20 pts. Lake 5 pts. For the Following: (Pool, Tennis Courts) 4 pts. For 3 of the Following: (Garage, Basement, Air CondiUoning, Modern Appliances, View, Fireplace) 3 pts. For Any 2 2 pts. Less than 2

MARKETING/LISTED (**Same Price, Area, CondiUons, Terms)

10 pts. Less than 3 ProperUes 3 pts. 3-6 ProperUes

SALE PROBABILITY RATING

TOTAL:458 TOTAL % OF SALE PROBABILITY RATER

REPAIRS NEEDED

5 pts. None 3 pts. 5% or Less than Sales Price in Repairs 0 pts. More than 5%

ESTHETICS (CURB APPEAL)

5 pts. Striking 3 pts. BeauUful 1 pt. Good 0 pts. Average

SALES AGREEMENT CONTINGENCIES

5 pts. Well & SepUc Cleaned 2 pts. Title Work 2 pts. Survey 5 pts. Subject to Approval of

MARKETING/SOLD

(**Same Price, Area, CondiUons, Terms)

20 pts. 5 or Over 3 pts. 3 to 5 0 pts. Less than 3

LOCATION

______________ 15 pts. ______________ 10 pts. ______________ 5 pts. ______________ 0 pts. ______________

Below Average

15 pts. Paint/Wallpaper/Carpet New 10 pts. Paint/Wallpaper/Carpet like mew 5 pts. Paint/Wallpaper/Carpet Serviceable 2 pts. Needs Paint 1 pt. Needs Carpet 0 pts. Needs Re-DecoraUng

15 pts. New Aluminum Siding 5 pts. New Replacement Windows 3 pts. New

Ceiling/ Sidewalls 3

Deck 2

New Roof Last 5 Years

YOUR

COMPARABLE ANAYSIS

Style SqFt BR BA Gar Bsmt Age Dom List Price Proximity Comments SUBJECT PROPERTY: Current Listings: Recent Solds: 1. 2. 3. 4. 5. 6. 7. 7. 8. 9. 10. IMPROVEMENTS NOTED TO IMPROVE SALEABILITY

Mortgage Solutions for the Non-Traditional Borrower

Just Missed (No More!)

The Just Missed product is a great solution for borrowers who may otherwise “just miss” qualifying using a traditional mortgage loan due to unpredictable income or recent credit challenges. With this product borrowers can use assets and income to supplement typical qualifying income requirements .

LOAN DETAILS:

• Loan amounts to $2MM

• 620 Min FICO

• Fixed and adjustable-rate mortgages Interest-only options available

• Debt-to-income (DTI) up to 55% with compensating factors

• Traditional income documentation

• All occupancy types (primary residence, second home or investment property)

• Assets may be used to supplement income

• Non-warrantable Condos may be considered

• 2 years removed for any major credit event

Reach out to find out how our mortgage solutions can help the non-traditional borrower!

OFFERING BUYER BENEFIT VERSUS REDUCING

LIST PRICE OF HOME-BUYDOWN

List Price of Home $400,000

Realtor suggests seller to contribute $15,000 toward buyer’s closing costs

Buyer with 5% down payment=$20,000 down for loan of $380,000 Buyer Option 1=2/1 Buydown 30 year Fixed Rate-buydown cost roughly $9,000 (remaining $6,000 buyer can use to pay 1 point and toward closing costs)

Rate with 1 point= 4.625% (yr.1)/5.625% (yr. 2)/6.625% (remaining 28 years)

Year 1 buyer saves $482.41 per month/Year 2 buyer saves $247.09 per month then goes to traditional rate

Buyer Option 2=Permanent 30 year Fixed Rate-buyer pays 2 points ($7,600) and remainder toward closing costs-current rate without buydown=6.625%

Rate 5.99% with 2 points

Buyer saves $157.33 monthly during 30 year term

Seller suggests to reduce home list price by $15,000 to $385,000 with no contribution to buyer

Buyers 5% down =$19,250 on a 30 year Fixed Rate-buyer doesn’t have funds to buy rate down

Rate 6.625% with zero points

Buyer pays $66.09 more per month than option 2 at higher price with the 2 point permanent buydown.

Buyer pays $388.21 more per month than they would have on year 1 and $154.45 more per month on year 2 of 2/1 buydown option

Buyer has more costs at closing, since no contribution from seller

Buyer’s payment is higher over the life of the loan

Seller reduced price, netting the same than they would have had they offered the $15,000 incentive to buyer

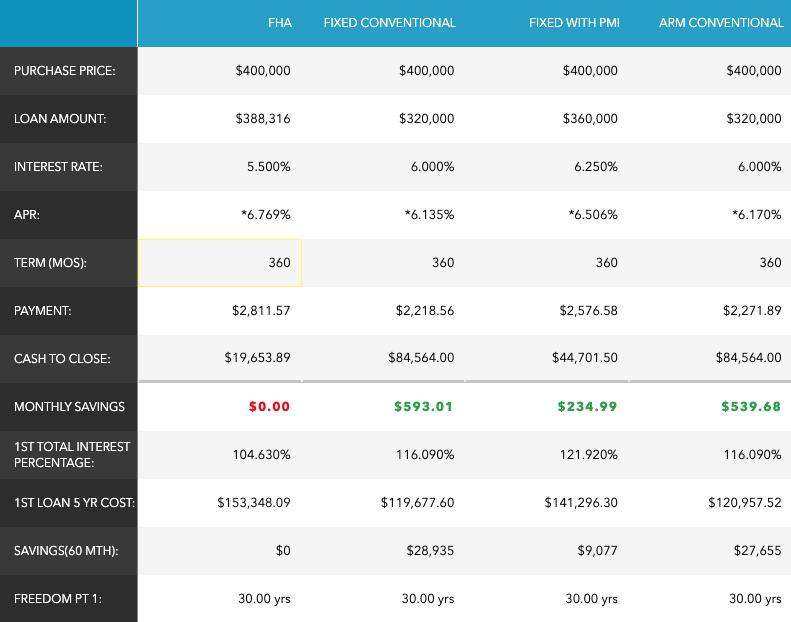

EXAMPLE LOAN COMPARE 95% LTV

Purchase Price $385,000

Loan Amount $365,750

Down Payment $19,250

Rate 6.625%

APR% 6.687%

Points 0

Loan Type: Conv. Fixed

Interest rates are subject to change daily and without notice.

Purchase Price $400,000

Loan Amount $380,000

Down Payment $20,000 Rate 5.99%

APR 6.139%

Points 2 ($7,600)

Loan Type: 30 year Fixed Permanent Buydown

400 North Harbor Place, Suite G&H | Davidson, NC 28036 | 704.728.0191 www.elementHL.com